662705c172128be5803041c0a275f2b6.ppt

- Количество слайдов: 94

TAXES:

TAXES:

What are TAXES ? Required payment to the govt (_____, ________) *look at your paycheck The main source of government revenue TAXES:

What are TAXES ? Required payment to the govt (_____, ________) *look at your paycheck The main source of government revenue TAXES:

SOCIAL CONTRACT THEORY -____? ______ As citizens, we authorize the govt to tax CONSTITUTION/ARTICLE 1 “TO LAY & COLLECT TAXES……. . PROVIDE FOR THE COMMON DEFENSE & GENERAL WELFARE Amendment 16 *gives Congress the power to lay and collect taxes

SOCIAL CONTRACT THEORY -____? ______ As citizens, we authorize the govt to tax CONSTITUTION/ARTICLE 1 “TO LAY & COLLECT TAXES……. . PROVIDE FOR THE COMMON DEFENSE & GENERAL WELFARE Amendment 16 *gives Congress the power to lay and collect taxes

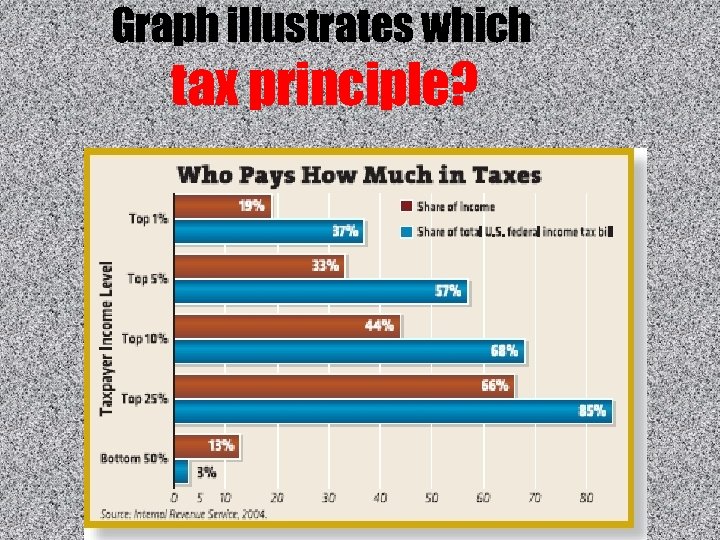

*TWO PRINCIPLES of TAXATION “Who pays What” is based on two principles: Benefit Principle - The more you benefit from something, the more you should pay. *Example: Your education is paid for mostly by the rich. Taxes on gasoline Ability to Pay - The more you make the more you should pay. *Rich people have an easier time paying taxes than those with less income.

*TWO PRINCIPLES of TAXATION “Who pays What” is based on two principles: Benefit Principle - The more you benefit from something, the more you should pay. *Example: Your education is paid for mostly by the rich. Taxes on gasoline Ability to Pay - The more you make the more you should pay. *Rich people have an easier time paying taxes than those with less income.

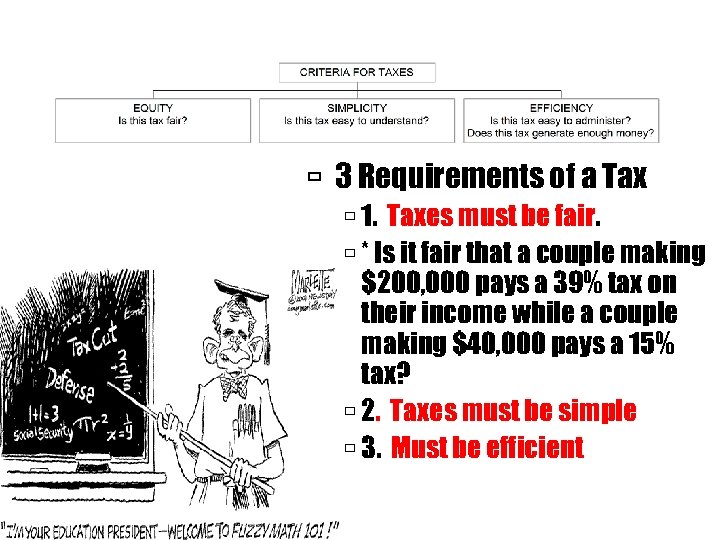

3 Requirements of a Tax 1. Taxes must be fair. * Is it fair that a couple making $200, 000 pays a 39% tax on their income while a couple making $40, 000 pays a 15% tax? 2. Taxes must be simple 3. Must be efficient

3 Requirements of a Tax 1. Taxes must be fair. * Is it fair that a couple making $200, 000 pays a 39% tax on their income while a couple making $40, 000 pays a 15% tax? 2. Taxes must be simple 3. Must be efficient

PAY AS YOU EARN * Ex’s Medieval Kings Colonial America

PAY AS YOU EARN * Ex’s Medieval Kings Colonial America

What is the Pay As You Earn (PAYE) system ? method of paying income tax and national insurance contributions.

What is the Pay As You Earn (PAYE) system ? method of paying income tax and national insurance contributions.

PAYE (Pay As You-Earn) is an amount collected by employers on behalf of the govt from employees.

PAYE (Pay As You-Earn) is an amount collected by employers on behalf of the govt from employees.

Income Tax or Federal Income Tax FIT Individual income taxes are paid over time through PAYE *** (just look at your paycheck). By April 15, you must file a tax return & Any difference in the amount paid compared to the amount owed is settled at this time. *RECONCILE

Income Tax or Federal Income Tax FIT Individual income taxes are paid over time through PAYE *** (just look at your paycheck). By April 15, you must file a tax return & Any difference in the amount paid compared to the amount owed is settled at this time. *RECONCILE

PAYE How does it work?

PAYE How does it work?

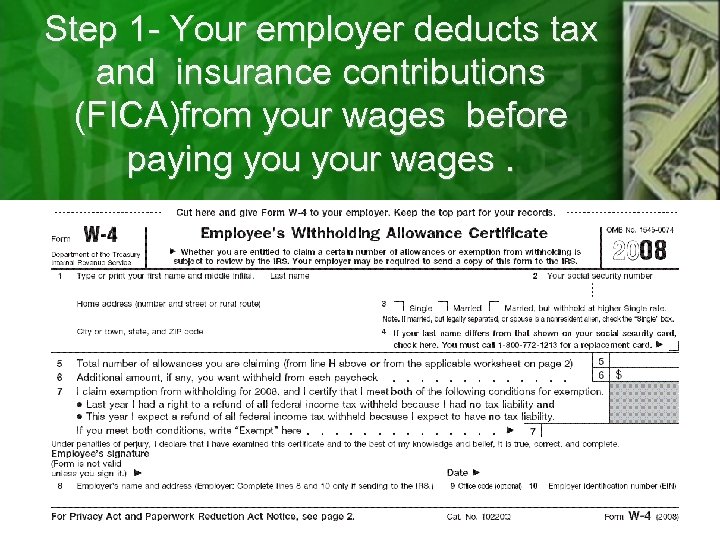

Step 1 - Your employer deducts tax and insurance contributions (FICA)from your wages before paying your wages.

Step 1 - Your employer deducts tax and insurance contributions (FICA)from your wages before paying your wages.

*W 4 Filled out by an employee when they start work. Why is withholding good? How many deductions should you take? Claiming “exempt” Extra withholdings Advice: File 0 deductions!

*W 4 Filled out by an employee when they start work. Why is withholding good? How many deductions should you take? Claiming “exempt” Extra withholdings Advice: File 0 deductions!

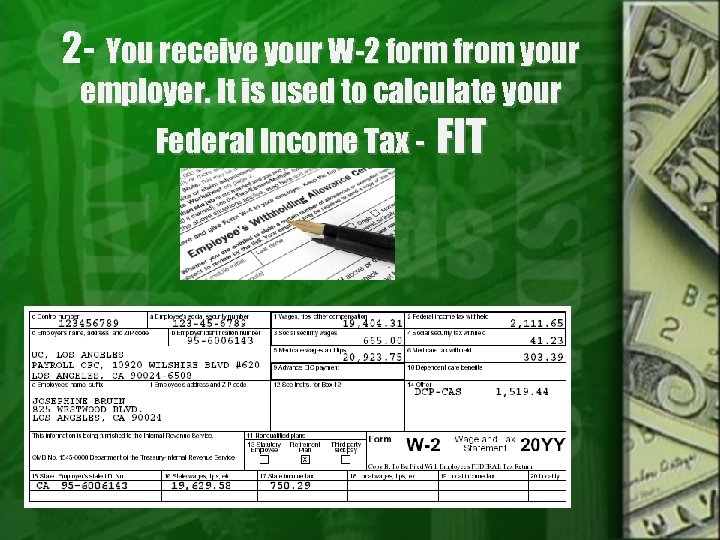

2 - You receive your W-2 form from your employer. It is used to calculate your Federal Income Tax - FIT

2 - You receive your W-2 form from your employer. It is used to calculate your Federal Income Tax - FIT

*Where do I get info to file taxes? W 2 from each employer usually mailed

*Where do I get info to file taxes? W 2 from each employer usually mailed

* How many dependents? Either you or your parents can claim you, NOT BOTH Who provides more than half of the support for a person? Often, “who can claim” is negotiated in a divorce settlement. If 2 taxpayers claim, whoever files first gets the deduction.

