433aa0c001eb5936af740bbe68357658.ppt

- Количество слайдов: 106

TAX ISSUES IN PRIVATE EQUITY & VENTURE CAPITAL ABA Section of Business Law August 12, 2007 Julie Divola Pillsbury Winthrop Shaw Pittman LLP John Lorito Stikeman Elliott LLP Jonathan Axelrad Wilson Sonsini Goodrich & Rosati John Simon KPMG LLP

TAX ISSUES IN PRIVATE EQUITY & VENTURE CAPITAL ABA Section of Business Law August 12, 2007 Julie Divola Pillsbury Winthrop Shaw Pittman LLP John Lorito Stikeman Elliott LLP Jonathan Axelrad Wilson Sonsini Goodrich & Rosati John Simon KPMG LLP

Introduction to VC/PE Fund Structures plus Update on Proposed Changes to Taxation of Carried Interest

Introduction to VC/PE Fund Structures plus Update on Proposed Changes to Taxation of Carried Interest

Introduction Ø Venture Capital and Private Equity (VC/PE) firms traditionally have used partnership structures for the “Funds” that they use to raise capital and make investments Ø These structures vary significantly and have evolved over time Ø Key considerations are tax, securities law, alignment of interests, difficulty of valuing private securities, and liability compartmentalization Ø This presentation briefly provides an overview of certain “typical” fund structures, primarily from a VC perspective Ø Special Bonus! A brief update on proposed changes to the taxation of carried interest 3

Introduction Ø Venture Capital and Private Equity (VC/PE) firms traditionally have used partnership structures for the “Funds” that they use to raise capital and make investments Ø These structures vary significantly and have evolved over time Ø Key considerations are tax, securities law, alignment of interests, difficulty of valuing private securities, and liability compartmentalization Ø This presentation briefly provides an overview of certain “typical” fund structures, primarily from a VC perspective Ø Special Bonus! A brief update on proposed changes to the taxation of carried interest 3

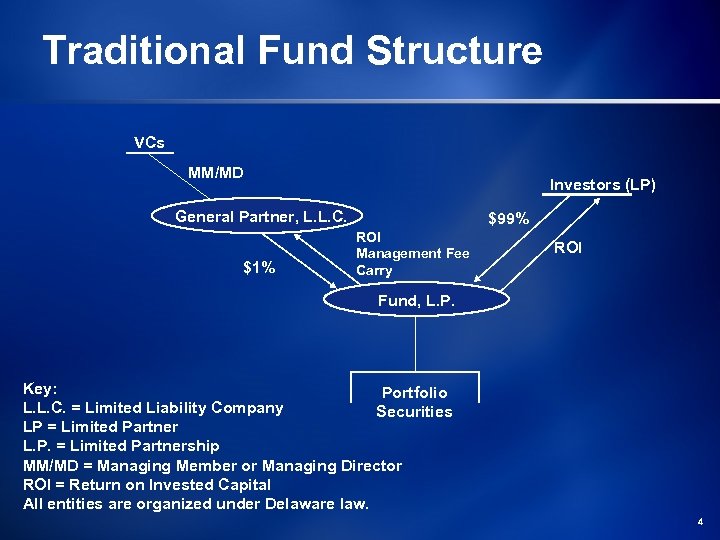

Traditional Fund Structure VCs MM/MD Investors (LP) General Partner, L. L. C. $1% $99% ROI Management Fee Carry ROI Fund, L. P. Key: Portfolio L. L. C. = Limited Liability Company Securities LP = Limited Partner L. P. = Limited Partnership MM/MD = Managing Member or Managing Director ROI = Return on Invested Capital All entities are organized under Delaware law. 4

Traditional Fund Structure VCs MM/MD Investors (LP) General Partner, L. L. C. $1% $99% ROI Management Fee Carry ROI Fund, L. P. Key: Portfolio L. L. C. = Limited Liability Company Securities LP = Limited Partner L. P. = Limited Partnership MM/MD = Managing Member or Managing Director ROI = Return on Invested Capital All entities are organized under Delaware law. 4

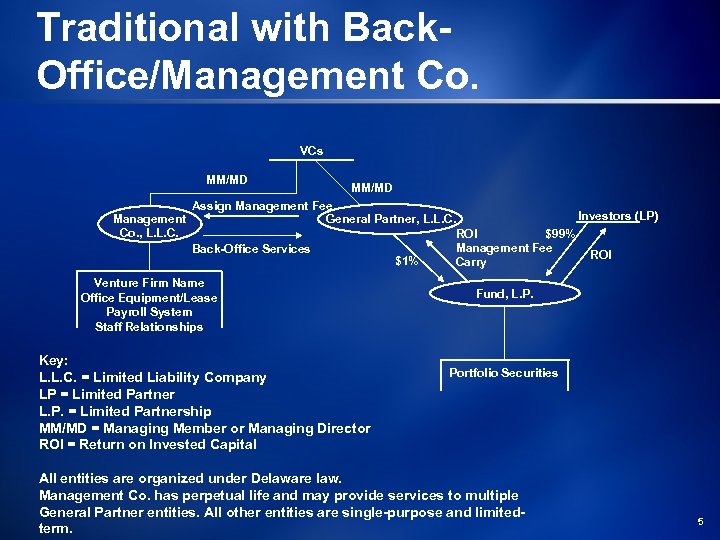

Traditional with Back. Office/Management Co. VCs MM/MD Management Co. , L. L. C. MM/MD Assign Management Fee Investors (LP) General Partner, L. L. C. ROI $99% Management Fee Back-Office Services ROI $1% Carry Venture Firm Name Office Equipment/Lease Payroll System Staff Relationships Key: L. L. C. = Limited Liability Company LP = Limited Partner L. P. = Limited Partnership MM/MD = Managing Member or Managing Director ROI = Return on Invested Capital Fund, L. P. Portfolio Securities All entities are organized under Delaware law. Management Co. has perpetual life and may provide services to multiple General Partner entities. All other entities are single-purpose and limitedterm. 5

Traditional with Back. Office/Management Co. VCs MM/MD Management Co. , L. L. C. MM/MD Assign Management Fee Investors (LP) General Partner, L. L. C. ROI $99% Management Fee Back-Office Services ROI $1% Carry Venture Firm Name Office Equipment/Lease Payroll System Staff Relationships Key: L. L. C. = Limited Liability Company LP = Limited Partner L. P. = Limited Partnership MM/MD = Managing Member or Managing Director ROI = Return on Invested Capital Fund, L. P. Portfolio Securities All entities are organized under Delaware law. Management Co. has perpetual life and may provide services to multiple General Partner entities. All other entities are single-purpose and limitedterm. 5

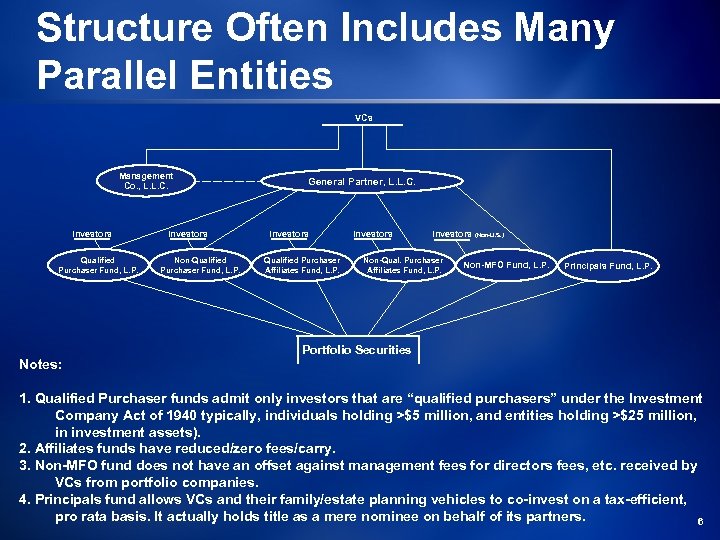

Structure Often Includes Many Parallel Entities VCs Management Co. , L. L. C. Investors Qualified Purchaser Fund, L. P. Investors Non-Qualified Purchaser Fund, L. P. General Partner, L. L. C. Investors Qualified Purchaser Affiliates Fund, L. P. Investors (Non-U. S. ) Non-Qual. Purchaser Affiliates Fund, L. P. Non-MFO Fund, L. P. Principals Fund, L. P. Portfolio Securities Notes: 1. Qualified Purchaser funds admit only investors that are “qualified purchasers” under the Investment Company Act of 1940 typically, individuals holding >$5 million, and entities holding >$25 million, in investment assets). 2. Affiliates funds have reduced/zero fees/carry. 3. Non-MFO fund does not have an offset against management fees for directors fees, etc. received by VCs from portfolio companies. 4. Principals fund allows VCs and their family/estate planning vehicles to co-invest on a tax-efficient, pro rata basis. It actually holds title as a mere nominee on behalf of its partners. 6

Structure Often Includes Many Parallel Entities VCs Management Co. , L. L. C. Investors Qualified Purchaser Fund, L. P. Investors Non-Qualified Purchaser Fund, L. P. General Partner, L. L. C. Investors Qualified Purchaser Affiliates Fund, L. P. Investors (Non-U. S. ) Non-Qual. Purchaser Affiliates Fund, L. P. Non-MFO Fund, L. P. Principals Fund, L. P. Portfolio Securities Notes: 1. Qualified Purchaser funds admit only investors that are “qualified purchasers” under the Investment Company Act of 1940 typically, individuals holding >$5 million, and entities holding >$25 million, in investment assets). 2. Affiliates funds have reduced/zero fees/carry. 3. Non-MFO fund does not have an offset against management fees for directors fees, etc. received by VCs from portfolio companies. 4. Principals fund allows VCs and their family/estate planning vehicles to co-invest on a tax-efficient, pro rata basis. It actually holds title as a mere nominee on behalf of its partners. 6

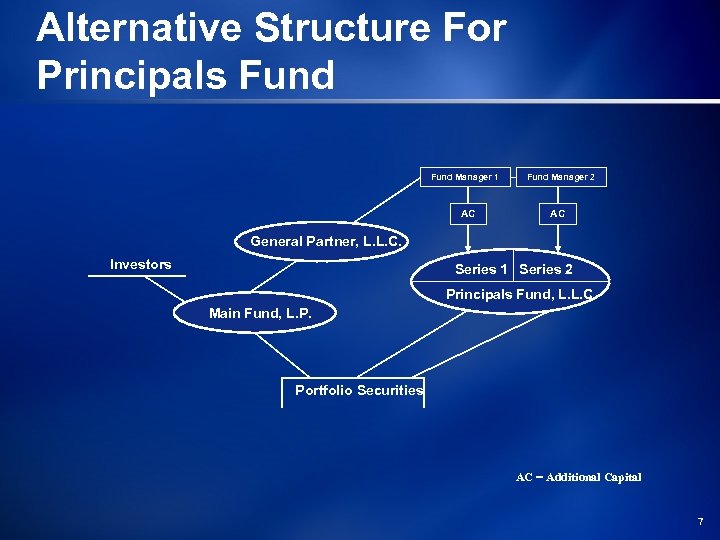

Alternative Structure For Principals Fund Manager 1 AC Fund Manager 2 AC General Partner, L. L. C. Investors Series 1 Series 2 Principals Fund, L. L. C. Main Fund, L. P. Portfolio Securities AC = Additional Capital 7

Alternative Structure For Principals Fund Manager 1 AC Fund Manager 2 AC General Partner, L. L. C. Investors Series 1 Series 2 Principals Fund, L. L. C. Main Fund, L. P. Portfolio Securities AC = Additional Capital 7

Sample Alternative For International Investing -- India Advisory Co Indian Co. Advisory Agreement General Partner Limited Partners Fund Cayman Islands LP FVCI Sub FII Sub Mauritius Co. Private Indian Investments Public Indian Investments 8

Sample Alternative For International Investing -- India Advisory Co Indian Co. Advisory Agreement General Partner Limited Partners Fund Cayman Islands LP FVCI Sub FII Sub Mauritius Co. Private Indian Investments Public Indian Investments 8

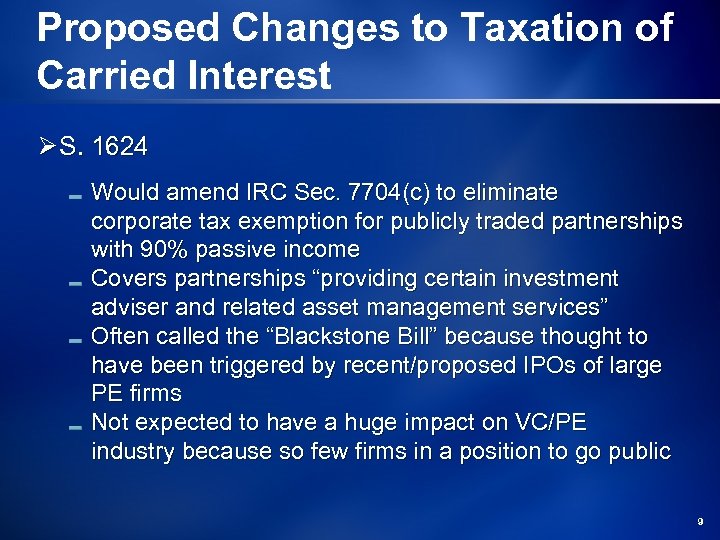

Proposed Changes to Taxation of Carried Interest Ø S. 1624 Would amend IRC Sec. 7704(c) to eliminate corporate tax exemption for publicly traded partnerships with 90% passive income Covers partnerships “providing certain investment adviser and related asset management services” Often called the “Blackstone Bill” because thought to have been triggered by recent/proposed IPOs of large PE firms Not expected to have a huge impact on VC/PE industry because so few firms in a position to go public 9

Proposed Changes to Taxation of Carried Interest Ø S. 1624 Would amend IRC Sec. 7704(c) to eliminate corporate tax exemption for publicly traded partnerships with 90% passive income Covers partnerships “providing certain investment adviser and related asset management services” Often called the “Blackstone Bill” because thought to have been triggered by recent/proposed IPOs of large PE firms Not expected to have a huge impact on VC/PE industry because so few firms in a position to go public 9

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 Would add new IRC Sec. 710 to treat carried interest “distributive share” as ordinary income for the performance of services, regardless of character of partnership’s underlying income Essentially based on a profit share that is disproportionately large relative to capital contribution Applies if there is provision of investment services in the active conduct of a trade or business Not clear how this would apply to a traditional fund structure, under which neither Fund nor General Partner typically would be engaged in a “trade or business” Per statements from Congress, intended to cover nearly all private investment partnerships, including VC/PE, real estate, oil and gas, etc. This bill is really just a first draft Many technical issues/glitches Hearings in process 10

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 Would add new IRC Sec. 710 to treat carried interest “distributive share” as ordinary income for the performance of services, regardless of character of partnership’s underlying income Essentially based on a profit share that is disproportionately large relative to capital contribution Applies if there is provision of investment services in the active conduct of a trade or business Not clear how this would apply to a traditional fund structure, under which neither Fund nor General Partner typically would be engaged in a “trade or business” Per statements from Congress, intended to cover nearly all private investment partnerships, including VC/PE, real estate, oil and gas, etc. This bill is really just a first draft Many technical issues/glitches Hearings in process 10

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) Extremely controversial Apparent loophole closer – rich fund managers paying capital gains taxes on income from their advisory services Leading Democrats voicing support (Clinton, Obama, Edwards) Republicans generally oppose (Treasury Dept. , etc. ) Lobbyists heavily engaged, with focus on International competitiveness (fund managers moving offshore; foreign investors outbidding for US investments) Impairment of innovation and capital formation Comparison with “founders stock” (if entrepreneurs can get capital gains treatment when their companies appreciate, why not VC/PE managers who also work hard for the companies’ success? ) 11

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) Extremely controversial Apparent loophole closer – rich fund managers paying capital gains taxes on income from their advisory services Leading Democrats voicing support (Clinton, Obama, Edwards) Republicans generally oppose (Treasury Dept. , etc. ) Lobbyists heavily engaged, with focus on International competitiveness (fund managers moving offshore; foreign investors outbidding for US investments) Impairment of innovation and capital formation Comparison with “founders stock” (if entrepreneurs can get capital gains treatment when their companies appreciate, why not VC/PE managers who also work hard for the companies’ success? ) 11

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) It will be difficult for Congress to craft a statute that can’t be structured around At least without vast changes to the IRC See lack of success in shutting down swap/exchange funds, despite several targeted IRC amendments Lack of definitive statutory text (assuming current bill really is just a first draft) makes it difficult to estimate what structures will be helpful Nevertheless. . . 12

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) It will be difficult for Congress to craft a statute that can’t be structured around At least without vast changes to the IRC See lack of success in shutting down swap/exchange funds, despite several targeted IRC amendments Lack of definitive statutory text (assuming current bill really is just a first draft) makes it difficult to estimate what structures will be helpful Nevertheless. . . 12

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) Potential gold mine for tax lawyers The stakes are high enough to pay for almost any degree of complex structuring Example: Assume $1 billion fund, which yields a 3 x return 20% carry to GP: $400 million Ordinary income vs. LTCG tax differential: $80 million » Employment taxes and timing differences would make spread even larger If the bill (or anything like it) passes. . . 13

Proposed Changes to Taxation of Carried Interest Ø H. R. 2834 (cont) Potential gold mine for tax lawyers The stakes are high enough to pay for almost any degree of complex structuring Example: Assume $1 billion fund, which yields a 3 x return 20% carry to GP: $400 million Ordinary income vs. LTCG tax differential: $80 million » Employment taxes and timing differences would make spread even larger If the bill (or anything like it) passes. . . 13

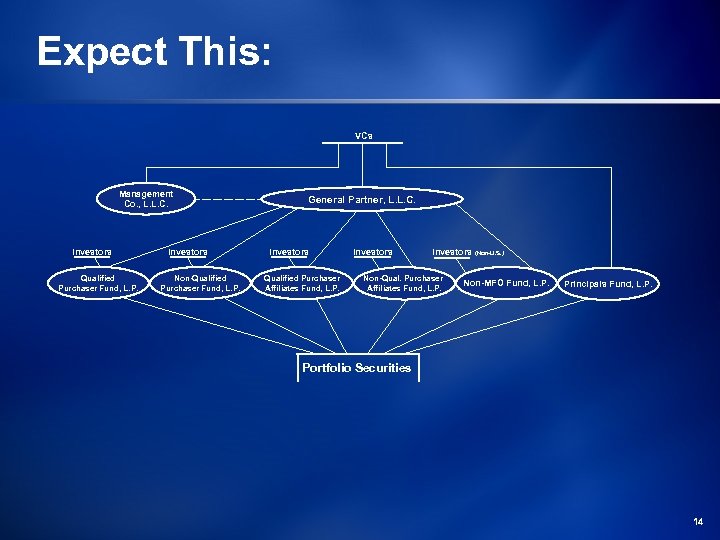

Expect This: VCs Management Co. , L. L. C. Investors Qualified Purchaser Fund, L. P. Investors Non-Qualified Purchaser Fund, L. P. General Partner, L. L. C. Investors Qualified Purchaser Affiliates Fund, L. P. Investors (Non-U. S. ) Non-Qual. Purchaser Affiliates Fund, L. P. Non-MFO Fund, L. P. Principals Fund, L. P. Portfolio Securities 14

