ce8acb57be68e4fccb1b468c7d3d5ed2.ppt

- Количество слайдов: 28

Supplemental Pension Plan Review Preliminary Report to Small Municipality USA May 2012 Presented by CBIZ Jon S. Ketzner and Jack Keller 11440 Tomahawk Creek Parkway Leawood, KS 66211 44 Baltimore Street Cumberland, MD 21502 1

Supplemental Pension Plan Review Preliminary Report to Small Municipality USA May 2012 Presented by CBIZ Jon S. Ketzner and Jack Keller 11440 Tomahawk Creek Parkway Leawood, KS 66211 44 Baltimore Street Cumberland, MD 21502 1

Project Mission • • Help City meet its fiduciarial responsibilities to tax payers and employees Review current program Review future expense impact on City Review alternative post-retirement approaches to the Supplemental Pension Plan that continue to meet the current goals and purpose for the City for retirement programs Supplemental Pension Plan Review May 2012 2

Project Mission • • Help City meet its fiduciarial responsibilities to tax payers and employees Review current program Review future expense impact on City Review alternative post-retirement approaches to the Supplemental Pension Plan that continue to meet the current goals and purpose for the City for retirement programs Supplemental Pension Plan Review May 2012 2

Current Goals and Purpose: When integrated with other retirement programs, the City's retirement benefits should aid with: • • Recruitment – The plan should act as an incentive for recruiting high quality employees. The program must be competitive with other cities for which we compete for employees. Retention - The program should act as an incentive for retaining high-quality employees and maintaining a stable workforce. The program should also be compatible with changing workforce and demographic trends. Reward - The program should provide a solid foundation for retirement security following a career in public service. Sustainability - The cost of each plan should be sustainable and predictable over the long term. Fundability – The total cost of retirement plans should be reasonable and affordable for the City. Affordability - The cost of each plan should be affordable for current and future employees. Equity - The program benefits should be equitable for all employees. Supplemental Pension Plan Review May 2012 3

Current Goals and Purpose: When integrated with other retirement programs, the City's retirement benefits should aid with: • • Recruitment – The plan should act as an incentive for recruiting high quality employees. The program must be competitive with other cities for which we compete for employees. Retention - The program should act as an incentive for retaining high-quality employees and maintaining a stable workforce. The program should also be compatible with changing workforce and demographic trends. Reward - The program should provide a solid foundation for retirement security following a career in public service. Sustainability - The cost of each plan should be sustainable and predictable over the long term. Fundability – The total cost of retirement plans should be reasonable and affordable for the City. Affordability - The cost of each plan should be affordable for current and future employees. Equity - The program benefits should be equitable for all employees. Supplemental Pension Plan Review May 2012 3

Current Program Three Defined Benefit Pension Plans • Kansas Public Employees Retirement System (1. 75% of final pay) • Kansas Police and Fire System (2. 5% of final pay) • Municipality Employees Supplemental Pension Plan (1%/. 75% of final pay) Unmatched 457 Plan (ING Platform) • Elective employee contributions only • Employee directed investments Post Retirement Health Plan (OPEB) • City pays 50% of single premium for 5 years after retirement Supplemental Pension Plan Review May 2012 4

Current Program Three Defined Benefit Pension Plans • Kansas Public Employees Retirement System (1. 75% of final pay) • Kansas Police and Fire System (2. 5% of final pay) • Municipality Employees Supplemental Pension Plan (1%/. 75% of final pay) Unmatched 457 Plan (ING Platform) • Elective employee contributions only • Employee directed investments Post Retirement Health Plan (OPEB) • City pays 50% of single premium for 5 years after retirement Supplemental Pension Plan Review May 2012 4

Current Post-Retirement Program • Compared with other employers (excluding Governments) – Generous • Compared with other governmental employers – Competitive to somewhat better than competitive • Competitive/adequacy comparison would need to consider all employee compensation • Most governmental agencies are currently reviewing their postretirement promises and obligations Supplemental Pension Plan Review May 2012 5

Current Post-Retirement Program • Compared with other employers (excluding Governments) – Generous • Compared with other governmental employers – Competitive to somewhat better than competitive • Competitive/adequacy comparison would need to consider all employee compensation • Most governmental agencies are currently reviewing their postretirement promises and obligations Supplemental Pension Plan Review May 2012 5

