64ad1cb7111011ee718592cf9d24dc64.ppt

- Количество слайдов: 43

Successful Retirement Investors: What Do They Know That You Need to Know? Gordon Tiffany, CFP®, CFS Director, Financial and Retirement Education ICMA-RC ICMA’s 91 st Annual Conference Monday, September 26, 12: 45 pm - 2: 00 pm Minneapolis, MN FPAC: 0830 -1

Successful Retirement Investors: What Do They Know That You Need to Know? Gordon Tiffany, CFP®, CFS Director, Financial and Retirement Education ICMA-RC ICMA’s 91 st Annual Conference Monday, September 26, 12: 45 pm - 2: 00 pm Minneapolis, MN FPAC: 0830 -1

Basics: Two Kinds of Retirement Plans • Defined Benefit – Pensions ³ ³ ³ Employer (maybe employee) funded on actuary calculation. Invested by trustees. Problem: Boom years under funding, enhanced benefits. • Defined Contribution – Accounts ³ ³ ³ Funded by employee (& employer? ) contributions. Invested by individuals. Problem: Under saving worsened by poor investing. 2

Basics: Two Kinds of Retirement Plans • Defined Benefit – Pensions ³ ³ ³ Employer (maybe employee) funded on actuary calculation. Invested by trustees. Problem: Boom years under funding, enhanced benefits. • Defined Contribution – Accounts ³ ³ ³ Funded by employee (& employer? ) contributions. Invested by individuals. Problem: Under saving worsened by poor investing. 2

How did we do? “Pension funds directed by trustees achieve results that are about 50% better than those achieved by individual investors. ” – Ed Dravo, The 4% Solution, Slate Magazine – citing Federal Reserve Bank of Atlanta 3

How did we do? “Pension funds directed by trustees achieve results that are about 50% better than those achieved by individual investors. ” – Ed Dravo, The 4% Solution, Slate Magazine – citing Federal Reserve Bank of Atlanta 3

Is there an ‘Institutional Advantage’? • Economies of scale? ³ Size does not correlate to performance. • Information advantage? ³ Insider information illegal, unreliable. • Smarter managers? ³ Same ones you can use; best pay not from pensions. • Longer time horizons, more risk? ³ Aggregate time horizon same. 4

Is there an ‘Institutional Advantage’? • Economies of scale? ³ Size does not correlate to performance. • Information advantage? ³ Insider information illegal, unreliable. • Smarter managers? ³ Same ones you can use; best pay not from pensions. • Longer time horizons, more risk? ³ Aggregate time horizon same. 4

Who is the Problem? “The investor’s chief problem, and even his worst enemy, is likely to be himself. ” – Benjamin Graham, The Intelligent Investor* *“By far the best book about investing ever written. ” – Warren Buffett 5

Who is the Problem? “The investor’s chief problem, and even his worst enemy, is likely to be himself. ” – Benjamin Graham, The Intelligent Investor* *“By far the best book about investing ever written. ” – Warren Buffett 5

A Look at Individual Investor Behavior • Classical economics assumes self-interest drives rational, maximizing decisions. • Behavioral economics asks how and why real people make real economic decisions. Bounded rationality: Individual economic decisions are rational, within emotional bounds. 6

A Look at Individual Investor Behavior • Classical economics assumes self-interest drives rational, maximizing decisions. • Behavioral economics asks how and why real people make real economic decisions. Bounded rationality: Individual economic decisions are rational, within emotional bounds. 6

Flawed “Mental Maps” Why Investors Chase Return • Availability heuristic* – Depending on available, understood data, even irrelevant. • “Representative heuristic”* – Seeing patterns where none are. ³ ³ “That fund has done well for 3 yrs, it must have a great manager. ” “I know and understand fund return, so I use it to predict future return. ” *Hueristic: “A speculative formulation serving as a guide in the investigation or solution of a problem. ” 7

Flawed “Mental Maps” Why Investors Chase Return • Availability heuristic* – Depending on available, understood data, even irrelevant. • “Representative heuristic”* – Seeing patterns where none are. ³ ³ “That fund has done well for 3 yrs, it must have a great manager. ” “I know and understand fund return, so I use it to predict future return. ” *Hueristic: “A speculative formulation serving as a guide in the investigation or solution of a problem. ” 7

Overconfidence Highest paid investors, lowest returns* • Richer investors more confident, trade more. ³ ³ More trades, the lower the returns. Overconfidence encourages them to trade more, resulting in lower returns. • Lower paid employees had better performance. * Source: Olivia Mitchell, Executive Director, Wharton's Pension Research Council and Stephen Utkus Director, Vanguard Center for Retirement Research 8

Overconfidence Highest paid investors, lowest returns* • Richer investors more confident, trade more. ³ ³ More trades, the lower the returns. Overconfidence encourages them to trade more, resulting in lower returns. • Lower paid employees had better performance. * Source: Olivia Mitchell, Executive Director, Wharton's Pension Research Council and Stephen Utkus Director, Vanguard Center for Retirement Research 8

Overconfidence Result “Trading is hazardous to your wealth. ”* • 1991 -1996 S&P 500 return: 17. 9% • Average Brokerage account: 16. 4% • Brokerage accounts traded most: 11. 4% • Reasons – ³ ³ Investor overconfidence, and Broker advice (commission motivated? ) * Barber and Odean, Journal of Finance, April, 2000 9

Overconfidence Result “Trading is hazardous to your wealth. ”* • 1991 -1996 S&P 500 return: 17. 9% • Average Brokerage account: 16. 4% • Brokerage accounts traded most: 11. 4% • Reasons – ³ ³ Investor overconfidence, and Broker advice (commission motivated? ) * Barber and Odean, Journal of Finance, April, 2000 9

