f22b76231eca581599da285a11f9232b.ppt

- Количество слайдов: 25

TARGET 2 De Nederlandsche Bank Richard Derksen 2 nd Conference Financial Sector of Macedonia on Payments and Securities Settlement Systems Ohrid 30 June 2009 De Nederlandsche Bank Eurosysteem

Contents TARGET l Scope and framework TARGET 2 l Single Shared Platform l Project planning l Migration l De Nederlandsche Bank Eurosysteem

TARGET l Trans-European l Automated l Real-time l Gross settlement l Express l Transfer system De Nederlandsche Bank Eurosysteem

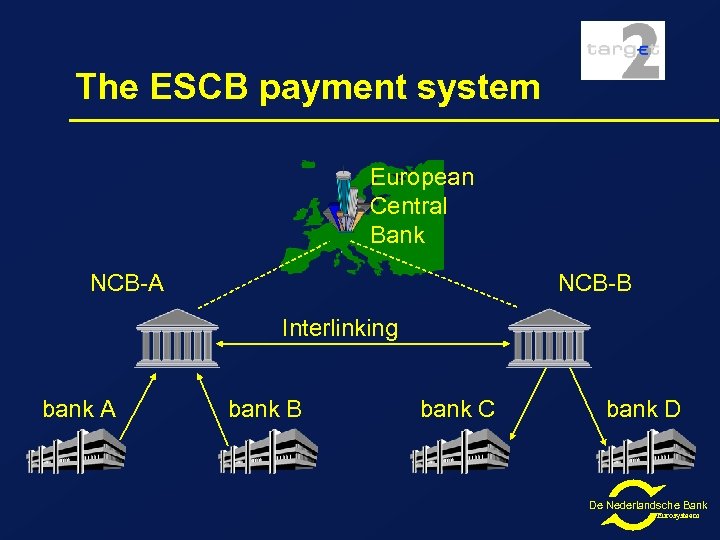

The ESCB payment system European Central Bank NCB-A NCB-B Interlinking bank A bank B bank C bank D De Nederlandsche Bank Eurosysteem

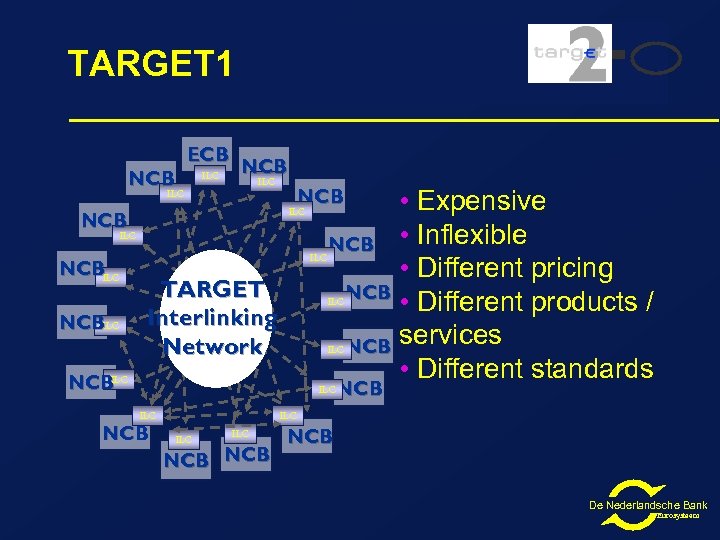

TARGET 1 NCB ECB ILC NCBILC • Expensive NCB • Inflexible • Different pricing NCB • Different products / NCB services • Different standards NCB ILC TARGET Interlinking Network ILC NCBILC ILC ILC NCB NCB NCB De Nederlandsche Bank Eurosysteem

