e3e414efa0572c9f84031c96a224169d.ppt

- Количество слайдов: 39

Tactical Trading Strategies Using ETFs Marvin Appel, MD, Ph. D CEO, Signalert Asset Management Corp. Great Neck, NY mappel@signalert. com QWAFAFEW NYC, 10/24/2017

Tactical Trading Strategies Using ETFs Marvin Appel, MD, Ph. D CEO, Signalert Asset Management Corp. Great Neck, NY mappel@signalert. com QWAFAFEW NYC, 10/24/2017

For my presentation today I’ll be reading the Power. Point slides word for word

For my presentation today I’ll be reading the Power. Point slides word for word

Outline—Oct 2017 • Option writing strategies with ETFs – Covered calls – Cash-secured puts • VIX as market timing filter to switch between BXM and SPY or PUT and SPY • Covered call writing– Not all ETFs are created equal. • Update from last year: EFA vs SPY, EEM vs SPY

Outline—Oct 2017 • Option writing strategies with ETFs – Covered calls – Cash-secured puts • VIX as market timing filter to switch between BXM and SPY or PUT and SPY • Covered call writing– Not all ETFs are created equal. • Update from last year: EFA vs SPY, EEM vs SPY

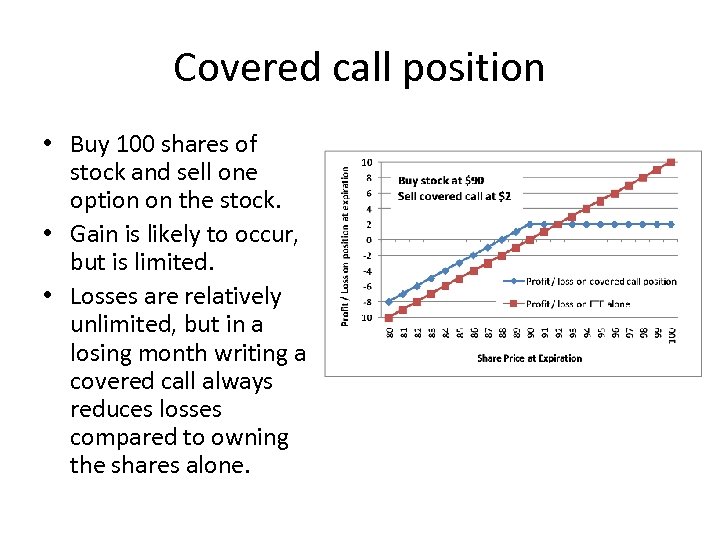

Covered call position • Buy 100 shares of stock and sell one option on the stock. • Gain is likely to occur, but is limited. • Losses are relatively unlimited, but in a losing month writing a covered call always reduces losses compared to owning the shares alone.

Covered call position • Buy 100 shares of stock and sell one option on the stock. • Gain is likely to occur, but is limited. • Losses are relatively unlimited, but in a losing month writing a covered call always reduces losses compared to owning the shares alone.

Put-Call parity Stock + dividends = call – put + cash (cash earns risk-free interest) As a result, Stock – call = cash – put In theory, covered call writing should return the same as cash-secured put writing.

Put-Call parity Stock + dividends = call – put + cash (cash earns risk-free interest) As a result, Stock – call = cash – put In theory, covered call writing should return the same as cash-secured put writing.

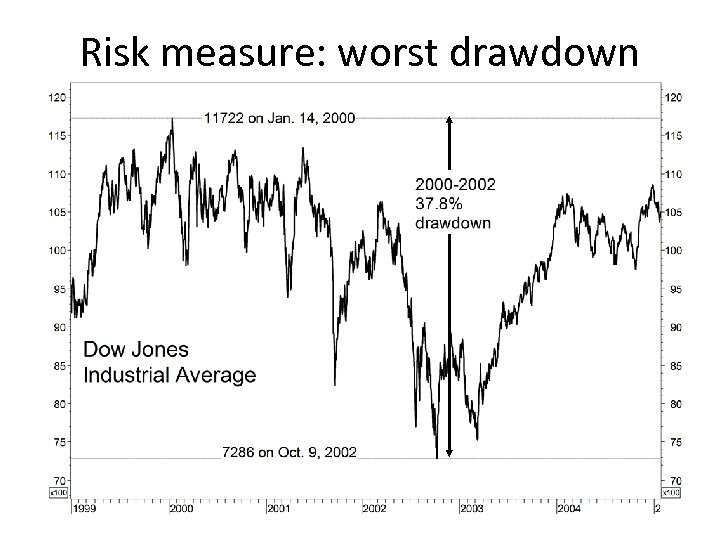

Risk measure: worst drawdown

Risk measure: worst drawdown

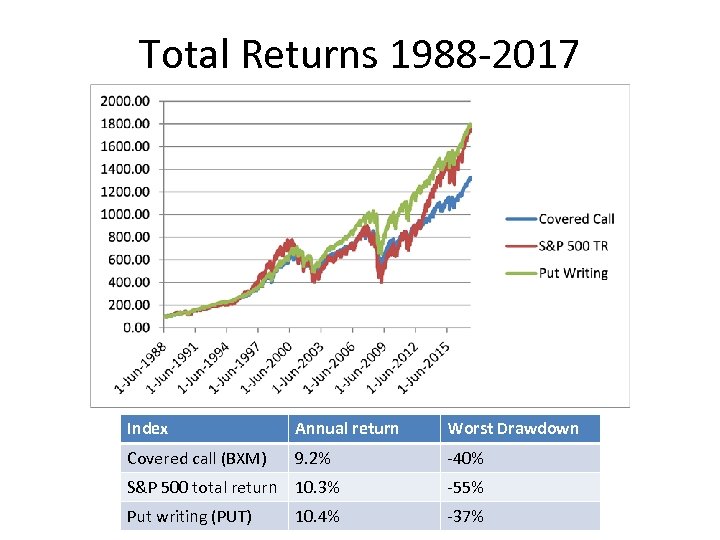

Total Returns 1988 -2017 Index Annual return Worst Drawdown Covered call (BXM) 9. 2% -40% S&P 500 total return 10. 3% -55% Put writing (PUT) 10. 4% -37%

Total Returns 1988 -2017 Index Annual return Worst Drawdown Covered call (BXM) 9. 2% -40% S&P 500 total return 10. 3% -55% Put writing (PUT) 10. 4% -37%

Implied volatility and VIX • “Implied volatility” is the level of volatility that a stock must demonstrate between now and expiration to make its stock options fairly priced. • VIX is an index that measures the average level of implied volatility (annualized) over the next 30 days built into S&P 500 Index options (puts and calls) expiring between 23 and 37 days from now. Its average value has been 19. 5%. • The higher the level of implied volatility, the more expensive the same level of option protection. • Just because options are cheap (low VIX) doesn’t mean that they are a bargain.

