59224b3fdef4df8a43896056d58ea091.ppt

- Количество слайдов: 94

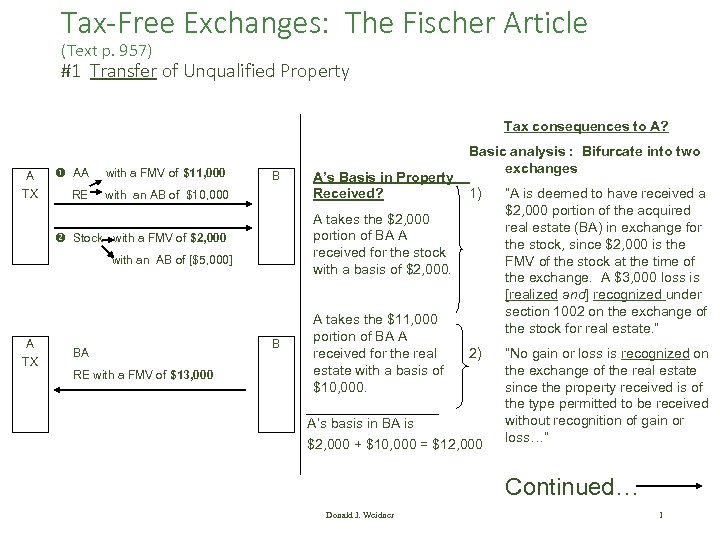

Tax-Free Exchanges: The Fischer Article (Text p. 957) #1 Transfer of Unqualified Property Tax consequences to A? A TX AA with a FMV of $11, 000 RE with an AB of $10, 000 B with an AB of [$5, 000] BA RE with a FMV of $13, 000 1) “A is deemed to have received a $2, 000 portion of the acquired real estate (BA) in exchange for the stock, since $2, 000 is the FMV of the stock at the time of the exchange. A $3, 000 loss is [realized and] recognized under section 1002 on the exchange of the stock for real estate. ” 2) “No gain or loss is recognized on the exchange of the real estate since the property received is of the type permitted to be received without recognition of gain or loss…” A takes the $2, 000 portion of BA A received for the stock with a basis of $2, 000. v Stock with a FMV of $2, 000 A TX A’s Basis in Property Received? Basic analysis : Bifurcate into two exchanges B A takes the $11, 000 portion of BA A received for the real estate with a basis of $10, 000. A’s basis in BA is $2, 000 + $10, 000 = $12, 000 Continued… Donald J. Weidner 1

Tax-Free Exchanges: The Fischer Article (Text p. 957) #1 Transfer of Unqualified Property Tax consequences to A? A TX AA with a FMV of $11, 000 RE with an AB of $10, 000 B with an AB of [$5, 000] BA RE with a FMV of $13, 000 1) “A is deemed to have received a $2, 000 portion of the acquired real estate (BA) in exchange for the stock, since $2, 000 is the FMV of the stock at the time of the exchange. A $3, 000 loss is [realized and] recognized under section 1002 on the exchange of the stock for real estate. ” 2) “No gain or loss is recognized on the exchange of the real estate since the property received is of the type permitted to be received without recognition of gain or loss…” A takes the $2, 000 portion of BA A received for the stock with a basis of $2, 000. v Stock with a FMV of $2, 000 A TX A’s Basis in Property Received? Basic analysis : Bifurcate into two exchanges B A takes the $11, 000 portion of BA A received for the real estate with a basis of $10, 000. A’s basis in BA is $2, 000 + $10, 000 = $12, 000 Continued… Donald J. Weidner 1

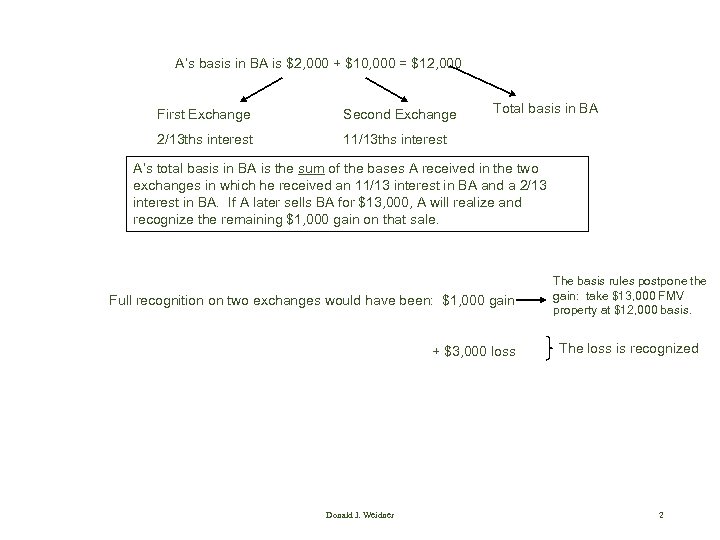

A’s basis in BA is $2, 000 + $10, 000 = $12, 000 First Exchange Second Exchange 2/13 ths interest Total basis in BA 11/13 ths interest A’s total basis in BA is the sum of the bases A received in the two exchanges in which he received an 11/13 interest in BA and a 2/13 interest in BA. If A later sells BA for $13, 000, A will realize and recognize the remaining $1, 000 gain on that sale. Full recognition on two exchanges would have been: $1, 000 gain + $3, 000 loss Donald J. Weidner The basis rules postpone the gain: take $13, 000 FMV property at $12, 000 basis. The loss is recognized 2

A’s basis in BA is $2, 000 + $10, 000 = $12, 000 First Exchange Second Exchange 2/13 ths interest Total basis in BA 11/13 ths interest A’s total basis in BA is the sum of the bases A received in the two exchanges in which he received an 11/13 interest in BA and a 2/13 interest in BA. If A later sells BA for $13, 000, A will realize and recognize the remaining $1, 000 gain on that sale. Full recognition on two exchanges would have been: $1, 000 gain + $3, 000 loss Donald J. Weidner The basis rules postpone the gain: take $13, 000 FMV property at $12, 000 basis. The loss is recognized 2

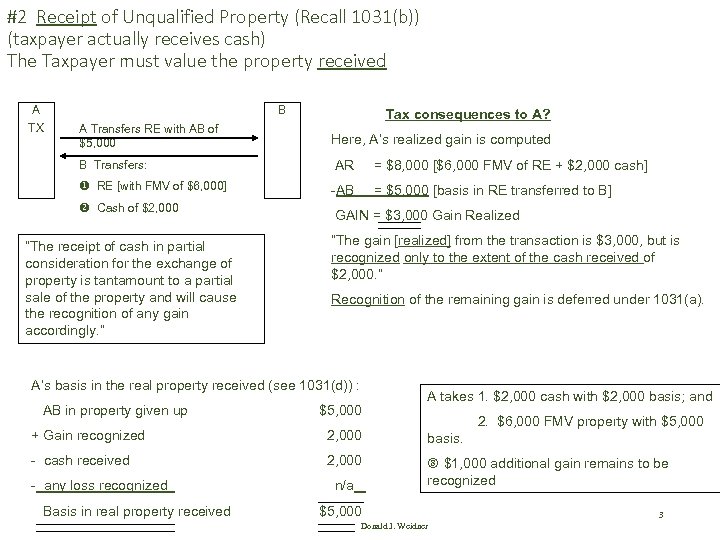

#2 Receipt of Unqualified Property (Recall 1031(b)) (taxpayer actually receives cash) The Taxpayer must value the property received A TX B A Transfers RE with AB of $5, 000 B Transfers: RE [with FMV of $6, 000] v Cash of $2, 000 “The receipt of cash in partial consideration for the exchange of property is tantamount to a partial sale of the property and will cause the recognition of any gain accordingly. ” Tax consequences to A? Here, A’s realized gain is computed AR = $8, 000 [$6, 000 FMV of RE + $2, 000 cash] -AB = $5, 000 [basis in RE transferred to B] GAIN = $3, 000 Gain Realized “The gain [realized] from the transaction is $3, 000, but is recognized only to the extent of the cash received of $2, 000. ” Recognition of the remaining gain is deferred under 1031(a). A’s basis in the real property received (see 1031(d)) : AB in property given up $5, 000 A takes 1. $2, 000 cash with $2, 000 basis; and 2. $6, 000 FMV property with $5, 000 + Gain recognized 2, 000 basis. - cash received 2, 000 $1, 000 additional gain remains to be recognized - any loss recognized Basis in real property received n/a $5, 000 Donald J. Weidner 3

#2 Receipt of Unqualified Property (Recall 1031(b)) (taxpayer actually receives cash) The Taxpayer must value the property received A TX B A Transfers RE with AB of $5, 000 B Transfers: RE [with FMV of $6, 000] v Cash of $2, 000 “The receipt of cash in partial consideration for the exchange of property is tantamount to a partial sale of the property and will cause the recognition of any gain accordingly. ” Tax consequences to A? Here, A’s realized gain is computed AR = $8, 000 [$6, 000 FMV of RE + $2, 000 cash] -AB = $5, 000 [basis in RE transferred to B] GAIN = $3, 000 Gain Realized “The gain [realized] from the transaction is $3, 000, but is recognized only to the extent of the cash received of $2, 000. ” Recognition of the remaining gain is deferred under 1031(a). A’s basis in the real property received (see 1031(d)) : AB in property given up $5, 000 A takes 1. $2, 000 cash with $2, 000 basis; and 2. $6, 000 FMV property with $5, 000 + Gain recognized 2, 000 basis. - cash received 2, 000 $1, 000 additional gain remains to be recognized - any loss recognized Basis in real property received n/a $5, 000 Donald J. Weidner 3

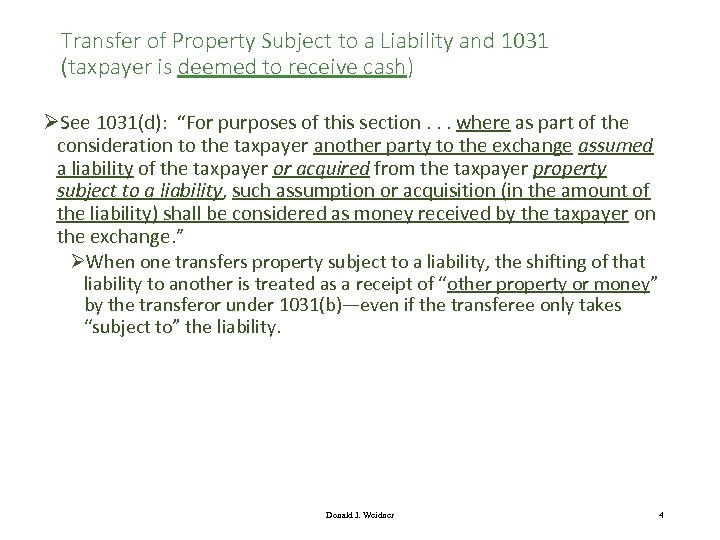

Transfer of Property Subject to a Liability and 1031 (taxpayer is deemed to receive cash) ØSee 1031(d): “For purposes of this section. . . where as part of the consideration to the taxpayer another party to the exchange assumed a liability of the taxpayer or acquired from the taxpayer property subject to a liability, such assumption or acquisition (in the amount of the liability) shall be considered as money received by the taxpayer on the exchange. ” ØWhen one transfers property subject to a liability, the shifting of that liability to another is treated as a receipt of “other property or money” by the transferor under 1031(b)—even if the transferee only takes “subject to” the liability. Donald J. Weidner 4

Transfer of Property Subject to a Liability and 1031 (taxpayer is deemed to receive cash) ØSee 1031(d): “For purposes of this section. . . where as part of the consideration to the taxpayer another party to the exchange assumed a liability of the taxpayer or acquired from the taxpayer property subject to a liability, such assumption or acquisition (in the amount of the liability) shall be considered as money received by the taxpayer on the exchange. ” ØWhen one transfers property subject to a liability, the shifting of that liability to another is treated as a receipt of “other property or money” by the transferor under 1031(b)—even if the transferee only takes “subject to” the liability. Donald J. Weidner 4

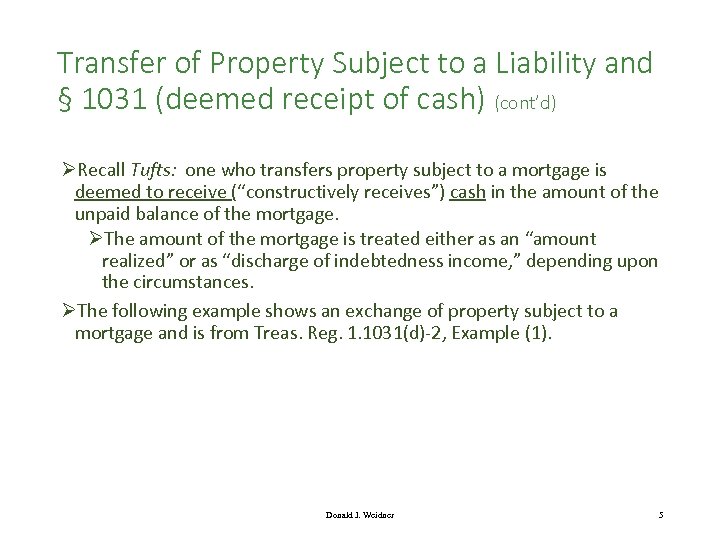

Transfer of Property Subject to a Liability and § 1031 (deemed receipt of cash) (cont’d) ØRecall Tufts: one who transfers property subject to a mortgage is deemed to receive (“constructively receives”) cash in the amount of the unpaid balance of the mortgage. ØThe amount of the mortgage is treated either as an “amount realized” or as “discharge of indebtedness income, ” depending upon the circumstances. ØThe following example shows an exchange of property subject to a mortgage and is from Treas. Reg. 1. 1031(d)-2, Example (1). Donald J. Weidner 5

