fec0cb7e4b202f9bf943298695f0ec10.ppt

- Количество слайдов: 61

Sudhir Kumar Jain A Presentation On Goods and Service Tax For Members of IBAI By CMA Sudhir Kumar Jain, Vice President , IBAI Director Embee Insurance Brokers Ltd Chandigarh 1

Sudhir Kumar Jain A Presentation On Goods and Service Tax For Members of IBAI By CMA Sudhir Kumar Jain, Vice President , IBAI Director Embee Insurance Brokers Ltd Chandigarh 1

Sudhir Kumar Jain GST A new system of indirect taxation in India has merged most of the existing taxes into single system of taxation. 2

Sudhir Kumar Jain GST A new system of indirect taxation in India has merged most of the existing taxes into single system of taxation. 2

Sudhir Kumar Jain EARLIER INDIRECT TAX LEVIES IN INDIA Central Levy State Levy SERVICE TAX SALES TAX/VAT CUSTOM DUTY+CVD+BCD ENTERTAINMENT TAX EXCISE DUTY ENTRY TAX CENTRAL SALES TAXES ON BETTING/GAMBLING 3

Sudhir Kumar Jain EARLIER INDIRECT TAX LEVIES IN INDIA Central Levy State Levy SERVICE TAX SALES TAX/VAT CUSTOM DUTY+CVD+BCD ENTERTAINMENT TAX EXCISE DUTY ENTRY TAX CENTRAL SALES TAXES ON BETTING/GAMBLING 3

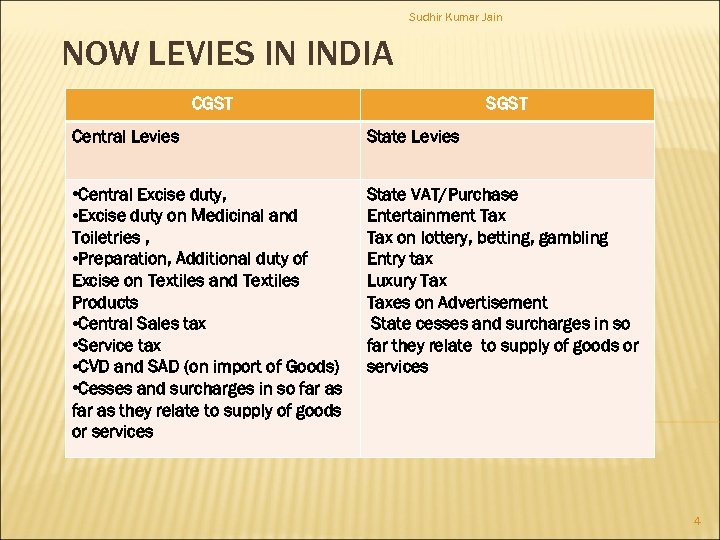

Sudhir Kumar Jain NOW LEVIES IN INDIA CGST SGST Central Levies State Levies • Central Excise duty, • Excise duty on Medicinal and Toiletries , • Preparation, Additional duty of Excise on Textiles and Textiles Products • Central Sales tax • Service tax • CVD and SAD (on import of Goods) • Cesses and surcharges in so far as they relate to supply of goods or services State VAT/Purchase Entertainment Tax on lottery, betting, gambling Entry tax Luxury Taxes on Advertisement State cesses and surcharges in so far they relate to supply of goods or services 4

Sudhir Kumar Jain NOW LEVIES IN INDIA CGST SGST Central Levies State Levies • Central Excise duty, • Excise duty on Medicinal and Toiletries , • Preparation, Additional duty of Excise on Textiles and Textiles Products • Central Sales tax • Service tax • CVD and SAD (on import of Goods) • Cesses and surcharges in so far as they relate to supply of goods or services State VAT/Purchase Entertainment Tax on lottery, betting, gambling Entry tax Luxury Taxes on Advertisement State cesses and surcharges in so far they relate to supply of goods or services 4

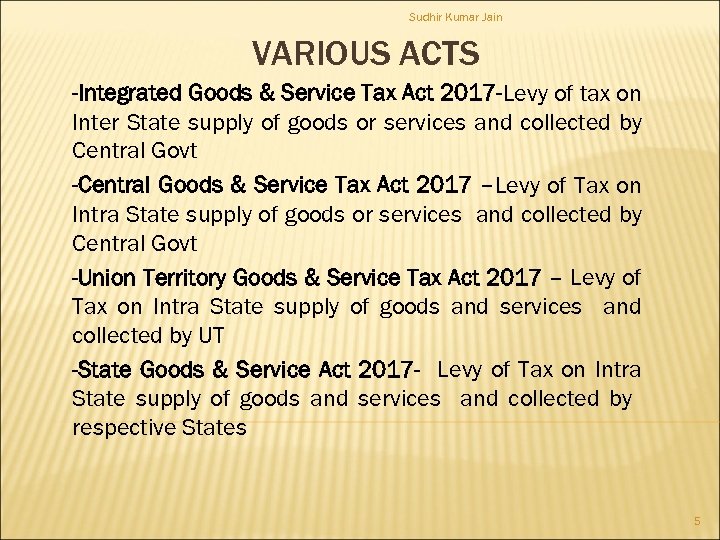

Sudhir Kumar Jain VARIOUS ACTS -Integrated Goods & Service Tax Act 2017 -Levy of tax on Inter State supply of goods or services and collected by Central Govt -Central Goods & Service Tax Act 2017 –Levy of Tax on Intra State supply of goods or services and collected by Central Govt -Union Territory Goods & Service Tax Act 2017 – Levy of Tax on Intra State supply of goods and services and collected by UT -State Goods & Service Act 2017 - Levy of Tax on Intra State supply of goods and services and collected by respective States 5

Sudhir Kumar Jain VARIOUS ACTS -Integrated Goods & Service Tax Act 2017 -Levy of tax on Inter State supply of goods or services and collected by Central Govt -Central Goods & Service Tax Act 2017 –Levy of Tax on Intra State supply of goods or services and collected by Central Govt -Union Territory Goods & Service Tax Act 2017 – Levy of Tax on Intra State supply of goods and services and collected by UT -State Goods & Service Act 2017 - Levy of Tax on Intra State supply of goods and services and collected by respective States 5

Sudhir Kumar Jain GST FOR THE DISCUSSION -only related to Insurance Brokers 6

Sudhir Kumar Jain GST FOR THE DISCUSSION -only related to Insurance Brokers 6

Sudhir Kumar Jain FINAL OUTCOME FOR INSURANCE BROKERS WEF 1/7/2017 Goods and Service Tax (GST) is Applicable in place of Service tax And Migration ST no. To GST 7

Sudhir Kumar Jain FINAL OUTCOME FOR INSURANCE BROKERS WEF 1/7/2017 Goods and Service Tax (GST) is Applicable in place of Service tax And Migration ST no. To GST 7

Sudhir Kumar Jain WHO SHOULD BE REGISTERED UNDER GST -MANDATORY 1, Total revenue is more than Rs 20 lakhs PA 2, In NE States whose total revenue is more than Rs 10 lakhs PA. 3, Already registered under ST 4, Providing Inter State Service or supply 5, Composition levy is not applicable under services- only Restaurants are eligible 8

Sudhir Kumar Jain WHO SHOULD BE REGISTERED UNDER GST -MANDATORY 1, Total revenue is more than Rs 20 lakhs PA 2, In NE States whose total revenue is more than Rs 10 lakhs PA. 3, Already registered under ST 4, Providing Inter State Service or supply 5, Composition levy is not applicable under services- only Restaurants are eligible 8

Sudhir Kumar Jain EFFECT OF NON REGISTRATION 1, Non registration will attract penalty of Rs 10, 000/- (30 th July 2017 is last date) 2, the Recipient of services (Insurer) will not pay GST 3, The Insurer may not accept the bill 4, The returns may not be filed which may attract penalty of Rs 100 /- per day 9

Sudhir Kumar Jain EFFECT OF NON REGISTRATION 1, Non registration will attract penalty of Rs 10, 000/- (30 th July 2017 is last date) 2, the Recipient of services (Insurer) will not pay GST 3, The Insurer may not accept the bill 4, The returns may not be filed which may attract penalty of Rs 100 /- per day 9

