825071a818f2c005e4b732d958d2d4af.ppt

- Количество слайдов: 20

Taking an interdisciplinary approach: The IDB’s Business Climate Initiative Brazil, October 26, 2004 Angela Paris Inter-American Development Bank Private Enterprise

Outline of the presentation l Outline of the problem l What needs to be done: why the traditional “project approach” is inadequate l How is the IDB approaching the problem l Closing remarks

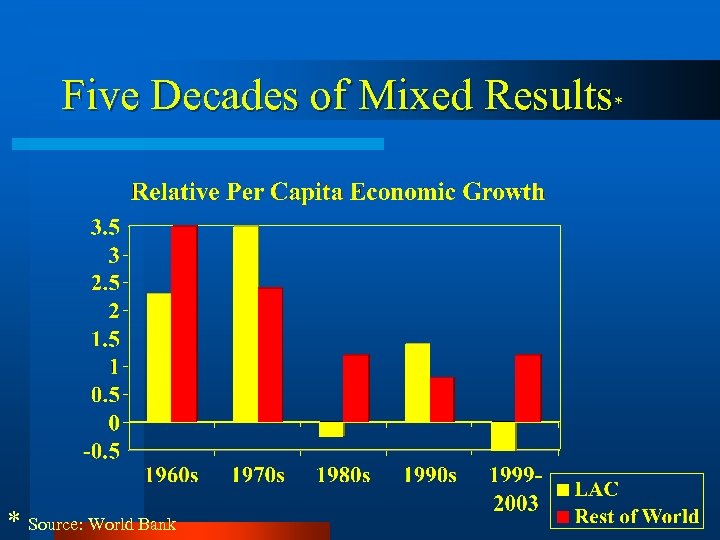

Five Decades of Mixed Results* * Source: World Bank

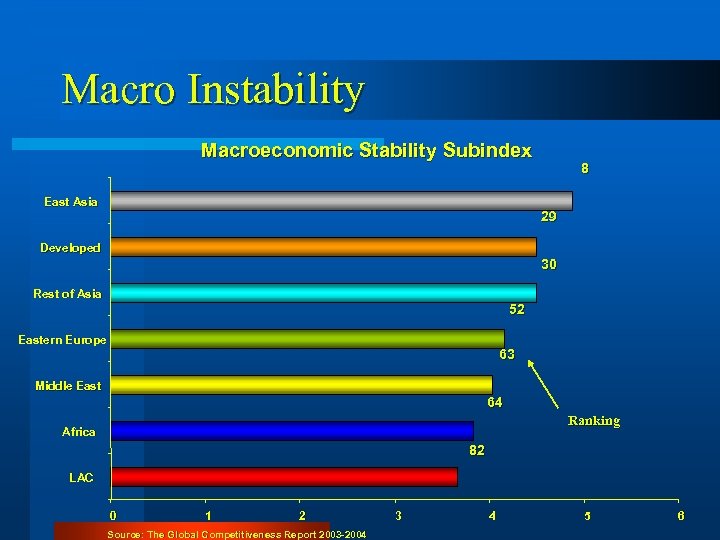

Macro Instability Macroeconomic Stability Subindex East Asia 8 29 Developed 30 Rest of Asia 52 Eastern Europe 63 Middle East 64 Ranking Africa 82 LAC 0 1 2 Source: The Global Competitiveness Report 2003 -2004 3 4 5 6

A reality check: Competitiveness Rankings ü ü ü ü EU AREA Finland: 1 -1 United Kingdom: 11 -15 Germany: 13 -13 Austria: 17 -17 Spain: 23 -23 France: 27 -26 … Italy: 47 -41 * Source: World Economic Forum. ü ü ü ü LAC Chile: 22 -28 Mexico: 48 -47 El Salvador: 53 -48 Brazil: 57 -54 Colombia: 64 -63 Argentina: 74 -78 Venezuela: 85 -82 2003 -2004 Rankings