Implied volatility and VIX • “Implied volatility” is the level of volatility that a stock must demonstrate between now and expiration to make its stock options fairly priced. • VIX is an index that measures the average level of implied volatility (annualized) over the next 30 days built into S&P 500 Index options (puts and calls) expiring between 23 and 37 days from now. Its average value has been 19. 5%. • The higher the level of implied volatility, the more expensive the same level of option protection. • Just because options are cheap (low VIX) doesn’t mean that they are a bargain.

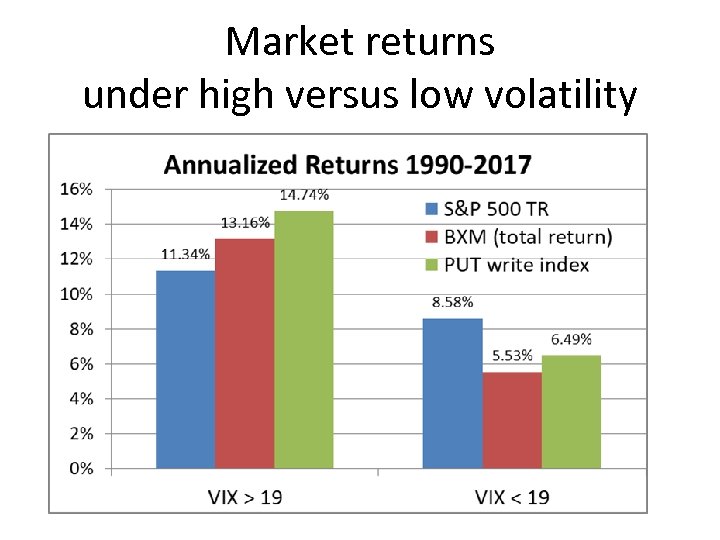

Market returns under high versus low volatility

Market returns under high versus low volatility

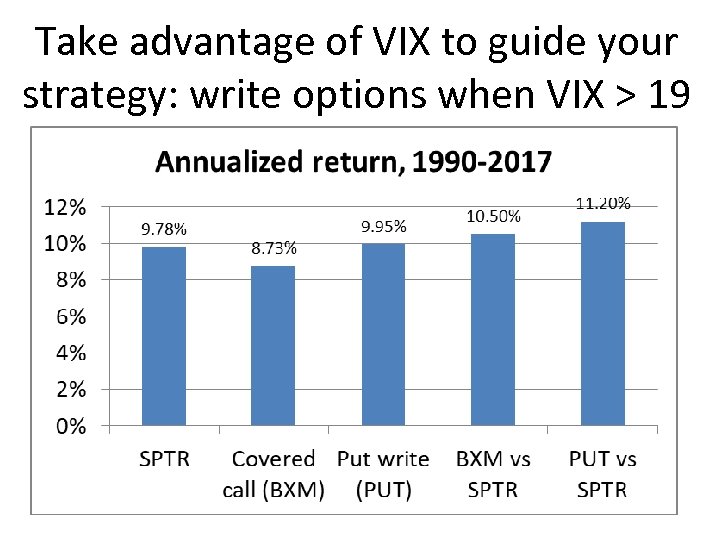

Take advantage of VIX to guide your strategy: write options when VIX > 19

Take advantage of VIX to guide your strategy: write options when VIX > 19

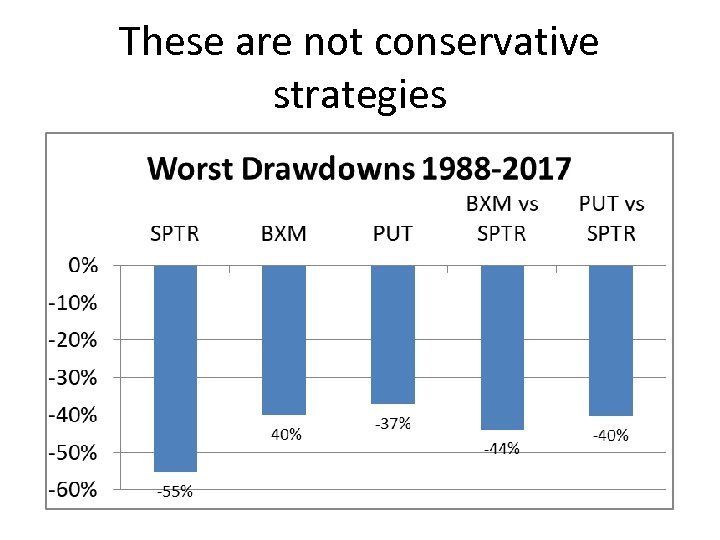

These are not conservative strategies

These are not conservative strategies

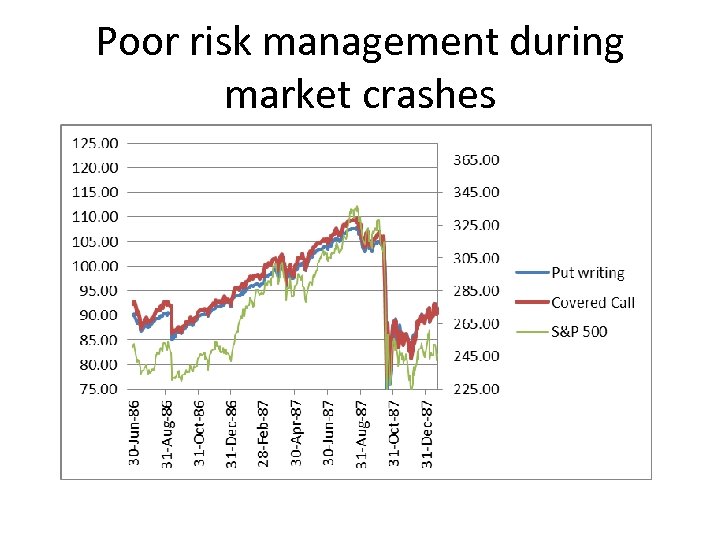

Poor risk management during market crashes

Poor risk management during market crashes

There are other covered call indexes available from CBOE • Dow Jones Industrial Average (BXD, 19972017) • Russell 2000 Index (BXR, 2001 -2017) • Nasdaq 100 Index (BXN, 1995 -2017) Beware: Not all ETF covered call strategies are created equal.

