85d6499088bf0c9cf9a29d66733b157c.ppt

- Количество слайдов: 68

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009

Sub-Millisecond Market Access Colocation with the London Stock Exchange Group An overview of Exchange Hosting, the new high performance connectivity service available from the London Stock Exchange Group Andrew Bailey July 2009

Sub-Millisecond Market Access Colocation with the London Stock Exchange Group An overview of Exchange Hosting, the new high performance connectivity service available from the London Stock Exchange Group Andrew Bailey July 2009

Exchange Hosting ‐ Agenda • Strategic drivers for Exchange Hosting product • Exchange Hosting product overview – performance benefits – facility overview • Phase 2 delivery progress update – Project timelines – External market data provision – Dedicated connectivity options 3

Exchange Hosting ‐ Agenda • Strategic drivers for Exchange Hosting product • Exchange Hosting product overview – performance benefits – facility overview • Phase 2 delivery progress update – Project timelines – External market data provision – Dedicated connectivity options 3

Our Strategic Approach to Growing Liquidity Continuously drive market efficiency Attract more issuers Launch market-led new products & services Facilitate more trading Improve access Implement planned technology enhancements By working in partnership with the market as a whole Liquidity growth By more participants In more securities We remain focused on these objectives 4

Our Strategic Approach to Growing Liquidity Continuously drive market efficiency Attract more issuers Launch market-led new products & services Facilitate more trading Improve access Implement planned technology enhancements By working in partnership with the market as a whole Liquidity growth By more participants In more securities We remain focused on these objectives 4

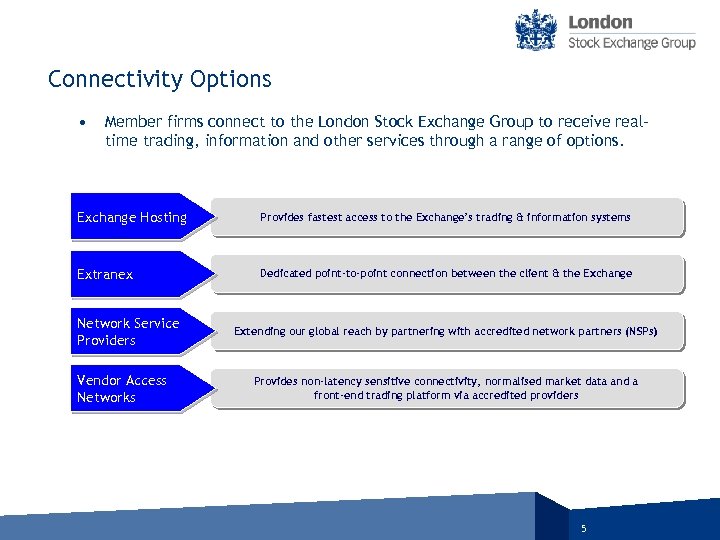

Connectivity Options • Member firms connect to the London Stock Exchange Group to receive real‐ time trading, information and other services through a range of options. Exchange Hosting Provides fastest access to the Exchange’s trading & information systems Extranex Dedicated point-to-point connection between the client & the Exchange Network Service Providers Vendor Access Networks Extending our global reach by partnering with accredited network partners (NSPs) Provides non-latency sensitive connectivity, normalised market data and a front-end trading platform via accredited providers 5

Connectivity Options • Member firms connect to the London Stock Exchange Group to receive real‐ time trading, information and other services through a range of options. Exchange Hosting Provides fastest access to the Exchange’s trading & information systems Extranex Dedicated point-to-point connection between the client & the Exchange Network Service Providers Vendor Access Networks Extending our global reach by partnering with accredited network partners (NSPs) Provides non-latency sensitive connectivity, normalised market data and a front-end trading platform via accredited providers 5

Exchange Hosting • • • As part of our ongoing commitment to improving market efficiency through liquidity generation and performance enhancements, we have introduced Exchange Hosting physically within the Exchange’s data centre ‐ as close as possible to the matching engines. Minimises the overall latency between the Exchange’s Trad. Elect and Infolect systems and the customer’s own trading applications: – – • • Transmission delay: physically close to the matching engines and infrastructure – • Propagation delay: reduced components for packets to pass through Processing delay: significantly less components for packets to be processed by Exchange Hosting covers access to all London Stock Exchange Group markets that are based in London, including MTA, Expandi, MOT and SEDEX. Service and facility managed entirely by the Exchange. Facility available to Trading Participants (including non‐members). 6

Exchange Hosting • • • As part of our ongoing commitment to improving market efficiency through liquidity generation and performance enhancements, we have introduced Exchange Hosting physically within the Exchange’s data centre ‐ as close as possible to the matching engines. Minimises the overall latency between the Exchange’s Trad. Elect and Infolect systems and the customer’s own trading applications: – – • • Transmission delay: physically close to the matching engines and infrastructure – • Propagation delay: reduced components for packets to pass through Processing delay: significantly less components for packets to be processed by Exchange Hosting covers access to all London Stock Exchange Group markets that are based in London, including MTA, Expandi, MOT and SEDEX. Service and facility managed entirely by the Exchange. Facility available to Trading Participants (including non‐members). 6

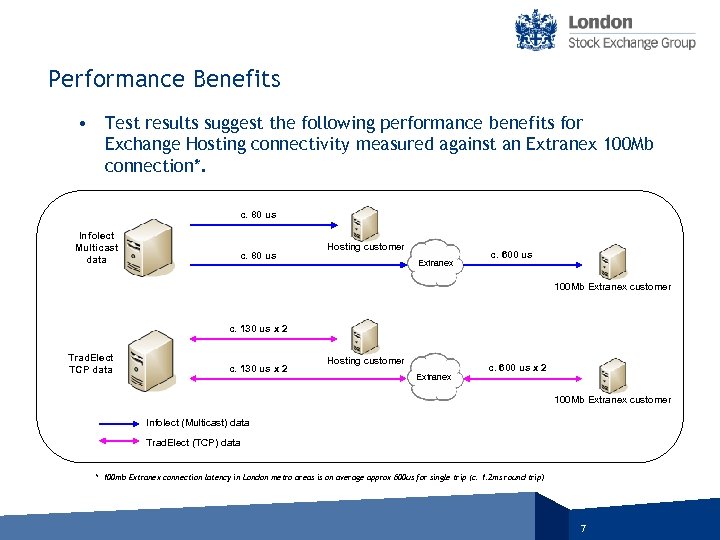

Performance Benefits • Test results suggest the following performance benefits for Exchange Hosting connectivity measured against an Extranex 100 Mb connection*. c. 80 us Infolect Multicast data c. 80 us Hosting customer Extranex c. 600 us 100 Mb Extranex customer c. 130 us x 2 Trad. Elect TCP data c. 130 us x 2 Hosting customer Extranex c. 600 us x 2 100 Mb Extranex customer Infolect (Multicast) data Trad. Elect (TCP) data * 100 mb Extranex connection latency in London metro areas is on average approx 600 us for single trip (c. 1. 2 ms round trip) 7

Performance Benefits • Test results suggest the following performance benefits for Exchange Hosting connectivity measured against an Extranex 100 Mb connection*. c. 80 us Infolect Multicast data c. 80 us Hosting customer Extranex c. 600 us 100 Mb Extranex customer c. 130 us x 2 Trad. Elect TCP data c. 130 us x 2 Hosting customer Extranex c. 600 us x 2 100 Mb Extranex customer Infolect (Multicast) data Trad. Elect (TCP) data * 100 mb Extranex connection latency in London metro areas is on average approx 600 us for single trip (c. 1. 2 ms round trip) 7

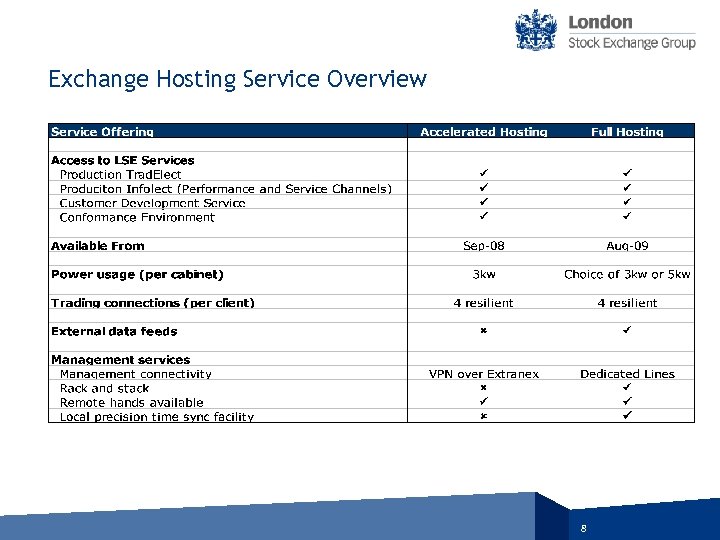

Exchange Hosting Service Overview 8

Exchange Hosting Service Overview 8

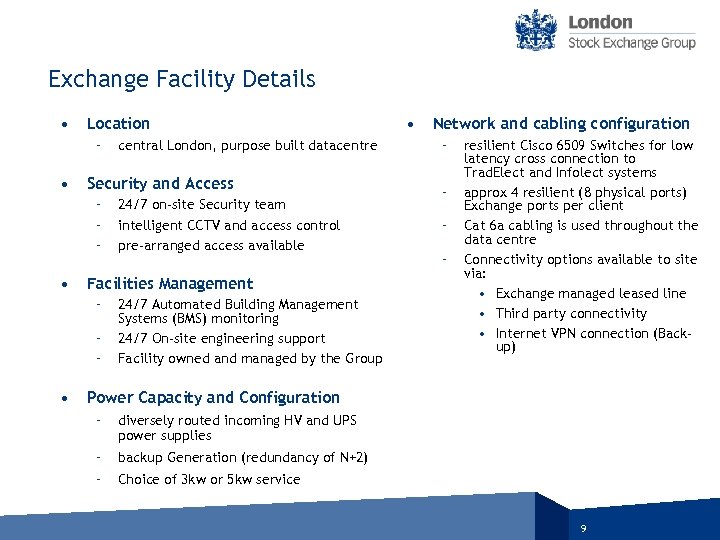

Exchange Facility Details • Location – • Security and Access – – – • 24/7 on‐site Security team intelligent CCTV and access control pre‐arranged access available Facilities Management – – – • central London, purpose built datacentre 24/7 Automated Building Management Systems (BMS) monitoring 24/7 On‐site engineering support Facility owned and managed by the Group • Network and cabling configuration – – resilient Cisco 6509 Switches for low latency cross connection to Trad. Elect and Infolect systems approx 4 resilient (8 physical ports) Exchange ports per client Cat 6 a cabling is used throughout the data centre Connectivity options available to site via: • Exchange managed leased line • Third party connectivity • Internet VPN connection (Back‐ up) Power Capacity and Configuration – diversely routed incoming HV and UPS power supplies – backup Generation (redundancy of N+2) – Choice of 3 kw or 5 kw service 9