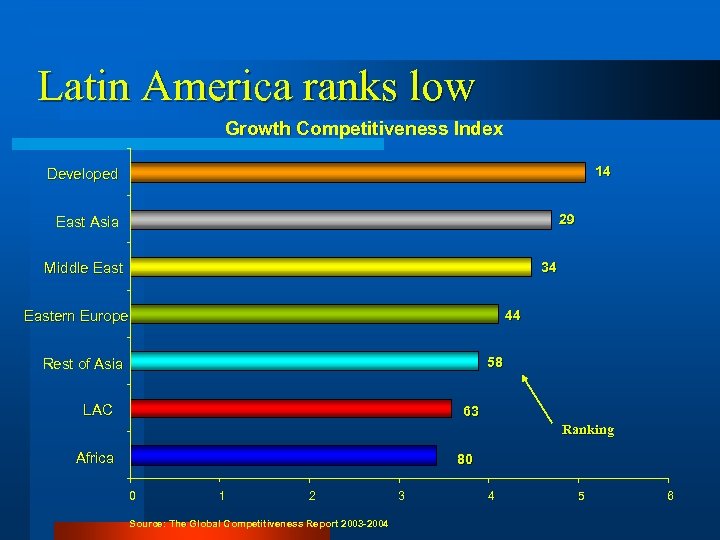

Latin America ranks low Growth Competitiveness Index 14 Developed 29 East Asia 34 Middle Eastern Europe 44 58 Rest of Asia LAC 63 Ranking Africa 80 0 1 2 Source: The Global Competitiveness Report 2003 -2004 3 4 5 6

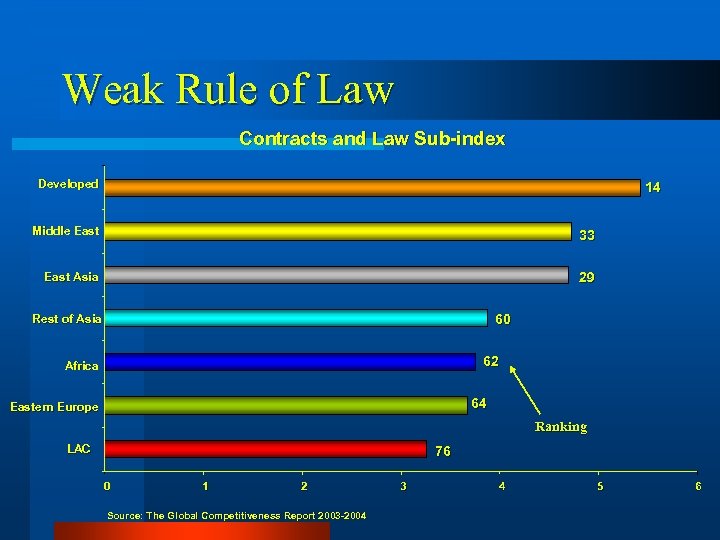

Weak Rule of Law Contracts and Law Sub-index Developed 14 Middle East 33 East Asia 29 60 Rest of Asia 62 Africa 64 Eastern Europe Ranking LAC 76 0 1 2 Source: The Global Competitiveness Report 2003 -2004 3 4 5 6

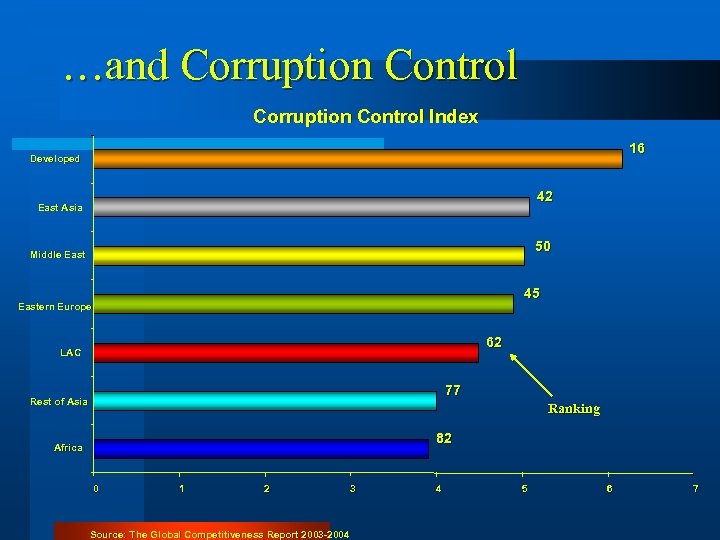

…and Corruption Control Index 16 Developed 42 East Asia 50 Middle East 45 Eastern Europe 62 LAC 77 Rest of Asia Ranking 82 Africa 0 1 2 Source: The Global Competitiveness Report 2003 -2004 3 4 5 6 7

