3fb99815aed82adadc1cc6b80bc153b4.ppt

- Количество слайдов: 28

SWIFT in the Securities Business Bagin Alex Senior Regional manager Middle East, alex. bagin@swift. com Slide 1

Agenda < SWIFT short intro < SWIFT in the securities market < SMPG scope < Egypt and South Africa example Slide 2

SWIFT’s mission SWIFT is a worldwide community of financial institutions whose purpose is to be the leader in communication solutions enabling interoperability between its members, their market infrastructures and their end user communities. Slide 3

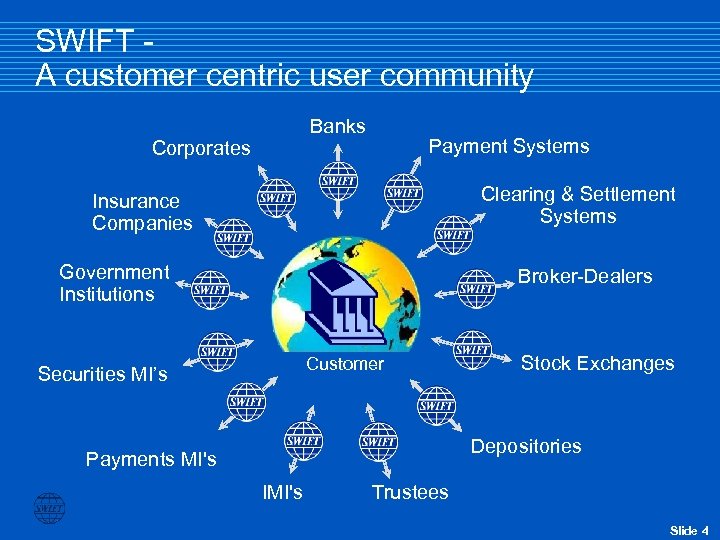

SWIFT A customer centric user community Banks Corporates Payment Systems Clearing & Settlement Systems Insurance Companies Government Institutions Broker-Dealers Customer Securities MI’s Stock Exchanges Depositories Payments MI's IMI's Trustees Slide 4

