38e4b96876ef386d93bd85f790bbcf3c.ppt

- Количество слайдов: 33

Study on China's outward foreign direct investment:a typical sample of newly developed economy Dr Chen yan itrade 8@gmail. com

Study on China's outward foreign direct investment:a typical sample of newly developed economy Dr Chen yan itrade 8@gmail. com

Objectives of the lecture The objective of this lecture is to understand the motivations for firms to internationalise (why) and the internationalization process (how)

Objectives of the lecture The objective of this lecture is to understand the motivations for firms to internationalise (why) and the internationalization process (how)

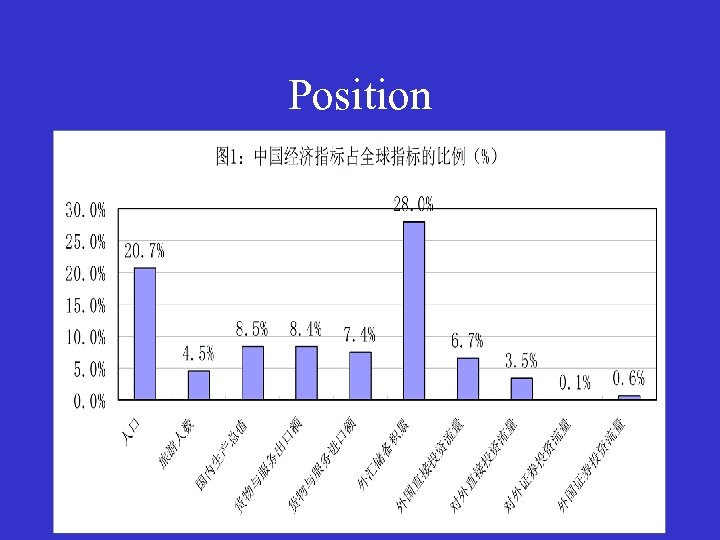

Position

Position

The motives for engaging in international business • The main motives for engaging in international business are: • resource seeking • market seeking • efficiency seeking • strategic asset or capability seeking

The motives for engaging in international business • The main motives for engaging in international business are: • resource seeking • market seeking • efficiency seeking • strategic asset or capability seeking

Resource Seeking Aim: To acquire resources at a lower real cost than could be obtained in their home country. Three types of resource seeking activities: 1. seeking physical resources (e. g. oil), raw materials and agricultural products 2. seeking supplies of cheap unskilled or semi-skilled labour. It is usually undertaken by firms from countries with high labour costs. 3. seeking technological capability as well as management and marketing expertise.

Resource Seeking Aim: To acquire resources at a lower real cost than could be obtained in their home country. Three types of resource seeking activities: 1. seeking physical resources (e. g. oil), raw materials and agricultural products 2. seeking supplies of cheap unskilled or semi-skilled labour. It is usually undertaken by firms from countries with high labour costs. 3. seeking technological capability as well as management and marketing expertise.

Market Seeking Aim: undertaken to sustain or protect existing markets, or to exploit and promote new markets. Difference between market seeking and resources seeking resource seeking: the products are manufactured in one country and sold in a different country market seeking: the products are manufactured in one country and also sold in that country

Market Seeking Aim: undertaken to sustain or protect existing markets, or to exploit and promote new markets. Difference between market seeking and resources seeking resource seeking: the products are manufactured in one country and sold in a different country market seeking: the products are manufactured in one country and also sold in that country

Market Seeking Reasons for market seeking investment: 1) follow their customers: when main customers set up foreign producing facilities, firms need to follow them in order to retain their business, e. g. Japanese car parts 2) product adaptation: to compete with local producers, firms need to adapt their products and marketing behaviour to the needs of the host country (local tastes, language, legal requirements) 3) lower production, transaction and transportation costs: The production of goods that are relatively costly to transport is more likely to be located near the main centres of consumption, (Example: washing machines are more likely to be produced in the target market than computers 4) strategic market investments; Such investments might be undertaken either for defensive or aggressive reasons. Defensive investment means following the investment of the competitors of a firm by making its own investment in the same markets. Aggressive investments are those designed to advance the global interests of a firm by investing in an expanding market (Example: Pepsi cola in Russia). 5) host government policy; • In the 1960 s and 1970 s, host governments imposed heavy tariff barriers on import. A way of overcoming such barriers was market seeking investment. • Since the 1980 s, many foreign governments have chosen to attract inward investment by offering investment incentives (e. g. tax concessions). As a result, foreign investment flourished, and global economic integration has been upgraded dramatically.

