f82fcda557cb6a07bdd761306cda1a69.ppt

- Количество слайдов: 86

TAIEX expert mission on implementation of prudential regulatory framework for financial markets and supervision Kiev, 25 – 26 August 2011

TAIEX expert mission on implementation of prudential regulatory framework for financial markets and supervision Kiev, 25 – 26 August 2011

Financial Supervisory Structure in Germany

Financial Supervisory Structure in Germany

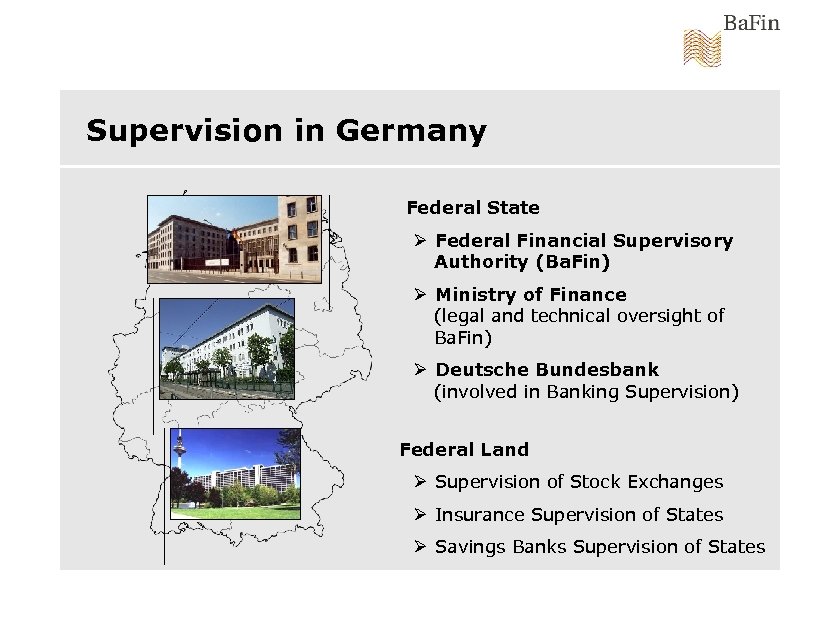

Supervision in Germany Federal State Ø Federal Financial Supervisory Authority (Ba. Fin) Ø Ministry of Finance (legal and technical oversight of Ba. Fin) Ø Deutsche Bundesbank (involved in Banking Supervision) Federal Land Ø Supervision of Stock Exchanges Ø Insurance Supervision of States Ø Savings Banks Supervision of States

Supervision in Germany Federal State Ø Federal Financial Supervisory Authority (Ba. Fin) Ø Ministry of Finance (legal and technical oversight of Ba. Fin) Ø Deutsche Bundesbank (involved in Banking Supervision) Federal Land Ø Supervision of Stock Exchanges Ø Insurance Supervision of States Ø Savings Banks Supervision of States

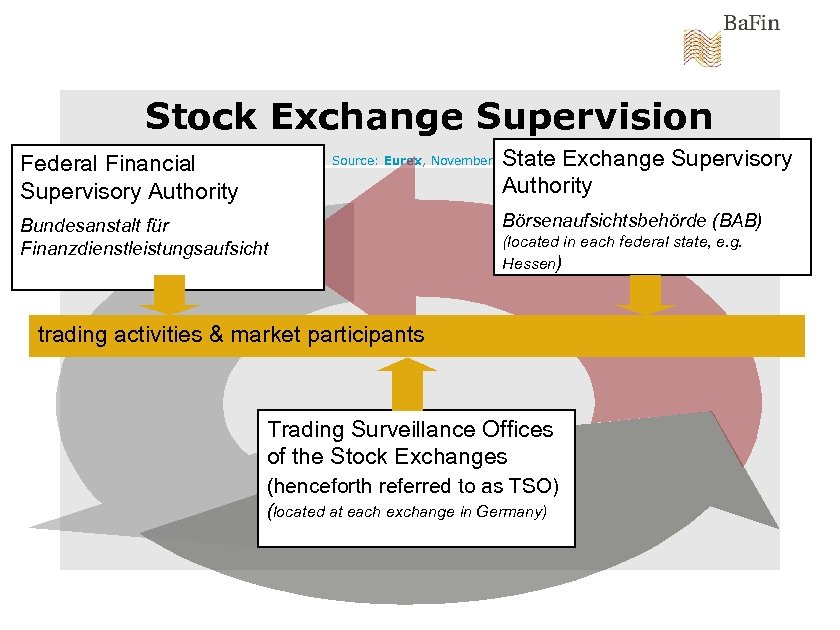

Stock Exchange Supervision State Exchange Supervisory Authority Federal Financial Supervisory Authority Source: Eurex, November 2009 Bundesanstalt für Finanzdienstleistungsaufsicht Börsenaufsichtsbehörde (BAB) (located in each federal state, e. g. Hessen) trading activities & market participants Trading Surveillance Offices of the Stock Exchanges (henceforth referred to as TSO) (located at each exchange in Germany)

Stock Exchange Supervision State Exchange Supervisory Authority Federal Financial Supervisory Authority Source: Eurex, November 2009 Bundesanstalt für Finanzdienstleistungsaufsicht Börsenaufsichtsbehörde (BAB) (located in each federal state, e. g. Hessen) trading activities & market participants Trading Surveillance Offices of the Stock Exchanges (henceforth referred to as TSO) (located at each exchange in Germany)

Supervision in Germany Federal Financial Supervisory Authority (Ba. Fin) Ø founded 1 May 2002 Ø Merger of the former Federal Authorities responsible for Banking Supervision (BAKred), Insurance Supervision (BAV) and Securities Trading Supervision (BAWe) Ø Introduction of integrated financial supervision (Single regulator) Ø Legal basis: Act Establishing the Federal Financial Supervisory Authority (Finanzdienstleistungsaufsichtsgesetz – Fin. DAG)

Supervision in Germany Federal Financial Supervisory Authority (Ba. Fin) Ø founded 1 May 2002 Ø Merger of the former Federal Authorities responsible for Banking Supervision (BAKred), Insurance Supervision (BAV) and Securities Trading Supervision (BAWe) Ø Introduction of integrated financial supervision (Single regulator) Ø Legal basis: Act Establishing the Federal Financial Supervisory Authority (Finanzdienstleistungsaufsichtsgesetz – Fin. DAG)

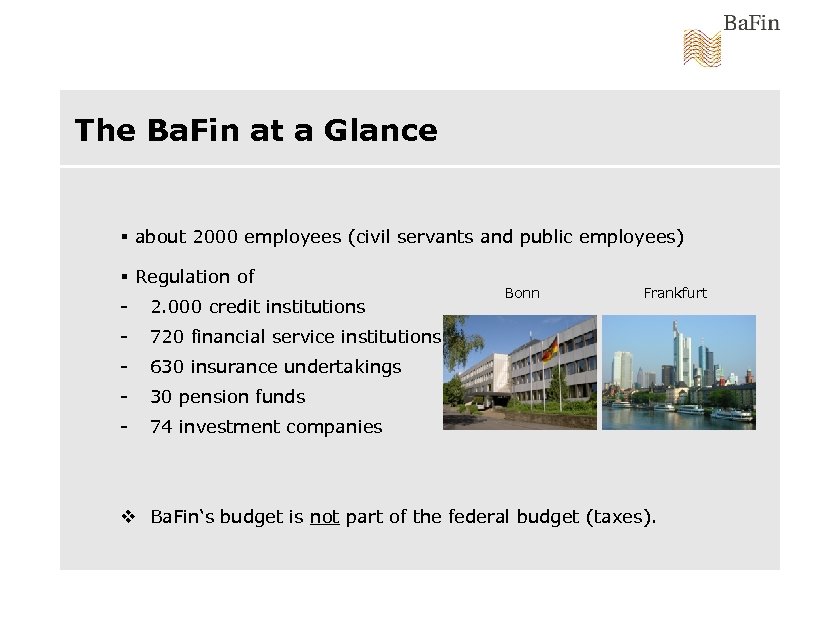

The Ba. Fin at a Glance § about 2000 employees (civil servants and public employees) § Regulation of - 2. 000 credit institutions - 630 insurance undertakings - 30 pension funds - Frankfurt 720 financial service institutions - Bonn 74 investment companies v Ba. Fin‘s budget is not part of the federal budget (taxes).

The Ba. Fin at a Glance § about 2000 employees (civil servants and public employees) § Regulation of - 2. 000 credit institutions - 630 insurance undertakings - 30 pension funds - Frankfurt 720 financial service institutions - Bonn 74 investment companies v Ba. Fin‘s budget is not part of the federal budget (taxes).

Supervision in Germany Ba. Fin‘s Tasks Ø Solvency Safeguard with regard to Banks, Insurers and Investment Firms Ø Safeguarding the Functioning, Stability and Integrity of the German financial System Ø Protection of Customers and Investors (Market Supervision) through Fairness and Transparency on the Securities Market Ø Prosecution of unauthorised Banking-, Insurance and Securities Businesses Ø Prevention of Money Laundring and the Financing of Terrorism Ø Dealing with Customer Complaints Ø International Cooperation

Supervision in Germany Ba. Fin‘s Tasks Ø Solvency Safeguard with regard to Banks, Insurers and Investment Firms Ø Safeguarding the Functioning, Stability and Integrity of the German financial System Ø Protection of Customers and Investors (Market Supervision) through Fairness and Transparency on the Securities Market Ø Prosecution of unauthorised Banking-, Insurance and Securities Businesses Ø Prevention of Money Laundring and the Financing of Terrorism Ø Dealing with Customer Complaints Ø International Cooperation

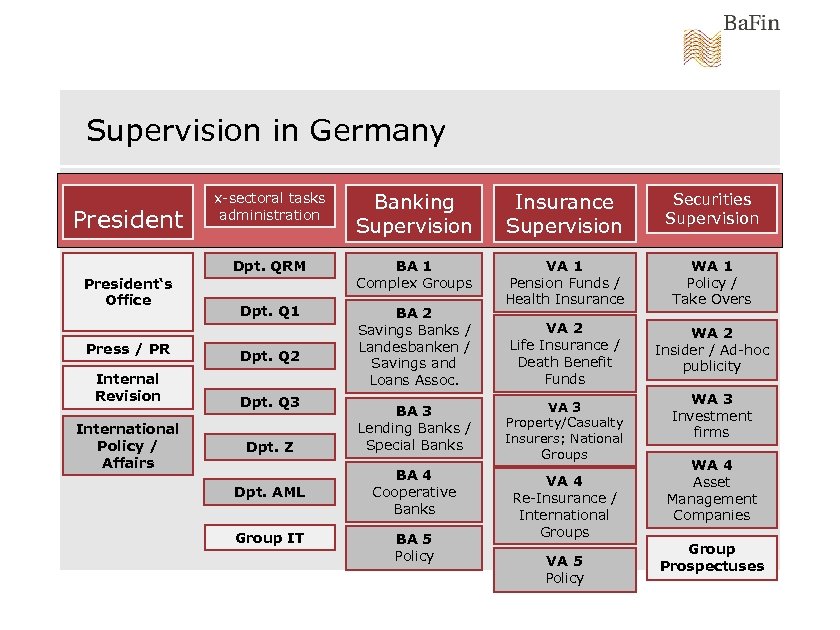

Supervision in Germany President‘s Office Press / PR Internal Revision International Policy / Affairs Banking Supervision Insurance Supervision Securities Supervision Dpt. QRM President x-sectoral tasks administration BA 1 Complex Groups Dpt. Q 1 BA 2 Savings Banks / Landesbanken / Savings and Loans Assoc. VA 1 Pension Funds / Health Insurance WA 1 Policy / Take Overs VA 2 Life Insurance / Death Benefit Funds WA 2 Insider / Ad-hoc publicity Dpt. Q 2 Dpt. Q 3 Dpt. Z Dpt. AML Group IT BA 3 Lending Banks / Special Banks BA 4 Cooperative Banks BA 5 Policy VA 3 Property/Casualty Insurers; National Groups VA 4 Re-Insurance / International Groups VA 5 Policy WA 3 Investment firms WA 4 Asset Management Companies Group Prospectuses

Supervision in Germany President‘s Office Press / PR Internal Revision International Policy / Affairs Banking Supervision Insurance Supervision Securities Supervision Dpt. QRM President x-sectoral tasks administration BA 1 Complex Groups Dpt. Q 1 BA 2 Savings Banks / Landesbanken / Savings and Loans Assoc. VA 1 Pension Funds / Health Insurance WA 1 Policy / Take Overs VA 2 Life Insurance / Death Benefit Funds WA 2 Insider / Ad-hoc publicity Dpt. Q 2 Dpt. Q 3 Dpt. Z Dpt. AML Group IT BA 3 Lending Banks / Special Banks BA 4 Cooperative Banks BA 5 Policy VA 3 Property/Casualty Insurers; National Groups VA 4 Re-Insurance / International Groups VA 5 Policy WA 3 Investment firms WA 4 Asset Management Companies Group Prospectuses

Funding Ba. Fin’s costs are to 100% borne by the supervised industry v fees (equivalence to a particular service upon request, fees e. g. seeking an approval of a securities prospectus) v allocation (contribution depending on turnover/performance) a) banking: ca. 90% credit institutions, only about 10% financial services enterprises b) insurance undertakings c) securities trading: ca. 75% credit institutions, 10% financial services enterprises, 10% issuers, 5% brokers v Administrative fines imposed by Ba. Fin, collected interest v Annual budget of 160. 5 million € in 2011 TAIEX Mission

