120e28c69496922be05af1b30e4cd1cf.ppt

- Количество слайдов: 19

Tax Considerations for Israeli Companies Operating in Germany DR. AYAL SHENHAV, ADV. March 19 th, 2013 © Privileged & Confidential - Shenhav & Co. , Law Offices

Tax Considerations for Israeli Companies Operating in Germany DR. AYAL SHENHAV, ADV. March 19 th, 2013 © Privileged & Confidential - Shenhav & Co. , Law Offices

Background - The Israeli Tax System • The Israeli tax system was amended in the Tax Reform of 2003, and a residency based tax regime was adopted. • Income of Israeli residents which is derived from sources outside of Israel, is taxable in Israel. • Dividends from non-Israeli companies are subject to the following tax rates: 2 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Background - The Israeli Tax System • The Israeli tax system was amended in the Tax Reform of 2003, and a residency based tax regime was adopted. • Income of Israeli residents which is derived from sources outside of Israel, is taxable in Israel. • Dividends from non-Israeli companies are subject to the following tax rates: 2 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

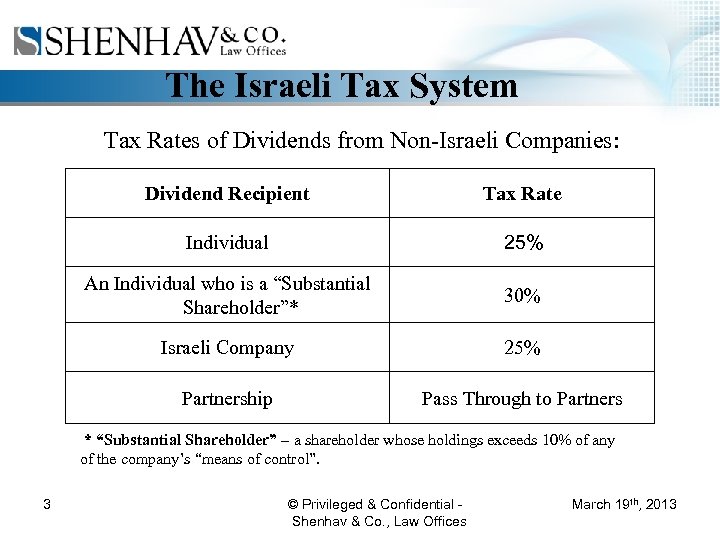

The Israeli Tax System Tax Rates of Dividends from Non-Israeli Companies: Dividend Recipient Tax Rate Individual 25% An Individual who is a “Substantial Shareholder”* 30% Israeli Company 25% Partnership Pass Through to Partners * “Substantial Shareholder” – a shareholder whose holdings exceeds 10% of any of the company’s “means of control”. 3 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