There are other covered call indexes available from CBOE • Dow Jones Industrial Average (BXD, 19972017) • Russell 2000 Index (BXR, 2001 -2017) • Nasdaq 100 Index (BXN, 1995 -2017) Beware: Not all ETF covered call strategies are created equal.

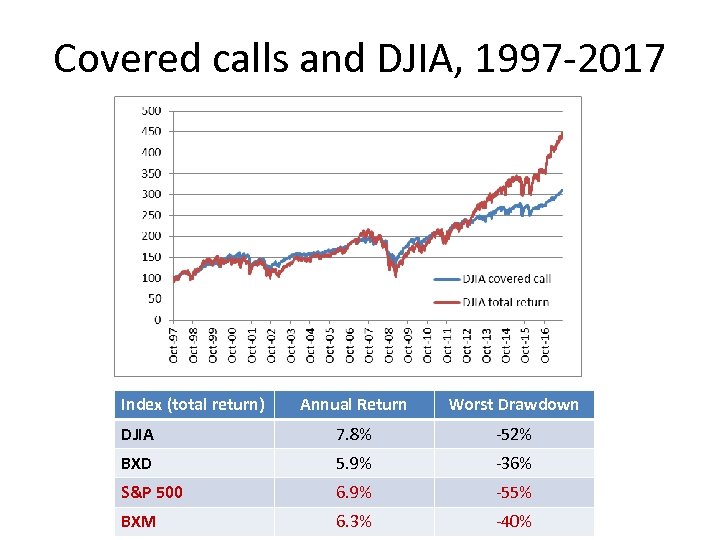

Covered calls and DJIA, 1997 -2017 Index (total return) Annual Return Worst Drawdown DJIA 7. 8% -52% BXD 5. 9% -36% S&P 500 6. 9% -55% BXM 6. 3% -40%

Covered calls and DJIA, 1997 -2017 Index (total return) Annual Return Worst Drawdown DJIA 7. 8% -52% BXD 5. 9% -36% S&P 500 6. 9% -55% BXM 6. 3% -40%

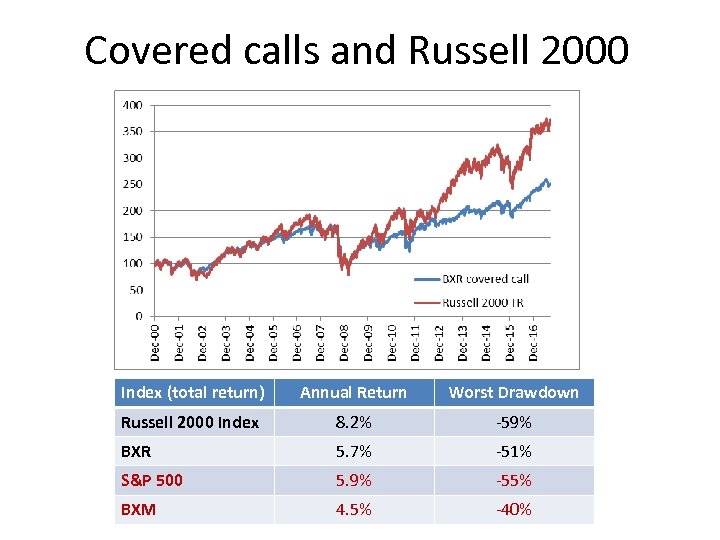

Covered calls and Russell 2000 Index (total return) Annual Return Worst Drawdown Russell 2000 Index 8. 2% -59% BXR 5. 7% -51% S&P 500 5. 9% -55% BXM 4. 5% -40%

Covered calls and Russell 2000 Index (total return) Annual Return Worst Drawdown Russell 2000 Index 8. 2% -59% BXR 5. 7% -51% S&P 500 5. 9% -55% BXM 4. 5% -40%

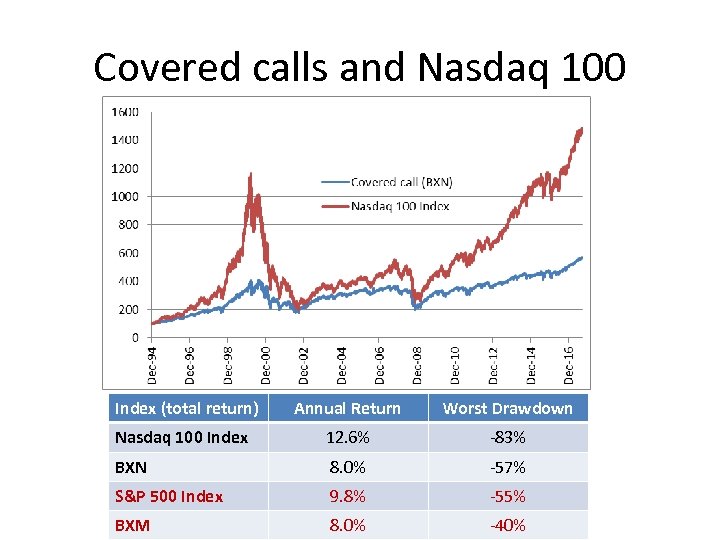

Covered calls and Nasdaq 100 Index (total return) Annual Return Worst Drawdown Nasdaq 100 Index 12. 6% -83% BXN 8. 0% -57% S&P 500 Index 9. 8% -55% BXM 8. 0% -40%

Covered calls and Nasdaq 100 Index (total return) Annual Return Worst Drawdown Nasdaq 100 Index 12. 6% -83% BXN 8. 0% -57% S&P 500 Index 9. 8% -55% BXM 8. 0% -40%

