ca5bb3fd76c89664a229de90370a9439.ppt

- Количество слайдов: 76

Surviving and Thriving in 2013 and Beyond A Wealth. Counsel Presentation © 2013 Wealth. Counsel, LLC 1

Introducing Your Presenters. . . William A. Conway C. Dennis Brislawn, Jr. A Wealth. Counsel Presentation © 2013 Wealth. Counsel, LLC 2

What Changed in 2013 • Federal Estate Tax Exemption – $5, 250, 000 – Inflation-adjusted • Generation Skipping Tax Exemption – $5, 250, 000 – Inflation-adjusted • Annual Exemption – $14, 000 • Obama Admin Proposal to Reduce Estate, GST, and Gift Tax Exemptions to $3, 500, 000 © 2013 Wealth. Counsel, LLC 3

What Changed in 2013 • State Estate Tax – Decoupling – Additional Tax Structures • Income Taxes – Dividends – Step-up in Basis • Obama. Care • Medicaid • Health Care Decision-Making © 2013 Wealth. Counsel, LLC 4

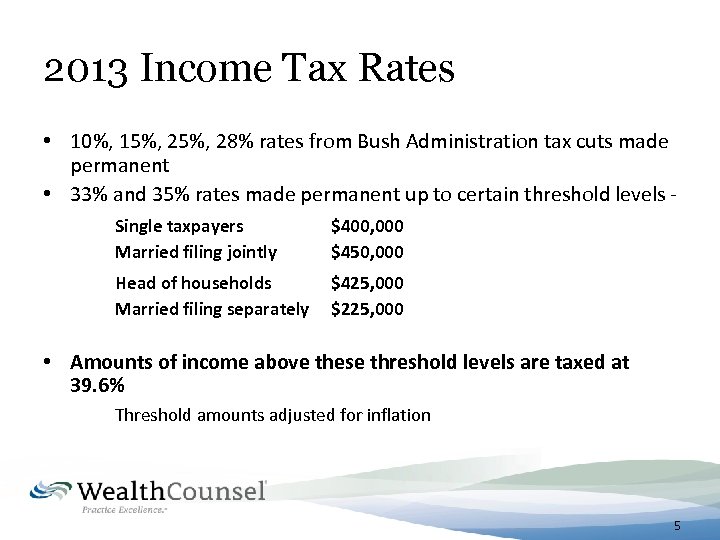

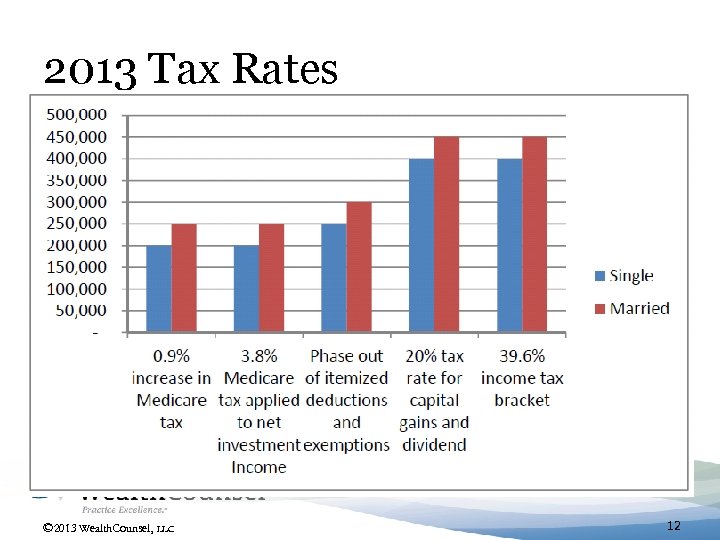

2013 Income Tax Rates • 10%, 15%, 28% rates from Bush Administration tax cuts made permanent • 33% and 35% rates made permanent up to certain threshold levels Single taxpayers Married filing jointly $400, 000 $450, 000 Head of households Married filing separately $425, 000 $225, 000 • Amounts of income above these threshold levels are taxed at 39. 6% Threshold amounts adjusted for inflation 5

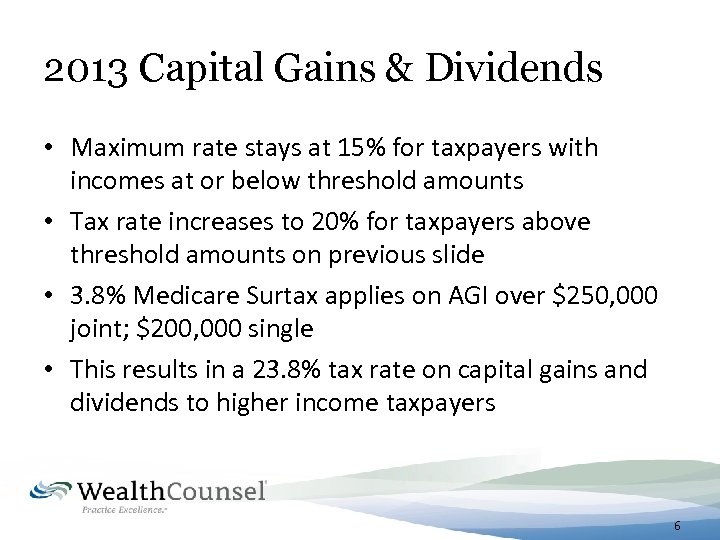

2013 Capital Gains & Dividends • Maximum rate stays at 15% for taxpayers with incomes at or below threshold amounts • Tax rate increases to 20% for taxpayers above threshold amounts on previous slide • 3. 8% Medicare Surtax applies on AGI over $250, 000 joint; $200, 000 single • This results in a 23. 8% tax rate on capital gains and dividends to higher income taxpayers 6

