64630ece82bfb25dbbb150b0ac3b84a3.ppt

- Количество слайдов: 47

STUDY CASE INVESTMENT OLIVERA ANDULAJEVIC

STUDY CASE INVESTMENT OLIVERA ANDULAJEVIC

Agenda 2 Problem & solution Executive summary Brief history Company analysis Alternatives Implementation

Agenda 2 Problem & solution Executive summary Brief history Company analysis Alternatives Implementation

Problem 3 Lack of corporate standards: project planning and systems develop. Decentralized project and portfolio management Decentralized widely distributed systems Four distinct cultures tailored to each line of the business No proven pathways for prioritization of IT projects

Problem 3 Lack of corporate standards: project planning and systems develop. Decentralized project and portfolio management Decentralized widely distributed systems Four distinct cultures tailored to each line of the business No proven pathways for prioritization of IT projects

Solution 4 • Define the enterprise data architecture • Implement a data governance process • Identify the critical data as sets • Collect and document the organization metadata • Assess the quality of source data and recommend corrective actions • Develop and build out the EDW solution architecture and infrastructure • Implement analytic tools and approaches to analyze the data Strategy & Operations Technology SAP IBM ORACLE Power BI • Restructure organization • Implementation professional development initiatives • Educational training Human Capital

Solution 4 • Define the enterprise data architecture • Implement a data governance process • Identify the critical data as sets • Collect and document the organization metadata • Assess the quality of source data and recommend corrective actions • Develop and build out the EDW solution architecture and infrastructure • Implement analytic tools and approaches to analyze the data Strategy & Operations Technology SAP IBM ORACLE Power BI • Restructure organization • Implementation professional development initiatives • Educational training Human Capital

5 BRIEF HISTORY

5 BRIEF HISTORY

RBC and competition 6

RBC and competition 6

History RBC 7 Royal Bank of Canada (RBC) was Canada’s largest bank. Royal Bank was originally founded in 1864, in Halifax, Nova Scotia, as the Merchants Bank. The brand name “RBC Financial Group” was introduced in 2001 to reflect the diverse range of businesses that were part of the bank.

History RBC 7 Royal Bank of Canada (RBC) was Canada’s largest bank. Royal Bank was originally founded in 1864, in Halifax, Nova Scotia, as the Merchants Bank. The brand name “RBC Financial Group” was introduced in 2001 to reflect the diverse range of businesses that were part of the bank.

Business Key Points - Strategic Goals 8 Canada: To be the undisputed leader in financial services International: To be a leading financial services partner valued for our expertise US: To be the preferred partner to corporate, institutional and high net worth clients and their businesses (18%)

Business Key Points - Strategic Goals 8 Canada: To be the undisputed leader in financial services International: To be a leading financial services partner valued for our expertise US: To be the preferred partner to corporate, institutional and high net worth clients and their businesses (18%)

Key Challenge 9 STRONG FUNDAMENTALS SUPERIOR CLIENT EXPERIENCE NORTH AMERICAN EXPANSION CROSSENTERPRISE LEVERAGE

Key Challenge 9 STRONG FUNDAMENTALS SUPERIOR CLIENT EXPERIENCE NORTH AMERICAN EXPANSION CROSSENTERPRISE LEVERAGE

Key Success Factors RBC 10 CUSTOMERS KEY SUCCESS FACTORS UX experience “everything the client sees, hears, feels, touches and does when interacting with us” Improved by building deeper client relationships through creative application of information technology: ü New digital imaging systems üThe RBC e. Learning Reference; üClient. Link, ; üFXDirect North American expansion The bank had recently made 12 U. S. acquisitions totaling approximately US$5. 5 billion, including Centura Banks (U. S. banking), Liberty Life Insurance (U. S. life insurance) and Dain Rauscher (U. S. brokerage). Cross-enterprise leverage Sharing best practices across business units, and integrating services where possible Strong fundamentals Priorities to improve bottom-line financial performance: Øshare price valuation Øearnings growth Ørevenue growth - lower than targeted

Key Success Factors RBC 10 CUSTOMERS KEY SUCCESS FACTORS UX experience “everything the client sees, hears, feels, touches and does when interacting with us” Improved by building deeper client relationships through creative application of information technology: ü New digital imaging systems üThe RBC e. Learning Reference; üClient. Link, ; üFXDirect North American expansion The bank had recently made 12 U. S. acquisitions totaling approximately US$5. 5 billion, including Centura Banks (U. S. banking), Liberty Life Insurance (U. S. life insurance) and Dain Rauscher (U. S. brokerage). Cross-enterprise leverage Sharing best practices across business units, and integrating services where possible Strong fundamentals Priorities to improve bottom-line financial performance: Øshare price valuation Øearnings growth Ørevenue growth - lower than targeted

11 RBCI ANALYSIS

11 RBCI ANALYSIS

RBC’s Investments 12 U. S. Wealth Management (through Dain Rauscher, Inc. ) Canadian Wealth Management Organization (investment brokerage unit) Global Asset Management (mutual fund management business unit) Global Private Banking (international banking unit)

RBC’s Investments 12 U. S. Wealth Management (through Dain Rauscher, Inc. ) Canadian Wealth Management Organization (investment brokerage unit) Global Asset Management (mutual fund management business unit) Global Private Banking (international banking unit)

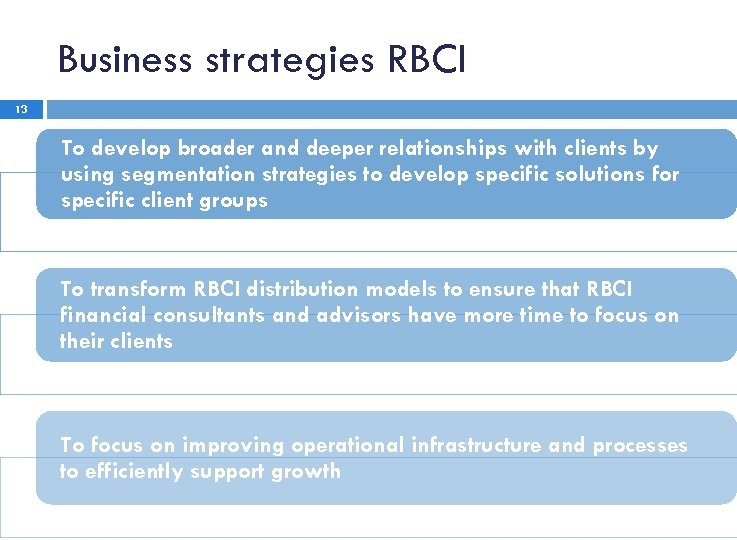

Business strategies RBCI 13 To develop broader and deeper relationships with clients by using segmentation strategies to develop specific solutions for specific client groups To transform RBCI distribution models to ensure that RBCI financial consultants and advisors have more time to focus on their clients To focus on improving operational infrastructure and processes to efficiently support growth