Expect This: VCs Management Co. , L. L. C. Investors Qualified Purchaser Fund, L. P. Investors Non-Qualified Purchaser Fund, L. P. General Partner, L. L. C. Investors Qualified Purchaser Affiliates Fund, L. P. Investors (Non-U. S. ) Non-Qual. Purchaser Affiliates Fund, L. P. Non-MFO Fund, L. P. Principals Fund, L. P. Portfolio Securities 14

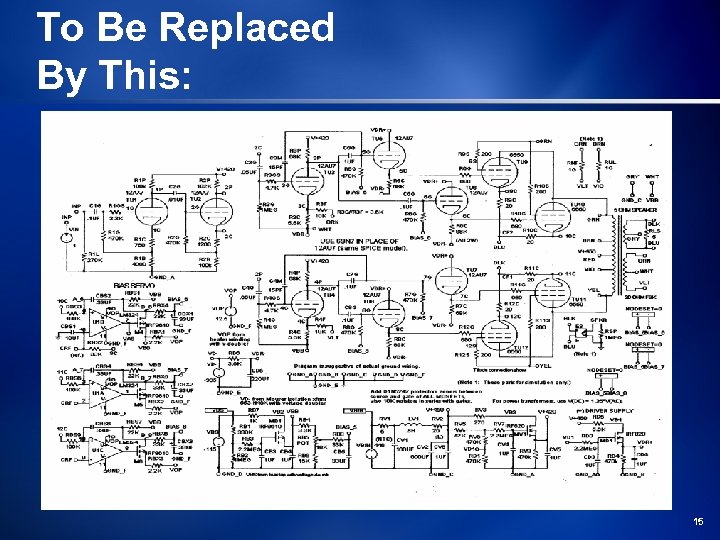

To Be Replaced By This: 15

To Be Replaced By This: 15

Tax Issues in Private Equity and Venture Capital: Blocker Corporations

Tax Issues in Private Equity and Venture Capital: Blocker Corporations

Taxation of Pass-Through Entities vs. Corporations

Taxation of Pass-Through Entities vs. Corporations

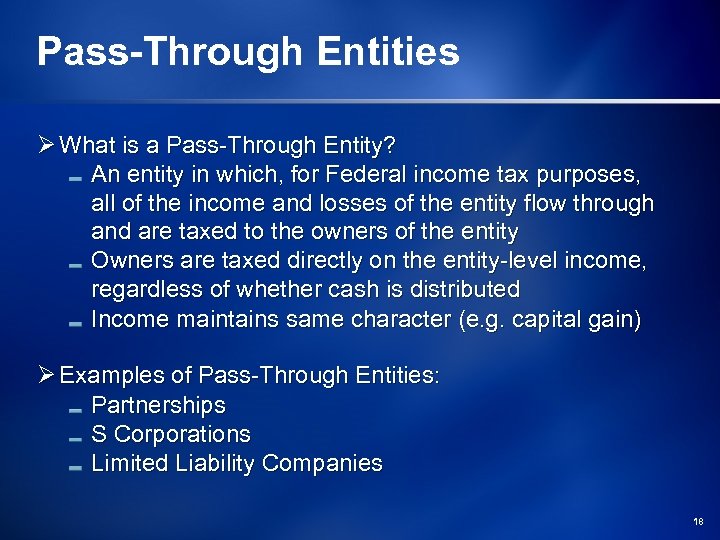

Pass-Through Entities Ø What is a Pass-Through Entity? An entity in which, for Federal income tax purposes, all of the income and losses of the entity flow through and are taxed to the owners of the entity Owners are taxed directly on the entity-level income, regardless of whether cash is distributed Income maintains same character (e. g. capital gain) Ø Examples of Pass-Through Entities: Partnerships S Corporations Limited Liability Companies 18

Pass-Through Entities Ø What is a Pass-Through Entity? An entity in which, for Federal income tax purposes, all of the income and losses of the entity flow through and are taxed to the owners of the entity Owners are taxed directly on the entity-level income, regardless of whether cash is distributed Income maintains same character (e. g. capital gain) Ø Examples of Pass-Through Entities: Partnerships S Corporations Limited Liability Companies 18

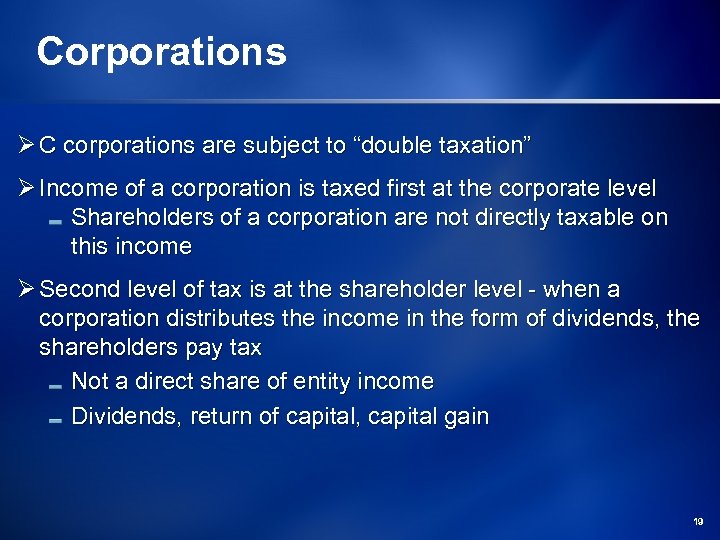

Corporations Ø C corporations are subject to “double taxation” Ø Income of a corporation is taxed first at the corporate level Shareholders of a corporation are not directly taxable on this income Ø Second level of tax is at the shareholder level - when a corporation distributes the income in the form of dividends, the shareholders pay tax Not a direct share of entity income Dividends, return of capital, capital gain 19

Corporations Ø C corporations are subject to “double taxation” Ø Income of a corporation is taxed first at the corporate level Shareholders of a corporation are not directly taxable on this income Ø Second level of tax is at the shareholder level - when a corporation distributes the income in the form of dividends, the shareholders pay tax Not a direct share of entity income Dividends, return of capital, capital gain 19

Private Equity Funds

Private Equity Funds

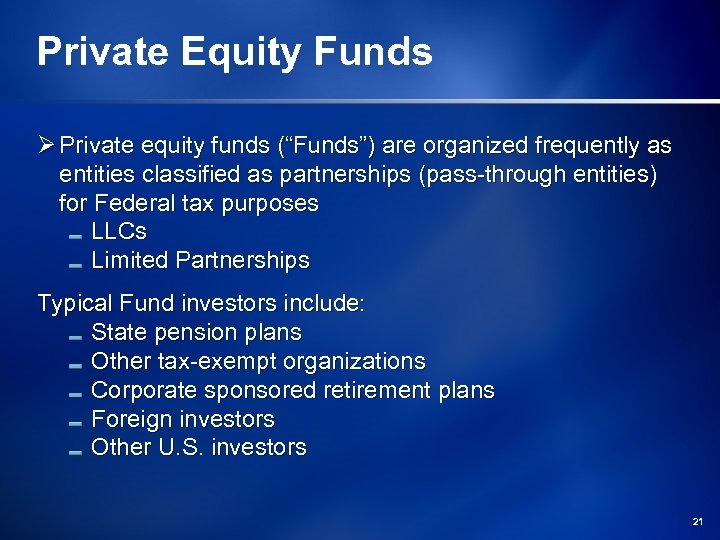

Private Equity Funds Ø Private equity funds (“Funds”) are organized frequently as entities classified as partnerships (pass-through entities) for Federal tax purposes LLCs Limited Partnerships Typical Fund investors include: State pension plans Other tax-exempt organizations Corporate sponsored retirement plans Foreign investors Other U. S. investors 21

Private Equity Funds Ø Private equity funds (“Funds”) are organized frequently as entities classified as partnerships (pass-through entities) for Federal tax purposes LLCs Limited Partnerships Typical Fund investors include: State pension plans Other tax-exempt organizations Corporate sponsored retirement plans Foreign investors Other U. S. investors 21

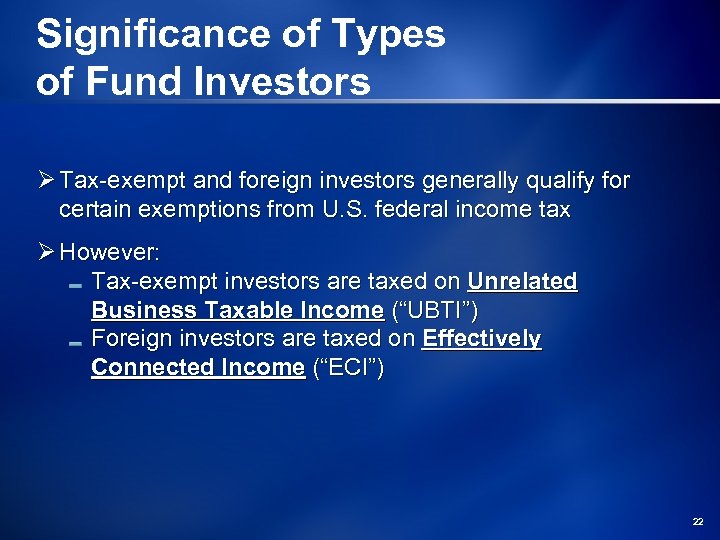

Significance of Types of Fund Investors Ø Tax-exempt and foreign investors generally qualify for certain exemptions from U. S. federal income tax Ø However: Tax-exempt investors are taxed on Unrelated Business Taxable Income (“UBTI”) Foreign investors are taxed on Effectively Connected Income (“ECI”) 22

Significance of Types of Fund Investors Ø Tax-exempt and foreign investors generally qualify for certain exemptions from U. S. federal income tax Ø However: Tax-exempt investors are taxed on Unrelated Business Taxable Income (“UBTI”) Foreign investors are taxed on Effectively Connected Income (“ECI”) 22

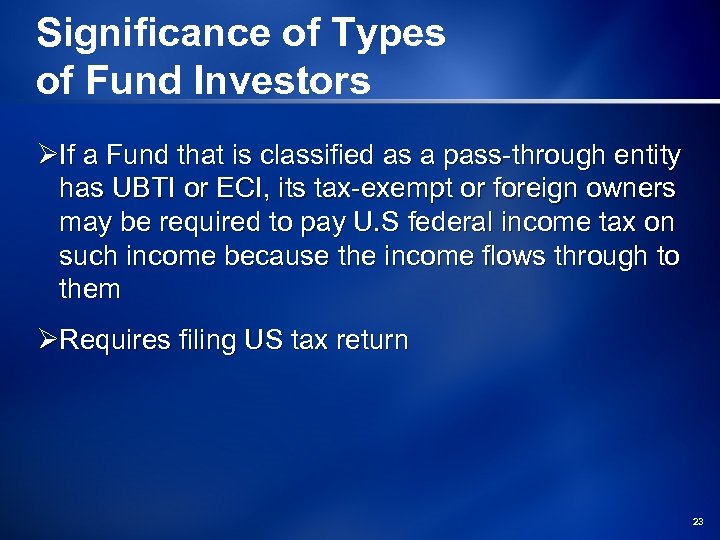

Significance of Types of Fund Investors ØIf a Fund that is classified as a pass-through entity has UBTI or ECI, its tax-exempt or foreign owners may be required to pay U. S federal income tax on such income because the income flows through to them ØRequires filing US tax return 23

Significance of Types of Fund Investors ØIf a Fund that is classified as a pass-through entity has UBTI or ECI, its tax-exempt or foreign owners may be required to pay U. S federal income tax on such income because the income flows through to them ØRequires filing US tax return 23

What is UBTI?

What is UBTI?

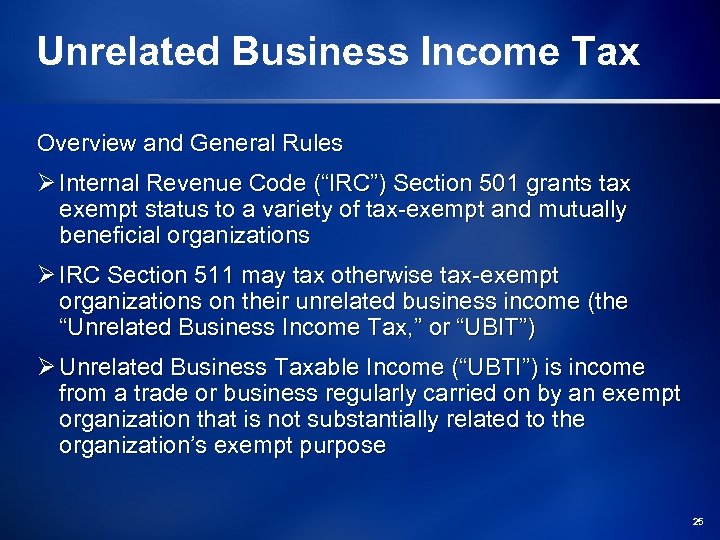

Unrelated Business Income Tax Overview and General Rules Ø Internal Revenue Code (“IRC”) Section 501 grants tax exempt status to a variety of tax-exempt and mutually beneficial organizations Ø IRC Section 511 may tax otherwise tax-exempt organizations on their unrelated business income (the “Unrelated Business Income Tax, ” or “UBIT”) Ø Unrelated Business Taxable Income (“UBTI”) is income from a trade or business regularly carried on by an exempt organization that is not substantially related to the organization’s exempt purpose 25

Unrelated Business Income Tax Overview and General Rules Ø Internal Revenue Code (“IRC”) Section 501 grants tax exempt status to a variety of tax-exempt and mutually beneficial organizations Ø IRC Section 511 may tax otherwise tax-exempt organizations on their unrelated business income (the “Unrelated Business Income Tax, ” or “UBIT”) Ø Unrelated Business Taxable Income (“UBTI”) is income from a trade or business regularly carried on by an exempt organization that is not substantially related to the organization’s exempt purpose 25

Unrelated Business Taxable Income ØThe following are excluded from UBTI unless they are derived from debt-financed property, or, in the case of interest, from controlled organizations: Gains from the sale of stock Interest Dividends 26

Unrelated Business Taxable Income ØThe following are excluded from UBTI unless they are derived from debt-financed property, or, in the case of interest, from controlled organizations: Gains from the sale of stock Interest Dividends 26

Sources of UBTI ØFor private investment funds the principal areas of concern are: Fund investments in portfolio passthrough entities Unrelated debt-financed income Fees earned by the Fund 27

Sources of UBTI ØFor private investment funds the principal areas of concern are: Fund investments in portfolio passthrough entities Unrelated debt-financed income Fees earned by the Fund 27

Sources of UBTI – Operating Partnerships ØUnrelated trade or business of a partnership is imputed to the tax-exempt partners The tax-exempt partner’s share of the income for the trade or business is UBTI ØTrade or business can be attributed up through partnerships If a Fund invests in a pass-through entity that is engaged in a trade or business, a taxexempt partner’s share of the entity’s income would be UBTI 28

Sources of UBTI – Operating Partnerships ØUnrelated trade or business of a partnership is imputed to the tax-exempt partners The tax-exempt partner’s share of the income for the trade or business is UBTI ØTrade or business can be attributed up through partnerships If a Fund invests in a pass-through entity that is engaged in a trade or business, a taxexempt partner’s share of the entity’s income would be UBTI 28

Portfolio Investments in Partnerships? Why would a Fund invest in a partnership? Ø Existing target is a partnership (e. g. an LLC) Ø Single level of tax on target earnings Stepped up basis from earned income Ø Exit strategy: sale of partnership can give buyer steppedup basis in target assets May result in higher sale price Ø Tax Distributions 29

Portfolio Investments in Partnerships? Why would a Fund invest in a partnership? Ø Existing target is a partnership (e. g. an LLC) Ø Single level of tax on target earnings Stepped up basis from earned income Ø Exit strategy: sale of partnership can give buyer steppedup basis in target assets May result in higher sale price Ø Tax Distributions 29

Partnership acquisition structure Investors Sellers Ø Fund can get basis step up through 754 election Ø Maintains single level of tax Target Fund New Portfolio Ø May avoid potential antichurning problem Ø Next buyer can get basis step up on sale of New Portfolio LLC Target Assets 30

Partnership acquisition structure Investors Sellers Ø Fund can get basis step up through 754 election Ø Maintains single level of tax Target Fund New Portfolio Ø May avoid potential antichurning problem Ø Next buyer can get basis step up on sale of New Portfolio LLC Target Assets 30

Unrelated debt-financed income ØCapital gain, interest and dividends normally excluded from UBTI are treated as UBTI to the extent the property generating the income is financed by debt ØIncludes both direct debt of the investor and investor’s allocable share of Fund or portfolio company (if a pass-through) debt 31

Unrelated debt-financed income ØCapital gain, interest and dividends normally excluded from UBTI are treated as UBTI to the extent the property generating the income is financed by debt ØIncludes both direct debt of the investor and investor’s allocable share of Fund or portfolio company (if a pass-through) debt 31

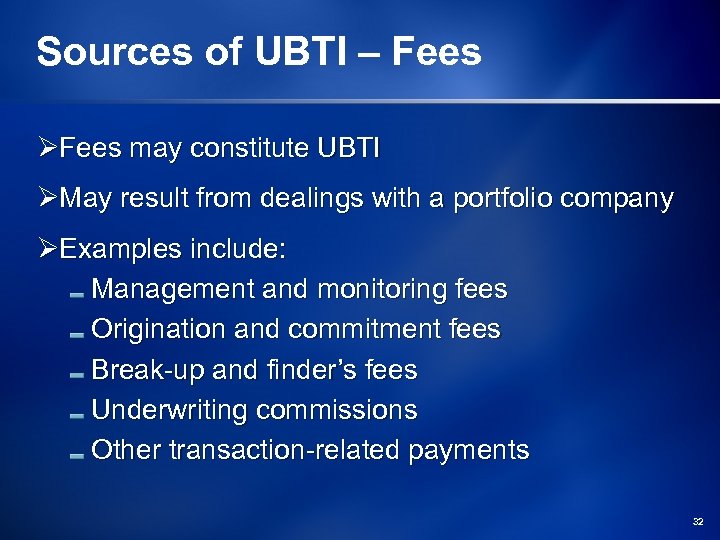

Sources of UBTI – Fees ØFees may constitute UBTI ØMay result from dealings with a portfolio company ØExamples include: Management and monitoring fees Origination and commitment fees Break-up and finder’s fees Underwriting commissions Other transaction-related payments 32

Sources of UBTI – Fees ØFees may constitute UBTI ØMay result from dealings with a portfolio company ØExamples include: Management and monitoring fees Origination and commitment fees Break-up and finder’s fees Underwriting commissions Other transaction-related payments 32

What is ECI?