Sudhir Kumar Jain REGISTRATION AT GIFT CITY 1, Gujrat International Finance Tech City divided into two parts SEZ and Non SEZ Reinsurance Brokers can open office in SEZ and considered as export unit. Separation registration under GST. Reinsurance and Direct Brokers can open office in Non SEZ also. 10

Sudhir Kumar Jain REGISTRATION AT GIFT CITY 1, Gujrat International Finance Tech City divided into two parts SEZ and Non SEZ Reinsurance Brokers can open office in SEZ and considered as export unit. Separation registration under GST. Reinsurance and Direct Brokers can open office in Non SEZ also. 10

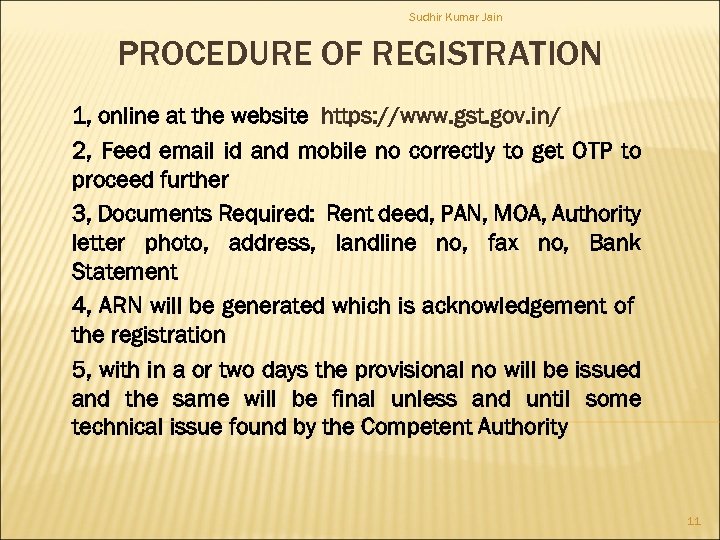

Sudhir Kumar Jain PROCEDURE OF REGISTRATION 1, online at the website https: //www. gst. gov. in/ 2, Feed email id and mobile no correctly to get OTP to proceed further 3, Documents Required: Rent deed, PAN, MOA, Authority letter photo, address, landline no, fax no, Bank Statement 4, ARN will be generated which is acknowledgement of the registration 5, with in a or two days the provisional no will be issued and the same will be final unless and until some technical issue found by the Competent Authority 11

Sudhir Kumar Jain PROCEDURE OF REGISTRATION 1, online at the website https: //www. gst. gov. in/ 2, Feed email id and mobile no correctly to get OTP to proceed further 3, Documents Required: Rent deed, PAN, MOA, Authority letter photo, address, landline no, fax no, Bank Statement 4, ARN will be generated which is acknowledgement of the registration 5, with in a or two days the provisional no will be issued and the same will be final unless and until some technical issue found by the Competent Authority 11

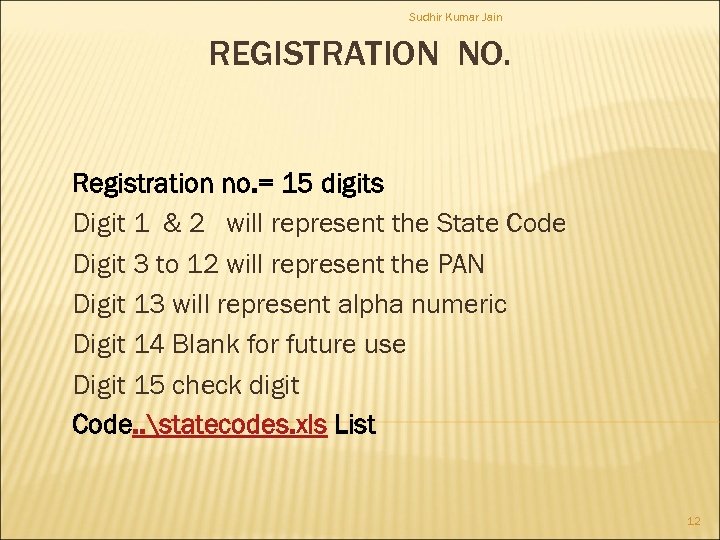

Sudhir Kumar Jain REGISTRATION NO. Registration no. = 15 digits Digit 1 & 2 will represent the State Code Digit 3 to 12 will represent the PAN Digit 13 will represent alpha numeric Digit 14 Blank for future use Digit 15 check digit Code. . statecodes. xls List 12

Sudhir Kumar Jain REGISTRATION NO. Registration no. = 15 digits Digit 1 & 2 will represent the State Code Digit 3 to 12 will represent the PAN Digit 13 will represent alpha numeric Digit 14 Blank for future use Digit 15 check digit Code. . statecodes. xls List 12

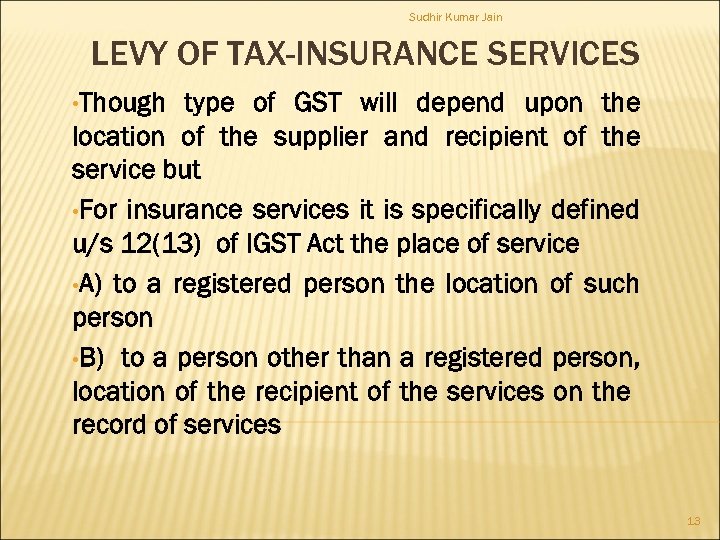

Sudhir Kumar Jain LEVY OF TAX-INSURANCE SERVICES • Though type of GST will depend upon the location of the supplier and recipient of the service but • For insurance services it is specifically defined u/s 12(13) of IGST Act the place of service • A) to a registered person the location of such person • B) to a person other than a registered person, location of the recipient of the services on the record of services 13

Sudhir Kumar Jain LEVY OF TAX-INSURANCE SERVICES • Though type of GST will depend upon the location of the supplier and recipient of the service but • For insurance services it is specifically defined u/s 12(13) of IGST Act the place of service • A) to a registered person the location of such person • B) to a person other than a registered person, location of the recipient of the services on the record of services 13

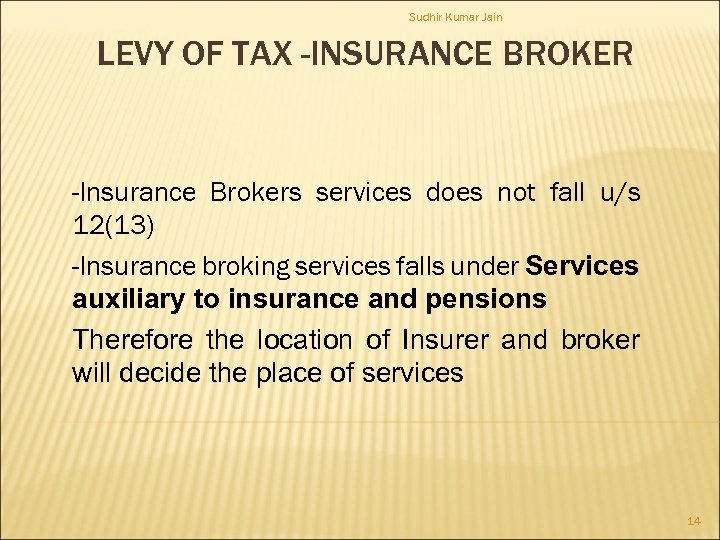

Sudhir Kumar Jain LEVY OF TAX -INSURANCE BROKER -Insurance Brokers services does not fall u/s 12(13) -Insurance broking services falls under Services auxiliary to insurance and pensions Therefore the location of Insurer and broker will decide the place of services 14

