66539b9758afc1b5a7c827dee8ca4c87.ppt

- Количество слайдов: 24

Targeting international investors Frank Ford Director, Middle East & Africa

Targeting international investors Frank Ford Director, Middle East & Africa

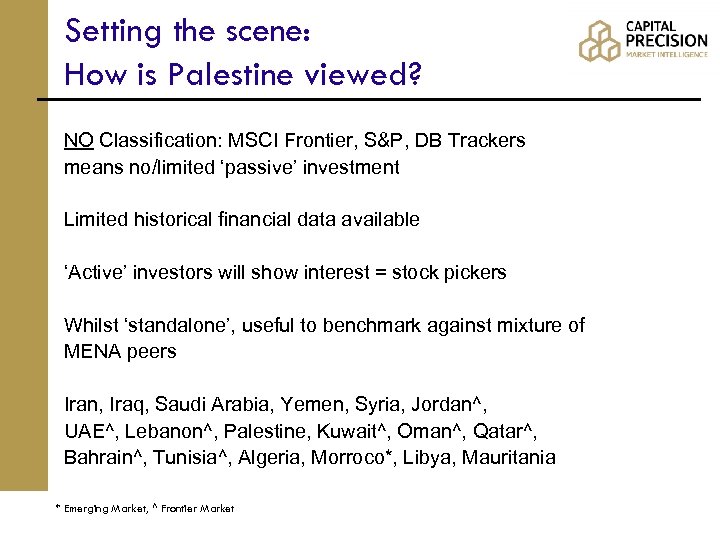

Setting the scene: How is Palestine viewed? NO Classification: MSCI Frontier, S&P, DB Trackers means no/limited ‘passive’ investment Limited historical financial data available ‘Active’ investors will show interest = stock pickers Whilst ‘standalone’, useful to benchmark against mixture of MENA peers Iran, Iraq, Saudi Arabia, Yemen, Syria, Jordan^, UAE^, Lebanon^, Palestine, Kuwait^, Oman^, Qatar^, Bahrain^, Tunisia^, Algeria, Morroco*, Libya, Mauritania * Emerging Market, ^ Frontier Market

Setting the scene: How is Palestine viewed? NO Classification: MSCI Frontier, S&P, DB Trackers means no/limited ‘passive’ investment Limited historical financial data available ‘Active’ investors will show interest = stock pickers Whilst ‘standalone’, useful to benchmark against mixture of MENA peers Iran, Iraq, Saudi Arabia, Yemen, Syria, Jordan^, UAE^, Lebanon^, Palestine, Kuwait^, Oman^, Qatar^, Bahrain^, Tunisia^, Algeria, Morroco*, Libya, Mauritania * Emerging Market, ^ Frontier Market

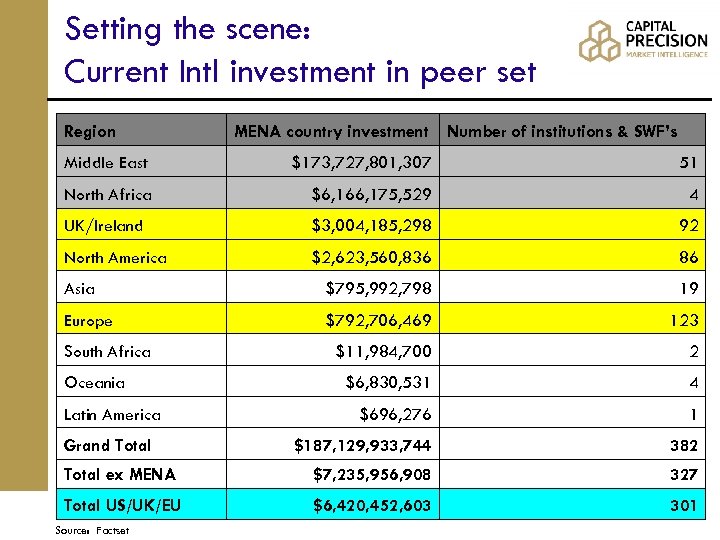

Setting the scene: Current Intl investment in peer set Region MENA country investment Number of institutions & SWF’s Middle East $173, 727, 801, 307 51 North Africa $6, 166, 175, 529 4 UK/Ireland $3, 004, 185, 298 92 North America $2, 623, 560, 836 86 Asia $795, 992, 798 19 Europe $792, 706, 469 123 $11, 984, 700 2 $6, 830, 531 4 $696, 276 1 $187, 129, 933, 744 382 Total ex MENA $7, 235, 956, 908 327 Total US/UK/EU $6, 420, 452, 603 301 South Africa Oceania Latin America Grand Total Source: Factset

