8000bf2d4aae57eea1cbda1afebac8c5.ppt

- Количество слайдов: 21

Tax reform 2015? Thinking about the personal property tax Todd A. Berry, Ph. D, President Wisconsin Taxpayers Alliance Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Overview n Why now? n Economic, demographic context n Our tax system; property tax background n Personal property – data and history n Where are we now? What do we do? Why? Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Why reform talk? n n n Lack of systemic reform, accumulating ‘detritus’ Growing need: — Slow-growth state economy — Rapidly evolving population trends — Dated and unbalanced tax system Recent actions: tinkering and stage-setting An open window. . . closing? And, of course. . . politics Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

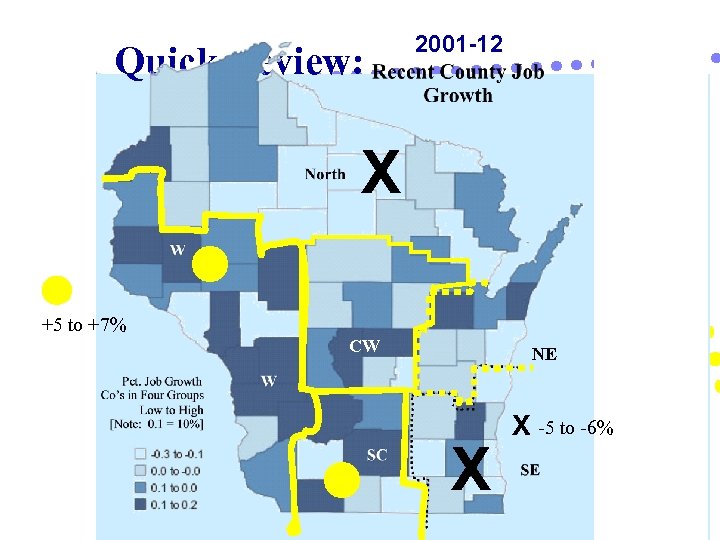

State economy. . . Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Quick review: 2001 -12 X +5 to +7% CW NE X X -5 to -6% Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

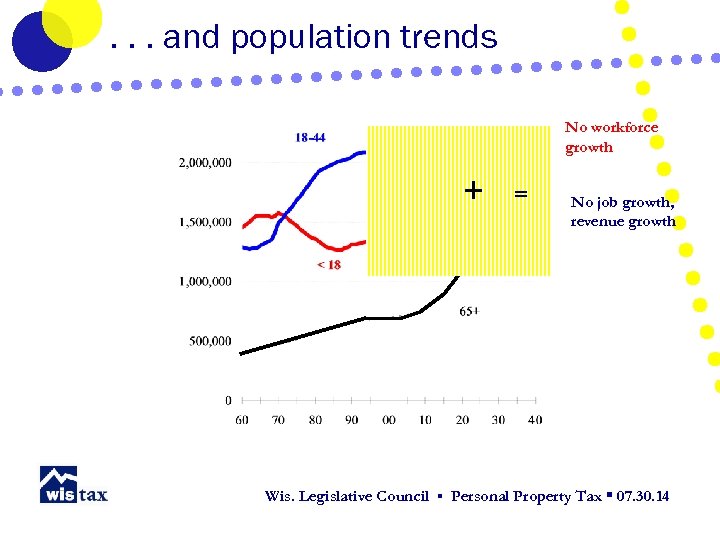

. . . and population trends No workforce growth + = No job growth, revenue growth Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

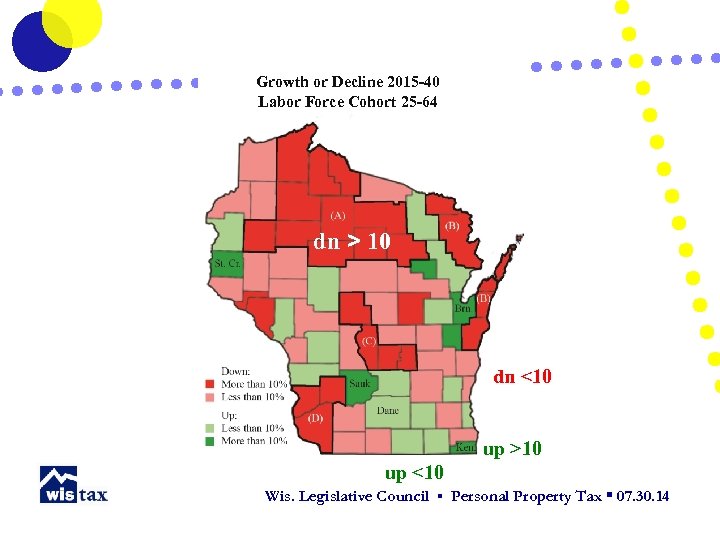

Growth or Decline 2015 -40 Labor Force Cohort 25 -64 dn > 10 dn <10 up >10 up <10 Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