Exchange Facility Details • Location – • Security and Access – – – • 24/7 on‐site Security team intelligent CCTV and access control pre‐arranged access available Facilities Management – – – • central London, purpose built datacentre 24/7 Automated Building Management Systems (BMS) monitoring 24/7 On‐site engineering support Facility owned and managed by the Group • Network and cabling configuration – – resilient Cisco 6509 Switches for low latency cross connection to Trad. Elect and Infolect systems approx 4 resilient (8 physical ports) Exchange ports per client Cat 6 a cabling is used throughout the data centre Connectivity options available to site via: • Exchange managed leased line • Third party connectivity • Internet VPN connection (Back‐ up) Power Capacity and Configuration – diversely routed incoming HV and UPS power supplies – backup Generation (redundancy of N+2) – Choice of 3 kw or 5 kw service 9

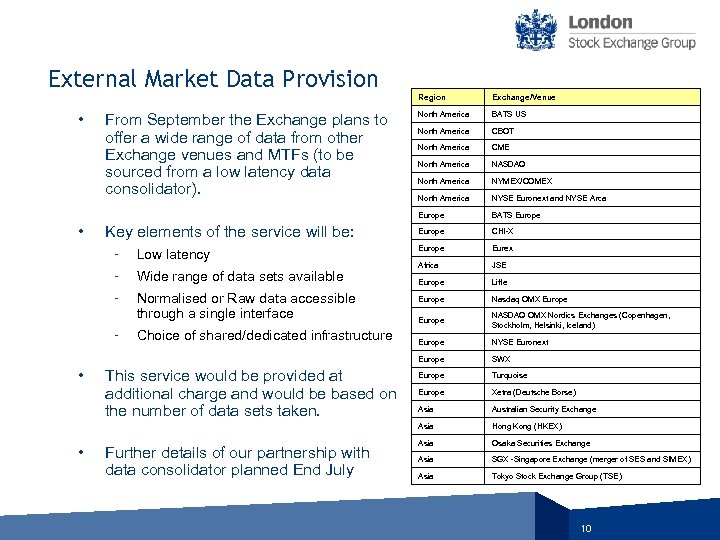

External Market Data Provision Region ‐ Low latency ‐ Wide range of data sets available ‐ Normalised or Raw data accessible through a single interface ‐ • • Choice of shared/dedicated infrastructure This service would be provided at additional charge and would be based on the number of data sets taken. Further details of our partnership with data consolidator planned End July North America CBOT North America CME North America NASDAQ North America NYMEX/COMEX North America NYSE Euronext and NYSE Arca BATS Europe CHI-X Europe Eurex Africa JSE Europe Liffe Europe Nasdaq OMX Europe NASDAQ OMX Nordics Exchanges (Copenhagen, Stockholm, Helsinki, Iceland) Europe NYSE Euronext SWX Europe Turquoise Europe Xetra (Deutsche Borse) Asia Australian Security Exchange Asia Key elements of the service will be: BATS US Europe • From September the Exchange plans to offer a wide range of data from other Exchange venues and MTFs (to be sourced from a low latency data consolidator). North America Europe • Exchange/Venue Hong Kong (HKEX) Asia Osaka Securities Exchange Asia SGX -Singapore Exchange (merger of SES and SIMEX) Asia Tokyo Stock Exchange Group (TSE) 10

External Market Data Provision Region ‐ Low latency ‐ Wide range of data sets available ‐ Normalised or Raw data accessible through a single interface ‐ • • Choice of shared/dedicated infrastructure This service would be provided at additional charge and would be based on the number of data sets taken. Further details of our partnership with data consolidator planned End July North America CBOT North America CME North America NASDAQ North America NYMEX/COMEX North America NYSE Euronext and NYSE Arca BATS Europe CHI-X Europe Eurex Africa JSE Europe Liffe Europe Nasdaq OMX Europe NASDAQ OMX Nordics Exchanges (Copenhagen, Stockholm, Helsinki, Iceland) Europe NYSE Euronext SWX Europe Turquoise Europe Xetra (Deutsche Borse) Asia Australian Security Exchange Asia Key elements of the service will be: BATS US Europe • From September the Exchange plans to offer a wide range of data from other Exchange venues and MTFs (to be sourced from a low latency data consolidator). North America Europe • Exchange/Venue Hong Kong (HKEX) Asia Osaka Securities Exchange Asia SGX -Singapore Exchange (merger of SES and SIMEX) Asia Tokyo Stock Exchange Group (TSE) 10

Dedicated Hosting Connectivity • The Exchange is planning to offer a choice of dedicated connectivity options for Exchange Hosting connectivity: 1. Option 1 ‐ Exchange managed solution – Single point of contact for all Hosting services – Resilient connection (two diversely routed active lines) – Low latency – Choice of connection sizes (likely to be 10 Mb, 100 Mb, 1 Gb and 10 Gb) 2. Option 2 ‐ Customers own provisioned lines – Client choice of connectivity provider – Low latency – Choice of connection sizes (and type) 3. Option 3 – 1 Mb internet connectivity – Basic connectivity option offered as part of Exchange Hosting – Single point of contact for all Hosting services and escalation 11

Dedicated Hosting Connectivity • The Exchange is planning to offer a choice of dedicated connectivity options for Exchange Hosting connectivity: 1. Option 1 ‐ Exchange managed solution – Single point of contact for all Hosting services – Resilient connection (two diversely routed active lines) – Low latency – Choice of connection sizes (likely to be 10 Mb, 100 Mb, 1 Gb and 10 Gb) 2. Option 2 ‐ Customers own provisioned lines – Client choice of connectivity provider – Low latency – Choice of connection sizes (and type) 3. Option 3 – 1 Mb internet connectivity – Basic connectivity option offered as part of Exchange Hosting – Single point of contact for all Hosting services and escalation 11

Current Delivery Status • Phase 1 (Accelerated Hosting) – Launched in September 2008 • Phase 2 (Full Hosting) – Launch planned for Monday 3 rd August (dependant on customer readiness) – High demand for space from new and existing clients – Currently on‐boarding new clients in to the Phase 2 space – Migration of Phase 1 clients to new data hall – External Market Data – available from September – Exchange Managed Dedicated Connectivity – available from September – Local precision time sync solution – available from August 12

Current Delivery Status • Phase 1 (Accelerated Hosting) – Launched in September 2008 • Phase 2 (Full Hosting) – Launch planned for Monday 3 rd August (dependant on customer readiness) – High demand for space from new and existing clients – Currently on‐boarding new clients in to the Phase 2 space – Migration of Phase 1 clients to new data hall – External Market Data – available from September – Exchange Managed Dedicated Connectivity – available from September – Local precision time sync solution – available from August 12

Further Information • If you are interested in Colocation/Hosting then please contact Andrew Bailey on +44 (0) 207 797 4114 or via email: abailey@londonstockexchange. com 10 Paternoster Square London EC 4 M 7 LS T +44 (0)20 7797 1000 www. londonstockexchangegroup. com

Further Information • If you are interested in Colocation/Hosting then please contact Andrew Bailey on +44 (0) 207 797 4114 or via email: abailey@londonstockexchange. com 10 Paternoster Square London EC 4 M 7 LS T +44 (0)20 7797 1000 www. londonstockexchangegroup. com

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009

Market Data Optimisation 2009 – Phase II Overview of changes Ollie Cadman Date: 10/07/2009 Author:

Market Data Optimisation 2009 – Phase II Overview of changes Ollie Cadman Date: 10/07/2009 Author:

Introduction • Market Data Optimisation 2009 went live in April and aligned Service Channels with the liquidity aligned structure of Performance Channels, along with a number of other enhancements • In May the Group consulted on a proposed second phase to MDO, which aims to deliver further enhancements and a more diverse distribution of instruments across channels • The existing Service and Performance Channel structure will be expanded to incorporate the reserved channels, providing improved load balancing and increased simultaneous publishing MDO Phase II will deliver the following benefits: • Improvements in the parallel distribution of real time messages • Optimised channel configurations, ensuring a consistent delivery approach across all markets and services 16

Introduction • Market Data Optimisation 2009 went live in April and aligned Service Channels with the liquidity aligned structure of Performance Channels, along with a number of other enhancements • In May the Group consulted on a proposed second phase to MDO, which aims to deliver further enhancements and a more diverse distribution of instruments across channels • The existing Service and Performance Channel structure will be expanded to incorporate the reserved channels, providing improved load balancing and increased simultaneous publishing MDO Phase II will deliver the following benefits: • Improvements in the parallel distribution of real time messages • Optimised channel configurations, ensuring a consistent delivery approach across all markets and services 16

Scope The confirmed scope items of Phase II are: • Additional load balancing of instruments across the ‘reserved’ Service and Performance channels • Reduction in idle poll interval from 15 to 5 seconds, • Transfer of all Covered Warrants market data messages (some ‘added value’ and ‘trade reports’ message types) to appropriate Covered Warrants Service/Performance Channels, • Rename of Px 3 channels to Px 2 to mirror Service Channel structure, • Decommissioning of the following legacy Level 1 Plus messages: — 5 AB Return Measures — 5 MV Market Share Top 5 — 5 AF Alpha/Betas — 5 AP Average Cumulative Volumes, • Decommissioning of the 5 UP Uncrossing Price message from the Level 2 channels. 17

Scope The confirmed scope items of Phase II are: • Additional load balancing of instruments across the ‘reserved’ Service and Performance channels • Reduction in idle poll interval from 15 to 5 seconds, • Transfer of all Covered Warrants market data messages (some ‘added value’ and ‘trade reports’ message types) to appropriate Covered Warrants Service/Performance Channels, • Rename of Px 3 channels to Px 2 to mirror Service Channel structure, • Decommissioning of the following legacy Level 1 Plus messages: — 5 AB Return Measures — 5 MV Market Share Top 5 — 5 AF Alpha/Betas — 5 AP Average Cumulative Volumes, • Decommissioning of the 5 UP Uncrossing Price message from the Level 2 channels. 17

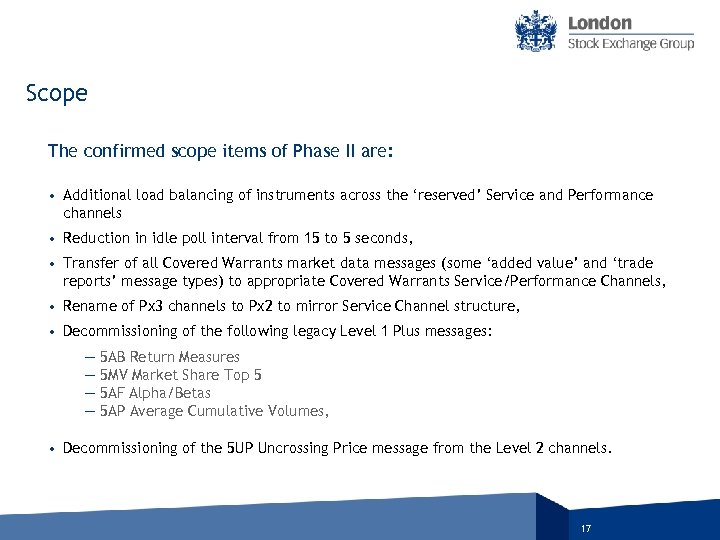

Channel distribution Channel Structure - Existing S/Pax SETS: FTSE 100 > 1% S/Pbx SETS: FTSE 100 < 1% S/Pcx SETS: FTSE 250 1 S/Pdx SETS: FTSE 250 2 S/Pex ETFs, ETCs & Specialists S/Pfx SETS, SETSqx, SEAQ, IRS & Misc. S/Pax FTSE 100 Group 1 S/Pgx Reserved for future use S/Pbx FTSE 100 Group 2 S/Phx Reserved for future use S/Pix Reserved for future use S/Pcx FTSE 100 Group 3 S/Pjx Reserved for future use S/Pdx FTSE 100 Group 4 S/Pex FTSE 100 Group 5 S/Pfx STMM, SET 2, SET 3, SSMM, SSMU, AMSM Group 1 S/Pgx STMM, SET 2, SET 3, SSMM, SSMU, AMSM Group 2 S/Phx ETFs, ETCs, Group 1 S/Pix ETFs, ETCs Group 2 S/Pjx SETSqx, SEAQ, SFM and Miscellaneous Channel Structure – Future (example) 18

