93e7af1ee5472479c866da7a4900a663.ppt

- Количество слайдов: 42

Taiwan as an international logistics and distribution center: Where your business opportunities begin … Jennifer Fang-Yu Huang Council for Economic Planning and Development The Executive Yuan, Taiwan, ROC April 28, 2004

Outline p The Global Economic and Trade Environment p Taiwan’s Competitive Advantages p Taiwan’s Global Logistics Development Plan p Policy Measures and Implementation Results p Global Logistics Trends and Business Opportunities p Conclusions

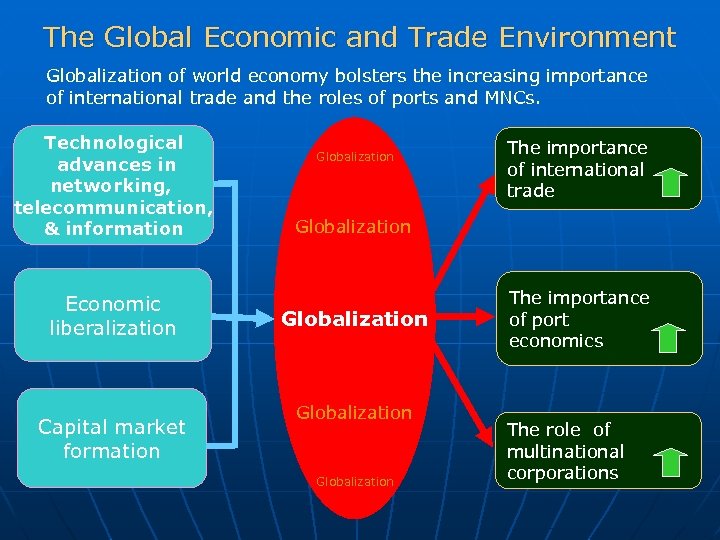

The Global Economic and Trade Environment Globalization of world economy bolsters the increasing importance of international trade and the roles of ports and MNCs. Technological advances in networking, telecommunication, & information Economic liberalization Capital market formation Globalization The importance of international trade Globalization The importance of port economics The role of multinational corporations

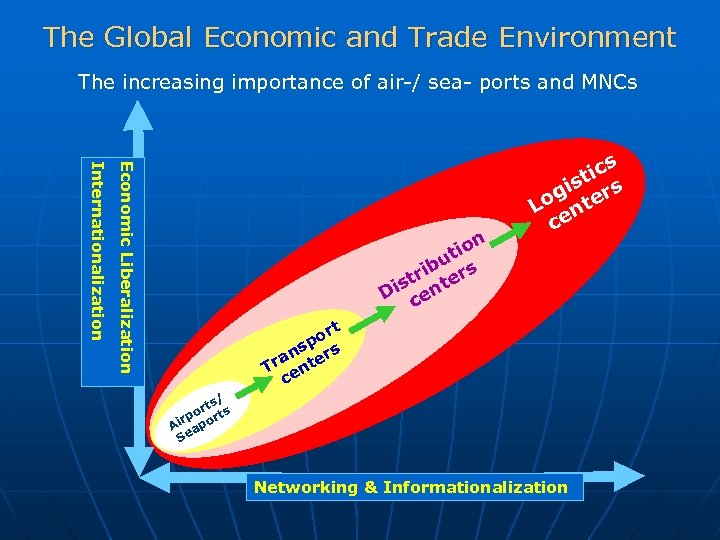

The Global Economic and Trade Environment The increasing importance of air-/ sea- ports and MNCs Economic Liberalization Internationalization n io t bu rs ri st nte Di ce ics ist rs g Lo nte ce t or p ns ers a Tr ent c / rts s o rt rp Ai apo Se Networking & Informationalization

The Global Economic and Trade Environment 1. China has increasingly become the big growth engine for global Logistics. p A huge consumer market p Manufacturing in China p Global sourcing of consumer goods from China raw materials goods

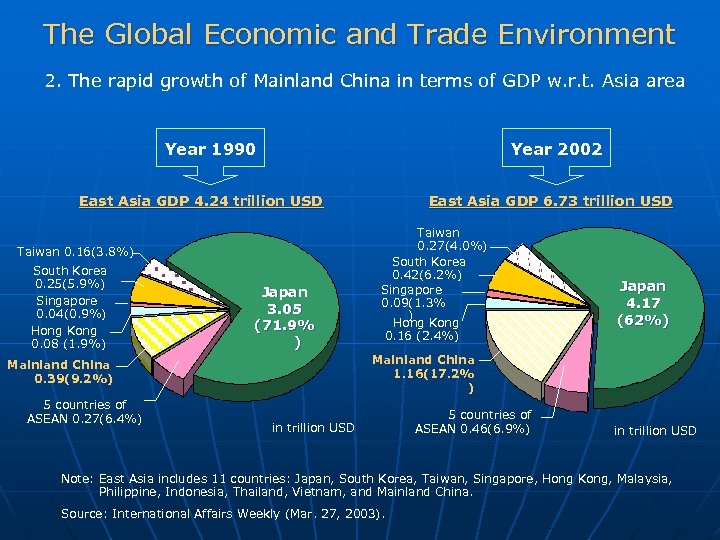

The Global Economic and Trade Environment 2. The rapid growth of Mainland China in terms of GDP w. r. t. Asia area Year 1990 Year 2002 East Asia GDP 4. 24 trillion USD Taiwan 0. 16(3. 8%) South Korea 0. 25(5. 9%) Singapore 0. 04(0. 9%) Hong Kong 0. 08 (1. 9%) Japan 3. 05 (71. 9% ) Taiwan 0. 27(4. 0%) South Korea 0. 42(6. 2%) Singapore 0. 09(1. 3% ) Hong Kong 0. 16 (2. 4%) Japan 4. 17 (62%) Mainland China 1. 16(17. 2% ) Mainland China 0. 39(9. 2%) 5 countries of ASEAN 0. 27(6. 4%) East Asia GDP 6. 73 trillion USD in trillion USD 5 countries of ASEAN 0. 46(6. 9%) in trillion USD Note: East Asia includes 11 countries: Japan, South Korea, Taiwan, Singapore, Hong Kong, Malaysia, Philippine, Indonesia, Thailand, Vietnam, and Mainland China. Source: International Affairs Weekly (Mar. 27, 2003).

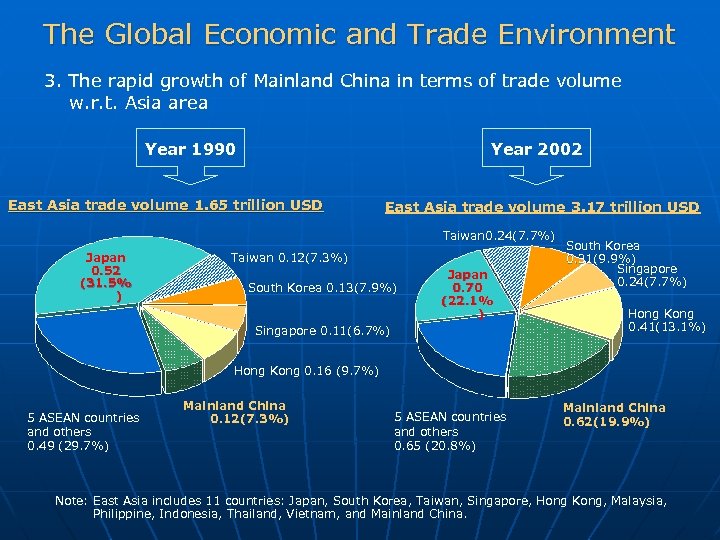

The Global Economic and Trade Environment 3. The rapid growth of Mainland China in terms of trade volume w. r. t. Asia area Year 1990 Year 2002 East Asia trade volume 1. 65 trillion USD East Asia trade volume 3. 17 trillion USD Taiwan 0. 24(7. 7%) Japan 0. 52 (31. 5% ) Taiwan 0. 12(7. 3%) South Korea 0. 13(7. 9%) Japan 0. 70 (22. 1% ) Singapore 0. 11(6. 7%) South Korea 0. 31(9. 9%) Singapore 0. 24(7. 7%) Hong Kong 0. 41(13. 1%) Hong Kong 0. 16 (9. 7%) 5 ASEAN countries and others 0. 49 (29. 7%) Mainland China 0. 12(7. 3%) 5 ASEAN countries and others 0. 65 (20. 8%) Mainland China 0. 62(19. 9%) Note: East Asia includes 11 countries: Japan, South Korea, Taiwan, Singapore, Hong Kong, Malaysia, Philippine, Indonesia, Thailand, Vietnam, and Mainland China.