Funding Ba. Fin’s costs are to 100% borne by the supervised industry v fees (equivalence to a particular service upon request, fees e. g. seeking an approval of a securities prospectus) v allocation (contribution depending on turnover/performance) a) banking: ca. 90% credit institutions, only about 10% financial services enterprises b) insurance undertakings c) securities trading: ca. 75% credit institutions, 10% financial services enterprises, 10% issuers, 5% brokers v Administrative fines imposed by Ba. Fin, collected interest v Annual budget of 160. 5 million € in 2011 TAIEX Mission

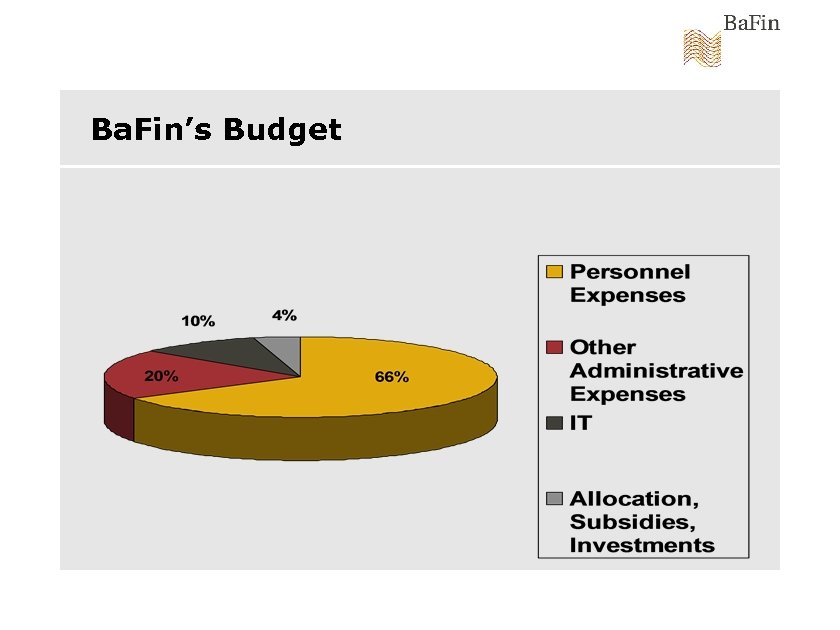

Ba. Fin’s Budget

Ba. Fin’s Budget

Supervision in Germany Ba. Fin as a Single Regulator Ø integrated financial supervision of all sectors combining both prudential and market aspects (e. g. in Germany, Hungary, Austria, Finland, Malta etc. ) Single Regulator Banking Supervision Insurance Supervision Securities Regulation

Supervision in Germany Ba. Fin as a Single Regulator Ø integrated financial supervision of all sectors combining both prudential and market aspects (e. g. in Germany, Hungary, Austria, Finland, Malta etc. ) Single Regulator Banking Supervision Insurance Supervision Securities Regulation

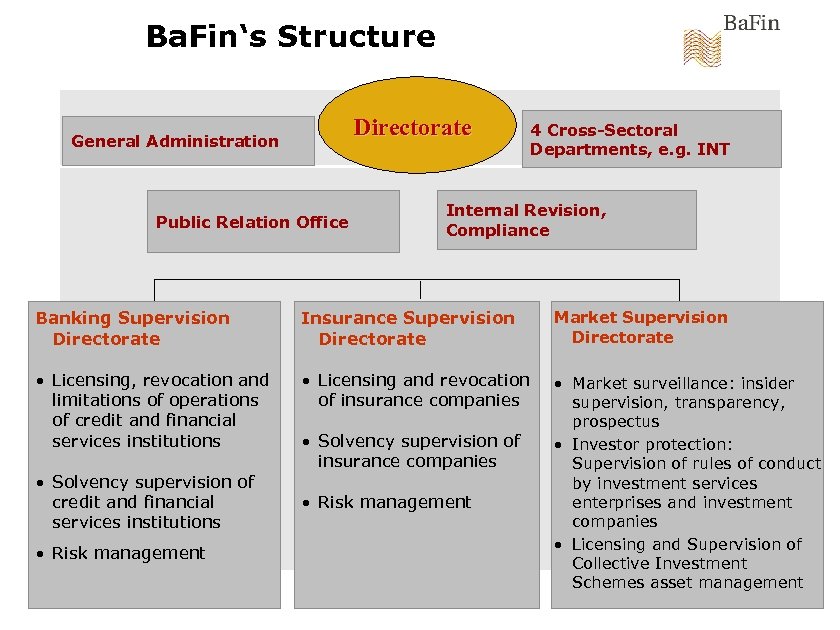

Ba. Fin‘s Structure Directorate General Administration Public Relation Office Internal Revision, Compliance Banking Supervision Directorate Insurance Supervision Directorate • Licensing, revocation and limitations of operations of credit and financial services institutions • Licensing and revocation of insurance companies • Solvency supervision of credit and financial services institutions • Risk management | 4 Cross-Sectoral Departments, e. g. INT • Solvency supervision of insurance companies • Risk management Market Supervision Directorate • Market surveillance: insider supervision, transparency, prospectus • Investor protection: Supervision of rules of conduct by investment services enterprises and investment companies • Licensing and Supervision of Collective Investment Schemes asset management

Ba. Fin‘s Structure Directorate General Administration Public Relation Office Internal Revision, Compliance Banking Supervision Directorate Insurance Supervision Directorate • Licensing, revocation and limitations of operations of credit and financial services institutions • Licensing and revocation of insurance companies • Solvency supervision of credit and financial services institutions • Risk management | 4 Cross-Sectoral Departments, e. g. INT • Solvency supervision of insurance companies • Risk management Market Supervision Directorate • Market surveillance: insider supervision, transparency, prospectus • Investor protection: Supervision of rules of conduct by investment services enterprises and investment companies • Licensing and Supervision of Collective Investment Schemes asset management

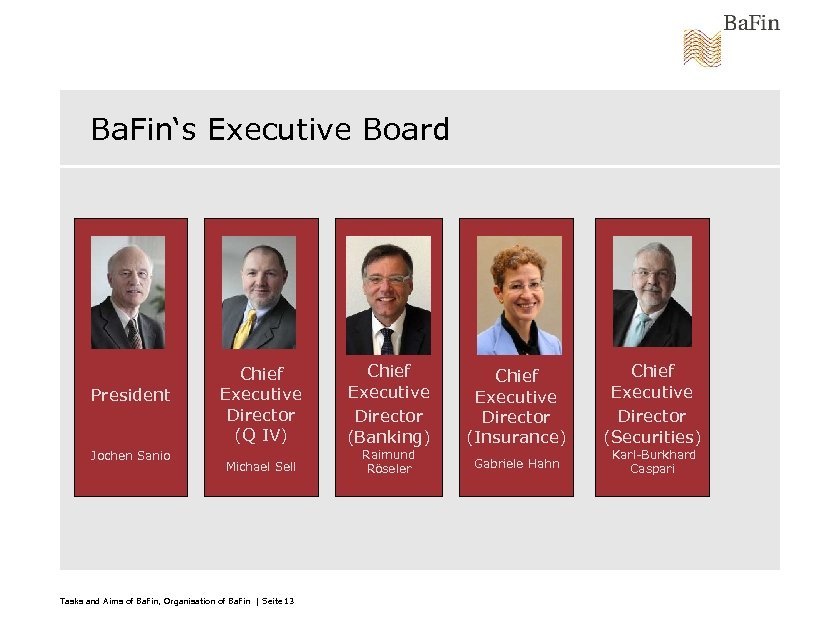

Ba. Fin‘s Executive Board President Jochen Sanio Chief Executive Director (Q IV) Michael Sell Tasks and Aims of Ba. Fin, Organisation of Ba. Fin | Seite 13 Chief Executive Director (Banking) Raimund Röseler Chief Executive Director (Insurance) Gabriele Hahn Chief Executive Director (Securities) Karl-Burkhard Caspari

Ba. Fin‘s Executive Board President Jochen Sanio Chief Executive Director (Q IV) Michael Sell Tasks and Aims of Ba. Fin, Organisation of Ba. Fin | Seite 13 Chief Executive Director (Banking) Raimund Röseler Chief Executive Director (Insurance) Gabriele Hahn Chief Executive Director (Securities) Karl-Burkhard Caspari

Cooperation between Ba. Fin and Deutsche Bundesbank Ø section 7 of the German Banking Act regulates the supervisory cooperation between Ba. Fin and Bundesbank Ø Ba. Fin and Deutsche Bundesbank cooperate closely in the day -to-day supervision Ø Ba. Fin continues to have the sole responsibility in taking measures in case of danger

Cooperation between Ba. Fin and Deutsche Bundesbank Ø section 7 of the German Banking Act regulates the supervisory cooperation between Ba. Fin and Bundesbank Ø Ba. Fin and Deutsche Bundesbank cooperate closely in the day -to-day supervision Ø Ba. Fin continues to have the sole responsibility in taking measures in case of danger

Tasks of Market Supervision Transparency Integrity Investor Protection / Education (? )

Tasks of Market Supervision Transparency Integrity Investor Protection / Education (? )

Transparency Market entry disclosure prospectus Ongoing disclosure Periodic Ad-hoc

Transparency Market entry disclosure prospectus Ongoing disclosure Periodic Ad-hoc

Key Regulations on Regulations Securities Market

Key Regulations on Regulations Securities Market

Nature of Regulated Markets and Their Relations to Market Operators TAIEX Mission

Nature of Regulated Markets and Their Relations to Market Operators TAIEX Mission

Regulated Markets (RM) in Germany: 7 Regulated Markets where shares are traded • Frankfurt (in May floor trading will be closed, XETRA is Frankfurt‘s electronic trading system) • Düsseldorf • Hamburg-Hannover (cooperation) • Berlin • Tradegate (Berlin) • Munich • Stuttgart Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011| page 19

Regulated Markets (RM) in Germany: 7 Regulated Markets where shares are traded • Frankfurt (in May floor trading will be closed, XETRA is Frankfurt‘s electronic trading system) • Düsseldorf • Hamburg-Hannover (cooperation) • Berlin • Tradegate (Berlin) • Munich • Stuttgart Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011| page 19

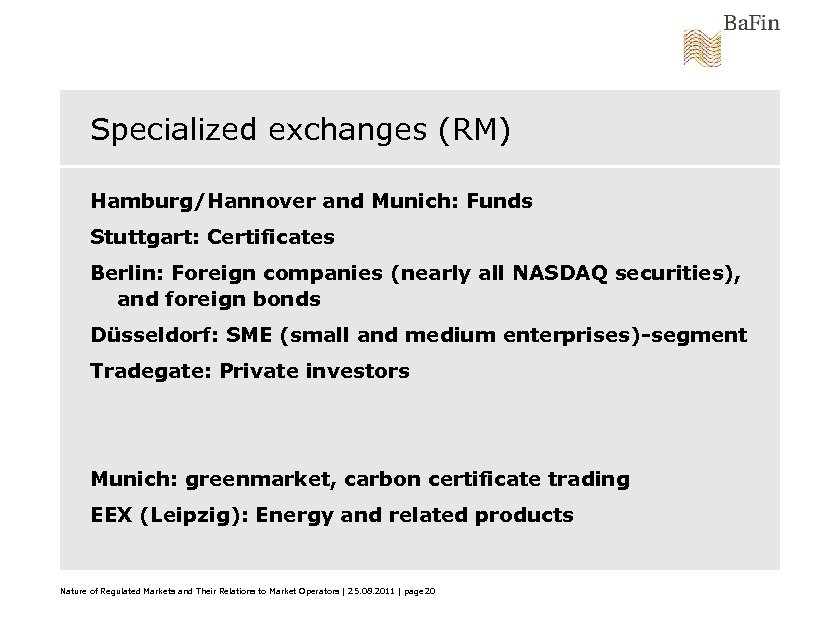

Specialized exchanges (RM) Hamburg/Hannover and Munich: Funds Stuttgart: Certificates Berlin: Foreign companies (nearly all NASDAQ securities), and foreign bonds Düsseldorf: SME (small and medium enterprises)-segment Tradegate: Private investors Munich: greenmarket, carbon certificate trading EEX (Leipzig): Energy and related products Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 20

Specialized exchanges (RM) Hamburg/Hannover and Munich: Funds Stuttgart: Certificates Berlin: Foreign companies (nearly all NASDAQ securities), and foreign bonds Düsseldorf: SME (small and medium enterprises)-segment Tradegate: Private investors Munich: greenmarket, carbon certificate trading EEX (Leipzig): Energy and related products Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 20

Market share in German Shares by turnover Exchange venue Jan-Sept 2008 (%) Jan-Sept 2010 (%) Deutsche Börse 42. 23 33. 52 Regional Stock Ex. 0. 76 1. 96 Foreign Stock Ex. 0. 82 1. 40 Regulated Markets 43. 82 36. 88 MTF 2. 19 (0. 0 Germany) 12. 48 (0. 1 Germany) Mi. FID OTC 53. 87 50. 55 Other 0. 13 0. 09 Total 100 Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 21

Market share in German Shares by turnover Exchange venue Jan-Sept 2008 (%) Jan-Sept 2010 (%) Deutsche Börse 42. 23 33. 52 Regional Stock Ex. 0. 76 1. 96 Foreign Stock Ex. 0. 82 1. 40 Regulated Markets 43. 82 36. 88 MTF 2. 19 (0. 0 Germany) 12. 48 (0. 1 Germany) Mi. FID OTC 53. 87 50. 55 Other 0. 13 0. 09 Total 100 Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 21