Market Seeking Reasons for market seeking investment: 1) follow their customers: when main customers set up foreign producing facilities, firms need to follow them in order to retain their business, e. g. Japanese car parts 2) product adaptation: to compete with local producers, firms need to adapt their products and marketing behaviour to the needs of the host country (local tastes, language, legal requirements) 3) lower production, transaction and transportation costs: The production of goods that are relatively costly to transport is more likely to be located near the main centres of consumption, (Example: washing machines are more likely to be produced in the target market than computers 4) strategic market investments; Such investments might be undertaken either for defensive or aggressive reasons. Defensive investment means following the investment of the competitors of a firm by making its own investment in the same markets. Aggressive investments are those designed to advance the global interests of a firm by investing in an expanding market (Example: Pepsi cola in Russia). 5) host government policy; • In the 1960 s and 1970 s, host governments imposed heavy tariff barriers on import. A way of overcoming such barriers was market seeking investment. • Since the 1980 s, many foreign governments have chosen to attract inward investment by offering investment incentives (e. g. tax concessions). As a result, foreign investment flourished, and global economic integration has been upgraded dramatically.

Efficiency Seeking Aim: undertaken to gain benefits from the common governance of geographically dispersed business activities in different countries. Such benefits are those of the economies of scale and scope, and of risk diversification. MNEs with this motive generally aim to take advantage of different factor endowments, cultures, economic systems and policies, and market structures by concentrating their production in a limited number of locations to serve multiple markets.

Efficiency Seeking Aim: undertaken to gain benefits from the common governance of geographically dispersed business activities in different countries. Such benefits are those of the economies of scale and scope, and of risk diversification. MNEs with this motive generally aim to take advantage of different factor endowments, cultures, economic systems and policies, and market structures by concentrating their production in a limited number of locations to serve multiple markets.

Two Types of Efficiency Seeking Investment 1) The first takes advantage of the differences in the availability and cost of a variety of factors in different countries. This explains why capital, technology and information intensive activities are concentrated in developed countries, while labour and natural resource intensive activities are concentrated in developing countries. (Example: the designing of computers in Silicon Valley; the production in East Asia; the products are sold all over the world. 2) The second kind of efficiency seeking investment takes place in countries with broadly similar economic structures. It is designed to take advantage of the economies of scales and scope, and of differences in consumer needs. (Example: car industry in Europe; a product can be produced for the whole market, but with different taste and requirement (modification of driving seat and air conditioning)).

Two Types of Efficiency Seeking Investment 1) The first takes advantage of the differences in the availability and cost of a variety of factors in different countries. This explains why capital, technology and information intensive activities are concentrated in developed countries, while labour and natural resource intensive activities are concentrated in developing countries. (Example: the designing of computers in Silicon Valley; the production in East Asia; the products are sold all over the world. 2) The second kind of efficiency seeking investment takes place in countries with broadly similar economic structures. It is designed to take advantage of the economies of scales and scope, and of differences in consumer needs. (Example: car industry in Europe; a product can be produced for the whole market, but with different taste and requirement (modification of driving seat and air conditioning)).