The Israeli Tax System Tax Rates of Dividends from Non-Israeli Companies: Dividend Recipient Tax Rate Individual 25% An Individual who is a “Substantial Shareholder”* 30% Israeli Company 25% Partnership Pass Through to Partners * “Substantial Shareholder” – a shareholder whose holdings exceeds 10% of any of the company’s “means of control”. 3 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Case Study Isra. Tech is an Israeli company which develops new security software for mobile phones. What are the tax considerations in the following scenarios: 1. Isra. Tech allows downloading of its Software, in Germany, through its website. 2. Isra. Tech open an office in Frankfurt. The office provides services and information to German customers. 3. In addition to Scenario 2 above, the German office employs a Marketing Director. 4 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Case Study Isra. Tech is an Israeli company which develops new security software for mobile phones. What are the tax considerations in the following scenarios: 1. Isra. Tech allows downloading of its Software, in Germany, through its website. 2. Isra. Tech open an office in Frankfurt. The office provides services and information to German customers. 3. In addition to Scenario 2 above, the German office employs a Marketing Director. 4 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Case Study (Cont. ) 4. The German office sells the Software to corporate clients. 5. A German subsidiary wholly owned by Isra. Tech is formed and sells to German customers. 6. Isra. Tech give an exclusive license to German. Com, to distribute and sell Isra. Tech’s Software in Germany. German. Com pays Isratech an annual fee of 1, 000 Euro per year, and 5 Euro for each mobile phone in which the Software is used. 7. Isratech sells its German subsidiary to German. Com. 5 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Case Study (Cont. ) 4. The German office sells the Software to corporate clients. 5. A German subsidiary wholly owned by Isra. Tech is formed and sells to German customers. 6. Isra. Tech give an exclusive license to German. Com, to distribute and sell Isra. Tech’s Software in Germany. German. Com pays Isratech an annual fee of 1, 000 Euro per year, and 5 Euro for each mobile phone in which the Software is used. 7. Isratech sells its German subsidiary to German. Com. 5 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 1 Isra. Tech allows the Downloading of its Software, in Germany, through its website. Analysis: • The profits of an Israeli company that does businesses in Germany are not subject to German tax unless, the Israeli company carries business in Germany through a "Permanent Establishment" situated in Germany. • Selling into Germany is therefore not taxable by Germany. 6 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 1 Isra. Tech allows the Downloading of its Software, in Germany, through its website. Analysis: • The profits of an Israeli company that does businesses in Germany are not subject to German tax unless, the Israeli company carries business in Germany through a "Permanent Establishment" situated in Germany. • Selling into Germany is therefore not taxable by Germany. 6 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 The German Office Provides Support Services and Information to German Customers. Analysis: A PE includes, among other things: • A place of management. • A branch. • An office. • A factory. • A person acting in Germany on behalf of an enterprise of Israeli company. 7 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 The German Office Provides Support Services and Information to German Customers. Analysis: A PE includes, among other things: • A place of management. • A branch. • An office. • A factory. • A person acting in Germany on behalf of an enterprise of Israeli company. 7 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) • If Isra. Tech carries on business in Germany through a PE, tax may be imposed in Germany on the profits of Isra. Tech, but only on so much of them as are attributable to the PE. • Isra. Tech shall not be deemed to have a PE in Germany merely because it carries on business in Germany through a broker, general commission, agent or any other agent of an independent status, where such persons are acting in the ordinary course of their business. 8 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) • If Isra. Tech carries on business in Germany through a PE, tax may be imposed in Germany on the profits of Isra. Tech, but only on so much of them as are attributable to the PE. • Isra. Tech shall not be deemed to have a PE in Germany merely because it carries on business in Germany through a broker, general commission, agent or any other agent of an independent status, where such persons are acting in the ordinary course of their business. 8 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) • Actions which are “preparatory and auxiliary” do not constitute a PE even if they take place in a fixed place of business. • The term “permanent establishment” is not be deemed to include: – The use of facilities solely for the purpose of storage, display or delivery of goods or merchandise belonging to the enterprise. – The maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or delivery. – The maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise. 9 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) • Actions which are “preparatory and auxiliary” do not constitute a PE even if they take place in a fixed place of business. • The term “permanent establishment” is not be deemed to include: – The use of facilities solely for the purpose of storage, display or delivery of goods or merchandise belonging to the enterprise. – The maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or delivery. – The maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise. 9 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) - The maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise or of collecting information, for the enterprise. - The maintenance of a fixed place of business solely for the purpose of carrying on, for the enterprise, any other activity of a preparatory or auxiliary character. - The maintenance of a fixed place of business solely for any combination of activities mentioned in sub-paragraphs a) to e), provided that the overall activity of the fixed place of business resulting from this combination is of a preparatory or auxiliary character. 10 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 2 (Cont. ) - The maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise or of collecting information, for the enterprise. - The maintenance of a fixed place of business solely for the purpose of carrying on, for the enterprise, any other activity of a preparatory or auxiliary character. - The maintenance of a fixed place of business solely for any combination of activities mentioned in sub-paragraphs a) to e), provided that the overall activity of the fixed place of business resulting from this combination is of a preparatory or auxiliary character. 10 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 3 The German Office Employs a Marketing Director. Analysis: • Can the activity of the German Marketing Director be classified as “preparatory or auxiliary”? • What are the profits that should be attributable to the German Marketing activity? • Which company owns the marketing know-how? 11 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 3 The German Office Employs a Marketing Director. Analysis: • Can the activity of the German Marketing Director be classified as “preparatory or auxiliary”? • What are the profits that should be attributable to the German Marketing activity? • Which company owns the marketing know-how? 11 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 4 In addition to Marketing, The Office is allowed to sell the Software to Corporate Clients. Analysis: • What are the profits that should be attributable to the German Marketing and Distribution activity? 12 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 4 In addition to Marketing, The Office is allowed to sell the Software to Corporate Clients. Analysis: • What are the profits that should be attributable to the German Marketing and Distribution activity? 12 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 5 A German Subsidiary wholly owned by Isra. Tech. Analysis • • • 13 The overall corporate tax rate in Germany, is 29. 55%. The overall income tax rate for corporations includes corporate income tax at a rate of 15%, Solidarity Surcharge at a rate of 0. 825% (5. 5% of the corporate income tax), and local trade tax. The local trade tax generally varies between 7% and 17. 15%. Dividends payable by a German company to an Israeli company are subject to a 25% withholding tax in Germany. Need to verify in each case if German tax (for example trade tax) is creditable against Israeli tax. © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 5 A German Subsidiary wholly owned by Isra. Tech. Analysis • • • 13 The overall corporate tax rate in Germany, is 29. 55%. The overall income tax rate for corporations includes corporate income tax at a rate of 15%, Solidarity Surcharge at a rate of 0. 825% (5. 5% of the corporate income tax), and local trade tax. The local trade tax generally varies between 7% and 17. 15%. Dividends payable by a German company to an Israeli company are subject to a 25% withholding tax in Germany. Need to verify in each case if German tax (for example trade tax) is creditable against Israeli tax. © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