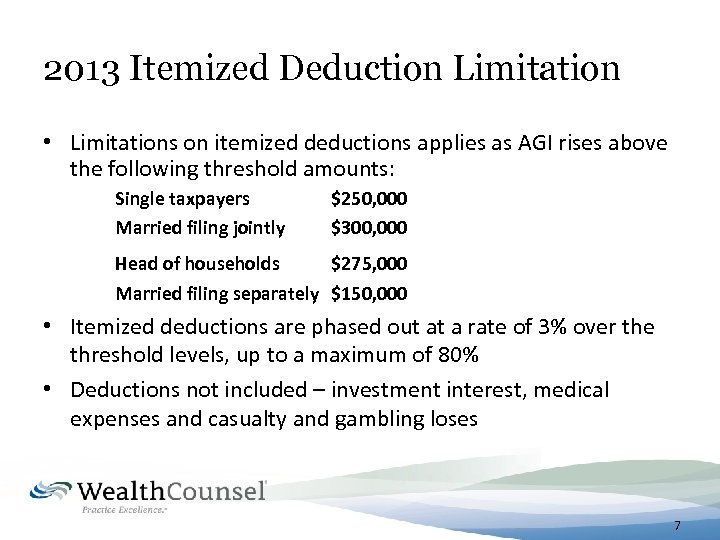

2013 Itemized Deduction Limitation • Limitations on itemized deductions applies as AGI rises above the following threshold amounts: Single taxpayers Married filing jointly $250, 000 $300, 000 Head of households $275, 000 Married filing separately $150, 000 • Itemized deductions are phased out at a rate of 3% over the threshold levels, up to a maximum of 80% • Deductions not included – investment interest, medical expenses and casualty and gambling loses 7

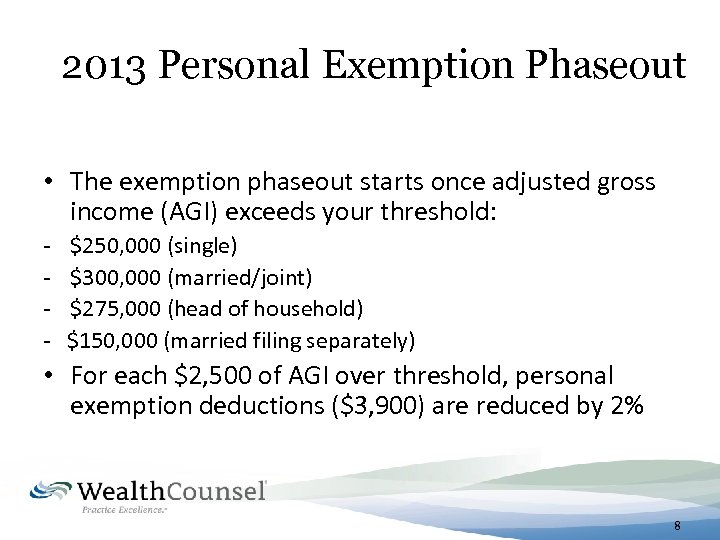

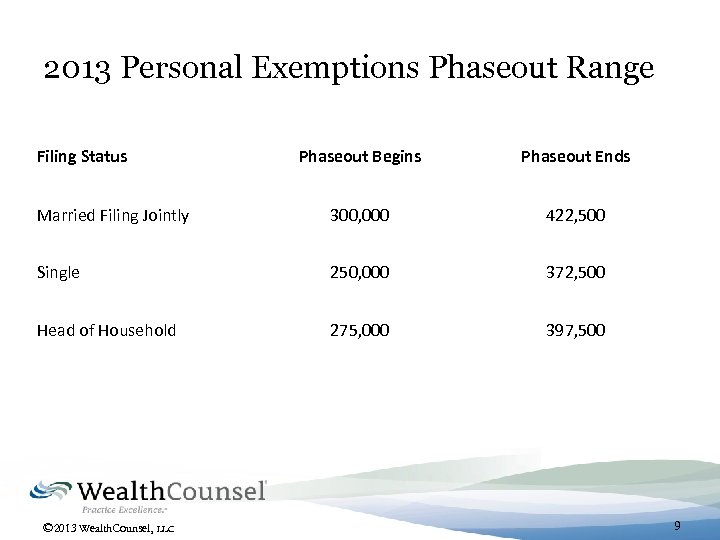

2013 Personal Exemption Phaseout • The exemption phaseout starts once adjusted gross income (AGI) exceeds your threshold: - $250, 000 (single) - $300, 000 (married/joint) - $275, 000 (head of household) - $150, 000 (married filing separately) • For each $2, 500 of AGI over threshold, personal exemption deductions ($3, 900) are reduced by 2% 8

2013 Personal Exemptions Phaseout Range Filing Status Phaseout Begins Phaseout Ends Married Filing Jointly 300, 000 422, 500 Single 250, 000 372, 500 Head of Household 275, 000 397, 500 © 2013 Wealth. Counsel, LLC 9

0. 9% Medicare Payroll Surtax in 2013 • The Medicare payroll surtax on employees is increased by 0. 9% on earned incomes over $200, 000 for single filers and $250, 000 for joint filers 10

3. 8% Medicare Surtax on Investment Income in 2013 • New Medicare surtax of 3. 8% on investment income is added for AGIs in excess of $200, 000 for single filers and $250, 000 for joint filers 11

2013 Tax Rates © 2013 Wealth. Counsel, LLC 12

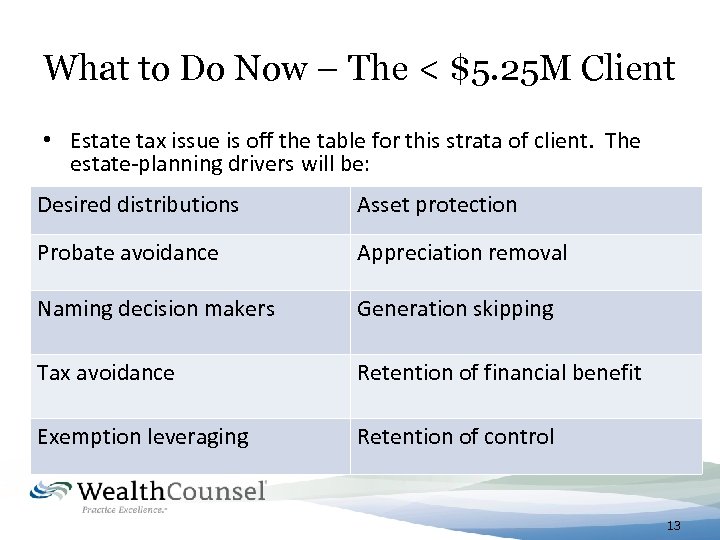

What to Do Now – The < $5. 25 M Client • Estate tax issue is off the table for this strata of client. The estate-planning drivers will be: Desired distributions Asset protection Probate avoidance Appreciation removal Naming decision makers Generation skipping Tax avoidance Retention of financial benefit • Income tax minimization planning • Detail-oriented trust and estate administration Exemption leveraging Retention of control 13

