401317464fe632d241df2f23e4b8900f.ppt

- Количество слайдов: 27

Sustainable Energy and Practice Financing Issues Presented by Mr. Anat Prapasawad Executive Officer Business Development Department TMB Bank Public Company Limited 1

Topics Opportunities Overview of the barriers and/or risks affecting investment in RE projects Risk / Return analysis to asses each major risk and the means to mitigate its potential impact on the project Financial risk management instruments currently supporting RE projects and those that could be developed to reduce uncertainty as barriers Innovative financial services 2

Opportunities Technologies Distribution • • Renewable Biofuel (biodiesel ethanol) PV Biomass gen, Co -gen Waste to energy Wind Turbine Hydro Geothermal Etc. Energy Efficiency • Controling • Replacing • Modifying Fuel Switching Conventional fuel Biofuel/NG 3

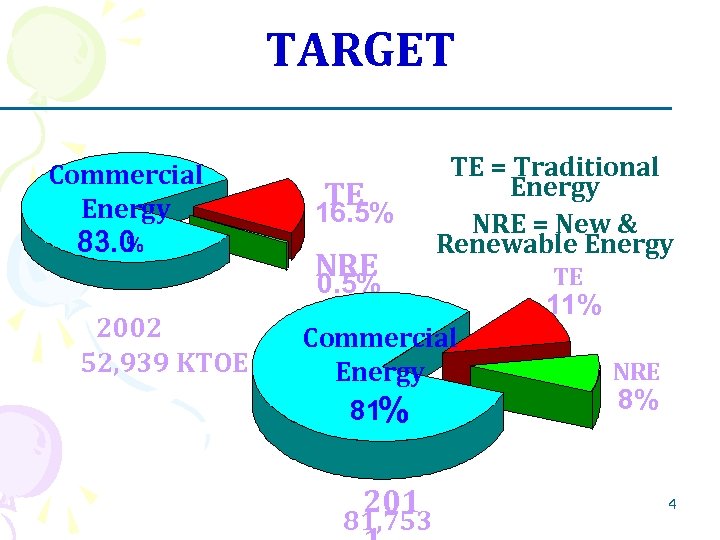

TARGET Commercial Energy. % 83. 0 TE 16. 5% NRE TE = Traditional Energy NRE = New & Renewable Energy 0. 5% 2002 52, 939 KTOE Commercial Energy 81% 201 81, 753 TE 11% NRE 8% 4 4

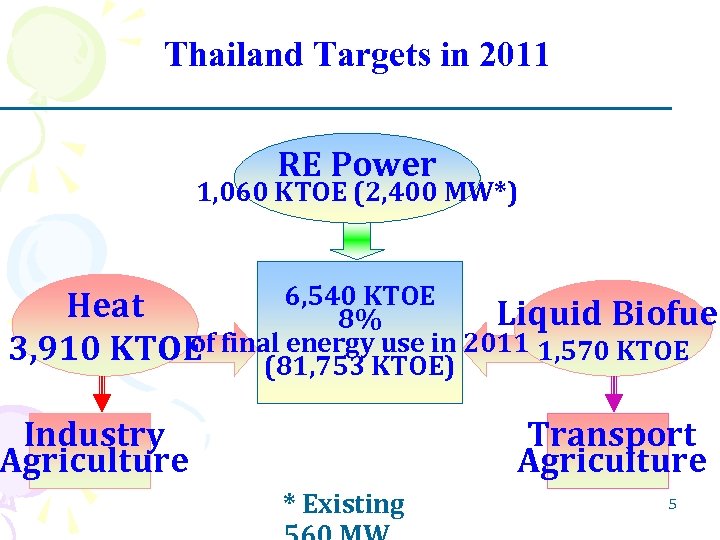

Thailand Targets in 2011 RE Power 1, 060 KTOE (2, 400 MW*) 6, 540 KTOE Heat Liquid Biofuel 8% of use in 3, 910 KTOE final energy. KTOE) 2011 1, 570 KTOE (81, 753 Industry Agriculture Transport Agriculture * Existing 5

