f00221de30025d29a888e388cb0d54bb.ppt

- Количество слайдов: 38

Super. Stream Data and Payment Standard Information for payroll developers Information current as at November 2014. For the latest information please refer to: https: //www. ato. gov. au/Super. Stream

Super. Stream Data and Payment Standard Information for payroll developers Information current as at November 2014. For the latest information please refer to: https: //www. ato. gov. au/Super. Stream

Overview Background Timeline Induction Testing and Certification Questions and Answers Super Stream 2

Overview Background Timeline Induction Testing and Certification Questions and Answers Super Stream 2

Background

Background

What is Super. Stream? Super. Stream is a government reform aimed at improving the efficiency of the superannuation system It introduces standard mandatory electronic processing of Superannuation data and payments Affects employers and super funds, including SMSFs Once fully implemented, Super. Stream should provide a simple and single process for employers to make super contributions electronically to all funds Super Stream 4

What is Super. Stream? Super. Stream is a government reform aimed at improving the efficiency of the superannuation system It introduces standard mandatory electronic processing of Superannuation data and payments Affects employers and super funds, including SMSFs Once fully implemented, Super. Stream should provide a simple and single process for employers to make super contributions electronically to all funds Super Stream 4

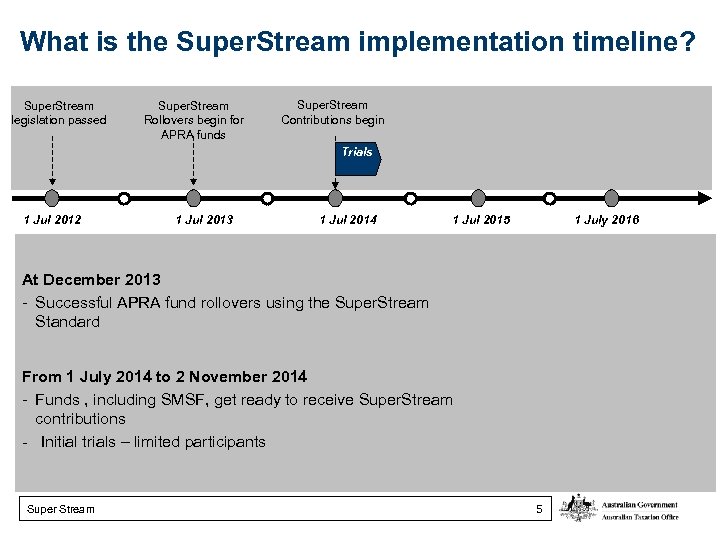

What is the Super. Stream implementation timeline? Super. Stream legislation passed Super. Stream Rollovers begin for APRA funds Super. Stream Contributions begin Trials 1 Jul 2012 1 Jul 2013 1 Jul 2014 1 Jul 2015 1 July 2016 At December 2013 - Successful APRA fund rollovers using the Super. Stream Standard From 1 July 2014 to 2 November 2014 - Funds , including SMSF, get ready to receive Super. Stream contributions - Initial trials – limited participants Super Stream 5

What is the Super. Stream implementation timeline? Super. Stream legislation passed Super. Stream Rollovers begin for APRA funds Super. Stream Contributions begin Trials 1 Jul 2012 1 Jul 2013 1 Jul 2014 1 Jul 2015 1 July 2016 At December 2013 - Successful APRA fund rollovers using the Super. Stream Standard From 1 July 2014 to 2 November 2014 - Funds , including SMSF, get ready to receive Super. Stream contributions - Initial trials – limited participants Super Stream 5

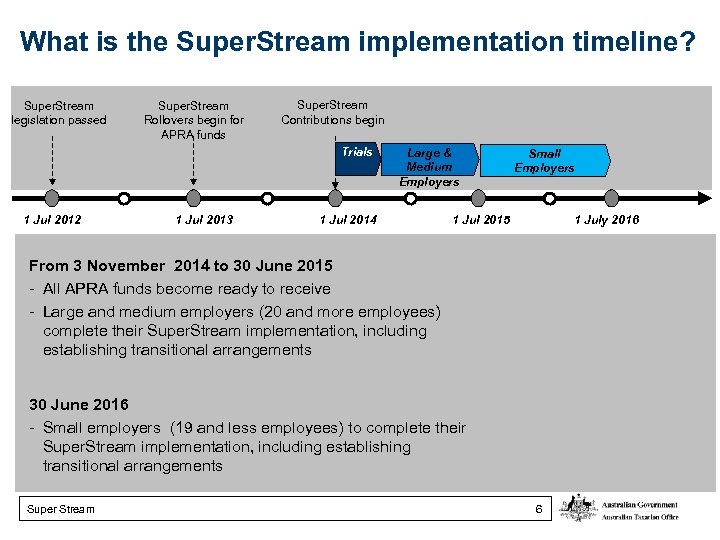

What is the Super. Stream implementation timeline? Super. Stream legislation passed Super. Stream Rollovers begin for APRA funds Super. Stream Contributions begin Trials 1 Jul 2012 1 Jul 2013 Large & Medium Employers 1 Jul 2014 Small Employers 1 Jul 2015 1 July 2016 From 3 November 2014 to 30 June 2015 - All APRA funds become ready to receive - Large and medium employers (20 and more employees) complete their Super. Stream implementation, including establishing transitional arrangements 30 June 2016 - Small employers (19 and less employees) to complete their Super. Stream implementation, including establishing transitional arrangements Super Stream 6

What is the Super. Stream implementation timeline? Super. Stream legislation passed Super. Stream Rollovers begin for APRA funds Super. Stream Contributions begin Trials 1 Jul 2012 1 Jul 2013 Large & Medium Employers 1 Jul 2014 Small Employers 1 Jul 2015 1 July 2016 From 3 November 2014 to 30 June 2015 - All APRA funds become ready to receive - Large and medium employers (20 and more employees) complete their Super. Stream implementation, including establishing transitional arrangements 30 June 2016 - Small employers (19 and less employees) to complete their Super. Stream implementation, including establishing transitional arrangements Super Stream 6

What is the transition period? Operates from 1 July 2014 – 30 June 2017 Alternate arrangements can be used if mutual agreement made between employer and fund Needs to be electronic – data and payment Can be existing electronic solutions e. g. fund portals or proprietary interfaces Needs to include the data fields as required by the standard Super Stream 7

What is the transition period? Operates from 1 July 2014 – 30 June 2017 Alternate arrangements can be used if mutual agreement made between employer and fund Needs to be electronic – data and payment Can be existing electronic solutions e. g. fund portals or proprietary interfaces Needs to include the data fields as required by the standard Super Stream 7

What are the benefits for employers and funds? Provides a consistent process for employers to make contributions and for funds to receive them Allows for increased automation and efficiencies Reduces processing costs in the long term Improves data quality Reduces reverse workflow and exceptions handling Super Stream 8

What are the benefits for employers and funds? Provides a consistent process for employers to make contributions and for funds to receive them Allows for increased automation and efficiencies Reduces processing costs in the long term Improves data quality Reduces reverse workflow and exceptions handling Super Stream 8

What are the options for employers? Every business is different. When choosing their solution and start date, employers will consider: options available (e. g. from their payroll provider, service provider or default fund) their business needs cost, benefits and service levels timing Payroll Stand alone Clearing House Bureaux Fund Portal Cloud We recommend employers plan to complete their implementation 3 months before the end date in case of any unexpected delays. Super Stream 9