* How many dependents? Either you or your parents can claim you, NOT BOTH Who provides more than half of the support for a person? Often, “who can claim” is negotiated in a divorce settlement. If 2 taxpayers claim, whoever files first gets the deduction.

3 -FILE YOUR TAXES

3 -FILE YOUR TAXES

Reconcile w/ the IRS Pay Taxes Due OR Wait For Check

Reconcile w/ the IRS Pay Taxes Due OR Wait For Check

http: //www. youtube. com/watch? v=eg 3 d. Xx. LHco. E Q But what if you are selfemployed? ? ? A ? *The self-employed have a special burden when it comes paying income and social

http: //www. youtube. com/watch? v=eg 3 d. Xx. LHco. E Q But what if you are selfemployed? ? ? A ? *The self-employed have a special burden when it comes paying income and social

*If you had more money withheld than you owe, then you don’t have to file -you can let the government keep the extra! Bad idea? ? ?

*If you had more money withheld than you owe, then you don’t have to file -you can let the government keep the extra! Bad idea? ? ?

* You should file if. . . If you are unmarried, and earned over $5450, OR If your “unearned income” is more than $900, OR If your earnings from selfemployment were $400 or more

* You should file if. . . If you are unmarried, and earned over $5450, OR If your “unearned income” is more than $900, OR If your earnings from selfemployment were $400 or more

We The Economy Ep. 11: TAXATION NATION | Jessica Yu https: //youtu. be/Hq. Vjf. F 9 oiv. A

We The Economy Ep. 11: TAXATION NATION | Jessica Yu https: //youtu. be/Hq. Vjf. F 9 oiv. A

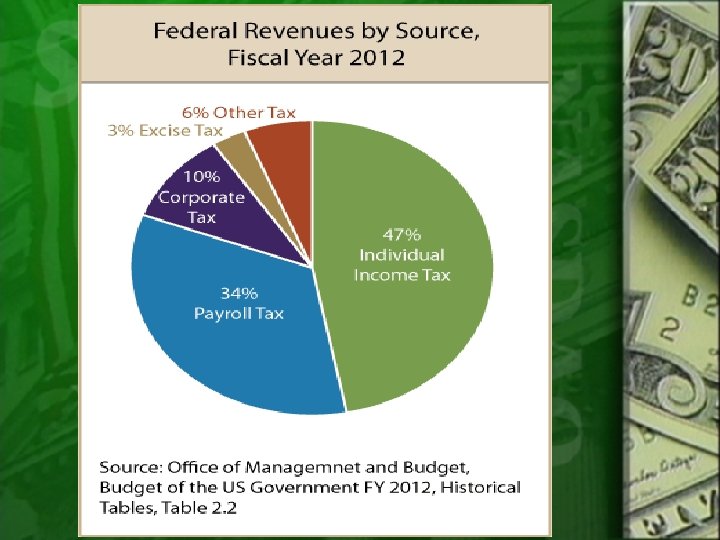

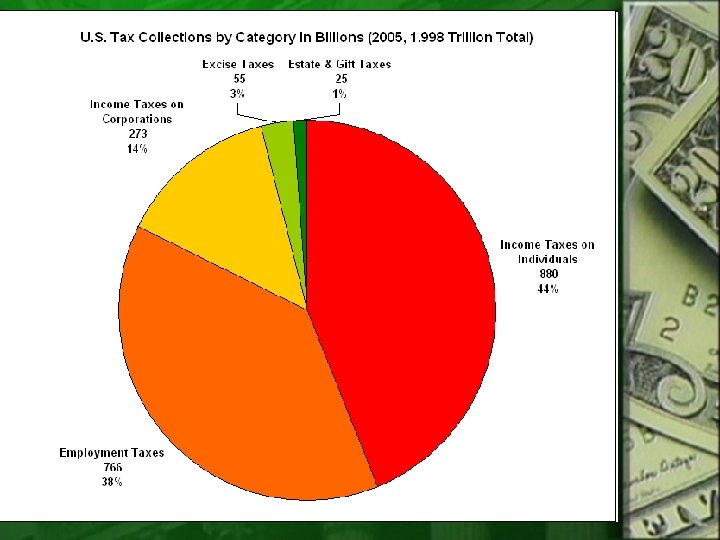

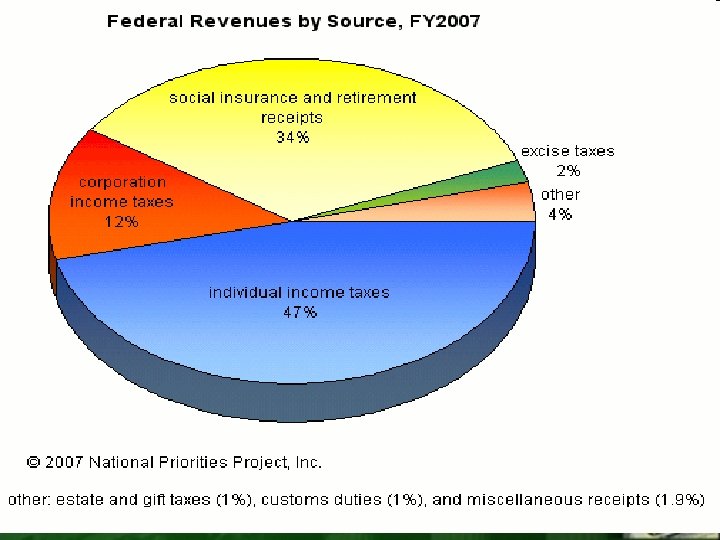

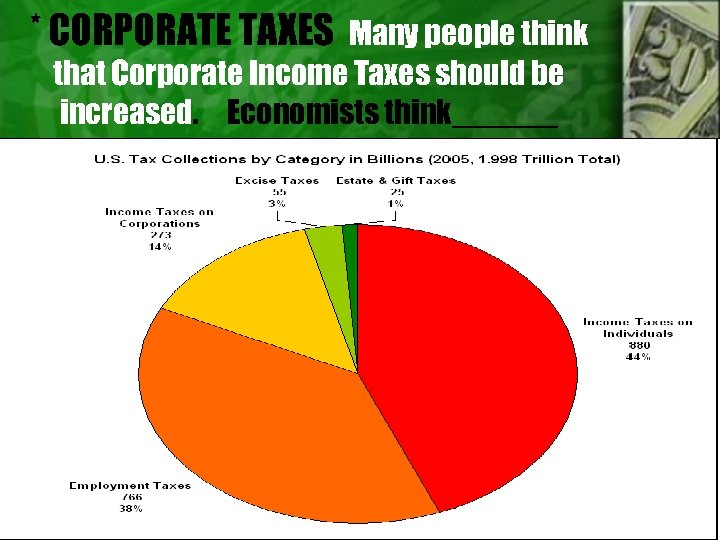

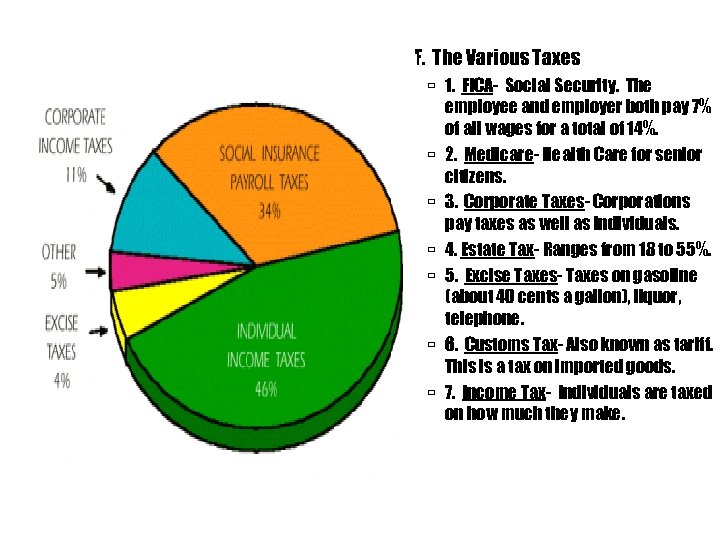

MAJOR SOURCES of FEDERAL INCOME

MAJOR SOURCES of FEDERAL INCOME

Q’s Largest source of revenue for GOVT? Second largest?

Q’s Largest source of revenue for GOVT? Second largest?

