7cbcc02d93a2b9ecaad07dfc05c09e40.ppt

- Количество слайдов: 18

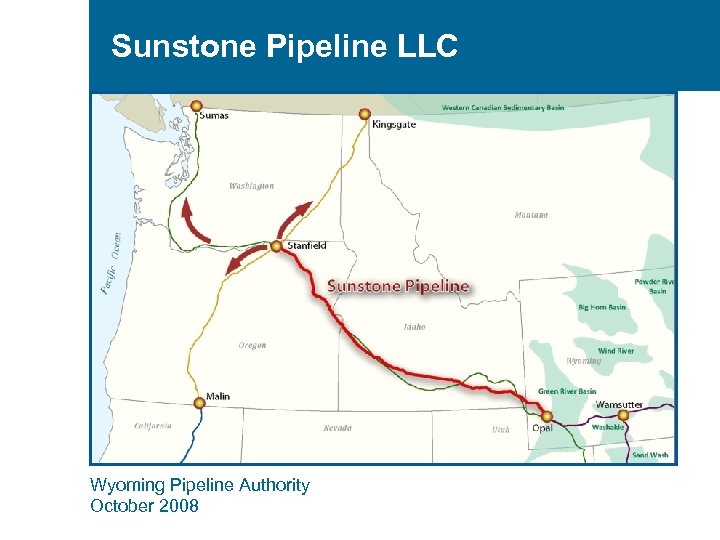

Sunstone Pipeline LLC Wyoming Pipeline Authority October 2008

Agenda 1. Sunstone Pipeline Project 2. Route Details 3. Capital Costs 4. Transportation Rates 5. Value To Shippers 6. Project Progress 7. Project Schedule 2

1. Sunstone Pipeline • JV partnership among Williams Gas Pipeline Company, Trans. Canada Pipeline and Sempra Pipelines & Storage Corp. • Provides the lowest cost transportation service to the broadest market – Pacific Northwest – California – Northern Nevada • Lower risk than greenfield construction – Existing corridors, existing infrastructure, existing operators – Lower miles – Reasonable, scrubbed cost estimate • Majority of the capacity subscribed 3

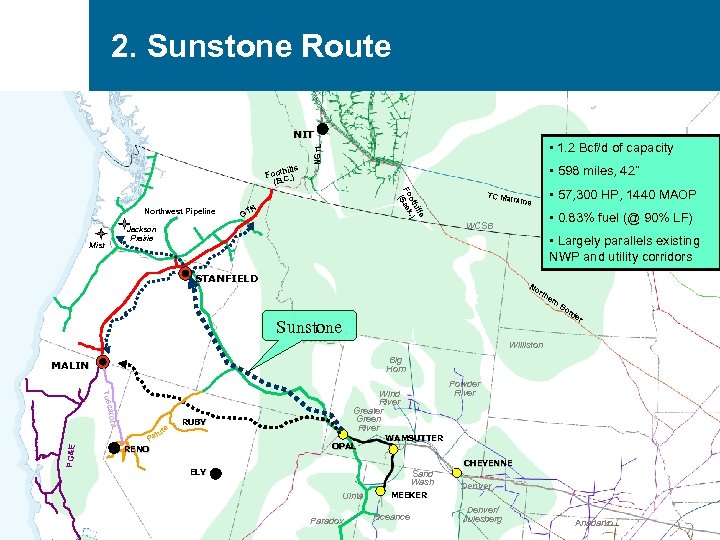

2. Sunstone Route NIT • 598 miles, 42” ills oth. ) Fo ask (S Northwest Pipeline NGTL hills Foot. ). C (B • 1. 2 Bcf/d of capacity TN G • 57, 300 HP, 1440 MAOP inline • 0. 83% fuel (@ 90% LF) WCSB Jackson Prairie Mist TC Ma • Largely parallels existing NWP and utility corridors STANFIELD No rth er n. B or Sunstone de r Williston Big Horn MALIN PG&E arora Tusc e iut Pa RUBY OPAL RENO Powder River Wind River Greater Green River WAMSUTTER CHEYENNE ELY Sand Wash Uinta 4 Paradox MEEKER Piceance Denver/ Julesberg Anadarko

