600fdccac4de10f96889777f8bb5928a.ppt

- Количество слайдов: 21

Technical Brief to The Board Housing Finance in Emerging Economies World Bank Group Board Presentation - June 9, 2005

Outline • Why Housing Finance ? • How to Expand Housing Finance • World Bank Strategy, Products • IFC Strategy, Products • Challenges for the World Bank Group 2

Why Housing Finance? • Engine of equitable economic growth • • • Key for investment, households wealth, savings, consumption, labor markets, fiscal returns, retirement system Collateral to unlock capital (“dead” housing assets, De Soto) ECA housing stock privatization: > $ 1 trillion (asset rich, cash poor) Meet a growing housing demand (urbanization, demographics) Prevent slum proliferation (cities built the way they are financed) Reduce poverty (asset building, retirement, empowerment, community strengthening, improved living conditions) • Take part in the financial sector liberalization (banks, non bank lenders, domestic bond markets, pension funds, etc. ) 3

How to build inclusive and sustainable HF system? • Sizeable & durable investment that needs debt leverage • Required sound foundations • Relative macroeconomic stability • Workable legal system (titles, foreclosure) • Risk management, funding tools & regulations • Competing private lenders • Affordable housing (cf. supply constraints) • Enabling role of the State • Less of direct lender/builder, rather build conducive market environment, catalyst role to expand accessibility 4

How to Expand Housing Finance • Products • Credit products (term, rates, amortization) • Broader distribution channels • Mortgage credit insurance for lenders • Micro finance applied to housing • Housing saving schemes • Construction, infrastructure and rental finance • Policy • Affordable land use & urban development rules • Efficient registration of property titles & liens • Smarter HF-related subsidies • Instruments to reallocate part of the additional risks • Framework for long-term mortgage securities (different models) 5

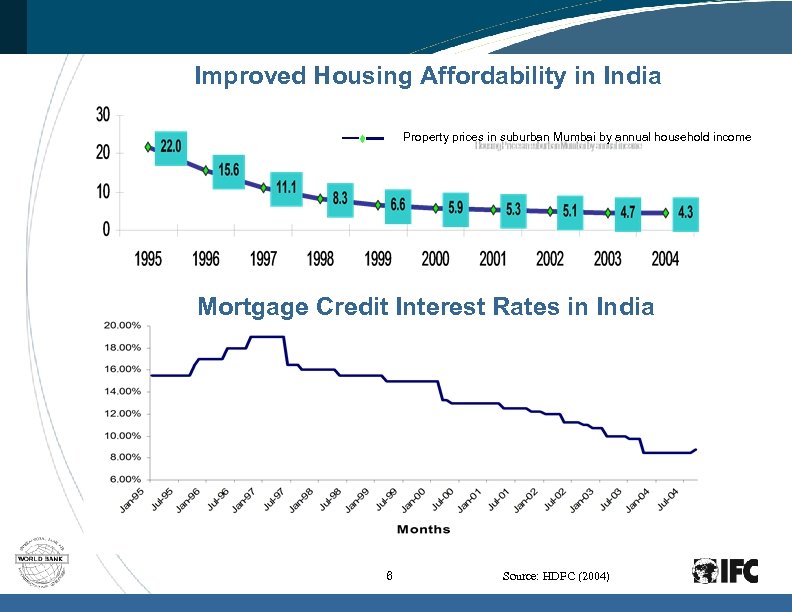

Improved Housing Affordability in India Property prices in suburban Mumbai by annual household income ♦ Mortgage Credit Interest Rates in India 6 Source: HDFC (2004)

Grounds for Cautious Optimism • Still gap between advanced economies (large and low -risk portfolios) and emerging economies • Yet promising portfolio growth & affordability (Chile, Malaysia, Baltic, Mexico, Jordan, India. . . ) • No optimal model: customization & sequencing, menu of products for different target groups • Key to develop primary local-currency mortgage markets before more sophisticated instruments • Caution needed to develop this sensitive sector 7

