a3cbcd8f745df6d954b171ce8d0758fb.ppt

- Количество слайдов: 33

Telecoms Software Strategies webinar Webinar Telecom software strategies with a focus on ‘BIG DATA’ January 2013 Patrick Kelly, Research Director © Analysys Mason Limited 2013

Telecoms Software Strategies webinar Executive summary New programmes ‘Big data’ and analytics Use case studies Recommendations © Analysys Mason Limited 2013 2

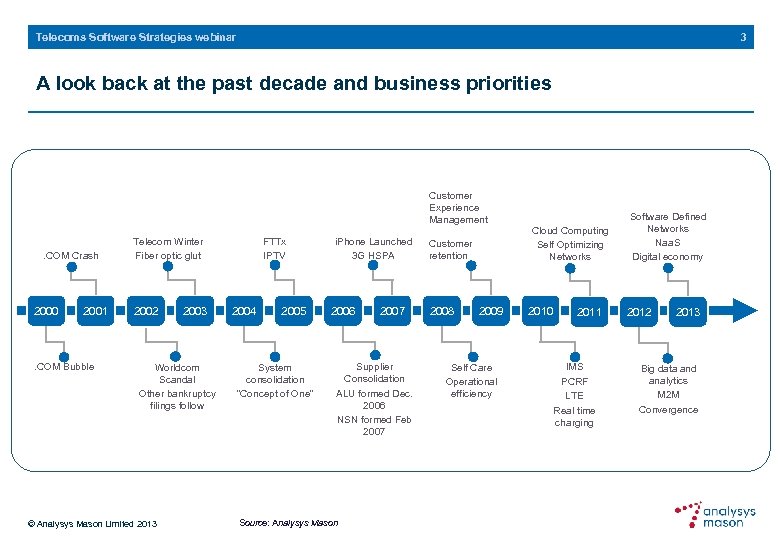

3 Telecoms Software Strategies webinar A look back at the past decade and business priorities Customer Experience Management. COM Crash 2000 2001 . COM Bubble Telecom Winter Fiber optic glut 2002 2003 Worldcom Scandal Other bankruptcy filings follow © Analysys Mason Limited 2013 FTTx IPTV 2004 2005 System consolidation “Concept of One” i. Phone Launched 3 G HSPA 2006 2007 Supplier Consolidation ALU formed Dec. 2006 NSN formed Feb 2007 Source: Analysys Mason Customer retention 2008 2009 Self Care Operational efficiency Cloud Computing Self Optimizing Networks 2010 2011 IMS PCRF LTE Real time charging Software Defined Networks Naa. S Digital economy 2012 2013 Big data and analytics M 2 M Convergence

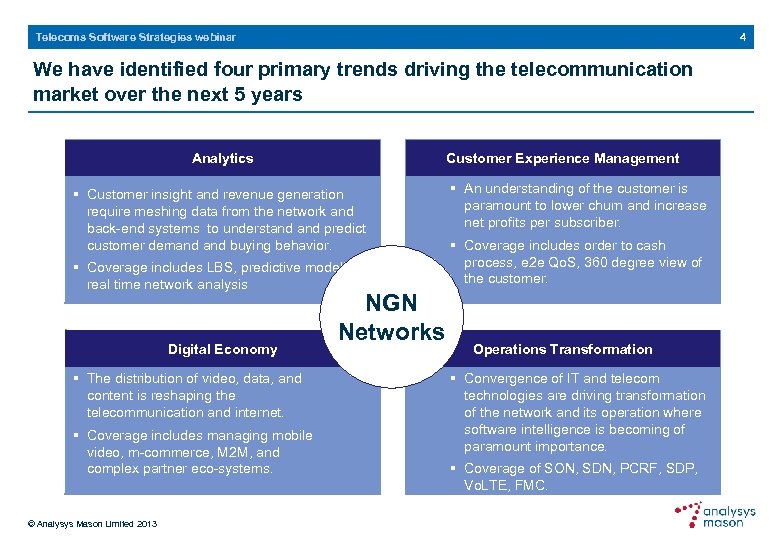

4 Telecoms Software Strategies webinar We have identified four primary trends driving the telecommunication market over the next 5 years Analytics Customer Experience Management § Customer insight and revenue generation require meshing data from the network and back-end systems to understand predict customer demand buying behavior. § Coverage includes LBS, predictive modeling, real time network analysis Digital Economy § The distribution of video, data, and content is reshaping the telecommunication and internet. § Coverage includes managing mobile video, m-commerce, M 2 M, and complex partner eco-systems. © Analysys Mason Limited 2013 NGN Networks § An understanding of the customer is paramount to lower churn and increase net profits per subscriber. § Coverage includes order to cash process, e 2 e Qo. S, 360 degree view of the customer. Operations Transformation § Convergence of IT and telecom technologies are driving transformation of the network and its operation where software intelligence is becoming of paramount importance. § Coverage of SON, SDN, PCRF, SDP, Vo. LTE, FMC.

Telecoms Software Strategies webinar Executive summary New programmes ‘Big data’ and analytics Use case studies Recommendations © Analysys Mason Limited 2013 5

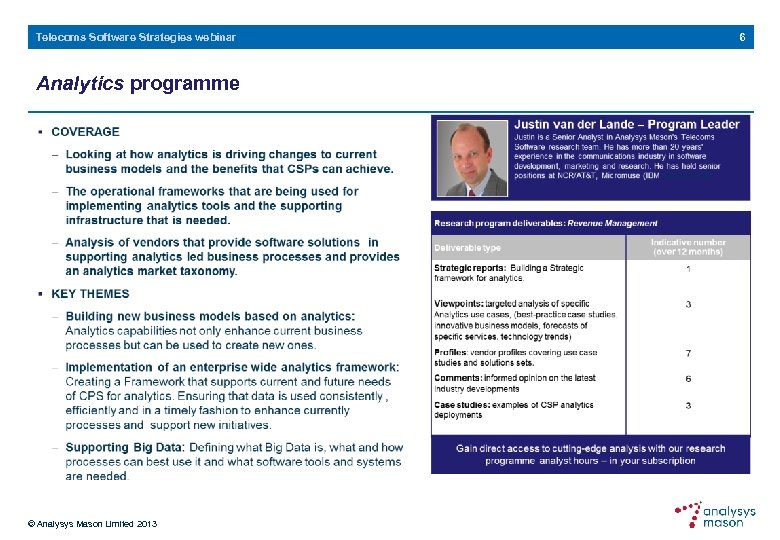

Telecoms Software Strategies webinar Analytics programme © Analysys Mason Limited 2013 6

