dd4e007534968b0a3ec11a7c735c29ce.ppt

- Количество слайдов: 119

TDS & Section 40(a)(ia) provisions Income Tax Act, 1961 CA. Manish Shah & Bhandari Chartered Accountants

TDS & Section 40(a)(ia) provisions Income Tax Act, 1961 CA. Manish Shah & Bhandari Chartered Accountants

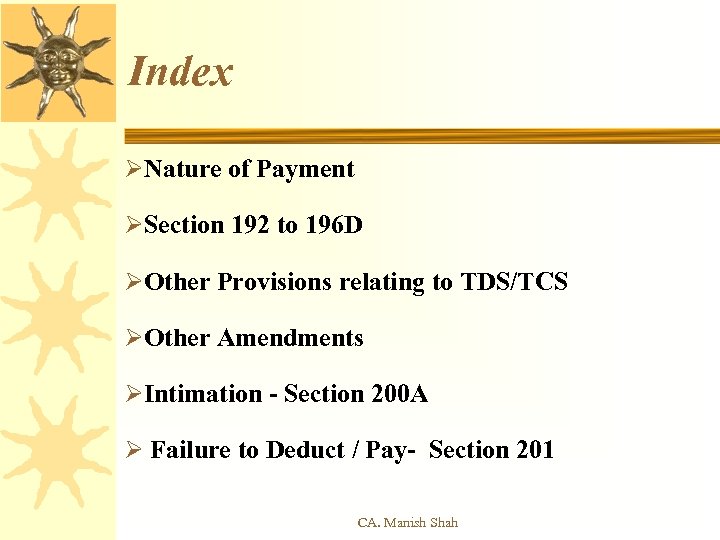

Index ØNature of Payment ØSection 192 to 196 D ØOther Provisions relating to TDS/TCS ØOther Amendments ØIntimation - Section 200 A Ø Failure to Deduct / Pay- Section 201 CA. Manish Shah

Index ØNature of Payment ØSection 192 to 196 D ØOther Provisions relating to TDS/TCS ØOther Amendments ØIntimation - Section 200 A Ø Failure to Deduct / Pay- Section 201 CA. Manish Shah

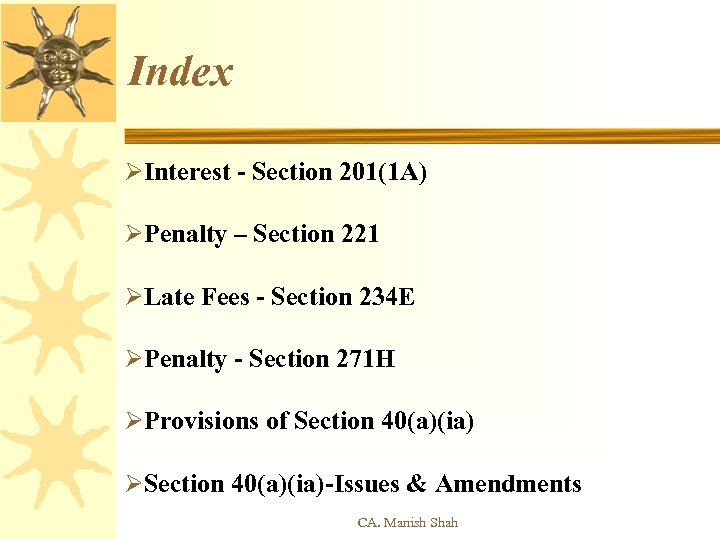

Index ØInterest - Section 201(1 A) ØPenalty – Section 221 ØLate Fees - Section 234 E ØPenalty - Section 271 H ØProvisions of Section 40(a)(ia) ØSection 40(a)(ia)-Issues & Amendments CA. Manish Shah

Index ØInterest - Section 201(1 A) ØPenalty – Section 221 ØLate Fees - Section 234 E ØPenalty - Section 271 H ØProvisions of Section 40(a)(ia) ØSection 40(a)(ia)-Issues & Amendments CA. Manish Shah

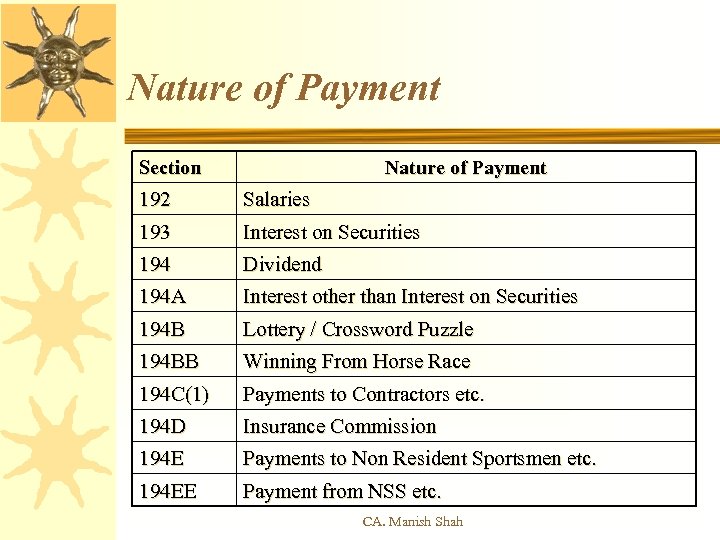

Nature of Payment Section Nature of Payment 192 Salaries 193 Interest on Securities 194 Dividend 194 A Interest other than Interest on Securities 194 B Lottery / Crossword Puzzle 194 BB Winning From Horse Race 194 C(1) Payments to Contractors etc. 194 D Insurance Commission 194 E Payments to Non Resident Sportsmen etc. 194 EE Payment from NSS etc. CA. Manish Shah

Nature of Payment Section Nature of Payment 192 Salaries 193 Interest on Securities 194 Dividend 194 A Interest other than Interest on Securities 194 B Lottery / Crossword Puzzle 194 BB Winning From Horse Race 194 C(1) Payments to Contractors etc. 194 D Insurance Commission 194 E Payments to Non Resident Sportsmen etc. 194 EE Payment from NSS etc. CA. Manish Shah

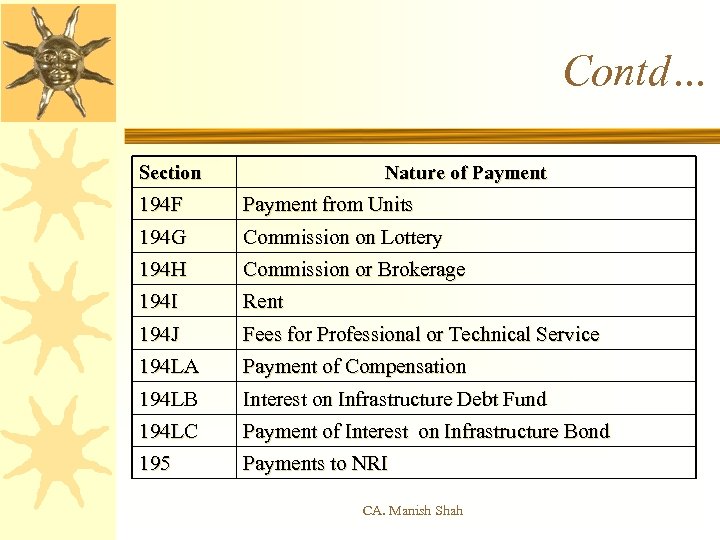

Contd… Section Nature of Payment 194 F Payment from Units 194 G Commission on Lottery 194 H Commission or Brokerage 194 I Rent 194 J Fees for Professional or Technical Service 194 LA Payment of Compensation 194 LB Interest on Infrastructure Debt Fund 194 LC Payment of Interest on Infrastructure Bond 195 Payments to NRI CA. Manish Shah

Contd… Section Nature of Payment 194 F Payment from Units 194 G Commission on Lottery 194 H Commission or Brokerage 194 I Rent 194 J Fees for Professional or Technical Service 194 LA Payment of Compensation 194 LB Interest on Infrastructure Debt Fund 194 LC Payment of Interest on Infrastructure Bond 195 Payments to NRI CA. Manish Shah

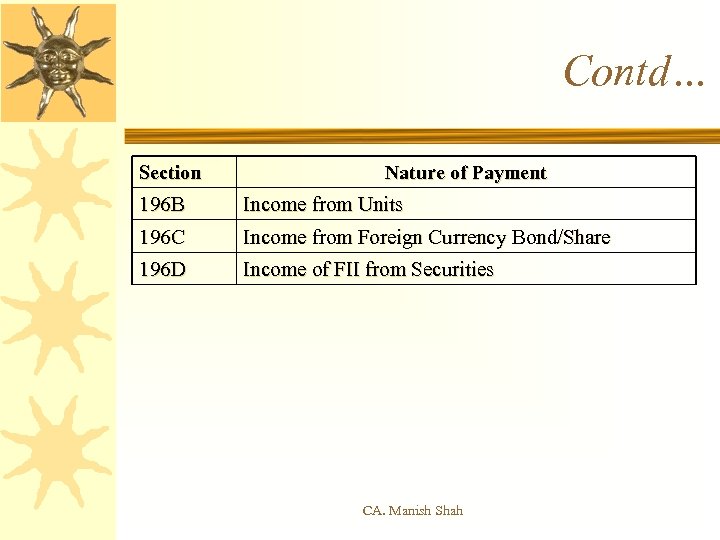

Contd… Section Nature of Payment 196 B Income from Units 196 C Income from Foreign Currency Bond/Share 196 D Income of FII from Securities CA. Manish Shah

Contd… Section Nature of Payment 196 B Income from Units 196 C Income from Foreign Currency Bond/Share 196 D Income of FII from Securities CA. Manish Shah

![Salary [Sec. 192] Ø Nature of Payment : Salary to Any Person Ø Exemption Salary [Sec. 192] Ø Nature of Payment : Salary to Any Person Ø Exemption](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-7.jpg) Salary [Sec. 192] Ø Nature of Payment : Salary to Any Person Ø Exemption Limit : • ` 5, 000/- Senior Citizen (80+) • ` 2, 50, 000/- Senior Citizen (60 -80 Years) • ` 2, 000/ - Any Other Employee Ø Deduction U/s 16, 80 CCC, 80 CCD, 80 CCE, 80 DD, 80 E, 80 GG & Loss under head “House Property”. CA. Manish Shah

Salary [Sec. 192] Ø Nature of Payment : Salary to Any Person Ø Exemption Limit : • ` 5, 000/- Senior Citizen (80+) • ` 2, 50, 000/- Senior Citizen (60 -80 Years) • ` 2, 000/ - Any Other Employee Ø Deduction U/s 16, 80 CCC, 80 CCD, 80 CCE, 80 DD, 80 E, 80 GG & Loss under head “House Property”. CA. Manish Shah

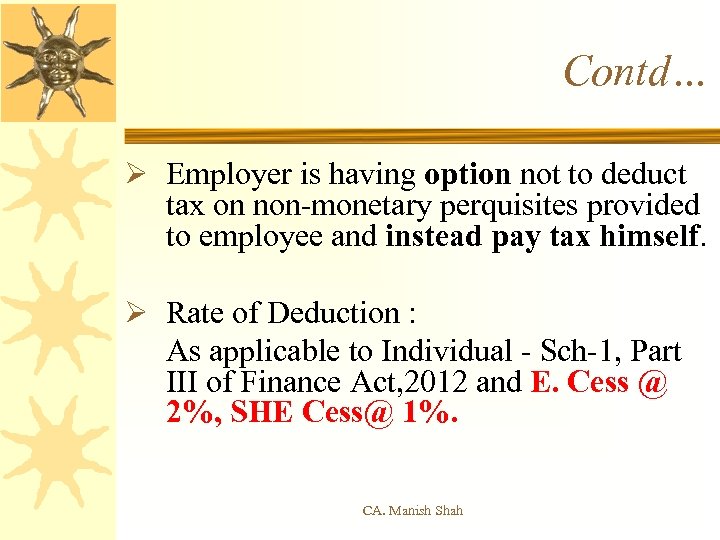

Contd… Ø Employer is having option not to deduct tax on non-monetary perquisites provided to employee and instead pay tax himself. Ø Rate of Deduction : As applicable to Individual - Sch-1, Part III of Finance Act, 2012 and E. Cess @ 2%, SHE Cess@ 1%. CA. Manish Shah

Contd… Ø Employer is having option not to deduct tax on non-monetary perquisites provided to employee and instead pay tax himself. Ø Rate of Deduction : As applicable to Individual - Sch-1, Part III of Finance Act, 2012 and E. Cess @ 2%, SHE Cess@ 1%. CA. Manish Shah

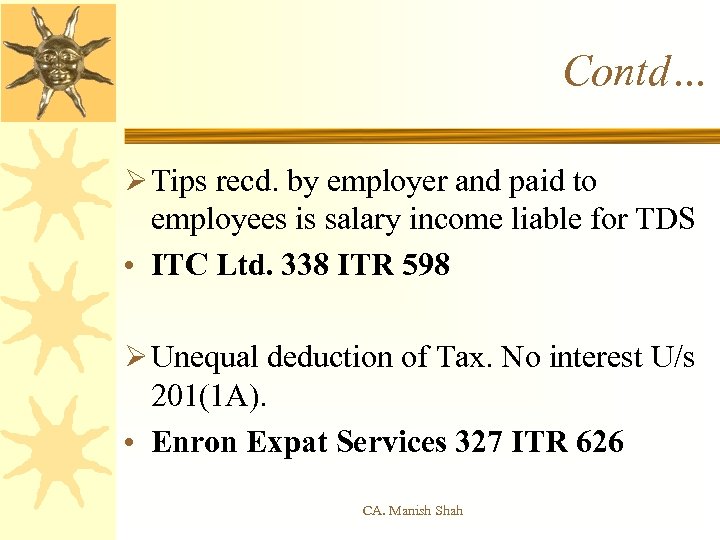

Contd… Ø Tips recd. by employer and paid to employees is salary income liable for TDS • ITC Ltd. 338 ITR 598 Ø Unequal deduction of Tax. No interest U/s 201(1 A). • Enron Expat Services 327 ITR 626 CA. Manish Shah

Contd… Ø Tips recd. by employer and paid to employees is salary income liable for TDS • ITC Ltd. 338 ITR 598 Ø Unequal deduction of Tax. No interest U/s 201(1 A). • Enron Expat Services 327 ITR 626 CA. Manish Shah

![Interest on Securities [Sec. 193 ] Rate of Deduction : a. Companies : 10% Interest on Securities [Sec. 193 ] Rate of Deduction : a. Companies : 10%](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-10.jpg) Interest on Securities [Sec. 193 ] Rate of Deduction : a. Companies : 10% b. Firms, Co-op. Society : 10% c. Individual/HUF/AOP/BOI : 10% Ø No threshold limit for non deduction except specified cases CA. Manish Shah

Interest on Securities [Sec. 193 ] Rate of Deduction : a. Companies : 10% b. Firms, Co-op. Society : 10% c. Individual/HUF/AOP/BOI : 10% Ø No threshold limit for non deduction except specified cases CA. Manish Shah