What are the options for employers? Every business is different. When choosing their solution and start date, employers will consider: options available (e. g. from their payroll provider, service provider or default fund) their business needs cost, benefits and service levels timing Payroll Stand alone Clearing House Bureaux Fund Portal Cloud We recommend employers plan to complete their implementation 3 months before the end date in case of any unexpected delays. Super Stream 9

What are the benefits for payroll developers? One standardized and mandated set of fields and values for superannuation One standardized file format (XBRL) and messaging component (eb. MS) Superstream based on existing Standard Business Reporting (SBR) taxonomy Future value – ATO moving to utilize this format for reporting to ATO and for the whole of government SBR reports The contribution message implementation guide and associated schedules details all requirements Super Stream 10

What are the benefits for payroll developers? One standardized and mandated set of fields and values for superannuation One standardized file format (XBRL) and messaging component (eb. MS) Superstream based on existing Standard Business Reporting (SBR) taxonomy Future value – ATO moving to utilize this format for reporting to ATO and for the whole of government SBR reports The contribution message implementation guide and associated schedules details all requirements Super Stream 10

What are the options for payroll developers? Update data fields and build fully integrated xbrl/eb. MS payroll solution Update data fields and build to XBRL file format Release new product or upgrade version Partner with solution service provider and/or test with and recommend solution service provider Update data fields in upgrade/new product version in other file formats Super Stream Release new product or upgrade version Advise client to source own solution to comply with xbrl/ebms or recommend a potential solution provider 11

What are the options for payroll developers? Update data fields and build fully integrated xbrl/eb. MS payroll solution Update data fields and build to XBRL file format Release new product or upgrade version Partner with solution service provider and/or test with and recommend solution service provider Update data fields in upgrade/new product version in other file formats Super Stream Release new product or upgrade version Advise client to source own solution to comply with xbrl/ebms or recommend a potential solution provider 11

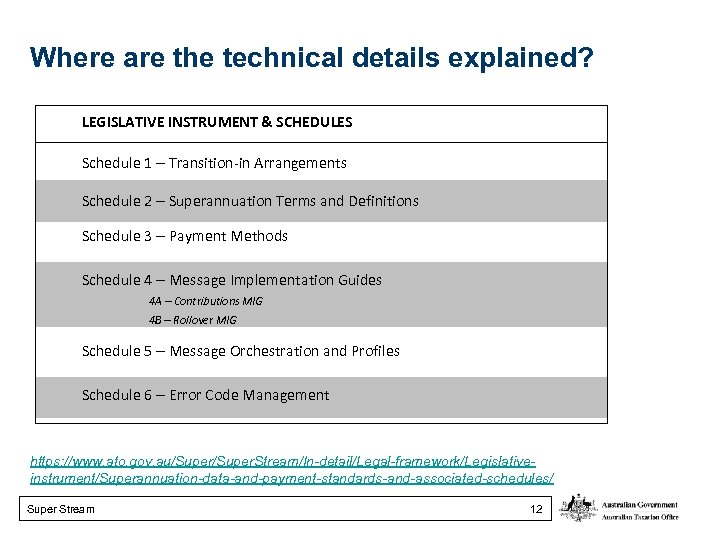

Where are the technical details explained? LEGISLATIVE INSTRUMENT & SCHEDULES Schedule 1 – Transition-in Arrangements Schedule 2 – Superannuation Terms and Definitions Schedule 3 – Payment Methods Schedule 4 – Message Implementation Guides 4 A – Contributions MIG 4 B – Rollover MIG Schedule 5 – Message Orchestration and Profiles Schedule 6 – Error Code Management https: //www. ato. gov. au/Super. Stream/In-detail/Legal-framework/Legislativeinstrument/Superannuation-data-and-payment-standards-and-associated-schedules/ Super Stream 12

Where are the technical details explained? LEGISLATIVE INSTRUMENT & SCHEDULES Schedule 1 – Transition-in Arrangements Schedule 2 – Superannuation Terms and Definitions Schedule 3 – Payment Methods Schedule 4 – Message Implementation Guides 4 A – Contributions MIG 4 B – Rollover MIG Schedule 5 – Message Orchestration and Profiles Schedule 6 – Error Code Management https: //www. ato. gov. au/Super. Stream/In-detail/Legal-framework/Legislativeinstrument/Superannuation-data-and-payment-standards-and-associated-schedules/ Super Stream 12

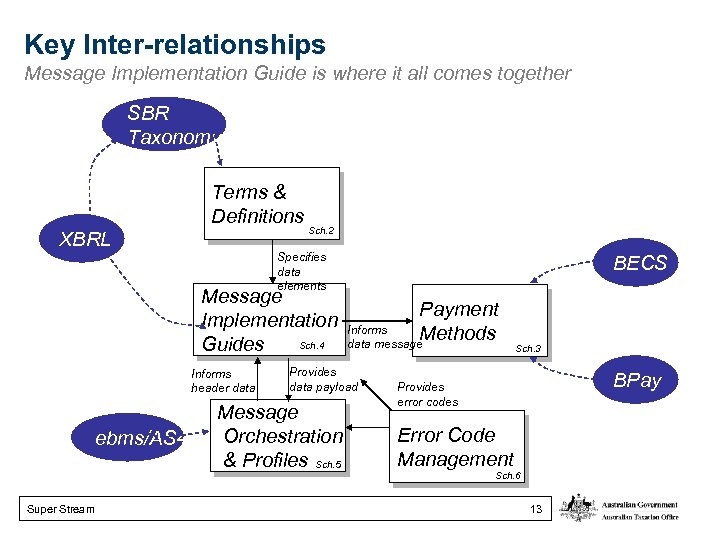

Key Inter-relationships Message Implementation Guide is where it all comes together SBR Taxonomy Terms & Definitions XBRL Sch. 2 Specifies data elements Message Implementation Sch. 4 Guides Informs header data ebms/AS 4 Super Stream BECS Payment Informs Methods data message Provides data payload Message Orchestration & Profiles Sch. 5 Sch. 3 BPay Provides error codes Error Code Management Sch. 6 13

Key Inter-relationships Message Implementation Guide is where it all comes together SBR Taxonomy Terms & Definitions XBRL Sch. 2 Specifies data elements Message Implementation Sch. 4 Guides Informs header data ebms/AS 4 Super Stream BECS Payment Informs Methods data message Provides data payload Message Orchestration & Profiles Sch. 5 Sch. 3 BPay Provides error codes Error Code Management Sch. 6 13

