51a22ad2369e797afac3acfac63577e8.ppt

- Количество слайдов: 32

SUPERVISION OF PENSION SYSTEMS – CURRENT TRENDS AND ISSUES. INTERNATIONAL EXPERIENCE. Financial Supervision Commission Bulgaria Warsaw, 19 September 2006 PENSION FUNDS REGULATION AND SUPERVISION IN BULGARIA BISSER PETKOV Deputy Chairman of Financial Supervision Commission Head of Social Insurance Supervision Division

SUPERVISION OF PENSION SYSTEMS – CURRENT TRENDS AND ISSUES. INTERNATIONAL EXPERIENCE. Financial Supervision Commission Bulgaria Warsaw, 19 September 2006 PENSION FUNDS REGULATION AND SUPERVISION IN BULGARIA BISSER PETKOV Deputy Chairman of Financial Supervision Commission Head of Social Insurance Supervision Division

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 2

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 2

1. Development and Regulation of Funded Pension Provision (1/12) Financial Supervision Commission Bulgaria Background 1994 – Voluntary pension funds launched - fully funded basis, individual accounts. 1999 – Legal regulation of pension provision activity (Adoption of the Law for Supplementary Voluntary Pension Provision and the Mandatory Social Insurance Code). 2000 – Establishment of the State Agency for Social Insurance Supervision and licensing of the first pension insurance companies. – Professional Pension Funds launched. 2002 – Universal Pension Funds launched. 2003 – Integration of supervision authority over the non bank financial sector - Establishment of Financial Supervision Commission (FSC) - Social Insurance Code adopted 3

1. Development and Regulation of Funded Pension Provision (1/12) Financial Supervision Commission Bulgaria Background 1994 – Voluntary pension funds launched - fully funded basis, individual accounts. 1999 – Legal regulation of pension provision activity (Adoption of the Law for Supplementary Voluntary Pension Provision and the Mandatory Social Insurance Code). 2000 – Establishment of the State Agency for Social Insurance Supervision and licensing of the first pension insurance companies. – Professional Pension Funds launched. 2002 – Universal Pension Funds launched. 2003 – Integration of supervision authority over the non bank financial sector - Establishment of Financial Supervision Commission (FSC) - Social Insurance Code adopted 3

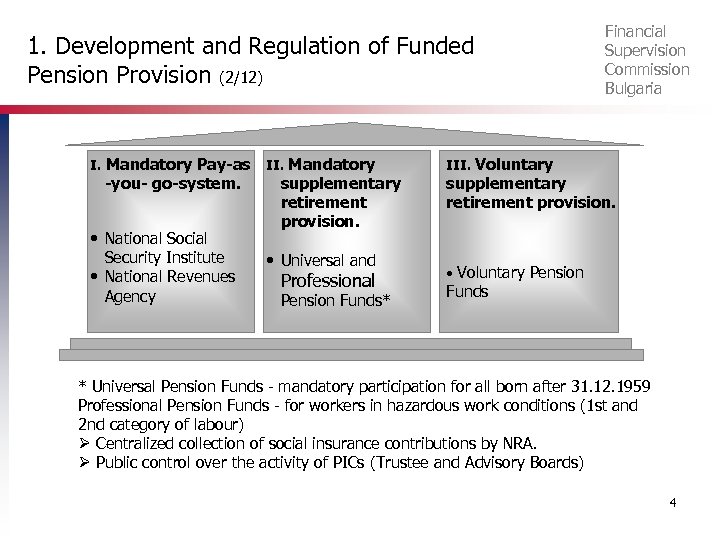

1. Development and Regulation of Funded Pension Provision (2/12) I. Mandatory Pay-as -you- go-system. • National Social Security Institute • National Revenues Agency II. Mandatory supplementary retirement provision. • Universal and Professional Pension Funds* Financial Supervision Commission Bulgaria III. Voluntary supplementary retirement provision. • Voluntary Pension Funds * Universal Pension Funds - mandatory participation for all born after 31. 12. 1959 Professional Pension Funds - for workers in hazardous work conditions (1 st and 2 nd category of labour) Ø Centralized collection of social insurance contributions by NRA. Ø Public control over the activity of PICs (Trustee and Advisory Boards) 4

1. Development and Regulation of Funded Pension Provision (2/12) I. Mandatory Pay-as -you- go-system. • National Social Security Institute • National Revenues Agency II. Mandatory supplementary retirement provision. • Universal and Professional Pension Funds* Financial Supervision Commission Bulgaria III. Voluntary supplementary retirement provision. • Voluntary Pension Funds * Universal Pension Funds - mandatory participation for all born after 31. 12. 1959 Professional Pension Funds - for workers in hazardous work conditions (1 st and 2 nd category of labour) Ø Centralized collection of social insurance contributions by NRA. Ø Public control over the activity of PICs (Trustee and Advisory Boards) 4

