b3f16b6cdb7f7e7fe2a712c45400061b.ppt

- Количество слайдов: 24

Tariff strategies for competitive environments: Aims and objectives Dr Tim Kelly (ITU), Seminar on tariff strategies for competitive environments, ALTTC, Ghaziabad, 20 -22 July 1999 The views expressed in this paper are those of the author and do not necessarily reflect the opinions of the ITU or its membership. Dr Kelly can be contacted at Tim. Kelly@itu. int.

Agenda l The state of the Telecoms sector worldwide ð The Public Switched Telephone Network ð Mobile Communications ð The Internet l l The growth of competition The competitive pressures facing Do. T Aims and objectives of the course Structure of the course

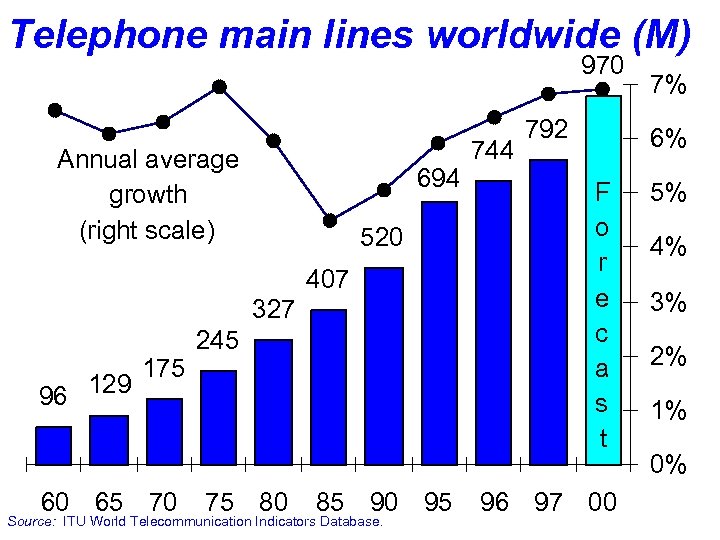

Telephone main lines worldwide (M) 970 Annual average growth (right scale) 694 520 407 327 96 129 175 60 65 70 245 75 80 85 90 95 Source: ITU World Telecommunication Indicators Database. 744 792 7% 6% F o r e c a s t 96 97 00 5% 4% 3% 2% 1% 0%

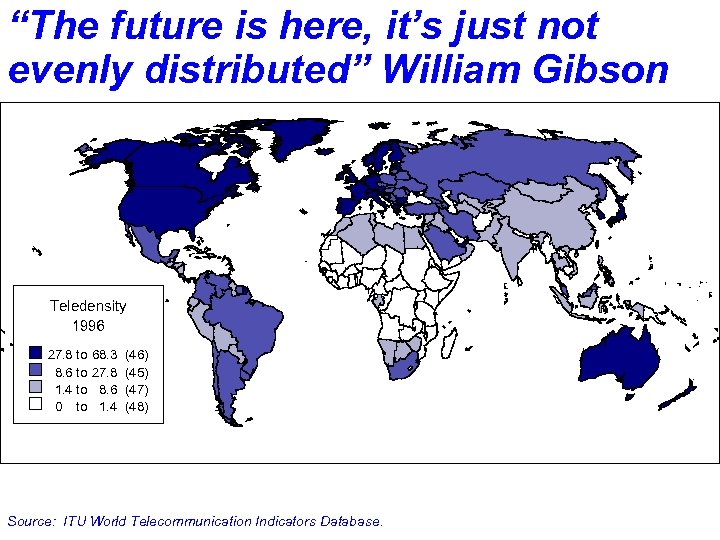

“The future is here, it’s just not evenly distributed” William Gibson Teledensity 1996 27. 8 to 8. 6 to 1. 4 to 0 to 68. 3 27. 8 8. 6 1. 4 (46) (45) (47) (48) Source: ITU World Telecommunication Indicators Database.