Sudhir Kumar Jain LEVY OF TAX -INSURANCE BROKER -Insurance Brokers services does not fall u/s 12(13) -Insurance broking services falls under Services auxiliary to insurance and pensions Therefore the location of Insurer and broker will decide the place of services 14

Sudhir Kumar Jain TYPES OF BROKERS -Direct Broker -Reinsurance Broker 15

Sudhir Kumar Jain TYPES OF BROKERS -Direct Broker -Reinsurance Broker 15

Sudhir Kumar Jain SERVICES PROVIDED BY THE BROKERS -Placement of insurance business on behalf of the client ( Remuneration paid by the Insurers) -Claim consultancy (Professional fees paid by the client ) -Reinsurance business on behalf of Insurers- ( Remuneration by Reinsurer) -Proposed functions under new Regulations 2017 -Risk Inspection (To be paid by Client) -Insurance consultancy (To be paid by Client) 16

Sudhir Kumar Jain SERVICES PROVIDED BY THE BROKERS -Placement of insurance business on behalf of the client ( Remuneration paid by the Insurers) -Claim consultancy (Professional fees paid by the client ) -Reinsurance business on behalf of Insurers- ( Remuneration by Reinsurer) -Proposed functions under new Regulations 2017 -Risk Inspection (To be paid by Client) -Insurance consultancy (To be paid by Client) 16

Sudhir Kumar Jain DIRECT BROKER -Insurance Business either of life or non life or both. -Service provided within India -In lieu services provided by him, entitle for Remuneration & Rewards 17

Sudhir Kumar Jain DIRECT BROKER -Insurance Business either of life or non life or both. -Service provided within India -In lieu services provided by him, entitle for Remuneration & Rewards 17

Sudhir Kumar Jain MODALITIES OF INSURANCE BROKING BUSINESS Providing professional services to the Clients to solicits the Insurance business either from Business Organization or Individual (which may or may not be registered under GST) 18

Sudhir Kumar Jain MODALITIES OF INSURANCE BROKING BUSINESS Providing professional services to the Clients to solicits the Insurance business either from Business Organization or Individual (which may or may not be registered under GST) 18

Sudhir Kumar Jain PECULIARITY OF INSURANCE BROKING BUSINESS Providing Services to the Clients and pays the premium to the Insurer who is bearing the risk of Business Organization or Individual But the Remuneration is paid to the Insurance Broker out of the premium received by the Insurer. 19

Sudhir Kumar Jain PECULIARITY OF INSURANCE BROKING BUSINESS Providing Services to the Clients and pays the premium to the Insurer who is bearing the risk of Business Organization or Individual But the Remuneration is paid to the Insurance Broker out of the premium received by the Insurer. 19

Sudhir Kumar Jain SET UP OF INSURANCE DIRECT BROKER Brokers without any Branch Brokers with one or more Branches 20

Sudhir Kumar Jain SET UP OF INSURANCE DIRECT BROKER Brokers without any Branch Brokers with one or more Branches 20

Sudhir Kumar Jain BROKERS WITHOUT ANY BRANCH As per Brokers Regulations, the Broker can place insurance business any where in India. If the broker place business within State where his HO is situated. The Insurer will pay CGST/SGST or UTGST to the broker on his remuneration If the broker place business in other than home State , the Insurer will pay IGST 21

Sudhir Kumar Jain BROKERS WITHOUT ANY BRANCH As per Brokers Regulations, the Broker can place insurance business any where in India. If the broker place business within State where his HO is situated. The Insurer will pay CGST/SGST or UTGST to the broker on his remuneration If the broker place business in other than home State , the Insurer will pay IGST 21

Sudhir Kumar Jain BROKERS WITHOUT ANY BRANCH-EXAMPLE Suppose a Broker Office – Mumbai (Only) Only one GSTIN Insurer will ask GSTIN on each Proposal If insurance business is placed in Mumbai with any Insurer–CGST/SGST will be paid If insurance business is placed out side Maharashtra say Delhi or Kolkatta - IGST will be paid by the Insurer. 22

Sudhir Kumar Jain BROKERS WITHOUT ANY BRANCH-EXAMPLE Suppose a Broker Office – Mumbai (Only) Only one GSTIN Insurer will ask GSTIN on each Proposal If insurance business is placed in Mumbai with any Insurer–CGST/SGST will be paid If insurance business is placed out side Maharashtra say Delhi or Kolkatta - IGST will be paid by the Insurer. 22

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES Suppose a Broker HO Office – Mumbai Delhi and IRDA approved branches at Delhi, Chennai, Kolkatta. In each State, the Broker Branch should have GSTIN If two or more branches are in the same State –only one GSTIN is permissible and additional place of business may be added 23

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES Suppose a Broker HO Office – Mumbai Delhi and IRDA approved branches at Delhi, Chennai, Kolkatta. In each State, the Broker Branch should have GSTIN If two or more branches are in the same State –only one GSTIN is permissible and additional place of business may be added 23

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES While placing the business the GSTIN of the Broker’s office to be disclosed Accordingly, the Insurer will book business in the name of that Broker’s Branch 24

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES While placing the business the GSTIN of the Broker’s office to be disclosed Accordingly, the Insurer will book business in the name of that Broker’s Branch 24

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES EXAMPLE: A Broking house having HO at Mumbai (Maharashtra) and Branches at Delhi, WB and TN If Mumbai Branch placed business at Delhi, the Insurer demand the GSTIN. If Broker provides the GSTIN of Delhi- CGST/SGST. If Broker provides the GSTIN of any Other branch- IGST will be payable 25

Sudhir Kumar Jain BROKERS WITH ONE OR MORE BRANCHES EXAMPLE: A Broking house having HO at Mumbai (Maharashtra) and Branches at Delhi, WB and TN If Mumbai Branch placed business at Delhi, the Insurer demand the GSTIN. If Broker provides the GSTIN of Delhi- CGST/SGST. If Broker provides the GSTIN of any Other branch- IGST will be payable 25

Sudhir Kumar Jain ADVISORY A separate GSTIN should be taken only for IRDA approved branches not otherwise Every broker must maintain the record of insurance business transaction wise and Insurer branch wise Similarly the transaction should be recorded broker branch wise also. 26

Sudhir Kumar Jain ADVISORY A separate GSTIN should be taken only for IRDA approved branches not otherwise Every broker must maintain the record of insurance business transaction wise and Insurer branch wise Similarly the transaction should be recorded broker branch wise also. 26

Sudhir Kumar Jain RAISING OF INVOICE Bill may be raised based on the data of insurance business maintained by the Broker But there can be differences of the business placed by Brokers and booked by the Insurers i. e. Non issue of policy for the premium deposit in the last 3 -4 days of the month, proposal not approved by the competent authority 27

Sudhir Kumar Jain RAISING OF INVOICE Bill may be raised based on the data of insurance business maintained by the Broker But there can be differences of the business placed by Brokers and booked by the Insurers i. e. Non issue of policy for the premium deposit in the last 3 -4 days of the month, proposal not approved by the competent authority 27

Sudhir Kumar Jain ISSUES- RAISING OF INVOICE The Broker may raise the invoice as per his record on each insurer branch wise. Insurer may pay less brokerage based on the business booked etc. If there is difference of invoice amount. The Insurer may not be able to get the Input Tax credit and may be debatable. Necessary rectifications to be made in the returns. 28

Sudhir Kumar Jain ISSUES- RAISING OF INVOICE The Broker may raise the invoice as per his record on each insurer branch wise. Insurer may pay less brokerage based on the business booked etc. If there is difference of invoice amount. The Insurer may not be able to get the Input Tax credit and may be debatable. Necessary rectifications to be made in the returns. 28

Sudhir Kumar Jain RAISING OF INVOICE-ADVISORY Take the details of business booked by the Insurer and amount of brokerage to be paid. The differences may be result into dispute at the time of filing of returns and higher amount of GST will have to be deposited. 29

Sudhir Kumar Jain RAISING OF INVOICE-ADVISORY Take the details of business booked by the Insurer and amount of brokerage to be paid. The differences may be result into dispute at the time of filing of returns and higher amount of GST will have to be deposited. 29

Sudhir Kumar Jain ADVISORY – EVENLY DISTRIBUTION OF ITC Those brokers who are having multiple branches in different States kindly ensure the evenly distribution of the income and ITC otherwise excess of ITC in one State cannot be adjusted against the balance of other State even PAN is the same. 30