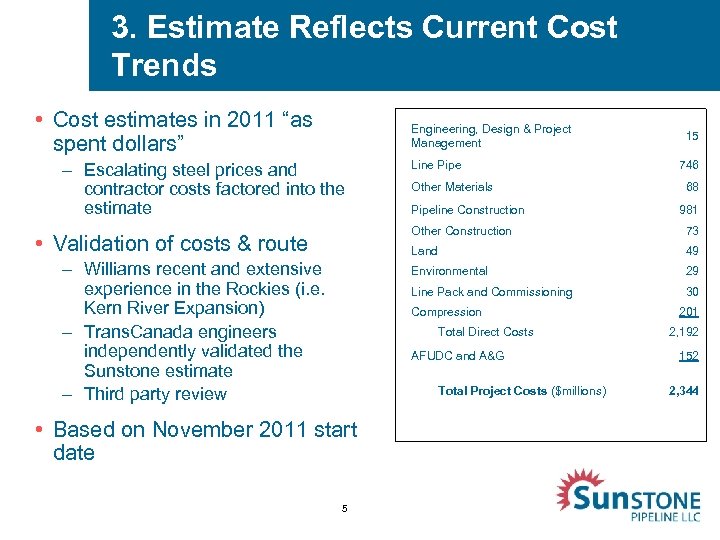

3. Estimate Reflects Current Cost Trends • Cost estimates in 2011 “as spent dollars” Engineering, Design & Project Management – Escalating steel prices and contractor costs factored into the estimate Line Pipe Other Materials Pipeline Construction 15 746 68 981 Other Construction Land 29 Line Pack and Commissioning – Williams recent and extensive experience in the Rockies (i. e. Kern River Expansion) – Trans. Canada engineers independently validated the Sunstone estimate – Third party review 49 Environmental • Validation of costs & route 73 30 Compression Total Direct Costs AFUDC and A&G Total Project Costs ($millions) • Based on November 2011 start date 5 201 2, 192 152 2, 344

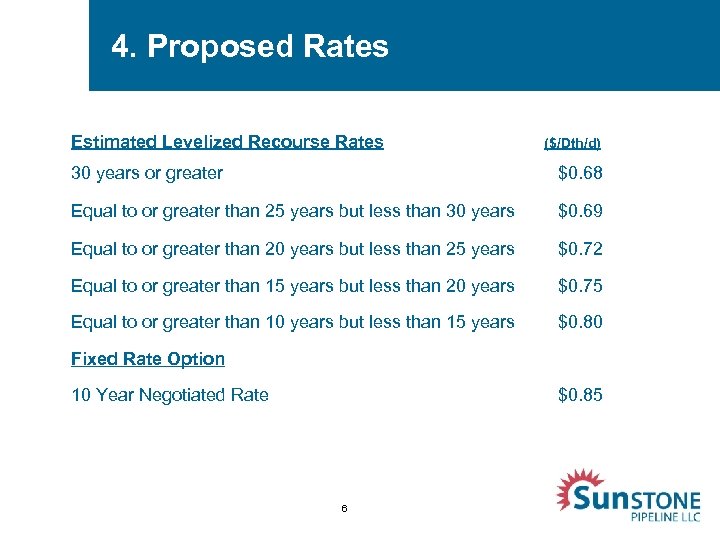

4. Proposed Rates Estimated Levelized Recourse Rates ($/Dth/d) 30 years or greater $0. 68 Equal to or greater than 25 years but less than 30 years $0. 69 Equal to or greater than 20 years but less than 25 years $0. 72 Equal to or greater than 15 years but less than 20 years $0. 75 Equal to or greater than 10 years but less than 15 years $0. 80 Fixed Rate Option 10 Year Negotiated Rate $0. 85 6