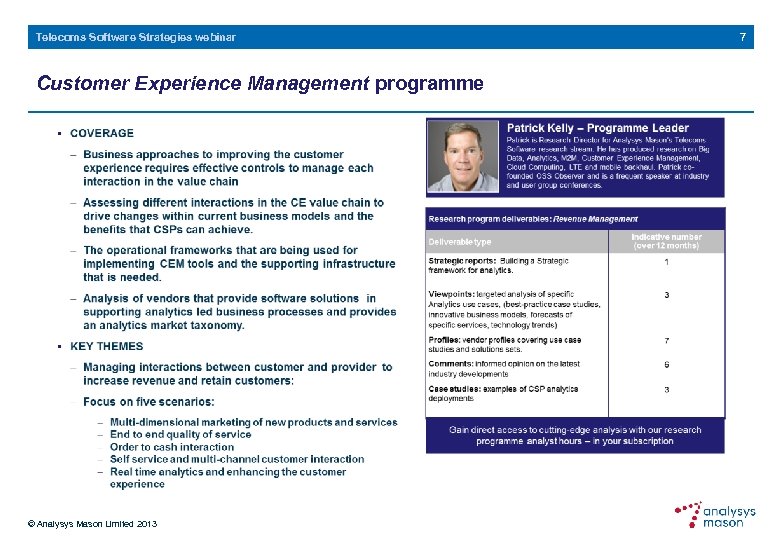

Telecoms Software Strategies webinar Customer Experience Management programme © Analysys Mason Limited 2013 7

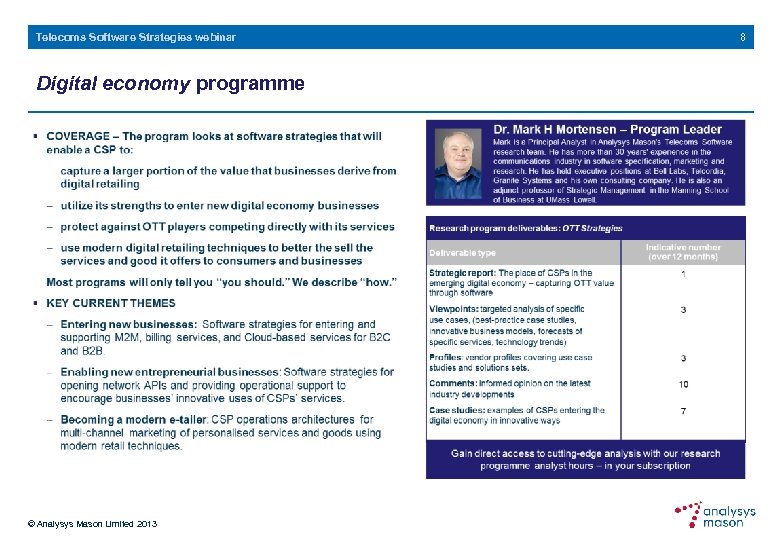

Telecoms Software Strategies webinar Digital economy programme © Analysys Mason Limited 2013 8

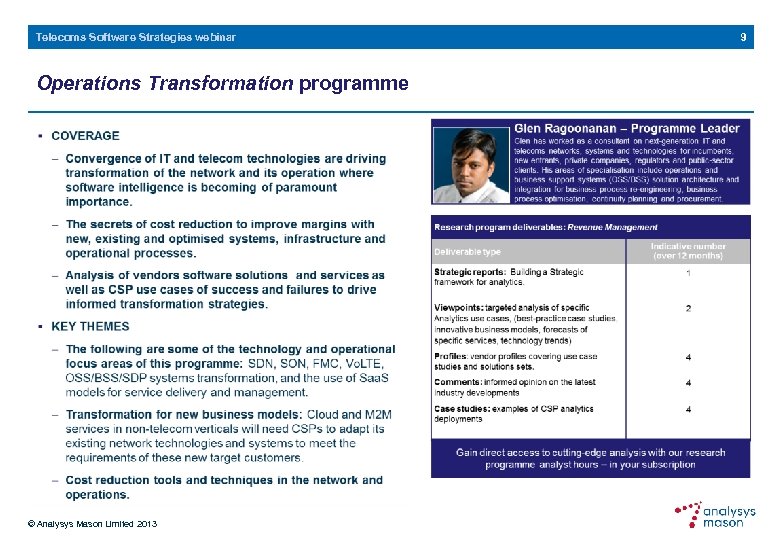

Telecoms Software Strategies webinar Operations Transformation programme © Analysys Mason Limited 2013 9

Telecoms Software Strategies webinar Executive summary New programmes ‘Big data’ and analytics Use case studies Recommendations © Analysys Mason Limited 2013 10

Telecoms Software Strategies webinar In this webinar we will analyse the ‘big data’ and analytics segment ‘Big data’ and analytics § Customer insight and revenue generation require meshing data from the network and back-end systems to understand predict customer demand buying behavior. § Coverage includes LBS, predictive modelling, real time network analysis § The distribution of video, data, and content is reshaping the telecommunication and internet. § Coverage includes managing mobile video, m-commerce, M 2 M, and complex partner eco-systems. © Analysys Mason Limited 2013 11

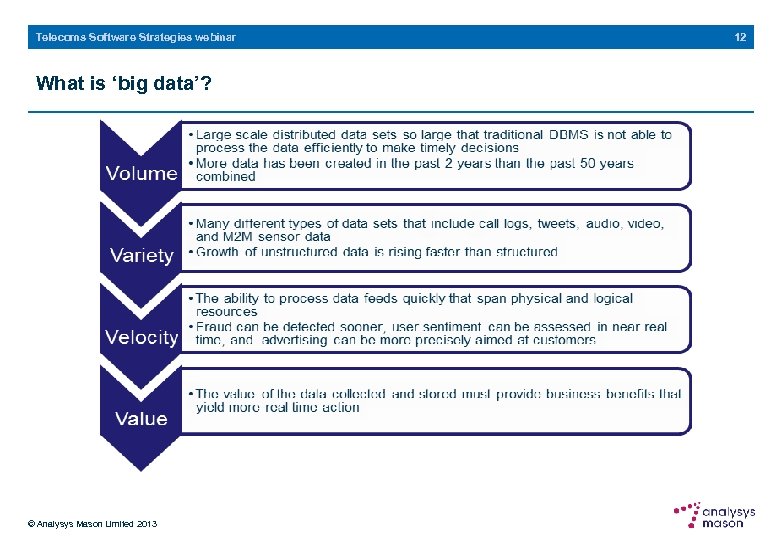

Telecoms Software Strategies webinar What is ‘big data’? © Analysys Mason Limited 2013 12