Sudhir Kumar Jain ADVISORY – EVENLY DISTRIBUTION OF ITC Those brokers who are having multiple branches in different States kindly ensure the evenly distribution of the income and ITC otherwise excess of ITC in one State cannot be adjusted against the balance of other State even PAN is the same. 30

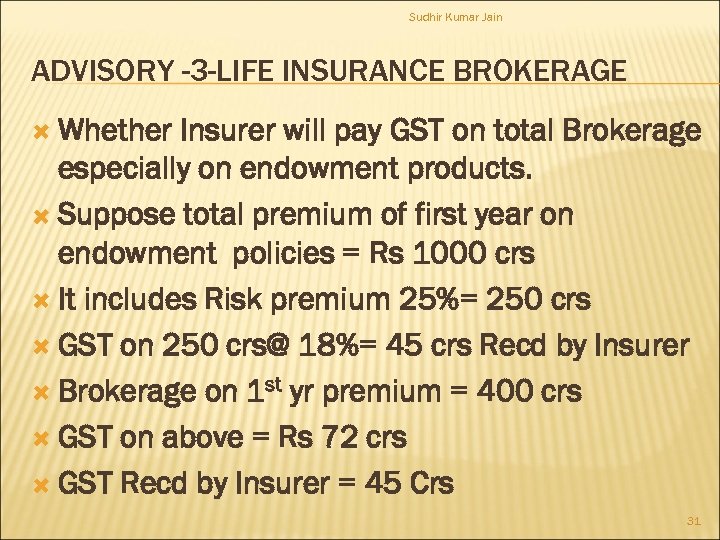

Sudhir Kumar Jain ADVISORY -3 -LIFE INSURANCE BROKERAGE Whether Insurer will pay GST on total Brokerage especially on endowment products. Suppose total premium of first year on endowment policies = Rs 1000 crs It includes Risk premium 25%= 250 crs GST on 250 crs@ 18%= 45 crs Recd by Insurer Brokerage on 1 st yr premium = 400 crs GST on above = Rs 72 crs GST Recd by Insurer = 45 Crs 31

Sudhir Kumar Jain ADVISORY -3 -LIFE INSURANCE BROKERAGE Whether Insurer will pay GST on total Brokerage especially on endowment products. Suppose total premium of first year on endowment policies = Rs 1000 crs It includes Risk premium 25%= 250 crs GST on 250 crs@ 18%= 45 crs Recd by Insurer Brokerage on 1 st yr premium = 400 crs GST on above = Rs 72 crs GST Recd by Insurer = 45 Crs 31

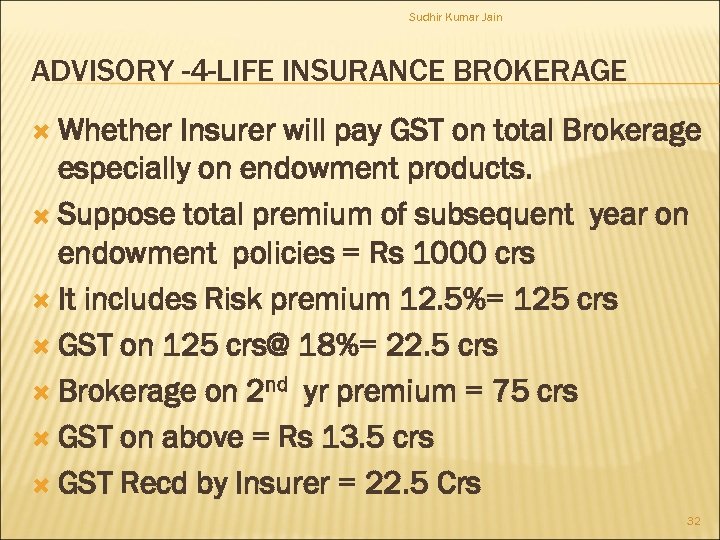

Sudhir Kumar Jain ADVISORY -4 -LIFE INSURANCE BROKERAGE Whether Insurer will pay GST on total Brokerage especially on endowment products. Suppose total premium of subsequent year on endowment policies = Rs 1000 crs It includes Risk premium 12. 5%= 125 crs GST on 125 crs@ 18%= 22. 5 crs Brokerage on 2 nd yr premium = 75 crs GST on above = Rs 13. 5 crs GST Recd by Insurer = 22. 5 Crs 32

Sudhir Kumar Jain ADVISORY -4 -LIFE INSURANCE BROKERAGE Whether Insurer will pay GST on total Brokerage especially on endowment products. Suppose total premium of subsequent year on endowment policies = Rs 1000 crs It includes Risk premium 12. 5%= 125 crs GST on 125 crs@ 18%= 22. 5 crs Brokerage on 2 nd yr premium = 75 crs GST on above = Rs 13. 5 crs GST Recd by Insurer = 22. 5 Crs 32

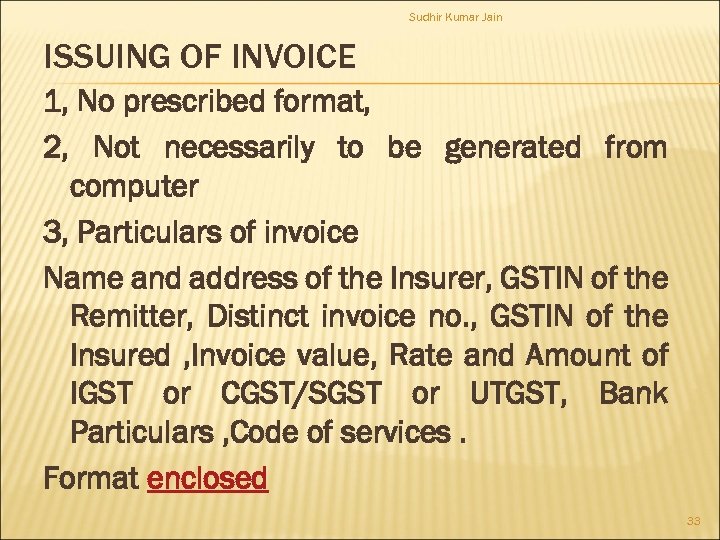

Sudhir Kumar Jain ISSUING OF INVOICE 1, No prescribed format, 2, Not necessarily to be generated from computer 3, Particulars of invoice Name and address of the Insurer, GSTIN of the Remitter, Distinct invoice no. , GSTIN of the Insured , Invoice value, Rate and Amount of IGST or CGST/SGST or UTGST, Bank Particulars , Code of services. Format enclosed 33

Sudhir Kumar Jain ISSUING OF INVOICE 1, No prescribed format, 2, Not necessarily to be generated from computer 3, Particulars of invoice Name and address of the Insurer, GSTIN of the Remitter, Distinct invoice no. , GSTIN of the Insured , Invoice value, Rate and Amount of IGST or CGST/SGST or UTGST, Bank Particulars , Code of services. Format enclosed 33

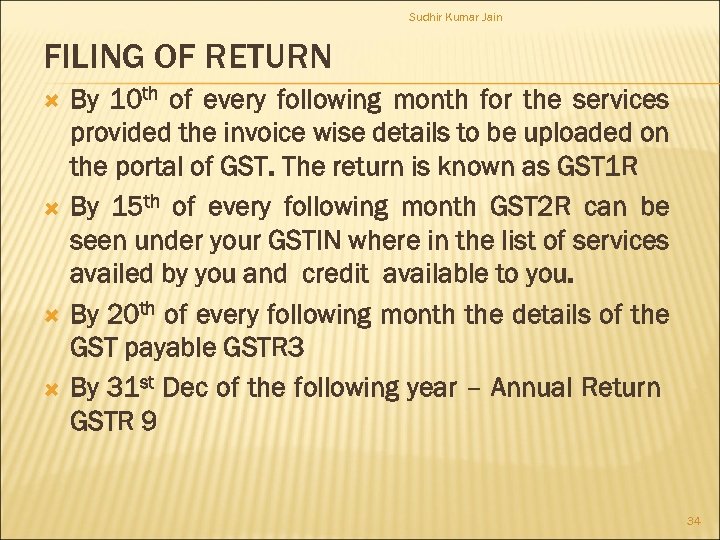

Sudhir Kumar Jain FILING OF RETURN By 10 th of every following month for the services provided the invoice wise details to be uploaded on the portal of GST. The return is known as GST 1 R By 15 th of every following month GST 2 R can be seen under your GSTIN where in the list of services availed by you and credit available to you. By 20 th of every following month the details of the GST payable GSTR 3 By 31 st Dec of the following year – Annual Return GSTR 9 34