What is ECI?

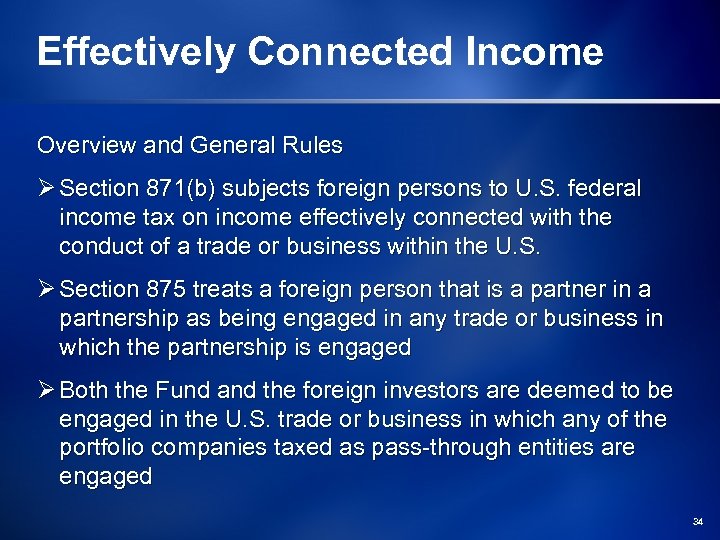

Effectively Connected Income Overview and General Rules Ø Section 871(b) subjects foreign persons to U. S. federal income tax on income effectively connected with the conduct of a trade or business within the U. S. Ø Section 875 treats a foreign person that is a partner in a partnership as being engaged in any trade or business in which the partnership is engaged Ø Both the Fund and the foreign investors are deemed to be engaged in the U. S. trade or business in which any of the portfolio companies taxed as pass-through entities are engaged 34

Effectively Connected Income Overview and General Rules Ø Section 871(b) subjects foreign persons to U. S. federal income tax on income effectively connected with the conduct of a trade or business within the U. S. Ø Section 875 treats a foreign person that is a partner in a partnership as being engaged in any trade or business in which the partnership is engaged Ø Both the Fund and the foreign investors are deemed to be engaged in the U. S. trade or business in which any of the portfolio companies taxed as pass-through entities are engaged 34

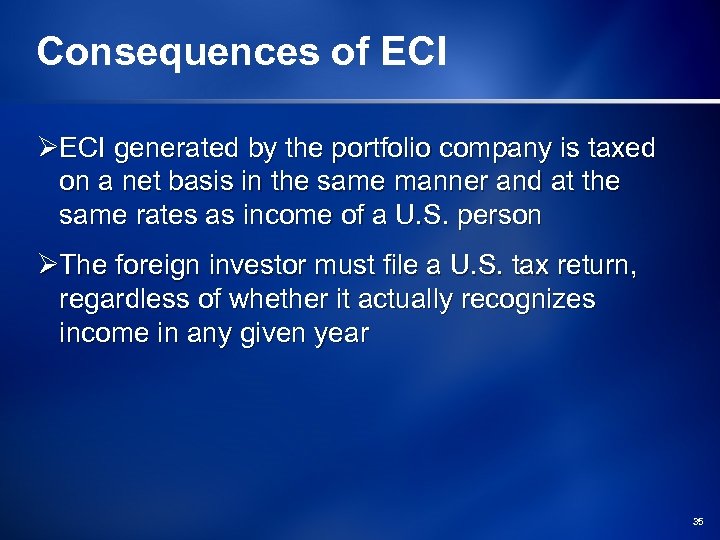

Consequences of ECI ØECI generated by the portfolio company is taxed on a net basis in the same manner and at the same rates as income of a U. S. person ØThe foreign investor must file a U. S. tax return, regardless of whether it actually recognizes income in any given year 35

Consequences of ECI ØECI generated by the portfolio company is taxed on a net basis in the same manner and at the same rates as income of a U. S. person ØThe foreign investor must file a U. S. tax return, regardless of whether it actually recognizes income in any given year 35

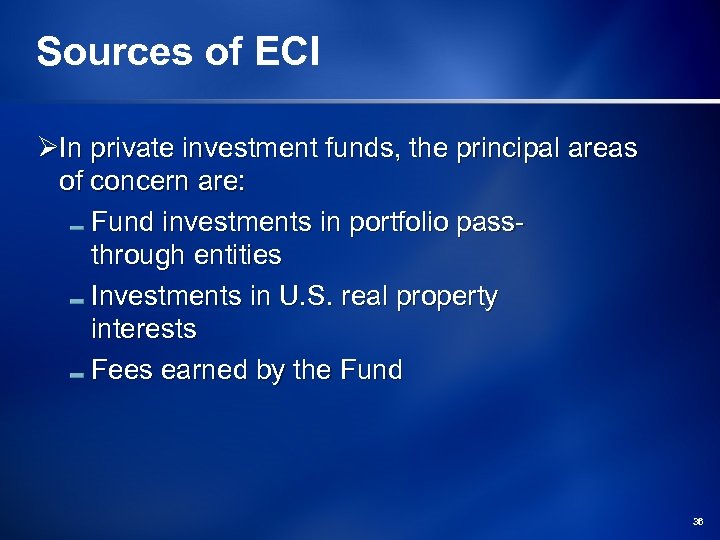

Sources of ECI ØIn private investment funds, the principal areas of concern are: Fund investments in portfolio passthrough entities Investments in U. S. real property interests Fees earned by the Fund 36

Sources of ECI ØIn private investment funds, the principal areas of concern are: Fund investments in portfolio passthrough entities Investments in U. S. real property interests Fees earned by the Fund 36

Sources of ECI – Fund Investments in Portfolio Pass-Through Entities Ø If a Fund invests in a pass-through entity that is engaged in a trade or business, a foreign partner’s share of the entity’s income would be ECI Ø A portion of any gain realized by the foreign investor upon the sale of its interest in a Fund that directly or indirectly conducts a US trade or business would be ECI to the extent of the foreign investor’s share of gain or loss on sale of Fund assets would be ECI. Ø Sale by Fund of investment in pass through entity can create ECI if assets used in US trade or business 37

Sources of ECI – Fund Investments in Portfolio Pass-Through Entities Ø If a Fund invests in a pass-through entity that is engaged in a trade or business, a foreign partner’s share of the entity’s income would be ECI Ø A portion of any gain realized by the foreign investor upon the sale of its interest in a Fund that directly or indirectly conducts a US trade or business would be ECI to the extent of the foreign investor’s share of gain or loss on sale of Fund assets would be ECI. Ø Sale by Fund of investment in pass through entity can create ECI if assets used in US trade or business 37

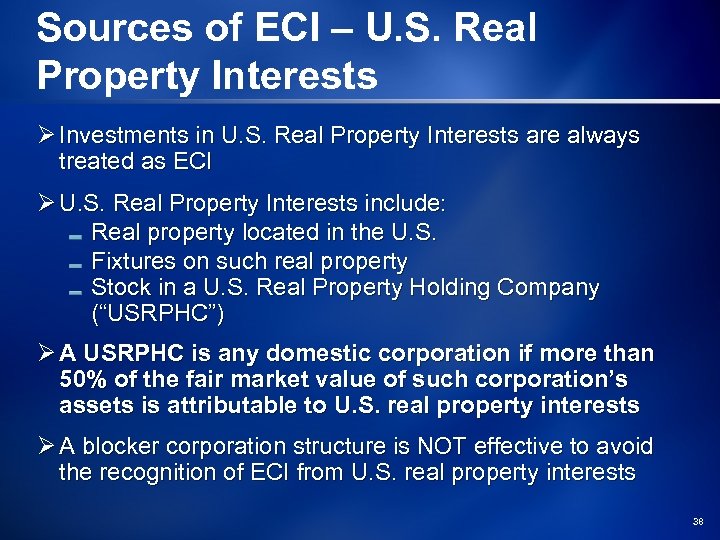

Sources of ECI – U. S. Real Property Interests Ø Investments in U. S. Real Property Interests are always treated as ECI Ø U. S. Real Property Interests include: Real property located in the U. S. Fixtures on such real property Stock in a U. S. Real Property Holding Company (“USRPHC”) Ø A USRPHC is any domestic corporation if more than 50% of the fair market value of such corporation’s assets is attributable to U. S. real property interests Ø A blocker corporation structure is NOT effective to avoid the recognition of ECI from U. S. real property interests 38

Sources of ECI – U. S. Real Property Interests Ø Investments in U. S. Real Property Interests are always treated as ECI Ø U. S. Real Property Interests include: Real property located in the U. S. Fixtures on such real property Stock in a U. S. Real Property Holding Company (“USRPHC”) Ø A USRPHC is any domestic corporation if more than 50% of the fair market value of such corporation’s assets is attributable to U. S. real property interests Ø A blocker corporation structure is NOT effective to avoid the recognition of ECI from U. S. real property interests 38

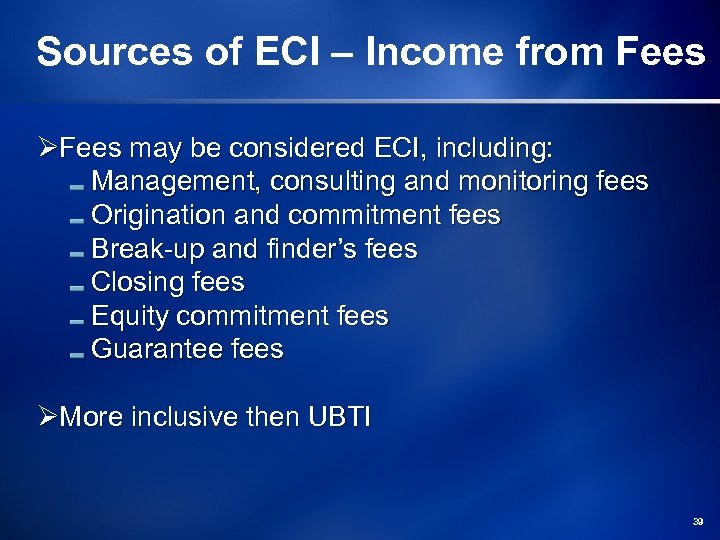

Sources of ECI – Income from Fees ØFees may be considered ECI, including: Management, consulting and monitoring fees Origination and commitment fees Break-up and finder’s fees Closing fees Equity commitment fees Guarantee fees ØMore inclusive then UBTI 39

Sources of ECI – Income from Fees ØFees may be considered ECI, including: Management, consulting and monitoring fees Origination and commitment fees Break-up and finder’s fees Closing fees Equity commitment fees Guarantee fees ØMore inclusive then UBTI 39

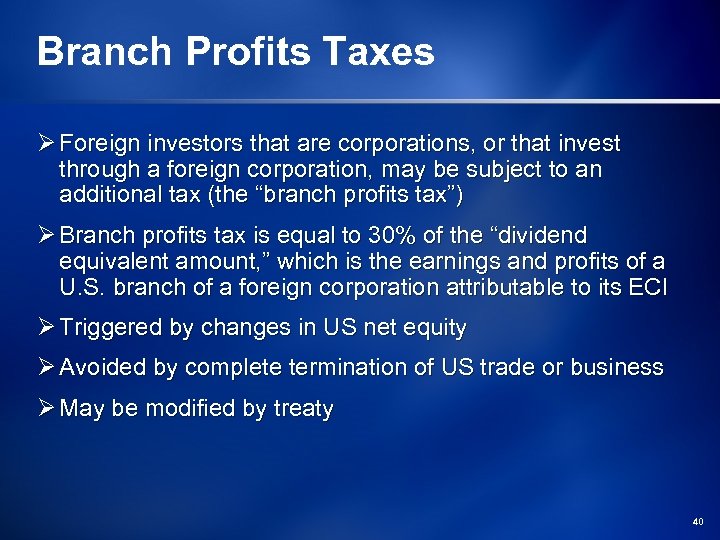

Branch Profits Taxes Ø Foreign investors that are corporations, or that invest through a foreign corporation, may be subject to an additional tax (the “branch profits tax”) Ø Branch profits tax is equal to 30% of the “dividend equivalent amount, ” which is the earnings and profits of a U. S. branch of a foreign corporation attributable to its ECI Ø Triggered by changes in US net equity Ø Avoided by complete termination of US trade or business Ø May be modified by treaty 40

Branch Profits Taxes Ø Foreign investors that are corporations, or that invest through a foreign corporation, may be subject to an additional tax (the “branch profits tax”) Ø Branch profits tax is equal to 30% of the “dividend equivalent amount, ” which is the earnings and profits of a U. S. branch of a foreign corporation attributable to its ECI Ø Triggered by changes in US net equity Ø Avoided by complete termination of US trade or business Ø May be modified by treaty 40

What is a Blocker Corporation?

What is a Blocker Corporation?

What is a Blocker Corporation? ØA “blocker corporation” is a corporation that is placed between the tax-exempt or foreign investors and the source of UBTI and ECI ØThe blocker corporation incurs and pays tax on the operating income that is allocated to it from the pass -through entity, and thus “blocks” such income from reaching the tax-exempt and foreign investors ØAny net after-tax proceeds distributed by the blocker corporation to the tax-exempt and foreign investors should be non-UBTI, non-ECI distributions 42

What is a Blocker Corporation? ØA “blocker corporation” is a corporation that is placed between the tax-exempt or foreign investors and the source of UBTI and ECI ØThe blocker corporation incurs and pays tax on the operating income that is allocated to it from the pass -through entity, and thus “blocks” such income from reaching the tax-exempt and foreign investors ØAny net after-tax proceeds distributed by the blocker corporation to the tax-exempt and foreign investors should be non-UBTI, non-ECI distributions 42

Structures Using Blocker Corporations There are generally three types of blocker structures: Parent Blocker, in which the blocker is positioned “above the Fund” as a direct investor in the Fund Subsidiary Blocker, in which the blocker is positioned “below the Fund” as a wholly-owned subsidiary of the Fund Parallel Blocker, in which the blocker is positioned below a parallel Fund that is formed to invest side-byside with the main Fund 43

Structures Using Blocker Corporations There are generally three types of blocker structures: Parent Blocker, in which the blocker is positioned “above the Fund” as a direct investor in the Fund Subsidiary Blocker, in which the blocker is positioned “below the Fund” as a wholly-owned subsidiary of the Fund Parallel Blocker, in which the blocker is positioned below a parallel Fund that is formed to invest side-byside with the main Fund 43

Tax Consequences of Using a Blocker Corporation Ø The U. S. tax consequences of holding a pass-through investment through a blocker corporation depends on the chosen structure Ø Specifically, the tax consequences depend on: Whether the blocker is domestic or foreign Whether the blocker holds all or only a subset of the fund investments Whether the blocker resides above, below, or parallel to the Fund Ø Threshold question is whether the blocker will be respected as the tax owner of the investment 44

Tax Consequences of Using a Blocker Corporation Ø The U. S. tax consequences of holding a pass-through investment through a blocker corporation depends on the chosen structure Ø Specifically, the tax consequences depend on: Whether the blocker is domestic or foreign Whether the blocker holds all or only a subset of the fund investments Whether the blocker resides above, below, or parallel to the Fund Ø Threshold question is whether the blocker will be respected as the tax owner of the investment 44

Blocker Structuring Examples

Blocker Structuring Examples

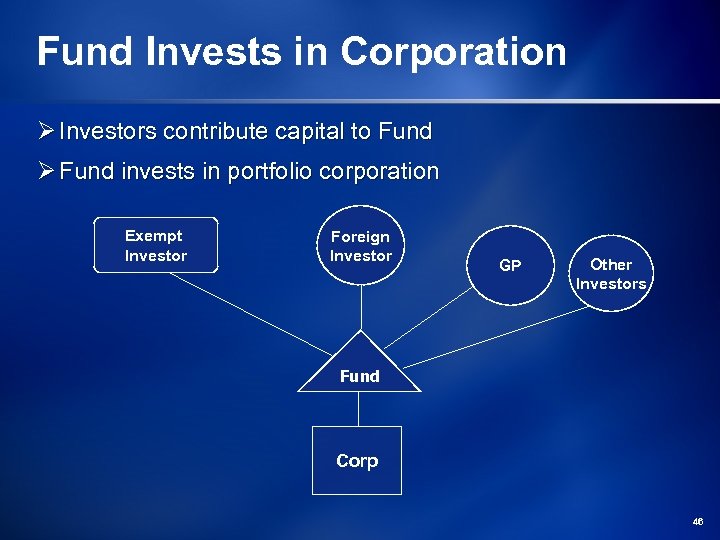

Fund Invests in Corporation Ø Investors contribute capital to Fund Ø Fund invests in portfolio corporation Exempt Investor Foreign Investor GP Other Investors Fund Corp 46

Fund Invests in Corporation Ø Investors contribute capital to Fund Ø Fund invests in portfolio corporation Exempt Investor Foreign Investor GP Other Investors Fund Corp 46

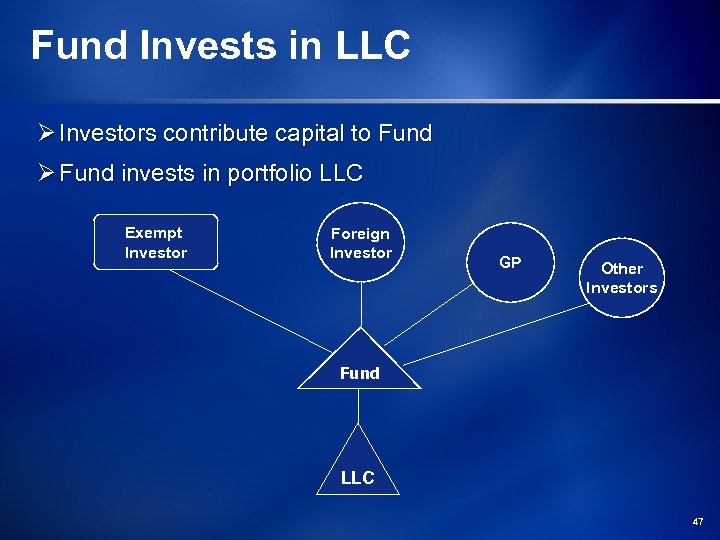

Fund Invests in LLC Ø Investors contribute capital to Fund Ø Fund invests in portfolio LLC Exempt Investor Foreign Investor GP Other Investors Fund LLC 47