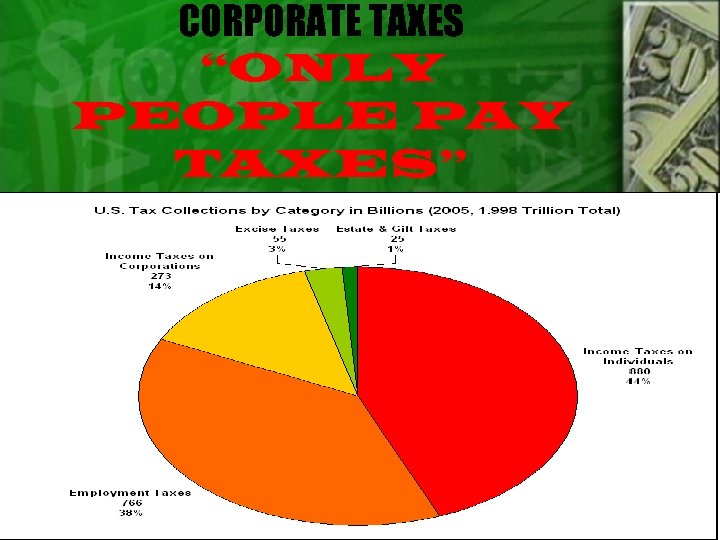

CORPORATE TAXES “ONLY PEOPLE PAY TAXES”

CORPORATE TAXES “ONLY PEOPLE PAY TAXES”

* CORPORATE TAXES Many people think that Corporate Income Taxes should be increased. Economists think______

* CORPORATE TAXES Many people think that Corporate Income Taxes should be increased. Economists think______

Graph illustrates which tax principle?

Graph illustrates which tax principle?

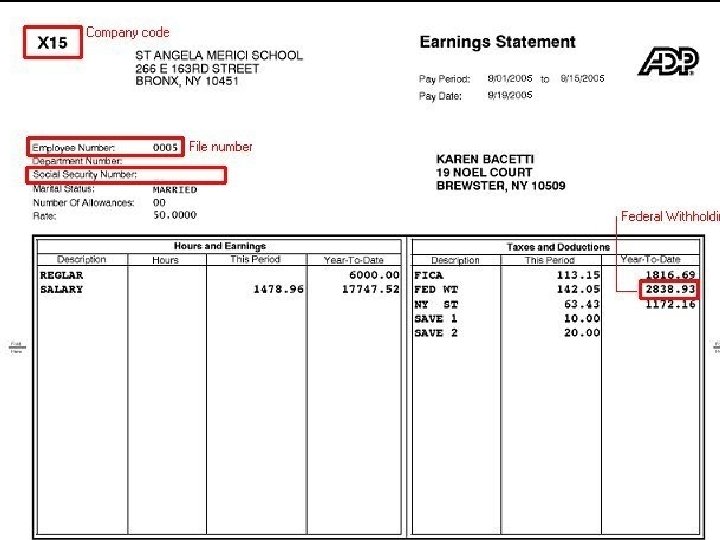

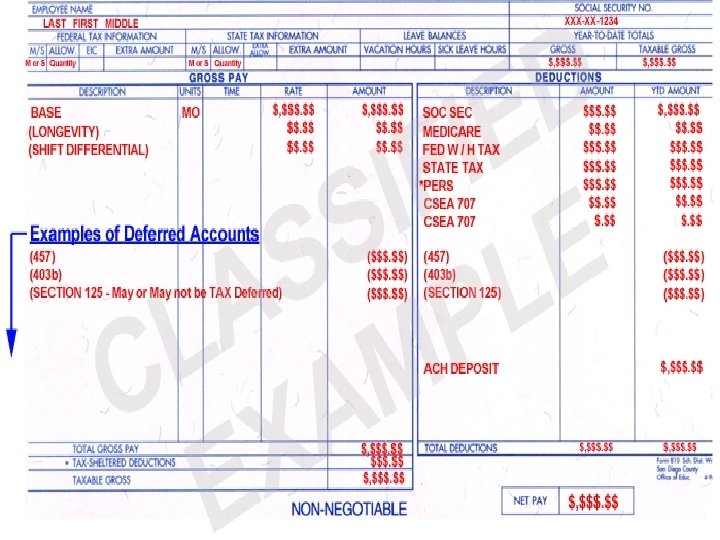

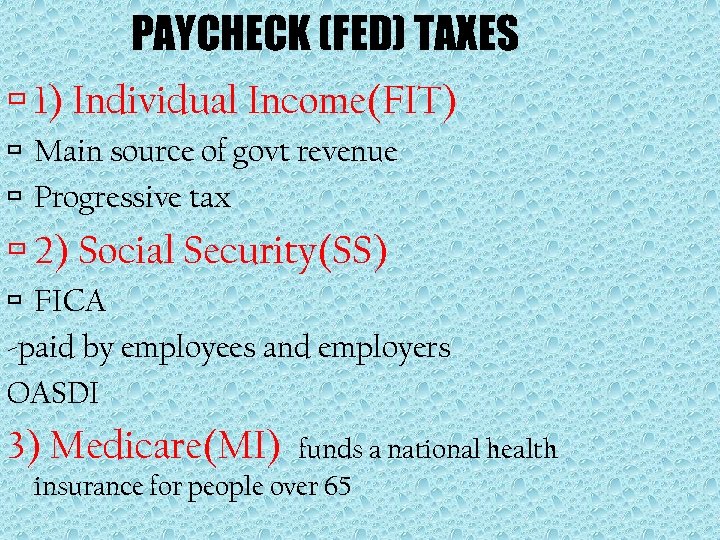

PAYCHECK (FED) TAXES 1) Individual Income(FIT) Main source of govt revenue Progressive tax 2) Social Security(SS) FICA -paid by employees and employers OASDI 3) Medicare(MI) funds a national health insurance for people over 65

PAYCHECK (FED) TAXES 1) Individual Income(FIT) Main source of govt revenue Progressive tax 2) Social Security(SS) FICA -paid by employees and employers OASDI 3) Medicare(MI) funds a national health insurance for people over 65

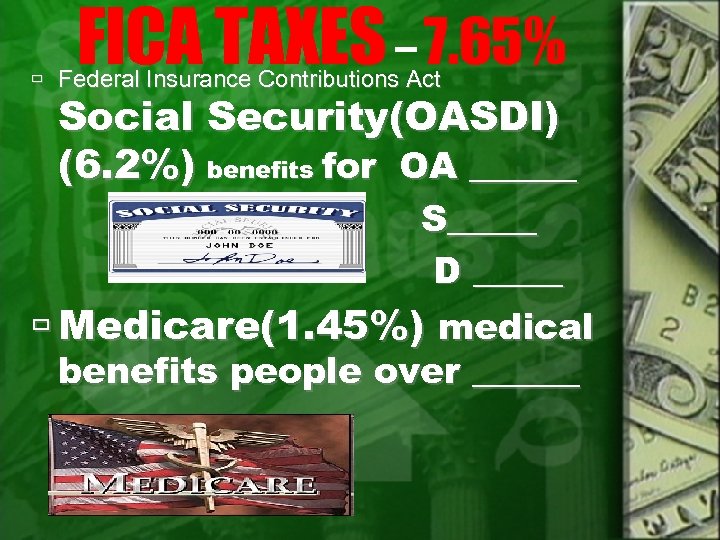

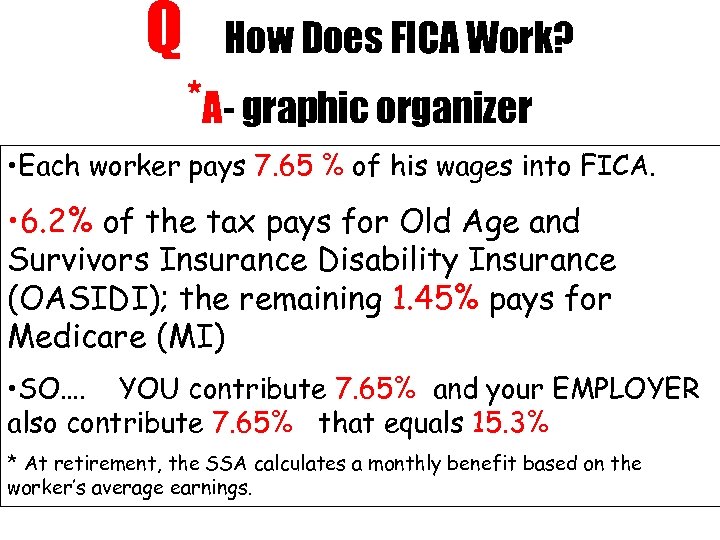

FICA TAXES – 7. 65% Federal Insurance Contributions Act Social Security(OASDI) (6. 2%) benefits for OA ______ S_____ D _____ Medicare(1. 45%) medical benefits people over ______

FICA TAXES – 7. 65% Federal Insurance Contributions Act Social Security(OASDI) (6. 2%) benefits for OA ______ S_____ D _____ Medicare(1. 45%) medical benefits people over ______

Q How Does FICA Work? *A- graphic organizer • Each worker pays 7. 65 % of his wages into FICA. • 6. 2% of the tax pays for Old Age and Survivors Insurance Disability Insurance (OASIDI); the remaining 1. 45% pays for Medicare (MI) • SO…. YOU contribute 7. 65% and your EMPLOYER also contribute 7. 65% that equals 15. 3% * At retirement, the SSA calculates a monthly benefit based on the worker’s average earnings.

Q How Does FICA Work? *A- graphic organizer • Each worker pays 7. 65 % of his wages into FICA. • 6. 2% of the tax pays for Old Age and Survivors Insurance Disability Insurance (OASIDI); the remaining 1. 45% pays for Medicare (MI) • SO…. YOU contribute 7. 65% and your EMPLOYER also contribute 7. 65% that equals 15. 3% * At retirement, the SSA calculates a monthly benefit based on the worker’s average earnings.