Channel distribution Channel Structure - Existing S/Pax SETS: FTSE 100 > 1% S/Pbx SETS: FTSE 100 < 1% S/Pcx SETS: FTSE 250 1 S/Pdx SETS: FTSE 250 2 S/Pex ETFs, ETCs & Specialists S/Pfx SETS, SETSqx, SEAQ, IRS & Misc. S/Pax FTSE 100 Group 1 S/Pgx Reserved for future use S/Pbx FTSE 100 Group 2 S/Phx Reserved for future use S/Pix Reserved for future use S/Pcx FTSE 100 Group 3 S/Pjx Reserved for future use S/Pdx FTSE 100 Group 4 S/Pex FTSE 100 Group 5 S/Pfx STMM, SET 2, SET 3, SSMM, SSMU, AMSM Group 1 S/Pgx STMM, SET 2, SET 3, SSMM, SSMU, AMSM Group 2 S/Phx ETFs, ETCs, Group 1 S/Pix ETFs, ETCs Group 2 S/Pjx SETSqx, SEAQ, SFM and Miscellaneous Channel Structure – Future (example) 18

Timelines August Customer Development Service July Service & Technical Description September Production 19

Timelines August Customer Development Service July Service & Technical Description September Production 19

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009

Update on FIX 5. 0 Interface & Hidden Order Functionality Author: Stuart English Date: 10 July 2009

Update on FIX 5. 0 Interface & Hidden Order Functionality Author: Stuart English Date: 10 July 2009

Introduction • • • FIX 5. 0 Project Update Performance Comparison: FIX Vs Native Functionality Supported on FIX 5. 0 and Native Hidden Order Functionality – New Native Messages Next Steps 22

Introduction • • • FIX 5. 0 Project Update Performance Comparison: FIX Vs Native Functionality Supported on FIX 5. 0 and Native Hidden Order Functionality – New Native Messages Next Steps 22

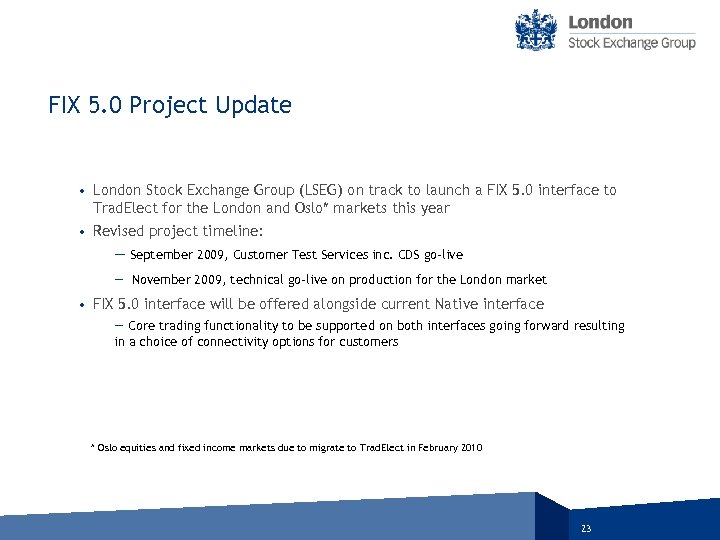

FIX 5. 0 Project Update • London Stock Exchange Group (LSEG) on track to launch a FIX 5. 0 interface to Trad. Elect for the London and Oslo* markets this year • Revised project timeline: — September 2009, Customer Test Services inc. CDS go‐live — November 2009, technical go‐live on production for the London market • FIX 5. 0 interface will be offered alongside current Native interface — Core trading functionality to be supported on both interfaces going forward resulting in a choice of connectivity options for customers * Oslo equities and fixed income markets due to migrate to Trad. Elect in February 2010 23

FIX 5. 0 Project Update • London Stock Exchange Group (LSEG) on track to launch a FIX 5. 0 interface to Trad. Elect for the London and Oslo* markets this year • Revised project timeline: — September 2009, Customer Test Services inc. CDS go‐live — November 2009, technical go‐live on production for the London market • FIX 5. 0 interface will be offered alongside current Native interface — Core trading functionality to be supported on both interfaces going forward resulting in a choice of connectivity options for customers * Oslo equities and fixed income markets due to migrate to Trad. Elect in February 2010 23

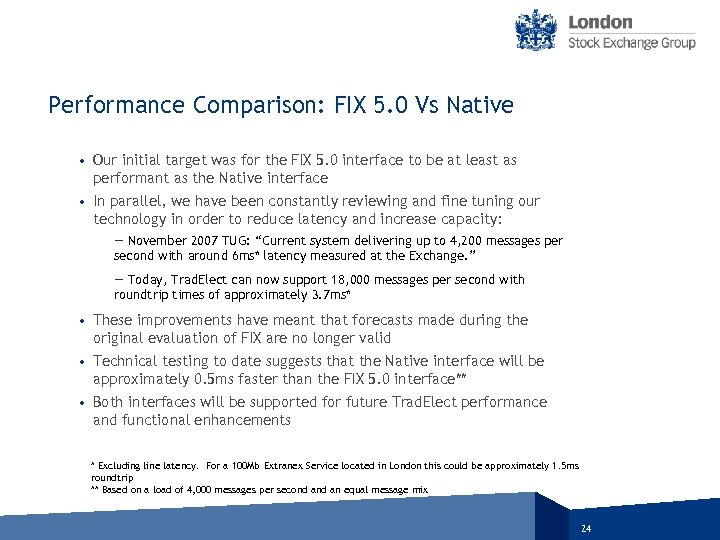

Performance Comparison: FIX 5. 0 Vs Native • Our initial target was for the FIX 5. 0 interface to be at least as performant as the Native interface • In parallel, we have been constantly reviewing and fine tuning our technology in order to reduce latency and increase capacity: — November 2007 TUG: “Current system delivering up to 4, 200 messages per second with around 6 ms* latency measured at the Exchange. ” — Today, Trad. Elect can now support 18, 000 messages per second with roundtrip times of approximately 3. 7 ms* • These improvements have meant that forecasts made during the original evaluation of FIX are no longer valid • Technical testing to date suggests that the Native interface will be approximately 0. 5 ms faster than the FIX 5. 0 interface** • Both interfaces will be supported for future Trad. Elect performance and functional enhancements * Excluding line latency. For a 100 Mb Extranex Service located in London this could be approximately 1. 5 ms roundtrip ** Based on a load of 4, 000 messages per second an equal message mix 24

Performance Comparison: FIX 5. 0 Vs Native • Our initial target was for the FIX 5. 0 interface to be at least as performant as the Native interface • In parallel, we have been constantly reviewing and fine tuning our technology in order to reduce latency and increase capacity: — November 2007 TUG: “Current system delivering up to 4, 200 messages per second with around 6 ms* latency measured at the Exchange. ” — Today, Trad. Elect can now support 18, 000 messages per second with roundtrip times of approximately 3. 7 ms* • These improvements have meant that forecasts made during the original evaluation of FIX are no longer valid • Technical testing to date suggests that the Native interface will be approximately 0. 5 ms faster than the FIX 5. 0 interface** • Both interfaces will be supported for future Trad. Elect performance and functional enhancements * Excluding line latency. For a 100 Mb Extranex Service located in London this could be approximately 1. 5 ms roundtrip ** Based on a load of 4, 000 messages per second an equal message mix 24

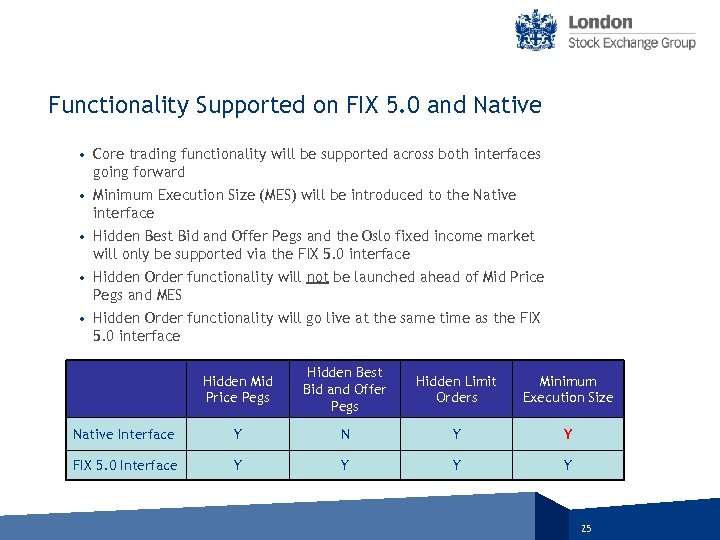

Functionality Supported on FIX 5. 0 and Native • Core trading functionality will be supported across both interfaces going forward • Minimum Execution Size (MES) will be introduced to the Native interface • Hidden Best Bid and Offer Pegs and the Oslo fixed income market will only be supported via the FIX 5. 0 interface • Hidden Order functionality will not be launched ahead of Mid Price Pegs and MES • Hidden Order functionality will go live at the same time as the FIX 5. 0 interface Hidden Mid Price Pegs Hidden Best Bid and Offer Pegs Hidden Limit Orders Minimum Execution Size Native Interface Y N Y Y FIX 5. 0 Interface Y Y 25

Functionality Supported on FIX 5. 0 and Native • Core trading functionality will be supported across both interfaces going forward • Minimum Execution Size (MES) will be introduced to the Native interface • Hidden Best Bid and Offer Pegs and the Oslo fixed income market will only be supported via the FIX 5. 0 interface • Hidden Order functionality will not be launched ahead of Mid Price Pegs and MES • Hidden Order functionality will go live at the same time as the FIX 5. 0 interface Hidden Mid Price Pegs Hidden Best Bid and Offer Pegs Hidden Limit Orders Minimum Execution Size Native Interface Y N Y Y FIX 5. 0 Interface Y Y 25