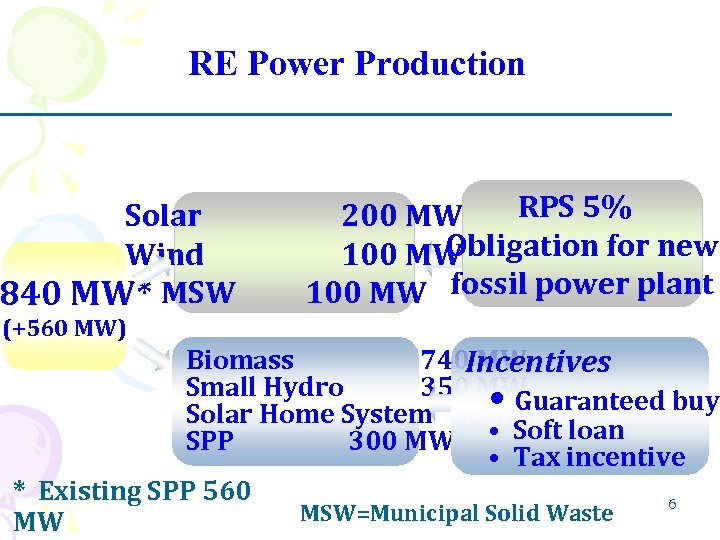

RE Power Production Solar Wind 840 MW* MSW (+560 MW) RPS 5% 200 MW Obligation for new 100 MW fossil power plant Biomass 740 Incentives MW Small Hydro 350 MW Solar Home System 50 • Guaranteed buy MW SPP 300 MW • Soft loan • Tax incentive * Existing SPP 560 6 MSW=Municipal Solid Waste MW

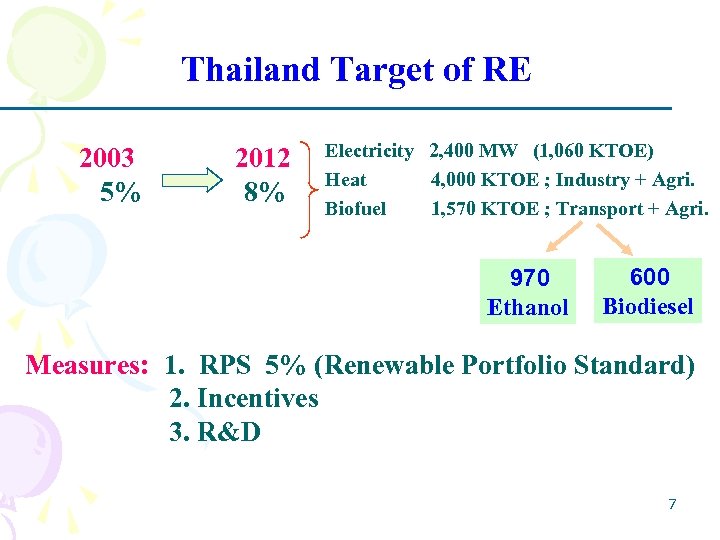

Thailand Target of RE 2003 5% 2012 8% Electricity 2, 400 MW (1, 060 KTOE) Heat 4, 000 KTOE ; Industry + Agri. Biofuel 1, 570 KTOE ; Transport + Agri. 970 Ethanol 600 Biodiesel Measures: 1. RPS 5% (Renewable Portfolio Standard) 2. Incentives 3. R&D 7

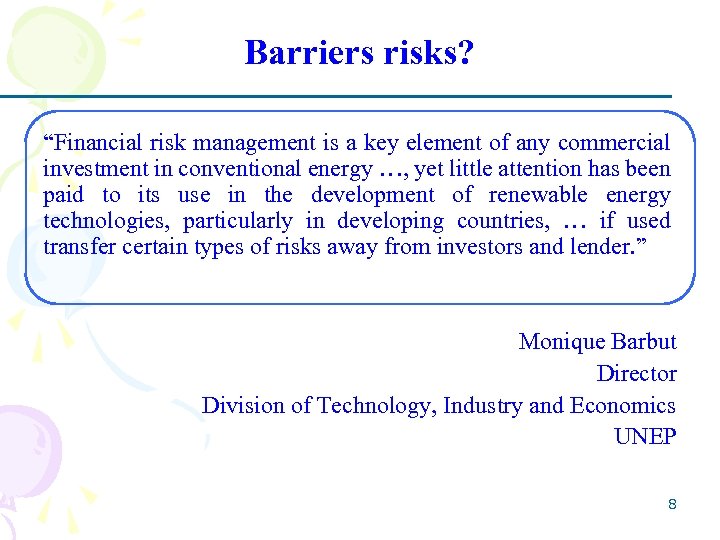

Barriers risks? “Financial risk management is a key element of any commercial investment in conventional energy …, yet little attention has been paid to its use in the development of renewable energy technologies, particularly in developing countries, … if used transfer certain types of risks away from investors and lender. ” Monique Barbut Director Division of Technology, Industry and Economics UNEP 8

