e0a2adbf4cf1a7e3504f609025763844.ppt

- Количество слайдов: 37

Summer FPW • June 11: Long Term Care Insurance • July 9: Everything you need to know about credit, credit bureaus & credit scores • August 13: Property insurance for home and vehicles 1

Summer FPW • June 11: Long Term Care Insurance • July 9: Everything you need to know about credit, credit bureaus & credit scores • August 13: Property insurance for home and vehicles 1

Mutual Funds for IRAs Financial Planning for Women Students from Advanced Family Finance Class: Samantha Nelson Jordan Aaberg Andrew Thompson

Mutual Funds for IRAs Financial Planning for Women Students from Advanced Family Finance Class: Samantha Nelson Jordan Aaberg Andrew Thompson

Overview • • • Diversification & asset allocation Invest in stocks for the long run IRA review What is a mutual fund? Target date retirement funds Specific TDR-MF recommendations based on student research 3

Overview • • • Diversification & asset allocation Invest in stocks for the long run IRA review What is a mutual fund? Target date retirement funds Specific TDR-MF recommendations based on student research 3

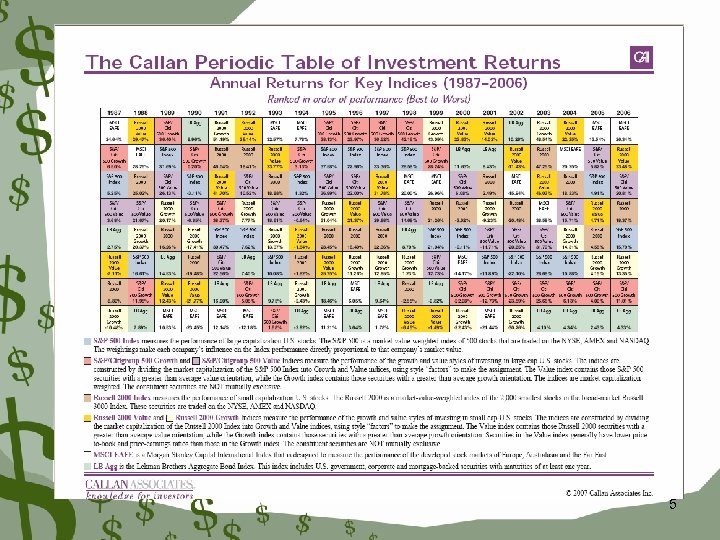

Asset allocation • Categories or classes of assets don’t rise and fall together – When one category is losing value, others are gaining – When US stocks are going down, International stocks tend to go up – When stocks are losing value, bonds may provide a positive return 4

Asset allocation • Categories or classes of assets don’t rise and fall together – When one category is losing value, others are gaining – When US stocks are going down, International stocks tend to go up – When stocks are losing value, bonds may provide a positive return 4

5

5

Diversify to Reduce Risk • Market timing doesn’t work • Invest in a wide variety of asset classes • Diversify – Don’t put all your eggs in one basket 6

Diversify to Reduce Risk • Market timing doesn’t work • Invest in a wide variety of asset classes • Diversify – Don’t put all your eggs in one basket 6

Why Stocks for the Long Run? • Higher risk = higher potential returns – Risk = volatility (annual returns = -50%-+50%) • Historic average annual rates of return – Stocks 10% – Bonds 6% – Cash equivalents (CDs) 3% • Inflation averages 3. 1%/year 7

Why Stocks for the Long Run? • Higher risk = higher potential returns – Risk = volatility (annual returns = -50%-+50%) • Historic average annual rates of return – Stocks 10% – Bonds 6% – Cash equivalents (CDs) 3% • Inflation averages 3. 1%/year 7

Individual Retirement Accounts • Tax-advantaged investing – the account is not taxed while it is growing – When $ is withdrawn in retirement • Traditional IRA withdrawals are taxed • Roth IRA withdrawals are tax-free 8

Individual Retirement Accounts • Tax-advantaged investing – the account is not taxed while it is growing – When $ is withdrawn in retirement • Traditional IRA withdrawals are taxed • Roth IRA withdrawals are tax-free 8