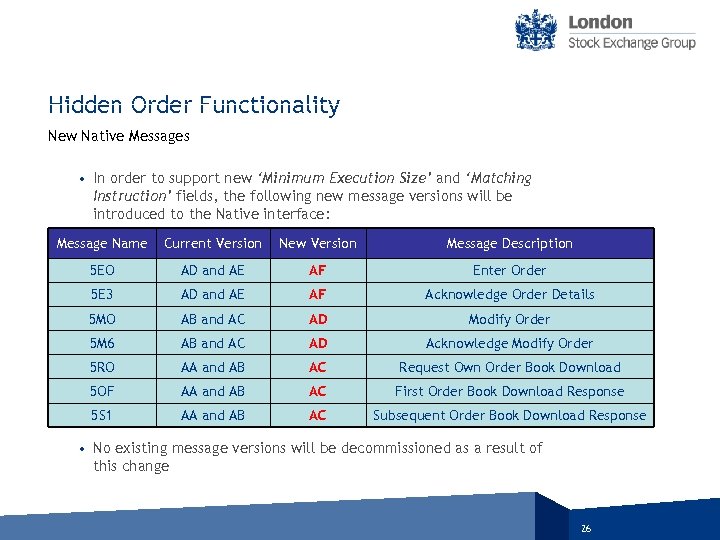

Hidden Order Functionality New Native Messages • In order to support new ‘Minimum Execution Size’ and ‘Matching Instruction’ fields, the following new message versions will be introduced to the Native interface: Message Name Current Version New Version Message Description 5 EO AD and AE AF Enter Order 5 E 3 AD and AE AF Acknowledge Order Details 5 MO AB and AC AD Modify Order 5 M 6 AB and AC AD Acknowledge Modify Order 5 RO AA and AB AC Request Own Order Book Download 5 OF AA and AB AC First Order Book Download Response 5 S 1 AA and AB AC Subsequent Order Book Download Response • No existing message versions will be decommissioned as a result of this change 26

Hidden Order Functionality New Native Messages • In order to support new ‘Minimum Execution Size’ and ‘Matching Instruction’ fields, the following new message versions will be introduced to the Native interface: Message Name Current Version New Version Message Description 5 EO AD and AE AF Enter Order 5 E 3 AD and AE AF Acknowledge Order Details 5 MO AB and AC AD Modify Order 5 M 6 AB and AC AD Acknowledge Modify Order 5 RO AA and AB AC Request Own Order Book Download 5 OF AA and AB AC First Order Book Download Response 5 S 1 AA and AB AC Subsequent Order Book Download Response • No existing message versions will be decommissioned as a result of this change 26

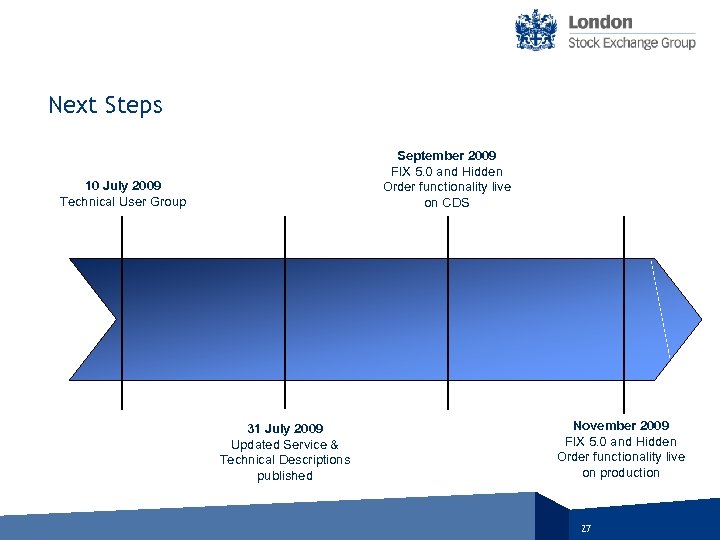

Next Steps September 2009 FIX 5. 0 and Hidden Order functionality live on CDS 10 July 2009 Technical User Group 31 July 2009 Updated Service & Technical Descriptions published November 2009 FIX 5. 0 and Hidden Order functionality live on production 27

Next Steps September 2009 FIX 5. 0 and Hidden Order functionality live on CDS 10 July 2009 Technical User Group 31 July 2009 Updated Service & Technical Descriptions published November 2009 FIX 5. 0 and Hidden Order functionality live on production 27

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009

10 th & 16 th July: London Stock Exchange Technical User Group Baikal Update Mark Ryland, Chief Technology Officer, Baikal Investment for experts

10 th & 16 th July: London Stock Exchange Technical User Group Baikal Update Mark Ryland, Chief Technology Officer, Baikal Investment for experts

Content • Baikal product overview • Relevance/context of dark pools • Baikal technology platform, partners & connectivity • Delivery plan • Summary 30

Content • Baikal product overview • Relevance/context of dark pools • Baikal technology platform, partners & connectivity • Delivery plan • Summary 30

Baikal product overview Investment for experts

Baikal product overview Investment for experts

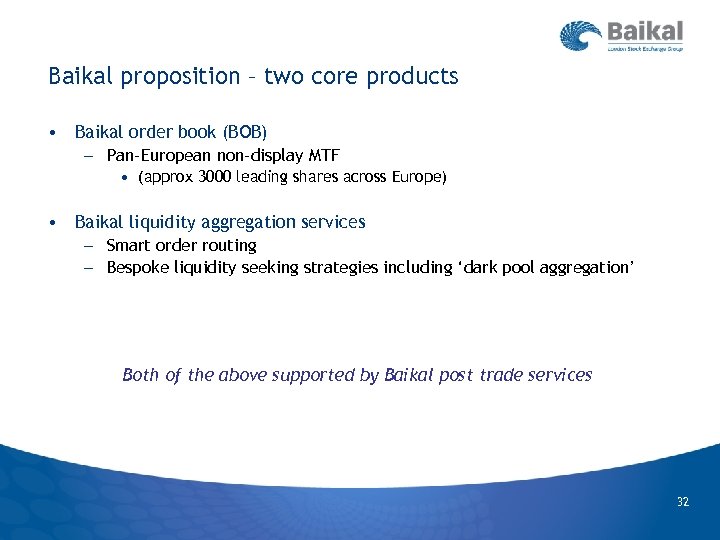

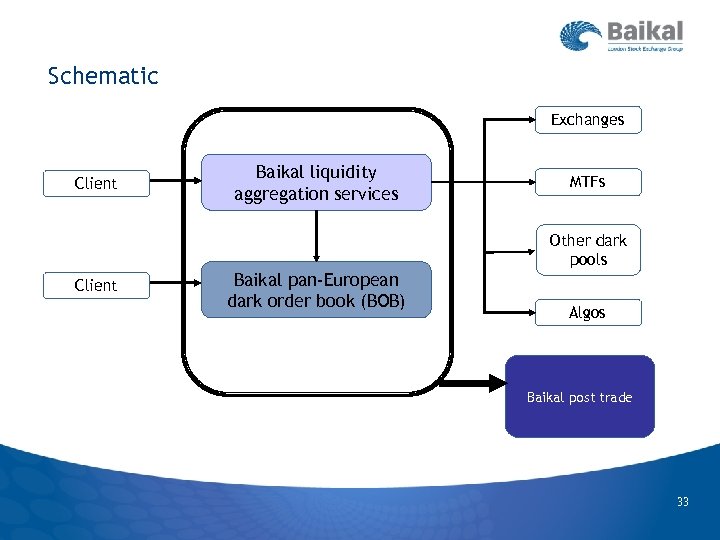

Baikal proposition – two core products • Baikal order book (BOB) – Pan‐European non‐display MTF • (approx 3000 leading shares across Europe) • Baikal liquidity aggregation services – Smart order routing – Bespoke liquidity seeking strategies including ‘dark pool aggregation’ Both of the above supported by Baikal post trade services 32

Baikal proposition – two core products • Baikal order book (BOB) – Pan‐European non‐display MTF • (approx 3000 leading shares across Europe) • Baikal liquidity aggregation services – Smart order routing – Bespoke liquidity seeking strategies including ‘dark pool aggregation’ Both of the above supported by Baikal post trade services 32

Schematic Exchanges Client Baikal liquidity aggregation services Baikal pan‐European dark order book (BOB) MTFs Other dark pools Algos Baikal post trade 33

Schematic Exchanges Client Baikal liquidity aggregation services Baikal pan‐European dark order book (BOB) MTFs Other dark pools Algos Baikal post trade 33

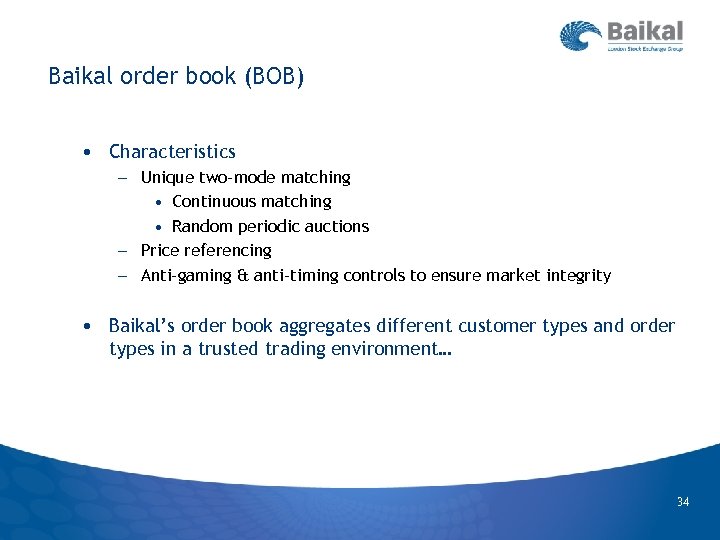

Baikal order book (BOB) • Characteristics – Unique two‐mode matching • Continuous matching • Random periodic auctions – Price referencing – Anti‐gaming & anti‐timing controls to ensure market integrity • Baikal’s order book aggregates different customer types and order types in a trusted trading environment… 34

Baikal order book (BOB) • Characteristics – Unique two‐mode matching • Continuous matching • Random periodic auctions – Price referencing – Anti‐gaming & anti‐timing controls to ensure market integrity • Baikal’s order book aggregates different customer types and order types in a trusted trading environment… 34

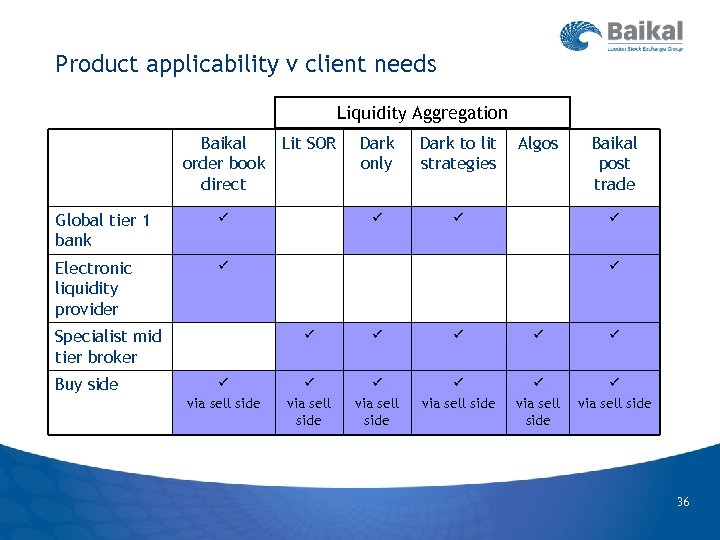

Liquidity aggregation strategies…examples • Lit smart order routing (aggressive) – Sweep (multi pass), post and dynamically re‐sweep • Dark only (passive) – Sweep, post, periodically re‐sweep – ‘Dark pool aggregation’ • Dark + lit (passive & aggressive) – Sweep dark, sweep lit (multi‐pass), post part dark/part lit, dynamically re‐ sweep – Aggressiveness controls level of participation in lit venues • Others… 35

