Team 1 - Personal Investing Low-Income vs. High. Income Real Estate Andrew Dunn Jeff Weintraub Silvio Tovar Adrian Hernandez

Team 1 - Personal Investing Low-Income vs. High. Income Real Estate Andrew Dunn Jeff Weintraub Silvio Tovar Adrian Hernandez

Scenarios ► Around $750, 000 -800, 000 to invest § Buy-out home at time of purchase § No mortgage § 30 -year period ► 2 specific locations to compare in L. A. County § Pomona- low-income area to invest § Claremont- high-income area to invest

Scenarios ► Around $750, 000 -800, 000 to invest § Buy-out home at time of purchase § No mortgage § 30 -year period ► 2 specific locations to compare in L. A. County § Pomona- low-income area to invest § Claremont- high-income area to invest

Pomona ► 1, 068 sq. ft. house ► 7298 sq. ft lot ► Contemporary style- 3 bedrooms, 2 bathrooms, 1 -car garage ► $299, 750 ► Investment equivalent to 3 of these homes

Pomona ► 1, 068 sq. ft. house ► 7298 sq. ft lot ► Contemporary style- 3 bedrooms, 2 bathrooms, 1 -car garage ► $299, 750 ► Investment equivalent to 3 of these homes

Claremont ► 2276 sq. ft. house ► 15310 sq. ft. lot ► Foothills home- 4 bedrooms, 3 bathrooms, attached 3 car garage, family room with fireplace and bar, 2 patios, RV parking, laundry room ► $775, 000

Claremont ► 2276 sq. ft. house ► 15310 sq. ft. lot ► Foothills home- 4 bedrooms, 3 bathrooms, attached 3 car garage, family room with fireplace and bar, 2 patios, RV parking, laundry room ► $775, 000

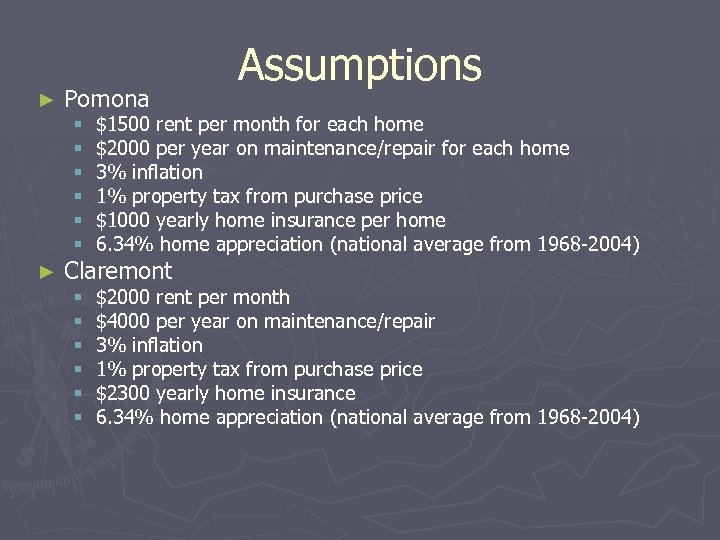

► Pomona Assumptions § § § ► $1500 rent per month for each home $2000 per year on maintenance/repair for each home 3% inflation 1% property tax from purchase price $1000 yearly home insurance per home 6. 34% home appreciation (national average from 1968 -2004) § § § $2000 rent per month $4000 per year on maintenance/repair 3% inflation 1% property tax from purchase price $2300 yearly home insurance 6. 34% home appreciation (national average from 1968 -2004) Claremont

► Pomona Assumptions § § § ► $1500 rent per month for each home $2000 per year on maintenance/repair for each home 3% inflation 1% property tax from purchase price $1000 yearly home insurance per home 6. 34% home appreciation (national average from 1968 -2004) § § § $2000 rent per month $4000 per year on maintenance/repair 3% inflation 1% property tax from purchase price $2300 yearly home insurance 6. 34% home appreciation (national average from 1968 -2004) Claremont

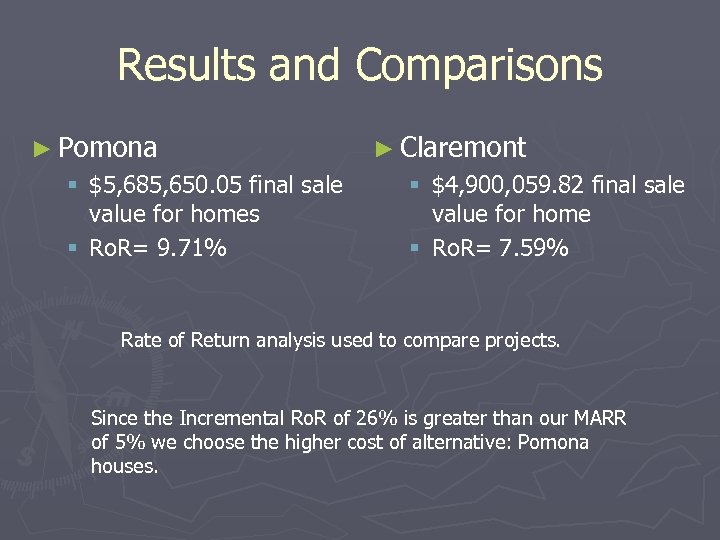

Results and Comparisons ► Pomona § $5, 685, 650. 05 final sale value for homes § Ro. R= 9. 71% ► Claremont § $4, 900, 059. 82 final sale value for home § Ro. R= 7. 59% Rate of Return analysis used to compare projects. Since the Incremental Ro. R of 26% is greater than our MARR of 5% we choose the higher cost of alternative: Pomona houses.

