whole pres version 2.pptx

- Количество слайдов: 25

TEAM #1 Balitskaya E. Berdinev A. Latypova A. Masyuk M. Paramonov E. Tsurkan M. Shubarkina P. Yusufov Y. ACCOUNTING AND FINANCE FUNCTIONS

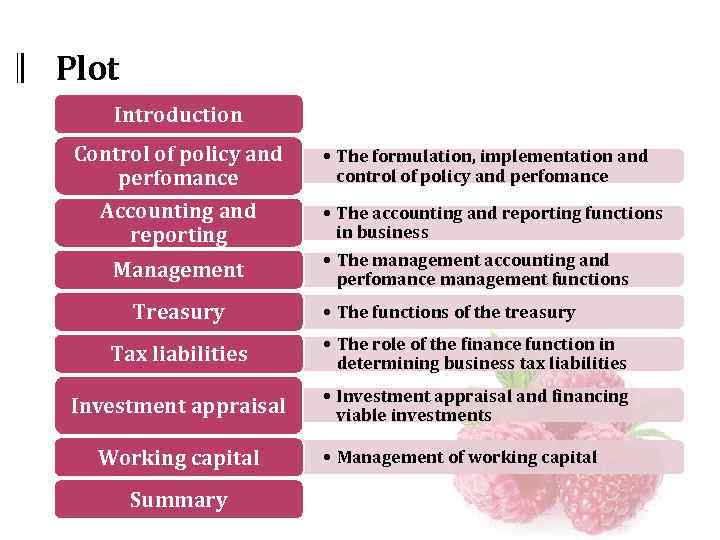

Plot Introduction Control of policy and perfomance Accounting and reporting Management Treasury • The formulation, implementation and control of policy and perfomance • The accounting and reporting functions in business • The management accounting and perfomance management functions • The functions of the treasury Tax liabilities • The role of the finance function in determining business tax liabilities Investment appraisal • Investment appraisal and financing viable investments Working capital Summary • Management of working capital

Introduction § Blah blah

The formulation, implementation and control of policy and perfomance The accounting function helps management to: § Formulate policy § Implement policy § Control performance

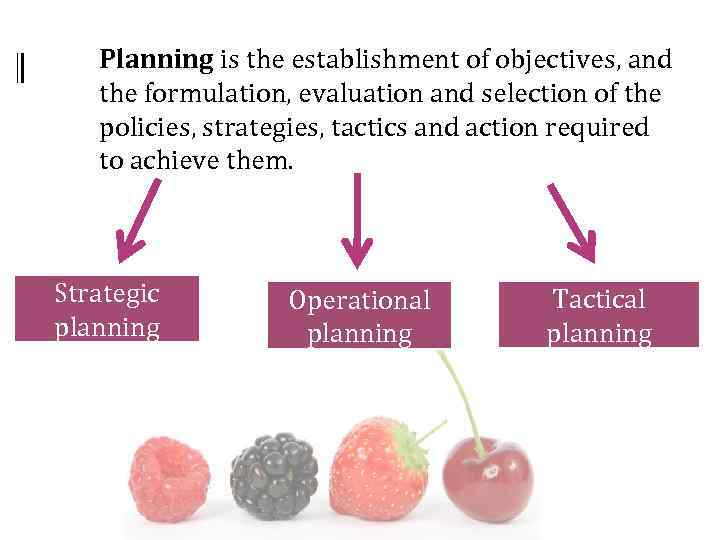

Planning is the establishment of objectives, and the formulation, evaluation and selection of the policies, strategies, tactics and action required to achieve them. Strategic planning Operational planning Tactical planning

Control Budgetary control Establishment of standards • Budgets are set as the totals of amounts of costs or revenues • Standards can be set for individual costs and revenues

The accounting and reporting functions in business How financial transactions are recorded by the accounting function; How financial information is codified and processed; The steps involved in preparing financial statements.

