2388604b9abf1b03d909f7d1e4ebfb19.ppt

- Количество слайдов: 18

Summary of comparison methods we know so far: Present worth Future worth Annual worth Still to come: Rate of return Cost/benefit Payback period

Summary of comparison methods we know so far: Present worth Future worth Annual worth Still to come: Rate of return Cost/benefit Payback period

Comparing Alternatives In comparing alternatives, any cost common to all the alternatives can be ignored. This will sometimes result in all the alternatives having negative present worth. Don’t worry – just choose the least negative. In many situations – for example, Question 2. 5 – you will need to be careful to set up the comparison fairly.

Comparing Alternatives In comparing alternatives, any cost common to all the alternatives can be ignored. This will sometimes result in all the alternatives having negative present worth. Don’t worry – just choose the least negative. In many situations – for example, Question 2. 5 – you will need to be careful to set up the comparison fairly.

Study Period Part of setting up the comparison fairly is to choose the same study period for each alternative. For example: The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? PW(Chopper) = -100 - 10(P/A, i, 4) PW(Lawn. Boy) = -120 - 15(P/A, i, 6) This is wrong!

Study Period Part of setting up the comparison fairly is to choose the same study period for each alternative. For example: The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? PW(Chopper) = -100 - 10(P/A, i, 4) PW(Lawn. Boy) = -120 - 15(P/A, i, 6) This is wrong!

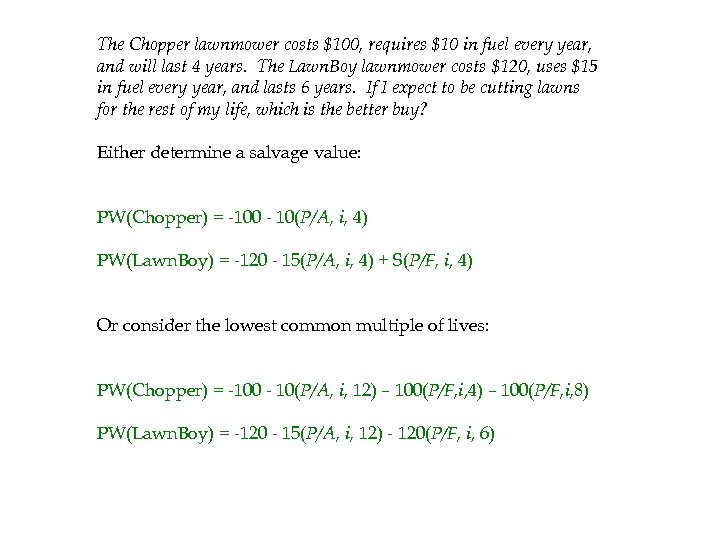

The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? Either determine a salvage value: PW(Chopper) = -100 - 10(P/A, i, 4) PW(Lawn. Boy) = -120 - 15(P/A, i, 4) + S(P/F, i, 4) Or consider the lowest common multiple of lives: PW(Chopper) = -100 - 10(P/A, i, 12) – 100(P/F, i, 4) – 100(P/F, i, 8) PW(Lawn. Boy) = -120 - 15(P/A, i, 12) - 120(P/F, i, 6)

The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? Either determine a salvage value: PW(Chopper) = -100 - 10(P/A, i, 4) PW(Lawn. Boy) = -120 - 15(P/A, i, 4) + S(P/F, i, 4) Or consider the lowest common multiple of lives: PW(Chopper) = -100 - 10(P/A, i, 12) – 100(P/F, i, 4) – 100(P/F, i, 8) PW(Lawn. Boy) = -120 - 15(P/A, i, 12) - 120(P/F, i, 6)