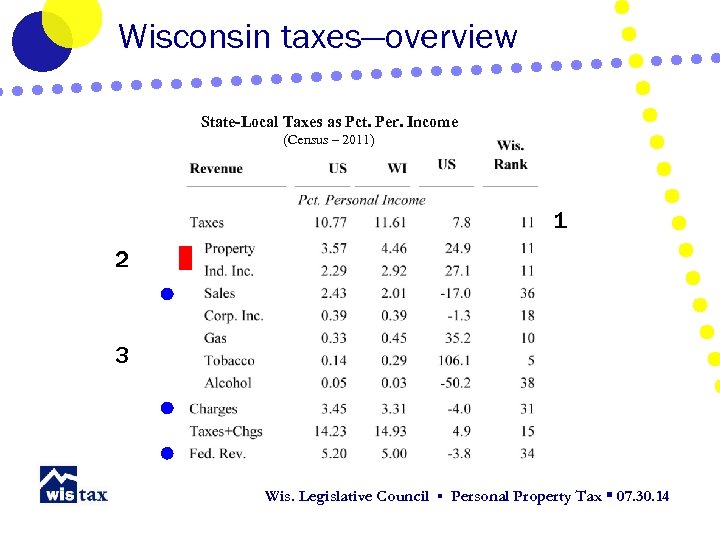

Wisconsin taxes—overview State-Local Taxes as Pct. Per. Income (Census – 2011) 1 2 3 Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

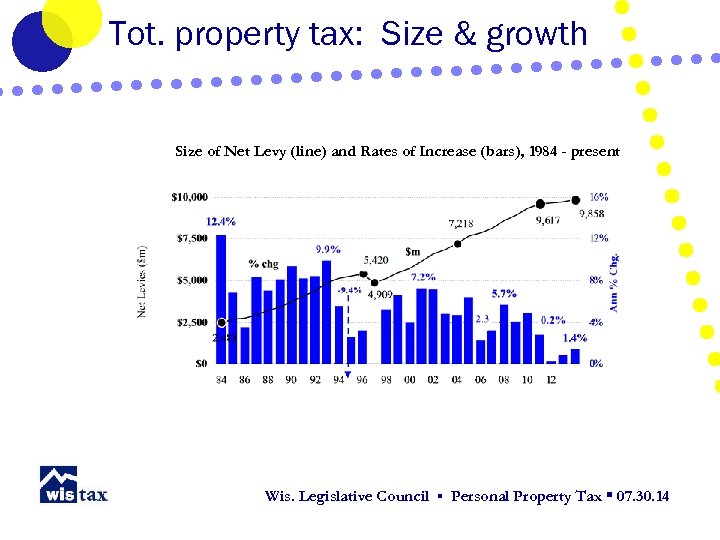

Tot. property tax: Size & growth Size of Net Levy (line) and Rates of Increase (bars), 1984 - present Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

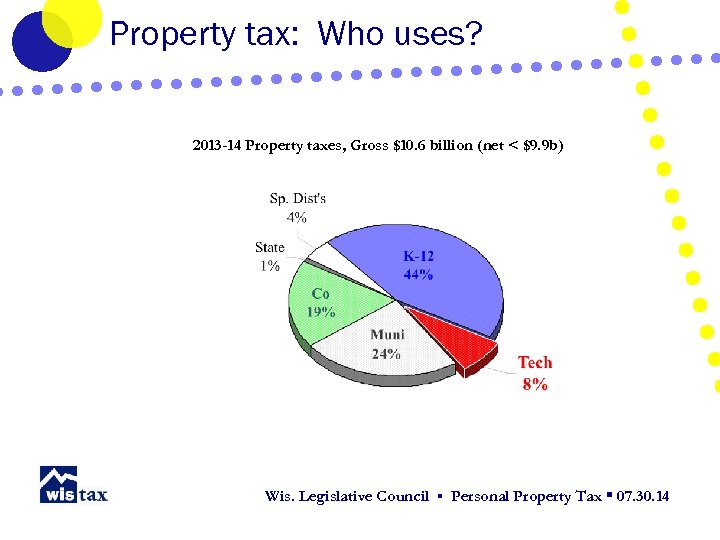

Property tax: Who uses? 2013 -14 Property taxes, Gross $10. 6 billion (net < $9. 9 b) Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