Setting the scene: Current Intl investment in peer set Region MENA country investment Number of institutions & SWF’s Middle East $173, 727, 801, 307 51 North Africa $6, 166, 175, 529 4 UK/Ireland $3, 004, 185, 298 92 North America $2, 623, 560, 836 86 Asia $795, 992, 798 19 Europe $792, 706, 469 123 $11, 984, 700 2 $6, 830, 531 4 $696, 276 1 $187, 129, 933, 744 382 Total ex MENA $7, 235, 956, 908 327 Total US/UK/EU $6, 420, 452, 603 301 South Africa Oceania Latin America Grand Total Source: Factset

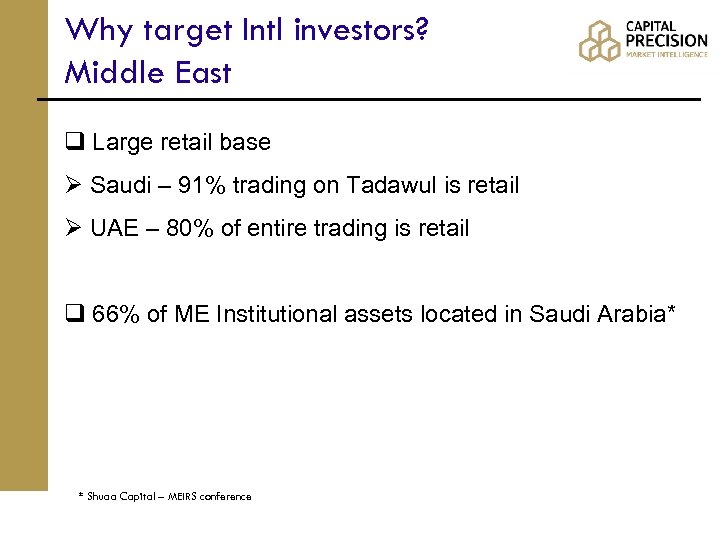

Why target Intl investors? Middle East q Large retail base Ø Saudi – 91% trading on Tadawul is retail Ø UAE – 80% of entire trading is retail q 66% of ME Institutional assets located in Saudi Arabia* * Shuaa Capital – MEIRS conference

Why target Intl investors? Middle East q Large retail base Ø Saudi – 91% trading on Tadawul is retail Ø UAE – 80% of entire trading is retail q 66% of ME Institutional assets located in Saudi Arabia* * Shuaa Capital – MEIRS conference

Why target Intl investors? Benefits q Additional source of capital q Encourages transparency & corporate governance q Credibility q Valuation q Liquidity q Stability (Institutional vs. retail)

Why target Intl investors? Benefits q Additional source of capital q Encourages transparency & corporate governance q Credibility q Valuation q Liquidity q Stability (Institutional vs. retail)

Targeting – A strategic Planning discipline: Taking control n In an ideal world a company would have a clear objective of the types of shareholders they would like to have in the future n The targeting process should be based upon anticipating what is likely to happen and not based ONLY upon what has happened n The challenge is to find investors whose investment profile matches your future investment proposition n The better the Targeting, the better control there is over the shareholder structure

Targeting – A strategic Planning discipline: Taking control n In an ideal world a company would have a clear objective of the types of shareholders they would like to have in the future n The targeting process should be based upon anticipating what is likely to happen and not based ONLY upon what has happened n The challenge is to find investors whose investment profile matches your future investment proposition n The better the Targeting, the better control there is over the shareholder structure

Structuring the shareholder base: Some questions to consider n Are you looking for liquidity or stability? n Are you looking to diversify the shareholder base? n Which shareholders are likely to rotate out and when? n Which current investors could buy more shares? n Who is not investing yet but could be? n Where are the strengths and weaknesses in the shareholder base? 7

Structuring the shareholder base: Some questions to consider n Are you looking for liquidity or stability? n Are you looking to diversify the shareholder base? n Which shareholders are likely to rotate out and when? n Which current investors could buy more shares? n Who is not investing yet but could be? n Where are the strengths and weaknesses in the shareholder base? 7