OASDI

OASDI

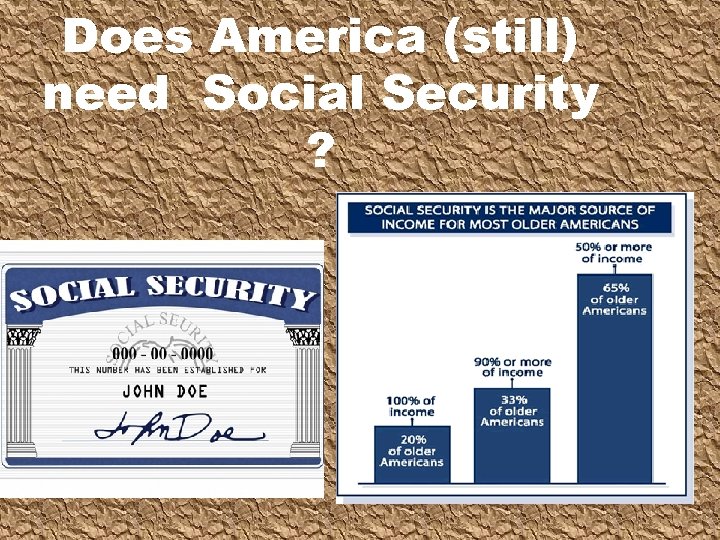

Does America (still) need Social Security ?

Does America (still) need Social Security ?

*BAD NEWS FOR YOU

*BAD NEWS FOR YOU

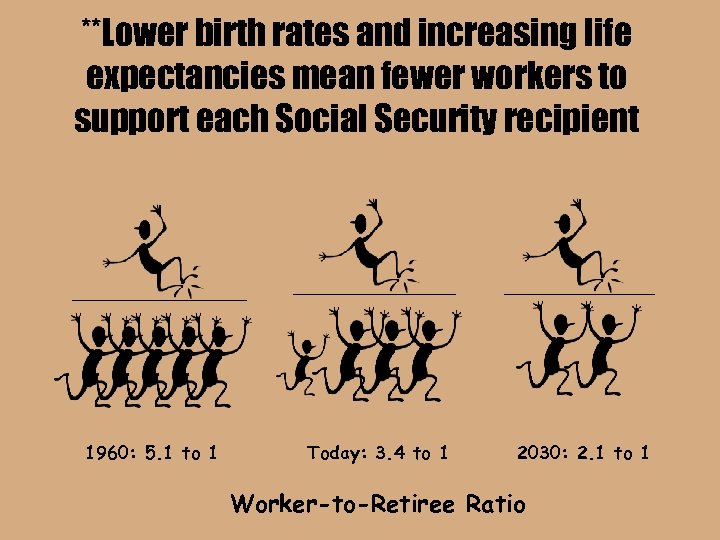

**Lower birth rates and increasing life expectancies mean fewer workers to support each Social Security recipient 1960: 5. 1 to 1 Today: 3. 4 to 1 2030: 2. 1 to 1 Worker-to-Retiree Ratio

**Lower birth rates and increasing life expectancies mean fewer workers to support each Social Security recipient 1960: 5. 1 to 1 Today: 3. 4 to 1 2030: 2. 1 to 1 Worker-to-Retiree Ratio

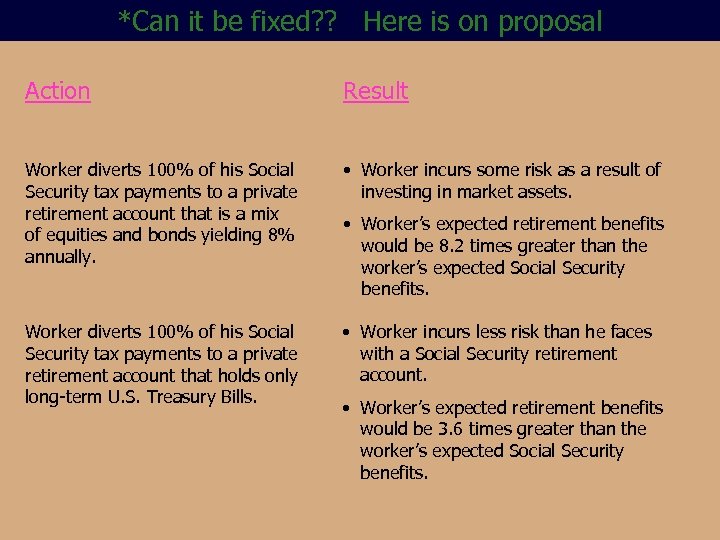

*Can it be fixed? ? Here is on proposal Action Result Worker diverts 100% of his Social Security tax payments to a private retirement account that is a mix of equities and bonds yielding 8% annually. • Worker incurs some risk as a result of investing in market assets. Worker diverts 100% of his Social Security tax payments to a private retirement account that holds only long-term U. S. Treasury Bills. • Worker incurs less risk than he faces with a Social Security retirement account. • Worker’s expected retirement benefits would be 8. 2 times greater than the worker’s expected Social Security benefits. • Worker’s expected retirement benefits would be 3. 6 times greater than the worker’s expected Social Security benefits.

*Can it be fixed? ? Here is on proposal Action Result Worker diverts 100% of his Social Security tax payments to a private retirement account that is a mix of equities and bonds yielding 8% annually. • Worker incurs some risk as a result of investing in market assets. Worker diverts 100% of his Social Security tax payments to a private retirement account that holds only long-term U. S. Treasury Bills. • Worker incurs less risk than he faces with a Social Security retirement account. • Worker’s expected retirement benefits would be 8. 2 times greater than the worker’s expected Social Security benefits. • Worker’s expected retirement benefits would be 3. 6 times greater than the worker’s expected Social Security benefits.

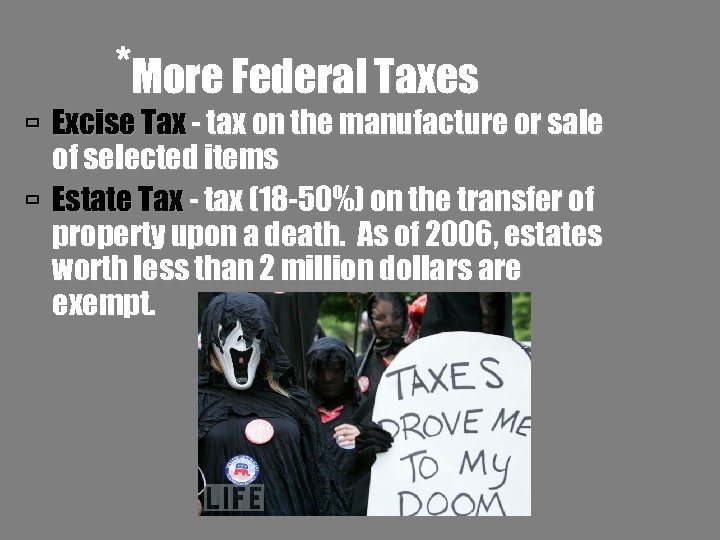

*More Federal Taxes Excise Tax - tax on the manufacture or sale of selected items Estate Tax - tax (18 -50%) on the transfer of property upon a death. As of 2006, estates worth less than 2 million dollars are exempt.

*More Federal Taxes Excise Tax - tax on the manufacture or sale of selected items Estate Tax - tax (18 -50%) on the transfer of property upon a death. As of 2006, estates worth less than 2 million dollars are exempt.

*More Federal Taxes Gift Tax - Tax on money donations, paid by the person donating. Customs Duties: Tax on imported goods. Exported goods may not be taxed.

*More Federal Taxes Gift Tax - Tax on money donations, paid by the person donating. Customs Duties: Tax on imported goods. Exported goods may not be taxed.