Business strategies RBCI 13 To develop broader and deeper relationships with clients by using segmentation strategies to develop specific solutions for specific client groups To transform RBCI distribution models to ensure that RBCI financial consultants and advisors have more time to focus on their clients To focus on improving operational infrastructure and processes to efficiently support growth

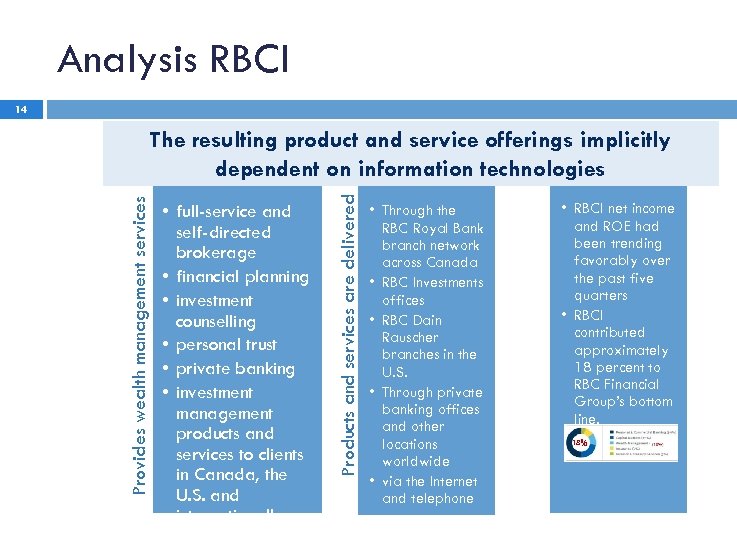

Analysis RBCI 14 • full-service and self-directed brokerage • financial planning • investment counselling • personal trust • private banking • investment management products and services to clients in Canada, the U. S. and internationally Products and services are delivered Provides wealth management services The resulting product and service offerings implicitly dependent on information technologies • Through the RBC Royal Bank branch network across Canada • RBC Investments offices • RBC Dain Rauscher branches in the U. S. • Through private banking offices and other locations worldwide • via the Internet and telephone • RBCI net income and ROE had been trending favorably over the past five quarters • RBCI contributed approximately 18 percent to RBC Financial Group’s bottom line. 18%

Analysis RBCI 14 • full-service and self-directed brokerage • financial planning • investment counselling • personal trust • private banking • investment management products and services to clients in Canada, the U. S. and internationally Products and services are delivered Provides wealth management services The resulting product and service offerings implicitly dependent on information technologies • Through the RBC Royal Bank branch network across Canada • RBC Investments offices • RBC Dain Rauscher branches in the U. S. • Through private banking offices and other locations worldwide • via the Internet and telephone • RBCI net income and ROE had been trending favorably over the past five quarters • RBCI contributed approximately 18 percent to RBC Financial Group’s bottom line. 18%

SWOT 15 External Internal Favourable Unfavourable Strengths • Strong reputation • The bank’s presence in Canada, US • Competent people, stable workforce, institutional knowledge • People want to be the best subject matter experts in their areas Weaknesses • Decentralized project and portfolio management • Over 300 disparate systems running on various platforms and operating systems • No existing corporate standards for project planning or systems development • Four distinct cultures tailored to each line of the business • No proven pathways for prioritization of IT projects or allocation of finances to IT projects • An internal company weakness Opportunities • Strategic plan • Consistent approach to evaluating performance and decision making (everyone on the same page; comprehensive, global set of goals) Threats • Trust in banks has decreased due to financial losses suffered by investors, who may be more inclined to invest elsewhere. • Financial losses affecting banks and investors on a global scale have resulted in less credit being available to customers • Competition

SWOT 15 External Internal Favourable Unfavourable Strengths • Strong reputation • The bank’s presence in Canada, US • Competent people, stable workforce, institutional knowledge • People want to be the best subject matter experts in their areas Weaknesses • Decentralized project and portfolio management • Over 300 disparate systems running on various platforms and operating systems • No existing corporate standards for project planning or systems development • Four distinct cultures tailored to each line of the business • No proven pathways for prioritization of IT projects or allocation of finances to IT projects • An internal company weakness Opportunities • Strategic plan • Consistent approach to evaluating performance and decision making (everyone on the same page; comprehensive, global set of goals) Threats • Trust in banks has decreased due to financial losses suffered by investors, who may be more inclined to invest elsewhere. • Financial losses affecting banks and investors on a global scale have resulted in less credit being available to customers • Competition

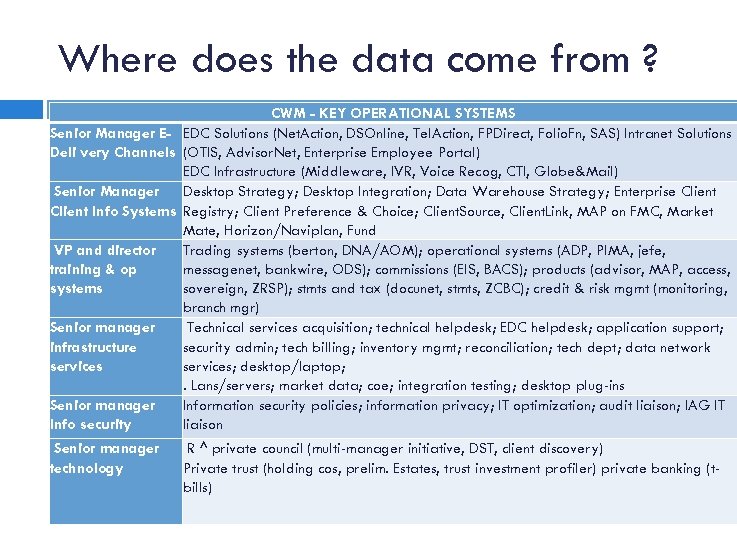

Where does the data come from ? CWM - KEY OPERATIONAL SYSTEMS Senior Manager E- EDC Solutions (Net. Action, DSOnline, Tel. Action, FPDirect, Folio. Fn, SAS) Intranet Solutions Deli very Channels (OTIS, Advisor. Net, Enterprise Employee Portal) EDC Infrastructure (Middleware, IVR, Voice Recog, CTI, Globe&Mail) Senior Manager Desktop Strategy; Desktop Integration; Data Warehouse Strategy; Enterprise Client Info Systems Registry; Client Preference & Choice; Client. Source, Client. Link, MAP on FMC, Market Mate, Horizon/Naviplan, Fund VP and director Trading systems (berton, DNA/AOM); operational systems (ADP, PIMA, jefe, training & op messagenet, bankwire, ODS); commissions (EIS, BACS); products (advisor, MAP, access, systems sovereign, ZRSP); stmts and tax (docunet, stmts, ZCBC); credit & risk mgmt (monitoring, branch mgr) Senior manager Technical services acquisition; technical helpdesk; EDC helpdesk; application support; infrastructure security admin; tech billing; inventory mgmt; reconciliation; tech dept; data network services; desktop/laptop; . Lans/servers; market data; coe; integration testing; desktop plug-ins Senior manager Information security policies; information privacy; IT optimization; audit liaison; IAG IT Info security liaison Senior manager technology R ^ private council (multi-manager initiative, DST, client discovery) Private trust (holding cos, prelim. Estates, trust investment profiler) private banking (tbills)