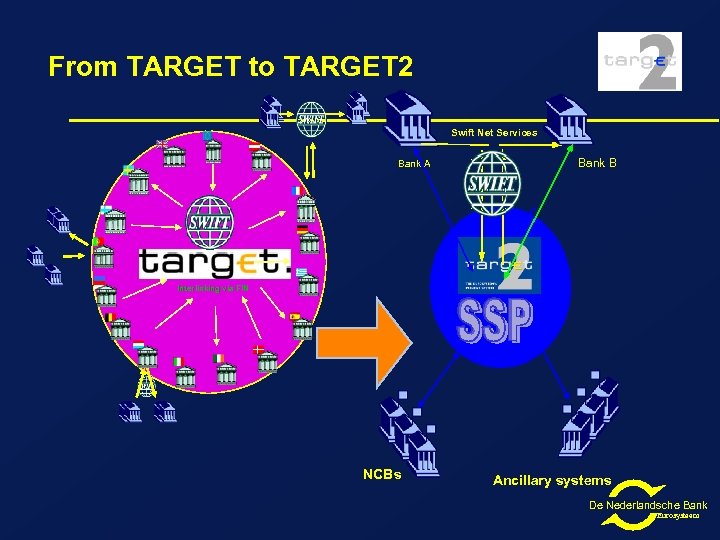

From TARGET to TARGET 2 Swift Net Services Bank A Bank B Interlinking via FIN NCBs Ancillary systems De Nederlandsche Bank Eurosysteem

TARGET 2 platform NL One central platform for NCBs for the real time gross settlement of large value payments The central TARGET 2 platform, called Single Shared Platfom (SSP), is built by 3 NCB´s (3 CB): Bundesbank, Banque de France and Banca d´Italia The platform offers some mandatory and some optional modules. Operational per 19 November 2007 (group 1) De Nederlandsche Bank Eurosysteem

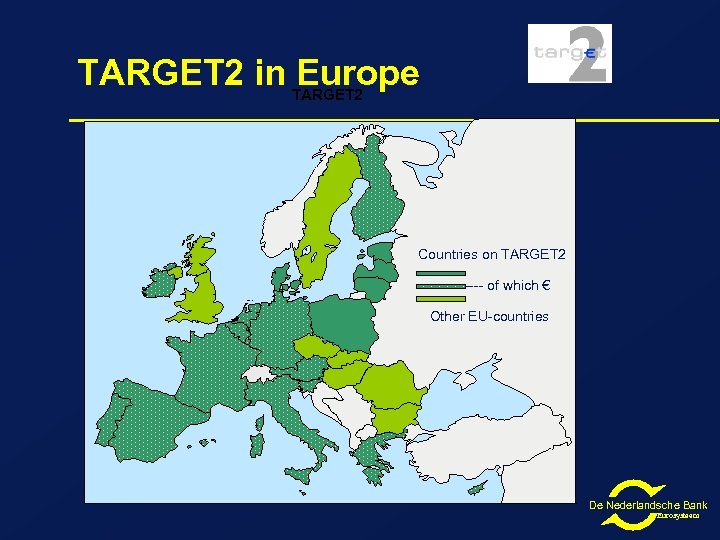

TARGET 2 in TARGET 2 Europe Countries on TARGET 2 ---- of which € Other EU-countries De Nederlandsche Bank Eurosysteem

TARGET 2 NL TARGET 2 offers: l High availability l Uniform pricing l Uniform functionality l Harmonisation l Advanced tools for liquidity management l Ready for new countries De Nederlandsche Bank Eurosysteem

TARGET 2: Operations l All RTGS operations may be processed in TARGET 2 l l All types of operations l l individual operations settled in real-time and in central bank money no exclusion according to amount or type of operations Wholesale payments are a main goal for TARGET 2 credit transfers direct debits (limited usage) mandated payments All types of business l l l payments between market participants central bank operations settlement operations of ancillary systems De Nederlandsche Bank Eurosysteem