The starting point for developing your Targeting Programme n Step 1 - The “stock take/health-check” – Where are you now? A clear understanding of this will help guide your targeting n The first step is to have a clear understanding of who is already holding your stock and why n The second step is to identify which shareholders could rotate out of the stock in the future n The third step is to determine the impact that this selling activity is likely to have on liquidity and smaller investors

The starting point for developing your Targeting Programme n Step 1 - The “stock take/health-check” – Where are you now? A clear understanding of this will help guide your targeting n The first step is to have a clear understanding of who is already holding your stock and why n The second step is to identify which shareholders could rotate out of the stock in the future n The third step is to determine the impact that this selling activity is likely to have on liquidity and smaller investors

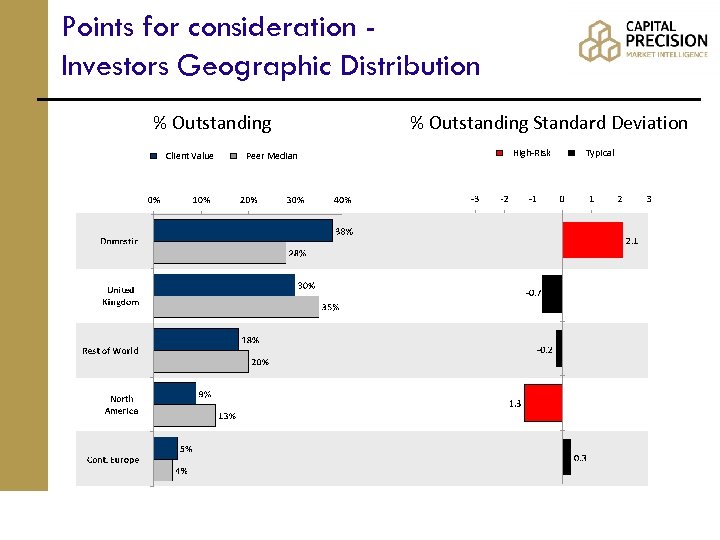

Points for consideration Investors Geographic Distribution % Outstanding Client Value Peer Median % Outstanding Standard Deviation High-Risk Typical

Points for consideration Investors Geographic Distribution % Outstanding Client Value Peer Median % Outstanding Standard Deviation High-Risk Typical

Investor Geographic Distribution n Although increased foreign investment is often very much desired, dependence on any one region for support can have significant impact on the turnover of your shareholder base. n Geographic considerations n n Perceived strength of your company’s country or region Regional/Global stability concerns Currency strength/weakness Governmental and/or regulatory impact

Investor Geographic Distribution n Although increased foreign investment is often very much desired, dependence on any one region for support can have significant impact on the turnover of your shareholder base. n Geographic considerations n n Perceived strength of your company’s country or region Regional/Global stability concerns Currency strength/weakness Governmental and/or regulatory impact

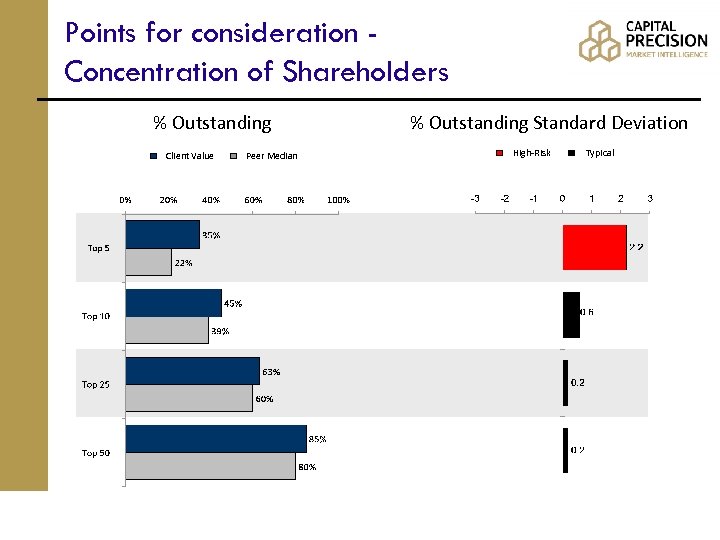

Points for consideration Concentration of Shareholders % Outstanding Client Value Peer Median % Outstanding Standard Deviation High-Risk Typical