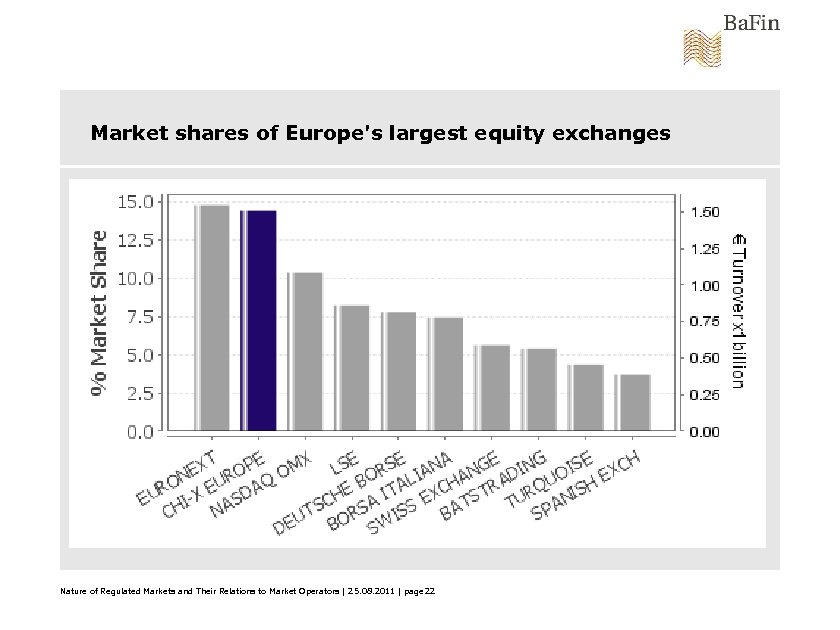

Market shares of Europe's largest equity exchanges Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 22

Market shares of Europe's largest equity exchanges Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 22

Main competition: MTF • Competition not only between RM, but also with MTFs (Multilateral Trading Facilities) • Less obligations for the issuer, no disclosure requirements by law, no permission for traded securities • Lower transaction costs, consequence of Mi. FID‘s „bestexecution-policy“ • Mainly „Chi-X“ seated in London, UK: serious competitor of XETRA/ Deutsche Börse • Rumours about merger talks of Chi-X and BATS Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 23

Main competition: MTF • Competition not only between RM, but also with MTFs (Multilateral Trading Facilities) • Less obligations for the issuer, no disclosure requirements by law, no permission for traded securities • Lower transaction costs, consequence of Mi. FID‘s „bestexecution-policy“ • Mainly „Chi-X“ seated in London, UK: serious competitor of XETRA/ Deutsche Börse • Rumours about merger talks of Chi-X and BATS Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 23

OTC Trading • High rate of neither RM nor MTF: OTC trading especially in the debt and derivatives market • Mi. FID review: OTF (Organized Trading Facility) • Crossing systems as a sub-regime within OTF • Technological development, emergence of alternative trading functionalities Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 24

OTC Trading • High rate of neither RM nor MTF: OTC trading especially in the debt and derivatives market • Mi. FID review: OTF (Organized Trading Facility) • Crossing systems as a sub-regime within OTF • Technological development, emergence of alternative trading functionalities Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 24

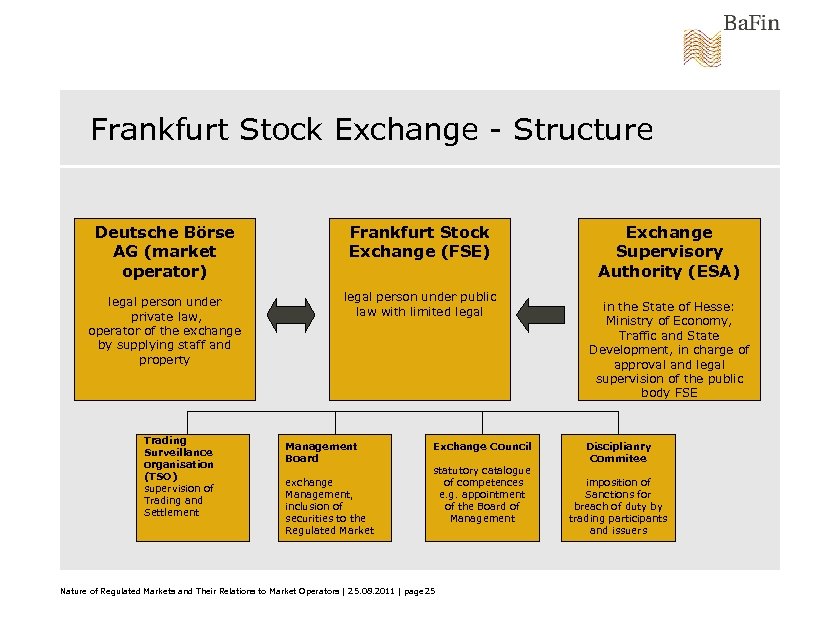

Frankfurt Stock Exchange - Structure Deutsche Börse AG (market operator) Frankfurt Stock Exchange (FSE) legal person under private law, operator of the exchange by supplying staff and property legal person under public law with limited legal Trading Surveillance organisation (TSO) supervision of Trading and Settlement Management Board exchange Management, inclusion of securities to the Regulated Market Exchange Council statutory catalogue of competences e. g. appointment of the Board of Management Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 25 Exchange Supervisory Authority (ESA) in the State of Hesse: Ministry of Economy, Traffic and State Development, in charge of approval and legal supervision of the public body FSE Disciplianry Commitee imposition of Sanctions for breach of duty by trading participants and issuers

Frankfurt Stock Exchange - Structure Deutsche Börse AG (market operator) Frankfurt Stock Exchange (FSE) legal person under private law, operator of the exchange by supplying staff and property legal person under public law with limited legal Trading Surveillance organisation (TSO) supervision of Trading and Settlement Management Board exchange Management, inclusion of securities to the Regulated Market Exchange Council statutory catalogue of competences e. g. appointment of the Board of Management Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 25 Exchange Supervisory Authority (ESA) in the State of Hesse: Ministry of Economy, Traffic and State Development, in charge of approval and legal supervision of the public body FSE Disciplianry Commitee imposition of Sanctions for breach of duty by trading participants and issuers

Stock exchanges as public authorities • Organs of an exchange: Management Board, Exchange Council, Trading Surveillance Office (TSO), Disciplinary Committee • The formation of an exchange requires an authorisation • Authorisations are issued, refused or revoked only by the states‘ authorities, Exchanges supervisory authorities (ESA) Nature of Regulated Markets and Their Relations to Market Operators | 14. 02. 2011 | page 26

Stock exchanges as public authorities • Organs of an exchange: Management Board, Exchange Council, Trading Surveillance Office (TSO), Disciplinary Committee • The formation of an exchange requires an authorisation • Authorisations are issued, refused or revoked only by the states‘ authorities, Exchanges supervisory authorities (ESA) Nature of Regulated Markets and Their Relations to Market Operators | 14. 02. 2011 | page 26

Market operator • Receives the authorisation to operate a securities exchange • Avoiding conflicts of interest between the stock exchange’s interests and the public interest of an orderly operated exchange market (risks for the exchange operation/supervisory duties) • Has to dispose of sufficient financial means to execute the trading, considering the specific structure and risks of the trades Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 27

Market operator • Receives the authorisation to operate a securities exchange • Avoiding conflicts of interest between the stock exchange’s interests and the public interest of an orderly operated exchange market (risks for the exchange operation/supervisory duties) • Has to dispose of sufficient financial means to execute the trading, considering the specific structure and risks of the trades Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 27

Persons exercising significant influence • Obligation to communicate certain thresholds • Revocation of the acquisition of shares in case of suspicion of disturbance of regular trading • Under certain conditions according to the buyer the acquisition may be refused by ESA Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 28

Persons exercising significant influence • Obligation to communicate certain thresholds • Revocation of the acquisition of shares in case of suspicion of disturbance of regular trading • Under certain conditions according to the buyer the acquisition may be refused by ESA Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 28

Management Board • admission of persons and companies to exchange trading • decisions on the inclusion, suspension and discontinuance of an official listing of securities • decisions on the price-fixing of securities • definition of the organisation and business procedures of the FSE • maintaining order on the trading floor premises • supervises the trading participants, TSO competences remain unaffected Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 29

Management Board • admission of persons and companies to exchange trading • decisions on the inclusion, suspension and discontinuance of an official listing of securities • decisions on the price-fixing of securities • definition of the organisation and business procedures of the FSE • maintaining order on the trading floor premises • supervises the trading participants, TSO competences remain unaffected Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 29

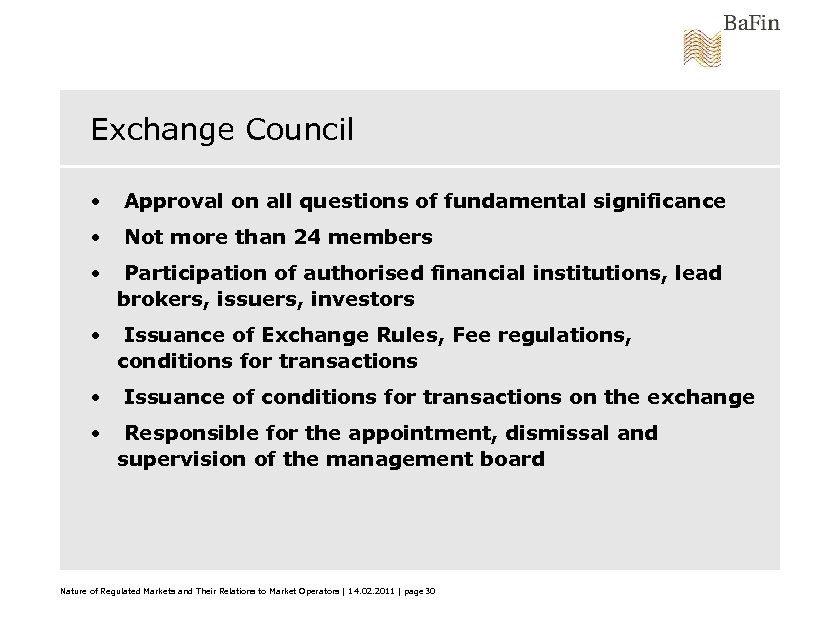

Exchange Council • Approval on all questions of fundamental significance • Not more than 24 members • Participation of authorised financial institutions, lead brokers, issuers, investors • Issuance of Exchange Rules, Fee regulations, conditions for transactions • Issuance of conditions for transactions on the exchange • Responsible for the appointment, dismissal and supervision of the management board Nature of Regulated Markets and Their Relations to Market Operators | 14. 02. 2011 | page 30

Exchange Council • Approval on all questions of fundamental significance • Not more than 24 members • Participation of authorised financial institutions, lead brokers, issuers, investors • Issuance of Exchange Rules, Fee regulations, conditions for transactions • Issuance of conditions for transactions on the exchange • Responsible for the appointment, dismissal and supervision of the management board Nature of Regulated Markets and Their Relations to Market Operators | 14. 02. 2011 | page 30

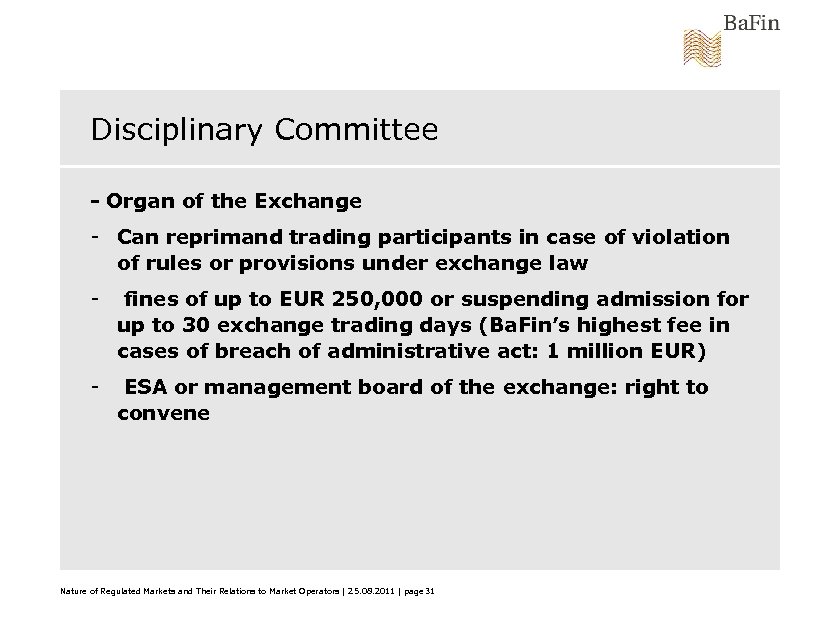

Disciplinary Committee - Organ of the Exchange - Can reprimand trading participants in case of violation of rules or provisions under exchange law - fines of up to EUR 250, 000 or suspending admission for up to 30 exchange trading days (Ba. Fin’s highest fee in cases of breach of administrative act: 1 million EUR) - ESA or management board of the exchange: right to convene Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 31

Disciplinary Committee - Organ of the Exchange - Can reprimand trading participants in case of violation of rules or provisions under exchange law - fines of up to EUR 250, 000 or suspending admission for up to 30 exchange trading days (Ba. Fin’s highest fee in cases of breach of administrative act: 1 million EUR) - ESA or management board of the exchange: right to convene Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 31