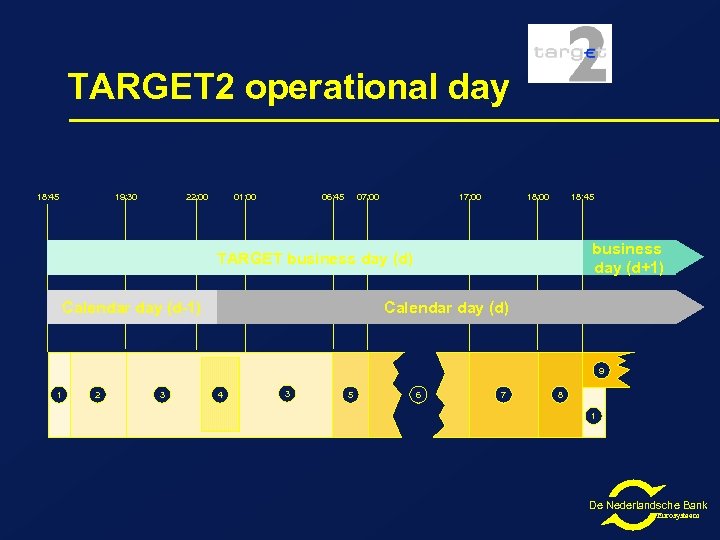

TARGET 2 operational day 18: 45 19: 30 01: 00 22: 00 06: 45 17: 00 07: 00 18: 45 18: 00 business day (d+1) TARGET business day (d) Calendar day (d-1) Calendar day (d) 9 1 2 3 4 3 5 6 7 8 1 De Nederlandsche Bank Eurosysteem

TARGET 2 operational day Purpose of the different phases: l l l l Start-of-day (1 & 2) Night-time processing (3) Technical maintenance window (4) Preparation for day trade phase (5) Day trade phase I (6) Day trade phase II (7) End-of-day (8 & 9) De Nederlandsche Bank Eurosysteem

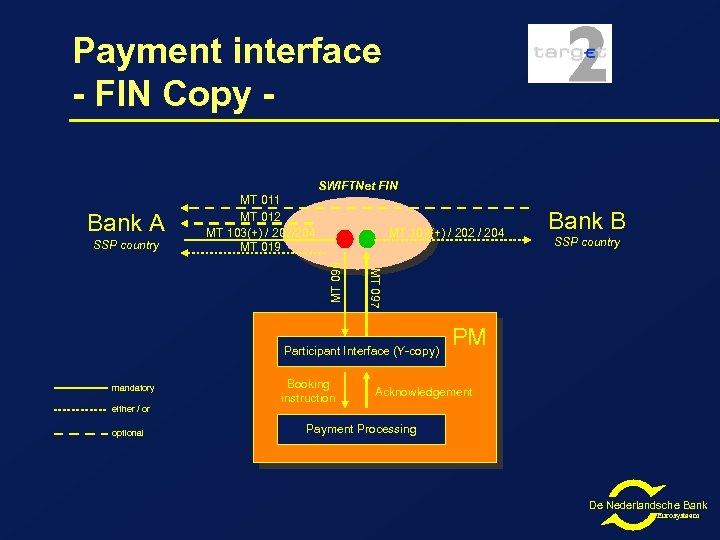

Payment interface - FIN Copy SWIFTNet FIN Bank A MT 103(+) / 202 / 204 Participant Interface (Y-copy) mandatory either / or optional Booking instruction Bank B SSP country MT 097 MT 096 SSP country MT 011 MT 012 MT 103(+) / 202/204 MT 019 PM Acknowledgement Payment Processing De Nederlandsche Bank Eurosysteem

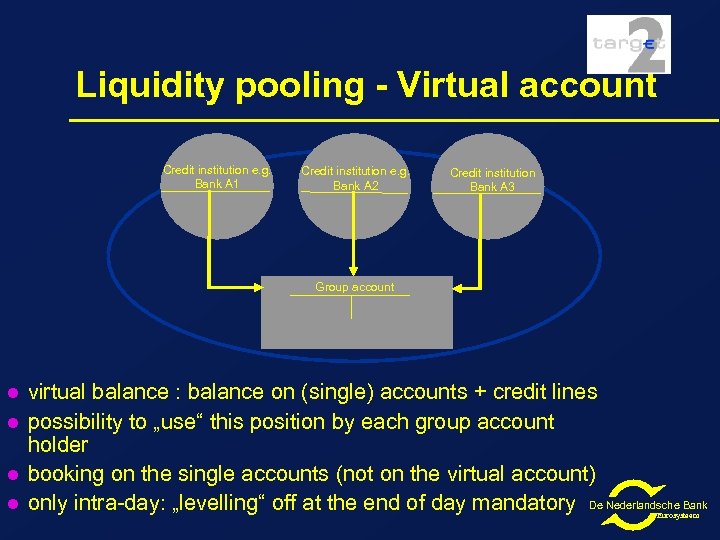

Liquidity pooling - Virtual account Credit institution e. g. Bank A 1 Credit institution e. g. Bank A 2 Credit institution Bank A 3 Group account l l virtual balance : balance on (single) accounts + credit lines possibility to „use“ this position by each group account holder booking on the single accounts (not on the virtual account) only intra-day: „levelling“ off at the end of day mandatory De Nederlandsche Bank Eurosysteem