Points for consideration Concentration of Shareholders % Outstanding Client Value Peer Median % Outstanding Standard Deviation High-Risk Typical

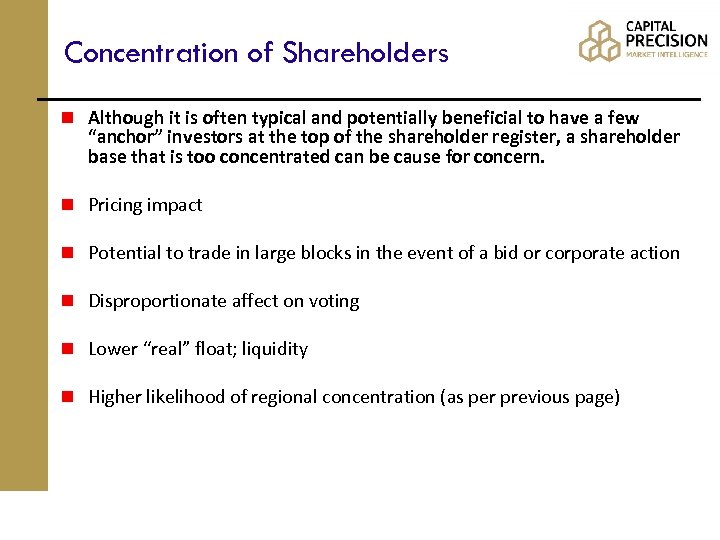

Concentration of Shareholders n Although it is often typical and potentially beneficial to have a few “anchor” investors at the top of the shareholder register, a shareholder base that is too concentrated can be cause for concern. n Pricing impact n Potential to trade in large blocks in the event of a bid or corporate action n Disproportionate affect on voting n Lower “real” float; liquidity n Higher likelihood of regional concentration (as per previous page)

Concentration of Shareholders n Although it is often typical and potentially beneficial to have a few “anchor” investors at the top of the shareholder register, a shareholder base that is too concentrated can be cause for concern. n Pricing impact n Potential to trade in large blocks in the event of a bid or corporate action n Disproportionate affect on voting n Lower “real” float; liquidity n Higher likelihood of regional concentration (as per previous page)

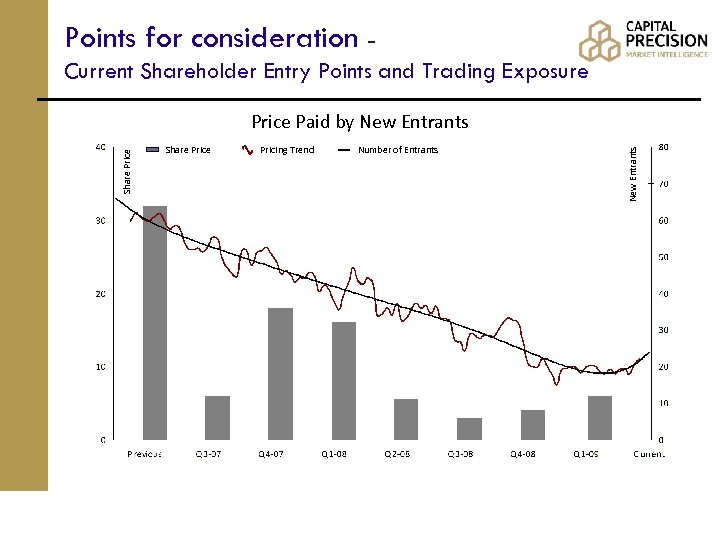

Points for consideration Current Shareholder Entry Points and Trading Exposure Share Pricing Trend Number of Entrants New Entrants Share Price Paid by New Entrants

Points for consideration Current Shareholder Entry Points and Trading Exposure Share Pricing Trend Number of Entrants New Entrants Share Price Paid by New Entrants

Current Shareholder Entry Points and Trading Exposure n It is assumed that investors which have suffered large losses or benefited from large gains are more likely to part with their shares. n The aim is to best estimate when the current shareholders entered the stock so as to estimate the number of investors which would be considered likely to be at risk. n The analysis should be viewed in the context of the general market and sector performance and be read in conjunction with the active versus passive analysis to give a picture of those individual investors at risk.