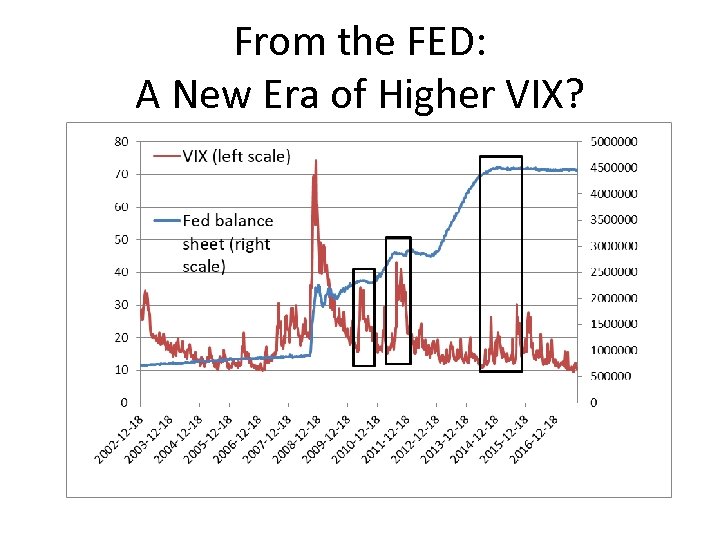

From the FED: A New Era of Higher VIX?

From the FED: A New Era of Higher VIX?

Foreign vs. U. S Equity Relative Strength Models

Foreign vs. U. S Equity Relative Strength Models

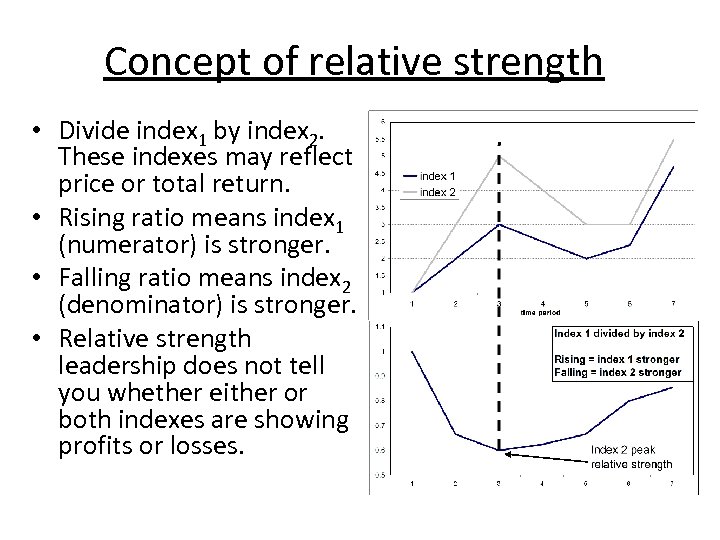

Concept of relative strength • Divide index 1 by index 2. These indexes may reflect price or total return. • Rising ratio means index 1 (numerator) is stronger. • Falling ratio means index 2 (denominator) is stronger. • Relative strength leadership does not tell you whether either or both indexes are showing profits or losses.

Concept of relative strength • Divide index 1 by index 2. These indexes may reflect price or total return. • Rising ratio means index 1 (numerator) is stronger. • Falling ratio means index 2 (denominator) is stronger. • Relative strength leadership does not tell you whether either or both indexes are showing profits or losses.

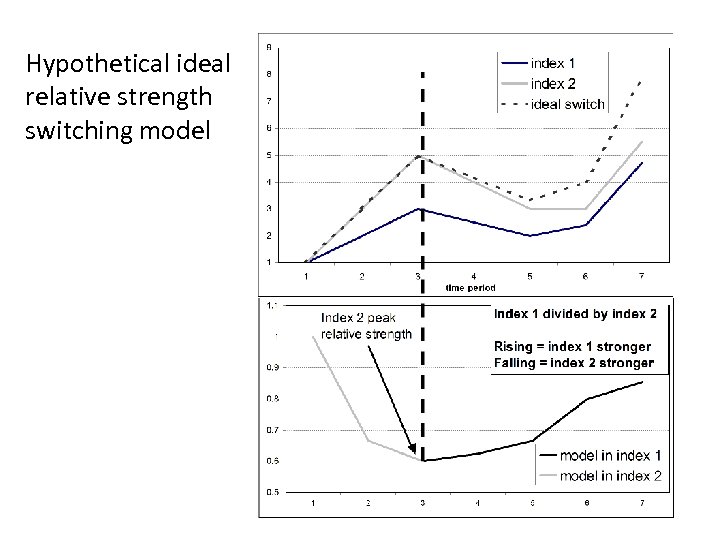

Hypothetical ideal relative strength switching model

Hypothetical ideal relative strength switching model

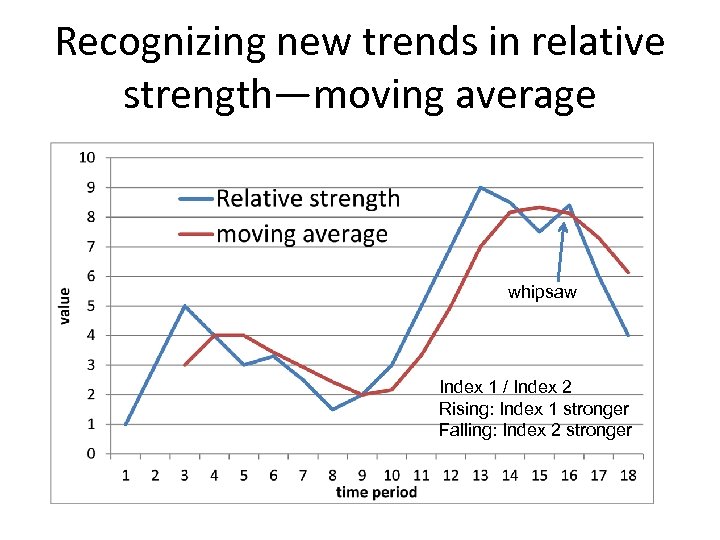

Recognizing new trends in relative strength—moving average whipsaw Index 1 / Index 2 Rising: Index 1 stronger Falling: Index 2 stronger

Recognizing new trends in relative strength—moving average whipsaw Index 1 / Index 2 Rising: Index 1 stronger Falling: Index 2 stronger

