b8fdd7ff3f95e21f5e6acffde709bf44.ppt

- Количество слайдов: 8

Taurus L. H. Fund Investor Seminar Oct 2011 1

Taurus L. H. Fund Investor Seminar Oct 2011 1

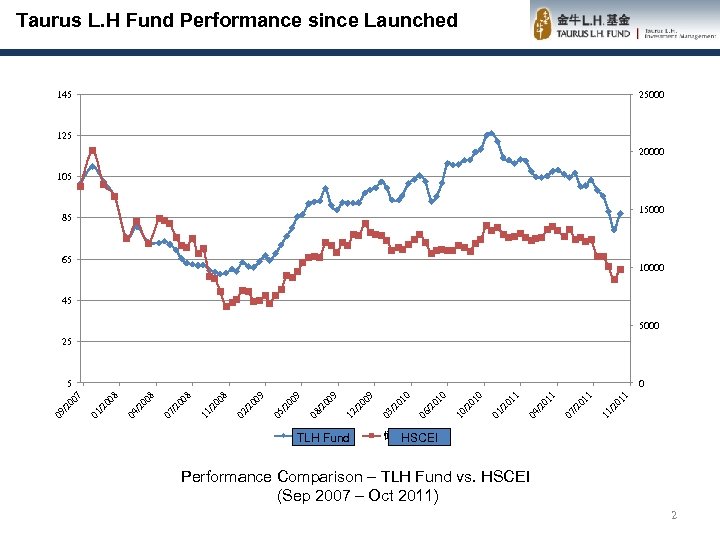

Taurus L. H Fund Performance since Launched 145 25000 125 20000 105 15000 85 65 10000 45 5000 25 11 /2 01 1 1 01 /2 07 1 /2 04 01 /2 01 01 1 0 01 /2 10 0 01 /2 06 0 01 /2 00 /2 12 金牛L. H. 基金 TLH Fund 03 9 9 00 08 /2 9 00 /2 05 9 00 /2 02 8 00 11 /2 8 00 /2 07 8 00 /2 04 /2 00 8 0 01 09 /2 00 7 5 恒生国企指数 HSCEI Performance Comparison – TLH Fund vs. HSCEI (Sep 2007 – Oct 2011) 2

Taurus L. H Fund Performance since Launched 145 25000 125 20000 105 15000 85 65 10000 45 5000 25 11 /2 01 1 1 01 /2 07 1 /2 04 01 /2 01 01 1 0 01 /2 10 0 01 /2 06 0 01 /2 00 /2 12 金牛L. H. 基金 TLH Fund 03 9 9 00 08 /2 9 00 /2 05 9 00 /2 02 8 00 11 /2 8 00 /2 07 8 00 /2 04 /2 00 8 0 01 09 /2 00 7 5 恒生国企指数 HSCEI Performance Comparison – TLH Fund vs. HSCEI (Sep 2007 – Oct 2011) 2

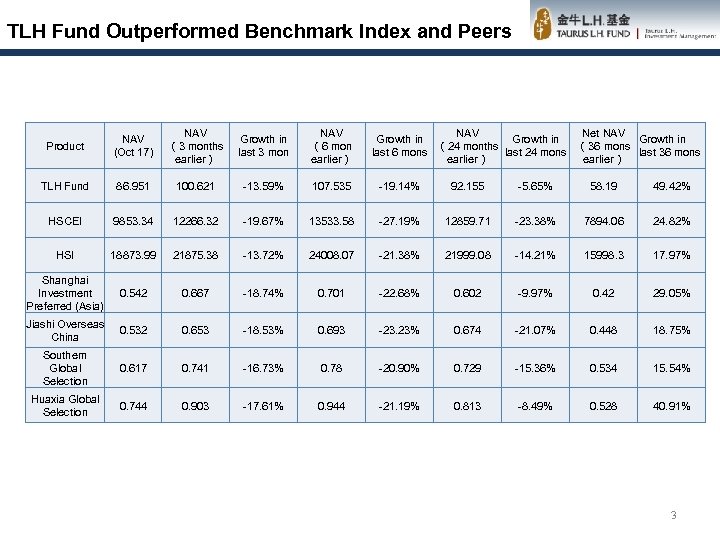

TLH Fund Outperformed Benchmark Index and Peers Product NAV (Oct 17) NAV (3 months earlier) Growth in last 3 mon NAV (6 mon earlier) NAV Net NAV Growth in (24 months (36 mons last 24 mons last 36 mons earlier) TLH Fund 86. 951 100. 621 -13. 59% 107. 535 -19. 14% 92. 155 -5. 65% 58. 19 49. 42% HSCEI 9853. 34 12266. 32 -19. 67% 13533. 58 -27. 19% 12859. 71 -23. 38% 7894. 06 24. 82% HSI 18873. 99 21875. 38 -13. 72% 24008. 07 -21. 38% 21999. 08 -14. 21% 15998. 3 17. 97% Shanghai Investment Preferred (Asia) 0. 542 0. 667 -18. 74% 0. 701 -22. 68% 0. 602 -9. 97% 0. 42 29. 05% Jiashi Overseas China 0. 532 0. 653 -18. 53% 0. 693 -23. 23% 0. 674 -21. 07% 0. 448 18. 75% Southern Global Selection 0. 617 0. 741 -16. 73% 0. 78 -20. 90% 0. 729 -15. 36% 0. 534 15. 54% Huaxia Global Selection 0. 744 0. 903 -17. 61% 0. 944 -21. 19% 0. 813 -8. 49% 0. 528 40. 91% 3