Sudhir Kumar Jain FILING OF RETURN By 10 th of every following month for the services provided the invoice wise details to be uploaded on the portal of GST. The return is known as GST 1 R By 15 th of every following month GST 2 R can be seen under your GSTIN where in the list of services availed by you and credit available to you. By 20 th of every following month the details of the GST payable GSTR 3 By 31 st Dec of the following year – Annual Return GSTR 9 34

Sudhir Kumar Jain FILING OF RETURN FORMATS OF RETURNS FORMATS FOR UPLOADING RETURNS THE 35

Sudhir Kumar Jain FILING OF RETURN FORMATS OF RETURNS FORMATS FOR UPLOADING RETURNS THE 35

IMPORTANT TERMINOLOGIES 1) Reverse Charge Mechanism (RCM) 2) Input Tax Credit (ITC)

IMPORTANT TERMINOLOGIES 1) Reverse Charge Mechanism (RCM) 2) Input Tax Credit (ITC)

Sudhir Kumar Jain REVERSE CHARGE MECHANISM As per section 2(98) of CGST Act’ 2017, “reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act; 37

Sudhir Kumar Jain REVERSE CHARGE MECHANISM As per section 2(98) of CGST Act’ 2017, “reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act; 37

Sudhir Kumar Jain NEED REVERSE CHARGE MECHANISM The purpose of reverse charge is to increase tax compliance and tax revenues. Earlier, the government was unable to collect service tax from various unorganized sectors like goods, transport etc. Compliances and tax collections will be increased through this mechanism. 38

Sudhir Kumar Jain NEED REVERSE CHARGE MECHANISM The purpose of reverse charge is to increase tax compliance and tax revenues. Earlier, the government was unable to collect service tax from various unorganized sectors like goods, transport etc. Compliances and tax collections will be increased through this mechanism. 38

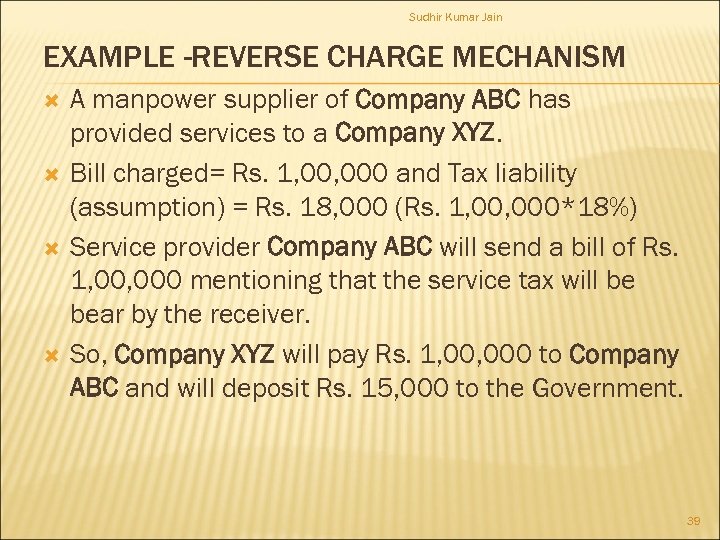

Sudhir Kumar Jain EXAMPLE -REVERSE CHARGE MECHANISM A manpower supplier of Company ABC has provided services to a Company XYZ. Bill charged= Rs. 1, 000 and Tax liability (assumption) = Rs. 18, 000 (Rs. 1, 000*18%) Service provider Company ABC will send a bill of Rs. 1, 000 mentioning that the service tax will be bear by the receiver. So, Company XYZ will pay Rs. 1, 000 to Company ABC and will deposit Rs. 15, 000 to the Government. 39

Sudhir Kumar Jain EXAMPLE -REVERSE CHARGE MECHANISM A manpower supplier of Company ABC has provided services to a Company XYZ. Bill charged= Rs. 1, 000 and Tax liability (assumption) = Rs. 18, 000 (Rs. 1, 000*18%) Service provider Company ABC will send a bill of Rs. 1, 000 mentioning that the service tax will be bear by the receiver. So, Company XYZ will pay Rs. 1, 000 to Company ABC and will deposit Rs. 15, 000 to the Government. 39

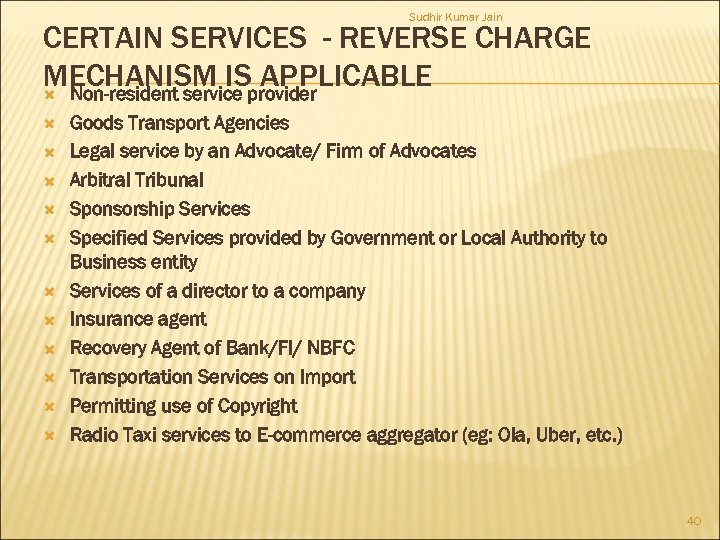

Sudhir Kumar Jain CERTAIN SERVICES - REVERSE CHARGE MECHANISM ISprovider APPLICABLE Non-resident service Goods Transport Agencies Legal service by an Advocate/ Firm of Advocates Arbitral Tribunal Sponsorship Services Specified Services provided by Government or Local Authority to Business entity Services of a director to a company Insurance agent Recovery Agent of Bank/FI/ NBFC Transportation Services on Import Permitting use of Copyright Radio Taxi services to E-commerce aggregator (eg: Ola, Uber, etc. ) 40

Sudhir Kumar Jain CERTAIN SERVICES - REVERSE CHARGE MECHANISM ISprovider APPLICABLE Non-resident service Goods Transport Agencies Legal service by an Advocate/ Firm of Advocates Arbitral Tribunal Sponsorship Services Specified Services provided by Government or Local Authority to Business entity Services of a director to a company Insurance agent Recovery Agent of Bank/FI/ NBFC Transportation Services on Import Permitting use of Copyright Radio Taxi services to E-commerce aggregator (eg: Ola, Uber, etc. ) 40

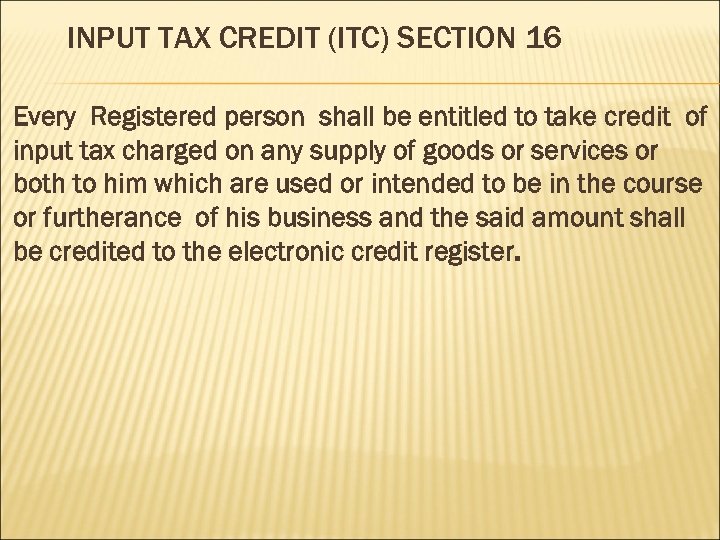

INPUT TAX CREDIT (ITC) SECTION 16 Every Registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be in the course or furtherance of his business and the said amount shall be credited to the electronic credit register.

