6a5dd8416e1f396f23573ac584e1668f.ppt

- Количество слайдов: 64

Tania, a student, is trying to decide which of two alternative summer jobs to take.

Tania, a student, is trying to decide which of two alternative summer jobs to take.

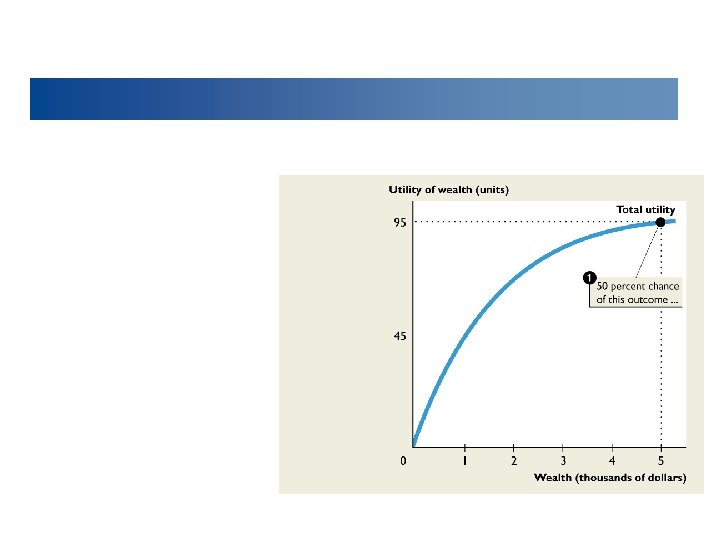

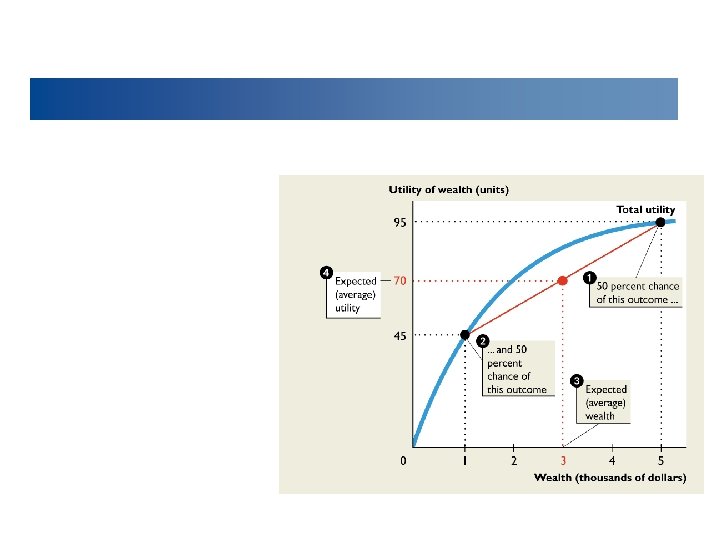

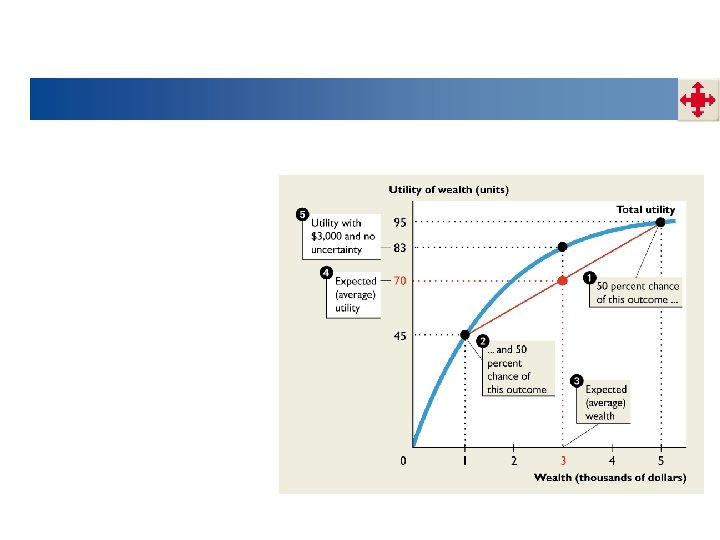

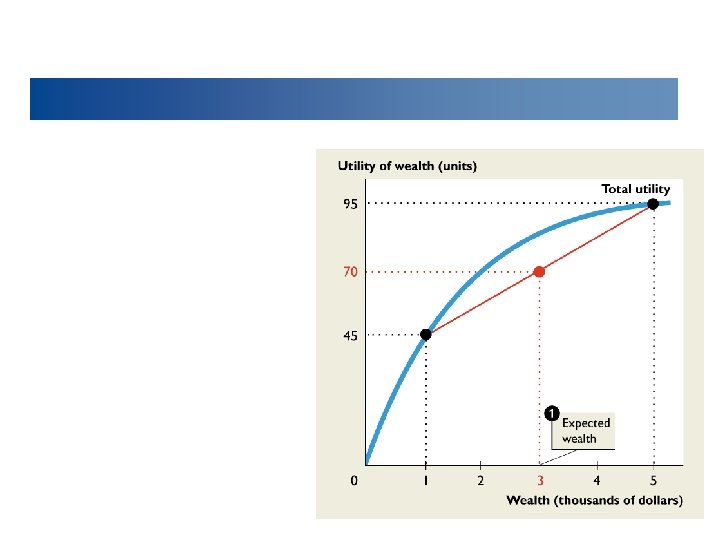

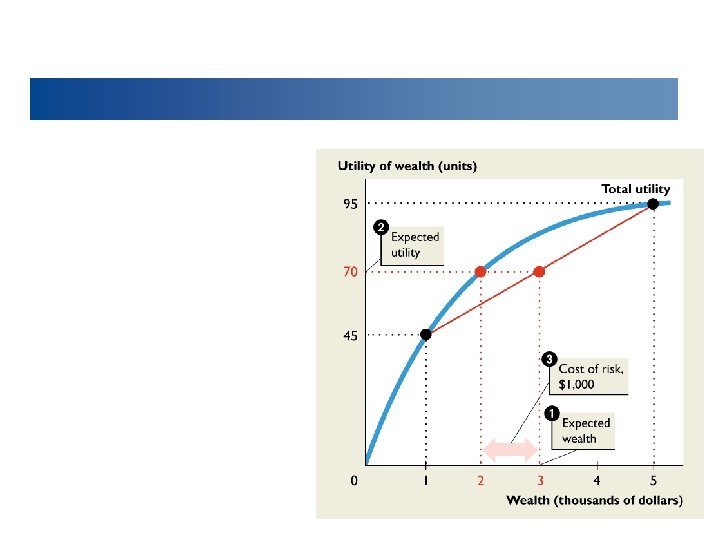

The probability that Tania will have $5, 000 is 0. 5 (a 50 percent chance). The probability that she will have $1, 000 is also 0. 5. Expected wealth = ($5, 000 × 0. 5) + ($1, 000 × 0. 5) = $3, 000. Tania can now compare the expected wealth from two jobs:

The probability that Tania will have $5, 000 is 0. 5 (a 50 percent chance). The probability that she will have $1, 000 is also 0. 5. Expected wealth = ($5, 000 × 0. 5) + ($1, 000 × 0. 5) = $3, 000. Tania can now compare the expected wealth from two jobs:

