c4e217168d9704de3c19d99d60e6e947.ppt

- Количество слайдов: 18

Swedish American Life Science Summit 2009 August 2009

Swedish American Life Science Summit 2009 August 2009

Private Equity in Life Science • Listed private equity company that builds successful life science companies together with inventors – – – Select right concepts Contribute with entrepreneurship and capital Formed in 1998 • Balanced portfolio currently with 12 companies and 1 wholly owned subsidiary – – – 4 in drug development and biotechnology 8 in diagnostics and medical technology/device 1 sales and distribution company Link. Med’s goals and objectives are • To generate a healthy return on shareholders’ equity, sustaining an average return of more than 20 percent per year over a five year period • To be a preferred partner for innovators and other venture capital investors within the area of life science • To be a leading listed private equity player within the area of life science in Sweden, thereby providing the opportunity to invest in unlisted R&D life science companies

Private Equity in Life Science • Listed private equity company that builds successful life science companies together with inventors – – – Select right concepts Contribute with entrepreneurship and capital Formed in 1998 • Balanced portfolio currently with 12 companies and 1 wholly owned subsidiary – – – 4 in drug development and biotechnology 8 in diagnostics and medical technology/device 1 sales and distribution company Link. Med’s goals and objectives are • To generate a healthy return on shareholders’ equity, sustaining an average return of more than 20 percent per year over a five year period • To be a preferred partner for innovators and other venture capital investors within the area of life science • To be a leading listed private equity player within the area of life science in Sweden, thereby providing the opportunity to invest in unlisted R&D life science companies

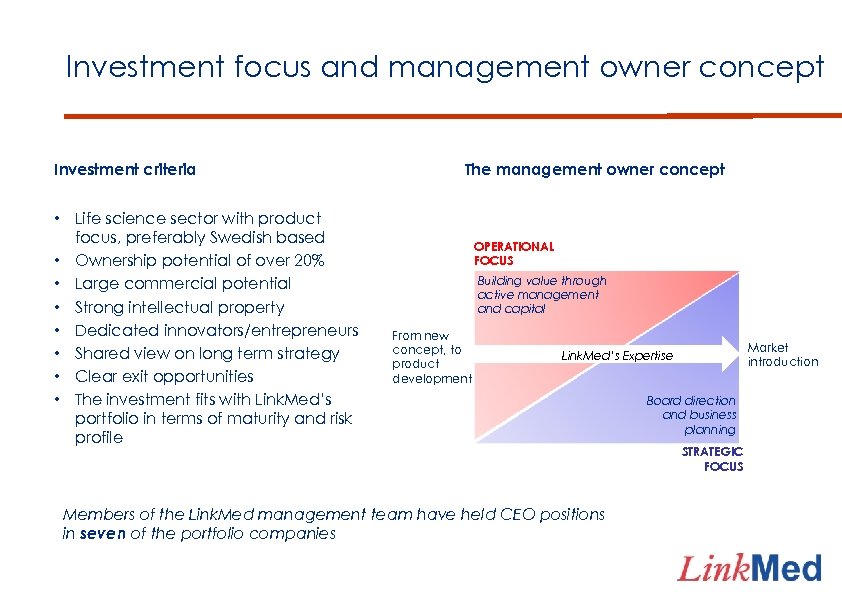

Investment focus and management owner concept Investment criteria • Life science sector with product focus, preferably Swedish based • Ownership potential of over 20% • Large commercial potential • Strong intellectual property • Dedicated innovators/entrepreneurs • Shared view on long term strategy • Clear exit opportunities • The investment fits with Link. Med’s portfolio in terms of maturity and risk profile The management owner concept OPERATIONAL FOCUS Building value through active management and capital From new concept, to product development Market introduction Link. Med’s Expertise Members of the Link. Med management team have held CEO positions in seven of the portfolio companies Board direction and business planning STRATEGIC FOCUS

Investment focus and management owner concept Investment criteria • Life science sector with product focus, preferably Swedish based • Ownership potential of over 20% • Large commercial potential • Strong intellectual property • Dedicated innovators/entrepreneurs • Shared view on long term strategy • Clear exit opportunities • The investment fits with Link. Med’s portfolio in terms of maturity and risk profile The management owner concept OPERATIONAL FOCUS Building value through active management and capital From new concept, to product development Market introduction Link. Med’s Expertise Members of the Link. Med management team have held CEO positions in seven of the portfolio companies Board direction and business planning STRATEGIC FOCUS