INPUT TAX CREDIT (ITC) SECTION 16 Every Registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be in the course or furtherance of his business and the said amount shall be credited to the electronic credit register.

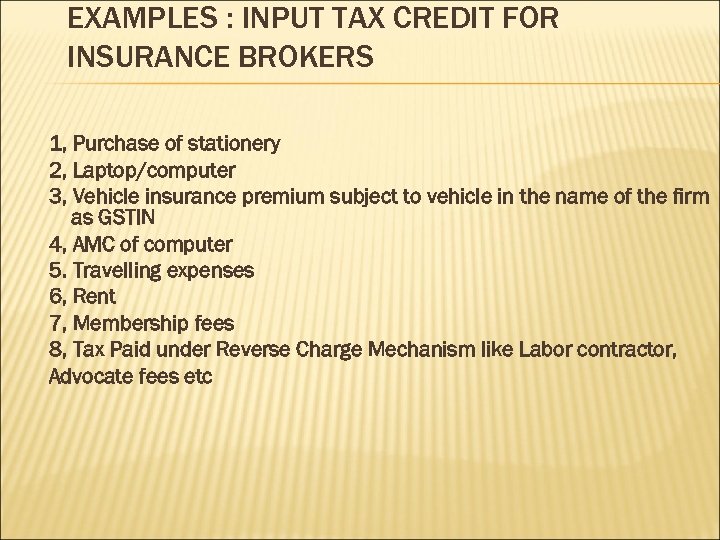

EXAMPLES : INPUT TAX CREDIT FOR INSURANCE BROKERS 1, Purchase of stationery 2, Laptop/computer 3, Vehicle insurance premium subject to vehicle in the name of the firm as GSTIN 4, AMC of computer 5. Travelling expenses 6, Rent 7, Membership fees 8, Tax Paid under Reverse Charge Mechanism like Labor contractor, Advocate fees etc

EXAMPLES : INPUT TAX CREDIT FOR INSURANCE BROKERS 1, Purchase of stationery 2, Laptop/computer 3, Vehicle insurance premium subject to vehicle in the name of the firm as GSTIN 4, AMC of computer 5. Travelling expenses 6, Rent 7, Membership fees 8, Tax Paid under Reverse Charge Mechanism like Labor contractor, Advocate fees etc

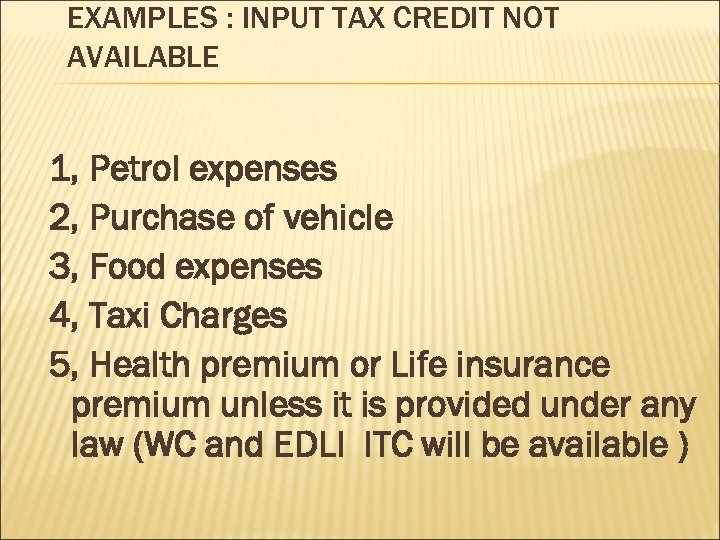

EXAMPLES : INPUT TAX CREDIT NOT AVAILABLE 1, Petrol expenses 2, Purchase of vehicle 3, Food expenses 4, Taxi Charges 5, Health premium or Life insurance premium unless it is provided under any law (WC and EDLI ITC will be available )

EXAMPLES : INPUT TAX CREDIT NOT AVAILABLE 1, Petrol expenses 2, Purchase of vehicle 3, Food expenses 4, Taxi Charges 5, Health premium or Life insurance premium unless it is provided under any law (WC and EDLI ITC will be available )

Sudhir Kumar Jain GST ISSUES Ø Ø At the time underwriting At the time of claim 44

Sudhir Kumar Jain GST ISSUES Ø Ø At the time underwriting At the time of claim 44

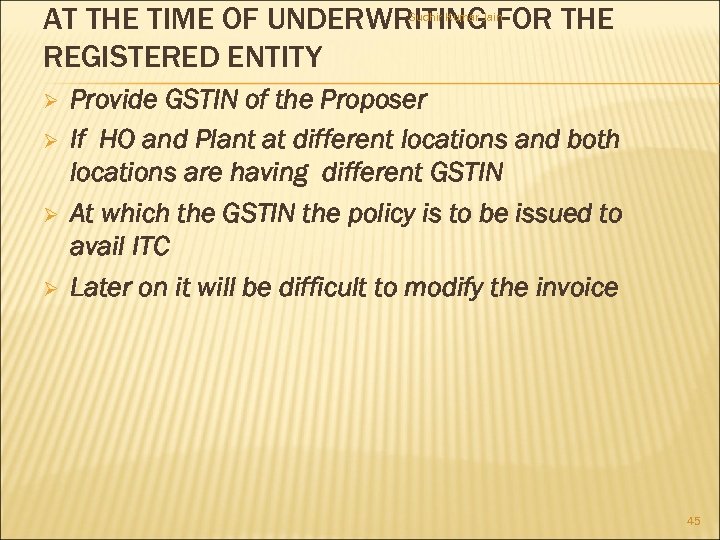

AT THE TIME OF UNDERWRITING FOR THE REGISTERED ENTITY Sudhir Kumar Jain Ø Ø Provide GSTIN of the Proposer If HO and Plant at different locations and both locations are having different GSTIN At which the GSTIN the policy is to be issued to avail ITC Later on it will be difficult to modify the invoice 45

AT THE TIME OF UNDERWRITING FOR THE REGISTERED ENTITY Sudhir Kumar Jain Ø Ø Provide GSTIN of the Proposer If HO and Plant at different locations and both locations are having different GSTIN At which the GSTIN the policy is to be issued to avail ITC Later on it will be difficult to modify the invoice 45

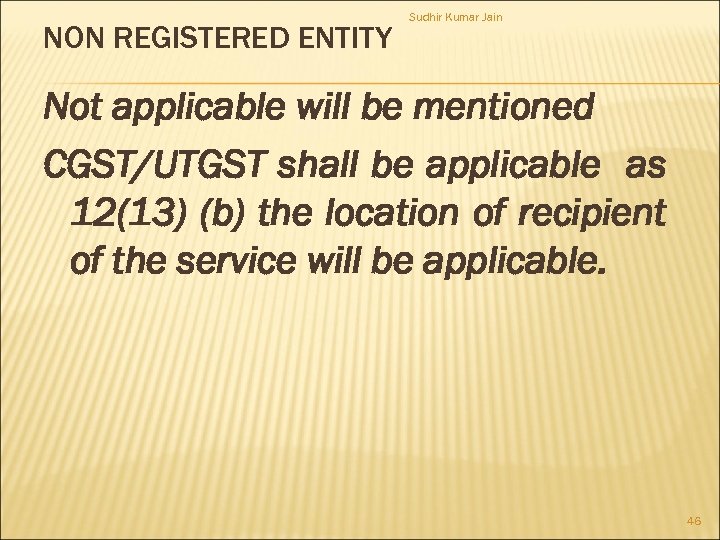

NON REGISTERED ENTITY Sudhir Kumar Jain Not applicable will be mentioned CGST/UTGST shall be applicable as 12(13) (b) the location of recipient of the service will be applicable. 46

NON REGISTERED ENTITY Sudhir Kumar Jain Not applicable will be mentioned CGST/UTGST shall be applicable as 12(13) (b) the location of recipient of the service will be applicable. 46