TLH Fund Outperformed Benchmark Index and Peers Product NAV (Oct 17) NAV (3 months earlier) Growth in last 3 mon NAV (6 mon earlier) NAV Net NAV Growth in (24 months (36 mons last 24 mons last 36 mons earlier) TLH Fund 86. 951 100. 621 -13. 59% 107. 535 -19. 14% 92. 155 -5. 65% 58. 19 49. 42% HSCEI 9853. 34 12266. 32 -19. 67% 13533. 58 -27. 19% 12859. 71 -23. 38% 7894. 06 24. 82% HSI 18873. 99 21875. 38 -13. 72% 24008. 07 -21. 38% 21999. 08 -14. 21% 15998. 3 17. 97% Shanghai Investment Preferred (Asia) 0. 542 0. 667 -18. 74% 0. 701 -22. 68% 0. 602 -9. 97% 0. 42 29. 05% Jiashi Overseas China 0. 532 0. 653 -18. 53% 0. 693 -23. 23% 0. 674 -21. 07% 0. 448 18. 75% Southern Global Selection 0. 617 0. 741 -16. 73% 0. 78 -20. 90% 0. 729 -15. 36% 0. 534 15. 54% Huaxia Global Selection 0. 744 0. 903 -17. 61% 0. 944 -21. 19% 0. 813 -8. 49% 0. 528 40. 91% 3

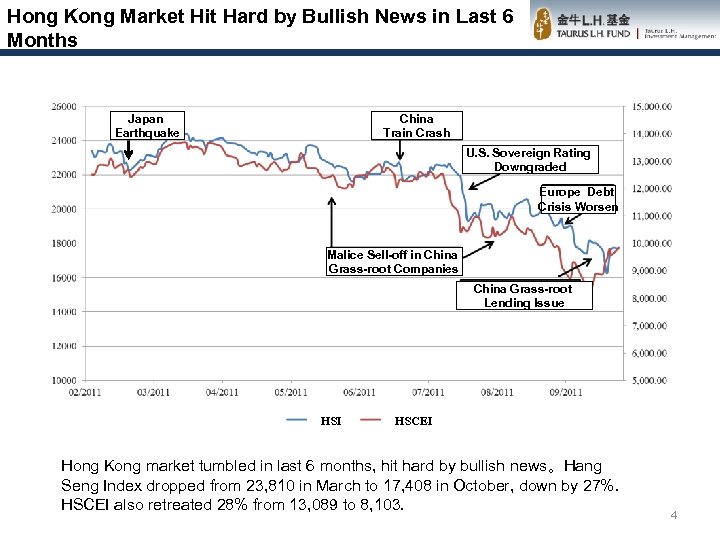

Hong Kong Market Hit Hard by Bullish News in Last 6 Months Japan Earthquake China Train Crash U. S. Sovereign Rating Downgraded Europe Debt Crisis Worsen Malice Sell-off in China Grass-root Companies China Grass-root Lending Issue HSI HSCEI Hong Kong market tumbled in last 6 months, hit hard by bullish news。Hang Seng Index dropped from 23, 810 in March to 17, 408 in October, down by 27%. HSCEI also retreated 28% from 13, 089 to 8, 103. 4

Hong Kong Market Hit Hard by Bullish News in Last 6 Months Japan Earthquake China Train Crash U. S. Sovereign Rating Downgraded Europe Debt Crisis Worsen Malice Sell-off in China Grass-root Companies China Grass-root Lending Issue HSI HSCEI Hong Kong market tumbled in last 6 months, hit hard by bullish news。Hang Seng Index dropped from 23, 810 in March to 17, 408 in October, down by 27%. HSCEI also retreated 28% from 13, 089 to 8, 103. 4

Some Reflection on Decline of Fund Net Worth • Under a proactive value investment philosophy, TLH fund once far outperformed market and its peers. However, our focus more on fundamentals than on market situation led to short term volatile fluctuation in net asset value, especially under deteriorating market environment. • Hong Kong Market was in a big cycle of bullish market since 2007, when T. L. H was first launched. • Affected by global financial market, Hong Kong market had tumbled more than expected. • Our reaction was not timely enough in the face of a fast change market situation. 5