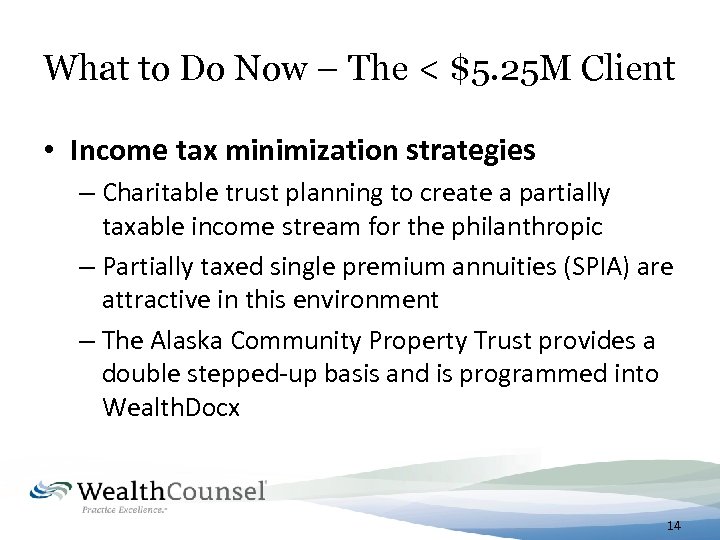

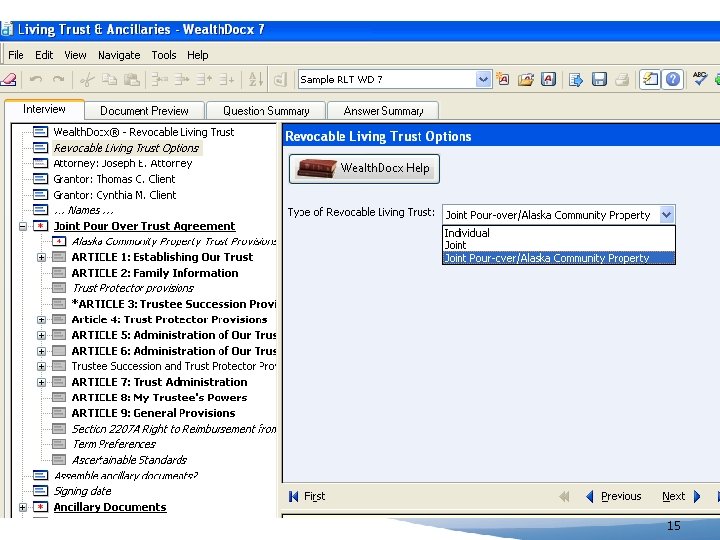

What to Do Now – The < $5. 25 M Client • Income tax minimization strategies – Charitable trust planning to create a partially taxable income stream for the philanthropic – Partially taxed single premium annuities (SPIA) are attractive in this environment – The Alaska Community Property Trust provides a double stepped-up basis and is programmed into Wealth. Docx 14

15

What to Do Now – The < $5. 25 M Client • Family Income Shifting Through Family Entities • Installment Sales of Real Estate and Business Assets or Entities • Tax-Free Cash Value of Life Insurance Held Within an Accessible Grantor Retirement Trust 16

What to Do Now – The < $5. 25 M Client • Remove or Reduce IRA and 401 K Assets from Owner and Beneficiary Income Taxes (IRA Annuitization and Life Insurance Within an ILIT) • Retirement Trust for Maximum IRA Stretch • Potential IRA/401 K Roth Conversions 17

What to Do Now – The < $5. 25 M Client Increase the depth of our client service: • Elder law issues, avoiding estate depletion to fund nursing home costs and long-term care insurance • “Legacy Planning” - an expanded conversation with clients about how they can pass their non-financial wealth and preserve family harmony (using heirloom property, for example) 18

“Endangered Strategies”- Obama Budget • Obama Proposals make these “endangered strategies”: – Grantor trusts still avoid estate tax, including (IDGTs) and (ILITs) – Discounts are still allowed on non-business interests or for transfers to minority interests – The 10 year minimum term for Grantor Retained Annuity Trusts (GRATs) was not enacted – 2 year rolling GRATs remain available – No 90 -year limit on the GST tax exemption was adopted. Dynasty Trusts are still possible 19

What to Do Now – The > $5. 25 M Client • Money can be loaned or property sold for an installment note with 3 - 9 year rates as low as . 87% in January 2013 (1% Section 7520 rate) • Ideal time for intra-family loans and sales 20

Business Tax Extensions-Opportunities • Reduction in S Corporation recognition period - 5 - year (formerly 10 years) holding period for built-in gains tax for sales occurring in 2012 and 2013. Carry forwards and installment sale rules are also clarified. • 100% exclusion for capital gain from sale of qualified small business stock extended for stock acquired before January 1, 2014 if the stock is owned longer than five years. – The AMT preference rules do not apply. 21

Addressing Change Flexibility & Certainty © 2013 Wealth. Counsel, LLC 22

Addressing Change • Flexibility - Trust Protectors/Advisors - Marital Deduction Formulas - Disclaimers - Revocable Irrevocable Trust - Self-Settled Trusts – 14 states © 2013 Wealth. Counsel, LLC 23

Addressing Change • Certainty - Freeze Transactions - After-Care Planning © 2013 Wealth. Counsel, LLC 24

What’s NOT Changing • The Fundamentals – Avoiding Living & Death Probate – Protection of Surviving Spouse – Philanthropic Objectives – Planning for Heirs • • Youth Responsibility & Skill Divorce Protection Preventing “Affluenza” © 2013 Wealth. Counsel, LLC 25

What’s NOT Changing • Business Planning-Business. Counsel Biz. Doxs – Entrance – Growth – Maintenance – Mergers/Acquisitions – Exit © 2013 Wealth. Counsel, LLC 26

What’s NOT Changing • Retirement Planning – Roth IRA Conversions – IRA Planning Via “Stand. Alone” Retirement Trusts – Stretch – Annuitization & Replacement – Reengineering Closely-Held Businesses © 2013 Wealth. Counsel, LLC 27

What’s NOT Changing Income Tax Planning • Mobility to avoid state income taxes - Seven states impose no income tax, EG. Texas, Fla, Wy - Two states tax only dividend and interest income • Income Shifting – within Family • Opportunity Shifting- newly Established Businesses © 2013 Wealth. Counsel, LLC 28

What’s NOT Changing • Elder Law Planning • Special Needs Planning • Asset Protection Planning © 2013 Wealth. Counsel, LLC 29

What’s NOT Changing • Need for Life Insurance – – – – Debt Liquidity Income Replacement Estate Equalization Pay State Death Taxes – 21 States, EG. Md, DC, Pa, NY, etc Wealth Replacement for Charitable Giving Buy-Sell Capital Gains Tax Liquidity (post-mortem) Supplemental “Tax Free “Retirement Planning © 2013 Wealth. Counsel, LLC 30

