1f66dee37821009cb311d107605cc4fa.ppt

- Количество слайдов: 29

SUMMARY of NVVN’S VIEWS & SUGGESTIONS on CERC STAFF PAPER ON DEVELOPING A COMMON PLATFORM FOR ELECTRICITY TRADING

SUMMARY of NVVN’S VIEWS & SUGGESTIONS on CERC STAFF PAPER ON DEVELOPING A COMMON PLATFORM FOR ELECTRICITY TRADING

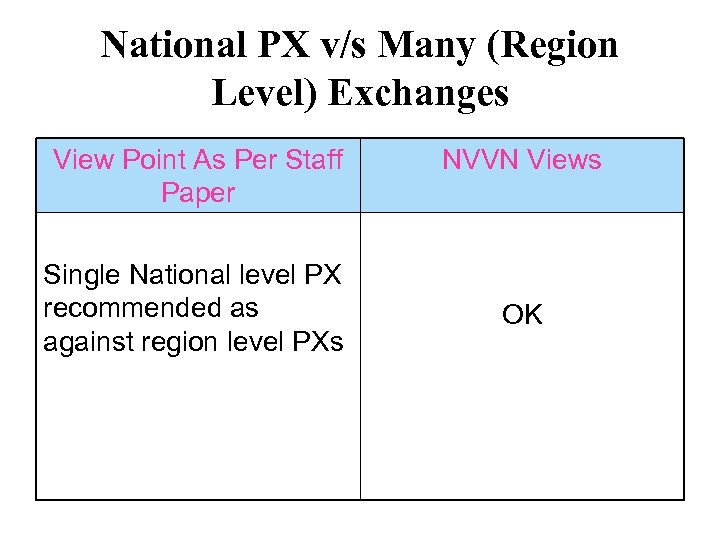

National PX v/s Many (Region Level) Exchanges View Point As Per Staff Paper Single National level PX recommended as against region level PXs NVVN Views OK

National PX v/s Many (Region Level) Exchanges View Point As Per Staff Paper Single National level PX recommended as against region level PXs NVVN Views OK

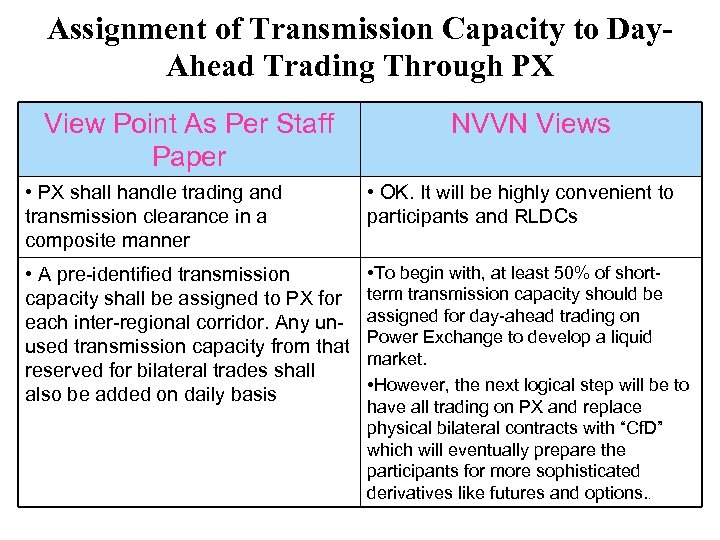

Assignment of Transmission Capacity to Day. Ahead Trading Through PX View Point As Per Staff Paper NVVN Views • PX shall handle trading and transmission clearance in a composite manner • OK. It will be highly convenient to participants and RLDCs • A pre-identified transmission capacity shall be assigned to PX for each inter-regional corridor. Any unused transmission capacity from that reserved for bilateral trades shall also be added on daily basis • To begin with, at least 50% of shortterm transmission capacity should be assigned for day-ahead trading on Power Exchange to develop a liquid market. • However, the next logical step will be to have all trading on PX and replace physical bilateral contracts with “Cf. D” which will eventually prepare the participants for more sophisticated derivatives like futures and options. .

Assignment of Transmission Capacity to Day. Ahead Trading Through PX View Point As Per Staff Paper NVVN Views • PX shall handle trading and transmission clearance in a composite manner • OK. It will be highly convenient to participants and RLDCs • A pre-identified transmission capacity shall be assigned to PX for each inter-regional corridor. Any unused transmission capacity from that reserved for bilateral trades shall also be added on daily basis • To begin with, at least 50% of shortterm transmission capacity should be assigned for day-ahead trading on Power Exchange to develop a liquid market. • However, the next logical step will be to have all trading on PX and replace physical bilateral contracts with “Cf. D” which will eventually prepare the participants for more sophisticated derivatives like futures and options. .

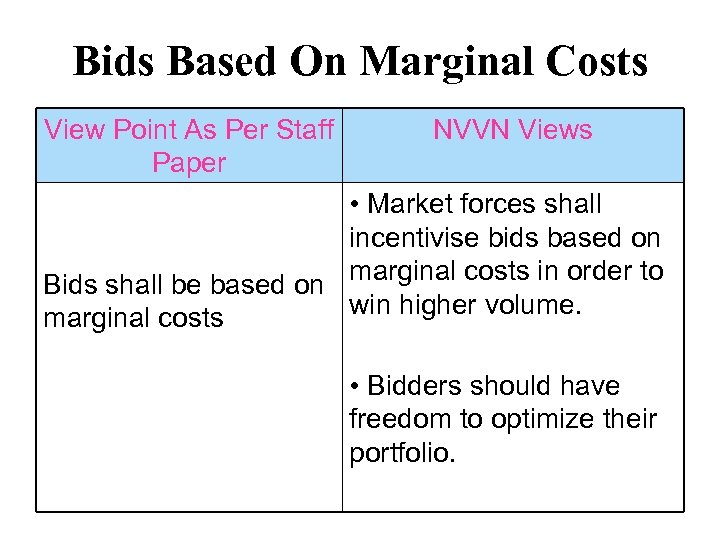

Bids Based On Marginal Costs View Point As Per Staff Paper NVVN Views • Market forces shall incentivise bids based on Bids shall be based on marginal costs in order to win higher volume. marginal costs • Bidders should have freedom to optimize their portfolio.