Two Types of Efficiency Seeking Investment Distinction between efficiency seeking investment and resources seeking: efficiency seeking: the manufacturing process is divided into several sections in different countries, seeking the best mix of production factors resources seeking: the production is mainly concentrated in one country, and the reason behind this investment is to utilise the cheap labour available in the host country, e. g. Nike

Two Types of Efficiency Seeking Investment Distinction between efficiency seeking investment and resources seeking: efficiency seeking: the manufacturing process is divided into several sections in different countries, seeking the best mix of production factors resources seeking: the production is mainly concentrated in one country, and the reason behind this investment is to utilise the cheap labour available in the host country, e. g. Nike

Strategic Asset Seeking Investment Aim: to attempt to acquire the assets of foreign firms so as to promote their long-term strategic objectives, especially advancing their international competitiveness. MNEs with this intention often establish global strategic alliances or acquire local firms. Example: Lenovo’s purchase of IBM’s PC business

Strategic Asset Seeking Investment Aim: to attempt to acquire the assets of foreign firms so as to promote their long-term strategic objectives, especially advancing their international competitiveness. MNEs with this intention often establish global strategic alliances or acquire local firms. Example: Lenovo’s purchase of IBM’s PC business

Other Motives for Engaging in IB 1) Escape Investments International investments are frequently made to escape restrictive legislation or macroorganisational policies by home governments. So escape investments are obviously most likely to originate from countries whose governments pursue strongly interventionist macroorganisational policies; and they tend to be concentrated in those sectors which are most regulated.

Other Motives for Engaging in IB 1) Escape Investments International investments are frequently made to escape restrictive legislation or macroorganisational policies by home governments. So escape investments are obviously most likely to originate from countries whose governments pursue strongly interventionist macroorganisational policies; and they tend to be concentrated in those sectors which are most regulated.

Other Motives for Engaging in IB Examples of escape investments: • Japanese banks that operate in Europe engage in a wider range of services for their customers than they are allowed to undertake in Japan • the shifting of its ‘cancer and immune system’ research of BASF, from Germany to the US; a way to deal with the legal and political challenges from the local ‘green’ movement • the investment by Israeli firms in EC before 1992 to by-pass the Arab boycott on products exported from Israel • MNEs’ investment in China – polluting heaven hypothesis

Other Motives for Engaging in IB Examples of escape investments: • Japanese banks that operate in Europe engage in a wider range of services for their customers than they are allowed to undertake in Japan • the shifting of its ‘cancer and immune system’ research of BASF, from Germany to the US; a way to deal with the legal and political challenges from the local ‘green’ movement • the investment by Israeli firms in EC before 1992 to by-pass the Arab boycott on products exported from Israel • MNEs’ investment in China – polluting heaven hypothesis

Other Motives for Engaging in IB Round tripping: another example of escape investment Many Chinese firms moved a large volume of capital from China. They then returned back as foreign investors, to be treated as ‘foreign’ in order to take advantage of the policy incentives given to foreign investment. This is called ‘round tripping’.

Other Motives for Engaging in IB Round tripping: another example of escape investment Many Chinese firms moved a large volume of capital from China. They then returned back as foreign investors, to be treated as ‘foreign’ in order to take advantage of the policy incentives given to foreign investment. This is called ‘round tripping’.

Other Motives for Engaging in IB 2) Support Investments • The purpose of these investments is to support the activities of the rest of the enterprise. These activities may incur costs but the rest of the same MNC can benefit enormously. • Usually, they are designed to promote exports, and to assist in the purchasing of foreign goods and services. • Most of such investment are trade-related, e. g. representative offices and trading branches.

Other Motives for Engaging in IB 2) Support Investments • The purpose of these investments is to support the activities of the rest of the enterprise. These activities may incur costs but the rest of the same MNC can benefit enormously. • Usually, they are designed to promote exports, and to assist in the purchasing of foreign goods and services. • Most of such investment are trade-related, e. g. representative offices and trading branches.