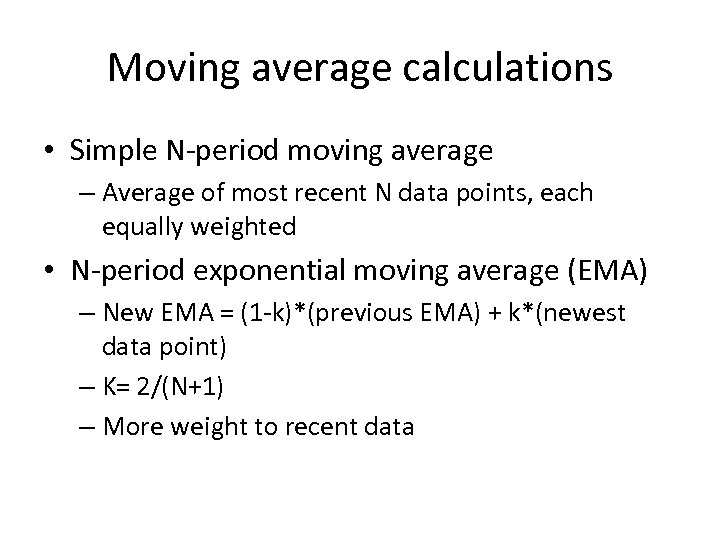

Moving average calculations • Simple N-period moving average – Average of most recent N data points, each equally weighted • N-period exponential moving average (EMA) – New EMA = (1 -k)*(previous EMA) + k*(newest data point) – K= 2/(N+1) – More weight to recent data

Moving average calculations • Simple N-period moving average – Average of most recent N data points, each equally weighted • N-period exponential moving average (EMA) – New EMA = (1 -k)*(previous EMA) + k*(newest data point) – K= 2/(N+1) – More weight to recent data

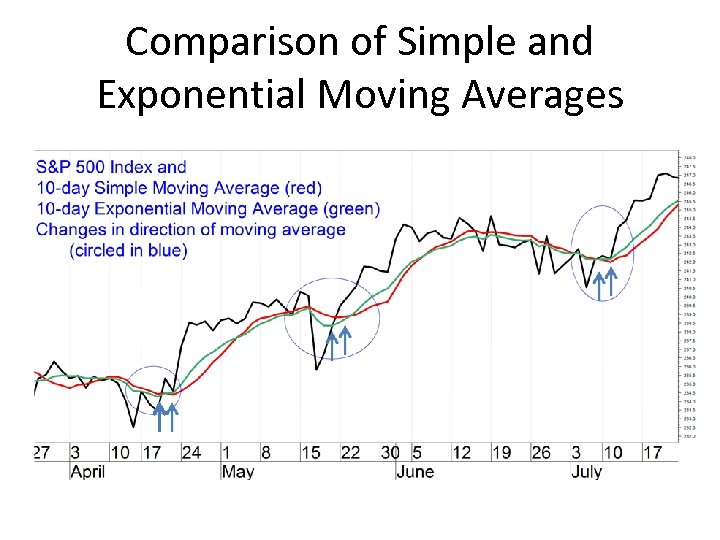

Comparison of Simple and Exponential Moving Averages

Comparison of Simple and Exponential Moving Averages

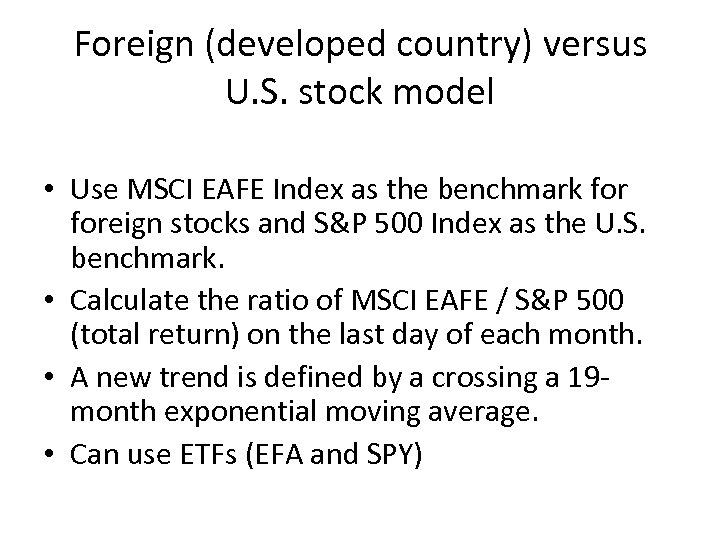

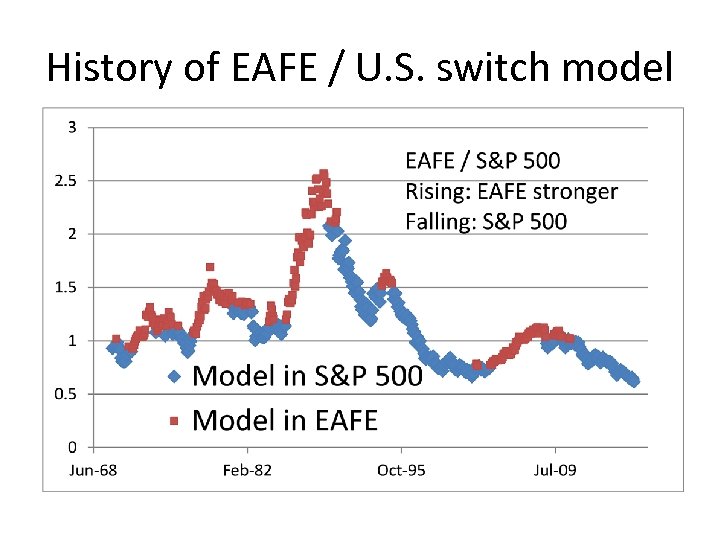

Foreign (developed country) versus U. S. stock model • Use MSCI EAFE Index as the benchmark foreign stocks and S&P 500 Index as the U. S. benchmark. • Calculate the ratio of MSCI EAFE / S&P 500 (total return) on the last day of each month. • A new trend is defined by a crossing a 19 month exponential moving average. • Can use ETFs (EFA and SPY)

Foreign (developed country) versus U. S. stock model • Use MSCI EAFE Index as the benchmark foreign stocks and S&P 500 Index as the U. S. benchmark. • Calculate the ratio of MSCI EAFE / S&P 500 (total return) on the last day of each month. • A new trend is defined by a crossing a 19 month exponential moving average. • Can use ETFs (EFA and SPY)