Transfer of Property Subject to a Liability and § 1031 (deemed receipt of cash) (cont’d) ØRecall Tufts: one who transfers property subject to a mortgage is deemed to receive (“constructively receives”) cash in the amount of the unpaid balance of the mortgage. ØThe amount of the mortgage is treated either as an “amount realized” or as “discharge of indebtedness income, ” depending upon the circumstances. ØThe following example shows an exchange of property subject to a mortgage and is from Treas. Reg. 1. 1031(d)-2, Example (1). Donald J. Weidner 5

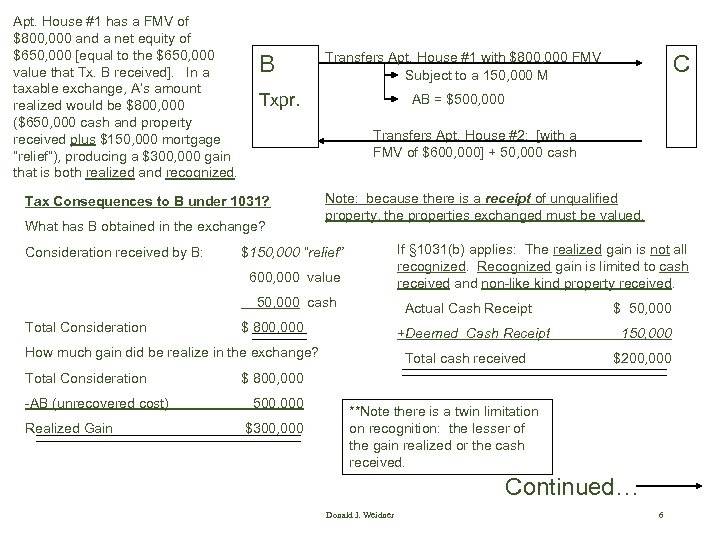

Apt. House #1 has a FMV of $800, 000 and a net equity of $650, 000 [equal to the $650, 000 value that Tx. B received]. In a taxable exchange, A’s amount realized would be $800, 000 ($650, 000 cash and property received plus $150, 000 mortgage “relief”), producing a $300, 000 gain that is both realized and recognized. B Txpr. What has B obtained in the exchange? AB = $500, 000 Note: because there is a receipt of unqualified property, the properties exchanged must be valued. If § 1031(b) applies: The realized gain is not all recognized. Recognized gain is limited to cash received and non-like kind property received. $150, 000 “relief” 600, 000 value 50, 000 cash Total Consideration Actual Cash Receipt $ 800, 000 +Deemed Cash Receipt How much gain did be realize in the exchange? Total Consideration -AB (unrecovered cost) Realized Gain C Transfers Apt. House #2: [with a FMV of $600, 000] + 50, 000 cash Tax Consequences to B under 1031? Consideration received by B: Transfers Apt. House #1 with $800, 000 FMV Subject to a 150, 000 M Total cash received $ 50, 000 150, 000 $200, 000 $ 800, 000 500, 000 $300, 000 **Note there is a twin limitation on recognition: the lesser of the gain realized or the cash received. Continued… Donald J. Weidner 6

Apt. House #1 has a FMV of $800, 000 and a net equity of $650, 000 [equal to the $650, 000 value that Tx. B received]. In a taxable exchange, A’s amount realized would be $800, 000 ($650, 000 cash and property received plus $150, 000 mortgage “relief”), producing a $300, 000 gain that is both realized and recognized. B Txpr. What has B obtained in the exchange? AB = $500, 000 Note: because there is a receipt of unqualified property, the properties exchanged must be valued. If § 1031(b) applies: The realized gain is not all recognized. Recognized gain is limited to cash received and non-like kind property received. $150, 000 “relief” 600, 000 value 50, 000 cash Total Consideration Actual Cash Receipt $ 800, 000 +Deemed Cash Receipt How much gain did be realize in the exchange? Total Consideration -AB (unrecovered cost) Realized Gain C Transfers Apt. House #2: [with a FMV of $600, 000] + 50, 000 cash Tax Consequences to B under 1031? Consideration received by B: Transfers Apt. House #1 with $800, 000 FMV Subject to a 150, 000 M Total cash received $ 50, 000 150, 000 $200, 000 $ 800, 000 500, 000 $300, 000 **Note there is a twin limitation on recognition: the lesser of the gain realized or the cash received. Continued… Donald J. Weidner 6

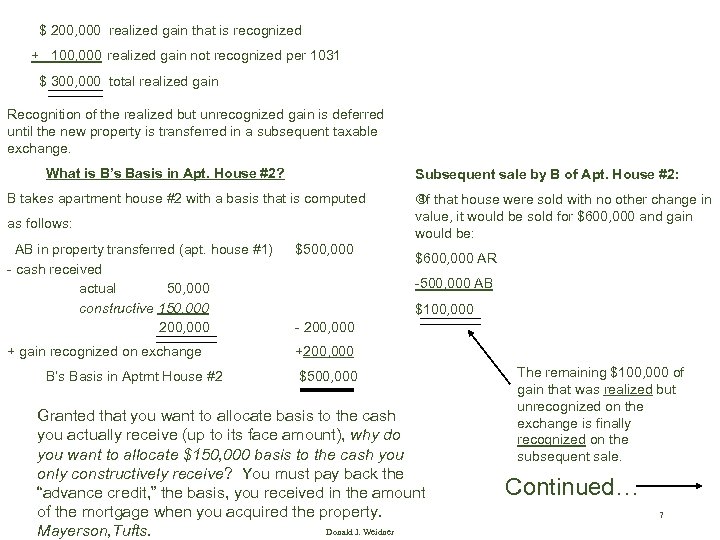

$ 200, 000 realized gain that is recognized + 100, 000 realized gain not recognized per 1031 $ 300, 000 total realized gain Recognition of the realized but unrecognized gain is deferred until the new property is transferred in a subsequent taxable exchange. What is B’s Basis in Apt. House #2? Subsequent sale by B of Apt. House #2: B takes apartment house #2 with a basis that is computed as follows: AB in property transferred (apt. house #1) - cash received actual 50, 000 constructive 150, 000 200, 000 $500, 000 + gain recognized on exchange that house were sold with no other change in If value, it would be sold for $600, 000 and gain would be: +200, 000 B’s Basis in Aptmt House #2 $600, 000 AR -500, 000 AB $100, 000 - 200, 000 $500, 000 Granted that you want to allocate basis to the cash you actually receive (up to its face amount), why do you want to allocate $150, 000 basis to the cash you only constructively receive? You must pay back the “advance credit, ” the basis, you received in the amount of the mortgage when you acquired the property. Donald J. Weidner Mayerson, Tufts. The remaining $100, 000 of gain that was realized but unrecognized on the exchange is finally recognized on the subsequent sale. Continued… 7

$ 200, 000 realized gain that is recognized + 100, 000 realized gain not recognized per 1031 $ 300, 000 total realized gain Recognition of the realized but unrecognized gain is deferred until the new property is transferred in a subsequent taxable exchange. What is B’s Basis in Apt. House #2? Subsequent sale by B of Apt. House #2: B takes apartment house #2 with a basis that is computed as follows: AB in property transferred (apt. house #1) - cash received actual 50, 000 constructive 150, 000 200, 000 $500, 000 + gain recognized on exchange that house were sold with no other change in If value, it would be sold for $600, 000 and gain would be: +200, 000 B’s Basis in Aptmt House #2 $600, 000 AR -500, 000 AB $100, 000 - 200, 000 $500, 000 Granted that you want to allocate basis to the cash you actually receive (up to its face amount), why do you want to allocate $150, 000 basis to the cash you only constructively receive? You must pay back the “advance credit, ” the basis, you received in the amount of the mortgage when you acquired the property. Donald J. Weidner Mayerson, Tufts. The remaining $100, 000 of gain that was realized but unrecognized on the exchange is finally recognized on the subsequent sale. Continued… 7

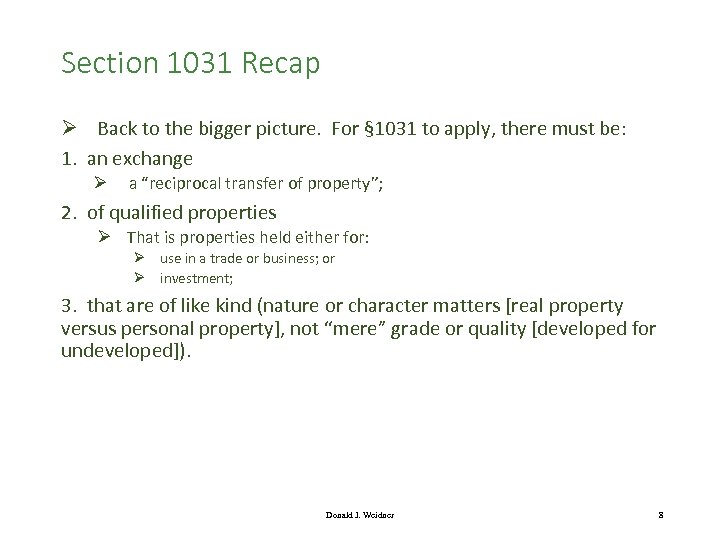

Section 1031 Recap Ø Back to the bigger picture. For § 1031 to apply, there must be: 1. an exchange Ø a “reciprocal transfer of property”; 2. of qualified properties Ø That is properties held either for: Ø use in a trade or business; or Ø investment; 3. that are of like kind (nature or character matters [real property versus personal property], not “mere” grade or quality [developed for undeveloped]). Donald J. Weidner 8

Section 1031 Recap Ø Back to the bigger picture. For § 1031 to apply, there must be: 1. an exchange Ø a “reciprocal transfer of property”; 2. of qualified properties Ø That is properties held either for: Ø use in a trade or business; or Ø investment; 3. that are of like kind (nature or character matters [real property versus personal property], not “mere” grade or quality [developed for undeveloped]). Donald J. Weidner 8

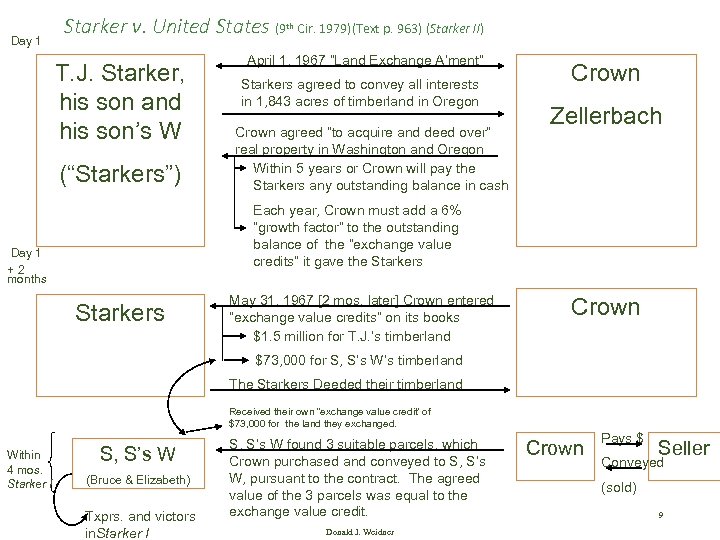

Day 1 Starker v. United States (9 th Cir. 1979)(Text p. 963) (Starker II) T. J. Starker, his son and his son’s W (“Starkers”) April 1, 1967 “Land Exchange A’ment” Starkers agreed to convey all interests in 1, 843 acres of timberland in Oregon Crown agreed “to acquire and deed over” real property in Washington and Oregon Within 5 years or Crown will pay the Starkers any outstanding balance in cash Crown Zellerbach Each year, Crown must add a 6% “growth factor” to the outstanding balance of the “exchange value credits” it gave the Starkers Day 1 +2 months Starkers May 31, 1967 [2 mos. later] Crown entered “exchange value credits” on its books $1. 5 million for T. J. ’s timberland Crown $73, 000 for S, S’s W’s timberland The Starkers Deeded their timberland Received their own “exchange value credit’ of $73, 000 for the land they exchanged. Within 4 mos. Starker I S, S’s W (Bruce & Elizabeth) Txprs. and victors in. Starker I S, S’s W found 3 suitable parcels, which Crown purchased and conveyed to S, S’s W, pursuant to the contract. The agreed value of the 3 parcels was equal to the exchange value credit. Donald J. Weidner Crown Pays $ Seller Conveyed (sold) 9

Day 1 Starker v. United States (9 th Cir. 1979)(Text p. 963) (Starker II) T. J. Starker, his son and his son’s W (“Starkers”) April 1, 1967 “Land Exchange A’ment” Starkers agreed to convey all interests in 1, 843 acres of timberland in Oregon Crown agreed “to acquire and deed over” real property in Washington and Oregon Within 5 years or Crown will pay the Starkers any outstanding balance in cash Crown Zellerbach Each year, Crown must add a 6% “growth factor” to the outstanding balance of the “exchange value credits” it gave the Starkers Day 1 +2 months Starkers May 31, 1967 [2 mos. later] Crown entered “exchange value credits” on its books $1. 5 million for T. J. ’s timberland Crown $73, 000 for S, S’s W’s timberland The Starkers Deeded their timberland Received their own “exchange value credit’ of $73, 000 for the land they exchanged. Within 4 mos. Starker I S, S’s W (Bruce & Elizabeth) Txprs. and victors in. Starker I S, S’s W found 3 suitable parcels, which Crown purchased and conveyed to S, S’s W, pursuant to the contract. The agreed value of the 3 parcels was equal to the exchange value credit. Donald J. Weidner Crown Pays $ Seller Conveyed (sold) 9

Starker I and Starker II: The Nonsimultaneous Transfers ØThe son and his wife were the taxpayers in Starker I—they defeated an IRS attempt to deny them 1031 treatment. ØHaving lost against the son and his wife, the IRS went after the father in Starker II. ØThe 9 th Circuit concluded that Starker I collaterally estopped the IRS from attacking the portion of the exchange dealing with 9 parcels that Crown purchased and conveyed to the father. ØWhich left with only 3 parcels to discuss in Starker II. ØNone of the 3 parcels discussed in Starker II was deeded to the father, T. J. (or to his daughter), at or near the time T. J. conveyed his timberland to Crown. ØThat is, the common issue as to all three parcels is that the reciprocal transfers were not simultaneous. Donald J. Weidner 10