Where does the data come from ? CWM - KEY OPERATIONAL SYSTEMS Senior Manager E- EDC Solutions (Net. Action, DSOnline, Tel. Action, FPDirect, Folio. Fn, SAS) Intranet Solutions Deli very Channels (OTIS, Advisor. Net, Enterprise Employee Portal) EDC Infrastructure (Middleware, IVR, Voice Recog, CTI, Globe&Mail) Senior Manager Desktop Strategy; Desktop Integration; Data Warehouse Strategy; Enterprise Client Info Systems Registry; Client Preference & Choice; Client. Source, Client. Link, MAP on FMC, Market Mate, Horizon/Naviplan, Fund VP and director Trading systems (berton, DNA/AOM); operational systems (ADP, PIMA, jefe, training & op messagenet, bankwire, ODS); commissions (EIS, BACS); products (advisor, MAP, access, systems sovereign, ZRSP); stmts and tax (docunet, stmts, ZCBC); credit & risk mgmt (monitoring, branch mgr) Senior manager Technical services acquisition; technical helpdesk; EDC helpdesk; application support; infrastructure security admin; tech billing; inventory mgmt; reconciliation; tech dept; data network services; desktop/laptop; . Lans/servers; market data; coe; integration testing; desktop plug-ins Senior manager Information security policies; information privacy; IT optimization; audit liaison; IAG IT Info security liaison Senior manager technology R ^ private council (multi-manager initiative, DST, client discovery) Private trust (holding cos, prelim. Estates, trust investment profiler) private banking (tbills)

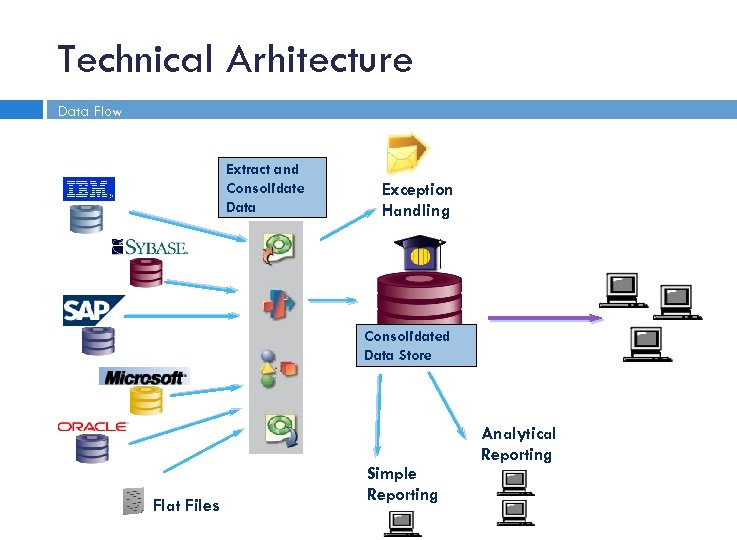

Technical Arhitecture Data Flow Extract and Consolidate Data Exception Handling Consolidated Data Store Flat Files Simple Reporting Analytical Reporting

Technical Arhitecture Data Flow Extract and Consolidate Data Exception Handling Consolidated Data Store Flat Files Simple Reporting Analytical Reporting

Organizational Chart 18

Organizational Chart 18

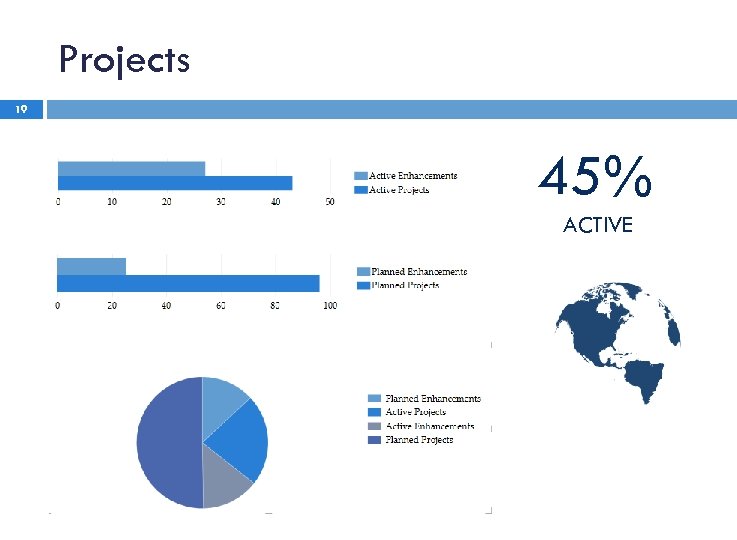

Projects 19 45% ACTIVE

Projects 19 45% ACTIVE

20 ALTERNATIVES (OPTIONS)

20 ALTERNATIVES (OPTIONS)

Recommendations 21 Solution #1 • Implementation BI Tools & Packaged BI Applications Solution #2 • Enterprise Data Warehouse environment and supporting ecosystem

Recommendations 21 Solution #1 • Implementation BI Tools & Packaged BI Applications Solution #2 • Enterprise Data Warehouse environment and supporting ecosystem

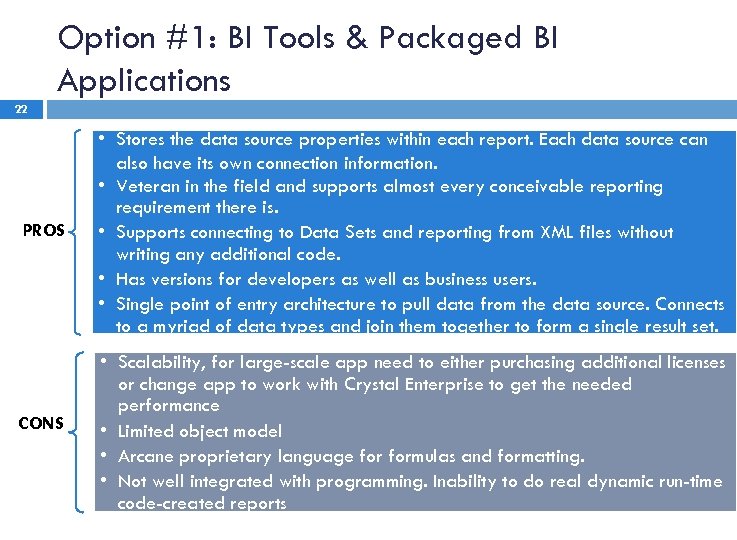

Option #1: BI Tools & Packaged BI Applications 22 PROS • Stores the data source properties within each report. Each data source can also have its own connection information. • Veteran in the field and supports almost every conceivable reporting requirement there is. • Supports connecting to Data Sets and reporting from XML files without writing any additional code. • Has versions for developers as well as business users. • Single point of entry architecture to pull data from the data source. Connects to a myriad of data types and join them together to form a single result set. CONS • Scalability, for large-scale app need to either purchasing additional licenses or change app to work with Crystal Enterprise to get the needed performance • Limited object model • Arcane proprietary language formulas and formatting. • Not well integrated with programming. Inability to do real dynamic run-time code-created reports