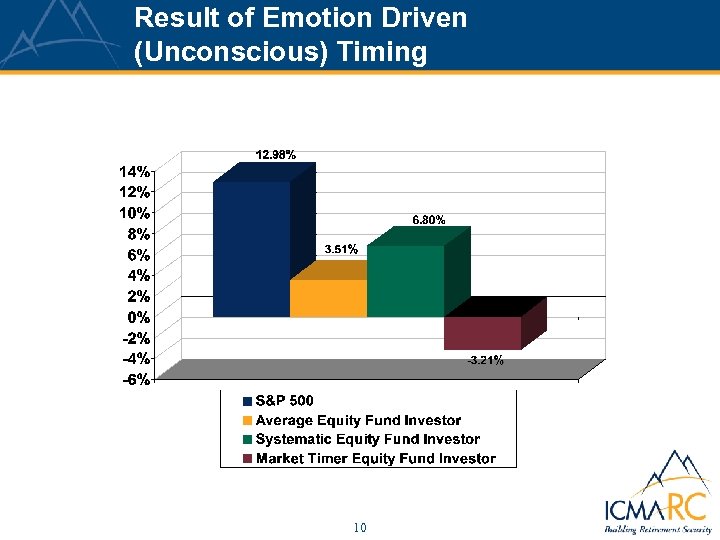

Result of Emotion Driven (Unconscious) Timing 10

Result of Emotion Driven (Unconscious) Timing 10

‘Expert’ Forecasts Are Usually Wrong! • ‘Expert’ market predictions, since 1929: ³ 23% of predictions expert were right. ³ Coin flipping is right 50%. • You must be right 70% of the time to successfully time markets! ³ – William Sharpe A two sided decision. * David Dreman, Chairman, Dreman Value Advisors, Beat the Market Going Against the Crowd (1998), 11

‘Expert’ Forecasts Are Usually Wrong! • ‘Expert’ market predictions, since 1929: ³ 23% of predictions expert were right. ³ Coin flipping is right 50%. • You must be right 70% of the time to successfully time markets! ³ – William Sharpe A two sided decision. * David Dreman, Chairman, Dreman Value Advisors, Beat the Market Going Against the Crowd (1998), 11

How to Turn $10, 000 into a Grande Café Mocha • From 1981 to 2002, you followed prior year’s top performing investment advice service? • Your results: ³ An annualized loss of 31. 4%. You have $2. 32 left from your $10, 000 nest egg! Source: Hulbert Financial Digest 12

How to Turn $10, 000 into a Grande Café Mocha • From 1981 to 2002, you followed prior year’s top performing investment advice service? • Your results: ³ An annualized loss of 31. 4%. You have $2. 32 left from your $10, 000 nest egg! Source: Hulbert Financial Digest 12

Ask The Experts • William F. Sharpe, Nobel Prize Laureate in Economics, “A manager should avoid market timing altogether. ” • Warren Buffet, Berkshire-Hathaway Chairman, “I never have the faintest idea what the stock market is going to do over the next six months, or the next year, or two. But… it is very easy to see what’s going to happen over the long term. ” • John Bogle, founder, Vanguard Group “…trying to do market timing is likely not only not to add value… but to be counterproductive. ” • Peter Lynch, legendary fund manager "Rule number one: Stop listening to professionals!“ 13

Ask The Experts • William F. Sharpe, Nobel Prize Laureate in Economics, “A manager should avoid market timing altogether. ” • Warren Buffet, Berkshire-Hathaway Chairman, “I never have the faintest idea what the stock market is going to do over the next six months, or the next year, or two. But… it is very easy to see what’s going to happen over the long term. ” • John Bogle, founder, Vanguard Group “…trying to do market timing is likely not only not to add value… but to be counterproductive. ” • Peter Lynch, legendary fund manager "Rule number one: Stop listening to professionals!“ 13

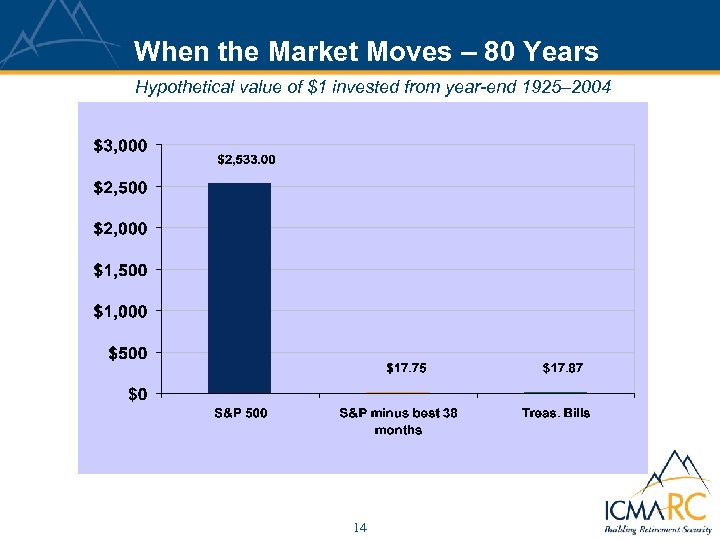

When the Market Moves – 80 Years Hypothetical value of $1 invested from year-end 1925– 2004 14

When the Market Moves – 80 Years Hypothetical value of $1 invested from year-end 1925– 2004 14

Doing Nothing Is A Mistake, Too. . • No changes considered as new investment choices are available. • No changes as target date nears. • No changes as your situation changes. • No changes in thirty years! 15

Doing Nothing Is A Mistake, Too. . • No changes considered as new investment choices are available. • No changes as target date nears. • No changes as your situation changes. • No changes in thirty years! 15