Starker I and Starker II: The Nonsimultaneous Transfers ØThe son and his wife were the taxpayers in Starker I—they defeated an IRS attempt to deny them 1031 treatment. ØHaving lost against the son and his wife, the IRS went after the father in Starker II. ØThe 9 th Circuit concluded that Starker I collaterally estopped the IRS from attacking the portion of the exchange dealing with 9 parcels that Crown purchased and conveyed to the father. ØWhich left with only 3 parcels to discuss in Starker II. ØNone of the 3 parcels discussed in Starker II was deeded to the father, T. J. (or to his daughter), at or near the time T. J. conveyed his timberland to Crown. ØThat is, the common issue as to all three parcels is that the reciprocal transfers were not simultaneous. Donald J. Weidner 10

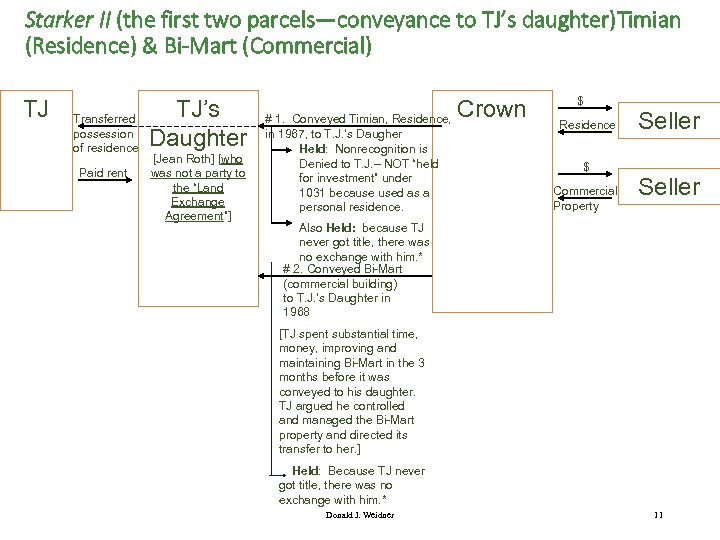

Starker II (the first two parcels—conveyance to TJ’s daughter)Timian (Residence) & Bi-Mart (Commercial) TJ Transferred possession of residence Paid rent TJ’s Daughter [Jean Roth] [who was not a party to the “Land Exchange Agreement”] Crown # 1. Conveyed Timian, Residence, in 1967, to T. J. ’s Daugher Held: Nonrecognition is Denied to T. J. – NOT “held for investment” under 1031 because used as a personal residence. $ Residence $ Commercial Property Seller Also Held: because TJ never got title, there was no exchange with him. * # 2. Conveyed Bi-Mart (commercial building) to T. J. ’s Daughter in 1968 [TJ spent substantial time, money, improving and maintaining Bi-Mart in the 3 months before it was conveyed to his daughter. TJ argued he controlled and managed the Bi-Mart property and directed its transfer to her. ] Held: Because TJ never got title, there was no exchange with him. * Donald J. Weidner 11

Starker II (the first two parcels—conveyance to TJ’s daughter)Timian (Residence) & Bi-Mart (Commercial) TJ Transferred possession of residence Paid rent TJ’s Daughter [Jean Roth] [who was not a party to the “Land Exchange Agreement”] Crown # 1. Conveyed Timian, Residence, in 1967, to T. J. ’s Daugher Held: Nonrecognition is Denied to T. J. – NOT “held for investment” under 1031 because used as a personal residence. $ Residence $ Commercial Property Seller Also Held: because TJ never got title, there was no exchange with him. * # 2. Conveyed Bi-Mart (commercial building) to T. J. ’s Daughter in 1968 [TJ spent substantial time, money, improving and maintaining Bi-Mart in the 3 months before it was conveyed to his daughter. TJ argued he controlled and managed the Bi-Mart property and directed its transfer to her. ] Held: Because TJ never got title, there was no exchange with him. * Donald J. Weidner 11

Starker II— IRS Arguments about the Timian (residence) Property Conveyed to T. J. ’s Daughter 1. First, There was no “exchange” of property with T. J. because there was no transfer to TJ-- title to the Timian property never went to T. J. ØBecause there was no identity of economic interests between T. J. and his daughter, a transfer to her did not constitute a transfer to him. Ø The court accepted this argument 2. Second, even if there were transfers of property to TJ, they were not “reciprocal” because they were not simultaneous (recall, IRS Regs. define an exchange as a “reciprocal transfer of property”) ØInstead, there was a sale on credit rather than an exchange. Ø Note, this is a plausible argument against all three transfers involved in “Starker II” Donald J. Weidner 12

Starker II— IRS Arguments about the Timian (residence) Property Conveyed to T. J. ’s Daughter 1. First, There was no “exchange” of property with T. J. because there was no transfer to TJ-- title to the Timian property never went to T. J. ØBecause there was no identity of economic interests between T. J. and his daughter, a transfer to her did not constitute a transfer to him. Ø The court accepted this argument 2. Second, even if there were transfers of property to TJ, they were not “reciprocal” because they were not simultaneous (recall, IRS Regs. define an exchange as a “reciprocal transfer of property”) ØInstead, there was a sale on credit rather than an exchange. Ø Note, this is a plausible argument against all three transfers involved in “Starker II” Donald J. Weidner 12

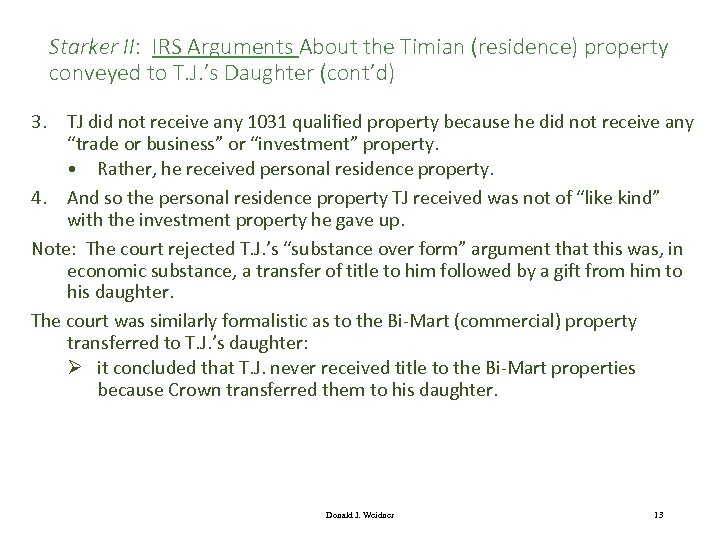

Starker II: IRS Arguments About the Timian (residence) property conveyed to T. J. ’s Daughter (cont’d) 3. TJ did not receive any 1031 qualified property because he did not receive any “trade or business” or “investment” property. • Rather, he received personal residence property. 4. And so the personal residence property TJ received was not of “like kind” with the investment property he gave up. Note: The court rejected T. J. ’s “substance over form” argument that this was, in economic substance, a transfer of title to him followed by a gift from him to his daughter. The court was similarly formalistic as to the Bi-Mart (commercial) property transferred to T. J. ’s daughter: Ø it concluded that T. J. never received title to the Bi-Mart properties because Crown transferred them to his daughter. Donald J. Weidner 13

Starker II: IRS Arguments About the Timian (residence) property conveyed to T. J. ’s Daughter (cont’d) 3. TJ did not receive any 1031 qualified property because he did not receive any “trade or business” or “investment” property. • Rather, he received personal residence property. 4. And so the personal residence property TJ received was not of “like kind” with the investment property he gave up. Note: The court rejected T. J. ’s “substance over form” argument that this was, in economic substance, a transfer of title to him followed by a gift from him to his daughter. The court was similarly formalistic as to the Bi-Mart (commercial) property transferred to T. J. ’s daughter: Ø it concluded that T. J. never received title to the Bi-Mart properties because Crown transferred them to his daughter. Donald J. Weidner 13

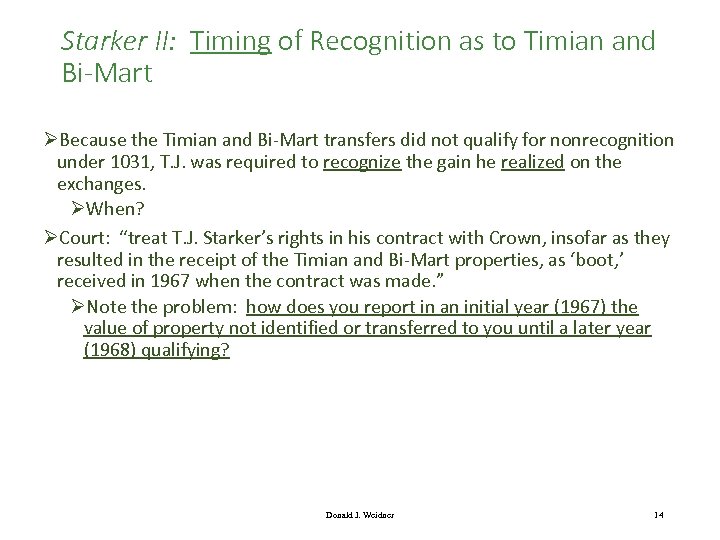

Starker II: Timing of Recognition as to Timian and Bi-Mart ØBecause the Timian and Bi-Mart transfers did not qualify for nonrecognition under 1031, T. J. was required to recognize the gain he realized on the exchanges. ØWhen? ØCourt: “treat T. J. Starker’s rights in his contract with Crown, insofar as they resulted in the receipt of the Timian and Bi-Mart properties, as ‘boot, ’ received in 1967 when the contract was made. ” ØNote the problem: how does you report in an initial year (1967) the value of property not identified or transferred to you until a later year (1968) qualifying? Donald J. Weidner 14

Starker II: Timing of Recognition as to Timian and Bi-Mart ØBecause the Timian and Bi-Mart transfers did not qualify for nonrecognition under 1031, T. J. was required to recognize the gain he realized on the exchanges. ØWhen? ØCourt: “treat T. J. Starker’s rights in his contract with Crown, insofar as they resulted in the receipt of the Timian and Bi-Mart properties, as ‘boot, ’ received in 1967 when the contract was made. ” ØNote the problem: how does you report in an initial year (1967) the value of property not identified or transferred to you until a later year (1968) qualifying? Donald J. Weidner 14

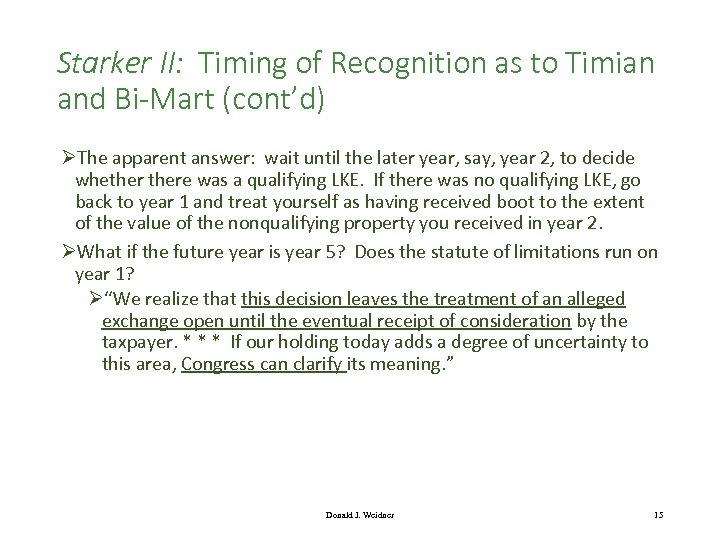

Starker II: Timing of Recognition as to Timian and Bi-Mart (cont’d) ØThe apparent answer: wait until the later year, say, year 2, to decide whethere was a qualifying LKE. If there was no qualifying LKE, go back to year 1 and treat yourself as having received boot to the extent of the value of the nonqualifying property you received in year 2. ØWhat if the future year is year 5? Does the statute of limitations run on year 1? Ø“We realize that this decision leaves the treatment of an alleged exchange open until the eventual receipt of consideration by the taxpayer. * * * If our holding today adds a degree of uncertainty to this area, Congress can clarify its meaning. ” Donald J. Weidner 15

Starker II: Timing of Recognition as to Timian and Bi-Mart (cont’d) ØThe apparent answer: wait until the later year, say, year 2, to decide whethere was a qualifying LKE. If there was no qualifying LKE, go back to year 1 and treat yourself as having received boot to the extent of the value of the nonqualifying property you received in year 2. ØWhat if the future year is year 5? Does the statute of limitations run on year 1? Ø“We realize that this decision leaves the treatment of an alleged exchange open until the eventual receipt of consideration by the taxpayer. * * * If our holding today adds a degree of uncertainty to this area, Congress can clarify its meaning. ” Donald J. Weidner 15