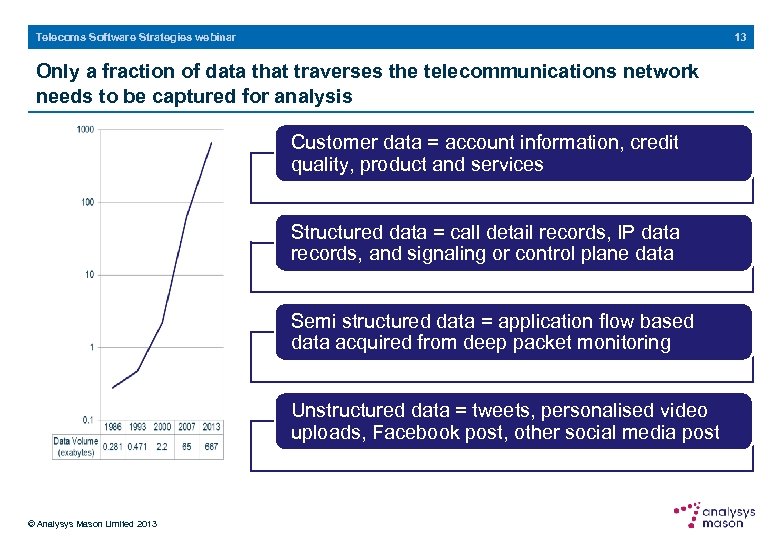

13 Telecoms Software Strategies webinar Only a fraction of data that traverses the telecommunications network needs to be captured for analysis Customer data = account information, credit quality, product and services Structured data = call detail records, IP data records, and signaling or control plane data Semi structured data = application flow based data acquired from deep packet monitoring Unstructured data = tweets, personalised video uploads, Facebook post, other social media post © Analysys Mason Limited 2013

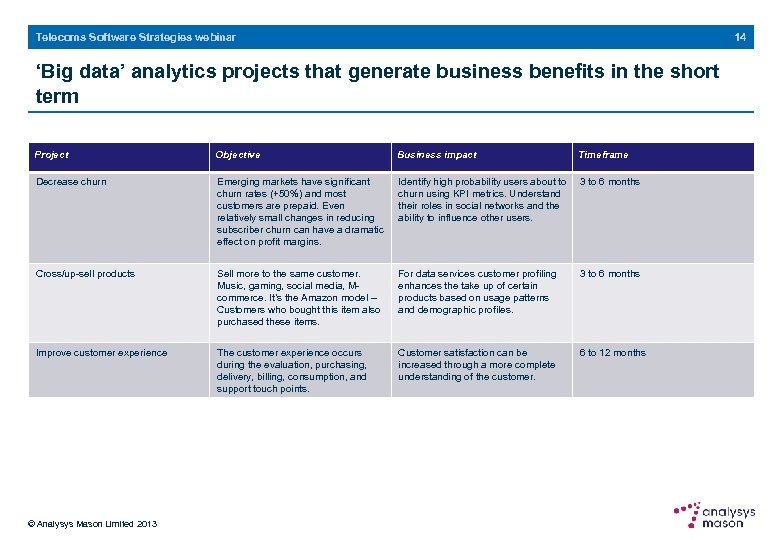

14 Telecoms Software Strategies webinar ‘Big data’ analytics projects that generate business benefits in the short term Project Objective Business impact Timeframe Decrease churn Emerging markets have significant churn rates (+50%) and most customers are prepaid. Even relatively small changes in reducing subscriber churn can have a dramatic effect on profit margins. Identify high probability users about to churn using KPI metrics. Understand their roles in social networks and the ability to influence other users. 3 to 6 months Cross/up-sell products Sell more to the same customer. Music, gaming, social media, Mcommerce. It’s the Amazon model – Customers who bought this item also purchased these items. For data services customer profiling enhances the take up of certain products based on usage patterns and demographic profiles. 3 to 6 months Improve customer experience The customer experience occurs during the evaluation, purchasing, delivery, billing, consumption, and support touch points. Customer satisfaction can be increased through a more complete understanding of the customer. 6 to 12 months © Analysys Mason Limited 2013

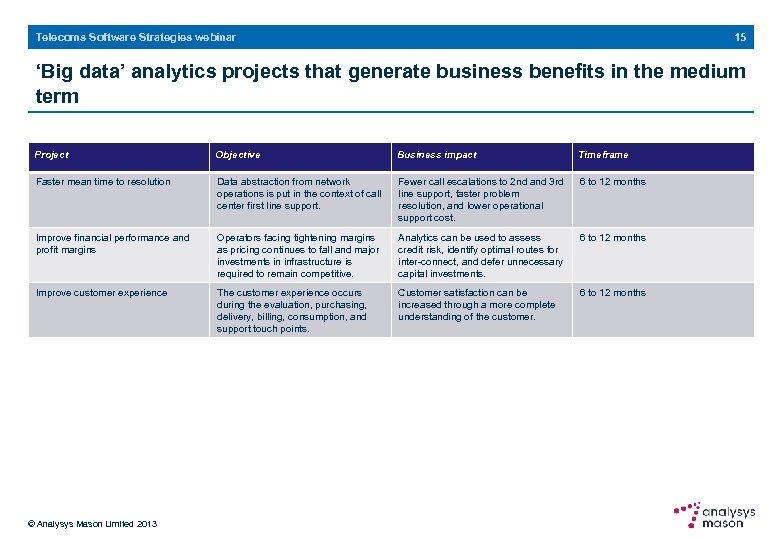

15 Telecoms Software Strategies webinar ‘Big data’ analytics projects that generate business benefits in the medium term Project Objective Business impact Timeframe Faster mean time to resolution Data abstraction from network operations is put in the context of call center first line support. Fewer call escalations to 2 nd and 3 rd line support, faster problem resolution, and lower operational support cost. 6 to 12 months Improve financial performance and profit margins Operators facing tightening margins as pricing continues to fall and major investments in infrastructure is required to remain competitive. Analytics can be used to assess credit risk, identify optimal routes for inter-connect, and defer unnecessary capital investments. 6 to 12 months Improve customer experience The customer experience occurs during the evaluation, purchasing, delivery, billing, consumption, and support touch points. Customer satisfaction can be increased through a more complete understanding of the customer. 6 to 12 months © Analysys Mason Limited 2013