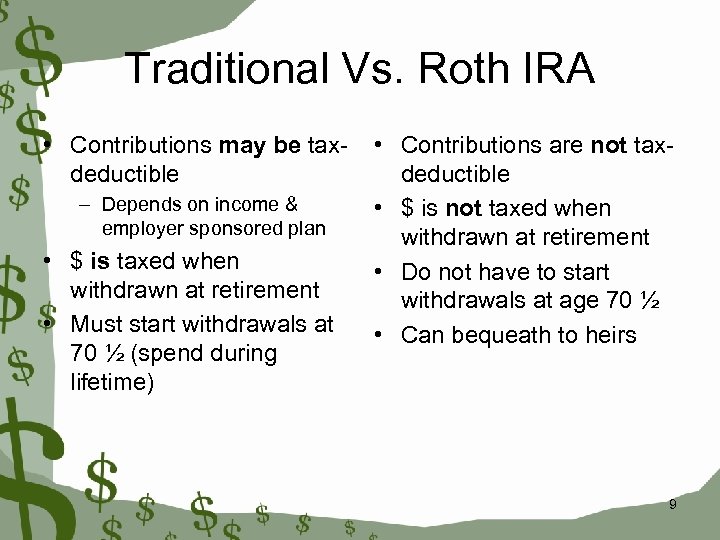

Traditional Vs. Roth IRA • Contributions may be taxdeductible – Depends on income & employer sponsored plan • $ is taxed when withdrawn at retirement • Must start withdrawals at 70 ½ (spend during lifetime) • Contributions are not taxdeductible • $ is not taxed when withdrawn at retirement • Do not have to start withdrawals at age 70 ½ • Can bequeath to heirs 9

Traditional Vs. Roth IRA • Contributions may be taxdeductible – Depends on income & employer sponsored plan • $ is taxed when withdrawn at retirement • Must start withdrawals at 70 ½ (spend during lifetime) • Contributions are not taxdeductible • $ is not taxed when withdrawn at retirement • Do not have to start withdrawals at age 70 ½ • Can bequeath to heirs 9

Questions? 10

Questions? 10

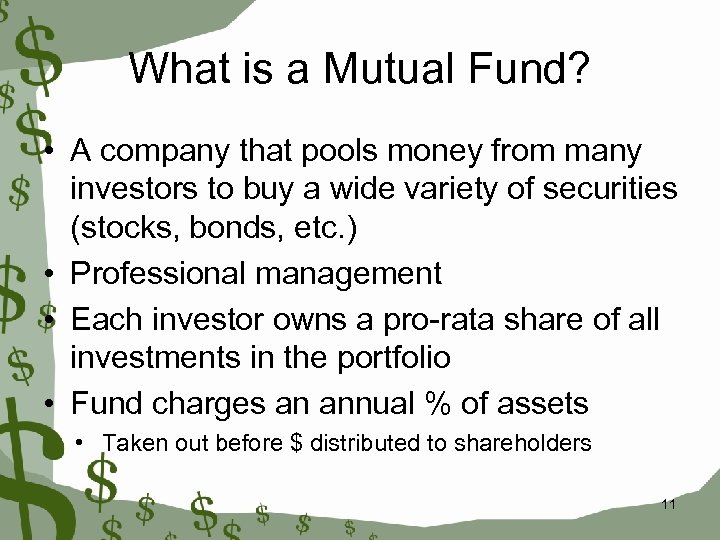

What is a Mutual Fund? • A company that pools money from many investors to buy a wide variety of securities (stocks, bonds, etc. ) • Professional management • Each investor owns a pro-rata share of all investments in the portfolio • Fund charges an annual % of assets • Taken out before $ distributed to shareholders 11

What is a Mutual Fund? • A company that pools money from many investors to buy a wide variety of securities (stocks, bonds, etc. ) • Professional management • Each investor owns a pro-rata share of all investments in the portfolio • Fund charges an annual % of assets • Taken out before $ distributed to shareholders 11

Why Mutual Funds? • Diversification – Own a piece of many companies – For a small $ amount you gain a great deal of diversification • Easy to match your investment objective • Convenient to purchase and sell 12

