Successes and Challenges in Tracking and Reporting on CBD-related Resource Mobilization Experiences from Canada Scott Wilson, Environment Canada WGRI-5, Montreal, Canada June 19, 2014

Successes and Challenges in Tracking and Reporting on CBD-related Resource Mobilization Experiences from Canada Scott Wilson, Environment Canada WGRI-5, Montreal, Canada June 19, 2014

What has Canada done? • In response to Decision X/3, Canada was one of the first • • • CBD Parties to submit a report on its resource mobilization data in June 2012. A reasonable set of financing statistics is needed to be able to inform policy discussions. Canada developed its own methodology to try to count its national biodiversity investments. The report provided an “indicative estimate of the scale and scope of resources being mobilized by Canada and Canadians in support of the objectives of the CBD” for the years 2006 -2010. Includes ODA, domestic public investments, domestic private investments. Page 2

What has Canada done? • In response to Decision X/3, Canada was one of the first • • • CBD Parties to submit a report on its resource mobilization data in June 2012. A reasonable set of financing statistics is needed to be able to inform policy discussions. Canada developed its own methodology to try to count its national biodiversity investments. The report provided an “indicative estimate of the scale and scope of resources being mobilized by Canada and Canadians in support of the objectives of the CBD” for the years 2006 -2010. Includes ODA, domestic public investments, domestic private investments. Page 2

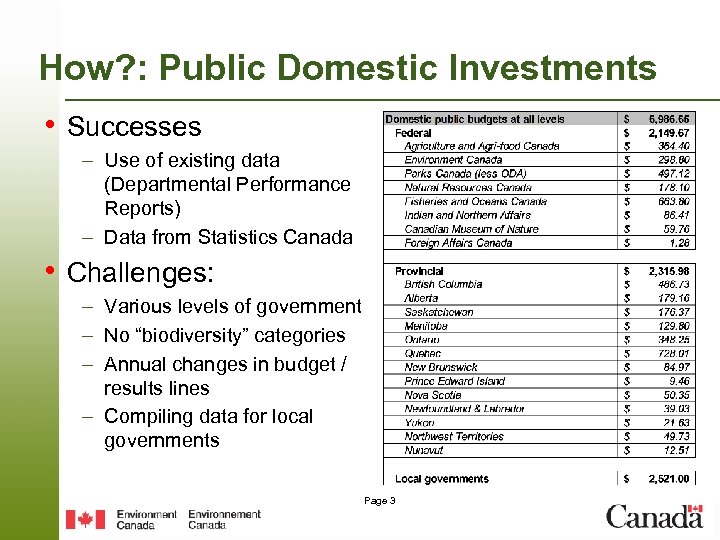

How? : Public Domestic Investments • Successes – Use of existing data (Departmental Performance Reports) – Data from Statistics Canada • Challenges: – Various levels of government – No “biodiversity” categories – Annual changes in budget / results lines – Compiling data for local governments Page 3

How? : Public Domestic Investments • Successes – Use of existing data (Departmental Performance Reports) – Data from Statistics Canada • Challenges: – Various levels of government – No “biodiversity” categories – Annual changes in budget / results lines – Compiling data for local governments Page 3

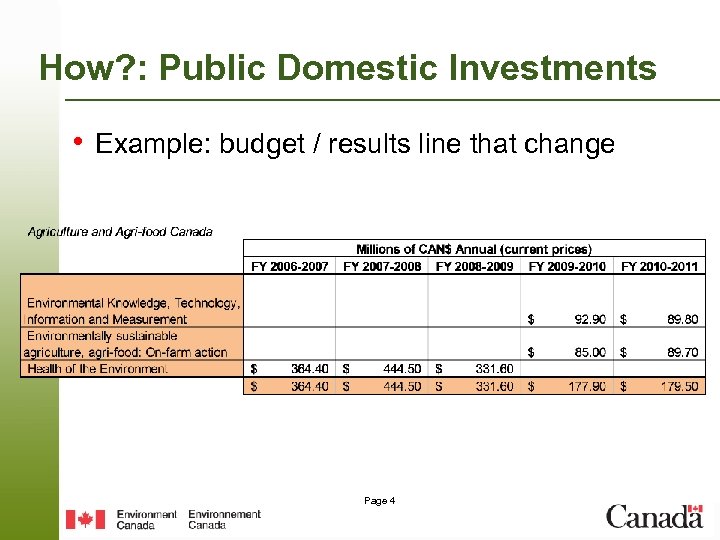

How? : Public Domestic Investments • Example: budget / results line that change Page 4