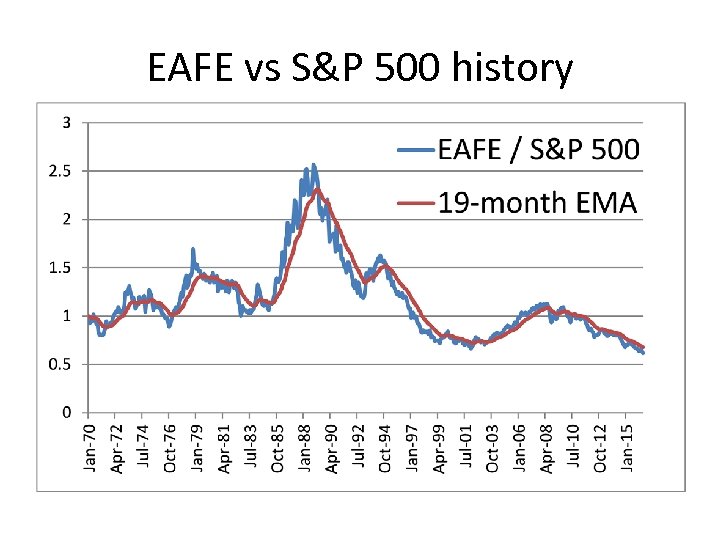

EAFE vs S&P 500 history

EAFE vs S&P 500 history

History of EAFE / U. S. switch model

History of EAFE / U. S. switch model

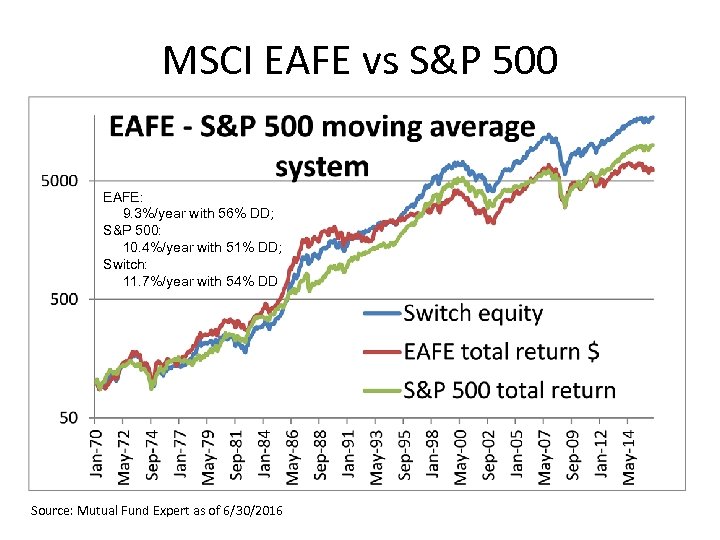

MSCI EAFE vs S&P 500 EAFE: 9. 3%/year with 56% DD; S&P 500: 10. 4%/year with 51% DD; Switch: 11. 7%/year with 54% DD Source: Mutual Fund Expert as of 6/30/2016

MSCI EAFE vs S&P 500 EAFE: 9. 3%/year with 56% DD; S&P 500: 10. 4%/year with 51% DD; Switch: 11. 7%/year with 54% DD Source: Mutual Fund Expert as of 6/30/2016

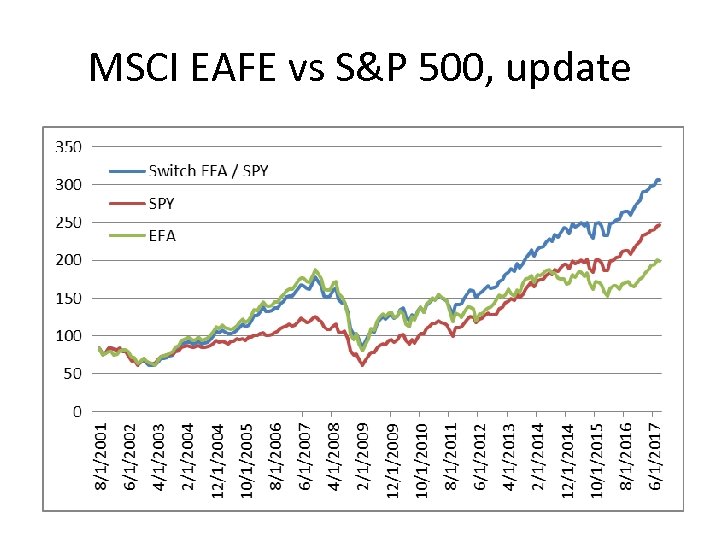

MSCI EAFE vs S&P 500, update

MSCI EAFE vs S&P 500, update

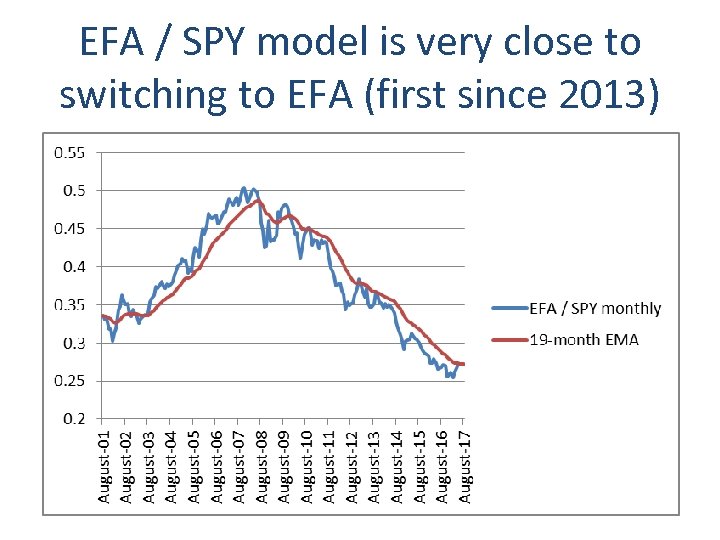

EFA / SPY model is very close to switching to EFA (first since 2013)

EFA / SPY model is very close to switching to EFA (first since 2013)

Monthly switching model: Emerging markets vs. U. S. • On the last trading day of each month update total return indexes for MSCI EM and for U. S. • Calculate the ratio (emerging markets divided by U. S. ) and update its 10 -month simple moving average. • If the ratio is above its moving average, be in emerging markets for the coming month. Otherwise, be in U. S. equities. (Model is in EM as of 3/31/2017). • Can use ETFs: EEM or VWO, and SPY

