1d864e2b1c6bea55dcfbd2f8988d1fbe.ppt

- Количество слайдов: 23

Telecom for improving investment climate & ICT use Rohan Samarajiva, Public Interest Program Unit, Ministry of Economic Reform, Science & Technology Samarajiva@lirne. net; +94 1 247 8733

Telecom for improving investment climate & ICT use Rohan Samarajiva, Public Interest Program Unit, Ministry of Economic Reform, Science & Technology Samarajiva@lirne. net; +94 1 247 8733

Purpose of presentation o o Reform of telecom is a necessary condition for investment overall Creating conditions for private investment in telecom n n o Market entry Independent & effective regulation Examples from Sri Lanka throughout

Purpose of presentation o o Reform of telecom is a necessary condition for investment overall Creating conditions for private investment in telecom n n o Market entry Independent & effective regulation Examples from Sri Lanka throughout

Sri Lanka’s telecom sector after 12 years of reforms o Multiple operators (70+) n n n o o o 3 national fixed (no waiters in urban areas) 4 national mobile (overtook fixed; real price declined) 5+ facilities-based data 30 external gateway (~66% decrease in price) 20+ non-facilities based data Fixed teledensity < 1 in 1991 almost 5 in 2003; Mobile ~0. 01 in 1991 5 < in 2003 Telecom & banking are fastest growing sectors in economy in 2003 (~16%) Telecom no longer a barrier to investment

Sri Lanka’s telecom sector after 12 years of reforms o Multiple operators (70+) n n n o o o 3 national fixed (no waiters in urban areas) 4 national mobile (overtook fixed; real price declined) 5+ facilities-based data 30 external gateway (~66% decrease in price) 20+ non-facilities based data Fixed teledensity < 1 in 1991 almost 5 in 2003; Mobile ~0. 01 in 1991 5 < in 2003 Telecom & banking are fastest growing sectors in economy in 2003 (~16%) Telecom no longer a barrier to investment

Telecom as a necessary condition for increased investment o Two solutions n n o Improve service only in enclave Improve sector performance everywhere Sri Lanka tried the enclave solution in 1980 s n n n Supplementing exchange & outside plant in Katunayake EPZ Giving priority to GCEC factories (investors) Poor results including ridiculous outcome of banning automatic rediallers

Telecom as a necessary condition for increased investment o Two solutions n n o Improve service only in enclave Improve sector performance everywhere Sri Lanka tried the enclave solution in 1980 s n n n Supplementing exchange & outside plant in Katunayake EPZ Giving priority to GCEC factories (investors) Poor results including ridiculous outcome of banning automatic rediallers

Investment in telecom sector overall is key. . . o What we want is n n o Adequate supply of services Lower prices Higher quality More choice How do we get it? n n n Not another reform of the failed government monopoly Not regulation, per se More investment

Investment in telecom sector overall is key. . . o What we want is n n o Adequate supply of services Lower prices Higher quality More choice How do we get it? n n n Not another reform of the failed government monopoly Not regulation, per se More investment

Private investment to improve telecom o Telecom is the infrastructure with the most dynamic industry structures and technologies n o o Integrated government monopolies lack nimbleness to play No multilateral/bilateral assistance for unreformed monopolies Public investments better used elsewhere

Private investment to improve telecom o Telecom is the infrastructure with the most dynamic industry structures and technologies n o o Integrated government monopolies lack nimbleness to play No multilateral/bilateral assistance for unreformed monopolies Public investments better used elsewhere

Government action to attract private investment in telecom o Greater private investment depends on positive answers to 2 questions n n o Are the returns adequate? (market risk) Are safeguards against administrative expropriation adequate? (regulatory risk) What can government do? n n Let investors look after market risk: no market-position guarantees Reduce regulatory risk

Government action to attract private investment in telecom o Greater private investment depends on positive answers to 2 questions n n o Are the returns adequate? (market risk) Are safeguards against administrative expropriation adequate? (regulatory risk) What can government do? n n Let investors look after market risk: no market-position guarantees Reduce regulatory risk

Government actions: Market entry & privatization o Minimize barriers to entry; SL policy is n n o License only where scarce resources are involved Otherwise authorizations Examples n External gateway operator licenses o o 30 given since March 2003 No discretion; no numerical limits

Government actions: Market entry & privatization o Minimize barriers to entry; SL policy is n n o License only where scarce resources are involved Otherwise authorizations Examples n External gateway operator licenses o o 30 given since March 2003 No discretion; no numerical limits