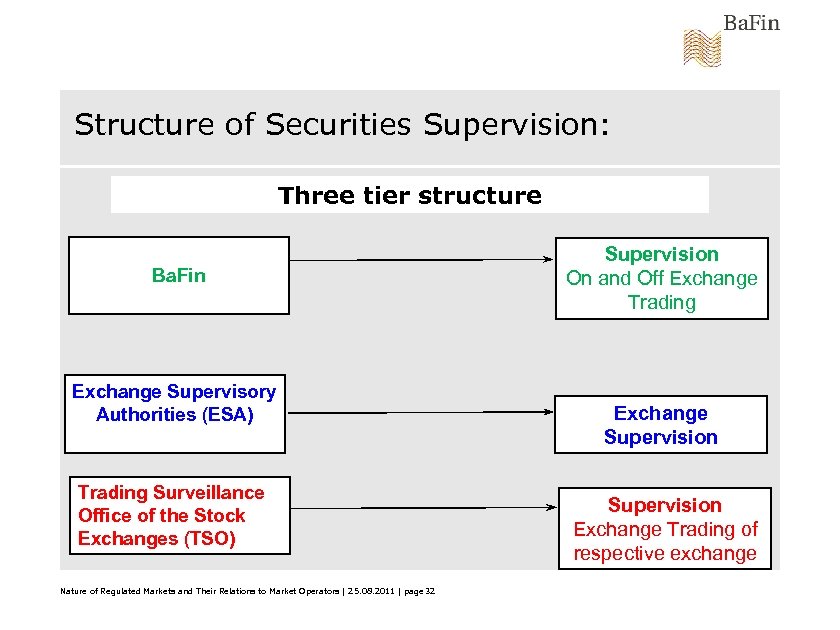

Structure of Securities Supervision: Three tier structure Ba. Fin Exchange Supervisory Authorities (ESA) Trading Surveillance Office of the Stock Exchanges (TSO) Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 32 Supervision On and Off Exchange Trading Exchange Supervision Exchange Trading of respective exchange

Structure of Securities Supervision: Three tier structure Ba. Fin Exchange Supervisory Authorities (ESA) Trading Surveillance Office of the Stock Exchanges (TSO) Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 32 Supervision On and Off Exchange Trading Exchange Supervision Exchange Trading of respective exchange

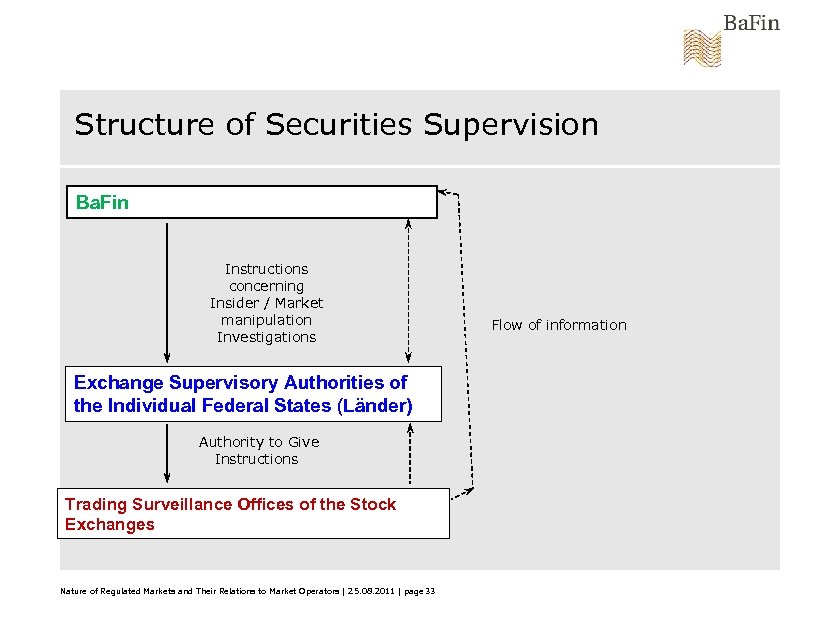

Structure of Securities Supervision Ba. Fin Instructions concerning Insider / Market manipulation Investigations Exchange Supervisory Authorities of the Individual Federal States (Länder) Authority to Give Instructions Trading Surveillance Offices of the Stock Exchanges Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 33 Flow of information

Structure of Securities Supervision Ba. Fin Instructions concerning Insider / Market manipulation Investigations Exchange Supervisory Authorities of the Individual Federal States (Länder) Authority to Give Instructions Trading Surveillance Offices of the Stock Exchanges Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 33 Flow of information

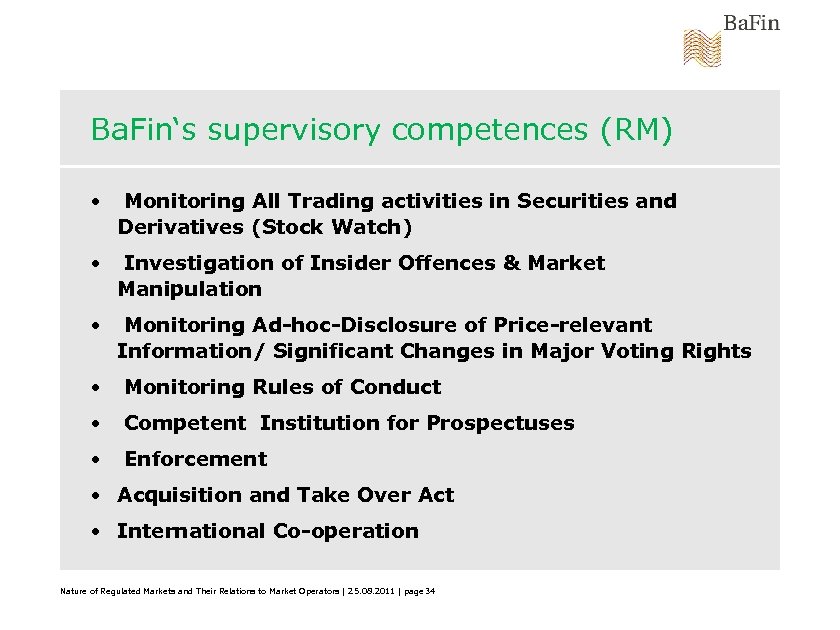

Ba. Fin‘s supervisory competences (RM) • Monitoring All Trading activities in Securities and Derivatives (Stock Watch) • Investigation of Insider Offences & Market Manipulation • Monitoring Ad-hoc-Disclosure of Price-relevant Information/ Significant Changes in Major Voting Rights • Monitoring Rules of Conduct • Competent Institution for Prospectuses • Enforcement • Acquisition and Take Over Act • International Co-operation Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 34

Ba. Fin‘s supervisory competences (RM) • Monitoring All Trading activities in Securities and Derivatives (Stock Watch) • Investigation of Insider Offences & Market Manipulation • Monitoring Ad-hoc-Disclosure of Price-relevant Information/ Significant Changes in Major Voting Rights • Monitoring Rules of Conduct • Competent Institution for Prospectuses • Enforcement • Acquisition and Take Over Act • International Co-operation Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 34

ESA’s competences • Legal and market Supervision of Stock Exchanges • Approval of Exchange Regulations • Investigations into Offences Against Rules and Regulations of Stock Exchanges • Supervision of Trading Surveillance Offices • Receives information about any personnel decision • ESA has the right to participate in any meeting of the exchange‘s organs Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 35

ESA’s competences • Legal and market Supervision of Stock Exchanges • Approval of Exchange Regulations • Investigations into Offences Against Rules and Regulations of Stock Exchanges • Supervision of Trading Surveillance Offices • Receives information about any personnel decision • ESA has the right to participate in any meeting of the exchange‘s organs Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 35

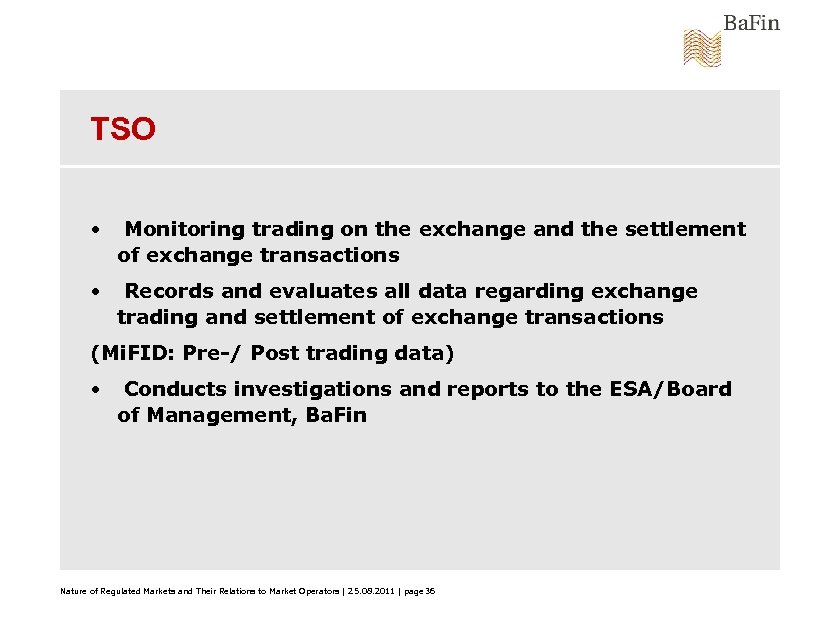

TSO • Monitoring trading on the exchange and the settlement of exchange transactions • Records and evaluates all data regarding exchange trading and settlement of exchange transactions (Mi. FID: Pre-/ Post trading data) • Conducts investigations and reports to the ESA/Board of Management, Ba. Fin Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 36

TSO • Monitoring trading on the exchange and the settlement of exchange transactions • Records and evaluates all data regarding exchange trading and settlement of exchange transactions (Mi. FID: Pre-/ Post trading data) • Conducts investigations and reports to the ESA/Board of Management, Ba. Fin Nature of Regulated Markets and Their Relations to Market Operators | 25. 08. 2011 | page 36

Markets in Financial Instruments Directive 2004/39/EC Implementation of Mi. FID into National Law (exchange regulation)

Markets in Financial Instruments Directive 2004/39/EC Implementation of Mi. FID into National Law (exchange regulation)

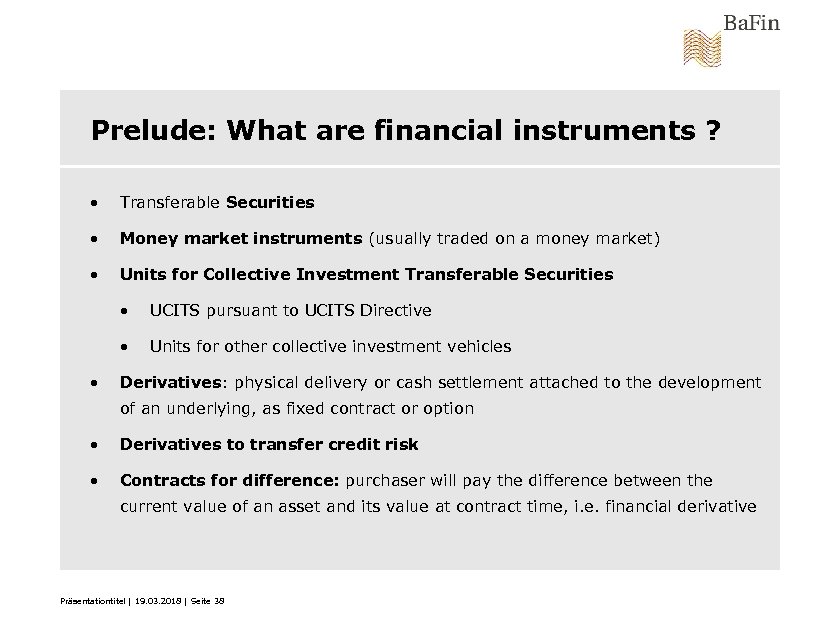

Prelude: What are financial instruments ? • Transferable Securities • Money market instruments (usually traded on a money market) • Units for Collective Investment Transferable Securities • • • UCITS pursuant to UCITS Directive Units for other collective investment vehicles Derivatives: physical delivery or cash settlement attached to the development of an underlying, as fixed contract or option • Derivatives to transfer credit risk • Contracts for difference: purchaser will pay the difference between the current value of an asset and its value at contract time, i. e. financial derivative Präsentationtitel | 19. 03. 2018 | Seite 38

Prelude: What are financial instruments ? • Transferable Securities • Money market instruments (usually traded on a money market) • Units for Collective Investment Transferable Securities • • • UCITS pursuant to UCITS Directive Units for other collective investment vehicles Derivatives: physical delivery or cash settlement attached to the development of an underlying, as fixed contract or option • Derivatives to transfer credit risk • Contracts for difference: purchaser will pay the difference between the current value of an asset and its value at contract time, i. e. financial derivative Präsentationtitel | 19. 03. 2018 | Seite 38

Transposition of Mi. FID - basics Mi. FID was transposed by the so called „Finanzmarktrichtlinie-Umsetzungsgesetz“ (FRUG) of 16 July 2007 FRUG amended several acts (in particular the securities trading act, Wp. HG) Major amendments in the Stock Exchange Act (Börsengesetz, Börs. G) Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 39

Transposition of Mi. FID - basics Mi. FID was transposed by the so called „Finanzmarktrichtlinie-Umsetzungsgesetz“ (FRUG) of 16 July 2007 FRUG amended several acts (in particular the securities trading act, Wp. HG) Major amendments in the Stock Exchange Act (Börsengesetz, Börs. G) Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 39

Mi. FID – Title III – Regulated Markets (RM) • Authorisation and applicable law • Requirements of the management of the RM • Requirements relating to persons with significant influence • Organisational requirements • Admission of financial instruments to trading • Suspension and removal of instruments from trading • Access to the RM • Monitoring of compliance • Pre- and post trade transparency • Provisions regarding CCP and Clearing and Settlement Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 40

Mi. FID – Title III – Regulated Markets (RM) • Authorisation and applicable law • Requirements of the management of the RM • Requirements relating to persons with significant influence • Organisational requirements • Admission of financial instruments to trading • Suspension and removal of instruments from trading • Access to the RM • Monitoring of compliance • Pre- and post trade transparency • Provisions regarding CCP and Clearing and Settlement Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 40

Authorisation and applicable law (Art. 36 Mi. FID) • transposed in the first chapter of Börs. G, especially Sections 1 -7 • before Mi. FID, authorisation was only granted if a new exchange was „needed“ Now: Right to authorisation for everybody fulfilling the requirements of Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 41