Option #1: BI Tools & Packaged BI Applications 22 PROS • Stores the data source properties within each report. Each data source can also have its own connection information. • Veteran in the field and supports almost every conceivable reporting requirement there is. • Supports connecting to Data Sets and reporting from XML files without writing any additional code. • Has versions for developers as well as business users. • Single point of entry architecture to pull data from the data source. Connects to a myriad of data types and join them together to form a single result set. CONS • Scalability, for large-scale app need to either purchasing additional licenses or change app to work with Crystal Enterprise to get the needed performance • Limited object model • Arcane proprietary language formulas and formatting. • Not well integrated with programming. Inability to do real dynamic run-time code-created reports

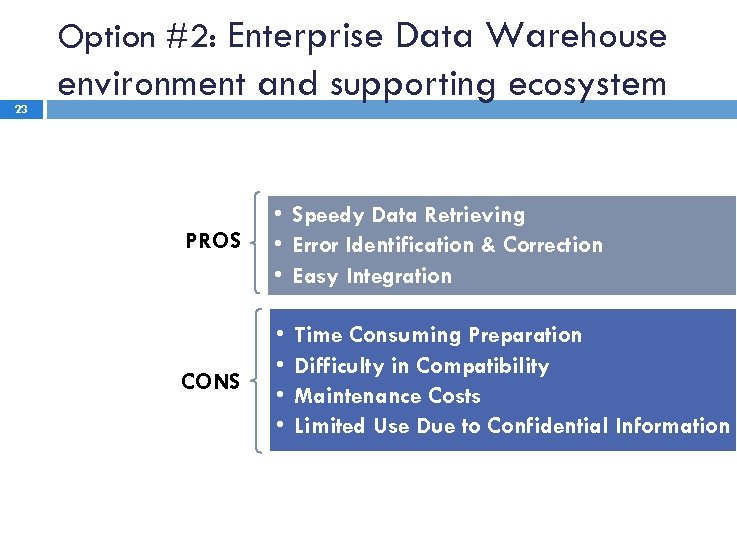

Option #2: Enterprise Data Warehouse 23 environment and supporting ecosystem PROS • Speedy Data Retrieving • Error Identification & Correction • Easy Integration CONS • • Time Consuming Preparation Difficulty in Compatibility Maintenance Costs Limited Use Due to Confidential Information

Option #2: Enterprise Data Warehouse 23 environment and supporting ecosystem PROS • Speedy Data Retrieving • Error Identification & Correction • Easy Integration CONS • • Time Consuming Preparation Difficulty in Compatibility Maintenance Costs Limited Use Due to Confidential Information

24 IMPLEMENTATION

24 IMPLEMENTATION

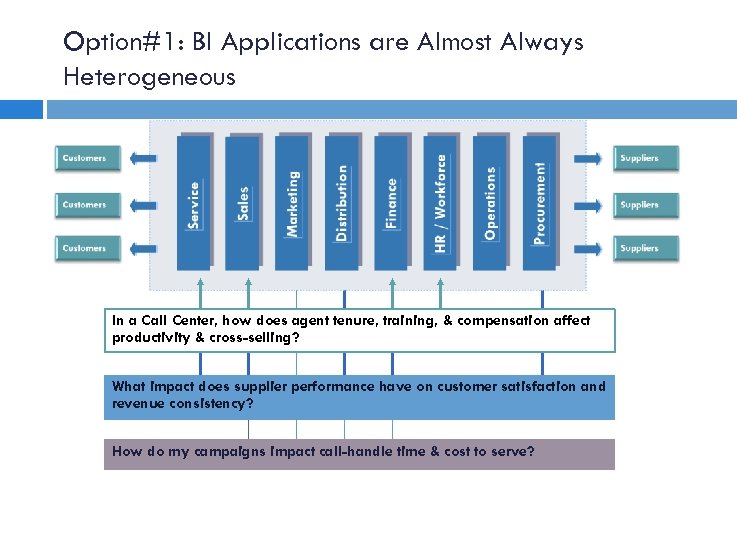

Option#1: BI Applications are Almost Always Heterogeneous In a Call Center, how does agent tenure, training, & compensation affect productivity & cross-selling? What impact does supplier performance have on customer satisfaction and revenue consistency? How do my campaigns impact call-handle time & cost to serve?

Option#1: BI Applications are Almost Always Heterogeneous In a Call Center, how does agent tenure, training, & compensation affect productivity & cross-selling? What impact does supplier performance have on customer satisfaction and revenue consistency? How do my campaigns impact call-handle time & cost to serve?

BI Tools & Packaged BI Applications Business Intelligence Applications Sales Analytics Interactive Dashboards Service Analytics Proactive Detection & Alerts Marketing Analytics Ad-Hoc Analytics Supply Chain Analytics Finance Analytics Workforce Analytics Mobile Analytics Predictive Analytics Intelligent Customer Interaction Pre. Built Enterprise Business Model Intelligence Platform (EE) Enterprise Business Intelligence Platform Enterprise Data Warehouse (EPM and/or SBA) ETL & Business Adapters Sales & Mktg Fin/HR Service SCM Operational Systems IVR Web • Comprehensive suite of prebuilt analytic applications • For Siebel, SAP, People. Soft, Oracle, and other sources • Based on industry and analytic best practices • Enable rapid deployment, low TCO, & assured Enterprise Business business value Help Desk Customer Interaction Systems Existing Data Warehouse & Data Mart Sources • Next-generation, scalable enterprise BI platform • Relevant and actionable insight for all users • Complete, real-time intelligence across enterprise sources • One common, fullyintegrated modern web architecture