A Few Questions 1. How have you responded to change? 2. What has worked? 3. What has not worked? 4. What do you need to succeed? © 2013 Wealth. Counsel, LLC 31

What’s Changing in Financial Services • Products/Services • Advisory vs. Commission • Equity Indexed Products • Private Annuities • Captive Insurance Companies © 2013 Wealth. Counsel, LLC 32

What’s NOT Changing in Financial Services • Need for Estate Planning • Need for Client Centric Planning • Financial Compliment to Legal Solutions © 2013 Wealth. Counsel, LLC 33

Reframe Your Referral Network A Wealth. Counsel Presentation © 2013 Wealth. Counsel, LLC 34

Reframe Your Referral Network Developing a Teamwork Approach that Produces Consistent Results © 2013 Wealth. Counsel, LLC 35

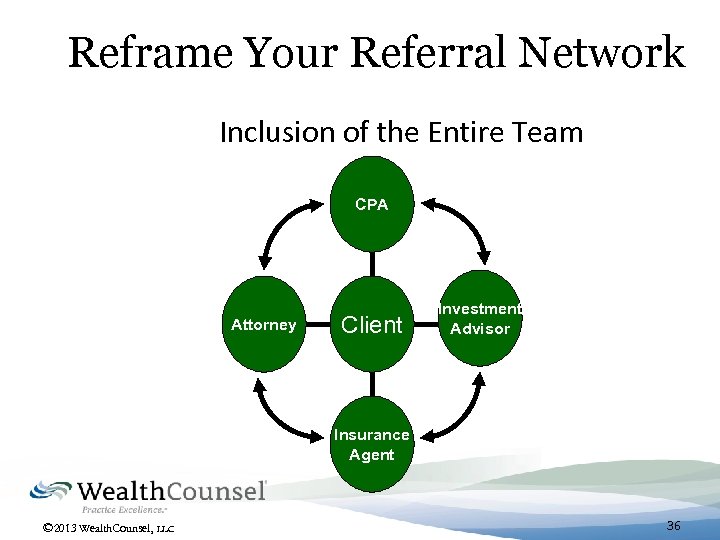

Reframe Your Referral Network Inclusion of the Entire Team CPA Attorney Client Investment Advisor Insurance Agent © 2013 Wealth. Counsel, LLC 36

Reframe Your Approach to Client Prospects A Wealth. Counsel Presentation © 2013 Wealth. Counsel, LLC 37

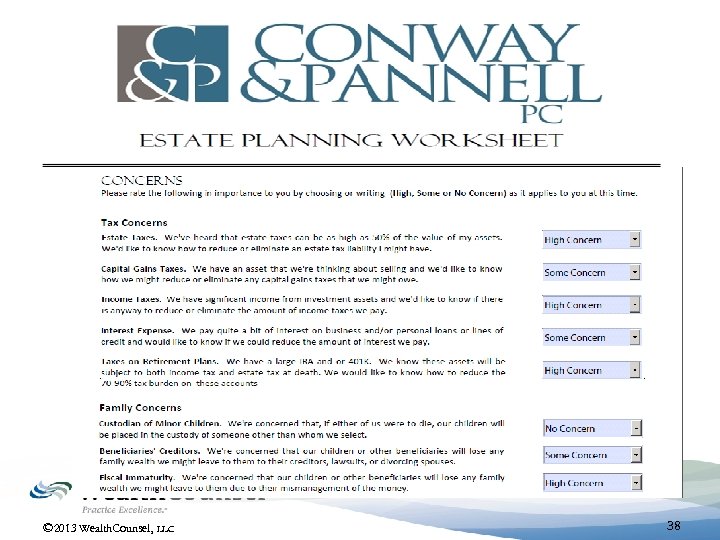

© 2013 Wealth. Counsel, LLC 38

The Client Meeting • Tax Concerns – Income Tax Concerns – Estate Taxes, now or future • Family Concerns – Asset Protection for/from Children – Asset Protection for Self – Second Marriage Protection for Spouse – Marriage/Divorce Protection for Children © 2013 Wealth. Counsel, LLC 39

The Client Meeting • Disability Concerns – Guardianship • Creditor Concerns – Frivolous Lawsuits • Long Term Care – Resources Available – Nursing Home Draining Resources • Post-Death Concerns – Probate – Fighting © 2013 Wealth. Counsel, LLC 40

The Client Meeting • Business Concerns – Losing Business to Lawsuits – Loss of Asset Protection – Entity Piercing – Lack of Exit Plan – Out-of-Date Buy-Sell Agreements – Lack of Maintenance Plan © 2013 Wealth. Counsel, LLC 41

Expanding Your Solution Set • Thriving Strategies : Post AFTA-Math A Wealth. Counsel Presentation © 2013 Wealth. Counsel, LLC 42

Issue Driven Solutions New Rules 1. Reduce and/ or eliminate current and future income taxes 2. Asset Protection 3. Provide means for future estate and generation-skipping tax inoculation Old ingredients, new recipes © 2013 Wealth. Counsel, LLC 43

New Thriving Solutions For the New Rules Recipes for New Income Tax Solutions Using Old and New Ingredients © 2013 Wealth. Counsel, LLC 44

Some Legal Recipe Ingredients • Revocable “Living” Trusts • Irrevocable Trusts – – Irrevocable Life Insurance Trusts (ILITs} Stand Alone “Dry” IRTs, - EG. for IRAs Intentional Grantor Trust for Asset Protection Inter- Vivos QTIPs • Family LPs & LLCs • Retirement Plans (IRAs, 401(k)s) © 2013 Wealth. Counsel, LLC 45

Some Financial Recipe Ingredients • Life Insurance – Insured • Single Life • Survivorship – Design Options • Low premium , high death benefit • High premium , low death benefit • Single premium , Modified Endowment (MEC) © 2013 Wealth. Counsel, LLC 46

Some Financial Ingredients • Life Insurance – Types • Cash Value Policies – – UL, guaranteed or non Variable UL – non-guaranteed only Equity indexed, guaranteed or non Whole Life –guaranteed • Term Policies © 2013 Wealth. Counsel, LLC 47

Some Financial Ingredients • Annuities – Right Tool for the Right Job – Deferred= “Surprise” LIFO Income Tax – Immediate Annuities • SPIAS (Single Premium Immediate Annuities) – Flavors of Immediate Annuities • Life only • Longer of Term of Years or Life • Multiple Lives © 2013 Wealth. Counsel, LLC 48