Authorisation and applicable law (Art. 36 Mi. FID) • transposed in the first chapter of Börs. G, especially Sections 1 -7 • before Mi. FID, authorisation was only granted if a new exchange was „needed“ Now: Right to authorisation for everybody fulfilling the requirements of Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 41

Authorisation (Art. 36 para 1) • Authorisation required pursuant to section 4 Börs. G Application has to include - proof of sufficient funds to operate the RM - information about management to check their reputation and experience (Art. 37 Mi. FID) - business plan including control mechanisms - information about the owners of the operator/persons with significant influence Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 42

Authorisation (Art. 36 para 1) • Authorisation required pursuant to section 4 Börs. G Application has to include - proof of sufficient funds to operate the RM - information about management to check their reputation and experience (Art. 37 Mi. FID) - business plan including control mechanisms - information about the owners of the operator/persons with significant influence Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 42

Obligations for RM and market operators Mi. FID requires clear determination of obligations for regulated markets and their operators (Art. 36 par. 1 subpar. 3) Börs. G provides a delienation between - Exchange as public entity with its own organs - obligations of market operator Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 43

Obligations for RM and market operators Mi. FID requires clear determination of obligations for regulated markets and their operators (Art. 36 par. 1 subpar. 3) Börs. G provides a delienation between - Exchange as public entity with its own organs - obligations of market operator Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 43

Obligations for market operators (I) Art. 37 and 38 Mi. FID are transposed in sections 4, 5 und 6 Börs. G Section 5 states, that the market operator has to provide sufficient funds, equipment and staff to operate and develop the exchange = Operation of the exchange has to be guaranteed Important with regard to current developments -merger of and Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 44

Obligations for market operators (I) Art. 37 and 38 Mi. FID are transposed in sections 4, 5 und 6 Börs. G Section 5 states, that the market operator has to provide sufficient funds, equipment and staff to operate and develop the exchange = Operation of the exchange has to be guaranteed Important with regard to current developments -merger of and Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 44

Obligations for market operators (II) Art. 38 Mi. FID is transposed in section 6 Börs. G Requrements for stake holders or persons with significant influence are rather detailed and strict This reflects importance of the exchange as a public entity for the promotion of the domestic capital market Ongoing merger plans and investments of hedge funds in Deutsche Börse AG triggered the amendment of this section. Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 45

Obligations for market operators (II) Art. 38 Mi. FID is transposed in section 6 Börs. G Requrements for stake holders or persons with significant influence are rather detailed and strict This reflects importance of the exchange as a public entity for the promotion of the domestic capital market Ongoing merger plans and investments of hedge funds in Deutsche Börse AG triggered the amendment of this section. Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 45

Supervision authority I (Art. 36 para 2 ) Art. 36 para 2 Mi. FID is transposed in section 3 Börs. G The section deals with the supervision powers of the Exchange Supervisory Authorities (ESAs) ESAs are run by the federal states. They have all powers to supervise exchanges and monitor compliance with Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 46

Supervision authority I (Art. 36 para 2 ) Art. 36 para 2 Mi. FID is transposed in section 3 Börs. G The section deals with the supervision powers of the Exchange Supervisory Authorities (ESAs) ESAs are run by the federal states. They have all powers to supervise exchanges and monitor compliance with Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 46

Supervision authority II (Art. 36 para 2 ) German system of a special ESA (not Ba. Fin) is quite unique, but in conformity with Mi. FID Several attempts for a concentration of supervision at Ba. Fin failed International developments might spark new discussions Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 47

Supervision authority II (Art. 36 para 2 ) German system of a special ESA (not Ba. Fin) is quite unique, but in conformity with Mi. FID Several attempts for a concentration of supervision at Ba. Fin failed International developments might spark new discussions Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 47

Organisational requirements (Art. 39 Mi. FID) Transposed in section 5 and 12 Börs. G market operator has to establish rules and procedures to deal with - conflicts of interest - internal controlling and risk management - emergency situations „Exchange council“ has to approve all internal ordinances and rules of the exchange after checking their compliance with Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 48

Organisational requirements (Art. 39 Mi. FID) Transposed in section 5 and 12 Börs. G market operator has to establish rules and procedures to deal with - conflicts of interest - internal controlling and risk management - emergency situations „Exchange council“ has to approve all internal ordinances and rules of the exchange after checking their compliance with Mi. FID resp. Börs. G Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 48

Admission to trading (Art. 40 Mi. FID) Transposed in section 32 Börs. G and respective ordinance (Börs. Zul. V) Management Board of the exchange (not market operator) is responsible for admission Examination of compliance with Prospectus regulation and Mi. FID rules Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 49

Admission to trading (Art. 40 Mi. FID) Transposed in section 32 Börs. G and respective ordinance (Börs. Zul. V) Management Board of the exchange (not market operator) is responsible for admission Examination of compliance with Prospectus regulation and Mi. FID rules Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 49

Suspension and removal from trading (Art. 41 Mi. FID) Transposed in section 39 Börs. G, section 3 Börs. G and section 4 Wp. HG Section 39 Börs. G. Competence of management board Section 3 Börs. G: Competence of ESA Section 4 Wp. HG: Competence of Ba. Fin Different preconditions for suspension and removal: Ba. Fin‘s competence e. g. with regard to market abuse and threats for the whole financial market Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 50

Suspension and removal from trading (Art. 41 Mi. FID) Transposed in section 39 Börs. G, section 3 Börs. G and section 4 Wp. HG Section 39 Börs. G. Competence of management board Section 3 Börs. G: Competence of ESA Section 4 Wp. HG: Competence of Ba. Fin Different preconditions for suspension and removal: Ba. Fin‘s competence e. g. with regard to market abuse and threats for the whole financial market Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 50

Access to the regulated market (Art. 42 Mi. FID) Transposed in section 19 Börs. G Regulation provides equal and non-discriminatory access to the exchange Access is granted by management board Like access to MTF, but different from access to broker crossing systems and other OTFs Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 51

Access to the regulated market (Art. 42 Mi. FID) Transposed in section 19 Börs. G Regulation provides equal and non-discriminatory access to the exchange Access is granted by management board Like access to MTF, but different from access to broker crossing systems and other OTFs Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 51

Monitoring of compliance (Art. 43 Mi. FID) Transposed in section 4 and 7 Börs. G Section 4: Internal monitoring of compliance with regulations Regulation (obligation of market operator) Section 7: Establishment of a trading surveillance office (TSO) TSO is a public authority, therefore even stricter supervision than Art. 43 Mi. FID requires Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 52

Monitoring of compliance (Art. 43 Mi. FID) Transposed in section 4 and 7 Börs. G Section 4: Internal monitoring of compliance with regulations Regulation (obligation of market operator) Section 7: Establishment of a trading surveillance office (TSO) TSO is a public authority, therefore even stricter supervision than Art. 43 Mi. FID requires Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 52

Pre- and post trade transparency (Art. 44, 45 Mi. FID) Transposed in section 30 and 31 Börs. G Generally 1: 1 implementation of Mi. FID, details are anyway in regulation 1287/2006/EC Extension to certificates representing shares Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 53

Pre- and post trade transparency (Art. 44, 45 Mi. FID) Transposed in section 30 and 31 Börs. G Generally 1: 1 implementation of Mi. FID, details are anyway in regulation 1287/2006/EC Extension to certificates representing shares Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 53

CCPs and clearing and settlement (Art. 46 Mi. FID) Transposed in section 21 Börs. G Possibility for use of external systems, but under several economic and technical requirements • Sufficient technical equipment and expertise • Details laid down in the Exchange Ordinance Eurex Clearing is the Clearing House for the entire product range traded on the Frankfurt Stock Exchange (FSE) Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 54

CCPs and clearing and settlement (Art. 46 Mi. FID) Transposed in section 21 Börs. G Possibility for use of external systems, but under several economic and technical requirements • Sufficient technical equipment and expertise • Details laid down in the Exchange Ordinance Eurex Clearing is the Clearing House for the entire product range traded on the Frankfurt Stock Exchange (FSE) Transposition of Mi. FID in National Law - exchanges | 19. 03. 2018 | Seite 54

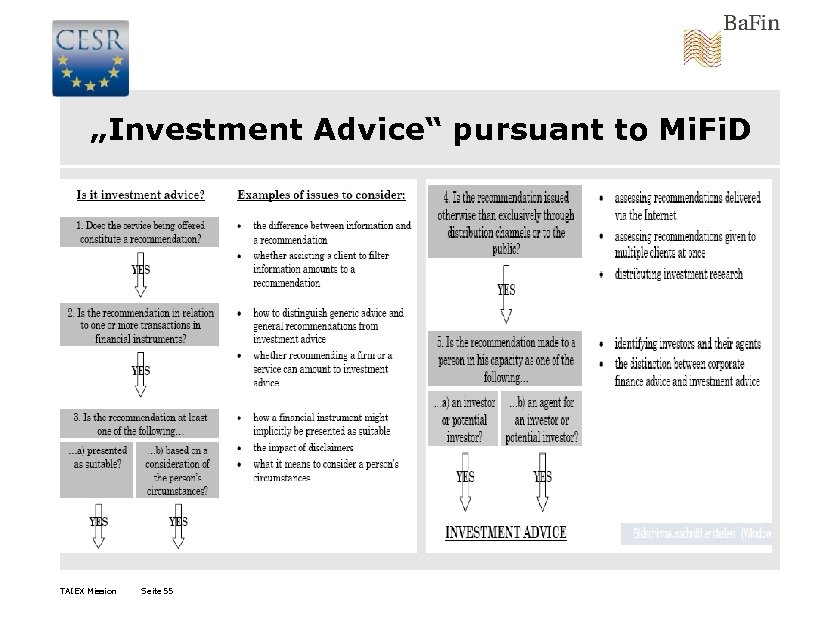

„Investment Advice“ pursuant to Mi. Fi. D TAIEX Mission Seite 55

„Investment Advice“ pursuant to Mi. Fi. D TAIEX Mission Seite 55

Compliance v Reporting obligations v Insider surveillance v Ad hoc publications v Prohibition of market manipulation v Major voting rights v Requirements for record keeping and retention v Analysis of financial instruments v Liability for incorrect or omitted market information v Information on financial futures transactions TAIEX Mission 19. 03. 2018 | Seite 56

Compliance v Reporting obligations v Insider surveillance v Ad hoc publications v Prohibition of market manipulation v Major voting rights v Requirements for record keeping and retention v Analysis of financial instruments v Liability for incorrect or omitted market information v Information on financial futures transactions TAIEX Mission 19. 03. 2018 | Seite 56

Ba. Fin Circulars • Financial commission business (3/2010) • Trading for own account (12/2009) • Contract brokerage Abschluss(12/2009) • Investment brokerage Anlage (5/2011) • Issue business (1/2009) • Placement business (12/2009) • Portfolio management (12/2009) • Operation of MTF (12/2009) • Investment Advice (5/2011) • Custody Business (9/2010) • Compliance/Minimum Requirements Ma. Comp (6/2010) TAIEX Mission 19. 03. 2018 | Seite 57

Ba. Fin Circulars • Financial commission business (3/2010) • Trading for own account (12/2009) • Contract brokerage Abschluss(12/2009) • Investment brokerage Anlage (5/2011) • Issue business (1/2009) • Placement business (12/2009) • Portfolio management (12/2009) • Operation of MTF (12/2009) • Investment Advice (5/2011) • Custody Business (9/2010) • Compliance/Minimum Requirements Ma. Comp (6/2010) TAIEX Mission 19. 03. 2018 | Seite 57

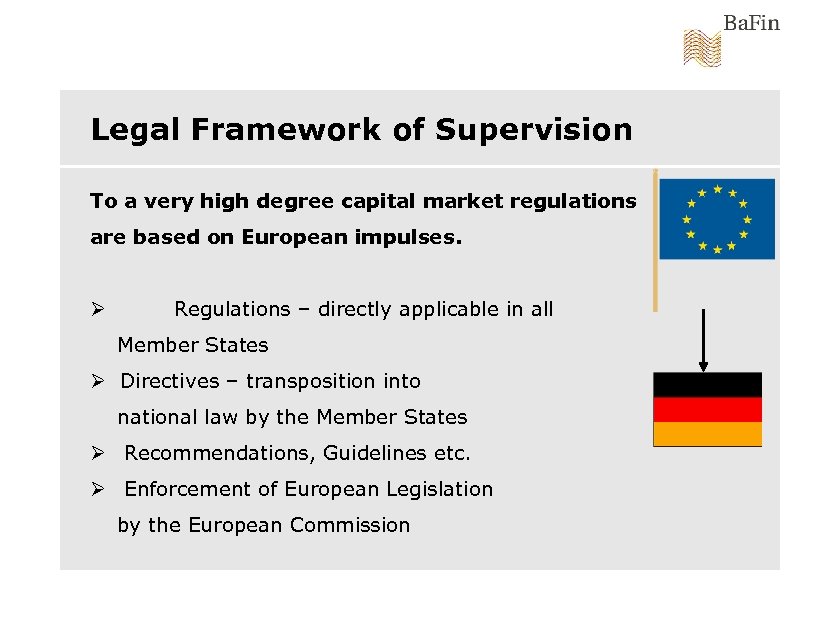

Excursion: Legal Framework of Supervision To a very high degree capital market regulations are based on European impulses. Ø Regulations – directly applicable in all Member States Ø Directives – transposition into national law by the Member States Ø Recommendations, Guidelines etc. Ø Enforcement of European Legislation by the European Commission

Excursion: Legal Framework of Supervision To a very high degree capital market regulations are based on European impulses. Ø Regulations – directly applicable in all Member States Ø Directives – transposition into national law by the Member States Ø Recommendations, Guidelines etc. Ø Enforcement of European Legislation by the European Commission

