f0d90516cf9ca2ce7341ce34e7c16bd3.ppt

- Количество слайдов: 31

SUPPORTIVE HOUSING CONFERENCE: June 9, 2011 DEMYSTIFYING BOND FINANCING TO BUILD SUPPORTIVE HOUSING 1

Three models of Bond Financing: Schermerhorn- 100% supportive housing units Urban Pathways -100% supportive housing units with NYS OMH funds Lindeguild Hall - Integrated - 'mixed income' market rate with middle, low income, and supportive 2

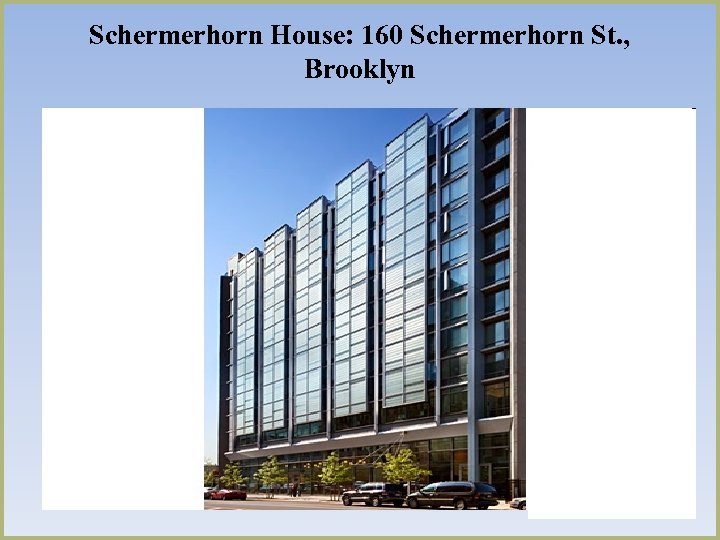

Schermerhorn House: 160 Schermerhorn St. , Brooklyn 3

4

5

6

7

8

Schermerhorn House: Studio Apartment 9

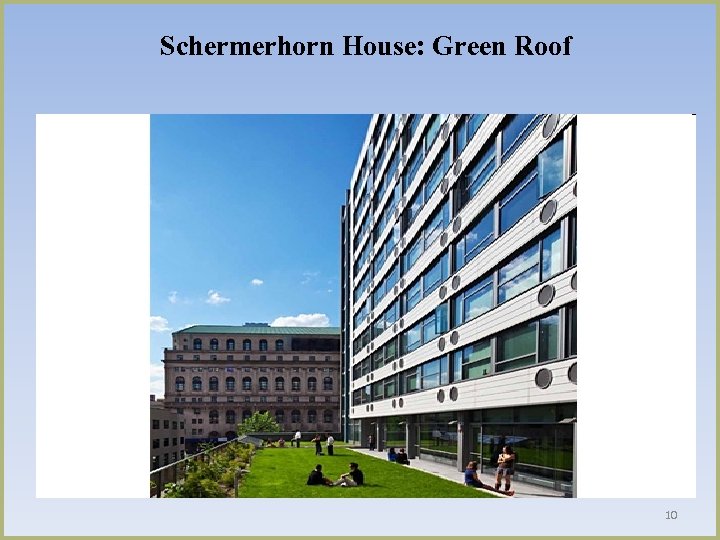

Schermerhorn House: Green Roof 10

Schermerhorn House: Common Space 11

Schermerhorn House: Accessory Community Space – Brooklyn Ballet 12

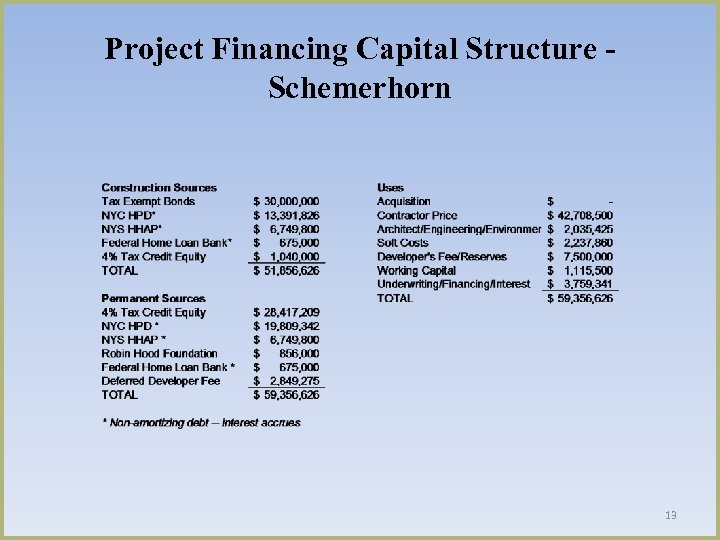

Project Financing Capital Structure Schemerhorn 13

Urban Pathways – Hughes House 14

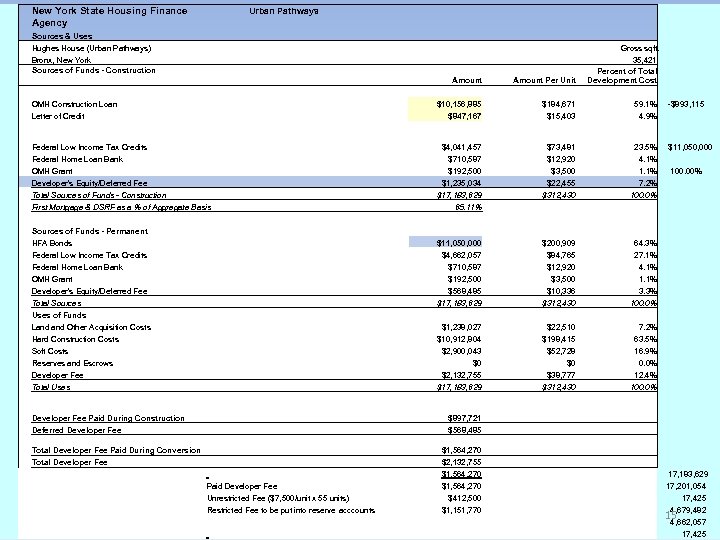

New York State Housing Finance Agency Urban Pathways Sources & Uses Hughes House (Urban Pathways) Bronx, New York Sources of Funds - Construction OMH Construction Loan Letter of Credit Federal Low Income Tax Credits Gross sqft. 35, 421 Percent of Total Development Cost Amount Per Unit $10, 156, 885 $847, 167 $184, 671 $15, 403 $4, 041, 457 $73, 481 Federal Home Loan Bank