Types of Taxes Proportional Tax Progressive Tax Regressive Tax

Types of Taxes Proportional Tax Progressive Tax Regressive Tax

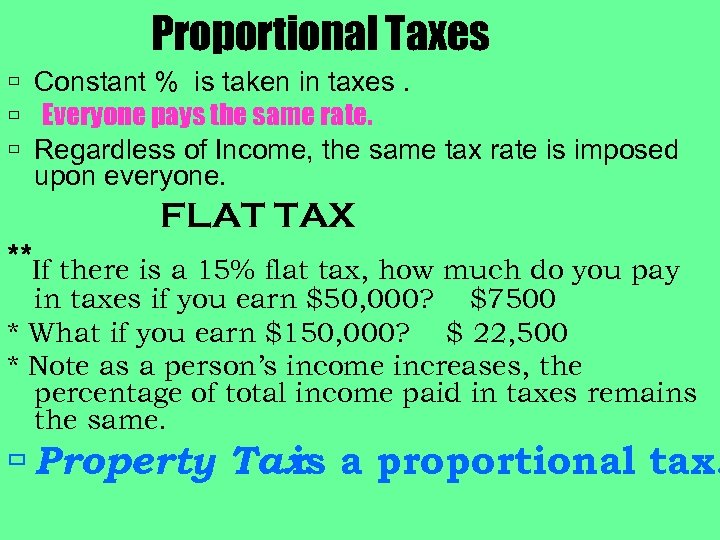

Proportional Taxes Constant % is taken in taxes. Everyone pays the same rate. Regardless of Income, the same tax rate is imposed upon everyone. FLAT TAX **If there is a 15% flat tax, how much do you pay in taxes if you earn $50, 000? $7500 * What if you earn $150, 000? $ 22, 500 * Note as a person’s income increases, the percentage of total income paid in taxes remains the same. Property Tax a proportional tax. is

Proportional Taxes Constant % is taken in taxes. Everyone pays the same rate. Regardless of Income, the same tax rate is imposed upon everyone. FLAT TAX **If there is a 15% flat tax, how much do you pay in taxes if you earn $50, 000? $7500 * What if you earn $150, 000? $ 22, 500 * Note as a person’s income increases, the percentage of total income paid in taxes remains the same. Property Tax a proportional tax. is

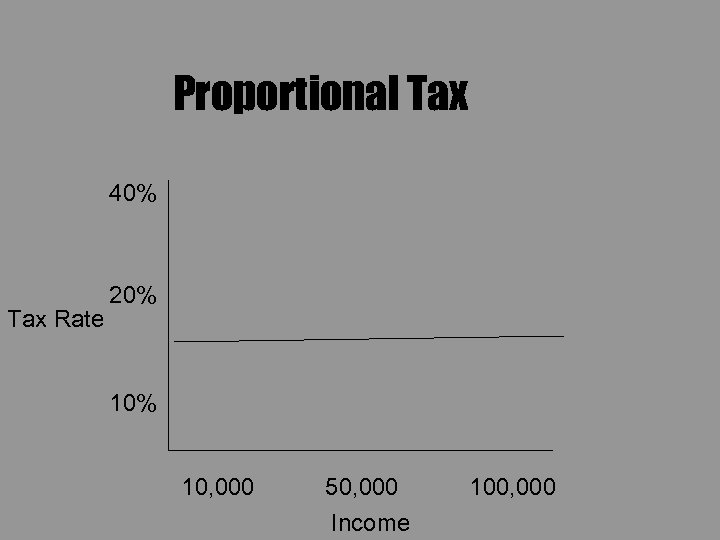

Proportional Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

Proportional Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

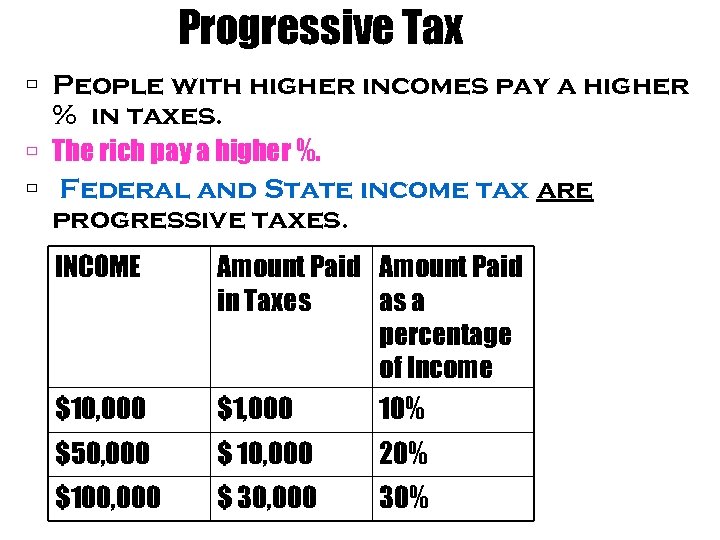

Progressive Tax People with higher incomes pay a higher % in taxes. The rich pay a higher %. Federal and State income tax are progressive taxes. INCOME $10, 000 Amount Paid in Taxes as a percentage of Income $1, 000 10% $50, 000 $ 10, 000 20% $100, 000 $ 30, 000 30%

Progressive Tax People with higher incomes pay a higher % in taxes. The rich pay a higher %. Federal and State income tax are progressive taxes. INCOME $10, 000 Amount Paid in Taxes as a percentage of Income $1, 000 10% $50, 000 $ 10, 000 20% $100, 000 $ 30, 000 30%

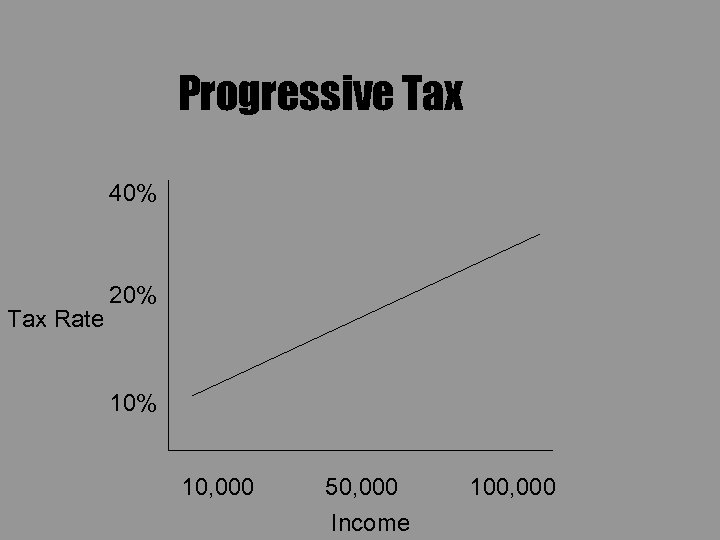

Progressive Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

Progressive Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

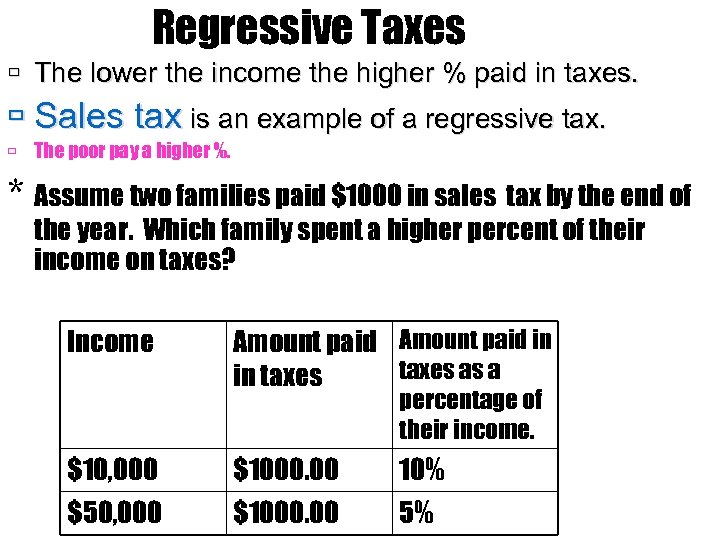

Regressive Taxes The lower the income the higher % paid in taxes. Sales tax is an example of a regressive tax. The poor pay a higher %. * Assume two families paid $1000 in sales tax by the end of the year. Which family spent a higher percent of their income on taxes? Income Amount paid in taxes as a in taxes percentage of their income. $10, 000 $1000. 00 10% $50, 000 $1000. 00 5%

Regressive Taxes The lower the income the higher % paid in taxes. Sales tax is an example of a regressive tax. The poor pay a higher %. * Assume two families paid $1000 in sales tax by the end of the year. Which family spent a higher percent of their income on taxes? Income Amount paid in taxes as a in taxes percentage of their income. $10, 000 $1000. 00 10% $50, 000 $1000. 00 5%

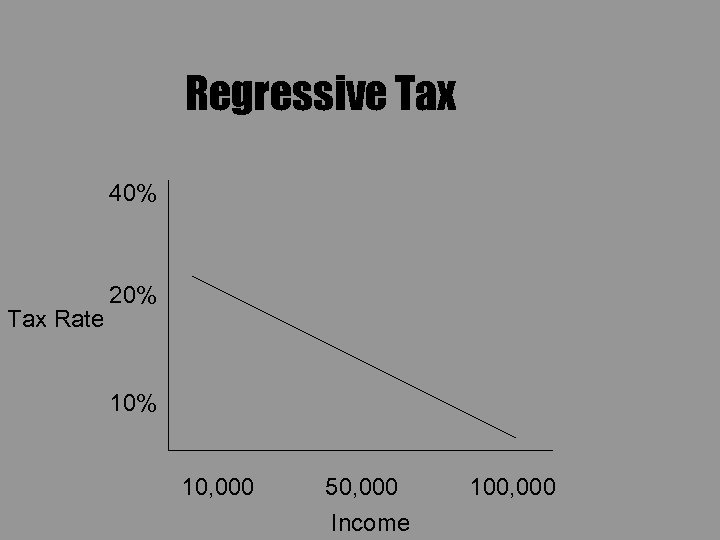

Regressive Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

Regressive Tax 40% Tax Rate 20% 10, 000 50, 000 Income 100, 000

* State Taxes and Local Taxes Property Tax Sales Tax Public Utility or State owned liquor stores Individual Income Tax Sales Tax - this varies from city to city!