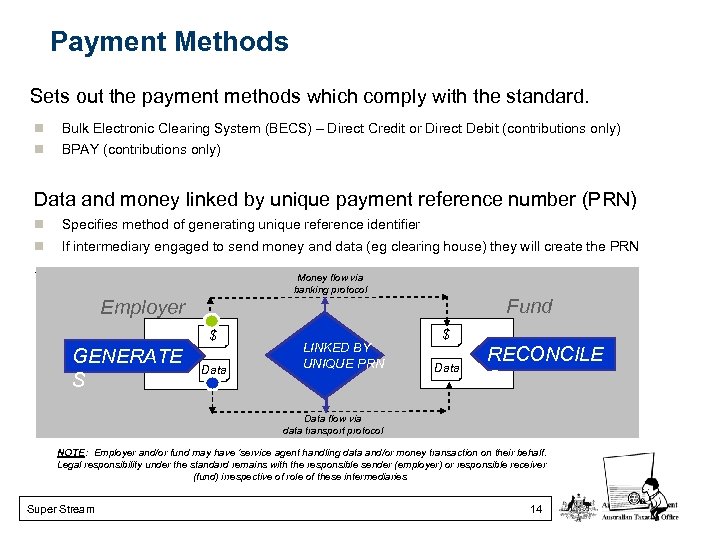

Payment Methods Sets out the payment methods which comply with the standard. Bulk Electronic Clearing System (BECS) – Direct Credit or Direct Debit (contributions only) BPAY (contributions only) Data and money linked by unique payment reference number (PRN) Specifies method of generating unique reference identifier If intermediary engaged to send money and data (eg clearing house) they will create the PRN . Money flow via banking protocol Fund Employer $ GENERATE S Data LINKED BY UNIQUE PRN $ Data RECONCILE S Data flow via data transport protocol NOTE: Employer and/or fund may have ‘service agent handling data and/or money transaction on their behalf. Legal responsibility under the standard remains with the responsible sender (employer) or responsible receiver (fund) irrespective of role of these intermediaries. Super Stream 14

Payment Methods Sets out the payment methods which comply with the standard. Bulk Electronic Clearing System (BECS) – Direct Credit or Direct Debit (contributions only) BPAY (contributions only) Data and money linked by unique payment reference number (PRN) Specifies method of generating unique reference identifier If intermediary engaged to send money and data (eg clearing house) they will create the PRN . Money flow via banking protocol Fund Employer $ GENERATE S Data LINKED BY UNIQUE PRN $ Data RECONCILE S Data flow via data transport protocol NOTE: Employer and/or fund may have ‘service agent handling data and/or money transaction on their behalf. Legal responsibility under the standard remains with the responsible sender (employer) or responsible receiver (fund) irrespective of role of these intermediaries. Super Stream 14

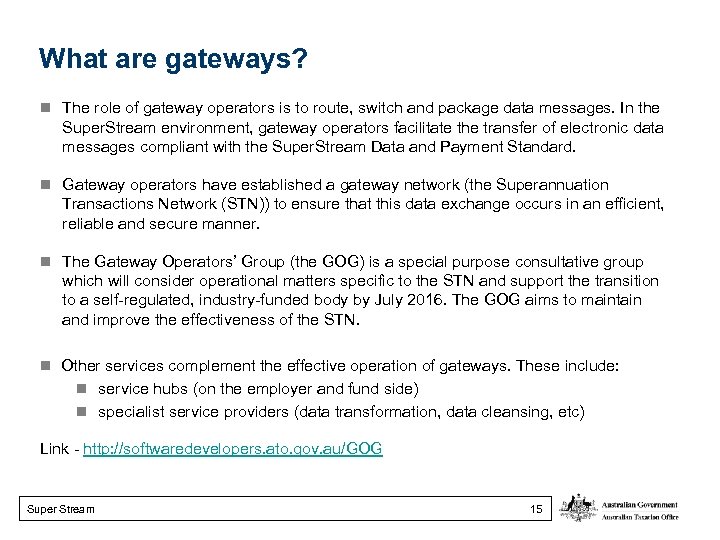

What are gateways? The role of gateway operators is to route, switch and package data messages. In the Super. Stream environment, gateway operators facilitate the transfer of electronic data messages compliant with the Super. Stream Data and Payment Standard. Gateway operators have established a gateway network (the Superannuation Transactions Network (STN)) to ensure that this data exchange occurs in an efficient, reliable and secure manner. The Gateway Operators’ Group (the GOG) is a special purpose consultative group which will consider operational matters specific to the STN and support the transition to a self-regulated, industry-funded body by July 2016. The GOG aims to maintain and improve the effectiveness of the STN. Other services complement the effective operation of gateways. These include: service hubs (on the employer and fund side) specialist service providers (data transformation, data cleansing, etc) Link - http: //softwaredevelopers. ato. gov. au/GOG Super Stream 15

What are gateways? The role of gateway operators is to route, switch and package data messages. In the Super. Stream environment, gateway operators facilitate the transfer of electronic data messages compliant with the Super. Stream Data and Payment Standard. Gateway operators have established a gateway network (the Superannuation Transactions Network (STN)) to ensure that this data exchange occurs in an efficient, reliable and secure manner. The Gateway Operators’ Group (the GOG) is a special purpose consultative group which will consider operational matters specific to the STN and support the transition to a self-regulated, industry-funded body by July 2016. The GOG aims to maintain and improve the effectiveness of the STN. Other services complement the effective operation of gateways. These include: service hubs (on the employer and fund side) specialist service providers (data transformation, data cleansing, etc) Link - http: //softwaredevelopers. ato. gov. au/GOG Super Stream 15

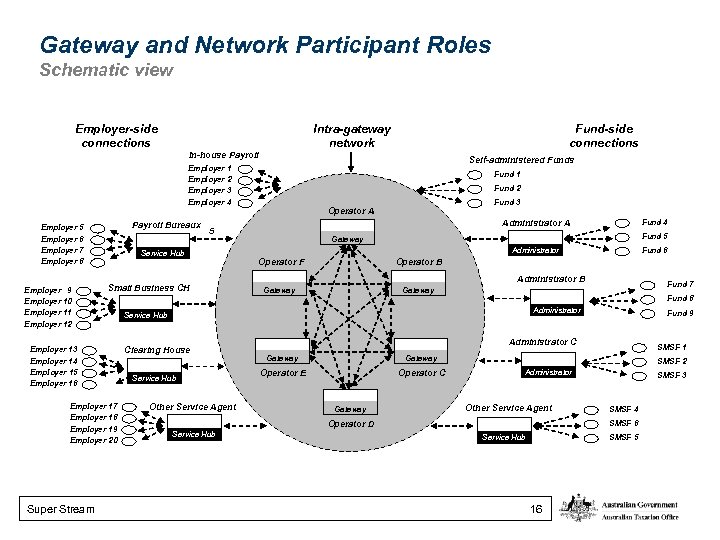

Gateway and Network Participant Roles Schematic view Employer-side connections Intra-gateway network Fund-side connections In-house Payroll Self-administered Funds Employer 1 Employer 2 Employer 3 Employer 4 Payroll Bureaux Employer 5 Employer 6 Employer 7 Employer 8 Employer 9 Employer 10 Employer 11 Employer 12 Small Business CH Employer 17 Employer 18 Employer 19 Employer 20 Super Stream Fund 2 Fund 3 Operator A Administrator A 5 Service Hub Employer 13 Employer 14 Employer 15 Employer 16 Fund 1 Fund 4 Fund 5 Gateway Fund 6 Administrator Operator F Operator B Gateway Administrator B Fund 7 Fund 8 Administrator Service Hub Clearing House Service Hub Other Service Agent Administrator C Gateway Operator E Operator C SMSF 1 Gateway SMSF 2 Administrator Other Service Agent SMSF 3 SMSF 4 SMSF 6 Operator D Service Hub Fund 9 SMSF 5 Service Hub 16