Why Mutual Funds? • Diversification – Own a piece of many companies – For a small $ amount you gain a great deal of diversification • Easy to match your investment objective • Convenient to purchase and sell 12

Load vs. No-Load • Load funds are sold by financial sales people who charge commissions – ~5% of every $, every time you invest • No-load (no commission) funds – Sold directly to investor (no salesperson) • web sites • 800 phone number • mail 13

Load vs. No-Load • Load funds are sold by financial sales people who charge commissions – ~5% of every $, every time you invest • No-load (no commission) funds – Sold directly to investor (no salesperson) • web sites • 800 phone number • mail 13

How to Choose a Mutual Fund • • • Investment Objective Diversification: more is better No-Load (no commission) Low expense ratio Minimum Initial/Subsequent Investment – Automatic investment plan • Independent ratings 14

How to Choose a Mutual Fund • • • Investment Objective Diversification: more is better No-Load (no commission) Low expense ratio Minimum Initial/Subsequent Investment – Automatic investment plan • Independent ratings 14

Initial/Subsequent Investment • Most funds require a large initial investment (i. e. , $1, 000 – 3, 000) • Lower subsequent minimum investments once in the fund ($50 -250) • A few funds allow you to bypass initial investment if you set up automatic investment plan (AIP) 15

Initial/Subsequent Investment • Most funds require a large initial investment (i. e. , $1, 000 – 3, 000) • Lower subsequent minimum investments once in the fund ($50 -250) • A few funds allow you to bypass initial investment if you set up automatic investment plan (AIP) 15

Expenses/Custodial Fees • Funds charge investors fees and expenses. • A fund with high costs must perform better than a low-cost fund to generate the same returns. • Small differences in fees can translate into large differences in returns over time. 16

Expenses/Custodial Fees • Funds charge investors fees and expenses. • A fund with high costs must perform better than a low-cost fund to generate the same returns. • Small differences in fees can translate into large differences in returns over time. 16

MF Expense Analyzer • Compares cost of owning a fund over time based on the fund’s expense ratio • FINRA – http: //apps. finra. org/investor_Information/ea/1/ mfetf. aspx – See examples on handout 17

MF Expense Analyzer • Compares cost of owning a fund over time based on the fund’s expense ratio • FINRA – http: //apps. finra. org/investor_Information/ea/1/ mfetf. aspx – See examples on handout 17

Expense Example • Invest $10, 000 for 20 years in a fund w/ 10% annual return • Average expense ratio for stock MFs = 1. 5% – 1. 5% expense ratio; grows to $49, 725 – 0. 5% expense ratio; grows to $60, 858 • 18% more! 18

Expense Example • Invest $10, 000 for 20 years in a fund w/ 10% annual return • Average expense ratio for stock MFs = 1. 5% – 1. 5% expense ratio; grows to $49, 725 – 0. 5% expense ratio; grows to $60, 858 • 18% more! 18

Questions? 19

Questions? 19

Target Date Retirement Funds • Funds that are constructed to give investors a diversified portfolio of stocks and bonds through a one-stop shop. • Fund of funds – Composed of other funds from same family • The target date is the year in which the investor plans to retire. 20

Target Date Retirement Funds • Funds that are constructed to give investors a diversified portfolio of stocks and bonds through a one-stop shop. • Fund of funds – Composed of other funds from same family • The target date is the year in which the investor plans to retire. 20

Target Date funds (continued) • As the fund nears the target date, the asset allocation automatically becomes more conservative. • Example: – Vanguard Target Retirement Date Funds » Beginning 87% stock/ 13% bond » Middle 70% stock/ 30% bond » End 30% stock/70% bond 21

Target Date funds (continued) • As the fund nears the target date, the asset allocation automatically becomes more conservative. • Example: – Vanguard Target Retirement Date Funds » Beginning 87% stock/ 13% bond » Middle 70% stock/ 30% bond » End 30% stock/70% bond 21

Target Funds Designed For • Investors who want to take a hands-off approach to investing. – But feel confident in their decision • Why might investors wish to put their investments on auto pilot? – What else would you do with your time? • Family & friends • Hobbies & activities 22