Prospect Theory Why Investors Unreasonably Avoid Risk • Losses are felt more strongly than gains: ³ $1 loss felt with twice emotional intensity of $1 gain. • “I’ll give up chance to gain $2 to avoid equal chance of losing $1. ” People with brain damage impairing their ability to experience emotions make better investment decisions. – WSJ Report, July, 2005 16

Prospect Theory Why Investors Unreasonably Avoid Risk • Losses are felt more strongly than gains: ³ $1 loss felt with twice emotional intensity of $1 gain. • “I’ll give up chance to gain $2 to avoid equal chance of losing $1. ” People with brain damage impairing their ability to experience emotions make better investment decisions. – WSJ Report, July, 2005 16

Confusion Too Many Choices, Lower Participation* • Candy and Jam: ³ 24 jam varieties: fewer sales than with 6. ³ 30 chocolate varieties: less satisfied, fewer repeat buys, than with 6. • Investments: ³ Each 10 new funds means 1. 5% to 2% less participation. • More choices means smaller differences between funds, trouble distinguishing, doubt. * Iyengar, Huberman, Jiang in Pension Design and Structure, 2004 17

Confusion Too Many Choices, Lower Participation* • Candy and Jam: ³ 24 jam varieties: fewer sales than with 6. ³ 30 chocolate varieties: less satisfied, fewer repeat buys, than with 6. • Investments: ³ Each 10 new funds means 1. 5% to 2% less participation. • More choices means smaller differences between funds, trouble distinguishing, doubt. * Iyengar, Huberman, Jiang in Pension Design and Structure, 2004 17

The Institutional Secret, Revealed: Pension funds take emotion out of investing with policy driven discipline: Investment Policy Statement 18

The Institutional Secret, Revealed: Pension funds take emotion out of investing with policy driven discipline: Investment Policy Statement 18

Addressing “The Investor’s Chief Problem” with Your Investment Policy Statement 1. Purpose, Target Date 2. Risk Tolerance 3. Diversification/Asset Allocation 4. Portfolio Maintenance a. Aging b. Rebalancing 5. Accountability 19

Addressing “The Investor’s Chief Problem” with Your Investment Policy Statement 1. Purpose, Target Date 2. Risk Tolerance 3. Diversification/Asset Allocation 4. Portfolio Maintenance a. Aging b. Rebalancing 5. Accountability 19

Your IPS 1. Investment Purpose, Target Date • Why are you investing? • Withdrawals: When & how much? • Retirement? ³ ³ • Understand retirement income sources & needs. Lifetime income? Early retirement expenses? Long term reserves? ³ • A thoughtful retirement expense prediction is needed. • Education fund? ³ For whom, when, etc. ? • Other? 20

Your IPS 1. Investment Purpose, Target Date • Why are you investing? • Withdrawals: When & how much? • Retirement? ³ ³ • Understand retirement income sources & needs. Lifetime income? Early retirement expenses? Long term reserves? ³ • A thoughtful retirement expense prediction is needed. • Education fund? ³ For whom, when, etc. ? • Other? 20

Your IPS 2. Risk Tolerance • Would a 20% loss of equity investments matter? ³ ³ ³ Comfort with short-term market swings? Willingness to accept long-term market uncertainty? Capacity to endure erosion of purchasing power over time? 21

Your IPS 2. Risk Tolerance • Would a 20% loss of equity investments matter? ³ ³ ³ Comfort with short-term market swings? Willingness to accept long-term market uncertainty? Capacity to endure erosion of purchasing power over time? 21

Your IPS: 3. Diversification & Asset Allocation • Equity/Debt/Cash Allocation ³ Equity – for growth potential component: ³ Value/Growth and Market Cap, investing ³ ³ style, foreign stock funds. Bond funds – for income component: ³ Short/Long and Government/Private Debt Funds. Cash – for safety component: ³ Stable value, short term debt 22

Your IPS: 3. Diversification & Asset Allocation • Equity/Debt/Cash Allocation ³ Equity – for growth potential component: ³ Value/Growth and Market Cap, investing ³ ³ style, foreign stock funds. Bond funds – for income component: ³ Short/Long and Government/Private Debt Funds. Cash – for safety component: ³ Stable value, short term debt 22

“Asset allocation is the process of combining asset classes such as stocks, bonds, and cash in a portfolio in order to meet your goals. ” • Strategic asset allocation: Your required job ³ Change slowly, less risk near target date. • Tactical asset allocation: Leave to pros ³ ³ Market, economic predictions. Active fund managers make tactical changes so you don’t have to! 23

“Asset allocation is the process of combining asset classes such as stocks, bonds, and cash in a portfolio in order to meet your goals. ” • Strategic asset allocation: Your required job ³ Change slowly, less risk near target date. • Tactical asset allocation: Leave to pros ³ ³ Market, economic predictions. Active fund managers make tactical changes so you don’t have to! 23

