cbd4a4e384bc4889807533d80f4d5276.ppt

- Количество слайдов: 14

Sustaining IGR in a Conflict Zone - A case situation of Yobe State Presented by: Ali Usman Ahmed BSc; MSc; CPA; MNIM The Chair, Yobe State Board of Internal Revenue NGF Peer Learning Workshop, Abuja 16 th November, 2015

Sustaining IGR in a Conflict Zone - A case situation of Yobe State Presented by: Ali Usman Ahmed BSc; MSc; CPA; MNIM The Chair, Yobe State Board of Internal Revenue NGF Peer Learning Workshop, Abuja 16 th November, 2015

Background of the State Yobe was carved out of former Borno State in 1991 State has relatively small population and low business activities Main preoccupation of the populace is subsistence farming The state has enormous untapped resources that could bring about economic growth and its attendant boost to Internally Generated Revenue (IGR) Govt is the main employer of labour as there are no much industries & other organized ventures IGR of the state has been relatively low

Background of the State Yobe was carved out of former Borno State in 1991 State has relatively small population and low business activities Main preoccupation of the populace is subsistence farming The state has enormous untapped resources that could bring about economic growth and its attendant boost to Internally Generated Revenue (IGR) Govt is the main employer of labour as there are no much industries & other organized ventures IGR of the state has been relatively low

Effects of Insurgency General effects ◦ It destabilizes and disrupts activities in all aspect ◦ Economic activities slow down significantly, and at times comes to complete standstill ◦ Patronage by outsiders become minimal Specific effects on revenue generation ◦ Tax liabilities and responsibilities are no longer priorities to the potential taxpayers Often leading to abandoning their responsibility of paying tax State’s revenue was at the lowest in 2012 when the crisis was at its peak ◦ Tax administration faces security challenges in carrying out necessary assessment and collection ◦ Security considerations and expenses overshadow traditional govt. activities that enable MDAs realize revenue

Effects of Insurgency General effects ◦ It destabilizes and disrupts activities in all aspect ◦ Economic activities slow down significantly, and at times comes to complete standstill ◦ Patronage by outsiders become minimal Specific effects on revenue generation ◦ Tax liabilities and responsibilities are no longer priorities to the potential taxpayers Often leading to abandoning their responsibility of paying tax State’s revenue was at the lowest in 2012 when the crisis was at its peak ◦ Tax administration faces security challenges in carrying out necessary assessment and collection ◦ Security considerations and expenses overshadow traditional govt. activities that enable MDAs realize revenue

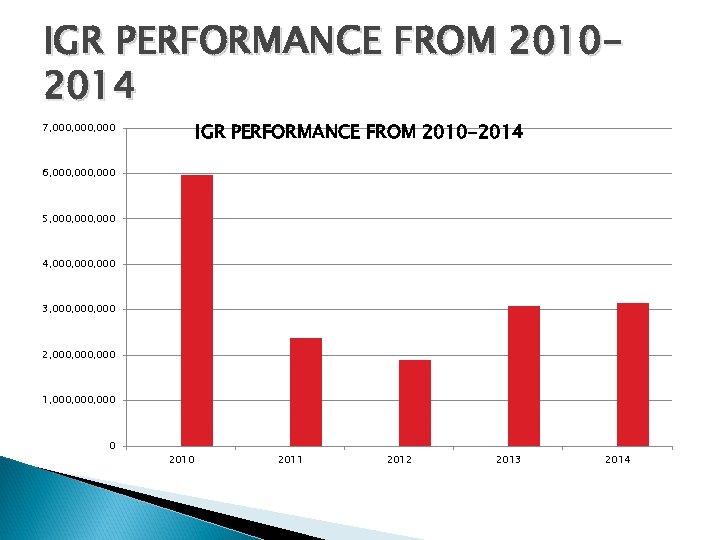

IGR PERFORMANCE FROM 20102014 IGR PERFORMANCE FROM 2010 -2014 7, 000, 000 6, 000, 000 5, 000, 000 4, 000, 000 3, 000, 000 2, 000, 000 1, 000, 000 0 2011 2012 2013 2014

IGR PERFORMANCE FROM 20102014 IGR PERFORMANCE FROM 2010 -2014 7, 000, 000 6, 000, 000 5, 000, 000 4, 000, 000 3, 000, 000 2, 000, 000 1, 000, 000 0 2011 2012 2013 2014