The internationalization process • • A firm’s international expansion occurs as a result of incremental decisions Johanson and Wiedersheim-Paul (1975) identified four successive stages in the firm’s international expansion: (1) (2) (3) (4) No regular export activities; Export activities via independent representatives or agents The establishment of an overseas subsidiary Overseas production and manufacturing units

The internationalization process • • A firm’s international expansion occurs as a result of incremental decisions Johanson and Wiedersheim-Paul (1975) identified four successive stages in the firm’s international expansion: (1) (2) (3) (4) No regular export activities; Export activities via independent representatives or agents The establishment of an overseas subsidiary Overseas production and manufacturing units

The Uppsala Model • Johanson and Vahlne (1977) formulated a ‘dynamic’ Uppsala Model • The Oppsala Model posits that firms proceed along the internationalization path in the form of logical steps, based on their gradual acquisition and use of information gathered from foreign markets and operations, which determines successive greater levels of market commitment to more international business activities.

The Uppsala Model • Johanson and Vahlne (1977) formulated a ‘dynamic’ Uppsala Model • The Oppsala Model posits that firms proceed along the internationalization path in the form of logical steps, based on their gradual acquisition and use of information gathered from foreign markets and operations, which determines successive greater levels of market commitment to more international business activities.

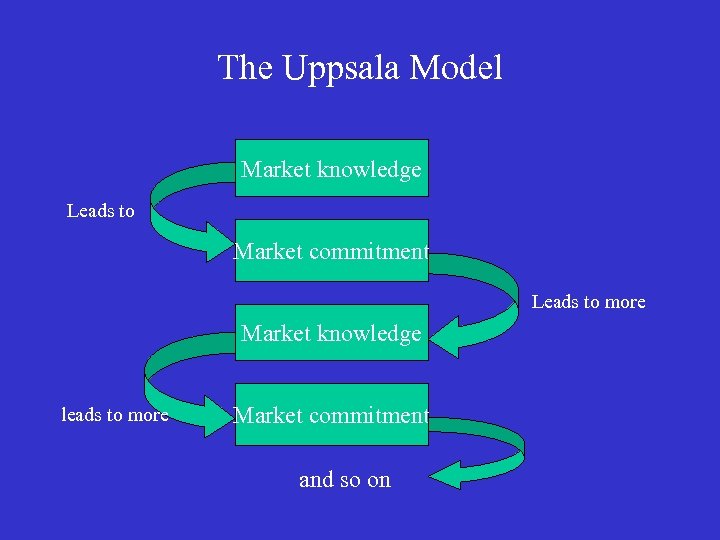

The Uppsala Model Market knowledge Leads to Market commitment Leads to more Market knowledge leads to more Market commitment and so on

The Uppsala Model Market knowledge Leads to Market commitment Leads to more Market knowledge leads to more Market commitment and so on

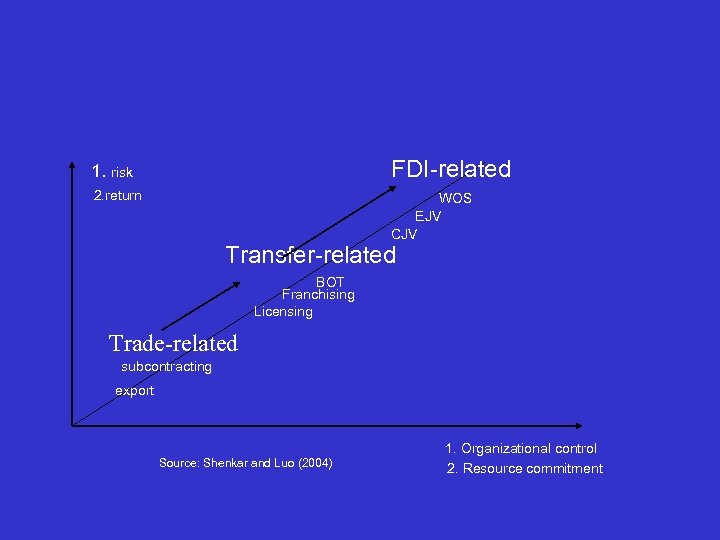

1. risk FDI-related 2. return WOS EJV CJV Transfer-related BOT Franchising Licensing Trade-related subcontracting export Source: Shenkar and Luo (2004) 1. Organizational control 2. Resource commitment