Liquidity aggregation strategies…examples • Lit smart order routing (aggressive) – Sweep (multi pass), post and dynamically re‐sweep • Dark only (passive) – Sweep, post, periodically re‐sweep – ‘Dark pool aggregation’ • Dark + lit (passive & aggressive) – Sweep dark, sweep lit (multi‐pass), post part dark/part lit, dynamically re‐ sweep – Aggressiveness controls level of participation in lit venues • Others… 35

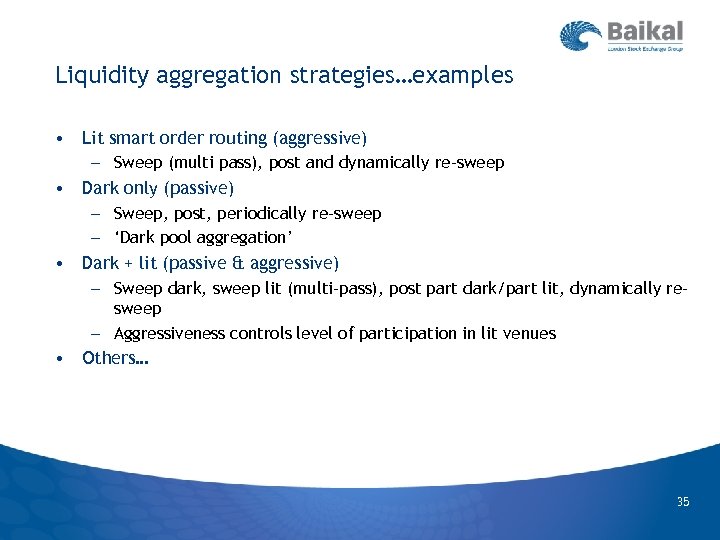

Product applicability v client needs Liquidity Aggregation Baikal Lit SOR order book direct Global tier 1 bank Electronic liquidity provider Dark to lit strategies Dark only Algos Specialist mid tier broker Buy side Baikal post trade via sell side via sell side 36

Product applicability v client needs Liquidity Aggregation Baikal Lit SOR order book direct Global tier 1 bank Electronic liquidity provider Dark to lit strategies Dark only Algos Specialist mid tier broker Buy side Baikal post trade via sell side via sell side 36

Relevance/context of dark pools Investment for experts

Relevance/context of dark pools Investment for experts

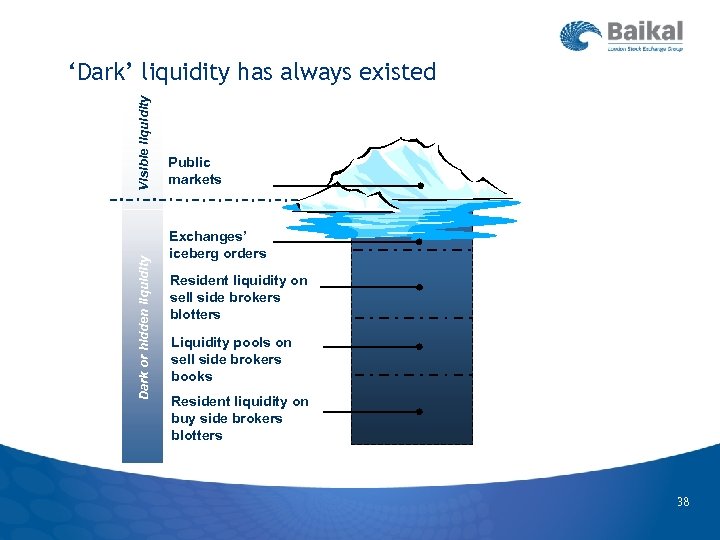

Dark or hidden liquidity Visible liquidity ‘Dark’ liquidity has always existed Public markets Exchanges’ iceberg orders Resident liquidity on sell side brokers blotters Liquidity pools on sell side brokers books Resident liquidity on buy side brokers blotters 38

Dark or hidden liquidity Visible liquidity ‘Dark’ liquidity has always existed Public markets Exchanges’ iceberg orders Resident liquidity on sell side brokers blotters Liquidity pools on sell side brokers books Resident liquidity on buy side brokers blotters 38

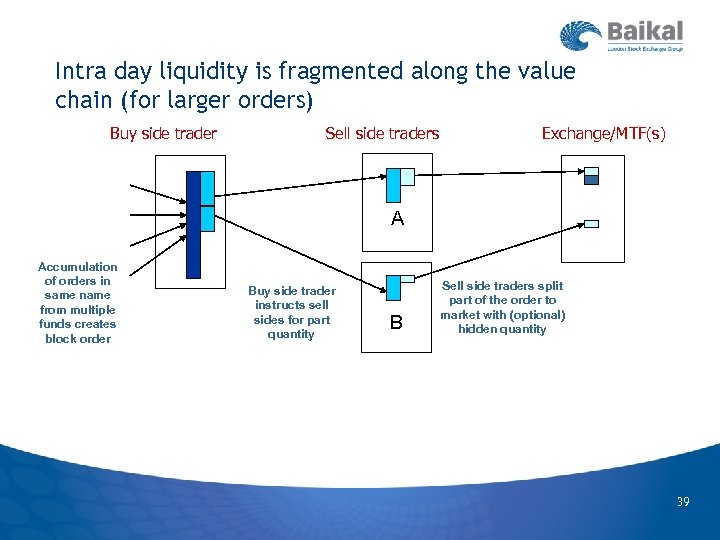

Intra day liquidity is fragmented along the value chain (for larger orders) Buy side trader Sell side traders Exchange/MTF(s) A Accumulation of orders in same name from multiple funds creates block order Buy side trader instructs sell sides for part quantity B Sell side traders split part of the order to market with (optional) hidden quantity 39

Intra day liquidity is fragmented along the value chain (for larger orders) Buy side trader Sell side traders Exchange/MTF(s) A Accumulation of orders in same name from multiple funds creates block order Buy side trader instructs sell sides for part quantity B Sell side traders split part of the order to market with (optional) hidden quantity 39

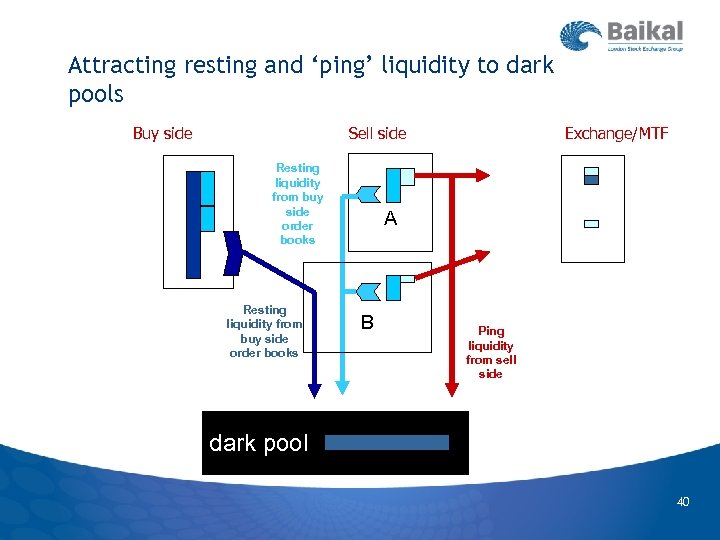

Attracting resting and ‘ping’ liquidity to dark pools Buy side Sell side Resting liquidity from buy side order books Exchange/MTF A B Ping liquidity from sell side dark pool 40

Attracting resting and ‘ping’ liquidity to dark pools Buy side Sell side Resting liquidity from buy side order books Exchange/MTF A B Ping liquidity from sell side dark pool 40

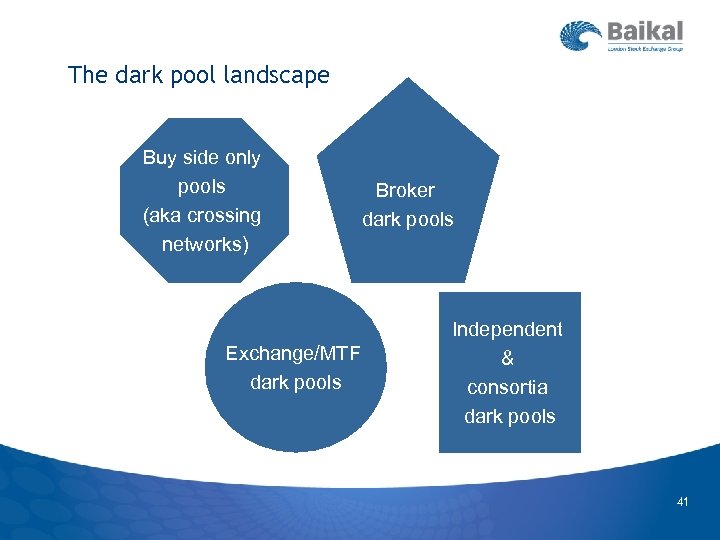

The dark pool landscape Buy side only pools (aka crossing networks) Exchange/MTF dark pools Broker dark pools Independent & consortia dark pools 41

The dark pool landscape Buy side only pools (aka crossing networks) Exchange/MTF dark pools Broker dark pools Independent & consortia dark pools 41

Dark pools seek to automate and improve efficiency • Huge opportunity to match dark liquidity in dark pools • Dark pools seek to deliver – Anonymity – No market impact – Improved execution price (typically mid‐price) – Economic operation • This concept invented and proliferated in the US over the last 5 years 42

Dark pools seek to automate and improve efficiency • Huge opportunity to match dark liquidity in dark pools • Dark pools seek to deliver – Anonymity – No market impact – Improved execution price (typically mid‐price) – Economic operation • This concept invented and proliferated in the US over the last 5 years 42

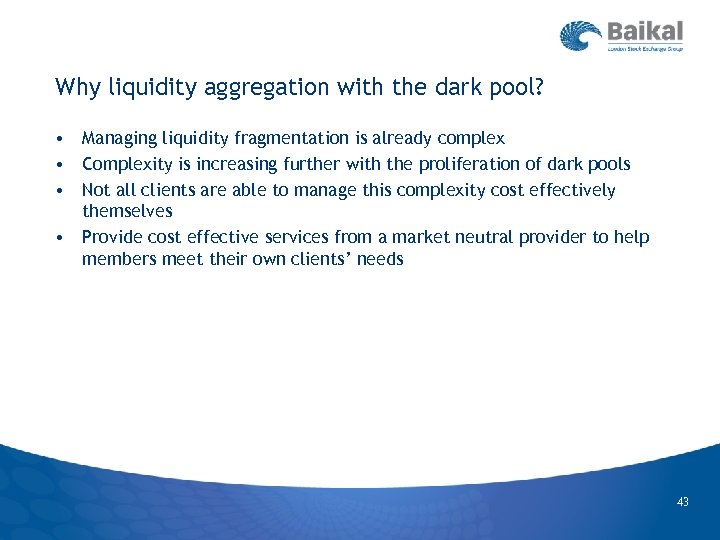

Why liquidity aggregation with the dark pool? • Managing liquidity fragmentation is already complex • Complexity is increasing further with the proliferation of dark pools • Not all clients are able to manage this complexity cost effectively themselves • Provide cost effective services from a market neutral provider to help members meet their own clients’ needs 43

