f48fca30d4e4e67bca4cc5c5a493568a.ppt

- Количество слайдов: 35

Sub-primes and the Credit Crisis PLS/EC 480 Greed and Need Dr. Emerson

Investment financing Want home n Save up n Find investor n Buy and n Repay with collateralize debt n

New Mortgage Market n n n Over priced houses Piggy back sub prime on prime mortgage Little or no documentation to collateralize debt

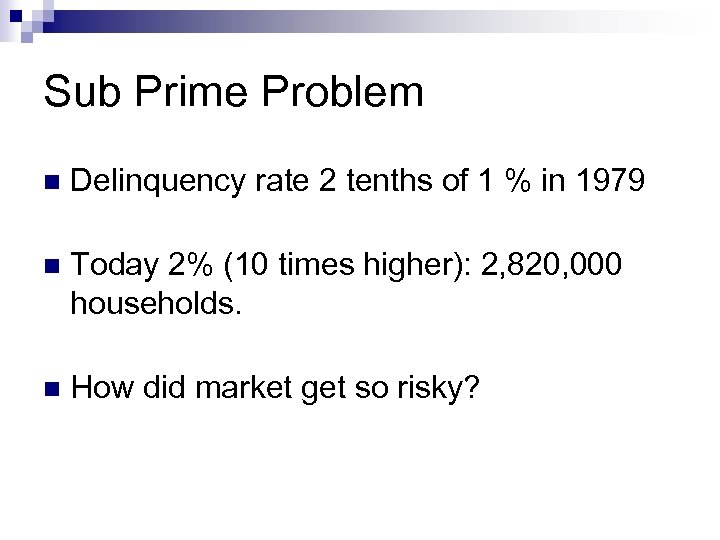

Sub Prime Problem n Delinquency rate 2 tenths of 1 % in 1979 n Today 2% (10 times higher): 2, 820, 000 households. n How did market get so risky?

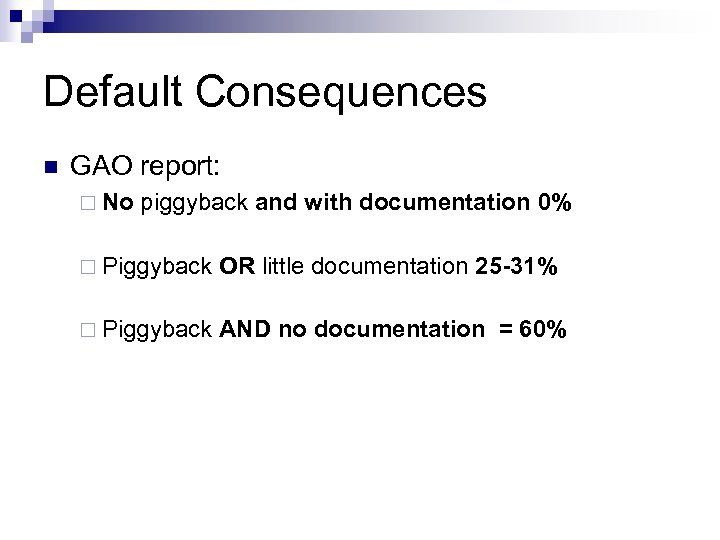

Default Consequences n GAO report: ¨ No piggyback and with documentation 0% ¨ Piggyback OR little documentation 25 -31% ¨ Piggyback AND no documentation = 60%

Cost of gambling n The Credit Crisis by J. Jarvis n http: //www. getrichslowly. org/blog/2009/02/25/the-credit-crisisvisualized/

The Micro Economic and Political Consequences n Bill Moyer’s Report http: //www. pbs. org/ moyers/journal/071 82008/watch. html

Context: Regulate or Deregulate n n n Constitution requires Congress regulate banks Regulation mostly by States. In 1913 FED authorized by Congress.

Little Regulation Until New Deal n n n Unregulated stock market Bank’s heavily invested in stocks Deposits not insured

Regulation n n Glass Steagall FDIC Security & Exchange Commission Freddie Mac/ Fannie Mae established HUD in 1960 s

Deregulation n Deregulation of thrifts No regulation of “derivatives” Mortgages can be sold in fractions. S&L scandal

Deregulation Continues n Despite warnings Congress repeals Glass Steagall in 1999.