Legal and Administrative Setup The Board derives its legal status from the establishment Acts inherited from former Borno State A Bill for establishing an autonomous Board is being processed by the state government Staff strength of the Board is 160 ◦ 9 of these are members of CITN Organizational Structure ◦ The Board has an Executive Chairman and Board Secretary that oversees departmental Directors (8 departments) ◦ The Board operates from the Headquarters and 6 Zonal offices that cater for all LGs in the state ◦ The Board has designated revenue collectors in all MDAs in the state, and a staff in Abuja

Legal and Administrative Setup The Board derives its legal status from the establishment Acts inherited from former Borno State A Bill for establishing an autonomous Board is being processed by the state government Staff strength of the Board is 160 ◦ 9 of these are members of CITN Organizational Structure ◦ The Board has an Executive Chairman and Board Secretary that oversees departmental Directors (8 departments) ◦ The Board operates from the Headquarters and 6 Zonal offices that cater for all LGs in the state ◦ The Board has designated revenue collectors in all MDAs in the state, and a staff in Abuja

Legal and Administrative Setup Cont’d The Board is making wider consultations to develop Corporate Plan ◦ To determine gaps in personnel requirements and proffer solutions ◦ To harmonise inter-departmental functions for improved service delivery ◦ To provide guide for capacity building

Legal and Administrative Setup Cont’d The Board is making wider consultations to develop Corporate Plan ◦ To determine gaps in personnel requirements and proffer solutions ◦ To harmonise inter-departmental functions for improved service delivery ◦ To provide guide for capacity building

Improvements Direct deductions of revenue at source Lead and Collecting Banks arrangement ◦ State has a central payment platform for revenues ◦ IGR remittance is thru direct lodgement into designated collection banks ◦ Mandated to automatically remit balances to lead bank at end of each month ◦ Lead bank transfers total collections to govt account within 1 st week of the following month ◦ BIR staff in MDAs crosscheck payments and issue receipts Re-establishment of Dept of Collection & Accounting ◦ This led to enhanced collection & reduced pilferage

Improvements Direct deductions of revenue at source Lead and Collecting Banks arrangement ◦ State has a central payment platform for revenues ◦ IGR remittance is thru direct lodgement into designated collection banks ◦ Mandated to automatically remit balances to lead bank at end of each month ◦ Lead bank transfers total collections to govt account within 1 st week of the following month ◦ BIR staff in MDAs crosscheck payments and issue receipts Re-establishment of Dept of Collection & Accounting ◦ This led to enhanced collection & reduced pilferage

Improvements Cont’d Taxpayers Identification Number ◦ Equipment & material have been deployed ◦ exercise could not commence last year for security concerns While waiting for TIN Project, the Board is currently planning to embark on registration exercises to boost its net tax Joint Tax Committee ◦ Chaired by BIR Chair ◦ Has representative from every LG & Min for Local Govt.

Improvements Cont’d Taxpayers Identification Number ◦ Equipment & material have been deployed ◦ exercise could not commence last year for security concerns While waiting for TIN Project, the Board is currently planning to embark on registration exercises to boost its net tax Joint Tax Committee ◦ Chaired by BIR Chair ◦ Has representative from every LG & Min for Local Govt.

Improvements Cont’d Conducts quarterly performance assessments of MDAs’ collections The Board conducts occasional in-house training and sponsors short courses Production of Revenue receipts by the Board (earlier produced by the state Treasury) Advocacy ◦ Use Radio & TV jingles ◦ Meet with various stakeholders for public enlightenment ◦ Initiated advocacy to traditional rulers & organised trade unions to solicit support in IGR

Improvements Cont’d Conducts quarterly performance assessments of MDAs’ collections The Board conducts occasional in-house training and sponsors short courses Production of Revenue receipts by the Board (earlier produced by the state Treasury) Advocacy ◦ Use Radio & TV jingles ◦ Meet with various stakeholders for public enlightenment ◦ Initiated advocacy to traditional rulers & organised trade unions to solicit support in IGR

