8a29da4ad01e8f19881c4a66fadcaa33.ppt

- Количество слайдов: 25

Tax Issues When Making Aliyah Presented by Philip Stein CPA, (USA)

Myths & Facts • Israeli taxes are outrageously high • Israel will take all of your money • Myth Ø Myth If you pay US tax; you don’t need to pay Israeli Income Tax • Ø Israel has a backward tax system and they will never catch you

A 10 year vacation from Israeli Tax

What does the exemption cover? • All passive income from outside of Israel • All active income from outside of Israel • No reporting requirements

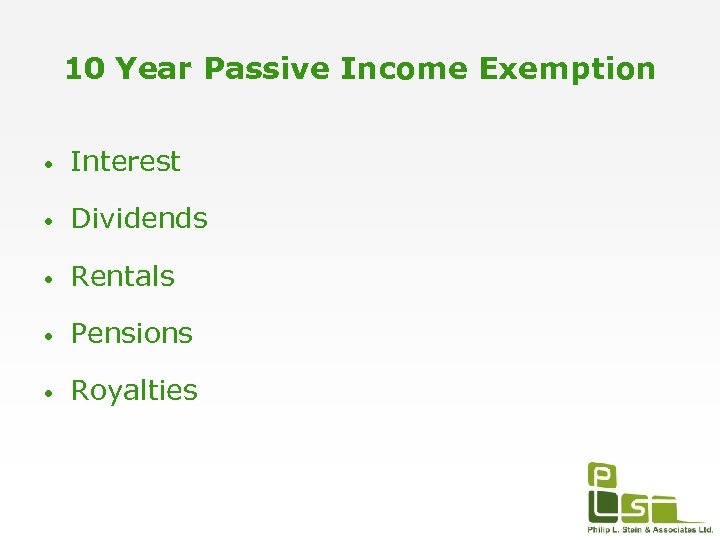

10 Year Passive Income Exemption • Interest • Dividends • Rentals • Pensions • Royalties

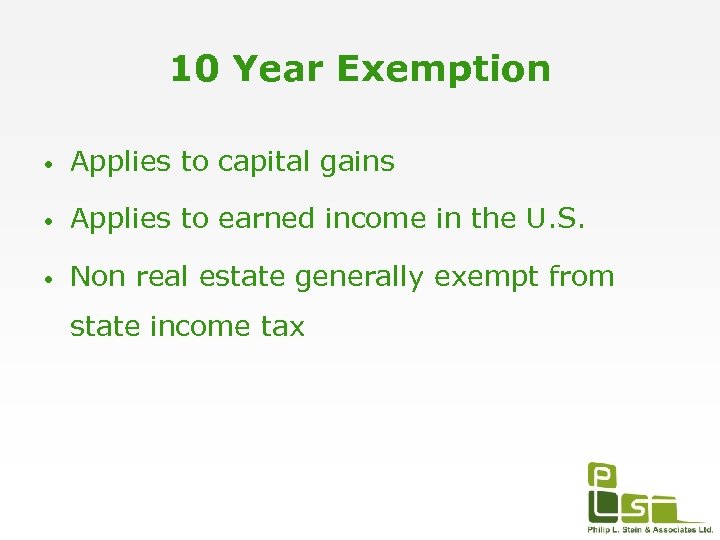

10 Year Exemption • Applies to capital gains • Applies to earned income in the U. S. • Non real estate generally exempt from state income tax

• No tax on social security payments • No tax for 10 years on pensions • No more state tax on retirement income

• Farewell to state tax • Farewell to higher taxes • Welcome to a new beginning

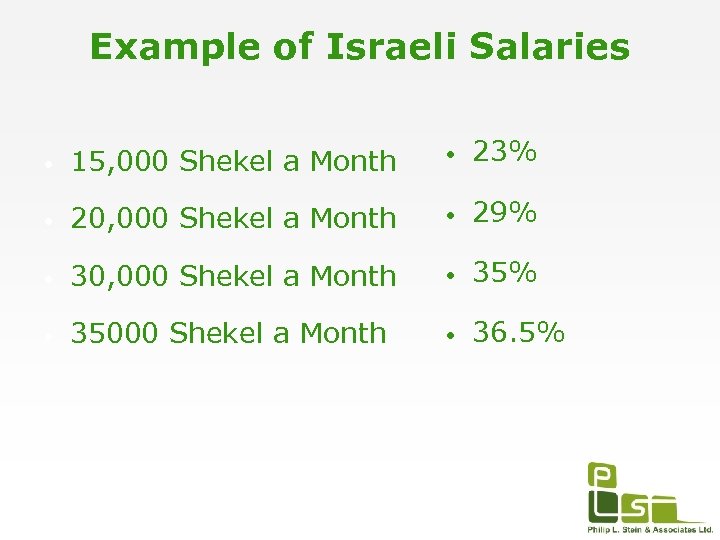

Example of Israeli Salaries • 15, 000 Shekel a Month • 23% • 20, 000 Shekel a Month • 29% • 30, 000 Shekel a Month • 35% • 35000 Shekel a Month • 36. 5%