Why liquidity aggregation with the dark pool? • Managing liquidity fragmentation is already complex • Complexity is increasing further with the proliferation of dark pools • Not all clients are able to manage this complexity cost effectively themselves • Provide cost effective services from a market neutral provider to help members meet their own clients’ needs 43

Technology platform & connectivity Investment for experts

Technology platform & connectivity Investment for experts

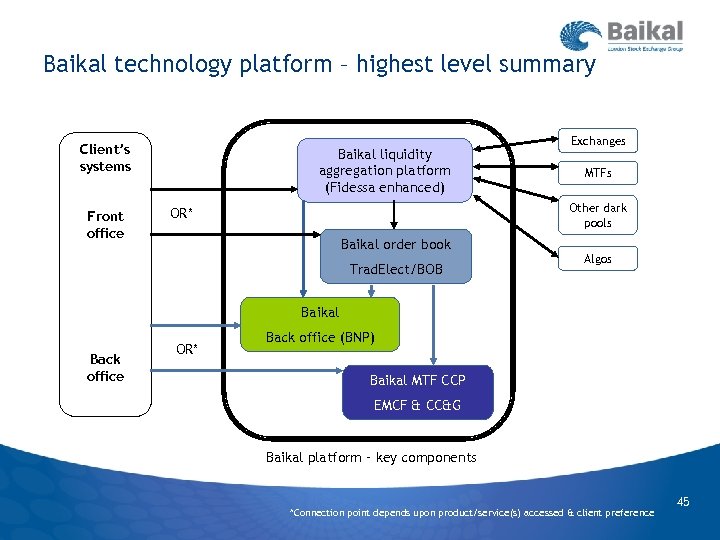

Baikal technology platform – highest level summary Client’s systems Front office Baikal liquidity aggregation platform (Fidessa enhanced) Exchanges MTFs Other dark pools OR* Baikal order book Trad. Elect/BOB Algos Baikal Back office OR* Back office (BNP) Baikal MTF CCP EMCF & CC&G Baikal platform – key components *Connection point depends upon product/service(s) accessed & client preference 45

Baikal technology platform – highest level summary Client’s systems Front office Baikal liquidity aggregation platform (Fidessa enhanced) Exchanges MTFs Other dark pools OR* Baikal order book Trad. Elect/BOB Algos Baikal Back office OR* Back office (BNP) Baikal MTF CCP EMCF & CC&G Baikal platform – key components *Connection point depends upon product/service(s) accessed & client preference 45

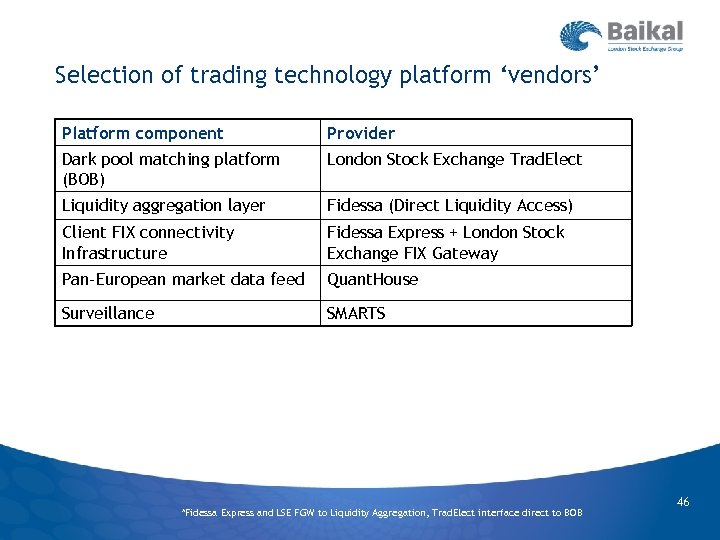

Selection of trading technology platform ‘vendors’ Platform component Provider Dark pool matching platform (BOB) London Stock Exchange Trad. Elect Liquidity aggregation layer Fidessa (Direct Liquidity Access) Client FIX connectivity Infrastructure Fidessa Express + London Stock Exchange FIX Gateway Pan‐European market data feed Quant. House Surveillance SMARTS *Fidessa Express and LSE FGW to Liquidity Aggregation, Trad. Elect interface direct to BOB 46

Selection of trading technology platform ‘vendors’ Platform component Provider Dark pool matching platform (BOB) London Stock Exchange Trad. Elect Liquidity aggregation layer Fidessa (Direct Liquidity Access) Client FIX connectivity Infrastructure Fidessa Express + London Stock Exchange FIX Gateway Pan‐European market data feed Quant. House Surveillance SMARTS *Fidessa Express and LSE FGW to Liquidity Aggregation, Trad. Elect interface direct to BOB 46

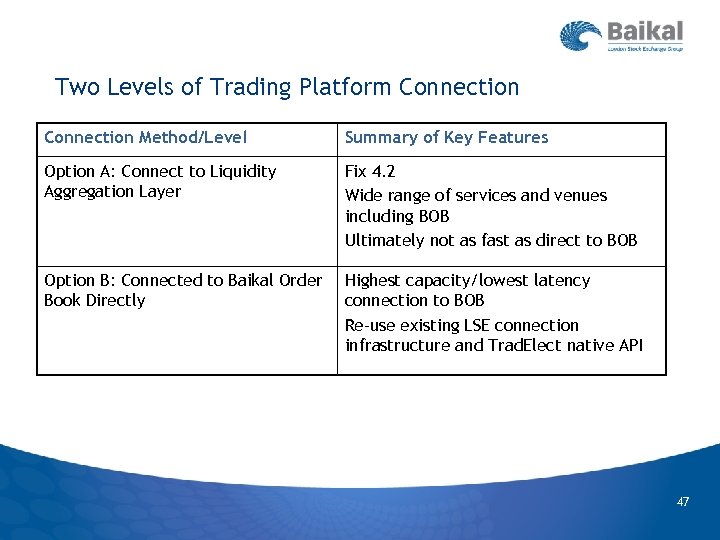

Two Levels of Trading Platform Connection Method/Level Summary of Key Features Option A: Connect to Liquidity Aggregation Layer Fix 4. 2 Wide range of services and venues including BOB Ultimately not as fast as direct to BOB Option B: Connected to Baikal Order Book Directly Highest capacity/lowest latency connection to BOB Re‐use existing LSE connection infrastructure and Trad. Elect native API 47

Two Levels of Trading Platform Connection Method/Level Summary of Key Features Option A: Connect to Liquidity Aggregation Layer Fix 4. 2 Wide range of services and venues including BOB Ultimately not as fast as direct to BOB Option B: Connected to Baikal Order Book Directly Highest capacity/lowest latency connection to BOB Re‐use existing LSE connection infrastructure and Trad. Elect native API 47

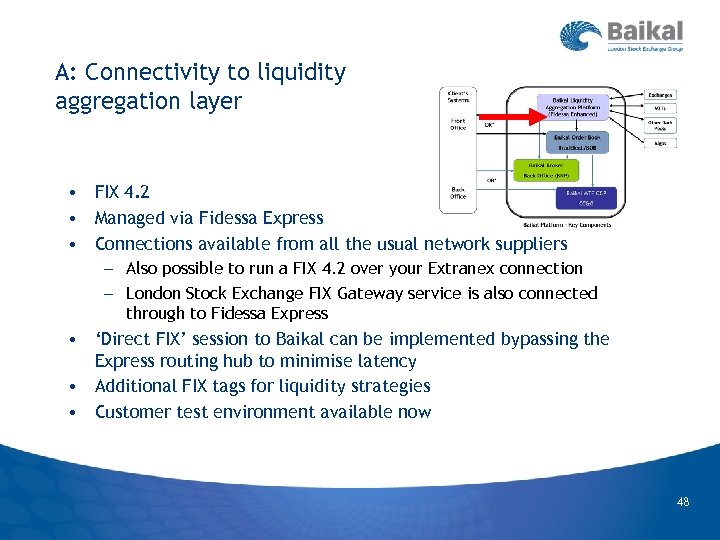

A: Connectivity to liquidity aggregation layer • FIX 4. 2 • Managed via Fidessa Express • Connections available from all the usual network suppliers – Also possible to run a FIX 4. 2 over your Extranex connection – London Stock Exchange FIX Gateway service is also connected through to Fidessa Express • ‘Direct FIX’ session to Baikal can be implemented bypassing the Express routing hub to minimise latency • Additional FIX tags for liquidity strategies • Customer test environment available now 48

A: Connectivity to liquidity aggregation layer • FIX 4. 2 • Managed via Fidessa Express • Connections available from all the usual network suppliers – Also possible to run a FIX 4. 2 over your Extranex connection – London Stock Exchange FIX Gateway service is also connected through to Fidessa Express • ‘Direct FIX’ session to Baikal can be implemented bypassing the Express routing hub to minimise latency • Additional FIX tags for liquidity strategies • Customer test environment available now 48

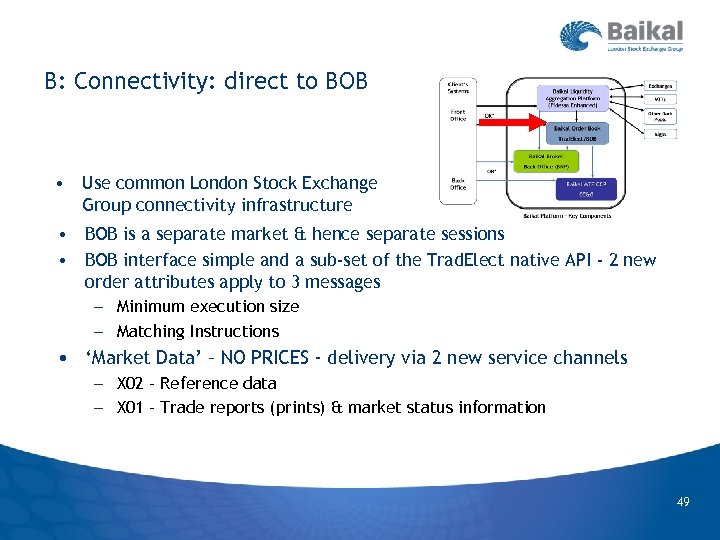

B: Connectivity: direct to BOB • Use common London Stock Exchange Group connectivity infrastructure • BOB is a separate market & hence separate sessions • BOB interface simple and a sub‐set of the Trad. Elect native API ‐ 2 new order attributes apply to 3 messages – Minimum execution size – Matching Instructions • ‘Market Data’ – NO PRICES ‐ delivery via 2 new service channels – X 02 – Reference data – X 01 – Trade reports (prints) & market status information 49

B: Connectivity: direct to BOB • Use common London Stock Exchange Group connectivity infrastructure • BOB is a separate market & hence separate sessions • BOB interface simple and a sub‐set of the Trad. Elect native API ‐ 2 new order attributes apply to 3 messages – Minimum execution size – Matching Instructions • ‘Market Data’ – NO PRICES ‐ delivery via 2 new service channels – X 02 – Reference data – X 01 – Trade reports (prints) & market status information 49