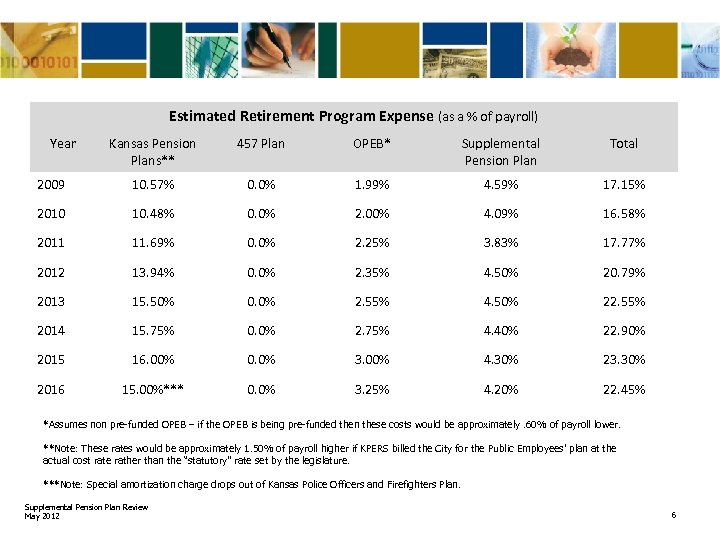

Estimated Retirement Program Expense (as a % of payroll) Year Kansas Pension Plans** 457 Plan OPEB* Supplemental Pension Plan Total 2009 10. 57% 0. 0% 1. 99% 4. 59% 17. 15% 2010 10. 48% 0. 0% 2. 00% 4. 09% 16. 58% 2011 11. 69% 0. 0% 2. 25% 3. 83% 17. 77% 2012 13. 94% 0. 0% 2. 35% 4. 50% 20. 79% 2013 15. 50% 0. 0% 2. 55% 4. 50% 22. 55% 2014 15. 75% 0. 0% 2. 75% 4. 40% 22. 90% 2015 16. 00% 0. 0% 3. 00% 4. 30% 23. 30% 2016 15. 00%*** 0. 0% 3. 25% 4. 20% 22. 45% *Assumes non pre-funded OPEB – if the OPEB is being pre-funded then these costs would be approximately. 60% of payroll lower. **Note: These rates would be approximately 1. 50% of payroll higher if KPERS billed the City for the Public Employees’ plan at the actual cost rate rather than the “statutory” rate set by the legislature. ***Note: Special amortization charge drops out of Kansas Police Officers and Firefighters Plan. Supplemental Pension Plan Review May 2012 6

Estimated Retirement Program Expense (as a % of payroll) Year Kansas Pension Plans** 457 Plan OPEB* Supplemental Pension Plan Total 2009 10. 57% 0. 0% 1. 99% 4. 59% 17. 15% 2010 10. 48% 0. 0% 2. 00% 4. 09% 16. 58% 2011 11. 69% 0. 0% 2. 25% 3. 83% 17. 77% 2012 13. 94% 0. 0% 2. 35% 4. 50% 20. 79% 2013 15. 50% 0. 0% 2. 55% 4. 50% 22. 55% 2014 15. 75% 0. 0% 2. 75% 4. 40% 22. 90% 2015 16. 00% 0. 0% 3. 00% 4. 30% 23. 30% 2016 15. 00%*** 0. 0% 3. 25% 4. 20% 22. 45% *Assumes non pre-funded OPEB – if the OPEB is being pre-funded then these costs would be approximately. 60% of payroll lower. **Note: These rates would be approximately 1. 50% of payroll higher if KPERS billed the City for the Public Employees’ plan at the actual cost rate rather than the “statutory” rate set by the legislature. ***Note: Special amortization charge drops out of Kansas Police Officers and Firefighters Plan. Supplemental Pension Plan Review May 2012 6

A Quick and Dirty Review of “Contract Clause” Protection Under Kansas State Law • The Supplemental Pension Plan may create a contract between the City and the Plan members (probably at employment – possibly at vesting date) • If Plan is amended to the disadvantage of participants – an offsetting advantage should be provided • Plan can be amended to just the extent necessary to maintain its integrity • Future benefit accruals can be modified, or require employee contributions • Plan can be eliminated or provide lower benefits to future employees (as with 2010 Amendment) City should seek legal advice if it amends the Supplemental Pension Plan Review May 2012 7

A Quick and Dirty Review of “Contract Clause” Protection Under Kansas State Law • The Supplemental Pension Plan may create a contract between the City and the Plan members (probably at employment – possibly at vesting date) • If Plan is amended to the disadvantage of participants – an offsetting advantage should be provided • Plan can be amended to just the extent necessary to maintain its integrity • Future benefit accruals can be modified, or require employee contributions • Plan can be eliminated or provide lower benefits to future employees (as with 2010 Amendment) City should seek legal advice if it amends the Supplemental Pension Plan Review May 2012 7

Valuation Date 01/01 Valuation Assets Actuarial Accrued Liabilities Funded Ratio Unfunded Actuarial Accrued Liabilities 2001 $922, 247 $3, 281, 712 28. 1 $2, 359, 465 2002 $1, 328, 295 $3, 880, 144 34. 2 $2, 551, 849 2003 $1, 750, 707 $4, 565, 697 38. 3 $2, 814, 990 2004 $2, 614, 536 $5, 059, 675 51. 7 $2, 445, 139 2005 $3, 341, 841 $5, 732, 344 58. 3 $2, 390, 503 2006 $4, 032, 152 $6, 771, 187 59. 5 $2, 739, 035 2007 $4, 902, 802 $7, 939, 483 61. 8 $3, 036, 681 2008 $5, 716, 905 $8, 716, 898 65. 6 $2, 999, 993 2009 $5, 194, 888 $10, 005, 957 51. 9 $4, 811, 069 2010 $7, 464, 260 $10, 999, 708 67. 9 $3, 535, 448 2011 $8, 892, 444 $11, 470, 971 77. 5 $2, 578, 527 2012 $9, 118, 571 $12, 311, 256 74. 1 $3, 192, 685 Supplemental Pension Plan Review May 2012 8