1. risk FDI-related 2. return WOS EJV CJV Transfer-related BOT Franchising Licensing Trade-related subcontracting export Source: Shenkar and Luo (2004) 1. Organizational control 2. Resource commitment

Limitations of the Uppsala Model (1) The model does not explain what triggers the first internationalization step (2) It does not explain the mechanism by which experiential knowledge of a foreign market affects commitment of resources to that market (Anderson and Gatignon, 1986)

Limitations of the Uppsala Model (1) The model does not explain what triggers the first internationalization step (2) It does not explain the mechanism by which experiential knowledge of a foreign market affects commitment of resources to that market (Anderson and Gatignon, 1986)

Limitations of the Uppsala Model (3) The basic assumption of the model is that lack of knowledge about foreign markets is a major obstacle to international operations – but what if the firm acquired knowledge through external recruitment rather than firm experiential knowledge? (4) The argument that MNEs enter countries that are culturally and geographically close to theirs before entering culturally and geographically distant countries does not always hold (example: Starbucks: its first international venture was in the Japanese market in 1995) (5) There are firms which do not follow the traditional internationalization process, but which are MNEs from the very start. These firms are called Born Global Firms.

Limitations of the Uppsala Model (3) The basic assumption of the model is that lack of knowledge about foreign markets is a major obstacle to international operations – but what if the firm acquired knowledge through external recruitment rather than firm experiential knowledge? (4) The argument that MNEs enter countries that are culturally and geographically close to theirs before entering culturally and geographically distant countries does not always hold (example: Starbucks: its first international venture was in the Japanese market in 1995) (5) There are firms which do not follow the traditional internationalization process, but which are MNEs from the very start. These firms are called Born Global Firms.

The Born Global firm • Born global firm is an business organization that from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries. • These firms view the world as their marketplace from the outset and see the domestic market as a support for their international business.

The Born Global firm • Born global firm is an business organization that from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries. • These firms view the world as their marketplace from the outset and see the domestic market as a support for their international business.

Characteristics of Born global firms • Born Global firms are generally small and medium hightech firms using well-known technology • Firms originating from small countries such as Nordic countries are more likely to adopt a Born Global strategy than firms from large countries such the US • A major characteristic of Born Global firms is the commitment of the manager or founder to internationalization. Born Global firms are managed or founded by people who have greater international exposure than managers of gradually internationalizing firms.

Characteristics of Born global firms • Born Global firms are generally small and medium hightech firms using well-known technology • Firms originating from small countries such as Nordic countries are more likely to adopt a Born Global strategy than firms from large countries such the US • A major characteristic of Born Global firms is the commitment of the manager or founder to internationalization. Born Global firms are managed or founded by people who have greater international exposure than managers of gradually internationalizing firms.

Activity Discussion questions: what are the motivations of the following FDI activities? • Taiwan Acer’s investment in the Silicon Valley, California (Acer is a giant computer manufacturer) • P & G has shifted some of its back-office accounting functions to the Philipines • Nanjing (China) Automobile Manufacturing Corporation’s acquisition of MG Rover • Chinese oil firms’ investment in Sudan and Nigeria • Hong Kong firms’ investment in the clothing industry of mainland China • Volkswagen’s investment in Shanghai, China 1. Japanese firms’ investment in British Pharmaceutical industry

Activity Discussion questions: what are the motivations of the following FDI activities? • Taiwan Acer’s investment in the Silicon Valley, California (Acer is a giant computer manufacturer) • P & G has shifted some of its back-office accounting functions to the Philipines • Nanjing (China) Automobile Manufacturing Corporation’s acquisition of MG Rover • Chinese oil firms’ investment in Sudan and Nigeria • Hong Kong firms’ investment in the clothing industry of mainland China • Volkswagen’s investment in Shanghai, China 1. Japanese firms’ investment in British Pharmaceutical industry