Competences in the wake of the financial crisis Legal Basis Pursuant to Section 4 para. 1 German Securities Trading Act Ba. Fin may issue orders to eliminate or prevent undesirable developments which may adversely affect the orderly conduct of trading with financial instruments or the provision of investment services or ancillary services or which may result in serious disadvantages for the financial market. TAIEX Mission| 19. 03. 2018 | Seite 59

Competences in the wake of the financial crisis Legal Basis Pursuant to Section 4 para. 1 German Securities Trading Act Ba. Fin may issue orders to eliminate or prevent undesirable developments which may adversely affect the orderly conduct of trading with financial instruments or the provision of investment services or ancillary services or which may result in serious disadvantages for the financial market. TAIEX Mission| 19. 03. 2018 | Seite 59

Competences in the wake of the financial crisis This competence was used to ban uncovered /naked short selling related to the shares of 10 important short selling German issuers in the segment of financial services first from September 2008 to January 2010 and again from May 2010 to July 2010. It was also the legal basis of the transparency system on net short positions concerning transparency system on net short positions these 10 issuers (March 2010) and for the ban on uncovered short selling in government bonds of Eurozone members and uncovered CDS related to such bonds (May 2010 to July 2010). Current overview of EU watchdogs’ measures on www. esma. europa. eu/data/document/2011_39. pdf TAIEX Mission| 19. 03. 2018 | Seite 60

Competences in the wake of the financial crisis This competence was used to ban uncovered /naked short selling related to the shares of 10 important short selling German issuers in the segment of financial services first from September 2008 to January 2010 and again from May 2010 to July 2010. It was also the legal basis of the transparency system on net short positions concerning transparency system on net short positions these 10 issuers (March 2010) and for the ban on uncovered short selling in government bonds of Eurozone members and uncovered CDS related to such bonds (May 2010 to July 2010). Current overview of EU watchdogs’ measures on www. esma. europa. eu/data/document/2011_39. pdf TAIEX Mission| 19. 03. 2018 | Seite 60

Competences in the wake of the financial crisis Competences due to the Act on the Prevention of Improper Securities and Derivatives Transactions in July 2010 Section 4 a Securities Trading Act provides Ba. Fin, in consultation with the Deutsche Bundesbank, with strong emergency powers for interventions in order to avoid negative impact on the stability of the financial markets or on the confidence in the proper functioning of the financial markets. Ba. Fin is able to temporarily stop the trading of financial instruments and prohibit transactions in certain derivatives linked to shares and to government bonds traded on a regulated market in Germany, that effectively create short positions. It could also ban several currency derivatives. Ba. Fin is also empowered to require notifications of positions and to publish them on its website. TIAEX Mission 19. 03. 2018 | Seite 61

Competences in the wake of the financial crisis Competences due to the Act on the Prevention of Improper Securities and Derivatives Transactions in July 2010 Section 4 a Securities Trading Act provides Ba. Fin, in consultation with the Deutsche Bundesbank, with strong emergency powers for interventions in order to avoid negative impact on the stability of the financial markets or on the confidence in the proper functioning of the financial markets. Ba. Fin is able to temporarily stop the trading of financial instruments and prohibit transactions in certain derivatives linked to shares and to government bonds traded on a regulated market in Germany, that effectively create short positions. It could also ban several currency derivatives. Ba. Fin is also empowered to require notifications of positions and to publish them on its website. TIAEX Mission 19. 03. 2018 | Seite 61

Competences in the wake of the financial crisis Section 30 h Securities Trading Act prohibits uncovered short sales of shares and of debt instruments issued by national and local governments that have been admitted to trading on the regulated market of a German stock exchange. Because of an intraday exemption market participants have to cover their uncovered short positions by the end of the relevant day. Exemptions apply to market makers and fixed price trades with customers. Market makers must notify Ba. Fin on their activity and the financial instruments concerned. Präsentationtitel | 19. 03. 2018 | Seite 62

Competences in the wake of the financial crisis Section 30 h Securities Trading Act prohibits uncovered short sales of shares and of debt instruments issued by national and local governments that have been admitted to trading on the regulated market of a German stock exchange. Because of an intraday exemption market participants have to cover their uncovered short positions by the end of the relevant day. Exemptions apply to market makers and fixed price trades with customers. Market makers must notify Ba. Fin on their activity and the financial instruments concerned. Präsentationtitel | 19. 03. 2018 | Seite 62

Competences in the wake of the financial crisis Section 30 i Securities Trading Act implements the CESR disclosure regime for short sales in requiring disclosure to Ba. Fin of net short positions, which reach or exceed 0. 2 percent of the shares admitted to trading on a German regulated market and requiring public disclosure of net short positions, which reach or exceed 0. 5 percent. This part of the act will come into force in March 2012. See also www. esma. europa. eu/popup 2. php? id=6487 TAIEX Mission| 19. 03. 2018 | Seite 63

Competences in the wake of the financial crisis Section 30 i Securities Trading Act implements the CESR disclosure regime for short sales in requiring disclosure to Ba. Fin of net short positions, which reach or exceed 0. 2 percent of the shares admitted to trading on a German regulated market and requiring public disclosure of net short positions, which reach or exceed 0. 5 percent. This part of the act will come into force in March 2012. See also www. esma. europa. eu/popup 2. php? id=6487 TAIEX Mission| 19. 03. 2018 | Seite 63

Competences in the wake of the financial crisis Section 30 j Securities Trading Act prohibits entering into credit derivative transactions in Germany where the underlying is a national or local government debt instrument denominated in Euro. The prohibition does not apply, if the transaction leads to a relevant reduction of an existing credit risk of the contracting party. Market Makers are exempted and must notify Ba. Fin in the same way as in Section 30 i Securities Trading Act. Violations of Sections 30 h to 30 j are punishable by a fine not exceeding 500. 000 Euros. Präsentationtitel | 19. 03. 2018 | Seite 64

Competences in the wake of the financial crisis Section 30 j Securities Trading Act prohibits entering into credit derivative transactions in Germany where the underlying is a national or local government debt instrument denominated in Euro. The prohibition does not apply, if the transaction leads to a relevant reduction of an existing credit risk of the contracting party. Market Makers are exempted and must notify Ba. Fin in the same way as in Section 30 i Securities Trading Act. Violations of Sections 30 h to 30 j are punishable by a fine not exceeding 500. 000 Euros. Präsentationtitel | 19. 03. 2018 | Seite 64

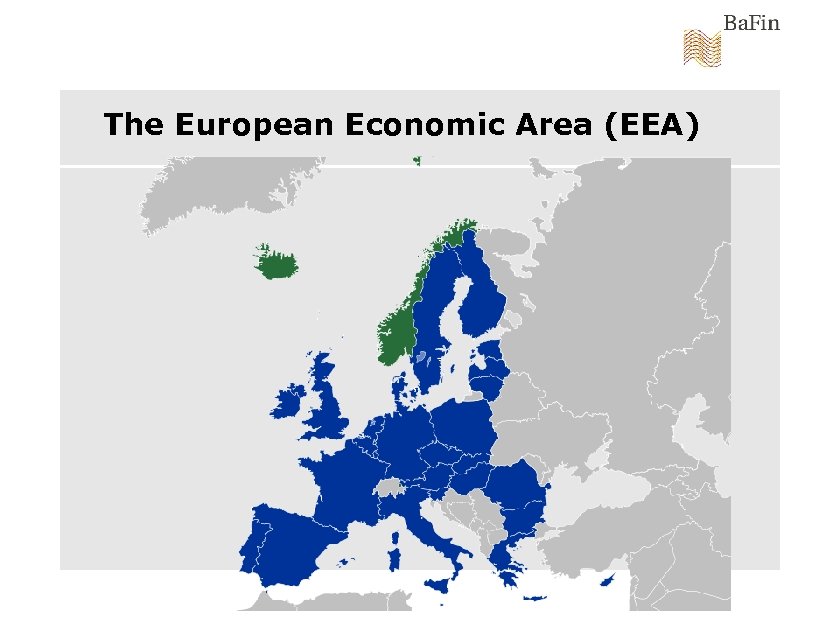

The European Economic Area (EEA)

The European Economic Area (EEA)

Legal Framework of Supervision To a very high degree capital market regulations are based on European impulses. Ø Regulations – directly applicable in all Member States Ø Directives – transposition into national law by the Member States Ø Recommendations, Guidelines etc. Ø Enforcement of European Legislation by the European Commission

Legal Framework of Supervision To a very high degree capital market regulations are based on European impulses. Ø Regulations – directly applicable in all Member States Ø Directives – transposition into national law by the Member States Ø Recommendations, Guidelines etc. Ø Enforcement of European Legislation by the European Commission

European Passport Aspects of the European Single Market The European Passport for Issuers / Products Concept: Authorization / approval by the administrative authority of one Member State only so that issuer has not to seek for another approval by other supervisory authorities.

European Passport Aspects of the European Single Market The European Passport for Issuers / Products Concept: Authorization / approval by the administrative authority of one Member State only so that issuer has not to seek for another approval by other supervisory authorities.

European Passport Towards a Pan-European Market The European Directives on Banking and Capital Market allow for trans-European activities of credit institutions and other actors. Ø targeting of 30 European States (EU + EEA, < 500 m. inhab. ) Ø interesting also for “third country issuers” – dealing with harmonised rules across Europe (without several authorisations)

European Passport Towards a Pan-European Market The European Directives on Banking and Capital Market allow for trans-European activities of credit institutions and other actors. Ø targeting of 30 European States (EU + EEA, < 500 m. inhab. ) Ø interesting also for “third country issuers” – dealing with harmonised rules across Europe (without several authorisations)

European Passport Example 2: European Passport for Issuers The German law (Wp. PG) is the transposition act of a European Directive (Directive 2003/71/EC), see http: //ec. europa. eu/internal_market/securities/prospectus/index_de. htm European Framework v minimum as well as maximum harmonization for the content of the prospectus inter alia v level playing field across Europe (EC/EEA) v “European Passport for Issuer”, approval by the Home Member State authority enables issuer to use the prospectus throughout Europe (accepted by Host Member States)

European Passport Example 2: European Passport for Issuers The German law (Wp. PG) is the transposition act of a European Directive (Directive 2003/71/EC), see http: //ec. europa. eu/internal_market/securities/prospectus/index_de. htm European Framework v minimum as well as maximum harmonization for the content of the prospectus inter alia v level playing field across Europe (EC/EEA) v “European Passport for Issuer”, approval by the Home Member State authority enables issuer to use the prospectus throughout Europe (accepted by Host Member States)

European Passport Investments Services Directive 93/22/EC Extension of the European Passport, i. e. free provision of services through the whole European Economic Area, to financial services Followed by the Markets in Financial Instruments Directive – Mi. FID 2004/39/EC -> major directive for capital market Transposition and application as of 1 November 2007 UCITS Directive (85/611/EEC) Authorization of UCITS shall be valid for all Member States (Art. 4 para. 1), followed by Directive 2007/16/EC

European Passport Investments Services Directive 93/22/EC Extension of the European Passport, i. e. free provision of services through the whole European Economic Area, to financial services Followed by the Markets in Financial Instruments Directive – Mi. FID 2004/39/EC -> major directive for capital market Transposition and application as of 1 November 2007 UCITS Directive (85/611/EEC) Authorization of UCITS shall be valid for all Member States (Art. 4 para. 1), followed by Directive 2007/16/EC

European Passport Similar passport concepts are in place for other services. Ø Passport for insurance companies Ø Passport for credit institutions However, still a number of indirect barriers and obstacles: Ø commercial and contract law not harmonized Ø established peculiarities within the EU market places Ø fragmentation due to different development and framework

European Passport Similar passport concepts are in place for other services. Ø Passport for insurance companies Ø Passport for credit institutions However, still a number of indirect barriers and obstacles: Ø commercial and contract law not harmonized Ø established peculiarities within the EU market places Ø fragmentation due to different development and framework

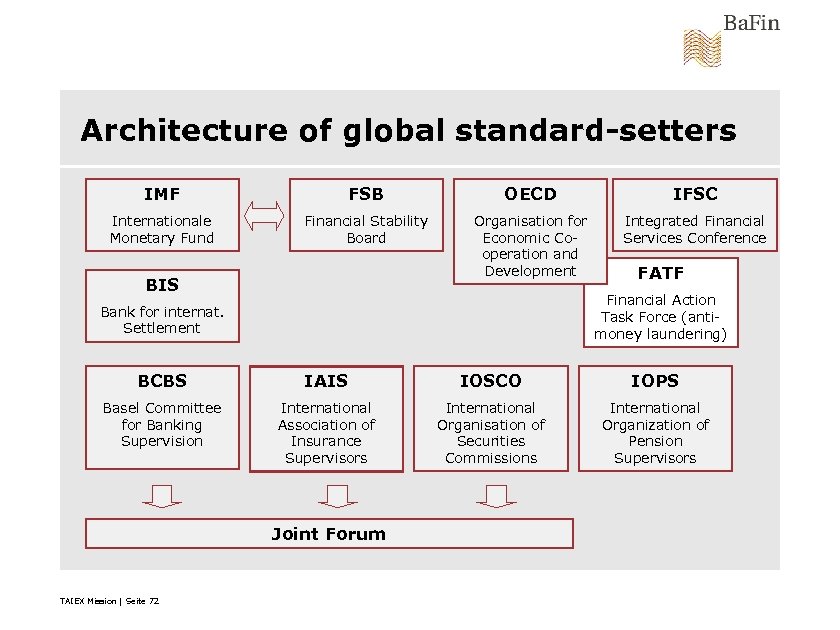

Architecture of global standard-setters IMF FSB OECD IFSC Internationale Monetary Fund Financial Stability Board Organisation for Economic Cooperation and Development Integrated Financial Services Conference BIS FATF Financial Action Task Force (antimoney laundering) Bank for internat. Settlement BCBS IAIS IOSCO IOPS Basel Committee for Banking Supervision International Association of Insurance Supervisors International Organisation of Securities Commissions International Organization of Pension Supervisors Joint Forum TAIEX Mission | Seite 72