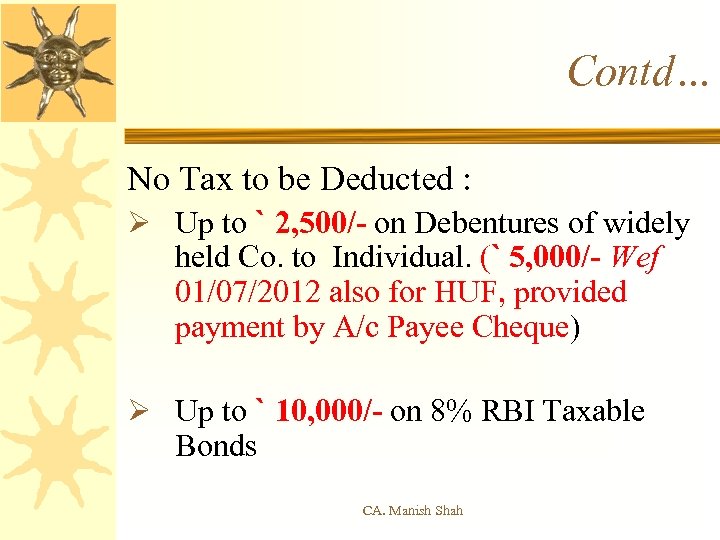

Contd… No Tax to be Deducted : Ø Up to ` 2, 500/- on Debentures of widely held Co. to Individual. (` 5, 000/- Wef 01/07/2012 also for HUF, provided payment by A/c Payee Cheque) Ø Up to ` 10, 000/- on 8% RBI Taxable Bonds CA. Manish Shah

Contd… No Tax to be Deducted : Ø Up to ` 2, 500/- on Debentures of widely held Co. to Individual. (` 5, 000/- Wef 01/07/2012 also for HUF, provided payment by A/c Payee Cheque) Ø Up to ` 10, 000/- on 8% RBI Taxable Bonds CA. Manish Shah

Contd… Ø Any Security of State/ Central Govt. Ø Interest Payable to LIC, GIC & other Insurer. Ø Listed Securities by Cos. CA. Manish Shah

Contd… Ø Any Security of State/ Central Govt. Ø Interest Payable to LIC, GIC & other Insurer. Ø Listed Securities by Cos. CA. Manish Shah

![Dividends [Sec. 194] Ø Rate of Deduction : 10% Ø Exemption Limit : ` Dividends [Sec. 194] Ø Rate of Deduction : 10% Ø Exemption Limit : `](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-13.jpg) Dividends [Sec. 194] Ø Rate of Deduction : 10% Ø Exemption Limit : ` 2500/Ø No TDS on 115 -O Dividend CA. Manish Shah

Dividends [Sec. 194] Ø Rate of Deduction : 10% Ø Exemption Limit : ` 2500/Ø No TDS on 115 -O Dividend CA. Manish Shah

![Interest other than Interest on Securities [Sec. 194 A ] Rate of Deduction : Interest other than Interest on Securities [Sec. 194 A ] Rate of Deduction :](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-14.jpg) Interest other than Interest on Securities [Sec. 194 A ] Rate of Deduction : Ø Companies, Firms : Ø Individual/HUF/AOP/BOI : 10% CA. Manish Shah

Interest other than Interest on Securities [Sec. 194 A ] Rate of Deduction : Ø Companies, Firms : Ø Individual/HUF/AOP/BOI : 10% CA. Manish Shah

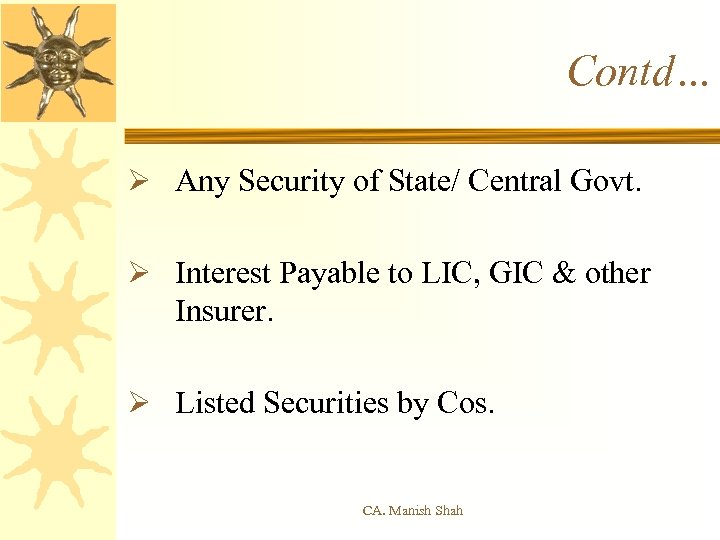

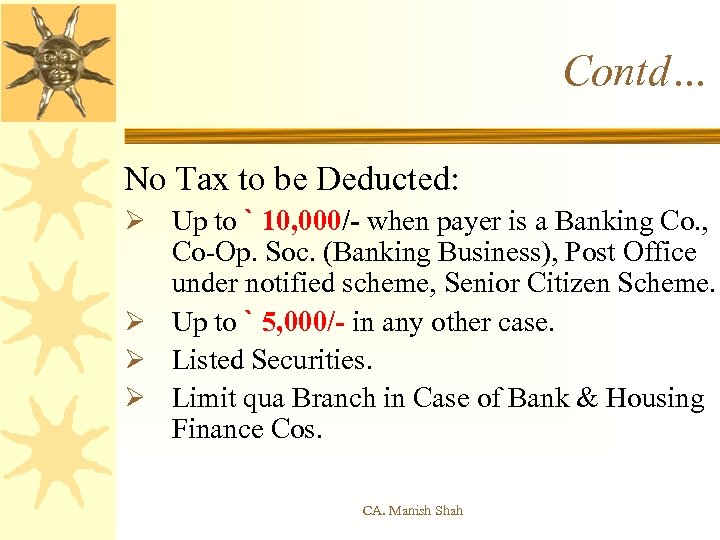

Contd… No Tax to be Deducted: Ø Up to ` 10, 000/- when payer is a Banking Co. , Co-Op. Soc. (Banking Business), Post Office under notified scheme, Senior Citizen Scheme. Ø Up to ` 5, 000/- in any other case. Ø Listed Securities. Ø Limit qua Branch in Case of Bank & Housing Finance Cos. CA. Manish Shah

Contd… No Tax to be Deducted: Ø Up to ` 10, 000/- when payer is a Banking Co. , Co-Op. Soc. (Banking Business), Post Office under notified scheme, Senior Citizen Scheme. Ø Up to ` 5, 000/- in any other case. Ø Listed Securities. Ø Limit qua Branch in Case of Bank & Housing Finance Cos. CA. Manish Shah

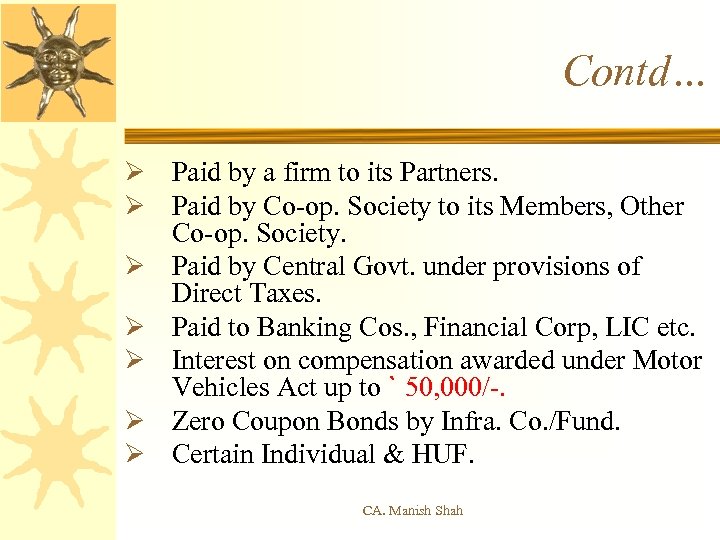

Contd… Ø Paid by a firm to its Partners. Ø Paid by Co-op. Society to its Members, Other Co-op. Society. Ø Paid by Central Govt. under provisions of Direct Taxes. Ø Paid to Banking Cos. , Financial Corp, LIC etc. Ø Interest on compensation awarded under Motor Vehicles Act up to ` 50, 000/-. Ø Zero Coupon Bonds by Infra. Co. /Fund. Ø Certain Individual & HUF. CA. Manish Shah

Contd… Ø Paid by a firm to its Partners. Ø Paid by Co-op. Society to its Members, Other Co-op. Society. Ø Paid by Central Govt. under provisions of Direct Taxes. Ø Paid to Banking Cos. , Financial Corp, LIC etc. Ø Interest on compensation awarded under Motor Vehicles Act up to ` 50, 000/-. Ø Zero Coupon Bonds by Infra. Co. /Fund. Ø Certain Individual & HUF. CA. Manish Shah

Contd… Ø EMI Loan from Finance Co. • SRL Ranbaxy Ltd. 143 TTJ 265 Ø In case of Motor Vehicle Compensation – Limit Qua Claimant • National Insurance 238 CTR 201 Ø In case of Motor Vehicle Compensation – Limit per year to be considered • United India Insurance 56 TDR 407 CA. Manish Shah

Contd… Ø EMI Loan from Finance Co. • SRL Ranbaxy Ltd. 143 TTJ 265 Ø In case of Motor Vehicle Compensation – Limit Qua Claimant • National Insurance 238 CTR 201 Ø In case of Motor Vehicle Compensation – Limit per year to be considered • United India Insurance 56 TDR 407 CA. Manish Shah

Contd… Ø Interest given as damages – S. 194 A not applicable • HP Housing Board 340 ITR 388 CA. Manish Shah

Contd… Ø Interest given as damages – S. 194 A not applicable • HP Housing Board 340 ITR 388 CA. Manish Shah

![Winnings of Lottery/Crossword Puzzles [ Sec. 194 B] Ø Includes winnings from – lotteries/ Winnings of Lottery/Crossword Puzzles [ Sec. 194 B] Ø Includes winnings from – lotteries/](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-19.jpg) Winnings of Lottery/Crossword Puzzles [ Sec. 194 B] Ø Includes winnings from – lotteries/ crossword/ puzzles/ card games/ or any other game. Ø Exemption Limit – ` 10, 000/- Ø In case of Cash prize & prize in kind – Tax to be deducted with reference to aggregate prize. Ø No TDS– in case of bonus or commission paid to agents or sellers of lottery tickets CA. Manish Shah

Winnings of Lottery/Crossword Puzzles [ Sec. 194 B] Ø Includes winnings from – lotteries/ crossword/ puzzles/ card games/ or any other game. Ø Exemption Limit – ` 10, 000/- Ø In case of Cash prize & prize in kind – Tax to be deducted with reference to aggregate prize. Ø No TDS– in case of bonus or commission paid to agents or sellers of lottery tickets CA. Manish Shah

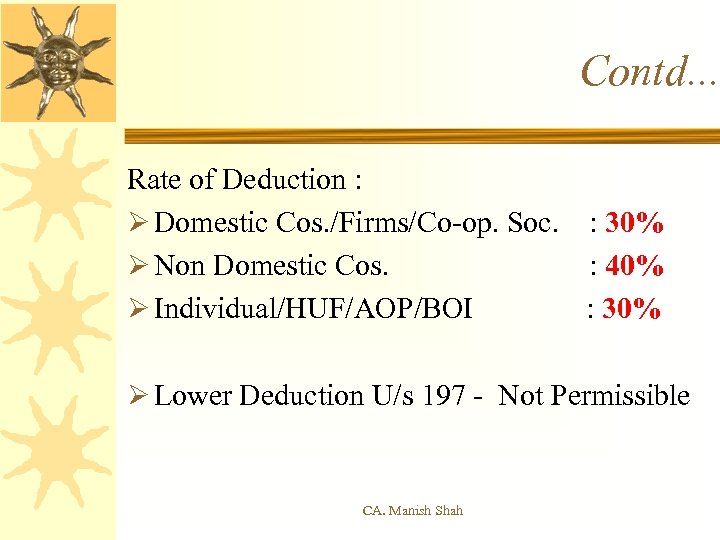

Contd. . . Rate of Deduction : Ø Domestic Cos. /Firms/Co-op. Soc. : 30% Ø Non Domestic Cos. : 40% Ø Individual/HUF/AOP/BOI : 30% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

Contd. . . Rate of Deduction : Ø Domestic Cos. /Firms/Co-op. Soc. : 30% Ø Non Domestic Cos. : 40% Ø Individual/HUF/AOP/BOI : 30% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

![Winnings from Horse Races [ Sec. 194 BB ] Ø Exemption Limit : ` Winnings from Horse Races [ Sec. 194 BB ] Ø Exemption Limit : `](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-21.jpg) Winnings from Horse Races [ Sec. 194 BB ] Ø Exemption Limit : ` 5, 000/- Ø Obligation to deduct TDS applies only where such winnings are paid to a bookmaker or person to whom license has been granted by Govt. under any law for time being in force. CA. Manish Shah

Winnings from Horse Races [ Sec. 194 BB ] Ø Exemption Limit : ` 5, 000/- Ø Obligation to deduct TDS applies only where such winnings are paid to a bookmaker or person to whom license has been granted by Govt. under any law for time being in force. CA. Manish Shah

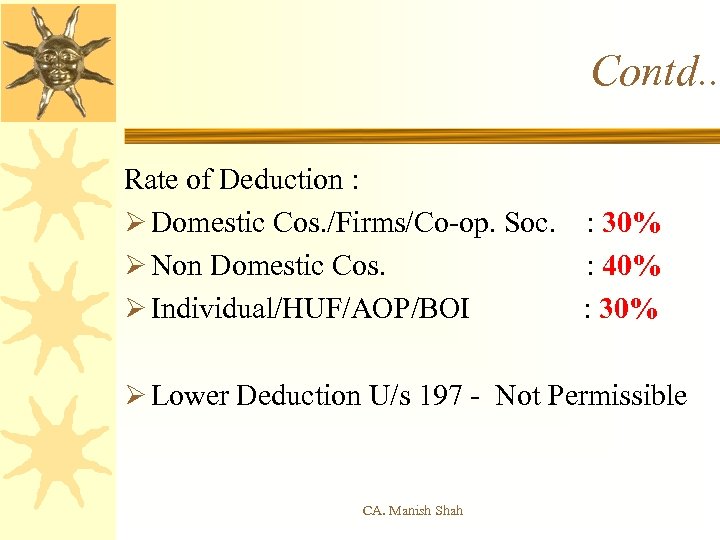

Contd. . Rate of Deduction : Ø Domestic Cos. /Firms/Co-op. Soc. : 30% Ø Non Domestic Cos. : 40% Ø Individual/HUF/AOP/BOI : 30% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