Federal Reserve Bank Policies n n Low interest Sub primes unregulated No action on defaults Fed vs. Congress

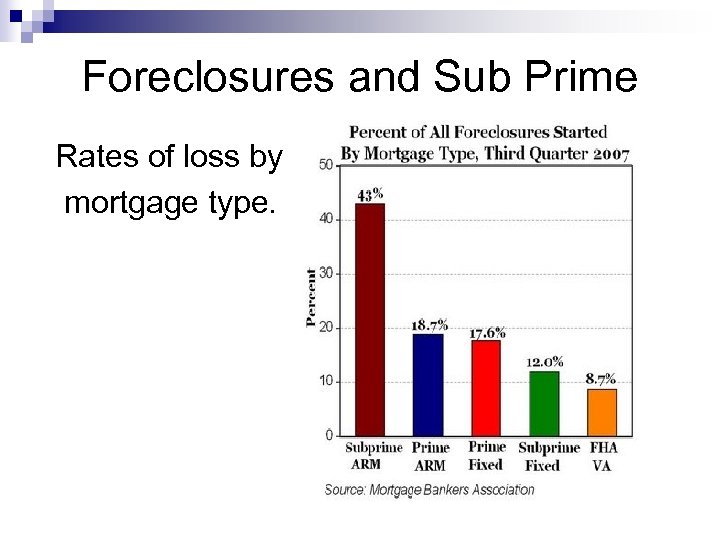

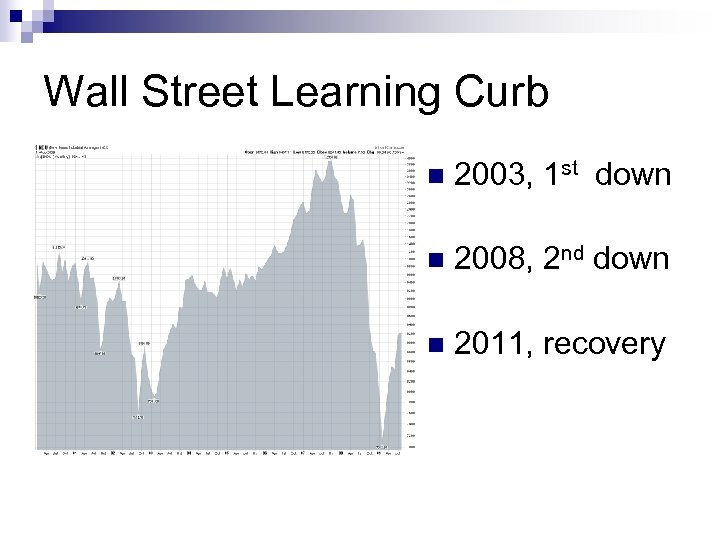

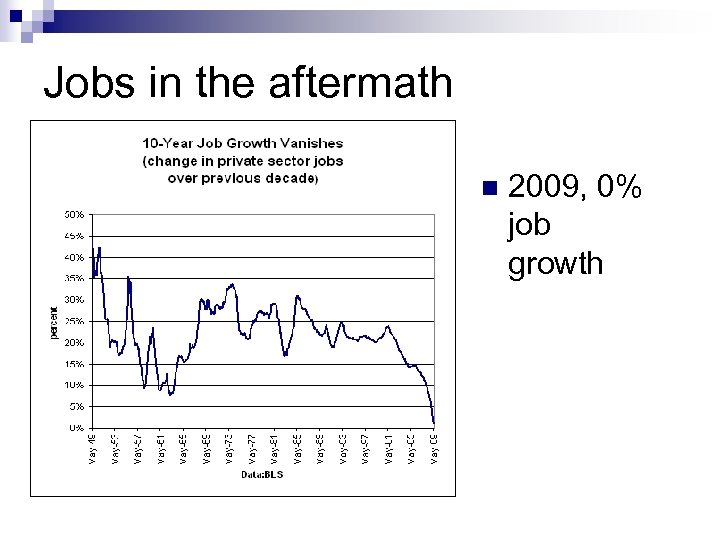

EVIDENCE Foreclosures by type and trends n Stock market learning curve n Jobs n U. S. and others n

Foreclosures and Sub Prime Rates of loss by mortgage type.