OMH Grant Developer's Equity/Deferred Fee Total Sources of Funds - Construction First Mortgage & DSRF as a % of Aggregate Basis Sources of Funds - Permanent HFA Bonds Federal Low Income Tax Credits Federal Home Loan Bank OMH Grant Developer's Equity/Deferred Fee Total Sources Uses of Funds Land Other Acquisition Costs Hard Construction Costs Soft Costs Reserves and Escrows Developer Fee Total Uses $710, 587 $192, 500 $1, 235, 034 $17, 183, 629 65. 11% $11, 050, 000 $4, 662, 057 $710, 587 $192, 500 $568, 485 $17, 183, 629 $1, 238, 027 $10, 912, 804 $2, 900, 043 $0 $2, 132, 755 $17, 183, 629 $12, 920 $3, 500 $22, 455 $312, 430 Developer Fee Paid During Construction $897, 721 Deferred Developer Fee $568, 485 Total Developer Fee Paid During Conversion $1, 564, 270 Total Developer Fee $2, 132, 755 $1, 564, 270 $412, 500 $1, 151, 770 Paid Developer Fee Unrestricted Fee ($7, 500/unit x 55 units) Restricted Fee to be put into reserve acccounts $200, 909 $84, 765 $12, 920 $3, 500 $10, 336 $312, 430 $22, 510 $198, 415 $52, 728 $0 $38, 777 $312, 430 59. 1% -$893, 115 4. 9% 23. 5% $11, 050, 000 4. 1% 1. 1% 100. 00% 7. 2% 100. 0% 64. 3% 27. 1% 4. 1% 1. 1% 3. 3% 100. 0% 7. 2% 63. 5% 16. 9% 0. 0% 12. 4% 100. 0% 17, 183, 629 17, 201, 054 17, 425 4, 679, 482 15 4, 662, 057 17, 425