* State Taxes and Local Taxes Property Tax Sales Tax Public Utility or State owned liquor stores Individual Income Tax Sales Tax - this varies from city to city!

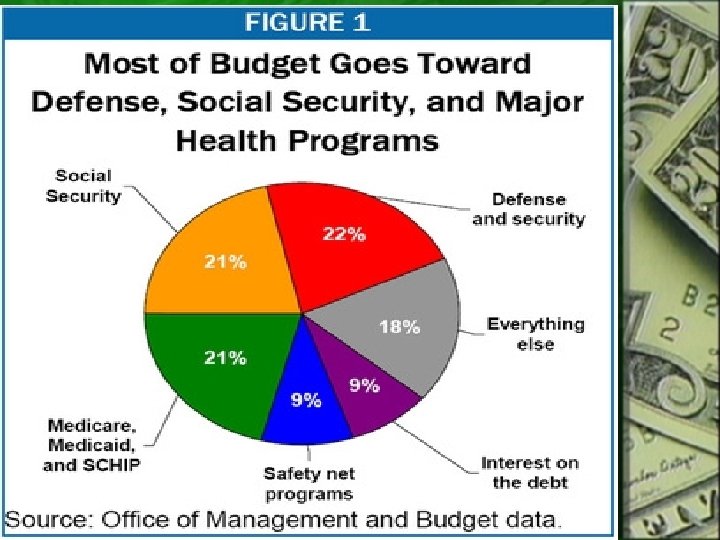

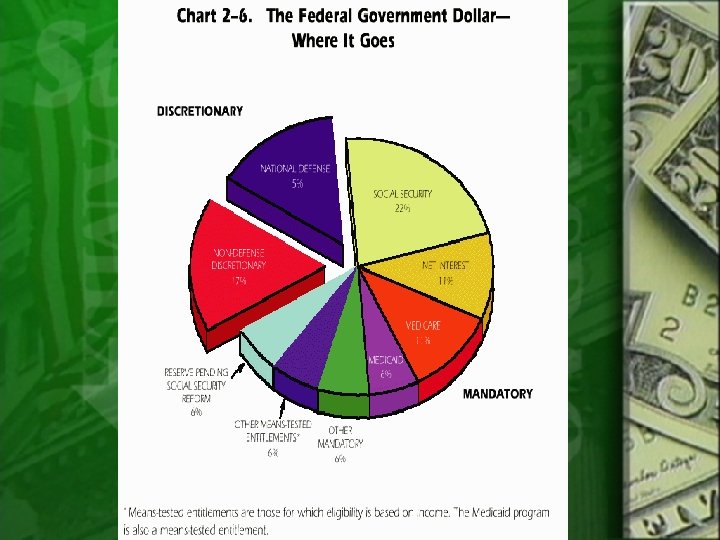

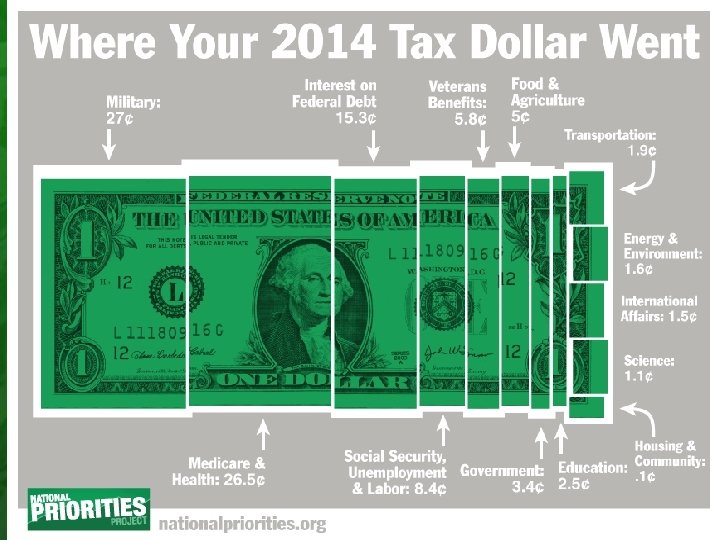

GOVT EXPENDITURE Largest? 2 nd Largest

GOVT EXPENDITURE Largest? 2 nd Largest

GOVT SPENDINGAn Oversimplification http: //www. youtube. com/watch? v=x. Jsm 4 y. SD 0 Ps

GOVT SPENDINGAn Oversimplification http: //www. youtube. com/watch? v=x. Jsm 4 y. SD 0 Ps

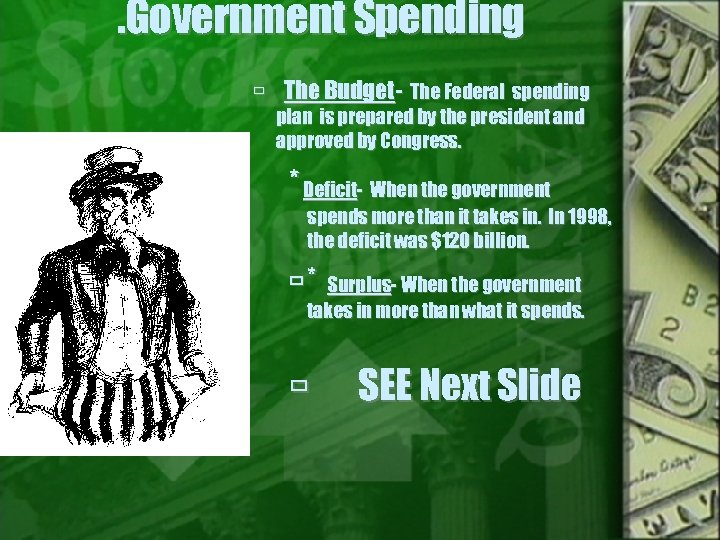

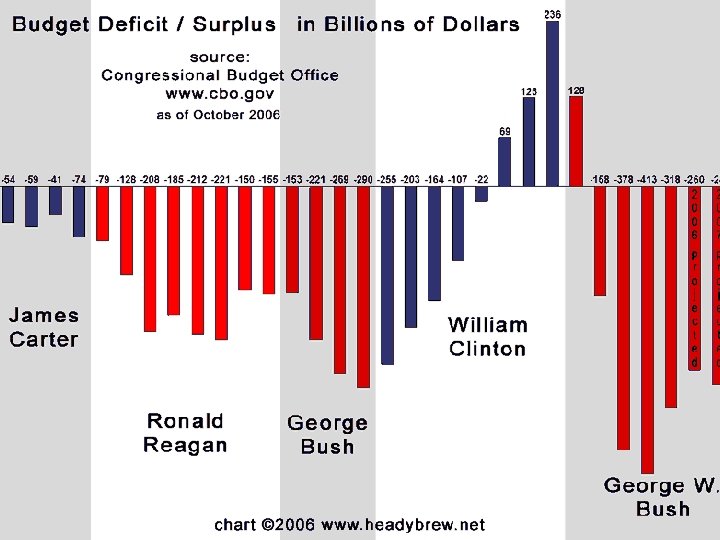

. Government Spending The Budget- The Federal spending plan is prepared by the president and approved by Congress. * Deficit- When the government spends more than it takes in. In 1998, the deficit was $120 billion. * Surplus- When the government takes in more than what it spends. SEE Next Slide

. Government Spending The Budget- The Federal spending plan is prepared by the president and approved by Congress. * Deficit- When the government spends more than it takes in. In 1998, the deficit was $120 billion. * Surplus- When the government takes in more than what it spends. SEE Next Slide

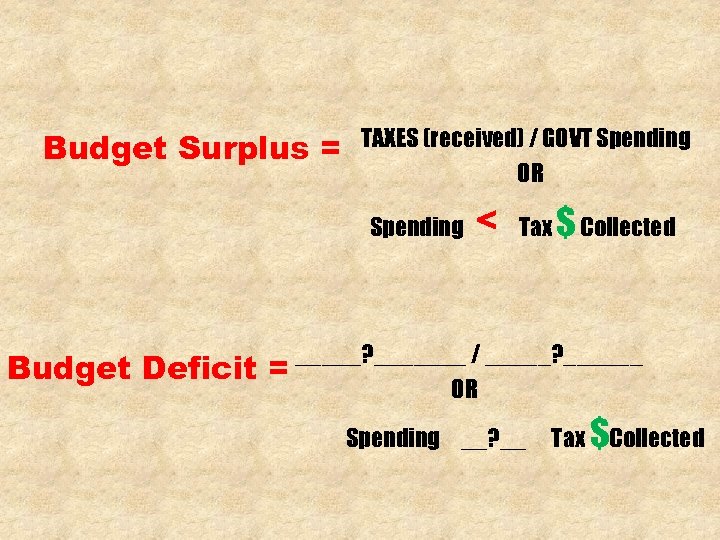

Budget Surplus = TAXES (received) / GOVT Spending OR Spending Budget Deficit < Tax $ Collected _____? _______ / _____? ______ = OR Spending __? __ Tax $Collected