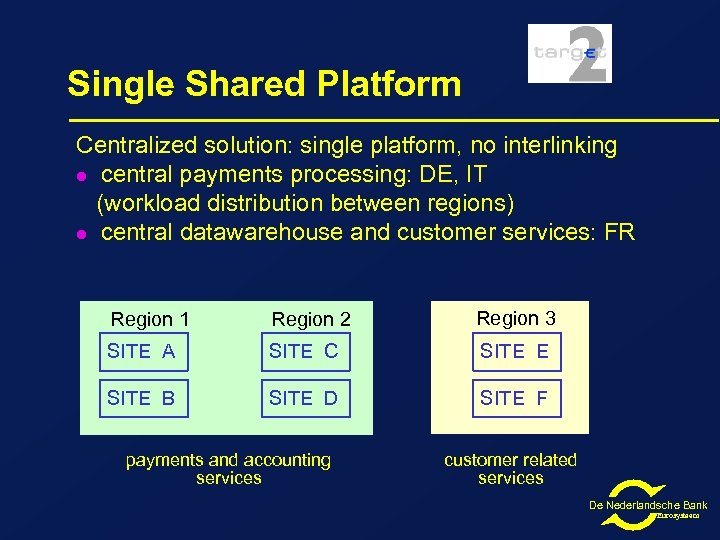

Single Shared Platform Centralized solution: single platform, no interlinking l central payments processing: DE, IT (workload distribution between regions) l central datawarehouse and customer services: FR Region 1 Region 2 Region 3 SITE A SITE C SITE E SITE B SITE D SITE F payments and accounting services customer related services De Nederlandsche Bank Eurosysteem

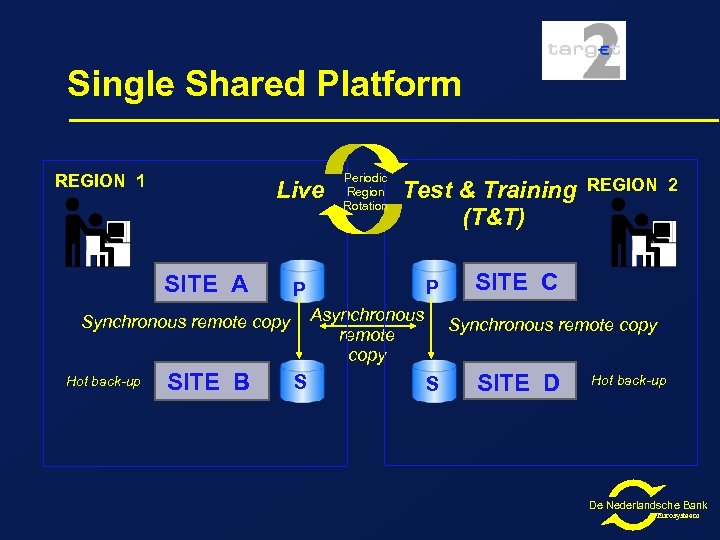

Single Shared Platform REGION 1 Live SITE A SITE B Test & Training (T&T) P P Asynchronous remote copy Synchronous remote copy Hot back-up Periodic Region Rotation S REGION 2 SITE C Synchronous remote copy S SITE D Hot back-up De Nederlandsche Bank Eurosysteem