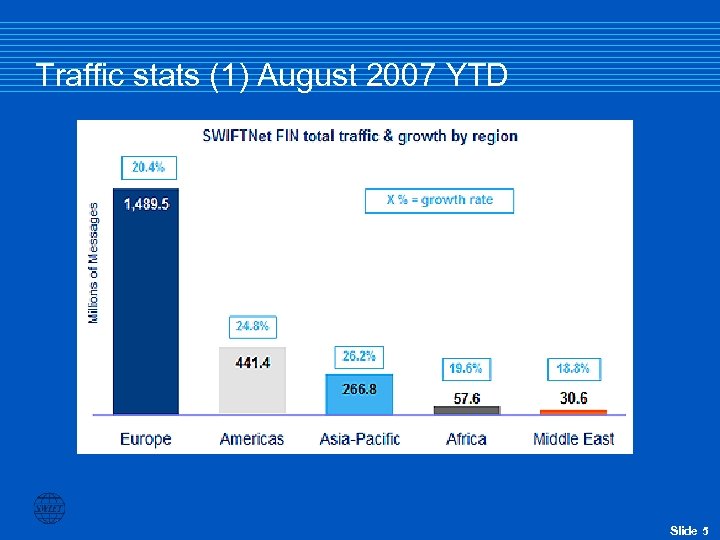

Traffic stats (1) August 2007 YTD Slide 5

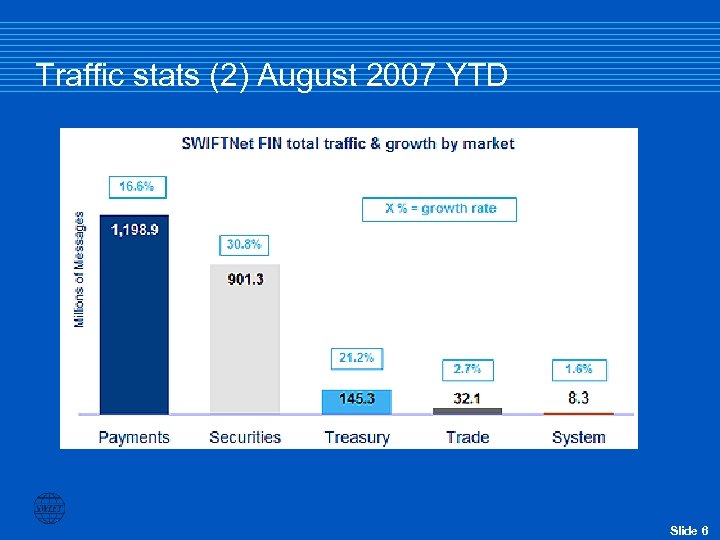

Traffic stats (2) August 2007 YTD Slide 6

Agenda < SWIFT short intro < SWIFT in the securities market < SMPG scope < Egypt and South Africa example Slide 10

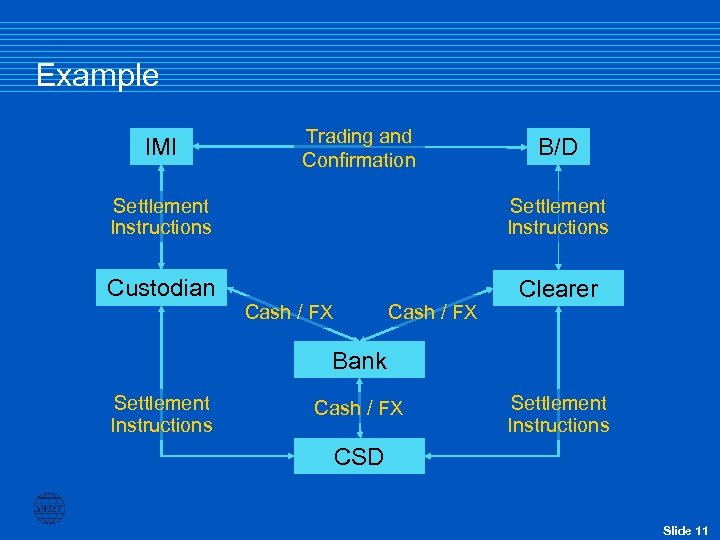

Example IMI Trading and Confirmation B/D Settlement Instructions Custodian Clearer Cash / FX Bank Settlement Instructions Cash / FX Settlement Instructions CSD Slide 11

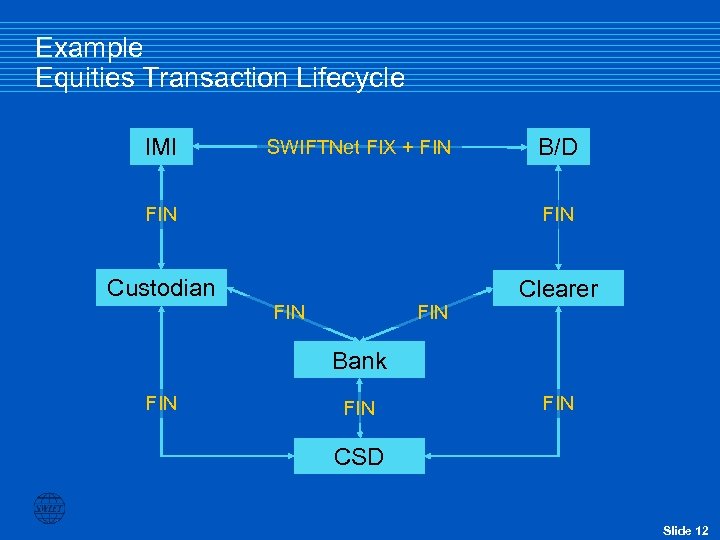

Example Equities Transaction Lifecycle IMI SWIFTNet FIX + FIN B/D FIN Custodian Clearer FIN Bank FIN FIN CSD Slide 12