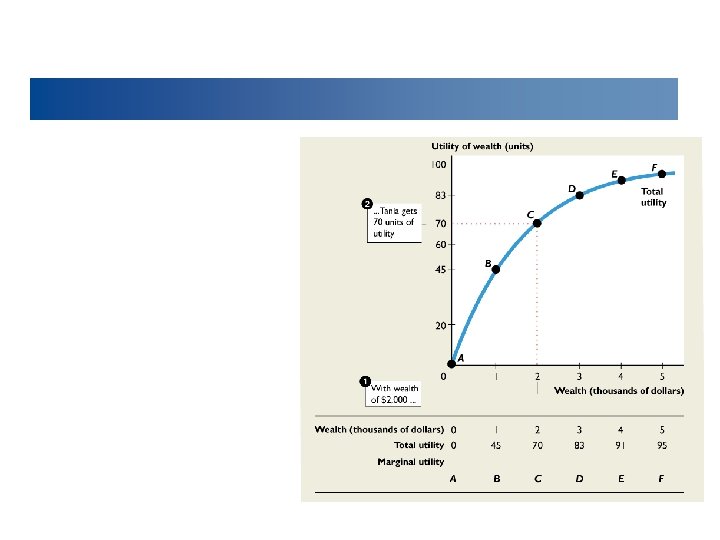

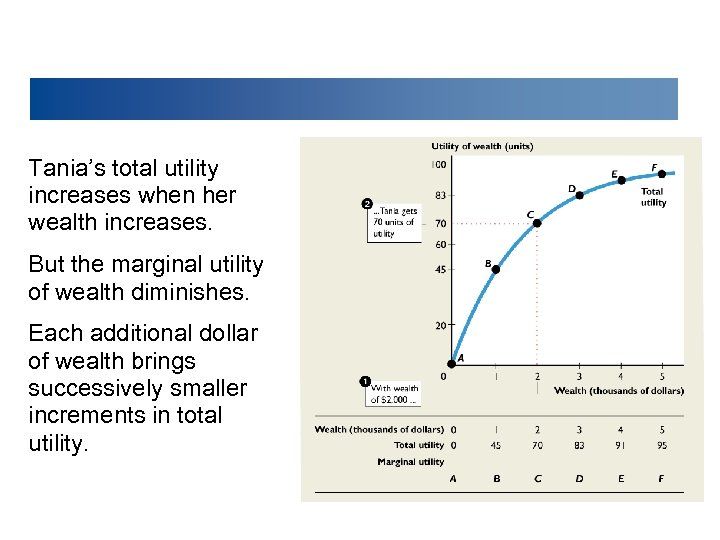

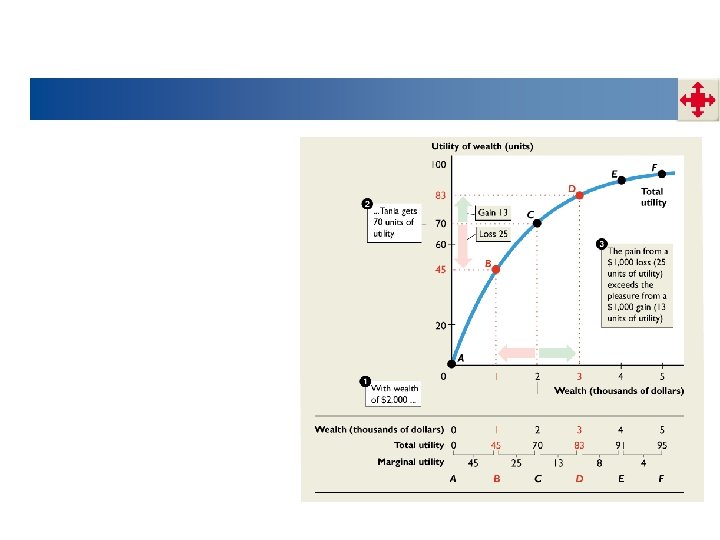

Tania’s total utility increases when her wealth increases. But the marginal utility of wealth diminishes. Each additional dollar of wealth brings successively smaller increments in total utility.

Tania’s total utility increases when her wealth increases. But the marginal utility of wealth diminishes. Each additional dollar of wealth brings successively smaller increments in total utility.

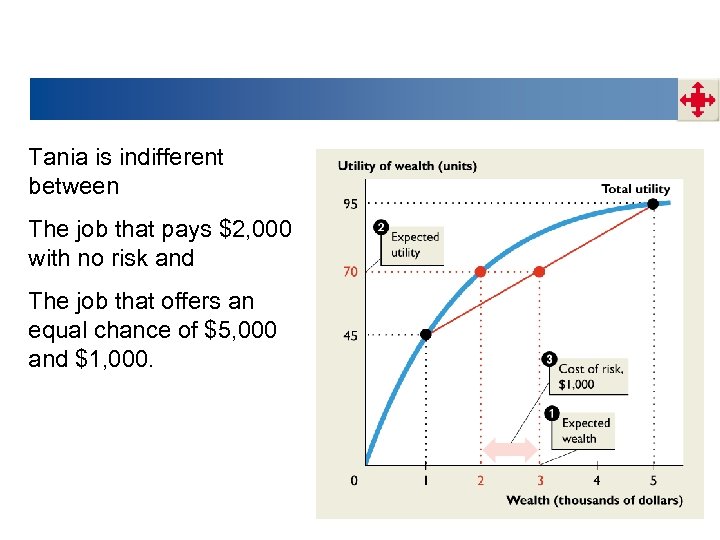

Tania is indifferent between The job that pays $2, 000 with no risk and The job that offers an equal chance of $5, 000 and $1, 000.

Tania is indifferent between The job that pays $2, 000 with no risk and The job that offers an equal chance of $5, 000 and $1, 000.