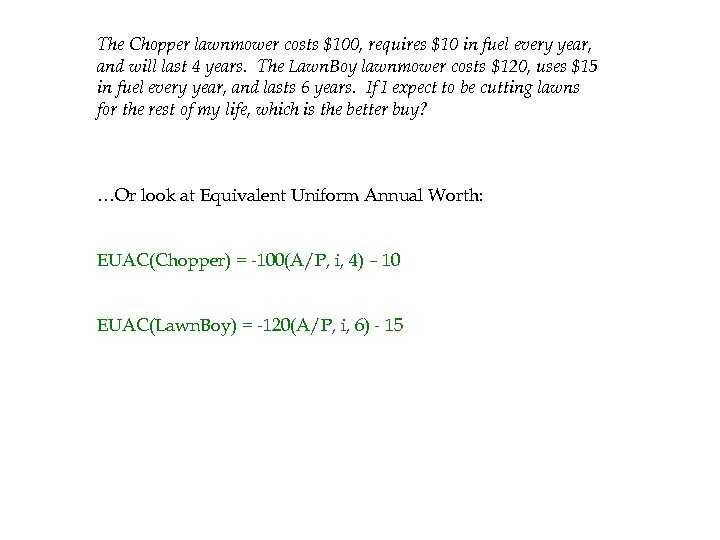

The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? …Or look at Equivalent Uniform Annual Worth: EUAC(Chopper) = -100(A/P, i, 4) – 10 EUAC(Lawn. Boy) = -120(A/P, i, 6) - 15

The Chopper lawnmower costs $100, requires $10 in fuel every year, and will last 4 years. The Lawn. Boy lawnmower costs $120, uses $15 in fuel every year, and lasts 6 years. If I expect to be cutting lawns for the rest of my life, which is the better buy? …Or look at Equivalent Uniform Annual Worth: EUAC(Chopper) = -100(A/P, i, 4) – 10 EUAC(Lawn. Boy) = -120(A/P, i, 6) - 15

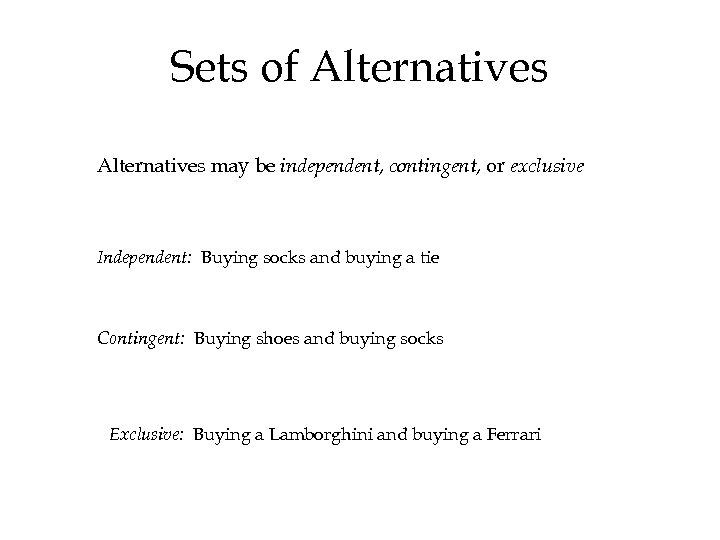

Sets of Alternatives may be independent, contingent, or exclusive Independent: Buying socks and buying a tie Contingent: Buying shoes and buying socks Exclusive: Buying a Lamborghini and buying a Ferrari

Sets of Alternatives may be independent, contingent, or exclusive Independent: Buying socks and buying a tie Contingent: Buying shoes and buying socks Exclusive: Buying a Lamborghini and buying a Ferrari