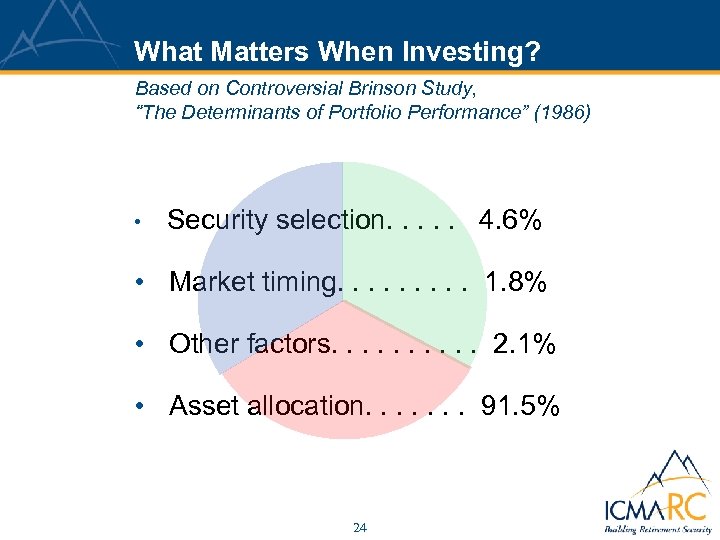

What Matters When Investing? Based on Controversial Brinson Study, “The Determinants of Portfolio Performance” (1986) • Security selection. . . 4. 6% • Market timing. . 1. 8% • Other factors. . 2. 1% • Asset allocation. . . . 91. 5% 24

What Matters When Investing? Based on Controversial Brinson Study, “The Determinants of Portfolio Performance” (1986) • Security selection. . . 4. 6% • Market timing. . 1. 8% • Other factors. . 2. 1% • Asset allocation. . . . 91. 5% 24

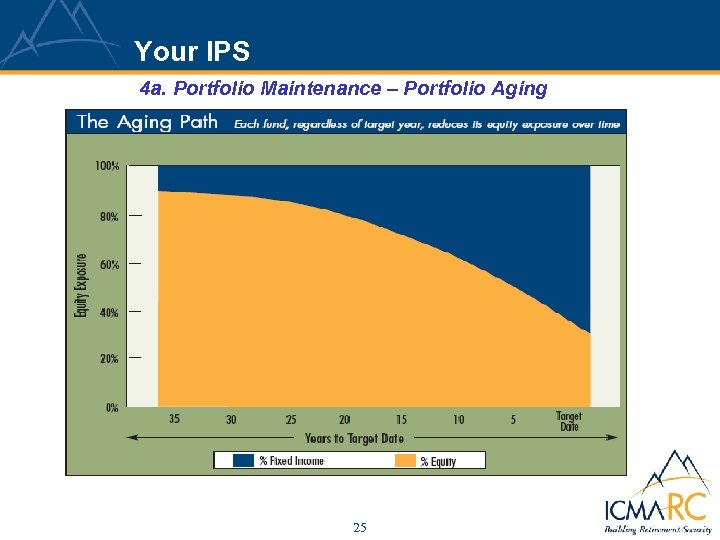

Your IPS 4 a. Portfolio Maintenance – Portfolio Aging 25

Your IPS 4 a. Portfolio Maintenance – Portfolio Aging 25

Your IPS 4 b. Portfolio Maintenance – Rebalancing • Make it a policy driven, automatic process to avoid inadvertent market timing • Predetermine rebalancing triggers asset drift - ex: of 5% ³ on schedule - ex: birthday, end of Q ³ What it feels like: Sell winners & buy losers! 26

Your IPS 4 b. Portfolio Maintenance – Rebalancing • Make it a policy driven, automatic process to avoid inadvertent market timing • Predetermine rebalancing triggers asset drift - ex: of 5% ³ on schedule - ex: birthday, end of Q ³ What it feels like: Sell winners & buy losers! 26

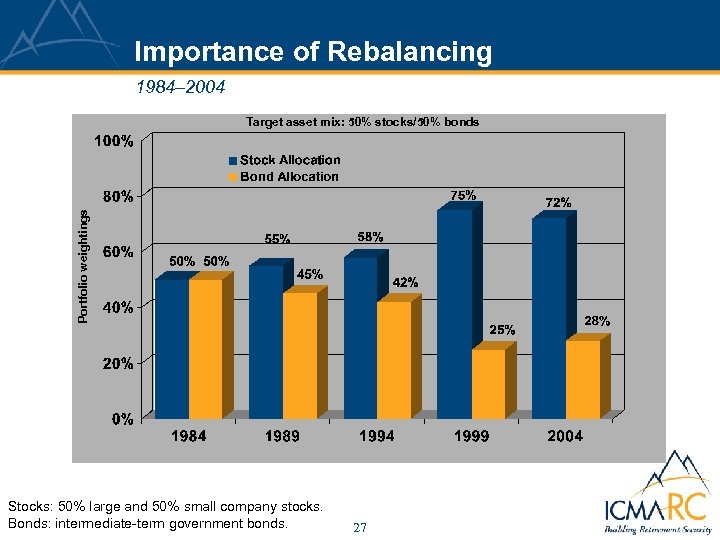

Importance of Rebalancing 1984– 2004 Portfolio weightings Target asset mix: 50% stocks/50% bonds Stocks: 50% large and 50% small company stocks. Bonds: intermediate-term government bonds. 27

Importance of Rebalancing 1984– 2004 Portfolio weightings Target asset mix: 50% stocks/50% bonds Stocks: 50% large and 50% small company stocks. Bonds: intermediate-term government bonds. 27

Your IPS 5. Accountability • How much investing work are you willing & able to do? • How much work will you hire out? • Have an investment journal as record of reasons for decisions. ³ ³ Record what, when, WHY. What is your rational? 28

Your IPS 5. Accountability • How much investing work are you willing & able to do? • How much work will you hire out? • Have an investment journal as record of reasons for decisions. ³ ³ Record what, when, WHY. What is your rational? 28

Condensed Personal IPS Example The Smiths 1. Purpose – Target Date: ³ Provide early retirement income 2020 to 2030 2. Risk Tolerance: ³ Moderate 3. Diversification, Asset Allocation: ³ 70% equity (10% foreign), 10% Core Bond, 20% PLUS 4. Portfolio maintenance: ³ ³ Age portfolio allocation each 5 years Rebalance Annually 5. Accountability: ³ Keep journal, confer annually 29