Architecture of global standard-setters IMF FSB OECD IFSC Internationale Monetary Fund Financial Stability Board Organisation for Economic Cooperation and Development Integrated Financial Services Conference BIS FATF Financial Action Task Force (antimoney laundering) Bank for internat. Settlement BCBS IAIS IOSCO IOPS Basel Committee for Banking Supervision International Association of Insurance Supervisors International Organisation of Securities Commissions International Organization of Pension Supervisors Joint Forum TAIEX Mission | Seite 72

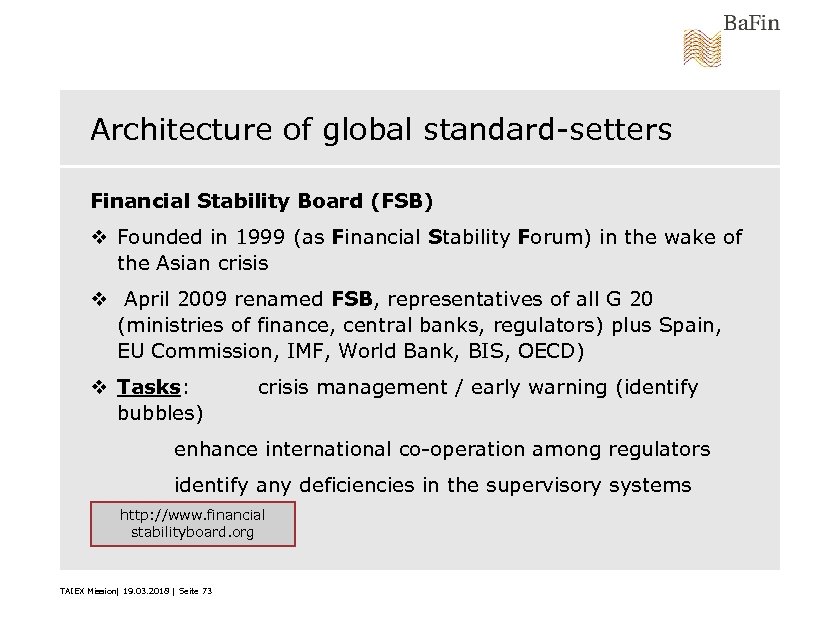

Architecture of global standard-setters Financial Stability Board (FSB) v Founded in 1999 (as Financial Stability Forum) in the wake of the Asian crisis v April 2009 renamed FSB, representatives of all G 20 (ministries of finance, central banks, regulators) plus Spain, EU Commission, IMF, World Bank, BIS, OECD) v Tasks: bubbles) crisis management / early warning (identify enhance international co-operation among regulators identify any deficiencies in the supervisory systems http: //www. financial stabilityboard. org TAIEX Mission| 19. 03. 2018 | Seite 73

Architecture of global standard-setters Financial Stability Board (FSB) v Founded in 1999 (as Financial Stability Forum) in the wake of the Asian crisis v April 2009 renamed FSB, representatives of all G 20 (ministries of finance, central banks, regulators) plus Spain, EU Commission, IMF, World Bank, BIS, OECD) v Tasks: bubbles) crisis management / early warning (identify enhance international co-operation among regulators identify any deficiencies in the supervisory systems http: //www. financial stabilityboard. org TAIEX Mission| 19. 03. 2018 | Seite 73

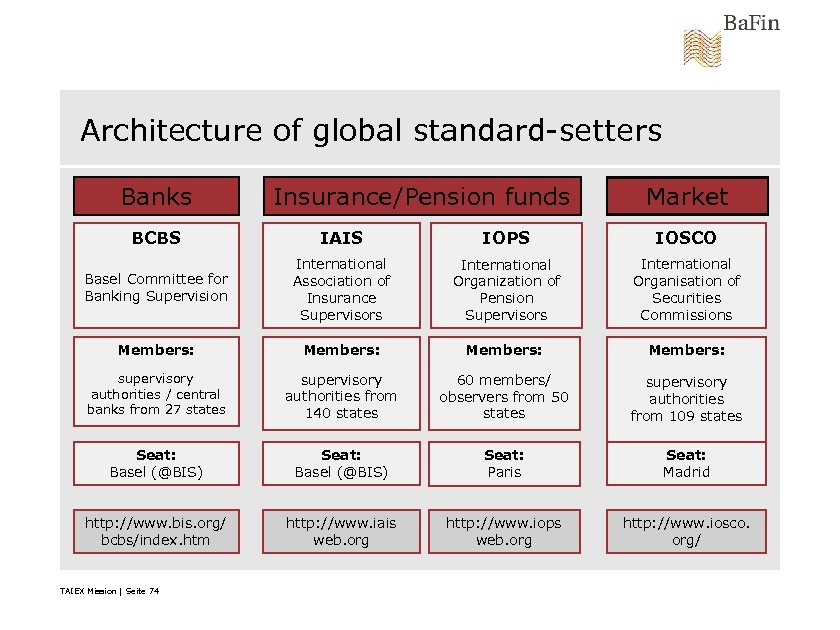

Architecture of global standard-setters Banks Insurance/Pension funds Market BCBS IAIS IOPS IOSCO Basel Committee for Banking Supervision International Association of Insurance Supervisors International Organization of Pension Supervisors International Organisation of Securities Commissions Members: supervisory authorities / central banks from 27 states supervisory authorities from 140 states 60 members/ observers from 50 states supervisory authorities from 109 states Seat: Basel (@BIS) Seat: Paris Seat: Madrid http: //www. bis. org/ bcbs/index. htm http: //www. iais web. org http: //www. iops web. org http: //www. iosco. org/ TAIEX Mission | Seite 74

Architecture of global standard-setters Banks Insurance/Pension funds Market BCBS IAIS IOPS IOSCO Basel Committee for Banking Supervision International Association of Insurance Supervisors International Organization of Pension Supervisors International Organisation of Securities Commissions Members: supervisory authorities / central banks from 27 states supervisory authorities from 140 states 60 members/ observers from 50 states supervisory authorities from 109 states Seat: Basel (@BIS) Seat: Paris Seat: Madrid http: //www. bis. org/ bcbs/index. htm http: //www. iais web. org http: //www. iops web. org http: //www. iosco. org/ TAIEX Mission | Seite 74

International Organisation of Securities Commissions v founded originally as pan-American organization v 1983 transformation into international body v Members plus observers round about 170 participants covering 95% of international capital market share Tasks of IOSCO Ø standard-setter in the field of securities supervision Ø internationale co-operation Ø technical assistance v Work in task forces, standing committees und subgroups v IOSCO Multilateral Memorandum of Understanding (MMo. U) TAIEX Mission| 19. 03. 2018 | Seite 75

International Organisation of Securities Commissions v founded originally as pan-American organization v 1983 transformation into international body v Members plus observers round about 170 participants covering 95% of international capital market share Tasks of IOSCO Ø standard-setter in the field of securities supervision Ø internationale co-operation Ø technical assistance v Work in task forces, standing committees und subgroups v IOSCO Multilateral Memorandum of Understanding (MMo. U) TAIEX Mission| 19. 03. 2018 | Seite 75

Reshaping of the European Financial Supervisory Architecture as of 1 January 2011

Reshaping of the European Financial Supervisory Architecture as of 1 January 2011

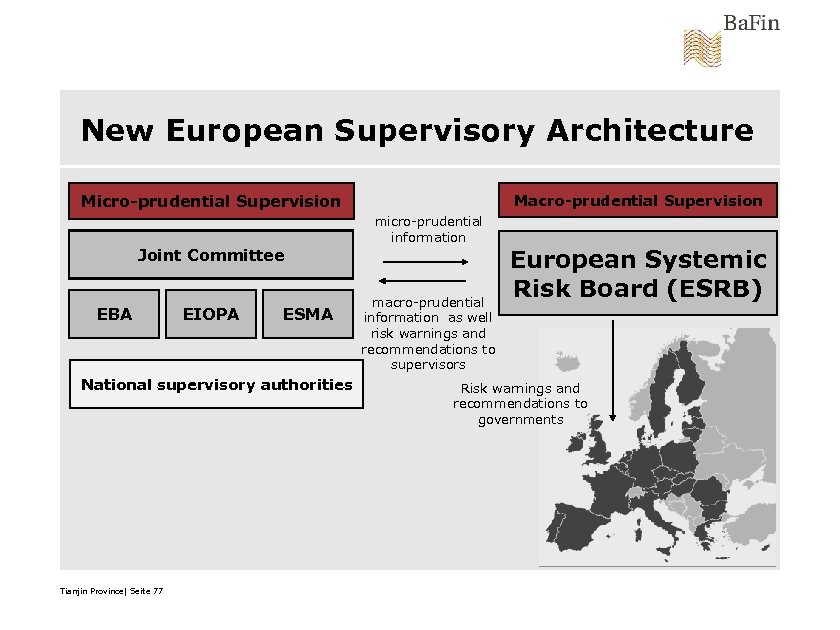

New European Supervisory Architecture Micro-prudential Supervision Macro-prudential Supervision micro-prudential information Joint Committee EBA EIOPA ESMA National supervisory authorities Tianjin Province| Seite 77 macro-prudential information as well risk warnings and recommendations to supervisors European Systemic Risk Board (ESRB) Risk warnings and recommendations to governments

New European Supervisory Architecture Micro-prudential Supervision Macro-prudential Supervision micro-prudential information Joint Committee EBA EIOPA ESMA National supervisory authorities Tianjin Province| Seite 77 macro-prudential information as well risk warnings and recommendations to supervisors European Systemic Risk Board (ESRB) Risk warnings and recommendations to governments

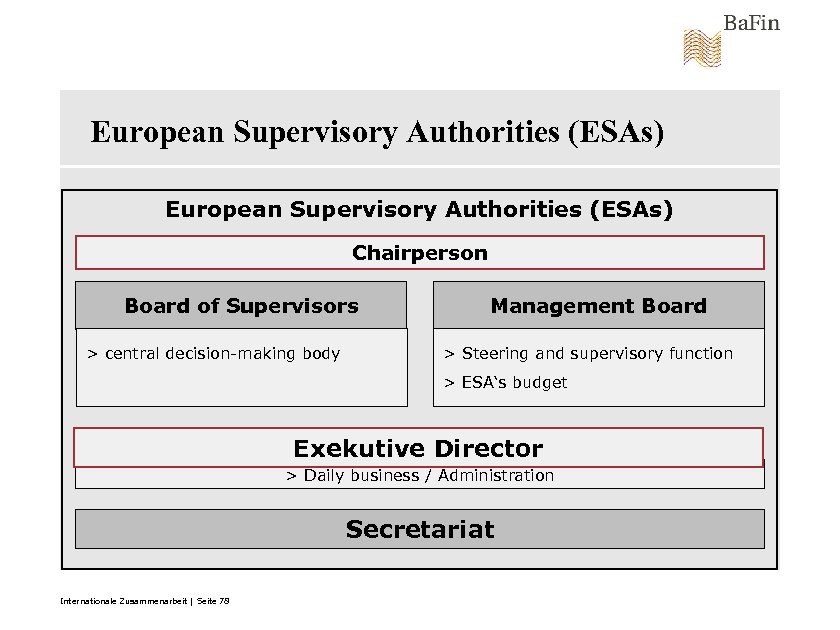

European Supervisory Authorities (ESAs) Chairperson Board of Supervisors > central decision-making body Management Board > Steering and supervisory function > ESA‘s budget Exekutive Director > Daily business / Administration Secretariat Internationale Zusammenarbeit | Seite 78

European Supervisory Authorities (ESAs) Chairperson Board of Supervisors > central decision-making body Management Board > Steering and supervisory function > ESA‘s budget Exekutive Director > Daily business / Administration Secretariat Internationale Zusammenarbeit | Seite 78

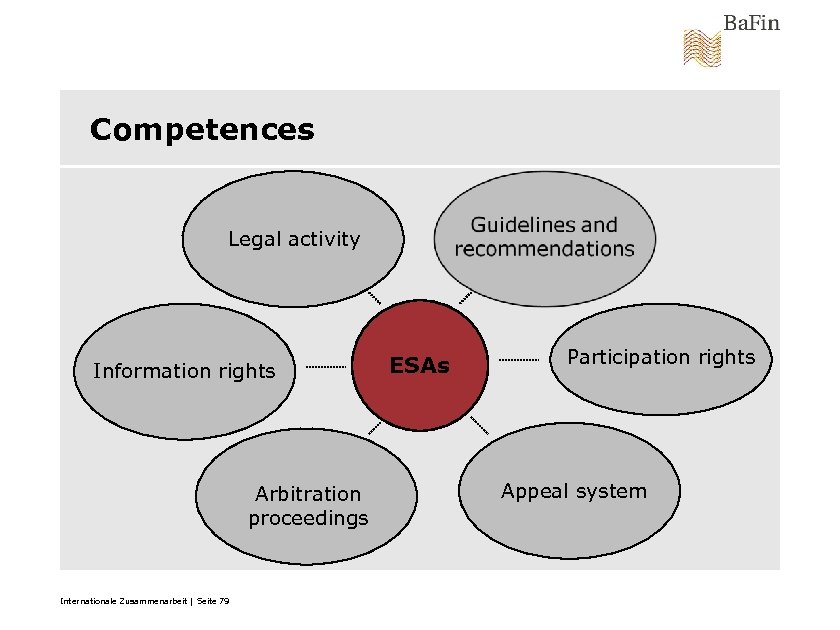

Competences Legal activity Information rights Arbitration proceedings Internationale Zusammenarbeit | Seite 79 ESAs Participation rights Appeal system