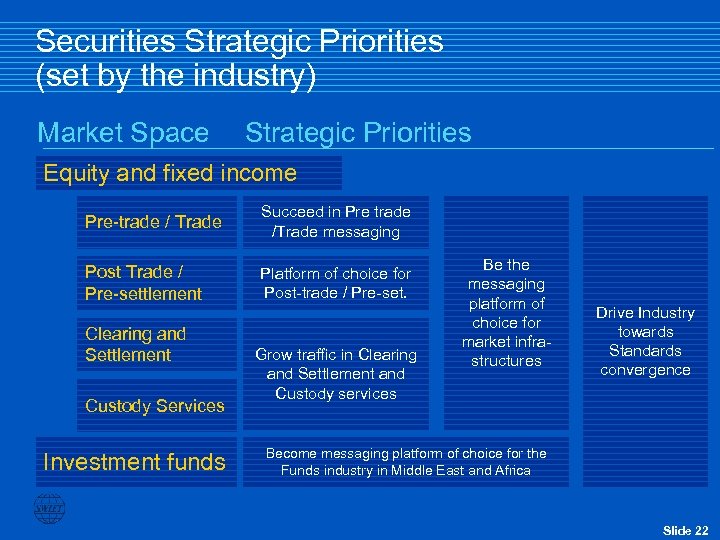

Securities Strategic Priorities (set by the industry) Market Space Strategic Priorities Equity and fixed income Pre-trade / Trade Succeed in Pre trade /Trade messaging Post Trade / Pre-settlement Platform of choice for Post-trade / Pre-set. Clearing and Settlement Custody Services Investment funds Grow traffic in Clearing and Settlement and Custody services Be the messaging platform of choice for market infrastructures Drive Industry towards Standards convergence Become messaging platform of choice for the Funds industry in Middle East and Africa Slide 22

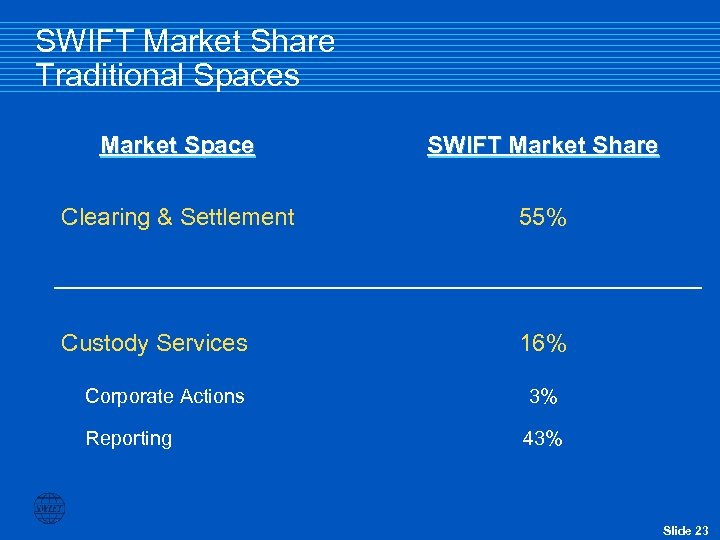

SWIFT Market Share Traditional Spaces Market Space SWIFT Market Share Clearing & Settlement 55% Custody Services 16% Corporate Actions 3% Reporting 43% Slide 23

SWIFT means value ü ü ü Straight-through-processing (STP) Scalability International Standards Cost effective solutions Security and reliability Slide 24

Agenda < SWIFT short intro < SWIFT in the securities market < SMPG scope < Egypt and South Africa example Slide 26

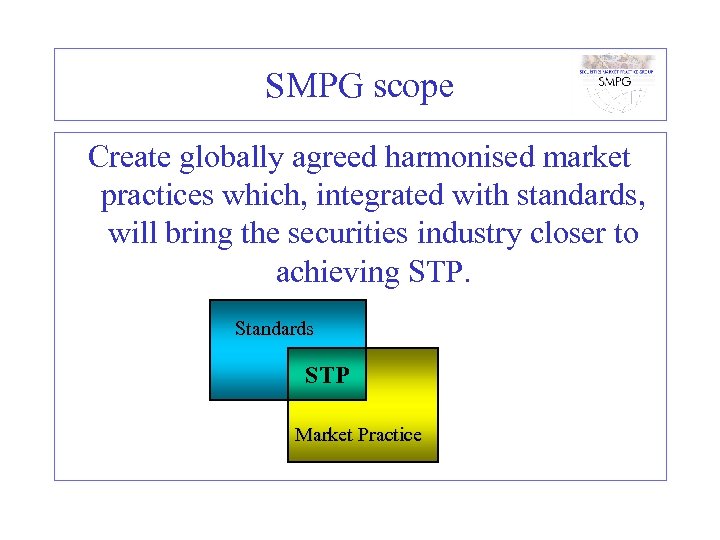

SMPG scope Create globally agreed harmonised market practices which, integrated with standards, will bring the securities industry closer to achieving STP. Standards STP Market Practice