Condensed Personal IPS Example The Smiths 1. Purpose – Target Date: ³ Provide early retirement income 2020 to 2030 2. Risk Tolerance: ³ Moderate 3. Diversification, Asset Allocation: ³ 70% equity (10% foreign), 10% Core Bond, 20% PLUS 4. Portfolio maintenance: ³ ³ Age portfolio allocation each 5 years Rebalance Annually 5. Accountability: ³ Keep journal, confer annually 29

Institutions Follow Uniform Prudent Investors Act • Establishes Modern Portfolios Theory as basis for prudent investing. • Risk/return relationship is basis of portfolio management. 43 States & DC require following U. P. I. A. 30

Institutions Follow Uniform Prudent Investors Act • Establishes Modern Portfolios Theory as basis for prudent investing. • Risk/return relationship is basis of portfolio management. 43 States & DC require following U. P. I. A. 30

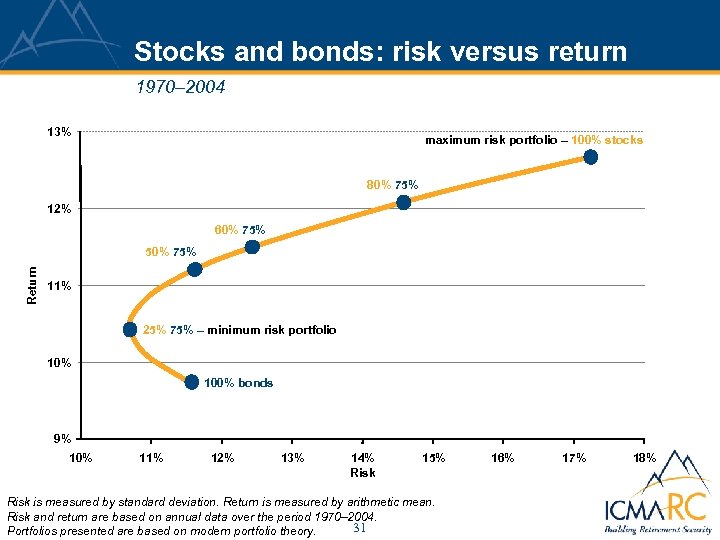

Stocks and bonds: risk versus return 1970– 2004 13% maximum risk portfolio – 100% stocks 80% 75% 12% 60% 75% Return 50% 75% 11% 25% 75% – minimum risk portfolio 10% 100% bonds 9% 10% 11% 12% 13% 14% Risk 15% Risk is measured by standard deviation. Return is measured by arithmetic mean. Risk and return are based on annual data over the period 1970– 2004. 31 Portfolios presented are based on modern portfolio theory. 16% 17% 18%

Stocks and bonds: risk versus return 1970– 2004 13% maximum risk portfolio – 100% stocks 80% 75% 12% 60% 75% Return 50% 75% 11% 25% 75% – minimum risk portfolio 10% 100% bonds 9% 10% 11% 12% 13% 14% Risk 15% Risk is measured by standard deviation. Return is measured by arithmetic mean. Risk and return are based on annual data over the period 1970– 2004. 31 Portfolios presented are based on modern portfolio theory. 16% 17% 18%

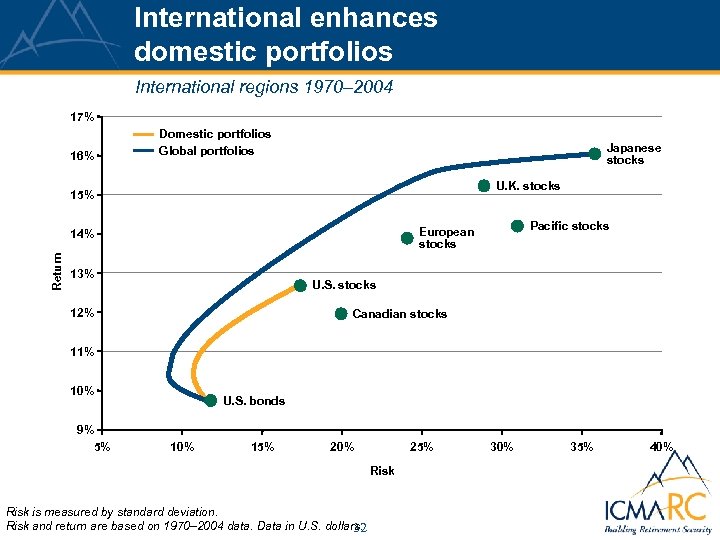

International enhances domestic portfolios International regions 1970– 2004 17% 16% Domestic portfolios Global portfolios Japanese stocks U. K. stocks 15% Return Pacific stocks European stocks 14% 13% U. S. stocks 12% Canadian stocks 11% 10% 9% 5% U. S. bonds 10% 15% 20% 25% Risk is measured by standard deviation. Risk and return are based on 1970– 2004 data. Data in U. S. dollars. 32 30% 35% 40%

International enhances domestic portfolios International regions 1970– 2004 17% 16% Domestic portfolios Global portfolios Japanese stocks U. K. stocks 15% Return Pacific stocks European stocks 14% 13% U. S. stocks 12% Canadian stocks 11% 10% 9% 5% U. S. bonds 10% 15% 20% 25% Risk is measured by standard deviation. Risk and return are based on 1970– 2004 data. Data in U. S. dollars. 32 30% 35% 40%