Fund Invests in LLC Ø Investors contribute capital to Fund Ø Fund invests in portfolio LLC Exempt Investor Foreign Investor GP Other Investors Fund LLC 47

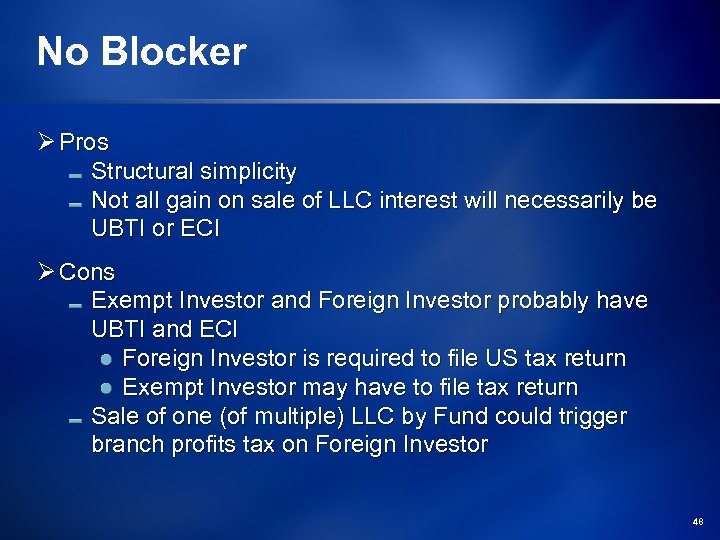

No Blocker Ø Pros Structural simplicity Not all gain on sale of LLC interest will necessarily be UBTI or ECI Ø Cons Exempt Investor and Foreign Investor probably have UBTI and ECI Foreign Investor is required to file US tax return Exempt Investor may have to file tax return Sale of one (of multiple) LLC by Fund could trigger branch profits tax on Foreign Investor 48

No Blocker Ø Pros Structural simplicity Not all gain on sale of LLC interest will necessarily be UBTI or ECI Ø Cons Exempt Investor and Foreign Investor probably have UBTI and ECI Foreign Investor is required to file US tax return Exempt Investor may have to file tax return Sale of one (of multiple) LLC by Fund could trigger branch profits tax on Foreign Investor 48

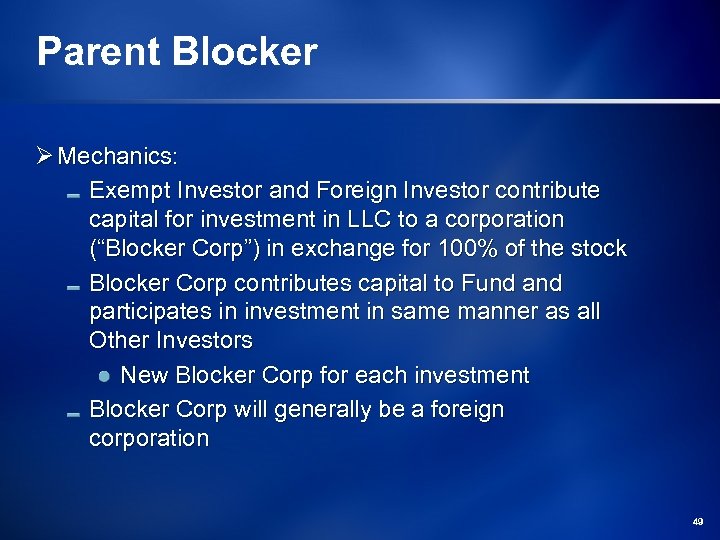

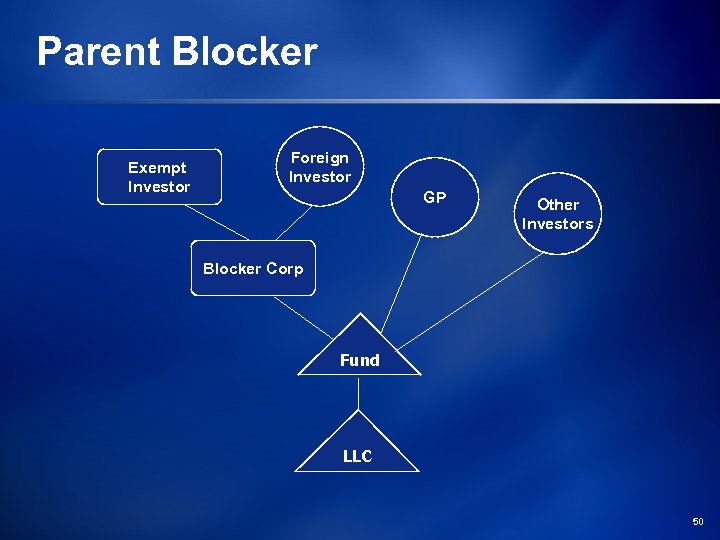

Parent Blocker Ø Mechanics: Exempt Investor and Foreign Investor contribute capital for investment in LLC to a corporation (“Blocker Corp”) in exchange for 100% of the stock Blocker Corp contributes capital to Fund and participates in investment in same manner as all Other Investors New Blocker Corp for each investment Blocker Corp will generally be a foreign corporation 49

Parent Blocker Ø Mechanics: Exempt Investor and Foreign Investor contribute capital for investment in LLC to a corporation (“Blocker Corp”) in exchange for 100% of the stock Blocker Corp contributes capital to Fund and participates in investment in same manner as all Other Investors New Blocker Corp for each investment Blocker Corp will generally be a foreign corporation 49

Parent Blocker Exempt Investor Foreign Investor GP Other Investors Blocker Corp Fund LLC 50

Parent Blocker Exempt Investor Foreign Investor GP Other Investors Blocker Corp Fund LLC 50

Parent Blocker Ø Pros Exempt Investor and Foreign Investor will not have to report UBTI or ECI Foreign and Exempt Investors will not have to file US tax return GP’s carried interest is not affected by Blocker Corp Ø Cons Difficult to avoid Blocker Corp level tax on disposition Potential Branch Profits Tax issue Tax rate to Foreign Investor 51

Parent Blocker Ø Pros Exempt Investor and Foreign Investor will not have to report UBTI or ECI Foreign and Exempt Investors will not have to file US tax return GP’s carried interest is not affected by Blocker Corp Ø Cons Difficult to avoid Blocker Corp level tax on disposition Potential Branch Profits Tax issue Tax rate to Foreign Investor 51

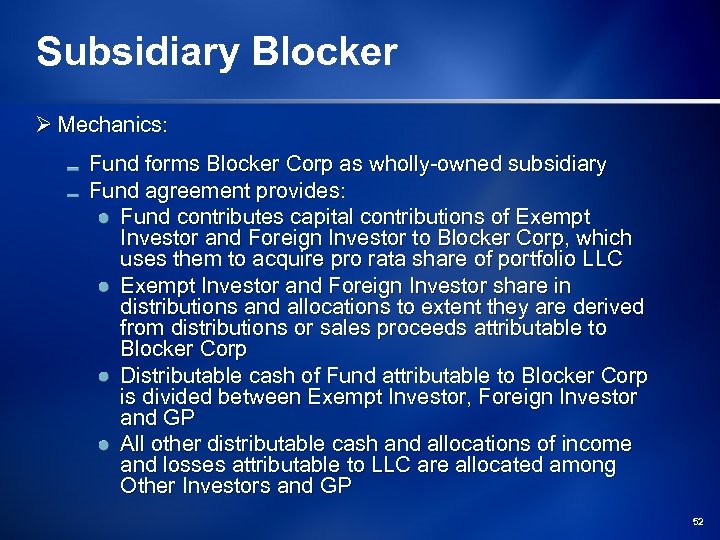

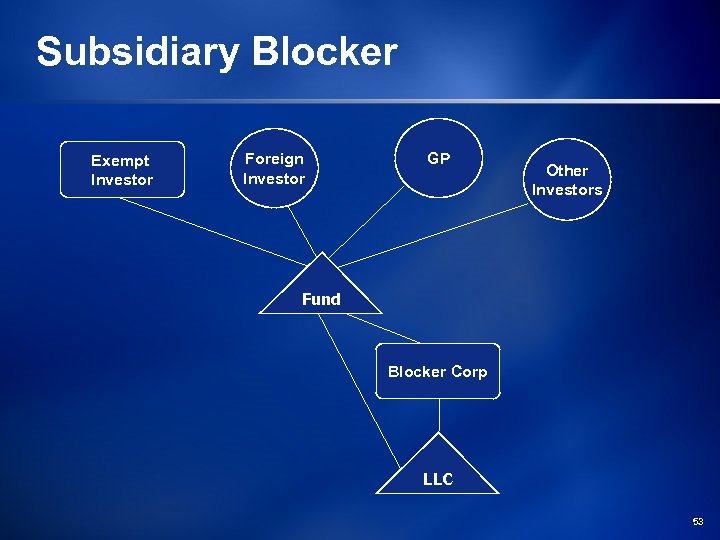

Subsidiary Blocker Ø Mechanics: Fund forms Blocker Corp as wholly-owned subsidiary Fund agreement provides: Fund contributes capital contributions of Exempt Investor and Foreign Investor to Blocker Corp, which uses them to acquire pro rata share of portfolio LLC Exempt Investor and Foreign Investor share in distributions and allocations to extent they are derived from distributions or sales proceeds attributable to Blocker Corp Distributable cash of Fund attributable to Blocker Corp is divided between Exempt Investor, Foreign Investor and GP All other distributable cash and allocations of income and losses attributable to LLC are allocated among Other Investors and GP 52

Subsidiary Blocker Ø Mechanics: Fund forms Blocker Corp as wholly-owned subsidiary Fund agreement provides: Fund contributes capital contributions of Exempt Investor and Foreign Investor to Blocker Corp, which uses them to acquire pro rata share of portfolio LLC Exempt Investor and Foreign Investor share in distributions and allocations to extent they are derived from distributions or sales proceeds attributable to Blocker Corp Distributable cash of Fund attributable to Blocker Corp is divided between Exempt Investor, Foreign Investor and GP All other distributable cash and allocations of income and losses attributable to LLC are allocated among Other Investors and GP 52

Subsidiary Blocker Exempt Investor Foreign Investor GP Other Investors Fund Blocker Corp LLC 53

Subsidiary Blocker Exempt Investor Foreign Investor GP Other Investors Fund Blocker Corp LLC 53

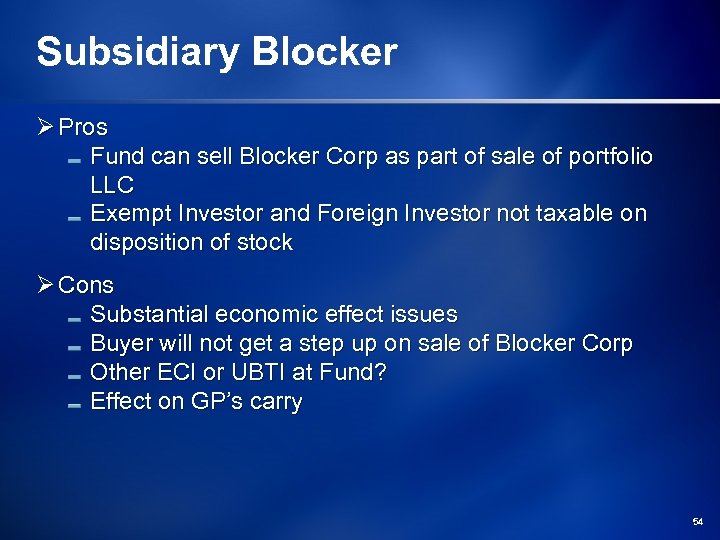

Subsidiary Blocker Ø Pros Fund can sell Blocker Corp as part of sale of portfolio LLC Exempt Investor and Foreign Investor not taxable on disposition of stock Ø Cons Substantial economic effect issues Buyer will not get a step up on sale of Blocker Corp Other ECI or UBTI at Fund? Effect on GP’s carry 54

Subsidiary Blocker Ø Pros Fund can sell Blocker Corp as part of sale of portfolio LLC Exempt Investor and Foreign Investor not taxable on disposition of stock Ø Cons Substantial economic effect issues Buyer will not get a step up on sale of Blocker Corp Other ECI or UBTI at Fund? Effect on GP’s carry 54

Subsidiary Blocker (alternative) Exempt Investor Foreign Investor GP Other Investors Fund Blocker Corp LLC 55

Subsidiary Blocker (alternative) Exempt Investor Foreign Investor GP Other Investors Fund Blocker Corp LLC 55

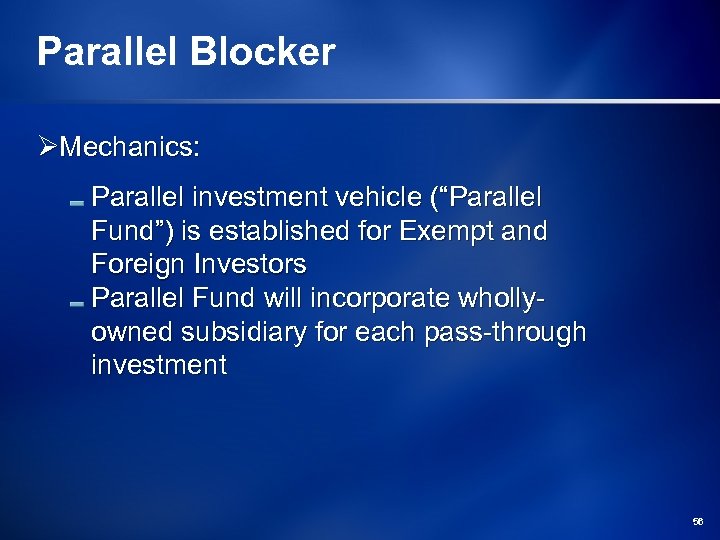

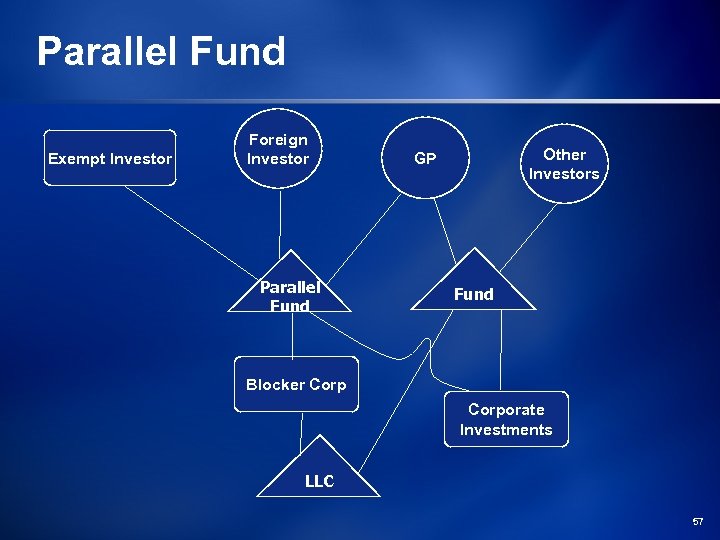

Parallel Blocker ØMechanics: Parallel investment vehicle (“Parallel Fund”) is established for Exempt and Foreign Investors Parallel Fund will incorporate whollyowned subsidiary for each pass-through investment 56

Parallel Blocker ØMechanics: Parallel investment vehicle (“Parallel Fund”) is established for Exempt and Foreign Investors Parallel Fund will incorporate whollyowned subsidiary for each pass-through investment 56

Parallel Fund Exempt Investor Foreign Investor Parallel Fund Other Investors GP Fund Blocker Corporate Investments LLC 57

Parallel Fund Exempt Investor Foreign Investor Parallel Fund Other Investors GP Fund Blocker Corporate Investments LLC 57

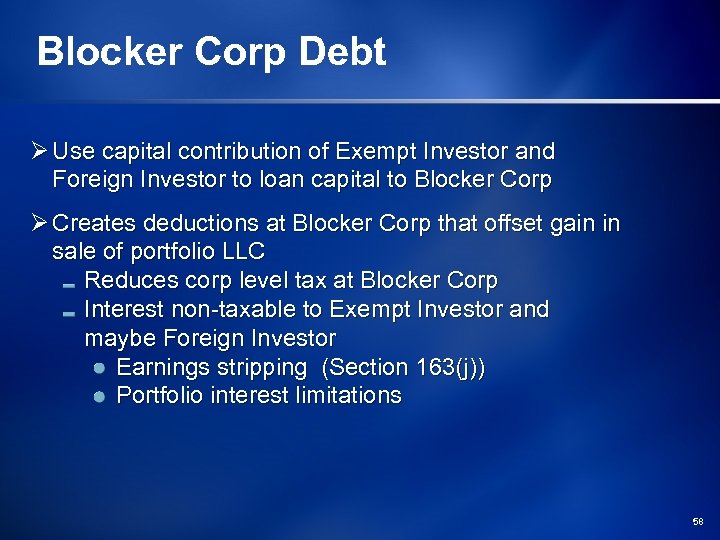

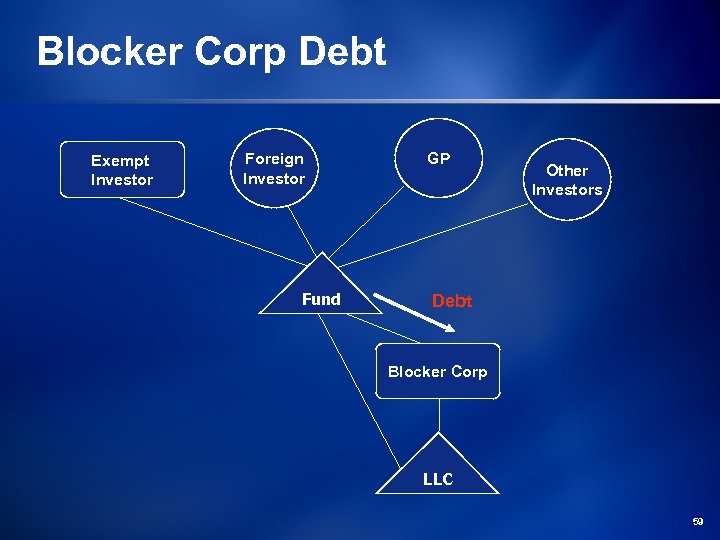

Blocker Corp Debt Ø Use capital contribution of Exempt Investor and Foreign Investor to loan capital to Blocker Corp Ø Creates deductions at Blocker Corp that offset gain in sale of portfolio LLC Reduces corp level tax at Blocker Corp Interest non-taxable to Exempt Investor and maybe Foreign Investor Earnings stripping (Section 163(j)) Portfolio interest limitations 58