SMPG tasks • • • Organise national market practice groups Collate national market practice rules Define cross-border market practice rules Harmonise market practice differences Publish market practice rules Identify conformance mechanisms

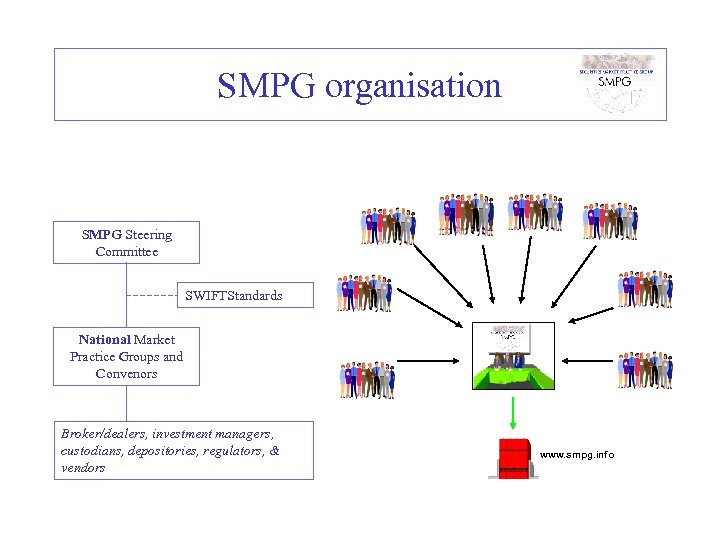

SMPG organisation SMPG Steering Committee SWIFTStandards National Market Practice Groups and Convenors Broker/dealers, investment managers, custodians, depositories, regulators, & vendors www. smpg. info

SMPG meetings • At National level: – Whenever felt appropriate – Minimum twice a year • At Global level – 2 times a year – Amsterdam (28 -30 March 2007) draft minutes available on smpg. info – Boston (5 -6 October 2007)

SMPG countries • Americas: BR, CA, MX, US. • EMEA: AT, BE, CH, DE, DK, ES, FI, FR, GB, IE, IL, IT, LU, NL, NO, PL, PT, RU, SE, TR, ZA, ICSDs • Asia/Pacific: AU, HK, JP, KR, NZ, SG, TH, TW, IN

Agenda < SWIFT short intro < SWIFT in the securities market < SMPG scope < Egypt and South Africa example Slide 32