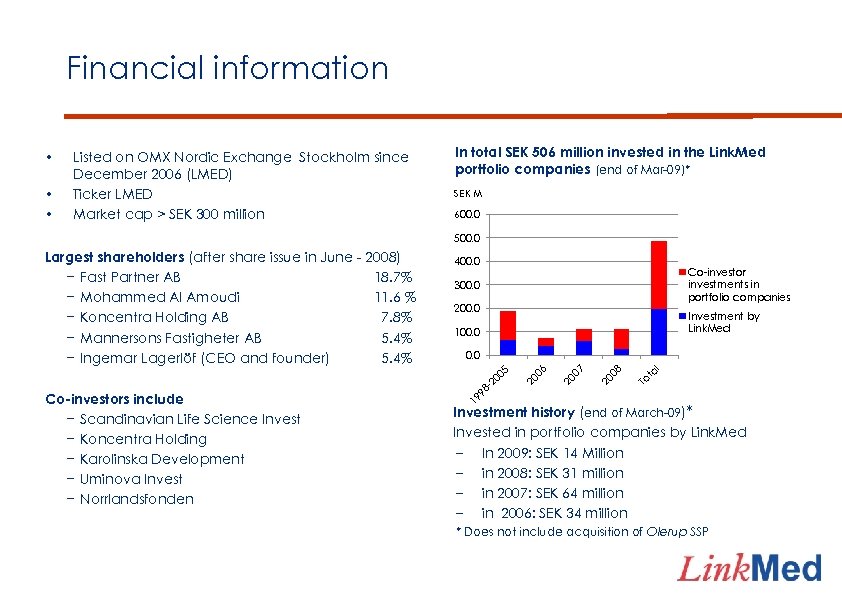

Financial information • • • Listed on OMX Nordic Exchange Stockholm since December 2006 (LMED) Ticker LMED Market cap > SEK 300 million In total SEK 506 million invested in the Link. Med portfolio companies (end of Mar-09)* SEK M 600. 0 500. 0 400. 0 Co-investor investments in portfolio companies 300. 0 200. 0 Investment by Link. Med 100. 0 l ta To 08 20 07 20 20 -2 0 98 19 Co-investors include − Scandinavian Life Science Invest − Koncentra Holding − Karolinska Development − Uminova Invest − Norrlandsfonden 06 0. 0 05 Largest shareholders (after share issue in June - 2008) − Fast Partner AB 18. 7% − Mohammed Al Amoudi 11. 6 % − Koncentra Holding AB 7. 8% − Mannersons Fastigheter AB 5. 4% − Ingemar Lagerlöf (CEO and founder) 5. 4% Investment history (end of March-09)* Invested in portfolio companies by Link. Med – In 2009: SEK 14 Million – in 2008: SEK 31 million – in 2007: SEK 64 million – in 2006: SEK 34 million * Does not include acquisition of Olerup SSP

Financial information • • • Listed on OMX Nordic Exchange Stockholm since December 2006 (LMED) Ticker LMED Market cap > SEK 300 million In total SEK 506 million invested in the Link. Med portfolio companies (end of Mar-09)* SEK M 600. 0 500. 0 400. 0 Co-investor investments in portfolio companies 300. 0 200. 0 Investment by Link. Med 100. 0 l ta To 08 20 07 20 20 -2 0 98 19 Co-investors include − Scandinavian Life Science Invest − Koncentra Holding − Karolinska Development − Uminova Invest − Norrlandsfonden 06 0. 0 05 Largest shareholders (after share issue in June - 2008) − Fast Partner AB 18. 7% − Mohammed Al Amoudi 11. 6 % − Koncentra Holding AB 7. 8% − Mannersons Fastigheter AB 5. 4% − Ingemar Lagerlöf (CEO and founder) 5. 4% Investment history (end of March-09)* Invested in portfolio companies by Link. Med – In 2009: SEK 14 Million – in 2008: SEK 31 million – in 2007: SEK 64 million – in 2006: SEK 34 million * Does not include acquisition of Olerup SSP