Contd. . Rate of Deduction : Ø Domestic Cos. /Firms/Co-op. Soc. : 30% Ø Non Domestic Cos. : 40% Ø Individual/HUF/AOP/BOI : 30% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

![Payment to Contractors [Sec. 194 C ] Contractor includes sub-contractor carrying out any Work Payment to Contractors [Sec. 194 C ] Contractor includes sub-contractor carrying out any Work](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-23.jpg) Payment to Contractors [Sec. 194 C ] Contractor includes sub-contractor carrying out any Work (including supply of Labour with or without Materials) & Work includes: Ø Advertising, Broadcasting & Telecasting incl. production of programmes. Ø Carriage of goods & passengers by mode of transport other than by railway Ø Catering Ø Manufacturing or Supply of Product by using material purchased from customer CA. Manish Shah

Payment to Contractors [Sec. 194 C ] Contractor includes sub-contractor carrying out any Work (including supply of Labour with or without Materials) & Work includes: Ø Advertising, Broadcasting & Telecasting incl. production of programmes. Ø Carriage of goods & passengers by mode of transport other than by railway Ø Catering Ø Manufacturing or Supply of Product by using material purchased from customer CA. Manish Shah

Contd. . . Ø Contractee includes • Town Development Authority • Specified Individual & HUF Ø Now no bifurcation between payment to Contractor/ Sub Contractor Ø Not applicable to Manufacturing Contract: • No TDS on value of material if stated in invoice CA. Manish Shah

Contd. . . Ø Contractee includes • Town Development Authority • Specified Individual & HUF Ø Now no bifurcation between payment to Contractor/ Sub Contractor Ø Not applicable to Manufacturing Contract: • No TDS on value of material if stated in invoice CA. Manish Shah

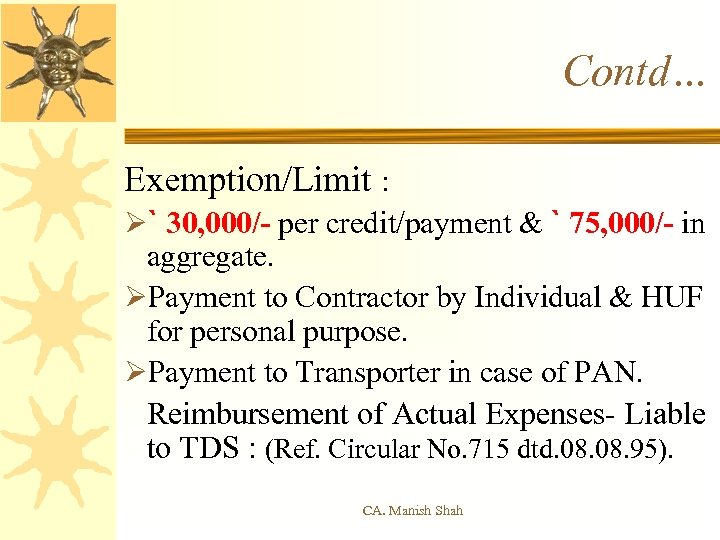

Contd… Exemption/Limit : Ø` 30, 000/- per credit/payment & ` 75, 000/- in aggregate. ØPayment to Contractor by Individual & HUF for personal purpose. ØPayment to Transporter in case of PAN. Reimbursement of Actual Expenses- Liable to TDS : (Ref. Circular No. 715 dtd. 08. 95). CA. Manish Shah

Contd… Exemption/Limit : Ø` 30, 000/- per credit/payment & ` 75, 000/- in aggregate. ØPayment to Contractor by Individual & HUF for personal purpose. ØPayment to Transporter in case of PAN. Reimbursement of Actual Expenses- Liable to TDS : (Ref. Circular No. 715 dtd. 08. 95). CA. Manish Shah

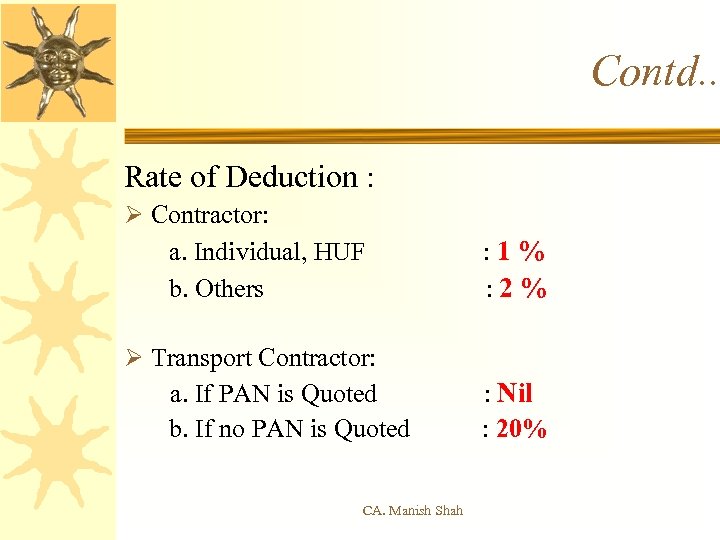

Contd. . Rate of Deduction : Ø Contractor: a. Individual, HUF : 1 % b. Others : 2 % Ø Transport Contractor: a. If PAN is Quoted : Nil b. If no PAN is Quoted : 20% CA. Manish Shah

Contd. . Rate of Deduction : Ø Contractor: a. Individual, HUF : 1 % b. Others : 2 % Ø Transport Contractor: a. If PAN is Quoted : Nil b. If no PAN is Quoted : 20% CA. Manish Shah

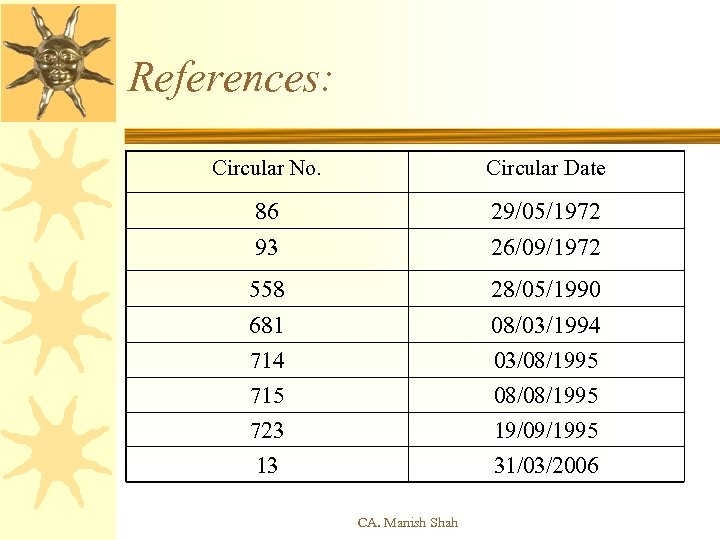

References: Circular No. Circular Date 86 93 29/05/1972 26/09/1972 558 28/05/1990 681 714 715 723 13 08/03/1994 03/08/1995 08/08/1995 19/09/1995 31/03/2006 CA. Manish Shah

References: Circular No. Circular Date 86 93 29/05/1972 26/09/1972 558 28/05/1990 681 714 715 723 13 08/03/1994 03/08/1995 08/08/1995 19/09/1995 31/03/2006 CA. Manish Shah

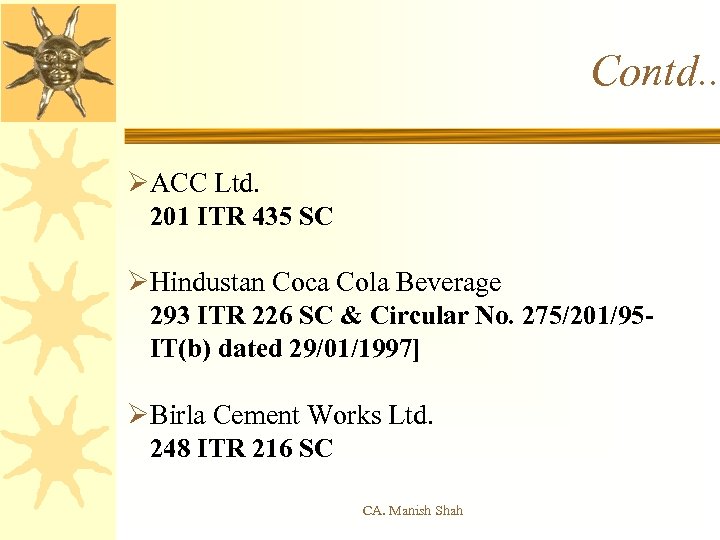

Contd. . ØACC Ltd. 201 ITR 435 SC ØHindustan Coca Cola Beverage 293 ITR 226 SC & Circular No. 275/201/95 IT(b) dated 29/01/1997] ØBirla Cement Works Ltd. 248 ITR 216 SC CA. Manish Shah

Contd. . ØACC Ltd. 201 ITR 435 SC ØHindustan Coca Cola Beverage 293 ITR 226 SC & Circular No. 275/201/95 IT(b) dated 29/01/1997] ØBirla Cement Works Ltd. 248 ITR 216 SC CA. Manish Shah

Contd. . Ø Contract of work vis-à-vis Contract for Sale: • If dominant object is to transfer goods, it • • would be contract of sale. If dominant object is to carry out work, it would be contract of work E. g. : 1. Office Renovation - Contract of work 2. Uniform of Employees- Contract of Sale CA. Manish Shah

Contd. . Ø Contract of work vis-à-vis Contract for Sale: • If dominant object is to transfer goods, it • • would be contract of sale. If dominant object is to carry out work, it would be contract of work E. g. : 1. Office Renovation - Contract of work 2. Uniform of Employees- Contract of Sale CA. Manish Shah

Contd. . Ø Transport Contract: The exemption is very wide and it covers that any payment made to contract during course of business of plying, hiring , leasing of good carriage [goods carriage as per Explanation to S. 44 AE(7)] CA. Manish Shah

Contd. . Ø Transport Contract: The exemption is very wide and it covers that any payment made to contract during course of business of plying, hiring , leasing of good carriage [goods carriage as per Explanation to S. 44 AE(7)] CA. Manish Shah

Contd. . Ø Payment to Couriers -194 C Ø Payment to Restaurant, FD Agent – Not 194 C Ø Payment to Recruitment Agency – 194 J not 194 C (Ref. Circular No. 715 dated 8/8/95) Ø Supply of Printed Material (Ref. Circular No. 715 dated 8/8/95 - But refer decisions) CA. Manish Shah

Contd. . Ø Payment to Couriers -194 C Ø Payment to Restaurant, FD Agent – Not 194 C Ø Payment to Recruitment Agency – 194 J not 194 C (Ref. Circular No. 715 dated 8/8/95) Ø Supply of Printed Material (Ref. Circular No. 715 dated 8/8/95 - But refer decisions) CA. Manish Shah

Contd. . Ø Hiring of vehicle for Transportation of employees - S. 194 C applicable. • Accenture Services P. Ltd. 44 SOT 290 Ø Act of commission agent or broker would be outside the purview of S. 194 C • SRF Finance Ltd. 211 ITR 861 Ø Franchise agreement- Sharing of profit. • Career Launcher 139 TTJ 48 CA. Manish Shah

Contd. . Ø Hiring of vehicle for Transportation of employees - S. 194 C applicable. • Accenture Services P. Ltd. 44 SOT 290 Ø Act of commission agent or broker would be outside the purview of S. 194 C • SRF Finance Ltd. 211 ITR 861 Ø Franchise agreement- Sharing of profit. • Career Launcher 139 TTJ 48 CA. Manish Shah

Contd. . Ø Various Services provided by hotel does not involve ‘carrying out any work’- outside the purview of S. 194 C • East India Hotels 320 ITR 526 Ø In case of cable operator, it is not broadcasting but it is telecasting. - S. 194 C is applicable. • Kurukshetra Darpans Pvt. Ltd. 169 Taxman 344 CA. Manish Shah

Contd. . Ø Various Services provided by hotel does not involve ‘carrying out any work’- outside the purview of S. 194 C • East India Hotels 320 ITR 526 Ø In case of cable operator, it is not broadcasting but it is telecasting. - S. 194 C is applicable. • Kurukshetra Darpans Pvt. Ltd. 169 Taxman 344 CA. Manish Shah

Contd. . Ø If property passes to customer on delivery & material is not purchased from customer. Sec. 194 C not applicable • Glenmark Pharmaceuticals Ltd. 324 ITR 199 Ø Labour payment through representative. Payment not exceeding ` 20, 000/-. No TDS • Lakshmi Protein 3 ITR (Trib. ) 768 CA. Manish Shah

Contd. . Ø If property passes to customer on delivery & material is not purchased from customer. Sec. 194 C not applicable • Glenmark Pharmaceuticals Ltd. 324 ITR 199 Ø Labour payment through representative. Payment not exceeding ` 20, 000/-. No TDS • Lakshmi Protein 3 ITR (Trib. ) 768 CA. Manish Shah

Contd. . Ø Supply of corrugated boxes with labels • Dabur India Ltd. 283 ITR 197 Ø Sale of Packing material. • Seagram Mfg. Pvt. Ltd. 221 CTR 509 • Mother Dairy 40 SOT 9 Ø Manufacturing agreements • Reebok India 306 ITR 124 CA. Manish Shah

Contd. . Ø Supply of corrugated boxes with labels • Dabur India Ltd. 283 ITR 197 Ø Sale of Packing material. • Seagram Mfg. Pvt. Ltd. 221 CTR 509 • Mother Dairy 40 SOT 9 Ø Manufacturing agreements • Reebok India 306 ITR 124 CA. Manish Shah

Contd… Ø Purchase of printed material • Markfed 304 ITR 17 Ø Transportation of material, hiring of dumper- S. 194 C applicable. Not S. 194 I • Shree Mahalakshmi Transport Co. 339 ITR 484 • Swayam Shipping Services P. Ltd. 339 ITR 647 Ø Car hiring falls u/s 194 C. Not S. 194 I • AUDA 13 ITR 73 (Trib). CA. Manish Shah

Contd… Ø Purchase of printed material • Markfed 304 ITR 17 Ø Transportation of material, hiring of dumper- S. 194 C applicable. Not S. 194 I • Shree Mahalakshmi Transport Co. 339 ITR 484 • Swayam Shipping Services P. Ltd. 339 ITR 647 Ø Car hiring falls u/s 194 C. Not S. 194 I • AUDA 13 ITR 73 (Trib). CA. Manish Shah

Contd. . Ø Combined transportation contract using truck of firm & partners. Payment by firm to partners. -S. 194 C not applicable. • Grewal Bros. 240 CTR 325 Ø With sale of material, transport charges separately collected. – S. 194 C Not applicable. • Chand Hing Tannery 42 BCAJ March P. 32 CA. Manish Shah