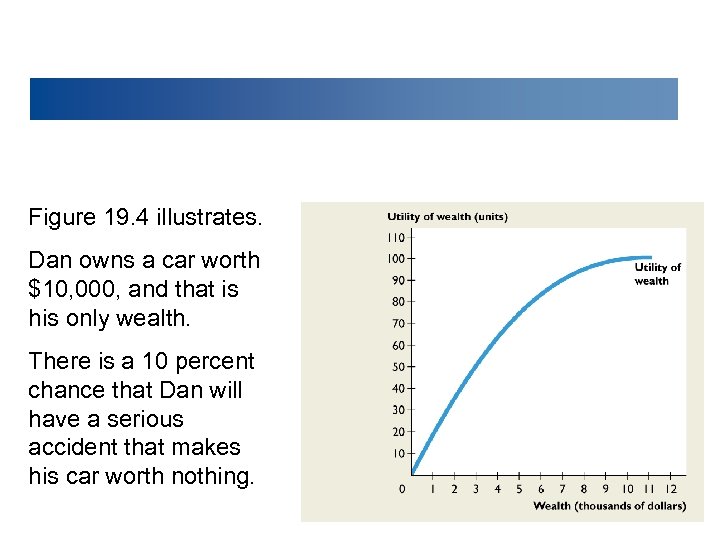

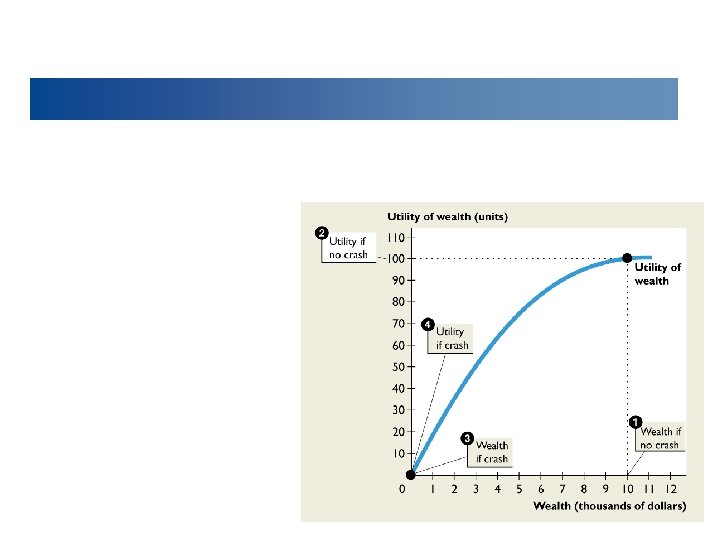

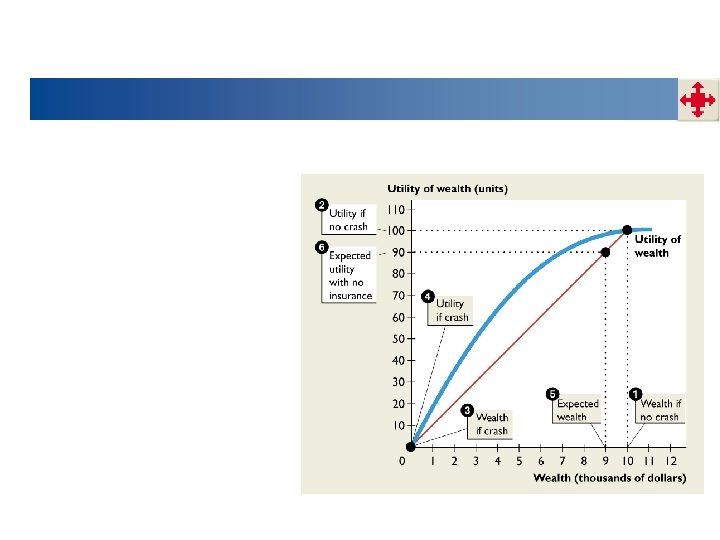

Figure 19. 4 illustrates. Dan owns a car worth $10, 000, and that is his only wealth. There is a 10 percent chance that Dan will have a serious accident that makes his car worth nothing.

Figure 19. 4 illustrates. Dan owns a car worth $10, 000, and that is his only wealth. There is a 10 percent chance that Dan will have a serious accident that makes his car worth nothing.

