dd1ddbed0ce5c8708fa1c511239cc6b7.ppt

- Количество слайдов: 32

Surveillance and Investigation of Trading Activities Md. Saifur Rahman Executive Director Bangladesh Securities and Exchange Commission

Surveillance and Investigation of Trading Activities Md. Saifur Rahman Executive Director Bangladesh Securities and Exchange Commission

Introduction One of the main functions of the Bangladesh Securities and Exchange Commission is to prohibit fraudulent and unfair trade practices relating to securities trading in capital market as well as to prohibit insider trading in securities. In this regard, the Surveillance Department of the Commission keeps vigil on securities transactions in Bangladesh through market surveillance.

Introduction One of the main functions of the Bangladesh Securities and Exchange Commission is to prohibit fraudulent and unfair trade practices relating to securities trading in capital market as well as to prohibit insider trading in securities. In this regard, the Surveillance Department of the Commission keeps vigil on securities transactions in Bangladesh through market surveillance.

Definition of Market Surveillance “Market Surveillance” refers to the following broad function: monitoring trading activity of stock exchanges using automated or manual means, and collecting and analyzing information either on a real-time, T+1 or historical basis for the purpose of detecting, deterring and taking action with respect to disorderly markets, market “abuse” or other suspicious activity that affects the integrity of the trading or price formation process of a market.

Definition of Market Surveillance “Market Surveillance” refers to the following broad function: monitoring trading activity of stock exchanges using automated or manual means, and collecting and analyzing information either on a real-time, T+1 or historical basis for the purpose of detecting, deterring and taking action with respect to disorderly markets, market “abuse” or other suspicious activity that affects the integrity of the trading or price formation process of a market.

Objectives of Market Surveillance o To ensure that trading in the market is fair and orderly ; o To detect possible instances or patterns of market abuse and to investigate referrals from market participants and the public; o To ensure proper compliance of securities laws, rules and regulations in securities trading;

Objectives of Market Surveillance o To ensure that trading in the market is fair and orderly ; o To detect possible instances or patterns of market abuse and to investigate referrals from market participants and the public; o To ensure proper compliance of securities laws, rules and regulations in securities trading;

Surveillance Functions of BSEC o Has on-line and off-line market surveillance system; o On-line surveillance through Instant. Watch Market Surveillance System; o Off-line surveillance through post trading data analysis and examination of collected documents; Continue…

Surveillance Functions of BSEC o Has on-line and off-line market surveillance system; o On-line surveillance through Instant. Watch Market Surveillance System; o Off-line surveillance through post trading data analysis and examination of collected documents; Continue…

Surveillance Functions of BSEC o Monitoring, assessment and investigation of alerts in Instant. Watch Market; o Analysis of suspicious order activity, trading activity and unusual price movement in shares of listed securities based on alerts and other available information; o To form enquiry committee to enquire into suspicious and unusual order activity, trading activity and price movement in shares of listed securities; Continue…

Surveillance Functions of BSEC o Monitoring, assessment and investigation of alerts in Instant. Watch Market; o Analysis of suspicious order activity, trading activity and unusual price movement in shares of listed securities based on alerts and other available information; o To form enquiry committee to enquire into suspicious and unusual order activity, trading activity and price movement in shares of listed securities; Continue…

Surveillance Functions of BSEC o Referral of possible market abuse cases (including market manipulation, insider trading) to stock exchanges for conducting investigation; o To query market intermediaries as part of daily market monitoring and surveillance; o Referral for enforcement action, if any contraventions of securities laws found in relation to trading activities;

Surveillance Functions of BSEC o Referral of possible market abuse cases (including market manipulation, insider trading) to stock exchanges for conducting investigation; o To query market intermediaries as part of daily market monitoring and surveillance; o Referral for enforcement action, if any contraventions of securities laws found in relation to trading activities;

Surveillance Functions of BSEC o To keep constant vigilance on the surveillance activities of stock exchanges; o Supervision and co-ordination of stock exchanges, CDBL and other market intermediaries in relation to market Surveillance function;

Surveillance Functions of BSEC o To keep constant vigilance on the surveillance activities of stock exchanges; o Supervision and co-ordination of stock exchanges, CDBL and other market intermediaries in relation to market Surveillance function;

Surveillance Functions of BSEC o To examine various enquiry/investigation reports and place in concerned files for taking next course of action. o To prepare and place different types of reports before the Commission for information and action.

Surveillance Functions of BSEC o To examine various enquiry/investigation reports and place in concerned files for taking next course of action. o To prepare and place different types of reports before the Commission for information and action.