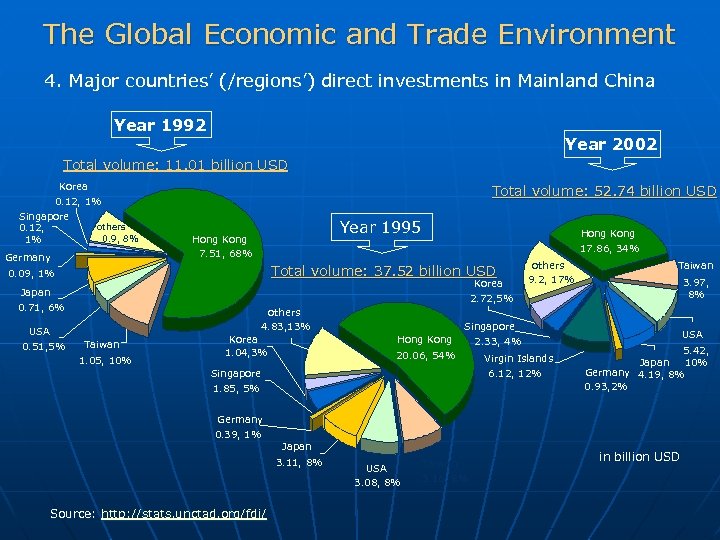

The Global Economic and Trade Environment 4. Major countries’ (/regions’) direct investments in Mainland China Year 1992 Year 2002 Total volume: 11. 01 billion USD Korea 0. 12, 1% Singapore 0. 12, 1% others 0. 9, 8% Germany Total volume: 52. 74 billion USD Year 1995 Hong Kong 7. 51, 68% Total volume: 37. 52 billion USD 0. 09, 1% Korea 2. 72, 5% Japan 0. 71, 6% USA 0. 51, 5% Hong Kong 17. 86, 34% others 4. 83, 13% Taiwan 1. 05, 10% Korea 1. 04, 3% Hong Kong others 9. 2, 17% Singapore 2. 33, 4% 20. 06, 54% Singapore 1. 85, 5% Virgin Islands 6. 12, 12% Taiwan 3. 97, 8% USA 5. 42, 10% Japan Germany 4. 19, 8% 0. 93, 2% Germany 0. 39, 1% Japan 3. 11, 8% Source: http: //stats. unctad. org/fdi/ USA 3. 08, 8% Taiwan 3. 16, 8% in billion USD

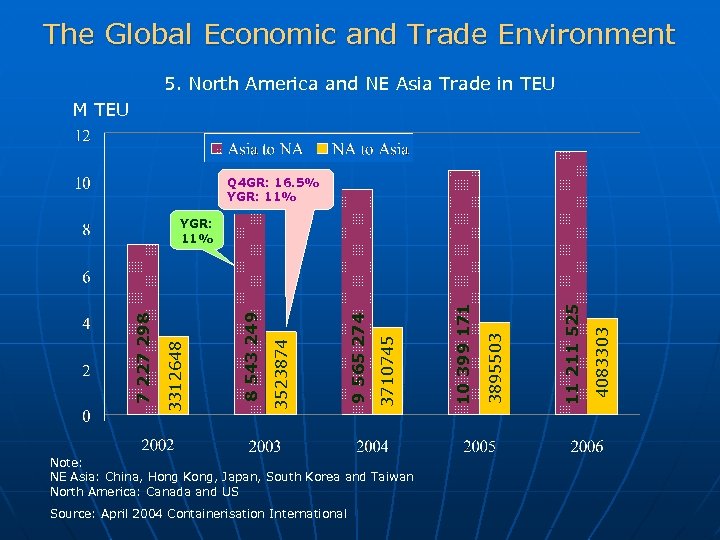

The Global Economic and Trade Environment 5. North America and NE Asia Trade in TEU M TEU Q 4 GR: 16. 5% YGR: 11% Note: NE Asia: China, Hong Kong, Japan, South Korea and Taiwan North America: Canada and US Source: April 2004 Containerisation International 4083303 11 211 525 3895503 10 399 171 3710745 9 565 274 3523874 8 543 249 3312648 7 227 298 YGR: 11%

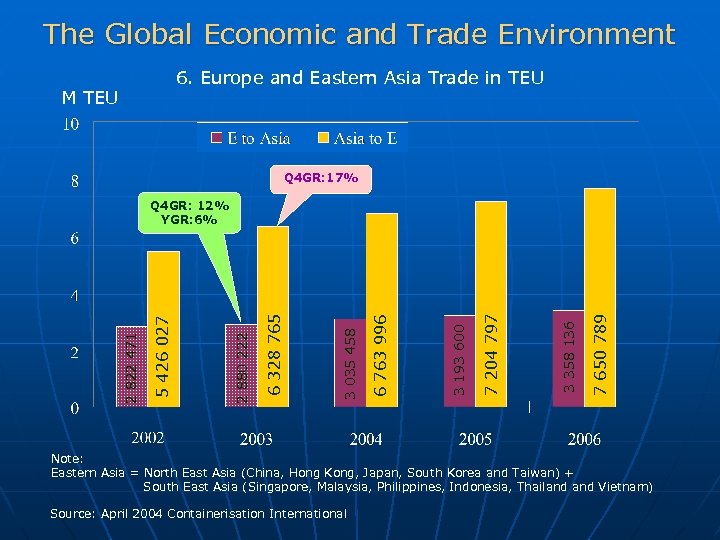

The Global Economic and Trade Environment 6. Europe and Eastern Asia Trade in TEU M TEU Q 4 GR: 17% 7 650 789 3 358 136 7 204 797 3 193 600 6 763 996 3 035 458 6 328 765 2 880 222 5 426 027 2 822 471 Q 4 GR: 12% YGR: 6% Note: Eastern Asia = North East Asia (China, Hong Kong, Japan, South Korea and Taiwan) + South East Asia (Singapore, Malaysia, Philippines, Indonesia, Thailand Vietnam) Source: April 2004 Containerisation International

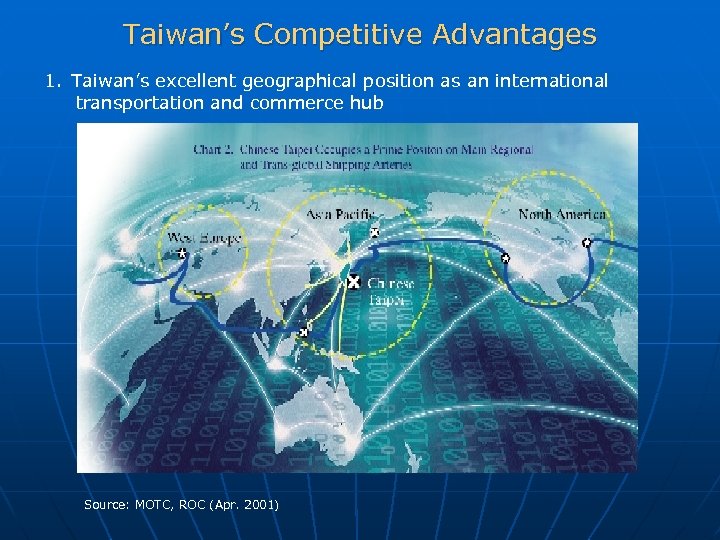

Taiwan’s Competitive Advantages 1. Taiwan’s excellent geographical position as an international transportation and commerce hub Source: MOTC, ROC (Apr. 2001)