Bids Based On Marginal Costs View Point As Per Staff Paper NVVN Views • Market forces shall incentivise bids based on Bids shall be based on marginal costs in order to win higher volume. marginal costs • Bidders should have freedom to optimize their portfolio.

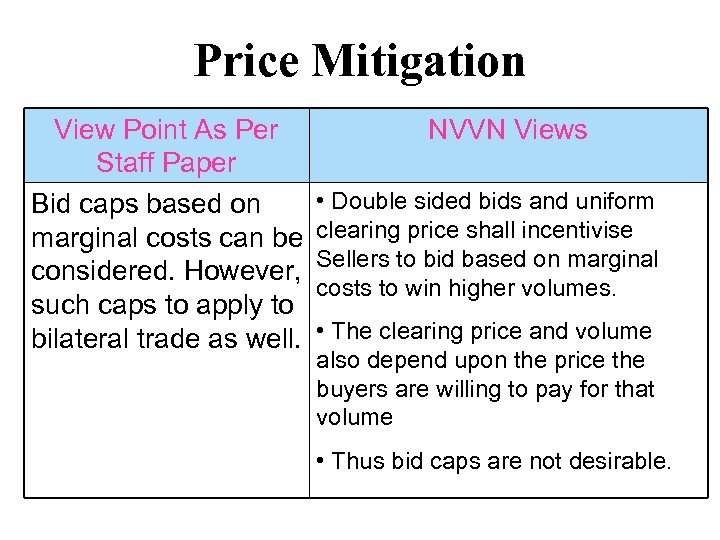

Price Mitigation View Point As Per Staff Paper Bid caps based on marginal costs can be considered. However, such caps to apply to bilateral trade as well. NVVN Views • Double sided bids and uniform clearing price shall incentivise Sellers to bid based on marginal costs to win higher volumes. • The clearing price and volume also depend upon the price the buyers are willing to pay for that volume • Thus bid caps are not desirable.

Price Mitigation View Point As Per Staff Paper Bid caps based on marginal costs can be considered. However, such caps to apply to bilateral trade as well. NVVN Views • Double sided bids and uniform clearing price shall incentivise Sellers to bid based on marginal costs to win higher volumes. • The clearing price and volume also depend upon the price the buyers are willing to pay for that volume • Thus bid caps are not desirable.

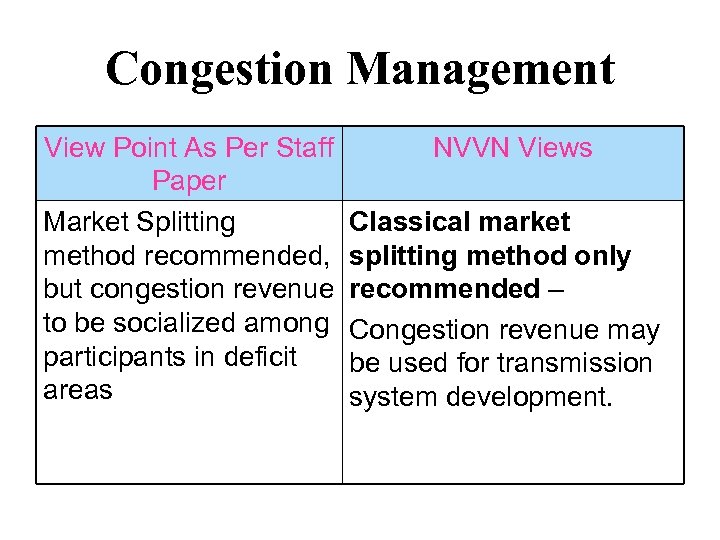

Congestion Management View Point As Per Staff Paper Market Splitting method recommended, but congestion revenue to be socialized among participants in deficit areas NVVN Views Classical market splitting method only recommended – Congestion revenue may be used for transmission system development.

Congestion Management View Point As Per Staff Paper Market Splitting method recommended, but congestion revenue to be socialized among participants in deficit areas NVVN Views Classical market splitting method only recommended – Congestion revenue may be used for transmission system development.

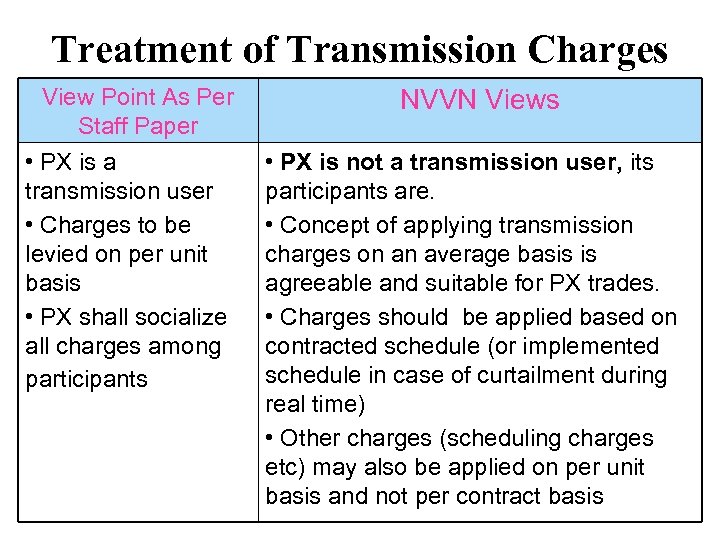

Treatment of Transmission Charges View Point As Per Staff Paper • PX is a transmission user • Charges to be levied on per unit basis • PX shall socialize all charges among participants NVVN Views • PX is not a transmission user, its participants are. • Concept of applying transmission charges on an average basis is agreeable and suitable for PX trades. • Charges should be applied based on contracted schedule (or implemented schedule in case of curtailment during real time) • Other charges (scheduling charges etc) may also be applied on per unit basis and not per contract basis