Contd. . Ø Combined transportation contract using truck of firm & partners. Payment by firm to partners. -S. 194 C not applicable. • Grewal Bros. 240 CTR 325 Ø With sale of material, transport charges separately collected. – S. 194 C Not applicable. • Chand Hing Tannery 42 BCAJ March P. 32 CA. Manish Shah

Contd… Ø Transporter- Accounts not auditable U/s 44 AB – Payment made to him not liable U/s 194 C • Dhirubhai Dajibhai Patel 133 TTJ 1 Ø Making of diaries and catalogues from own materials. S. 194 C not applicable. • Eastern Medikit 135 ITD 461 CA. Manish Shah

Contd… Ø Transporter- Accounts not auditable U/s 44 AB – Payment made to him not liable U/s 194 C • Dhirubhai Dajibhai Patel 133 TTJ 1 Ø Making of diaries and catalogues from own materials. S. 194 C not applicable. • Eastern Medikit 135 ITD 461 CA. Manish Shah

![Insurance Commission [ Sec. 194 D ] Ø Tax to be deducted on payment Insurance Commission [ Sec. 194 D ] Ø Tax to be deducted on payment](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-39.jpg) Insurance Commission [ Sec. 194 D ] Ø Tax to be deducted on payment whether by way of commission or otherwise for procuring Insurance Business including business relating : a. continuance b. renewal or revival of policies. Ø Exemption Limit - ` 20, 000/- p. a. CA. Manish Shah

Insurance Commission [ Sec. 194 D ] Ø Tax to be deducted on payment whether by way of commission or otherwise for procuring Insurance Business including business relating : a. continuance b. renewal or revival of policies. Ø Exemption Limit - ` 20, 000/- p. a. CA. Manish Shah

Contd… Rate of deduction: ØFor Companies : 10% ØFor Firms, Co-op Soc. : 10% ØFor Individuals/HUF/AOP/BOI : 10% CA. Manish Shah

Contd… Rate of deduction: ØFor Companies : 10% ØFor Firms, Co-op Soc. : 10% ØFor Individuals/HUF/AOP/BOI : 10% CA. Manish Shah

![Non- Resident Sportsmen or Association [ Se. 194 E ] Ø Tax to be Non- Resident Sportsmen or Association [ Se. 194 E ] Ø Tax to be](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-41.jpg) Non- Resident Sportsmen or Association [ Se. 194 E ] Ø Tax to be deducted on payment to a nonresident foreign citizen sportsman (including athlete) & entertainer (Wef 01/07/2012) or non-resident sports association Ø No threshold limit. Ø Rate of Deduction : 10% (Wef 01/07/2012 20%) Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

Non- Resident Sportsmen or Association [ Se. 194 E ] Ø Tax to be deducted on payment to a nonresident foreign citizen sportsman (including athlete) & entertainer (Wef 01/07/2012) or non-resident sports association Ø No threshold limit. Ø Rate of Deduction : 10% (Wef 01/07/2012 20%) Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

Contd… Ø Payment to Referee, Umpires is not a payment to sportsman • Indicom 335 ITR 485 CA. Manish Shah

Contd… Ø Payment to Referee, Umpires is not a payment to sportsman • Indicom 335 ITR 485 CA. Manish Shah

![National Savings Scheme [Sec. 194 EE ] Ø Tax to be deducted on payment National Savings Scheme [Sec. 194 EE ] Ø Tax to be deducted on payment](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-43.jpg) National Savings Scheme [Sec. 194 EE ] Ø Tax to be deducted on payment referred to in Sec. 80 CCA(2)(a) Ø Exemption Limit: ` 2500/- Ø No tax to be deducted if payment made to the heirs of the deceased assessee i. e. . original depositor Ø Rate of Deduction : 20% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

National Savings Scheme [Sec. 194 EE ] Ø Tax to be deducted on payment referred to in Sec. 80 CCA(2)(a) Ø Exemption Limit: ` 2500/- Ø No tax to be deducted if payment made to the heirs of the deceased assessee i. e. . original depositor Ø Rate of Deduction : 20% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

![Repurchase of Units [Sec. 194 F] Ø Tax to be deducted on payment referred Repurchase of Units [Sec. 194 F] Ø Tax to be deducted on payment referred](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-44.jpg) Repurchase of Units [Sec. 194 F] Ø Tax to be deducted on payment referred to in Sec. 80 CCB(2) Ø No threshold limit. Ø Rate of Deduction : Resident – 20% Non Resident – 20% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

Repurchase of Units [Sec. 194 F] Ø Tax to be deducted on payment referred to in Sec. 80 CCB(2) Ø No threshold limit. Ø Rate of Deduction : Resident – 20% Non Resident – 20% Ø Lower Deduction U/s 197 - Not Permissible CA. Manish Shah

![Commission on Sale of Lottery Ticket [Sec. 194 G] Ø Payment for commission, remuneration Commission on Sale of Lottery Ticket [Sec. 194 G] Ø Payment for commission, remuneration](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-45.jpg) Commission on Sale of Lottery Ticket [Sec. 194 G] Ø Payment for commission, remuneration or prize on lottery ticket. Ø Exemption Limit: ` 1, 000/Ø Rate of Deduction : 10% CA. Manish Shah

Commission on Sale of Lottery Ticket [Sec. 194 G] Ø Payment for commission, remuneration or prize on lottery ticket. Ø Exemption Limit: ` 1, 000/Ø Rate of Deduction : 10% CA. Manish Shah

Contd… Ø Purchase of lottery ticket at a discount. Sec. 194 G not applicable • M. S. Hameed 249 ITR 186 CA. Manish Shah

Contd… Ø Purchase of lottery ticket at a discount. Sec. 194 G not applicable • M. S. Hameed 249 ITR 186 CA. Manish Shah

![Commission or Brokerage [ Sec. 194 H ] Ø Commission or Brokerage includes income Commission or Brokerage [ Sec. 194 H ] Ø Commission or Brokerage includes income](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-47.jpg) Commission or Brokerage [ Sec. 194 H ] Ø Commission or Brokerage includes income earned for services rendered in course of buying/selling of goods or assets, valuable article or thing, not being securities. Ø Commission or Brokerage does not include any income earned while rendering professional services, insurance service. Ø Exemption Limit - ` 5, 000/- p. a. CA. Manish Shah

Commission or Brokerage [ Sec. 194 H ] Ø Commission or Brokerage includes income earned for services rendered in course of buying/selling of goods or assets, valuable article or thing, not being securities. Ø Commission or Brokerage does not include any income earned while rendering professional services, insurance service. Ø Exemption Limit - ` 5, 000/- p. a. CA. Manish Shah

Contd… Ø No deduction for commission or brokerage payable by BSNL & MTNL to their PCO franchises. (Instruction No. 3/2009) Ø Rate of deduction: a. Co, Firms, Co-op Soc. : 10% b. Individual/HUF/AOP/BOI : CA. Manish Shah 10%

Contd… Ø No deduction for commission or brokerage payable by BSNL & MTNL to their PCO franchises. (Instruction No. 3/2009) Ø Rate of deduction: a. Co, Firms, Co-op Soc. : 10% b. Individual/HUF/AOP/BOI : CA. Manish Shah 10%

Contd… Ø Airline agent- Difference between ticket price is not Brokerage/ Commission. • Qatar Airways 332 ITR 253 • ITL Tours & Travels 44 SOT 277 Ø Sim card- prepaid/ recharge coupon - Commission - S. 194 H applicable. • Bharti Cellular 244 CTR 185 • Vodafone Essar 141 TTJ 461 CA. Manish Shah

Contd… Ø Airline agent- Difference between ticket price is not Brokerage/ Commission. • Qatar Airways 332 ITR 253 • ITL Tours & Travels 44 SOT 277 Ø Sim card- prepaid/ recharge coupon - Commission - S. 194 H applicable. • Bharti Cellular 244 CTR 185 • Vodafone Essar 141 TTJ 461 CA. Manish Shah

Contd… Ø Roaming charges paid by mobile Co. to another mobile Co. - Not commission. S. 194 H not applicable. • Vodafone Essar 9 ITR 182 (Trib). Ø Incentive and discount to distributor – S. 194 H not applicable. • Jai Drinks 242 CTR 505 CA. Manish Shah

Contd… Ø Roaming charges paid by mobile Co. to another mobile Co. - Not commission. S. 194 H not applicable. • Vodafone Essar 9 ITR 182 (Trib). Ø Incentive and discount to distributor – S. 194 H not applicable. • Jai Drinks 242 CTR 505 CA. Manish Shah

Contd… Ø Commission to Stamp Vendors – Discount on sales. Sec. 194 H not applicable. • Ahmedabad Stamp Vendor Asso. 257 ITR 202 Ø Agreement between DD and Advt. agent – Sec. 194 H applicable. • Prasad Bharati Doordarshan 189 Taxman 315 CA. Manish Shah

Contd… Ø Commission to Stamp Vendors – Discount on sales. Sec. 194 H not applicable. • Ahmedabad Stamp Vendor Asso. 257 ITR 202 Ø Agreement between DD and Advt. agent – Sec. 194 H applicable. • Prasad Bharati Doordarshan 189 Taxman 315 CA. Manish Shah

Contd… Ø Medical Collection Centre-Not Commission - S. 194 H not applicable. • SRL Ranbaxy Ltd. 143 TTJ 265. In this case, it was observed that hospital was not making payment to collection center but collection centers were making payment after deducting their margin. Ø Bank guarantee commission – S. 194 H not applicable. • Kotak Securities Ltd. 50 SOT 158 CA. Manish Shah

Contd… Ø Medical Collection Centre-Not Commission - S. 194 H not applicable. • SRL Ranbaxy Ltd. 143 TTJ 265. In this case, it was observed that hospital was not making payment to collection center but collection centers were making payment after deducting their margin. Ø Bank guarantee commission – S. 194 H not applicable. • Kotak Securities Ltd. 50 SOT 158 CA. Manish Shah

![Rent [ Sec. 194 I ] Rent includes: Ø Payment made under lease/sub-lease/ tenancy Rent [ Sec. 194 I ] Rent includes: Ø Payment made under lease/sub-lease/ tenancy](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-53.jpg) Rent [ Sec. 194 I ] Rent includes: Ø Payment made under lease/sub-lease/ tenancy or any other agreement/ arrangement for use separately or together of : • Land, Building (incl. Factory building) land appurtenant thereto with Furniture & Fittings, • Plant & Machinery, Equipment Ø All or Any assets may not be owned by Payee. CA. Manish Shah

Rent [ Sec. 194 I ] Rent includes: Ø Payment made under lease/sub-lease/ tenancy or any other agreement/ arrangement for use separately or together of : • Land, Building (incl. Factory building) land appurtenant thereto with Furniture & Fittings, • Plant & Machinery, Equipment Ø All or Any assets may not be owned by Payee. CA. Manish Shah

Contd… Ø Exemption/limit • If payment does not exceed ` 1, 80, 000/- p. a. • No TDS on Municipal Taxes, Ground Rent Ø Rate of deduction: Plant, Machinery, Equipment : 2% Land, Building, Furniture : 10% CA. Manish Shah

Contd… Ø Exemption/limit • If payment does not exceed ` 1, 80, 000/- p. a. • No TDS on Municipal Taxes, Ground Rent Ø Rate of deduction: Plant, Machinery, Equipment : 2% Land, Building, Furniture : 10% CA. Manish Shah

Contd… Ø Limit is per owner in case of joint owners with definite shares. Ø Applicable, if Hotel accommodation is taken on regular basis. (Ref. Circular No. 715) Ø On Interest bearing Deposits – Sec. 194 A is applicable. (Ref. Circular No. 715) Ø Film exhibition – Not Rent (Ref. Circular No. 736) Ø Cold Storage Charges- S. 194 C is applicable. Not Sec. 194 I (Ref. Circular No. 1/2008) Ø Rent doesn't include Service Tax -‘Rent Income’ (Ref. Circular No. 4/2008) CA. Manish Shah

Contd… Ø Limit is per owner in case of joint owners with definite shares. Ø Applicable, if Hotel accommodation is taken on regular basis. (Ref. Circular No. 715) Ø On Interest bearing Deposits – Sec. 194 A is applicable. (Ref. Circular No. 715) Ø Film exhibition – Not Rent (Ref. Circular No. 736) Ø Cold Storage Charges- S. 194 C is applicable. Not Sec. 194 I (Ref. Circular No. 1/2008) Ø Rent doesn't include Service Tax -‘Rent Income’ (Ref. Circular No. 4/2008) CA. Manish Shah

Contd… Ø Payment to Electricity Board-Transmission of electricity & not for use of wires etc. S. 194 I not applicable • Chhatisgarh State Electricity Board 143 TTJ 151 CA. Manish Shah

Contd… Ø Payment to Electricity Board-Transmission of electricity & not for use of wires etc. S. 194 I not applicable • Chhatisgarh State Electricity Board 143 TTJ 151 CA. Manish Shah

![Fees for Professional or Technical Services [ Sec. 194 J ] Ø Fees for Fees for Professional or Technical Services [ Sec. 194 J ] Ø Fees for](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-57.jpg) Fees for Professional or Technical Services [ Sec. 194 J ] Ø Fees for Professional Services: Legal/ Medical/ Engineering/ Architectural/Accountancy/ Technical/ Interior Decoration/Advertising (i. e. . Models, Artists, Photographers etc. ) & any notified profession Ø Fees for Technical Services - Sec. 9(1)(vii)–Expl-2 Ø Remuneration, Fees, Commission to Directors (other than S. 192 Wef 01/07/2012) Ø Royalty - Sec. 9(1)(vi)–Expl-2 Ø Non Compete Fees CA. Manish Shah

Fees for Professional or Technical Services [ Sec. 194 J ] Ø Fees for Professional Services: Legal/ Medical/ Engineering/ Architectural/Accountancy/ Technical/ Interior Decoration/Advertising (i. e. . Models, Artists, Photographers etc. ) & any notified profession Ø Fees for Technical Services - Sec. 9(1)(vii)–Expl-2 Ø Remuneration, Fees, Commission to Directors (other than S. 192 Wef 01/07/2012) Ø Royalty - Sec. 9(1)(vi)–Expl-2 Ø Non Compete Fees CA. Manish Shah

Contd… Ø Exemption Limit : ` 30, 000/- (except payment to Director) Ø Rate of Deduction – 10% Ø No T. D. S on payment of professional fees for personal purposes by Individual & H. U. F. Ø TDS to be deducted under one section only i. e. . 194 C /194 J. CA. Manish Shah

Contd… Ø Exemption Limit : ` 30, 000/- (except payment to Director) Ø Rate of Deduction – 10% Ø No T. D. S on payment of professional fees for personal purposes by Individual & H. U. F. Ø TDS to be deducted under one section only i. e. . 194 C /194 J. CA. Manish Shah

Contd… Ø Payments made to : • Hospital for medical service, • Share Registrar, • Commission of Advertisement Agency • Event Manager, Anchors • Sportspersons, Umpires, Coaches, Trainers, Commentators, Columnists, Physiotherapists, etc. CA. Manish Shah