Valuation Date 01/01 Valuation Assets Actuarial Accrued Liabilities Funded Ratio Unfunded Actuarial Accrued Liabilities 2001 $922, 247 $3, 281, 712 28. 1 $2, 359, 465 2002 $1, 328, 295 $3, 880, 144 34. 2 $2, 551, 849 2003 $1, 750, 707 $4, 565, 697 38. 3 $2, 814, 990 2004 $2, 614, 536 $5, 059, 675 51. 7 $2, 445, 139 2005 $3, 341, 841 $5, 732, 344 58. 3 $2, 390, 503 2006 $4, 032, 152 $6, 771, 187 59. 5 $2, 739, 035 2007 $4, 902, 802 $7, 939, 483 61. 8 $3, 036, 681 2008 $5, 716, 905 $8, 716, 898 65. 6 $2, 999, 993 2009 $5, 194, 888 $10, 005, 957 51. 9 $4, 811, 069 2010 $7, 464, 260 $10, 999, 708 67. 9 $3, 535, 448 2011 $8, 892, 444 $11, 470, 971 77. 5 $2, 578, 527 2012 $9, 118, 571 $12, 311, 256 74. 1 $3, 192, 685 Supplemental Pension Plan Review May 2012 8

Retirement Program Alternatives Defined Benefit Plan Defined Contribution Plan (Supplemental Pension) 457 or 401(a) • • • Traditional governmental program City bears all investment and mortality risk High Maintenance Costs – Investment Advisory – Administrative – Actuaries Essentially mandatory and potentially volatile Funding Requirements Private sector is abandoning very conspicuously which is putting pressure on governments to do the same Supplemental Pension Plan Review May 2012 • • Emerging alternative for governmental employers Employee bears all investment and mortality risk Lower Maintenance Costs – Employees invest – Administration Discretionary funding requirements 9

Retirement Program Alternatives Defined Benefit Plan Defined Contribution Plan (Supplemental Pension) 457 or 401(a) • • • Traditional governmental program City bears all investment and mortality risk High Maintenance Costs – Investment Advisory – Administrative – Actuaries Essentially mandatory and potentially volatile Funding Requirements Private sector is abandoning very conspicuously which is putting pressure on governments to do the same Supplemental Pension Plan Review May 2012 • • Emerging alternative for governmental employers Employee bears all investment and mortality risk Lower Maintenance Costs – Employees invest – Administration Discretionary funding requirements 9

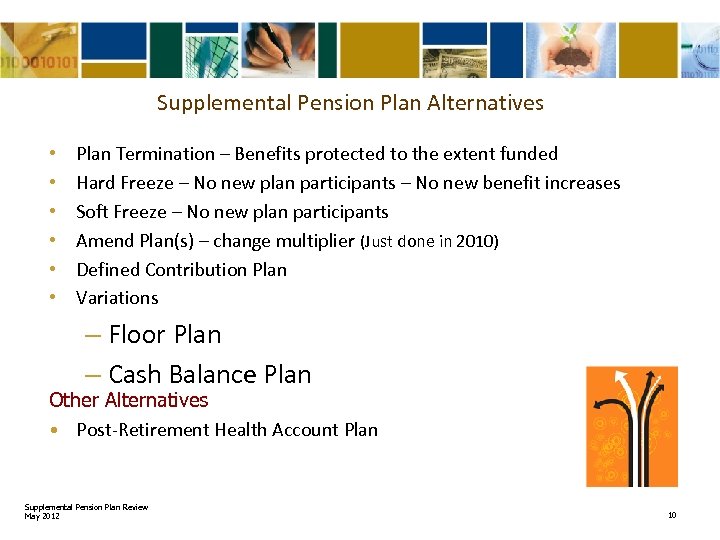

Supplemental Pension Plan Alternatives • • • Plan Termination – Benefits protected to the extent funded Hard Freeze – No new plan participants – No new benefit increases Soft Freeze – No new plan participants Amend Plan(s) – change multiplier (Just done in 2010) Defined Contribution Plan Variations – Floor Plan – Cash Balance Plan Other Alternatives • Post-Retirement Health Account Plan Supplemental Pension Plan Review May 2012 10

Supplemental Pension Plan Alternatives • • • Plan Termination – Benefits protected to the extent funded Hard Freeze – No new plan participants – No new benefit increases Soft Freeze – No new plan participants Amend Plan(s) – change multiplier (Just done in 2010) Defined Contribution Plan Variations – Floor Plan – Cash Balance Plan Other Alternatives • Post-Retirement Health Account Plan Supplemental Pension Plan Review May 2012 10

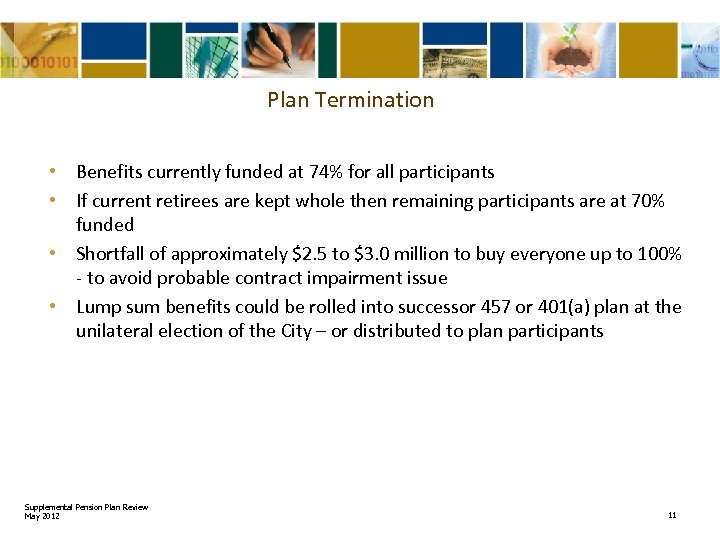

Plan Termination • Benefits currently funded at 74% for all participants • If current retirees are kept whole then remaining participants are at 70% funded • Shortfall of approximately $2. 5 to $3. 0 million to buy everyone up to 100% - to avoid probable contract impairment issue • Lump sum benefits could be rolled into successor 457 or 401(a) plan at the unilateral election of the City – or distributed to plan participants Supplemental Pension Plan Review May 2012 11