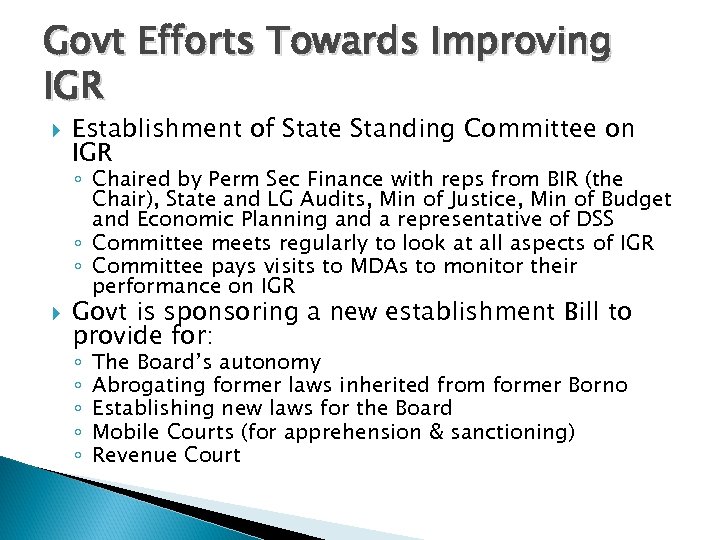

Govt Efforts Towards Improving IGR Establishment of State Standing Committee on IGR ◦ Chaired by Perm Sec Finance with reps from BIR (the Chair), State and LG Audits, Min of Justice, Min of Budget and Economic Planning and a representative of DSS ◦ Committee meets regularly to look at all aspects of IGR ◦ Committee pays visits to MDAs to monitor their performance on IGR Govt is sponsoring a new establishment Bill to provide for: ◦ ◦ ◦ The Board’s autonomy Abrogating former laws inherited from former Borno Establishing new laws for the Board Mobile Courts (for apprehension & sanctioning) Revenue Court

Govt Efforts Towards Improving IGR Establishment of State Standing Committee on IGR ◦ Chaired by Perm Sec Finance with reps from BIR (the Chair), State and LG Audits, Min of Justice, Min of Budget and Economic Planning and a representative of DSS ◦ Committee meets regularly to look at all aspects of IGR ◦ Committee pays visits to MDAs to monitor their performance on IGR Govt is sponsoring a new establishment Bill to provide for: ◦ ◦ ◦ The Board’s autonomy Abrogating former laws inherited from former Borno Establishing new laws for the Board Mobile Courts (for apprehension & sanctioning) Revenue Court

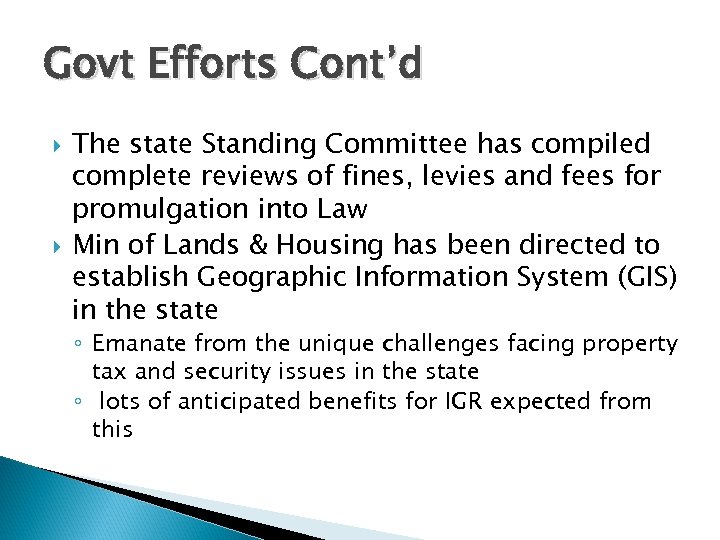

Govt Efforts Cont’d The state Standing Committee has compiled complete reviews of fines, levies and fees for promulgation into Law Min of Lands & Housing has been directed to establish Geographic Information System (GIS) in the state ◦ Emanate from the unique challenges facing property tax and security issues in the state ◦ lots of anticipated benefits for IGR expected from this

Govt Efforts Cont’d The state Standing Committee has compiled complete reviews of fines, levies and fees for promulgation into Law Min of Lands & Housing has been directed to establish Geographic Information System (GIS) in the state ◦ Emanate from the unique challenges facing property tax and security issues in the state ◦ lots of anticipated benefits for IGR expected from this