Treatment of Transmission Charges View Point As Per Staff Paper • PX is a transmission user • Charges to be levied on per unit basis • PX shall socialize all charges among participants NVVN Views • PX is not a transmission user, its participants are. • Concept of applying transmission charges on an average basis is agreeable and suitable for PX trades. • Charges should be applied based on contracted schedule (or implemented schedule in case of curtailment during real time) • Other charges (scheduling charges etc) may also be applied on per unit basis and not per contract basis

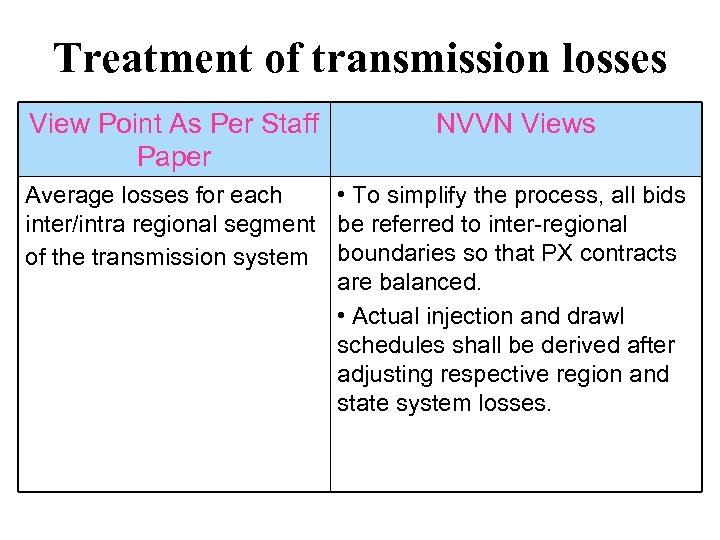

Treatment of transmission losses View Point As Per Staff Paper NVVN Views Average losses for each • To simplify the process, all bids inter/intra regional segment be referred to inter-regional of the transmission system boundaries so that PX contracts are balanced. • Actual injection and drawl schedules shall be derived after adjusting respective region and state system losses.

Treatment of transmission losses View Point As Per Staff Paper NVVN Views Average losses for each • To simplify the process, all bids inter/intra regional segment be referred to inter-regional of the transmission system boundaries so that PX contracts are balanced. • Actual injection and drawl schedules shall be derived after adjusting respective region and state system losses.

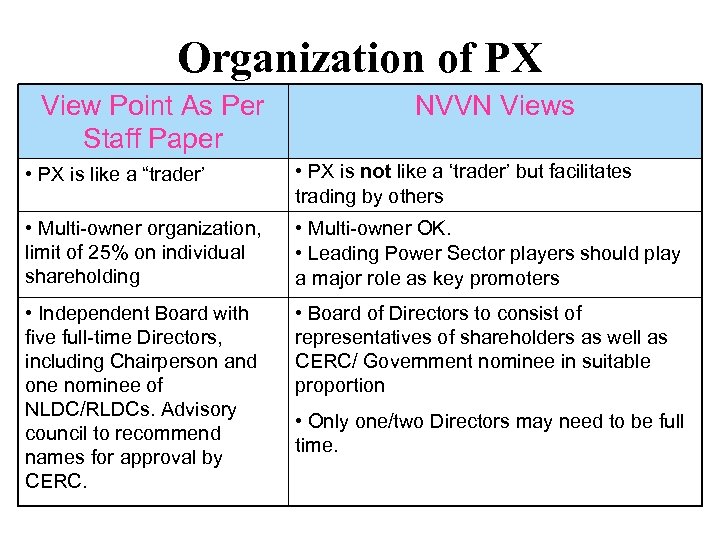

Organization of PX View Point As Per Staff Paper NVVN Views • PX is like a “trader’ • PX is not like a ‘trader’ but facilitates trading by others • Multi-owner organization, limit of 25% on individual shareholding • Multi-owner OK. • Leading Power Sector players should play a major role as key promoters • Independent Board with five full-time Directors, including Chairperson and one nominee of NLDC/RLDCs. Advisory council to recommend names for approval by CERC. • Board of Directors to consist of representatives of shareholders as well as CERC/ Government nominee in suitable proportion • Only one/two Directors may need to be full time.

Organization of PX View Point As Per Staff Paper NVVN Views • PX is like a “trader’ • PX is not like a ‘trader’ but facilitates trading by others • Multi-owner organization, limit of 25% on individual shareholding • Multi-owner OK. • Leading Power Sector players should play a major role as key promoters • Independent Board with five full-time Directors, including Chairperson and one nominee of NLDC/RLDCs. Advisory council to recommend names for approval by CERC. • Board of Directors to consist of representatives of shareholders as well as CERC/ Government nominee in suitable proportion • Only one/two Directors may need to be full time.