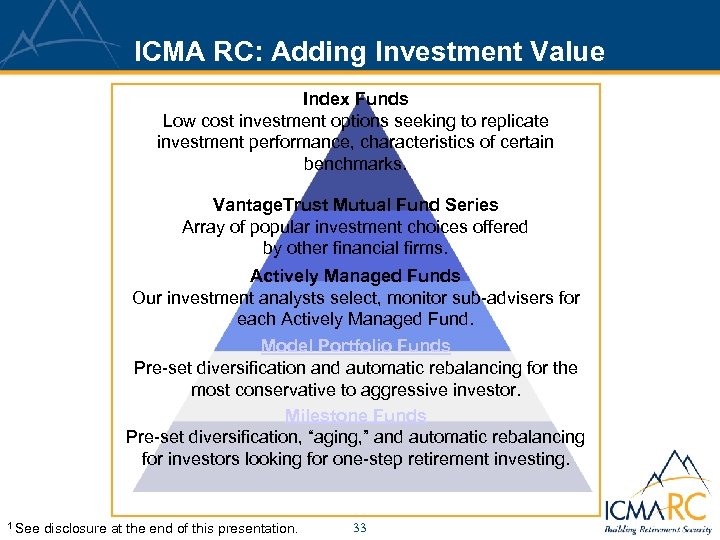

ICMA RC: Adding Investment Value Index Funds Low cost investment options seeking to replicate investment performance, characteristics of certain benchmarks. Vantage. Trust Mutual Fund Series Array of popular investment choices offered by other financial firms. Actively Managed Funds Our investment analysts select, monitor sub-advisers for each Actively Managed Fund. Model Portfolio Funds Pre-set diversification and automatic rebalancing for the most conservative to aggressive investor. Milestone Funds Pre-set diversification, “aging, ” and automatic rebalancing for investors looking for one-step retirement investing. 1 See disclosure at the end of this presentation. 33

ICMA RC: Adding Investment Value Index Funds Low cost investment options seeking to replicate investment performance, characteristics of certain benchmarks. Vantage. Trust Mutual Fund Series Array of popular investment choices offered by other financial firms. Actively Managed Funds Our investment analysts select, monitor sub-advisers for each Actively Managed Fund. Model Portfolio Funds Pre-set diversification and automatic rebalancing for the most conservative to aggressive investor. Milestone Funds Pre-set diversification, “aging, ” and automatic rebalancing for investors looking for one-step retirement investing. 1 See disclosure at the end of this presentation. 33

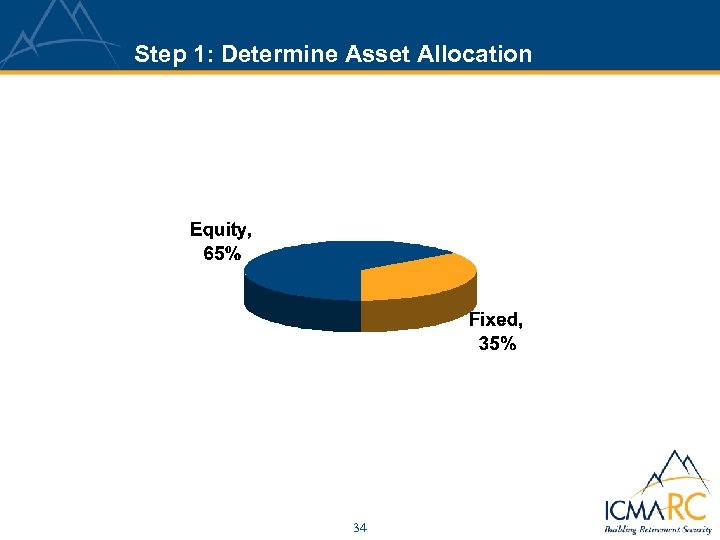

Step 1: Determine Asset Allocation 34

Step 1: Determine Asset Allocation 34

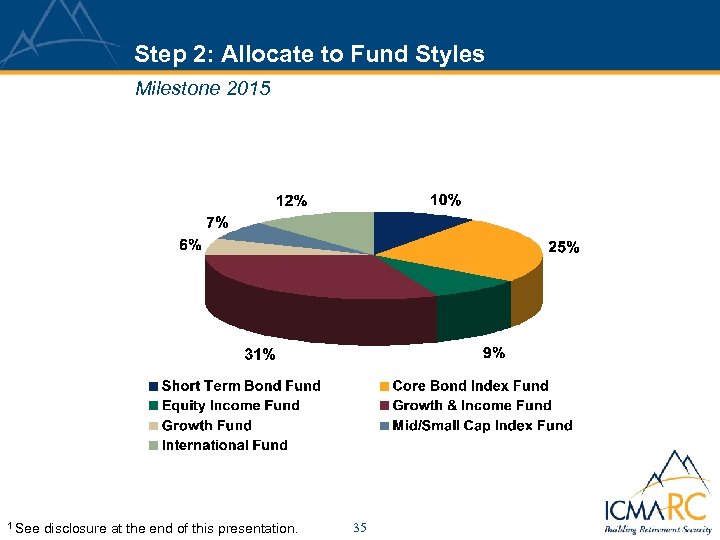

Step 2: Allocate to Fund Styles Milestone 2015 1 See disclosure at the end of this presentation. 35

Step 2: Allocate to Fund Styles Milestone 2015 1 See disclosure at the end of this presentation. 35