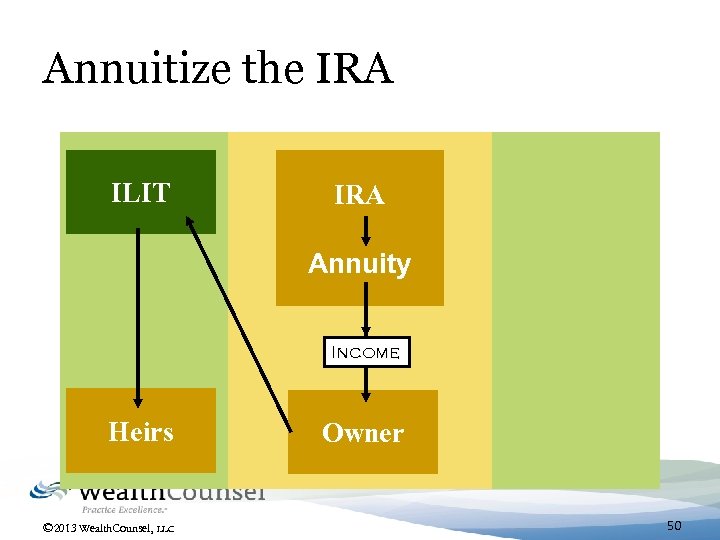

Annuitize the IRA • Purchase an Immediate Annuity(within the IRA) Using Some IRA Assets • Use Annuity Distribution from IRA to fund: – Payment of Income Tax Due – Life Insurance Premiums for Tax Free Inheritance – Increase Standard of Living • Life Insurance Trust (ILIT)Owns Life Insurance © 2013 Wealth. Counsel, LLC 49

Annuitize the IRA ILIT IRA Annuity Income Heirs © 2013 Wealth. Counsel, LLC Owner 50

Annuitize the IRA • Advantages – Pension like performance – Guaranteed lifetime income (not tied to market performance) – Eliminates income tax to heirs on inherited assets – Eliminates all estate tax/GST if coupled with ILIT – Guaranteed death benefit to age 100 and beyond • Disadvantage – Depends on health- for insurability – Some of IRA is now committed to income generation © 2013 Wealth. Counsel, LLC 51

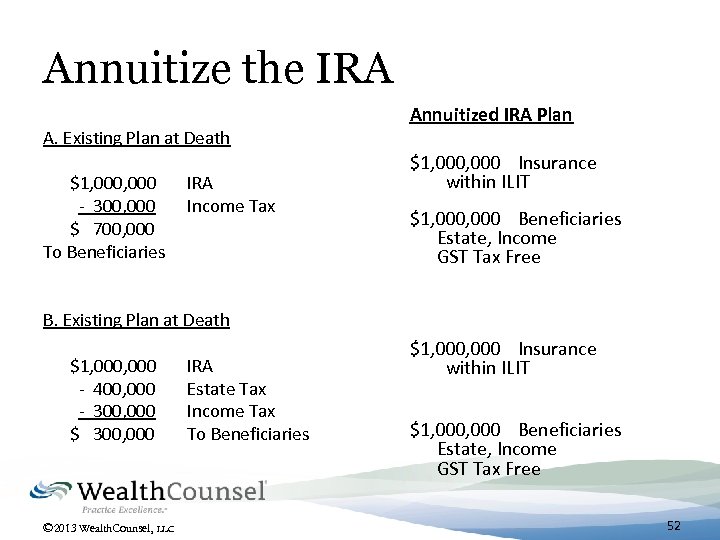

Annuitize the IRA A. Existing Plan at Death $1, 000 IRA - 300, 000 Income Tax $ 700, 000 To Beneficiaries Annuitized IRA Plan $1, 000 Insurance within ILIT $1, 000 Beneficiaries Estate, Income GST Tax Free B. Existing Plan at Death $1, 000 - 400, 000 - 300, 000 $ 300, 000 © 2013 Wealth. Counsel, LLC IRA Estate Tax Income Tax To Beneficiaries $1, 000 Insurance within ILIT $1, 000 Beneficiaries Estate, Income GST Tax Free 52

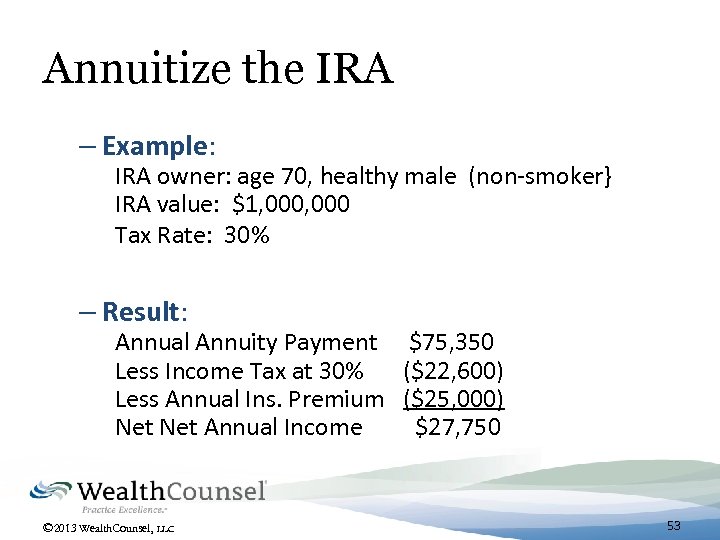

Annuitize the IRA – Example: IRA owner: age 70, healthy male (non-smoker} IRA value: $1, 000 Tax Rate: 30% – Result: Annual Annuity Payment $75, 350 Less Income Tax at 30% ($22, 600) Less Annual Ins. Premium ($25, 000) Net Annual Income $27, 750 © 2013 Wealth. Counsel, LLC 53

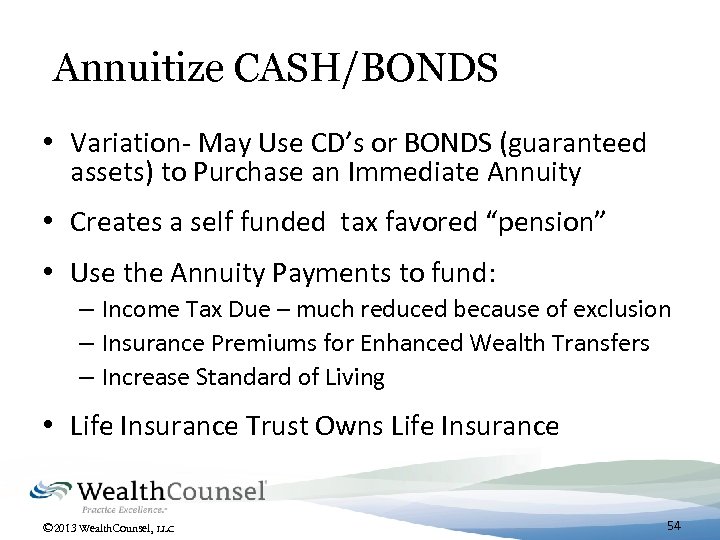

Annuitize CASH/BONDS • Variation- May Use CD’s or BONDS (guaranteed assets) to Purchase an Immediate Annuity • Creates a self funded tax favored “pension” • Use the Annuity Payments to fund: – Income Tax Due – much reduced because of exclusion – Insurance Premiums for Enhanced Wealth Transfers – Increase Standard of Living • Life Insurance Trust Owns Life Insurance © 2013 Wealth. Counsel, LLC 54