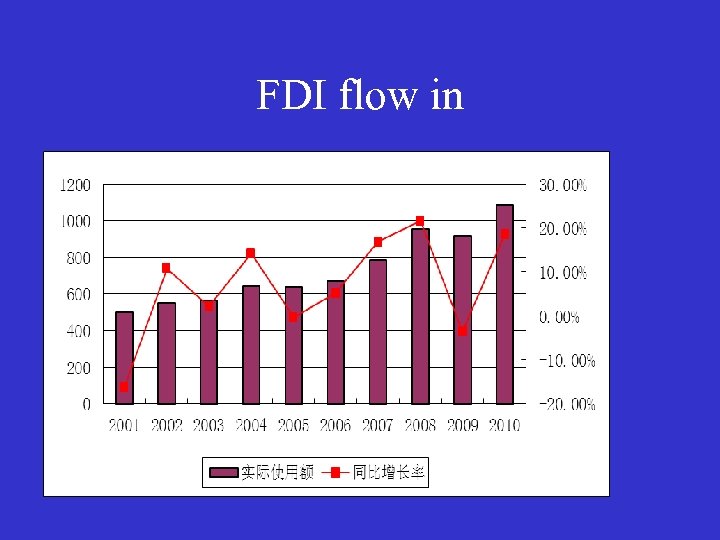

FDI flow in

FDI flow in

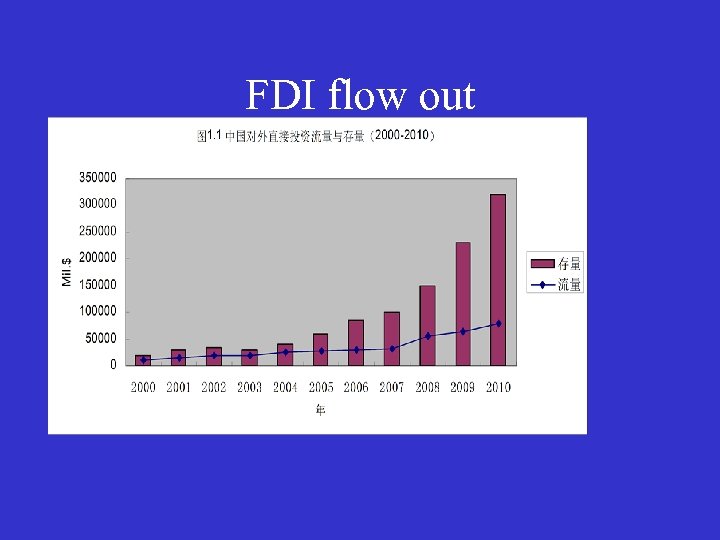

FDI flow out

FDI flow out

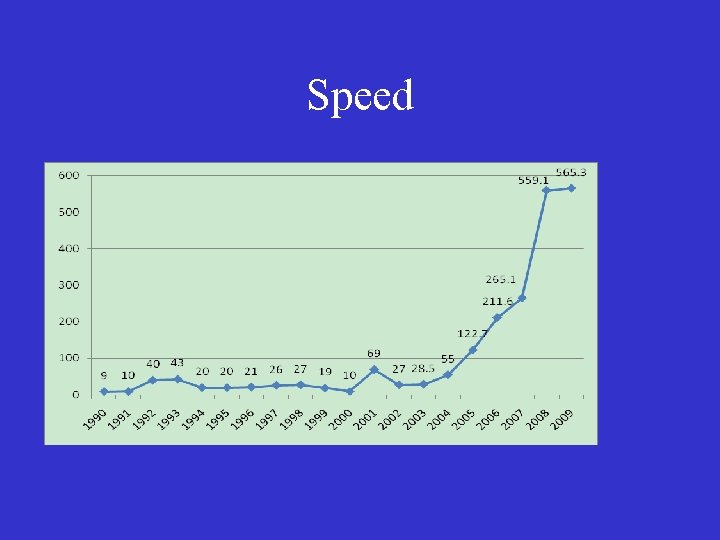