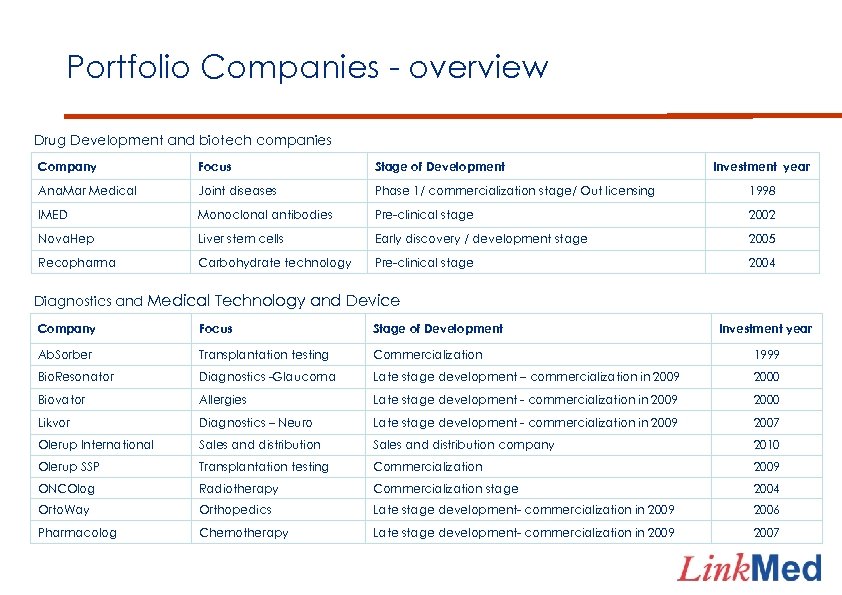

Portfolio Companies - overview Drug Development and biotech companies Company Focus Stage of Development Investment year Ana. Mar Medical Joint diseases Phase 1/ commercialization stage/ Out licensing 1998 IMED Monoclonal antibodies Pre-clinical stage 2002 Nova. Hep Liver stem cells Early discovery / development stage 2005 Recopharma Carbohydrate technology Pre-clinical stage 2004 Diagnostics and Medical Technology and Device Company Focus Stage of Development Investment year Ab. Sorber Transplantation testing Commercialization 1999 Bio. Resonator Diagnostics -Glaucoma Late stage development – commercialization in 2009 2000 Biovator Allergies Late stage development - commercialization in 2009 2000 Likvor Diagnostics – Neuro Late stage development - commercialization in 2009 2007 Olerup International Sales and distribution company 2010 Olerup SSP Transplantation testing Commercialization 2009 ONCOlog Radiotherapy Commercialization stage 2004 Orto. Way Orthopedics Late stage development- commercialization in 2009 2006 Pharmacolog Chemotherapy Late stage development- commercialization in 2009 2007

Portfolio Companies - overview Drug Development and biotech companies Company Focus Stage of Development Investment year Ana. Mar Medical Joint diseases Phase 1/ commercialization stage/ Out licensing 1998 IMED Monoclonal antibodies Pre-clinical stage 2002 Nova. Hep Liver stem cells Early discovery / development stage 2005 Recopharma Carbohydrate technology Pre-clinical stage 2004 Diagnostics and Medical Technology and Device Company Focus Stage of Development Investment year Ab. Sorber Transplantation testing Commercialization 1999 Bio. Resonator Diagnostics -Glaucoma Late stage development – commercialization in 2009 2000 Biovator Allergies Late stage development - commercialization in 2009 2000 Likvor Diagnostics – Neuro Late stage development - commercialization in 2009 2007 Olerup International Sales and distribution company 2010 Olerup SSP Transplantation testing Commercialization 2009 ONCOlog Radiotherapy Commercialization stage 2004 Orto. Way Orthopedics Late stage development- commercialization in 2009 2006 Pharmacolog Chemotherapy Late stage development- commercialization in 2009 2007