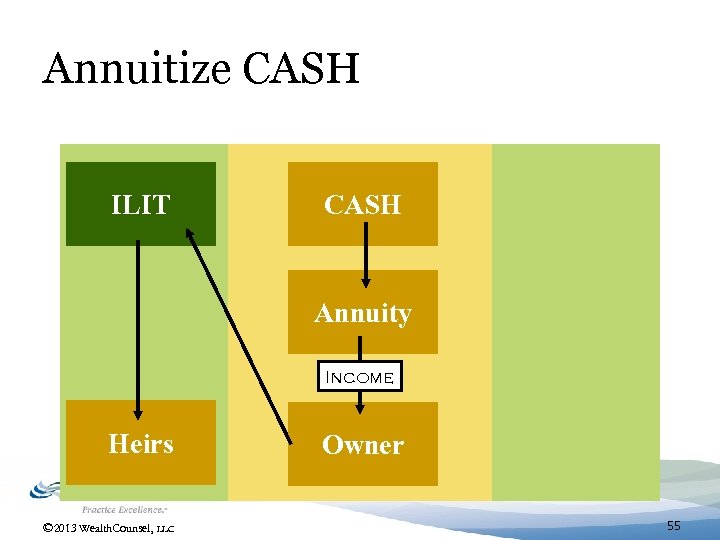

Annuitize CASH ILIT CASH Annuity Income Heirs © 2013 Wealth. Counsel, LLC Owner 55

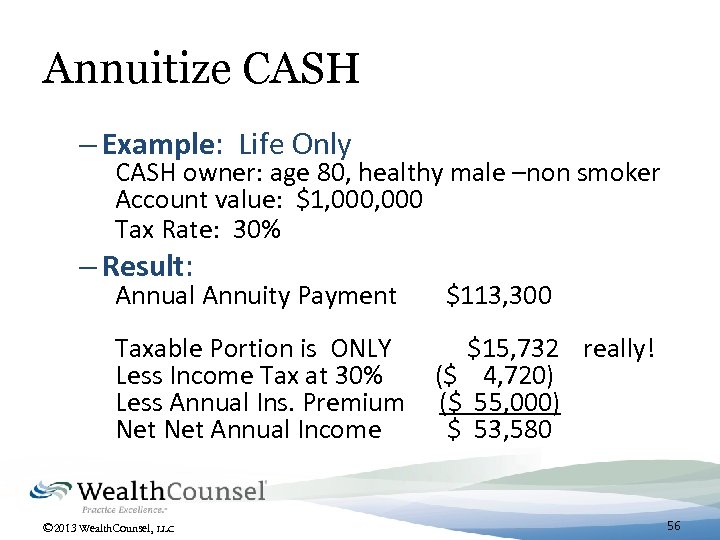

Annuitize CASH – Example: Life Only CASH owner: age 80, healthy male –non smoker Account value: $1, 000 Tax Rate: 30% – Result: Annual Annuity Payment $113, 300 Taxable Portion is ONLY $15, 732 really! Less Income Tax at 30% ($ 4, 720) Less Annual Ins. Premium ($ 55, 000) Net Annual Income $ 53, 580 © 2013 Wealth. Counsel, LLC 56

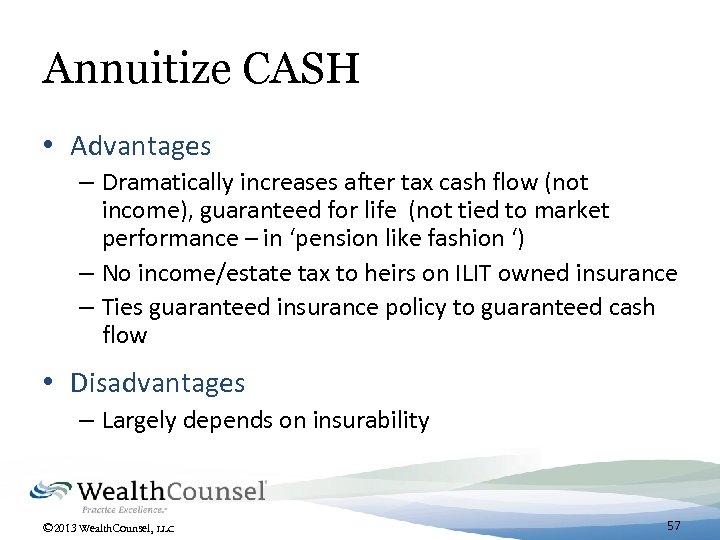

Annuitize CASH • Advantages – Dramatically increases after tax cash flow (not income), guaranteed for life (not tied to market performance – in ‘pension like fashion ‘) – No income/estate tax to heirs on ILIT owned insurance – Ties guaranteed insurance policy to guaranteed cash flow • Disadvantages – Largely depends on insurability © 2013 Wealth. Counsel, LLC 57

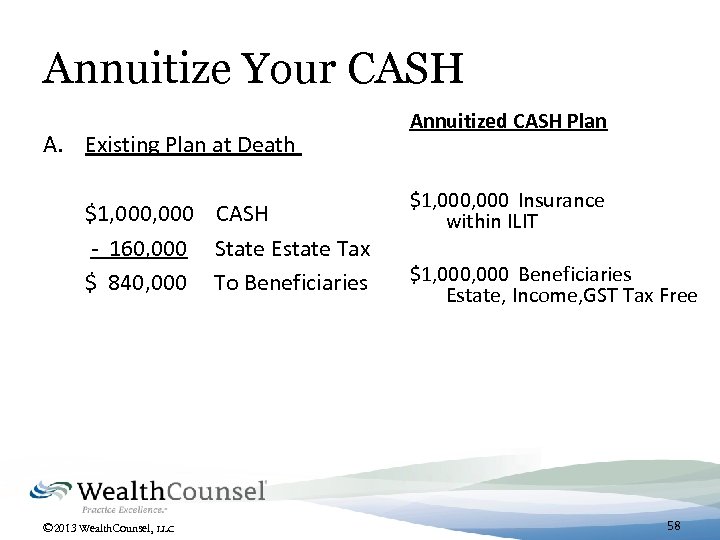

Annuitize Your CASH A. Existing Plan at Death $1, 000 CASH - 160, 000 State Estate Tax $ 840, 000 To Beneficiaries © 2013 Wealth. Counsel, LLC Annuitized CASH Plan $1, 000 Insurance within ILIT $1, 000 Beneficiaries Estate, Income, GST Tax Free 58