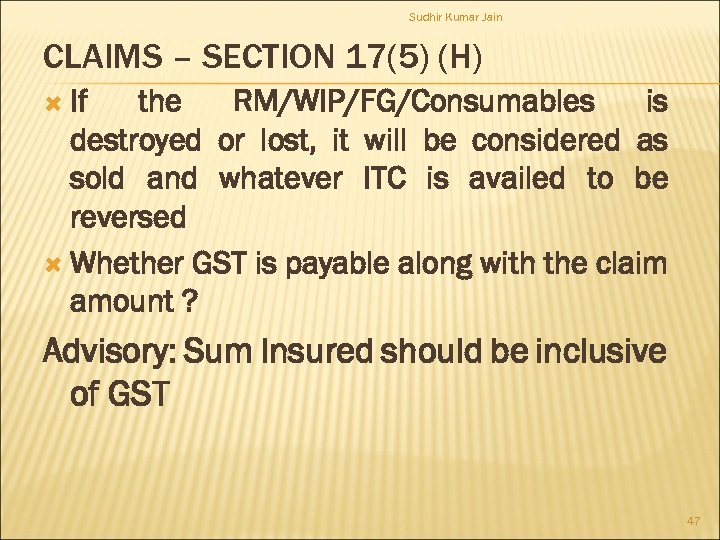

Sudhir Kumar Jain CLAIMS – SECTION 17(5) (H) If the RM/WIP/FG/Consumables is destroyed or lost, it will be considered as sold and whatever ITC is availed to be reversed Whether GST is payable along with the claim amount ? Advisory: Sum Insured should be inclusive of GST 47

Sudhir Kumar Jain CLAIMS – SECTION 17(5) (H) If the RM/WIP/FG/Consumables is destroyed or lost, it will be considered as sold and whatever ITC is availed to be reversed Whether GST is payable along with the claim amount ? Advisory: Sum Insured should be inclusive of GST 47

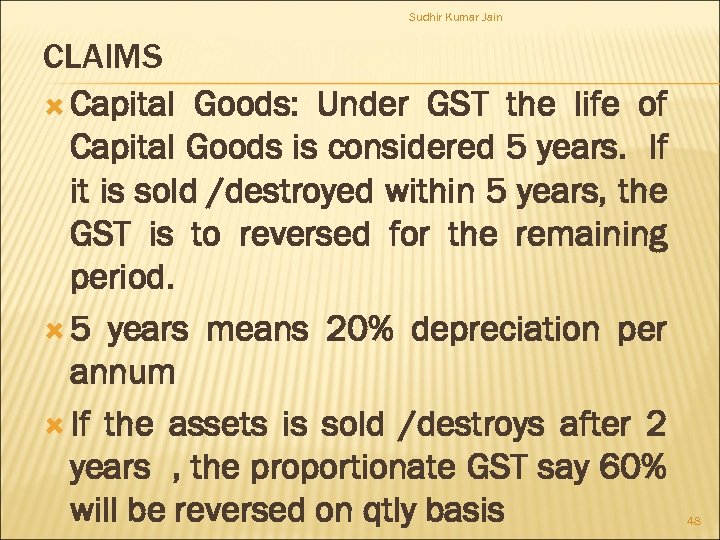

Sudhir Kumar Jain CLAIMS Capital Goods: Under GST the life of Capital Goods is considered 5 years. If it is sold /destroyed within 5 years, the GST is to reversed for the remaining period. 5 years means 20% depreciation per annum If the assets is sold /destroys after 2 years , the proportionate GST say 60% will be reversed on qtly basis 48

Sudhir Kumar Jain CLAIMS Capital Goods: Under GST the life of Capital Goods is considered 5 years. If it is sold /destroyed within 5 years, the GST is to reversed for the remaining period. 5 years means 20% depreciation per annum If the assets is sold /destroys after 2 years , the proportionate GST say 60% will be reversed on qtly basis 48

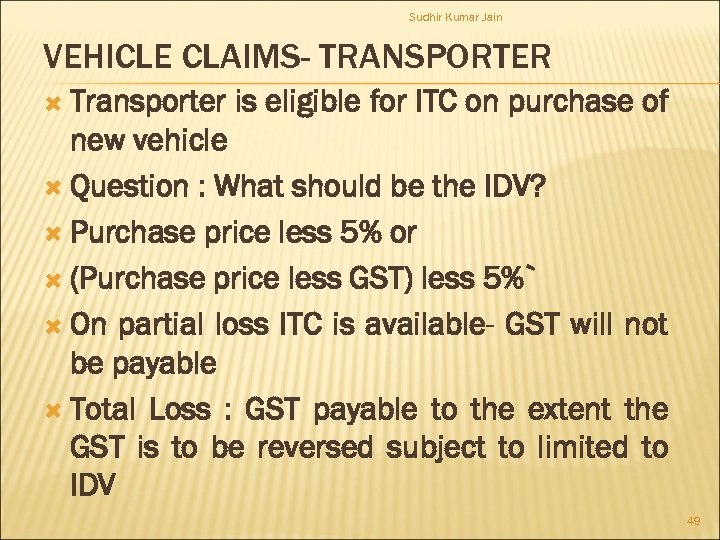

Sudhir Kumar Jain VEHICLE CLAIMS- TRANSPORTER Transporter is eligible for ITC on purchase of new vehicle Question : What should be the IDV? Purchase price less 5% or (Purchase price less GST) less 5%` On partial loss ITC is available- GST will not be payable Total Loss : GST payable to the extent the GST is to be reversed subject to limited to IDV 49

Sudhir Kumar Jain VEHICLE CLAIMS- TRANSPORTER Transporter is eligible for ITC on purchase of new vehicle Question : What should be the IDV? Purchase price less 5% or (Purchase price less GST) less 5%` On partial loss ITC is available- GST will not be payable Total Loss : GST payable to the extent the GST is to be reversed subject to limited to IDV 49

Sudhir Kumar Jain BUSINESS OF REINSURANCE BROKERS Outward Reinsurance Business : Indian reinsurance business is either placed within India or outside India Inward Reinsurance Business: Reinsurance business is being brought from India or Abroad 50

Sudhir Kumar Jain BUSINESS OF REINSURANCE BROKERS Outward Reinsurance Business : Indian reinsurance business is either placed within India or outside India Inward Reinsurance Business: Reinsurance business is being brought from India or Abroad 50

Sudhir Kumar Jain MODALITIES OF REINSURANCE BUSINESS Reinsurance brokers deal with Insurers and Reinsurers situated in India and abroad. The service is provided to Insurers situated in India or abroad but the premium is paid to Reinsurers who pay the remuneration to the brokers. Further as per Insurance Brokers Regulations, the reinsurance premium can be collected by brokers before it is remitted to Reinsurers after deducting remuneration from the premium amount. 51

Sudhir Kumar Jain MODALITIES OF REINSURANCE BUSINESS Reinsurance brokers deal with Insurers and Reinsurers situated in India and abroad. The service is provided to Insurers situated in India or abroad but the premium is paid to Reinsurers who pay the remuneration to the brokers. Further as per Insurance Brokers Regulations, the reinsurance premium can be collected by brokers before it is remitted to Reinsurers after deducting remuneration from the premium amount. 51

Sudhir Kumar Jain NATURE OF TRANSACTION OF REINSURANCE BUSINESS-OUTWARD TRANSACTION 1) Both Insurer and Reinsurer are based in India: The insurance premium including remuneration collected from Insurer will attract IGST or CGST and SGST depending on the location of the Broker and Insurer. On remitting the premium to Reinsurer again it will attract GST 52

Sudhir Kumar Jain NATURE OF TRANSACTION OF REINSURANCE BUSINESS-OUTWARD TRANSACTION 1) Both Insurer and Reinsurer are based in India: The insurance premium including remuneration collected from Insurer will attract IGST or CGST and SGST depending on the location of the Broker and Insurer. On remitting the premium to Reinsurer again it will attract GST 52

Sudhir Kumar Jain INSURER IN INDIA AND REINSURER ABROAD Under this situation, the premium will be paid by the Insurer to the Reinsurer Broker or directly remitted to Reinsurer in FE. If directly remitted to Reinsurer being a non taxable person in India, the Insurer will have to deposit IGST under Reverse Charge Mechanism (RCM) and avail ITC of the tax deposited. The IGST or CGST and SGST on the remaining amount i. e. remuneration will be paid to the Reinsurance Broker. If total amount is paid to the Reinsurance broker, the broker is supposed to get total amount along with IGST and deposit IGST with Govt while remitting the premium to Reinsurer under RCM and avail ITC. 53