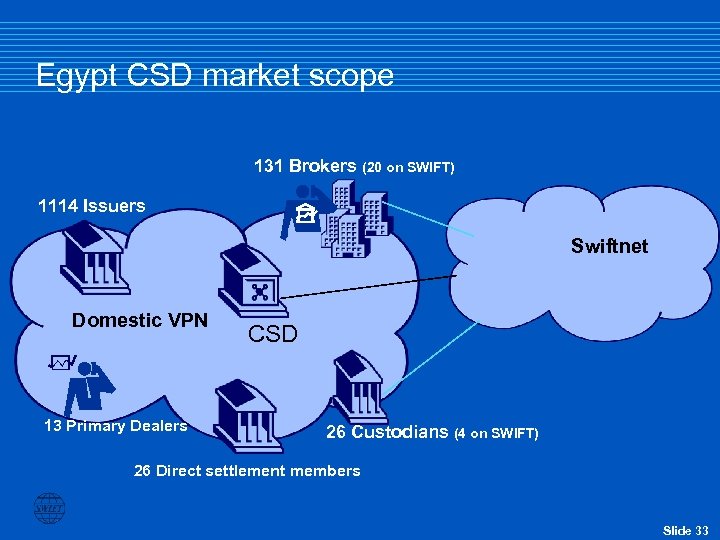

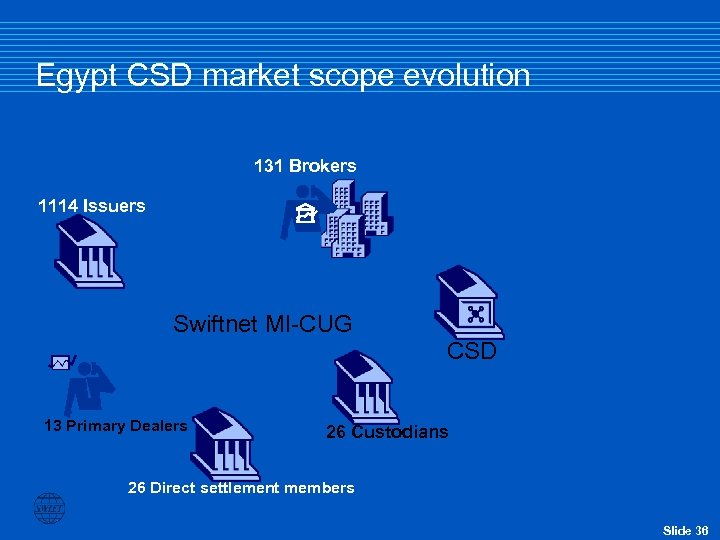

Egypt CSD market scope 131 Brokers (20 on SWIFT) 1114 Issuers Swiftnet Domestic VPN 13 Primary Dealers CSD 26 Custodians (4 on SWIFT) 26 Direct settlement members Slide 33

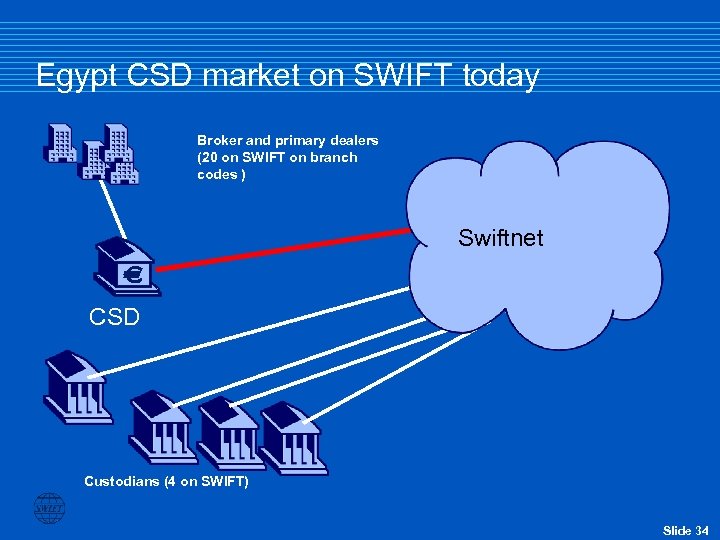

Egypt CSD market on SWIFT today Broker and primary dealers (20 on SWIFT on branch codes ) SWIFTNet Swiftnet CSD Custodians (4 on SWIFT) Slide 34

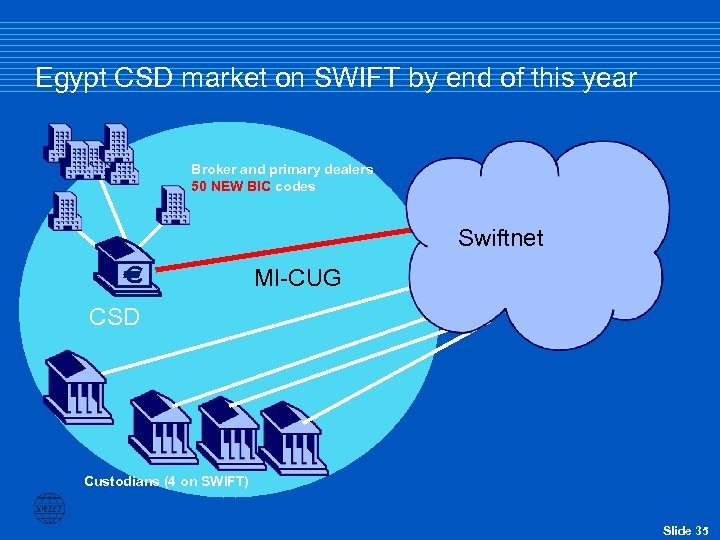

Egypt CSD market on SWIFT by end of this year Broker and primary dealers 50 NEW BIC codes SWIFTNet Swiftnet MI-CUG CSD Custodians (4 on SWIFT) Slide 35