Gateway and Network Participant Roles Schematic view Employer-side connections Intra-gateway network Fund-side connections In-house Payroll Self-administered Funds Employer 1 Employer 2 Employer 3 Employer 4 Payroll Bureaux Employer 5 Employer 6 Employer 7 Employer 8 Employer 9 Employer 10 Employer 11 Employer 12 Small Business CH Employer 17 Employer 18 Employer 19 Employer 20 Super Stream Fund 2 Fund 3 Operator A Administrator A 5 Service Hub Employer 13 Employer 14 Employer 15 Employer 16 Fund 1 Fund 4 Fund 5 Gateway Fund 6 Administrator Operator F Operator B Gateway Administrator B Fund 7 Fund 8 Administrator Service Hub Clearing House Service Hub Other Service Agent Administrator C Gateway Operator E Operator C SMSF 1 Gateway SMSF 2 Administrator Other Service Agent SMSF 3 SMSF 4 SMSF 6 Operator D Service Hub Fund 9 SMSF 5 Service Hub 16

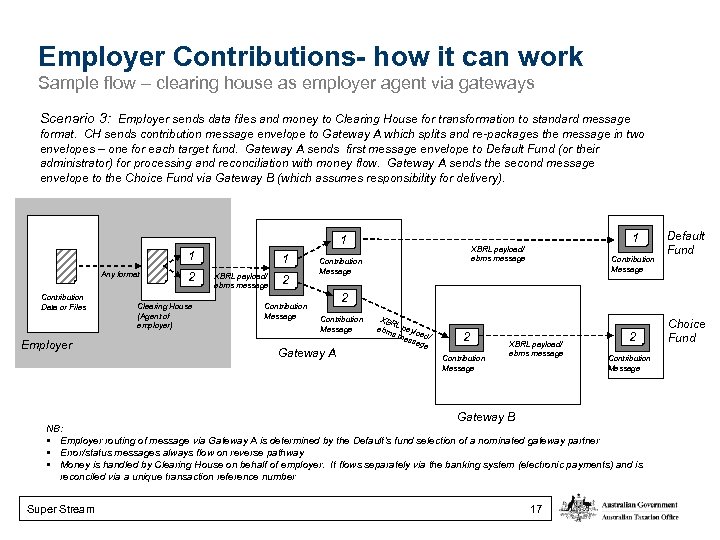

Employer Contributions- how it can work Sample flow – clearing house as employer agent via gateways Scenario 3: Employer sends data files and money to Clearing House for transformation to standard message format. CH sends contribution message envelope to Gateway A which splits and re-packages the message in two envelopes – one for each target fund. Gateway A sends first message envelope to Default Fund (or their administrator) for processing and reconciliation with money flow. Gateway A sends the second message envelope to the Choice Fund via Gateway B (which assumes responsibility for delivery). 1 1 1 Any format Contribution Data or Files Employer XBRL payload/ ebms message 2 Clearing House (Agent of employer) 1 XBRL payload/ ebms message 2 Contribution Message XBRL payload/ ebms message Contribution Message 2 Contribution Message Gateway A XBR ebm L paylo sm a ess d/ age 2 Contribution Message XBRL payload/ ebms message Gateway B 2 Contribution Message NB: § Employer routing of message via Gateway A is determined by the Default’s fund selection of a nominated gateway partner § Error/status messages always flow on reverse pathway § Money is handled by Clearing House on behalf of employer. It flows separately via the banking system (electronic payments) and is reconciled via a unique transaction reference number Super Stream Default Fund 17 Choice Fund

Employer Contributions- how it can work Sample flow – clearing house as employer agent via gateways Scenario 3: Employer sends data files and money to Clearing House for transformation to standard message format. CH sends contribution message envelope to Gateway A which splits and re-packages the message in two envelopes – one for each target fund. Gateway A sends first message envelope to Default Fund (or their administrator) for processing and reconciliation with money flow. Gateway A sends the second message envelope to the Choice Fund via Gateway B (which assumes responsibility for delivery). 1 1 1 Any format Contribution Data or Files Employer XBRL payload/ ebms message 2 Clearing House (Agent of employer) 1 XBRL payload/ ebms message 2 Contribution Message XBRL payload/ ebms message Contribution Message 2 Contribution Message Gateway A XBR ebm L paylo sm a ess d/ age 2 Contribution Message XBRL payload/ ebms message Gateway B 2 Contribution Message NB: § Employer routing of message via Gateway A is determined by the Default’s fund selection of a nominated gateway partner § Error/status messages always flow on reverse pathway § Money is handled by Clearing House on behalf of employer. It flows separately via the banking system (electronic payments) and is reconciled via a unique transaction reference number Super Stream Default Fund 17 Choice Fund

What is the Superstream Alternative File Format? Intended to complement the standard Intended to simplify the amount of development required to support transitional and enduring alternative arrangements Use is optional but by mutual agreement between employer and fund or employer and service provider Data items align with those as required in the standard Required to refer to the standard (including taxonomy files) to understand details (mandatory or optional) Guidance note on its use is available on http: //softwaredevelopers. ato. gov. au/contributions Testing and certification on the ATO Alternative File Format can be done through compliancetest – https: //www. compliancetest. net Super Stream 18

What is the Superstream Alternative File Format? Intended to complement the standard Intended to simplify the amount of development required to support transitional and enduring alternative arrangements Use is optional but by mutual agreement between employer and fund or employer and service provider Data items align with those as required in the standard Required to refer to the standard (including taxonomy files) to understand details (mandatory or optional) Guidance note on its use is available on http: //softwaredevelopers. ato. gov. au/contributions Testing and certification on the ATO Alternative File Format can be done through compliancetest – https: //www. compliancetest. net Super Stream 18

Induction

Induction

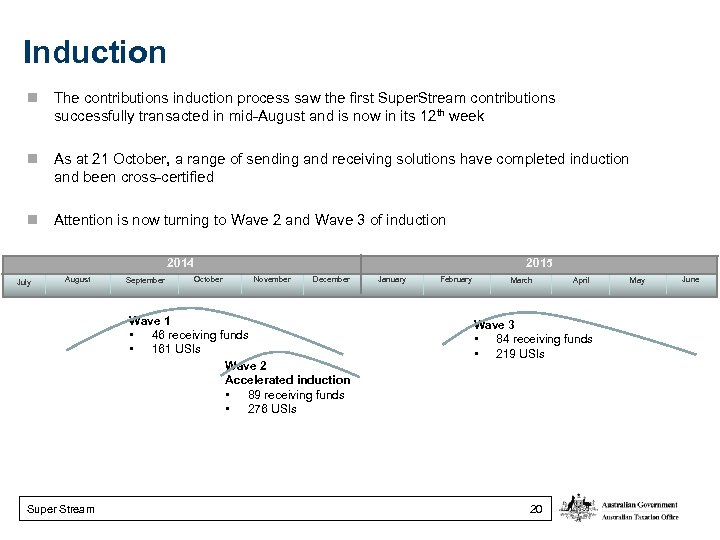

Induction The contributions induction process saw the first Super. Stream contributions successfully transacted in mid-August and is now in its 12 th week As at 21 October, a range of sending and receiving solutions have completed induction and been cross-certified Attention is now turning to Wave 2 and Wave 3 of induction 2014 July August September October 2015 November December Wave 1 • 46 receiving funds • 161 USIs Wave 2 Accelerated induction • 89 receiving funds • 276 USIs Super Stream January February March April Wave 3 • 84 receiving funds • 219 USIs 20 May June

Induction The contributions induction process saw the first Super. Stream contributions successfully transacted in mid-August and is now in its 12 th week As at 21 October, a range of sending and receiving solutions have completed induction and been cross-certified Attention is now turning to Wave 2 and Wave 3 of induction 2014 July August September October 2015 November December Wave 1 • 46 receiving funds • 161 USIs Wave 2 Accelerated induction • 89 receiving funds • 276 USIs Super Stream January February March April Wave 3 • 84 receiving funds • 219 USIs 20 May June