BI Tools & Packaged BI Applications Business Intelligence Applications Sales Analytics Interactive Dashboards Service Analytics Proactive Detection & Alerts Marketing Analytics Ad-Hoc Analytics Supply Chain Analytics Finance Analytics Workforce Analytics Mobile Analytics Predictive Analytics Intelligent Customer Interaction Pre. Built Enterprise Business Model Intelligence Platform (EE) Enterprise Business Intelligence Platform Enterprise Data Warehouse (EPM and/or SBA) ETL & Business Adapters Sales & Mktg Fin/HR Service SCM Operational Systems IVR Web • Comprehensive suite of prebuilt analytic applications • For Siebel, SAP, People. Soft, Oracle, and other sources • Based on industry and analytic best practices • Enable rapid deployment, low TCO, & assured Enterprise Business business value Help Desk Customer Interaction Systems Existing Data Warehouse & Data Mart Sources • Next-generation, scalable enterprise BI platform • Relevant and actionable insight for all users • Complete, real-time intelligence across enterprise sources • One common, fullyintegrated modern web architecture

Benefit from BI Applications while maintaining single BI architecture Build from Scratch with Traditional BI Tools BI Applications Training & Roll-out Define Metrics & Dashboards DW Design Back-end ETL and Mapping ü Faster deployment ü Lower TCO ü Assured business value Training & Rollout Specific Metrics & Dashboards DW Design Mod Pre-built ETL Tailoring Quarters or Years Weeks or months Role-based dashboards and alerts Thousands of pre-defined metrics Prebuilt DW design Adaptable to your enterprise DW Prebuilt ETL Business Adapters for Oracle, SAP, others

Benefit from BI Applications while maintaining single BI architecture Build from Scratch with Traditional BI Tools BI Applications Training & Roll-out Define Metrics & Dashboards DW Design Back-end ETL and Mapping ü Faster deployment ü Lower TCO ü Assured business value Training & Rollout Specific Metrics & Dashboards DW Design Mod Pre-built ETL Tailoring Quarters or Years Weeks or months Role-based dashboards and alerts Thousands of pre-defined metrics Prebuilt DW design Adaptable to your enterprise DW Prebuilt ETL Business Adapters for Oracle, SAP, others

Current BI BI and Hadoop Extensive processes and costs: § Data Analyses § Data Cleansing § Entity Relationship Modeling § Dimensional Modeling § Database Design & Implementation § Database Population through ETL/ELT § Downstream Applications linkage Metadata Source § Data Maintaining the processes Cloud Analytical Database Data Marts Analytical Database

Current BI BI and Hadoop Extensive processes and costs: § Data Analyses § Data Cleansing § Entity Relationship Modeling § Dimensional Modeling § Database Design & Implementation § Database Population through ETL/ELT § Downstream Applications linkage Metadata Source § Data Maintaining the processes Cloud Analytical Database Data Marts Analytical Database

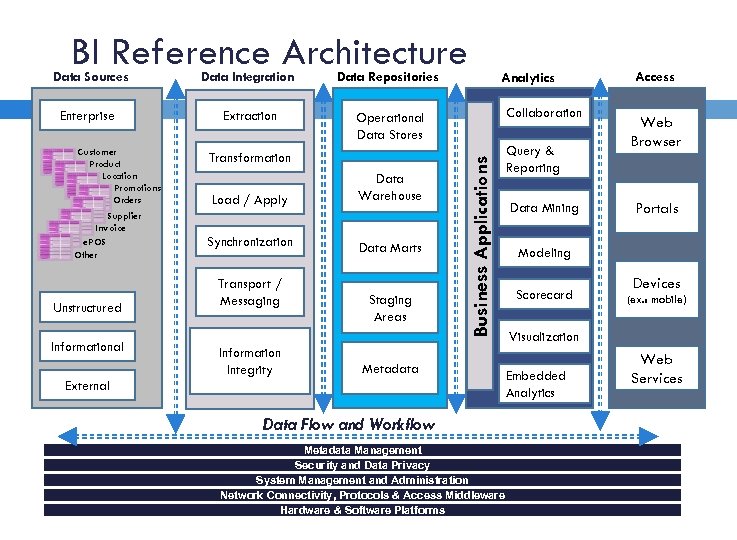

BI Reference Architecture Data Integration Data Repositories Enterprise Extraction Operational Data Stores Customer Product Location Promotions Orders Supplier Invoice e. POS Other Unstructured Informational Transformation Load / Apply Data Warehouse Synchronization Data Marts Transport / Messaging Information Integrity Staging Areas Analytics Collaboration Business Applications Data Sources Metadata External Data Flow and Workflow Metadata Management Security and Data Privacy System Management and Administration Network Connectivity, Protocols & Access Middleware Hardware & Software Platforms Query & Reporting Data Mining Access Web Browser Portals Modeling Scorecard Devices (ex. : mobile) Visualization Embedded Analytics Web Services

BI Reference Architecture Data Integration Data Repositories Enterprise Extraction Operational Data Stores Customer Product Location Promotions Orders Supplier Invoice e. POS Other Unstructured Informational Transformation Load / Apply Data Warehouse Synchronization Data Marts Transport / Messaging Information Integrity Staging Areas Analytics Collaboration Business Applications Data Sources Metadata External Data Flow and Workflow Metadata Management Security and Data Privacy System Management and Administration Network Connectivity, Protocols & Access Middleware Hardware & Software Platforms Query & Reporting Data Mining Access Web Browser Portals Modeling Scorecard Devices (ex. : mobile) Visualization Embedded Analytics Web Services

What bankers need from their technology investments Alignment Single view of sales, customer service and data to make datadriven decisions, fast. 30 Agility People get the information they need when and how they need it to react in a rapidly, changing environment Value at every step Single platform enables banks to start anywhere and build value by expanding department by department to transform other areas of business.

What bankers need from their technology investments Alignment Single view of sales, customer service and data to make datadriven decisions, fast. 30 Agility People get the information they need when and how they need it to react in a rapidly, changing environment Value at every step Single platform enables banks to start anywhere and build value by expanding department by department to transform other areas of business.

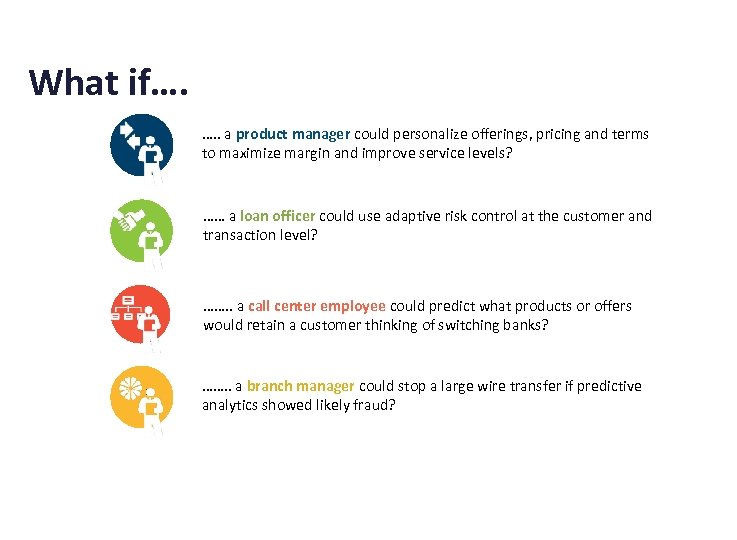

What if…. …. . a product manager could personalize offerings, pricing and terms to maximize margin and improve service levels? …… a loan officer could use adaptive risk control at the customer and transaction level? ……. . a call center employee could predict what products or offers would retain a customer thinking of switching banks? ……. . a branch manager could stop a large wire transfer if predictive analytics showed likely fraud?