Plan Termination • Benefits currently funded at 74% for all participants • If current retirees are kept whole then remaining participants are at 70% funded • Shortfall of approximately $2. 5 to $3. 0 million to buy everyone up to 100% - to avoid probable contract impairment issue • Lump sum benefits could be rolled into successor 457 or 401(a) plan at the unilateral election of the City – or distributed to plan participants Supplemental Pension Plan Review May 2012 11

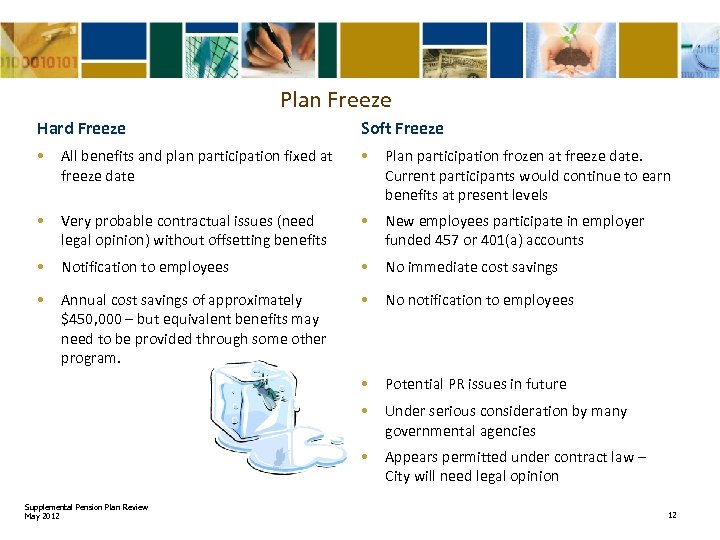

Plan Freeze Hard Freeze Soft Freeze • All benefits and plan participation fixed at freeze date • Plan participation frozen at freeze date. Current participants would continue to earn benefits at present levels • Very probable contractual issues (need legal opinion) without offsetting benefits • New employees participate in employer funded 457 or 401(a) accounts • Notification to employees • No immediate cost savings • Annual cost savings of approximately $450, 000 – but equivalent benefits may need to be provided through some other program. • No notification to employees • Potential PR issues in future • Under serious consideration by many governmental agencies • Appears permitted under contract law – City will need legal opinion Supplemental Pension Plan Review May 2012 12

Plan Freeze Hard Freeze Soft Freeze • All benefits and plan participation fixed at freeze date • Plan participation frozen at freeze date. Current participants would continue to earn benefits at present levels • Very probable contractual issues (need legal opinion) without offsetting benefits • New employees participate in employer funded 457 or 401(a) accounts • Notification to employees • No immediate cost savings • Annual cost savings of approximately $450, 000 – but equivalent benefits may need to be provided through some other program. • No notification to employees • Potential PR issues in future • Under serious consideration by many governmental agencies • Appears permitted under contract law – City will need legal opinion Supplemental Pension Plan Review May 2012 12

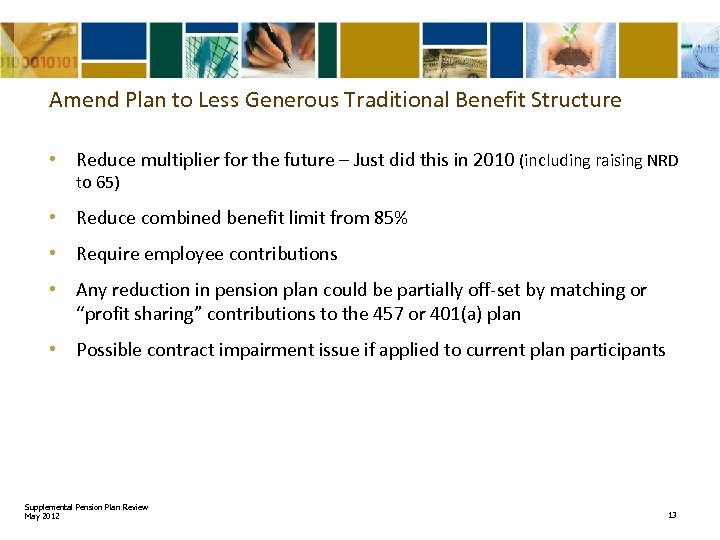

Amend Plan to Less Generous Traditional Benefit Structure • Reduce multiplier for the future – Just did this in 2010 (including raising NRD to 65) • Reduce combined benefit limit from 85% • Require employee contributions • Any reduction in pension plan could be partially off-set by matching or “profit sharing” contributions to the 457 or 401(a) plan • Possible contract impairment issue if applied to current plan participants Supplemental Pension Plan Review May 2012 13