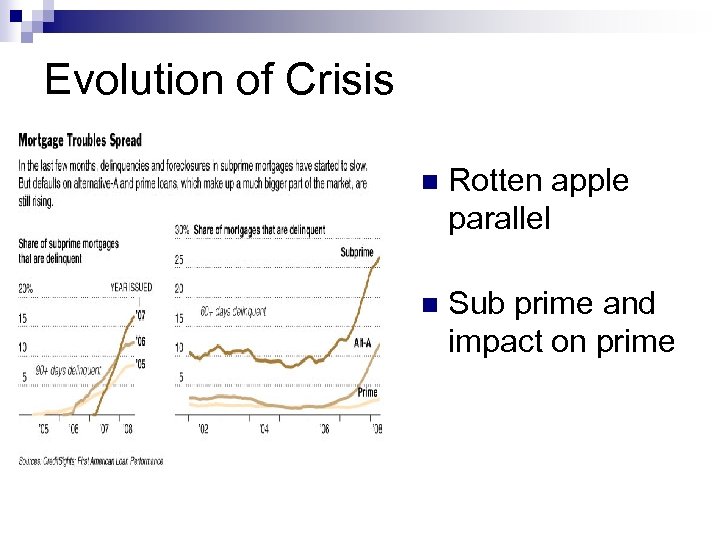

Evolution of Crisis n Rotten apple parallel n Sub prime and impact on prime

Wall Street Learning Curb n 2003, 1 st down n 2008, 2 nd down n 2011, recovery

Jobs in the aftermath n 2009, 0% job growth

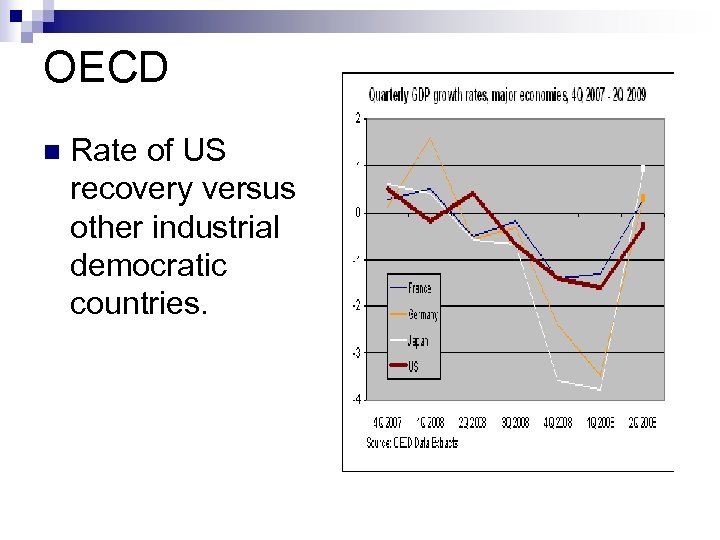

OECD n Rate of US recovery versus other industrial democratic countries.

Break n Be back in 10 minutes for the analysis

Inside the Meltdown: What the Bush Administration did to forestall the implosion of the national economy. n Congressional action and authority n http: //www. pbs. org/wgbh/pages/frontline/m eltdown/view/ n

Building a robust financial system 1. 2. 3. 4. 5. 6. Madison’s perspective Role for state government Role for federal government Democratic capitalist view Democratic socialists view Conservatives vs. liberals view.

Madison’s Perspective n Why did system fail?

What should States do? n --

National Responsibility n Federal Government n Uncle Sam

Democratic Socialist view n --

Democratic Capitalist view n --

Liberals --

Conservatives n --

Conclusions n --

Citations n Alford, Rob (2003). What are the origins of Freddie Mac and Fannie Mae. Accessed August 28, 2008 at http: //hnn. us/articles/1849. html. n Bitner, Richard (2008). Inside the Subprime Debacle. U. S. News and World Report. 145 (2) 12. n GAO Report (2007) Briefing to the Committee on Financial Service, House of Representatives. GPO: Washington, D. C.

Citations n Jost, Kenneth (2008). Financial Crisis. CQ Researcher 18(18), 409 -422 n Phillips, Kevin (2002). Wealth and Democracy. New York: Random House. n Stigliz, Joseph 2010. Freefall: America, free markets and the sinking of the world economy. New York: Norton Press.

Q and A

Postscript n Define issue n Use Library Resources, no Wikipedia http: //www. colbertnation. com/the-colbert-report-videos/81454/january-292007/the-word---wikilobbying? video. Id=81454 n See http: //www. csupomona. edu/~library/datab ases/politicalscience. html

Postscript (cont. ) Use correct APA citations. See: http: //owl. english. purdue. edu/owl/resource /560/01/ n Looking for: timely, data (e. g. GAO), both sides of issue. NOT http: //www. hillbillyreport. com/blog/bear_st earns// n

f48fca30d4e4e67bca4cc5c5a493568a.ppt