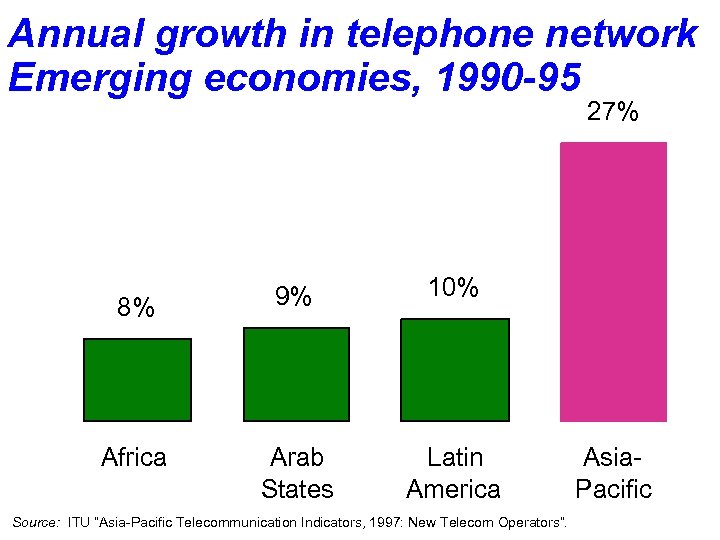

Annual growth in telephone network Emerging economies, 1990 -95 27% 8% 9% 10% Africa Arab States Latin America Source: ITU “Asia-Pacific Telecommunication Indicators, 1997: New Telecom Operators”. Asia. Pacific

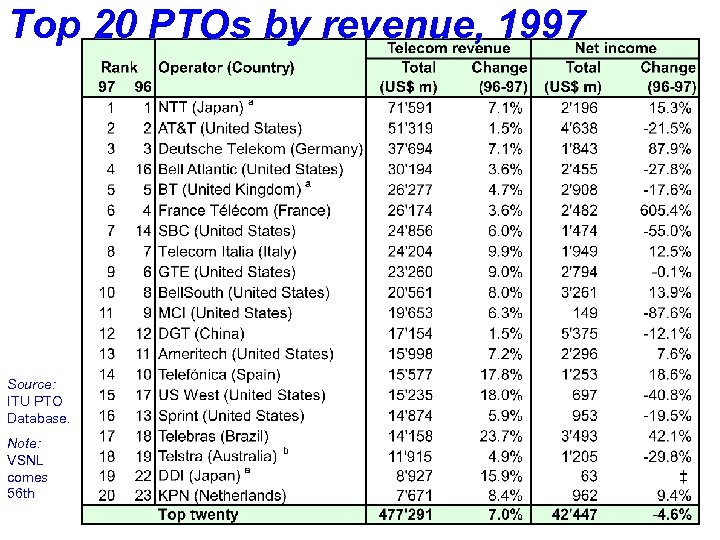

Top 20 PTOs by revenue, 1997 Source: ITU PTO Database. Note: VSNL comes 56 th

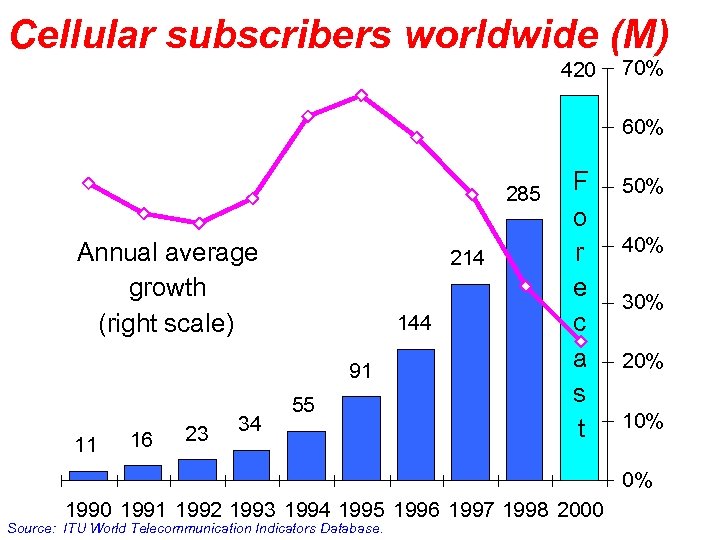

Cellular subscribers worldwide (M) 420 70% 60% 285 Annual average growth (right scale) 214 144 91 11 16 23 34 55 F o r e c a s t 50% 40% 30% 20% 10% 0% 1990 1991 1992 1993 1994 1995 1996 1997 1998 2000 Source: ITU World Telecommunication Indicators Database.