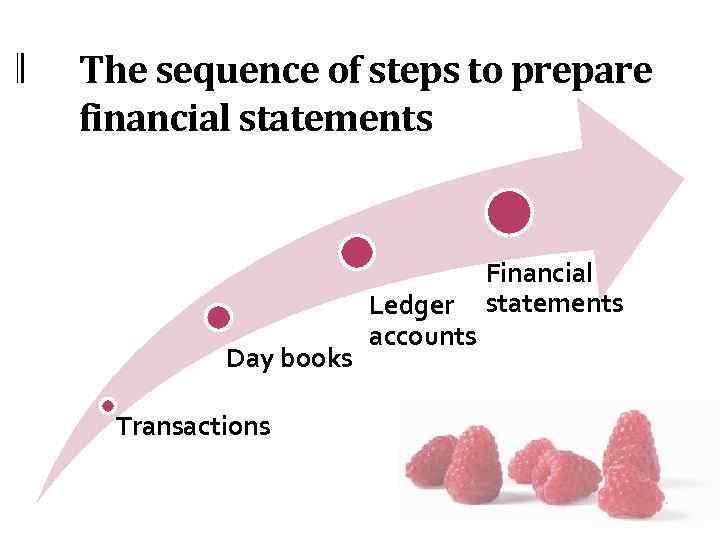

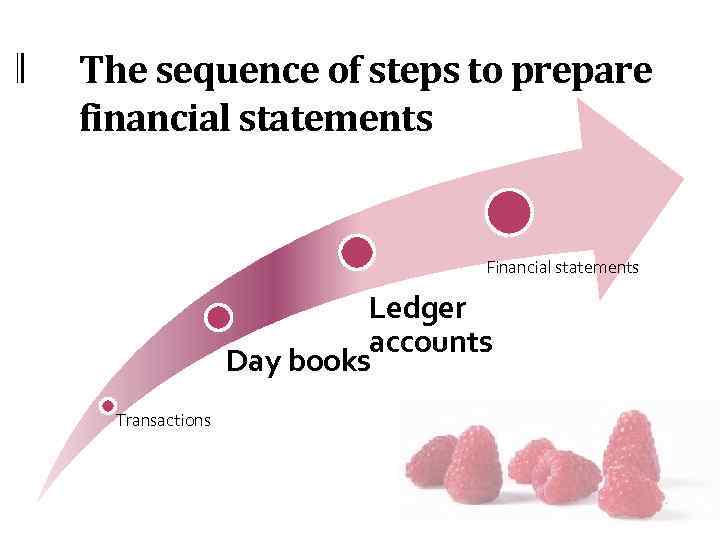

The sequence of steps to prepare financial statements Day books Transactions Financial Ledger statements accounts

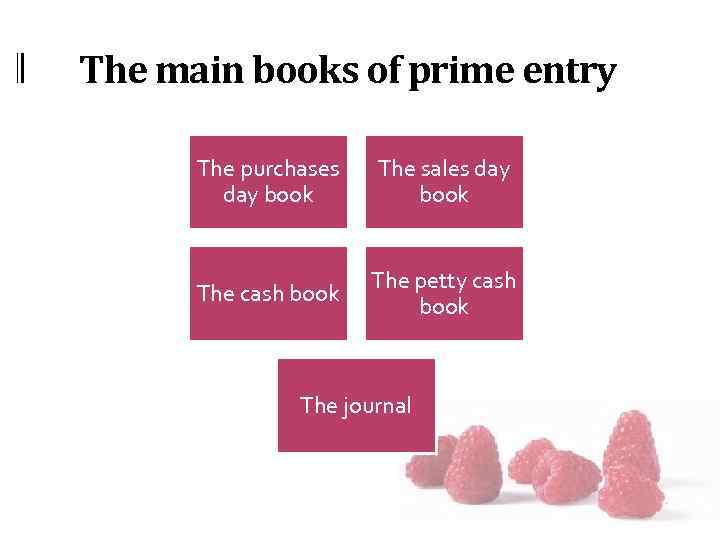

The main books of prime entry The purchases day book The sales day book The cash book The petty cash book The journal

The sequence of steps to prepare financial statements Financial statements Ledger accounts Day books Transactions