Contd… Ø Payments made to : • Hospital for medical service, • Share Registrar, • Commission of Advertisement Agency • Event Manager, Anchors • Sportspersons, Umpires, Coaches, Trainers, Commentators, Columnists, Physiotherapists, etc. CA. Manish Shah

Contd… Ø Reimbursement of Actual Expenses & Service Tax to be included- as 'Any Sum Paid’: (Ref. Circular No. 715 & Letter No. F 275/73/2007) Ø No TDS on acquisition of software, where software is acquired in subsequent transfer without modification & tax has been deducted U/194 J or U/s 195 for any previous transfer & certificate is obtained from transferor with PAN (Ref. Notification 21/02012 dated 13/06/2012) CA. Manish Shah

Contd… Ø Reimbursement of Actual Expenses & Service Tax to be included- as 'Any Sum Paid’: (Ref. Circular No. 715 & Letter No. F 275/73/2007) Ø No TDS on acquisition of software, where software is acquired in subsequent transfer without modification & tax has been deducted U/194 J or U/s 195 for any previous transfer & certificate is obtained from transferor with PAN (Ref. Notification 21/02012 dated 13/06/2012) CA. Manish Shah

Contd… Ø Transaction Charges of Stock Exchange- Fees for technical services. S. 194 J applicable. • Kotak Securities Ltd. 340 ITR 333 In this case, the court observed that since no claim was made by department in earlier year, no liability arises. CA. Manish Shah

Contd… Ø Transaction Charges of Stock Exchange- Fees for technical services. S. 194 J applicable. • Kotak Securities Ltd. 340 ITR 333 In this case, the court observed that since no claim was made by department in earlier year, no liability arises. CA. Manish Shah

Contd… Ø Lease line charges- not fees for technical services. S. 194 J not applicable. • Omniscint Securities 15 ITR (Trib. ) 82 • Angel Broking 3 ITR (Trib. ) 294 Ø Payment by TPA to hospitals. S. 194 J applicable. • Dedicated Healthcare Services 324 ITR 345 (Circular No. 8/2009) • Vipul Medcorp 202 Taxman 463 CA. Manish Shah

Contd… Ø Lease line charges- not fees for technical services. S. 194 J not applicable. • Omniscint Securities 15 ITR (Trib. ) 82 • Angel Broking 3 ITR (Trib. ) 294 Ø Payment by TPA to hospitals. S. 194 J applicable. • Dedicated Healthcare Services 324 ITR 345 (Circular No. 8/2009) • Vipul Medcorp 202 Taxman 463 CA. Manish Shah

![Compensation for Compulsory Acquisition Property [Sec. 194 LA] Ø Payment made as Compensation, enhanced Compensation for Compulsory Acquisition Property [Sec. 194 LA] Ø Payment made as Compensation, enhanced](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-63.jpg) Compensation for Compulsory Acquisition Property [Sec. 194 LA] Ø Payment made as Compensation, enhanced compensation, consideration, enhanced consideration on account of compulsory acquisition of any immovable property. Ø Immovable property does not include Agricultural Land [as per Section 2 (14)]. CA. Manish Shah

Compensation for Compulsory Acquisition Property [Sec. 194 LA] Ø Payment made as Compensation, enhanced compensation, consideration, enhanced consideration on account of compulsory acquisition of any immovable property. Ø Immovable property does not include Agricultural Land [as per Section 2 (14)]. CA. Manish Shah

Contd… Ø Exemption Limit : ` 1, 000/ (Wef 01/07/2012 - ` 2, 000/-) Ø Rate of Deduction : 10% Ø No need to prove that land is used for agriculture- • Special Land Acquisition Officer 46 SOT 458 CA. Manish Shah

Contd… Ø Exemption Limit : ` 1, 000/ (Wef 01/07/2012 - ` 2, 000/-) Ø Rate of Deduction : 10% Ø No need to prove that land is used for agriculture- • Special Land Acquisition Officer 46 SOT 458 CA. Manish Shah

![Interest by Infra. Debt Fund [Sec. 194 LB] Ø Interest to Non Resident & Interest by Infra. Debt Fund [Sec. 194 LB] Ø Interest to Non Resident &](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-65.jpg) Interest by Infra. Debt Fund [Sec. 194 LB] Ø Interest to Non Resident & Foreign Co. by Infrastructure Debt Fund as per Section 10(47) Ø Rate of Deduction : 5% Ø No threshold Limit CA. Manish Shah

Interest by Infra. Debt Fund [Sec. 194 LB] Ø Interest to Non Resident & Foreign Co. by Infrastructure Debt Fund as per Section 10(47) Ø Rate of Deduction : 5% Ø No threshold Limit CA. Manish Shah

![Interest from Indian Cos. [Sec. 194 LC] Ø Interest payable to Non Resident & Interest from Indian Cos. [Sec. 194 LC] Ø Interest payable to Non Resident &](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-66.jpg) Interest from Indian Cos. [Sec. 194 LC] Ø Interest payable to Non Resident & Foreign Co. by Indian Co. for money borrowed 01/07/2012 - 01/07/2015 in foreign currency under loan agreement or Long Term Infra. Bonds Ø Rate of Deduction : 5% Ø No threshold Limit CA. Manish Shah

Interest from Indian Cos. [Sec. 194 LC] Ø Interest payable to Non Resident & Foreign Co. by Indian Co. for money borrowed 01/07/2012 - 01/07/2015 in foreign currency under loan agreement or Long Term Infra. Bonds Ø Rate of Deduction : 5% Ø No threshold Limit CA. Manish Shah

![Payment to Non-Residents [Sec. 195] Ø Applicable to Interest and any other payment other Payment to Non-Residents [Sec. 195] Ø Applicable to Interest and any other payment other](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-67.jpg) Payment to Non-Residents [Sec. 195] Ø Applicable to Interest and any other payment other than Salary to Non Resident & Foreign Co. Ø Rate of Deduction : As per D. T. A. A or As per Sch. 1, Part II of Finance Act, 2007 Whichever is beneficial to the assessee However in case of No PAN @ 20% CA. Manish Shah

Payment to Non-Residents [Sec. 195] Ø Applicable to Interest and any other payment other than Salary to Non Resident & Foreign Co. Ø Rate of Deduction : As per D. T. A. A or As per Sch. 1, Part II of Finance Act, 2007 Whichever is beneficial to the assessee However in case of No PAN @ 20% CA. Manish Shah

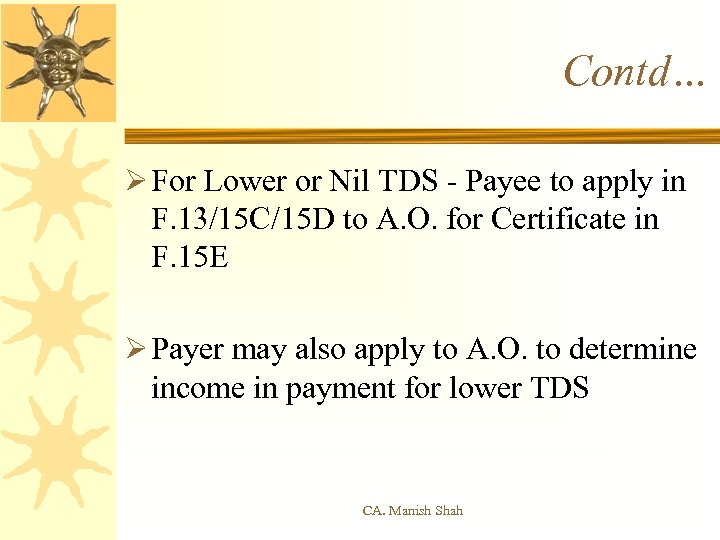

Contd… Ø For Lower or Nil TDS - Payee to apply in F. 13/15 C/15 D to A. O. for Certificate in F. 15 E Ø Payer may also apply to A. O. to determine income in payment for lower TDS CA. Manish Shah

Contd… Ø For Lower or Nil TDS - Payee to apply in F. 13/15 C/15 D to A. O. for Certificate in F. 15 E Ø Payer may also apply to A. O. to determine income in payment for lower TDS CA. Manish Shah

![Income from Units [196 B] Ø Applicable to Long Term Capital Gain of Offshore Income from Units [196 B] Ø Applicable to Long Term Capital Gain of Offshore](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-69.jpg) Income from Units [196 B] Ø Applicable to Long Term Capital Gain of Offshore Fund. Ø Units referred to Section 115 AB Ø Rate of Deduction – 10% CA. Manish Shah

Income from Units [196 B] Ø Applicable to Long Term Capital Gain of Offshore Fund. Ø Units referred to Section 115 AB Ø Rate of Deduction – 10% CA. Manish Shah

![Income from FC Bonds [196 C] Ø Applicable to Foreign Currency Bonds & GDR Income from FC Bonds [196 C] Ø Applicable to Foreign Currency Bonds & GDR](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-70.jpg) Income from FC Bonds [196 C] Ø Applicable to Foreign Currency Bonds & GDR of Indian Companies. Ø Bonds & GDR referred to Section 115 AC Ø Rate of Deduction – 10% CA. Manish Shah

Income from FC Bonds [196 C] Ø Applicable to Foreign Currency Bonds & GDR of Indian Companies. Ø Bonds & GDR referred to Section 115 AC Ø Rate of Deduction – 10% CA. Manish Shah

![Income of FII [196 D] Ø Applicable to Income of FII from Securities not Income of FII [196 D] Ø Applicable to Income of FII from Securities not](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-71.jpg) Income of FII [196 D] Ø Applicable to Income of FII from Securities not being Dividend, LT & ST Gain. Ø Securities referred in Section 115 AD Ø Rate of Deduction– 20% CA. Manish Shah

Income of FII [196 D] Ø Applicable to Income of FII from Securities not being Dividend, LT & ST Gain. Ø Securities referred in Section 115 AD Ø Rate of Deduction– 20% CA. Manish Shah

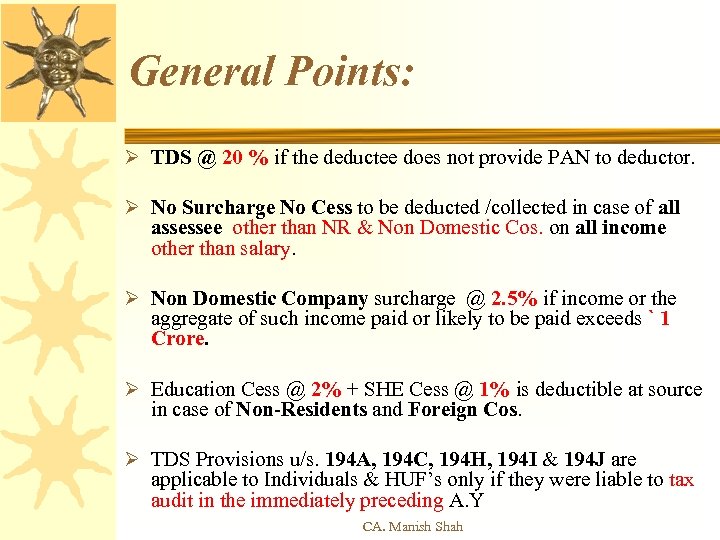

General Points: Ø TDS @ 20 % if the deductee does not provide PAN to deductor. Ø No Surcharge No Cess to be deducted /collected in case of all assessee other than NR & Non Domestic Cos. on all income other than salary. Ø Non Domestic Company surcharge @ 2. 5% if income or the aggregate of such income paid or likely to be paid exceeds ` 1 Crore. Ø Education Cess @ 2% + SHE Cess @ 1% is deductible at source in case of Non-Residents and Foreign Cos. Ø TDS Provisions u/s. 194 A, 194 C, 194 H, 194 I & 194 J are applicable to Individuals & HUF’s only if they were liable to tax audit in the immediately preceding A. Y CA. Manish Shah

General Points: Ø TDS @ 20 % if the deductee does not provide PAN to deductor. Ø No Surcharge No Cess to be deducted /collected in case of all assessee other than NR & Non Domestic Cos. on all income other than salary. Ø Non Domestic Company surcharge @ 2. 5% if income or the aggregate of such income paid or likely to be paid exceeds ` 1 Crore. Ø Education Cess @ 2% + SHE Cess @ 1% is deductible at source in case of Non-Residents and Foreign Cos. Ø TDS Provisions u/s. 194 A, 194 C, 194 H, 194 I & 194 J are applicable to Individuals & HUF’s only if they were liable to tax audit in the immediately preceding A. Y CA. Manish Shah

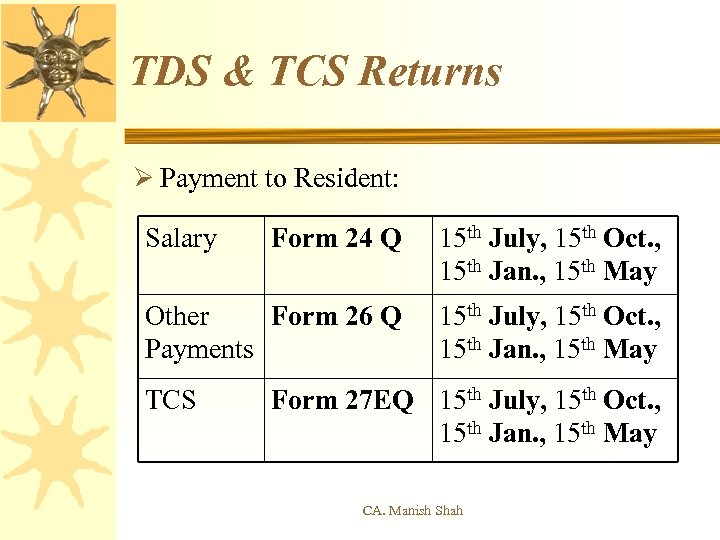

TDS & TCS Returns Ø Payment to Resident: Salary Form 24 Q 15 th July, 15 th Oct. , 15 th Jan. , 15 th May Other Form 26 Q Payments 15 th July, 15 th Oct. , 15 th Jan. , 15 th May TCS Form 27 EQ 15 th July, 15 th Oct. , 15 th Jan. , 15 th May CA. Manish Shah

TDS & TCS Returns Ø Payment to Resident: Salary Form 24 Q 15 th July, 15 th Oct. , 15 th Jan. , 15 th May Other Form 26 Q Payments 15 th July, 15 th Oct. , 15 th Jan. , 15 th May TCS Form 27 EQ 15 th July, 15 th Oct. , 15 th Jan. , 15 th May CA. Manish Shah