Amend Plan to Less Generous Traditional Benefit Structure • Reduce multiplier for the future – Just did this in 2010 (including raising NRD to 65) • Reduce combined benefit limit from 85% • Require employee contributions • Any reduction in pension plan could be partially off-set by matching or “profit sharing” contributions to the 457 or 401(a) plan • Possible contract impairment issue if applied to current plan participants Supplemental Pension Plan Review May 2012 13

Defined Contribution Plan • Primary retirement plan design for private sector • Account plan • Predictable contributions – Unpredictable retirement benefit outcomes (opposite of defined benefit plan) • City’s current employee-only funded 457 Plan is a defined contribution plan and could possibly be used as a successor plan for City contributions • If 457 Plan is not available, then City could adopt a “ 401(a)” Defined Contribution Plan instead • Equivalent level of City contributions (approximately 4% of payroll) probably will meet contract impairment requirement – need legal opinion. Supplemental Pension Plan Review May 2012 14

Defined Contribution Plan • Primary retirement plan design for private sector • Account plan • Predictable contributions – Unpredictable retirement benefit outcomes (opposite of defined benefit plan) • City’s current employee-only funded 457 Plan is a defined contribution plan and could possibly be used as a successor plan for City contributions • If 457 Plan is not available, then City could adopt a “ 401(a)” Defined Contribution Plan instead • Equivalent level of City contributions (approximately 4% of payroll) probably will meet contract impairment requirement – need legal opinion. Supplemental Pension Plan Review May 2012 14

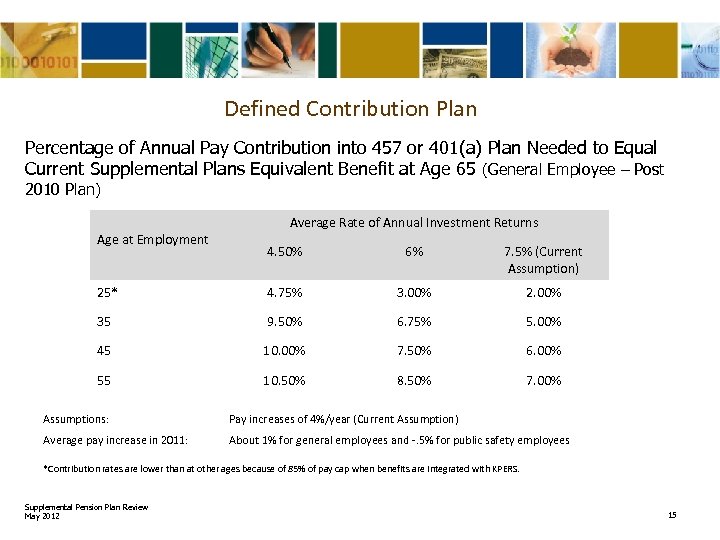

Defined Contribution Plan Percentage of Annual Pay Contribution into 457 or 401(a) Plan Needed to Equal Current Supplemental Plans Equivalent Benefit at Age 65 (General Employee – Post 2010 Plan) Age at Employment Average Rate of Annual Investment Returns 4. 50% 6% 7. 5% (Current Assumption) 25* 4. 75% 3. 00% 2. 00% 35 9. 50% 6. 75% 5. 00% 45 10. 00% 7. 50% 6. 00% 55 10. 50% 8. 50% 7. 00% Assumptions: Pay increases of 4%/year (Current Assumption) Average pay increase in 2011: About 1% for general employees and -. 5% for public safety employees *Contribution rates are lower than at other ages because of 85% of pay cap when benefits are integrated with KPERS. Supplemental Pension Plan Review May 2012 15

Defined Contribution Plan Percentage of Annual Pay Contribution into 457 or 401(a) Plan Needed to Equal Current Supplemental Plans Equivalent Benefit at Age 65 (General Employee – Post 2010 Plan) Age at Employment Average Rate of Annual Investment Returns 4. 50% 6% 7. 5% (Current Assumption) 25* 4. 75% 3. 00% 2. 00% 35 9. 50% 6. 75% 5. 00% 45 10. 00% 7. 50% 6. 00% 55 10. 50% 8. 50% 7. 00% Assumptions: Pay increases of 4%/year (Current Assumption) Average pay increase in 2011: About 1% for general employees and -. 5% for public safety employees *Contribution rates are lower than at other ages because of 85% of pay cap when benefits are integrated with KPERS. Supplemental Pension Plan Review May 2012 15

Floor Plan Basic Concept: Supplemental Pension Plan is frozen and, instead, the City contributes monies into the 457 or 401(a) plan on everyone’s behalf At retirement, if certain protected employees (say those currently employed) do not receive as much from the frozen pension plan plus the City contributed 457 or 401(a) plan monies as they would have from the original Supplemental Pension Plan, then the frozen Supplemental Pension Plan will make up the difference. Issues: • Avoids contract impairment issue • 457 or 401(a) matching contributions may not be able to be used as part of the “floor” • Accelerates migration to a full defined contribution approach Supplemental Pension Plan Review May 2012 • City would probably want to control its 457 or 401(a) investments used for floor benefits 16