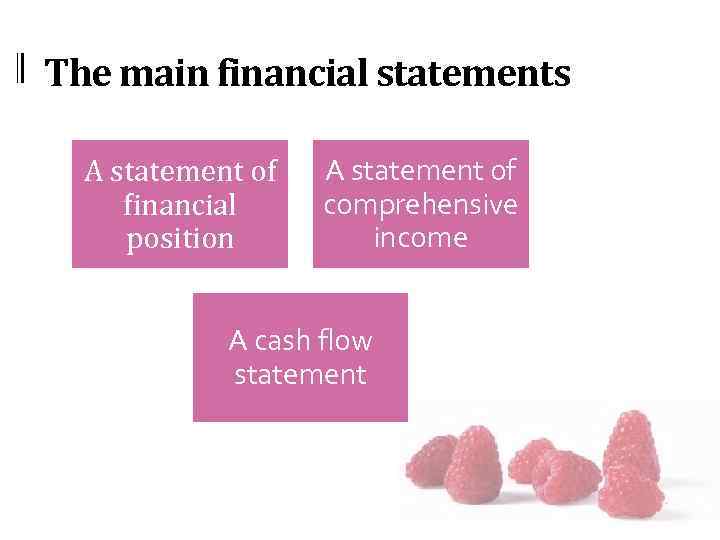

The main financial statements A statement of financial position A statement of comprehensive income A cash flow statement

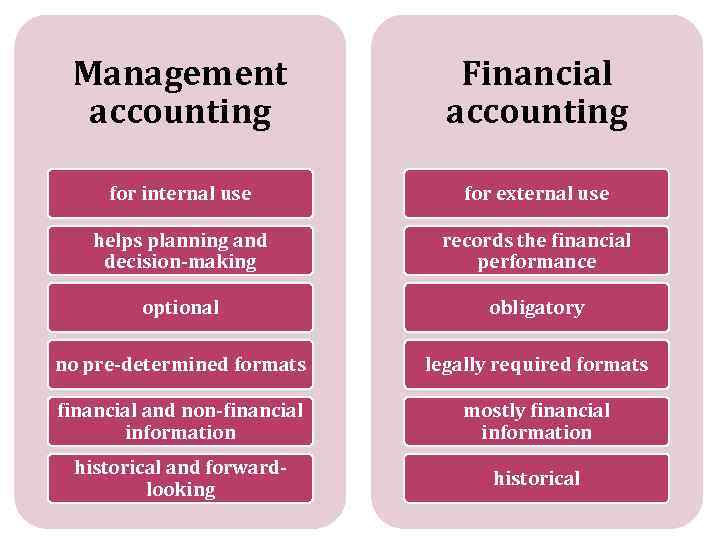

Management accounting Financial accounting for internal use for external use helps planning and decision-making records the financial performance optional obligatory no pre-determined formats legally required formats financial and non-financial information mostly financial information historical and forwardlooking historical

Cost schedule break-even analysis prici ng deci sion s key factor analysis inve stm ent anal ysis Cost schedule

Budget Crumpet! § § § § Co-ordination Responsibility Utilisation Motivation Planning Evaluation Telling

Variance report Control measures: § prevent unfavourable variances in the future § repeat a favourable variance in the future § bring actual results back on course to achieve the budgeted targets

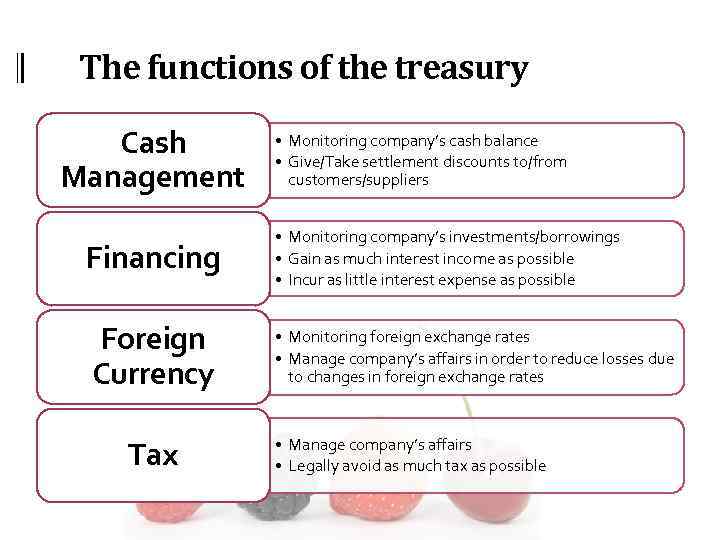

The functions of the treasury Cash Management Financing Foreign Currency Tax • Monitoring company’s cash balance • Give/Take settlement discounts to/from customers/suppliers • Monitoring company’s investments/borrowings • Gain as much interest income as possible • Incur as little interest expense as possible • Monitoring foreign exchange rates • Manage company’s affairs in order to reduce losses due to changes in foreign exchange rates • Manage company’s affairs • Legally avoid as much tax as possible