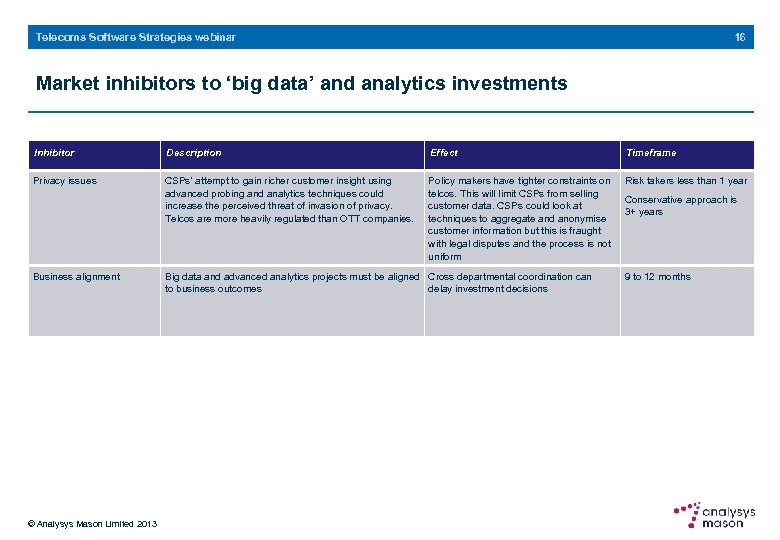

16 Telecoms Software Strategies webinar Market inhibitors to ‘big data’ and analytics investments Inhibitor Description Effect Timeframe Privacy issues CSPs’ attempt to gain richer customer insight using advanced probing and analytics techniques could increase the perceived threat of invasion of privacy. Telcos are more heavily regulated than OTT companies. Policy makers have tighter constraints on telcos. This will limit CSPs from selling customer data. CSPs could look at techniques to aggregate and anonymise customer information but this is fraught with legal disputes and the process is not uniform Risk takers less than 1 year Business alignment © Analysys Mason Limited 2013 Big data and advanced analytics projects must be aligned Cross departmental coordination can to business outcomes delay investment decisions Conservative approach is 3+ years 9 to 12 months

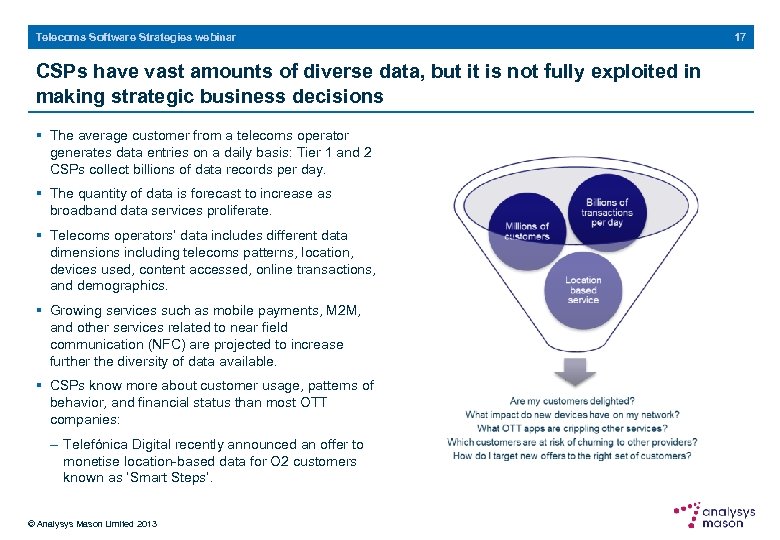

Telecoms Software Strategies webinar CSPs have vast amounts of diverse data, but it is not fully exploited in making strategic business decisions § The average customer from a telecoms operator generates data entries on a daily basis: Tier 1 and 2 CSPs collect billions of data records per day. § The quantity of data is forecast to increase as broadband data services proliferate. § Telecoms operators’ data includes different data dimensions including telecoms patterns, location, devices used, content accessed, online transactions, and demographics. § Growing services such as mobile payments, M 2 M, and other services related to near field communication (NFC) are projected to increase further the diversity of data available. § CSPs know more about customer usage, patterns of behavior, and financial status than most OTT companies: - Telefónica Digital recently announced an offer to monetise location-based data for O 2 customers known as ‘Smart Steps’. © Analysys Mason Limited 2013 17