“The financial incentive package for each country is carefully crafted to suit its economic, legal, and fiscal system. The types of incentives used include concessional import duties, excise tax benefits, corporate and income tax benefits (including tax exemptions, holidays, credits, and deduction as well as depreciation), subsidies against investment cost, low interest loans, and premium power purchase prices. ” World Bank Discussion Paper No. 391 9

Type of Finance Project Finance (PF) Funding of major capital Cashflow of the project as sources of fund for repayment Asset of the project as collateral Risk management through transference (allocate to parties best able and willing to accept) 10

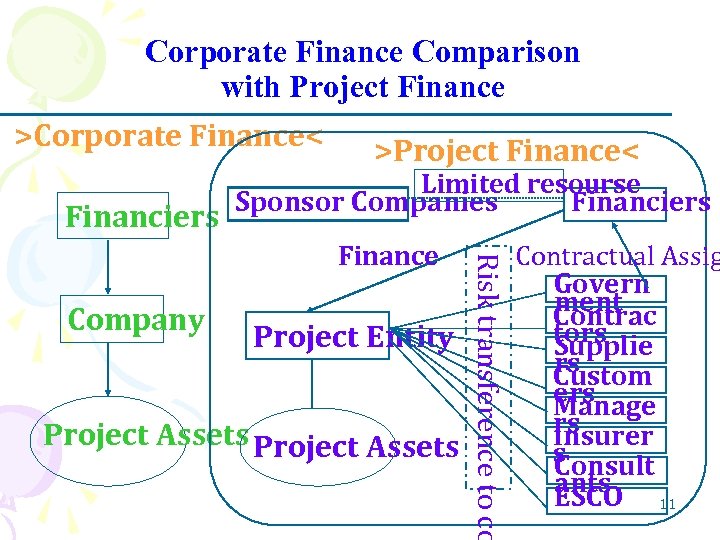

Corporate Finance Comparison with Project Finance >Corporate Finance< >Project Finance< Financiers Limited resourse Sponsor Companies Financiers Company Project Entity Project Assets Risk transference to co Finance Contractual Assig Govern ment Contrac tors Supplie rs Custom ers Manage rs Insurer s Consult ants ESCO 11

Major Risk & Management Major risk categories (throughout project cycle) Control of risks (identifying, analyzing, allocating) 12

Project Feasibility Analysis Financial aspect Marketing aspect Technical aspect Management aspect 13

Major Risk Categories (throughout project cycle) Project Cycle Project Identification Project Development Project Appraisal Project Implementation Project Operation 14

Typical Barriers High transaction Relatively small size Low marginal return Perceived weak credit worthiness of companies Resource availability and supply risk Country risk (political & economy instability) Lack of legal and Institutional Frameworks to support RE projects Analytical barriers (quality&availability information) Cognitive barriers Other priority investment Unfamiliarity with technologies Collateral problem Lack of expertise in company FI lack of knowledge Benefit sharing Cultural 15

Risk Management Instruments Contracts (gov. , suppliers, consultant, ESCO) Insurance / Reinsurance Credit enhancement products (Guarantee) Alternative risk transfer instruments (various type of asset backed securities) Private sector risk management Risk pooling Securitization structure Bundling small projects (reduce transaction cost) Carbon Finance Guarantee 16

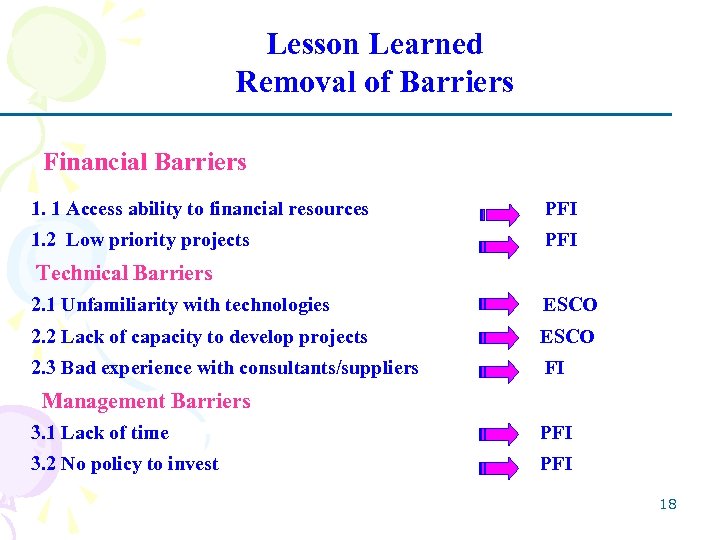

How to build portfolio? : Lesson Learned Barriers 1. Financial Barriers 1. 1 Access ability to financial resources 1. 2 Low priority projects 2. Technical Barriers 2. 1 Unfamiliarity with technologies 2. 2 Lack of capacity to develop projects 2. 3 Bad experience with consultants/suppliers 3. Management Barriers 3. 1 Lack of time 3. 2 No policy to invest 17