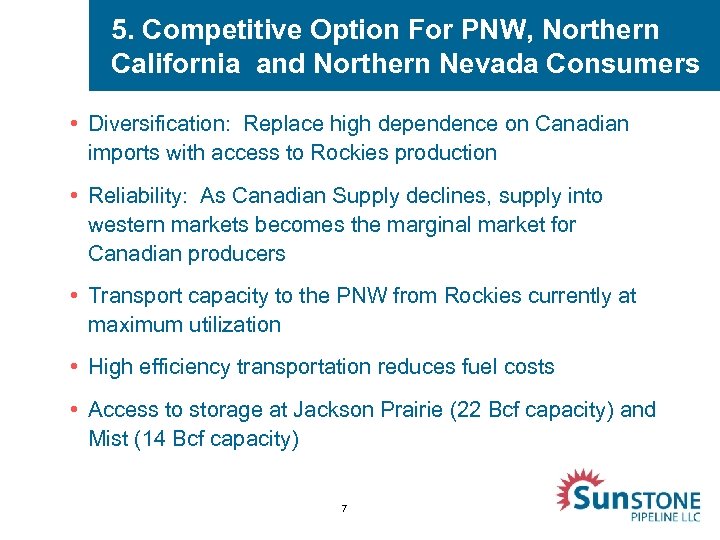

5. Competitive Option For PNW, Northern California and Northern Nevada Consumers • Diversification: Replace high dependence on Canadian imports with access to Rockies production • Reliability: As Canadian Supply declines, supply into western markets becomes the marginal market for Canadian producers • Transport capacity to the PNW from Rockies currently at maximum utilization • High efficiency transportation reduces fuel costs • Access to storage at Jackson Prairie (22 Bcf capacity) and Mist (14 Bcf capacity) 7

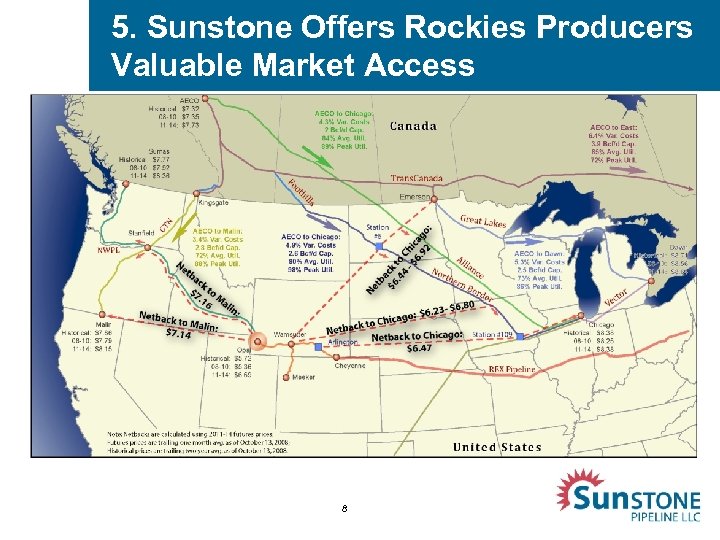

5. Sunstone Offers Rockies Producers Valuable Market Access 8

5. Valuable Access For Rockies Producers Sunstone features: • Highest netback out of the Rockies – Lower cost to access Malin • Of the two-thirds capacity already committed, 376 MMcfd represents long-term subscription from endusers, reducing producer commitment to launch project • Lowest reservation charge, minimizes risk and financial commitment • Term differentiated rate options without huge disparity among shippers maintains competitiveness for ALL shippers 9

5. Valuable Access For Rockies Producers (continued) Sunstone provides access to multiple markets and end-use meters: • From Stanfield through interconnects with Northwest Pipeline and GTN • Increase in electric generation loads fueling market growth – Electric generation loads counter-seasonal to California generation loads • Downstream expansions proposed to serve PNW market growth • No expansion required on GTN to serve Northern California and Northern Nevada – Currently 329 MDth/d available – GTN motivated to retain and expand customer base 10