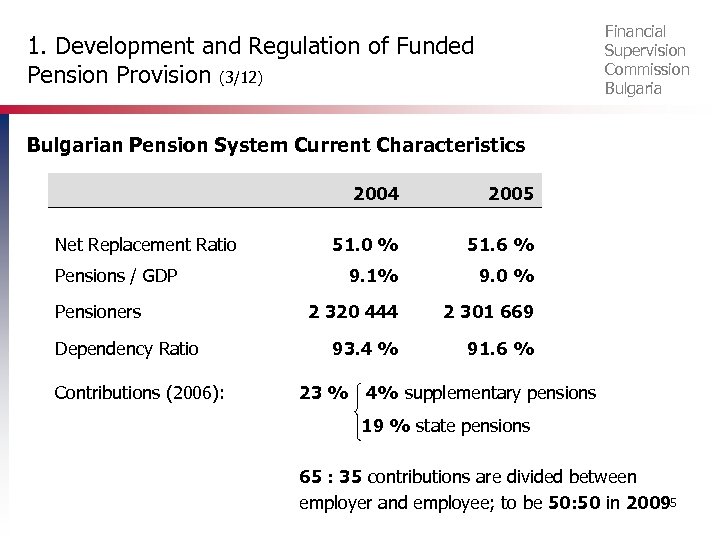

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (3/12) Bulgarian Pension System Current Characteristics 2004 Net Replacement Ratio Pensions / GDP Pensioners Dependency Ratio Contributions (2006): 2005 51. 0 % 51. 6 % 9. 1% 9. 0 % 2 320 444 2 301 669 93. 4 % 91. 6 % 23 % 4% supplementary pensions 19 % state pensions 65 : 35 contributions are divided between employer and employee; to be 50: 50 in 20095

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (3/12) Bulgarian Pension System Current Characteristics 2004 Net Replacement Ratio Pensions / GDP Pensioners Dependency Ratio Contributions (2006): 2005 51. 0 % 51. 6 % 9. 1% 9. 0 % 2 320 444 2 301 669 93. 4 % 91. 6 % 23 % 4% supplementary pensions 19 % state pensions 65 : 35 contributions are divided between employer and employee; to be 50: 50 in 20095

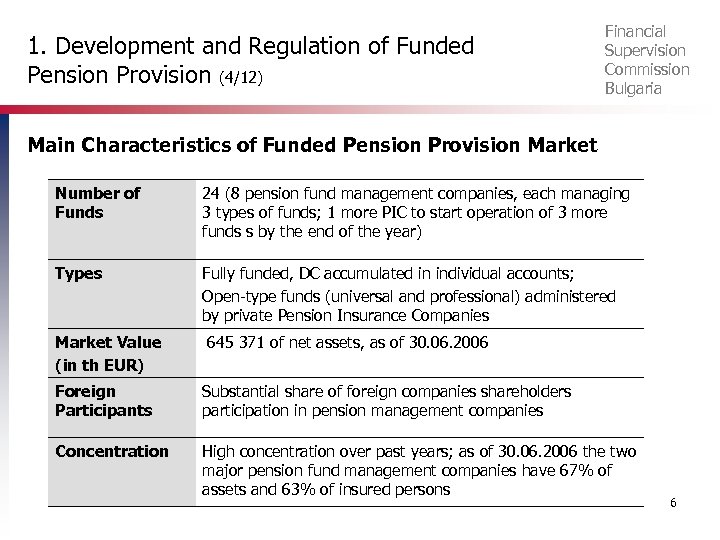

1. Development and Regulation of Funded Pension Provision (4/12) Financial Supervision Commission Bulgaria Main Characteristics of Funded Pension Provision Market Number of Funds 24 (8 pension fund management companies, each managing 3 types of funds; 1 more PIC to start operation of 3 more funds s by the end of the year) Types Fully funded, DC accumulated in individual accounts; Open-type funds (universal and professional) administered by private Pension Insurance Companies Market Value (in th EUR) 645 371 of net assets, as of 30. 06. 2006 Foreign Participants Substantial share of foreign companies shareholders participation in pension management companies Concentration High concentration over past years; as of 30. 06. 2006 the two major pension fund management companies have 67% of assets and 63% of insured persons 6

1. Development and Regulation of Funded Pension Provision (4/12) Financial Supervision Commission Bulgaria Main Characteristics of Funded Pension Provision Market Number of Funds 24 (8 pension fund management companies, each managing 3 types of funds; 1 more PIC to start operation of 3 more funds s by the end of the year) Types Fully funded, DC accumulated in individual accounts; Open-type funds (universal and professional) administered by private Pension Insurance Companies Market Value (in th EUR) 645 371 of net assets, as of 30. 06. 2006 Foreign Participants Substantial share of foreign companies shareholders participation in pension management companies Concentration High concentration over past years; as of 30. 06. 2006 the two major pension fund management companies have 67% of assets and 63% of insured persons 6

1. Development and Regulation of Funded Pension Provision (5/12) Financial Supervision Commission Bulgaria Regulatory framework v Social Insurance Code v Financial Supervision Commission Act v Secondary legislation acts adopted by: Ø Financial Supervision Commission Ø Council of Ministers Ø Bulgarian National Bank, Ministry of Finance, NSSI Recent Regulatory Changes v Introduction of occupational pension schemes (transposition Directive 2003/41) v Liberalisation of pension funds investment regime 7

1. Development and Regulation of Funded Pension Provision (5/12) Financial Supervision Commission Bulgaria Regulatory framework v Social Insurance Code v Financial Supervision Commission Act v Secondary legislation acts adopted by: Ø Financial Supervision Commission Ø Council of Ministers Ø Bulgarian National Bank, Ministry of Finance, NSSI Recent Regulatory Changes v Introduction of occupational pension schemes (transposition Directive 2003/41) v Liberalisation of pension funds investment regime 7