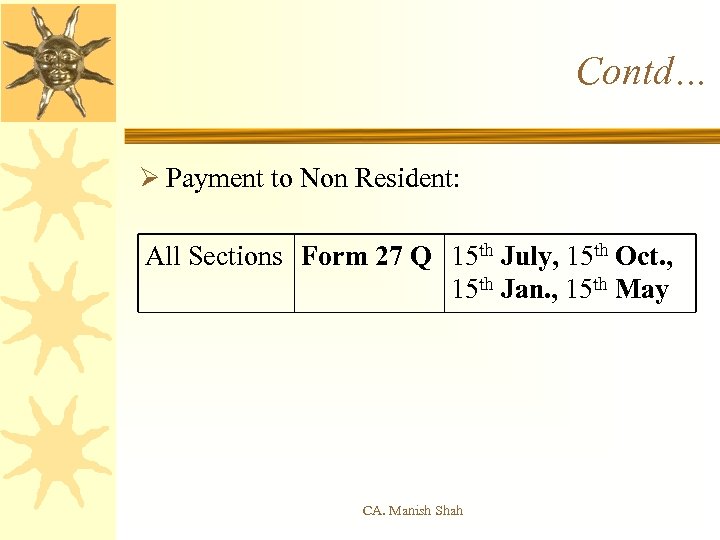

Contd… Ø Payment to Non Resident: All Sections Form 27 Q 15 th July, 15 th Oct. , 15 th Jan. , 15 th May CA. Manish Shah

Contd… Ø Payment to Non Resident: All Sections Form 27 Q 15 th July, 15 th Oct. , 15 th Jan. , 15 th May CA. Manish Shah

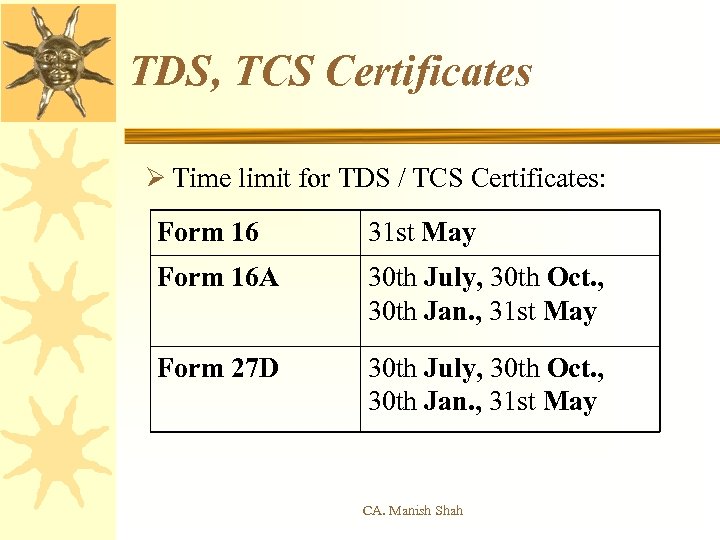

TDS, TCS Certificates Ø Time limit for TDS / TCS Certificates: Form 16 31 st May Form 16 A 30 th July, 30 th Oct. , 30 th Jan. , 31 st May Form 27 D 30 th July, 30 th Oct. , 30 th Jan. , 31 st May CA. Manish Shah

TDS, TCS Certificates Ø Time limit for TDS / TCS Certificates: Form 16 31 st May Form 16 A 30 th July, 30 th Oct. , 30 th Jan. , 31 st May Form 27 D 30 th July, 30 th Oct. , 30 th Jan. , 31 st May CA. Manish Shah

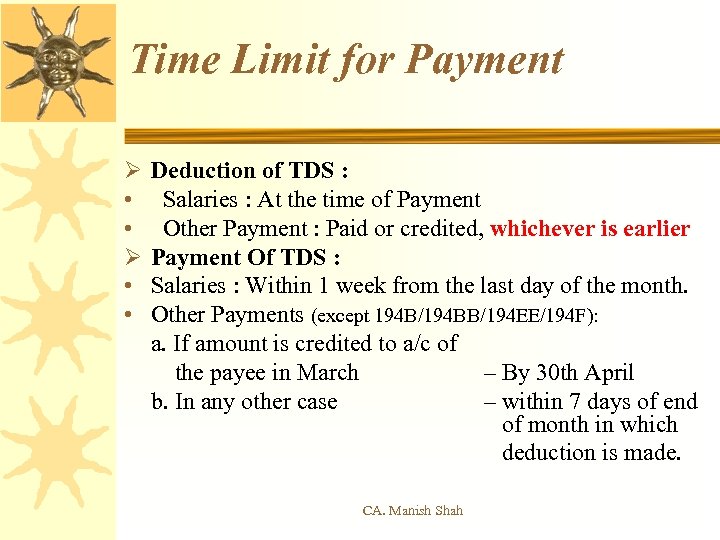

Time Limit for Payment Ø • • Deduction of TDS : Salaries : At the time of Payment Other Payment : Paid or credited, whichever is earlier Payment Of TDS : Salaries : Within 1 week from the last day of the month. Other Payments (except 194 B/194 BB/194 EE/194 F): a. If amount is credited to a/c of the payee in March – By 30 th April b. In any other case – within 7 days of end of month in which deduction is made. CA. Manish Shah

Time Limit for Payment Ø • • Deduction of TDS : Salaries : At the time of Payment Other Payment : Paid or credited, whichever is earlier Payment Of TDS : Salaries : Within 1 week from the last day of the month. Other Payments (except 194 B/194 BB/194 EE/194 F): a. If amount is credited to a/c of the payee in March – By 30 th April b. In any other case – within 7 days of end of month in which deduction is made. CA. Manish Shah

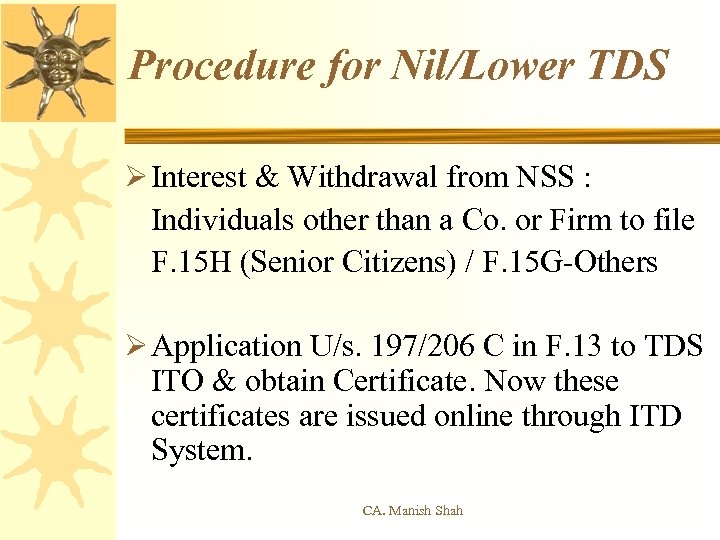

Procedure for Nil/Lower TDS Ø Interest & Withdrawal from NSS : Individuals other than a Co. or Firm to file F. 15 H (Senior Citizens) / F. 15 G-Others Ø Application U/s. 197/206 C in F. 13 to TDS ITO & obtain Certificate. Now these certificates are issued online through ITD System. CA. Manish Shah

Procedure for Nil/Lower TDS Ø Interest & Withdrawal from NSS : Individuals other than a Co. or Firm to file F. 15 H (Senior Citizens) / F. 15 G-Others Ø Application U/s. 197/206 C in F. 13 to TDS ITO & obtain Certificate. Now these certificates are issued online through ITD System. CA. Manish Shah

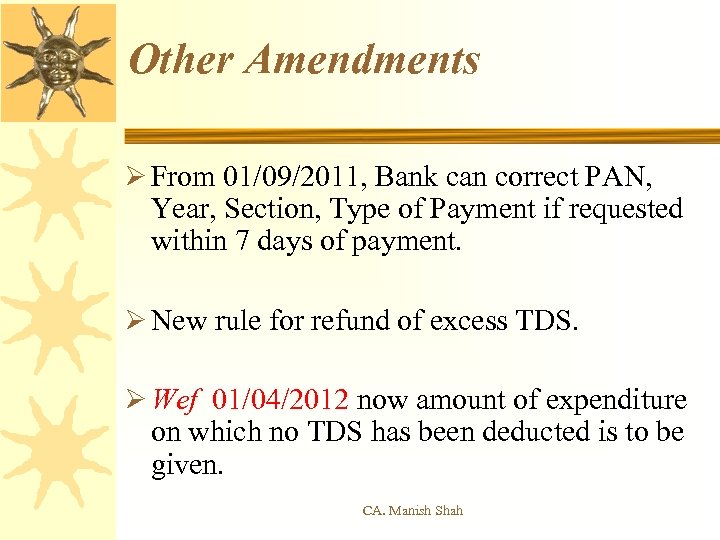

Other Amendments Ø From 01/09/2011, Bank can correct PAN, Year, Section, Type of Payment if requested within 7 days of payment. Ø New rule for refund of excess TDS. Ø Wef 01/04/2012 now amount of expenditure on which no TDS has been deducted is to be given. CA. Manish Shah

Other Amendments Ø From 01/09/2011, Bank can correct PAN, Year, Section, Type of Payment if requested within 7 days of payment. Ø New rule for refund of excess TDS. Ø Wef 01/04/2012 now amount of expenditure on which no TDS has been deducted is to be given. CA. Manish Shah

Contd… Ø Wef 01/04/2012, all deductors to issue Form 16 A through TIN System with manual or digital sign. Ø In Form 15 G, 15 H and all lower TDS application, quoting PAN is must. Ø Form 15 H - Age limit for filing it has been reduced to 60 years. CA. Manish Shah

Contd… Ø Wef 01/04/2012, all deductors to issue Form 16 A through TIN System with manual or digital sign. Ø In Form 15 G, 15 H and all lower TDS application, quoting PAN is must. Ø Form 15 H - Age limit for filing it has been reduced to 60 years. CA. Manish Shah

Contd… Ø TCS @ 1% on : Wef 01/07/2012 • Minerals being Coal, Lignite & Iron ore • Cash Sale of : Ø Bullions (other than coin or article less than 10 gms) >` 2 Lacs Ø Jewellery > ` 5 Lacs CA. Manish Shah

Contd… Ø TCS @ 1% on : Wef 01/07/2012 • Minerals being Coal, Lignite & Iron ore • Cash Sale of : Ø Bullions (other than coin or article less than 10 gms) >` 2 Lacs Ø Jewellery > ` 5 Lacs CA. Manish Shah

![Intimation [200 A] Ø Intimation of demand /refund shall be send to Assessee Ø Intimation [200 A] Ø Intimation of demand /refund shall be send to Assessee Ø](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-81.jpg) Intimation [200 A] Ø Intimation of demand /refund shall be send to Assessee Ø TDS return shall be processed & after making adjustments of arithmetical error & incorrect apparent claim, Ø Interest, if any, shall be computed & demand if any or refund due shall be determined after adjusting TDS due & interest payable U/s 201. Ø Intimation shall be sent within 1 year from end of F. Y in which TDS return has been filed. CA. Manish Shah

Intimation [200 A] Ø Intimation of demand /refund shall be send to Assessee Ø TDS return shall be processed & after making adjustments of arithmetical error & incorrect apparent claim, Ø Interest, if any, shall be computed & demand if any or refund due shall be determined after adjusting TDS due & interest payable U/s 201. Ø Intimation shall be sent within 1 year from end of F. Y in which TDS return has been filed. CA. Manish Shah

Contd… Ø Deductor needs to verify the defects Ø Pay demand or file revised return if needed. Ø Intimate AO of filing revised return or File an appeal Ø This intimation is now subject to rectification / appeal also Wef 01/07/2012 & it will be deemed to be notice U/s 156. CA. Manish Shah

Contd… Ø Deductor needs to verify the defects Ø Pay demand or file revised return if needed. Ø Intimate AO of filing revised return or File an appeal Ø This intimation is now subject to rectification / appeal also Wef 01/07/2012 & it will be deemed to be notice U/s 156. CA. Manish Shah

Reasons for Defects Ø Short Deduction: 1. 2. 3. 4. 5. 6. 7. 8. Wrong rate of TDS Rounding off to lower rupee PAN not matching Not mentioning lower rate & wrong payment Wrong deductee code Wrong Section Wrong gender of employee Wrong exemption information CA. Manish Shah

Reasons for Defects Ø Short Deduction: 1. 2. 3. 4. 5. 6. 7. 8. Wrong rate of TDS Rounding off to lower rupee PAN not matching Not mentioning lower rate & wrong payment Wrong deductee code Wrong Section Wrong gender of employee Wrong exemption information CA. Manish Shah

Contd… Ø TDS not paid: 1. 2. 3. 4. Actually not paid Wrong challan information Splitting & merging of challan Wrong minor code of challan CA. Manish Shah

Contd… Ø TDS not paid: 1. 2. 3. 4. Actually not paid Wrong challan information Splitting & merging of challan Wrong minor code of challan CA. Manish Shah

Contd… Ø Interest on late payment: 1. 2. 3. 4. 5. No interest paid on delay Less interest paid Wrong CIN for interest Cheque realized after due date Challan due date is holiday CA. Manish Shah

Contd… Ø Interest on late payment: 1. 2. 3. 4. 5. No interest paid on delay Less interest paid Wrong CIN for interest Cheque realized after due date Challan due date is holiday CA. Manish Shah

![Failure to Deduct or Pay [Sec. 201] Ø If any person does not deduct Failure to Deduct or Pay [Sec. 201] Ø If any person does not deduct](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-86.jpg) Failure to Deduct or Pay [Sec. 201] Ø If any person does not deduct or doesn’t pay or after so deducting fails to pay whole or part of the tax as required by or under this Act, he or it shall, without prejudice to any other consequences which he or it may incur, be deemed to be an assessee in default in respect of such tax (subject to amendment made Wef 01/07/2012). Ø Such person shall also be liable to pay interest U/s 201(1 A) & Penalty U/s 221. CA. Manish Shah

Failure to Deduct or Pay [Sec. 201] Ø If any person does not deduct or doesn’t pay or after so deducting fails to pay whole or part of the tax as required by or under this Act, he or it shall, without prejudice to any other consequences which he or it may incur, be deemed to be an assessee in default in respect of such tax (subject to amendment made Wef 01/07/2012). Ø Such person shall also be liable to pay interest U/s 201(1 A) & Penalty U/s 221. CA. Manish Shah

Contd… Ø Interest U/s 201(1 A) shall be paid before filing TDS returns. Ø No penalty shall be charged U/s 221 unless the Assessing Officer is satisfied that such person has without good and sufficient reasons failed to deduct and pay the tax. Ø Where tax has not been paid after deduction, the tax + interest shall be charged on all the assets of the assessee. CA. Manish Shah

Contd… Ø Interest U/s 201(1 A) shall be paid before filing TDS returns. Ø No penalty shall be charged U/s 221 unless the Assessing Officer is satisfied that such person has without good and sufficient reasons failed to deduct and pay the tax. Ø Where tax has not been paid after deduction, the tax + interest shall be charged on all the assets of the assessee. CA. Manish Shah