Current Shareholder Entry Points and Trading Exposure n It is assumed that investors which have suffered large losses or benefited from large gains are more likely to part with their shares. n The aim is to best estimate when the current shareholders entered the stock so as to estimate the number of investors which would be considered likely to be at risk. n The analysis should be viewed in the context of the general market and sector performance and be read in conjunction with the active versus passive analysis to give a picture of those individual investors at risk.

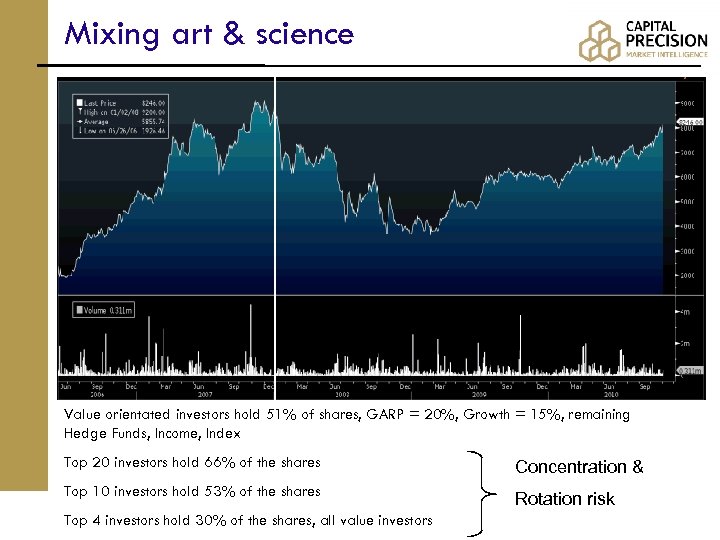

Mixing art & science Value orientated investors hold 51% of shares, GARP = 20%, Growth = 15%, remaining Hedge Funds, Income, Index Top 20 investors hold 66% of the shares Concentration & Top 10 investors hold 53% of the shares Rotation risk Top 4 investors hold 30% of the shares, all value investors

Mixing art & science Value orientated investors hold 51% of shares, GARP = 20%, Growth = 15%, remaining Hedge Funds, Income, Index Top 20 investors hold 66% of the shares Concentration & Top 10 investors hold 53% of the shares Rotation risk Top 4 investors hold 30% of the shares, all value investors

How can targets be evaluated? Step 2. Identify targets with the “Appetite” to buy n Monitor current buying and selling activity in the peer group n Monitor current capital flows across the sector n Monitor current capital flows across the region n Monitor qualitative sentiment – VERY important to balance this with quantitative data 16

How can targets be evaluated? Step 2. Identify targets with the “Appetite” to buy n Monitor current buying and selling activity in the peer group n Monitor current capital flows across the sector n Monitor current capital flows across the region n Monitor qualitative sentiment – VERY important to balance this with quantitative data 16

How can targets be evaluated? Step 3. Identify Targets with the capacity to buy n Net asset value of the fund n % Fund exposure to the sector n % Fund exposure to the country n % Fund exposure to the rest of world n Top 10 holdings of each individual fund 17

How can targets be evaluated? Step 3. Identify Targets with the capacity to buy n Net asset value of the fund n % Fund exposure to the sector n % Fund exposure to the country n % Fund exposure to the rest of world n Top 10 holdings of each individual fund 17

What information sources can you use to determine who to Target? n The Share Register n A Broker / Bank n A “Public Filing” Database n Bespoke Analysis

What information sources can you use to determine who to Target? n The Share Register n A Broker / Bank n A “Public Filing” Database n Bespoke Analysis

The “Weighting” objective n Most Targeting methodologies rely on a “Weighting Principle” n This is achieved by identifying funds/institutions that are currently overweight in the peers/sector/region but underweight in you n The goal is to be at least fairly weighted n The objective is to identify funds/institutions that are currently buying into the peers/sector/region

The “Weighting” objective n Most Targeting methodologies rely on a “Weighting Principle” n This is achieved by identifying funds/institutions that are currently overweight in the peers/sector/region but underweight in you n The goal is to be at least fairly weighted n The objective is to identify funds/institutions that are currently buying into the peers/sector/region