Budget Surplus = TAXES (received) / GOVT Spending OR Spending Budget Deficit < Tax $ Collected _____? _______ / _____? ______ = OR Spending __? __ Tax $Collected

Deficit Vs Debt https: //youtu. be/n 7 N-0 q 4 Wg. B 4

Deficit Vs Debt https: //youtu. be/n 7 N-0 q 4 Wg. B 4

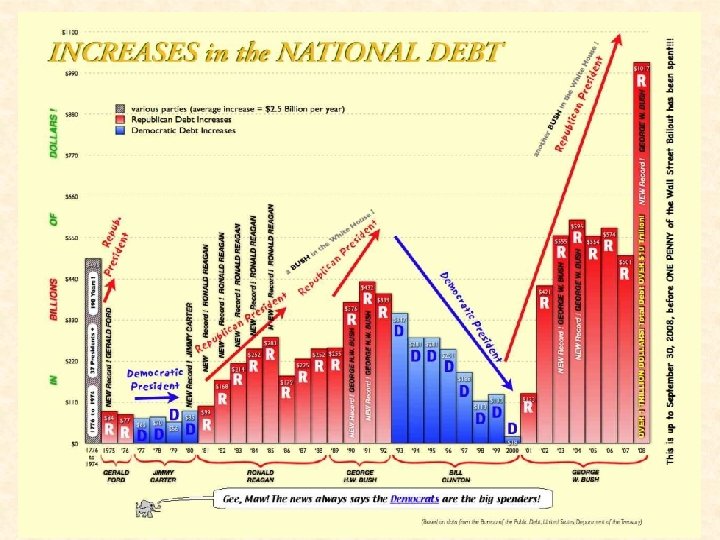

As of TODAY the NATIONAL DEBT is – $ ___ Trillion http: //www. usdebtclock. org/

As of TODAY the NATIONAL DEBT is – $ ___ Trillion http: //www. usdebtclock. org/

U. S. NATIONAL DEBT CLOCK The Outstanding Public Debt as of Oct, 2016 is: $_________ Concerned? Then tell Congress and the White House! VOTE!!!

U. S. NATIONAL DEBT CLOCK The Outstanding Public Debt as of Oct, 2016 is: $_________ Concerned? Then tell Congress and the White House! VOTE!!!

HOW MUCH IS A TRILLION? http: //www. youtube. com/watch? v=G NFb 6 qe 7 Tmg How Big is a Trillion? In the U. S. , one trillion is written as the number "1" followed by 12 zeros (1, 000, 000).

HOW MUCH IS A TRILLION? http: //www. youtube. com/watch? v=G NFb 6 qe 7 Tmg How Big is a Trillion? In the U. S. , one trillion is written as the number "1" followed by 12 zeros (1, 000, 000).

DON’T PANIC Not like a family Not like a business

DON’T PANIC Not like a family Not like a business

Medicare & Medicade * Medicare. Health care for the elderly. Along with S. S. this makes up 35% of the budget. Medicade , Food Stamps and other Social Programs * Health care and food for the poor. Makes up 17% of the budget.

Medicare & Medicade * Medicare. Health care for the elderly. Along with S. S. this makes up 35% of the budget. Medicade , Food Stamps and other Social Programs * Health care and food for the poor. Makes up 17% of the budget.

SIN TAX Behavior adjustment - attempt to change a person’s behavior * pack tax on cigarettes from 39 cents to $1. 01. The money generated will be used to support health care for low income children.

SIN TAX Behavior adjustment - attempt to change a person’s behavior * pack tax on cigarettes from 39 cents to $1. 01. The money generated will be used to support health care for low income children.

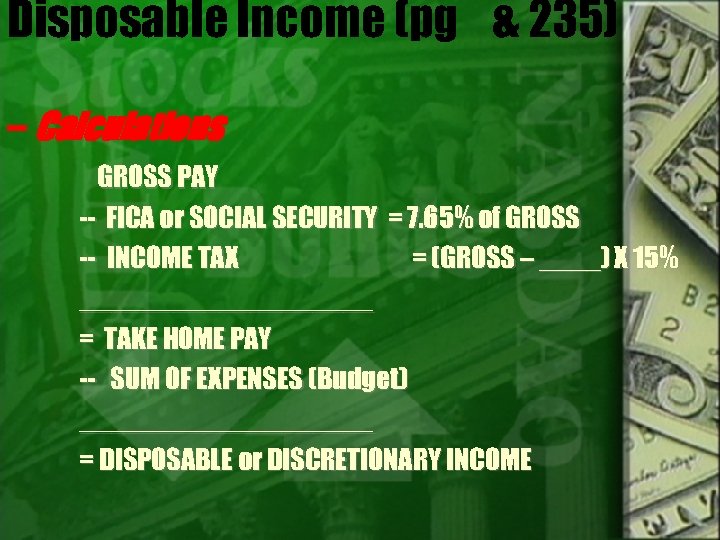

Disposable Income (pg & 235) -- Calculations GROSS PAY -- FICA or SOCIAL SECURITY = 7. 65% of GROSS -- INCOME TAX = (GROSS – ____) X 15% __________ = TAKE HOME PAY -- SUM OF EXPENSES (Budget) __________ = DISPOSABLE or DISCRETIONARY INCOME

Disposable Income (pg & 235) -- Calculations GROSS PAY -- FICA or SOCIAL SECURITY = 7. 65% of GROSS -- INCOME TAX = (GROSS – ____) X 15% __________ = TAKE HOME PAY -- SUM OF EXPENSES (Budget) __________ = DISPOSABLE or DISCRETIONARY INCOME

http: //www. youtube. com/watch? v=Vr. Xw. J b. Wyj 9 A

http: //www. youtube. com/watch? v=Vr. Xw. J b. Wyj 9 A

Practice Quiz © 2004 South-Western

Practice Quiz © 2004 South-Western

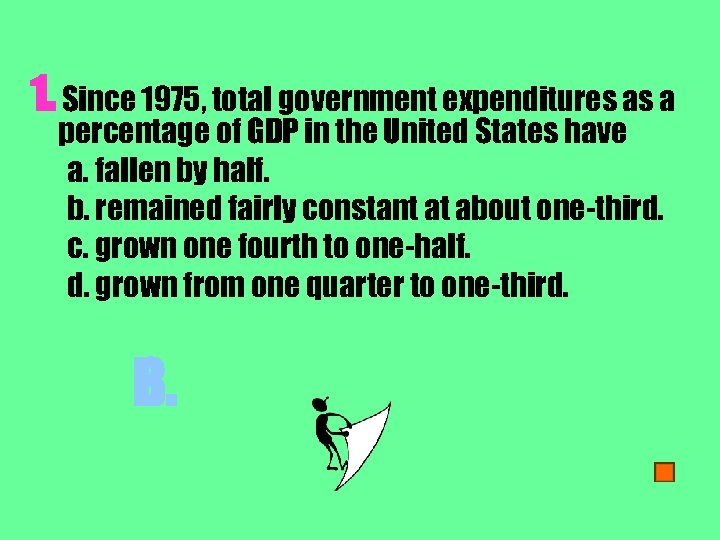

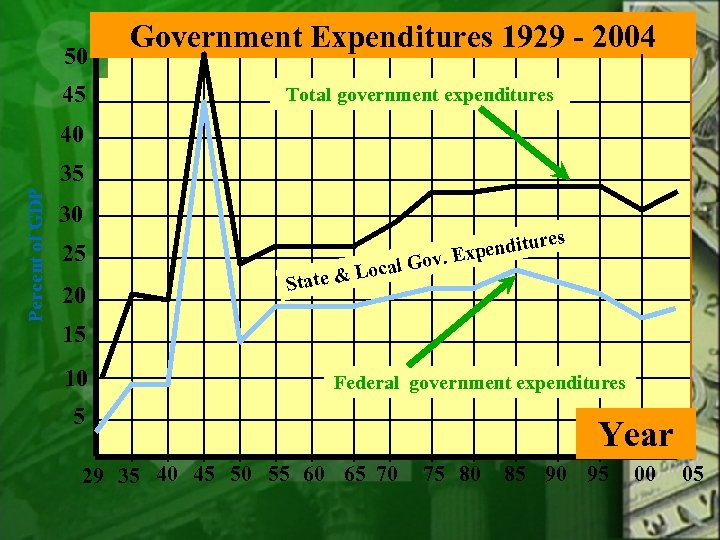

1. Since 1975, total government expenditures as a percentage of GDP in the United States have a. fallen by half. b. remained fairly constant at about one-third. c. grown one fourth to one-half. d. grown from one quarter to one-third. B.

1. Since 1975, total government expenditures as a percentage of GDP in the United States have a. fallen by half. b. remained fairly constant at about one-third. c. grown one fourth to one-half. d. grown from one quarter to one-third. B.