Target Funds Designed For • Investors who want to take a hands-off approach to investing. – But feel confident in their decision • Why might investors wish to put their investments on auto pilot? – What else would you do with your time? • Family & friends • Hobbies & activities 22

Advantages • Simple • Based on sound investment principles – Asset allocation – Diversification – Automatic rebalancing – Become more conservative as retirement nears • Little account maintenance required 23

Advantages • Simple • Based on sound investment principles – Asset allocation – Diversification – Automatic rebalancing – Become more conservative as retirement nears • Little account maintenance required 23

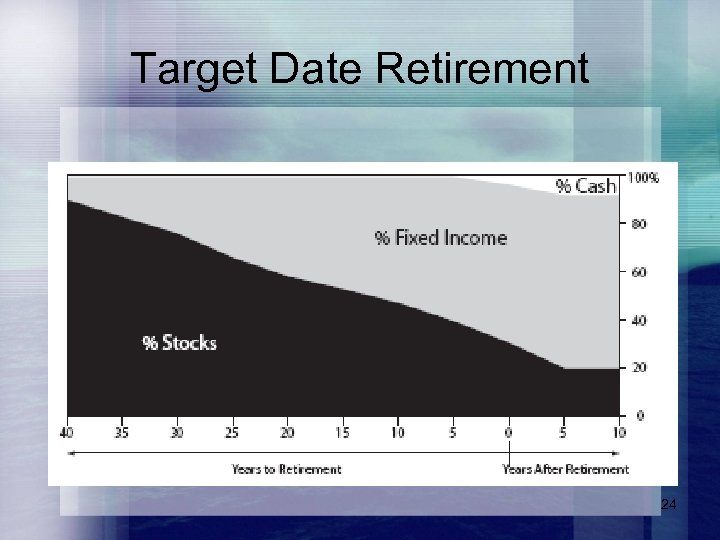

Target Date Retirement 24

Target Date Retirement 24

Funds Chosen by Adv. FF Class • Target Retirement Date – Vanguard Fund – T. Rowe Price 25

Funds Chosen by Adv. FF Class • Target Retirement Date – Vanguard Fund – T. Rowe Price 25

Vanguard Target Retirement Inception date: 2003 – underlying funds have much longer track record • Expense Ratio: 0. 21% • Expect 8 -10% returns over long run 26

Vanguard Target Retirement Inception date: 2003 – underlying funds have much longer track record • Expense Ratio: 0. 21% • Expect 8 -10% returns over long run 26

Target Retirement Funds • 2045: For people in their 20 s who plan to retire between 2040 & 2049 – 94% invested in U. S. & international stocks • Other funds for earlier retirement dates: – – 2035: 77% stocks/23% bonds 2025: 59% stocks/41% bonds 2015: 49% stocks/48% bonds/3% inflation-protected 2005: 33% stocks/49% bonds/18% inflation-protected 27

Target Retirement Funds • 2045: For people in their 20 s who plan to retire between 2040 & 2049 – 94% invested in U. S. & international stocks • Other funds for earlier retirement dates: – – 2035: 77% stocks/23% bonds 2025: 59% stocks/41% bonds 2015: 49% stocks/48% bonds/3% inflation-protected 2005: 33% stocks/49% bonds/18% inflation-protected 27

Underlying Vanguard Funds (asset allocation) 2045 Fund • Stocks – Total Stock Market Index Fund 71. 7% – European Stock Index Fund 10. 1% – Pacific Stock Index Fund 4. 4% – Emerging Markets Stock Index Fund 3. 8% • Bonds Total Bond Market Index Fund 10. 0% 28

Underlying Vanguard Funds (asset allocation) 2045 Fund • Stocks – Total Stock Market Index Fund 71. 7% – European Stock Index Fund 10. 1% – Pacific Stock Index Fund 4. 4% – Emerging Markets Stock Index Fund 3. 8% • Bonds Total Bond Market Index Fund 10. 0% 28

Vanguard Target Retirement • Minimum Initial Investment $3, 000 • Minimum Subsequent Investment: $100 or $50 w/ AIP 29