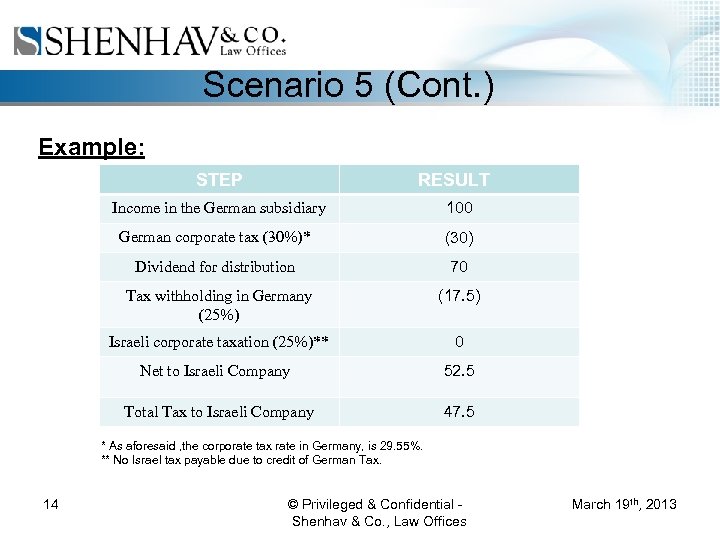

Scenario 5 (Cont. ) Example: STEP RESULT 100 German corporate tax (30%)* (30) Dividend for distribution 70 Tax withholding in Germany (25%) (17. 5) Israeli corporate taxation (25%)** 0 Net to Israeli Company 52. 5 Total Tax to Israeli Company Income in the German subsidiary 47. 5 * As aforesaid , the corporate tax rate in Germany, is 29. 55%. ** No Israel tax payable due to credit of German Tax. 14 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 5 (Cont. ) Example: STEP RESULT 100 German corporate tax (30%)* (30) Dividend for distribution 70 Tax withholding in Germany (25%) (17. 5) Israeli corporate taxation (25%)** 0 Net to Israeli Company 52. 5 Total Tax to Israeli Company Income in the German subsidiary 47. 5 * As aforesaid , the corporate tax rate in Germany, is 29. 55%. ** No Israel tax payable due to credit of German Tax. 14 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Reducing German Tax Burden • As can be inferred total corporate and dividend tax in Germany is higher than the Israeli Corporate Tax. • Reducing German tax is possible in a variety of ways: – Operating through a branch and not a subsidiary. – Financing the subsidiary through a shareholder loan (reduces dividend tax and corporate income due to interest deductions). – Inter company agreement (and commensurate transfer pricing allocation) favoring Israel (such as cost plus operations in Germany). – Charging management fees by the Israeli Company to the German Company. – Operating through a company in a third country (for example Cyprus, Netherlands). 15 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Reducing German Tax Burden • As can be inferred total corporate and dividend tax in Germany is higher than the Israeli Corporate Tax. • Reducing German tax is possible in a variety of ways: – Operating through a branch and not a subsidiary. – Financing the subsidiary through a shareholder loan (reduces dividend tax and corporate income due to interest deductions). – Inter company agreement (and commensurate transfer pricing allocation) favoring Israel (such as cost plus operations in Germany). – Charging management fees by the Israeli Company to the German Company. – Operating through a company in a third country (for example Cyprus, Netherlands). 15 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 6 Isra. Tech Provides an Exclusive License to German. Com, to Distribute and sell Isra. Tech’s Software in Germany. German. Com pays Isratech annual fees of 1, 000 Euro per year, and 5 Euro for each Mobile Phone on which the Software is used. Anaylsis: - Is the payment a royalty? Is it purchase of software? - Royalties to Isra. Tech shall be taxable in Germany at the rate of 5% (additional tax in Israel). - When Isra. Tech has a PE in Germany the proceeds may be attributable to the PE. 16 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 6 Isra. Tech Provides an Exclusive License to German. Com, to Distribute and sell Isra. Tech’s Software in Germany. German. Com pays Isratech annual fees of 1, 000 Euro per year, and 5 Euro for each Mobile Phone on which the Software is used. Anaylsis: - Is the payment a royalty? Is it purchase of software? - Royalties to Isra. Tech shall be taxable in Germany at the rate of 5% (additional tax in Israel). - When Isra. Tech has a PE in Germany the proceeds may be attributable to the PE. 16 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