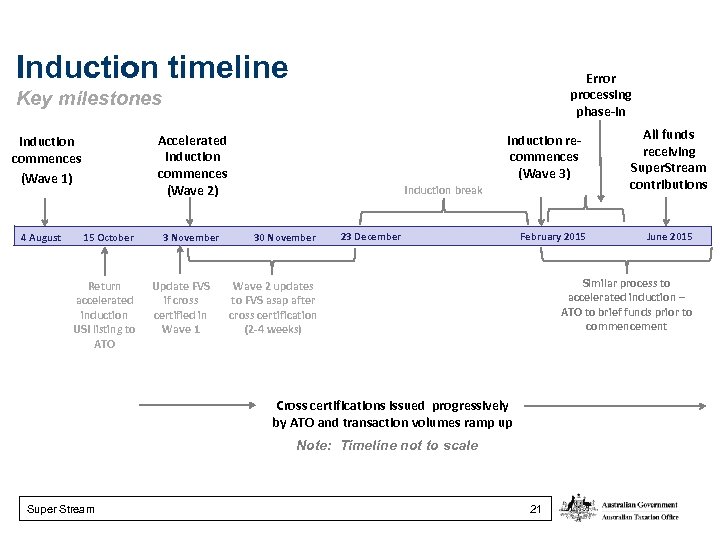

Induction timeline Error processing phase-in Key milestones Accelerated induction commences (Wave 2) Induction commences (Wave 1) 4 August 15 October Return accelerated induction USI listing to ATO 3 November Update FVS if cross certified in Wave 1 Induction recommences (Wave 3) Induction break 30 November 23 December February 2015 June 2015 30 June 2015 Similar process to accelerated induction – ATO to brief funds prior to commencement Wave 2 updates to FVS asap after cross certification (2 -4 weeks) Cross certifications issued progressively by ATO and transaction volumes ramp up Note: Timeline not to scale Super Stream All funds receiving Super. Stream contributions 21

Induction timeline Error processing phase-in Key milestones Accelerated induction commences (Wave 2) Induction commences (Wave 1) 4 August 15 October Return accelerated induction USI listing to ATO 3 November Update FVS if cross certified in Wave 1 Induction recommences (Wave 3) Induction break 30 November 23 December February 2015 June 2015 30 June 2015 Similar process to accelerated induction – ATO to brief funds prior to commencement Wave 2 updates to FVS asap after cross certification (2 -4 weeks) Cross certifications issued progressively by ATO and transaction volumes ramp up Note: Timeline not to scale Super Stream All funds receiving Super. Stream contributions 21

Induction documentation http: /softwaredevelopers. ato. gov. au/Contributionsinduction Contributions Induction Process Guide Contributions induction timetable APRA Funds Induction Schedule Sending Solutions Induction Schedule Induction process updates Fund details for induction groups Accelerated induction process Contributions implementation timetable for APRA funds Super Stream 22

Induction documentation http: /softwaredevelopers. ato. gov. au/Contributionsinduction Contributions Induction Process Guide Contributions induction timetable APRA Funds Induction Schedule Sending Solutions Induction Schedule Induction process updates Fund details for induction groups Accelerated induction process Contributions implementation timetable for APRA funds Super Stream 22

Readiness - what stakeholders are telling us These are generalisations – do not apply to all, but they highlight the need to improve overall visibility, communication and sense of urgency Little or no visibility of what payroll software providers are doing and their readiness level Software product register on SILU is not helping stakeholders - Use of ‘intent to comply’ is of no value Lack of firm information to base plans on The reliance of payroll products on a clearing house for certification is not sufficient to provide assurance to receiving funds - Conformance with xbrl and messaging formats is only part of the story – exceptions will generate from poorly collected and poorly constructed data - Don’t be surprised as volumes grow, exception and error rates grow, where the payroll solution has not been certified or tested end-to-end Employers want to know if their payroll product is Super. Stream compliant – and if not know, then will it be. Super Stream 23

Readiness - what stakeholders are telling us These are generalisations – do not apply to all, but they highlight the need to improve overall visibility, communication and sense of urgency Little or no visibility of what payroll software providers are doing and their readiness level Software product register on SILU is not helping stakeholders - Use of ‘intent to comply’ is of no value Lack of firm information to base plans on The reliance of payroll products on a clearing house for certification is not sufficient to provide assurance to receiving funds - Conformance with xbrl and messaging formats is only part of the story – exceptions will generate from poorly collected and poorly constructed data - Don’t be surprised as volumes grow, exception and error rates grow, where the payroll solution has not been certified or tested end-to-end Employers want to know if their payroll product is Super. Stream compliant – and if not know, then will it be. Super Stream 23

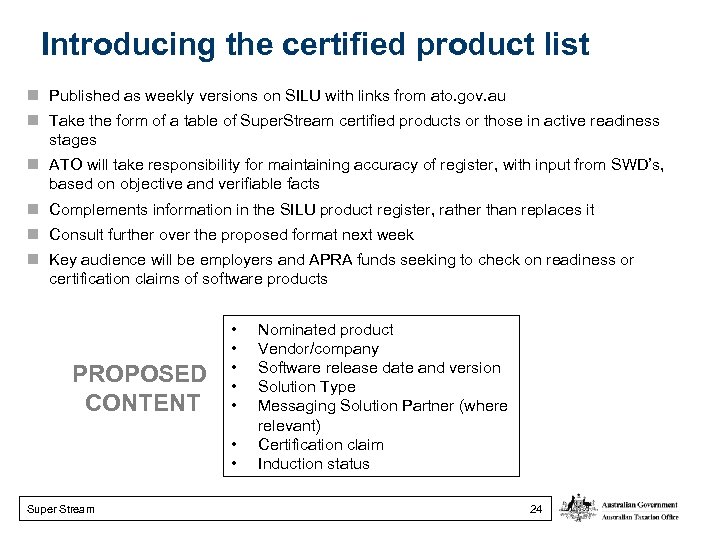

Introducing the certified product list Published as weekly versions on SILU with links from ato. gov. au Take the form of a table of Super. Stream certified products or those in active readiness stages ATO will take responsibility for maintaining accuracy of register, with input from SWD’s, based on objective and verifiable facts Complements information in the SILU product register, rather than replaces it Consult further over the proposed format next week Key audience will be employers and APRA funds seeking to check on readiness or certification claims of software products PROPOSED CONTENT • • Super Stream Nominated product Vendor/company Software release date and version Solution Type Messaging Solution Partner (where relevant) Certification claim Induction status 24

Introducing the certified product list Published as weekly versions on SILU with links from ato. gov. au Take the form of a table of Super. Stream certified products or those in active readiness stages ATO will take responsibility for maintaining accuracy of register, with input from SWD’s, based on objective and verifiable facts Complements information in the SILU product register, rather than replaces it Consult further over the proposed format next week Key audience will be employers and APRA funds seeking to check on readiness or certification claims of software products PROPOSED CONTENT • • Super Stream Nominated product Vendor/company Software release date and version Solution Type Messaging Solution Partner (where relevant) Certification claim Induction status 24