Ab. Sorber XM-ONE® - new transplantation crossmatch test • XM-ONE® is unique in that it is the first standardized test that can detect antibodies against the cells that line the inside of blood vessels • These endothelial cells are the first point of contact between the transplanted organ and the recipient’s immune system • Anti-endothelial cell antibodies have been shown to play a key role in causing post-transplantation rejections • Focus on kidney transplantation • CE market for sales in the EU countries • FDA registered for sales in the US World market • • 75, 000 organs are transplanted annually and of those 55, 000 are kidneys US market stands for one third of all organ transplantations • First US order in January 2009 from UCLA

Ab. Sorber XM-ONE® - new transplantation crossmatch test • XM-ONE® is unique in that it is the first standardized test that can detect antibodies against the cells that line the inside of blood vessels • These endothelial cells are the first point of contact between the transplanted organ and the recipient’s immune system • Anti-endothelial cell antibodies have been shown to play a key role in causing post-transplantation rejections • Focus on kidney transplantation • CE market for sales in the EU countries • FDA registered for sales in the US World market • • 75, 000 organs are transplanted annually and of those 55, 000 are kidneys US market stands for one third of all organ transplantations • First US order in January 2009 from UCLA

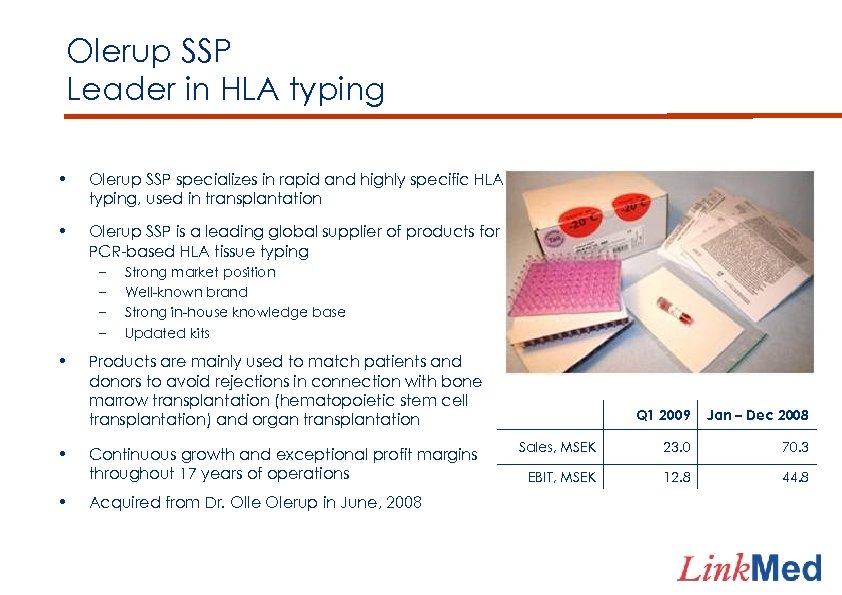

Olerup SSP Leader in HLA typing • Olerup SSP specializes in rapid and highly specific HLA typing, used in transplantation • Olerup SSP is a leading global supplier of products for PCR-based HLA tissue typing – – • • • Strong market position Well-known brand Strong in-house knowledge base Updated kits Products are mainly used to match patients and donors to avoid rejections in connection with bone marrow transplantation (hematopoietic stem cell transplantation) and organ transplantation Continuous growth and exceptional profit margins throughout 17 years of operations Acquired from Dr. Olle Olerup in June, 2008 Q 1 2009 Jan – Dec 2008 Sales, MSEK 23. 0 70. 3 EBIT, MSEK 12. 8 44. 8

Olerup SSP Leader in HLA typing • Olerup SSP specializes in rapid and highly specific HLA typing, used in transplantation • Olerup SSP is a leading global supplier of products for PCR-based HLA tissue typing – – • • • Strong market position Well-known brand Strong in-house knowledge base Updated kits Products are mainly used to match patients and donors to avoid rejections in connection with bone marrow transplantation (hematopoietic stem cell transplantation) and organ transplantation Continuous growth and exceptional profit margins throughout 17 years of operations Acquired from Dr. Olle Olerup in June, 2008 Q 1 2009 Jan – Dec 2008 Sales, MSEK 23. 0 70. 3 EBIT, MSEK 12. 8 44. 8