How? : Public Domestic Investments • Example: budget / results line that change Page 4

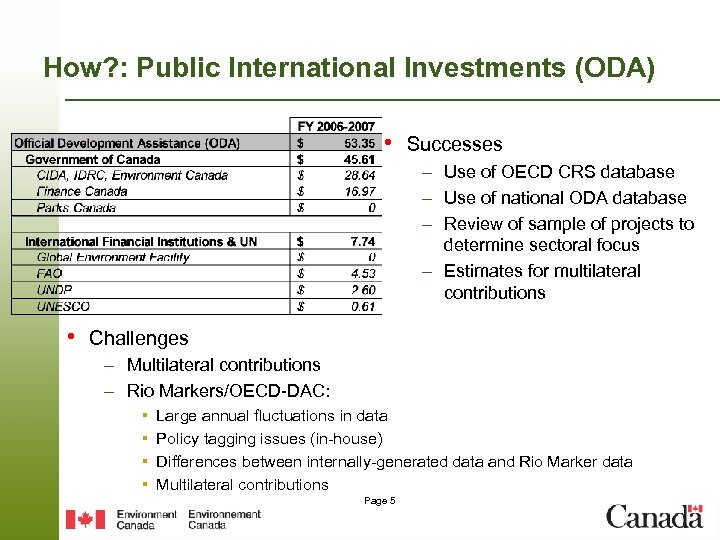

How? : Public International Investments (ODA) • Successes – Use of OECD CRS database – Use of national ODA database – Review of sample of projects to determine sectoral focus – Estimates for multilateral contributions • Challenges – Multilateral contributions – Rio Markers/OECD-DAC: ▪ ▪ Large annual fluctuations in data Policy tagging issues (in-house) Differences between internally-generated data and Rio Marker data Multilateral contributions Page 5

How? : Public International Investments (ODA) • Successes – Use of OECD CRS database – Use of national ODA database – Review of sample of projects to determine sectoral focus – Estimates for multilateral contributions • Challenges – Multilateral contributions – Rio Markers/OECD-DAC: ▪ ▪ Large annual fluctuations in data Policy tagging issues (in-house) Differences between internally-generated data and Rio Marker data Multilateral contributions Page 5

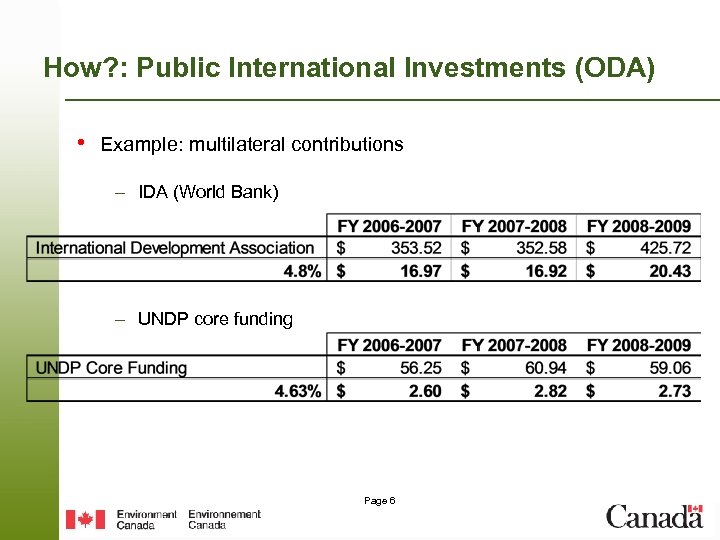

How? : Public International Investments (ODA) • Example: multilateral contributions – IDA (World Bank) – UNDP core funding Page 6

How? : Public International Investments (ODA) • Example: multilateral contributions – IDA (World Bank) – UNDP core funding Page 6