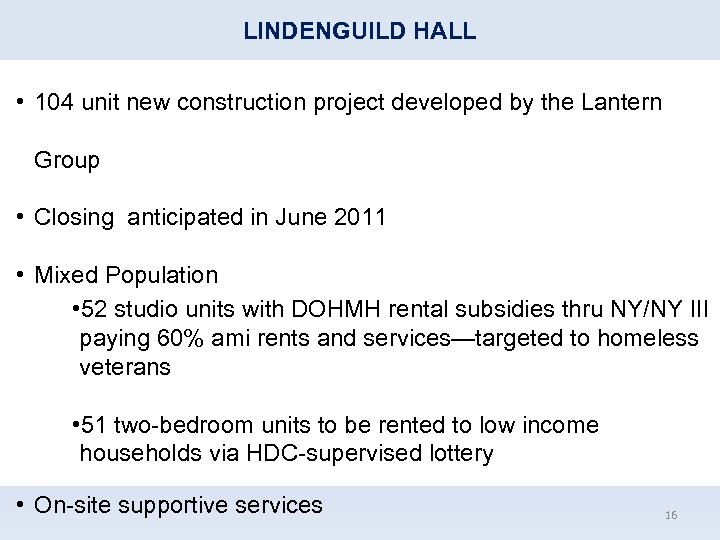

LINDENGUILD HALL • 104 unit new construction project developed by the Lantern Group • Closing anticipated in June 2011 • Mixed Population • 52 studio units with DOHMH rental subsidies thru NY/NY III paying 60% ami rents and services—targeted to homeless veterans • 51 two-bedroom units to be rented to low income households via HDC-supervised lottery • On-site supportive services 16