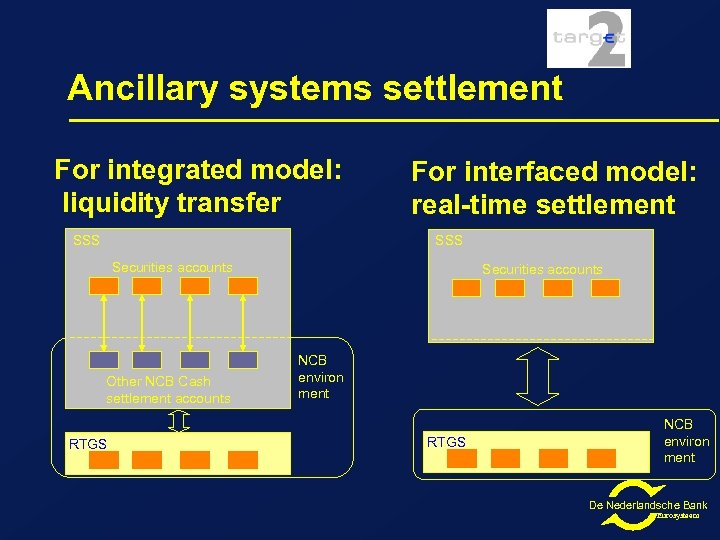

Ancillary systems settlement For integrated model: liquidity transfer SSS For interfaced model: real-time settlement SSS Securities accounts Other NCB Cash settlement accounts RTGS Securities accounts NCB environ ment RTGS NCB environ ment De Nederlandsche Bank Eurosysteem

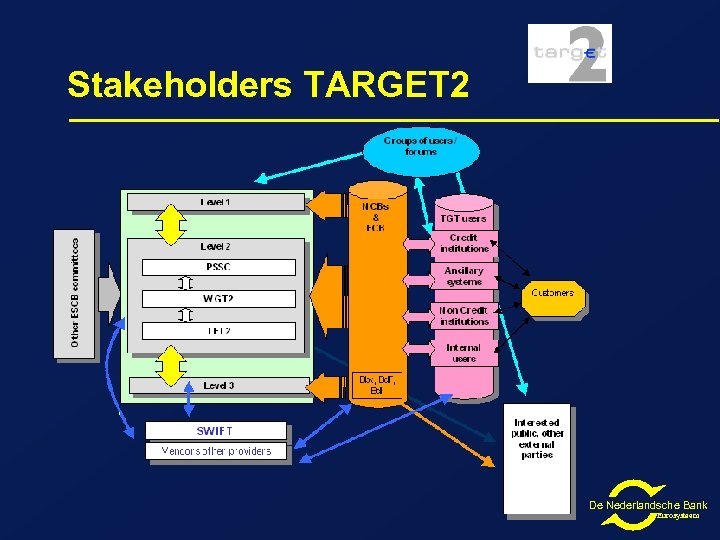

Stakeholders TARGET 2 De Nederlandsche Bank Eurosysteem

Migration groups l. Group composition aimed at minimising project risk, reducing effect on level playing field and limiting the costs for central banks and users l Data migration: 19 November 2007, 18 February 2008, 19 May 2008 Group 1 Austria Cyprus Germany Latvia Lithuania Luxembourg Malta Slovenia Group 2 Belgium Finland France Ireland Netherlands Portugal Spain Group 3 Denmark Estonia ECB Greece Italy Poland Group 4 Not needed Reserved for contingency De Nederlandsche Bank Eurosysteem

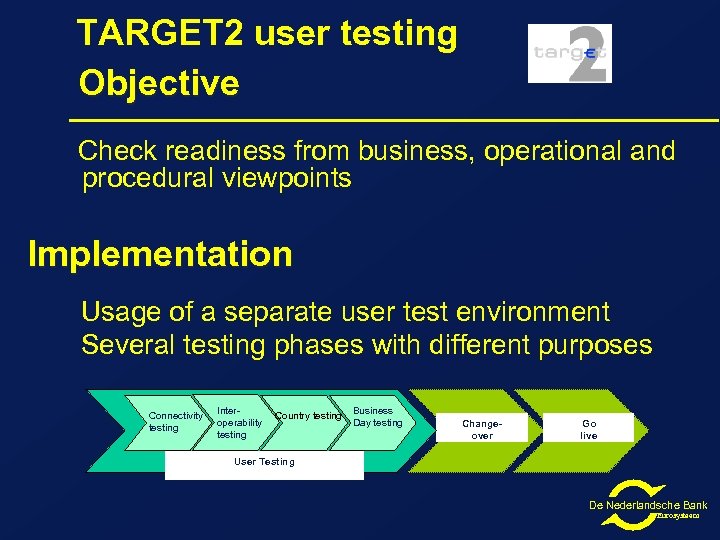

TARGET 2 user testing Objective Check readiness from business, operational and procedural viewpoints Implementation Usage of a separate user test environment Several testing phases with different purposes Connectivity testing Interoperability testing Country testing Business Day testing Changeover Go live User Testing De Nederlandsche Bank Eurosysteem