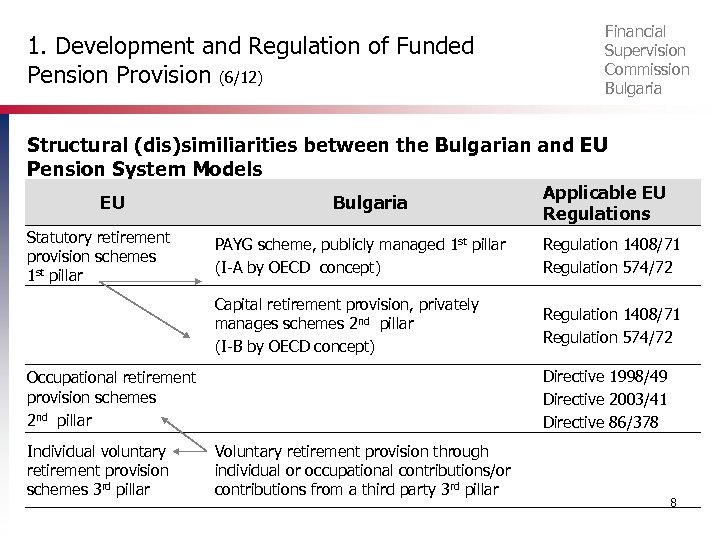

1. Development and Regulation of Funded Pension Provision (6/12) Financial Supervision Commission Bulgaria Structural (dis)similiarities between the Bulgarian and EU Pension System Models EU Statutory retirement provision schemes 1 st pillar Bulgaria Applicable EU Regulations PAYG scheme, publicly managed 1 st pillar (I-A by OECD concept) Regulation 1408/71 Regulation 574/72 Capital retirement provision, privately manages schemes 2 nd pillar (I-B by OECD concept) Regulation 1408/71 Regulation 574/72 Directive 1998/49 Directive 2003/41 Directive 86/378 Occupational retirement provision schemes 2 nd pillar Individual voluntary retirement provision schemes 3 rd pillar Voluntary retirement provision through individual or occupational contributions/or contributions from a third party 3 rd pillar 8

1. Development and Regulation of Funded Pension Provision (6/12) Financial Supervision Commission Bulgaria Structural (dis)similiarities between the Bulgarian and EU Pension System Models EU Statutory retirement provision schemes 1 st pillar Bulgaria Applicable EU Regulations PAYG scheme, publicly managed 1 st pillar (I-A by OECD concept) Regulation 1408/71 Regulation 574/72 Capital retirement provision, privately manages schemes 2 nd pillar (I-B by OECD concept) Regulation 1408/71 Regulation 574/72 Directive 1998/49 Directive 2003/41 Directive 86/378 Occupational retirement provision schemes 2 nd pillar Individual voluntary retirement provision schemes 3 rd pillar Voluntary retirement provision through individual or occupational contributions/or contributions from a third party 3 rd pillar 8

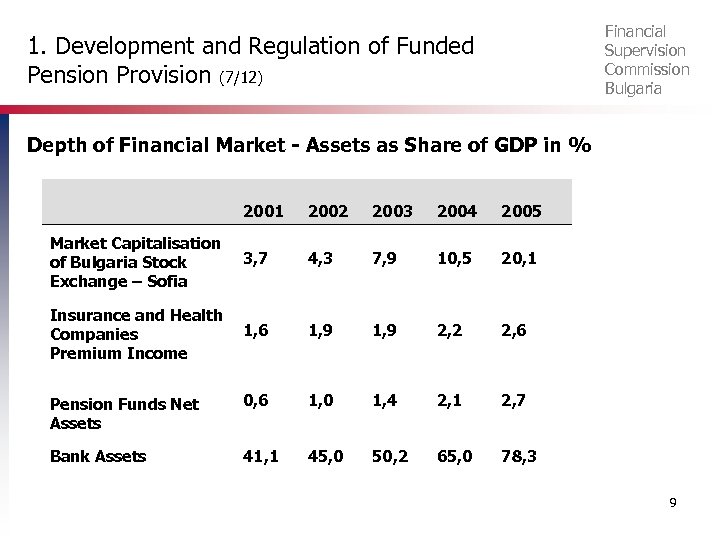

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (7/12) Depth of Financial Market - Assets as Share of GDP in % 2001 2002 2003 2004 2005 Market Capitalisation of Bulgaria Stock Exchange – Sofia 3, 7 4, 3 7, 9 10, 5 20, 1 Insurance and Health Companies Premium Income 1, 6 1, 9 2, 2 2, 6 Pension Funds Net Assets 0, 6 1, 0 1, 4 2, 1 2, 7 Bank Assets 41, 1 45, 0 50, 2 65, 0 78, 3 9

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (7/12) Depth of Financial Market - Assets as Share of GDP in % 2001 2002 2003 2004 2005 Market Capitalisation of Bulgaria Stock Exchange – Sofia 3, 7 4, 3 7, 9 10, 5 20, 1 Insurance and Health Companies Premium Income 1, 6 1, 9 2, 2 2, 6 Pension Funds Net Assets 0, 6 1, 0 1, 4 2, 1 2, 7 Bank Assets 41, 1 45, 0 50, 2 65, 0 78, 3 9