50 45 Government Expenditures 1929 - 2004 Total government expenditures 40 Percent of GDP 35 30 25 20 s nditure v. Expe o Local G State & 15 10 Federal government expenditures 5 29 35 40 45 50 55 60 65 70 Year 75 80 85 90 95 00 05

50 45 Government Expenditures 1929 - 2004 Total government expenditures 40 Percent of GDP 35 30 25 20 s nditure v. Expe o Local G State & 15 10 Federal government expenditures 5 29 35 40 45 50 55 60 65 70 Year 75 80 85 90 95 00 05

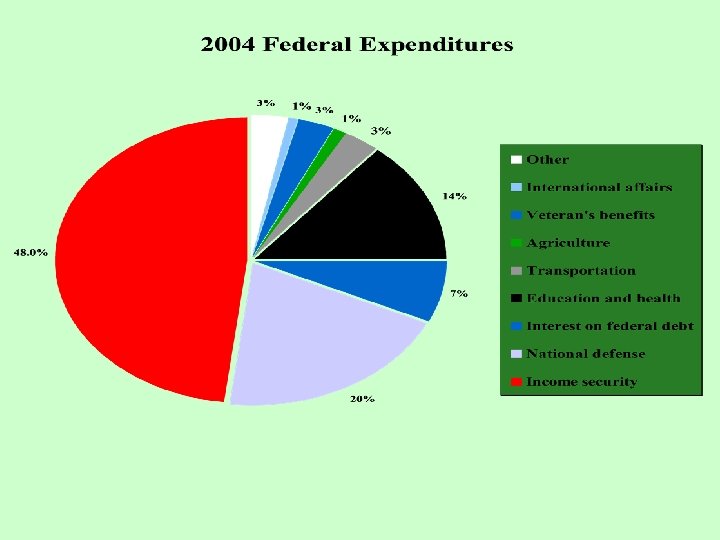

2. Which of the following accounts for the second largest percentage of total federal government expenditures as of 2004 ? a. Income security. b. National defense- War in Iraq. c. Interest on the national debt. d. Education and health. B

2. Which of the following accounts for the second largest percentage of total federal government expenditures as of 2004 ? a. Income security. b. National defense- War in Iraq. c. Interest on the national debt. d. Education and health. B

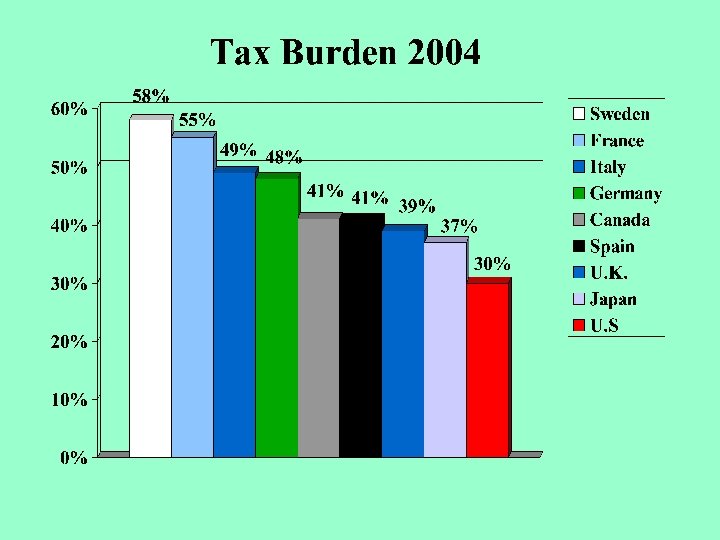

3. Which of the following countries devotes about the same percentage of its GDP to taxes as the United States? a. Sweden. b. Italy. c. United Kingdom. d. Japan. D.

3. Which of the following countries devotes about the same percentage of its GDP to taxes as the United States? a. Sweden. b. Italy. c. United Kingdom. d. Japan. D.

4. “The poor should not pay income taxes. ” This statement reflects which of the following principles for a tax? a. Fairness of contribution. b. Benefits received. c. Inexpensive to collect. d. Ability to pay. D. Since the poor lack the ability to pay, the tax system should be designed so they pay less taxes than people with higher incomes.

4. “The poor should not pay income taxes. ” This statement reflects which of the following principles for a tax? a. Fairness of contribution. b. Benefits received. c. Inexpensive to collect. d. Ability to pay. D. Since the poor lack the ability to pay, the tax system should be designed so they pay less taxes than people with higher incomes.

5. Some cities finance their airports with a departure tax. Every person leaving the city by plane is charged a small fixed dollar amount that is used to help pay for building and running the airport. The departure tax follows the a. benefits-received principle. b. ability-to-pay principle. c. flat-rate principle. d. public-choice principle. A. People who use the airport are the ones who are paying the most for it.

5. Some cities finance their airports with a departure tax. Every person leaving the city by plane is charged a small fixed dollar amount that is used to help pay for building and running the airport. The departure tax follows the a. benefits-received principle. b. ability-to-pay principle. c. flat-rate principle. d. public-choice principle. A. People who use the airport are the ones who are paying the most for it.

6. Which of the following statements is true? a. The most important source of revenue to the federal government is personal income taxes. b. The most important source of revenue for state and local governments is sales and property taxes. d. The taxation burden, measured by taxes as a percentage of GDP, is lighter in the U. S. than in most other advanced industrial countries. e. All of the above are true. E. All of the above are true statements.

6. Which of the following statements is true? a. The most important source of revenue to the federal government is personal income taxes. b. The most important source of revenue for state and local governments is sales and property taxes. d. The taxation burden, measured by taxes as a percentage of GDP, is lighter in the U. S. than in most other advanced industrial countries. e. All of the above are true. E. All of the above are true statements.

7. Which of the following statements is true? a. A sales tax on food is a regressive tax. b. The largest source of federal government tax revenue is individual income taxes. c. The largest source of state and local government tax revenue is sales taxes. d. All the above are true statements. D. All the above are true statements.

7. Which of the following statements is true? a. A sales tax on food is a regressive tax. b. The largest source of federal government tax revenue is individual income taxes. c. The largest source of state and local government tax revenue is sales taxes. d. All the above are true statements. D. All the above are true statements.

8. A tax that is structured so that people with higher incomes pay a larger percentage of their income for the tax than do people with smaller incomes is called a (an) a. income tax. b. regressive tax. c. property tax. d. progressive tax. D. a is not specific; b is the opposite principle c is based on property not income.

8. A tax that is structured so that people with higher incomes pay a larger percentage of their income for the tax than do people with smaller incomes is called a (an) a. income tax. b. regressive tax. c. property tax. d. progressive tax. D. a is not specific; b is the opposite principle c is based on property not income.

9. Generally, most economists feel that a ______type of income tax is a fairer way to raise government revenue than a sales tax. a. regressive. b. proportional. c. flat-rate. d. progressive. D. A progressive tax is argued to be fair because people with higher incomes pay more tax.

9. Generally, most economists feel that a ______type of income tax is a fairer way to raise government revenue than a sales tax. a. regressive. b. proportional. c. flat-rate. d. progressive. D. A progressive tax is argued to be fair because people with higher incomes pay more tax.

10. The federal income tax FIT is an example of a (an) a. excise tax. b. proportional tax. c. progressive tax. d. regressive tax. C. Since the marginal tax rate increases with income, the federal income tax is a progressive tax.

10. The federal income tax FIT is an example of a (an) a. excise tax. b. proportional tax. c. progressive tax. d. regressive tax. C. Since the marginal tax rate increases with income, the federal income tax is a progressive tax.

11. A 5% sales tax on food is an example of a a. flat tax. b. progressive tax. c. proportional tax. d. regressive tax. D. A sales tax on food is a regressive tax because people with higher incomes do not spend proportionately more on food.

11. A 5% sales tax on food is an example of a a. flat tax. b. progressive tax. c. proportional tax. d. regressive tax. D. A sales tax on food is a regressive tax because people with higher incomes do not spend proportionately more on food.

12. Margaret pays a local income tax of 2 %, regardless of the size of her income. This tax is a. proportional. b. regressive. c. progressive. d. a mix of (a) and (b). A. Less tax is paid by a regressive tax and more tax is paid by a progressive tax as people’s incomes rise.

12. Margaret pays a local income tax of 2 %, regardless of the size of her income. This tax is a. proportional. b. regressive. c. progressive. d. a mix of (a) and (b). A. Less tax is paid by a regressive tax and more tax is paid by a progressive tax as people’s incomes rise.

F. The Various Taxes 1. FICA- Social Security. The employee and employer both pay 7% of all wages for a total of 14%. 2. Medicare- Health Care for senior citizens. 3. Corporate Taxes- Corporations pay taxes as well as individuals. 4. Estate Tax- Ranges from 18 to 55%. 5. Excise Taxes- Taxes on gasoline (about 40 cents a gallon), liquor, telephone. 6. Customs Tax- Also known as tariff. This is a tax on imported goods. 7. Income Tax- Individuals are taxed on how much they make.

F. The Various Taxes 1. FICA- Social Security. The employee and employer both pay 7% of all wages for a total of 14%. 2. Medicare- Health Care for senior citizens. 3. Corporate Taxes- Corporations pay taxes as well as individuals. 4. Estate Tax- Ranges from 18 to 55%. 5. Excise Taxes- Taxes on gasoline (about 40 cents a gallon), liquor, telephone. 6. Customs Tax- Also known as tariff. This is a tax on imported goods. 7. Income Tax- Individuals are taxed on how much they make.

END

END