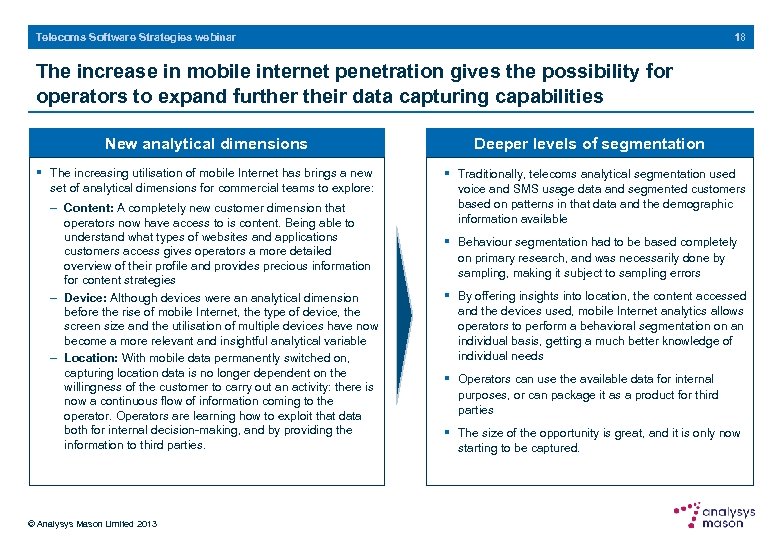

18 Telecoms Software Strategies webinar The increase in mobile internet penetration gives the possibility for operators to expand further their data capturing capabilities New analytical dimensions § The increasing utilisation of mobile Internet has brings a new set of analytical dimensions for commercial teams to explore: - Content: A completely new customer dimension that operators now have access to is content. Being able to understand what types of websites and applications customers access gives operators a more detailed overview of their profile and provides precious information for content strategies - Device: Although devices were an analytical dimension before the rise of mobile Internet, the type of device, the screen size and the utilisation of multiple devices have now become a more relevant and insightful analytical variable - Location: With mobile data permanently switched on, capturing location data is no longer dependent on the willingness of the customer to carry out an activity: there is now a continuous flow of information coming to the operator. Operators are learning how to exploit that data both for internal decision-making, and by providing the information to third parties. © Analysys Mason Limited 2013 Deeper levels of segmentation § Traditionally, telecoms analytical segmentation used voice and SMS usage data and segmented customers based on patterns in that data and the demographic information available § Behaviour segmentation had to be based completely on primary research, and was necessarily done by sampling, making it subject to sampling errors § By offering insights into location, the content accessed and the devices used, mobile Internet analytics allows operators to perform a behavioral segmentation on an individual basis, getting a much better knowledge of individual needs § Operators can use the available data for internal purposes, or can package it as a product for third parties § The size of the opportunity is great, and it is only now starting to be captured.

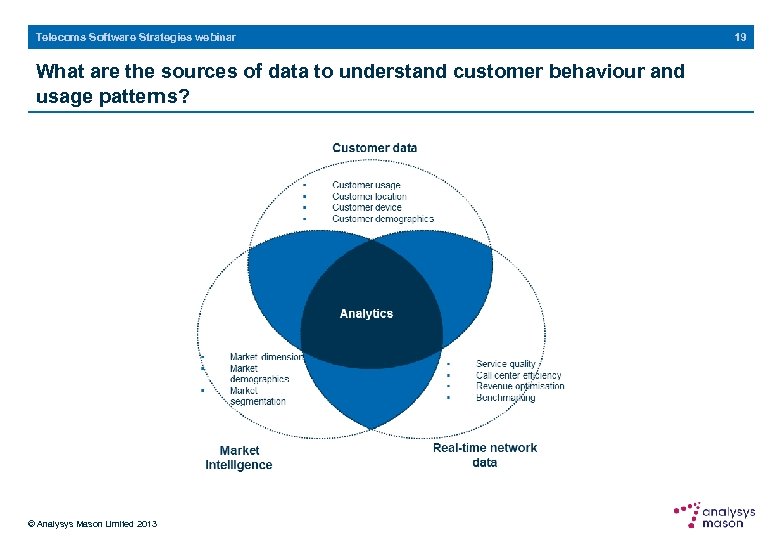

Telecoms Software Strategies webinar What are the sources of data to understand customer behaviour and usage patterns? © Analysys Mason Limited 2013 19

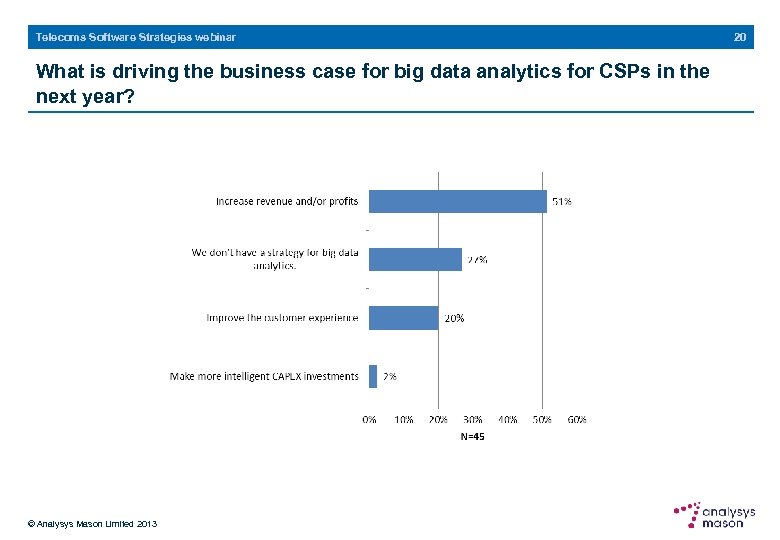

Telecoms Software Strategies webinar What is driving the business case for big data analytics for CSPs in the next year? © Analysys Mason Limited 2013 20

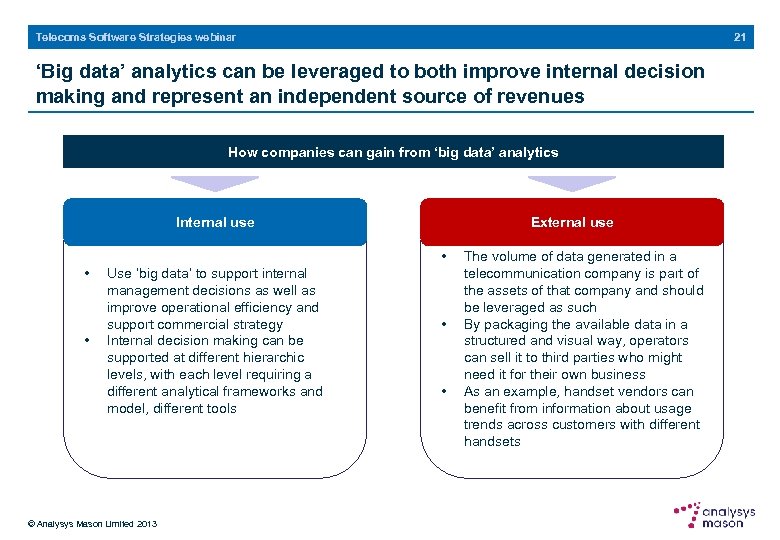

21 Telecoms Software Strategies webinar ‘Big data’ analytics can be leveraged to both improve internal decision making and represent an independent source of revenues How companies can gain from ‘big data’ analytics Internal use External use • • • Use ‘big data’ to support internal management decisions as well as improve operational efficiency and support commercial strategy Internal decision making can be supported at different hierarchic levels, with each level requiring a different analytical frameworks and model, different tools © Analysys Mason Limited 2013 • • The volume of data generated in a telecommunication company is part of the assets of that company and should be leveraged as such By packaging the available data in a structured and visual way, operators can sell it to third parties who might need it for their own business As an example, handset vendors can benefit from information about usage trends across customers with different handsets