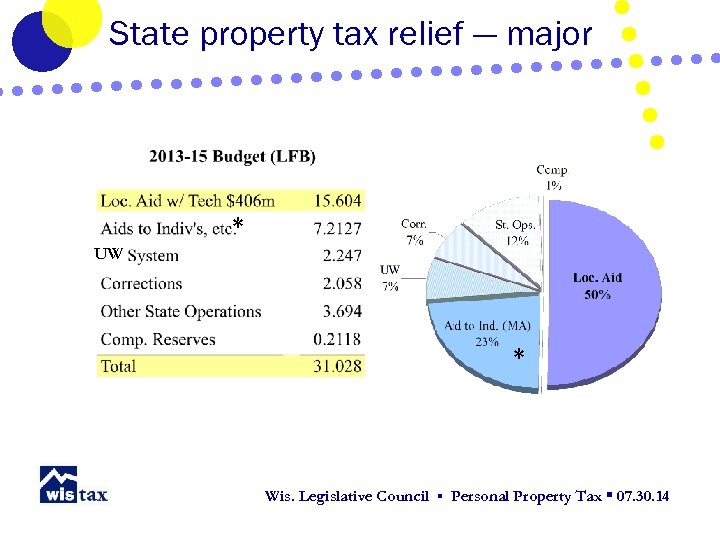

State property tax relief — major * UW * Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

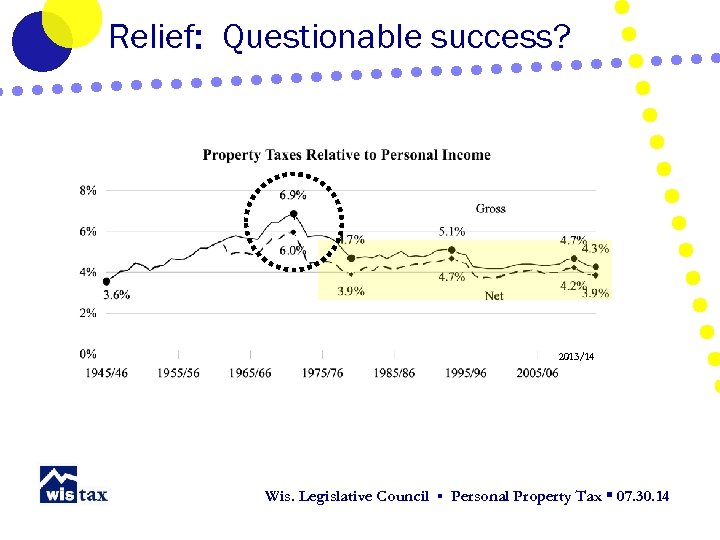

Relief: Questionable success? ` 2013/14 Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

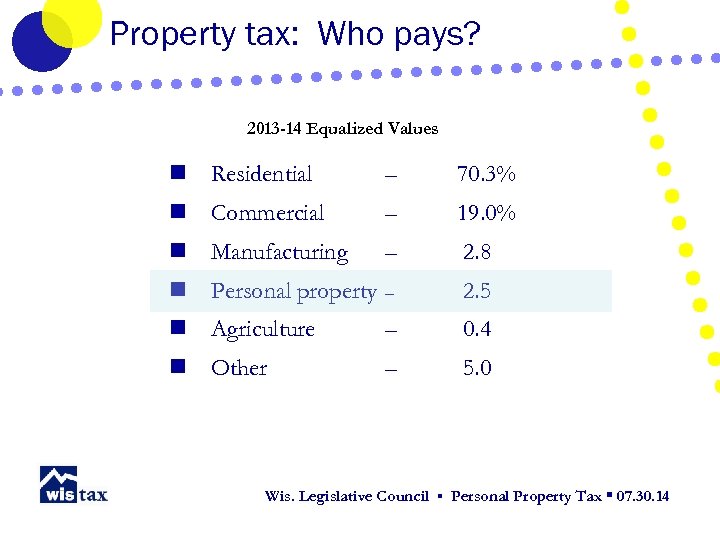

Property tax: Who pays? 2013 -14 Equalized Values n Residential – 70. 3% n Commercial – 19. 0% n Manufacturing – 2. 8 n Personal property – 2. 5 n Agriculture – 0. 4 n Other – 5. 0 Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