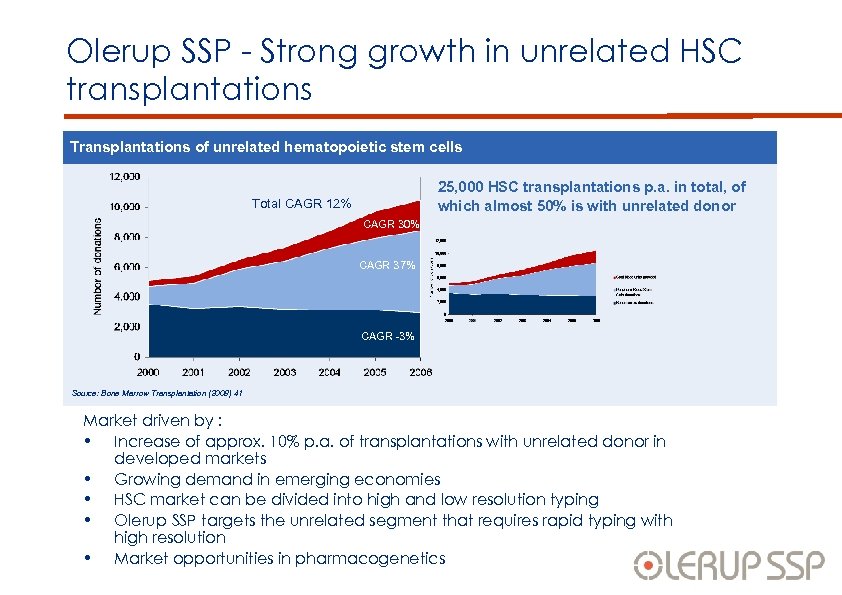

Olerup SSP - Strong growth in unrelated HSC transplantations Transplantations of unrelated hematopoietic stem cells 25, 000 HSC transplantations p. a. in total, of which almost 50% is with unrelated donor Total CAGR 12% CAGR 30% CAGR 37% CAGR -3% Source: Bone Marrow Transplantation (2008) 41 Market driven by : • Increase of approx. 10% p. a. of transplantations with unrelated donor in developed markets • Growing demand in emerging economies • HSC market can be divided into high and low resolution typing • Olerup SSP targets the unrelated segment that requires rapid typing with high resolution • Market opportunities in pharmacogenetics

Olerup SSP - Strong growth in unrelated HSC transplantations Transplantations of unrelated hematopoietic stem cells 25, 000 HSC transplantations p. a. in total, of which almost 50% is with unrelated donor Total CAGR 12% CAGR 30% CAGR 37% CAGR -3% Source: Bone Marrow Transplantation (2008) 41 Market driven by : • Increase of approx. 10% p. a. of transplantations with unrelated donor in developed markets • Growing demand in emerging economies • HSC market can be divided into high and low resolution typing • Olerup SSP targets the unrelated segment that requires rapid typing with high resolution • Market opportunities in pharmacogenetics

Opportunities to build Developing companies Challenges − Cash − Market knowledge and reach Prospect − Growth opportunities New identity - Products on the market - Steady cash flow - Strong growth opportunities Cash flow generating companies Challenges − Future sales growth − New products Prospect − Sustainable cash flow - Opportunities to acquire new companies or products Further growth opportunities

Opportunities to build Developing companies Challenges − Cash − Market knowledge and reach Prospect − Growth opportunities New identity - Products on the market - Steady cash flow - Strong growth opportunities Cash flow generating companies Challenges − Future sales growth − New products Prospect − Sustainable cash flow - Opportunities to acquire new companies or products Further growth opportunities

Olerup International – global distribution and sales company recent acquisition and Joint Venture • Olerup International is an global distribution and sales company with two subsidiaries Olerup Gmb. H and Olerup Inc. Olerup Gmb. H with an office in Vienna, and Olerup Inc. with an office in West Chester, PA. • Acquired QIAGEN Gmb. H, Vienna, in June, 2008 now Olerup Gmb. H • Take over of key HLA skilled personnel plus infrastructure from Nor. Diag Inc West Chester, PA, USA – formed Joint Venture with Nor. Diag a Norwegian biotech company to make this work • Global sales organization handling sales of Olerup SSP typing kits and Absorbers XM-One® and other products in the transplantation field including product from Nor. Diag • Gives full control over sales and products get to a better margin • Enhance the opportunity to add other products from outside the group