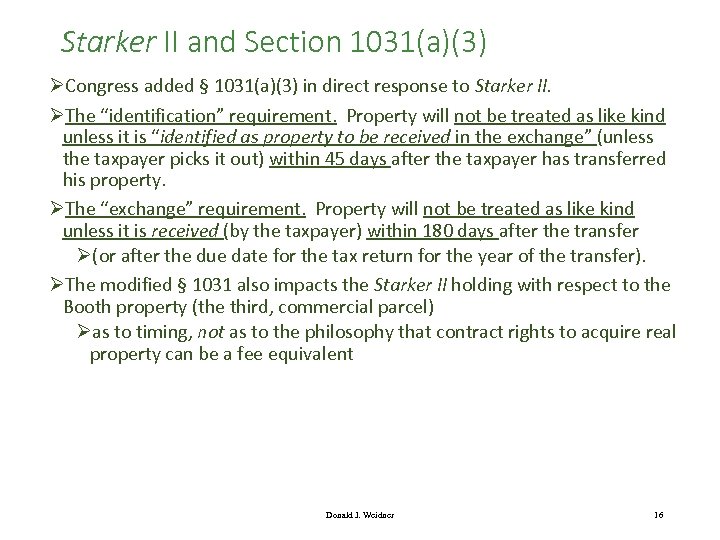

Starker II and Section 1031(a)(3) ØCongress added § 1031(a)(3) in direct response to Starker II. ØThe “identification” requirement. Property will not be treated as like kind unless it is “identified as property to be received in the exchange” (unless the taxpayer picks it out) within 45 days after the taxpayer has transferred his property. ØThe “exchange” requirement. Property will not be treated as like kind unless it is received (by the taxpayer) within 180 days after the transfer Ø(or after the due date for the tax return for the year of the transfer). ØThe modified § 1031 also impacts the Starker II holding with respect to the Booth property (the third, commercial parcel) Øas to timing, not as to the philosophy that contract rights to acquire real property can be a fee equivalent Donald J. Weidner 16

Starker II and Section 1031(a)(3) ØCongress added § 1031(a)(3) in direct response to Starker II. ØThe “identification” requirement. Property will not be treated as like kind unless it is “identified as property to be received in the exchange” (unless the taxpayer picks it out) within 45 days after the taxpayer has transferred his property. ØThe “exchange” requirement. Property will not be treated as like kind unless it is received (by the taxpayer) within 180 days after the transfer Ø(or after the due date for the tax return for the year of the transfer). ØThe modified § 1031 also impacts the Starker II holding with respect to the Booth property (the third, commercial parcel) Øas to timing, not as to the philosophy that contract rights to acquire real property can be a fee equivalent Donald J. Weidner 16

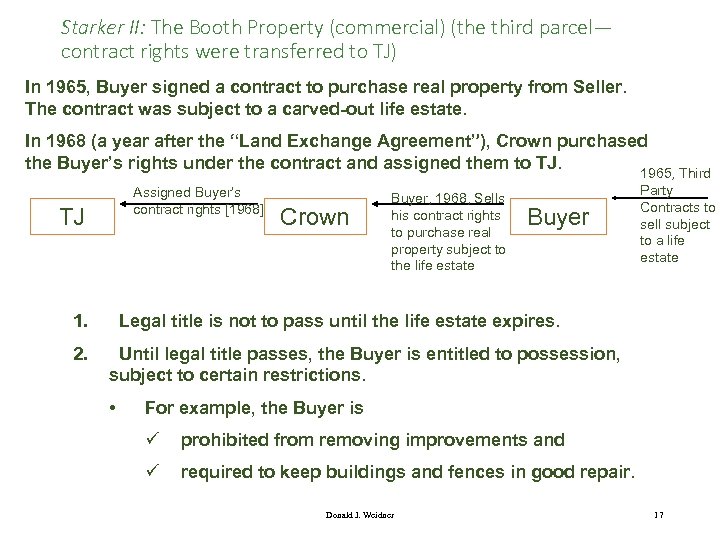

Starker II: The Booth Property (commercial) (the third parcel— contract rights were transferred to TJ) In 1965, Buyer signed a contract to purchase real property from Seller. The contract was subject to a carved-out life estate. In 1968 (a year after the “Land Exchange Agreement”), Crown purchased the Buyer’s rights under the contract and assigned them to TJ. Assigned Buyer’s contract rights [1968] TJ 1. 2. Crown Buyer, 1968, Sells his contract rights to purchase real property subject to the life estate Buyer 1965, Third Party Contracts to sell subject to a life estate Legal title is not to pass until the life estate expires. Until legal title passes, the Buyer is entitled to possession, subject to certain restrictions. • For example, the Buyer is ü prohibited from removing improvements and ü required to keep buildings and fences in good repair. Donald J. Weidner 17

Starker II: The Booth Property (commercial) (the third parcel— contract rights were transferred to TJ) In 1965, Buyer signed a contract to purchase real property from Seller. The contract was subject to a carved-out life estate. In 1968 (a year after the “Land Exchange Agreement”), Crown purchased the Buyer’s rights under the contract and assigned them to TJ. Assigned Buyer’s contract rights [1968] TJ 1. 2. Crown Buyer, 1968, Sells his contract rights to purchase real property subject to the life estate Buyer 1965, Third Party Contracts to sell subject to a life estate Legal title is not to pass until the life estate expires. Until legal title passes, the Buyer is entitled to possession, subject to certain restrictions. • For example, the Buyer is ü prohibited from removing improvements and ü required to keep buildings and fences in good repair. Donald J. Weidner 17

Starker II: The Booth Property ØIRS argued: There was no exchange. ØNot only was there a lack of simultaneity to the conveyances between T. J. and Crown; Øthere was no conveyance at all to T. J. (there was a “total lack of deed transfer”) ØEven after the expiration of 10 years ØStated differently, the IRS argued that, because T. J. never received a conveyance of land, he never received property that was of a “like kind” with the land he transferred. Donald J. Weidner 18

Starker II: The Booth Property ØIRS argued: There was no exchange. ØNot only was there a lack of simultaneity to the conveyances between T. J. and Crown; Øthere was no conveyance at all to T. J. (there was a “total lack of deed transfer”) ØEven after the expiration of 10 years ØStated differently, the IRS argued that, because T. J. never received a conveyance of land, he never received property that was of a “like kind” with the land he transferred. Donald J. Weidner 18

Starker II: The Booth Property ØThe Court rejected the IRS argument and held instead that T. J. had been transferred the equivalent of a fee: ØIRS Regulations say that a lease with 30 years or more to run is the equivalent of a fee; ØT. J. ’s rights are at least as great as those of a long-term lessee; and Øthe fact that his interest will ripen into a fee prior to the expiration of 30 years, if the life tenant dies, only makes the equivalence with a fee stronger. ØOnce the court said that contract rights are of “like kind” with a fee, it was brought to the basic question: is the exchange disqualified because the transfers were not simultaneous (and hence not “reciprocal”). Donald J. Weidner 19

Starker II: The Booth Property ØThe Court rejected the IRS argument and held instead that T. J. had been transferred the equivalent of a fee: ØIRS Regulations say that a lease with 30 years or more to run is the equivalent of a fee; ØT. J. ’s rights are at least as great as those of a long-term lessee; and Øthe fact that his interest will ripen into a fee prior to the expiration of 30 years, if the life tenant dies, only makes the equivalence with a fee stronger. ØOnce the court said that contract rights are of “like kind” with a fee, it was brought to the basic question: is the exchange disqualified because the transfers were not simultaneous (and hence not “reciprocal”). Donald J. Weidner 19

Nonsimultaneous Transfers ØRecall the basic justifications of 1031 ØDo non-simultaneous transfers fall within them? ØLiquidity rationale. Doesn’t fully explain 1031. ØIf you sell, then immediately reinvest the proceeds, the benefits of 1031 are not available even though the reinvestment leaves the taxpayer illiquid. ØConversely, the benefits of 1031 seem to be available even if the taxpayer has no liquidity problems. ØValuation rationale. Doesn’t fully explain 1031. ØWhenever the taxpayer receives any cash or non-qualifying property in an exchange that otherwise qualifies, the property received must be valued to compute the realized gain, a part of which must be recognized. Donald J. Weidner 20

Nonsimultaneous Transfers ØRecall the basic justifications of 1031 ØDo non-simultaneous transfers fall within them? ØLiquidity rationale. Doesn’t fully explain 1031. ØIf you sell, then immediately reinvest the proceeds, the benefits of 1031 are not available even though the reinvestment leaves the taxpayer illiquid. ØConversely, the benefits of 1031 seem to be available even if the taxpayer has no liquidity problems. ØValuation rationale. Doesn’t fully explain 1031. ØWhenever the taxpayer receives any cash or non-qualifying property in an exchange that otherwise qualifies, the property received must be valued to compute the realized gain, a part of which must be recognized. Donald J. Weidner 20

Nonsimultaneous Transfers (cont’d) ØThree aspects of the case make the IRS position appealing (9 th Circuit focused only on the last two): Øthe “exchange agreement” gave the Starkers the equivalent of a deposit into a checking account, not on a bank but on a major corporation; Øit also gave them the possibility that they might ultimately simply receive cash; and Øthe agreement could remain open for a long time. Donald J. Weidner 21

Nonsimultaneous Transfers (cont’d) ØThree aspects of the case make the IRS position appealing (9 th Circuit focused only on the last two): Øthe “exchange agreement” gave the Starkers the equivalent of a deposit into a checking account, not on a bank but on a major corporation; Øit also gave them the possibility that they might ultimately simply receive cash; and Øthe agreement could remain open for a long time. Donald J. Weidner 21

Final Thoughts on Starker II Ø 9 th Circuit said: 1. if the parties intended to effect a swap of property, 1031 treatment is not denied simply because cash was to be transferred if a swap could not be arranged Ø Recall Rev. Rul. 90 -34 (Supp. p. 247) 2. elsewhere, in an attempt to deny taxpayers a loss, the IRS has argued that 1031 applies even if there is no strict simultaneity. Donald J. Weidner 22

Final Thoughts on Starker II Ø 9 th Circuit said: 1. if the parties intended to effect a swap of property, 1031 treatment is not denied simply because cash was to be transferred if a swap could not be arranged Ø Recall Rev. Rul. 90 -34 (Supp. p. 247) 2. elsewhere, in an attempt to deny taxpayers a loss, the IRS has argued that 1031 applies even if there is no strict simultaneity. Donald J. Weidner 22

Final Thoughts on Starker II (cont’d) ØIRC 1031(a)(2)(F) says that 1031 does not apply to an exchange of “choses in action. ” ØAs to the argument that these contract rights were mere choses in action and not equal to a fee, the 9 th Circuit stated: 1. “[T]itle to real property is nothing more than a bundle of potential causes of action: for trespass, to quiet title, for interference with quiet enjoyment, and so on; ” and 2. “The bundle of rights associated with ownership is obviously not excluded from section 1031; a contractual right to assume the rights of ownership should not. . . be treated as any different than the ownership rights themselves. ” Ø Analyzing the bundle of rights and liabilities that make up an interest is also done in the analysis of leasing arrangements, including sale/leasebacks. Donald J. Weidner 23

Final Thoughts on Starker II (cont’d) ØIRC 1031(a)(2)(F) says that 1031 does not apply to an exchange of “choses in action. ” ØAs to the argument that these contract rights were mere choses in action and not equal to a fee, the 9 th Circuit stated: 1. “[T]itle to real property is nothing more than a bundle of potential causes of action: for trespass, to quiet title, for interference with quiet enjoyment, and so on; ” and 2. “The bundle of rights associated with ownership is obviously not excluded from section 1031; a contractual right to assume the rights of ownership should not. . . be treated as any different than the ownership rights themselves. ” Ø Analyzing the bundle of rights and liabilities that make up an interest is also done in the analysis of leasing arrangements, including sale/leasebacks. Donald J. Weidner 23

The Sale-Leaseback: Advantages to “Buyer” ØStarker’s “bundle of rights” discussion is evocative of Justice Scalia’s observation in Bollinger: “The problem we face here is that two different taxpayers can plausibly be regarded as the owner. ” ØThis is also often the case in the sale-leaseback area. ØFor years, most life insurance company investments involved saleleasebacks with creditworthy corporations. ØThey received statutory authority in the late 1940 s to make direct investments in income-producing real property ØA life insurance company typically received rent for the property it purchased sufficient to enable it, over the initial term of the lease, Øto recover its entire investment, Øplus a satisfactory rate of return on that investment. Donald J. Weidner 24

The Sale-Leaseback: Advantages to “Buyer” ØStarker’s “bundle of rights” discussion is evocative of Justice Scalia’s observation in Bollinger: “The problem we face here is that two different taxpayers can plausibly be regarded as the owner. ” ØThis is also often the case in the sale-leaseback area. ØFor years, most life insurance company investments involved saleleasebacks with creditworthy corporations. ØThey received statutory authority in the late 1940 s to make direct investments in income-producing real property ØA life insurance company typically received rent for the property it purchased sufficient to enable it, over the initial term of the lease, Øto recover its entire investment, Øplus a satisfactory rate of return on that investment. Donald J. Weidner 24

The Sale-Leaseback: Advantages to “Buyer” (cont’d) ØThe lease provided that the life insurance company would be made whole by the tenant, even in the event of total condemnation or destruction of the property. ØRecall Bolger, in which the tenant’s obligation to pay rent continued even if the property were destroyed ØAlthough the insurance company/buyer must include the rent in income, it gets to take depreciation deductions on its investment in the building Øassuming the form of the transaction is respected for federal income tax purposes ØAs in Leslie (where the seller also claimed a loss on the sale) Donald J. Weidner 25

The Sale-Leaseback: Advantages to “Buyer” (cont’d) ØThe lease provided that the life insurance company would be made whole by the tenant, even in the event of total condemnation or destruction of the property. ØRecall Bolger, in which the tenant’s obligation to pay rent continued even if the property were destroyed ØAlthough the insurance company/buyer must include the rent in income, it gets to take depreciation deductions on its investment in the building Øassuming the form of the transaction is respected for federal income tax purposes ØAs in Leslie (where the seller also claimed a loss on the sale) Donald J. Weidner 25

The Sale-Leaseback: Benefits and Burdens of “Tenant” ØSmith & Lubell, Reflections on the Sale-Leaseback, 7 Real Estate Review 11 -13 (Winter 1978) states: “This lease imposes on the lessee virtually all of the obligations, and gives the lessee substantially all of the benefits, of ownership, subject of course to the lessor’s reversionary rights in the fee. ” ØRecall, for example, Bolger. Allocating virtually all the burdens and benefits of ownership to the tenant during the life of the lease, creates the risk that the lessee might be seen as the substantive owner-mortgagor. Donald J. Weidner 26