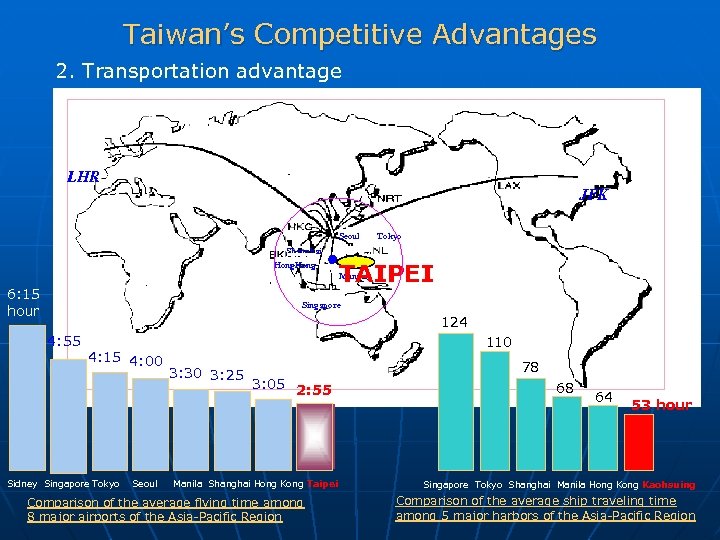

Taiwan’s Competitive Advantages 2. Transportation advantage LHR JFK Seoul Tokyo Shanghai Hong. Kong TAIPEI Manila 6: 15 hour Singapore 124 4: 55 4: 15 4: 00 Sidney Singapore Tokyo Seoul 110 3: 30 3: 25 78 3: 05 2: 55 Manila Shanghai Hong Kong Taipei Comparison of the average flying time among 8 major airports of the Asia-Pacific Region 68 64 53 hour Singapore Tokyo Shanghai Manila Hong Kaohsuing Comparison of the average ship traveling time among 5 major harbors of the Asia-Pacific Region

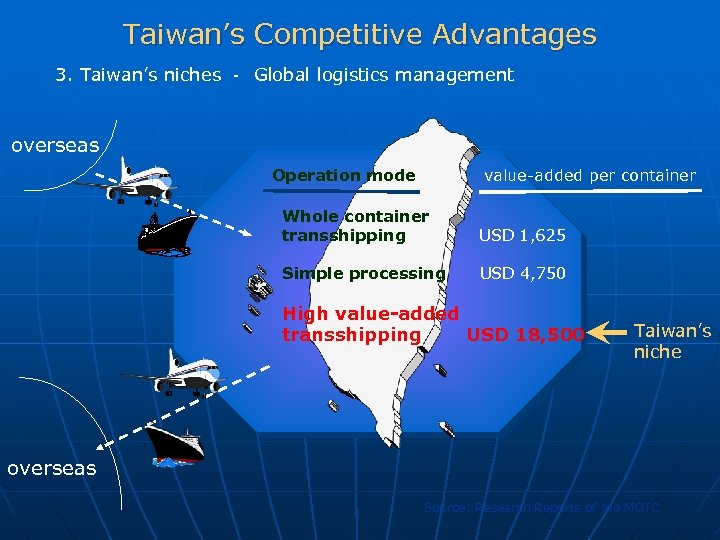

Taiwan’s Competitive Advantages 3. Taiwan’s niches - Global logistics management overseas Operation mode value-added per container Whole container transshipping USD 1, 625 Simple processing USD 4, 750 High value-added transshipping USD 18, 500 Taiwan’s niche overseas Source: Research Reports of the MOTC

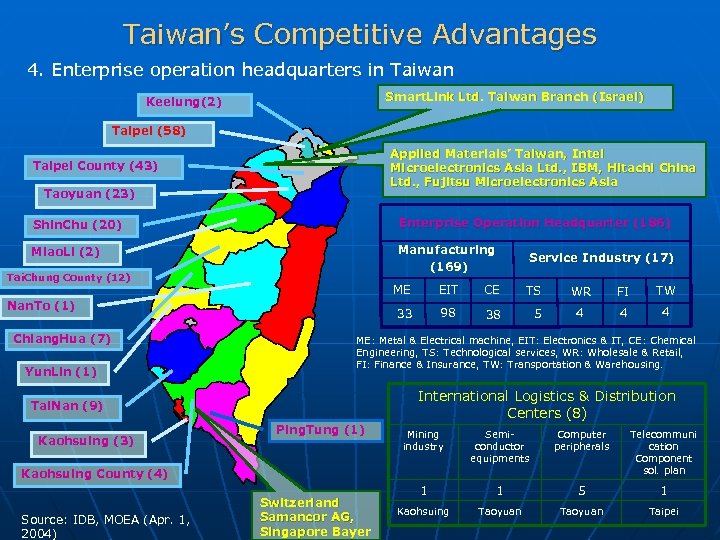

Taiwan’s Competitive Advantages 4. Enterprise operation headquarters in Taiwan Smart. Link Ltd. Taiwan Branch (Israel) Keelung(2) Taipei (58) Applied Materials’ Taiwan, Intel Microelectronics Asia Ltd. , IBM, Hitachi China Ltd. , Fujitsu Microelectronics Asia Taipei County (43) Taoyuan (23) Shin. Chu (20) Enterprise Operation Headquarter (186) Miao. Li (2) Manufacturing (169) Tai. Chung County (12) ME Yun. Lin (1) CE TS 98 38 5 WR FI TW 4 4 4 ME: Metal & Electrical machine, EIT: Electronics & IT, CE: Chemical Engineering, TS: Technological services, WR: Wholesale & Retail, FI: Finance & Insurance, TW: Transportation & Warehousing. International Logistics & Distribution Centers (8) Tai. Nan (9) Kaohsuing (3) EIT 33 Nan. To (1) Chiang. Hua (7) Service Industry (17) Ping. Tung (1) Mining industry Semiconductor equipments Computer peripherals Telecommuni cation Component sol. plan 1 1 5 1 Kaohsuing Taoyuan Taipei Kaohsuing County (4) Source: IDB, MOEA (Apr. 1, 2004) Switzerland Samancor AG, Singapore Bayer

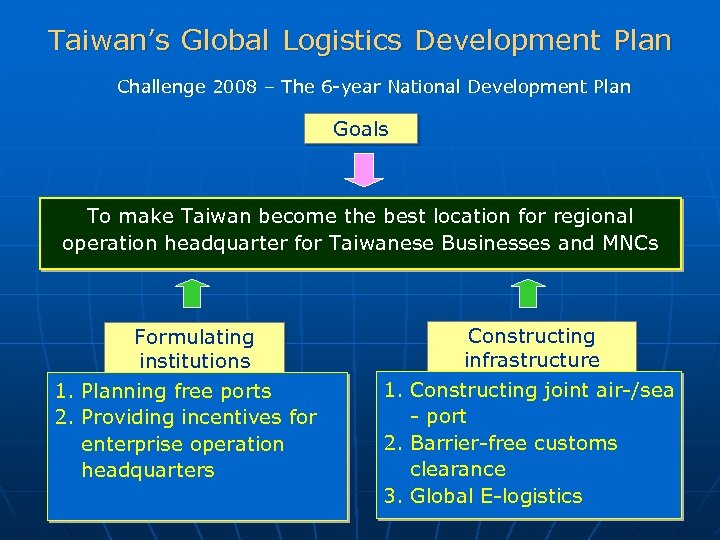

Taiwan’s Global Logistics Development Plan Challenge 2008 – The 6 -year National Development Plan Goals To make Taiwan become the best location for regional operation headquarter for Taiwanese Businesses and MNCs Formulating institutions 1. Planning free ports 2. Providing incentives for enterprise operation headquarters Constructing infrastructure 1. Constructing joint air-/sea - port 2. Barrier-free customs clearance 3. Global E-logistics