Olerup International – global distribution and sales company recent acquisition and Joint Venture • Olerup International is an global distribution and sales company with two subsidiaries Olerup Gmb. H and Olerup Inc. Olerup Gmb. H with an office in Vienna, and Olerup Inc. with an office in West Chester, PA. • Acquired QIAGEN Gmb. H, Vienna, in June, 2008 now Olerup Gmb. H • Take over of key HLA skilled personnel plus infrastructure from Nor. Diag Inc West Chester, PA, USA – formed Joint Venture with Nor. Diag a Norwegian biotech company to make this work • Global sales organization handling sales of Olerup SSP typing kits and Absorbers XM-One® and other products in the transplantation field including product from Nor. Diag • Gives full control over sales and products get to a better margin • Enhance the opportunity to add other products from outside the group

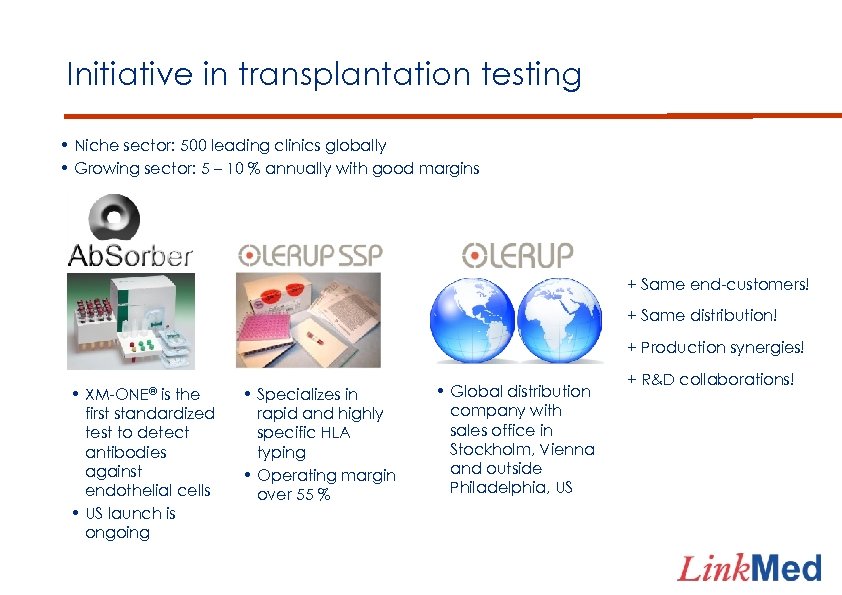

Initiative in transplantation testing • Niche sector: 500 leading clinics globally • Growing sector: 5 – 10 % annually with good margins + Same end-customers! + Same distribution! + Production synergies! • XM-ONE® is the first standardized test to detect antibodies against endothelial cells • US launch is ongoing • Specializes in rapid and highly specific HLA typing • Operating margin over 55 % • Global distribution company with sales office in Stockholm, Vienna and outside Philadelphia, US + R&D collaborations!

Initiative in transplantation testing • Niche sector: 500 leading clinics globally • Growing sector: 5 – 10 % annually with good margins + Same end-customers! + Same distribution! + Production synergies! • XM-ONE® is the first standardized test to detect antibodies against endothelial cells • US launch is ongoing • Specializes in rapid and highly specific HLA typing • Operating margin over 55 % • Global distribution company with sales office in Stockholm, Vienna and outside Philadelphia, US + R&D collaborations!