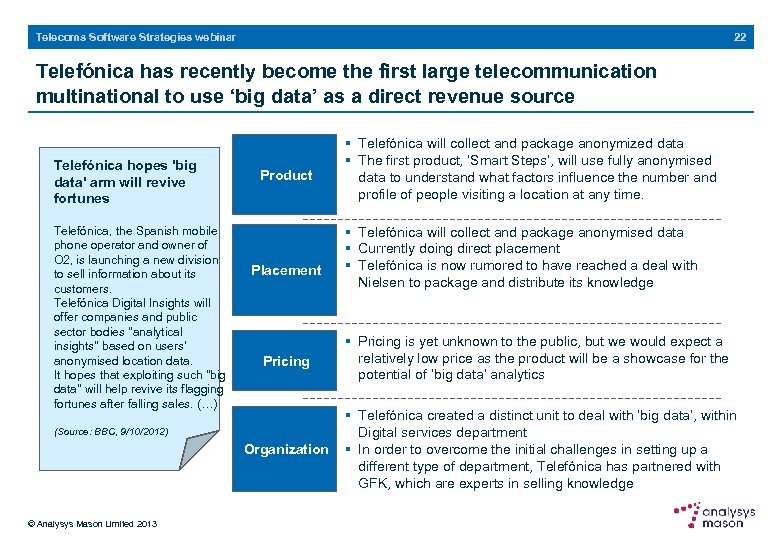

22 Telecoms Software Strategies webinar Telefónica has recently become the first large telecommunication multinational to use ‘big data’ as a direct revenue source Telefónica hopes 'big data' arm will revive fortunes Telefónica, the Spanish mobile phone operator and owner of O 2, is launching a new division to sell information about its customers. Telefónica Digital Insights will offer companies and public sector bodies "analytical insights" based on users' anonymised location data. It hopes that exploiting such "big data" will help revive its flagging fortunes after falling sales. (…) Product Placement § Telefónica will collect and package anonymized data § The first product, ‘Smart Steps’, will use fully anonymised data to understand what factors influence the number and profile of people visiting a location at any time. § Telefónica will collect and package anonymised data § Currently doing direct placement § Telefónica is now rumored to have reached a deal with Nielsen to package and distribute its knowledge Pricing § Pricing is yet unknown to the public, but we would expect a relatively low price as the product will be a showcase for the potential of ‘big data’ analytics Organization § Telefónica created a distinct unit to deal with ‘big data’, within Digital services department § In order to overcome the initial challenges in setting up a different type of department, Telefónica has partnered with GFK, which are experts in selling knowledge (Source: BBC, 9/10/2012) © Analysys Mason Limited 2013

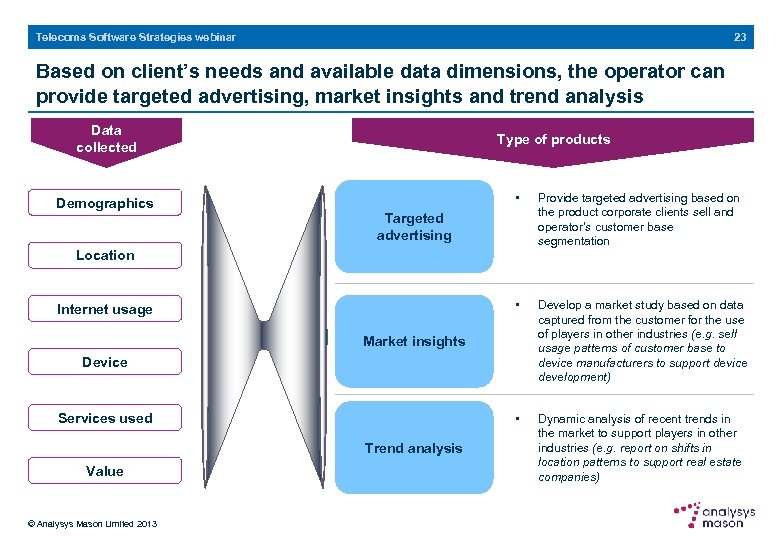

23 Telecoms Software Strategies webinar Based on client’s needs and available data dimensions, the operator can provide targeted advertising, market insights and trend analysis Data collected Type of products • Provide targeted advertising based on the product corporate clients sell and operator’s customer base segmentation • Develop a market study based on data captured from the customer for the use of players in other industries (e. g. sell usage patterns of customer base to device manufacturers to support device development) • Demographics Dynamic analysis of recent trends in the market to support players in other industries (e. g. report on shifts in location patterns to support real estate companies) Targeted advertising Location Internet usage Market insights Device Services used Trend analysis Value © Analysys Mason Limited 2013