Sudhir Kumar Jain INSURER IN INDIA AND REINSURER ABROAD Under this situation, the premium will be paid by the Insurer to the Reinsurer Broker or directly remitted to Reinsurer in FE. If directly remitted to Reinsurer being a non taxable person in India, the Insurer will have to deposit IGST under Reverse Charge Mechanism (RCM) and avail ITC of the tax deposited. The IGST or CGST and SGST on the remaining amount i. e. remuneration will be paid to the Reinsurance Broker. If total amount is paid to the Reinsurance broker, the broker is supposed to get total amount along with IGST and deposit IGST with Govt while remitting the premium to Reinsurer under RCM and avail ITC. 53

Sudhir Kumar Jain INSURER ABROAD AND REINSURER IN INDIA For the above situation, it is to be considered as export service therefore, not taxable under GST. But as per practice the total premium received by the Reinsurance broker which is considered export services subsequently the premium is remitted to Indian Reinsurer by the Broker and such transaction will not be considered as export service. The best option will be that the invoice may be raised on the Foreign Insurer by showing separate Premium amount and remuneration separately so that GST liability will not arise. If premium and remuneration is not shown separately, RCM is to be followed by the reinsurance broker. 54

Sudhir Kumar Jain INSURER ABROAD AND REINSURER IN INDIA For the above situation, it is to be considered as export service therefore, not taxable under GST. But as per practice the total premium received by the Reinsurance broker which is considered export services subsequently the premium is remitted to Indian Reinsurer by the Broker and such transaction will not be considered as export service. The best option will be that the invoice may be raised on the Foreign Insurer by showing separate Premium amount and remuneration separately so that GST liability will not arise. If premium and remuneration is not shown separately, RCM is to be followed by the reinsurance broker. 54

Sudhir Kumar Jain INSURER AND REINSURER IN ABROAD Incoming premium will be considered as an export services –No GST While remitting premium outside India by Reinsurer Broker – IGST payable on RCM basis and avail ITC 55

Sudhir Kumar Jain INSURER AND REINSURER IN ABROAD Incoming premium will be considered as an export services –No GST While remitting premium outside India by Reinsurer Broker – IGST payable on RCM basis and avail ITC 55

Sudhir Kumar Jain MODE OF PREMIUM PAYMENT 1, Advance payment received from Insurer (Rule 3 of time of supply) 2, Through credit/debit notes 3, Against invoice All above modes will attract GST even paid to brokers unless & until the premium and brokerage is shown separately in the invoice as per Rule 7 of Determination of value of supply : 56

Sudhir Kumar Jain MODE OF PREMIUM PAYMENT 1, Advance payment received from Insurer (Rule 3 of time of supply) 2, Through credit/debit notes 3, Against invoice All above modes will attract GST even paid to brokers unless & until the premium and brokerage is shown separately in the invoice as per Rule 7 of Determination of value of supply : 56

Sudhir Kumar Jain EXAMPLE M/s ABC Reinsurance Broker provides the services to M/s XYZ Insurer and receives the amount of Rs 100 lakhs consist of Rs 95 lakhs as premium and Rs 5 laksh as remuneration. If the invoice is raised for Rs 100 lakhs the IGST or CGST and SGST will be applicable on Rs 100 lakhs @ 18% which comes out to Rs 18 lakhs. It means the broker will consider his income of Rs 100 lakhs and not Rs 5 lakhs. It may inflate his revenue and while remitting this amount to Reinsurer it will be his expenditure and GST is also applicable on it. Otherwise, Rs 5 lakhs being an actual income will attract GST. 57

Sudhir Kumar Jain EXAMPLE M/s ABC Reinsurance Broker provides the services to M/s XYZ Insurer and receives the amount of Rs 100 lakhs consist of Rs 95 lakhs as premium and Rs 5 laksh as remuneration. If the invoice is raised for Rs 100 lakhs the IGST or CGST and SGST will be applicable on Rs 100 lakhs @ 18% which comes out to Rs 18 lakhs. It means the broker will consider his income of Rs 100 lakhs and not Rs 5 lakhs. It may inflate his revenue and while remitting this amount to Reinsurer it will be his expenditure and GST is also applicable on it. Otherwise, Rs 5 lakhs being an actual income will attract GST. 57

Sudhir Kumar Jain ADVISORY The premium amount remuneration may be shown separately to avoid the liability that may arise any liability on reinsurance premium. 58

Sudhir Kumar Jain ADVISORY The premium amount remuneration may be shown separately to avoid the liability that may arise any liability on reinsurance premium. 58

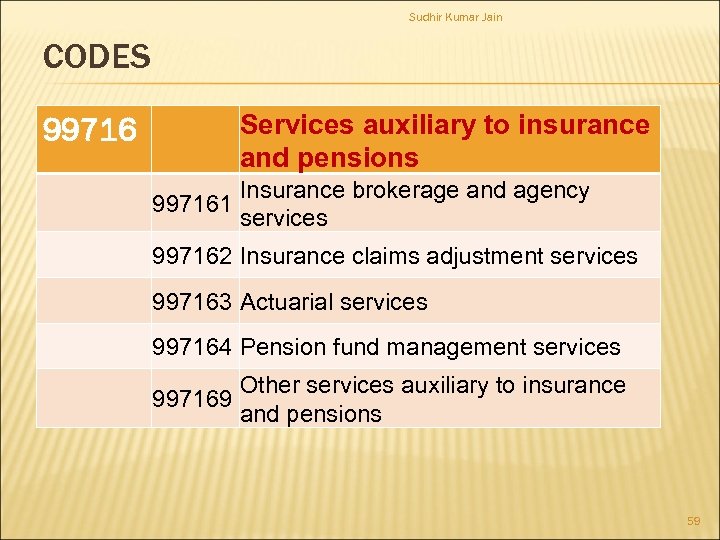

Sudhir Kumar Jain CODES Services auxiliary to insurance and pensions 99716 Insurance brokerage and agency 997161 services 997162 Insurance claims adjustment services 997163 Actuarial services 997164 Pension fund management services 997169 Other services auxiliary to insurance and pensions 59

Sudhir Kumar Jain CODES Services auxiliary to insurance and pensions 99716 Insurance brokerage and agency 997161 services 997162 Insurance claims adjustment services 997163 Actuarial services 997164 Pension fund management services 997169 Other services auxiliary to insurance and pensions 59

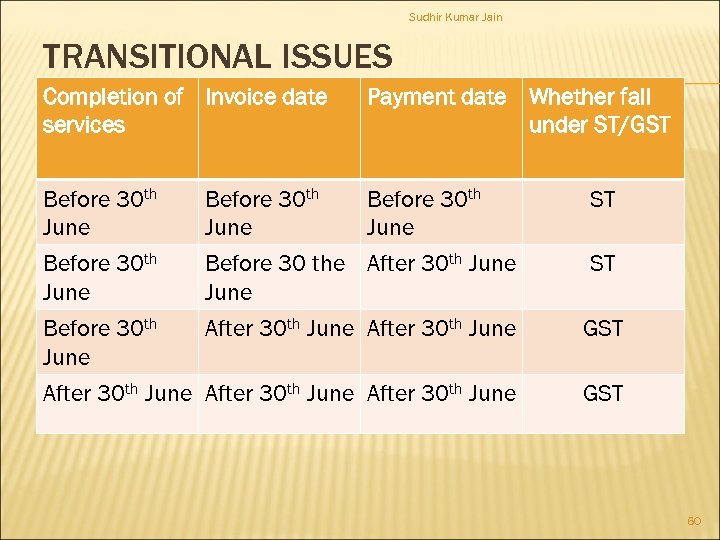

Sudhir Kumar Jain TRANSITIONAL ISSUES Completion of Invoice date services Payment date Whether fall under ST/GST Before 30 th June Before 30 th June Before 30 the After 30 th June After 30 th June GST ST ST 60

Sudhir Kumar Jain TRANSITIONAL ISSUES Completion of Invoice date services Payment date Whether fall under ST/GST Before 30 th June Before 30 th June Before 30 the After 30 th June After 30 th June GST ST ST 60

Sudhir Kumar Jain WELCOME To Questions 61

Sudhir Kumar Jain WELCOME To Questions 61