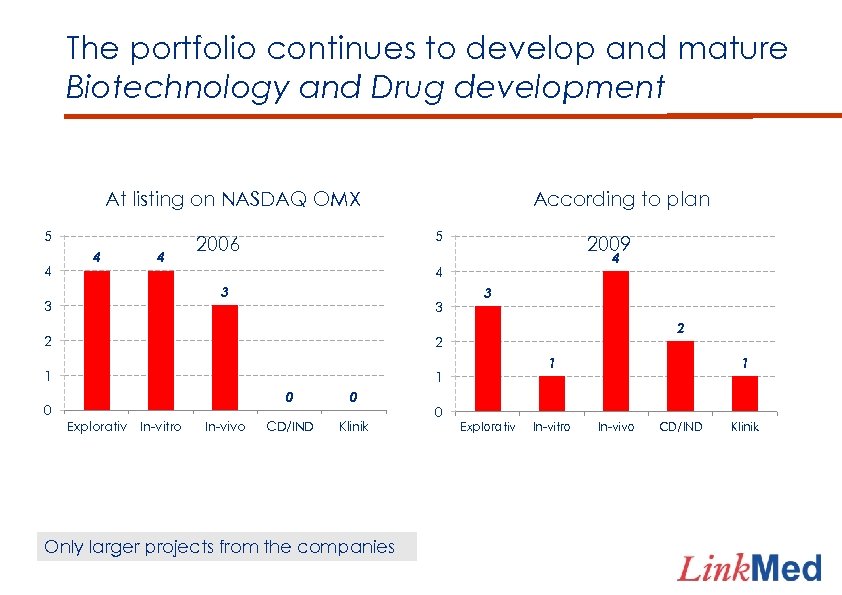

The portfolio continues to develop and mature Biotechnology and Drug development At listing on NASDAQ OMX 5 4 4 4 5 2006 2009 4 4 3 3 According to plan 3 2 2 2 1 3 1 0 0 Explorativ In-vitro In-vivo 0 CD/IND Klinik Only larger projects from the companies 0 1 Explorativ In-vitro 1 In-vivo CD/IND Klinik

The portfolio continues to develop and mature Biotechnology and Drug development At listing on NASDAQ OMX 5 4 4 4 5 2006 2009 4 4 3 3 According to plan 3 2 2 2 1 3 1 0 0 Explorativ In-vitro In-vivo 0 CD/IND Klinik Only larger projects from the companies 0 1 Explorativ In-vitro 1 In-vivo CD/IND Klinik

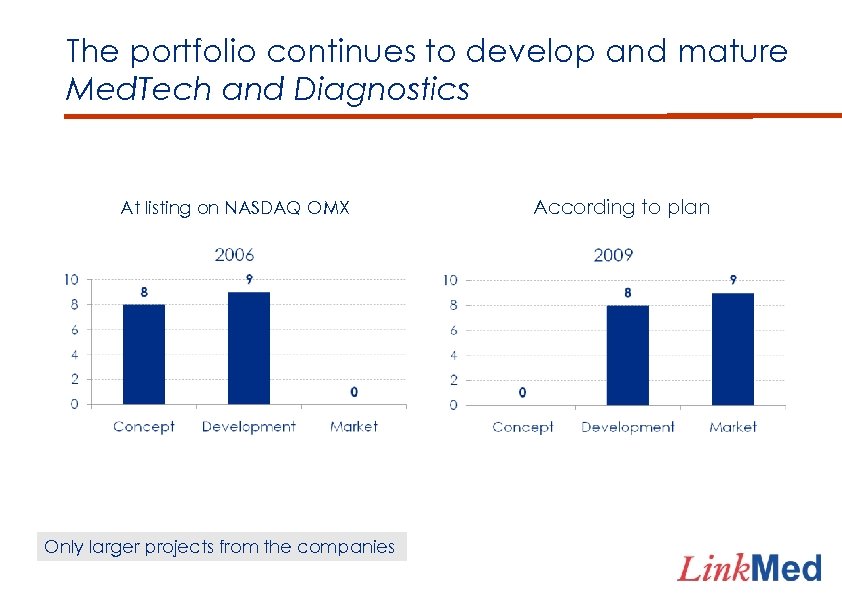

The portfolio continues to develop and mature Med. Tech and Diagnostics At listing on NASDAQ OMX Only larger projects from the companies According to plan

The portfolio continues to develop and mature Med. Tech and Diagnostics At listing on NASDAQ OMX Only larger projects from the companies According to plan

Portfolio companies selling on the market A number of Biomarkers XM-ONE® for USA and Europe More than 300 typing kits A number of products within radiotherapy

Portfolio companies selling on the market A number of Biomarkers XM-ONE® for USA and Europe More than 300 typing kits A number of products within radiotherapy