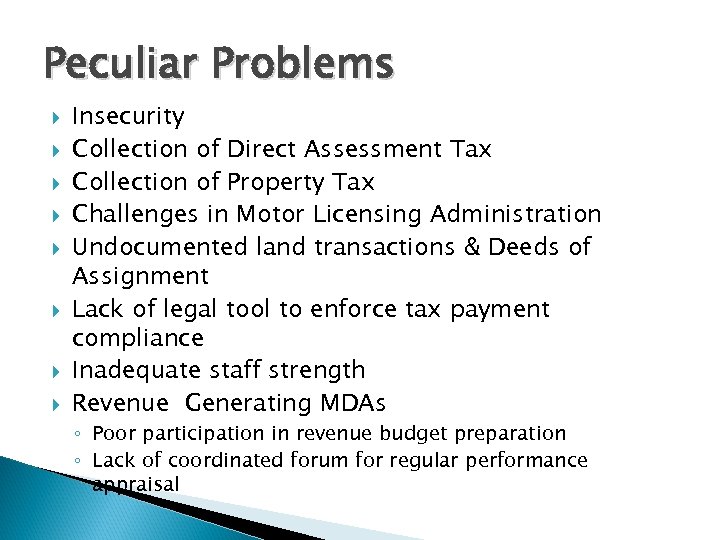

Peculiar Problems Insecurity Collection of Direct Assessment Tax Collection of Property Tax Challenges in Motor Licensing Administration Undocumented land transactions & Deeds of Assignment Lack of legal tool to enforce tax payment compliance Inadequate staff strength Revenue Generating MDAs ◦ Poor participation in revenue budget preparation ◦ Lack of coordinated forum for regular performance appraisal

Peculiar Problems Insecurity Collection of Direct Assessment Tax Collection of Property Tax Challenges in Motor Licensing Administration Undocumented land transactions & Deeds of Assignment Lack of legal tool to enforce tax payment compliance Inadequate staff strength Revenue Generating MDAs ◦ Poor participation in revenue budget preparation ◦ Lack of coordinated forum for regular performance appraisal

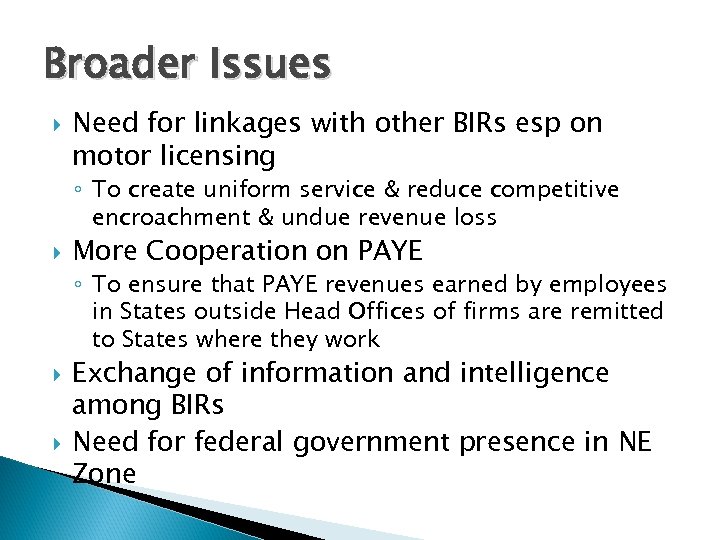

Broader Issues Need for linkages with other BIRs esp on motor licensing ◦ To create uniform service & reduce competitive encroachment & undue revenue loss More Cooperation on PAYE ◦ To ensure that PAYE revenues earned by employees in States outside Head Offices of firms are remitted to States where they work Exchange of information and intelligence among BIRs Need for federal government presence in NE Zone

Broader Issues Need for linkages with other BIRs esp on motor licensing ◦ To create uniform service & reduce competitive encroachment & undue revenue loss More Cooperation on PAYE ◦ To ensure that PAYE revenues earned by employees in States outside Head Offices of firms are remitted to States where they work Exchange of information and intelligence among BIRs Need for federal government presence in NE Zone

Thank You

Thank You