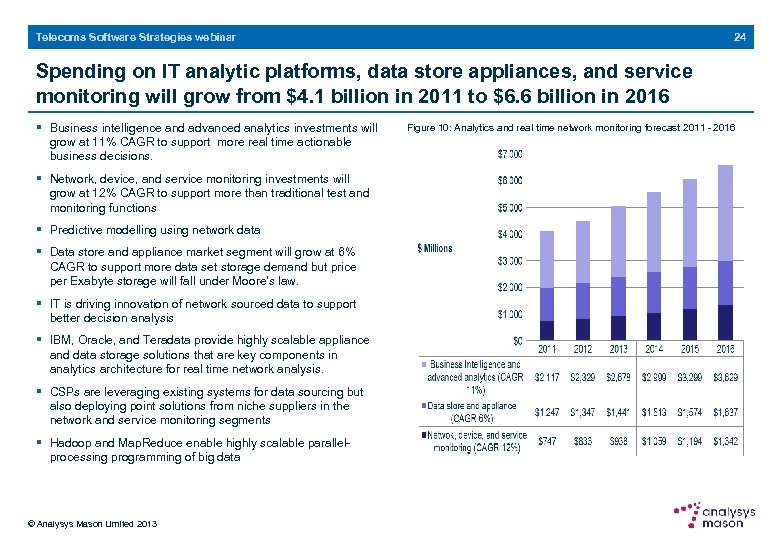

24 Telecoms Software Strategies webinar Spending on IT analytic platforms, data store appliances, and service monitoring will grow from $4. 1 billion in 2011 to $6. 6 billion in 2016 § Business intelligence and advanced analytics investments will grow at 11% CAGR to support more real time actionable business decisions. § Network, device, and service monitoring investments will grow at 12% CAGR to support more than traditional test and monitoring functions § Predictive modelling using network data § Data store and appliance market segment will grow at 6% CAGR to support more data set storage demand but price per Exabyte storage will fall under Moore's law. § IT is driving innovation of network sourced data to support better decision analysis § IBM, Oracle, and Teradata provide highly scalable appliance and data storage solutions that are key components in analytics architecture for real time network analysis. § CSPs are leveraging existing systems for data sourcing but also deploying point solutions from niche suppliers in the network and service monitoring segments § Hadoop and Map. Reduce enable highly scalable parallelprocessing programming of big data © Analysys Mason Limited 2013 Figure 10: Analytics and real time network monitoring forecast 2011 - 2016

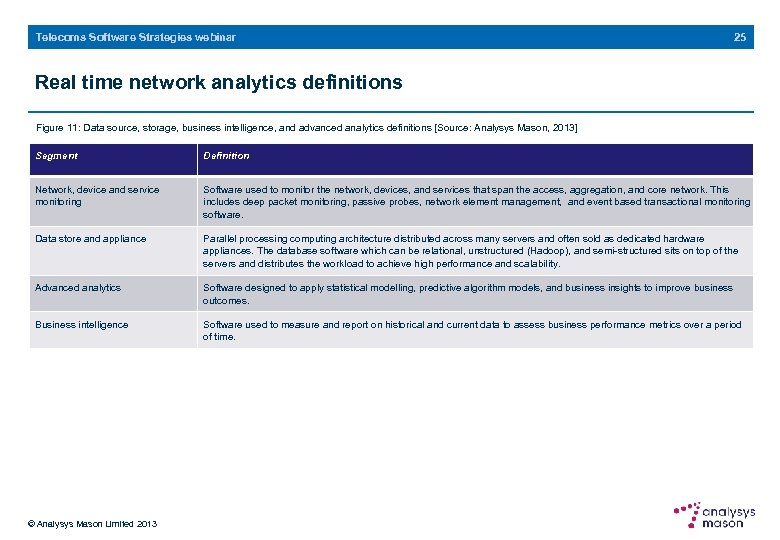

Telecoms Software Strategies webinar 25 Real time network analytics definitions Figure 11: Data source, storage, business intelligence, and advanced analytics definitions [Source: Analysys Mason, 2013] Segment Definition Network, device and service monitoring Software used to monitor the network, devices, and services that span the access, aggregation, and core network. This includes deep packet monitoring, passive probes, network element management, and event based transactional monitoring software. Data store and appliance Parallel processing computing architecture distributed across many servers and often sold as dedicated hardware appliances. The database software which can be relational, unstructured (Hadoop), and semi-structured sits on top of the servers and distributes the workload to achieve high performance and scalability. Advanced analytics Software designed to apply statistical modelling, predictive algorithm models, and business insights to improve business outcomes. Business intelligence Software used to measure and report on historical and current data to assess business performance metrics over a period of time. © Analysys Mason Limited 2013

Telecoms Software Strategies webinar Executive summary New programmes ‘Big data’ and analytics Use case studies Recommendations © Analysys Mason Limited 2013 26

27 Telecoms Software Strategies webinar Use case: Improvements in first call resolution yields annual cost savings of EUR 5 million Business drivers Deployment § A surge in the use of smart devices and applications is causing more complex support issues for customers such as increasing number of support calls and longer handling times related to mobile data. § Deployed network analytics solution to gain a real-time view of consumer behaviour including applications, devices, locations and service types. § The CSP needed a better approach to improve first call resolution for mobile data. Operations approach § For the CSP in question, 7% of calls pertaining to mobile data received by customer care were escalated from 1 st line to 2 nd line support and 50% of those calls (3. 5% of total calls) were further escalated from 2 nd line to more expensive 3 rd line support team. On an average, each call took approx. 12 minutes. Benefits § Project executed within six months. The solution empowered support teams with more detailed customer experience metrics in real time such as throughput performance, network alerts, handset issues. § Achieved 50% reduction (3. 5% instead of 7% earlier) in calls escalated from 1 st line to 2 nd line support and 71% reduction (2. 5 % instead of 3. 5% earlier) in calls escalated from 2 nd line to 3 rd line support. Software Strategy § Reduced call resolution times to 8 mins, a saving of 4 mins or 33%. § Engaged a vendor to perform a detailed analysis of what types of issues were reported to the 1 st line, what type of information would be required to fix those issues. § Annual cost savings of EUR 5 million in reduced resource requirements on a subscriber base of approx. 10 million customers. § Using analytics, the network information was sourced, processed and presented in a way that the 1 st and 2 nd line teams could better understand use it to resolve customer issues more efficiently. © Analysys Mason Limited 2013