Monthly switching model: Emerging markets vs. U. S. • On the last trading day of each month update total return indexes for MSCI EM and for U. S. • Calculate the ratio (emerging markets divided by U. S. ) and update its 10 -month simple moving average. • If the ratio is above its moving average, be in emerging markets for the coming month. Otherwise, be in U. S. equities. (Model is in EM as of 3/31/2017). • Can use ETFs: EEM or VWO, and SPY

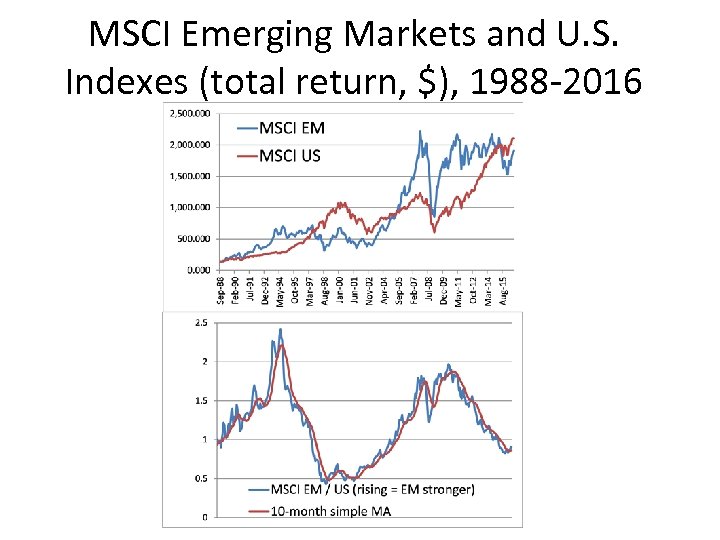

MSCI Emerging Markets and U. S. Indexes (total return, $), 1988 -2016

MSCI Emerging Markets and U. S. Indexes (total return, $), 1988 -2016

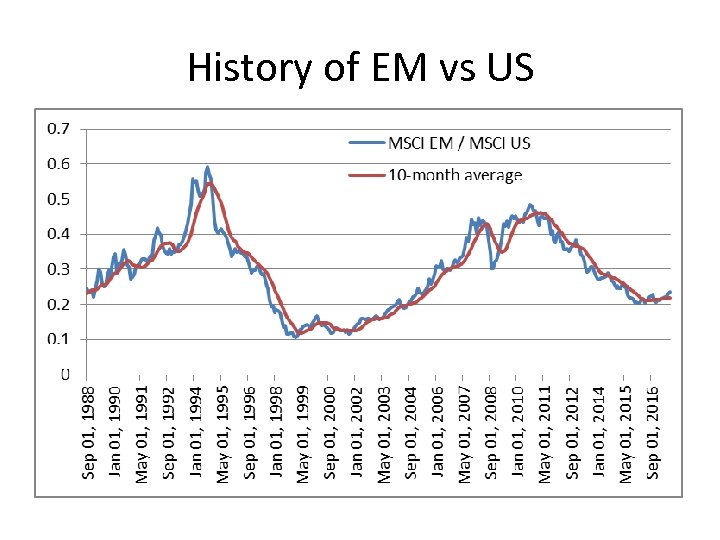

History of EM vs US

History of EM vs US

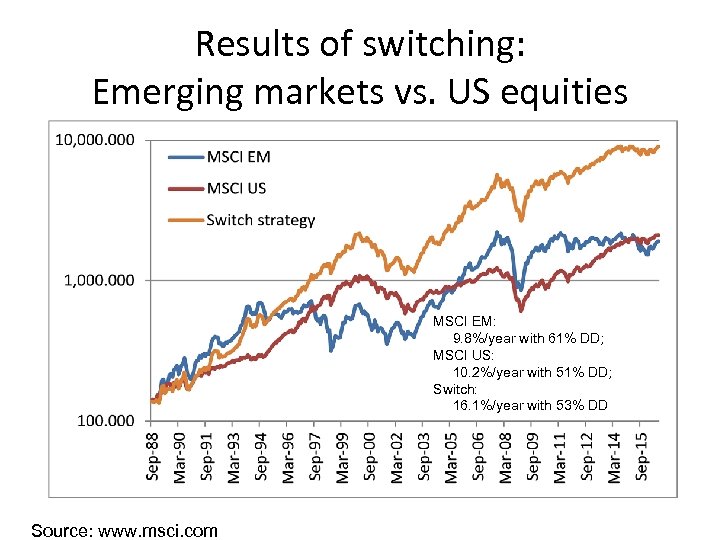

Results of switching: Emerging markets vs. US equities MSCI EM: 9. 8%/year with 61% DD; MSCI US: 10. 2%/year with 51% DD; Switch: 16. 1%/year with 53% DD Source: www. msci. com

Results of switching: Emerging markets vs. US equities MSCI EM: 9. 8%/year with 61% DD; MSCI US: 10. 2%/year with 51% DD; Switch: 16. 1%/year with 53% DD Source: www. msci. com