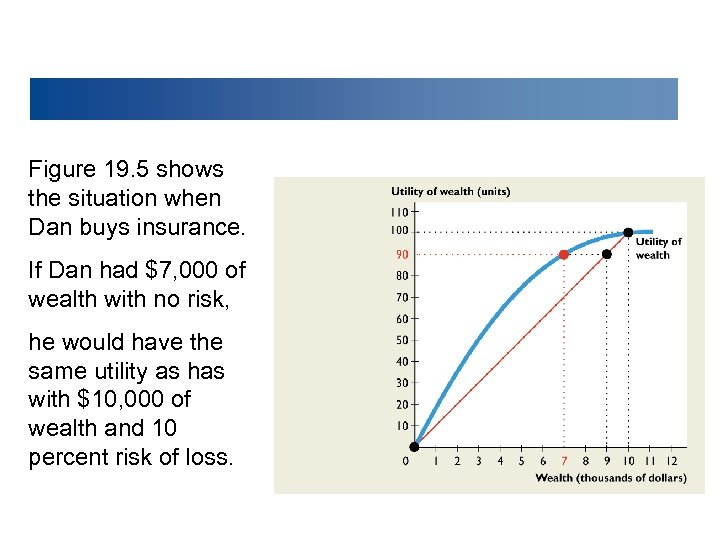

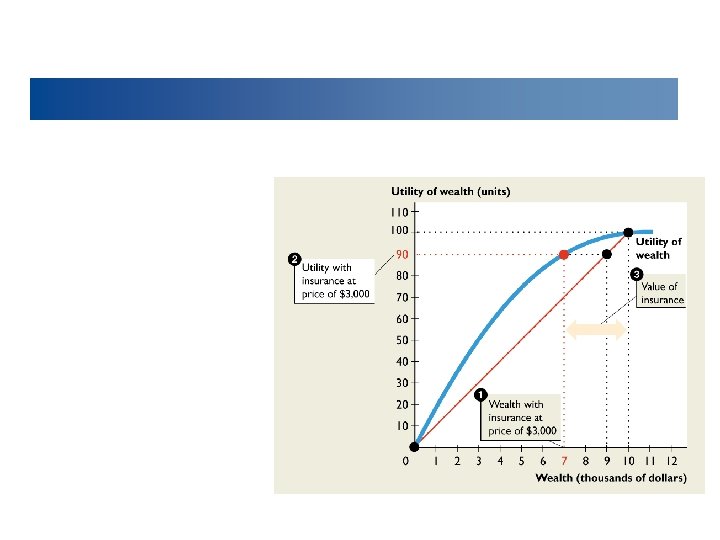

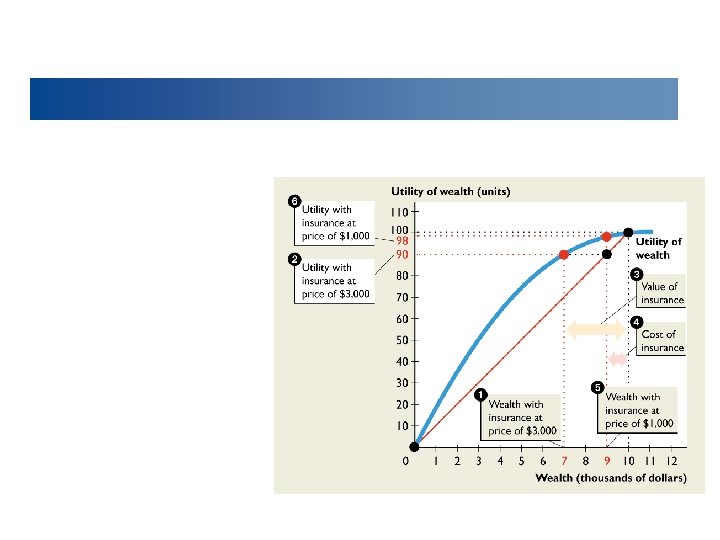

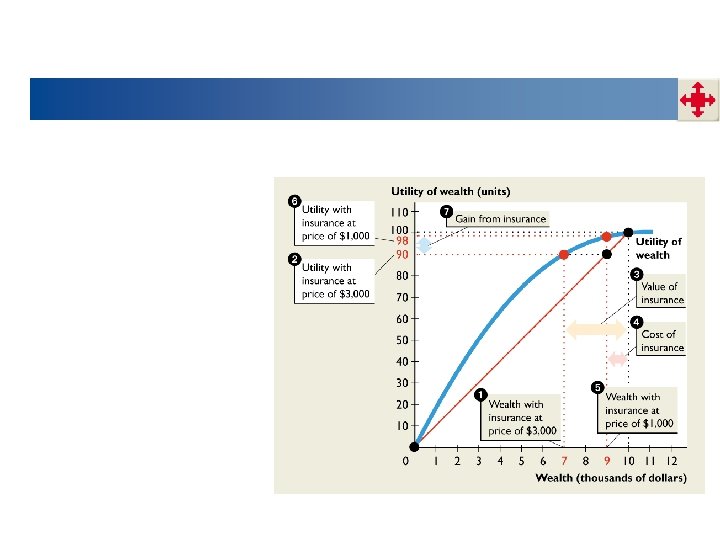

Figure 19. 5 shows the situation when Dan buys insurance. If Dan had $7, 000 of wealth with no risk, he would have the same utility as has with $10, 000 of wealth and 10 percent risk of loss.

Figure 19. 5 shows the situation when Dan buys insurance. If Dan had $7, 000 of wealth with no risk, he would have the same utility as has with $10, 000 of wealth and 10 percent risk of loss.