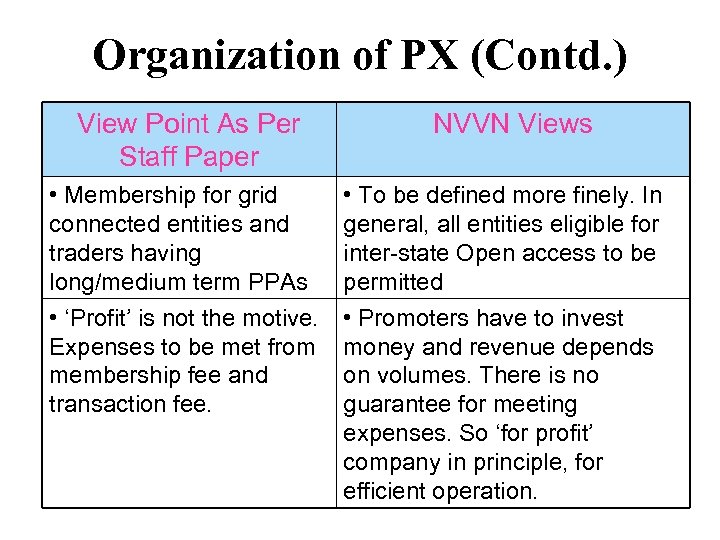

Organization of PX (Contd. ) View Point As Per Staff Paper • Membership for grid connected entities and traders having long/medium term PPAs • ‘Profit’ is not the motive. Expenses to be met from membership fee and transaction fee. NVVN Views • To be defined more finely. In general, all entities eligible for inter-state Open access to be permitted • Promoters have to invest money and revenue depends on volumes. There is no guarantee for meeting expenses. So ‘for profit’ company in principle, for efficient operation.

Organization of PX (Contd. ) View Point As Per Staff Paper • Membership for grid connected entities and traders having long/medium term PPAs • ‘Profit’ is not the motive. Expenses to be met from membership fee and transaction fee. NVVN Views • To be defined more finely. In general, all entities eligible for inter-state Open access to be permitted • Promoters have to invest money and revenue depends on volumes. There is no guarantee for meeting expenses. So ‘for profit’ company in principle, for efficient operation.

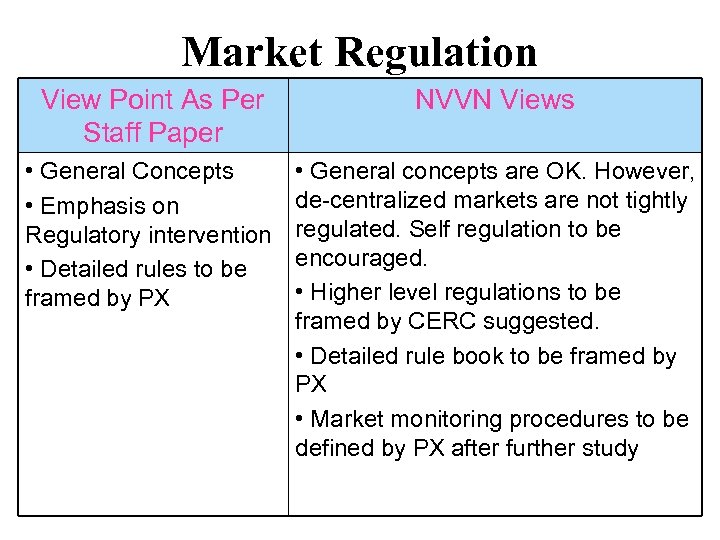

Market Regulation View Point As Per Staff Paper NVVN Views • General Concepts • Emphasis on Regulatory intervention • Detailed rules to be framed by PX • General concepts are OK. However, de-centralized markets are not tightly regulated. Self regulation to be encouraged. • Higher level regulations to be framed by CERC suggested. • Detailed rule book to be framed by PX • Market monitoring procedures to be defined by PX after further study

Market Regulation View Point As Per Staff Paper NVVN Views • General Concepts • Emphasis on Regulatory intervention • Detailed rules to be framed by PX • General concepts are OK. However, de-centralized markets are not tightly regulated. Self regulation to be encouraged. • Higher level regulations to be framed by CERC suggested. • Detailed rule book to be framed by PX • Market monitoring procedures to be defined by PX after further study

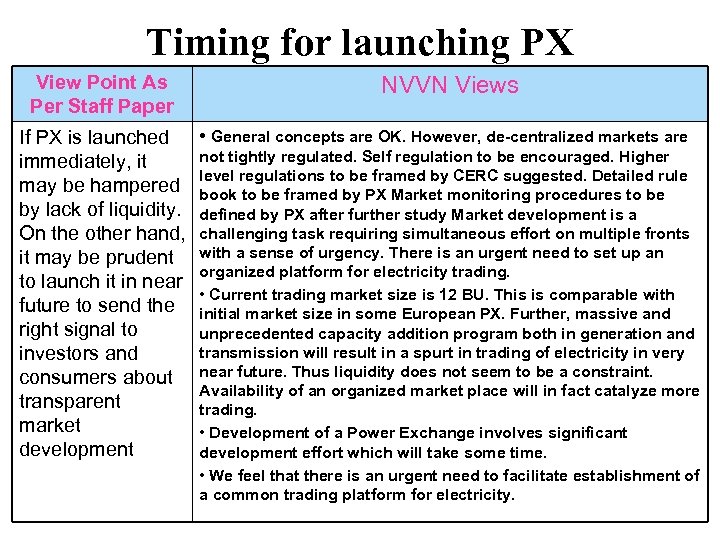

Timing for launching PX View Point As Per Staff Paper NVVN Views • General concepts are OK. However, de-centralized markets are If PX is launched not tightly regulated. Self regulation to be encouraged. Higher immediately, it level regulations to be framed by CERC suggested. Detailed rule may be hampered book to be framed by PX Market monitoring procedures to be by lack of liquidity. defined by PX after further study Market development is a On the other hand, challenging task requiring simultaneous effort on multiple fronts it may be prudent with a sense of urgency. There is an urgent need to set up an organized platform for electricity trading. to launch it in near • Current trading market size is 12 BU. This is comparable with future to send the initial market size in some European PX. Further, massive and right signal to unprecedented capacity addition program both in generation and transmission will result in a spurt in trading of electricity in very investors and consumers about near future. Thus liquidity does not seem to be a constraint. Availability of an organized market place will in fact catalyze more transparent trading. market • Development of a Power Exchange involves significant development effort which will take some time. • We feel that there is an urgent need to facilitate establishment of a common trading platform for electricity.