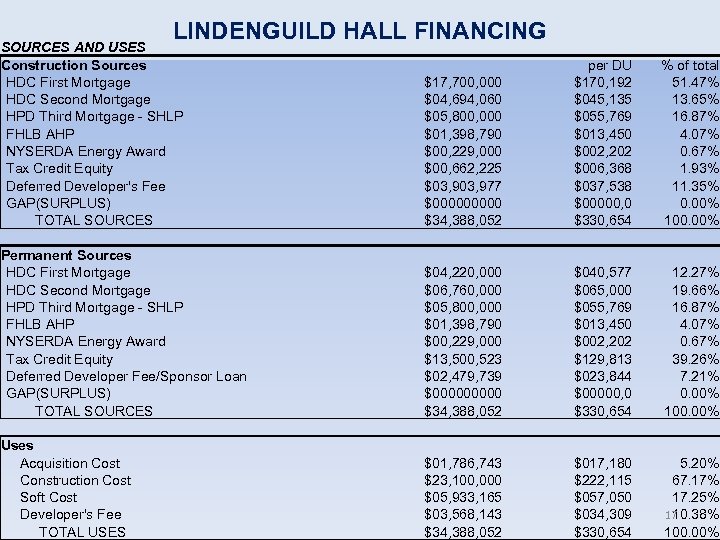

LINDENGUILD HALL FINANCING SOURCES AND USES Construction Sources HDC First Mortgage HDC Second Mortgage HPD Third Mortgage - SHLP FHLB AHP NYSERDA Energy Award Tax Credit Equity Deferred Developer's Fee GAP(SURPLUS) TOTAL SOURCES Permanent Sources HDC First Mortgage HDC Second Mortgage HPD Third Mortgage - SHLP FHLB AHP NYSERDA Energy Award Tax Credit Equity Deferred Developer Fee/Sponsor Loan GAP(SURPLUS) TOTAL SOURCES Uses Acquisition Cost Construction Cost Soft Cost Developer's Fee TOTAL USES $17, 700, 000 $04, 694, 060 $05, 800, 000 $01, 398, 790 $00, 229, 000 $00, 662, 225 $03, 977 $00000 $34, 388, 052 $04, 220, 000 $06, 760, 000 $05, 800, 000 $01, 398, 790 $00, 229, 000 $13, 500, 523 $02, 479, 739 $00000 $34, 388, 052 $01, 786, 743 $23, 100, 000 $05, 933, 165 $03, 568, 143 $34, 388, 052 per DU $170, 192 $045, 135 $055, 769 $013, 450 $002, 202 $006, 368 $037, 538 $00000, 0 $330, 654 % of total 51. 47% 13. 65% 16. 87% 4. 07% 0. 67% 1. 93% 11. 35% 0. 00% 100. 00% $040, 577 $065, 000 $055, 769 $013, 450 $002, 202 $129, 813 $023, 844 $00000, 0 $330, 654 12. 27% 19. 66% 16. 87% 4. 07% 0. 67% 39. 26% 7. 21% 0. 00% 100. 00% $017, 180 $222, 115 $057, 050 $034, 309 $330, 654 5. 20% 67. 17% 17. 25% 17 10. 38% 100. 00%

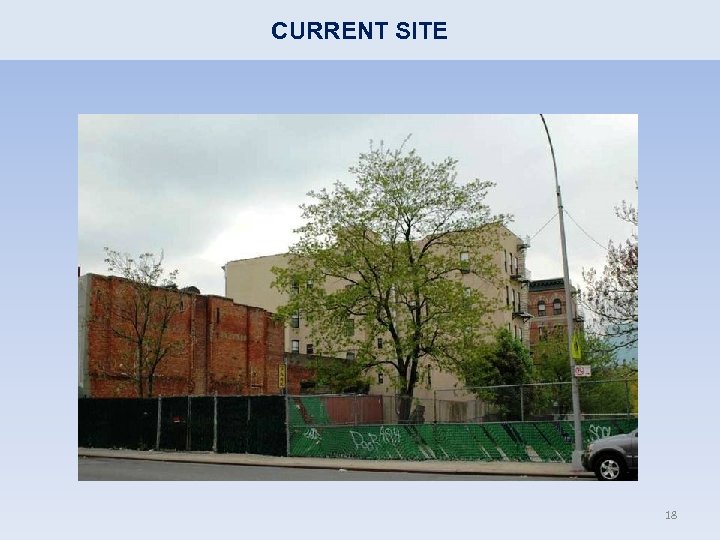

CURRENT SITE 18

ARCHITECTURAL RENDERING 19

What Are Tax Exempt Bonds What are the benefits of financing? What types of housing can be built with tax exempt bonds, qualified rental housing? In terms of financing tools, how should the development community think about the differences between 9% and 4% credits? Who can issue bonds? Who are the parties in a bond transaction? 20

What Are Tax Exempt Bonds Cont’ What are the obligations of the sponsor/developer with respect to the bonds? What special rules apply to a 501(c)(3) sponsor? 21