Vanguard Target Retirement • Minimum Initial Investment $3, 000 • Minimum Subsequent Investment: $100 or $50 w/ AIP 29

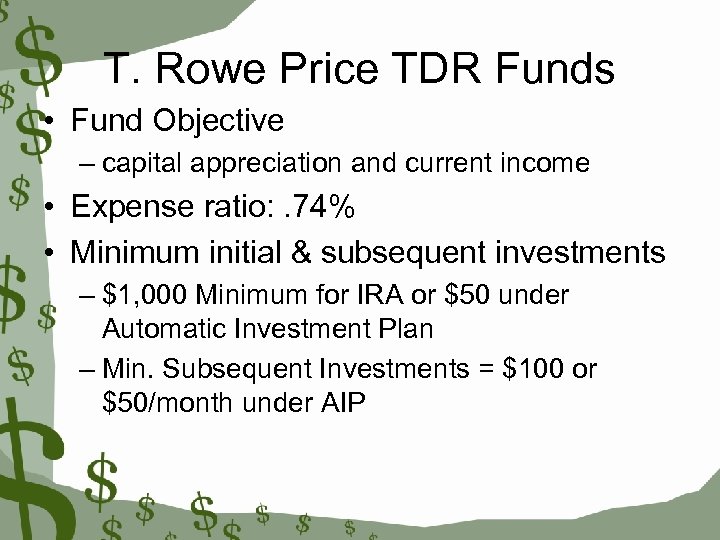

T. Rowe Price TDR Funds • Fund Objective – capital appreciation and current income • Expense ratio: . 74% • Minimum initial & subsequent investments – $1, 000 Minimum for IRA or $50 under Automatic Investment Plan – Min. Subsequent Investments = $100 or $50/month under AIP

T. Rowe Price TDR Funds • Fund Objective – capital appreciation and current income • Expense ratio: . 74% • Minimum initial & subsequent investments – $1, 000 Minimum for IRA or $50 under Automatic Investment Plan – Min. Subsequent Investments = $100 or $50/month under AIP

T. R. Price underlying funds – Growth Stock – Value Stock – Equity Index 500 – New Income – International Stock – Mid Cap Growth – International Growth & Income – Mid-Cap Value – High-Yield Bond

T. R. Price underlying funds – Growth Stock – Value Stock – Equity Index 500 – New Income – International Stock – Mid Cap Growth – International Growth & Income – Mid-Cap Value – High-Yield Bond

How to Choose? • If you can afford $3, 000 investment – Vanguard Target Date Retirement Fund • Lowest expense ratio = low costs + higher returns in long run • To start with low initial investment ($50 AIP) – T. Rowe Price Target Date Retirement Fund • Most important: get started today! 32

How to Choose? • If you can afford $3, 000 investment – Vanguard Target Date Retirement Fund • Lowest expense ratio = low costs + higher returns in long run • To start with low initial investment ($50 AIP) – T. Rowe Price Target Date Retirement Fund • Most important: get started today! 32

Questions? 33

Questions? 33

How to open an IRA • Simple process • Read proscectus! – Online – www. vanguard. com – www. troweprice. com – Call to get forms in mail 34

How to open an IRA • Simple process • Read proscectus! – Online – www. vanguard. com – www. troweprice. com – Call to get forms in mail 34

How Does Your IRA Compare? • Want to transfer to one of our recommendations? • Specific forms are on-line 35

How Does Your IRA Compare? • Want to transfer to one of our recommendations? • Specific forms are on-line 35

It’s not magic, just do your homework 36

It’s not magic, just do your homework 36

Web sites • Vanguard – https: //personal. vanguard. com/us/content/Fun ds/Funds. Vanguard. Funds. Target. Overview. JSP. jsp • T. Rowe Price – http: //ira. troweprice. com/retirement_funds/? ph one=6066 37

Web sites • Vanguard – https: //personal. vanguard. com/us/content/Fun ds/Funds. Vanguard. Funds. Target. Overview. JSP. jsp • T. Rowe Price – http: //ira. troweprice. com/retirement_funds/? ph one=6066 37