What to expect next from ATO Remove intent section in Software Developer register Replace with a certified products list for Super. Stream – Maintained by the ATO to reflect actual engagement with the testing, certification and induction process Renewed emphasis on the importance of payroll solutions obtaining certification and participating in induction Highlighting the important reliance of employers on representations by SWD’s on their release and compliance plans – Flexibility for employers in meeting the compliance expectations of the ATO is predicated on an employer having a realistic implementation plan and start date Brokering meetings between key software developers and major APRA funds to improve: – Mutual understanding of issues and readiness – Fast track end to end testing arrangements Extending the ATO’s offer to work one-on-one with individual payroll providers in helping guide their approach and resolve issues relevant to getting ready for Super. Stream. Super Stream 25

What to expect next from ATO Remove intent section in Software Developer register Replace with a certified products list for Super. Stream – Maintained by the ATO to reflect actual engagement with the testing, certification and induction process Renewed emphasis on the importance of payroll solutions obtaining certification and participating in induction Highlighting the important reliance of employers on representations by SWD’s on their release and compliance plans – Flexibility for employers in meeting the compliance expectations of the ATO is predicated on an employer having a realistic implementation plan and start date Brokering meetings between key software developers and major APRA funds to improve: – Mutual understanding of issues and readiness – Fast track end to end testing arrangements Extending the ATO’s offer to work one-on-one with individual payroll providers in helping guide their approach and resolve issues relevant to getting ready for Super. Stream. Super Stream 25

What do payroll providers need to do? Assess the options and decide on your solution Set your target product release date Communicate your solution and release dates to your client base Undertake testing and certification of your end to end solution Release product well before 30 June 2015 to ensure clients are able to test product/solution in time to meet their compliance requirements Super Stream 26

What do payroll providers need to do? Assess the options and decide on your solution Set your target product release date Communicate your solution and release dates to your client base Undertake testing and certification of your end to end solution Release product well before 30 June 2015 to ensure clients are able to test product/solution in time to meet their compliance requirements Super Stream 26

Testing and certification

Testing and certification

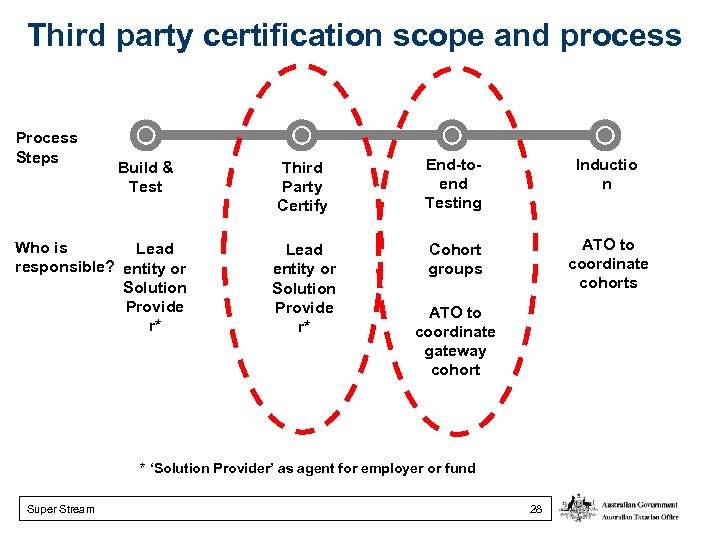

Third party certification scope and process Process Steps Build & Test Who is Lead responsible? entity or Solution Provide r* Third Party Certify End-toend Testing Inductio n Lead entity or Solution Provide r* Cohort groups ATO to coordinate cohorts ATO to coordinate gateway cohort * ‘Solution Provider’ as agent for employer or fund Super Stream 28

Third party certification scope and process Process Steps Build & Test Who is Lead responsible? entity or Solution Provide r* Third Party Certify End-toend Testing Inductio n Lead entity or Solution Provide r* Cohort groups ATO to coordinate cohorts ATO to coordinate gateway cohort * ‘Solution Provider’ as agent for employer or fund Super Stream 28

What do you need to do? Work out your product strategy for Super. Stream compliance - Tip: focus on your flagship or high volume products Commit to a product release date Back up your Super. Stream compliance claims - Obtain third party certification - Get scheduled into the induction process = cross-certified product! Organise end-to-end testing (before entering induction) Keep the ATO informed so we keep our readiness list up to date Let your clients know what your Super. Stream readiness plan is! Now let’s focus on three key steps: • Third party certification • End-to-end testing • Induction (cross-certification) Super Stream 29

What do you need to do? Work out your product strategy for Super. Stream compliance - Tip: focus on your flagship or high volume products Commit to a product release date Back up your Super. Stream compliance claims - Obtain third party certification - Get scheduled into the induction process = cross-certified product! Organise end-to-end testing (before entering induction) Keep the ATO informed so we keep our readiness list up to date Let your clients know what your Super. Stream readiness plan is! Now let’s focus on three key steps: • Third party certification • End-to-end testing • Induction (cross-certification) Super Stream 29

Key points in relation to 3 rd party certification for sending solutions Straightforward process that is highly automated Doesn’t take inordinate amount of time, will have a look at the test cases required next Cost effective Enables confidence to be built into the Super. Stream network, assurance for receivers and positive confirmation of compliance to standards from senders Super Stream 30

Key points in relation to 3 rd party certification for sending solutions Straightforward process that is highly automated Doesn’t take inordinate amount of time, will have a look at the test cases required next Cost effective Enables confidence to be built into the Super. Stream network, assurance for receivers and positive confirmation of compliance to standards from senders Super Stream 30

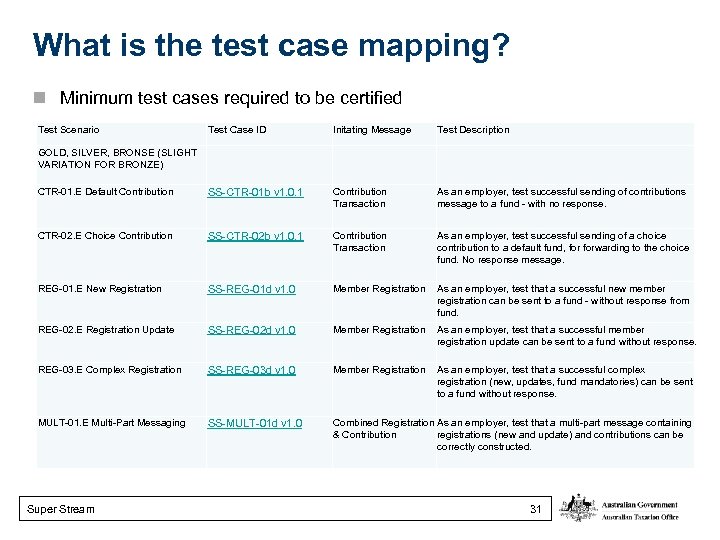

What is the test case mapping? Minimum test cases required to be certified Test Scenario Initating Message Test Description GOLD, SILVER, BRONSE (SLIGHT VARIATION FOR BRONZE) CTR-01. E Default Contribution SS-CTR-01 b v 1. 0. 1 Contribution Transaction As an employer, test successful sending of contributions message to a fund - with no response. CTR-02. E Choice Contribution SS-CTR-02 b v 1. 0. 1 Contribution Transaction As an employer, test successful sending of a choice contribution to a default fund, forwarding to the choice fund. No response message. REG-01. E New Registration SS-REG-01 d v 1. 0 Member Registration As an employer, test that a successful new member registration can be sent to a fund - without response from fund. REG-02. E Registration Update SS-REG-02 d v 1. 0 Member Registration As an employer, test that a successful member registration update can be sent to a fund without response. REG-03. E Complex Registration SS-REG-03 d v 1. 0 Member Registration As an employer, test that a successful complex registration (new, updates, fund mandatories) can be sent to a fund without response. MULT-01. E Multi-Part Messaging SS-MULT-01 d v 1. 0 Combined Registration As an employer, test that a multi-part message containing & Contribution registrations (new and update) and contributions can be correctly constructed. Super Stream Test Case ID 31