Timing for launching PX View Point As Per Staff Paper NVVN Views • General concepts are OK. However, de-centralized markets are If PX is launched not tightly regulated. Self regulation to be encouraged. Higher immediately, it level regulations to be framed by CERC suggested. Detailed rule may be hampered book to be framed by PX Market monitoring procedures to be by lack of liquidity. defined by PX after further study Market development is a On the other hand, challenging task requiring simultaneous effort on multiple fronts it may be prudent with a sense of urgency. There is an urgent need to set up an organized platform for electricity trading. to launch it in near • Current trading market size is 12 BU. This is comparable with future to send the initial market size in some European PX. Further, massive and right signal to unprecedented capacity addition program both in generation and transmission will result in a spurt in trading of electricity in very investors and consumers about near future. Thus liquidity does not seem to be a constraint. Availability of an organized market place will in fact catalyze more transparent trading. market • Development of a Power Exchange involves significant development effort which will take some time. • We feel that there is an urgent need to facilitate establishment of a common trading platform for electricity.

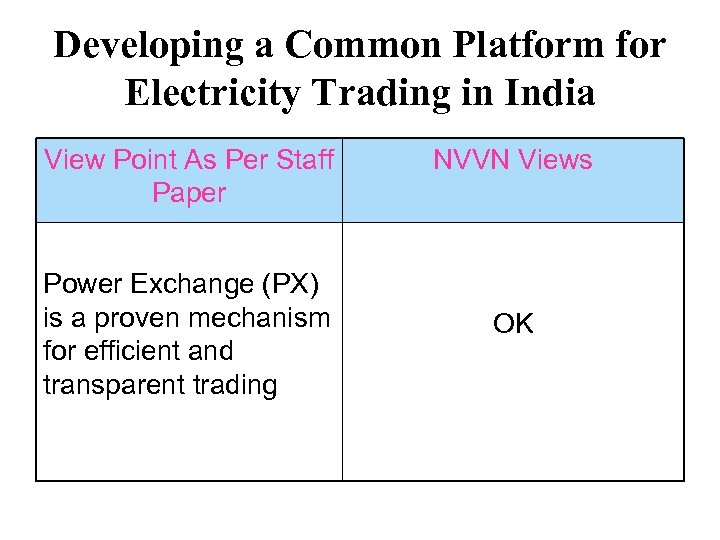

Developing a Common Platform for Electricity Trading in India View Point As Per Staff Paper Power Exchange (PX) is a proven mechanism for efficient and transparent trading NVVN Views OK

Developing a Common Platform for Electricity Trading in India View Point As Per Staff Paper Power Exchange (PX) is a proven mechanism for efficient and transparent trading NVVN Views OK

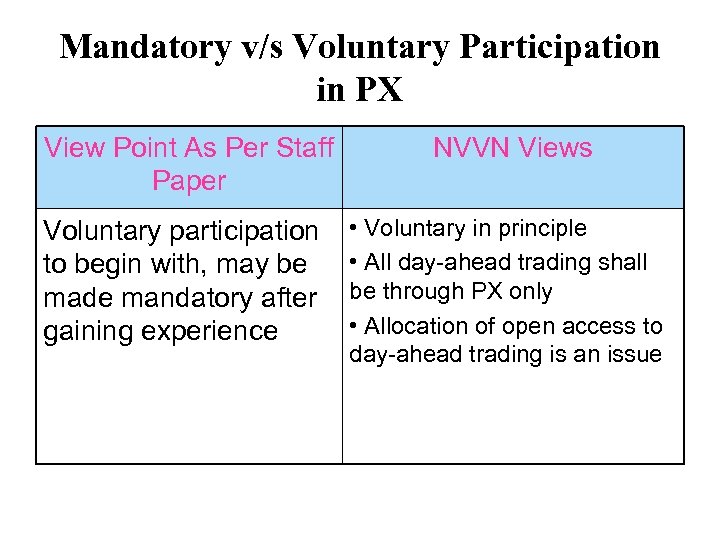

Mandatory v/s Voluntary Participation in PX View Point As Per Staff Paper NVVN Views Voluntary participation to begin with, may be made mandatory after gaining experience • Voluntary in principle • All day-ahead trading shall be through PX only • Allocation of open access to day-ahead trading is an issue

Mandatory v/s Voluntary Participation in PX View Point As Per Staff Paper NVVN Views Voluntary participation to begin with, may be made mandatory after gaining experience • Voluntary in principle • All day-ahead trading shall be through PX only • Allocation of open access to day-ahead trading is an issue

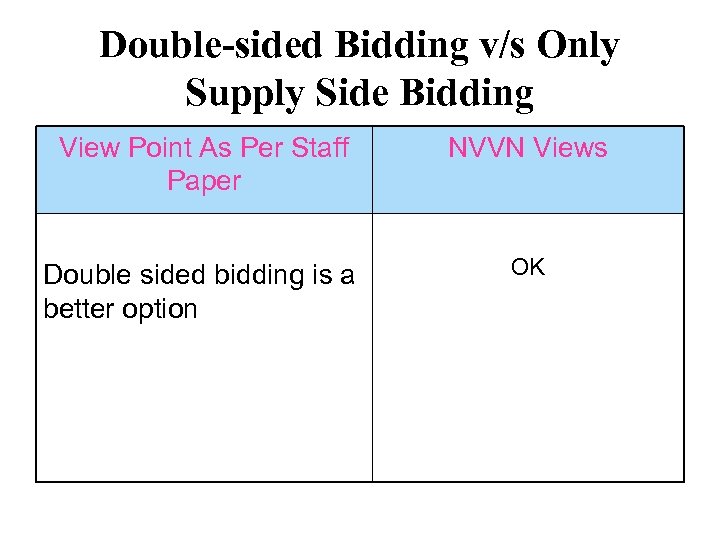

Double-sided Bidding v/s Only Supply Side Bidding View Point As Per Staff Paper NVVN Views Double sided bidding is a better option OK