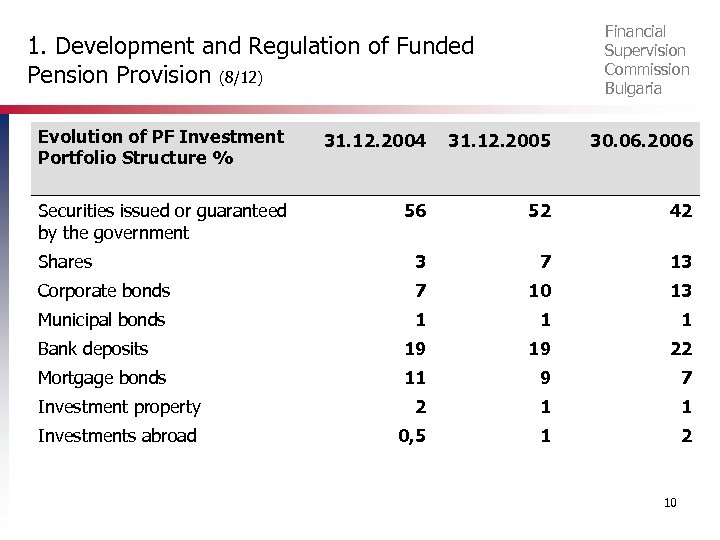

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (8/12) Evolution of PF Investment Portfolio Structure % 31. 12. 2004 31. 12. 2005 30. 06. 2006 Securities issued or guaranteed by the government 56 52 42 Shares 3 7 13 Corporate bonds 7 10 13 Municipal bonds 1 1 1 Bank deposits 19 19 22 Mortgage bonds 11 9 7 Investment property 2 1 1 Investments abroad 0, 5 1 2 10

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (8/12) Evolution of PF Investment Portfolio Structure % 31. 12. 2004 31. 12. 2005 30. 06. 2006 Securities issued or guaranteed by the government 56 52 42 Shares 3 7 13 Corporate bonds 7 10 13 Municipal bonds 1 1 1 Bank deposits 19 19 22 Mortgage bonds 11 9 7 Investment property 2 1 1 Investments abroad 0, 5 1 2 10

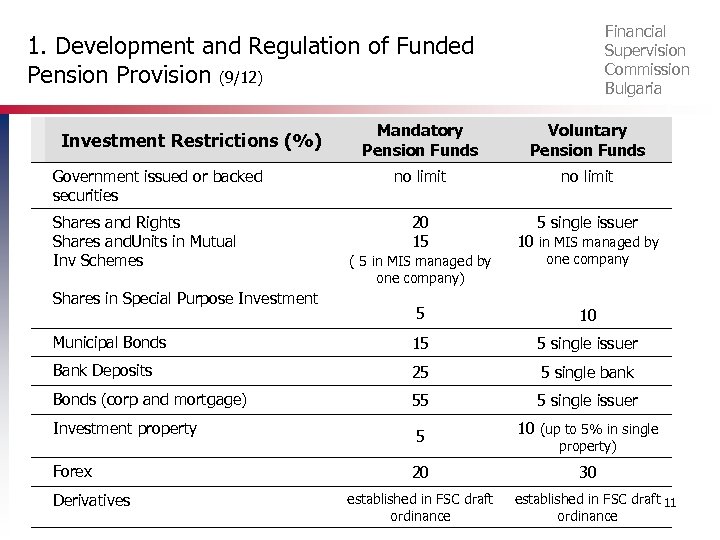

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (9/12) Investment Restrictions (%) Government issued or backed securities Shares and Rights Shares and. Units in Mutual Inv Schemes Mandatory Pension Funds Voluntary Pension Funds no limit 20 15 5 single issuer 10 in MIS managed by ( 5 in MIS managed by one company) one company 5 10 Municipal Bonds 15 5 single issuer Bank Deposits 25 5 single bank Bonds (corp and mortgage) 55 5 single issuer Shares in Special Purpose Investment property Forex Derivatives 5 20 established in FSC draft ordinance 10 (up to 5% in single property) 30 established in FSC draft 11 ordinance

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (9/12) Investment Restrictions (%) Government issued or backed securities Shares and Rights Shares and. Units in Mutual Inv Schemes Mandatory Pension Funds Voluntary Pension Funds no limit 20 15 5 single issuer 10 in MIS managed by ( 5 in MIS managed by one company) one company 5 10 Municipal Bonds 15 5 single issuer Bank Deposits 25 5 single bank Bonds (corp and mortgage) 55 5 single issuer Shares in Special Purpose Investment property Forex Derivatives 5 20 established in FSC draft ordinance 10 (up to 5% in single property) 30 established in FSC draft 11 ordinance