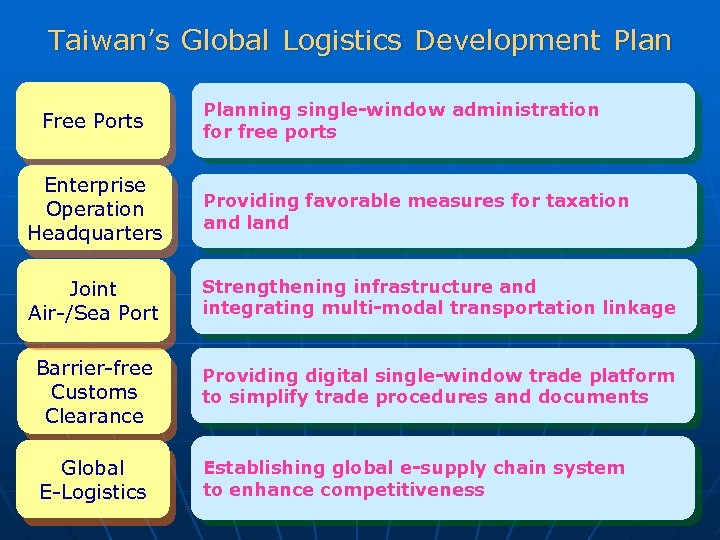

Taiwan’s Global Logistics Development Plan Free Ports Planning single-window administration for free ports Enterprise Operation Headquarters Providing favorable measures for taxation and land Joint Air-/Sea Port Strengthening infrastructure and integrating multi-modal transportation linkage Barrier-free Customs Clearance Providing digital single-window trade platform to simplify trade procedures and documents Global E-Logistics Establishing global e-supply chain system to enhance competitiveness

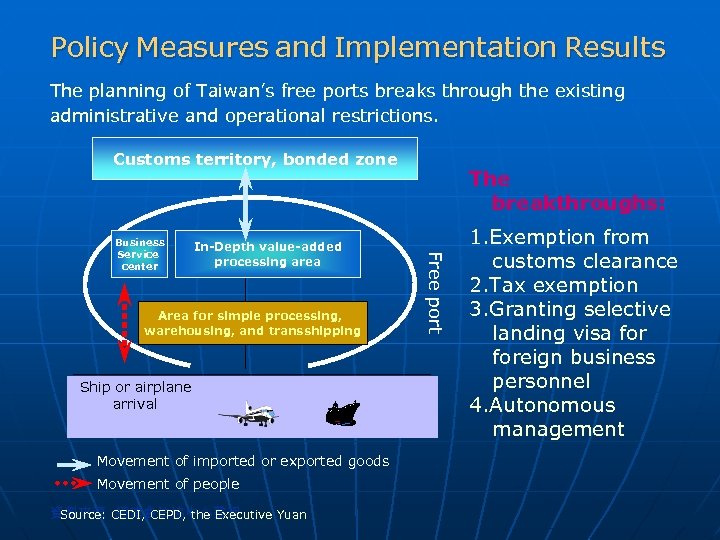

Policy Measures and Implementation Results The planning of Taiwan’s free ports breaks through the existing administrative and operational restrictions. Customs territory, bonded zone In-Depth value-added processing area Area for simple processing, warehousing, and transshipping Ship or airplane arrival Movement of imported or exported goods Movement of people 資料來源 CEDI, CEPD, the Executive Yuan Source: : 經建會法協中心整理 Free port Business Service center The breakthroughs: 1. Exemption from customs clearance 2. Tax exemption 3. Granting selective landing visa foreign business personnel 4. Autonomous management

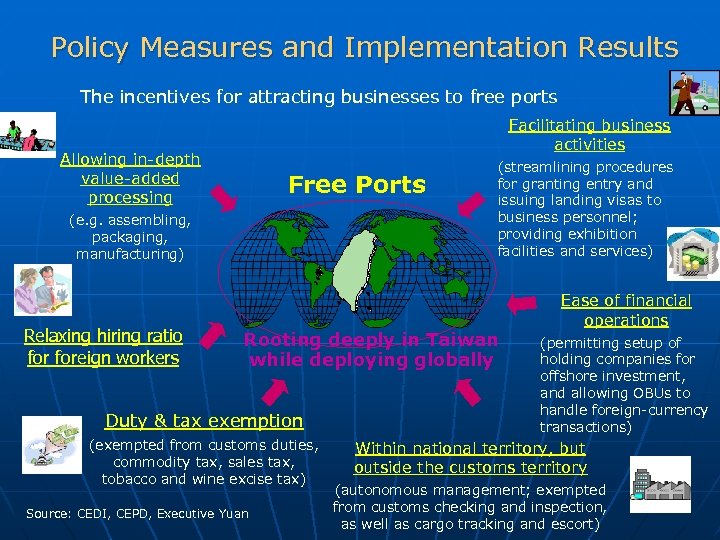

Policy Measures and Implementation Results The incentives for attracting businesses to free ports Facilitating business activities Allowing in-depth value-added processing Free Ports (e. g. assembling, packaging, manufacturing) Relaxing hiring ratio foreign workers (streamlining procedures for granting entry and issuing landing visas to business personnel; providing exhibition facilities and services) Rooting deeply in Taiwan while deploying globally Duty & tax exemption (exempted from customs duties, commodity tax, sales tax, tobacco and wine excise tax) Source: CEDI, CEPD, Executive Yuan Ease of financial operations (permitting setup of holding companies for offshore investment, and allowing OBUs to handle foreign-currency transactions) Within national territory, but outside the customs territory (autonomous management; exempted from customs checking and inspection, as well as cargo tracking and escort)

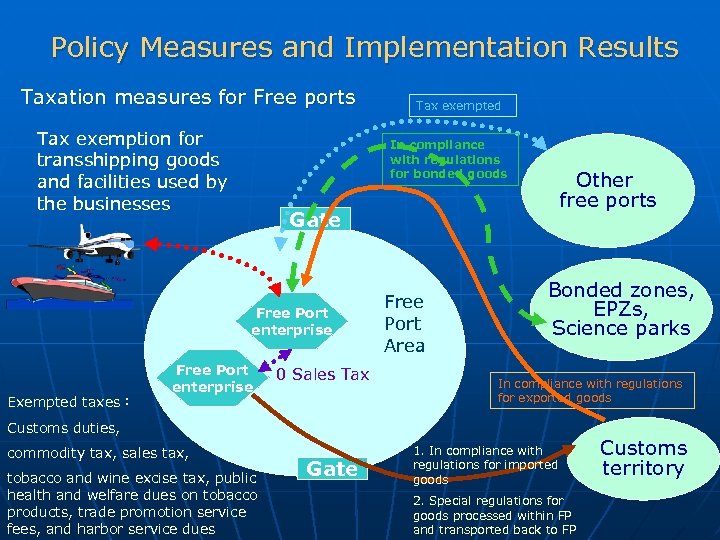

Policy Measures and Implementation Results Taxation measures for Free ports Tax exemption for transshipping goods and facilities used by the businesses In compliance with regulations for bonded goods Other free ports Gate Free Port enterprise Exempted taxes: Tax exempted Free Port enterprise 0 Sales Tax Free Port Area Bonded zones, EPZs, Science parks In compliance with regulations for exported goods Customs duties, commodity tax, sales tax, tobacco and wine excise tax, public health and welfare dues on tobacco products, trade promotion service fees, and harbor service dues Gate 1. In compliance with regulations for imported goods 2. Special regulations for goods processed within FP and transported back to FP Customs territory

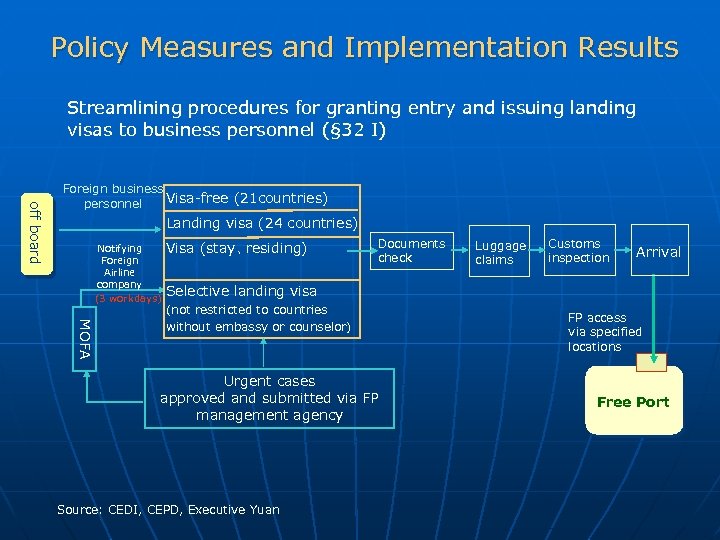

Policy Measures and Implementation Results Streamlining procedures for granting entry and issuing landing visas to business personnel (§ 32 I) off board Foreign business Visa-free (21 countries) personnel Landing visa (24 countries) Notifying Foreign Airline company (3 workdays) Visa (stay、 residing) Documents check Luggage claims Customs inspection Arrival Selective landing visa MOFA (not restricted to countries without embassy or counselor) Urgent cases approved and submitted via FP management agency Source: CEDI, CEPD, Executive Yuan FP access via specified locations Free Port