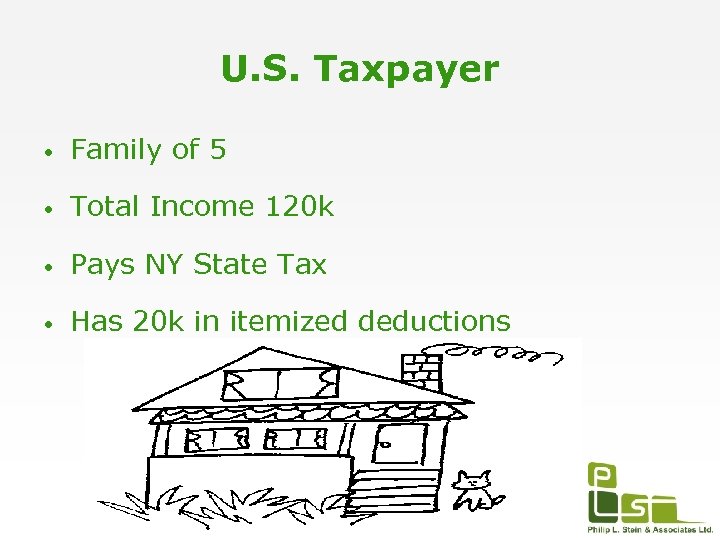

U. S. Taxpayer • Family of 5 • Total Income 120 k • Pays NY State Tax • Has 20 k in itemized deductions

Effective Tax? 26. 1%

Hidden Taxes in the US Tuition

Where do I work Where do I earn my income

Where Do I Pay? • Treaty since 1995 • Prevents Double Taxation • Always pay the higher amount • Framework that both countries respect

“But I don’t work for an Israeli company” • Self employed in Israel for a U. S. company • Working in Israel for a U. S. company • Where do you pay tax?

Do I have to open a ‘tik’? • • • ‘Atzmai’ Incorporate Outsource

What taxes do I pay in Israel? • Income Tax- ‘Mas Hachnasa’ • ‘Bituach Leumi’- 9% • ‘Mas Briut’- 5%

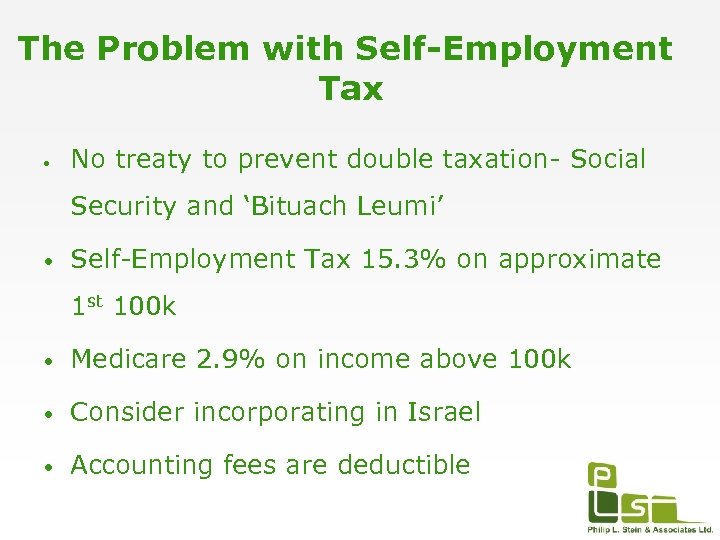

The Problem with Self-Employment Tax • No treaty to prevent double taxation- Social Security and ‘Bituach Leumi’ • Self-Employment Tax 15. 3% on approximate 1 st 100 k • Medicare 2. 9% on income above 100 k • Consider incorporating in Israel • Accounting fees are deductible

What about VAT? • • Rate 16% Different than sales tax?

Arnona • • Real Estate Tax Who pays?

Your House- rent or sell? • • • No gain + no rent = no tax Gain + no rent = up to $500, 000 exclusion Gain + Rent = new rules

New Rules for sale of house • • Part of gain can’t be excluded The longer the rental period, the smaller the exclusion Leaving the house empty, preserves the tax exemption Must sell no more than 3 years after leaving

Trust Exemption • Established and funded by long term non. Israeli resident • Israeli beneficiary is not trustee • Israeli beneficiary has no control • Israeli beneficiary cannot contribute to the trust

Philip Stein & Associates Ltd. pstein@pstein. com admin@pstein. com www. pstein. com U. S. Phone: 866 -995 -1040 U. S. Fax: 866 -611 -8256

8a29da4ad01e8f19881c4a66fadcaa33.ppt