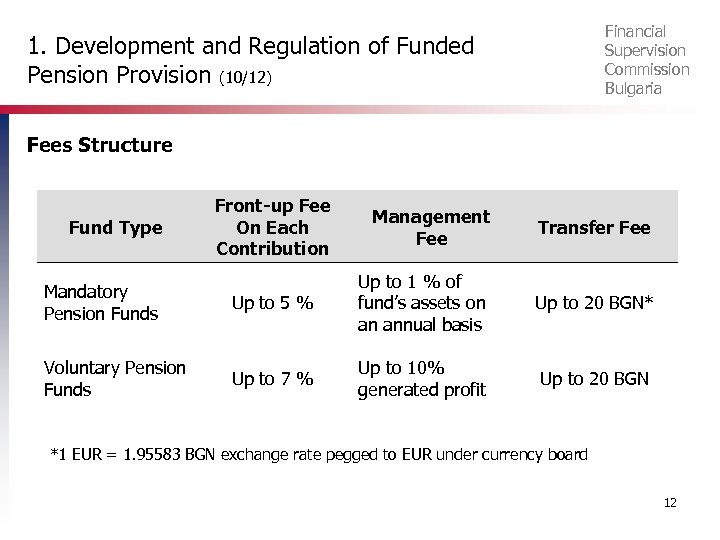

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (10/12) Fees Structure Fund Type Front-up Fee On Each Contribution Management Fee Transfer Fee Up to 20 BGN* Up to 20 BGN Mandatory Pension Funds Up to 5 % Up to 1 % of fund’s assets on an annual basis Voluntary Pension Funds Up to 7 % Up to 10% generated profit *1 EUR = 1. 95583 BGN exchange rate pegged to EUR under currency board 12

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (10/12) Fees Structure Fund Type Front-up Fee On Each Contribution Management Fee Transfer Fee Up to 20 BGN* Up to 20 BGN Mandatory Pension Funds Up to 5 % Up to 1 % of fund’s assets on an annual basis Voluntary Pension Funds Up to 7 % Up to 10% generated profit *1 EUR = 1. 95583 BGN exchange rate pegged to EUR under currency board 12

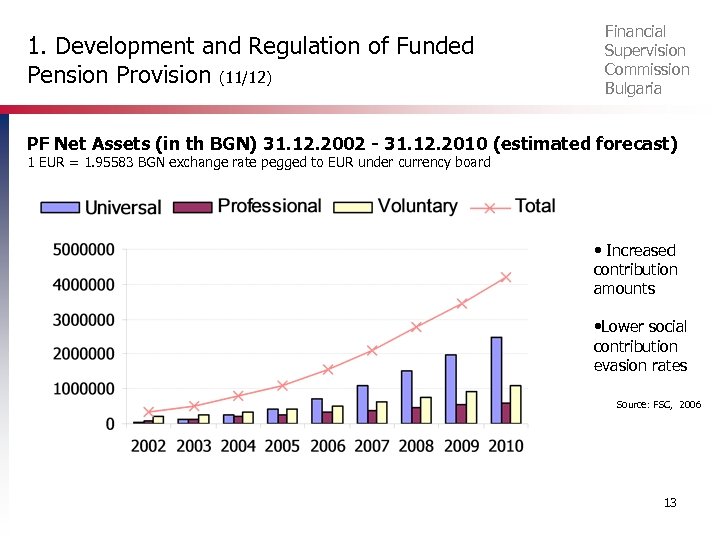

1. Development and Regulation of Funded Pension Provision (11/12) Financial Supervision Commission Bulgaria PF Net Assets (in th BGN) 31. 12. 2002 - 31. 12. 2010 (estimated forecast) 1 EUR = 1. 95583 BGN exchange rate pegged to EUR under currency board • Increased contribution amounts • Lower social contribution evasion rates Source: FSC, 2006 13

1. Development and Regulation of Funded Pension Provision (11/12) Financial Supervision Commission Bulgaria PF Net Assets (in th BGN) 31. 12. 2002 - 31. 12. 2010 (estimated forecast) 1 EUR = 1. 95583 BGN exchange rate pegged to EUR under currency board • Increased contribution amounts • Lower social contribution evasion rates Source: FSC, 2006 13

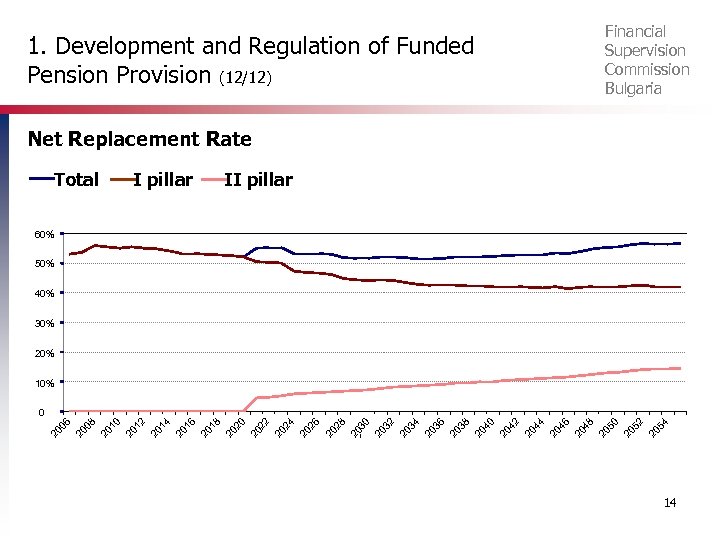

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (12/12) Net Replacement Rate Total I pillar II pillar 60% 50% 40% 30% 20% 10% 20 54 20 52 20 50 20 48 20 46 20 44 20 42 20 40 20 38 20 36 20 34 20 32 20 30 20 28 20 26 20 24 20 22 20 20 20 18 20 16 20 14 20 12 20 10 20 08 20 06 0 14

Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision (12/12) Net Replacement Rate Total I pillar II pillar 60% 50% 40% 30% 20% 10% 20 54 20 52 20 50 20 48 20 46 20 44 20 42 20 40 20 38 20 36 20 34 20 32 20 30 20 28 20 26 20 24 20 22 20 20 20 18 20 16 20 14 20 12 20 10 20 08 20 06 0 14

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 15

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 15

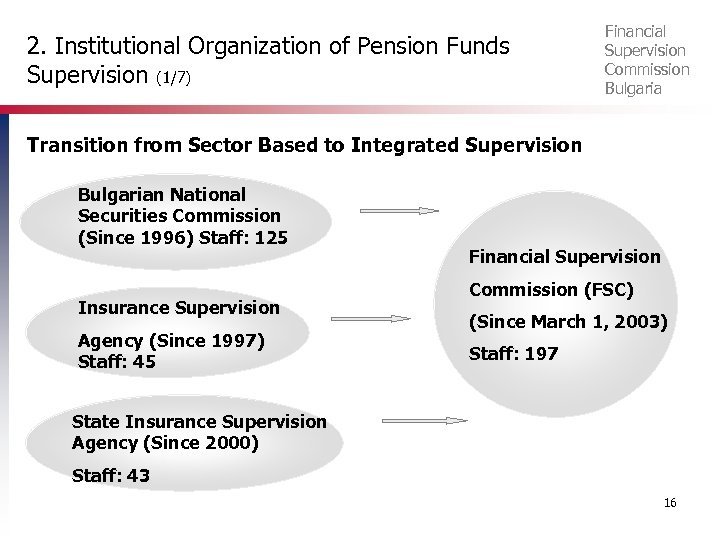

2. Institutional Organization of Pension Funds Supervision (1/7) Financial Supervision Commission Bulgaria Transition from Sector Based to Integrated Supervision Bulgarian National Securities Commission (Since 1996) Staff: 125 Insurance Supervision Agency (Since 1997) Staff: 45 Financial Supervision Commission (FSC) (Since March 1, 2003) Staff: 197 State Insurance Supervision Agency (Since 2000) Staff: 43 16

2. Institutional Organization of Pension Funds Supervision (1/7) Financial Supervision Commission Bulgaria Transition from Sector Based to Integrated Supervision Bulgarian National Securities Commission (Since 1996) Staff: 125 Insurance Supervision Agency (Since 1997) Staff: 45 Financial Supervision Commission (FSC) (Since March 1, 2003) Staff: 197 State Insurance Supervision Agency (Since 2000) Staff: 43 16

2. Institutional Organization of Pension Funds Supervision (2/7) Financial Supervision Commission Bulgaria Institutional Environment of Pension Supervision v Financial Supervision Commission v Ministry of Labor and Social Policy v National Social Security Institute v Ministry of Finance v Bulgarian National Bank v Financial Stability Consultative Council (Coordination Body) 17

2. Institutional Organization of Pension Funds Supervision (2/7) Financial Supervision Commission Bulgaria Institutional Environment of Pension Supervision v Financial Supervision Commission v Ministry of Labor and Social Policy v National Social Security Institute v Ministry of Finance v Bulgarian National Bank v Financial Stability Consultative Council (Coordination Body) 17

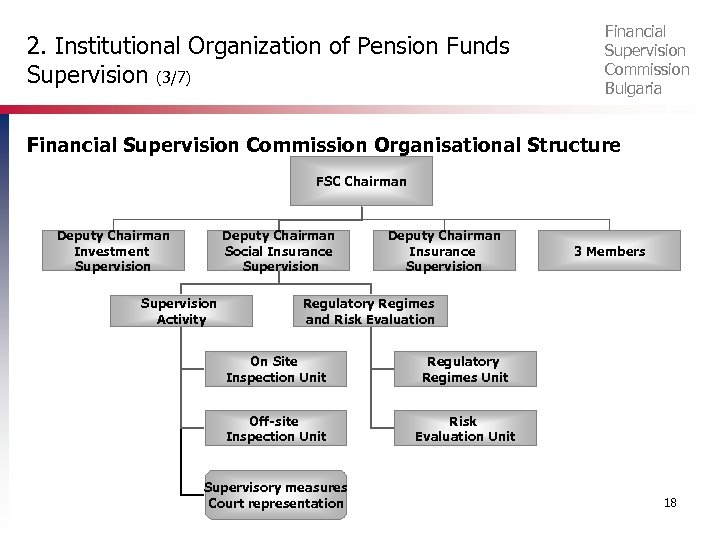

2. Institutional Organization of Pension Funds Supervision (3/7) Financial Supervision Commission Bulgaria Financial Supervision Commission Organisational Structure FSC Chairman Deputy Chairman Investment Supervision Deputy Chairman Social Insurance Supervision Activity Deputy Chairman Insurance Supervision 3 Members Regulatory Regimes and Risk Evaluation On Site Inspection Unit Regulatory Regimes Unit Off-site Inspection Unit Risk Evaluation Unit Supervisory measures Court representation 18