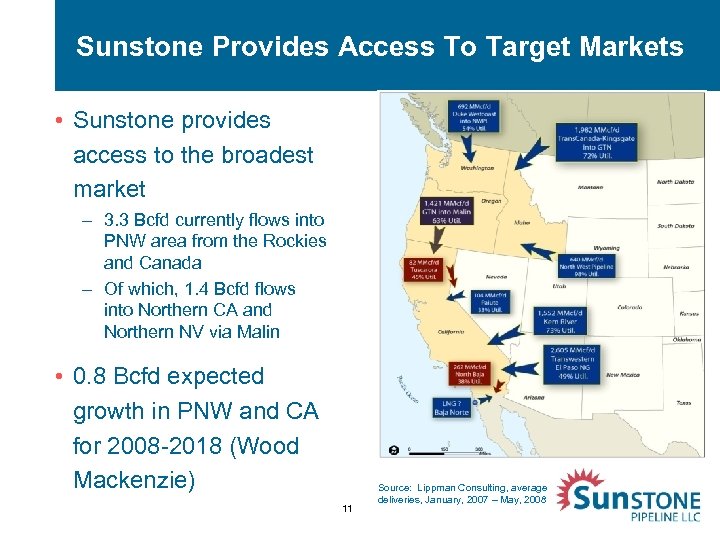

Sunstone Provides Access To Target Markets • Sunstone provides access to the broadest market – 3. 3 Bcfd currently flows into PNW area from the Rockies and Canada – Of which, 1. 4 Bcfd flows into Northern CA and Northern NV via Malin • 0. 8 Bcfd expected growth in PNW and CA for 2008 -2018 (Wood Mackenzie) 11 Source: Lippman Consulting, average deliveries, January, 2007 – May, 2008

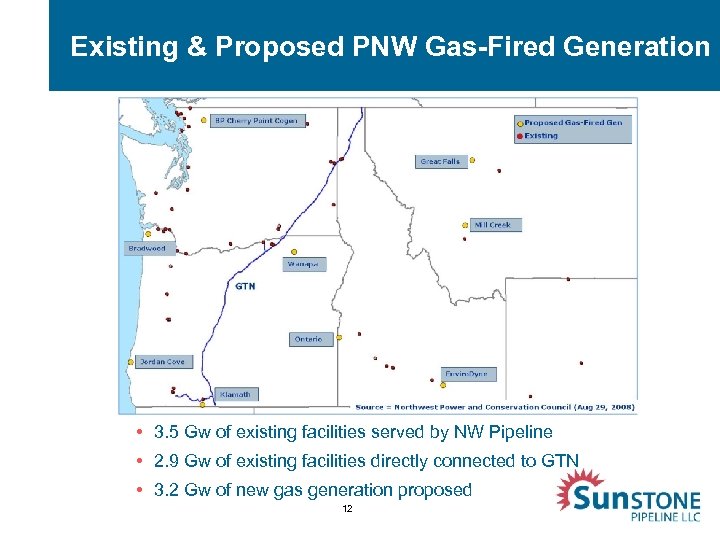

Existing & Proposed PNW Gas-Fired Generation • 3. 5 Gw of existing facilities served by NW Pipeline • 2. 9 Gw of existing facilities directly connected to GTN • 3. 2 Gw of new gas generation proposed 12