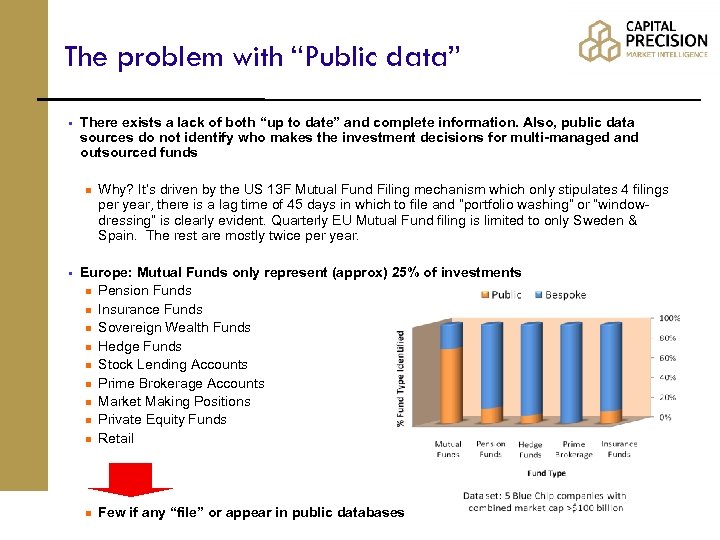

The problem with “Public data” § There exists a lack of both “up to date” and complete information. Also, public data sources do not identify who makes the investment decisions for multi-managed and outsourced funds n § Why? It’s driven by the US 13 F Mutual Fund Filing mechanism which only stipulates 4 filings per year, there is a lag time of 45 days in which to file and “portfolio washing” or “windowdressing” is clearly evident. Quarterly EU Mutual Fund filing is limited to only Sweden & Spain. The rest are mostly twice per year. Europe: Mutual Funds only represent (approx) 25% of investments n Pension Funds n Insurance Funds n Sovereign Wealth Funds n Hedge Funds n Stock Lending Accounts n Prime Brokerage Accounts n Market Making Positions n Private Equity Funds n Retail n Few if any “file” or appear in public databases

The problem with “Public data” § There exists a lack of both “up to date” and complete information. Also, public data sources do not identify who makes the investment decisions for multi-managed and outsourced funds n § Why? It’s driven by the US 13 F Mutual Fund Filing mechanism which only stipulates 4 filings per year, there is a lag time of 45 days in which to file and “portfolio washing” or “windowdressing” is clearly evident. Quarterly EU Mutual Fund filing is limited to only Sweden & Spain. The rest are mostly twice per year. Europe: Mutual Funds only represent (approx) 25% of investments n Pension Funds n Insurance Funds n Sovereign Wealth Funds n Hedge Funds n Stock Lending Accounts n Prime Brokerage Accounts n Market Making Positions n Private Equity Funds n Retail n Few if any “file” or appear in public databases

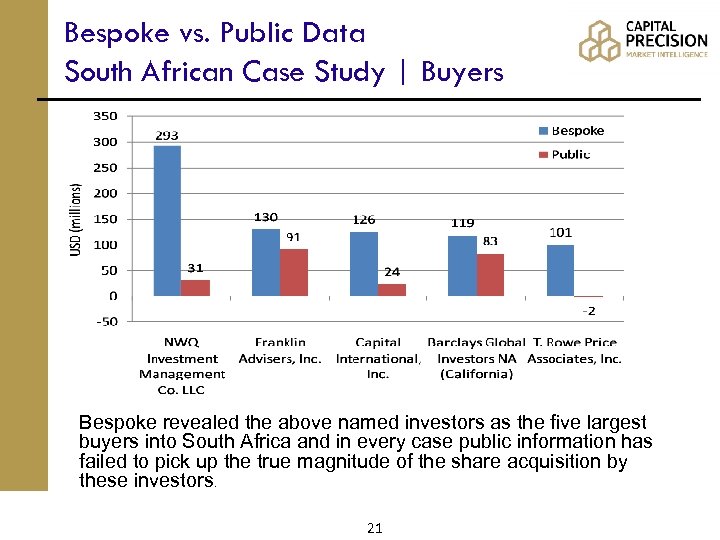

Bespoke vs. Public Data South African Case Study | Buyers Bespoke revealed the above named investors as the five largest buyers into South Africa and in every case public information has failed to pick up the true magnitude of the share acquisition by these investors. 21