2. Institutional Organization of Pension Funds Supervision (3/7) Financial Supervision Commission Bulgaria Financial Supervision Commission Organisational Structure FSC Chairman Deputy Chairman Investment Supervision Deputy Chairman Social Insurance Supervision Activity Deputy Chairman Insurance Supervision 3 Members Regulatory Regimes and Risk Evaluation On Site Inspection Unit Regulatory Regimes Unit Off-site Inspection Unit Risk Evaluation Unit Supervisory measures Court representation 18

2. Institutional Organization of Pension Funds Supervision (4/7) Financial Supervision Commission Bulgaria FSC Objectives v Protecting the interests of the investors, insurance policy holders and pension insured persons; v Providing integrity, transparency and credibility of the financial markets 19

2. Institutional Organization of Pension Funds Supervision (4/7) Financial Supervision Commission Bulgaria FSC Objectives v Protecting the interests of the investors, insurance policy holders and pension insured persons; v Providing integrity, transparency and credibility of the financial markets 19

2. Institutional Organization of Pension Funds Supervision (5/7) Financial Supervision Commission Bulgaria Powers of the Financial Supervision Commission v v Development of the regulatory framework Licensing regime Supervision Sanctions Powers of the Deputy Chairman of FSC in Charge of Social Insurance Supervision v v v Issues authorisations as provided in the Social Insurance Code Approves documents and defines the requirements thereof Approves methodological guidelines, document samples, etc. Orders on-site inspections Implements enforcement measures and issues penalty decrees 20

2. Institutional Organization of Pension Funds Supervision (5/7) Financial Supervision Commission Bulgaria Powers of the Financial Supervision Commission v v Development of the regulatory framework Licensing regime Supervision Sanctions Powers of the Deputy Chairman of FSC in Charge of Social Insurance Supervision v v v Issues authorisations as provided in the Social Insurance Code Approves documents and defines the requirements thereof Approves methodological guidelines, document samples, etc. Orders on-site inspections Implements enforcement measures and issues penalty decrees 20

2. Institutional Organization of Pension Funds Supervision (6/7) Financial Supervision Commission Bulgaria Institutional Independence of FSC v Autonomous institution created under a special legislative act v Reporting to Parliament v Selection of the FSC members by the Parliament with a 6 year term in office v Mixed funding (State Budget/ Supervised entities) 21

2. Institutional Organization of Pension Funds Supervision (6/7) Financial Supervision Commission Bulgaria Institutional Independence of FSC v Autonomous institution created under a special legislative act v Reporting to Parliament v Selection of the FSC members by the Parliament with a 6 year term in office v Mixed funding (State Budget/ Supervised entities) 21

2. Institutional Organization of Pension Funds Supervision (7/7) Financial Supervision Commission Bulgaria Cooperation and Consultation v FSC is member of: Ø Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS) (observer status); Ø International Organization of Pension Supervisors (IOPS); Ø International Organization of Securities Commissions (IOSCO); Ø International Association of Insurance Supervisors (IAIS). v Memorandums of Understanding and Exchange of Information signed with partner institutions. 22

2. Institutional Organization of Pension Funds Supervision (7/7) Financial Supervision Commission Bulgaria Cooperation and Consultation v FSC is member of: Ø Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS) (observer status); Ø International Organization of Pension Supervisors (IOPS); Ø International Organization of Securities Commissions (IOSCO); Ø International Association of Insurance Supervisors (IAIS). v Memorandums of Understanding and Exchange of Information signed with partner institutions. 22

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 23

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges Facing Regulation and Supervision of Supplementary Pension Provision 23

3. Supervisory Approach (1/5) Financial Supervision Commission Bulgaria Characteristics of the style and approach implemented in Bulgarian pension supervision v Restrictive – license with strict requirements for stepping into the social insurance market v Proactive – on-going monitoring and regular interventions v Intensive – daily communication v Legislatively oriented (compliance based) 24

3. Supervisory Approach (1/5) Financial Supervision Commission Bulgaria Characteristics of the style and approach implemented in Bulgarian pension supervision v Restrictive – license with strict requirements for stepping into the social insurance market v Proactive – on-going monitoring and regular interventions v Intensive – daily communication v Legislatively oriented (compliance based) 24

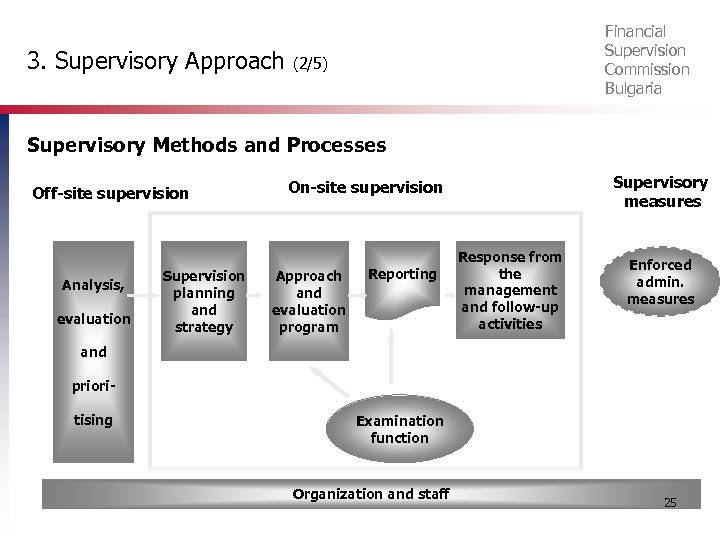

3. Supervisory Approach Financial Supervision Commission Bulgaria (2/5) Supervisory Methods and Processes Off-site supervision Analysis, evaluation Supervision planning and strategy Supervisory measures On-site supervision Approach and evaluation program Reporting Response from the management and follow-up activities Enforced admin. measures and prioritising Examination function Organization and staff 25