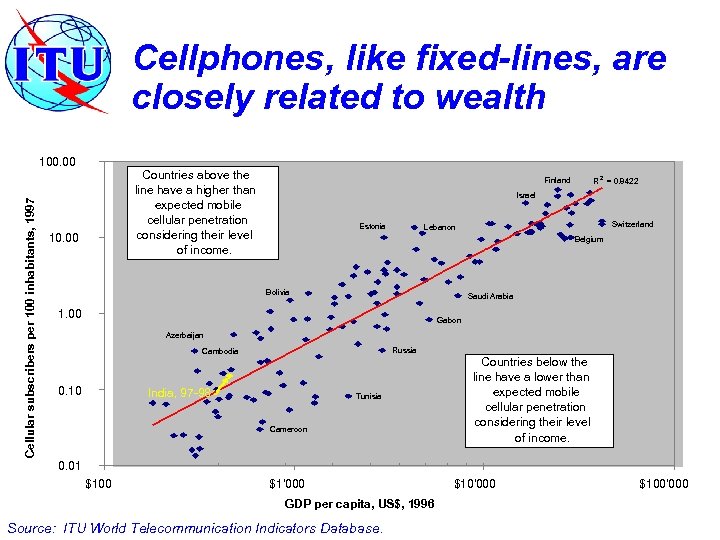

Cellphones, like fixed-lines, are closely related to wealth Cellular subscribers per 100 inhabitants, 1997 100. 00 Countries above the line have a higher than expected mobile cellular penetration considering their level of income. 10. 00 R 2 = 0. 8422 Finland Israel Estonia Switzerland Lebanon Belgium Bolivia Saudi Arabia 1. 00 Gabon Azerbaijan Russia Cambodia 0. 10 India, 97 -98 Tunisia Cameroon Countries below the line have a lower than expected mobile cellular penetration considering their level of income. 0. 01 $100 $1'000 GDP per capita, US$, 1996 Source: ITU World Telecommunication Indicators Database. $10'000 $100'000

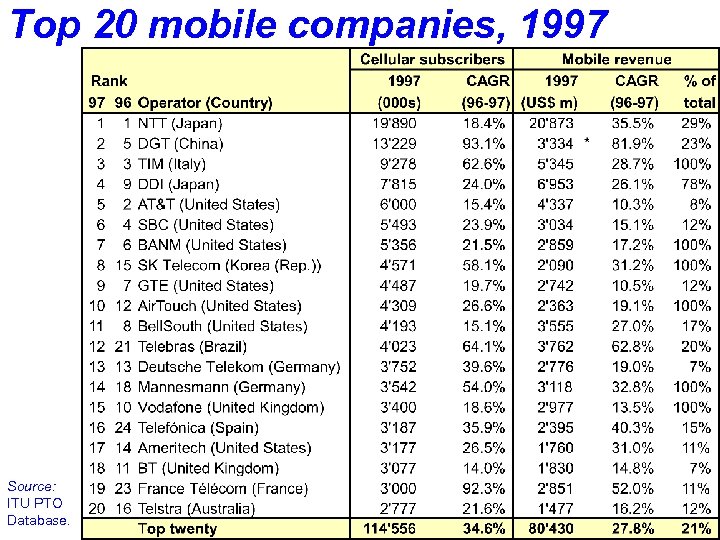

Top 20 mobile companies, 1997 Source: ITU PTO Database.

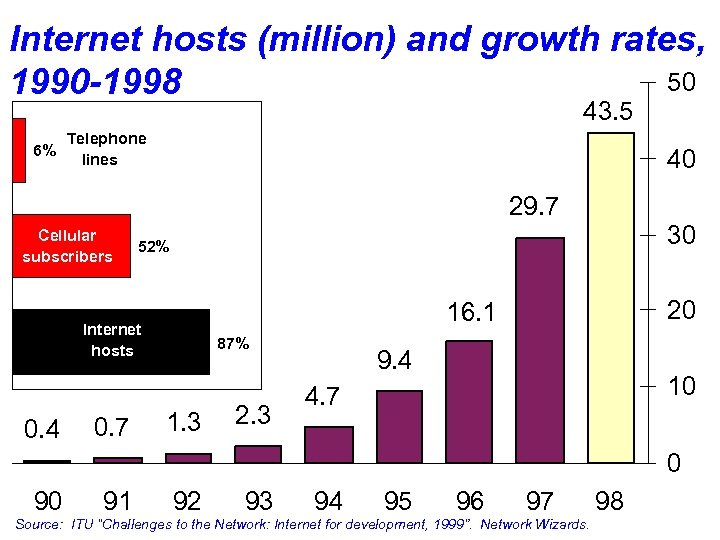

Internet hosts (million) and growth rates, 50 1990 -1998 43. 5 Telephone 6% lines 40 29. 7 Cellular subscribers 0. 4 20 16. 1 Internet hosts 0. 7 30 52% 87% 1. 3 2. 3 9. 4 10 4. 7 0 90 91 92 93 94 95 96 97 Source: ITU “Challenges to the Network: Internet for development, 1999”. Network Wizards. 98