Floor Plan Basic Concept: Supplemental Pension Plan is frozen and, instead, the City contributes monies into the 457 or 401(a) plan on everyone’s behalf At retirement, if certain protected employees (say those currently employed) do not receive as much from the frozen pension plan plus the City contributed 457 or 401(a) plan monies as they would have from the original Supplemental Pension Plan, then the frozen Supplemental Pension Plan will make up the difference. Issues: • Avoids contract impairment issue • 457 or 401(a) matching contributions may not be able to be used as part of the “floor” • Accelerates migration to a full defined contribution approach Supplemental Pension Plan Review May 2012 • City would probably want to control its 457 or 401(a) investments used for floor benefits 16

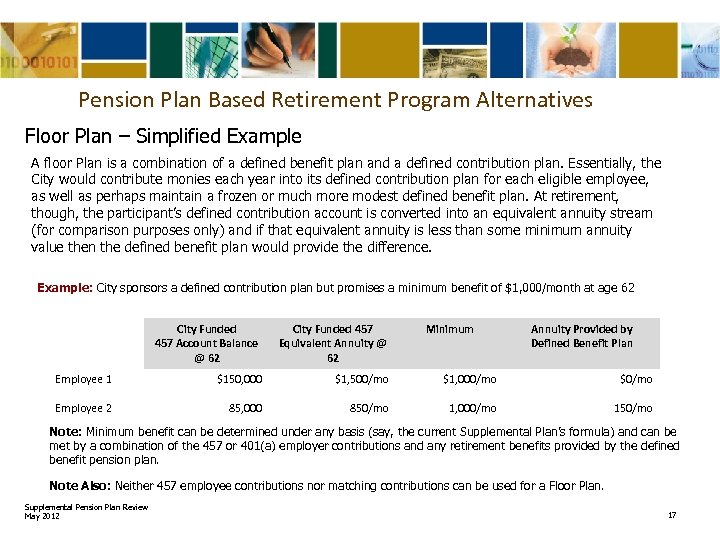

Pension Plan Based Retirement Program Alternatives Floor Plan – Simplified Example A floor Plan is a combination of a defined benefit plan and a defined contribution plan. Essentially, the City would contribute monies each year into its defined contribution plan for each eligible employee, as well as perhaps maintain a frozen or much more modest defined benefit plan. At retirement, though, the participant’s defined contribution account is converted into an equivalent annuity stream (for comparison purposes only) and if that equivalent annuity is less than some minimum annuity value then the defined benefit plan would provide the difference. Example: City sponsors a defined contribution plan but promises a minimum benefit of $1, 000/month at age 62 City Funded 457 Account Balance @ 62 City Funded 457 Equivalent Annuity @ 62 Minimum Annuity Provided by Defined Benefit Plan Employee 1 $150, 000 $1, 500/mo $1, 000/mo $0/mo Employee 2 85, 000 850/mo 1, 000/mo 150/mo Note: Minimum benefit can be determined under any basis (say, the current Supplemental Plan’s formula) and can be met by a combination of the 457 or 401(a) employer contributions and any retirement benefits provided by the defined benefit pension plan. Note Also: Neither 457 employee contributions nor matching contributions can be used for a Floor Plan. Supplemental Pension Plan Review May 2012 17

Pension Plan Based Retirement Program Alternatives Floor Plan – Simplified Example A floor Plan is a combination of a defined benefit plan and a defined contribution plan. Essentially, the City would contribute monies each year into its defined contribution plan for each eligible employee, as well as perhaps maintain a frozen or much more modest defined benefit plan. At retirement, though, the participant’s defined contribution account is converted into an equivalent annuity stream (for comparison purposes only) and if that equivalent annuity is less than some minimum annuity value then the defined benefit plan would provide the difference. Example: City sponsors a defined contribution plan but promises a minimum benefit of $1, 000/month at age 62 City Funded 457 Account Balance @ 62 City Funded 457 Equivalent Annuity @ 62 Minimum Annuity Provided by Defined Benefit Plan Employee 1 $150, 000 $1, 500/mo $1, 000/mo $0/mo Employee 2 85, 000 850/mo 1, 000/mo 150/mo Note: Minimum benefit can be determined under any basis (say, the current Supplemental Plan’s formula) and can be met by a combination of the 457 or 401(a) employer contributions and any retirement benefits provided by the defined benefit pension plan. Note Also: Neither 457 employee contributions nor matching contributions can be used for a Floor Plan. Supplemental Pension Plan Review May 2012 17

Cash Balance Plan • Defined Benefit Plan – Actuaries – City still bears investment and mortality risk – but investment risk is less because benefits are tied, to some extent, to capital markets – Funding Volatility – but much less then traditional final pay formula plans • Benefit structure is an “account” – just like a 457 or 401(a) plan • Modern Benefit Design – popular in private sector • At retirement, “account” is annuitized • City guarantees some level of investment return on the account – unlike a traditional defined contribution plan (like the 457 plan) • Current Supplemental Pension Plan could be amended into a Cash Balance Plan for future accruals • KPERS may adopt Cash Balance Plan Supplemental Pension Plan Review May 2012 18