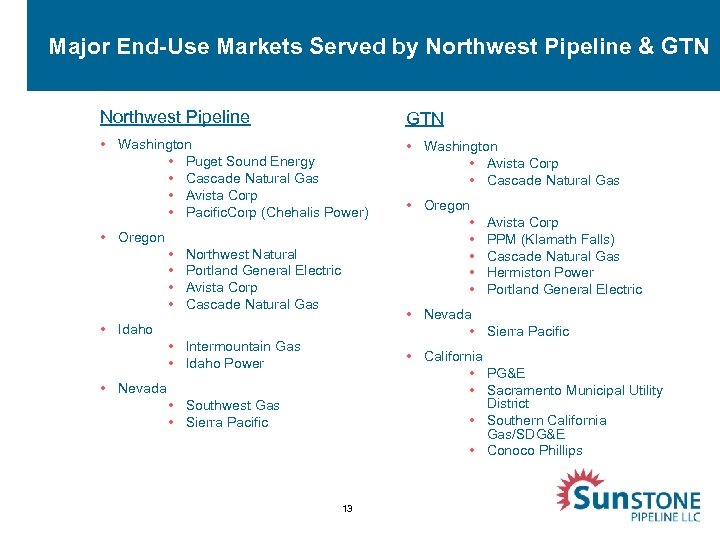

Major End-Use Markets Served by Northwest Pipeline & GTN Northwest Pipeline GTN • Washington • Puget Sound Energy • Cascade Natural Gas • Avista Corp • Pacific. Corp (Chehalis Power) • Washington • Avista Corp • Cascade Natural Gas • Oregon • • Northwest Natural Portland General Electric Avista Corp Cascade Natural Gas • Oregon • • • Avista Corp PPM (Klamath Falls) Cascade Natural Gas Hermiston Power Portland General Electric • Nevada • Sierra Pacific • Idaho • Intermountain Gas • Idaho Power • California • PG&E • Sacramento Municipal Utility District • Southern California Gas/SDG&E • Conoco Phillips • Nevada • Southwest Gas • Sierra Pacific 13

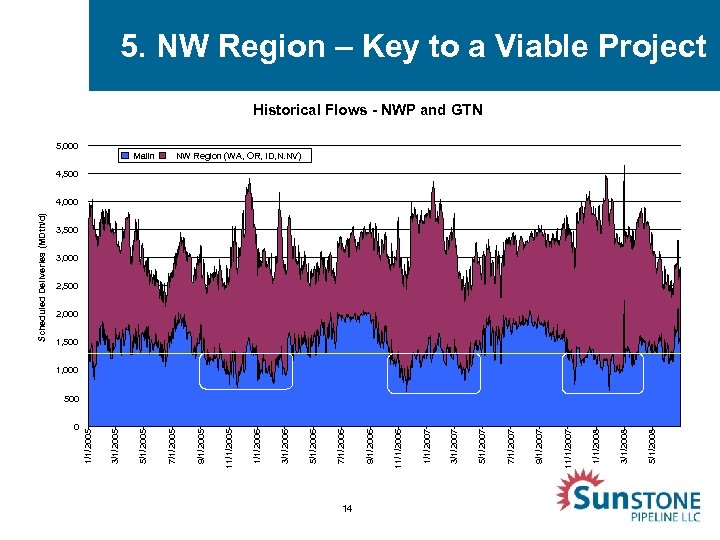

0 14 5/1/2008 3/1/2008 11/1/2007 9/1/2007 7/1/2007 5/1/2007 3/1/2007 11/1/2006 9/1/2006 7/1/2006 5/1/2006 3/1/2006 11/1/2005 9/1/2005 Malin 7/1/2005 5/1/2005 3/1/2005 1/1/2005 Scheduled Deliveries (MDth/d) 5. NW Region – Key to a Viable Project Historical Flows - NWP and GTN 5, 000 NW Region (WA, OR, ID, N. NV) 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500

6. Project Progress On Track • Route is essentially fixed, with formal approval process for small reroutes • Survey progress: – – Wetland surveys complete by year end Cultural surveys complete by year end Paleontology surveys complete by year end Survey permission received from 82% of landowners • Meetings with regulatory agencies continue to go well – Successful FERC pre-filing meeting on October 7 – Formal request for pre-filing scheduled for October 21 • Seven open houses scheduled for mid-November 15

7. Schedule • Conducted Open Season: March 17 – May 30, 2008 • Perform Biological and Cultural Surveys: Summer/Fall 2008 • NEPA Pre-Filing Request with FERC: October 2008 • Place Pipe and Materials Order: No later than May 2009 • FERC filing: Q 2 2009 • FERC Certificate: Q 2 2010 • Construction Start: Summer 2010 • In-Service Date: November 1, 2011 16

These Economic Times… • Three financially sound partners able to execute on construction of a large pipeline project • The silver lining: – Economic slowdown means pipe and construction costs may drop before partners need to commit to these costs – For every drop of $100 per ton of steel, project saves $40 million

Sunstone Mantras • Existing corridor • Fewer miles • Realistic cost • Market diversity and size • Lowest cost transportation 18

7cbcc02d93a2b9ecaad07dfc05c09e40.ppt