What if…. …. . a product manager could personalize offerings, pricing and terms to maximize margin and improve service levels? …… a loan officer could use adaptive risk control at the customer and transaction level? ……. . a call center employee could predict what products or offers would retain a customer thinking of switching banks? ……. . a branch manager could stop a large wire transfer if predictive analytics showed likely fraud?

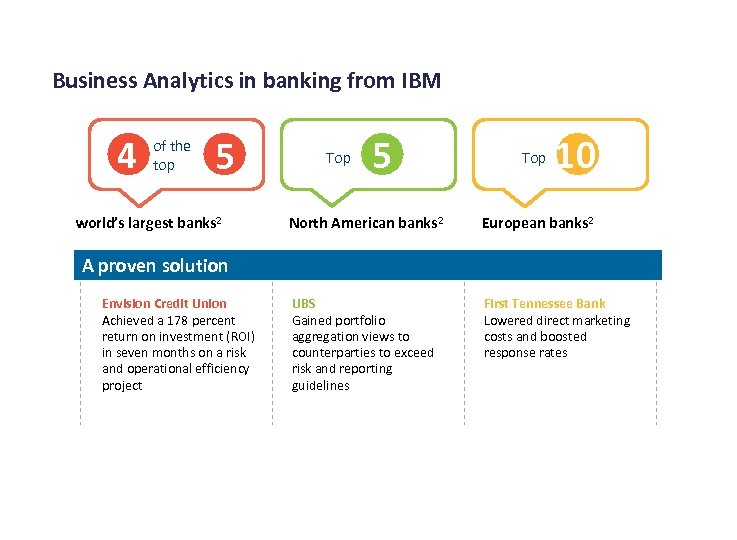

Business Analytics in banking from IBM 4 of the top 5 world’s largest banks 2 Top 5 Top 10 North American banks 2 European banks 2 UBS Gained portfolio aggregation views to counterparties to exceed risk and reporting guidelines First Tennessee Bank Lowered direct marketing costs and boosted response rates A proven solution Envision Credit Union Achieved a 178 percent return on investment (ROI) in seven months on a risk and operational efficiency project

Business Analytics in banking from IBM 4 of the top 5 world’s largest banks 2 Top 5 Top 10 North American banks 2 European banks 2 UBS Gained portfolio aggregation views to counterparties to exceed risk and reporting guidelines First Tennessee Bank Lowered direct marketing costs and boosted response rates A proven solution Envision Credit Union Achieved a 178 percent return on investment (ROI) in seven months on a risk and operational efficiency project

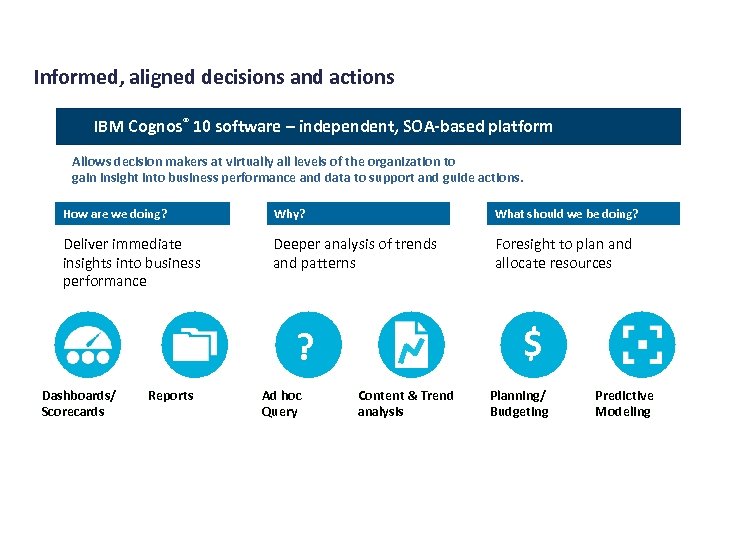

Informed, aligned decisions and actions IBM Cognos® 10 software – independent, SOA-based platform Allows decision makers at virtually all levels of the organization to gain insight into business performance and data to support and guide actions. How are we doing? Why? What should we be doing? Deliver immediate insights into business performance Deeper analysis of trends and patterns Foresight to plan and allocate resources $ ? Dashboards/ Scorecards Reports Ad hoc Query Content & Trend analysis Planning/ Budgeting Predictive Modeling

Informed, aligned decisions and actions IBM Cognos® 10 software – independent, SOA-based platform Allows decision makers at virtually all levels of the organization to gain insight into business performance and data to support and guide actions. How are we doing? Why? What should we be doing? Deliver immediate insights into business performance Deeper analysis of trends and patterns Foresight to plan and allocate resources $ ? Dashboards/ Scorecards Reports Ad hoc Query Content & Trend analysis Planning/ Budgeting Predictive Modeling

IBM Business Analytics Deliver insights that help drive better business performance Operational efficiency Integrated risk management Customer care and insight $ Payments and securities

IBM Business Analytics Deliver insights that help drive better business performance Operational efficiency Integrated risk management Customer care and insight $ Payments and securities

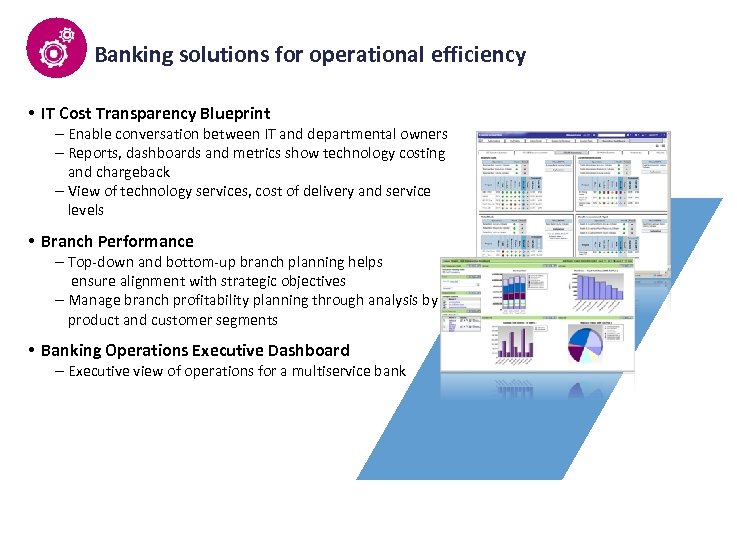

Banking solutions for operational efficiency • IT Cost Transparency Blueprint – Enable conversation between IT and departmental owners – Reports, dashboards and metrics show technology costing and chargeback – View of technology services, cost of delivery and service levels • Branch Performance – Top-down and bottom-up branch planning helps ensure alignment with strategic objectives – Manage branch profitability planning through analysis by product and customer segments • Banking Operations Executive Dashboard – Executive view of operations for a multiservice bank

