TECHNOLOGICAL INNOVATION INCENTIVES IN TIMES OF CRISIS 3 rd Annual International Conference on Business, Law & Economics – Athens, Greece

TECHNOLOGICAL INNOVATION INCENTIVES IN TIMES OF CRISIS 3 rd Annual International Conference on Business, Law & Economics – Athens, Greece

RESEARCHERS ACADEMIC AND PROFESSIONAL BACKGROUND Iggor Gomes ROCHA Henrique Domenici de ALENCAR Master in Economic Law – PUC (Brazil) Master in International Tax Law – Tilburg University (NL) and King’s College London (UK) Lawyer on Public Contracts Researcher on Brazilian Public Law Legal Advisor in Chamber of Deputies IFA Associate Researcher 2015 Wolters Kluwer Independent Service Provider

RESEARCHERS ACADEMIC AND PROFESSIONAL BACKGROUND Iggor Gomes ROCHA Henrique Domenici de ALENCAR Master in Economic Law – PUC (Brazil) Master in International Tax Law – Tilburg University (NL) and King’s College London (UK) Lawyer on Public Contracts Researcher on Brazilian Public Law Legal Advisor in Chamber of Deputies IFA Associate Researcher 2015 Wolters Kluwer Independent Service Provider

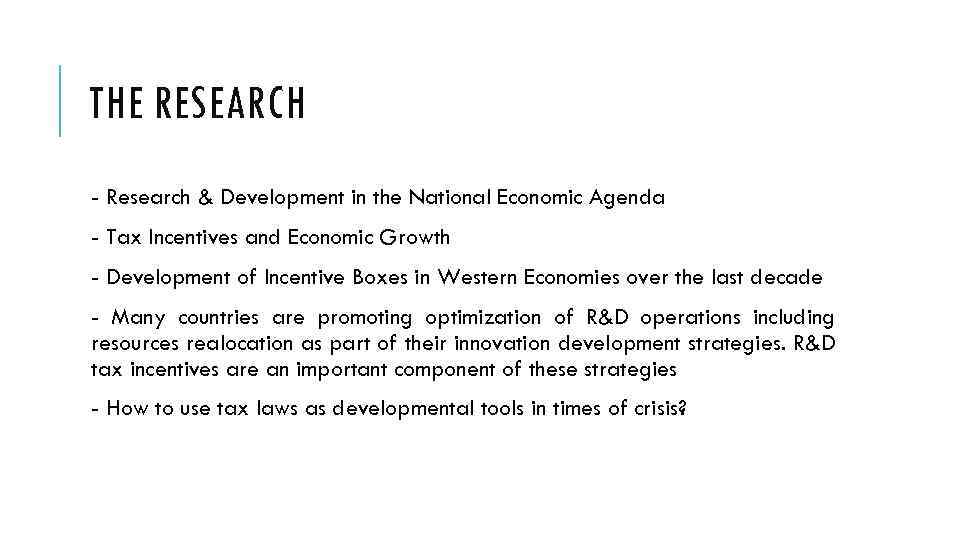

THE RESEARCH - Research & Development in the National Economic Agenda - Tax Incentives and Economic Growth - Development of Incentive Boxes in Western Economies over the last decade - Many countries are promoting optimization of R&D operations including resources realocation as part of their innovation development strategies. R&D tax incentives are an important component of these strategies - How to use tax laws as developmental tools in times of crisis?

THE RESEARCH - Research & Development in the National Economic Agenda - Tax Incentives and Economic Growth - Development of Incentive Boxes in Western Economies over the last decade - Many countries are promoting optimization of R&D operations including resources realocation as part of their innovation development strategies. R&D tax incentives are an important component of these strategies - How to use tax laws as developmental tools in times of crisis?