Lesson Learned Removal of Barriers Financial Barriers 1. 1 Access ability to financial resources PFI 1. 2 Low priority projects PFI Technical Barriers 2. 1 Unfamiliarity with technologies ESCO 2. 2 Lack of capacity to develop projects ESCO 2. 3 Bad experience with consultants/suppliers FI Management Barriers 3. 1 Lack of time PFI 3. 2 No policy to invest PFI 18

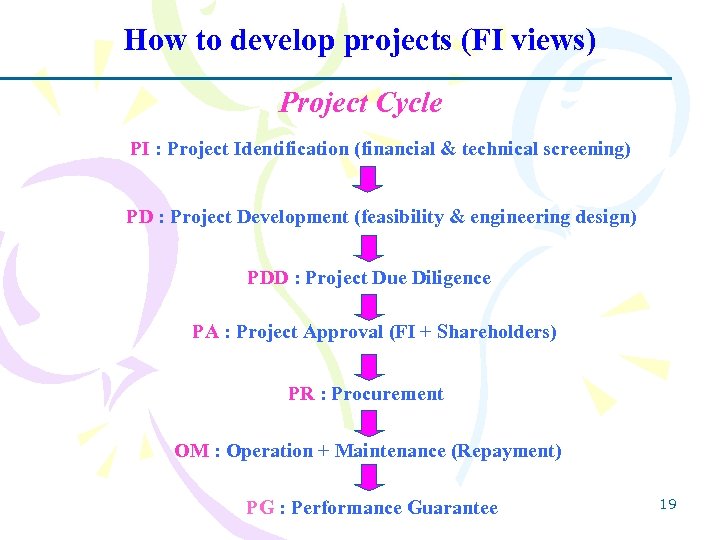

How to develop projects (FI views) Project Cycle PI : Project Identification (financial & technical screening) PD : Project Development (feasibility & engineering design) PDD : Project Due Diligence PA : Project Approval (FI + Shareholders) PR : Procurement OM : Operation + Maintenance (Repayment) PG : Performance Guarantee 19

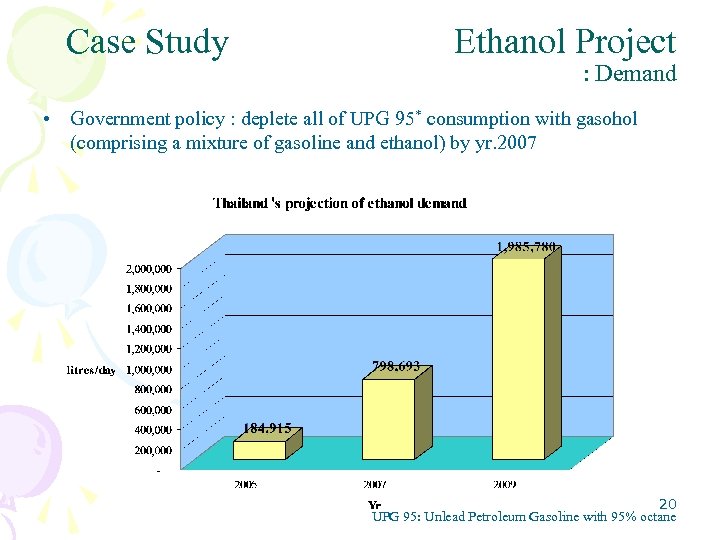

Case Study Ethanol Project : Demand • Government policy : deplete all of UPG 95* consumption with gasohol (comprising a mixture of gasoline and ethanol) by yr. 2007 20 UPG 95: Unlead Petroleum Gasoline with 95% octane

Ethanol Project : Supply • Total licensee 24 plants, registered capacity 4. 985 Million litres/day • Yr. 2006 : operate only 3 plants with total production capacity 0. 285 Million litres/day 21