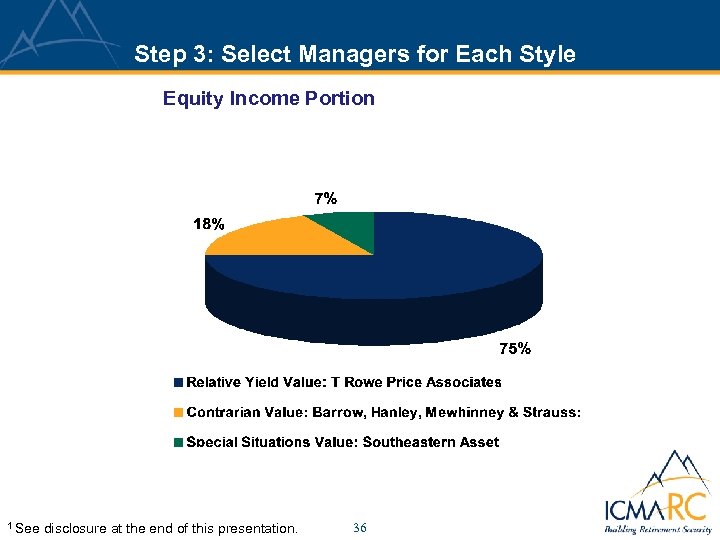

Step 3: Select Managers for Each Style Equity Income Portion 1 See disclosure at the end of this presentation. 36

Step 3: Select Managers for Each Style Equity Income Portion 1 See disclosure at the end of this presentation. 36

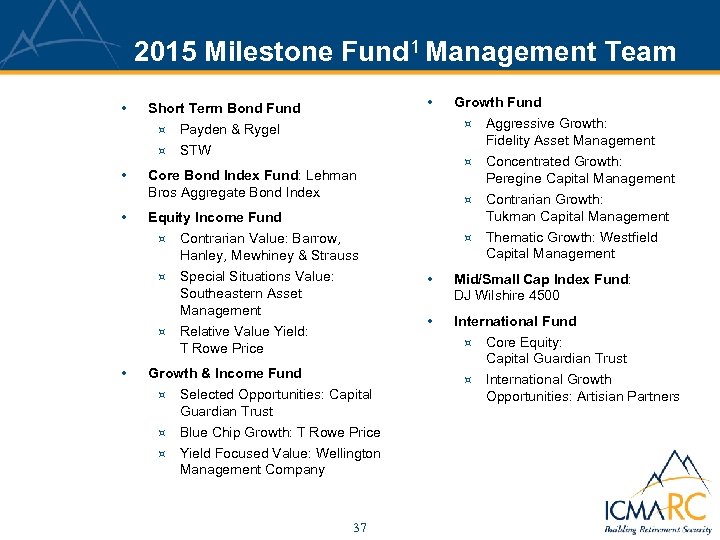

2015 Milestone Fund 1 Management Team • ³ • • Growth Fund ³ Payden & Rygel ³ • • Short Term Bond Fund STW ³ Core Bond Index Fund: Lehman Bros Aggregate Bond Index Equity Income Fund ³ Contrarian Value: Barrow, Hanley, Mewhiney & Strauss ³ Special Situations Value: Southeastern Asset Management ³ Relative Value Yield: T Rowe Price Growth & Income Fund ³ Selected Opportunities: Capital Guardian Trust ³ Blue Chip Growth: T Rowe Price ³ Yield Focused Value: Wellington Management Company 37 ³ ³ Aggressive Growth: Fidelity Asset Management Concentrated Growth: Peregine Capital Management Contrarian Growth: Tukman Capital Management Thematic Growth: Westfield Capital Management • Mid/Small Cap Index Fund: DJ Wilshire 4500 • International Fund ³ Core Equity: Capital Guardian Trust ³ International Growth Opportunities: Artisian Partners

2015 Milestone Fund 1 Management Team • ³ • • Growth Fund ³ Payden & Rygel ³ • • Short Term Bond Fund STW ³ Core Bond Index Fund: Lehman Bros Aggregate Bond Index Equity Income Fund ³ Contrarian Value: Barrow, Hanley, Mewhiney & Strauss ³ Special Situations Value: Southeastern Asset Management ³ Relative Value Yield: T Rowe Price Growth & Income Fund ³ Selected Opportunities: Capital Guardian Trust ³ Blue Chip Growth: T Rowe Price ³ Yield Focused Value: Wellington Management Company 37 ³ ³ Aggressive Growth: Fidelity Asset Management Concentrated Growth: Peregine Capital Management Contrarian Growth: Tukman Capital Management Thematic Growth: Westfield Capital Management • Mid/Small Cap Index Fund: DJ Wilshire 4500 • International Fund ³ Core Equity: Capital Guardian Trust ³ International Growth Opportunities: Artisian Partners

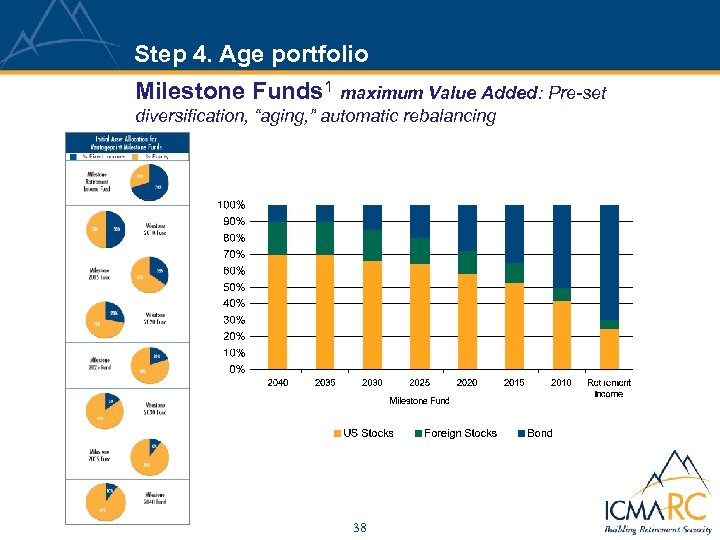

Step 4. Age portfolio Milestone Funds 1 maximum Value Added: Pre-set diversification, “aging, ” automatic rebalancing 38