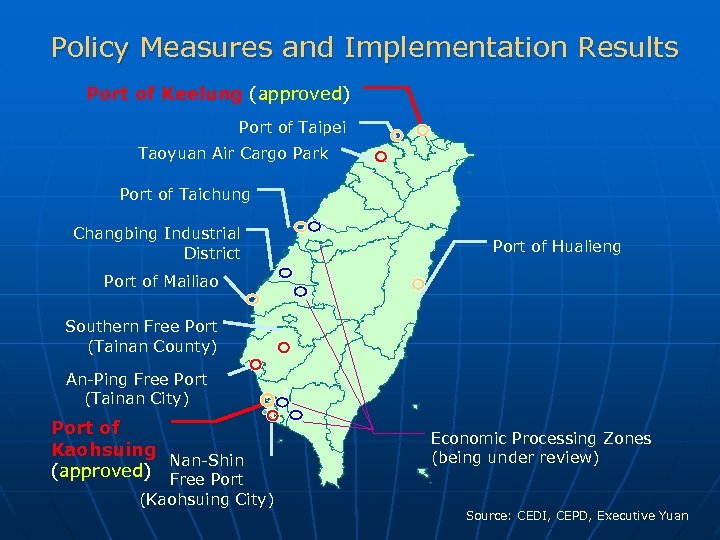

Policy Measures and Implementation Results Port of Keelung (approved) Port of Taipei Taoyuan Air Cargo Park Port of Taichung 2 Changbing Industrial District Port of Hualieng Port of Mailiao Southern Free Port (Tainan County) An-Ping Free Port (Tainan City) Port of Kaohsuing Nan-Shin (approved) Free Port 3 Economic Processing Zones (being under review) (Kaohsuing City) Source: CEDI, CEPD, Executive Yuan

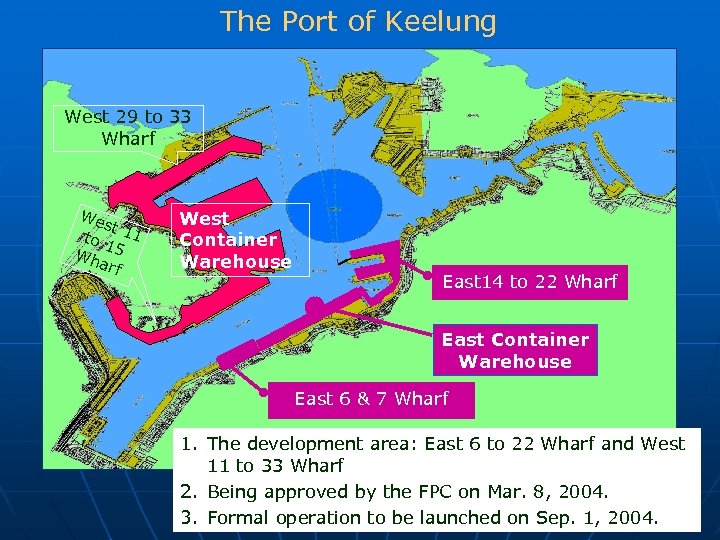

The Port of Keelung West 29 to 33 Wharf We st to 1 11 Wh 5 arf West Container Warehouse East 14 to 22 Wharf East Container Warehouse East 6 & 7 Wharf 1. The development area: East 6 to 22 Wharf and West 11 to 33 Wharf 2. Being approved by the FPC on Mar. 8, 2004. 3. Formal operation to be launched on Sep. 1, 2004.

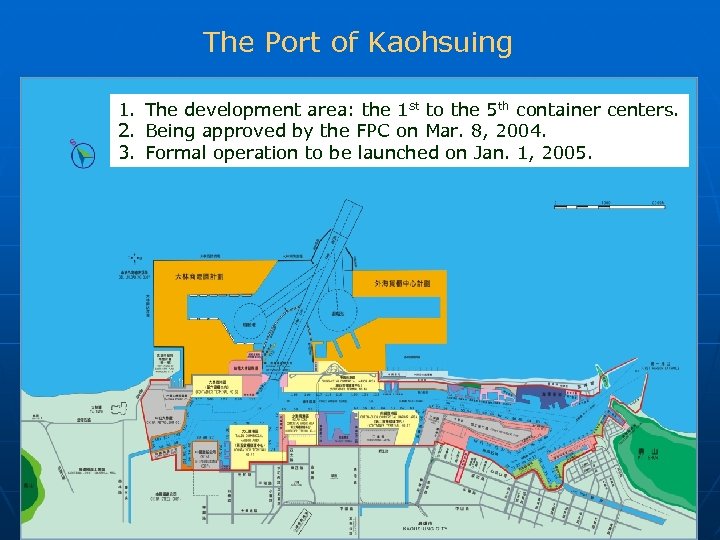

The Port of Kaohsuing 1. The development area: the 1 st to the 5 th container centers. 2. Being approved by the FPC on Mar. 8, 2004. 3. Formal operation to be launched on Jan. 1, 2005.

Taoyuan Air Cargo Park Far Glory Air Cargo Park CKS International Airport Port of Taipei Port of Keelung Taipei Keelung Taoyuan Chung. Li Highway Shing. Chu Taipei County HSR MRT Express way Railway

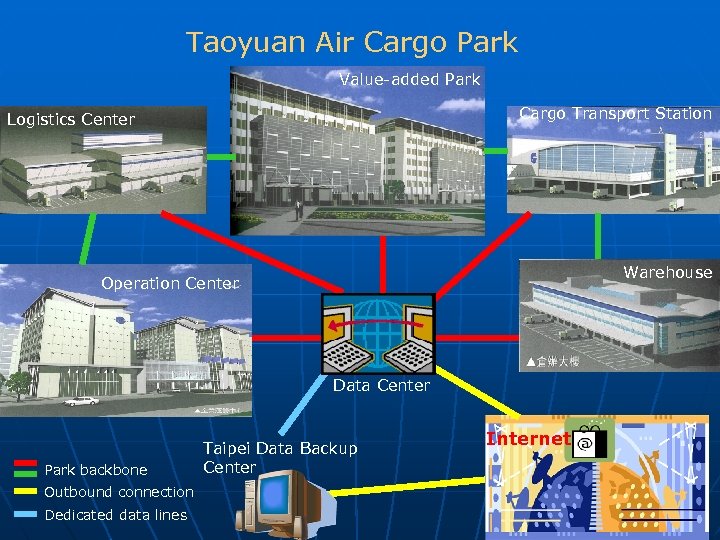

Taoyuan Air Cargo Park Value-added Park Cargo Transport Station Logistics Center Warehouse Operation Center Data Center Park backbone Outbound connection Dedicated data lines Taipei Data Backup Center Internet

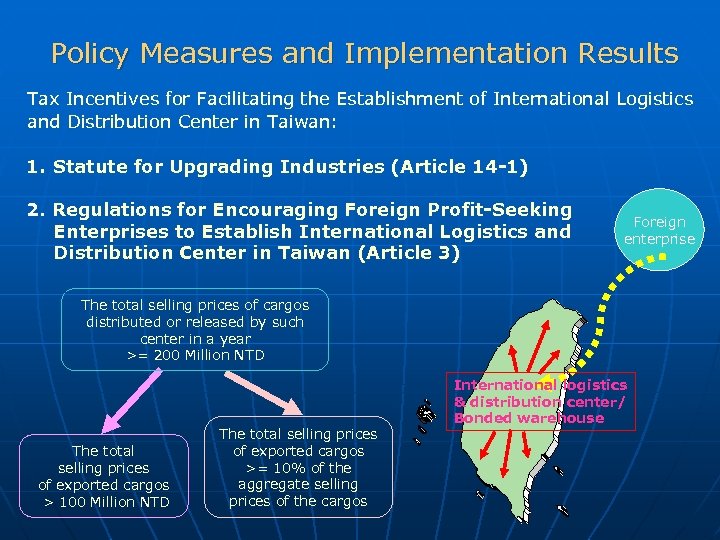

Policy Measures and Implementation Results Tax Incentives for Facilitating the Establishment of International Logistics and Distribution Center in Taiwan: 1. Statute for Upgrading Industries (Article 14 -1) 2. Regulations for Encouraging Foreign Profit-Seeking Enterprises to Establish International Logistics and Distribution Center in Taiwan (Article 3) Foreign enterprise The total selling prices of cargos distributed or released by such center in a year >= 200 Million NTD The total selling prices of exported cargos > 100 Million NTD The total selling prices of exported cargos >= 10% of the aggregate selling prices of the cargos International logistics & distribution center/ Bonded warehouse