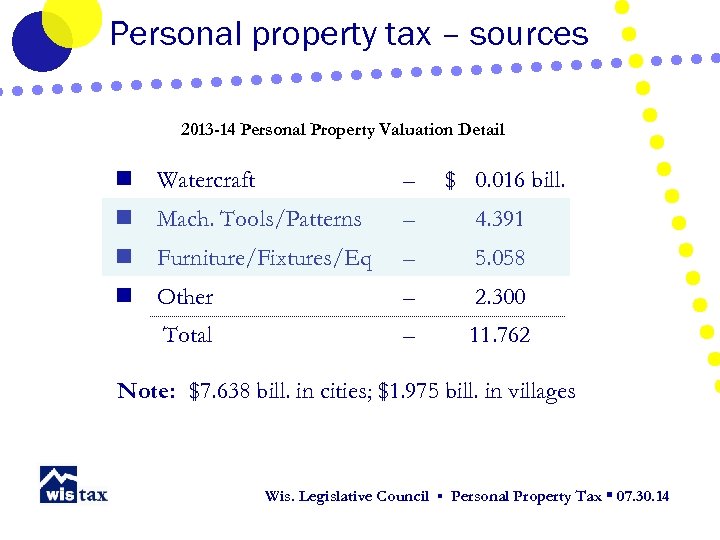

Personal property tax – sources 2013 -14 Personal Property Valuation Detail n Watercraft – $ 0. 016 bill. n Mach. Tools/Patterns – 4. 391 n Furniture/Fixtures/Eq – 5. 058 n Other – 2. 300 Total – 11. 762 Note: $7. 638 bill. in cities; $1. 975 bill. in villages Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

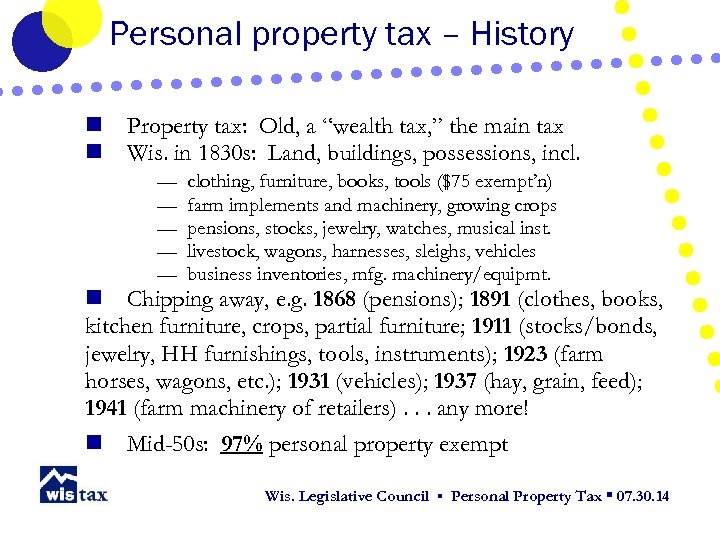

Personal property tax – History n n Property tax: Old, a “wealth tax, ” the main tax Wis. in 1830 s: Land, buildings, possessions, incl. — — — clothing, furniture, books, tools ($75 exempt’n) farm implements and machinery, growing crops pensions, stocks, jewelry, watches, musical inst. livestock, wagons, harnesses, sleighs, vehicles business inventories, mfg. machinery/equipmt. n Chipping away, e. g. 1868 (pensions); 1891 (clothes, books, kitchen furniture, crops, partial furniture; 1911 (stocks/bonds, jewelry, HH furnishings, tools, instruments); 1923 (farm horses, wagons, etc. ); 1931 (vehicles); 1937 (hay, grain, feed); 1941 (farm machinery of retailers). . . any more! n Mid-50 s: 97% personal property exempt Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