![Interest [Sec. 201(1 A)] Where the assessee after deducting TDS fails to pay the Interest [Sec. 201(1 A)] Where the assessee after deducting TDS fails to pay the](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-88.jpg) Interest [Sec. 201(1 A)] Where the assessee after deducting TDS fails to pay the tax as required by or under this Act Liable to simple interest @ 18% p. a [i. e. 1. 5% p. m. ] from the date on which the tax was deducted till the date on which the payment is actually made. Where the assessee fails to deduct TDS and make the payment as required by or under this Act Liable to simple interest @ 12% p. a [i. e. 1% p. m. ] from the date on which the tax was deductible till the date on which the TDS deducted. CA. Manish Shah

Interest [Sec. 201(1 A)] Where the assessee after deducting TDS fails to pay the tax as required by or under this Act Liable to simple interest @ 18% p. a [i. e. 1. 5% p. m. ] from the date on which the tax was deducted till the date on which the payment is actually made. Where the assessee fails to deduct TDS and make the payment as required by or under this Act Liable to simple interest @ 12% p. a [i. e. 1% p. m. ] from the date on which the tax was deductible till the date on which the TDS deducted. CA. Manish Shah

Contd… Ø No Order U/s 201 can be made for failure to deduct: • After 2 Years from end of the F. Y in which TDS return is filed. • After 4 Years from end of the F. Y in which payment is made or credit is given. This time limit is increased to 6 Years Wef 01/07/2012 Ø Wef 01/07/2012, no interest U/s 220(2) shall be charged if interest is charged U/s 201(1 A) on tax payable in the intimation U/s 200 A(1) of the Act on the same amount for same period- Section 220(2 B) CA. Manish Shah

Contd… Ø No Order U/s 201 can be made for failure to deduct: • After 2 Years from end of the F. Y in which TDS return is filed. • After 4 Years from end of the F. Y in which payment is made or credit is given. This time limit is increased to 6 Years Wef 01/07/2012 Ø Wef 01/07/2012, no interest U/s 220(2) shall be charged if interest is charged U/s 201(1 A) on tax payable in the intimation U/s 200 A(1) of the Act on the same amount for same period- Section 220(2 B) CA. Manish Shah

Amendment to Section 201 Ø Wef 01/07/2012, failure to deduct tax whole or part, the assessee shall not be deemed to be in default provided: 1. Payee has furnished his ROI U/s 139(1) [includes Sec. 139(4) also] 2. Payee has considered such amount in the computing the income in ROI CA. Manish Shah

Amendment to Section 201 Ø Wef 01/07/2012, failure to deduct tax whole or part, the assessee shall not be deemed to be in default provided: 1. Payee has furnished his ROI U/s 139(1) [includes Sec. 139(4) also] 2. Payee has considered such amount in the computing the income in ROI CA. Manish Shah

Contd… 3. Has paid tax due on returned income 4. Furnishes certificate to that effect by a CA in the prescribed form. Ø However, in all such cases, interest @ 1% would be payable from the date on which TDS was deductible till the date on which ROI is furnished by the payee. CA. Manish Shah

Contd… 3. Has paid tax due on returned income 4. Furnishes certificate to that effect by a CA in the prescribed form. Ø However, in all such cases, interest @ 1% would be payable from the date on which TDS was deductible till the date on which ROI is furnished by the payee. CA. Manish Shah

Contd… ØIssues: • Year of income • Non filing of return due loss or below taxable income. • No tax payable on return income • Still penalty chargeable U/s 221 • Insertion of word “further” why? CA. Manish Shah

Contd… ØIssues: • Year of income • Non filing of return due loss or below taxable income. • No tax payable on return income • Still penalty chargeable U/s 221 • Insertion of word “further” why? CA. Manish Shah

Contd… Ø When can assessee be treated as “assessee in default”? • There must be a reasoned/speaking order passed U/s 201(1) • Letter/intimation is not an order. • Sec. 246(1)(ha) indicates that the statute contemplates a written order so that person can file appeal. • Refer : AM Agencies 239 ITR 136 Mettur Chemicals 150 ITR 341 CA. Manish Shah

Contd… Ø When can assessee be treated as “assessee in default”? • There must be a reasoned/speaking order passed U/s 201(1) • Letter/intimation is not an order. • Sec. 246(1)(ha) indicates that the statute contemplates a written order so that person can file appeal. • Refer : AM Agencies 239 ITR 136 Mettur Chemicals 150 ITR 341 CA. Manish Shah

Penalty U/s 221 Ø When an assessee is in default or deemed to be in default in making payment. Ø Liable to Maximum penalty @100% of Tax + Arrear of tax + Interest U/s 220 (2) payable Ø No Penalty if A. O. is satisfied Ø No amendment in this Section in spite of amendment in Sec. 201 and Sec. 220. CA. Manish Shah

Penalty U/s 221 Ø When an assessee is in default or deemed to be in default in making payment. Ø Liable to Maximum penalty @100% of Tax + Arrear of tax + Interest U/s 220 (2) payable Ø No Penalty if A. O. is satisfied Ø No amendment in this Section in spite of amendment in Sec. 201 and Sec. 220. CA. Manish Shah

![Levy of Fess [234 E ] Ø Section 234 E Ø Applicable to Returns Levy of Fess [234 E ] Ø Section 234 E Ø Applicable to Returns](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-95.jpg) Levy of Fess [234 E ] Ø Section 234 E Ø Applicable to Returns due after 01/07/2012 Ø Non filing & Late filing of TDS, TCS Returns Ø ` 200/- per day – maximum to the extent of TDS/TCS Ø To be paid with returns. Ø Penalty U/s 272 A of ` 100/- per day removed. CA. Manish Shah

Levy of Fess [234 E ] Ø Section 234 E Ø Applicable to Returns due after 01/07/2012 Ø Non filing & Late filing of TDS, TCS Returns Ø ` 200/- per day – maximum to the extent of TDS/TCS Ø To be paid with returns. Ø Penalty U/s 272 A of ` 100/- per day removed. CA. Manish Shah

![Penalty [271 H] Ø Non Filing or Late of TDS & TCS Returns Ø Penalty [271 H] Ø Non Filing or Late of TDS & TCS Returns Ø](https://present5.com/presentation/dd4e007534968b0a3ec11a7c735c29ce/image-96.jpg) Penalty [271 H] Ø Non Filing or Late of TDS & TCS Returns Ø Incorrect Information in Returns Ø Applicable to Returns due after 01/07/2012 Ø No penalty if Tax, Interest, Late Fees paid & returns filed before 1 year from due date. Ø Penalty : Minimum- `10, 000/ Maximum- `1, 000/CA. Manish Shah

Penalty [271 H] Ø Non Filing or Late of TDS & TCS Returns Ø Incorrect Information in Returns Ø Applicable to Returns due after 01/07/2012 Ø No penalty if Tax, Interest, Late Fees paid & returns filed before 1 year from due date. Ø Penalty : Minimum- `10, 000/ Maximum- `1, 000/CA. Manish Shah

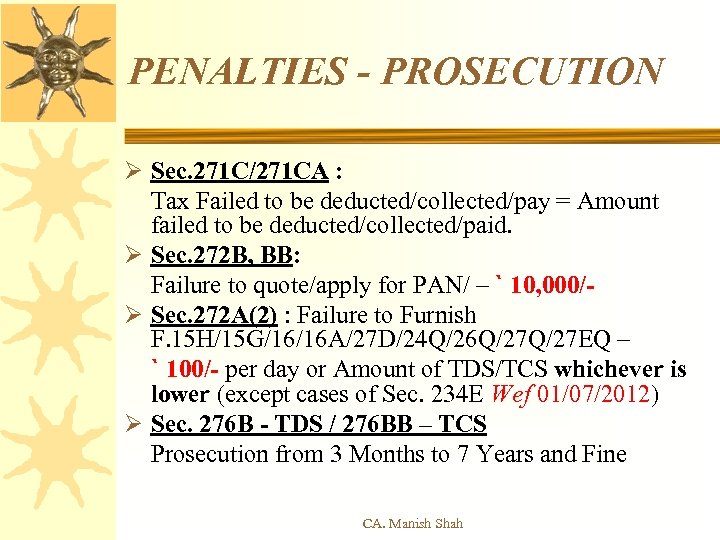

PENALTIES - PROSECUTION Ø Sec. 271 C/271 CA : Tax Failed to be deducted/collected/pay = Amount failed to be deducted/collected/paid. Ø Sec. 272 B, BB: Failure to quote/apply for PAN/ – ` 10, 000/Ø Sec. 272 A(2) : Failure to Furnish F. 15 H/15 G/16/16 A/27 D/24 Q/26 Q/27 EQ – ` 100/- per day or Amount of TDS/TCS whichever is lower (except cases of Sec. 234 E Wef 01/07/2012) Ø Sec. 276 B - TDS / 276 BB – TCS Prosecution from 3 Months to 7 Years and Fine CA. Manish Shah

PENALTIES - PROSECUTION Ø Sec. 271 C/271 CA : Tax Failed to be deducted/collected/pay = Amount failed to be deducted/collected/paid. Ø Sec. 272 B, BB: Failure to quote/apply for PAN/ – ` 10, 000/Ø Sec. 272 A(2) : Failure to Furnish F. 15 H/15 G/16/16 A/27 D/24 Q/26 Q/27 EQ – ` 100/- per day or Amount of TDS/TCS whichever is lower (except cases of Sec. 234 E Wef 01/07/2012) Ø Sec. 276 B - TDS / 276 BB – TCS Prosecution from 3 Months to 7 Years and Fine CA. Manish Shah

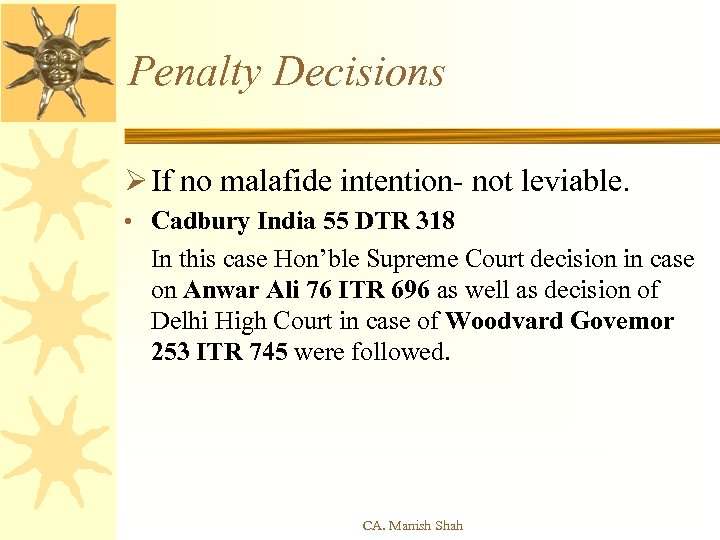

Penalty Decisions Ø If no malafide intention- not leviable. • Cadbury India 55 DTR 318 In this case Hon’ble Supreme Court decision in case on Anwar Ali 76 ITR 696 as well as decision of Delhi High Court in case of Woodvard Govemor 253 ITR 745 were followed. CA. Manish Shah

Penalty Decisions Ø If no malafide intention- not leviable. • Cadbury India 55 DTR 318 In this case Hon’ble Supreme Court decision in case on Anwar Ali 76 ITR 696 as well as decision of Delhi High Court in case of Woodvard Govemor 253 ITR 745 were followed. CA. Manish Shah

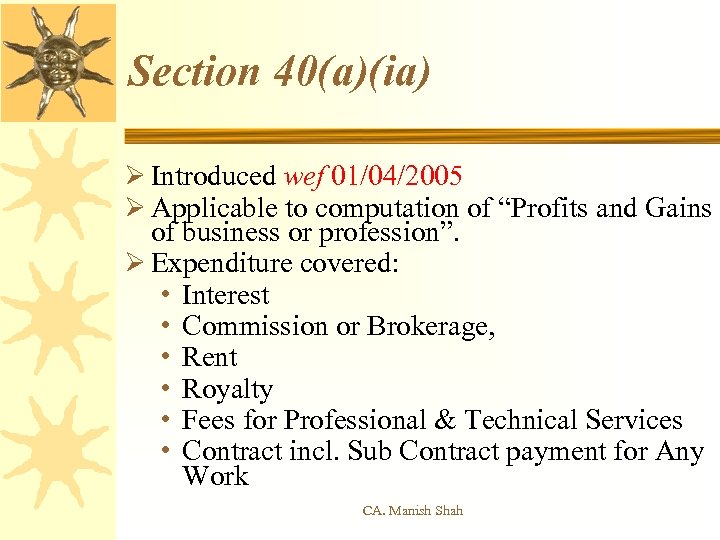

Section 40(a)(ia) Ø Introduced wef 01/04/2005 Ø Applicable to computation of “Profits and Gains of business or profession”. Ø Expenditure covered: • Interest • Commission or Brokerage, • Rent • Royalty • Fees for Professional & Technical Services • Contract incl. Sub Contract payment for Any Work CA. Manish Shah

Section 40(a)(ia) Ø Introduced wef 01/04/2005 Ø Applicable to computation of “Profits and Gains of business or profession”. Ø Expenditure covered: • Interest • Commission or Brokerage, • Rent • Royalty • Fees for Professional & Technical Services • Contract incl. Sub Contract payment for Any Work CA. Manish Shah

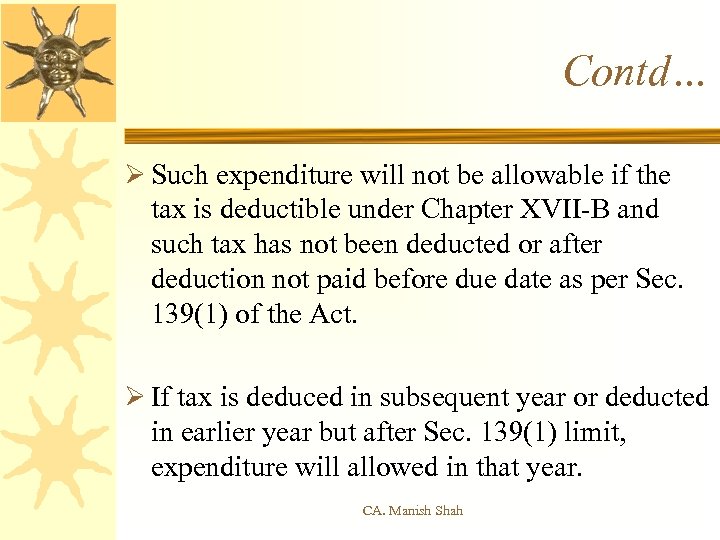

Contd… Ø Such expenditure will not be allowable if the tax is deductible under Chapter XVII-B and such tax has not been deducted or after deduction not paid before due date as per Sec. 139(1) of the Act. Ø If tax is deduced in subsequent year or deducted in earlier year but after Sec. 139(1) limit, expenditure will allowed in that year. CA. Manish Shah

Contd… Ø Such expenditure will not be allowable if the tax is deductible under Chapter XVII-B and such tax has not been deducted or after deduction not paid before due date as per Sec. 139(1) of the Act. Ø If tax is deduced in subsequent year or deducted in earlier year but after Sec. 139(1) limit, expenditure will allowed in that year. CA. Manish Shah