The Sale-Leaseback: Benefits and Burdens of “Tenant” ØSmith & Lubell, Reflections on the Sale-Leaseback, 7 Real Estate Review 11 -13 (Winter 1978) states: “This lease imposes on the lessee virtually all of the obligations, and gives the lessee substantially all of the benefits, of ownership, subject of course to the lessor’s reversionary rights in the fee. ” ØRecall, for example, Bolger. Allocating virtually all the burdens and benefits of ownership to the tenant during the life of the lease, creates the risk that the lessee might be seen as the substantive owner-mortgagor. Donald J. Weidner 26

The Sale-Leaseback: Benefits and Burdens of “Tenant” (cont’d) ØSmith & Lubell state the burdens that fall on the tenant: As in “any ground lease or other absolutely net lease, ” “the lessee is obligated to pay rent without off-set or deduction and also to pay ØReal estate taxes; ØFire, liability and other insurance premiums; ØAll costs of operating, maintaining, repairing, and restoring the premises; and ØAll other costs relating to the premises that an owner would normally bear. ” Donald J. Weidner 27

The Sale-Leaseback: Benefits and Burdens of “Tenant” (cont’d) ØSmith & Lubell state the burdens that fall on the tenant: As in “any ground lease or other absolutely net lease, ” “the lessee is obligated to pay rent without off-set or deduction and also to pay ØReal estate taxes; ØFire, liability and other insurance premiums; ØAll costs of operating, maintaining, repairing, and restoring the premises; and ØAll other costs relating to the premises that an owner would normally bear. ” Donald J. Weidner 27

The Sale-Leaseback: Other Advantages to “Seller-Tenant” Ø Some of the tenant benefits under the lease: 1. Seller-tenant retains the use of the property. 2. Seller-tenant may minimize its equity investment in a property. Ø Greater financing may be available to a developer who sells and then leases back than under “conventional mortgage financing. ” Ø Some corporate tenants may obtain 100% financing. Donald J. Weidner 28

The Sale-Leaseback: Other Advantages to “Seller-Tenant” Ø Some of the tenant benefits under the lease: 1. Seller-tenant retains the use of the property. 2. Seller-tenant may minimize its equity investment in a property. Ø Greater financing may be available to a developer who sells and then leases back than under “conventional mortgage financing. ” Ø Some corporate tenants may obtain 100% financing. Donald J. Weidner 28

The Sale-Leaseback: Other Advantages to “Seller. Tenant” (cont’d) (and one disadvantage) 3. Seller-tenant may achieve “off-balance sheet” financing Ø If the Financial Accounting Standards Board (FASB) classifies the lease as an “operating lease” rather than as a “capital lease. ” Ø Until ASU 2016 -2 takes effect and every lease for more than year must be capitalized and recorded on the balance sheet as a “lease liability” 4. Seller-tenant gets the right to deduct all rent (while losing the depreciation deduction on its investment in the building) Ø including the rent for the land, thereby effectively writing off the land cost. Ø The loss of the property at the end of the lease term is a disadvantage—a benefit that passes to the buyer-lessor Ø unless there are options to renew or to purchase Ø but that remote “price” may have a low present value. Donald J. Weidner 29

The Sale-Leaseback: Other Advantages to “Seller. Tenant” (cont’d) (and one disadvantage) 3. Seller-tenant may achieve “off-balance sheet” financing Ø If the Financial Accounting Standards Board (FASB) classifies the lease as an “operating lease” rather than as a “capital lease. ” Ø Until ASU 2016 -2 takes effect and every lease for more than year must be capitalized and recorded on the balance sheet as a “lease liability” 4. Seller-tenant gets the right to deduct all rent (while losing the depreciation deduction on its investment in the building) Ø including the rent for the land, thereby effectively writing off the land cost. Ø The loss of the property at the end of the lease term is a disadvantage—a benefit that passes to the buyer-lessor Ø unless there are options to renew or to purchase Ø but that remote “price” may have a low present value. Donald J. Weidner 29

Some Recent Developments ØMany other institutional and foreign investors have been providing financing through sale-leasebacks. ØAs other forms of 100% financing became available, such as through real estate subsidiaries, large creditworthy corporations entered into fewer direct sale-leaseback transactions with insurance company investors. ØAccounting rules have for years made it much more difficult for sale leasebacks to be used to take debt off balance sheets. ØThere has been more room in the case of leases of property the tenant did not previously own ØAfter ASU 2016 -2, all leases for more than a year must be recorded on the balance sheet as representing both a “right of use” asset and a “lease liability” ØThe Liability that is listed is the present value of the future lease payments. ØToday, many creditworthy corporations obtain financing through special purpose entities that issue securities ØRecall Bolger Donald J. Weidner 30

Some Recent Developments ØMany other institutional and foreign investors have been providing financing through sale-leasebacks. ØAs other forms of 100% financing became available, such as through real estate subsidiaries, large creditworthy corporations entered into fewer direct sale-leaseback transactions with insurance company investors. ØAccounting rules have for years made it much more difficult for sale leasebacks to be used to take debt off balance sheets. ØThere has been more room in the case of leases of property the tenant did not previously own ØAfter ASU 2016 -2, all leases for more than a year must be recorded on the balance sheet as representing both a “right of use” asset and a “lease liability” ØThe Liability that is listed is the present value of the future lease payments. ØToday, many creditworthy corporations obtain financing through special purpose entities that issue securities ØRecall Bolger Donald J. Weidner 30

Sale-Leasebacks as Equitable Mortgages Ø FASB has long limited the use of the sale-leaseback to take financing off the “tenant’s” balance sheet. Ø Saying that many leases, especially those arising from sale/leasebacks, are “capital leases” that must be reported as mortgages on the tenant’s books. Ø The latest FASB rules being phased in require the present value of all lease payments (if the lease is for more than a year) to be recorded on the balance sheet as a “lease liability” Ø The off-balance sheet issue has most commonly arisen when the sellerlessee is unwilling to give up the reversionary interest in the property. Ø There can be “significant exposure” because the transaction may be treated, either for state law purposes or federal income tax purposes, say Smith and Lubell, as “an equitable mortgage, rather than a true conveyance and a true lease. ” Donald J. Weidner 31

Sale-Leasebacks as Equitable Mortgages Ø FASB has long limited the use of the sale-leaseback to take financing off the “tenant’s” balance sheet. Ø Saying that many leases, especially those arising from sale/leasebacks, are “capital leases” that must be reported as mortgages on the tenant’s books. Ø The latest FASB rules being phased in require the present value of all lease payments (if the lease is for more than a year) to be recorded on the balance sheet as a “lease liability” Ø The off-balance sheet issue has most commonly arisen when the sellerlessee is unwilling to give up the reversionary interest in the property. Ø There can be “significant exposure” because the transaction may be treated, either for state law purposes or federal income tax purposes, say Smith and Lubell, as “an equitable mortgage, rather than a true conveyance and a true lease. ” Donald J. Weidner 31

Consequences if Substance Trumps Form ØIf the form of a sale-leaseback is disregarded and it is treated as, in substance, a mortgage: 1. The lessee will be seen as having an equity of redemption such that, if the lessee defaults, the lessor will not be permitted to evict by summary proceedings but will be required to foreclose the lessee’s equity of redemption; 2. If the lessee becomes bankrupt or insolvent, the lessor will have the rights of a secured creditor rather than the rights of a landlord; 3. A deemed mortgage may be subject to substantial mortgage and intangible taxes that were not anticipated; Donald J. Weidner 32

Consequences if Substance Trumps Form ØIf the form of a sale-leaseback is disregarded and it is treated as, in substance, a mortgage: 1. The lessee will be seen as having an equity of redemption such that, if the lessee defaults, the lessor will not be permitted to evict by summary proceedings but will be required to foreclose the lessee’s equity of redemption; 2. If the lessee becomes bankrupt or insolvent, the lessor will have the rights of a secured creditor rather than the rights of a landlord; 3. A deemed mortgage may be subject to substantial mortgage and intangible taxes that were not anticipated; Donald J. Weidner 32

Consequences if Substance Trumps Form 4. The resulting mortgage may be found to be usurious; and 5. The tax consequences of the transaction will change: 1. There will be no gain or loss on the sale; 2. The rent will be treated as debt service (with only interest deductible by the tenant and included by the landord); 3. The tenant, and not the landlord, will be entitled to depreciation deductions. Donald J. Weidner 33

Consequences if Substance Trumps Form 4. The resulting mortgage may be found to be usurious; and 5. The tax consequences of the transaction will change: 1. There will be no gain or loss on the sale; 2. The rent will be treated as debt service (with only interest deductible by the tenant and included by the landord); 3. The tenant, and not the landlord, will be entitled to depreciation deductions. Donald J. Weidner 33

Bankruptcy or Insolvency of Tenant Ø In general, in bankruptcy, a lease is an executory contract and, as such, is subject to special rules. Ø An executory contract is both an asset and a liability because there is still substantial performance required on both sides of the contract. 1. If the lease characterization is upheld: Ø In the event of a lessee’s bankruptcy (Ch. 11 reorganization), the Debtor (in the bankruptcy sense) In Possession (“DIP”) has a choice to affirm or reject the lease. Ø If the lessee’s DIP affirms the lease, it must start making current payments. Ø If the lessee’s DIP rejects the lease, the rejection will be treated as an anticipatory breach of the lease and the landlord will have an unsecured claim for damages. Donald J. Weidner 34

Bankruptcy or Insolvency of Tenant Ø In general, in bankruptcy, a lease is an executory contract and, as such, is subject to special rules. Ø An executory contract is both an asset and a liability because there is still substantial performance required on both sides of the contract. 1. If the lease characterization is upheld: Ø In the event of a lessee’s bankruptcy (Ch. 11 reorganization), the Debtor (in the bankruptcy sense) In Possession (“DIP”) has a choice to affirm or reject the lease. Ø If the lessee’s DIP affirms the lease, it must start making current payments. Ø If the lessee’s DIP rejects the lease, the rejection will be treated as an anticipatory breach of the lease and the landlord will have an unsecured claim for damages. Donald J. Weidner 34

Bankruptcy or Insolvency of Tenant (cont’d) 2. If the lease is recharacterized as a mortgage: ØThe “Lessor’s” claim against the tenant is treated as a secured claim (rather than a landlord’s claim for breach of a lease) and the tenant’s Debtor In Possession will be excused from paying debt service during the bankruptcy proceeding. ØThen, if a “plan” is confirmed, debt service payments from the tenant to the lessor will resume (although the plan may restructure the loan agreement). Donald J. Weidner 35

Bankruptcy or Insolvency of Tenant (cont’d) 2. If the lease is recharacterized as a mortgage: ØThe “Lessor’s” claim against the tenant is treated as a secured claim (rather than a landlord’s claim for breach of a lease) and the tenant’s Debtor In Possession will be excused from paying debt service during the bankruptcy proceeding. ØThen, if a “plan” is confirmed, debt service payments from the tenant to the lessor will resume (although the plan may restructure the loan agreement). Donald J. Weidner 35

Bankruptcy or Insolvency of Tenant (cont’d) ØG. Nelson and D. Whitman Real Estate Finance Law 73 (5 th ed. 2007): Ø“[I]f the lessee-seller goes into bankruptcy, he or she usually finds it much more advantageous to be a mortgagee than a lessee. ØThis is because a lessee who files a bankruptcy petition must either assume or reject the lease within a short period of time or the lease will be deemed rejected. In the latter situation, the lessee will be required to surrender the property immediately to the lessor. ØOn the other hand, if the transaction is characterized as a mortgage, the seller-mortgagor often will be able to retain possession of the real estate and restructure the mortgage obligation as part of a bankruptcy reorganization plan. Ø Finally, on rare occasions, a lessor-purchaser rather than the lesseeseller will seek to recharacterize a sale-leaseback transaction as an equitable mortgage. ” Donald J. Weidner 36

Bankruptcy or Insolvency of Tenant (cont’d) ØG. Nelson and D. Whitman Real Estate Finance Law 73 (5 th ed. 2007): Ø“[I]f the lessee-seller goes into bankruptcy, he or she usually finds it much more advantageous to be a mortgagee than a lessee. ØThis is because a lessee who files a bankruptcy petition must either assume or reject the lease within a short period of time or the lease will be deemed rejected. In the latter situation, the lessee will be required to surrender the property immediately to the lessor. ØOn the other hand, if the transaction is characterized as a mortgage, the seller-mortgagor often will be able to retain possession of the real estate and restructure the mortgage obligation as part of a bankruptcy reorganization plan. Ø Finally, on rare occasions, a lessor-purchaser rather than the lesseeseller will seek to recharacterize a sale-leaseback transaction as an equitable mortgage. ” Donald J. Weidner 36

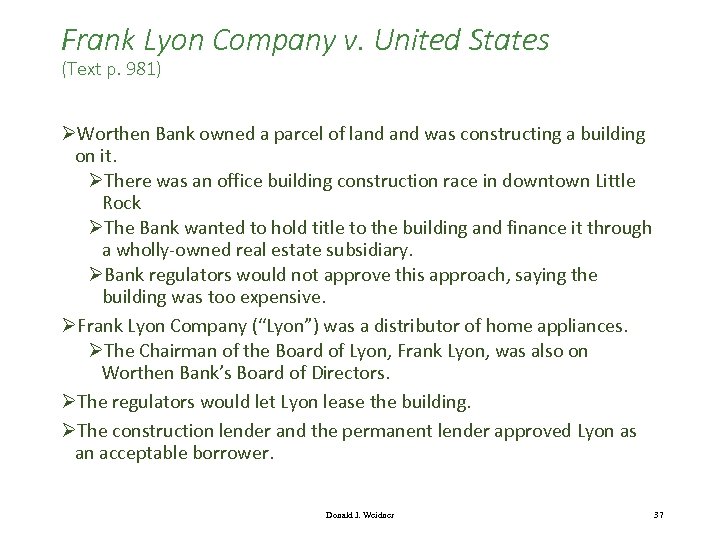

Frank Lyon Company v. United States (Text p. 981) ØWorthen Bank owned a parcel of land was constructing a building on it. ØThere was an office building construction race in downtown Little Rock ØThe Bank wanted to hold title to the building and finance it through a wholly-owned real estate subsidiary. ØBank regulators would not approve this approach, saying the building was too expensive. ØFrank Lyon Company (“Lyon”) was a distributor of home appliances. ØThe Chairman of the Board of Lyon, Frank Lyon, was also on Worthen Bank’s Board of Directors. ØThe regulators would let Lyon lease the building. ØThe construction lender and the permanent lender approved Lyon as an acceptable borrower. Donald J. Weidner 37