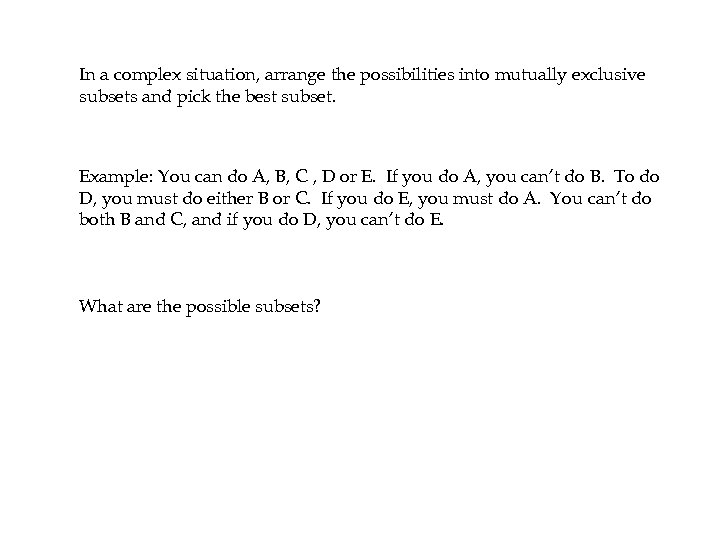

In a complex situation, arrange the possibilities into mutually exclusive subsets and pick the best subset. Example: You can do A, B, C , D or E. If you do A, you can’t do B. To do D, you must do either B or C. If you do E, you must do A. You can’t do both B and C, and if you do D, you can’t do E. What are the possible subsets?

In a complex situation, arrange the possibilities into mutually exclusive subsets and pick the best subset. Example: You can do A, B, C , D or E. If you do A, you can’t do B. To do D, you must do either B or C. If you do E, you must do A. You can’t do both B and C, and if you do D, you can’t do E. What are the possible subsets?

Rates of Return

Rates of Return

What is your interest rate?

What is your interest rate?

The MARR This is your Minimum Acceptable Rate of Return If you’re in business at all, it’s because you think you can make more money from your investment than the bank can. So, your MARR must be at least as great as the bank rate.

The MARR This is your Minimum Acceptable Rate of Return If you’re in business at all, it’s because you think you can make more money from your investment than the bank can. So, your MARR must be at least as great as the bank rate.

The MARR If all the initial investment in the business is yours, your MARR is whatever you think it should be. If you’ve borrowed some of the money from the bank, your MARR must be enough to pay the interest on the loan.

The MARR If all the initial investment in the business is yours, your MARR is whatever you think it should be. If you’ve borrowed some of the money from the bank, your MARR must be enough to pay the interest on the loan.

If your business is owned by its shareholders… your rate of return must be high enough to keep them happy.

If your business is owned by its shareholders… your rate of return must be high enough to keep them happy.

The Internal Rate of Return One way of comparing projects is to calculate their rates of return. If the project’s rate of return is less than your MARR, don’t do it. If you have several projects, the one with the highest rate of return might be the best…

The Internal Rate of Return One way of comparing projects is to calculate their rates of return. If the project’s rate of return is less than your MARR, don’t do it. If you have several projects, the one with the highest rate of return might be the best…

The Internal Rate of Return If your project requires a single present investment, P, and yields a single future payout, F, in N years time, then its rate of return is the solution to: P = F(P/F, i, N)

The Internal Rate of Return If your project requires a single present investment, P, and yields a single future payout, F, in N years time, then its rate of return is the solution to: P = F(P/F, i, N)

The Internal Rate of Return This can be re-stated as: PW = P - F(P/F, i, N) = 0 More generally, the internal rate of return, or IRR, is the interest rate which makes the total present worth of the project cashflows equal to zero.

The Internal Rate of Return This can be re-stated as: PW = P - F(P/F, i, N) = 0 More generally, the internal rate of return, or IRR, is the interest rate which makes the total present worth of the project cashflows equal to zero.

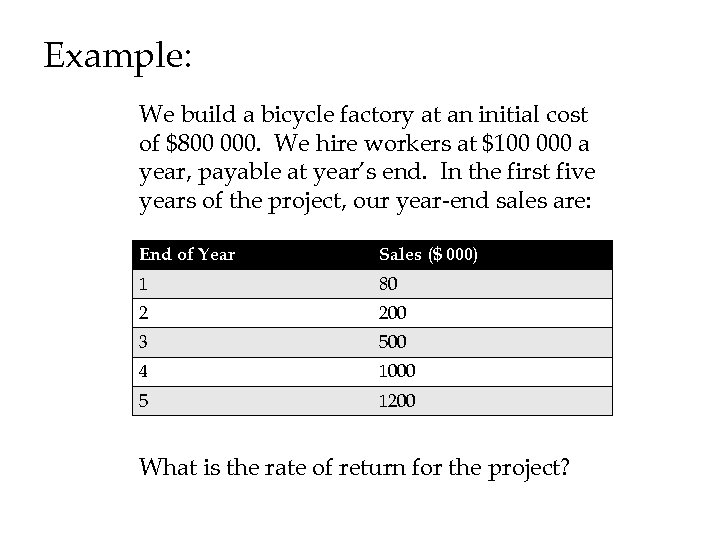

Example: We build a bicycle factory at an initial cost of $800 000. We hire workers at $100 000 a year, payable at year’s end. In the first five years of the project, our year-end sales are: End of Year Sales ($ 000) 1 80 2 200 3 500 4 1000 5 1200 What is the rate of return for the project?