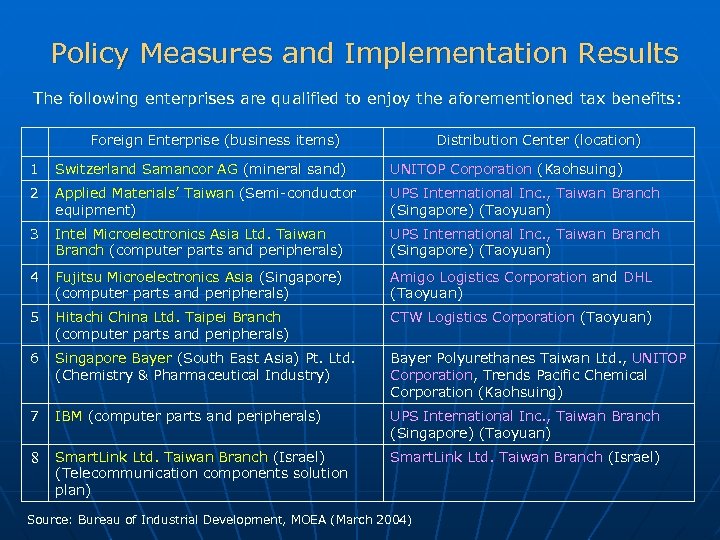

Policy Measures and Implementation Results The following enterprises are qualified to enjoy the aforementioned tax benefits: Foreign Enterprise (business items) Distribution Center (location) 1 Switzerland Samancor AG (mineral sand) UNITOP Corporation (Kaohsuing) 2 Applied Materials’ Taiwan (Semi-conductor equipment) UPS International Inc. , Taiwan Branch (Singapore) (Taoyuan) 3 Intel Microelectronics Asia Ltd. Taiwan Branch (computer parts and peripherals) UPS International Inc. , Taiwan Branch (Singapore) (Taoyuan) 4 Fujitsu Microelectronics Asia (Singapore) (computer parts and peripherals) Amigo Logistics Corporation and DHL (Taoyuan) 5 Hitachi China Ltd. Taipei Branch (computer parts and peripherals) CTW Logistics Corporation (Taoyuan) 6 Singapore Bayer (South East Asia) Pt. Ltd. (Chemistry & Pharmaceutical Industry) Bayer Polyurethanes Taiwan Ltd. , UNITOP Corporation, Trends Pacific Chemical Corporation (Kaohsuing) 7 IBM (computer parts and peripherals) UPS International Inc. , Taiwan Branch (Singapore) (Taoyuan) 8 Smart. Link Ltd. Taiwan Branch (Israel) (Telecommunication components solution plan) Source: Bureau of Industrial Development, MOEA (March 2004)

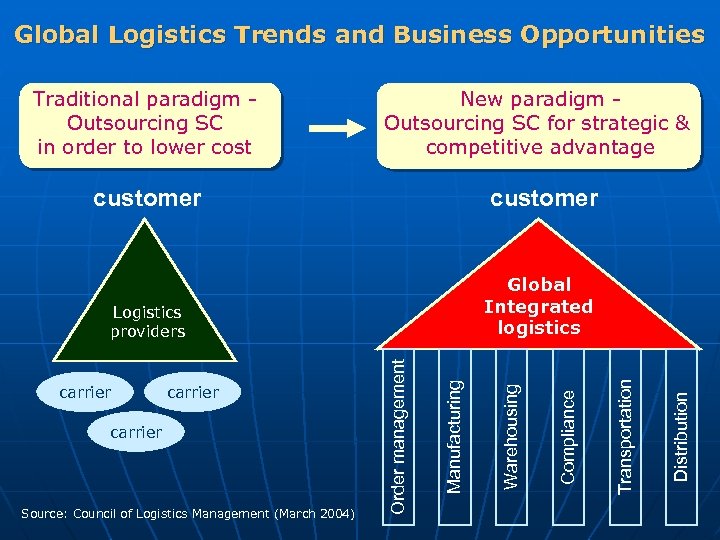

Global Logistics Trends and Business Opportunities New paradigm Outsourcing SC for strategic & competitive advantage customer Source: Council of Logistics Management (March 2004) Distribution carrier Transportation carrier Manufacturing carrier Order management Logistics providers Compliance Global Integrated logistics Warehousing Traditional paradigm Outsourcing SC in order to lower cost

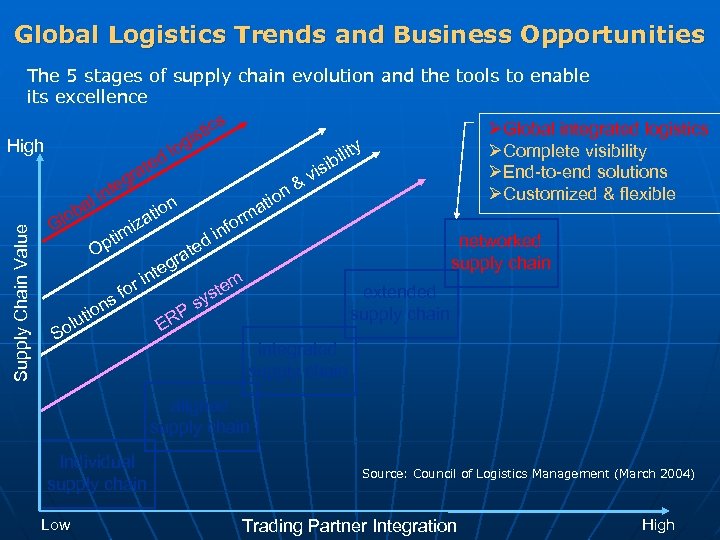

Global Logistics Trends and Business Opportunities Supply Chain Value The 5 stages of supply chain evolution and the tools to enable its excellence s ØGlobal integrated logistics tic is High log ØComplete visibility d bil i e t ØEnd-to-end solutions vis gra & e t n ØCustomized & flexible l in tio n a a o ti m ob za Gl i for n m networked di pti te O ra supply chain eg nt i tem extended for s sy ns io supply chain RP lut E So integrated supply chain aligned supply chain Individual supply chain Low Source: Council of Logistics Management (March 2004) Trading Partner Integration High

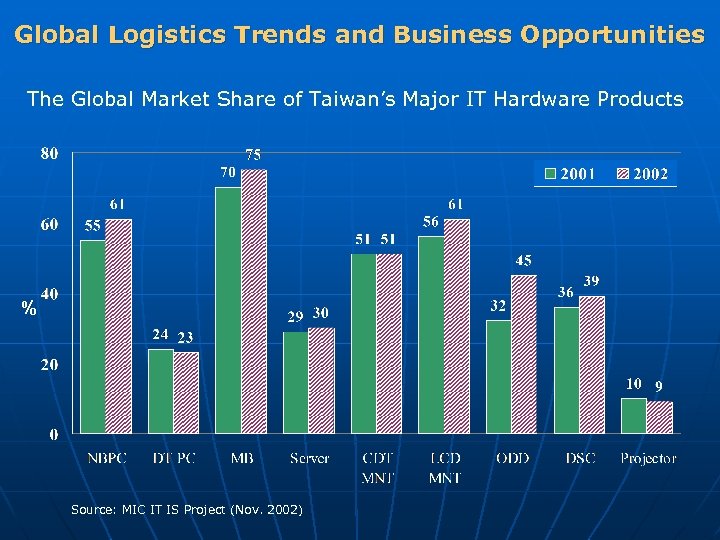

Global Logistics Trends and Business Opportunities The Global Market Share of Taiwan’s Major IT Hardware Products % Source: MIC IT IS Project (Nov. 2002)