Speed

Speed

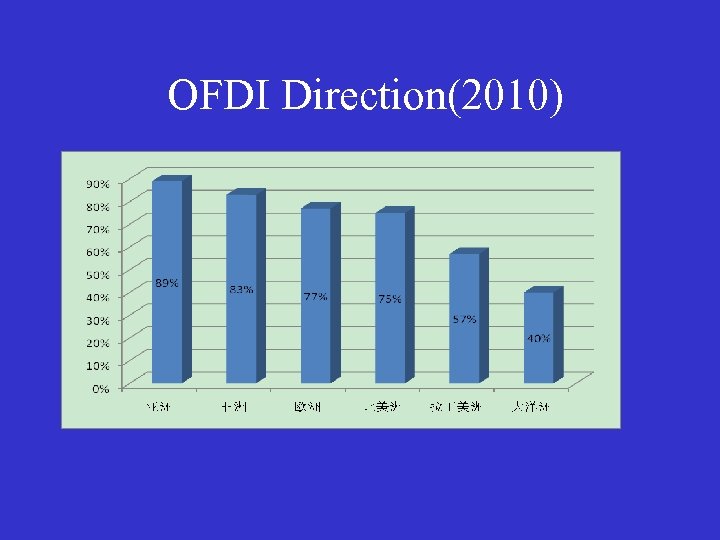

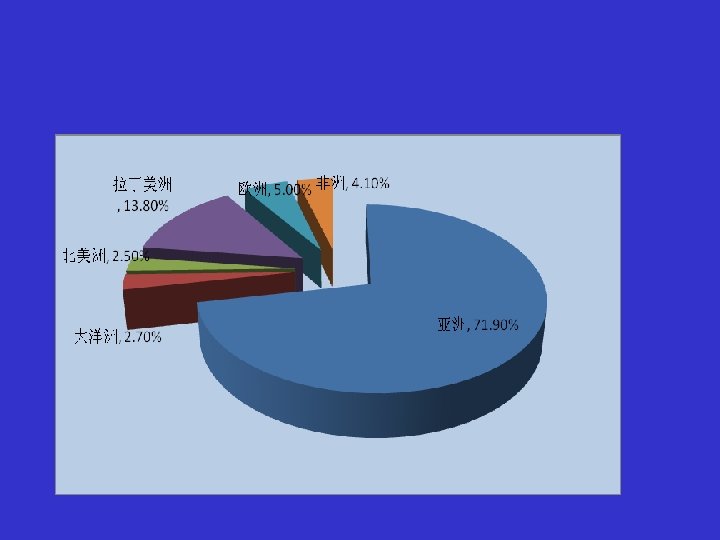

OFDI Direction(2010)

OFDI Direction(2010)