Blocker Corp Debt Ø Use capital contribution of Exempt Investor and Foreign Investor to loan capital to Blocker Corp Ø Creates deductions at Blocker Corp that offset gain in sale of portfolio LLC Reduces corp level tax at Blocker Corp Interest non-taxable to Exempt Investor and maybe Foreign Investor Earnings stripping (Section 163(j)) Portfolio interest limitations 58

Blocker Corp Debt Exempt Investor Foreign Investor Fund GP Other Investors Debt Blocker Corp LLC 59

Blocker Corp Debt Exempt Investor Foreign Investor Fund GP Other Investors Debt Blocker Corp LLC 59

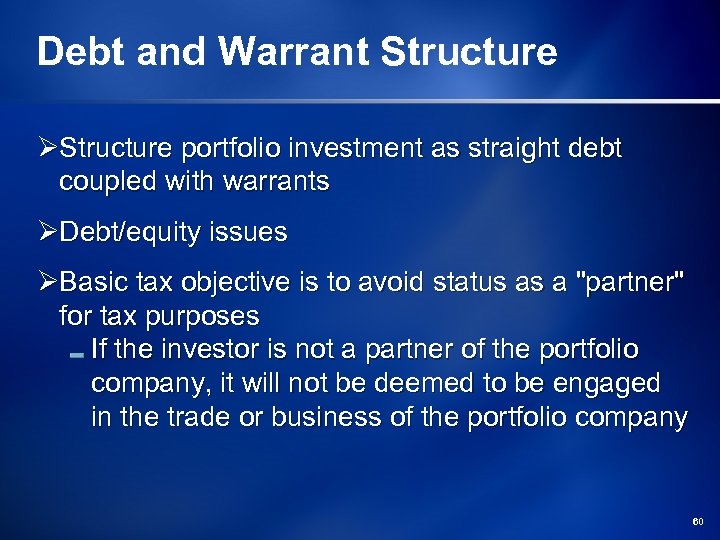

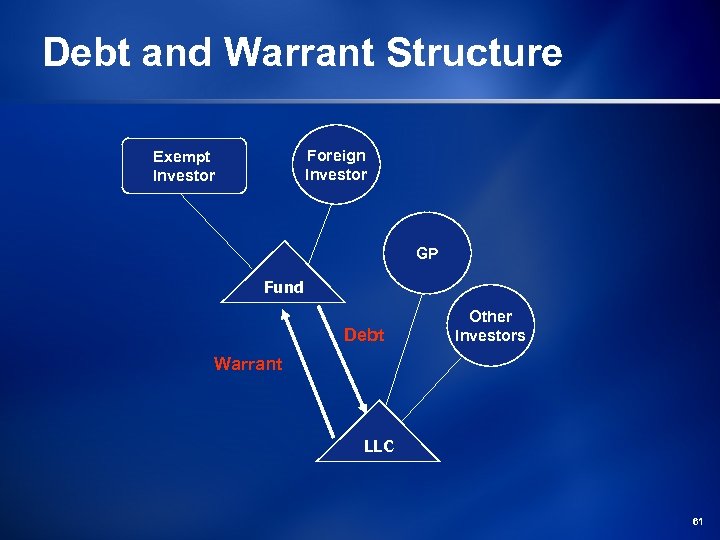

Debt and Warrant Structure ØStructure portfolio investment as straight debt coupled with warrants ØDebt/equity issues ØBasic tax objective is to avoid status as a "partner" for tax purposes If the investor is not a partner of the portfolio company, it will not be deemed to be engaged in the trade or business of the portfolio company 60

Debt and Warrant Structure ØStructure portfolio investment as straight debt coupled with warrants ØDebt/equity issues ØBasic tax objective is to avoid status as a "partner" for tax purposes If the investor is not a partner of the portfolio company, it will not be deemed to be engaged in the trade or business of the portfolio company 60

Debt and Warrant Structure Foreign Investor Exempt Investor GP Fund Debt Other Investors Warrant LLC 61

Debt and Warrant Structure Foreign Investor Exempt Investor GP Fund Debt Other Investors Warrant LLC 61

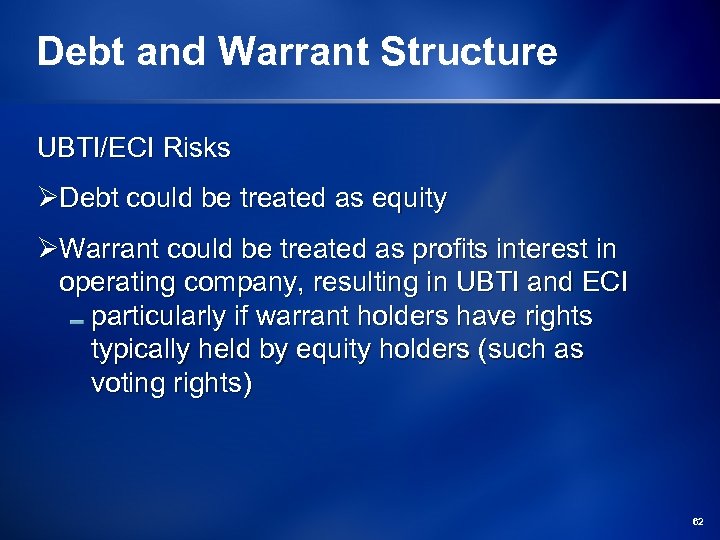

Debt and Warrant Structure UBTI/ECI Risks ØDebt could be treated as equity ØWarrant could be treated as profits interest in operating company, resulting in UBTI and ECI particularly if warrant holders have rights typically held by equity holders (such as voting rights) 62

Debt and Warrant Structure UBTI/ECI Risks ØDebt could be treated as equity ØWarrant could be treated as profits interest in operating company, resulting in UBTI and ECI particularly if warrant holders have rights typically held by equity holders (such as voting rights) 62

Structuring Investments in or Acquisitions of Portfolio Companies

Structuring Investments in or Acquisitions of Portfolio Companies

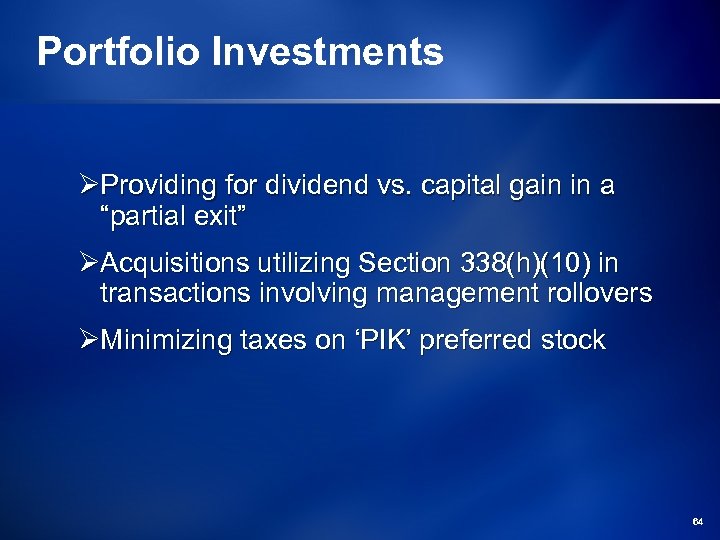

Portfolio Investments ØProviding for dividend vs. capital gain in a “partial exit” ØAcquisitions utilizing Section 338(h)(10) in transactions involving management rollovers ØMinimizing taxes on ‘PIK’ preferred stock 64

Portfolio Investments ØProviding for dividend vs. capital gain in a “partial exit” ØAcquisitions utilizing Section 338(h)(10) in transactions involving management rollovers ØMinimizing taxes on ‘PIK’ preferred stock 64

Dividend vs. Capital Gain in a “Partial Exit”

Dividend vs. Capital Gain in a “Partial Exit”

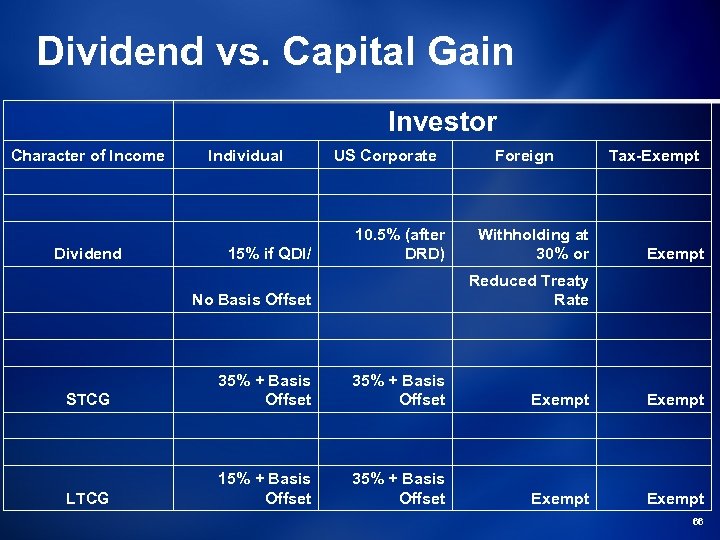

Dividend vs. Capital Gain Investor Character of Income Individual US Corporate Foreign Tax-Exempt Dividend 15% if QDI/ 10. 5% (after DRD) Withholding at 30% or Exempt No Basis Offset Reduced Treaty Rate 35% + Basis Offset Exempt 15% + Basis Offset 35% + Basis Offset Exempt STCG LTCG 66

Dividend vs. Capital Gain Investor Character of Income Individual US Corporate Foreign Tax-Exempt Dividend 15% if QDI/ 10. 5% (after DRD) Withholding at 30% or Exempt No Basis Offset Reduced Treaty Rate 35% + Basis Offset Exempt 15% + Basis Offset 35% + Basis Offset Exempt STCG LTCG 66

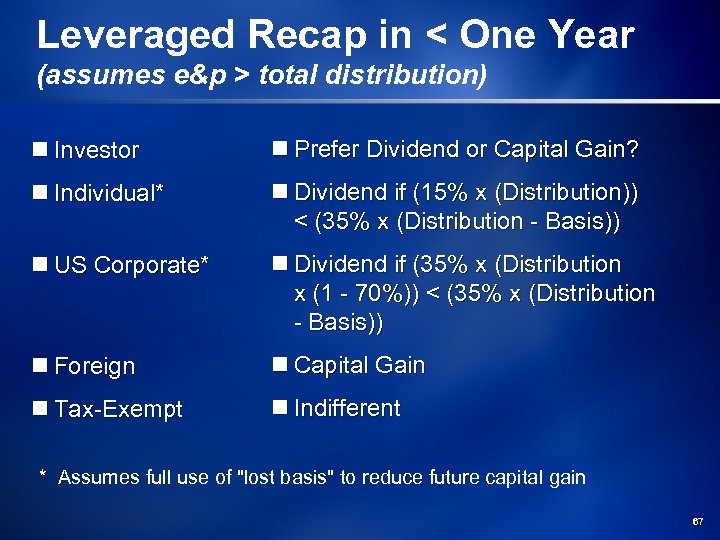

Leveraged Recap in < One Year (assumes e&p > total distribution) n Investor n Prefer Dividend or Capital Gain? n Individual* n Dividend if (15% x (Distribution)) < (35% x (Distribution - Basis)) n US Corporate* n Dividend if (35% x (Distribution x (1 - 70%)) < (35% x (Distribution - Basis)) n Foreign n Capital Gain n Tax-Exempt n Indifferent * Assumes full use of "lost basis" to reduce future capital gain 67

Leveraged Recap in < One Year (assumes e&p > total distribution) n Investor n Prefer Dividend or Capital Gain? n Individual* n Dividend if (15% x (Distribution)) < (35% x (Distribution - Basis)) n US Corporate* n Dividend if (35% x (Distribution x (1 - 70%)) < (35% x (Distribution - Basis)) n Foreign n Capital Gain n Tax-Exempt n Indifferent * Assumes full use of "lost basis" to reduce future capital gain 67

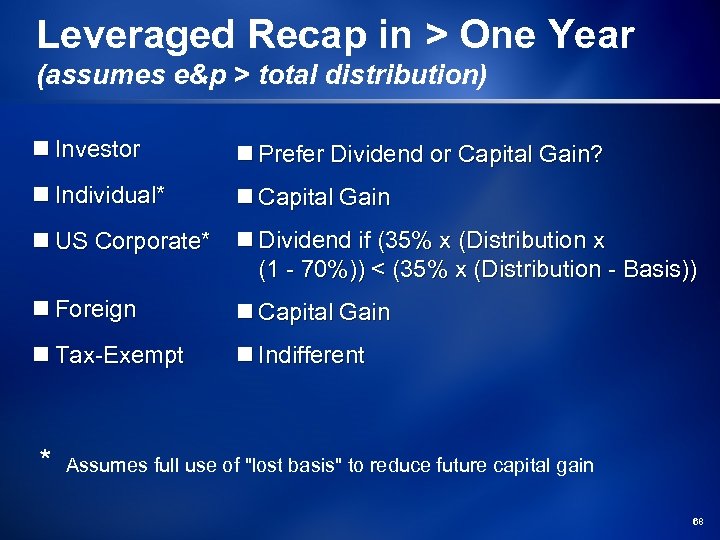

Leveraged Recap in > One Year (assumes e&p > total distribution) n Investor n Prefer Dividend or Capital Gain? n Individual* n Capital Gain n US Corporate* n Dividend if (35% x (Distribution x (1 - 70%)) < (35% x (Distribution - Basis)) n Foreign n Capital Gain n Tax-Exempt n Indifferent * Assumes full use of "lost basis" to reduce future capital gain 68

Leveraged Recap in > One Year (assumes e&p > total distribution) n Investor n Prefer Dividend or Capital Gain? n Individual* n Capital Gain n US Corporate* n Dividend if (35% x (Distribution x (1 - 70%)) < (35% x (Distribution - Basis)) n Foreign n Capital Gain n Tax-Exempt n Indifferent * Assumes full use of "lost basis" to reduce future capital gain 68

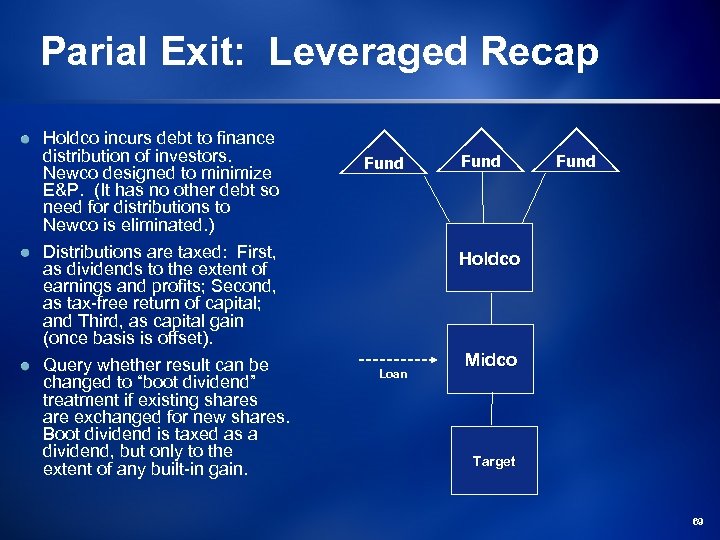

Parial Exit: Leveraged Recap Holdco incurs debt to finance distribution of investors. Newco designed to minimize E&P. (It has no other debt so need for distributions to Newco is eliminated. ) Distributions are taxed: First, as dividends to the extent of earnings and profits; Second, as tax-free return of capital; and Third, as capital gain (once basis is offset). Query whether result can be changed to “boot dividend” treatment if existing shares are exchanged for new shares. Boot dividend is taxed as a dividend, but only to the extent of any built-in gain. Fund Holdco Loan Midco Target 69

Parial Exit: Leveraged Recap Holdco incurs debt to finance distribution of investors. Newco designed to minimize E&P. (It has no other debt so need for distributions to Newco is eliminated. ) Distributions are taxed: First, as dividends to the extent of earnings and profits; Second, as tax-free return of capital; and Third, as capital gain (once basis is offset). Query whether result can be changed to “boot dividend” treatment if existing shares are exchanged for new shares. Boot dividend is taxed as a dividend, but only to the extent of any built-in gain. Fund Holdco Loan Midco Target 69

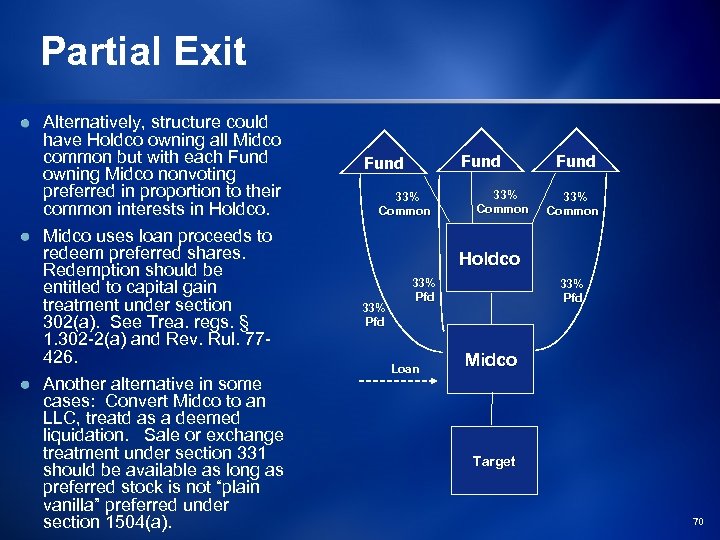

Partial Exit Alternatively, structure could have Holdco owning all Midco common but with each Fund owning Midco nonvoting preferred in proportion to their common interests in Holdco. Midco uses loan proceeds to redeem preferred shares. Redemption should be entitled to capital gain treatment under section 302(a). See Trea. regs. § 1. 302 -2(a) and Rev. Rul. 77426. Another alternative in some cases: Convert Midco to an LLC, treatd as a deemed liquidation. Sale or exchange treatment under section 331 should be available as long as preferred stock is not “plain vanilla” preferred under section 1504(a). Fund 33% Common Holdco 33% Pfd Loan 33% Pfd Midco Target 70