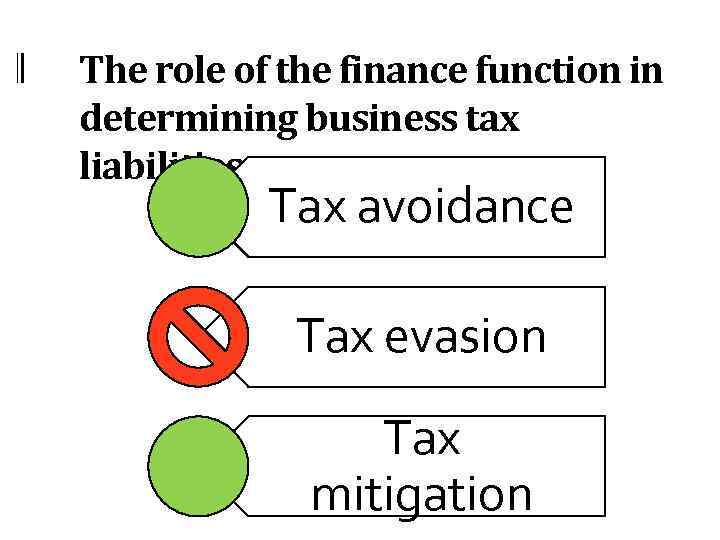

The role of the finance function in determining business tax liabilities Tax avoidance Tax evasion Tax mitigation

Responsibilities of the finance functions § Maintaining proper accounting records of the company § Calculating the tax liability arising from the profits earned each year, and paying amounts due to the tax authorities on a timely basis

Investment appraisal and financing viable investments § Так и оставить пустой слайд?

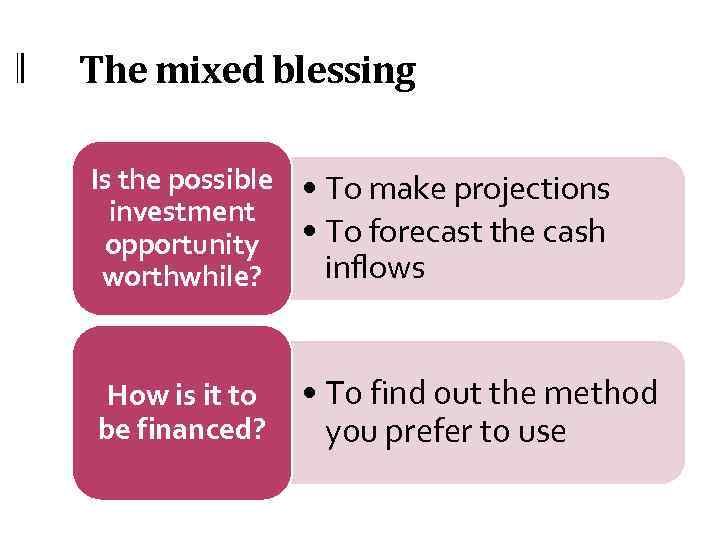

The mixed blessing Is the possible • To make projections investment opportunity • To forecast the cash inflows worthwhile? How is it to be financed? • To find out the method you prefer to use