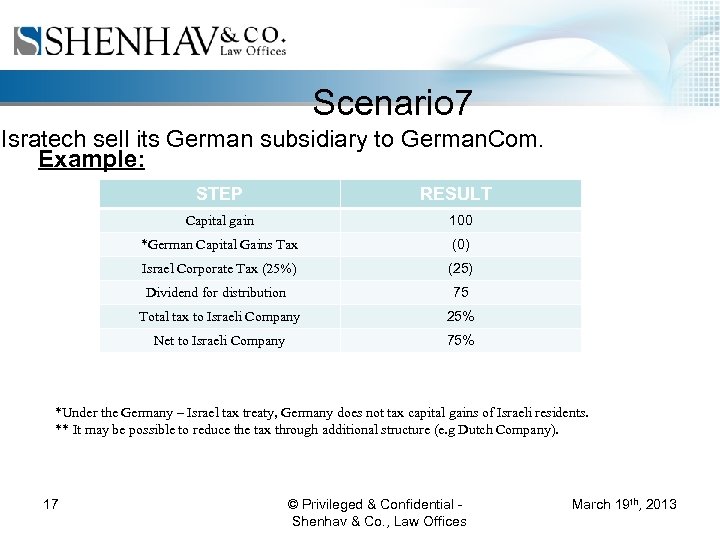

Scenario 7 Isratech sell its German subsidiary to German. Com. Example: STEP RESULT Capital gain 100 *German Capital Gains Tax (0) Israel Corporate Tax (25%) (25) Dividend for distribution 75 Total tax to Israeli Company 25% Net to Israeli Company 75% *Under the Germany – Israel tax treaty, Germany does not tax capital gains of Israeli residents. ** It may be possible to reduce the tax through additional structure (e. g Dutch Company). 17 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Scenario 7 Isratech sell its German subsidiary to German. Com. Example: STEP RESULT Capital gain 100 *German Capital Gains Tax (0) Israel Corporate Tax (25%) (25) Dividend for distribution 75 Total tax to Israeli Company 25% Net to Israeli Company 75% *Under the Germany – Israel tax treaty, Germany does not tax capital gains of Israeli residents. ** It may be possible to reduce the tax through additional structure (e. g Dutch Company). 17 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Conclusions • Germany is an economic powerhouse, has a large local market and can be the Gateway to Europe. • However, careful tax planning is required to avoid excessive taxation, reporting and more. 18 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

Conclusions • Germany is an economic powerhouse, has a large local market and can be the Gateway to Europe. • However, careful tax planning is required to avoid excessive taxation, reporting and more. 18 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

THANK YOU Dr. Ayal Shenhav & Co. , Law Offices Tel: 972 -3 -611 -760 ayal@shenhavlaw. co. il www. shenhavlaw. co. il 19 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013

THANK YOU Dr. Ayal Shenhav & Co. , Law Offices Tel: 972 -3 -611 -760 ayal@shenhavlaw. co. il www. shenhavlaw. co. il 19 © Privileged & Confidential - Shenhav & Co. , Law Offices March 19 th, 2013