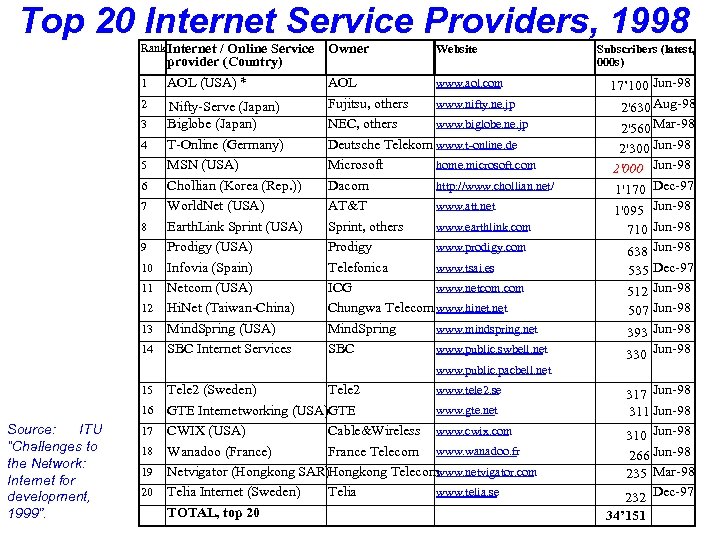

Top 20 Internet Service Providers, 1998 Rank Internet / Online Service provider (Country) 1 AOL (USA) * 2 Nifty-Serve (Japan) Biglobe (Japan) T-Online (Germany) MSN (USA) Chollian (Korea (Rep. )) World. Net (USA) Earth. Link Sprint (USA) Prodigy (USA) Infovia (Spain) Netcom (USA) Hi. Net (Taiwan-China) Mind. Spring (USA) SBC Internet Services 3 4 5 6 7 8 9 10 11 12 13 14 Owner Website www. aol. com AOL www. nifty. ne. jp Fujitsu, others www. biglobe. ne. jp NEC, others Deutsche Telekom www. t-online. de home. microsoft. com Microsoft http: //www. chollian. net/ Dacom www. att. net AT&T www. earthlink. com Sprint, others www. prodigy. com Prodigy www. tsai. es Telefonica www. netcom. com ICG Chungwa Telecom www. hinet. net www. mindspring. net Mind. Spring www. public. swbell. net SBC Subscribers (latest, 000 s) 17’ 100 Jun-98 2'630 Aug-98 2'560 Mar-98 2'300 Jun-98 2'000 Jun-98 1'170 Dec-97 1'095 Jun-98 710 Jun-98 638 Jun-98 535 Dec-97 512 Jun-98 507 Jun-98 393 Jun-98 330 Jun-98 www. public. pacbell. net 15 16 Source: ITU “Challenges to the Network: Internet for development, 1999”. 17 18 19 20 www. tele 2. se Tele 2 (Sweden) Tele 2 www. gte. net GTE Internetworking (USA)GTE CWIX (USA) Cable&Wireless www. cwix. com Wanadoo (France) France Telecom www. wanadoo. fr www. netvigator. com Netvigator (Hongkong SAR)Hongkong Telecom www. telia. se Telia Internet (Sweden) Telia TOTAL, top 20 317 Jun-98 311 Jun-98 310 Jun-98 266 Jun-98 235 Mar-98 232 Dec-97 34’ 151