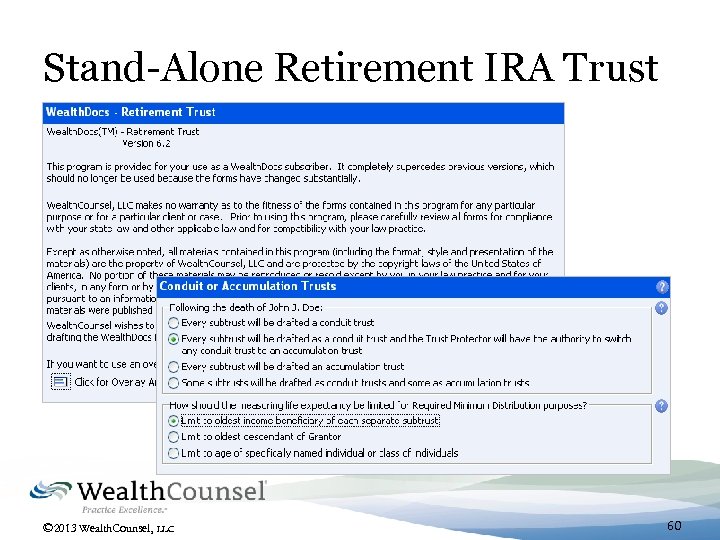

IRA Retirement Trust • Guarantees Income Tax Deferral “Stretch” Plan • Asset/Divorce Protection for Beneficiaries • Opportunity for Significant Income Deferral While Providing Trust Benefits © 2013 Wealth. Counsel, LLC 59

Stand-Alone Retirement IRA Trust © 2013 Wealth. Counsel, LLC 60

Stand-Alone Retirement/Education Trust • Income Tax Free 529 Held by Trust During Life • All Assets are Asset Protected • Enhanced by IRA Proceeds at Death • All Assets Are Income Tax Free or Deferred © 2013 Wealth. Counsel, LLC 61

Life Insurance Retirement Trust • ILIT with Carefully Drafted Loan Provisions to Provide Supplemental Retirement Benefits to Grantor and Spouse • Trust Owned Low Death Benefit, High Cash Value Policy • Spouse or Grantor May Borrow Cash Value -Tax Free • Maintain Estate Tax Exclusion for Death Benefits “Have It Both Ways” © 2013 Wealth. Counsel, LLC 62

Survivorship Life Policy as Legacy Gift • Survivorship (second to die) Policy as alternative investment within ILIT • Policy design is opposite of Retirement ILIT – for maximum insurance leverage • Thus low cash value, high death benefit policy • Estate Tax, Income Tax and GST Legacy Gift © 2013 Wealth. Counsel, LLC 63

Self-Settled Asset Protection Trusts • Hot Trend in Law • 14 States and counting • Gift tax defective? – Could be, especially where no estate concerns • Logic behind law © 2013 Wealth. Counsel, LLC 64

Intergenerational Income Shifting • Children (over 22) are in lower income tax brackets • Parents have high income tax • Create FLP/LLC (with low/no discounts) family entity • Hire Family Managers- W-2 or 1099 income on/off switch • Gifts of Interests to Children –”Opportunity Shifting” • Frees up annual exclusion gifts for other purposes © 2013 Wealth. Counsel, LLC 65

New Rules Reducing/Eliminating Discounts • Discounts from entity no longer needed • New battleground is income not estate tax • Continued asset protection desired • Amend all previous “discount clauses” in FLP/LLC agreements to provide “put right”, or withdrawal right etc. © 2013 Wealth. Counsel, LLC 66

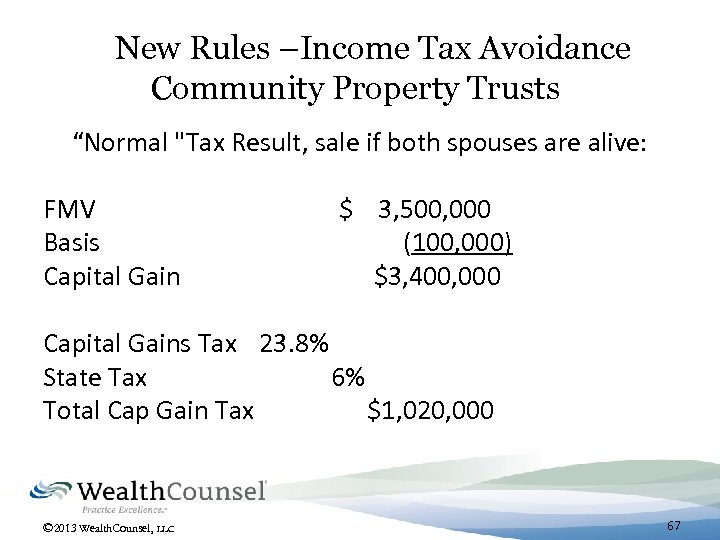

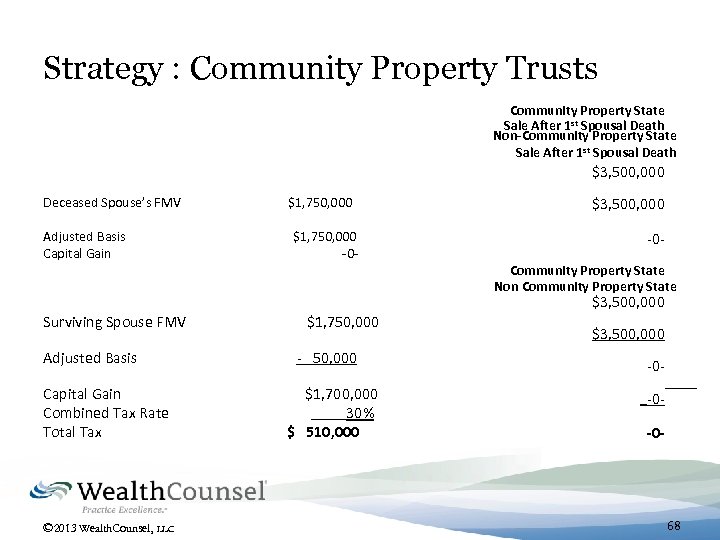

New Rules –Income Tax Avoidance Community Property Trusts “Normal "Tax Result, sale if both spouses are alive: FMV $ 3, 500, 000 Basis (100, 000) Capital Gain $3, 400, 000 Capital Gains Tax 23. 8% State Tax 6% Total Cap Gain Tax $1, 020, 000 © 2013 Wealth. Counsel, LLC 67