Results and Comparisons ► Pomona § $5, 685, 650. 05 final sale value for homes § Ro. R= 9. 71% ► Claremont § $4, 900, 059. 82 final sale value for home § Ro. R= 7. 59% Rate of Return analysis used to compare projects. Since the Incremental Ro. R of 26% is greater than our MARR of 5% we choose the higher cost of alternative: Pomona houses.

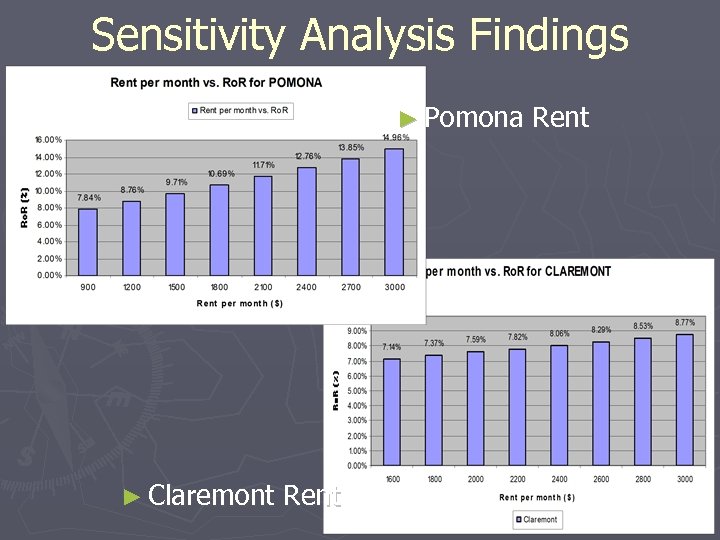

Sensitivity Analysis Findings ► Pomona ► Claremont Rent

Sensitivity Analysis Findings ► Pomona ► Claremont Rent

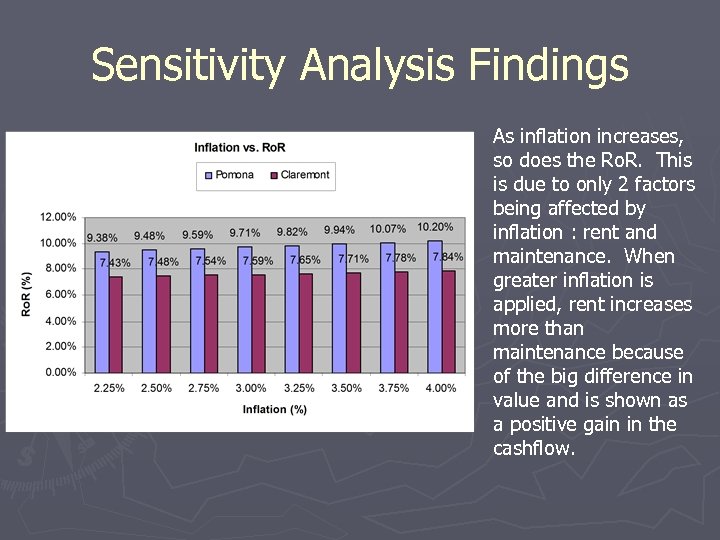

Sensitivity Analysis Findings As inflation increases, so does the Ro. R. This is due to only 2 factors being affected by inflation : rent and maintenance. When greater inflation is applied, rent increases more than maintenance because of the big difference in value and is shown as a positive gain in the cashflow.

Sensitivity Analysis Findings As inflation increases, so does the Ro. R. This is due to only 2 factors being affected by inflation : rent and maintenance. When greater inflation is applied, rent increases more than maintenance because of the big difference in value and is shown as a positive gain in the cashflow.

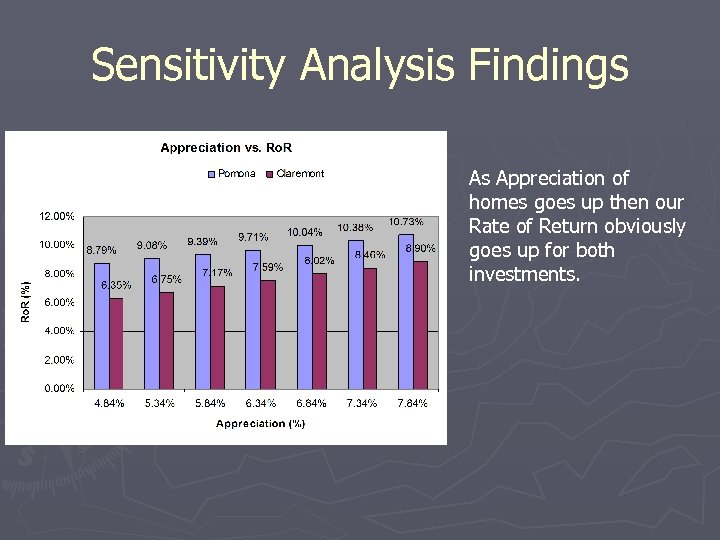

Sensitivity Analysis Findings As Appreciation of homes goes up then our Rate of Return obviously goes up for both investments.

Sensitivity Analysis Findings As Appreciation of homes goes up then our Rate of Return obviously goes up for both investments.

References ► http: //www. homes. com ► http: //homes. realtor. com/ ► http: //www. realestateabc. com/insights/appr eciation. htm ► http: //www. invest 2 win. com/appreciation. html ► http: //interactive. web. insurance. ca. gov/surv ey/survey? type=homeowners

References ► http: //www. homes. com ► http: //homes. realtor. com/ ► http: //www. realestateabc. com/insights/appr eciation. htm ► http: //www. invest 2 win. com/appreciation. html ► http: //interactive. web. insurance. ca. gov/surv ey/survey? type=homeowners