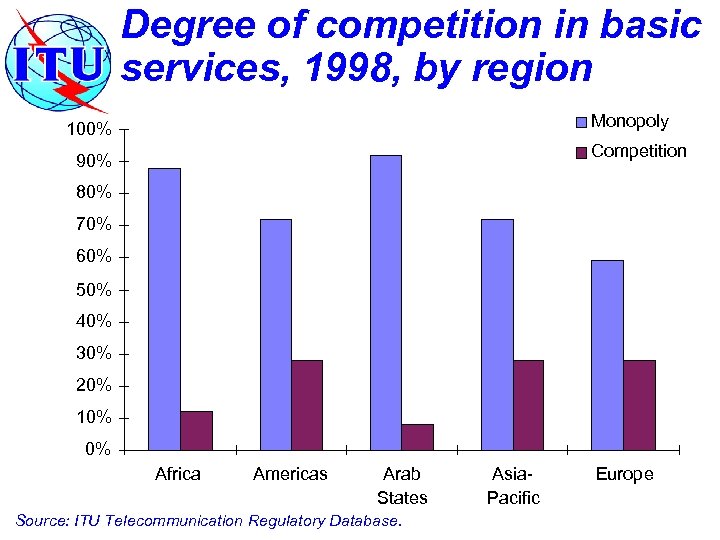

Degree of competition in basic services, 1998, by region Monopoly 100% Competition 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Africa Americas Arab States Source: ITU Telecommunication Regulatory Database. Asia. Pacific Europe

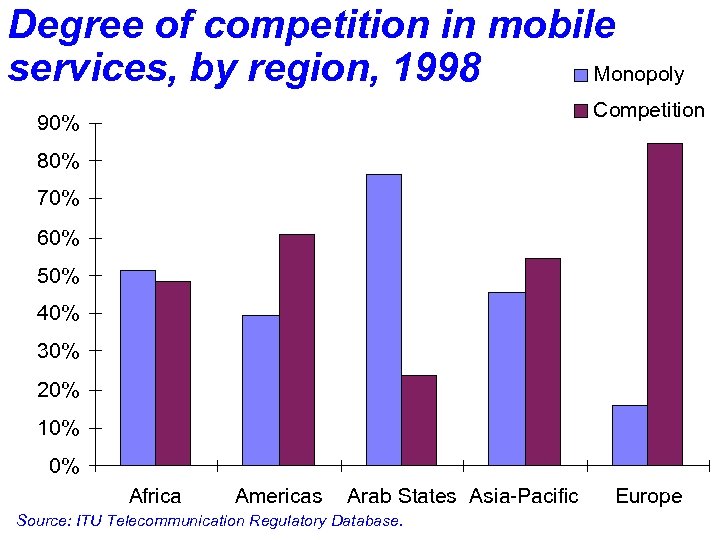

Degree of competition in mobile Monopoly services, by region, 1998 Competition 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Africa Americas Arab States Asia-Pacific Source: ITU Telecommunication Regulatory Database. Europe

Why introduce competition into the Sector? l To introduce fresh investment and/or foreign investment into the Sector ð Existing network may be ageing or poorly maintained ð Existing operator may be debt-ridden or financially constrained l To introduce innovation, price competition and new management techniques l To create new business opportunities for local entrepreneurs and other suppliers l To create more choice for consumers l To improve level of teledensity and pace of network roll-out

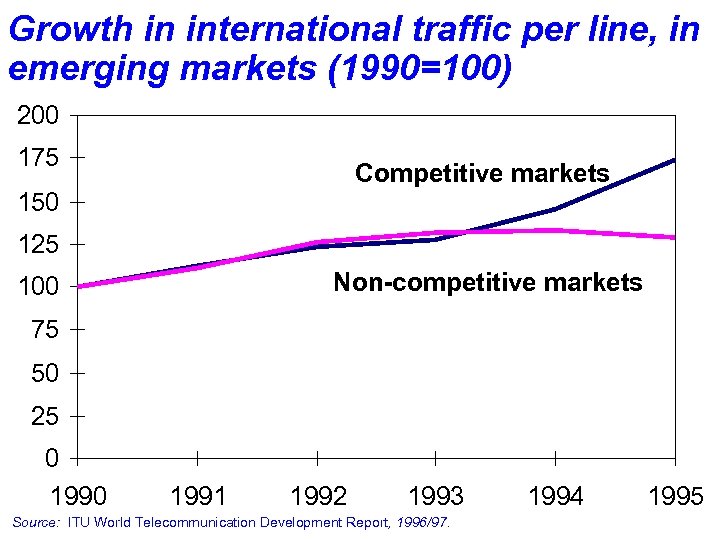

Competitive markets tend to grow faster than monopolistic ones Source: ITU “World Telecom Development Report 1998: Universal Access”