Step 4. Age portfolio Milestone Funds 1 maximum Value Added: Pre-set diversification, “aging, ” automatic rebalancing 38

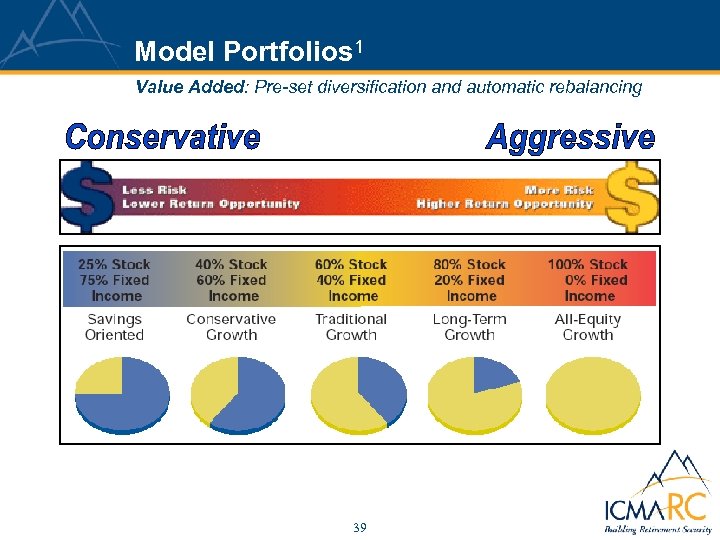

Model Portfolios 1 Value Added: Pre-set diversification and automatic rebalancing 39

Model Portfolios 1 Value Added: Pre-set diversification and automatic rebalancing 39

Actively Managed Funds Value Added: Investment analysts select, monitor sub-advisers. • • • Vantagepoint Growth & Income Fund • Vantagepoint Growth Fund • Vantagepoint Short-Term Bond Fund Vantagepoint Equity Income Fund Vantagepoint Aggressive Opportunities Fund • Vantagepoint International Fund Vantage. Trust PLUS Fund • • • 1, 2, 3 See • Vantagepoint Money Market Fund Vantagepoint US Government Securities Fund Vantagepoint Asset Allocation Fund disclosures at the end of this presentation. 40

Actively Managed Funds Value Added: Investment analysts select, monitor sub-advisers. • • • Vantagepoint Growth & Income Fund • Vantagepoint Growth Fund • Vantagepoint Short-Term Bond Fund Vantagepoint Equity Income Fund Vantagepoint Aggressive Opportunities Fund • Vantagepoint International Fund Vantage. Trust PLUS Fund • • • 1, 2, 3 See • Vantagepoint Money Market Fund Vantagepoint US Government Securities Fund Vantagepoint Asset Allocation Fund disclosures at the end of this presentation. 40

A Tool for the “Do-It-Your-(almost)-Selfer” Online Advice from 41

A Tool for the “Do-It-Your-(almost)-Selfer” Online Advice from 41

Put your effort where it matters the most: ü You can’t control the markets; timing is likely to reduce return, nit add to it. ü Investment results depends on investment behavior. ü Successful institutional investors take emotion out of investing behavior with an Investment Policy Statement ü Use a Personal Investment Policy Statement to guide your investment behavior, shielding you from emotional investing. ü Use RC’s value added to help make technical investing decisions. 42

Put your effort where it matters the most: ü You can’t control the markets; timing is likely to reduce return, nit add to it. ü Investment results depends on investment behavior. ü Successful institutional investors take emotion out of investing behavior with an Investment Policy Statement ü Use a Personal Investment Policy Statement to guide your investment behavior, shielding you from emotional investing. ü Use RC’s value added to help make technical investing decisions. 42

Disclosure 1. Please consult both the current Vantagepoint Funds prospectus and MAKING SOUND INVESTMENT DECISIONS: A Retirement Investment Guide carefully for a complete summary of all fees, expenses, charges, financial highlights, investment objectives, risks and performance information. Investors should consider the Fund’s investment objectives, risks, charges, and expenses before investing or sending money. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing. Vantagepoint securities are distributed by ICMA-RC Services LLC, a broker dealer affiliate of ICMA-RC, member NASD/SIPC. For a current prospectus, contact ICMA-RC LLC, 777 North Capitol Street NE, Washington, DC 20002 -4240. 1 -800 -669 -7400. 2. Foreign Investments are subject to risks not ordinary associated with domestic investments (i. e. Currency, economic, and political risks). 3. Mid/Small cap funds invest in small and /or mid-size company stocks typically involve greater risk, particularly in the short-term, than those investing in larger, more established companies. 43

Disclosure 1. Please consult both the current Vantagepoint Funds prospectus and MAKING SOUND INVESTMENT DECISIONS: A Retirement Investment Guide carefully for a complete summary of all fees, expenses, charges, financial highlights, investment objectives, risks and performance information. Investors should consider the Fund’s investment objectives, risks, charges, and expenses before investing or sending money. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing. Vantagepoint securities are distributed by ICMA-RC Services LLC, a broker dealer affiliate of ICMA-RC, member NASD/SIPC. For a current prospectus, contact ICMA-RC LLC, 777 North Capitol Street NE, Washington, DC 20002 -4240. 1 -800 -669 -7400. 2. Foreign Investments are subject to risks not ordinary associated with domestic investments (i. e. Currency, economic, and political risks). 3. Mid/Small cap funds invest in small and /or mid-size company stocks typically involve greater risk, particularly in the short-term, than those investing in larger, more established companies. 43