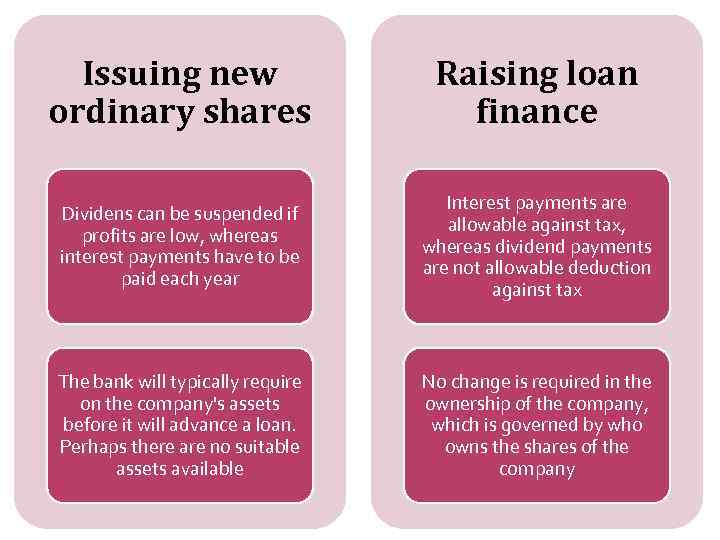

Issuing new ordinary shares Raising loan finance Dividens can be suspended if profits are low, whereas interest payments have to be paid each year Interest payments are allowable against tax, whereas dividend payments are not allowable deduction against tax The bank will typically require on the company's assets before it will advance a loan. Perhaps there are no suitable assets available No change is required in the ownership of the company, which is governed by who owns the shares of the company

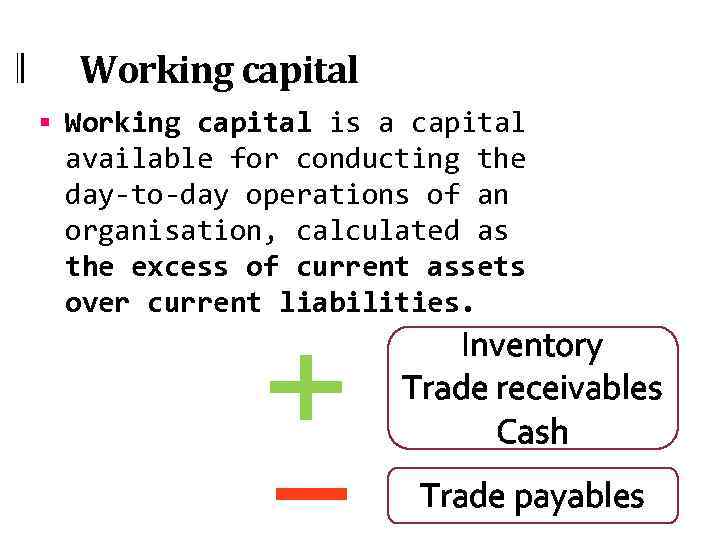

Working capital § Working capital is a capital available for conducting the day-to-day operations of an organisation, calculated as the excess of current assets over current liabilities. Inventory Trade receivables Cash Trade payables

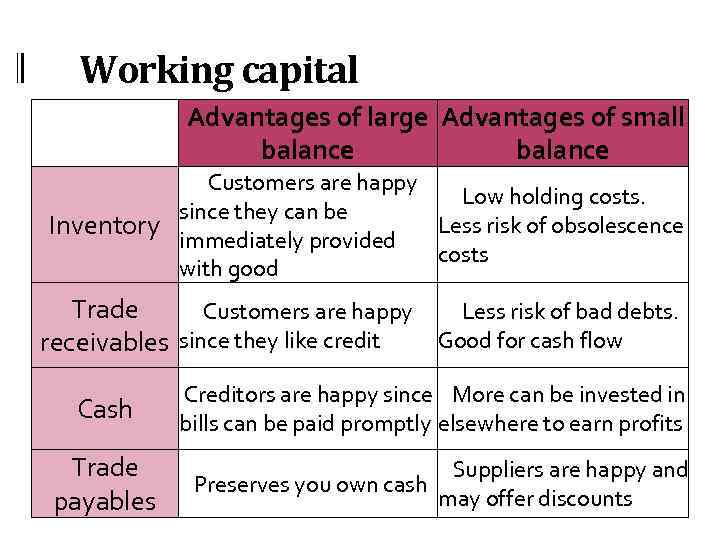

Working capital Advantages of large Advantages of small balance Customers are happy Low holding costs. since they can be Inventory immediately provided Less risk of obsolescence costs with good Trade Customers are happy Less risk of bad debts. Good for cash flow receivables since they like credit Cash Trade payables Creditors are happy since More can be invested in bills can be paid promptly elsewhere to earn profits Preserves you own cash Suppliers are happy and may offer discounts

Summary, conclusion

Thank you for attention!

whole pres version 2.pptx