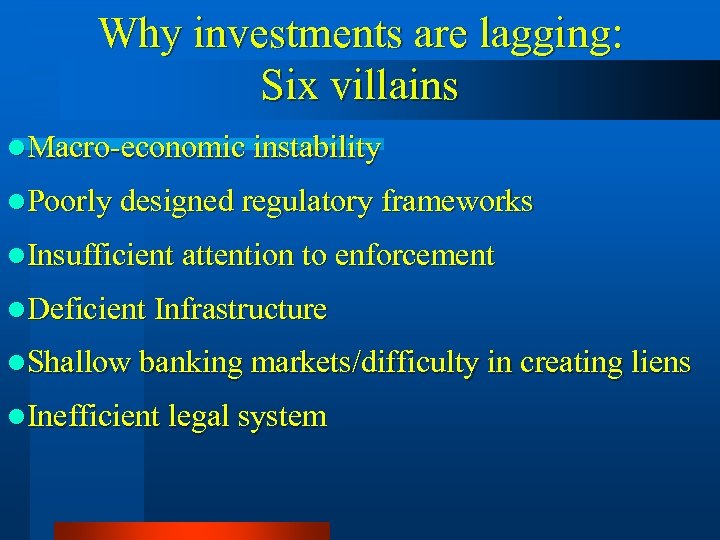

Why investments are lagging: Six villains l. Macro-economic instability l. Poorly designed regulatory frameworks l. Insufficient attention to enforcement l. Deficient Infrastructure l. Shallow banking markets/difficulty in creating liens l. Inefficient legal system

Informality: the silent ambush l Good macro-economic policies and private ownership necessary but not sufficient conditions for economic growth l Micro-policy issues – value chains l Effects on: – Productivity – Labor – Competition

Not just one cause, not just one solution l Fiscal policy l Regulatory burden l Labor markets l Institutional quality l Access to markets l Access to financing

Foreign Investors Challenges l Contract enforcement l Cash flow profiles – Asymmetry in negotiation power – Change in financial equilibrium – Unreliable environment l Foreign exchange exposure l Overreaction by stock markets l Economies of scale

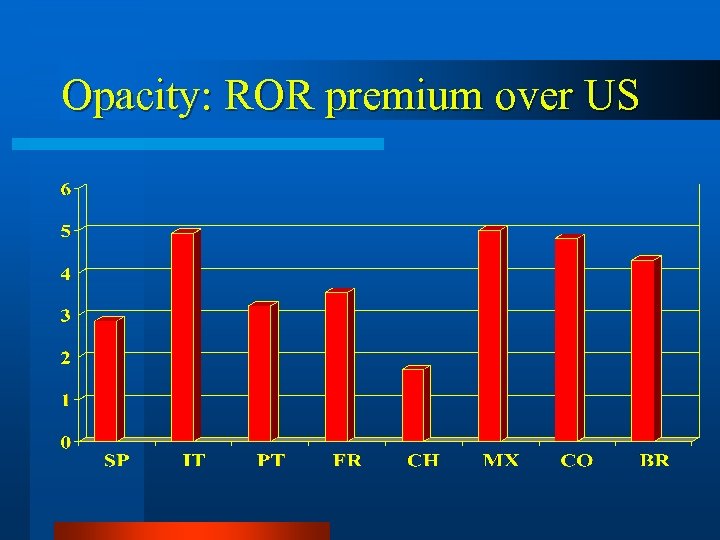

Opacity: ROR premium over US

Lessons Learned • Macro-economic and regulatory stability a necessary but not sufficient condition • Public disillusionment with private ownership (especially foreign) • Size of economy obstacle for large investments • Subsidies for lower income customers may still be a necessity • Public acceptance of tariffs is still a central issue

The future of business l Should we wait for the perfect business climate before we invest? l Importance of “good-enough governance” l Must design investments to avoid the major obstacles and capitalize on the good points, including entering in partnerships with the public sector. Reduce “climate dependency” l In the meantime, the IDB is working to remove obstacles to doing business and create a “good-enough governance”

The IDB’s Business Climate Initiative Part of the implementation of the Competitiveness Strategy and the first Strategic Direction of the Private Sector Development Strategy. Recognition that private sector is a significant driving force of economic growth and it needs to be supported.

Pragmatic and results oriented initiative l l l l Macroeconomic Framework Financial Systems Development Legal and Regulatory Frameworks Governance Institutional Development Public Private Partnerships Cooperation with International Community

A Process, not a project l Multifaceted problems: multi-expert teams l Inter-disciplinary solutions l Evolutionary and comprehensive approach: Property rights, collateral, bankruptcy laws AND procedures AND courts AND alternative methods of resolution AND enforcement

Closing Remarks l In spite of volatility, LAC economies have made some progress in their business climate, but much remains to be done l Project by project approach will fail l Ongoing, incremental, process of change l Interdisciplinary processes need to be adopted l Closer cooperation and coordination among international community (IFIs, donors, Agencies) is required

Thank You Angela Paris Inter-American Development Bank Angelap@iadb. org Te. 202 623 1143

825071a818f2c005e4b732d958d2d4af.ppt