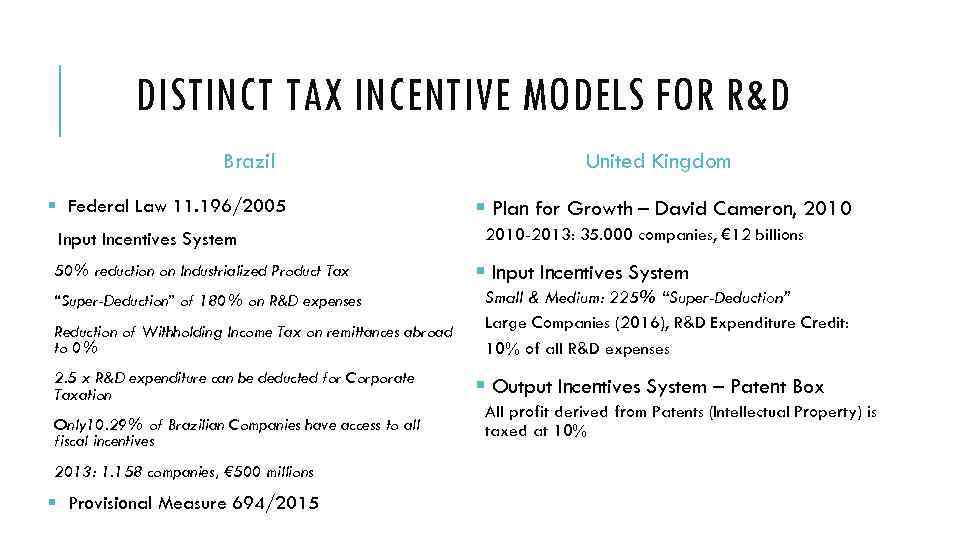

DISTINCT TAX INCENTIVE MODELS FOR R&D Brazil § Federal Law 11. 196/2005 Input Incentives System 50% reduction on Industrialized Product Tax “Super-Deduction” of 180% on R&D expenses Reduction of Withholding Income Tax on remittances abroad to 0% 2. 5 x R&D expenditure can be deducted for Corporate Taxation Only 10. 29% of Brazilian Companies have access to all fiscal incentives 2013: 1. 158 companies, € 500 millions § Provisional Measure 694/2015 United Kingdom § Plan for Growth – David Cameron, 2010 -2013: 35. 000 companies, € 12 billions § Input Incentives System Small & Medium: 225% “Super-Deduction” Large Companies (2016), R&D Expenditure Credit: 10% of all R&D expenses § Output Incentives System – Patent Box All profit derived from Patents (Intellectual Property) is taxed at 10%

DISTINCT TAX INCENTIVE MODELS FOR R&D Brazil § Federal Law 11. 196/2005 Input Incentives System 50% reduction on Industrialized Product Tax “Super-Deduction” of 180% on R&D expenses Reduction of Withholding Income Tax on remittances abroad to 0% 2. 5 x R&D expenditure can be deducted for Corporate Taxation Only 10. 29% of Brazilian Companies have access to all fiscal incentives 2013: 1. 158 companies, € 500 millions § Provisional Measure 694/2015 United Kingdom § Plan for Growth – David Cameron, 2010 -2013: 35. 000 companies, € 12 billions § Input Incentives System Small & Medium: 225% “Super-Deduction” Large Companies (2016), R&D Expenditure Credit: 10% of all R&D expenses § Output Incentives System – Patent Box All profit derived from Patents (Intellectual Property) is taxed at 10%