Egypt CSD market scope evolution 131 Brokers 1114 Issuers Swiftnet MI-CUG CSD 13 Primary Dealers 26 Custodians 26 Direct settlement members Slide 36

Agenda < SWIFT short intro < SWIFT in the securities market < SMPG scope < Egypt and South Africa example Slide 37

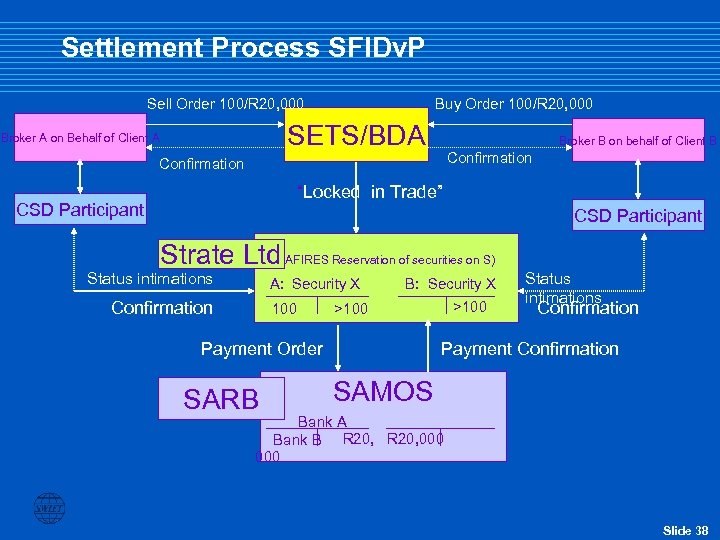

Settlement Process SFIDv. P Sell Order 100/R 20, 000 Buy Order 100/R 20, 000 SETS/BDA Broker A on Behalf of Client A Broker B on behalf of Client B Confirmation “Locked in Trade” CSD Participant Strate Ltd. SAFIRES Reservation of securities on S) Status intimations A: Security X Confirmation 100 B: Security X Payment Order SARB >100 Status intimations Confirmation Payment Confirmation SAMOS Bank A Bank B R 20, 000 Slide 38

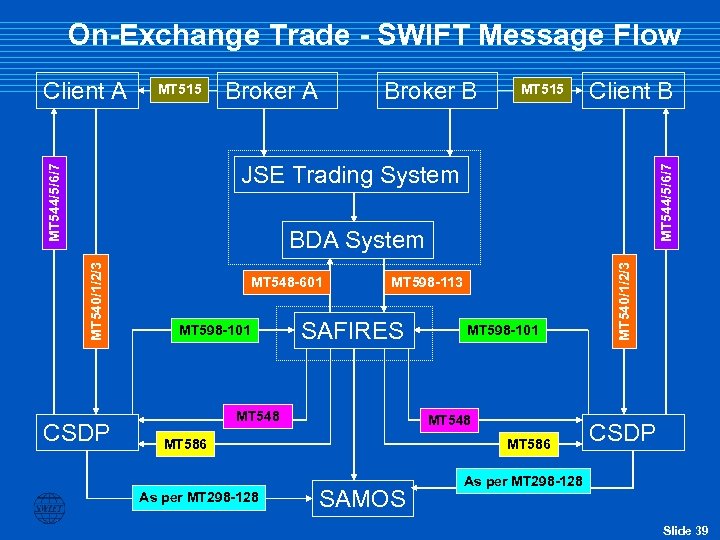

On-Exchange Trade - SWIFT Message Flow Client A MT 515 Broker A Broker B MT 515 Client B MT 544/5/6/7 JSE Trading System CSDP MT 548 -601 MT 598 -113 SAFIRES MT 548 MT 586 As per MT 298 -128 MT 598 -101 MT 586 SAMOS MT 540/1/2/3 BDA System CSDP As per MT 298 -128 Slide 39

SWIFT Middle East regional conference 2008 17, 18 and 19 March, Conrad Hotel, Cairo, Egypt Slide 42

Shoucran Slide 43

3fb99815aed82adadc1cc6b80bc153b4.ppt