Double-sided Bidding v/s Only Supply Side Bidding View Point As Per Staff Paper NVVN Views Double sided bidding is a better option OK

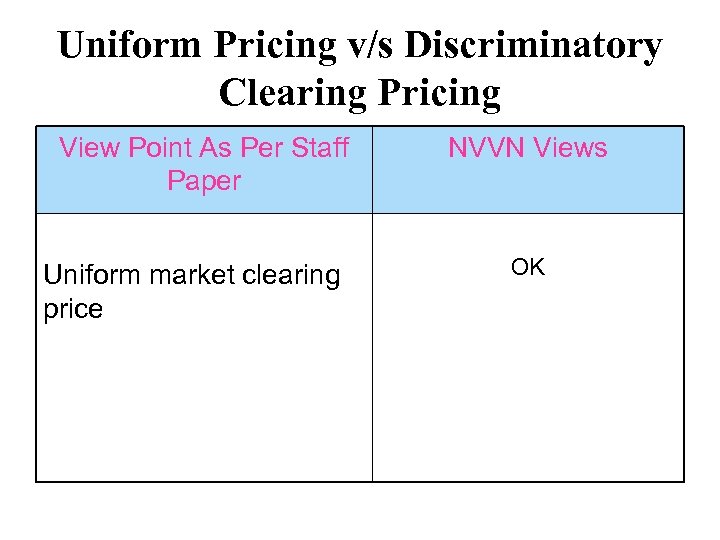

Uniform Pricing v/s Discriminatory Clearing Pricing View Point As Per Staff Paper Uniform market clearing price NVVN Views OK

Uniform Pricing v/s Discriminatory Clearing Pricing View Point As Per Staff Paper Uniform market clearing price NVVN Views OK

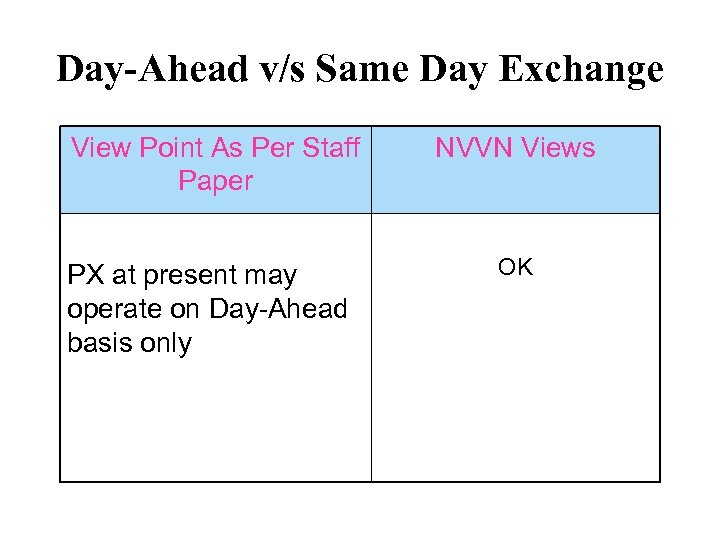

Day-Ahead v/s Same Day Exchange View Point As Per Staff Paper PX at present may operate on Day-Ahead basis only NVVN Views OK

Day-Ahead v/s Same Day Exchange View Point As Per Staff Paper PX at present may operate on Day-Ahead basis only NVVN Views OK

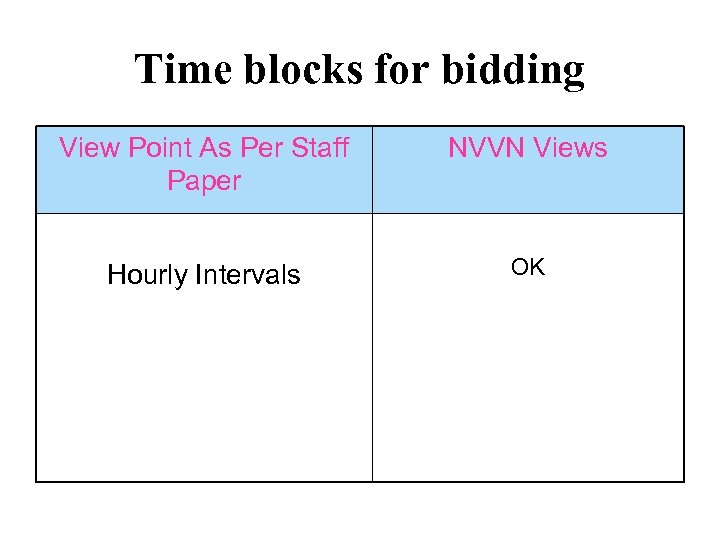

Time blocks for bidding View Point As Per Staff Paper NVVN Views Hourly Intervals OK

Time blocks for bidding View Point As Per Staff Paper NVVN Views Hourly Intervals OK

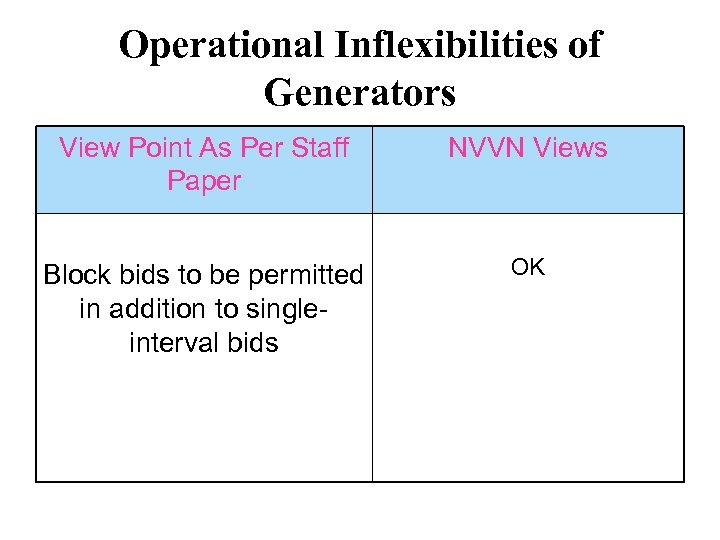

Operational Inflexibilities of Generators View Point As Per Staff Paper NVVN Views Block bids to be permitted in addition to singleinterval bids OK