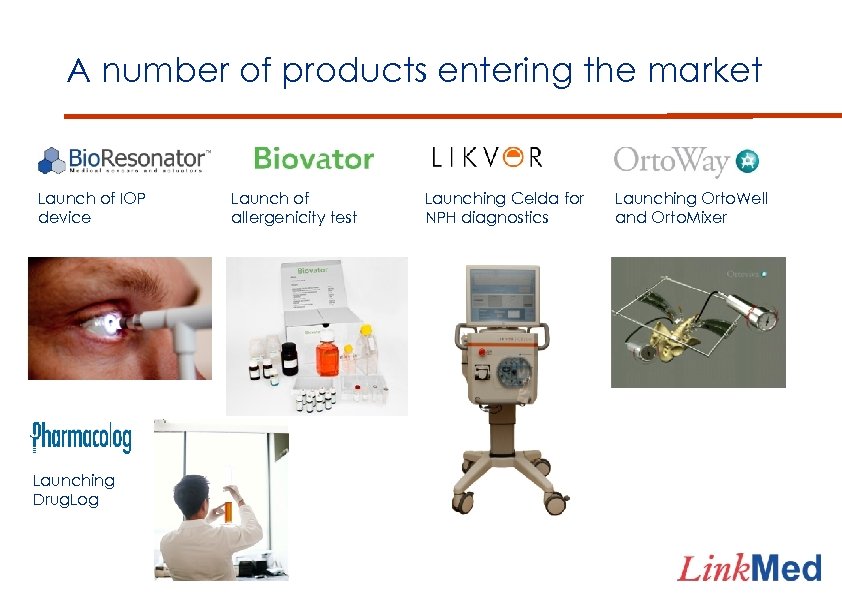

A number of products entering the market Launch of IOP device Launching Drug. Log Launch of allergenicity test Launching Celda for NPH diagnostics Launching Orto. Well and Orto. Mixer

A number of products entering the market Launch of IOP device Launching Drug. Log Launch of allergenicity test Launching Celda for NPH diagnostics Launching Orto. Well and Orto. Mixer

High expectations going forward Orto. Well: Instrumentation system for the controlled separation of vertebrae and accurate placement of artificial spinal implants or otherapies, CE marked in December 2008 Orto. Mixer: The bone cement preparation and administration system Likvor’s diagnostic breakthrough instrument for assessment of the CSF dynamics will be ready later in 2009. It will help neurologist and neurosurgeons to diagnose patients with Normal Pressure Hydrocephalus (NPH). It can also be used to check if a patient’s shunt is working properly Ana. Mar is currently running clinical phase testing with their compound against rheumatoid arthritis and osteoarthritis, results later in 2009 Biovator’s first test that predicts whether chemical substances may cause allergies will be introduced to the market. It will dramatically reduce the use of animal testing. Successful launch of XM-ONE in the US and increased sales force in Europe together with Olerup International

High expectations going forward Orto. Well: Instrumentation system for the controlled separation of vertebrae and accurate placement of artificial spinal implants or otherapies, CE marked in December 2008 Orto. Mixer: The bone cement preparation and administration system Likvor’s diagnostic breakthrough instrument for assessment of the CSF dynamics will be ready later in 2009. It will help neurologist and neurosurgeons to diagnose patients with Normal Pressure Hydrocephalus (NPH). It can also be used to check if a patient’s shunt is working properly Ana. Mar is currently running clinical phase testing with their compound against rheumatoid arthritis and osteoarthritis, results later in 2009 Biovator’s first test that predicts whether chemical substances may cause allergies will be introduced to the market. It will dramatically reduce the use of animal testing. Successful launch of XM-ONE in the US and increased sales force in Europe together with Olerup International

Why invest in Link. Med? • • • Portfolio of select companies Strong and dedicated management Liquidity in the share Transparency and governance of the company Less risk Unique opportunity to reach unlisted Nordic life science companies Several companies on the edge of breakthrough with products ready for the market Attractive valuation Strong cash position after a successful share issue Leading private equity life science

Why invest in Link. Med? • • • Portfolio of select companies Strong and dedicated management Liquidity in the share Transparency and governance of the company Less risk Unique opportunity to reach unlisted Nordic life science companies Several companies on the edge of breakthrough with products ready for the market Attractive valuation Strong cash position after a successful share issue Leading private equity life science

Swedish American Life Science Summit 2009 August 2009 www. linkmed. se

Swedish American Life Science Summit 2009 August 2009 www. linkmed. se