3. Supervisory Approach Financial Supervision Commission Bulgaria (2/5) Supervisory Methods and Processes Off-site supervision Analysis, evaluation Supervision planning and strategy Supervisory measures On-site supervision Approach and evaluation program Reporting Response from the management and follow-up activities Enforced admin. measures and prioritising Examination function Organization and staff 25

3. Supervisory Approach (3/5) Financial Supervision Commission Bulgaria Preliminary Supervision Licensing Requirements for Pension Insurance Companies as regards: v Capital v Shareholders with significant participation v Managerial and controlling bodies and the actuaries v Internal control system v Technical equipment, staffing and information provision 26

3. Supervisory Approach (3/5) Financial Supervision Commission Bulgaria Preliminary Supervision Licensing Requirements for Pension Insurance Companies as regards: v Capital v Shareholders with significant participation v Managerial and controlling bodies and the actuaries v Internal control system v Technical equipment, staffing and information provision 26

3. Supervisory Approach (4/5) Financial Supervision Commission Bulgaria Off-site Supervision of Pension Insurance Companies (1) v On-going monitoring over Ø Asset valuation of pension funds, Ø Calculation of unit value Ø Keeping of investment limits v Information sources: Ø Daily reports by the PICs and the custodian banks submitted electronically to the FSC v Supervision over the contents of the PIC’s WEB-pages v Means of supervsion: Ø IT system for supervision (Е-fsc) through built-in filters v Supervisory activities/ measures: Ø Requests for corrections Ø Imposition of enforces administrative measures Ø Imposition of property payments 27

3. Supervisory Approach (4/5) Financial Supervision Commission Bulgaria Off-site Supervision of Pension Insurance Companies (1) v On-going monitoring over Ø Asset valuation of pension funds, Ø Calculation of unit value Ø Keeping of investment limits v Information sources: Ø Daily reports by the PICs and the custodian banks submitted electronically to the FSC v Supervision over the contents of the PIC’s WEB-pages v Means of supervsion: Ø IT system for supervision (Е-fsc) through built-in filters v Supervisory activities/ measures: Ø Requests for corrections Ø Imposition of enforces administrative measures Ø Imposition of property payments 27

3. Supervisory Approach (5/5) Financial Supervision Commission Bulgaria On-site Supervision of Pension Insurance Companies v Planning of examinations v Types of examination – planned (theme), and claims based v Integration of the off-site and on-site supervision 28

3. Supervisory Approach (5/5) Financial Supervision Commission Bulgaria On-site Supervision of Pension Insurance Companies v Planning of examinations v Types of examination – planned (theme), and claims based v Integration of the off-site and on-site supervision 28

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges and Possible Solutions for Funded Pension Funds Supervision and Regulation 29

Agenda Financial Supervision Commission Bulgaria 1. Development and Regulation of Funded Pension Provision 2. Institutional Organization of Pension Supervision 3. Supervisory Approach 4. Challenges and Possible Solutions for Funded Pension Funds Supervision and Regulation 29

4. Challenges in Private Pension Funds Supervision and Regulation (1/2) Financial Supervision Commission Bulgaria v Regulation of the pay-out phase regarding the life-long pensions under the second pillar v Expanding the investment choice opportunities of participants in the voluntary pension insurance v Transition from the approach of quantitative portfolio limits to the prudent person investment approach 30

4. Challenges in Private Pension Funds Supervision and Regulation (1/2) Financial Supervision Commission Bulgaria v Regulation of the pay-out phase regarding the life-long pensions under the second pillar v Expanding the investment choice opportunities of participants in the voluntary pension insurance v Transition from the approach of quantitative portfolio limits to the prudent person investment approach 30

4. Challenges in Private Pension Funds Supervision and Regulation (2/2) Financial Supervision Commission Bulgaria v Integrated regulation of the financial markets in keeping with the EU directives v Transition towards functional integration and consolidated supervision over the non-banking financial sector v Change in the supervision approach and style: from traditional (static) to dynamic (risk-based) 31

4. Challenges in Private Pension Funds Supervision and Regulation (2/2) Financial Supervision Commission Bulgaria v Integrated regulation of the financial markets in keeping with the EU directives v Transition towards functional integration and consolidated supervision over the non-banking financial sector v Change in the supervision approach and style: from traditional (static) to dynamic (risk-based) 31

Financial Supervision Commission Bulgaria Q & A? Thank you for your attention! e-mail: petkov_b@fsc. bg phone: (+359 2) 94 04 575 fax: (+359 2) 829 43 21 32

Financial Supervision Commission Bulgaria Q & A? Thank you for your attention! e-mail: petkov_b@fsc. bg phone: (+359 2) 94 04 575 fax: (+359 2) 829 43 21 32