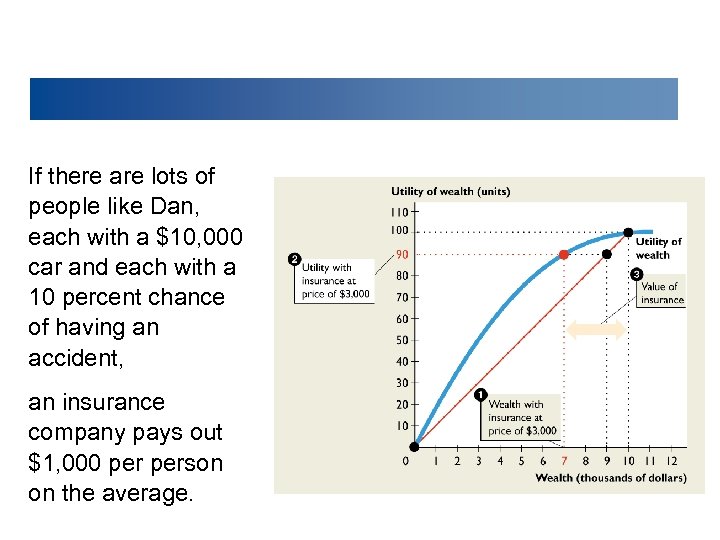

If there are lots of people like Dan, each with a $10, 000 car and each with a 10 percent chance of having an accident, an insurance company pays out $1, 000 person on the average.

If there are lots of people like Dan, each with a $10, 000 car and each with a 10 percent chance of having an accident, an insurance company pays out $1, 000 person on the average.

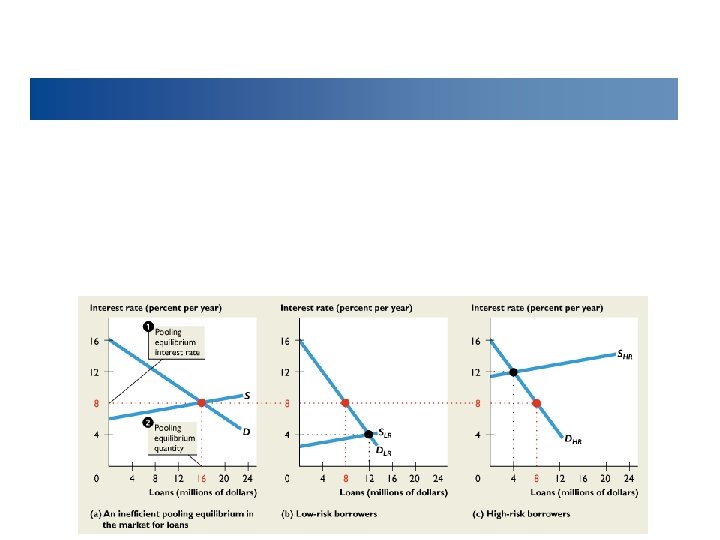

In the markets that you’ve studied so far, the buyer and the seller are well informed about the features and value of the good, service, or factor of production being traded. But in some markets, either the buyers or the sellers are better informed about the value of the items being traded than the person on the other side of the market. These buyers or sellers have private information. Examples are your knowledge about the quality of your driving, your work effort, the quality of your car, and whether you intend to repay a loan

In the markets that you’ve studied so far, the buyer and the seller are well informed about the features and value of the good, service, or factor of production being traded. But in some markets, either the buyers or the sellers are better informed about the value of the items being traded than the person on the other side of the market. These buyers or sellers have private information. Examples are your knowledge about the quality of your driving, your work effort, the quality of your car, and whether you intend to repay a loan