Cash Balance Plan • Defined Benefit Plan – Actuaries – City still bears investment and mortality risk – but investment risk is less because benefits are tied, to some extent, to capital markets – Funding Volatility – but much less then traditional final pay formula plans • Benefit structure is an “account” – just like a 457 or 401(a) plan • Modern Benefit Design – popular in private sector • At retirement, “account” is annuitized • City guarantees some level of investment return on the account – unlike a traditional defined contribution plan (like the 457 plan) • Current Supplemental Pension Plan could be amended into a Cash Balance Plan for future accruals • KPERS may adopt Cash Balance Plan Supplemental Pension Plan Review May 2012 18

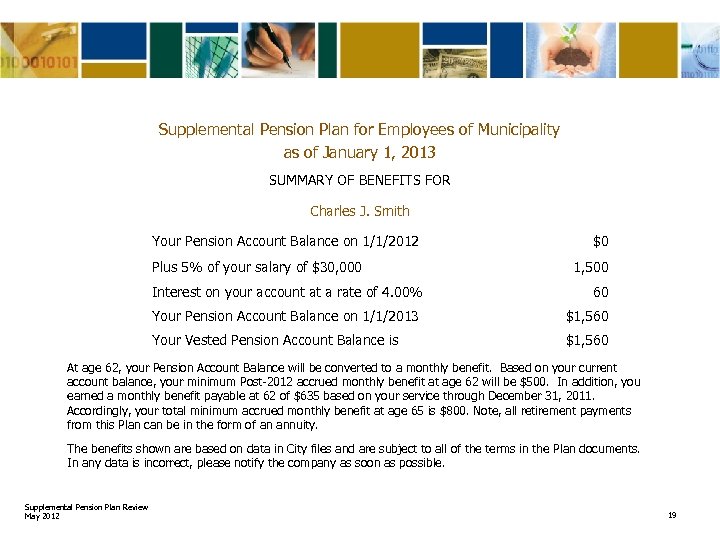

Supplemental Pension Plan for Employees of Municipality as of January 1, 2013 SUMMARY OF BENEFITS FOR Charles J. Smith Your Pension Account Balance on 1/1/2012 Plus 5% of your salary of $30, 000 $0 1, 500 Interest on your account at a rate of 4. 00% 60 Your Pension Account Balance on 1/1/2013 $1, 560 Your Vested Pension Account Balance is $1, 560 At age 62, your Pension Account Balance will be converted to a monthly benefit. Based on your current account balance, your minimum Post-2012 accrued monthly benefit at age 62 will be $500. In addition, you earned a monthly benefit payable at 62 of $635 based on your service through December 31, 2011. Accordingly, your total minimum accrued monthly benefit at age 65 is $800. Note, all retirement payments from this Plan can be in the form of an annuity. The benefits shown are based on data in City files and are subject to all of the terms in the Plan documents. In any data is incorrect, please notify the company as soon as possible. Supplemental Pension Plan Review May 2012 19

Supplemental Pension Plan for Employees of Municipality as of January 1, 2013 SUMMARY OF BENEFITS FOR Charles J. Smith Your Pension Account Balance on 1/1/2012 Plus 5% of your salary of $30, 000 $0 1, 500 Interest on your account at a rate of 4. 00% 60 Your Pension Account Balance on 1/1/2013 $1, 560 Your Vested Pension Account Balance is $1, 560 At age 62, your Pension Account Balance will be converted to a monthly benefit. Based on your current account balance, your minimum Post-2012 accrued monthly benefit at age 62 will be $500. In addition, you earned a monthly benefit payable at 62 of $635 based on your service through December 31, 2011. Accordingly, your total minimum accrued monthly benefit at age 65 is $800. Note, all retirement payments from this Plan can be in the form of an annuity. The benefits shown are based on data in City files and are subject to all of the terms in the Plan documents. In any data is incorrect, please notify the company as soon as possible. Supplemental Pension Plan Review May 2012 19

Post-Retirement Health Account Plan • Can be used to replace some of any reduced benefits from the Supplemental Pension Plan • Exclusively to provide post-retirement health benefits – Could provide for retiree’s cost-sharing or post-65 benefits, for example • Defined contribution (i. e. account) benefit structure • Benefits are tax-free • Current expense is much less than apparent benefit. • Relatively straight-forward to administer Supplemental Pension Plan Review May 2012 20

Post-Retirement Health Account Plan • Can be used to replace some of any reduced benefits from the Supplemental Pension Plan • Exclusively to provide post-retirement health benefits – Could provide for retiree’s cost-sharing or post-65 benefits, for example • Defined contribution (i. e. account) benefit structure • Benefits are tax-free • Current expense is much less than apparent benefit. • Relatively straight-forward to administer Supplemental Pension Plan Review May 2012 20

Preliminary Recommendation – Cost Savings • Eliminate benefits for future hires – Review again in 3 years – If future economic conditions permit, the new hires could be made eligible for the plan with all past service benefits restored. – If City provides some other type of benefit (say, makes contributions to the 457 plan in behalf of new hires) then the new hires could be made eligible to the Supplemental Pension Plan sometime in the future with only service from that point credited for benefits. – City costs would decline to 0% of pay over 16 years at current amortizations. Supplemental Pension Plan Review May 2012 22

Preliminary Recommendation – Cost Savings • Eliminate benefits for future hires – Review again in 3 years – If future economic conditions permit, the new hires could be made eligible for the plan with all past service benefits restored. – If City provides some other type of benefit (say, makes contributions to the 457 plan in behalf of new hires) then the new hires could be made eligible to the Supplemental Pension Plan sometime in the future with only service from that point credited for benefits. – City costs would decline to 0% of pay over 16 years at current amortizations. Supplemental Pension Plan Review May 2012 22