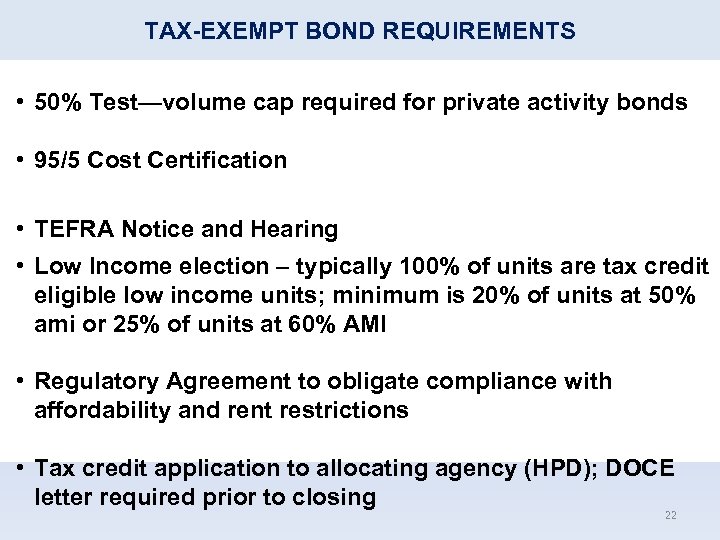

TAX-EXEMPT BOND REQUIREMENTS • 50% Test—volume cap required for private activity bonds • 95/5 Cost Certification • TEFRA Notice and Hearing • Low Income election – typically 100% of units are tax credit eligible low income units; minimum is 20% of units at 50% ami or 25% of units at 60% AMI • Regulatory Agreement to obligate compliance with affordability and rent restrictions • Tax credit application to allocating agency (HPD); DOCE letter required prior to closing 22

HDC BOND FINANCED SUPPORTIVE HOUSING Generally follows Low Income Affordable Marketplace Program(LAMP) Tax exempt private activity bonds to meet 50% test As of right 4% Federal Low Income Housing Tax Credits Construction Loans—fully enhanced by bank to insulate bondholders from real estate risk Permanent Loans – sized to project NOI, insured or credit enhanced for term Rental assistance and supportive services contract required for all supportive units 23

BUDGET CONSIDERATIONS FOR BOND DEALS Bond Costs of Issuance (1. 5% of Construction bond) Negative Arbitrage (interest paid on fully funded construction bond amount) NYS Bond Issuance Charge Credit Enhancement Fees Type and amount of rental assistance for supportive units Supportive services on budget or off budget. 24

How To Apply for Funds How does a project apply? Why would you apply to HFA vs. HDC ? 25

Credit Enhancement—and role of private lender What is the role of bank in bond financing? How does bank analyzing a supportive housing transaction? Underwriting concerns? What impact does the equity investor have on how a bank underwrites the deal? What are the typical costs of Letter of Credit? 26

OMH Transactions- Alternative to Letter of Credit – OMH Letter of Credit What are the challenges to financing OMH deals? What is a quick draw letter of Credit? 27

FUTURE What steps are state and city taking to increase access to bond financing for supportive housing and integrated housing? 28

29

SUPPORTIVE HOUSING DEVELOPMENT LIST 30% of Units for Formerly Homeless Supportive Housing Integrated Housing Senior Housing with Rental Assistance and/or Services Development Name Washington Avenue 600 Concord Avenue Claremont Park Apartments Casa del Sol Apartments 15 East Clarke Place Urban Horizons II Prospect Avenue 45 Malta St. 1068 Gerard Avenue Morrisania Terrace 830 Fox Street St. Peter's Avenue Apartments 1211 Southern Blvd East Tremont Ave Apts West 153 rd Street St. Ann's Terrace CDE Schermerhorn, L. P. Pitt Street Development Silverleaf Cedars Project Pitt Street Development 1825 Atlantic Avenue Serviam Towers Lindenguild Hall Kings County Senior Residence Serviam Towers Riverway Apartments Astoria Senior Residence Crown Heights Senior Residence Council Towers VI Self Help KVII Units 100 83 98 114 102 128 124 48 82 42 58 58 127 73 85 314 217 263 118 95 263 150 160 104 173 160 115 184 144 78 92 Borough Bronx Bronx Brooklyn Bronx Bronx Manhattan Bronx Brooklyn Manhattan Bronx Manhattan Brooklyn Bronx Brooklyn Queens Close Date 07/17/03 12/22/03 07/22/04 06/23/05 06/29/05 11/30/05 12/28/05 06/29/06 06/30/06 06/25/09 12/14/05 12/28/06 06/29/04 11/01/06 12/28/06 06/28/07 12/23/08 ACTIVE 06/30/05 12/23/08 ACTIVE 12/22/06 12/20/07 06/29/10 12/22/10

Questions and Answers 31

f0d90516cf9ca2ce7341ce34e7c16bd3.ppt