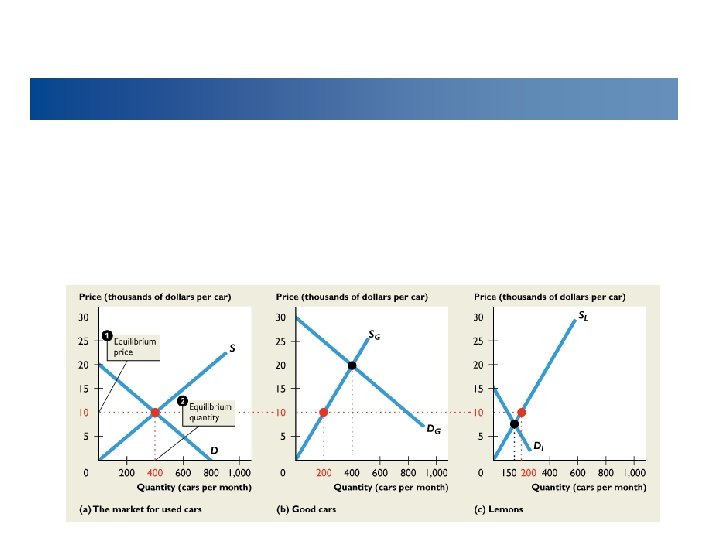

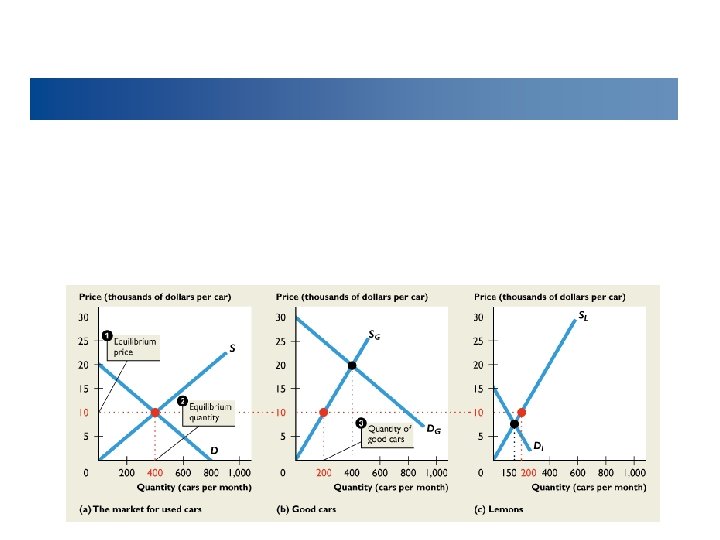

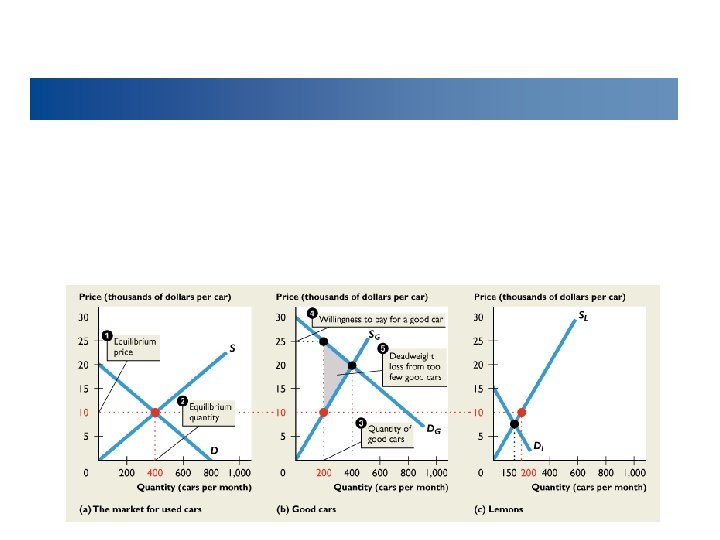

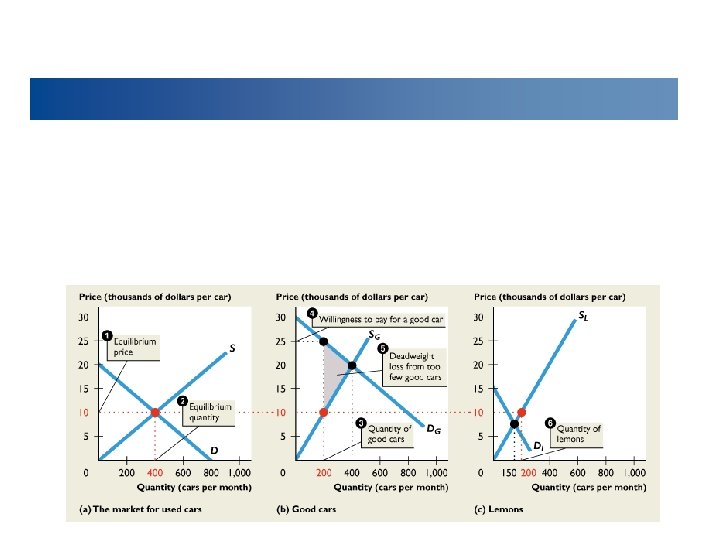

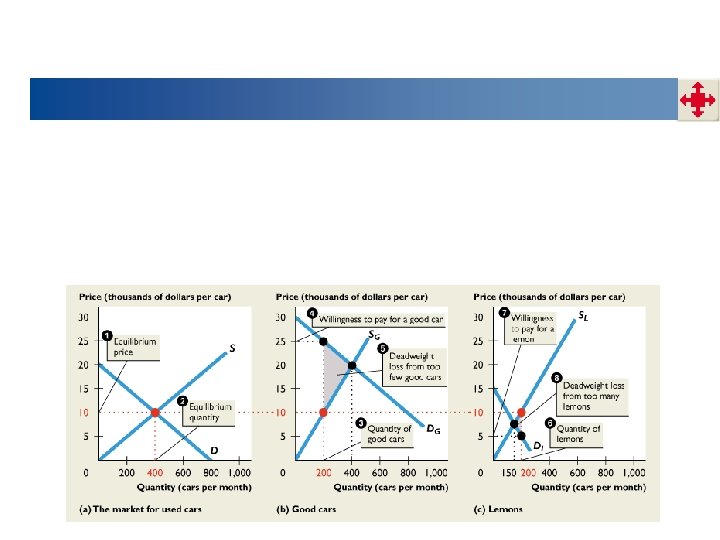

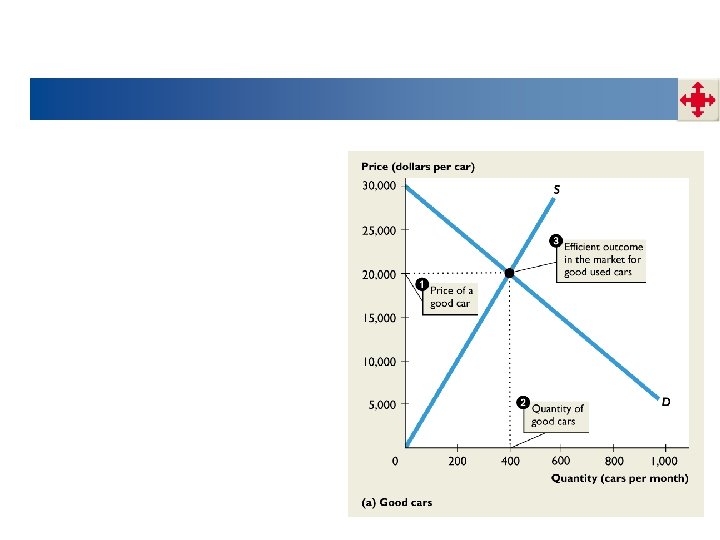

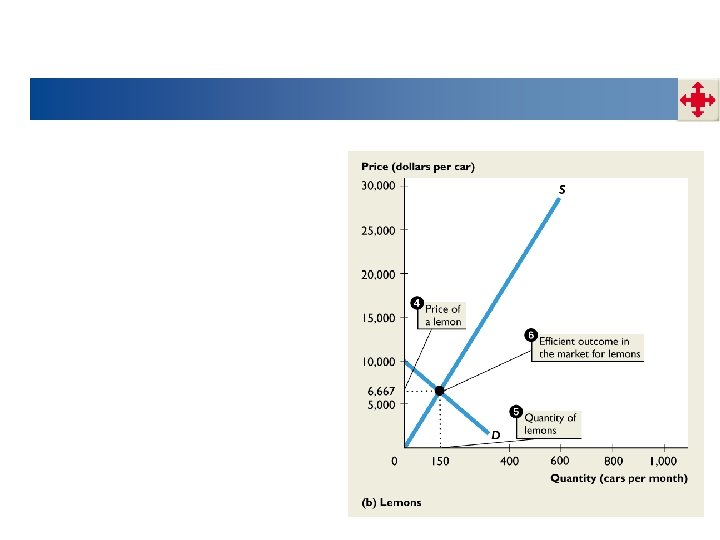

Because buyers can’t tell the difference between a lemon and a good car, the price they are willing to pay reflects the fact that the car might be a lemon. The highest price that a buyer will pay must be less than $25, 000 because the car might be a lemon. Some people with low incomes and time to fix a car are willing to buy lemons as long as they know what they are buying and paying for. What is the price of a used car?

Because buyers can’t tell the difference between a lemon and a good car, the price they are willing to pay reflects the fact that the car might be a lemon. The highest price that a buyer will pay must be less than $25, 000 because the car might be a lemon. Some people with low incomes and time to fix a car are willing to buy lemons as long as they know what they are buying and paying for. What is the price of a used car?

So the most that the buyer knows is the probability of buying a lemon. If half of the used cars sold turn out to be lemons, the buyer know that he has a 50 percent chance of getting a good car and a 50 percent chance of getting a lemon. The price that a buyer is willing to pay for a car of unknown quality is more than the value of a lemon because the car might be a good one. But the price is less than the value of a good car because it might turn out to be a lemon.

So the most that the buyer knows is the probability of buying a lemon. If half of the used cars sold turn out to be lemons, the buyer know that he has a 50 percent chance of getting a good car and a 50 percent chance of getting a lemon. The price that a buyer is willing to pay for a car of unknown quality is more than the value of a lemon because the car might be a good one. But the price is less than the value of a good car because it might turn out to be a lemon.

Sellers of used cars know the quality of their cars. Someone who owns a good car is going to be offered a price that is less than the value of that car to the buyer. Many owners will be reluctant to sell, so fewer good cars will be supplied than if the price reflected its value. But someone who owns a lemon is going to be offered more than the value of that car to the buyer. Owners of lemons will be eager to sell, so more lemons will be supplied than if the price reflected its value.

Sellers of used cars know the quality of their cars. Someone who owns a good car is going to be offered a price that is less than the value of that car to the buyer. Many owners will be reluctant to sell, so fewer good cars will be supplied than if the price reflected its value. But someone who owns a lemon is going to be offered more than the value of that car to the buyer. Owners of lemons will be eager to sell, so more lemons will be supplied than if the price reflected its value.