Cost Savings - Alternative • Add employee contributions – Reduce long term costs to approximately 2. 5% of pay – 1% of pay for Fire and Police – 2% of pay for General Employers • Employees already make fairly significant contribution to State program • Uncertainty of KPERS/KP&F future contribution rates a concern Supplemental Pension Plan Review May 2012 23

Cost Savings - Alternative • Add employee contributions – Reduce long term costs to approximately 2. 5% of pay – 1% of pay for Fire and Police – 2% of pay for General Employers • Employees already make fairly significant contribution to State program • Uncertainty of KPERS/KP&F future contribution rates a concern Supplemental Pension Plan Review May 2012 23

Preliminary Recommendation – Cost Neutral • Keep Supplemental Pension Plan – Review again in 3 years – Replacement plans would cost about the same and create disruption – Long term costs = 4% of pay Note: $200, 000/year Current Benefit Accruals = $450, 000/year Current Plan Assets = Supplemental Pension Plan Review May 2012 Current Benefit Payments = $9. 2 million 24

Preliminary Recommendation – Cost Neutral • Keep Supplemental Pension Plan – Review again in 3 years – Replacement plans would cost about the same and create disruption – Long term costs = 4% of pay Note: $200, 000/year Current Benefit Accruals = $450, 000/year Current Plan Assets = Supplemental Pension Plan Review May 2012 Current Benefit Payments = $9. 2 million 24

Cost Neutral - Alternative I • Hard Freeze Supplemental Pension Plan and add 3% of pay to each employee’s 457 (or new 401(a)) account beginning January 1, 2013 • Floor benefits for current employees using frozen Supplemental Pension Plan. New employees will not be covered by Floor Plan • Long term costs = 4% of pay Supplemental Pension Plan Review May 2012 25

Cost Neutral - Alternative I • Hard Freeze Supplemental Pension Plan and add 3% of pay to each employee’s 457 (or new 401(a)) account beginning January 1, 2013 • Floor benefits for current employees using frozen Supplemental Pension Plan. New employees will not be covered by Floor Plan • Long term costs = 4% of pay Supplemental Pension Plan Review May 2012 25

Cost Neutral - Alternative II • Terminate Supplemental Pension Plan (after funding up benefits - $2. 5 - $3. 0 million) • Roll monies into 457 plan or new 401(a) plan • City match 457 employee contributions at 50% up to 4% of pay (i. e. 2% of pay maximum match) • City credits 2% of pay into Post-Retirement Health Account Plan • Long term costs = 4. 0% of pay (including value of current plan buy-up) Supplemental Pension Plan Review May 2012 26

Cost Neutral - Alternative II • Terminate Supplemental Pension Plan (after funding up benefits - $2. 5 - $3. 0 million) • Roll monies into 457 plan or new 401(a) plan • City match 457 employee contributions at 50% up to 4% of pay (i. e. 2% of pay maximum match) • City credits 2% of pay into Post-Retirement Health Account Plan • Long term costs = 4. 0% of pay (including value of current plan buy-up) Supplemental Pension Plan Review May 2012 26

New Governmental Accounting Standards • GASB issued "Preliminary Views" on June 16, 2010 and “Public • • • Comment” on June 27, 2011 (due by September 30, 2011). Final adoption expected June 2012. Covers only Pension recognition issues (i. e. GASB 25/27) "Views" on note disclosures and supplemental information coming next Principal concept - Separates Accounting from Funding (as in private sector) Effective Date – Generally, period beginning June 15, 2013 Filling the GAAP Gap 2012 ACOPA Advanced Actuarial Conference 27

New Governmental Accounting Standards • GASB issued "Preliminary Views" on June 16, 2010 and “Public • • • Comment” on June 27, 2011 (due by September 30, 2011). Final adoption expected June 2012. Covers only Pension recognition issues (i. e. GASB 25/27) "Views" on note disclosures and supplemental information coming next Principal concept - Separates Accounting from Funding (as in private sector) Effective Date – Generally, period beginning June 15, 2013 Filling the GAAP Gap 2012 ACOPA Advanced Actuarial Conference 27

New Governmental Accounting Standards • Requires use of Entry Age Normal Cost Method Would require change back to EAN method – Modest revision to model • Requires use of Market Value of Plan Assets County already complies • Requires net liability on sponsor's balance sheet INCLUDING COST SHARING EMPLOYERS • More volatility in year to year "expense" charges (shorter amortization periods - investment gains and losses treated separately) • Funding policy may well be disconnected from accounting recognition Filling the GAAP Gap 2012 ACOPA Advanced Actuarial Conference 28

New Governmental Accounting Standards • Requires use of Entry Age Normal Cost Method Would require change back to EAN method – Modest revision to model • Requires use of Market Value of Plan Assets County already complies • Requires net liability on sponsor's balance sheet INCLUDING COST SHARING EMPLOYERS • More volatility in year to year "expense" charges (shorter amortization periods - investment gains and losses treated separately) • Funding policy may well be disconnected from accounting recognition Filling the GAAP Gap 2012 ACOPA Advanced Actuarial Conference 28

Questions? Supplemental Pension Plan Review May 2012 29

Questions? Supplemental Pension Plan Review May 2012 29