Institution Subject to BSEC’s Market Surveillance o o o o o Issuer Companies Stock Exchanges Stock-brokers and stock-dealers of stock exchanges Merchant Banks Institutional Investors Individual investors Directors/Sponsor directors of listed companies Foreign investors CDBL Depository Participants (DP)

Institution Subject to BSEC’s Market Surveillance o o o o o Issuer Companies Stock Exchanges Stock-brokers and stock-dealers of stock exchanges Merchant Banks Institutional Investors Individual investors Directors/Sponsor directors of listed companies Foreign investors CDBL Depository Participants (DP)

Market Abuse Market abuse may for example arise when trading participants: o have used information which is not publicly available; o have distorted the price-setting mechanism of financial instruments and o have disseminated false or misleading information.

Market Abuse Market abuse may for example arise when trading participants: o have used information which is not publicly available; o have distorted the price-setting mechanism of financial instruments and o have disseminated false or misleading information.

Market Abuse Market abuse can be divided into two aspects: o Insider trading and o Market manipulation.

Market Abuse Market abuse can be divided into two aspects: o Insider trading and o Market manipulation.

Insider Trading Buy, Sale or Transfer of Securities based on undisclosed price sensitive information

Insider Trading Buy, Sale or Transfer of Securities based on undisclosed price sensitive information

Market Manipulation o A deliberate attempt to interfere with the free and fair operation of the market and, o create artificial, false or misleading appearances with respect to the price of, or market for, a financial instrument.

Market Manipulation o A deliberate attempt to interfere with the free and fair operation of the market and, o create artificial, false or misleading appearances with respect to the price of, or market for, a financial instrument.

Surveillance System of BSEC o Before December 17, 2012, BSEC used Surveillance System of Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. o From December 17, 2012, BSEC has been using its own state of the art surveillance system, Instant. Watch.

Surveillance System of BSEC o Before December 17, 2012, BSEC used Surveillance System of Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. o From December 17, 2012, BSEC has been using its own state of the art surveillance system, Instant. Watch.

New Surveillance System of BSEC q‘Instant. Watch Market’ - new surveillance system of BSEC which is procured under “Improvement of Capital Markets Governance Project” financed by Government of Bangladesh and Asian Development Bank and q. International Securities Consultancy Ltd. , Hong Kong has provided the consultancy service.

New Surveillance System of BSEC q‘Instant. Watch Market’ - new surveillance system of BSEC which is procured under “Improvement of Capital Markets Governance Project” financed by Government of Bangladesh and Asian Development Bank and q. International Securities Consultancy Ltd. , Hong Kong has provided the consultancy service.

“Instant. Watch Market” o A leading, independent European System for securities market surveillance; o Used for the detection of insider trading, market manipulation and other market abuse and o Can monitor trading on both DSE & CSE simultaneously and at individual BO level.

“Instant. Watch Market” o A leading, independent European System for securities market surveillance; o Used for the detection of insider trading, market manipulation and other market abuse and o Can monitor trading on both DSE & CSE simultaneously and at individual BO level.

Key Features of Instant. Watch Market o It analyses a flow of financial transactions (such as trades, orders and news from stock exchanges) and issues required alerts; o It helps to detect possible market manipulation and insider trading at early stage by using alerts, investigation and reporting tools and o Track, prioritise, manage and log suspicious activities.

Key Features of Instant. Watch Market o It analyses a flow of financial transactions (such as trades, orders and news from stock exchanges) and issues required alerts; o It helps to detect possible market manipulation and insider trading at early stage by using alerts, investigation and reporting tools and o Track, prioritise, manage and log suspicious activities.

Alert Types in Instant. Watch Market: q Price deviations; q Turnover deviations; q Short selling; q Position limit; q Circular movement; q Wash sales;

Alert Types in Instant. Watch Market: q Price deviations; q Turnover deviations; q Short selling; q Position limit; q Circular movement; q Wash sales;

Alert Types in Instant. Watch Market: o Trade concentration; o Marking the Close; o Front running; o Insider trading; o Spoofing and o Late withdrawal, etc

Alert Types in Instant. Watch Market: o Trade concentration; o Marking the Close; o Front running; o Insider trading; o Spoofing and o Late withdrawal, etc

Handling of Alerts Surveillance officers handle alerts using the following tools of the system: q Instrument Monitor q Reports

Handling of Alerts Surveillance officers handle alerts using the following tools of the system: q Instrument Monitor q Reports

Instrument Monitor Three components of Instrument Monitor: q Monitor – graphs and details about the trading day q Order replay – Step through order events q Instrument info – Short info about the instrument

Instrument Monitor Three components of Instrument Monitor: q Monitor – graphs and details about the trading day q Order replay – Step through order events q Instrument info – Short info about the instrument