Operational Inflexibilities of Generators View Point As Per Staff Paper NVVN Views Block bids to be permitted in addition to singleinterval bids OK

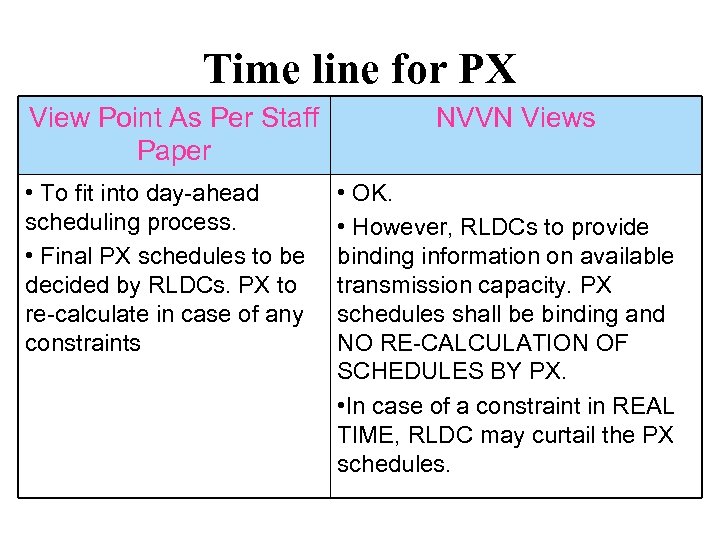

Time line for PX View Point As Per Staff Paper • To fit into day-ahead scheduling process. • Final PX schedules to be decided by RLDCs. PX to re-calculate in case of any constraints NVVN Views • OK. • However, RLDCs to provide binding information on available transmission capacity. PX schedules shall be binding and NO RE-CALCULATION OF SCHEDULES BY PX. • In case of a constraint in REAL TIME, RLDC may curtail the PX schedules.

Time line for PX View Point As Per Staff Paper • To fit into day-ahead scheduling process. • Final PX schedules to be decided by RLDCs. PX to re-calculate in case of any constraints NVVN Views • OK. • However, RLDCs to provide binding information on available transmission capacity. PX schedules shall be binding and NO RE-CALCULATION OF SCHEDULES BY PX. • In case of a constraint in REAL TIME, RLDC may curtail the PX schedules.

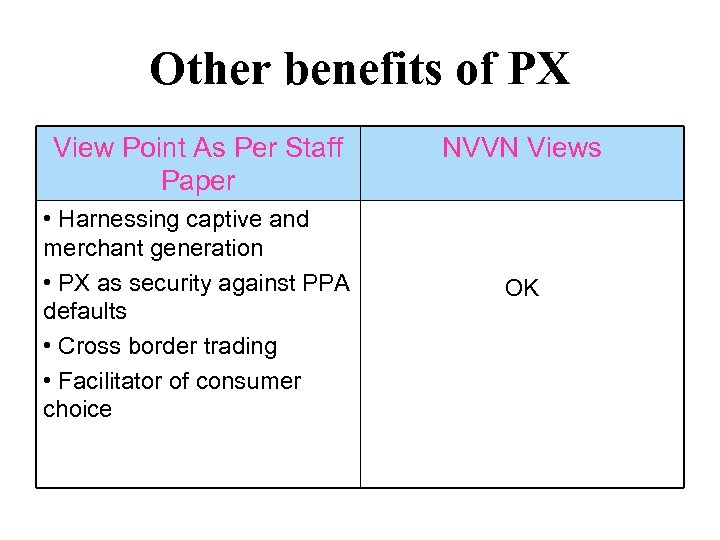

Other benefits of PX View Point As Per Staff Paper • Harnessing captive and merchant generation • PX as security against PPA defaults • Cross border trading • Facilitator of consumer choice NVVN Views OK

Other benefits of PX View Point As Per Staff Paper • Harnessing captive and merchant generation • PX as security against PPA defaults • Cross border trading • Facilitator of consumer choice NVVN Views OK

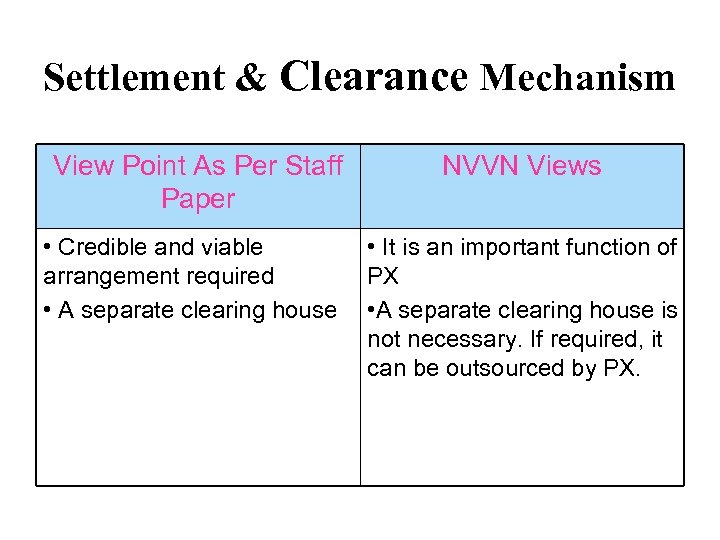

Settlement & Clearance Mechanism View Point As Per Staff Paper • Credible and viable arrangement required • A separate clearing house NVVN Views • It is an important function of PX • A separate clearing house is not necessary. If required, it can be outsourced by PX.