Contd… The provision of not disallowing the expenditure if TDS is paid before due date U/s 139(1) has been introduced wef 01/04/2010 by Finance Act 2010. CA. Manish Shah

Contd… The provision of not disallowing the expenditure if TDS is paid before due date U/s 139(1) has been introduced wef 01/04/2010 by Finance Act 2010. CA. Manish Shah

Issues: Ø Whether the amendment made in Sec. 40(a)(ia) by Finance Act, 2010 is retrospective or not? • Virgin Creations (Calcutta High Court- ITA No. 302/2011 dated 23 -11 -2011) This decision is followed by ITAT Ahmedabad in case of Alpha Projects Society Pvt. Ltd. ITA No. 2869/Ahd/2011 • Hon’ble Supreme Courts decisions in case Allied Motors (224 ITR 677), Alom Extrusion (319 ITR 306) RB Jodha Mal (82 ITR 570) Followed. • Decision of the Mumbai Special Bench in Bharti Shipyard Ltd. 132 ITD 53 (SB) Overruled by Virgin Creations CA. Manish Shah

Issues: Ø Whether the amendment made in Sec. 40(a)(ia) by Finance Act, 2010 is retrospective or not? • Virgin Creations (Calcutta High Court- ITA No. 302/2011 dated 23 -11 -2011) This decision is followed by ITAT Ahmedabad in case of Alpha Projects Society Pvt. Ltd. ITA No. 2869/Ahd/2011 • Hon’ble Supreme Courts decisions in case Allied Motors (224 ITR 677), Alom Extrusion (319 ITR 306) RB Jodha Mal (82 ITR 570) Followed. • Decision of the Mumbai Special Bench in Bharti Shipyard Ltd. 132 ITD 53 (SB) Overruled by Virgin Creations CA. Manish Shah

Contd… • • • Kanubhai Ramjibhai Makwana 44 SOT 264 Piyush C Mehta 20 Taxmann. com 473 Bansal Parivahan 43 SOT 611 Sanjaykumar Pradhan 14 ITR 150 (Trib) Kulwantsingh 10 Taxmann. com 25 Raja Mahendri Shipping 51 SOT 242 CA. Manish Shah

Contd… • • • Kanubhai Ramjibhai Makwana 44 SOT 264 Piyush C Mehta 20 Taxmann. com 473 Bansal Parivahan 43 SOT 611 Sanjaykumar Pradhan 14 ITR 150 (Trib) Kulwantsingh 10 Taxmann. com 25 Raja Mahendri Shipping 51 SOT 242 CA. Manish Shah

Contd… Ø If the payee has paid tax - DICGC Ltd. 14 ITR (Trib. ) 194 (Against) Skycell Communications 251 ITR 53 Kotak Securities Ltd. 340 ITR 333 – Non Taxing Provision. • Reliance Hindustan Coca cola Beverage 293 ITR 226 SC Circular No. 275/201/95 -IT(b) dated 29/01/1997 • • • Ø Short Deduction of TDS - • • • S. K. Tekriwal 48 SOT 515 Chandabhoy Jassobhoy 49 SOT 448 Beekaylon Synthetics ITA No. 6506/Mum. /2008 CA. Manish Shah

Contd… Ø If the payee has paid tax - DICGC Ltd. 14 ITR (Trib. ) 194 (Against) Skycell Communications 251 ITR 53 Kotak Securities Ltd. 340 ITR 333 – Non Taxing Provision. • Reliance Hindustan Coca cola Beverage 293 ITR 226 SC Circular No. 275/201/95 -IT(b) dated 29/01/1997 • • • Ø Short Deduction of TDS - • • • S. K. Tekriwal 48 SOT 515 Chandabhoy Jassobhoy 49 SOT 448 Beekaylon Synthetics ITA No. 6506/Mum. /2008 CA. Manish Shah

Contd… Ø TDS default – • Bapusaheb Nanasaheb Dhumal 132 TTJ 694 • M. G. Vishwanath Reddy 51 SOT 420 • H S Mahindra Traders 132 TTJ 701 Ø Joint Ventures – No Sub Contract – Only money routed through – • Rishikesh Buildcon 206 Taxman 567 CA. Manish Shah

Contd… Ø TDS default – • Bapusaheb Nanasaheb Dhumal 132 TTJ 694 • M. G. Vishwanath Reddy 51 SOT 420 • H S Mahindra Traders 132 TTJ 701 Ø Joint Ventures – No Sub Contract – Only money routed through – • Rishikesh Buildcon 206 Taxman 567 CA. Manish Shah

Contd… Ø • • Ø • Section 40(a)(ia) has been introduced wef 01/04/2005 that Finance Act was brought in force in October, any payment before the same would not be disallowed. Golden Stables Lifestyle Center ITA No. 5145/Mum/2009 Shri Jivrajbhai Devjibhai Patel ITA No. 2479/Ahd/2008 Assessee has paid excess tax – hence did not deduct TDS U/s 194 C – Not Permissible. SCC Pati Joint Venture 46 SOT 263 CA. Manish Shah

Contd… Ø • • Ø • Section 40(a)(ia) has been introduced wef 01/04/2005 that Finance Act was brought in force in October, any payment before the same would not be disallowed. Golden Stables Lifestyle Center ITA No. 5145/Mum/2009 Shri Jivrajbhai Devjibhai Patel ITA No. 2479/Ahd/2008 Assessee has paid excess tax – hence did not deduct TDS U/s 194 C – Not Permissible. SCC Pati Joint Venture 46 SOT 263 CA. Manish Shah

Contd… Ø If interest paid is as part of purchase price, then no TDS U/s 194 A – Section 40(a)(ia) doesn’t apply • Parag Mansukhlal Shah 46 SOT 302 Ahd. Ø Retrospective Amendment – impossibility for assessee to deduct tax – • Sterling Abrasive Ltd. 40 TTJ 68 Ahd. CA. Manish Shah

Contd… Ø If interest paid is as part of purchase price, then no TDS U/s 194 A – Section 40(a)(ia) doesn’t apply • Parag Mansukhlal Shah 46 SOT 302 Ahd. Ø Retrospective Amendment – impossibility for assessee to deduct tax – • Sterling Abrasive Ltd. 40 TTJ 68 Ahd. CA. Manish Shah

Contd… Ø Late submission of Form 15 G – submitted during course of assessment – • Shyamsundar Kailashchand 141 ITD 126 Ø Cost Sharing with group concerns • Emerson Process Management 47 SOT 157 Ø Interest paid as part of Debt – No TDS • Akber Abdul Ali- 43 B BCAJ 25 (March-12) CA. Manish Shah

Contd… Ø Late submission of Form 15 G – submitted during course of assessment – • Shyamsundar Kailashchand 141 ITD 126 Ø Cost Sharing with group concerns • Emerson Process Management 47 SOT 157 Ø Interest paid as part of Debt – No TDS • Akber Abdul Ali- 43 B BCAJ 25 (March-12) CA. Manish Shah

Contd… Ø Commission to Non Resident agents for services outside India - • • Devi’s Laboratory Ltd. 140 TTJ 746 Eon Technology Pvt. Ltd. 246 CTR 40 Ø Cash payment of labour expense – Sec. 194 C & Sec. 40(a)(ia) - Applicable • Nalawade C. Maruti 48 SOT 566 Ø Section 40 a(ia) – Not ultra vires • Rakesh Kumar & Co. 325 ITR 35 CA. Manish Shah

Contd… Ø Commission to Non Resident agents for services outside India - • • Devi’s Laboratory Ltd. 140 TTJ 746 Eon Technology Pvt. Ltd. 246 CTR 40 Ø Cash payment of labour expense – Sec. 194 C & Sec. 40(a)(ia) - Applicable • Nalawade C. Maruti 48 SOT 566 Ø Section 40 a(ia) – Not ultra vires • Rakesh Kumar & Co. 325 ITR 35 CA. Manish Shah

Contd… Ø Controversy between - Sec. 194 C & 194 J • • Nalawade C. Maruti 48 SOT 566 Sanjaykumar 143 TTJ 415 Ø Reimbursement of expenses of C & F Agents like sea freight, CCI charges, steam freight charges, container charges, etc. - • • Minpro Industries 143 TTJ 331 Karnavati Co-op Bank Ltd 134 ITD 486 Charged separately Choice Sanitary Ware 9 Taxmann. com 120 (Raj) • CA. Manish Shah

Contd… Ø Controversy between - Sec. 194 C & 194 J • • Nalawade C. Maruti 48 SOT 566 Sanjaykumar 143 TTJ 415 Ø Reimbursement of expenses of C & F Agents like sea freight, CCI charges, steam freight charges, container charges, etc. - • • Minpro Industries 143 TTJ 331 Karnavati Co-op Bank Ltd 134 ITD 486 Charged separately Choice Sanitary Ware 9 Taxmann. com 120 (Raj) • CA. Manish Shah

Contd… Ø Brokerage paid on derivatives – Sec. 194 H not applicable – • Noble Enclave & Towers Pvt. Ltd. 50 SOT 5 Ø Commission to Directors – • Jhangir Biri 126 TTJ 567 Ø Freight Charges-Truck hired for own use - Sec. 194 C not applicable - • Kranti Road Transport Pvt. Ltd. 50 SOT 15 CA. Manish Shah

Contd… Ø Brokerage paid on derivatives – Sec. 194 H not applicable – • Noble Enclave & Towers Pvt. Ltd. 50 SOT 5 Ø Commission to Directors – • Jhangir Biri 126 TTJ 567 Ø Freight Charges-Truck hired for own use - Sec. 194 C not applicable - • Kranti Road Transport Pvt. Ltd. 50 SOT 15 CA. Manish Shah

Contd… Ø S. 40(a)(ia) would apply only to expenditure that remain payable at the end of relevant F. Y and cannot be invoked to disallow amounts which have already been paid without TDS • Merilyne Shipping & Transports 136 ITD 23 (Vishakhapatnam Sp. Bench) K. Srinivas Naidu 131 TTJ 17 Teja Construction 129 TTJ 57 Ashika Stock Broking 139 TTJ 192 • • • CA. Manish Shah

Contd… Ø S. 40(a)(ia) would apply only to expenditure that remain payable at the end of relevant F. Y and cannot be invoked to disallow amounts which have already been paid without TDS • Merilyne Shipping & Transports 136 ITD 23 (Vishakhapatnam Sp. Bench) K. Srinivas Naidu 131 TTJ 17 Teja Construction 129 TTJ 57 Ashika Stock Broking 139 TTJ 192 • • • CA. Manish Shah

Contd… Ø Failure to deduct tax on reimbursement of expenses. Sec. 40(a)(ia) is invoked only when some expense is claimed as deduction & reimbursement of expense is profit neutral, it is not rooted through P & L A/c, it is not an expense and does not attract S. 40(a)(ia) • Sharma Kajaria & Co. 145 TTJ 1 Ø Failure to Disallow U/s 40 a(ia) – Section 263 • Raja & Co. 335 ITR 381 CA. Manish Shah

Contd… Ø Failure to deduct tax on reimbursement of expenses. Sec. 40(a)(ia) is invoked only when some expense is claimed as deduction & reimbursement of expense is profit neutral, it is not rooted through P & L A/c, it is not an expense and does not attract S. 40(a)(ia) • Sharma Kajaria & Co. 145 TTJ 1 Ø Failure to Disallow U/s 40 a(ia) – Section 263 • Raja & Co. 335 ITR 381 CA. Manish Shah

Contd… Ø In case of Joint Venture formed mainly to get a contract - work is being done by each party separately - no relation of contract & sub. Contract. Hence, no TDS • ITO v. UAN Raju Constructions 48 SOT 178 Ø Charitable Trust – Income computed U/s 11 • Mahatma Gandhi Seva Mandir 21 Taxmann. com 321 CA. Manish Shah

Contd… Ø In case of Joint Venture formed mainly to get a contract - work is being done by each party separately - no relation of contract & sub. Contract. Hence, no TDS • ITO v. UAN Raju Constructions 48 SOT 178 Ø Charitable Trust – Income computed U/s 11 • Mahatma Gandhi Seva Mandir 21 Taxmann. com 321 CA. Manish Shah

Contd… Ø Contract for supply of goods and along with the supply of goods, there are services like supply of gas by GAIL. Payment is made for gas as well as transportation. Not liable for TDS – • Krishak Bharati Co-op Ltd. 10 ITR 527 (Trib. ) Ø Brokerage Paid on sale of Property – No Business – No TDS • Mrs. Sushila Mallick 142 TTJ 372 CA. Manish Shah

Contd… Ø Contract for supply of goods and along with the supply of goods, there are services like supply of gas by GAIL. Payment is made for gas as well as transportation. Not liable for TDS – • Krishak Bharati Co-op Ltd. 10 ITR 527 (Trib. ) Ø Brokerage Paid on sale of Property – No Business – No TDS • Mrs. Sushila Mallick 142 TTJ 372 CA. Manish Shah

Contd… Ø Payments made on account of capital Expenditure. Sec. 40(a)(ia) applicable. No distinction between capital and revenue expenditure - • Spaco Carburettors (I) Ltd. 3 SOT 798 Ø In case of assessment U/s 145 (3) • Teja Construction 129 TTJ 57 Ø Expenses other than Section 30 to 38 • Teja Construction 129 TTJ 57 CA. Manish Shah

Contd… Ø Payments made on account of capital Expenditure. Sec. 40(a)(ia) applicable. No distinction between capital and revenue expenditure - • Spaco Carburettors (I) Ltd. 3 SOT 798 Ø In case of assessment U/s 145 (3) • Teja Construction 129 TTJ 57 Ø Expenses other than Section 30 to 38 • Teja Construction 129 TTJ 57 CA. Manish Shah

Amendment to Section 40 a(ia) Ø 2 nd Provision inserted Wef 01/04/2013 Ø It provides that if the assessee is “not deemed to be assessee” in default as per 1 st Proviso to Section 201(1) for non deduction of TDS, it shall be deemed that the assessee has deducted & paid tax on the date of filing return & no disallowance shall be made. Ø Retrospective Effect? CA. Manish Shah

Amendment to Section 40 a(ia) Ø 2 nd Provision inserted Wef 01/04/2013 Ø It provides that if the assessee is “not deemed to be assessee” in default as per 1 st Proviso to Section 201(1) for non deduction of TDS, it shall be deemed that the assessee has deducted & paid tax on the date of filing return & no disallowance shall be made. Ø Retrospective Effect? CA. Manish Shah

Questions? Shah & Bhandari Chartered Accountants shahbhandari@gmail. com ca. mgshah@gmail. com CA. Manish Shah

Questions? Shah & Bhandari Chartered Accountants shahbhandari@gmail. com ca. mgshah@gmail. com CA. Manish Shah

Thank You CA. Manish Shah

Thank You CA. Manish Shah