Pricing l Objectives: cost recovery, competitiveness and broad access l Pricing of transactions: pricing scheme with a monthly fee (100 euro or 1. 250 euro) plus transaction fee of between EUR 0. 125 and 0. 80 l Optional services (e. g. liquidity pooling and services related to ancillary systems) are priced separately De Nederlandsche Bank Eurosysteem

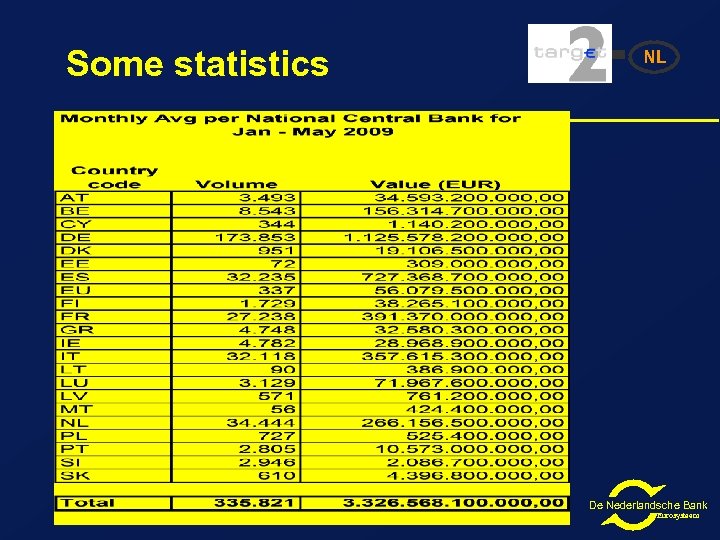

Some statistics NL De Nederlandsche Bank Eurosysteem

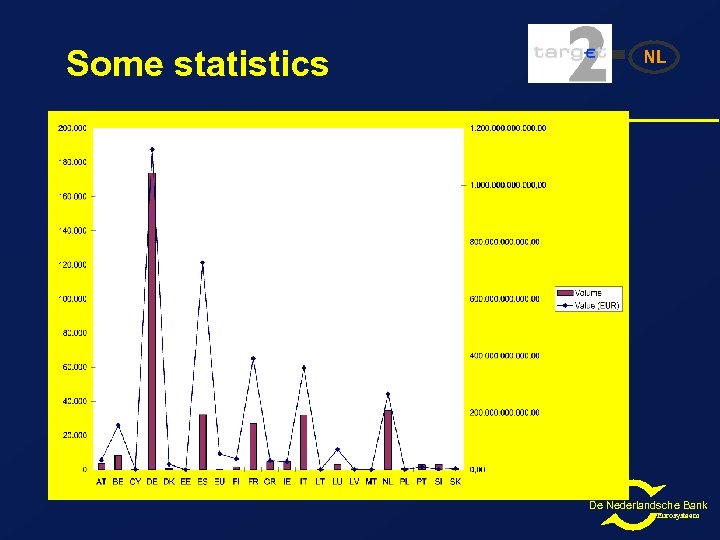

Some statistics NL De Nederlandsche Bank Eurosysteem

Summing up l l NL TARGET 2 is a sort of 3 rd wave of Euro Impact for national markets is big, but provides them (and foreign banks) directly with all benefits of a technically centralized platform ( legally it is a decentralized system) One pot of liquidity, one window for info on all TARGET payments Migration will be challenging and require a lot of testing and hard work De Nederlandsche Bank Eurosysteem

De Nederlandsche Bank Eurosysteem

f22b76231eca581599da285a11f9232b.ppt