Settlement & Clearance Mechanism View Point As Per Staff Paper • Credible and viable arrangement required • A separate clearing house NVVN Views • It is an important function of PX • A separate clearing house is not necessary. If required, it can be outsourced by PX.

DEVELOPMENT OF POWER EXCHANGE AT NATIONAL LEVEL NTPC Ltd NVVN Ltd

DEVELOPMENT OF POWER EXCHANGE AT NATIONAL LEVEL NTPC Ltd NVVN Ltd

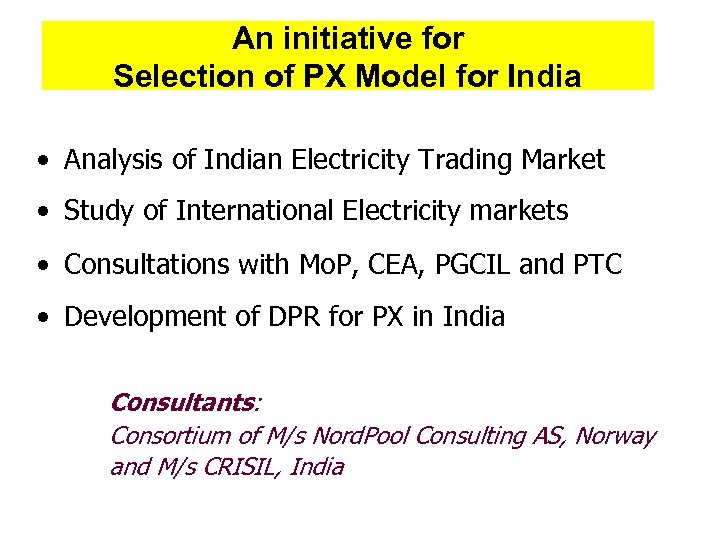

An initiative for Selection of PX Model for India • Analysis of Indian Electricity Trading Market • Study of International Electricity markets • Consultations with Mo. P, CEA, PGCIL and PTC • Development of DPR for PX in India Consultants: Consortium of M/s Nord. Pool Consulting AS, Norway and M/s CRISIL, India

An initiative for Selection of PX Model for India • Analysis of Indian Electricity Trading Market • Study of International Electricity markets • Consultations with Mo. P, CEA, PGCIL and PTC • Development of DPR for PX in India Consultants: Consortium of M/s Nord. Pool Consulting AS, Norway and M/s CRISIL, India

Preparatory Work Done • A professionally prepared DPR • Consultations with other stakeholders during preparation of DPR – Core Team – Workshop for stakeholders • Full implementation plan available – – Hardware & software issues Procurement, Training & Implementation Model Agreements Business Case

Preparatory Work Done • A professionally prepared DPR • Consultations with other stakeholders during preparation of DPR – Core Team – Workshop for stakeholders • Full implementation plan available – – Hardware & software issues Procurement, Training & Implementation Model Agreements Business Case

Our Proposal • Power Exchange may be promoted as a separate company by key players in power sectors and gradually provided with more diversified ownership and governance structure. CERC Staff Paper on PX also recommends a diversified ownership. It is common to find examples of PX promoted by the stakeholders in European Markets. • Development of Power Exchange for physical delivery market is complex due to nature of electricity. Therefore, the design of the product, trade system and operational procedures require a thorough understanding of generation, transmission, consumption and trading of electricity as well as system operation.

Our Proposal • Power Exchange may be promoted as a separate company by key players in power sectors and gradually provided with more diversified ownership and governance structure. CERC Staff Paper on PX also recommends a diversified ownership. It is common to find examples of PX promoted by the stakeholders in European Markets. • Development of Power Exchange for physical delivery market is complex due to nature of electricity. Therefore, the design of the product, trade system and operational procedures require a thorough understanding of generation, transmission, consumption and trading of electricity as well as system operation.

Our Proposal • The focus of PX is market development. In India, the trading market is small and limited to tradable shortterm surplus. Therefore support and participation by market players is crucial for market development. • CPSUs under the Mo. P are respective market leaders, possess significant domain knowledge, technical & managerial expertise and financial strength. They also have an experienced pool of necessary manpower to support the creation and operation of PX. Further, the Government Companies playing a leading role in the development of PX shall provide significant comfort to the market participants with regard to neutrality and transparency.

Our Proposal • The focus of PX is market development. In India, the trading market is small and limited to tradable shortterm surplus. Therefore support and participation by market players is crucial for market development. • CPSUs under the Mo. P are respective market leaders, possess significant domain knowledge, technical & managerial expertise and financial strength. They also have an experienced pool of necessary manpower to support the creation and operation of PX. Further, the Government Companies playing a leading role in the development of PX shall provide significant comfort to the market participants with regard to neutrality and transparency.

Our Proposal • • • Accordingly, the following may be considered for establishing the Power Exchange: Power Exchange shall be promoted as a separate company under the Companies Act with CPSUs under Mo. P as the initial promoters, who shall contribute Initial 50% of the authorized capital in equal proportion. (Authorized capital shall be of the order of Rs. 50 crores. ) Balance 50% of the authorized capital shall be issued subsequently to State power utilities, FIs, Banks, Traders etc. Shareholding by an individual entity may be limited to 25% of the paid-up capital. The Company shall have Shareholders’ representatives and also the nominee of CERC/ Government in suitable proportion on its Board of Directors.

Our Proposal • • • Accordingly, the following may be considered for establishing the Power Exchange: Power Exchange shall be promoted as a separate company under the Companies Act with CPSUs under Mo. P as the initial promoters, who shall contribute Initial 50% of the authorized capital in equal proportion. (Authorized capital shall be of the order of Rs. 50 crores. ) Balance 50% of the authorized capital shall be issued subsequently to State power utilities, FIs, Banks, Traders etc. Shareholding by an individual entity may be limited to 25% of the paid-up capital. The Company shall have Shareholders’ representatives and also the nominee of CERC/ Government in suitable proportion on its Board of Directors.

Thank you

Thank you