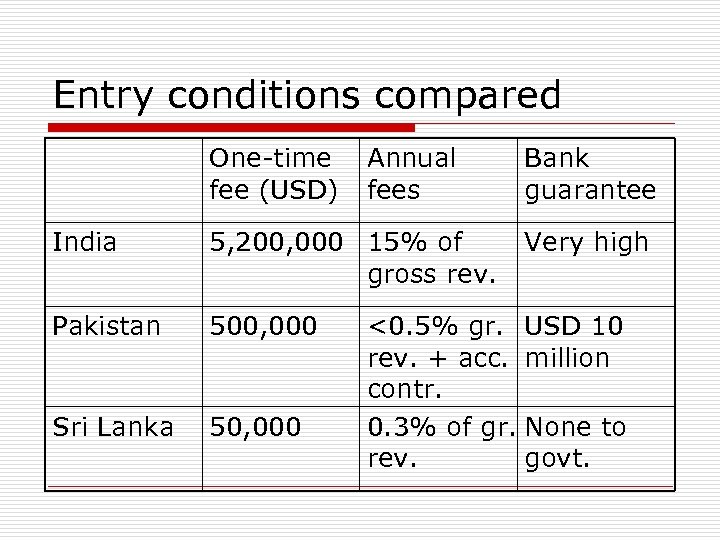

Entry conditions compared One-time fee (USD) Annual fees India 5, 200, 000 15% of gross rev. Pakistan 500, 000 Sri Lanka 50, 000 Bank guarantee Very high <0. 5% gr. USD 10 rev. + acc. million contr. 0. 3% of gr. None to rev. govt.

Entry conditions compared One-time fee (USD) Annual fees India 5, 200, 000 15% of gross rev. Pakistan 500, 000 Sri Lanka 50, 000 Bank guarantee Very high <0. 5% gr. USD 10 rev. + acc. million contr. 0. 3% of gr. None to rev. govt.

Results. . . o o o From unstable monopoly to open entry. . . From SLR 75 a minute to 20 -25. . . Telecom no longer seen as barrier to BPO investments

Results. . . o o o From unstable monopoly to open entry. . . From SLR 75 a minute to 20 -25. . . Telecom no longer seen as barrier to BPO investments

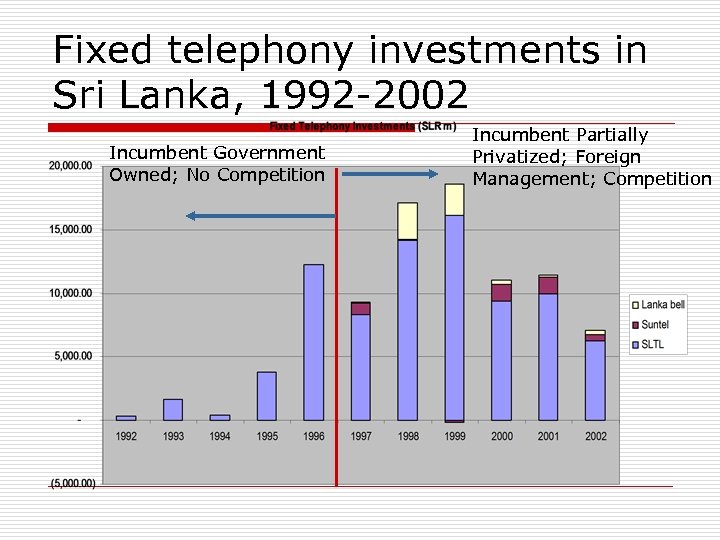

Fixed telephony investments in Sri Lanka, 1992 -2002 Incumbent Government Owned; No Competition Incumbent Partially Privatized; Foreign Management; Competition

Fixed telephony investments in Sri Lanka, 1992 -2002 Incumbent Government Owned; No Competition Incumbent Partially Privatized; Foreign Management; Competition

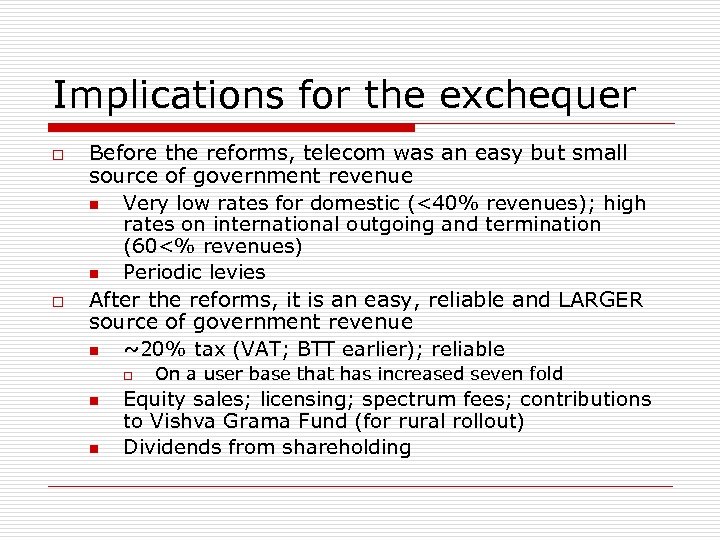

Implications for the exchequer o o Before the reforms, telecom was an easy but small source of government revenue n Very low rates for domestic (<40% revenues); high rates on international outgoing and termination (60<% revenues) n Periodic levies After the reforms, it is an easy, reliable and LARGER source of government revenue n ~20% tax (VAT; BTT earlier); reliable o n n On a user base that has increased seven fold Equity sales; licensing; spectrum fees; contributions to Vishva Grama Fund (for rural rollout) Dividends from shareholding