Client Testing Environments • Liquidity aggregation layer – Available now! • BOB – Will be available through the same Customer Development Service (CDS) as other Trad. Elect markets from September • Customers choosing direct BOB connection will need to participate in a conformance test – New message versions 5 EO, 5 MO, 5 OF & its response 5 S 1 – New trade types HL & HM (hidden limit & market) 50

Client Testing Environments • Liquidity aggregation layer – Available now! • BOB – Will be available through the same Customer Development Service (CDS) as other Trad. Elect markets from September • Customers choosing direct BOB connection will need to participate in a conformance test – New message versions 5 EO, 5 MO, 5 OF & its response 5 S 1 – New trade types HL & HM (hidden limit & market) 50

Delivery plan phasing Investment for experts

Delivery plan phasing Investment for experts

Delivery schedule phasing • Initial delivery – end June – LIVE NOW! – Lit SOR liquidity aggregation – Baikal back office for OTC client settlement • September delivery – Baikal order book (BOB) available in customer test (CDS) • Q 4 delivery – BOB live – Wide range of liquidity aggregation strategies including ‘dark pool aggregation’ • Subsequent phases – TBA 52

Delivery schedule phasing • Initial delivery – end June – LIVE NOW! – Lit SOR liquidity aggregation – Baikal back office for OTC client settlement • September delivery – Baikal order book (BOB) available in customer test (CDS) • Q 4 delivery – BOB live – Wide range of liquidity aggregation strategies including ‘dark pool aggregation’ • Subsequent phases – TBA 52

Baikal session summary • • • Pan‐European dark pool & liquidity aggregation services Cost effective, differentiated services from a market neutral provider Technology platform uses proven technology + partners Connectivity is simple/standard and leverages existing pipes & APIs Phased release schedule has started Plan & start implementing your connections to Baikal Order Book now! Investment for experts

Baikal session summary • • • Pan‐European dark pool & liquidity aggregation services Cost effective, differentiated services from a market neutral provider Technology platform uses proven technology + partners Connectivity is simple/standard and leverages existing pipes & APIs Phased release schedule has started Plan & start implementing your connections to Baikal Order Book now! Investment for experts

IMPORTANT NOTICE Baikal Global Limited is a company registered in England & Wales with Company Number 06630018, whose Registered Address is 10 Paternoster Square, London EC 4 M 7 LS. Baikal Global Limited is a wholly‐owned subsidiary of London Stock Exchange Group plc. Please note that Baikal Global Limited has applied for authorisation as an Investment Firm (as defined in the Financial Services and Markets Act 2000) which is regulated by the Financial Services Authority, and is seeking permission to operate a Multilateral Trading Facility (as defined in the Markets in Financial Instruments Directive). Therefore, the operation of Baikal Global Limited as an authorised Investment Firm and as an MTF both remain subject to gaining the necessary regulatory approvals. This material is furnished on a confidential basis only for the use of the intended recipient and only for discussion purposes. This material may be amended and/or supplemented without notice and may not be relied upon for the purposes of entering into any transaction. The information presented herein will be deemed to be superseded by any subsequent versions of this material and is subject to the information later appearing in any related prospectus, offering circular, pricing supplement or other offer document (the "Related Documentation"). Information other than indicative terms presented herein (including market data and statistical information) has been obtained from various sources which Baikal considers to be reliable. However, Baikal and its affiliates make no representation as to, and accept no responsibility or liability whatsoever for, the accuracy or completeness of such information. All projections, valuations and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. They may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results and, to the extent that they are based on historical information, they should not be relied upon as an accurate prediction of future performance. This material does not constitute advice or a recommendation to enter into any transaction or an offer or an agreement, or a solicitation of an offer or an agreement, to enter into any transaction (including, without limitation, for the provision of any services). By furnishing this material to the recipient, neither Baikal nor any of its affiliates is not committing to any transaction. Although any indicative information included in this material is reflective of the terms, as of the specified date, under which Baikal believes a transaction might be arranged or agreed, no assurance is given that such a transaction could, in fact, be executed at the specific levels or on the specific terms indicated. This material and its contents are proprietary to Baikal and its affiliates, and no part of this material or its subject matter may be reproduced, disseminated or disclosed without its prior written approval. © 2009 Baikal Global Limited. All rights reserved. References herein to "London Stock Exchange" shall include London Stock Exchange Group plc and its affiliates. London Stock Exchange and the London Stock Exchange coat of arms device are registered trade marks of London Stock Exchange plc. The Baikal trade mark is a service mark of London Stock Exchange plc and is subject to trade mark applications. All other logos, organisations and company names referred to may be the trade marks of their respective owners. 54

IMPORTANT NOTICE Baikal Global Limited is a company registered in England & Wales with Company Number 06630018, whose Registered Address is 10 Paternoster Square, London EC 4 M 7 LS. Baikal Global Limited is a wholly‐owned subsidiary of London Stock Exchange Group plc. Please note that Baikal Global Limited has applied for authorisation as an Investment Firm (as defined in the Financial Services and Markets Act 2000) which is regulated by the Financial Services Authority, and is seeking permission to operate a Multilateral Trading Facility (as defined in the Markets in Financial Instruments Directive). Therefore, the operation of Baikal Global Limited as an authorised Investment Firm and as an MTF both remain subject to gaining the necessary regulatory approvals. This material is furnished on a confidential basis only for the use of the intended recipient and only for discussion purposes. This material may be amended and/or supplemented without notice and may not be relied upon for the purposes of entering into any transaction. The information presented herein will be deemed to be superseded by any subsequent versions of this material and is subject to the information later appearing in any related prospectus, offering circular, pricing supplement or other offer document (the "Related Documentation"). Information other than indicative terms presented herein (including market data and statistical information) has been obtained from various sources which Baikal considers to be reliable. However, Baikal and its affiliates make no representation as to, and accept no responsibility or liability whatsoever for, the accuracy or completeness of such information. All projections, valuations and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. They may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results and, to the extent that they are based on historical information, they should not be relied upon as an accurate prediction of future performance. This material does not constitute advice or a recommendation to enter into any transaction or an offer or an agreement, or a solicitation of an offer or an agreement, to enter into any transaction (including, without limitation, for the provision of any services). By furnishing this material to the recipient, neither Baikal nor any of its affiliates is not committing to any transaction. Although any indicative information included in this material is reflective of the terms, as of the specified date, under which Baikal believes a transaction might be arranged or agreed, no assurance is given that such a transaction could, in fact, be executed at the specific levels or on the specific terms indicated. This material and its contents are proprietary to Baikal and its affiliates, and no part of this material or its subject matter may be reproduced, disseminated or disclosed without its prior written approval. © 2009 Baikal Global Limited. All rights reserved. References herein to "London Stock Exchange" shall include London Stock Exchange Group plc and its affiliates. London Stock Exchange and the London Stock Exchange coat of arms device are registered trade marks of London Stock Exchange plc. The Baikal trade mark is a service mark of London Stock Exchange plc and is subject to trade mark applications. All other logos, organisations and company names referred to may be the trade marks of their respective owners. 54

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009

An overview of MTS The European Bond Exchange Author: Fabrizio Cazzulini Date: July 10 th, 2009

An overview of MTS The European Bond Exchange Author: Fabrizio Cazzulini Date: July 10 th, 2009

About MTS • MTS S. p. A. , founded in 1988 and privatised in 1997, was the first electronic market for government bonds and is the founding member (in 1998) of the MTS Group of companies. • Since its launch over 10 years ago, the MTS Group has established itself as the leading pan‐European market for fixed income securities, setting new standards of transparency and liquidity for government bonds. • With average trading volumes of up to € 90 billion a day, MTS is active in all the Eurozone countries and now also extends into the Middle East. • The majority of shares in the Company are owned by the London Stock Exchange Group (60. 37%). Major international financial institutions hold the remaining shares. 57

About MTS • MTS S. p. A. , founded in 1988 and privatised in 1997, was the first electronic market for government bonds and is the founding member (in 1998) of the MTS Group of companies. • Since its launch over 10 years ago, the MTS Group has established itself as the leading pan‐European market for fixed income securities, setting new standards of transparency and liquidity for government bonds. • With average trading volumes of up to € 90 billion a day, MTS is active in all the Eurozone countries and now also extends into the Middle East. • The majority of shares in the Company are owned by the London Stock Exchange Group (60. 37%). Major international financial institutions hold the remaining shares. 57

Products Trading Services MTS provide facilities for trading: • Government Bonds and Repos • Selected Pfandbriefe and Covered Bonds and Repos • Corporate Bonds and Repos • Sovereign Agency and Supranational securities • EONIA Swaps Euro. MTS Indices The Euro. MTS Indices are the first independent, transparent, real‐time and tradable fixed income indices in the Eurozone. The indices currently consist of five main index groups: • Euro. MTS Index • Euro. MTS Government Broad Index • Euro. MTS Inflation‐linked Indices • Euro. MTS New EU Index • Euro. MTS Covered Bond Index 58

Products Trading Services MTS provide facilities for trading: • Government Bonds and Repos • Selected Pfandbriefe and Covered Bonds and Repos • Corporate Bonds and Repos • Sovereign Agency and Supranational securities • EONIA Swaps Euro. MTS Indices The Euro. MTS Indices are the first independent, transparent, real‐time and tradable fixed income indices in the Eurozone. The indices currently consist of five main index groups: • Euro. MTS Index • Euro. MTS Government Broad Index • Euro. MTS Inflation‐linked Indices • Euro. MTS New EU Index • Euro. MTS Covered Bond Index 58

Markets Inter‐dealer Cash Markets The wholesale markets managed by MTS include: Euro. MTS, Euro. Credit MTS, New. Euro. MTS, Euro. Global. MTS, MTS Quasi‐Government Market, Eurobenchmark Treasury Bills Market, Euro. MTS Linkers Market, MTS Cedulas Market, MTS Amsterdam, MTS Austrian Market, MTS Belgium, MTS Denmark, MTS Deutschland, MTS España, MTS Finland, MTS France, MTS Greek Market, MTS Ireland, MTS Israel, MTS Italy, MTS Poland, MTS Portugal and MTS Slovenia. Money Markets The Money Market Facility (MMF) platform provides a dedicated segment of MTS for the electronic transaction of repurchase agreements, buy/sellbacks and EONIA swaps through an efficient order driven market place. Bond. Vision is the fastest growing Multidealer‐to‐Client market for Fixed Income trading. Bond. Vision is also a regulated market, thus providing a “best execution” environment. The Italian Ministry of Finance regulates the government bond trading area whilst CONSOB regulates the non‐government trading section. 59

Markets Inter‐dealer Cash Markets The wholesale markets managed by MTS include: Euro. MTS, Euro. Credit MTS, New. Euro. MTS, Euro. Global. MTS, MTS Quasi‐Government Market, Eurobenchmark Treasury Bills Market, Euro. MTS Linkers Market, MTS Cedulas Market, MTS Amsterdam, MTS Austrian Market, MTS Belgium, MTS Denmark, MTS Deutschland, MTS España, MTS Finland, MTS France, MTS Greek Market, MTS Ireland, MTS Israel, MTS Italy, MTS Poland, MTS Portugal and MTS Slovenia. Money Markets The Money Market Facility (MMF) platform provides a dedicated segment of MTS for the electronic transaction of repurchase agreements, buy/sellbacks and EONIA swaps through an efficient order driven market place. Bond. Vision is the fastest growing Multidealer‐to‐Client market for Fixed Income trading. Bond. Vision is also a regulated market, thus providing a “best execution” environment. The Italian Ministry of Finance regulates the government bond trading area whilst CONSOB regulates the non‐government trading section. 59