What is the test case mapping? Minimum test cases required to be certified Test Scenario Initating Message Test Description GOLD, SILVER, BRONSE (SLIGHT VARIATION FOR BRONZE) CTR-01. E Default Contribution SS-CTR-01 b v 1. 0. 1 Contribution Transaction As an employer, test successful sending of contributions message to a fund - with no response. CTR-02. E Choice Contribution SS-CTR-02 b v 1. 0. 1 Contribution Transaction As an employer, test successful sending of a choice contribution to a default fund, forwarding to the choice fund. No response message. REG-01. E New Registration SS-REG-01 d v 1. 0 Member Registration As an employer, test that a successful new member registration can be sent to a fund - without response from fund. REG-02. E Registration Update SS-REG-02 d v 1. 0 Member Registration As an employer, test that a successful member registration update can be sent to a fund without response. REG-03. E Complex Registration SS-REG-03 d v 1. 0 Member Registration As an employer, test that a successful complex registration (new, updates, fund mandatories) can be sent to a fund without response. MULT-01. E Multi-Part Messaging SS-MULT-01 d v 1. 0 Combined Registration As an employer, test that a multi-part message containing & Contribution registrations (new and update) and contributions can be correctly constructed. Super Stream Test Case ID 31

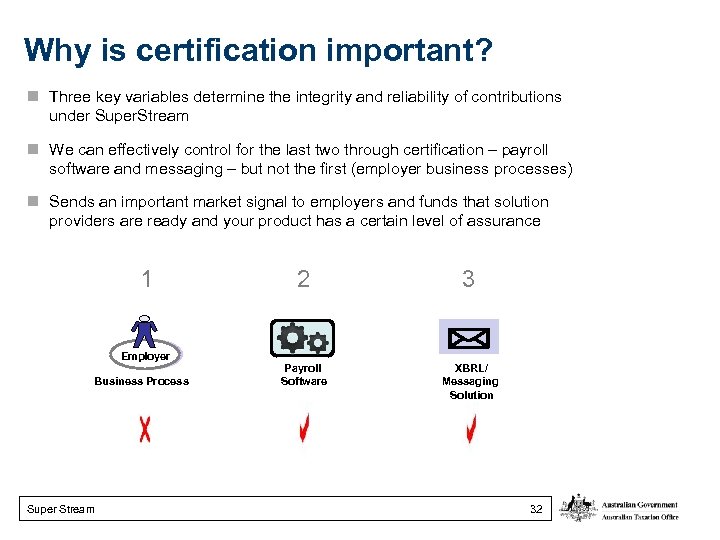

Why is certification important? Three key variables determine the integrity and reliability of contributions under Super. Stream We can effectively control for the last two through certification – payroll software and messaging – but not the first (employer business processes) Sends an important market signal to employers and funds that solution providers are ready and your product has a certain level of assurance 1 2 3 Payroll Software XBRL/ Messaging Solution Employer Business Process Super Stream 32

Why is certification important? Three key variables determine the integrity and reliability of contributions under Super. Stream We can effectively control for the last two through certification – payroll software and messaging – but not the first (employer business processes) Sends an important market signal to employers and funds that solution providers are ready and your product has a certain level of assurance 1 2 3 Payroll Software XBRL/ Messaging Solution Employer Business Process Super Stream 32

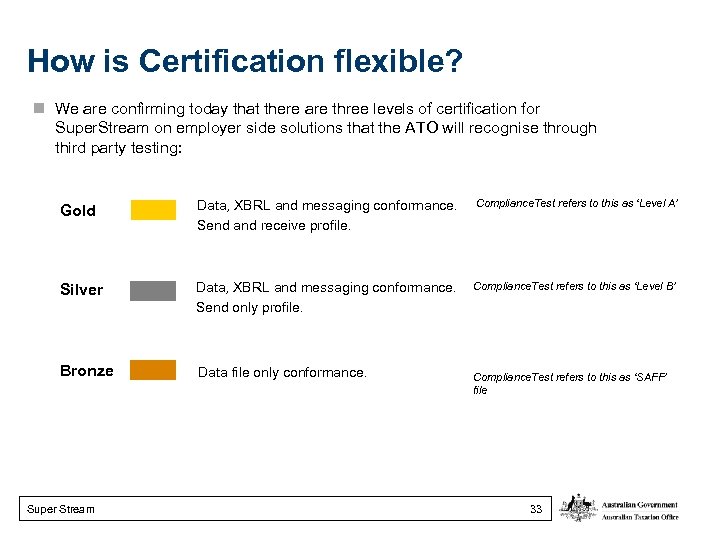

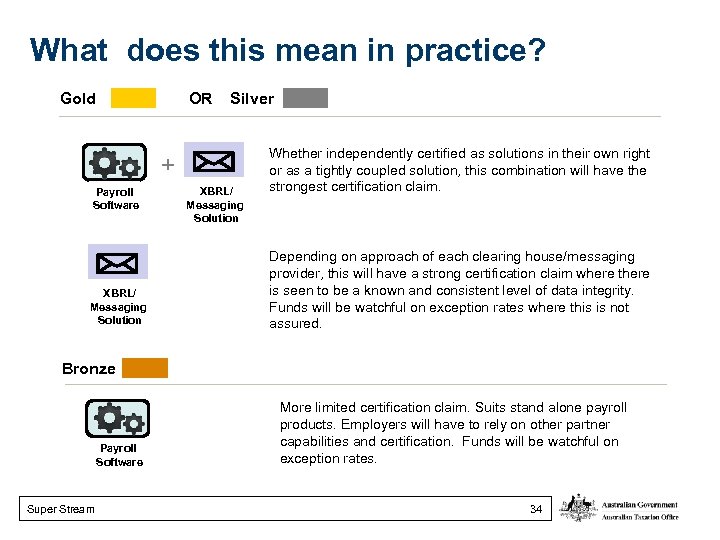

How is Certification flexible? We are confirming today that there are three levels of certification for Super. Stream on employer side solutions that the ATO will recognise through third party testing: Gold Data, XBRL and messaging conformance. Send and receive profile. Compliance. Test refers to this as ‘Level A’ Silver Data, XBRL and messaging conformance. Send only profile. Compliance. Test refers to this as ‘Level B’ Bronze Data file only conformance. Super Stream Compliance. Test refers to this as ‘SAFF’ file 33

How is Certification flexible? We are confirming today that there are three levels of certification for Super. Stream on employer side solutions that the ATO will recognise through third party testing: Gold Data, XBRL and messaging conformance. Send and receive profile. Compliance. Test refers to this as ‘Level A’ Silver Data, XBRL and messaging conformance. Send only profile. Compliance. Test refers to this as ‘Level B’ Bronze Data file only conformance. Super Stream Compliance. Test refers to this as ‘SAFF’ file 33