Frank Lyon Company v. United States (Text p. 981) ØWorthen Bank owned a parcel of land was constructing a building on it. ØThere was an office building construction race in downtown Little Rock ØThe Bank wanted to hold title to the building and finance it through a wholly-owned real estate subsidiary. ØBank regulators would not approve this approach, saying the building was too expensive. ØFrank Lyon Company (“Lyon”) was a distributor of home appliances. ØThe Chairman of the Board of Lyon, Frank Lyon, was also on Worthen Bank’s Board of Directors. ØThe regulators would let Lyon lease the building. ØThe construction lender and the permanent lender approved Lyon as an acceptable borrower. Donald J. Weidner 37

Frank Lyon (cont’d) ØWorthen Bank: ØRetained title to the land; ØNet leased the land to Lyon for 76 years; ØSold the building, piece by piece, as it was constructed, to Lyon; and ØLeased back the building from Lyon for 66 years. ØIn short, Worthen conveyed to Lyon the right to possess the land for 10 years longer than Worthen retained the right to possess the building. ØLyon owned the reversion in the building, which would become possessory after Worthen’s 66 -year lease ended. That is, during Lyon’s last 10 years as tenant under the ground lease, Worthen no longer had the right to be a tenant of the building. Lyon could occupy the building itself or lease it to someone else. ØPresumably, after that 10 -year period, Lyon would have to remove its building from Worthen’s land or take out a new lease. ØWas this transaction ever expected to go to term? Donald J. Weidner 38

Frank Lyon (cont’d) ØWorthen Bank: ØRetained title to the land; ØNet leased the land to Lyon for 76 years; ØSold the building, piece by piece, as it was constructed, to Lyon; and ØLeased back the building from Lyon for 66 years. ØIn short, Worthen conveyed to Lyon the right to possess the land for 10 years longer than Worthen retained the right to possess the building. ØLyon owned the reversion in the building, which would become possessory after Worthen’s 66 -year lease ended. That is, during Lyon’s last 10 years as tenant under the ground lease, Worthen no longer had the right to be a tenant of the building. Lyon could occupy the building itself or lease it to someone else. ØPresumably, after that 10 -year period, Lyon would have to remove its building from Worthen’s land or take out a new lease. ØWas this transaction ever expected to go to term? Donald J. Weidner 38

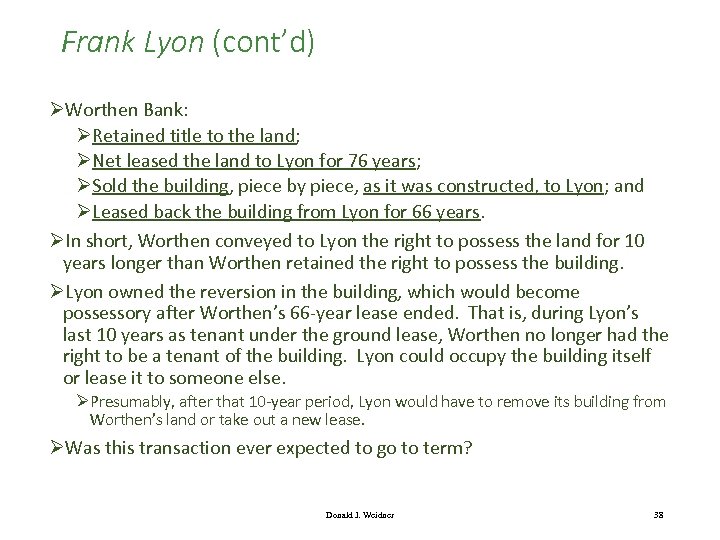

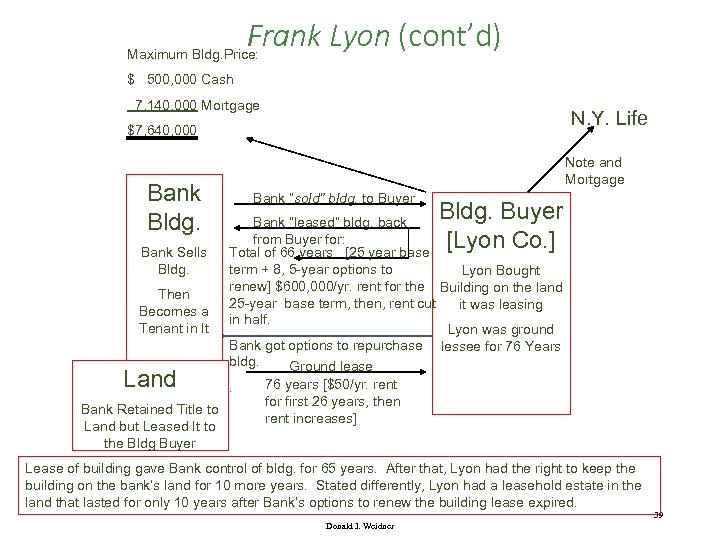

Frank Lyon (cont’d) Maximum Bldg. Price: $ 500, 000 Cash 7, 140, 000 Mortgage N. Y. Life $7, 640, 000 Bank Bldg. Note and Mortgage Bank “sold” bldg. to Buyer Bldg. Buyer [Lyon Co. ] Bank “leased” bldg. back from Buyer for: Total of 66 years [25 year base Bank Sells term + 8, 5 -year options to Bldg. Lyon Bought renew] $600, 000/yr. rent for the Building on the land Then 25 -year base term, then, rent cut it was leasing Becomes a in half. Tenant in It Lyon was ground Bank got options to repurchase lessee for 76 Years bldg. Ground lease 76 years [$50/yr. rent. for first 26 years, then Bank Retained Title to rent increases] Land but Leased It to the Bldg Buyer Land Lease of building gave Bank control of bldg. for 65 years. After that, Lyon had the right to keep the building on the bank’s land for 10 more years. Stated differently, Lyon had a leasehold estate in the land that lasted for only 10 years after Bank’s options to renew the building lease expired. 39 Donald J. Weidner

Frank Lyon (cont’d) Maximum Bldg. Price: $ 500, 000 Cash 7, 140, 000 Mortgage N. Y. Life $7, 640, 000 Bank Bldg. Note and Mortgage Bank “sold” bldg. to Buyer Bldg. Buyer [Lyon Co. ] Bank “leased” bldg. back from Buyer for: Total of 66 years [25 year base Bank Sells term + 8, 5 -year options to Bldg. Lyon Bought renew] $600, 000/yr. rent for the Building on the land Then 25 -year base term, then, rent cut it was leasing Becomes a in half. Tenant in It Lyon was ground Bank got options to repurchase lessee for 76 Years bldg. Ground lease 76 years [$50/yr. rent. for first 26 years, then Bank Retained Title to rent increases] Land but Leased It to the Bldg Buyer Land Lease of building gave Bank control of bldg. for 65 years. After that, Lyon had the right to keep the building on the bank’s land for 10 more years. Stated differently, Lyon had a leasehold estate in the land that lasted for only 10 years after Bank’s options to renew the building lease expired. 39 Donald J. Weidner

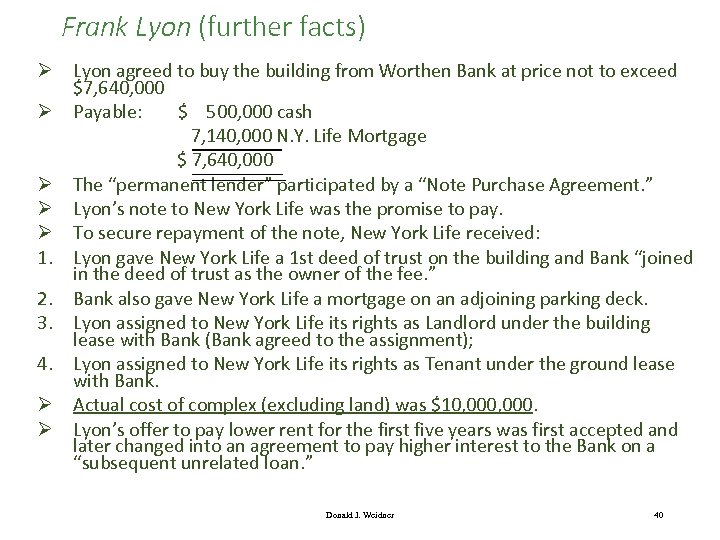

Frank Lyon (further facts) Ø Lyon agreed to buy the building from Worthen Bank at price not to exceed $7, 640, 000 Ø Payable: $ 500, 000 cash 7, 140, 000 N. Y. Life Mortgage $ 7, 640, 000 Ø The “permanent lender” participated by a “Note Purchase Agreement. ” Ø Lyon’s note to New York Life was the promise to pay. Ø To secure repayment of the note, New York Life received: 1. Lyon gave New York Life a 1 st deed of trust on the building and Bank “joined in the deed of trust as the owner of the fee. ” 2. Bank also gave New York Life a mortgage on an adjoining parking deck. 3. Lyon assigned to New York Life its rights as Landlord under the building lease with Bank (Bank agreed to the assignment); 4. Lyon assigned to New York Life its rights as Tenant under the ground lease with Bank. Ø Actual cost of complex (excluding land) was $10, 000. Ø Lyon’s offer to pay lower rent for the first five years was first accepted and later changed into an agreement to pay higher interest to the Bank on a “subsequent unrelated loan. ” Donald J. Weidner 40

Frank Lyon (further facts) Ø Lyon agreed to buy the building from Worthen Bank at price not to exceed $7, 640, 000 Ø Payable: $ 500, 000 cash 7, 140, 000 N. Y. Life Mortgage $ 7, 640, 000 Ø The “permanent lender” participated by a “Note Purchase Agreement. ” Ø Lyon’s note to New York Life was the promise to pay. Ø To secure repayment of the note, New York Life received: 1. Lyon gave New York Life a 1 st deed of trust on the building and Bank “joined in the deed of trust as the owner of the fee. ” 2. Bank also gave New York Life a mortgage on an adjoining parking deck. 3. Lyon assigned to New York Life its rights as Landlord under the building lease with Bank (Bank agreed to the assignment); 4. Lyon assigned to New York Life its rights as Tenant under the ground lease with Bank. Ø Actual cost of complex (excluding land) was $10, 000. Ø Lyon’s offer to pay lower rent for the first five years was first accepted and later changed into an agreement to pay higher interest to the Bank on a “subsequent unrelated loan. ” Donald J. Weidner 40

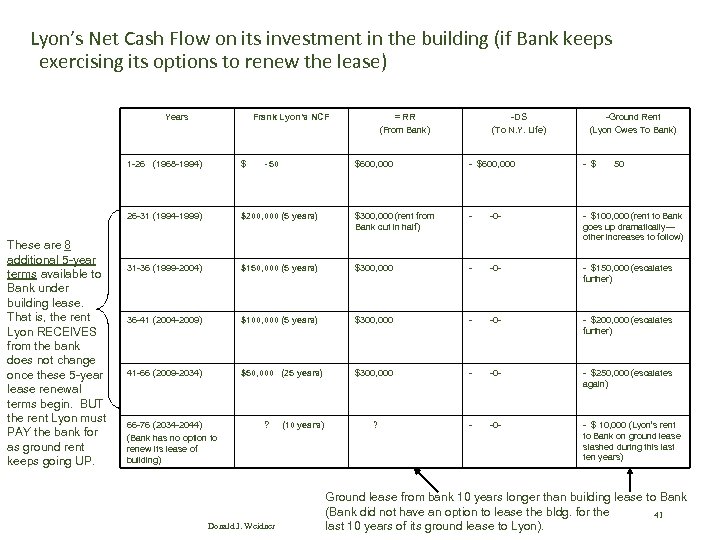

Lyon’s Net Cash Flow on its investment in the building (if Bank keeps exercising its options to renew the lease) Years Frank Lyon’s NCF 1 -26 (1968 -1994) 26 -31 (1994 -1999) These are 8 additional 5 -year terms available to Bank under building lease. That is, the rent Lyon RECEIVES from the bank does not change once these 5 -year lease renewal terms begin. BUT the rent Lyon must PAY the bank for as ground rent keeps going UP. $ -Ground Rent (Lyon Owes To Bank) $600, 000 - $ $200, 000 (5 years) $300, 000 (rent from Bank cut in half) - -0 - - $100, 000 (rent to Bank goes up dramatically— other increases to follow) 31 -36 (1999 -2004) $150, 000 (5 years) $300, 000 - -0 - - $150, 000 (escalates further) 36 -41 (2004 -2009) $100, 000 (5 years) $300, 000 - -0 - - $200, 000 (escalates further) 41 -66 (2009 -2034) $50, 000 (25 years) $300, 000 - -0 - - $250, 000 (escalates again) ? - -0 - - $ 10, 000 (Lyon’s rent to Bank on ground lease slashed during this last ten years) 66 -76 (2034 -2044) (Bank has no option to renew its lease of building) - 50 -DS (To N. Y. Life) = RR (From Bank) ? Donald J. Weidner (10 years) 50 Ground lease from bank 10 years longer than building lease to Bank (Bank did not have an option to lease the bldg. for the 41 last 10 years of its ground lease to Lyon).