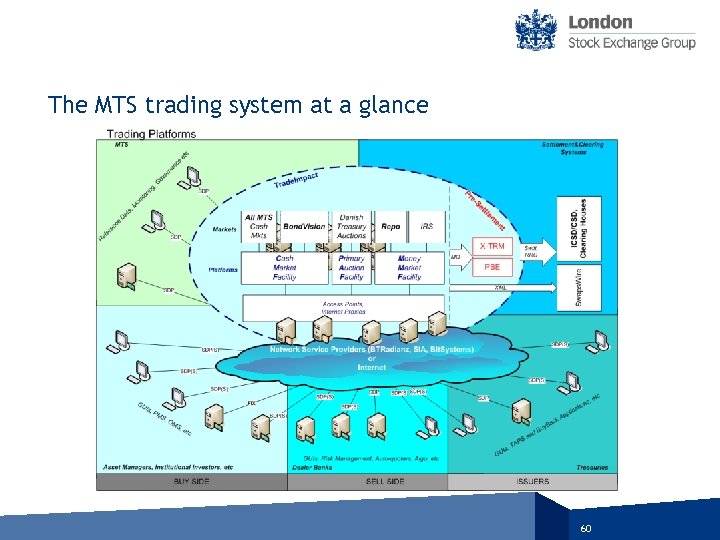

The MTS trading system at a glance 60

The MTS trading system at a glance 60

Key Technical Features Speed • Trade. Impact has reached the highest level of performances in the Fixed Income industry. Flexibility • Trade. Impact’s modularity has allowed MTS to respond rapidly to changing business needs with no significant impact on architecture. • Primary Market Auctions, “Click and Trade” activity and negotiation via Request for Competitive Quotes use same technology and infrastructure. Scalability • The modularity of the components, all designed with a multi‐threads approach and a multi‐layers architecture, allow both horizontal and vertical scalability. • Hardware platform is mostly based on a cost‐effective Linux/Intel architecture. Resilience • Each software process is replicated on different systems, with no single‐points of failure. A secondary Disaster Recovery site can handle emergency situations and restore trading services within 3 hours from any severe event impairing the primary system site. 61

Key Technical Features Speed • Trade. Impact has reached the highest level of performances in the Fixed Income industry. Flexibility • Trade. Impact’s modularity has allowed MTS to respond rapidly to changing business needs with no significant impact on architecture. • Primary Market Auctions, “Click and Trade” activity and negotiation via Request for Competitive Quotes use same technology and infrastructure. Scalability • The modularity of the components, all designed with a multi‐threads approach and a multi‐layers architecture, allow both horizontal and vertical scalability. • Hardware platform is mostly based on a cost‐effective Linux/Intel architecture. Resilience • Each software process is replicated on different systems, with no single‐points of failure. A secondary Disaster Recovery site can handle emergency situations and restore trading services within 3 hours from any severe event impairing the primary system site. 61

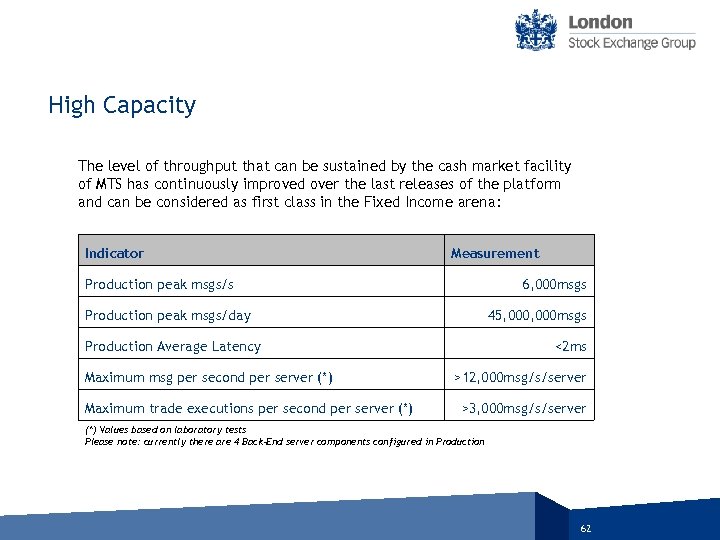

High Capacity The level of throughput that can be sustained by the cash market facility of MTS has continuously improved over the last releases of the platform and can be considered as first class in the Fixed Income arena: Indicator Measurement Production peak msgs/s 6, 000 msgs Production peak msgs/day 45, 000 msgs Production Average Latency Maximum msg per second per server (*) Maximum trade executions per second per server (*) <2 ms >12, 000 msg/s/server >3, 000 msg/s/server (*) Values based on laboratory tests Please note: currently there are 4 Back-End server components configured in Production 62

High Capacity The level of throughput that can be sustained by the cash market facility of MTS has continuously improved over the last releases of the platform and can be considered as first class in the Fixed Income arena: Indicator Measurement Production peak msgs/s 6, 000 msgs Production peak msgs/day 45, 000 msgs Production Average Latency Maximum msg per second per server (*) Maximum trade executions per second per server (*) <2 ms >12, 000 msg/s/server >3, 000 msg/s/server (*) Values based on laboratory tests Please note: currently there are 4 Back-End server components configured in Production 62

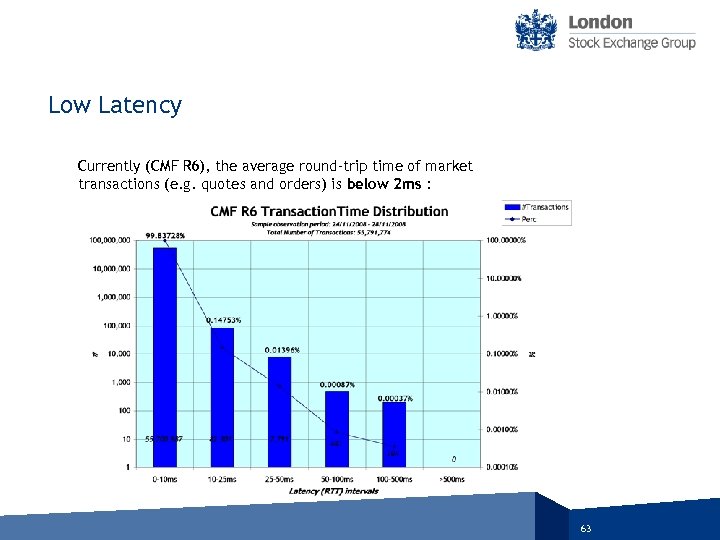

Low Latency Currently (CMF R 6), the average round‐trip time of market transactions (e. g. quotes and orders) is below 2 ms : 63

Low Latency Currently (CMF R 6), the average round‐trip time of market transactions (e. g. quotes and orders) is below 2 ms : 63

Connectivity User Software MTS provides market members with a Reference Graphical User Interface allowing traders to connect to markets. Members can decide to implement more sophisticated solutions or integrate MTS trading functionality within their existing applications via MTS protocols. Amongst the others, the ISVs providing software for MTS markets include: • ION Trading Ltd • List Sp. A • Icubic AG • etc Network Connections Participants can connect to the MTS markets through any of its authorised network service providers, i. e. : • BIt. Systems • BTRadianz • SIASSB 64

Connectivity User Software MTS provides market members with a Reference Graphical User Interface allowing traders to connect to markets. Members can decide to implement more sophisticated solutions or integrate MTS trading functionality within their existing applications via MTS protocols. Amongst the others, the ISVs providing software for MTS markets include: • ION Trading Ltd • List Sp. A • Icubic AG • etc Network Connections Participants can connect to the MTS markets through any of its authorised network service providers, i. e. : • BIt. Systems • BTRadianz • SIASSB 64

Next Releases (I) MMF R 2. 1 • Introduction of OTC Trade Registration Facility – Members will be able to utilise the extensive MTS member and settlement network in order to register trades that did not originate on the MTS Trading platform taking advantage of the automated settlement and Straight Through Processing to all major European settlement entities and clearing houses. The registration can be performed by either of the counterparties to a trade or by MTS or potentially by a third party. • Improvements to RFQ mechanism, Messaging and addition of MTS Support Chat function – RFQ mechanism is being updated to improve ergonomics and its integration with the messaging facility. – A new messaging function will allow traders to contact directly their MTS representative within their Trading application. • Improvements to GC allocation and Best Execution reporting • Upgrade of the Reference GUI MMF R 2. 1 is due to go live on July 20 th 65

Next Releases (I) MMF R 2. 1 • Introduction of OTC Trade Registration Facility – Members will be able to utilise the extensive MTS member and settlement network in order to register trades that did not originate on the MTS Trading platform taking advantage of the automated settlement and Straight Through Processing to all major European settlement entities and clearing houses. The registration can be performed by either of the counterparties to a trade or by MTS or potentially by a third party. • Improvements to RFQ mechanism, Messaging and addition of MTS Support Chat function – RFQ mechanism is being updated to improve ergonomics and its integration with the messaging facility. – A new messaging function will allow traders to contact directly their MTS representative within their Trading application. • Improvements to GC allocation and Best Execution reporting • Upgrade of the Reference GUI MMF R 2. 1 is due to go live on July 20 th 65

Next Releases (II) CMF R 6. 1 • Introduction of Multi‐leg RFCQ Functionality – Buyside members can build trading lists of bonds (up to 100) to buy or sell and issue a unique request for competitive quote to a number of dealers. – Sellside members will be able to either send quotes for single bonds in the list, ignore/reject single bonds or the RFCQ as a whole. • Introduction of Single Dealer Pages – Bond. Vision sellside dealers will have the possibility of showing individual pages with specific prices for their clients. • Pre‐Allocation mechanism at Central System Level • Improvements of Best Execution mechanism for Bond. Vision RFCQs • Improvements of the Trading Relations mechanism CMF R 6. 1 is due to go live by Q 4. 2009 66

Next Releases (II) CMF R 6. 1 • Introduction of Multi‐leg RFCQ Functionality – Buyside members can build trading lists of bonds (up to 100) to buy or sell and issue a unique request for competitive quote to a number of dealers. – Sellside members will be able to either send quotes for single bonds in the list, ignore/reject single bonds or the RFCQ as a whole. • Introduction of Single Dealer Pages – Bond. Vision sellside dealers will have the possibility of showing individual pages with specific prices for their clients. • Pre‐Allocation mechanism at Central System Level • Improvements of Best Execution mechanism for Bond. Vision RFCQs • Improvements of the Trading Relations mechanism CMF R 6. 1 is due to go live by Q 4. 2009 66

Questions 10 Paternoster Square London EC 4 M 7 LS T +44 (0)20 7797 1000 www. londonstockexchangegroup. com

Questions 10 Paternoster Square London EC 4 M 7 LS T +44 (0)20 7797 1000 www. londonstockexchangegroup. com

Technical User Group London Date: 10 July 2009

Technical User Group London Date: 10 July 2009