What does this mean in practice? OR Gold Silver + Payroll Software XBRL/ Messaging Solution Whether independently certified as solutions in their own right or as a tightly coupled solution, this combination will have the strongest certification claim. Depending on approach of each clearing house/messaging provider, this will have a strong certification claim where there is seen to be a known and consistent level of data integrity. Funds will be watchful on exception rates where this is not assured. Bronze Payroll Software Super Stream More limited certification claim. Suits stand alone payroll products. Employers will have to rely on other partner capabilities and certification. Funds will be watchful on exception rates. 34

What does this mean in practice? OR Gold Silver + Payroll Software XBRL/ Messaging Solution Whether independently certified as solutions in their own right or as a tightly coupled solution, this combination will have the strongest certification claim. Depending on approach of each clearing house/messaging provider, this will have a strong certification claim where there is seen to be a known and consistent level of data integrity. Funds will be watchful on exception rates where this is not assured. Bronze Payroll Software Super Stream More limited certification claim. Suits stand alone payroll products. Employers will have to rely on other partner capabilities and certification. Funds will be watchful on exception rates. 34

End-To-End Testing – Compliance Test Support superstream business rules testing via XBRL, SAFF, or throughgateway-testing (TGT) Support both the superstream certification testing and the end-to-end testing processes Can act as the employer gateway service provider for end-to-end testing purposes All services are covered at minimal cost, initial subscription fee has been removed please contact compliance test for cost details Note: substantial discounts for ABSIA members Details at www. compliancetest. net -> help & FAQ -> documentation -> end to end testing support Super Stream 35

End-To-End Testing – Compliance Test Support superstream business rules testing via XBRL, SAFF, or throughgateway-testing (TGT) Support both the superstream certification testing and the end-to-end testing processes Can act as the employer gateway service provider for end-to-end testing purposes All services are covered at minimal cost, initial subscription fee has been removed please contact compliance test for cost details Note: substantial discounts for ABSIA members Details at www. compliancetest. net -> help & FAQ -> documentation -> end to end testing support Super Stream 35

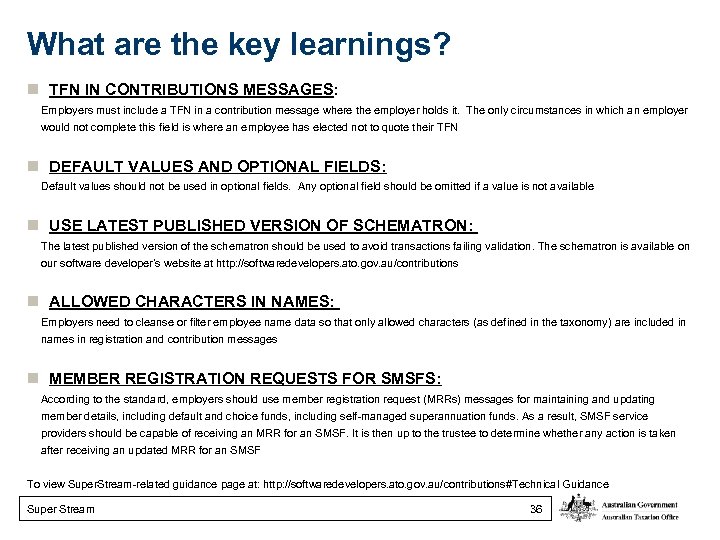

What are the key learnings? TFN IN CONTRIBUTIONS MESSAGES: Employers must include a TFN in a contribution message where the employer holds it. The only circumstances in which an employer would not complete this field is where an employee has elected not to quote their TFN DEFAULT VALUES AND OPTIONAL FIELDS: Default values should not be used in optional fields. Any optional field should be omitted if a value is not available USE LATEST PUBLISHED VERSION OF SCHEMATRON: The latest published version of the schematron should be used to avoid transactions failing validation. The schematron is available on our software developer’s website at http: //softwaredevelopers. ato. gov. au/contributions ALLOWED CHARACTERS IN NAMES: Employers need to cleanse or filter employee name data so that only allowed characters (as defined in the taxonomy) are included in names in registration and contribution messages MEMBER REGISTRATION REQUESTS FOR SMSFS: According to the standard, employers should use member registration request (MRRs) messages for maintaining and updating member details, including default and choice funds, including self-managed superannuation funds. As a result, SMSF service providers should be capable of receiving an MRR for an SMSF. It is then up to the trustee to determine whether any action is taken after receiving an updated MRR for an SMSF To view Super. Stream-related guidance page at: http: //softwaredevelopers. ato. gov. au/contributions#Technical Guidance Super Stream 36

What are the key learnings? TFN IN CONTRIBUTIONS MESSAGES: Employers must include a TFN in a contribution message where the employer holds it. The only circumstances in which an employer would not complete this field is where an employee has elected not to quote their TFN DEFAULT VALUES AND OPTIONAL FIELDS: Default values should not be used in optional fields. Any optional field should be omitted if a value is not available USE LATEST PUBLISHED VERSION OF SCHEMATRON: The latest published version of the schematron should be used to avoid transactions failing validation. The schematron is available on our software developer’s website at http: //softwaredevelopers. ato. gov. au/contributions ALLOWED CHARACTERS IN NAMES: Employers need to cleanse or filter employee name data so that only allowed characters (as defined in the taxonomy) are included in names in registration and contribution messages MEMBER REGISTRATION REQUESTS FOR SMSFS: According to the standard, employers should use member registration request (MRRs) messages for maintaining and updating member details, including default and choice funds, including self-managed superannuation funds. As a result, SMSF service providers should be capable of receiving an MRR for an SMSF. It is then up to the trustee to determine whether any action is taken after receiving an updated MRR for an SMSF To view Super. Stream-related guidance page at: http: //softwaredevelopers. ato. gov. au/contributions#Technical Guidance Super Stream 36

Questions? © COMMONWEALTH OF AUSTRALIA 2014 This presentation was current in October 2014 Super Stream 37

Questions? © COMMONWEALTH OF AUSTRALIA 2014 This presentation was current in October 2014 Super Stream 37

Find out more /atogovau @ato_gov_au Links https: /www. ato. gov. au/Super. Stream - general information https: /www. ato. gov. au/Super. Stream. Checklist - checklist https: //www. ato. gov. au/Super. Stream/In-detail/What-you-need-to-know/SMSFs---the. Super. Stream-standard-for-contributions - SMSF information https: //www. ato. gov. au/Super. Stream/In-detail/Contributions/Super. Stream-compliance-statement--employers-and-SMSFs/ – compliance statement http: //softwaredevelopers. ato. gov. au/superreformsincludingdatastandards - contribution technical information http: //softwaredevelopers. ato. gov. au/node/100016469 - conformance suite Email Superstreamstandards@ato. gov. au SPRWebinars@ato. gov. au Super Stream 38

Find out more /atogovau @ato_gov_au Links https: /www. ato. gov. au/Super. Stream - general information https: /www. ato. gov. au/Super. Stream. Checklist - checklist https: //www. ato. gov. au/Super. Stream/In-detail/What-you-need-to-know/SMSFs---the. Super. Stream-standard-for-contributions - SMSF information https: //www. ato. gov. au/Super. Stream/In-detail/Contributions/Super. Stream-compliance-statement--employers-and-SMSFs/ – compliance statement http: //softwaredevelopers. ato. gov. au/superreformsincludingdatastandards - contribution technical information http: //softwaredevelopers. ato. gov. au/node/100016469 - conformance suite Email Superstreamstandards@ato. gov. au SPRWebinars@ato. gov. au Super Stream 38