Reports of Instant. Watch Market q q q Intra Day Price Intraday Turnover Order Report Simple Trade Report Turnover Report Account Report

Reports of Instant. Watch Market q q q Intra Day Price Intraday Turnover Order Report Simple Trade Report Turnover Report Account Report

Reports of Instant. Watch Market Position Exposure Limit Top Ten Brokers Trade Concentration of Traded Quantity q Trade Report q q

Reports of Instant. Watch Market Position Exposure Limit Top Ten Brokers Trade Concentration of Traded Quantity q Trade Report q q

Basis of Enquiry/Investigation Surveillance staffs look into the following matters to determine whether formal investigation/enquiry is required: o o Movement of share prices and trading volumes; Unusual or improper order activity; Unusual or improper trading activity; Press releases and news from listed companies;

Basis of Enquiry/Investigation Surveillance staffs look into the following matters to determine whether formal investigation/enquiry is required: o o Movement of share prices and trading volumes; Unusual or improper order activity; Unusual or improper trading activity; Press releases and news from listed companies;

Basis of Enquiry/Investigation o Tips from market participants; o Internet; o Complaints and information from investors; o Rumors in the market; o News from the media; o Primary observation/findings from stock exchanges.

Basis of Enquiry/Investigation o Tips from market participants; o Internet; o Complaints and information from investors; o Rumors in the market; o News from the media; o Primary observation/findings from stock exchanges.

Enquiry Conducted by BSEC On the basis of above analysis, the Commission constitutes formal enquiry committee to enquire into suspicious and unusual order activities, trading activities and price movement in shares of listed securities.

Enquiry Conducted by BSEC On the basis of above analysis, the Commission constitutes formal enquiry committee to enquire into suspicious and unusual order activities, trading activities and price movement in shares of listed securities.

Investigation Conducted by Stock Exchanges The Commission also instructs stock exchanges to investigate into suspicious and unusual order activities, trading activities and price movement in shares of listed securities.

Investigation Conducted by Stock Exchanges The Commission also instructs stock exchanges to investigate into suspicious and unusual order activities, trading activities and price movement in shares of listed securities.

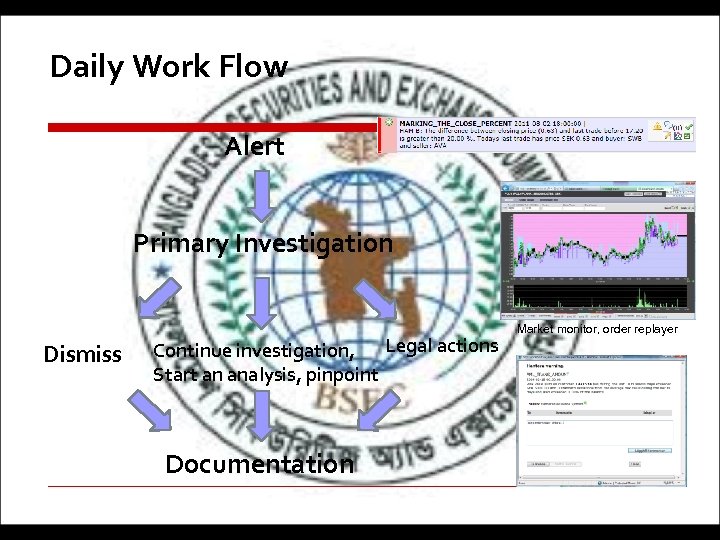

Daily Work Flow Alert Primary Investigation Dismiss Continue investigation, Legal actions Start an analysis, pinpoint Documentation Market monitor, order replayer

Daily Work Flow Alert Primary Investigation Dismiss Continue investigation, Legal actions Start an analysis, pinpoint Documentation Market monitor, order replayer

Benefits of Using Instant. Watch Market o Provides clues for detecting improper order activity, trading activity, possible market manipulation, insider trading and other market abuses; o Helps to detect market abuse at initial stage; o It has been possible to investigate into specific cases/incidents;

Benefits of Using Instant. Watch Market o Provides clues for detecting improper order activity, trading activity, possible market manipulation, insider trading and other market abuses; o Helps to detect market abuse at initial stage; o It has been possible to investigate into specific cases/incidents;

Benefits of Using Instant. Watch Market o The database and reporting system helps a lot in enquiry/investigation process; o Market intermediaries are becoming more aware about unfair trading practices; o The practice of short-selling of securities has been reduced, since the system automatically detects short-selling of securities.

Benefits of Using Instant. Watch Market o The database and reporting system helps a lot in enquiry/investigation process; o Market intermediaries are becoming more aware about unfair trading practices; o The practice of short-selling of securities has been reduced, since the system automatically detects short-selling of securities.

Thank You

Thank You