Implications for the exchequer o o Before the reforms, telecom was an easy but small source of government revenue n Very low rates for domestic (<40% revenues); high rates on international outgoing and termination (60<% revenues) n Periodic levies After the reforms, it is an easy, reliable and LARGER source of government revenue n ~20% tax (VAT; BTT earlier); reliable o n n On a user base that has increased seven fold Equity sales; licensing; spectrum fees; contributions to Vishva Grama Fund (for rural rollout) Dividends from shareholding

Key reform events o 1989 -1994 n o 1996 n o Licensing of 15+ facilities-based operators, including Incumbent which was changed to corporation Licensing of two fixed competitors (USD 120 m) 1997 n 35% sale of Incumbent to NTT of Japan for USD 225 million with 5 -year management agreement

Key reform events o 1989 -1994 n o 1996 n o Licensing of 15+ facilities-based operators, including Incumbent which was changed to corporation Licensing of two fixed competitors (USD 120 m) 1997 n 35% sale of Incumbent to NTT of Japan for USD 225 million with 5 -year management agreement

Key reform events o 1998 n n n o Active regulation starts First step of 5 year rate rebalancing Satellite gateways liberalized 1999 n n Incumbent found to be in violation of license condition and pays consumers US$ 1 million First public hearing conducted

Key reform events o 1998 n n n o Active regulation starts First step of 5 year rate rebalancing Satellite gateways liberalized 1999 n n Incumbent found to be in violation of license condition and pays consumers US$ 1 million First public hearing conducted

Key reform events o 2002 n o Government sells 12. 5% of Incumbent’s equity, bringing government ownership to <50% 2003 n n 30+ External Gateway Licenses issued New Interconnection Rules gazetted Implementation ongoing Already a commitment of USD 90 million additional investment

Key reform events o 2002 n o Government sells 12. 5% of Incumbent’s equity, bringing government ownership to <50% 2003 n n 30+ External Gateway Licenses issued New Interconnection Rules gazetted Implementation ongoing Already a commitment of USD 90 million additional investment

Government actions: Regulation o Reduce regulatory risk n Poor countries are poor because o o Government does not work well regulatory risk is high investments are low/skewed infrastructure is inadequate economy is hobbled Solution: independent and effective regulatory agency

Government actions: Regulation o Reduce regulatory risk n Poor countries are poor because o o Government does not work well regulatory risk is high investments are low/skewed infrastructure is inadequate economy is hobbled Solution: independent and effective regulatory agency

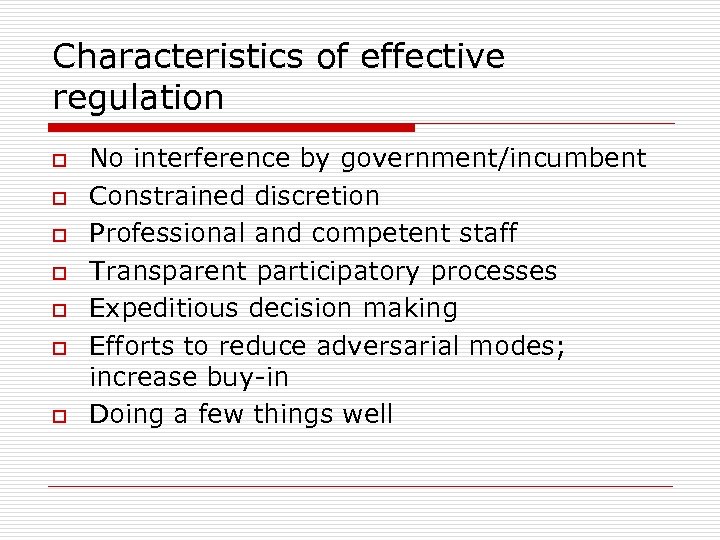

Characteristics of effective regulation o o o o No interference by government/incumbent Constrained discretion Professional and competent staff Transparent participatory processes Expeditious decision making Efforts to reduce adversarial modes; increase buy-in Doing a few things well

Characteristics of effective regulation o o o o No interference by government/incumbent Constrained discretion Professional and competent staff Transparent participatory processes Expeditious decision making Efforts to reduce adversarial modes; increase buy-in Doing a few things well