Banking solutions for operational efficiency • IT Cost Transparency Blueprint – Enable conversation between IT and departmental owners – Reports, dashboards and metrics show technology costing and chargeback – View of technology services, cost of delivery and service levels • Branch Performance – Top-down and bottom-up branch planning helps ensure alignment with strategic objectives – Manage branch profitability planning through analysis by product and customer segments • Banking Operations Executive Dashboard – Executive view of operations for a multiservice bank

Option #2: Implementation EDW 36 Define the enterprise data architecture Implement a data governance process Identify the critical data assets Collect and document the organization metadata Assess the quality of source data and recommend corrective actions Develop and build out the EDW solution architecture and infrastructure Implement analytic tools and approaches to analyze the data

Option #2: Implementation EDW 36 Define the enterprise data architecture Implement a data governance process Identify the critical data assets Collect and document the organization metadata Assess the quality of source data and recommend corrective actions Develop and build out the EDW solution architecture and infrastructure Implement analytic tools and approaches to analyze the data

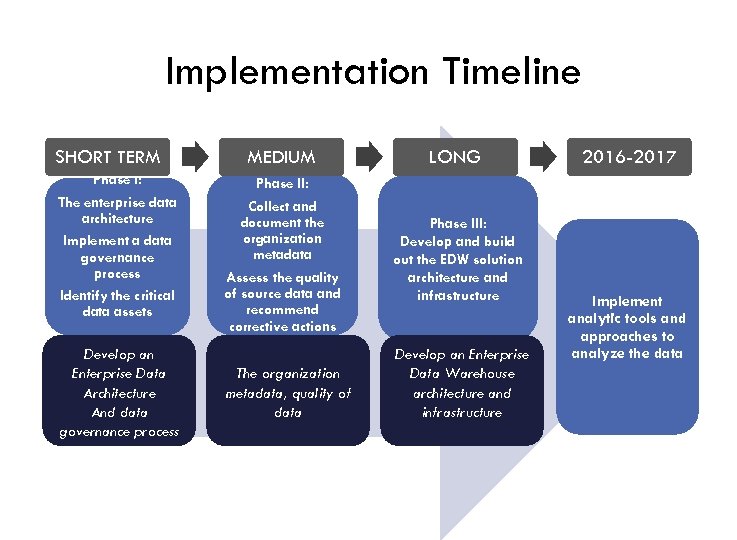

Implementation Timeline SHORT TERM Phase I: The enterprise data architecture Implement a data governance process Identify the critical data assets Develop an Enterprise Data Architecture And data governance process MEDIUM LONG Phase II: Collect and document the organization metadata Assess the quality of source data and recommend corrective actions Phase III: Develop and build out the EDW solution architecture and infrastructure The organization metadata, quality of data Develop an Enterprise Data Warehouse architecture and infrastructure 2016 -2017 Implement analytic tools and approaches to analyze the data

Implementation Timeline SHORT TERM Phase I: The enterprise data architecture Implement a data governance process Identify the critical data assets Develop an Enterprise Data Architecture And data governance process MEDIUM LONG Phase II: Collect and document the organization metadata Assess the quality of source data and recommend corrective actions Phase III: Develop and build out the EDW solution architecture and infrastructure The organization metadata, quality of data Develop an Enterprise Data Warehouse architecture and infrastructure 2016 -2017 Implement analytic tools and approaches to analyze the data

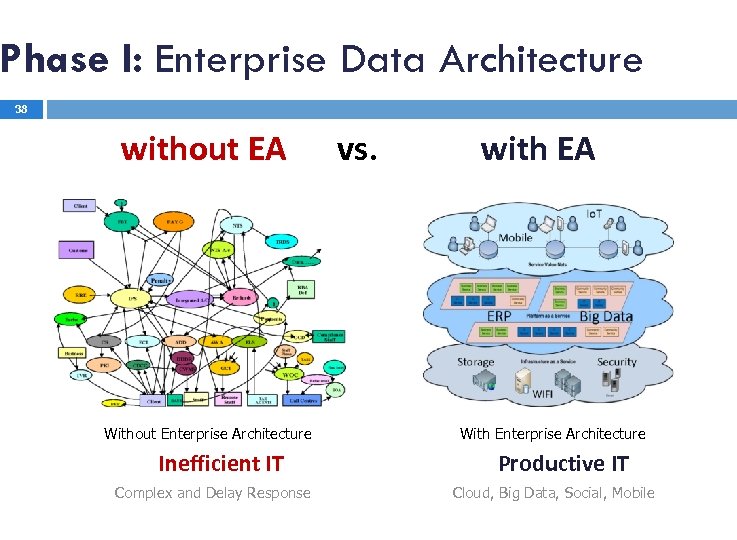

Phase I: Enterprise Data Architecture 38 without EA Without Enterprise Architecture Inefficient IT Complex and Delay Response vs. with EA With Enterprise Architecture Productive IT Cloud, Big Data, Social, Mobile

Phase I: Enterprise Data Architecture 38 without EA Without Enterprise Architecture Inefficient IT Complex and Delay Response vs. with EA With Enterprise Architecture Productive IT Cloud, Big Data, Social, Mobile

Enterprise Architecture Framework 39 Enterprise Architecture Business Architecture Application Architecture Data Architecture Technology Architecture Security Architecture

Enterprise Architecture Framework 39 Enterprise Architecture Business Architecture Application Architecture Data Architecture Technology Architecture Security Architecture