Partial Exit Alternatively, structure could have Holdco owning all Midco common but with each Fund owning Midco nonvoting preferred in proportion to their common interests in Holdco. Midco uses loan proceeds to redeem preferred shares. Redemption should be entitled to capital gain treatment under section 302(a). See Trea. regs. § 1. 302 -2(a) and Rev. Rul. 77426. Another alternative in some cases: Convert Midco to an LLC, treatd as a deemed liquidation. Sale or exchange treatment under section 331 should be available as long as preferred stock is not “plain vanilla” preferred under section 1504(a). Fund 33% Common Holdco 33% Pfd Loan 33% Pfd Midco Target 70

Section 338(h)(10) Transactions Involving Management Rollovers

Section 338(h)(10) Transactions Involving Management Rollovers

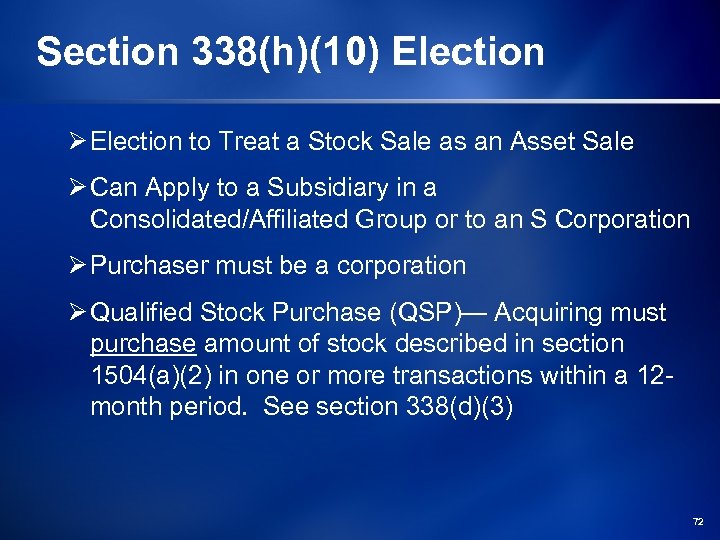

Section 338(h)(10) Election Ø Election to Treat a Stock Sale as an Asset Sale Ø Can Apply to a Subsidiary in a Consolidated/Affiliated Group or to an S Corporation Ø Purchaser must be a corporation Ø Qualified Stock Purchase (QSP)— Acquiring must purchase amount of stock described in section 1504(a)(2) in one or more transactions within a 12 month period. See section 338(d)(3) 72

Section 338(h)(10) Election Ø Election to Treat a Stock Sale as an Asset Sale Ø Can Apply to a Subsidiary in a Consolidated/Affiliated Group or to an S Corporation Ø Purchaser must be a corporation Ø Qualified Stock Purchase (QSP)— Acquiring must purchase amount of stock described in section 1504(a)(2) in one or more transactions within a 12 month period. See section 338(d)(3) 72

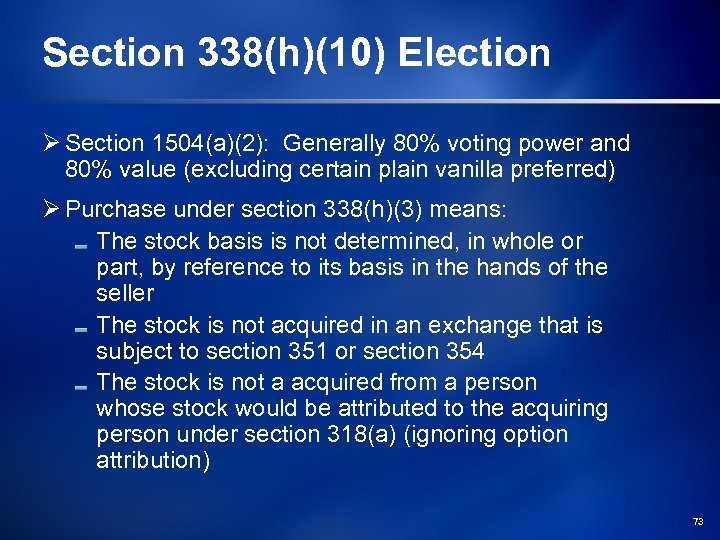

Section 338(h)(10) Election Ø Section 1504(a)(2): Generally 80% voting power and 80% value (excluding certain plain vanilla preferred) Ø Purchase under section 338(h)(3) means: The stock basis is not determined, in whole or part, by reference to its basis in the hands of the seller The stock is not acquired in an exchange that is subject to section 351 or section 354 The stock is not a acquired from a person whose stock would be attributed to the acquiring person under section 318(a) (ignoring option attribution) 73

Section 338(h)(10) Election Ø Section 1504(a)(2): Generally 80% voting power and 80% value (excluding certain plain vanilla preferred) Ø Purchase under section 338(h)(3) means: The stock basis is not determined, in whole or part, by reference to its basis in the hands of the seller The stock is not acquired in an exchange that is subject to section 351 or section 354 The stock is not a acquired from a person whose stock would be attributed to the acquiring person under section 318(a) (ignoring option attribution) 73

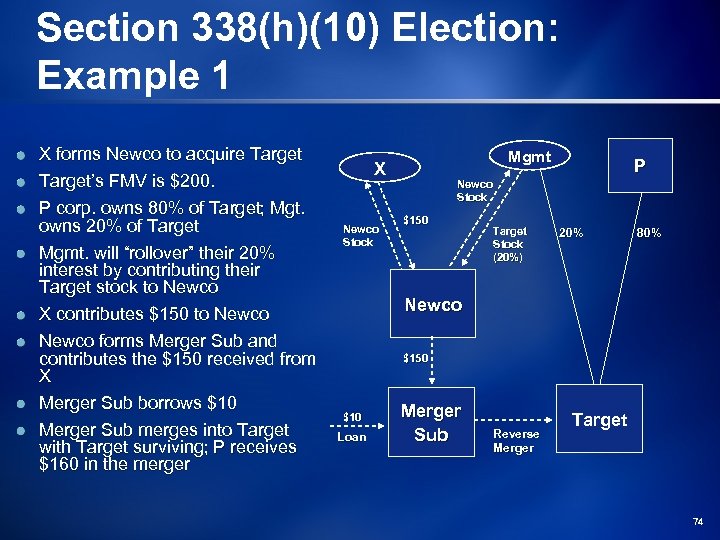

Section 338(h)(10) Election: Example 1 X forms Newco to acquire Target’s FMV is $200. P corp. owns 80% of Target; Mgt. owns 20% of Target Mgmt. will “rollover” their 20% interest by contributing their Target stock to Newco X contributes $150 to Newco forms Merger Sub and contributes the $150 received from X Merger Sub borrows $10 Merger Sub merges into Target with Target surviving; P receives $160 in the merger Mgmt X Newco Stock P Newco Stock $150 Target Stock (20%) 20% 80% Newco $150 $10 Loan Merger Sub Reverse Merger Target 74

Section 338(h)(10) Election: Example 1 X forms Newco to acquire Target’s FMV is $200. P corp. owns 80% of Target; Mgt. owns 20% of Target Mgmt. will “rollover” their 20% interest by contributing their Target stock to Newco X contributes $150 to Newco forms Merger Sub and contributes the $150 received from X Merger Sub borrows $10 Merger Sub merges into Target with Target surviving; P receives $160 in the merger Mgmt X Newco Stock P Newco Stock $150 Target Stock (20%) 20% 80% Newco $150 $10 Loan Merger Sub Reverse Merger Target 74

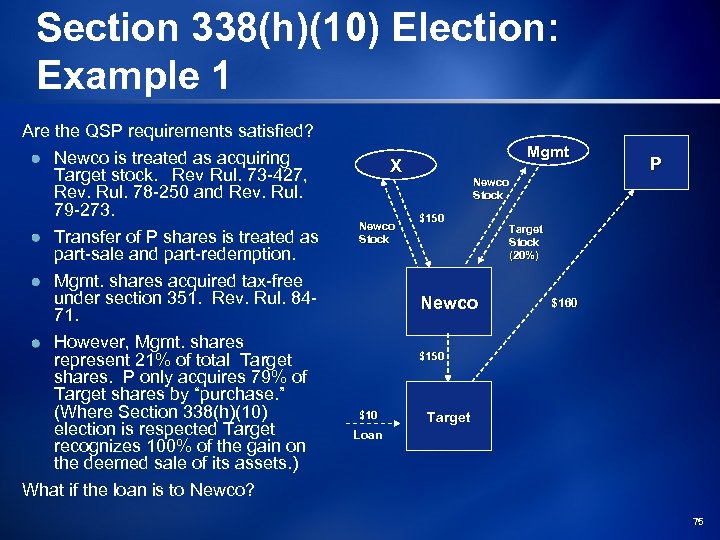

Section 338(h)(10) Election: Example 1 Are the QSP requirements satisfied? Newco is treated as acquiring Target stock. Rev Rul. 73 -427, Rev. Rul. 78 -250 and Rev. Rul. 79 -273. Transfer of P shares is treated as part-sale and part-redemption. Mgmt. shares acquired tax-free under section 351. Rev. Rul. 8471. However, Mgmt. shares represent 21% of total Target shares. P only acquires 79% of Target shares by “purchase. ” (Where Section 338(h)(10) election is respected Target recognizes 100% of the gain on the deemed sale of its assets. ) What if the loan is to Newco? Mgmt X Newco Stock P Newco Stock $150 Newco Target Stock (20%) $160 $150 $10 Target Loan 75

Section 338(h)(10) Election: Example 1 Are the QSP requirements satisfied? Newco is treated as acquiring Target stock. Rev Rul. 73 -427, Rev. Rul. 78 -250 and Rev. Rul. 79 -273. Transfer of P shares is treated as part-sale and part-redemption. Mgmt. shares acquired tax-free under section 351. Rev. Rul. 8471. However, Mgmt. shares represent 21% of total Target shares. P only acquires 79% of Target shares by “purchase. ” (Where Section 338(h)(10) election is respected Target recognizes 100% of the gain on the deemed sale of its assets. ) What if the loan is to Newco? Mgmt X Newco Stock P Newco Stock $150 Newco Target Stock (20%) $160 $150 $10 Target Loan 75

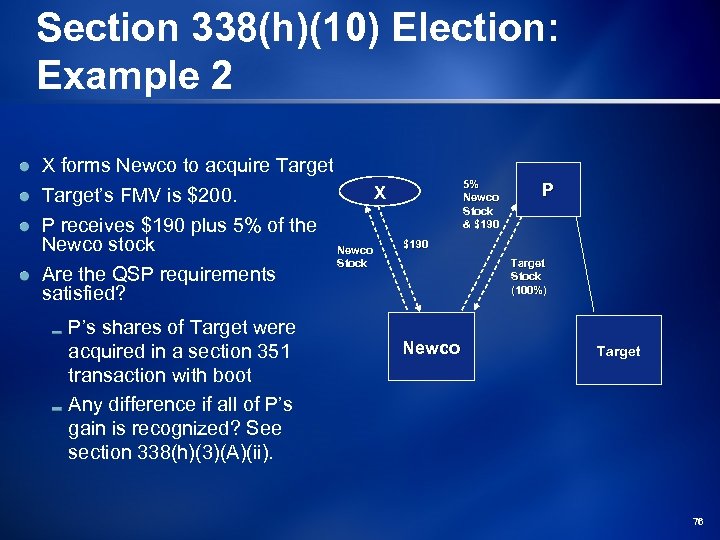

Section 338(h)(10) Election: Example 2 X forms Newco to acquire Target’s FMV is $200. P receives $190 plus 5% of the Newco stock Are the QSP requirements satisfied? P’s shares of Target were acquired in a section 351 transaction with boot Any difference if all of P’s gain is recognized? See section 338(h)(3)(A)(ii). 5% Newco Stock & $190 X Newco Stock P $190 Target Stock (100%) Newco Target 76

Section 338(h)(10) Election: Example 2 X forms Newco to acquire Target’s FMV is $200. P receives $190 plus 5% of the Newco stock Are the QSP requirements satisfied? P’s shares of Target were acquired in a section 351 transaction with boot Any difference if all of P’s gain is recognized? See section 338(h)(3)(A)(ii). 5% Newco Stock & $190 X Newco Stock P $190 Target Stock (100%) Newco Target 76

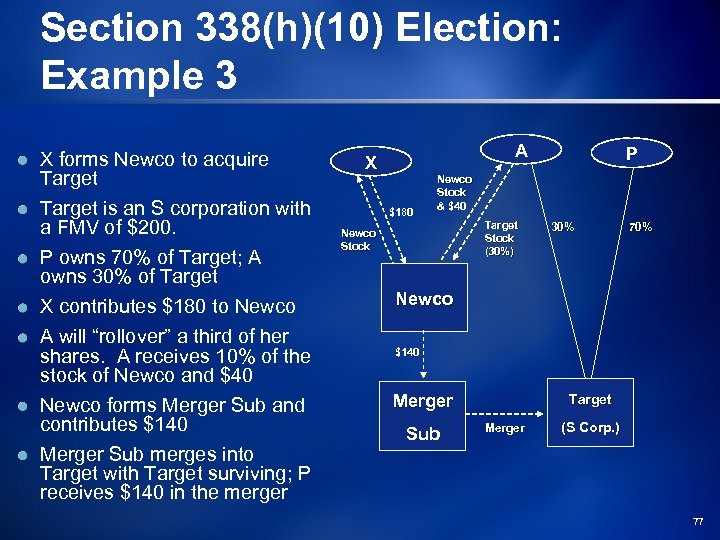

Section 338(h)(10) Election: Example 3 X forms Newco to acquire Target is an S corporation with a FMV of $200. P owns 70% of Target; A owns 30% of Target X contributes $180 to Newco A will “rollover” a third of her shares. A receives 10% of the stock of Newco and $40 Newco forms Merger Sub and contributes $140 Merger Sub merges into Target with Target surviving; P receives $140 in the merger A X $180 P Newco Stock & $40 Target Stock (30%) Newco Stock 30% 70% Newco $140 Merger Sub Target Merger (S Corp. ) 77

Section 338(h)(10) Election: Example 3 X forms Newco to acquire Target is an S corporation with a FMV of $200. P owns 70% of Target; A owns 30% of Target X contributes $180 to Newco A will “rollover” a third of her shares. A receives 10% of the stock of Newco and $40 Newco forms Merger Sub and contributes $140 Merger Sub merges into Target with Target surviving; P receives $140 in the merger A X $180 P Newco Stock & $40 Target Stock (30%) Newco Stock 30% 70% Newco $140 Merger Sub Target Merger (S Corp. ) 77

Section 338(h)(10) Election: Example 3 Are the QSP requirements satisfied? A’s shares (equal to 30% of Target) were acquired in a section 351 transaction A X Newco Stock $180 P Newco Stock & $40 Target Stock (30%) Newco $140 Target (S Corp. ) 78

Section 338(h)(10) Election: Example 3 Are the QSP requirements satisfied? A’s shares (equal to 30% of Target) were acquired in a section 351 transaction A X Newco Stock $180 P Newco Stock & $40 Target Stock (30%) Newco $140 Target (S Corp. ) 78

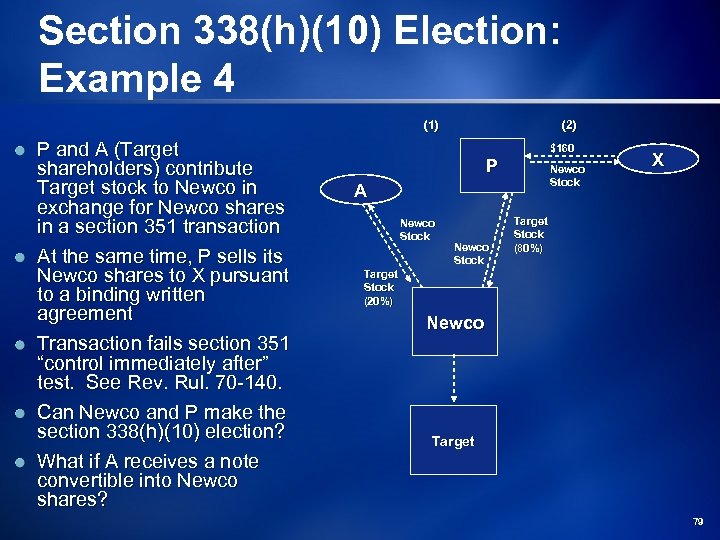

Section 338(h)(10) Election: Example 4 (1) P and A (Target shareholders) contribute Target stock to Newco in exchange for Newco shares in a section 351 transaction At the same time, P sells its Newco shares to X pursuant to a binding written agreement Transaction fails section 351 “control immediately after” test. See Rev. Rul. 70 -140. Can Newco and P make the section 338(h)(10) election? What if A receives a note convertible into Newco shares? (2) $160 P Newco Stock A Newco Stock X Target Stock (80%) Target Stock (20%) Newco Target 79

Section 338(h)(10) Election: Example 4 (1) P and A (Target shareholders) contribute Target stock to Newco in exchange for Newco shares in a section 351 transaction At the same time, P sells its Newco shares to X pursuant to a binding written agreement Transaction fails section 351 “control immediately after” test. See Rev. Rul. 70 -140. Can Newco and P make the section 338(h)(10) election? What if A receives a note convertible into Newco shares? (2) $160 P Newco Stock A Newco Stock X Target Stock (80%) Target Stock (20%) Newco Target 79

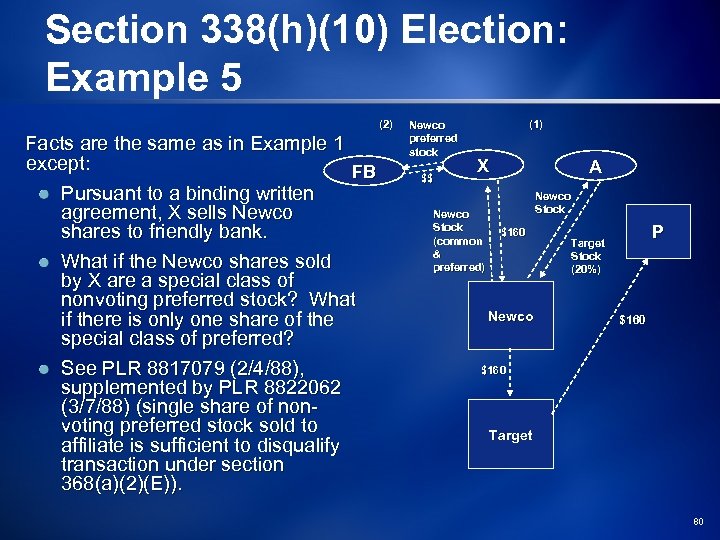

Section 338(h)(10) Election: Example 5 (2) Facts are the same as in Example 1 except: FB Pursuant to a binding written agreement, X sells Newco shares to friendly bank. What if the Newco shares sold by X are a special class of nonvoting preferred stock? What if there is only one share of the special class of preferred? See PLR 8817079 (2/4/88), supplemented by PLR 8822062 (3/7/88) (single share of nonvoting preferred stock sold to affiliate is sufficient to disqualify transaction under section 368(a)(2)(E)). Newco preferred stock $$ (1) X Newco Stock (common & preferred) A Newco Stock $160 Newco P Target Stock (20%) $160 Target 80