Some Reflection on Decline of Fund Net Worth • Under a proactive value investment philosophy, TLH fund once far outperformed market and its peers. However, our focus more on fundamentals than on market situation led to short term volatile fluctuation in net asset value, especially under deteriorating market environment. • Hong Kong Market was in a big cycle of bullish market since 2007, when T. L. H was first launched. • Affected by global financial market, Hong Kong market had tumbled more than expected. • Our reaction was not timely enough in the face of a fast change market situation. 5

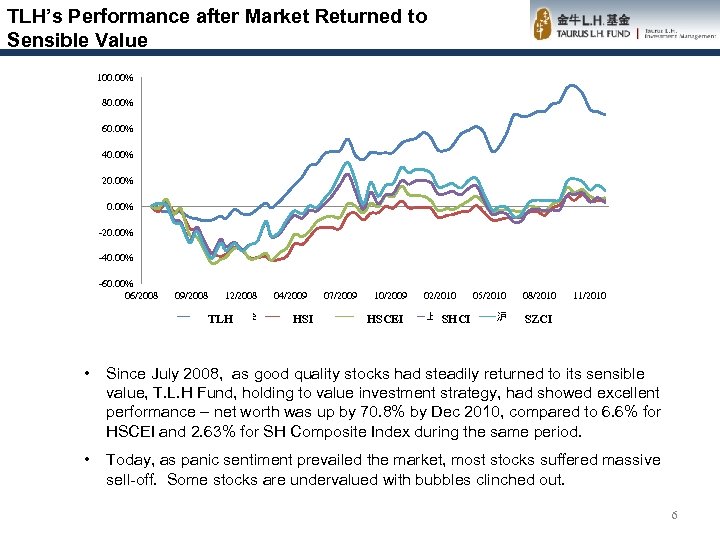

TLH’s Performance after Market Returned to Sensible Value 100. 00% 80. 00% 60. 00% 40. 00% 20. 00% -20. 00% -40. 00% -60. 00% 06/2008 09/2008 12/2008 金牛L. H. 基金 TLH 04/2009 07/2009 恒生指数 HSI 10/2009 国企指数 HSCEI 02/2010 上证指数 SHCI 05/2010 08/2010 11/2010 沪深 300指数 SZCI • Since July 2008, as good quality stocks had steadily returned to its sensible value, T. L. H Fund, holding to value investment strategy, had showed excellent performance – net worth was up by 70. 8% by Dec 2010, compared to 6. 6% for HSCEI and 2. 63% for SH Composite Index during the same period. • Today, as panic sentiment prevailed the market, most stocks suffered massive sell-off. Some stocks are undervalued with bubbles clinched out. 6

TLH’s Performance after Market Returned to Sensible Value 100. 00% 80. 00% 60. 00% 40. 00% 20. 00% -20. 00% -40. 00% -60. 00% 06/2008 09/2008 12/2008 金牛L. H. 基金 TLH 04/2009 07/2009 恒生指数 HSI 10/2009 国企指数 HSCEI 02/2010 上证指数 SHCI 05/2010 08/2010 11/2010 沪深 300指数 SZCI • Since July 2008, as good quality stocks had steadily returned to its sensible value, T. L. H Fund, holding to value investment strategy, had showed excellent performance – net worth was up by 70. 8% by Dec 2010, compared to 6. 6% for HSCEI and 2. 63% for SH Composite Index during the same period. • Today, as panic sentiment prevailed the market, most stocks suffered massive sell-off. Some stocks are undervalued with bubbles clinched out. 6

We continue to improve Investment Strategy System • We will continue to hold on to value investment philosophy, searching value in capital market with the eyes of industrial capital, in order to gain consistent return in the long term. • Our research team will focus more on trend analysis and investment strategies in Hong Kong market, in order to have quick reaction to fast market changes. • We had introduced professionals from some Hong Kong hedge fund, who will pay more attention to market trend research, buy/sell data analysis, in order to avoid risks in individual stocks and diversify investment targets. • Through in-depth research, we have shortlisted some good quality stocks with investment value and safe margin. We expect those excellent and good potential market leaders will give us high return in the 3 to 5 years to come. 7

We continue to improve Investment Strategy System • We will continue to hold on to value investment philosophy, searching value in capital market with the eyes of industrial capital, in order to gain consistent return in the long term. • Our research team will focus more on trend analysis and investment strategies in Hong Kong market, in order to have quick reaction to fast market changes. • We had introduced professionals from some Hong Kong hedge fund, who will pay more attention to market trend research, buy/sell data analysis, in order to avoid risks in individual stocks and diversify investment targets. • Through in-depth research, we have shortlisted some good quality stocks with investment value and safe margin. We expect those excellent and good potential market leaders will give us high return in the 3 to 5 years to come. 7

Thank you ! 8

Thank you ! 8