Example: We build a bicycle factory at an initial cost of $800 000. We hire workers at $100 000 a year, payable at year’s end. In the first five years of the project, our year-end sales are: End of Year Sales ($ 000) 1 80 2 200 3 500 4 1000 5 1200 What is the rate of return for the project?

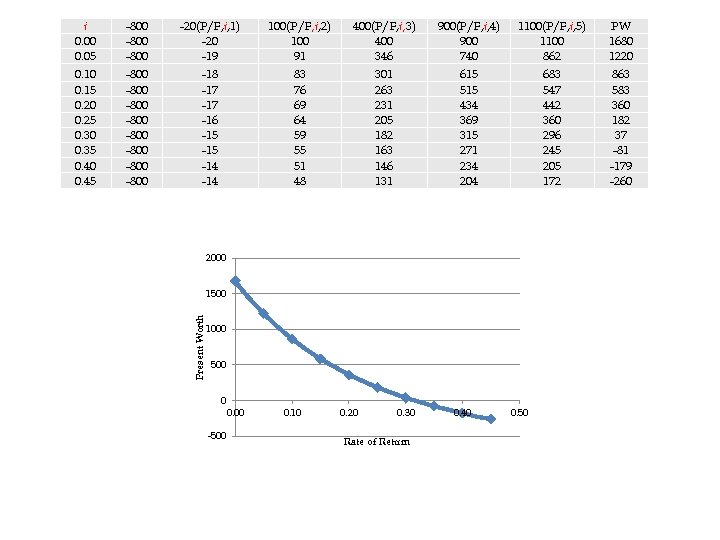

A good way of solving these problems is to build a spreadsheet. We work out the value of: PW = - 800 - 20(P/F, i, 1) + 100(P/F, i, 2) + 400(P/F, i, 3) + 900(P/F, i, 4) + 1100(P/F, i, 5) For different values of i and plot a graph.

A good way of solving these problems is to build a spreadsheet. We work out the value of: PW = - 800 - 20(P/F, i, 1) + 100(P/F, i, 2) + 400(P/F, i, 3) + 900(P/F, i, 4) + 1100(P/F, i, 5) For different values of i and plot a graph.

i 0. 00 0. 05 -800 -20(P/F, i, 1) -20 -19 100(P/F, i, 2) 100 91 400(P/F, i, 3) 400 346 900(P/F, i, 4) 900 740 1100(P/F, i, 5) 1100 862 PW 1680 1220 0. 15 0. 20 0. 25 0. 30 0. 35 0. 40 0. 45 -800 -800 -18 -17 -16 -15 -14 83 76 69 64 59 55 51 48 301 263 231 205 182 163 146 131 615 515 434 369 315 271 234 204 683 547 442 360 296 245 205 172 863 583 360 182 37 -81 -179 -260 2000 Present Worth 1500 1000 500 0 0. 00 -500 0. 10 0. 20 0. 30 Rate of Return 0. 40 0. 50

i 0. 00 0. 05 -800 -20(P/F, i, 1) -20 -19 100(P/F, i, 2) 100 91 400(P/F, i, 3) 400 346 900(P/F, i, 4) 900 740 1100(P/F, i, 5) 1100 862 PW 1680 1220 0. 15 0. 20 0. 25 0. 30 0. 35 0. 40 0. 45 -800 -800 -18 -17 -16 -15 -14 83 76 69 64 59 55 51 48 301 263 231 205 182 163 146 131 615 515 434 369 315 271 234 204 683 547 442 360 296 245 205 172 863 583 360 182 37 -81 -179 -260 2000 Present Worth 1500 1000 500 0 0. 00 -500 0. 10 0. 20 0. 30 Rate of Return 0. 40 0. 50