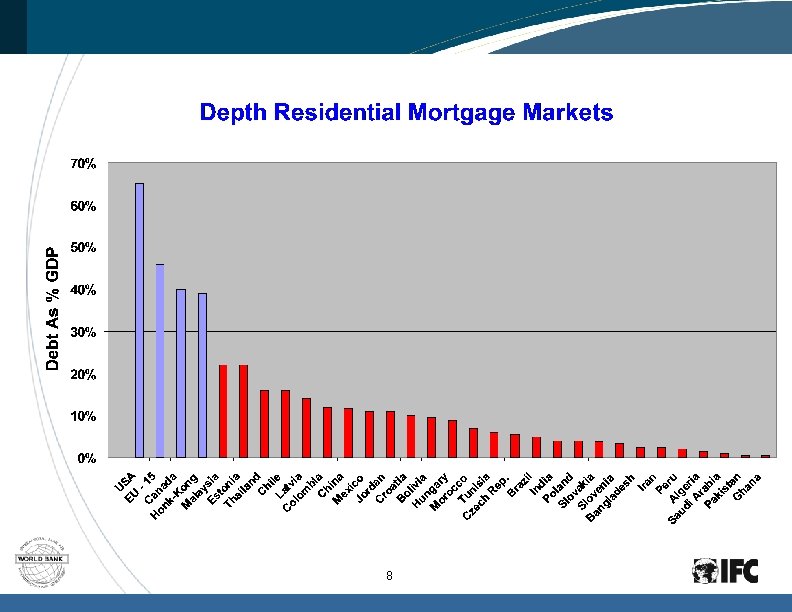

8

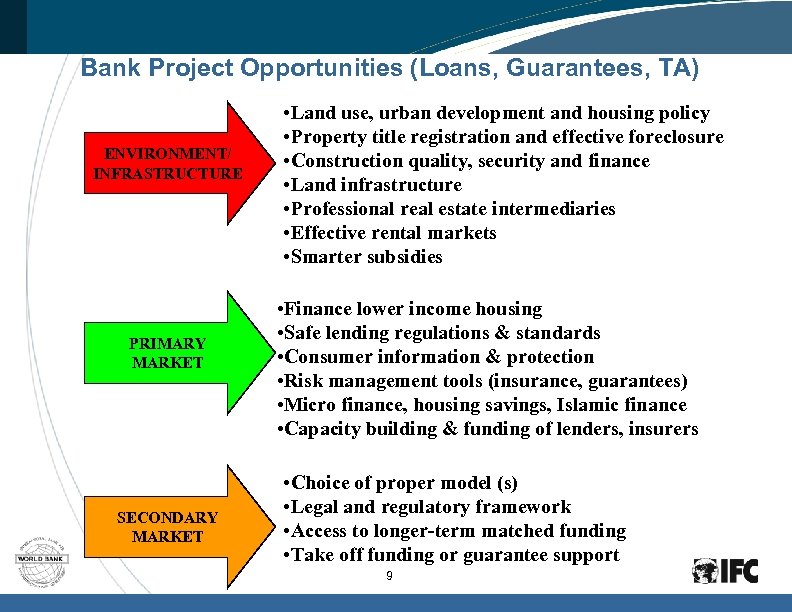

Bank Project Opportunities (Loans, Guarantees, TA) ENVIRONMENT/ INFRASTRUCTURE PRIMARY MARKET SECONDARY MARKET • Land use, urban development and housing policy • Property title registration and effective foreclosure • Construction quality, security and finance • Land infrastructure • Professional real estate intermediaries • Effective rental markets • Smarter subsidies • Finance lower income housing • Safe lending regulations & standards • Consumer information & protection • Risk management tools (insurance, guarantees) • Micro finance, housing savings, Islamic finance • Capacity building & funding of lenders, insurers • Choice of proper model (s) • Legal and regulatory framework • Access to longer-term matched funding • Take off funding or guarantee support 9

Bank Organization and Operations What do we do ? • Growing scope (up to 30 countries, ambitious reforms) • Broader range of TA and loans • Conferences & training programs • HF flagship book in FY 06 • Limited anchor size • Challenge to access grant funds 10

Example: Colombia • IBRD loans and TA • • • Rebuild after crisis sound infrastructure of primary and secondary mortgage markets Increase the accessibility for lower-income groups IFC: key support to a private securitization company Example: Jordan • • Sustainable development in a small economy Support to a liquidity facility (issue bonds, refinance lenders) Reduce lending risks, catalyst of credit affordability gains Targeted program of interest buy down vouchers 11