Competences Legal activity Information rights Arbitration proceedings Internationale Zusammenarbeit | Seite 79 ESAs Participation rights Appeal system

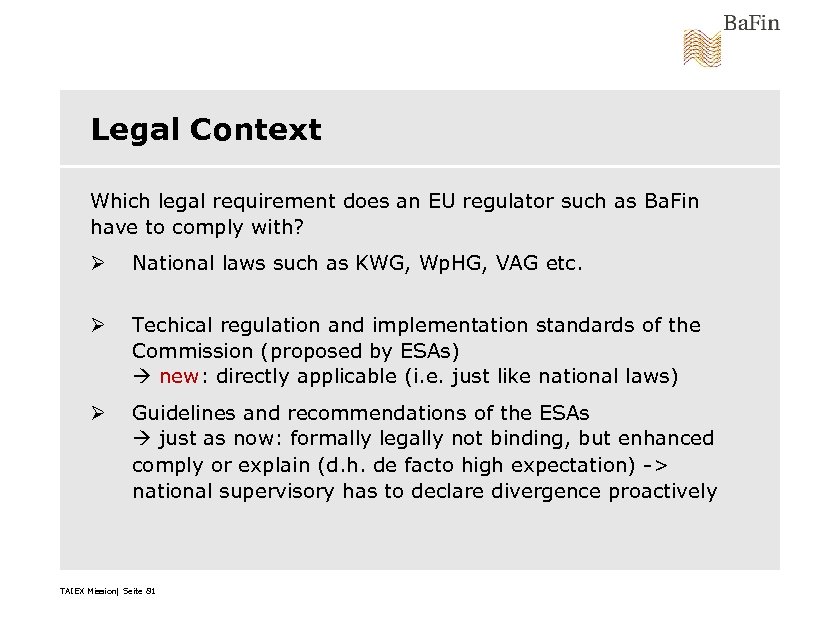

Legal Context Which legal requirement does an EU regulator such as Ba. Fin have to comply with? Ø National laws such as KWG, Wp. HG, VAG etc. Ø Techical regulation and implementation standards of the Commission (proposed by ESAs) new: directly applicable (i. e. just like national laws) new Ø Guidelines and recommendations of the ESAs just as now: formally legally not binding, but enhanced comply or explain (d. h. de facto high expectation) -> national supervisory has to declare divergence proactively TAIEX Mission| Seite 81

Legal Context Which legal requirement does an EU regulator such as Ba. Fin have to comply with? Ø National laws such as KWG, Wp. HG, VAG etc. Ø Techical regulation and implementation standards of the Commission (proposed by ESAs) new: directly applicable (i. e. just like national laws) new Ø Guidelines and recommendations of the ESAs just as now: formally legally not binding, but enhanced comply or explain (d. h. de facto high expectation) -> national supervisory has to declare divergence proactively TAIEX Mission| Seite 81

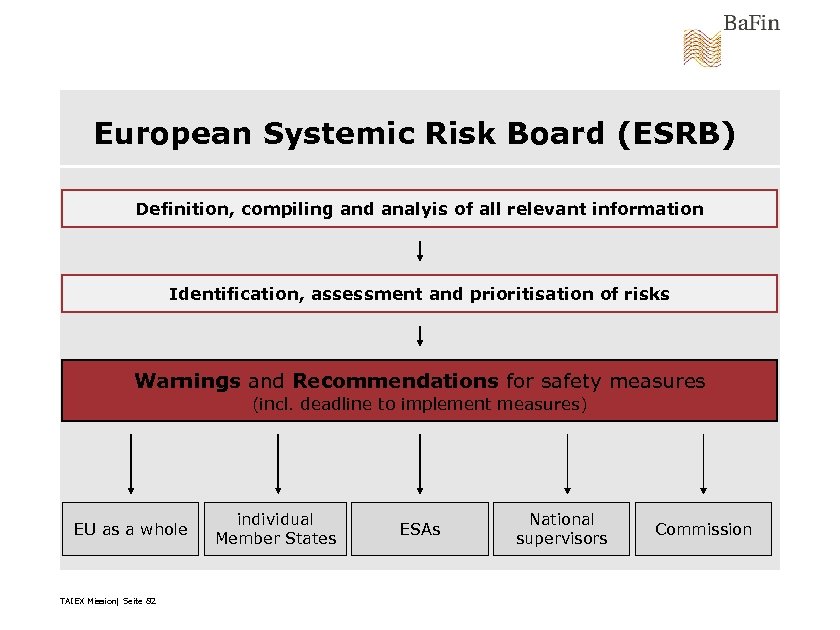

European Systemic Risk Board (ESRB) Definition, compiling and analyis of all relevant information Identification, assessment and prioritisation of risks Warnings and Recommendations for safety measures (incl. deadline to implement measures) EU as a whole TAIEX Mission| Seite 82 individual Member States ESAs National supervisors Commission

European Systemic Risk Board (ESRB) Definition, compiling and analyis of all relevant information Identification, assessment and prioritisation of risks Warnings and Recommendations for safety measures (incl. deadline to implement measures) EU as a whole TAIEX Mission| Seite 82 individual Member States ESAs National supervisors Commission

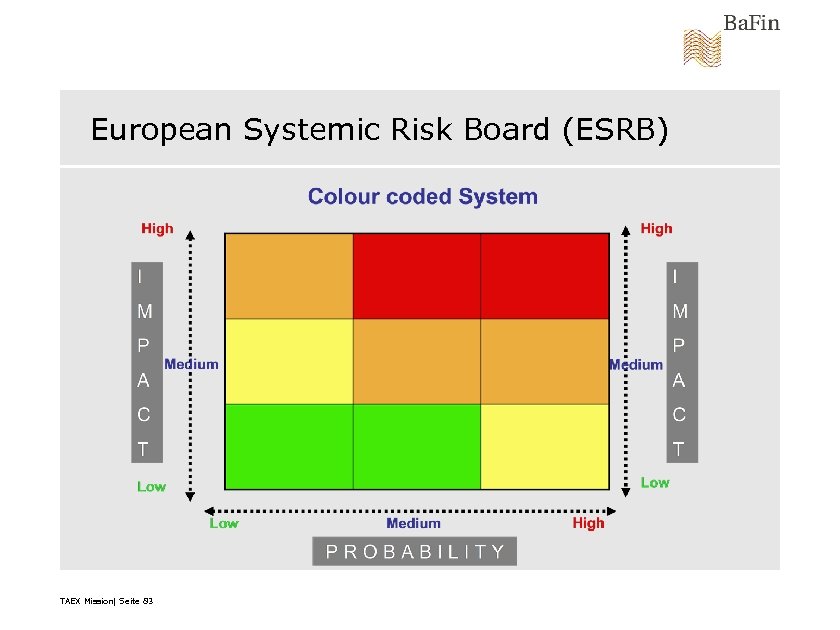

European Systemic Risk Board (ESRB) TAEX Mission| Seite 83

European Systemic Risk Board (ESRB) TAEX Mission| Seite 83

Current Development In the wake of the financial meltdown Ø Basis interest rate on record low set by ECB, FED and others Quantitative easing- exit strategy vs. Euro crisis Ø two economic stimulus plans (“Konjunkturpakete”) 2008/2009 Ø ban on naked short selling – first in form of Ba. Fin decree, later on by law, also covering Euro government bonds Ø strengthening of consumer protection, e. g. “key investor document” since 1 st of July 2011 for quick information document Ø G 20 Summits in the limelight (overpassing G 7/8) Ø Financial Stability Board (formerly FSF) established in 2009 with new members from emerging markets and broader mandate Ø reshaping of the European financial architecture TAIEX Mission| 19. 03. 2018 | Seite 84

Current Development In the wake of the financial meltdown Ø Basis interest rate on record low set by ECB, FED and others Quantitative easing- exit strategy vs. Euro crisis Ø two economic stimulus plans (“Konjunkturpakete”) 2008/2009 Ø ban on naked short selling – first in form of Ba. Fin decree, later on by law, also covering Euro government bonds Ø strengthening of consumer protection, e. g. “key investor document” since 1 st of July 2011 for quick information document Ø G 20 Summits in the limelight (overpassing G 7/8) Ø Financial Stability Board (formerly FSF) established in 2009 with new members from emerging markets and broader mandate Ø reshaping of the European financial architecture TAIEX Mission| 19. 03. 2018 | Seite 84

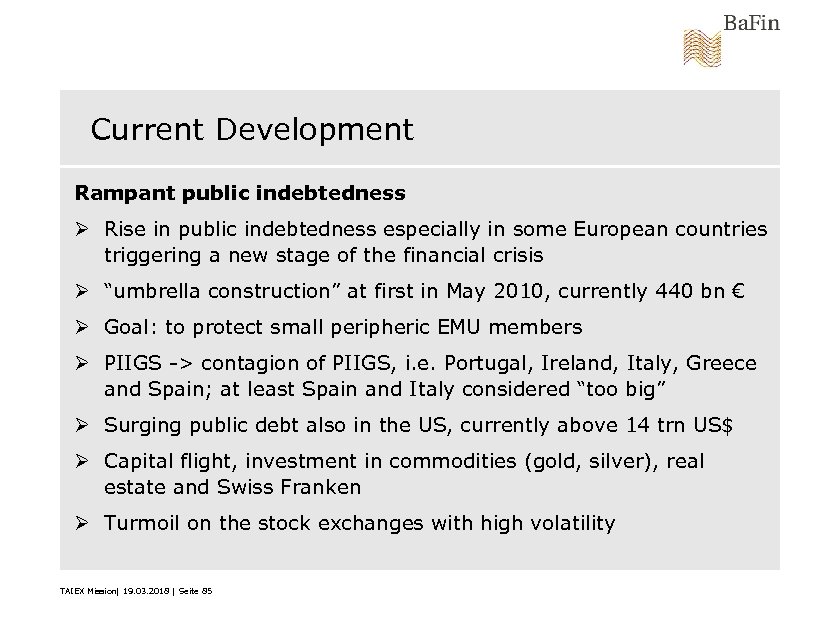

Current Development Rampant public indebtedness Ø Rise in public indebtedness especially in some European countries triggering a new stage of the financial crisis Ø “umbrella construction” at first in May 2010, currently 440 bn € Ø Goal: to protect small peripheric EMU members Ø PIIGS -> contagion of PIIGS, i. e. Portugal, Ireland, Italy, Greece and Spain; at least Spain and Italy considered “too big” Ø Surging public debt also in the US, currently above 14 trn US$ Ø Capital flight, investment in commodities (gold, silver), real estate and Swiss Franken Ø Turmoil on the stock exchanges with high volatility TAIEX Mission| 19. 03. 2018 | Seite 85

Current Development Rampant public indebtedness Ø Rise in public indebtedness especially in some European countries triggering a new stage of the financial crisis Ø “umbrella construction” at first in May 2010, currently 440 bn € Ø Goal: to protect small peripheric EMU members Ø PIIGS -> contagion of PIIGS, i. e. Portugal, Ireland, Italy, Greece and Spain; at least Spain and Italy considered “too big” Ø Surging public debt also in the US, currently above 14 trn US$ Ø Capital flight, investment in commodities (gold, silver), real estate and Swiss Franken Ø Turmoil on the stock exchanges with high volatility TAIEX Mission| 19. 03. 2018 | Seite 85

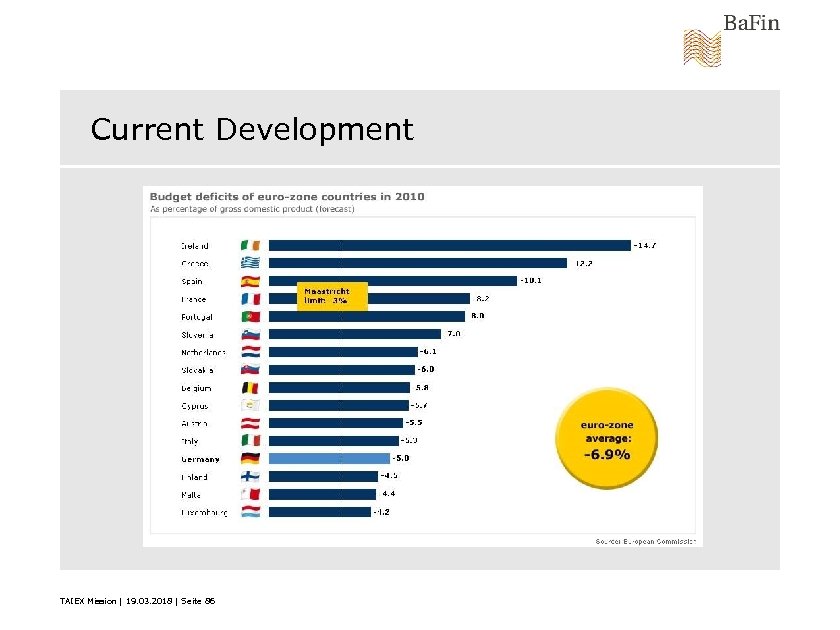

Current Development TAIEX Mission | 19. 03. 2018 | Seite 86

Current Development TAIEX Mission | 19. 03. 2018 | Seite 86

Contact Thank you for your attention! ******************* In case of future questions, please do not hesitate to contact me. E-Mail: jochenrobert. elsen@bafin. de Telephone: (+49) 228 4108 -3309 Telefax: (+49) 228 4108 - 123

Contact Thank you for your attention! ******************* In case of future questions, please do not hesitate to contact me. E-Mail: jochenrobert. elsen@bafin. de Telephone: (+49) 228 4108 -3309 Telefax: (+49) 228 4108 - 123