Growth in international traffic per line, in emerging markets (1990=100) 200 175 Competitive markets 150 125 Non-competitive markets 100 75 50 25 0 1991 1992 1993 Source: ITU World Telecommunication Development Report, 1996/97. 1994 1995

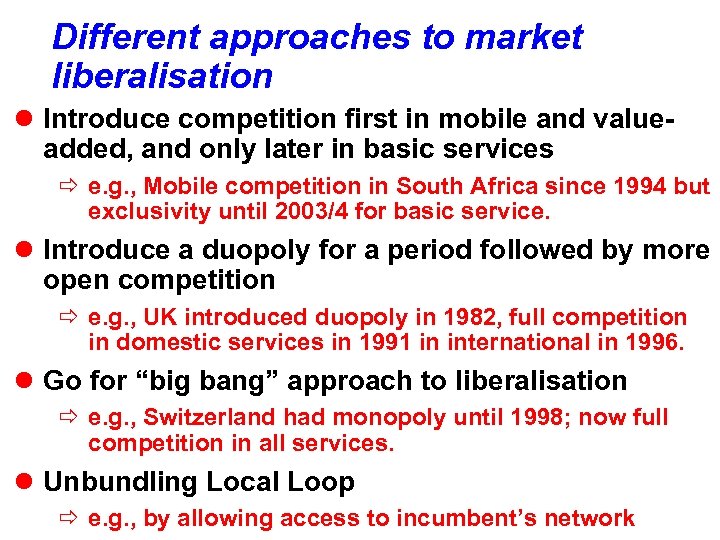

Different approaches to market liberalisation l Introduce competition first in mobile and valueadded, and only later in basic services ð e. g. , Mobile competition in South Africa since 1994 but exclusivity until 2003/4 for basic service. l Introduce a duopoly for a period followed by more open competition ð e. g. , UK introduced duopoly in 1982, full competition in domestic services in 1991 in international in 1996. l Go for “big bang” approach to liberalisation ð e. g. , Switzerland had monopoly until 1998; now full competition in all services. l Unbundling Local Loop ð e. g. , by allowing access to incumbent’s network

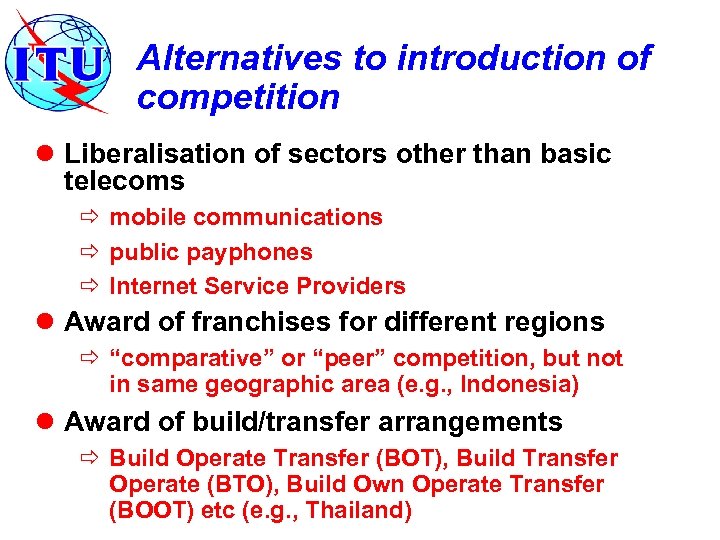

Alternatives to introduction of competition l Liberalisation of sectors other than basic telecoms ð mobile communications ð public payphones ð Internet Service Providers l Award of franchises for different regions ð “comparative” or “peer” competition, but not in same geographic area (e. g. , Indonesia) l Award of build/transfer arrangements ð Build Operate Transfer (BOT), Build Transfer Operate (BTO), Build Own Operate Transfer (BOOT) etc (e. g. , Thailand)