Independence of regulatory agency o Information & Communication Commission that will replace TRC n n n Members appointed with concurrence of Constitutional Council Accountable to/removable by Parliament Not reporting to Minister for Telecom

Independence of regulatory agency o Information & Communication Commission that will replace TRC n n n Members appointed with concurrence of Constitutional Council Accountable to/removable by Parliament Not reporting to Minister for Telecom

Constrained discretion o Rate rebalancing in 1998 -2003 governed by legal agreement that set revenue requirements n Regulator decided specific tariffs that would yield promised revenues

Constrained discretion o Rate rebalancing in 1998 -2003 governed by legal agreement that set revenue requirements n Regulator decided specific tariffs that would yield promised revenues

Telecom regulation should focus on o Interconnection & anti-competitive issues n In Sri Lanka o New interconnection rules in March 2003 n n o Dominant position rules being framed n o Including access to undersea cable station Implementation in process New legislation will remove tariff regulation from non-dominant operators Anti-competitive practices proceedings soon

Telecom regulation should focus on o Interconnection & anti-competitive issues n In Sri Lanka o New interconnection rules in March 2003 n n o Dominant position rules being framed n o Including access to undersea cable station Implementation in process New legislation will remove tariff regulation from non-dominant operators Anti-competitive practices proceedings soon

Regulation should focus on o Efficient management of scarce resources (spectrum, rights of way and numbers) n In Sri Lanka o o o Allocation & assignments made public 1800 MHz, CDMA & Wi. Fi consultations First frequency auction in May 2003 New legislation on rights of way including “final offer” arbitration New numbering plan being implemented

Regulation should focus on o Efficient management of scarce resources (spectrum, rights of way and numbers) n In Sri Lanka o o o Allocation & assignments made public 1800 MHz, CDMA & Wi. Fi consultations First frequency auction in May 2003 New legislation on rights of way including “final offer” arbitration New numbering plan being implemented

. . . And get out of unnecessary areas o o o Most retail tariffs unregulated in new Act (except of dominant operators) Equipment approvals power replaced by Mutual Recognition approach Consumer issues to be covered by consumer contracts n Regulator intervenes only when contract provisions exhausted

. . . And get out of unnecessary areas o o o Most retail tariffs unregulated in new Act (except of dominant operators) Equipment approvals power replaced by Mutual Recognition approach Consumer issues to be covered by consumer contracts n Regulator intervenes only when contract provisions exhausted

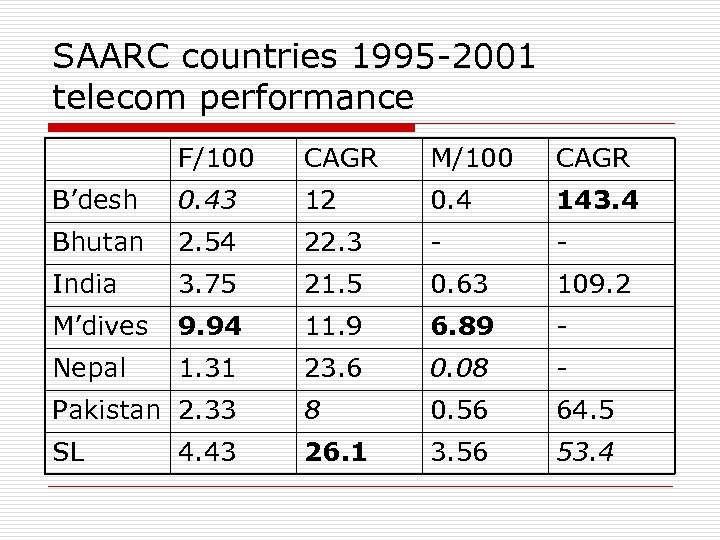

SAARC countries 1995 -2001 telecom performance F/100 CAGR M/100 CAGR B’desh 0. 43 12 0. 4 143. 4 Bhutan 2. 54 22. 3 - - India 3. 75 21. 5 0. 63 109. 2 M’dives 9. 94 11. 9 6. 89 - Nepal 1. 31 23. 6 0. 08 - Pakistan 2. 33 8 0. 56 64. 5 SL 26. 1 3. 56 53. 4 4. 43

SAARC countries 1995 -2001 telecom performance F/100 CAGR M/100 CAGR B’desh 0. 43 12 0. 4 143. 4 Bhutan 2. 54 22. 3 - - India 3. 75 21. 5 0. 63 109. 2 M’dives 9. 94 11. 9 6. 89 - Nepal 1. 31 23. 6 0. 08 - Pakistan 2. 33 8 0. 56 64. 5 SL 26. 1 3. 56 53. 4 4. 43