Section 338(h)(10) Election: Example 5 (2) Facts are the same as in Example 1 except: FB Pursuant to a binding written agreement, X sells Newco shares to friendly bank. What if the Newco shares sold by X are a special class of nonvoting preferred stock? What if there is only one share of the special class of preferred? See PLR 8817079 (2/4/88), supplemented by PLR 8822062 (3/7/88) (single share of nonvoting preferred stock sold to affiliate is sufficient to disqualify transaction under section 368(a)(2)(E)). Newco preferred stock $$ (1) X Newco Stock (common & preferred) A Newco Stock $160 Newco P Target Stock (20%) $160 Target 80

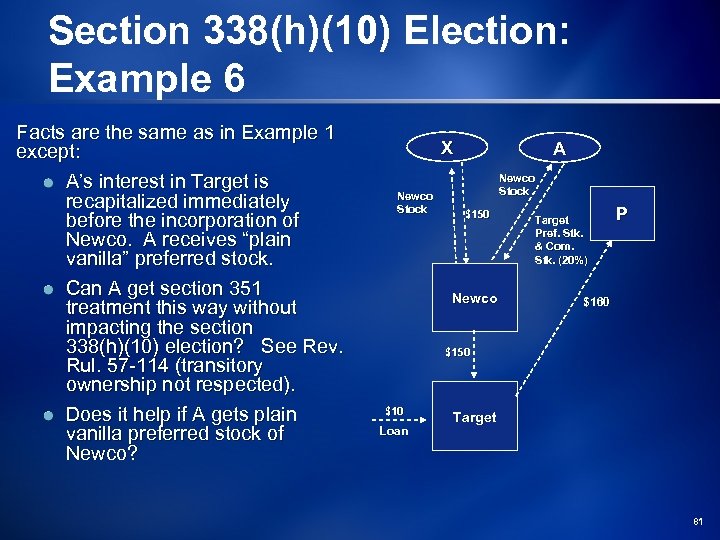

Section 338(h)(10) Election: Example 6 Facts are the same as in Example 1 except: A’s interest in Target is recapitalized immediately before the incorporation of Newco. A receives “plain vanilla” preferred stock. Can A get section 351 treatment this way without impacting the section 338(h)(10) election? See Rev. Rul. 57 -114 (transitory ownership not respected). Does it help if A gets plain vanilla preferred stock of Newco? X Newco Stock A Newco Stock $150 Newco Target Pref. Stk. & Com. Stk. (20%) P $160 $150 $10 Loan Target 81

Section 338(h)(10) Election: Example 6 Facts are the same as in Example 1 except: A’s interest in Target is recapitalized immediately before the incorporation of Newco. A receives “plain vanilla” preferred stock. Can A get section 351 treatment this way without impacting the section 338(h)(10) election? See Rev. Rul. 57 -114 (transitory ownership not respected). Does it help if A gets plain vanilla preferred stock of Newco? X Newco Stock A Newco Stock $150 Newco Target Pref. Stk. & Com. Stk. (20%) P $160 $150 $10 Loan Target 81

Alternatives to Section 338(h)(10)

Alternatives to Section 338(h)(10)

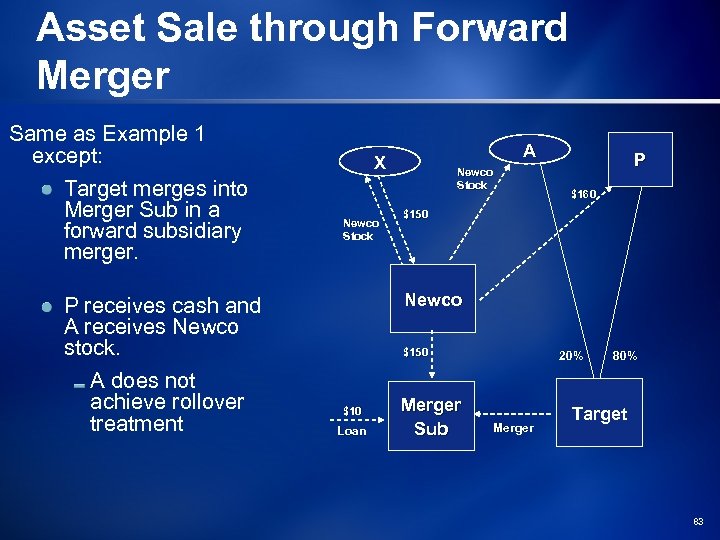

Asset Sale through Forward Merger Same as Example 1 except: Target merges into Merger Sub in a forward subsidiary merger. P receives cash and A receives Newco stock. A does not achieve rollover treatment A X Newco Stock P $160 $150 Newco $150 $10 Loan Merger Sub 20% Merger 80% Target 83

Asset Sale through Forward Merger Same as Example 1 except: Target merges into Merger Sub in a forward subsidiary merger. P receives cash and A receives Newco stock. A does not achieve rollover treatment A X Newco Stock P $160 $150 Newco $150 $10 Loan Merger Sub 20% Merger 80% Target 83

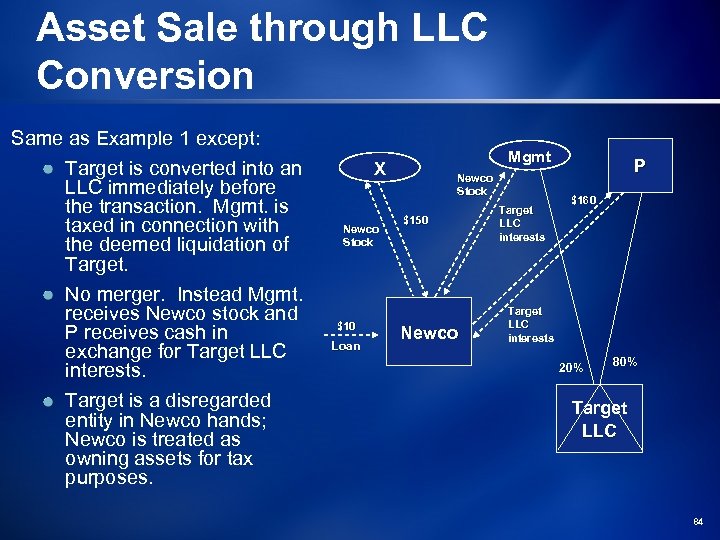

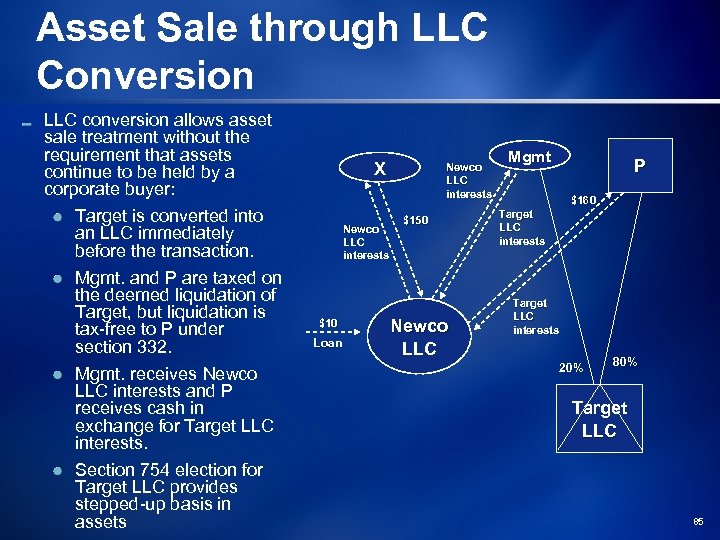

Asset Sale through LLC Conversion Same as Example 1 except: Target is converted into an LLC immediately before the transaction. Mgmt. is taxed in connection with the deemed liquidation of Target. No merger. Instead Mgmt. receives Newco stock and P receives cash in exchange for Target LLC interests. Target is a disregarded entity in Newco hands; Newco is treated as owning assets for tax purposes. Mgmt X Newco Stock $10 Loan Newco Stock $150 Newco Target LLC interests P $160 Target LLC interests 20% 80% Target LLC 84

Asset Sale through LLC Conversion Same as Example 1 except: Target is converted into an LLC immediately before the transaction. Mgmt. is taxed in connection with the deemed liquidation of Target. No merger. Instead Mgmt. receives Newco stock and P receives cash in exchange for Target LLC interests. Target is a disregarded entity in Newco hands; Newco is treated as owning assets for tax purposes. Mgmt X Newco Stock $10 Loan Newco Stock $150 Newco Target LLC interests P $160 Target LLC interests 20% 80% Target LLC 84

Asset Sale through LLC Conversion LLC conversion allows asset sale treatment without the requirement that assets continue to be held by a corporate buyer: Target is converted into an LLC immediately before the transaction. Mgmt. and P are taxed on the deemed liquidation of Target, but liquidation is tax-free to P under section 332. Mgmt. receives Newco LLC interests and P receives cash in exchange for Target LLC interests. Section 754 election for Target LLC provides stepped-up basis in assets X Newco LLC interests $10 Loan Newco LLC interests $150 Newco LLC Mgmt P $160 Target LLC interests 20% 80% Target LLC 85

Asset Sale through LLC Conversion LLC conversion allows asset sale treatment without the requirement that assets continue to be held by a corporate buyer: Target is converted into an LLC immediately before the transaction. Mgmt. and P are taxed on the deemed liquidation of Target, but liquidation is tax-free to P under section 332. Mgmt. receives Newco LLC interests and P receives cash in exchange for Target LLC interests. Section 754 election for Target LLC provides stepped-up basis in assets X Newco LLC interests $10 Loan Newco LLC interests $150 Newco LLC Mgmt P $160 Target LLC interests 20% 80% Target LLC 85

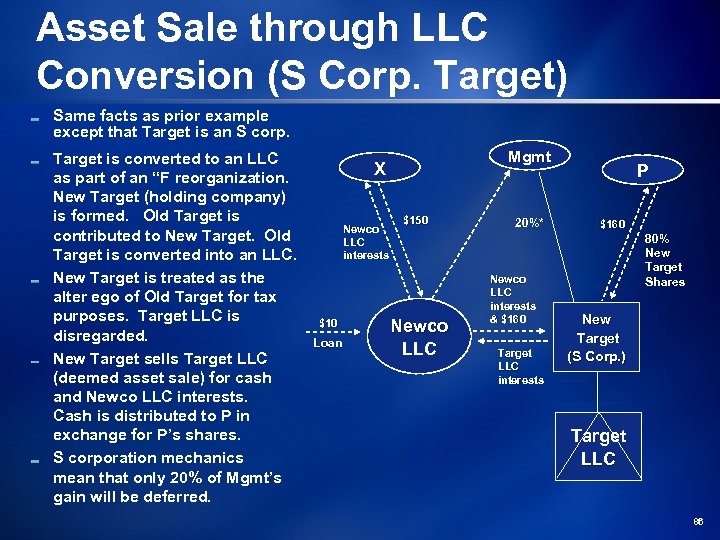

Asset Sale through LLC Conversion (S Corp. Target) Same facts as prior example except that Target is an S corp. Target is converted to an LLC as part of an “F reorganization. New Target (holding company) is formed. Old Target is contributed to New Target. Old Target is converted into an LLC. New Target is treated as the alter ego of Old Target for tax purposes. Target LLC is disregarded. New Target sells Target LLC (deemed asset sale) for cash and Newco LLC interests. Cash is distributed to P in exchange for P’s shares. S corporation mechanics mean that only 20% of Mgmt’s gain will be deferred. Mgmt X Newco LLC interests $10 Loan $150 Newco LLC 20%* Newco LLC interests & $160 Target LLC interests P $160 80% New Target Shares New Target (S Corp. ) Target LLC 86

Asset Sale through LLC Conversion (S Corp. Target) Same facts as prior example except that Target is an S corp. Target is converted to an LLC as part of an “F reorganization. New Target (holding company) is formed. Old Target is contributed to New Target. Old Target is converted into an LLC. New Target is treated as the alter ego of Old Target for tax purposes. Target LLC is disregarded. New Target sells Target LLC (deemed asset sale) for cash and Newco LLC interests. Cash is distributed to P in exchange for P’s shares. S corporation mechanics mean that only 20% of Mgmt’s gain will be deferred. Mgmt X Newco LLC interests $10 Loan $150 Newco LLC 20%* Newco LLC interests & $160 Target LLC interests P $160 80% New Target Shares New Target (S Corp. ) Target LLC 86

Minimizing Dividend Taxes on ‘PIK’ Preferred Stock

Minimizing Dividend Taxes on ‘PIK’ Preferred Stock

Significance to Participants ØForeign Investors Avoid U. S. withholding taxes Avoid accelerated liability for tax Potential tax exemption ØU. S. Investors Avoid accelerated liability for tax Capital gain conversion 88

Significance to Participants ØForeign Investors Avoid U. S. withholding taxes Avoid accelerated liability for tax Potential tax exemption ØU. S. Investors Avoid accelerated liability for tax Capital gain conversion 88

“Pre-Money” Valuation Disputes ØConversion Price = LP / # of Common Shares ØConversion Price usually ‘at-the-money’ ØPIK Preferred to bridge 89

“Pre-Money” Valuation Disputes ØConversion Price = LP / # of Common Shares ØConversion Price usually ‘at-the-money’ ØPIK Preferred to bridge 89

A Common Valuation Dispute The founders of XYZ Corp need to raise $20 million. They value the business at $30 million. Venture. Co proposes to invest $20 million in exchange for newly-issued convertible preferred stock, but values the business at only $20 million. So the founders propose that the preferred be convertible into 40% of the common stock (i. e. , $20/($20 + $30)), Venture. Co proposes that the preferred be convertible into 50% of the common stock (i. e. , $20/($20 + $20)). 90

A Common Valuation Dispute The founders of XYZ Corp need to raise $20 million. They value the business at $30 million. Venture. Co proposes to invest $20 million in exchange for newly-issued convertible preferred stock, but values the business at only $20 million. So the founders propose that the preferred be convertible into 40% of the common stock (i. e. , $20/($20 + $30)), Venture. Co proposes that the preferred be convertible into 50% of the common stock (i. e. , $20/($20 + $20)). 90

The ‘PIK’ Solution Ø XYZ Co issues PIK preferred stock, initially convertible into 40% of the underlying common. The PIK dividend rate is 8. 5%. Ø After 5 years, the preferred stock is now convertible into 50% of the common stock (i. e. , ($20 M x 1. 085)^5 = $30 M). Ø By “PIKing” the dividends, Venture. Co receives its desired conversion price after 5 years, even though it invested at a pre-money valuation of $30 million. 91

The ‘PIK’ Solution Ø XYZ Co issues PIK preferred stock, initially convertible into 40% of the underlying common. The PIK dividend rate is 8. 5%. Ø After 5 years, the preferred stock is now convertible into 50% of the common stock (i. e. , ($20 M x 1. 085)^5 = $30 M). Ø By “PIKing” the dividends, Venture. Co receives its desired conversion price after 5 years, even though it invested at a pre-money valuation of $30 million. 91

§ 305 Issues with PIK Preferred PIK dividend is taxed to the extent of E&P: ا 305 (b)(4): distributions ‘on’ preferred stock. ا 305 (b)(5): distributions ‘of’ convertible preferred stock ا 305 (b)(2): cash to some, increase in proportionate interest to others 92

§ 305 Issues with PIK Preferred PIK dividend is taxed to the extent of E&P: ا 305 (b)(4): distributions ‘on’ preferred stock. ا 305 (b)(5): distributions ‘of’ convertible preferred stock ا 305 (b)(2): cash to some, increase in proportionate interest to others 92

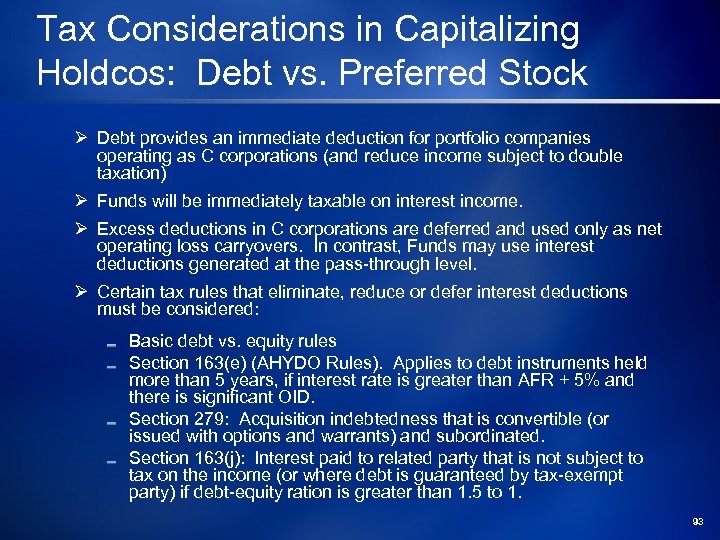

Tax Considerations in Capitalizing Holdcos: Debt vs. Preferred Stock Ø Debt provides an immediate deduction for portfolio companies operating as C corporations (and reduce income subject to double taxation) Ø Funds will be immediately taxable on interest income. Ø Excess deductions in C corporations are deferred and used only as net operating loss carryovers. In contrast, Funds may use interest deductions generated at the pass-through level. Ø Certain tax rules that eliminate, reduce or defer interest deductions must be considered: Basic debt vs. equity rules Section 163(e) (AHYDO Rules). Applies to debt instruments held more than 5 years, if interest rate is greater than AFR + 5% and there is significant OID. Section 279: Acquisition indebtedness that is convertible (or issued with options and warrants) and subordinated. Section 163(j): Interest paid to related party that is not subject to tax on the income (or where debt is guaranteed by tax-exempt party) if debt-equity ration is greater than 1. 5 to 1. 93