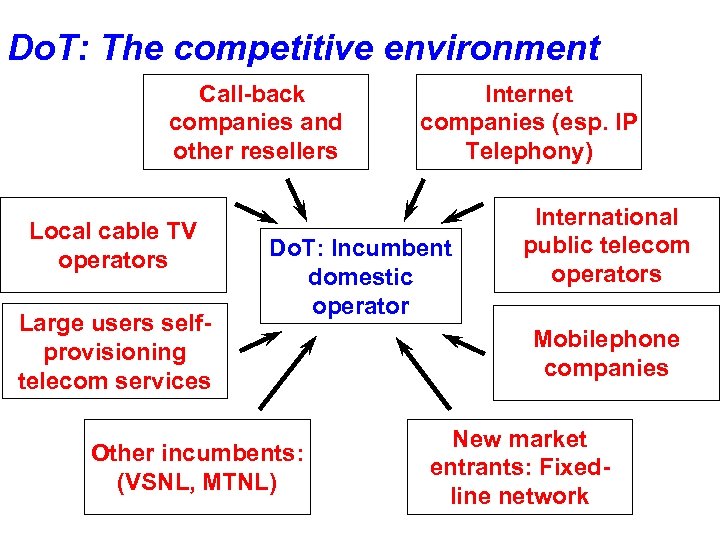

Do. T: The competitive environment Call-back companies and other resellers Local cable TV operators Large users selfprovisioning telecom services Internet companies (esp. IP Telephony) Do. T: Incumbent domestic operator Other incumbents: (VSNL, MTNL) International public telecom operators Mobilephone companies New market entrants: Fixedline network

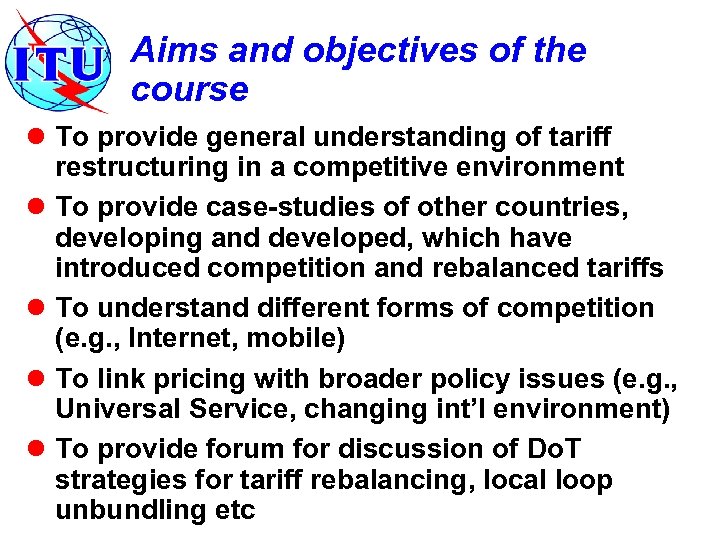

Aims and objectives of the course l To provide general understanding of tariff restructuring in a competitive environment l To provide case-studies of other countries, developing and developed, which have introduced competition and rebalanced tariffs l To understand different forms of competition (e. g. , Internet, mobile) l To link pricing with broader policy issues (e. g. , Universal Service, changing int’l environment) l To provide forum for discussion of Do. T strategies for tariff rebalancing, local loop unbundling etc

Introduction to Course Lecturers l Dr Tim Kelly, Head, Operations Analysis, International Telecommunication Union, Geneva, Switzerland E-mail: Tim. Kelly@itu. int l Dr Chris Doyle, Senior Research Fellow, London Business School, UK E-mail: cdoyle@lbs. ac. uk

Structure of course (Day 1) 11. 30: Tariff strategies for competitive environments: Aims and objectives 2. 00: 3. 00: 4. 30: 5. 30: Cost-based and demand-based tariffs (Tim Kelly) Tariff rebalancing (Chris Doyle) Tariff comparisons: global trends (Tim Kelly) Discussion

Structure of course (Day 2) 9. 00: Tariff policies and Universal Service (Tim Kelly) 10. 00: Tariffs and Service Quality (Chris Doyle) 11. 30: Tariff strategies and the Internet (Tim Kelly) 2. 00: 3. 00: 4. 30: 5. 30: Pricing of international telecom services (Tim Kelly) Tariff regulation: Mobile and fixed (Chris Doyle) TRAI proposals on tariff reform (Tim Kelly) Discussion

Structure of course (Day 3) 9. 00: Tariff and pricing of interconnect (Chris Doyle) 10. 00: Tariff strategies for competitive markets: Implications for India (Sidhu Sinha? ) 11. 30: Designing tariff strategies to match customer requirements (Chris Doyle) 12. 30: Discussion

b3f16b6cdb7f7e7fe2a712c45400061b.ppt