Lyon’s Net Cash Flow on its investment in the building (if Bank keeps exercising its options to renew the lease) Years Frank Lyon’s NCF 1 -26 (1968 -1994) 26 -31 (1994 -1999) These are 8 additional 5 -year terms available to Bank under building lease. That is, the rent Lyon RECEIVES from the bank does not change once these 5 -year lease renewal terms begin. BUT the rent Lyon must PAY the bank for as ground rent keeps going UP. $ -Ground Rent (Lyon Owes To Bank) $600, 000 - $ $200, 000 (5 years) $300, 000 (rent from Bank cut in half) - -0 - - $100, 000 (rent to Bank goes up dramatically— other increases to follow) 31 -36 (1999 -2004) $150, 000 (5 years) $300, 000 - -0 - - $150, 000 (escalates further) 36 -41 (2004 -2009) $100, 000 (5 years) $300, 000 - -0 - - $200, 000 (escalates further) 41 -66 (2009 -2034) $50, 000 (25 years) $300, 000 - -0 - - $250, 000 (escalates again) ? - -0 - - $ 10, 000 (Lyon’s rent to Bank on ground lease slashed during this last ten years) 66 -76 (2034 -2044) (Bank has no option to renew its lease of building) - 50 -DS (To N. Y. Life) = RR (From Bank) ? Donald J. Weidner (10 years) 50 Ground lease from bank 10 years longer than building lease to Bank (Bank did not have an option to lease the bldg. for the 41 last 10 years of its ground lease to Lyon).

Condemnation or Destruction Ø Bank’s obligation to pay rent to Lyon was not affected by any damage or destruction to the building. Ø That is, Bank had greater obligations than those of a normal tenant Ø But not greater obligations than those of tenants in sale-leasebacks. Ø Any (a) condemnation award, and (b) any insurance proceeds resulting from a total destruction of the building, would be applied in the following order: 1. to New York Life in an amount sufficient to fully prepay the mortgage; 2. the next tranche to Lyon up to the amount of Lyon’s $500, 000 down payment plus 6%; then 3. any excess to Bank. Ø Thus: condemnation awards were allocated as if Bank was the owner and New York Life and Lyon were both lenders. Ø Bank had the option to either replace the building or to purchase it in the event of a partial condemnation or total destruction on or after December 1, 1980 (after about 12 years). Ø Here again, Bank had more of the bundle of sticks than is usually in the hands of a “mere” tenant. Donald J. Weidner 42

Condemnation or Destruction Ø Bank’s obligation to pay rent to Lyon was not affected by any damage or destruction to the building. Ø That is, Bank had greater obligations than those of a normal tenant Ø But not greater obligations than those of tenants in sale-leasebacks. Ø Any (a) condemnation award, and (b) any insurance proceeds resulting from a total destruction of the building, would be applied in the following order: 1. to New York Life in an amount sufficient to fully prepay the mortgage; 2. the next tranche to Lyon up to the amount of Lyon’s $500, 000 down payment plus 6%; then 3. any excess to Bank. Ø Thus: condemnation awards were allocated as if Bank was the owner and New York Life and Lyon were both lenders. Ø Bank had the option to either replace the building or to purchase it in the event of a partial condemnation or total destruction on or after December 1, 1980 (after about 12 years). Ø Here again, Bank had more of the bundle of sticks than is usually in the hands of a “mere” tenant. Donald J. Weidner 42

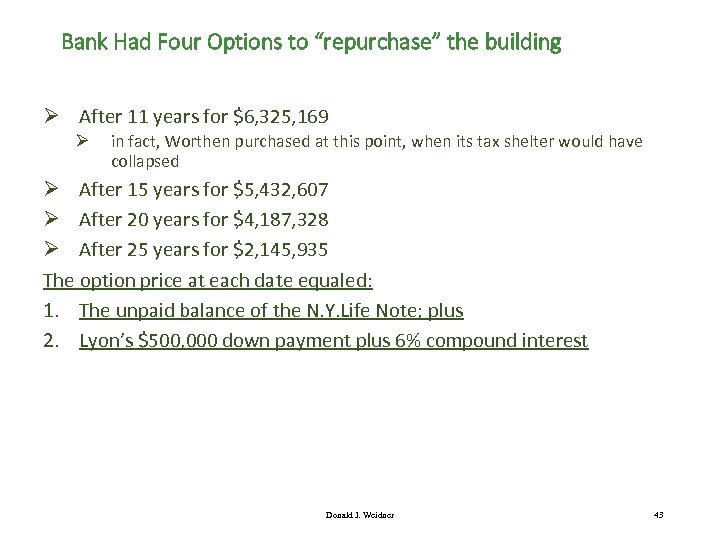

Bank Had Four Options to “repurchase” the building Ø After 11 years for $6, 325, 169 Ø in fact, Worthen purchased at this point, when its tax shelter would have collapsed Ø After 15 years for $5, 432, 607 Ø After 20 years for $4, 187, 328 Ø After 25 years for $2, 145, 935 The option price at each date equaled: 1. The unpaid balance of the N. Y. Life Note; plus 2. Lyon’s $500, 000 down payment plus 6% compound interest Donald J. Weidner 43

Bank Had Four Options to “repurchase” the building Ø After 11 years for $6, 325, 169 Ø in fact, Worthen purchased at this point, when its tax shelter would have collapsed Ø After 15 years for $5, 432, 607 Ø After 20 years for $4, 187, 328 Ø After 25 years for $2, 145, 935 The option price at each date equaled: 1. The unpaid balance of the N. Y. Life Note; plus 2. Lyon’s $500, 000 down payment plus 6% compound interest Donald J. Weidner 43

Bank’s options to “repurchase” the building (cont’d) The prices on the options to purchase were the same as if Lyon had a 6% passbook account with the Bank. However, the District Court said that the option price: “also represents the negotiated estimate of [Lyon] and [Bank] as to the fair market value of the building on the option dates, which the court finds to be reasonable. The [IRS] produced no witnesses to contest the reasonableness of the option prices. ” Was the District Court too credulous? Donald J. Weidner 44

Bank’s options to “repurchase” the building (cont’d) The prices on the options to purchase were the same as if Lyon had a 6% passbook account with the Bank. However, the District Court said that the option price: “also represents the negotiated estimate of [Lyon] and [Bank] as to the fair market value of the building on the option dates, which the court finds to be reasonable. The [IRS] produced no witnesses to contest the reasonableness of the option prices. ” Was the District Court too credulous? Donald J. Weidner 44

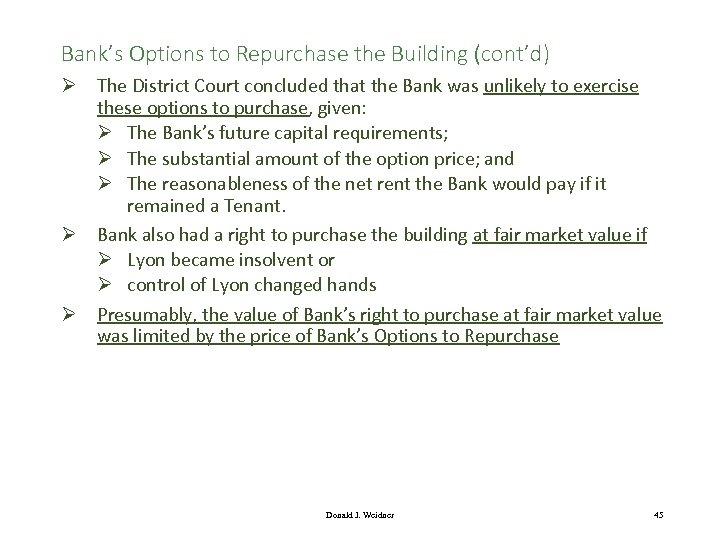

Bank’s Options to Repurchase the Building (cont’d) Ø The District Court concluded that the Bank was unlikely to exercise these options to purchase, given: Ø The Bank’s future capital requirements; Ø The substantial amount of the option price; and Ø The reasonableness of the net rent the Bank would pay if it remained a Tenant. Ø Bank also had a right to purchase the building at fair market value if Ø Lyon became insolvent or Ø control of Lyon changed hands Ø Presumably, the value of Bank’s right to purchase at fair market value was limited by the price of Bank’s Options to Repurchase Donald J. Weidner 45

Bank’s Options to Repurchase the Building (cont’d) Ø The District Court concluded that the Bank was unlikely to exercise these options to purchase, given: Ø The Bank’s future capital requirements; Ø The substantial amount of the option price; and Ø The reasonableness of the net rent the Bank would pay if it remained a Tenant. Ø Bank also had a right to purchase the building at fair market value if Ø Lyon became insolvent or Ø control of Lyon changed hands Ø Presumably, the value of Bank’s right to purchase at fair market value was limited by the price of Bank’s Options to Repurchase Donald J. Weidner 45

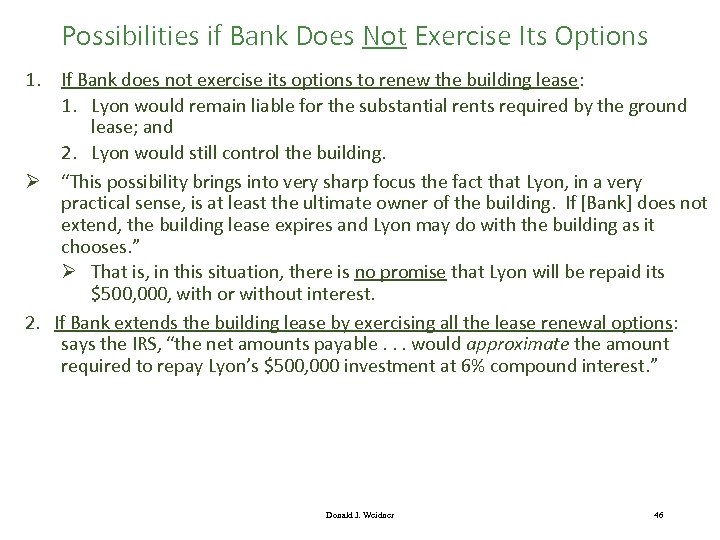

Possibilities if Bank Does Not Exercise Its Options 1. If Bank does not exercise its options to renew the building lease: 1. Lyon would remain liable for the substantial rents required by the ground lease; and 2. Lyon would still control the building. Ø “This possibility brings into very sharp focus the fact that Lyon, in a very practical sense, is at least the ultimate owner of the building. If [Bank] does not extend, the building lease expires and Lyon may do with the building as it chooses. ” Ø That is, in this situation, there is no promise that Lyon will be repaid its $500, 000, with or without interest. 2. If Bank extends the building lease by exercising all the lease renewal options: says the IRS, “the net amounts payable. . . would approximate the amount required to repay Lyon’s $500, 000 investment at 6% compound interest. ” Donald J. Weidner 46

Possibilities if Bank Does Not Exercise Its Options 1. If Bank does not exercise its options to renew the building lease: 1. Lyon would remain liable for the substantial rents required by the ground lease; and 2. Lyon would still control the building. Ø “This possibility brings into very sharp focus the fact that Lyon, in a very practical sense, is at least the ultimate owner of the building. If [Bank] does not extend, the building lease expires and Lyon may do with the building as it chooses. ” Ø That is, in this situation, there is no promise that Lyon will be repaid its $500, 000, with or without interest. 2. If Bank extends the building lease by exercising all the lease renewal options: says the IRS, “the net amounts payable. . . would approximate the amount required to repay Lyon’s $500, 000 investment at 6% compound interest. ” Donald J. Weidner 46

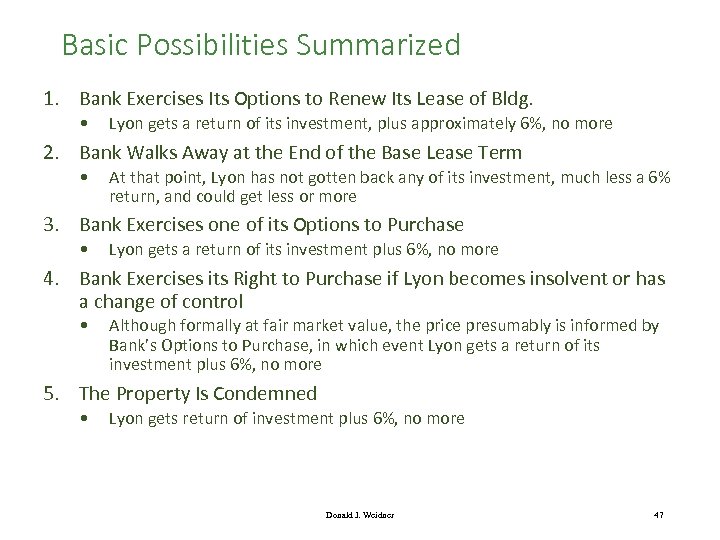

Basic Possibilities Summarized 1. Bank Exercises Its Options to Renew Its Lease of Bldg. • Lyon gets a return of its investment, plus approximately 6%, no more 2. Bank Walks Away at the End of the Base Lease Term • At that point, Lyon has not gotten back any of its investment, much less a 6% return, and could get less or more 3. Bank Exercises one of its Options to Purchase • Lyon gets a return of its investment plus 6%, no more 4. Bank Exercises its Right to Purchase if Lyon becomes insolvent or has a change of control • Although formally at fair market value, the price presumably is informed by Bank’s Options to Purchase, in which event Lyon gets a return of its investment plus 6%, no more 5. The Property Is Condemned • Lyon gets return of investment plus 6%, no more Donald J. Weidner 47

Basic Possibilities Summarized 1. Bank Exercises Its Options to Renew Its Lease of Bldg. • Lyon gets a return of its investment, plus approximately 6%, no more 2. Bank Walks Away at the End of the Base Lease Term • At that point, Lyon has not gotten back any of its investment, much less a 6% return, and could get less or more 3. Bank Exercises one of its Options to Purchase • Lyon gets a return of its investment plus 6%, no more 4. Bank Exercises its Right to Purchase if Lyon becomes insolvent or has a change of control • Although formally at fair market value, the price presumably is informed by Bank’s Options to Purchase, in which event Lyon gets a return of its investment plus 6%, no more 5. The Property Is Condemned • Lyon gets return of investment plus 6%, no more Donald J. Weidner 47