Tax Considerations in Capitalizing Holdcos: Debt vs. Preferred Stock Ø Debt provides an immediate deduction for portfolio companies operating as C corporations (and reduce income subject to double taxation) Ø Funds will be immediately taxable on interest income. Ø Excess deductions in C corporations are deferred and used only as net operating loss carryovers. In contrast, Funds may use interest deductions generated at the pass-through level. Ø Certain tax rules that eliminate, reduce or defer interest deductions must be considered: Basic debt vs. equity rules Section 163(e) (AHYDO Rules). Applies to debt instruments held more than 5 years, if interest rate is greater than AFR + 5% and there is significant OID. Section 279: Acquisition indebtedness that is convertible (or issued with options and warrants) and subordinated. Section 163(j): Interest paid to related party that is not subject to tax on the income (or where debt is guaranteed by tax-exempt party) if debt-equity ration is greater than 1. 5 to 1. 93

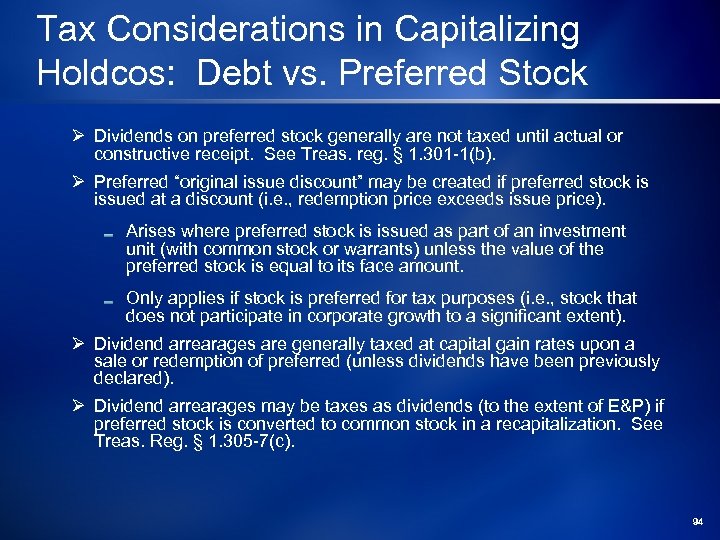

Tax Considerations in Capitalizing Holdcos: Debt vs. Preferred Stock Ø Dividends on preferred stock generally are not taxed until actual or constructive receipt. See Treas. reg. § 1. 301 -1(b). Ø Preferred “original issue discount” may be created if preferred stock is issued at a discount (i. e. , redemption price exceeds issue price). Arises where preferred stock is issued as part of an investment unit (with common stock or warrants) unless the value of the preferred stock is equal to its face amount. Only applies if stock is preferred for tax purposes (i. e. , stock that does not participate in corporate growth to a significant extent). Ø Dividend arrearages are generally taxed at capital gain rates upon a sale or redemption of preferred (unless dividends have been previously declared). Ø Dividend arrearages may be taxes as dividends (to the extent of E&P) if preferred stock is converted to common stock in a recapitalization. See Treas. Reg. § 1. 305 -7(c). 94

Tax Considerations in Capitalizing Holdcos: Debt vs. Preferred Stock Ø Dividends on preferred stock generally are not taxed until actual or constructive receipt. See Treas. reg. § 1. 301 -1(b). Ø Preferred “original issue discount” may be created if preferred stock is issued at a discount (i. e. , redemption price exceeds issue price). Arises where preferred stock is issued as part of an investment unit (with common stock or warrants) unless the value of the preferred stock is equal to its face amount. Only applies if stock is preferred for tax purposes (i. e. , stock that does not participate in corporate growth to a significant extent). Ø Dividend arrearages are generally taxed at capital gain rates upon a sale or redemption of preferred (unless dividends have been previously declared). Ø Dividend arrearages may be taxes as dividends (to the extent of E&P) if preferred stock is converted to common stock in a recapitalization. See Treas. Reg. § 1. 305 -7(c). 94

Tax Considerations in Making Private Equity Investments in Canada

Tax Considerations in Making Private Equity Investments in Canada

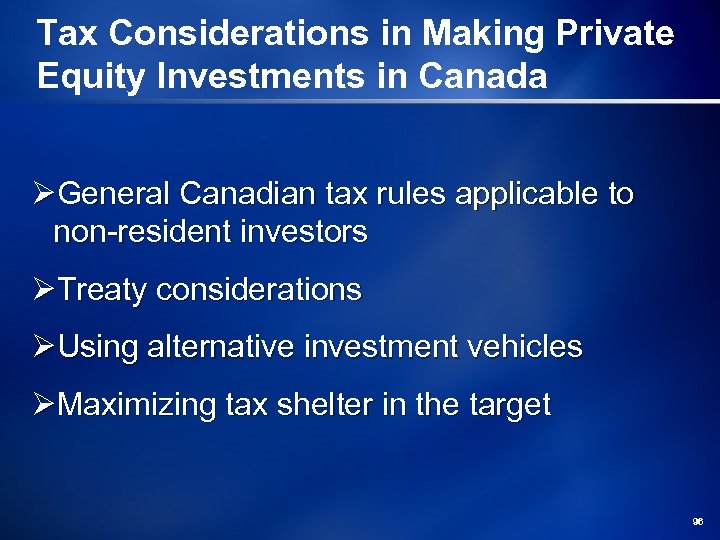

Tax Considerations in Making Private Equity Investments in Canada ØGeneral Canadian tax rules applicable to non-resident investors ØTreaty considerations ØUsing alternative investment vehicles ØMaximizing tax shelter in the target 96

Tax Considerations in Making Private Equity Investments in Canada ØGeneral Canadian tax rules applicable to non-resident investors ØTreaty considerations ØUsing alternative investment vehicles ØMaximizing tax shelter in the target 96

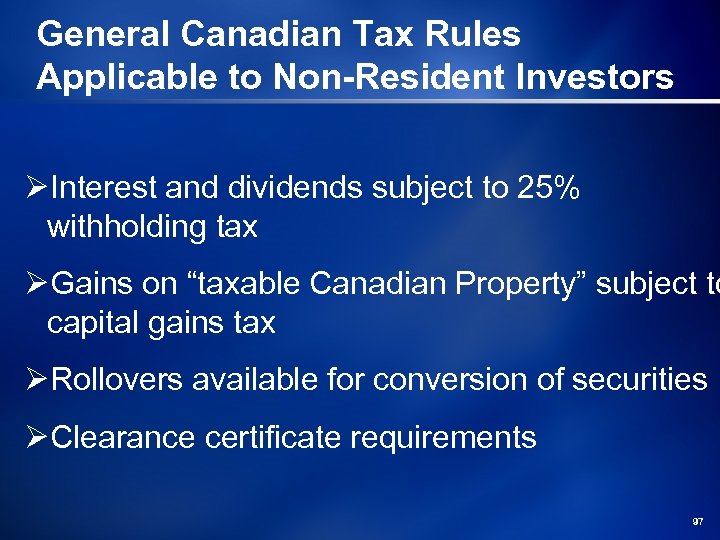

General Canadian Tax Rules Applicable to Non-Resident Investors ØInterest and dividends subject to 25% withholding tax ØGains on “taxable Canadian Property” subject to capital gains tax ØRollovers available for conversion of securities ØClearance certificate requirements 97

General Canadian Tax Rules Applicable to Non-Resident Investors ØInterest and dividends subject to 25% withholding tax ØGains on “taxable Canadian Property” subject to capital gains tax ØRollovers available for conversion of securities ØClearance certificate requirements 97

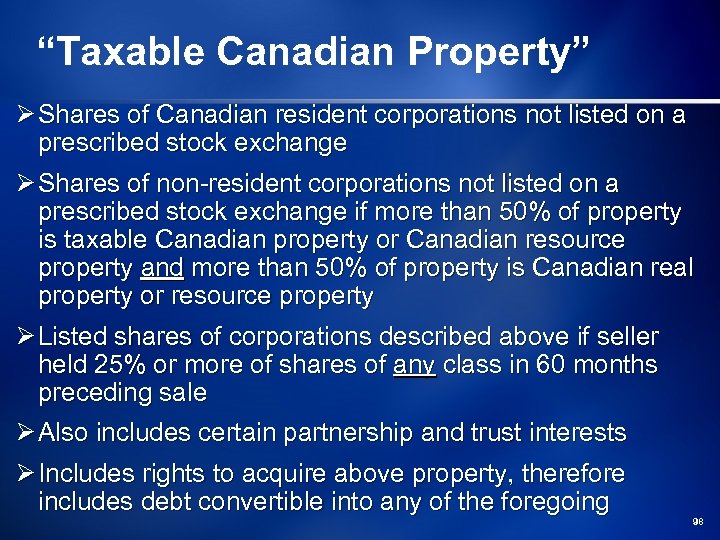

“Taxable Canadian Property” Ø Shares of Canadian resident corporations not listed on a prescribed stock exchange Ø Shares of non-resident corporations not listed on a prescribed stock exchange if more than 50% of property is taxable Canadian property or Canadian resource property and more than 50% of property is Canadian real property or resource property Ø Listed shares of corporations described above if seller held 25% or more of shares of any class in 60 months preceding sale Ø Also includes certain partnership and trust interests Ø Includes rights to acquire above property, therefore includes debt convertible into any of the foregoing 98

“Taxable Canadian Property” Ø Shares of Canadian resident corporations not listed on a prescribed stock exchange Ø Shares of non-resident corporations not listed on a prescribed stock exchange if more than 50% of property is taxable Canadian property or Canadian resource property and more than 50% of property is Canadian real property or resource property Ø Listed shares of corporations described above if seller held 25% or more of shares of any class in 60 months preceding sale Ø Also includes certain partnership and trust interests Ø Includes rights to acquire above property, therefore includes debt convertible into any of the foregoing 98

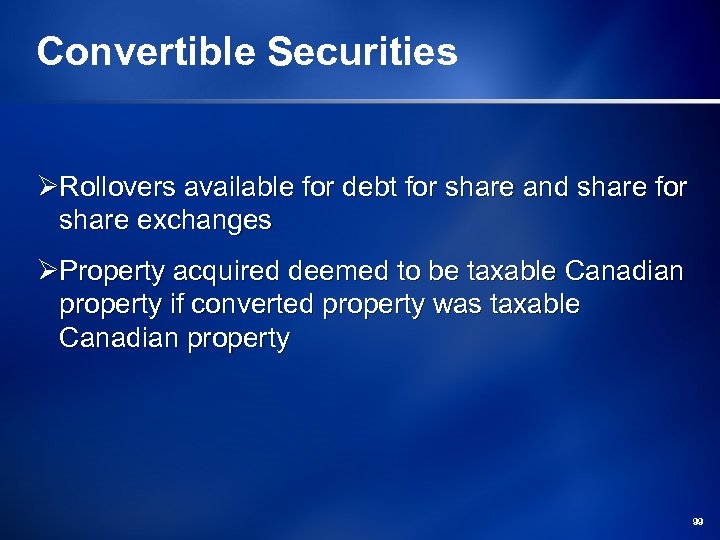

Convertible Securities ØRollovers available for debt for share and share for share exchanges ØProperty acquired deemed to be taxable Canadian property if converted property was taxable Canadian property 99

Convertible Securities ØRollovers available for debt for share and share for share exchanges ØProperty acquired deemed to be taxable Canadian property if converted property was taxable Canadian property 99

Clearance Certificates ØSection 116 clearance certificate required when non-resident sells taxable Canadian property that is not “excluded property” ØExcluded property includes shares listed on a prescribed stock exchange, debt obligations and “deemed” taxable Canadian property ØInformation required for all vendors including partners of partnerships ØCould be administratively burdensome procedure 100

Clearance Certificates ØSection 116 clearance certificate required when non-resident sells taxable Canadian property that is not “excluded property” ØExcluded property includes shares listed on a prescribed stock exchange, debt obligations and “deemed” taxable Canadian property ØInformation required for all vendors including partners of partnerships ØCould be administratively burdensome procedure 100

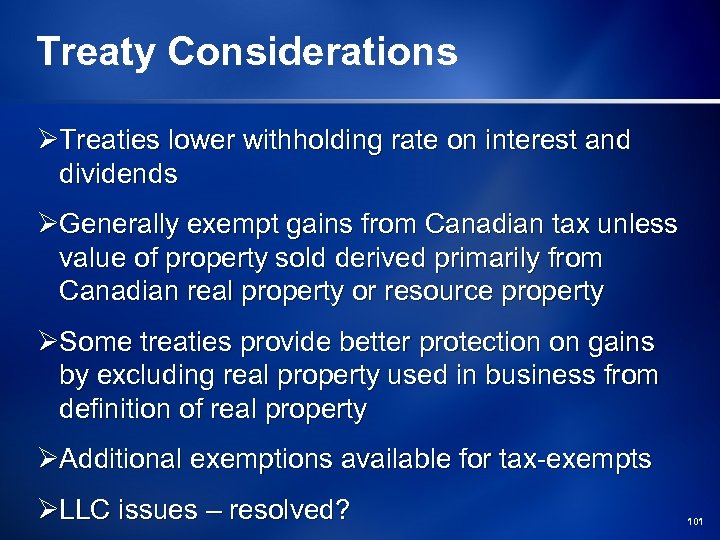

Treaty Considerations ØTreaties lower withholding rate on interest and dividends ØGenerally exempt gains from Canadian tax unless value of property sold derived primarily from Canadian real property or resource property ØSome treaties provide better protection on gains by excluding real property used in business from definition of real property ØAdditional exemptions available for tax-exempts ØLLC issues – resolved? 101

Treaty Considerations ØTreaties lower withholding rate on interest and dividends ØGenerally exempt gains from Canadian tax unless value of property sold derived primarily from Canadian real property or resource property ØSome treaties provide better protection on gains by excluding real property used in business from definition of real property ØAdditional exemptions available for tax-exempts ØLLC issues – resolved? 101

Alternative Investment Vehicles ØCanadian investments may be made through intermediary entities in offshore jurisdictions such as Barbados, Luxembourg ØAdvantages: added treaty protection simplified clearance certificate procedures ØDisadvantages: maintenance costs, inconvenience assessment risk 102

Alternative Investment Vehicles ØCanadian investments may be made through intermediary entities in offshore jurisdictions such as Barbados, Luxembourg ØAdvantages: added treaty protection simplified clearance certificate procedures ØDisadvantages: maintenance costs, inconvenience assessment risk 102

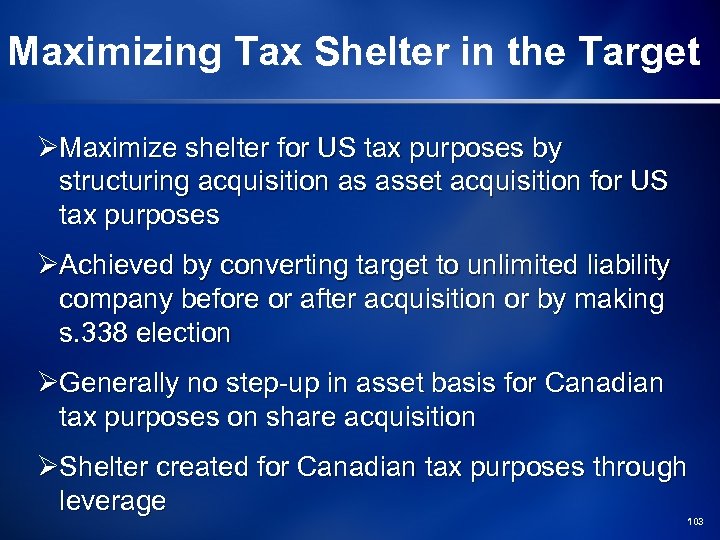

Maximizing Tax Shelter in the Target ØMaximize shelter for US tax purposes by structuring acquisition as asset acquisition for US tax purposes ØAchieved by converting target to unlimited liability company before or after acquisition or by making s. 338 election ØGenerally no step-up in asset basis for Canadian tax purposes on share acquisition ØShelter created for Canadian tax purposes through leverage 103

Maximizing Tax Shelter in the Target ØMaximize shelter for US tax purposes by structuring acquisition as asset acquisition for US tax purposes ØAchieved by converting target to unlimited liability company before or after acquisition or by making s. 338 election ØGenerally no step-up in asset basis for Canadian tax purposes on share acquisition ØShelter created for Canadian tax purposes through leverage 103

Leveraged Equity ØEquity to be used for acquisition can be structured as two-thirds debt for Canadian tax purposes Ø 2: 1 debt to equity ratio required to comply with Canadian thin capitalization rules ØPossible to structure so no immediate income inclusion for interest on debt by using “blocker” entity Ø 35% tax savings achieved in exchange for 10% withholding tax 104

Leveraged Equity ØEquity to be used for acquisition can be structured as two-thirds debt for Canadian tax purposes Ø 2: 1 debt to equity ratio required to comply with Canadian thin capitalization rules ØPossible to structure so no immediate income inclusion for interest on debt by using “blocker” entity Ø 35% tax savings achieved in exchange for 10% withholding tax 104

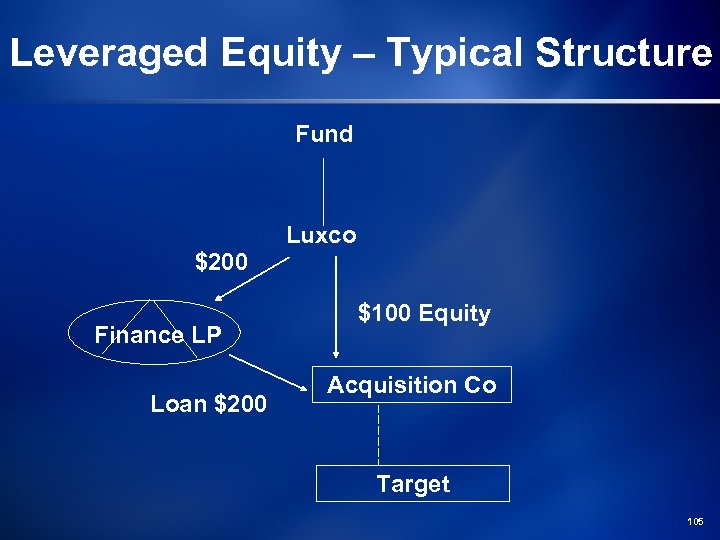

Leveraged Equity – Typical Structure Fund $200 Finance LP Loan $200 Luxco $100 Equity Acquisition Co Target 105

Leveraged Equity – Typical Structure Fund $200 Finance LP Loan $200 Luxco $100 Equity Acquisition Co Target 105

QUESTIONS & ANSWERS

QUESTIONS & ANSWERS