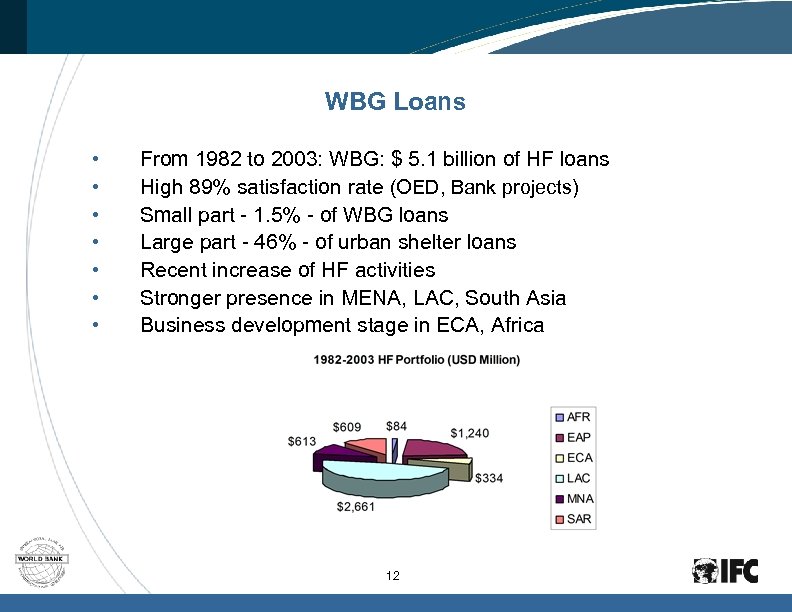

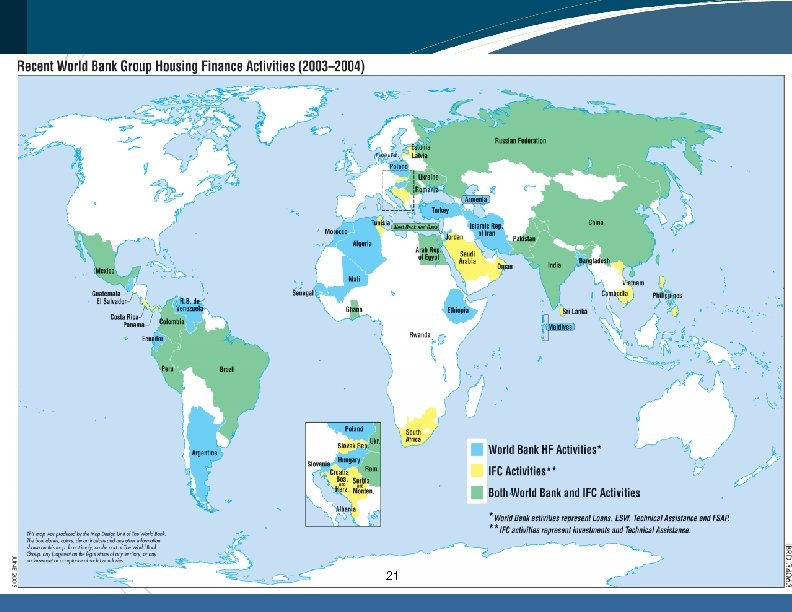

WBG Loans • • From 1982 to 2003: WBG: $ 5. 1 billion of HF loans High 89% satisfaction rate (OED, Bank projects) Small part - 1. 5% - of WBG loans Large part - 46% - of urban shelter loans Recent increase of HF activities Stronger presence in MENA, LAC, South Asia Business development stage in ECA, Africa 12

Evolution of IFC Housing Finance Activities … we have reorganized ourselves to optimize our role Key Elements of Current IFC HF Strategy • Programmatic approach that blends TA with investment to maximize impact • Wider regional representation requiring innovation and tailored solutions • Expanded product menu • Expanded and independent role of TA. 13

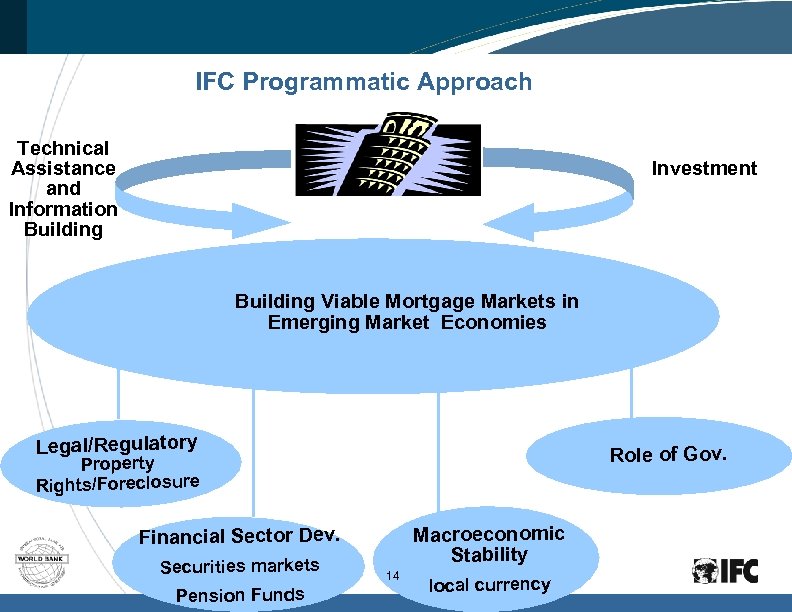

IFC Programmatic Approach Technical Assistance and Information Building Investment Building Viable Mortgage Markets in Emerging Market Economies Legal/Regulatory Role of Gov. Property Rights/Foreclosure Macroeconomic Stability Financial Sector Dev. Securities markets Pension Funds 14 local currency