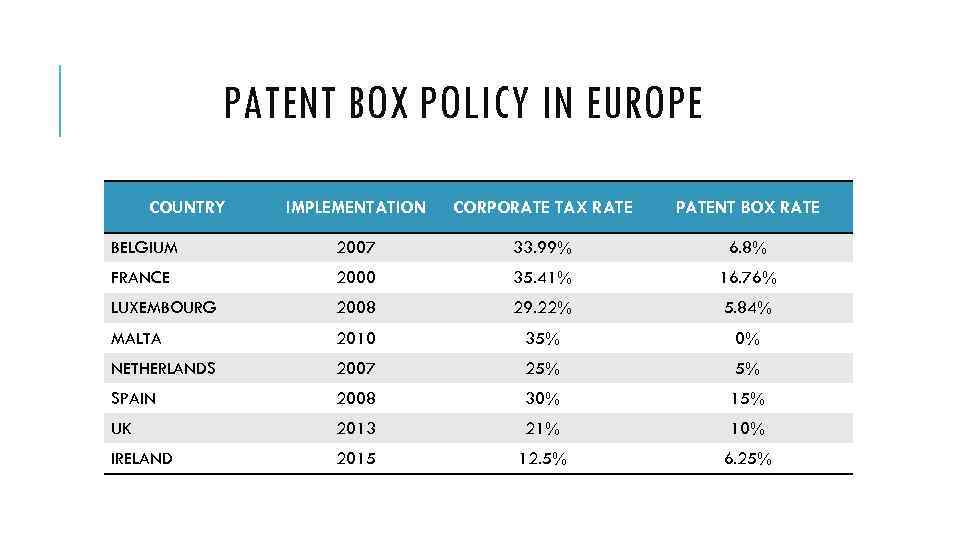

PATENT BOX POLICY IN EUROPE COUNTRY IMPLEMENTATION CORPORATE TAX RATE PATENT BOX RATE BELGIUM 2007 33. 99% 6. 8% FRANCE 2000 35. 41% 16. 76% LUXEMBOURG 2008 29. 22% 5. 84% MALTA 2010 35% 0% NETHERLANDS 2007 25% 5% SPAIN 2008 30% 15% UK 2013 21% 10% IRELAND 2015 12. 5% 6. 25%

PATENT BOX POLICY IN EUROPE COUNTRY IMPLEMENTATION CORPORATE TAX RATE PATENT BOX RATE BELGIUM 2007 33. 99% 6. 8% FRANCE 2000 35. 41% 16. 76% LUXEMBOURG 2008 29. 22% 5. 84% MALTA 2010 35% 0% NETHERLANDS 2007 25% 5% SPAIN 2008 30% 15% UK 2013 21% 10% IRELAND 2015 12. 5% 6. 25%

RECENT DEVELOPMENTS ü OECD – BASE EROSION AND PROFIT SHIFTING ü UNITED STATES PROPOSALS FOR PATENT BOX • ACTION 5 – HARMFUL TAX PRACTICES • “Priority on requiring substantial activity for preferential tax regimes” • INNOVATION PROMOTION ACT 2015 - Bipartisan legislative proposal - American Innovation Matters, US business lobby on Congress - Effective 10. 15% tax rate on Patent Box • • • NEXUS APPROACH Tax benefits in proportion to R&D expenses More R&D, More benefited income Existing regimes: 5 more years NON EU countries may adopt jurisdiction rules ü GERMANY ALSO CONSIDERING PATENT BOX – WAITING BEPS DEVELOPMENT

RECENT DEVELOPMENTS ü OECD – BASE EROSION AND PROFIT SHIFTING ü UNITED STATES PROPOSALS FOR PATENT BOX • ACTION 5 – HARMFUL TAX PRACTICES • “Priority on requiring substantial activity for preferential tax regimes” • INNOVATION PROMOTION ACT 2015 - Bipartisan legislative proposal - American Innovation Matters, US business lobby on Congress - Effective 10. 15% tax rate on Patent Box • • • NEXUS APPROACH Tax benefits in proportion to R&D expenses More R&D, More benefited income Existing regimes: 5 more years NON EU countries may adopt jurisdiction rules ü GERMANY ALSO CONSIDERING PATENT BOX – WAITING BEPS DEVELOPMENT

FIRST CONCLUSIONS - The emergence of patent box and other incentive regimes had an influence on the management of investments in IP - The high proportion of economic growth attributable to technological advances has escalated the competition amongst governments to attract research investments through the use of tax subsidies - Nations in crisis can’t allow the low fiscal income moment lead to cuts in such a crucial sector for the economy - Huge example for countries like Brazil: British companies and Government decided to increase R&D spending despite crisis

FIRST CONCLUSIONS - The emergence of patent box and other incentive regimes had an influence on the management of investments in IP - The high proportion of economic growth attributable to technological advances has escalated the competition amongst governments to attract research investments through the use of tax subsidies - Nations in crisis can’t allow the low fiscal income moment lead to cuts in such a crucial sector for the economy - Huge example for countries like Brazil: British companies and Government decided to increase R&D spending despite crisis