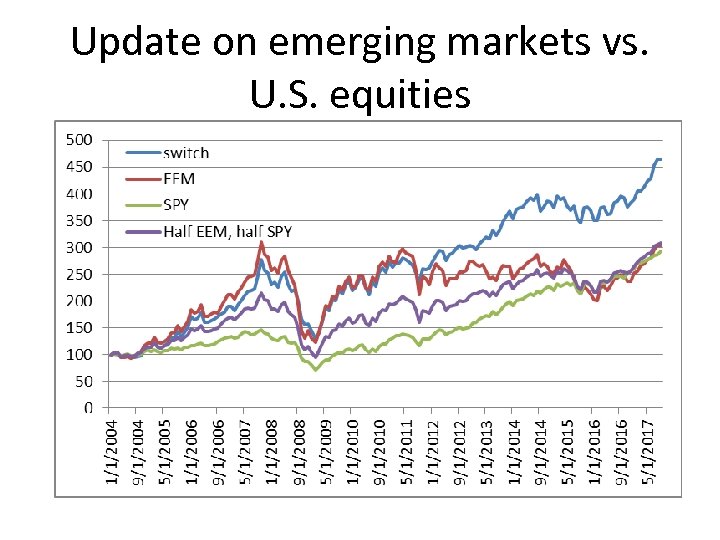

Update on emerging markets vs. U. S. equities

Update on emerging markets vs. U. S. equities

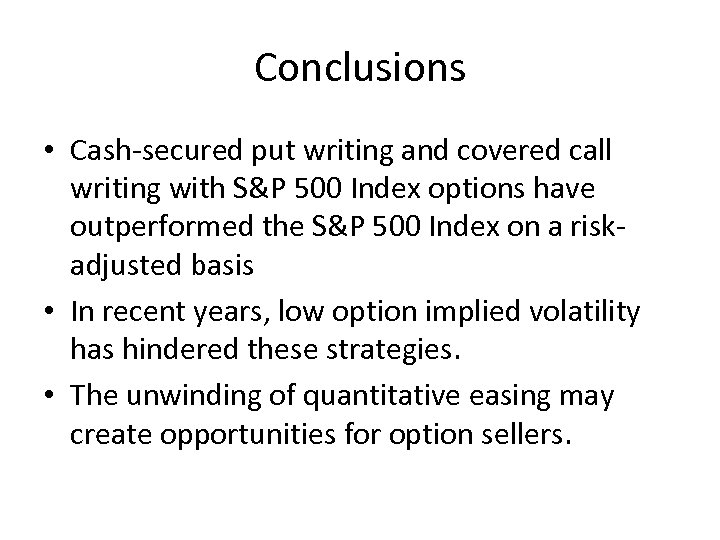

Conclusions • Cash-secured put writing and covered call writing with S&P 500 Index options have outperformed the S&P 500 Index on a riskadjusted basis • In recent years, low option implied volatility has hindered these strategies. • The unwinding of quantitative easing may create opportunities for option sellers.

Conclusions • Cash-secured put writing and covered call writing with S&P 500 Index options have outperformed the S&P 500 Index on a riskadjusted basis • In recent years, low option implied volatility has hindered these strategies. • The unwinding of quantitative easing may create opportunities for option sellers.

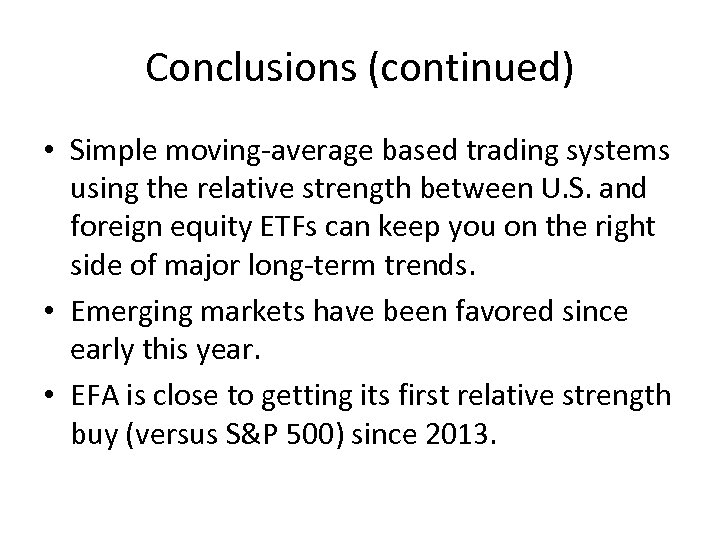

Conclusions (continued) • Simple moving-average based trading systems using the relative strength between U. S. and foreign equity ETFs can keep you on the right side of major long-term trends. • Emerging markets have been favored since early this year. • EFA is close to getting its first relative strength buy (versus S&P 500) since 2013.

Conclusions (continued) • Simple moving-average based trading systems using the relative strength between U. S. and foreign equity ETFs can keep you on the right side of major long-term trends. • Emerging markets have been favored since early this year. • EFA is close to getting its first relative strength buy (versus S&P 500) since 2013.

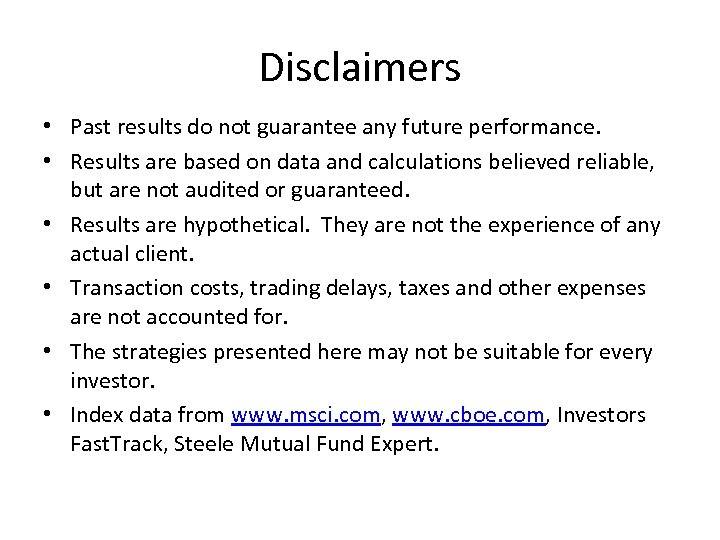

Disclaimers • Past results do not guarantee any future performance. • Results are based on data and calculations believed reliable, but are not audited or guaranteed. • Results are hypothetical. They are not the experience of any actual client. • Transaction costs, trading delays, taxes and other expenses are not accounted for. • The strategies presented here may not be suitable for every investor. • Index data from www. msci. com, www. cboe. com, Investors Fast. Track, Steele Mutual Fund Expert.

Disclaimers • Past results do not guarantee any future performance. • Results are based on data and calculations believed reliable, but are not audited or guaranteed. • Results are hypothetical. They are not the experience of any actual client. • Transaction costs, trading delays, taxes and other expenses are not accounted for. • The strategies presented here may not be suitable for every investor. • Index data from www. msci. com, www. cboe. com, Investors Fast. Track, Steele Mutual Fund Expert.

My investment newsletter: www. systemsandforecasts. com Visit our website to sign up for a free trial.

My investment newsletter: www. systemsandforecasts. com Visit our website to sign up for a free trial.

For a copy of these slides, email me: Marvin Appel mappel@signalert. com Signalert Asset Management 525 Northern Boulevard, Suite 210 Great Neck, NY 11021 516 -829 -6444

For a copy of these slides, email me: Marvin Appel mappel@signalert. com Signalert Asset Management 525 Northern Boulevard, Suite 210 Great Neck, NY 11021 516 -829 -6444