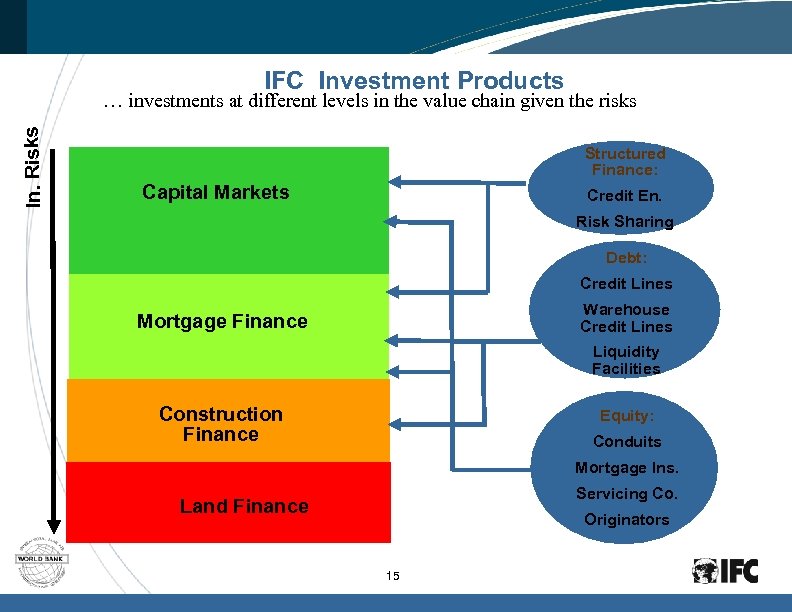

IFC Investment Products In. Risks … investments at different levels in the value chain given the risks Structured Finance: CAPITAL Capital Markets MARKETS Credit En. Risk Sharing Debt: Credit Lines Warehouse Credit Lines MORTGAGE Mortgage Finance FINANCE Liquidity Facilities CONSTRUCTION Construction FINANCE Finance Equity: Conduits Mortgage Ins. Servicing Co. Land Finance Originators 15

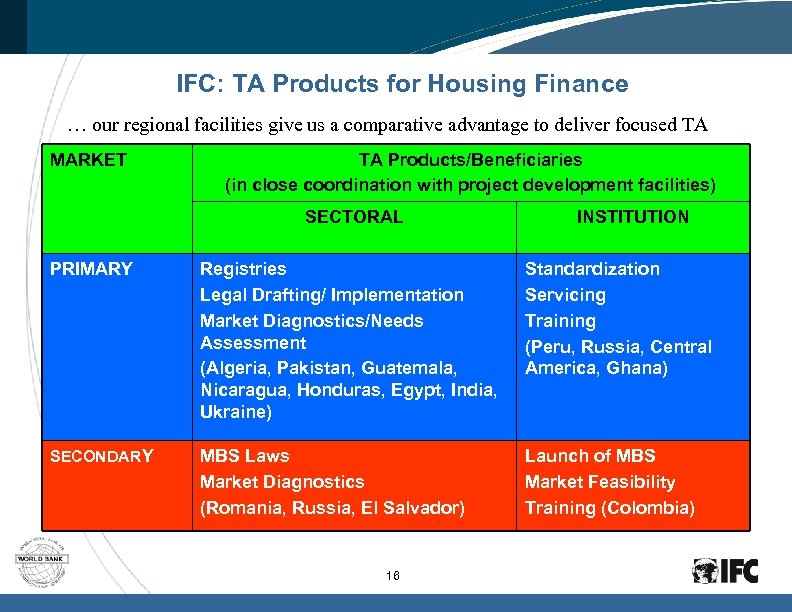

IFC: TA Products for Housing Finance … our regional facilities give us a comparative advantage to deliver focused TA MARKET TA Products/Beneficiaries (in close coordination with project development facilities) SECTORAL INSTITUTION PRIMARY Registries Legal Drafting/ Implementation Market Diagnostics/Needs Assessment (Algeria, Pakistan, Guatemala, Nicaragua, Honduras, Egypt, India, Ukraine) Standardization Servicing Training (Peru, Russia, Central America, Ghana) SECONDARY MBS Laws Market Diagnostics (Romania, Russia, El Salvador) Launch of MBS Market Feasibility Training (Colombia) 16