Bespoke vs. Public Data South African Case Study | Buyers Bespoke revealed the above named investors as the five largest buyers into South Africa and in every case public information has failed to pick up the true magnitude of the share acquisition by these investors. 21

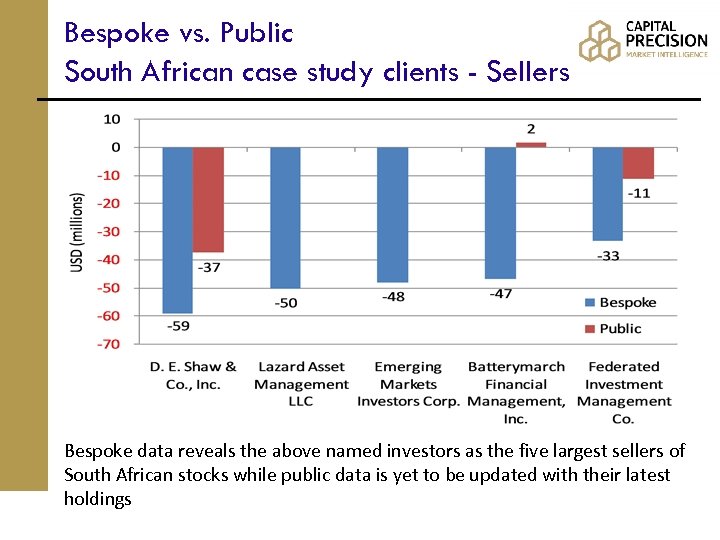

Bespoke vs. Public South African case study clients - Sellers Bespoke data reveals the above named investors as the five largest sellers of South African stocks while public data is yet to be updated with their latest holdings

Bespoke vs. Public South African case study clients - Sellers Bespoke data reveals the above named investors as the five largest sellers of South African stocks while public data is yet to be updated with their latest holdings

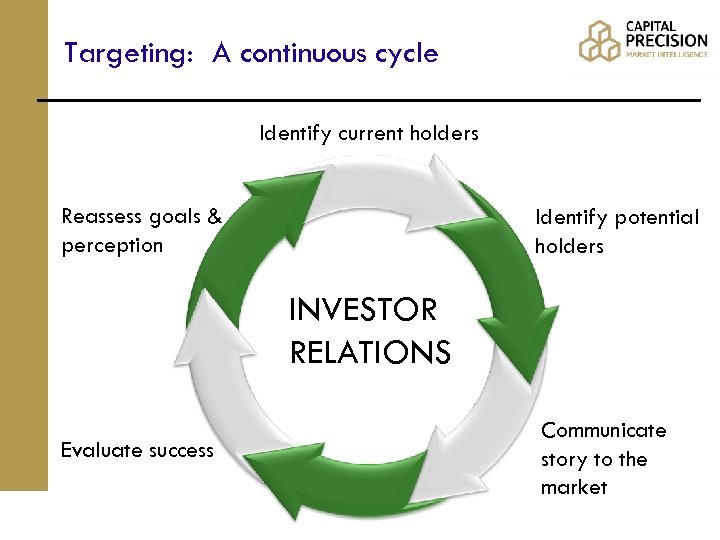

Targeting: A continuous cycle Identify current holders Reassess goals & perception Identify potential holders INVESTOR RELATIONS Evaluate success Communicate story to the market

Targeting: A continuous cycle Identify current holders Reassess goals & perception Identify potential holders INVESTOR RELATIONS Evaluate success Communicate story to the market

Targeting – In Summary n Take control n Determine who you want as shareholders…and why? n Determine what is likely to happen to your existing n n n shareholder base going forward – “Stock take” Identify those institutions who are going to be most interested in your FUTURE investment proposition…and check your messaging! Segment the investment community based upon where you believe you will get best future traction Balance quantitative ‘weighting’ with qualitative sentiment Use as many different sources of help possible to maximize the success of your targeting programme A constantly evolving process

Targeting – In Summary n Take control n Determine who you want as shareholders…and why? n Determine what is likely to happen to your existing n n n shareholder base going forward – “Stock take” Identify those institutions who are going to be most interested in your FUTURE investment proposition…and check your messaging! Segment the investment community based upon where you believe you will get best future traction Balance quantitative ‘weighting’ with qualitative sentiment Use as many different sources of help possible to maximize the success of your targeting programme A constantly evolving process