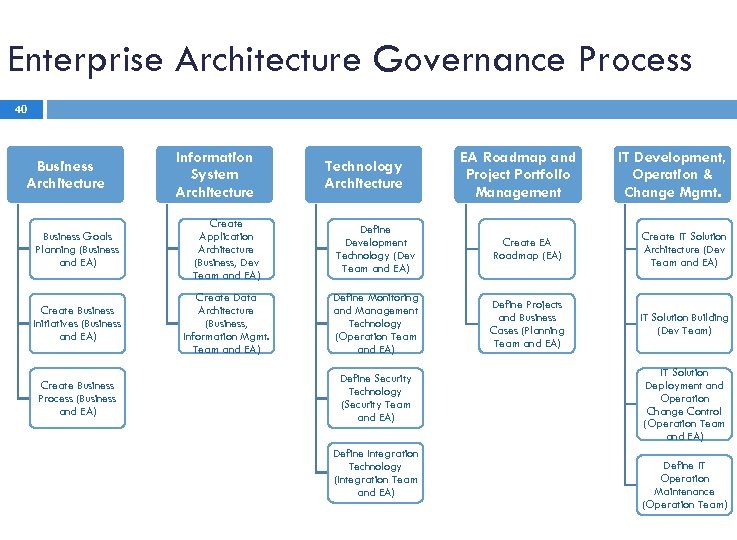

Enterprise Architecture Governance Process 40 Business Architecture Information System Architecture Technology Architecture EA Roadmap and Project Portfolio Management IT Development, Operation & Change Mgmt. Business Goals Planning (Business and EA) Create Application Architecture (Business, Dev Team and EA) Define Development Technology (Dev Team and EA) Create EA Roadmap (EA) Create IT Solution Architecture (Dev Team and EA) Create Business Initiatives (Business and EA) Create Data Architecture (Business, Information Mgmt. Team and EA) Define Monitoring and Management Technology (Operation Team and EA) Define Projects and Business Cases (Planning Team and EA) IT Solution Building (Dev Team) Create Business Process (Business and EA) Define Security Technology (Security Team and EA) Define Integration Technology (Integration Team and EA) IT Solution Deployment and Operation Change Control (Operation Team and EA) Define IT Operation Maintenance (Operation Team)

Enterprise Architecture Governance Process 40 Business Architecture Information System Architecture Technology Architecture EA Roadmap and Project Portfolio Management IT Development, Operation & Change Mgmt. Business Goals Planning (Business and EA) Create Application Architecture (Business, Dev Team and EA) Define Development Technology (Dev Team and EA) Create EA Roadmap (EA) Create IT Solution Architecture (Dev Team and EA) Create Business Initiatives (Business and EA) Create Data Architecture (Business, Information Mgmt. Team and EA) Define Monitoring and Management Technology (Operation Team and EA) Define Projects and Business Cases (Planning Team and EA) IT Solution Building (Dev Team) Create Business Process (Business and EA) Define Security Technology (Security Team and EA) Define Integration Technology (Integration Team and EA) IT Solution Deployment and Operation Change Control (Operation Team and EA) Define IT Operation Maintenance (Operation Team)

Architecture Data Warehouse 41

Architecture Data Warehouse 41

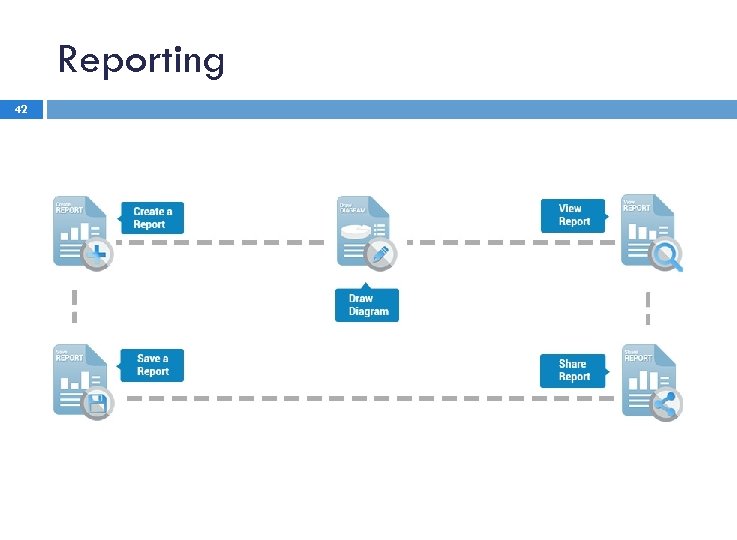

Reporting 42

Reporting 42

Risks & Mitigation 43 Avoid Mitigate Validate source and version of true data Reduce the redundant data RISK Accept Transfer Data that is more timely Project will take longer Consultant

Risks & Mitigation 43 Avoid Mitigate Validate source and version of true data Reduce the redundant data RISK Accept Transfer Data that is more timely Project will take longer Consultant

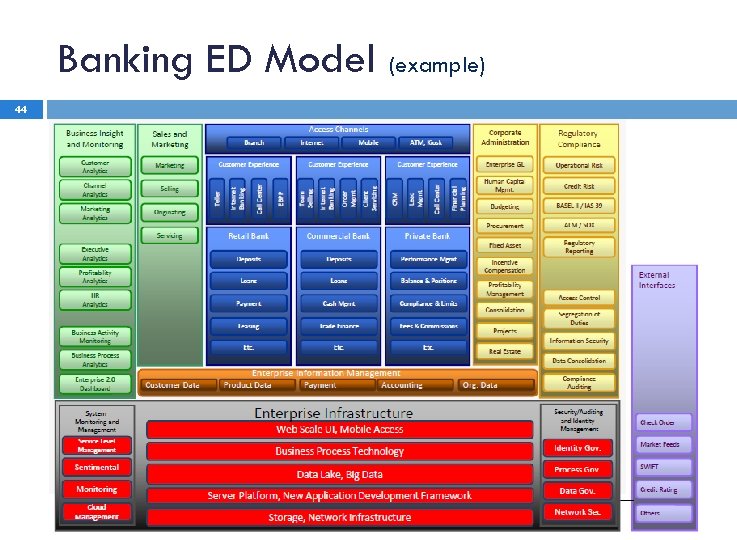

Banking ED Model (example) 44

Banking ED Model (example) 44

45 Recap In addition to deploying an integrated EDW, the bank is able to use this scenario as a case study to: 1. Identify other areas of weakness (process and system) that may be exploited by using data profiling to find anomalies. 2. Implement extensive fraud detection safeguards as part of the Data Profiling and Enterprise Data Warehouse initiatives, further reducing potential losses due to fraud.

45 Recap In addition to deploying an integrated EDW, the bank is able to use this scenario as a case study to: 1. Identify other areas of weakness (process and system) that may be exploited by using data profiling to find anomalies. 2. Implement extensive fraud detection safeguards as part of the Data Profiling and Enterprise Data Warehouse initiatives, further reducing potential losses due to fraud.

THANK YOU NEXT STEP IDENTIFY OTHER AREAS OF WEAKNESS (PROCESS AND SYSTEM) THAT MAY BE EXPLOITED BY USING DATA PROFILING TO FIND ANOMALIES. Questions?

THANK YOU NEXT STEP IDENTIFY OTHER AREAS OF WEAKNESS (PROCESS AND SYSTEM) THAT MAY BE EXPLOITED BY USING DATA PROFILING TO FIND ANOMALIES. Questions?

References 47 www. gavroshe. com www. ibm. com www. oracle. com Agile Data Warehousing for the Enterprise by Ralph Hughe

References 47 www. gavroshe. com www. ibm. com www. oracle. com Agile Data Warehousing for the Enterprise by Ralph Hughe