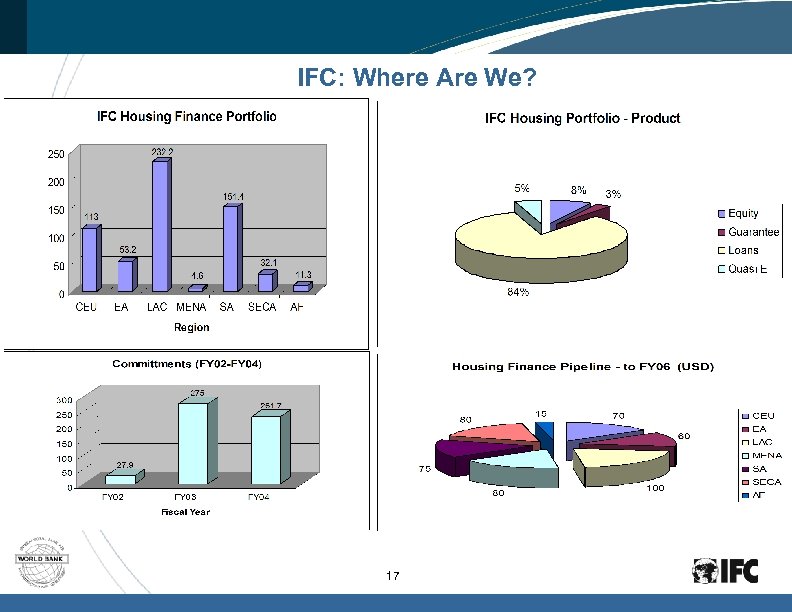

IFC: Where Are We? 17

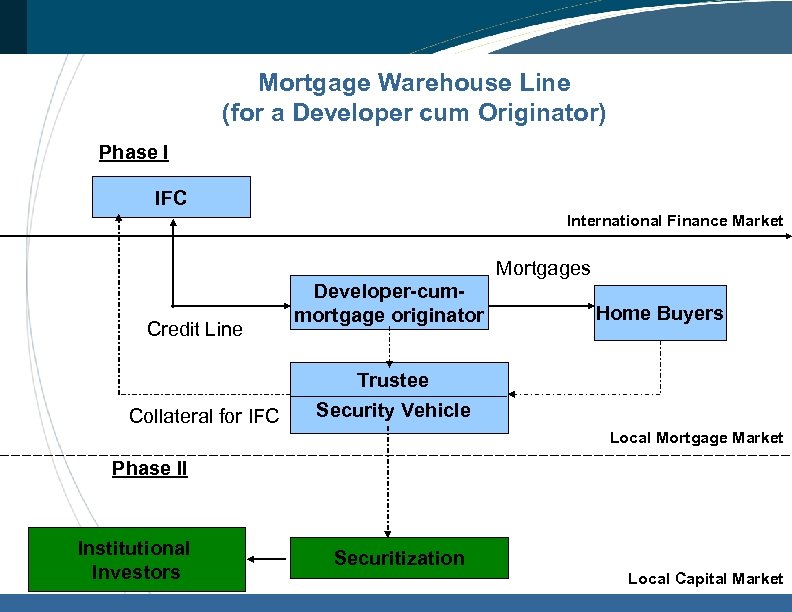

Mortgage Warehouse Line (for a Developer cum Originator) Phase I IFC International Finance Market Mortgages Credit Line Developer-cummortgage originator Home Buyers Trustee Collateral for IFC Security Vehicle Local Mortgage Market Phase II Institutional Investors Securitization Local Capital Market

IFC: the Challenges for the Future • How to get to true poor? (“The case of Mexico”) • Microfinance for housing; and • Remittance mortgages • Impacting the supply side • Increase house production via developer financing • Ensure affordability • Creating new products/relationships to expand impact • Access to long term local currency (NCPIC program) • Islamic housing finance • Energy efficiency products • Mortgage finance provided by sub-sovereigns 19

World Bank Group Role • Develop housing finance markets • Set up infrastructure, legal and regulatory framework for markets • Make housing markets more affordable & secure property rights • Develop framework for risk management and funding tools • IFC to support private transactions • WBG comparative advantages • Honest broker role • Long-term presence during a process of reforms • World expertise & knowledge transfer • Integrated approach: urban & finance, public & private sectors 20

21

600fdccac4de10f96889777f8bb5928a.ppt