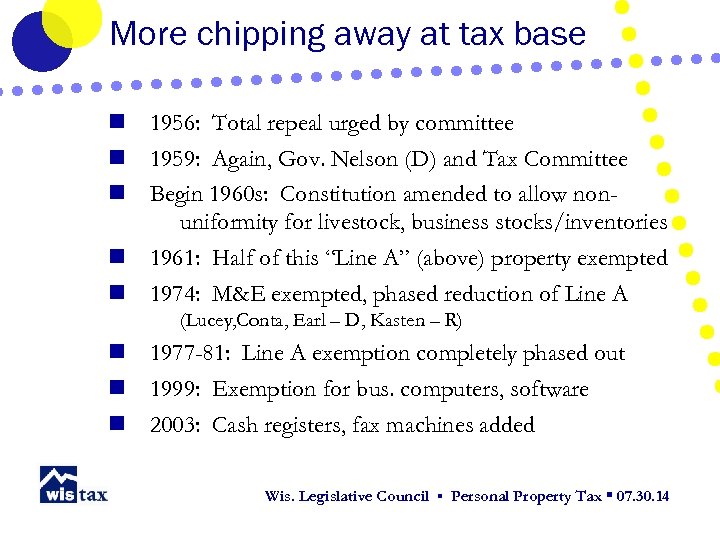

More chipping away at tax base n 1956: Total repeal urged by committee n n 1959: Again, Gov. Nelson (D) and Tax Committee Begin 1960 s: Constitution amended to allow nonuniformity for livestock, business stocks/inventories 1961: Half of this “Line A” (above) property exempted 1974: M&E exempted, phased reduction of Line A n n (Lucey, Conta, Earl – D, Kasten – R) n n n 1977 -81: Line A exemption completely phased out 1999: Exemption for bus. computers, software 2003: Cash registers, fax machines added Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

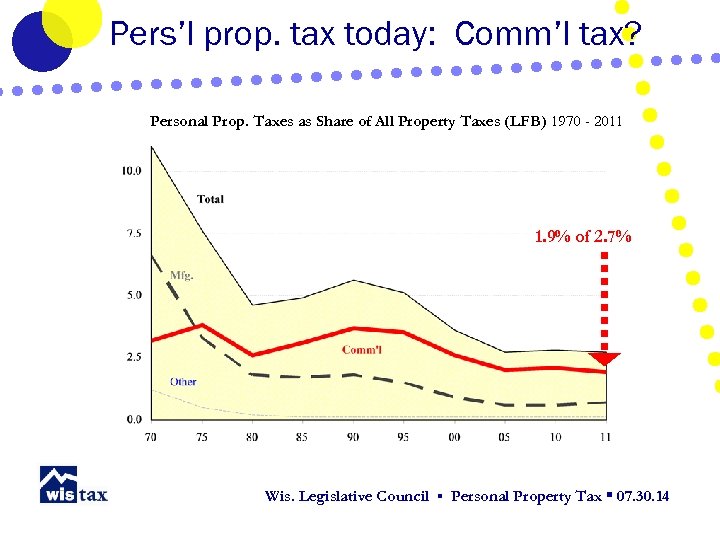

Pers’l prop. tax today: Comm’l tax? Personal Prop. Taxes as Share of All Property Taxes (LFB) 1970 - 2011 1. 9% of 2. 7% Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Where are we now? n Unbalanced tax system n n Property tax: Largest, most unpopular Personal property tax: ▪ 150 + years of slow death, almost gone by 1950 s ▪ More erosion since. Today: Vestigial “tail”? Property tax relief efforts mixed ▪ 20 th century “buy down” approach unsuccessful? ▪ Now, what should property tax be used FOR? As a ‘user-charge? ’ As a ‘local’ tax? n Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Now, where does that leave us? n Test of a ‘good’ revenue source? ▪ ▪ ▪ ▪ n Efficient, easy to administer Stable, productive Understood, easy to comply with Ideally, linked to service produced Equitable: Who taxed? What taxed? Economically neutral, nonintrusive Promotes accountability Permanent, ‘doable, ’ sustainable property tax relief? ▪ State property tax, forestry ▪ Technical college property tax ▪ Personal property tax and the ‘test’ Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Thank you! Questions? wistax. org Over 80 years of independent policy research and citizen education. Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

Wis. Legislative Council ▪ Personal Property Tax ▪ 07. 30. 14

8000bf2d4aae57eea1cbda1afebac8c5.ppt