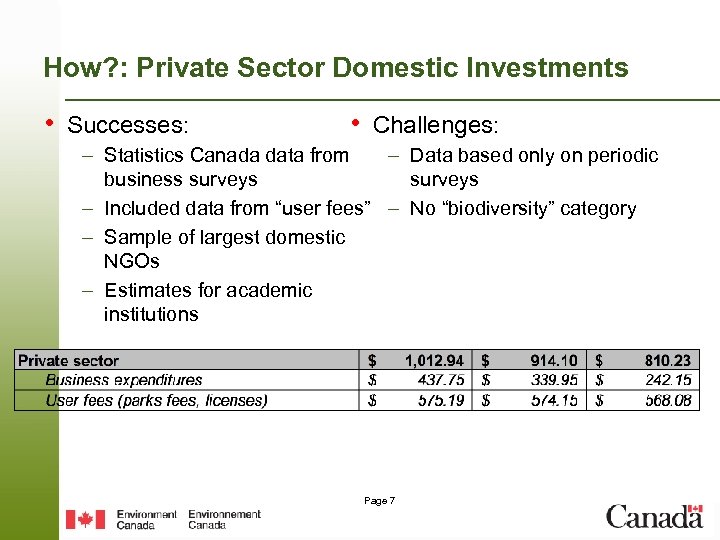

How? : Private Sector Domestic Investments • Successes: • Challenges: – Statistics Canada data from – Data based only on periodic business surveys – Included data from “user fees” – No “biodiversity” category – Sample of largest domestic NGOs – Estimates for academic institutions Page 7

How? : Private Sector Domestic Investments • Successes: • Challenges: – Statistics Canada data from – Data based only on periodic business surveys – Included data from “user fees” – No “biodiversity” category – Sample of largest domestic NGOs – Estimates for academic institutions Page 7

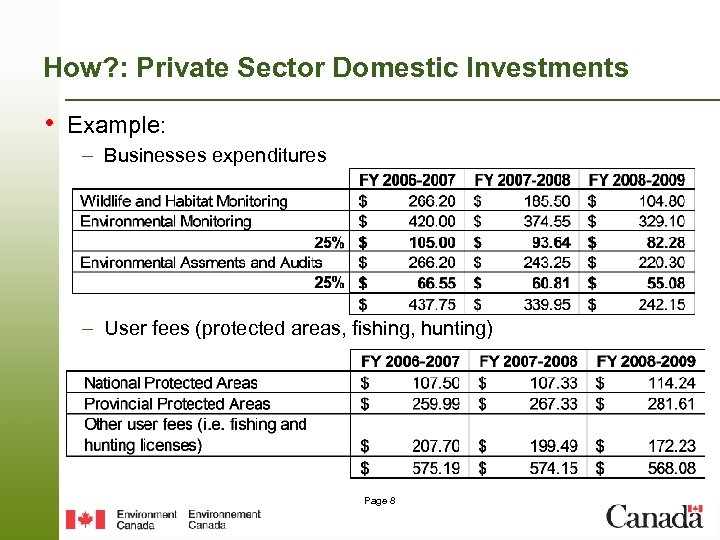

How? : Private Sector Domestic Investments • Example: – Businesses expenditures – User fees (protected areas, fishing, hunting) Page 8

How? : Private Sector Domestic Investments • Example: – Businesses expenditures – User fees (protected areas, fishing, hunting) Page 8

How? : Private Sector International Investments • Challenges: – No reliable data Page 9

How? : Private Sector International Investments • Challenges: – No reliable data Page 9

Conclusions • Successes and Lessons Learned: – Existing data is available – Conservative estimates – “Don’t let the perfect be the enemy of the good” – Be consistent with methodology (baseline vs 2011+ data) • Challenges and Opportunities: – Need common methodology not just on ODA, but also domestic investments ▪ Opportunity IMF Government Finance Statistics (GFS) ▪ Ongoing work to improve Rio Markers at OECD-DAC – Need critical mass of data in order to determine trends – How to track private sector investments? ▪ Businesses’ expenditures? ▪ Users / green markets? Page 10

Conclusions • Successes and Lessons Learned: – Existing data is available – Conservative estimates – “Don’t let the perfect be the enemy of the good” – Be consistent with methodology (baseline vs 2011+ data) • Challenges and Opportunities: – Need common methodology not just on ODA, but also domestic investments ▪ Opportunity IMF Government Finance Statistics (GFS) ▪ Ongoing work to improve Rio Markers at OECD-DAC – Need critical mass of data in order to determine trends – How to track private sector investments? ▪ Businesses’ expenditures? ▪ Users / green markets? Page 10