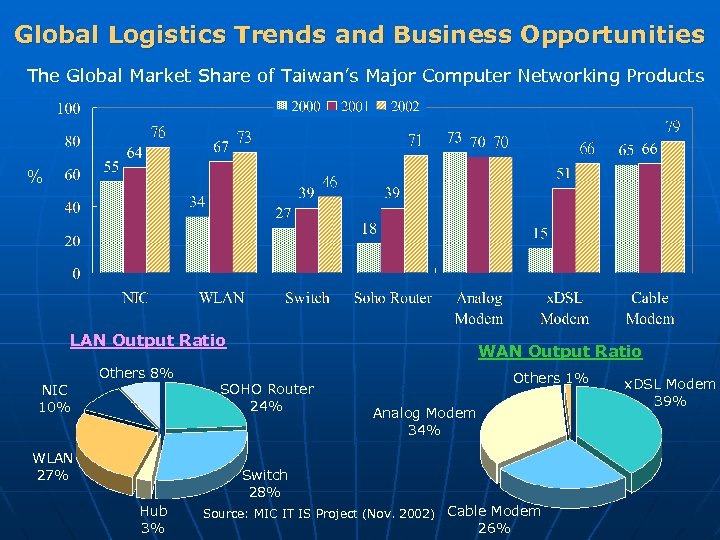

Global Logistics Trends and Business Opportunities The Global Market Share of Taiwan’s Major Computer Networking Products % LAN Output Ratio NIC 10% Others 8% WLAN 27% WAN Output Ratio SOHO Router 24% Others 1% Analog Modem 34% Switch 28% Hub 3% Source: MIC IT IS Project (Nov. 2002) Cable Modem 26% x. DSL Modem 39%

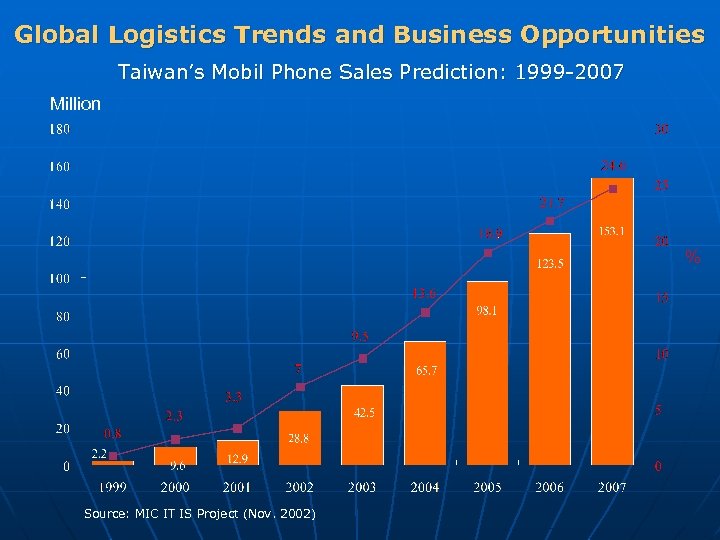

Global Logistics Trends and Business Opportunities Taiwan’s Mobil Phone Sales Prediction: 1999 -2007 Million % Source: MIC IT IS Project (Nov. 2002)

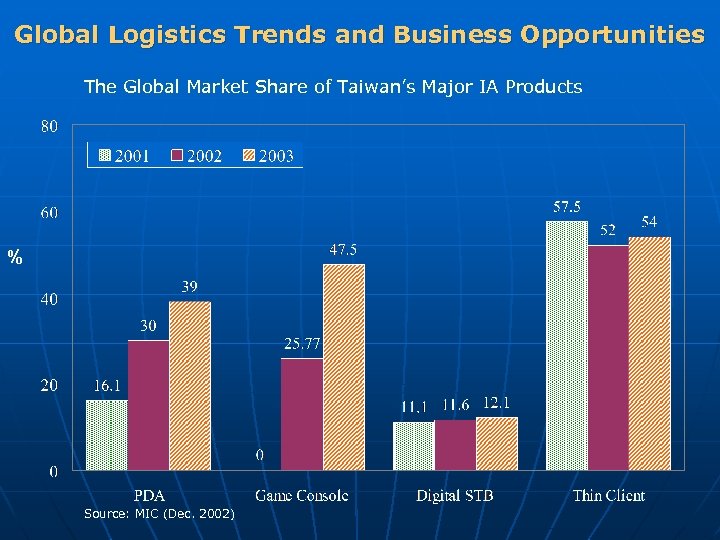

Global Logistics Trends and Business Opportunities The Global Market Share of Taiwan’s Major IA Products % Source: MIC (Dec. 2002)

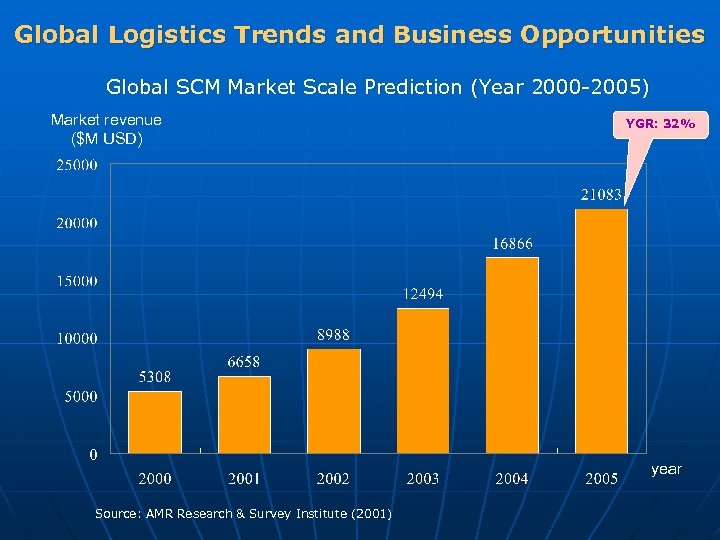

Global Logistics Trends and Business Opportunities Global SCM Market Scale Prediction (Year 2000 -2005) Market revenue ($M USD) YGR: 32% year Source: AMR Research & Survey Institute (2001)

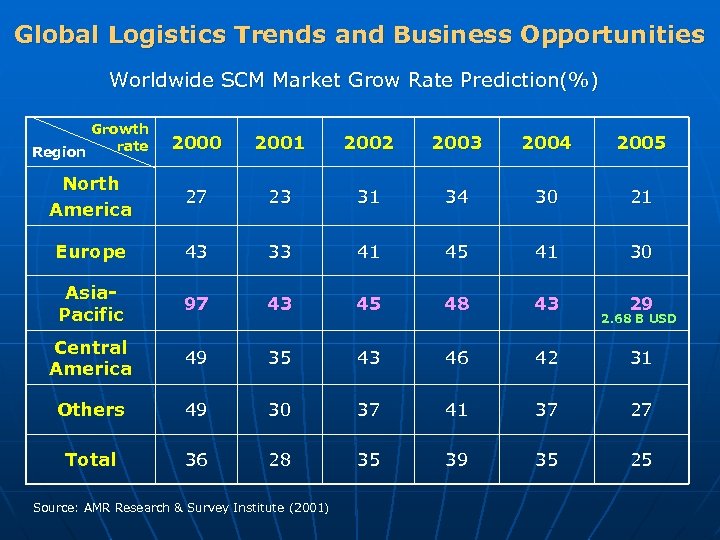

Global Logistics Trends and Business Opportunities Worldwide SCM Market Grow Rate Prediction(%) Growth rate Region 2000 2001 2002 2003 2004 2005 North America 27 23 31 34 30 21 Europe 43 33 41 45 41 30 Asia. Pacific 97 43 45 48 43 Central America 49 35 43 46 42 31 Others 49 30 37 41 37 27 Total 36 28 35 39 35 25 Source: AMR Research & Survey Institute (2001) 29 2. 68 B USD