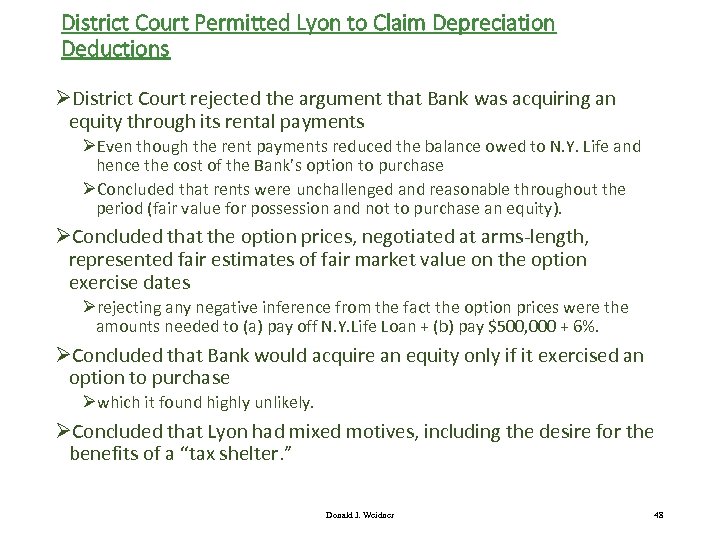

District Court Permitted Lyon to Claim Depreciation Deductions ØDistrict Court rejected the argument that Bank was acquiring an equity through its rental payments ØEven though the rent payments reduced the balance owed to N. Y. Life and hence the cost of the Bank’s option to purchase ØConcluded that rents were unchallenged and reasonable throughout the period (fair value for possession and not to purchase an equity). ØConcluded that the option prices, negotiated at arms-length, represented fair estimates of fair market value on the option exercise dates Ørejecting any negative inference from the fact the option prices were the amounts needed to (a) pay off N. Y. Life Loan + (b) pay $500, 000 + 6%. ØConcluded that Bank would acquire an equity only if it exercised an option to purchase Øwhich it found highly unlikely. ØConcluded that Lyon had mixed motives, including the desire for the benefits of a “tax shelter. ” Donald J. Weidner 48

District Court Permitted Lyon to Claim Depreciation Deductions ØDistrict Court rejected the argument that Bank was acquiring an equity through its rental payments ØEven though the rent payments reduced the balance owed to N. Y. Life and hence the cost of the Bank’s option to purchase ØConcluded that rents were unchallenged and reasonable throughout the period (fair value for possession and not to purchase an equity). ØConcluded that the option prices, negotiated at arms-length, represented fair estimates of fair market value on the option exercise dates Ørejecting any negative inference from the fact the option prices were the amounts needed to (a) pay off N. Y. Life Loan + (b) pay $500, 000 + 6%. ØConcluded that Bank would acquire an equity only if it exercised an option to purchase Øwhich it found highly unlikely. ØConcluded that Lyon had mixed motives, including the desire for the benefits of a “tax shelter. ” Donald J. Weidner 48

Eighth Circuit Reversed the District Court Ø Eight Circuit held: Lyon was not the true owner Ø Therefore, Lyon was not entitled to depreciation deductions. Ø Property rights are analogous to a “bundle of sticks, ” and “Lyon ‘totes an empty bundle’ of ownership sticks: ” 1. Lyon’s right to profit from its investment was circumscribed by Bank’s option to purchase at a price equal to Lyon’s investment, plus 6% thereon, plus the unpaid balance on the N. Y. Life mortgage; Ø That is, Bank had the option to get title to the building back by treating Lyon as a second mortgagee @ 6% 2. The prices of Bank’s options to purchase did not take into account any appreciation in the value of the building, even from inflation; Ø Hence, Lyon had fewer rights than the normal owner of a commercial building Donald J. Weidner 49

Eighth Circuit Reversed the District Court Ø Eight Circuit held: Lyon was not the true owner Ø Therefore, Lyon was not entitled to depreciation deductions. Ø Property rights are analogous to a “bundle of sticks, ” and “Lyon ‘totes an empty bundle’ of ownership sticks: ” 1. Lyon’s right to profit from its investment was circumscribed by Bank’s option to purchase at a price equal to Lyon’s investment, plus 6% thereon, plus the unpaid balance on the N. Y. Life mortgage; Ø That is, Bank had the option to get title to the building back by treating Lyon as a second mortgagee @ 6% 2. The prices of Bank’s options to purchase did not take into account any appreciation in the value of the building, even from inflation; Ø Hence, Lyon had fewer rights than the normal owner of a commercial building Donald J. Weidner 49

Eighth Circuit Reversal (cont’d) ØLyon’s “empty bundle” (cont’d) 3. Any amount realized from destruction or condemnation in excess of the NY Life mortgage and return of Lyon’s $500, 000 plus 6% would go to Bank rather than to Lyon; and ØThat is, Bank got all of any equity through amortization and/or appreciation 4. The building rent during the base term was equal to debt service and hence gave Lyon zero cash flow; and 5. Bank retained control over the building through its: Øa) options to purchase the building, Øb) options to renew its lease of the building, and Øc) ownership of the site. ØIn summary, Bank had virtually all of the benefits and burdens of ownership of the building and Lyon merely got a tax shelter for 11 years. Donald J. Weidner 50

Eighth Circuit Reversal (cont’d) ØLyon’s “empty bundle” (cont’d) 3. Any amount realized from destruction or condemnation in excess of the NY Life mortgage and return of Lyon’s $500, 000 plus 6% would go to Bank rather than to Lyon; and ØThat is, Bank got all of any equity through amortization and/or appreciation 4. The building rent during the base term was equal to debt service and hence gave Lyon zero cash flow; and 5. Bank retained control over the building through its: Øa) options to purchase the building, Øb) options to renew its lease of the building, and Øc) ownership of the site. ØIn summary, Bank had virtually all of the benefits and burdens of ownership of the building and Lyon merely got a tax shelter for 11 years. Donald J. Weidner 50

Supreme Court reversed Eighth Circuit and Allowed Lyon the Depreciation Deductions Consider the significance of each of the following points made by the Supreme Court: ØSupreme Court distinguished Lazarus (which treated a sale-leaseback as a mortgage, which is what the IRS wanted done in Lyon) by saying it involved only two parties: Ø“The present case, in contrast, involves three parties, [Bank], Lyon and the finance agency. ” ØThe Court also noted that the transaction was compelled: Ø“Despite Frank Lyon’s presence on [Bank’s] board of directors, the transaction, as it ultimately developed, was not a familial one arranged by [Bank], but one compelled by the realities of the restrictions imposed upon the bank. Had Lyon not appeared, another interested investor would have been selected. ” ØThis last part is what troubles the IRS—someone was going to get a pretty naked tax shelter, at least for the first 11 years. Donald J. Weidner 51

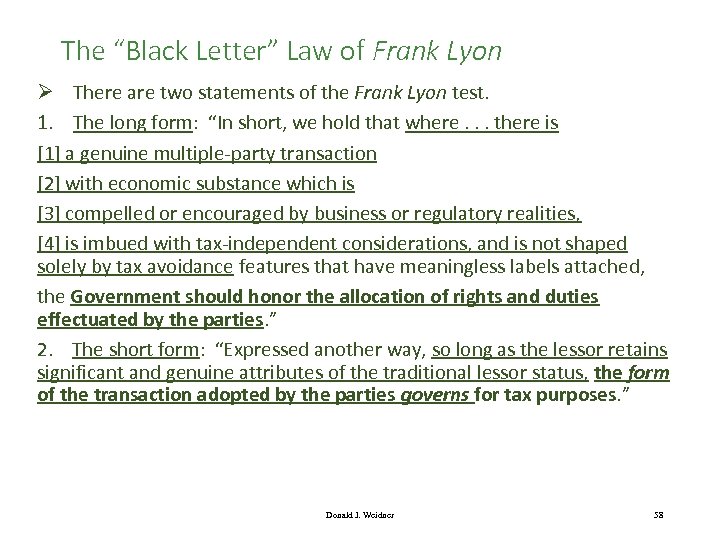

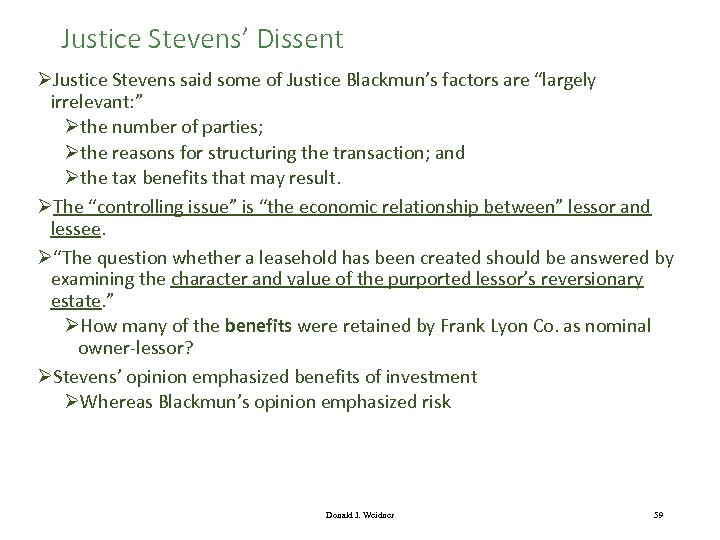

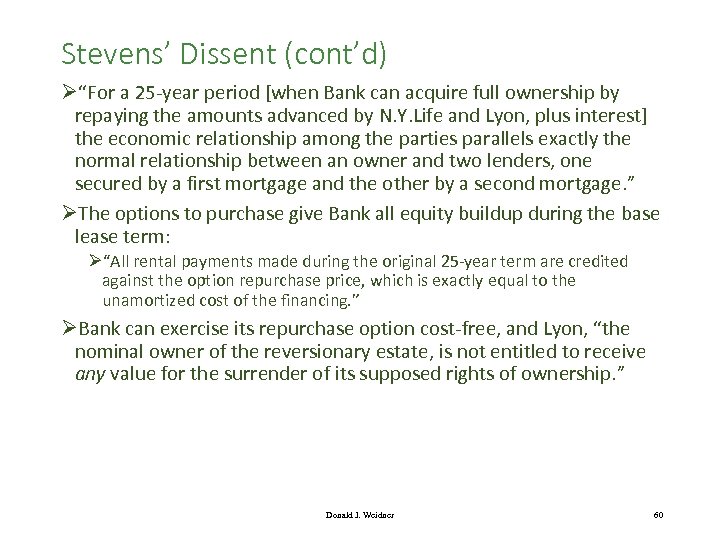

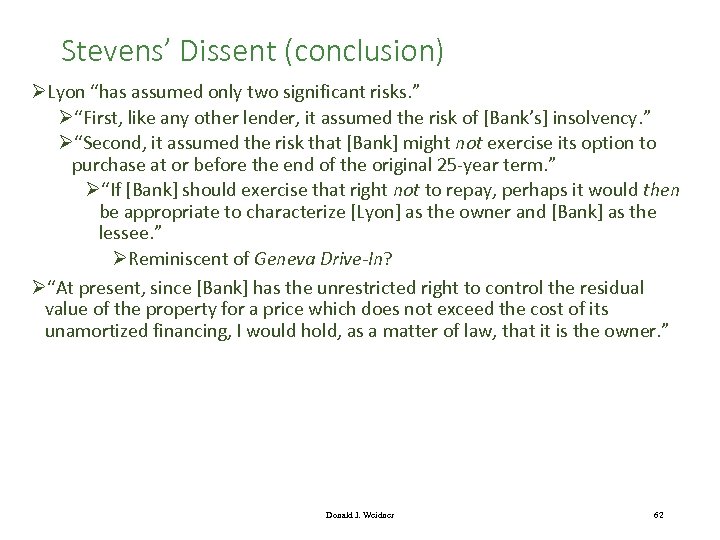

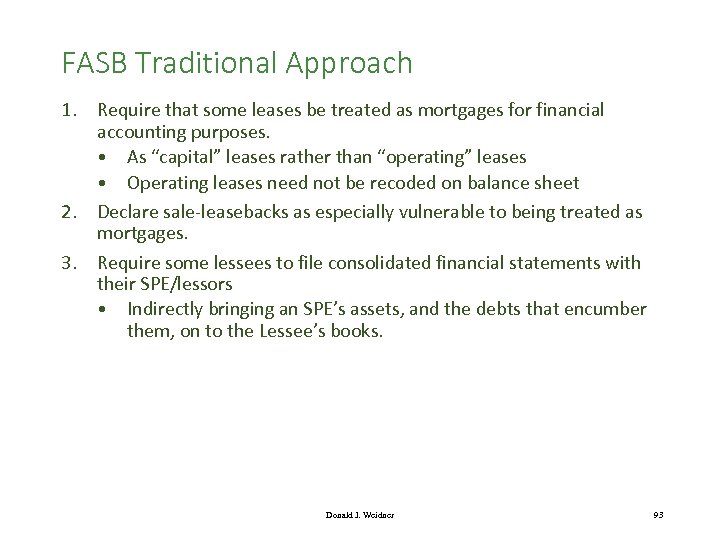

Supreme Court reversed Eighth Circuit and Allowed Lyon the Depreciation Deductions Consider the significance of each of the following points made by the Supreme Court: ØSupreme Court distinguished Lazarus (which treated a sale-leaseback as a mortgage, which is what the IRS wanted done in Lyon) by saying it involved only two parties: Ø“The present case, in contrast, involves three parties, [Bank], Lyon and the finance agency. ” ØThe Court also noted that the transaction was compelled: Ø“Despite Frank Lyon’s presence on [Bank’s] board of directors, the transaction, as it ultimately developed, was not a familial one arranged by [Bank], but one compelled by the realities of the restrictions imposed upon the bank. Had Lyon not appeared, another interested investor would have been selected. ” ØThis last part is what troubles the IRS—someone was going to get a pretty naked tax shelter, at least for the first 11 years. Donald J. Weidner 51