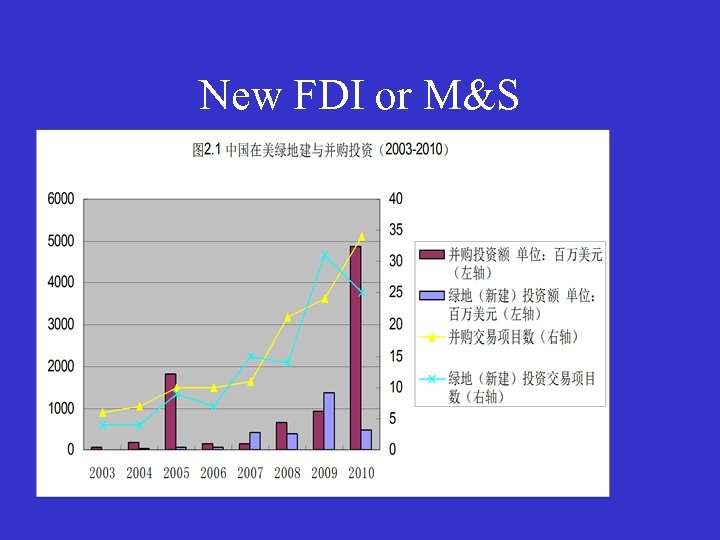

New FDI or M&S

New FDI or M&S

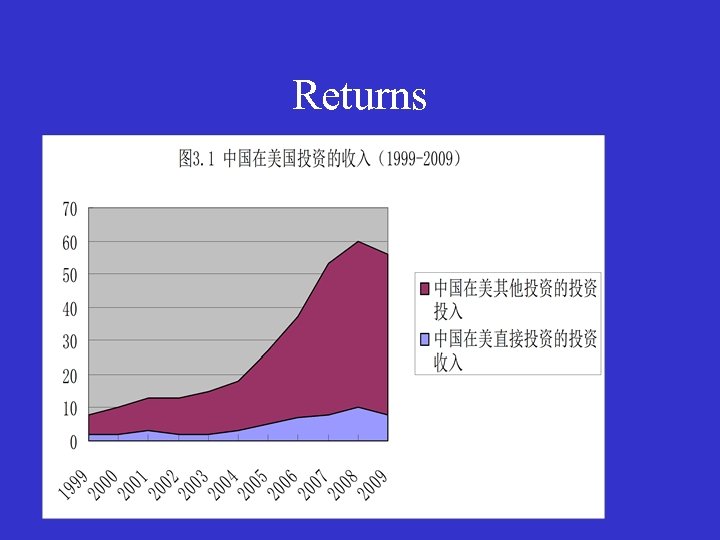

Returns

Returns

Question 1. Does China’s FDI in US follow the Uppsala model? 2. Your comments on entry mode of China’s FDI to US ? 2. Opportunity and Challenge?

Question 1. Does China’s FDI in US follow the Uppsala model? 2. Your comments on entry mode of China’s FDI to US ? 2. Opportunity and Challenge?

Reading Axinn, N. C. and Matthyssens, P. (2002) “Limits of Internationalization Theories in an Unlimited World, ” International Marketing Review, 19(5): 436 -449. Cazurra, C. A. , Maloney, M. and Manrakhan, S. (2007) “Causes of the Difficulties in Internationalization, ” Journal of International Business Studies, 38: 709 -725. Child, John and David Faulkner (1998) Strategies of Cooperation, Oxford University Press. Dunning J. (1992) Multinational Enterprises and the Global Economy, Addison Wesley. Ch 3 ‘the motives foreign production’. Li, L. , Li, D. and Dalgic, T. (2004) “Internationalization Process of Small and Medium-sized Enterprises: Towards a Hybrid Model of Experiential Learning and Planning, ” Management International Review, 44(1): 93 -116. Lu J. W. , Beamish P. W. (2004) “International Diversification and Firm. Performance: The S-Curve Hypothesis, ” Academy of Management Journal, 47(4), 598 -609. Mc. Dougall, P. , Shane, S. , and Oviatt, B. M. (1994) Explaining the Format of International New Ventures: the Limits of Theories from International Business Research, Journal of Business Venturing, 9(6): 469 -87.

Reading Axinn, N. C. and Matthyssens, P. (2002) “Limits of Internationalization Theories in an Unlimited World, ” International Marketing Review, 19(5): 436 -449. Cazurra, C. A. , Maloney, M. and Manrakhan, S. (2007) “Causes of the Difficulties in Internationalization, ” Journal of International Business Studies, 38: 709 -725. Child, John and David Faulkner (1998) Strategies of Cooperation, Oxford University Press. Dunning J. (1992) Multinational Enterprises and the Global Economy, Addison Wesley. Ch 3 ‘the motives foreign production’. Li, L. , Li, D. and Dalgic, T. (2004) “Internationalization Process of Small and Medium-sized Enterprises: Towards a Hybrid Model of Experiential Learning and Planning, ” Management International Review, 44(1): 93 -116. Lu J. W. , Beamish P. W. (2004) “International Diversification and Firm. Performance: The S-Curve Hypothesis, ” Academy of Management Journal, 47(4), 598 -609. Mc. Dougall, P. , Shane, S. , and Oviatt, B. M. (1994) Explaining the Format of International New Ventures: the Limits of Theories from International Business Research, Journal of Business Venturing, 9(6): 469 -87.