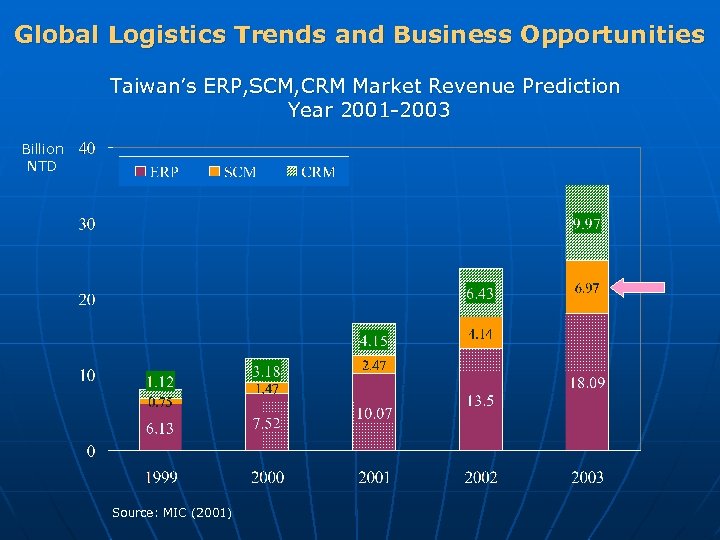

Global Logistics Trends and Business Opportunities Taiwan’s ERP, SCM, CRM Market Revenue Prediction Year 2001 -2003 Billion NTD Source: MIC (2001)

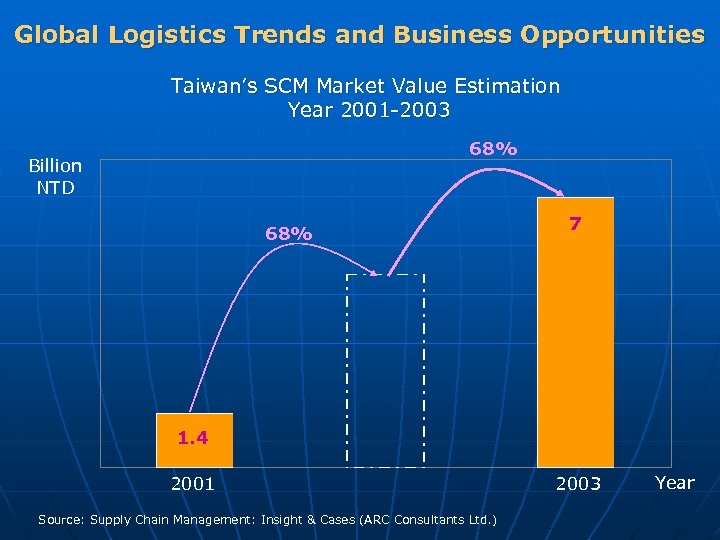

Global Logistics Trends and Business Opportunities Taiwan’s SCM Market Value Estimation Year 2001 -2003 68% Billion NTD 68% 7 1. 4 2001 Source: Supply Chain Management: Insight & Cases (ARC Consultants Ltd. ) 2003 Year

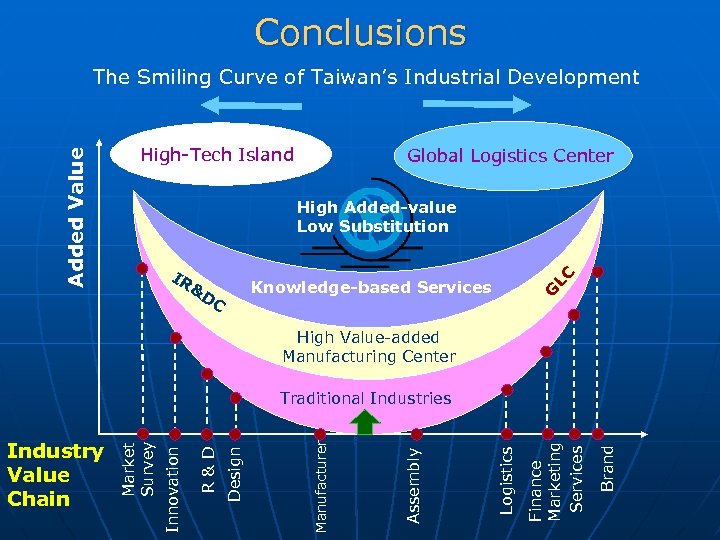

Conclusions High-Tech Island Global Logistics Center IR &D LC High Added-value Low Substitution Knowledge-based Services C G Added Value The Smiling Curve of Taiwan’s Industrial Development High Value-added Manufacturing Center Brand Finance Marketing Services Logistics Assembly Manufacturer Design R&D Innovation Industry Value Chain Market Survey Traditional Industries

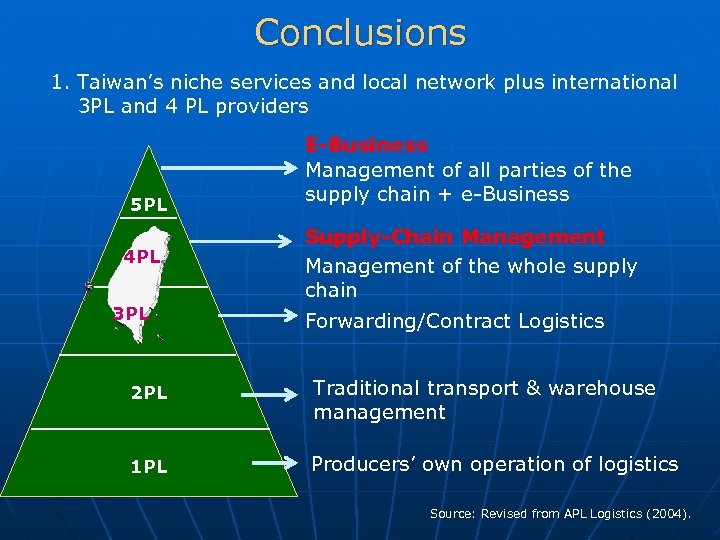

Conclusions 1. Taiwan’s niche services and local network plus international 3 PL and 4 PL providers 5 PL 4 PL 3 PL E-Business Management of all parties of the supply chain + e-Business Supply-Chain Management of the whole supply chain Forwarding/Contract Logistics 2 PL Traditional transport & warehouse management 1 PL Producers’ own operation of logistics Source: Revised from APL Logistics (2004).

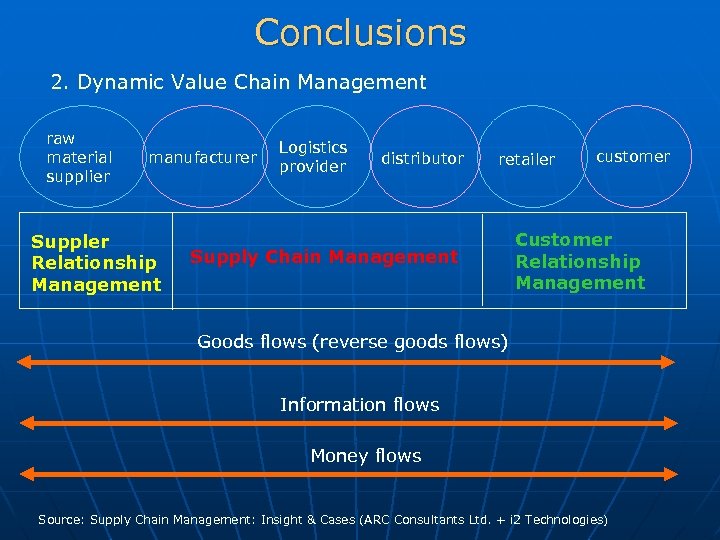

Conclusions 2. Dynamic Value Chain Management raw material supplier manufacturer Suppler Relationship Management Logistics provider distributor retailer Supply Chain Management customer Customer Relationship Management Goods flows (reverse goods flows) Information flows Money flows Source: Supply Chain Management: Insight & Cases (ARC Consultants Ltd. + i 2 Technologies)

Conclusions 3. Possible areas of cooperation between Taiwan and Singapore – The Twin Hub System for the Asia-Pacific Region p Training & Development p Professional networking p Information exchange p Logistics portal linkage

Council for Economic Planning and Development The Executive Yuan, Taiwan, ROC

93e7af1ee5472479c866da7a4900a663.ppt