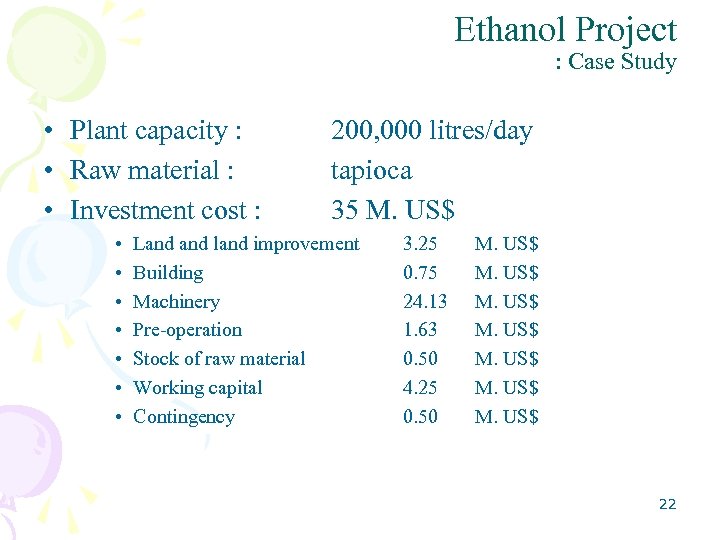

Ethanol Project : Case Study • Plant capacity : • Raw material : • Investment cost : • • 200, 000 litres/day tapioca 35 M. US$ Land land improvement Building Machinery Pre-operation Stock of raw material Working capital Contingency 3. 25 0. 75 24. 13 1. 63 0. 50 4. 25 0. 50 M. US$ M. US$ 22

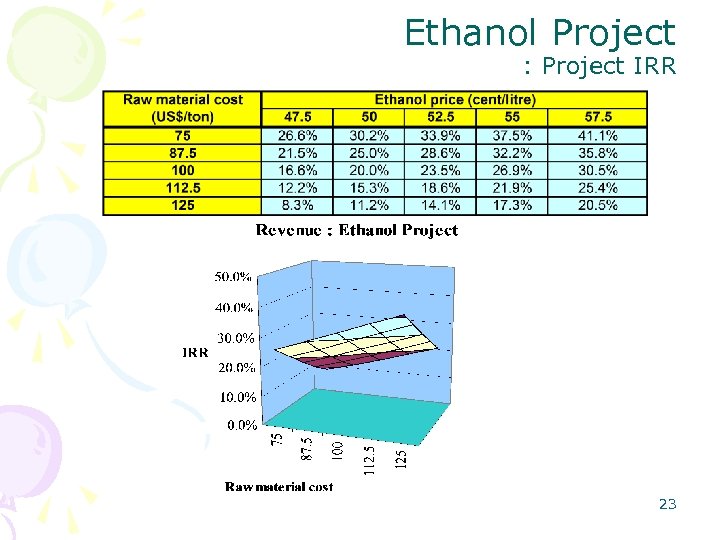

Ethanol Project : Project IRR 23

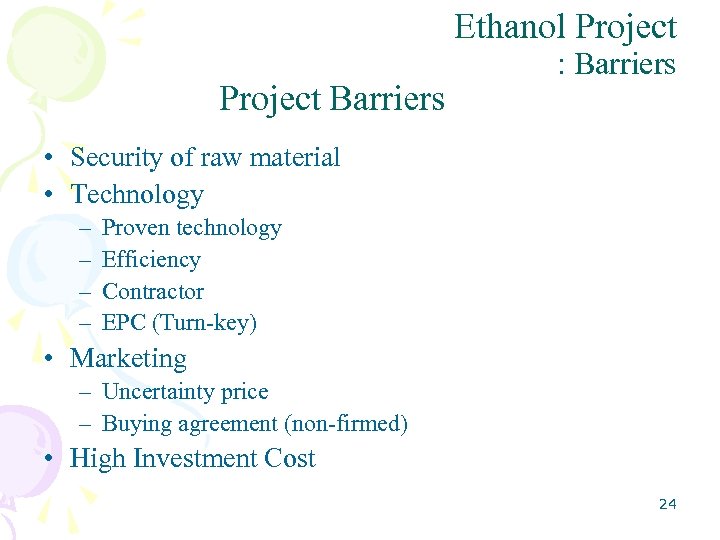

Ethanol Project Barriers : Barriers • Security of raw material • Technology – – Proven technology Efficiency Contractor EPC (Turn-key) • Marketing – Uncertainty price – Buying agreement (non-firmed) • High Investment Cost 24

Ethanol Project External Barriers : Barriers • Government Policy • Commercial Bank Policy 25

Ethanol Project Removal of Barriers • Security of raw material • Technology : Barriers Through Contracts Through proven technologies/ Bank guideline • Marketing Through Contracts • High Investment Cost Equity Fund 26

Thank you Presented by Mr. Anat Prapasawad Executive Officer Business Development Department TMB Bank Public Company Limited 27

401317464fe632d241df2f23e4b8900f.ppt