28 Telecoms Software Strategies webinar Use case: European MVNO achieves an unified view of service usage and profitability of its Fixed-Mobile business customers Business drivers § To optimise the business performance and ensure customer profitability across the Fixed-Mobile converged solution, the CSP needed to understand manage the performance and usage of its services. § The CSP wanted to monitor service quality and proactively avoid churn among business customers. Operations approach § It wanted to link usage of its different services to a single profile of the customer. The aim was to deliver a unified view of their business by combining product, billing, traffic and customer data enabling the performance measurement of the delivered business services by customer. Software Strategy § It commissioned a single OSS reporting system to unify customer reporting and understanding by performing real time network analytics. The expectation was to gain near real time visibility and control of the business at a customer level. Deployment § The solution was deployed in a best of breed architecture with the analytics platform and DPI probes provided by different vendors. © Analysys Mason Limited 2013 § The solution combined data from CRM, billing and network management systems - covering tickets, prices, traffic data, handsets, fault codes, locations and customer data - and produced a holistic unified data model ready for analysis and reporting. § The completed solution provides regular unified reports for all business lines to senior management, sales and marketing, delivery, finance, legal and product management departments. These automated reports provide detailed information about customers’ behaviour and their product and service usage - including top customers, revenues, profitability, volumes, service levels and service reliability Benefits § Improved profitability by more efficient business management from instant access to key business indicators. The CSP can optimise packaging, tariffs and pricing to their customers based on actual service consumption and revenues. § Cost savings and improved operational efficiency with access to information not freely available before; the usage of real time network analytics has significantly reduced requests for bespoke and ad-hoc reports from across the organisation. § By delivering the reporting data via their customer portal, the CSP is able to provide service level reporting for mobile customers as a value added service with increased customer satisfaction and reduced churn

29 Telecoms Software Strategies webinar Use case: Asian CSP increases marketing effectiveness by better customer segmentation and targeted promotions Business drivers Benefits § The CSP wanted to improve customer loyalty and increase ARPU/revenue by improving marketing effectiveness. § The CSP’s marketing team can now discover target groups for marketing activities as well as cross and upselling opportunities. Post marketing campaign launch, the team are able to monitor day to day usage and react immediately to changes in customer behaviour and campaign performance. Improved overall response by 30%. Operations approach § The CSP deployed an OSS platform to gather real time network data and perform real-time analysis of customer experiences and behaviour, and do effective market segmentation as well as targeted marketing with specific offers. Software Strategy § It deployed an adjunct system to achieve its operational goals. It decided to introduce a customer experience analytics solution to perform real time network analytics. Deployment § The solution combined and cross-correlated customer, billing and network traffic records to provide a data model for comprehensive analytics and real-time results forming the basis for effective segmentation for a targeted and differentiated offerings approach. § The probes were supplied by third party vendors. © Analysys Mason Limited 2013 § Technical problems in the network can now be discovered, such as poor coverage, enabling network operations to quickly identify the root causes of the issue and rapidly and proactively fix them. § Improved operational efficiency through quick access to information significantly reducing the time taken to identify target segments and improved accuracy of the lists.

Telecoms Software Strategies webinar Executive summary New programmes ‘Big data’ and analytics Use case studies Recommendations © Analysys Mason Limited 2013 30

Telecoms Software Strategies webinar 31 Recommendations for CSPs § CSPs should understand the business outcomes in specific areas of their business before investing in big data and analytics - Increase net profit margins 12% thru cross marketing and sales promotions - Improve customer retention 0. 2% via loyalty campaigns - Defer capital investments in the RAN without degrading service yielding $50 M in savings. § Approach big data and real time network analytics as a broader solution and not a data warehouse silo. § Be selective with data capture. Only a fraction of data is required and it must be made usable in minutes not days. § Challenge supplier claims and validate successful attributes of deployments specific to targeted business outcomes. § Blend organic data in-house with advanced analytics commercial software that have demonstrated success in other industry verticals (retail / e-commerce) - Consumer micro segmentation - Demand driven predictive modelling. § Tread lightly on privacy concerns. Opt-in campaigns limit regulatory scrutiny and instill goodwill towards the brand © Analysys Mason Limited 2013

Telecoms Software Strategies webinar 32 About the authors Partick Kelly (Research Director) leads Analysys Mason’s Telecoms Software research stream, which focuses on identifying the rapidly growing segments in the telecoms software market and providing forecast and market share data on each of the 29 segments by region and service type. He has produced research on IP next-generation service assurance, the 3 G mobile software market and customer experience management. Patrick is a frequent speaker at industry conferences. He holds a BSc from the University of Vermont, and an MBA from Plymouth College. Published by Analysys Mason Limited • Bush House • North West Wing • Aldwych • London • WC 2 B 4 PJ • UK Tel: +44 (0)845 600 5244 • Fax: +44 (0)845 528 0760 • Email: research@analysysmason. com • www. analysysmason. com/research • Registered in England No. 5177472 © Analysys Mason Limited 2013. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise – without the prior written permission of the publisher. Figures and projections contained in this report are based on publicly available information only and are produced by the Research Division of Analysys Mason Limited independently of any clientspecific work within Analysys Mason Limited. The opinions expressed are those of the stated authors only. Analysys Mason Limited recognises that many terms appearing in this report are proprietary; all such trademarks are acknowledged and every effort has been made to indicate them by the normal UK publishing practice of capitalisation. However, the presence of a term, in whatever form, does not affect its legal status as a trademark. Analysys Mason Limited maintains that all reasonable care and skill have been used in the compilation of this publication. However, Analysys Mason Limited shall not be under any liability for loss or damage (including consequential loss) whatsoever or howsoever arising as a result of the use of this publication by the customer, his servants, agents or any third party. © Analysys Mason Limited 2013

33 Telecoms Software Strategies webinar About Analysys Mason The only constant is change. What worked yesterday won’t necessarily work today. That’s why we look beyond the obvious, seeing things from a client’s perspective so that a truly effective solution is delivered every time. A key part of this is our international perspective. Business never sleeps, and with offices spanning six time zones, neither does Analysys Mason. Telecoms, media and technology (TMT) are our world; we live and breathe TMT. This total immersion in our subject underpins and informs everything we do, from the strength and reliability of our market analysis, to improving business performance for clients in more than 100 countries around the world. For more than 25 years, our consultants have been bringing the benefits of applied intelligence to enable clients around the world to make the most of their opportunities. We advise clients on regulatory matters, support multi-billion dollar investments, advise on network performance and recommend commercial partnering options and new business strategies. For more information about our consulting services, please visit www. analysysmason. com/consulting. Our subscription research programmes address key industry dynamics in order to help clients interpret the changing market. We analyse, track and forecast the different services accessed by consumers and enterprises, as well as the software, infrastructure and technology that underpin the delivery of those services. Many of the world’s leading network operators, vendors, regulators and investors subscribe to our programmes and rely on our insight on a daily basis to inform their decision making. For more information about our subscription research programmes, please visit www. analysysmason. com/research. © Analysys Mason Limited 2013

a3cbcd8f745df6d954b171ce8d0758fb.ppt