Strategy : Community Property Trusts Community Property State Sale After 1 st Spousal Death Non-Community Property State Sale After 1 st Spousal Death $3, 500, 000 Deceased Spouse’s FMV $1, 750, 000 Adjusted Basis $1, 750, 000 Capital Gain -0 $3, 500, 000 -0 Community Property State Non Community Property State $3, 500, 000 Surviving Spouse FMV $1, 750, 000 $3, 500, 000 Adjusted Basis - 50, 000 Capital Gain $1, 700, 000 Combined Tax Rate 30% Total Tax $ 510, 000 © 2013 Wealth. Counsel, LLC -0 -0 - -0 - 68

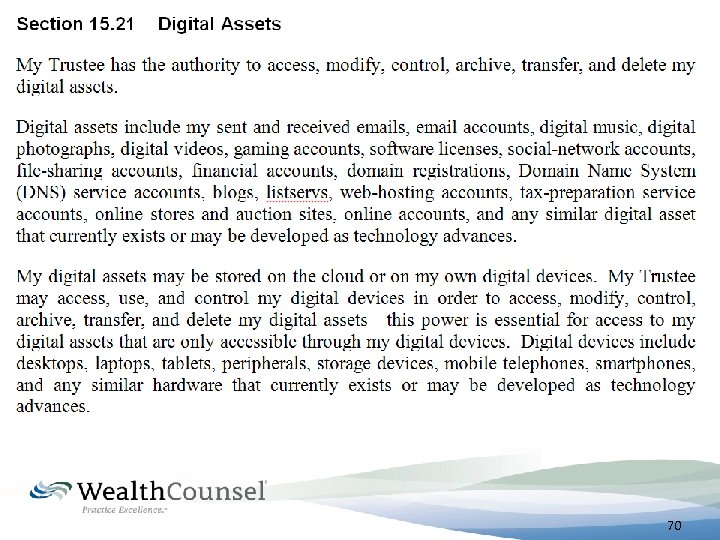

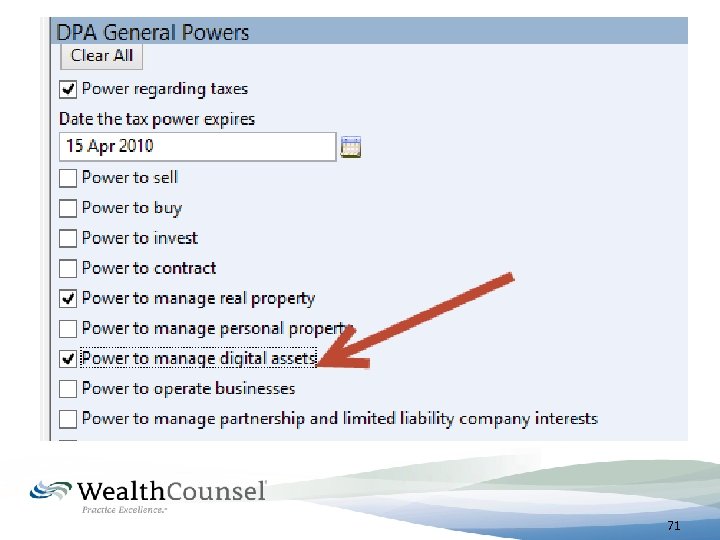

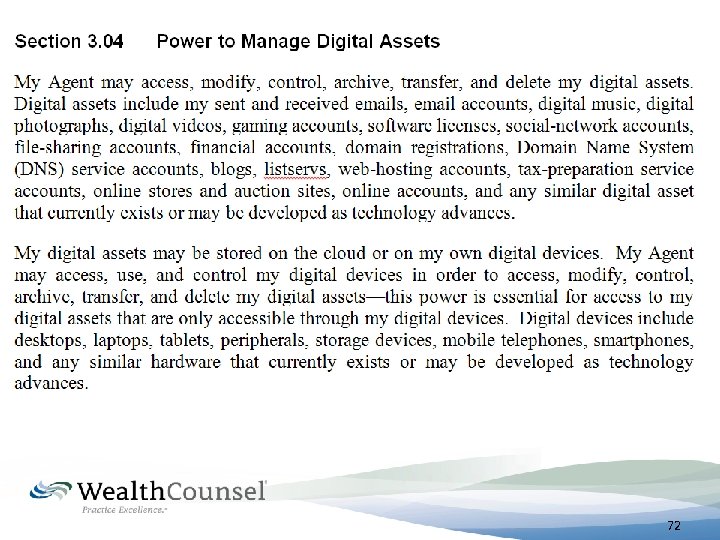

Restatements for Digital Assets • How does the Holder of the Power of Attorney and/or Successor Trustee gain control over: • Passwords for Financial Accounts ? • Facebook/Social Media /Photo Accounts ? • Restate all Trusts / Create New POAs © 2013 Wealth. Counsel, LLC 69

70

71

72

Review of Thriving Strategies IRA Annuitization Stand-Alone Retirement Trusts Retirement Life Insurance Access ILITs “Guaranteed” Survivorship Life Policy within an ILIT as a Legacy Gift • Self-Settled Asset Protection Trusts • • © 2013 Wealth. Counsel, LLC 73

Review of Thriving Strategies • • • Domestic Self-Settled Asset Protection Trust Income Shifting with Family Entities Reducing or Eliminating Discounts Community Property Trusts –Alaska Sited Amendment/Restatements to All POAs/ Estate Plans For Access to Digital Assets- © 2013 Wealth. Counsel, LLC 74

Additional Thriving Strategies • Senior Asset Protection Trust • Maintenance Programs • Life Insurance Audits- Especially ILIT owned • Social Security Analysis and Payout Strategies © 2013 Wealth. Counsel, LLC 75

Thank You © 2013 Wealth. Counsel, LLC 76

ca5bb3fd76c89664a229de90370a9439.ppt