59be425fd3b9796170c1b13343186afd.ppt

- Количество слайдов: 53

Student Payroll Employment Forms

Student Payroll Employment Forms

Contact Information Tax Services Website: http: //www. financialreporting. mnscu. e du/Tax_Services/index. html n Ann Page, 651 -632 -5007 Ann. Page@so. mnscu. edu n Steve Gednalske, 651 -632 -5016, Steve. Gednalske@so. mnscu. edu n

Contact Information Tax Services Website: http: //www. financialreporting. mnscu. e du/Tax_Services/index. html n Ann Page, 651 -632 -5007 Ann. Page@so. mnscu. edu n Steve Gednalske, 651 -632 -5016, Steve. Gednalske@so. mnscu. edu n

Employment Forms Ø Form I-9, Employment Eligibility Verification Ø Form W-4, Employee’s Withholding Allowance Certificate

Employment Forms Ø Form I-9, Employment Eligibility Verification Ø Form W-4, Employee’s Withholding Allowance Certificate

Tax Form Management n n General form information Form maintenance & documentation Form storage suggestions Record retention requirements

Tax Form Management n n General form information Form maintenance & documentation Form storage suggestions Record retention requirements

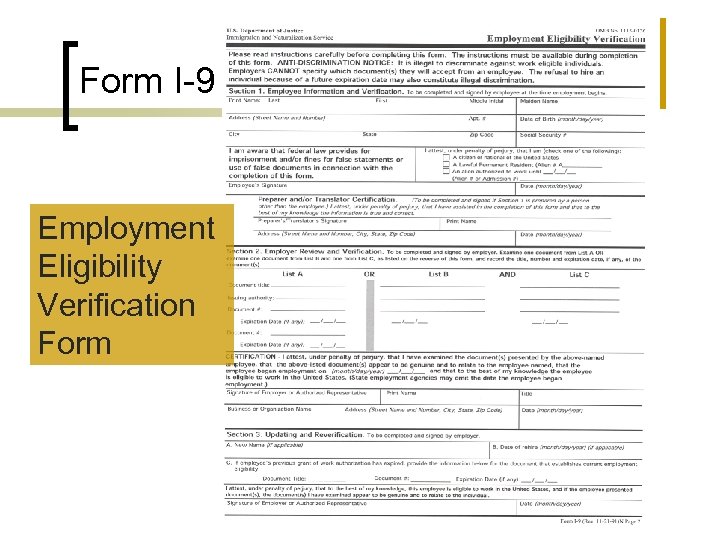

Form I-9 Employment Eligibility Verification Form

Form I-9 Employment Eligibility Verification Form

Form I-9, Employment Eligibility Verification n Department of Homeland Security ¡ USCIS: United States Citizenship & Immigration Services Law: The Immigration & Control Act n U. S. Employers & Employees n Last updated: 1991 n

Form I-9, Employment Eligibility Verification n Department of Homeland Security ¡ USCIS: United States Citizenship & Immigration Services Law: The Immigration & Control Act n U. S. Employers & Employees n Last updated: 1991 n

Form I-9, Employment Eligibility Verification n Employee’s responsibility ¡ n Complete Section I; Prior to the close of business on the first day of employment services Employer’s responsibility ¡ Review employment authorization documentation prior to the close of business on 3 rd day of employment services

Form I-9, Employment Eligibility Verification n Employee’s responsibility ¡ n Complete Section I; Prior to the close of business on the first day of employment services Employer’s responsibility ¡ Review employment authorization documentation prior to the close of business on 3 rd day of employment services

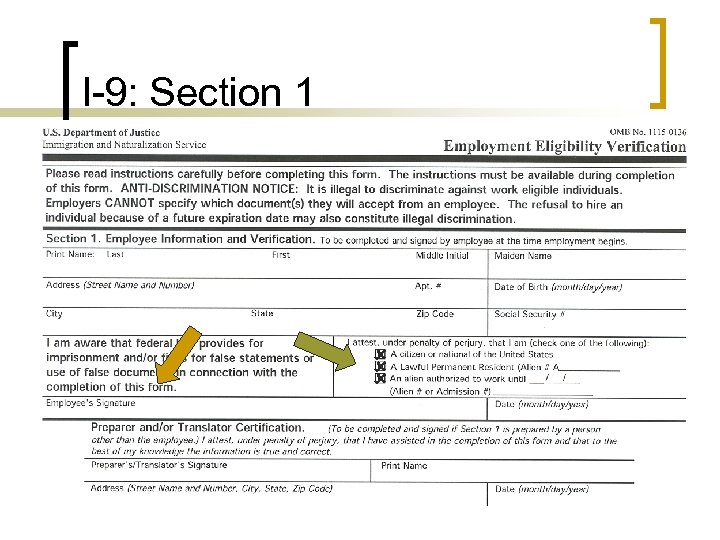

I-9: Section 1

I-9: Section 1

Section 2: Form I-9, Employment Eligibility Verification n Review Documentation 1. Authorization to work in U. S. 2. Establish identity ¡ Must match n n Record Document Information Recommended: Copy Documents

Section 2: Form I-9, Employment Eligibility Verification n Review Documentation 1. Authorization to work in U. S. 2. Establish identity ¡ Must match n n Record Document Information Recommended: Copy Documents

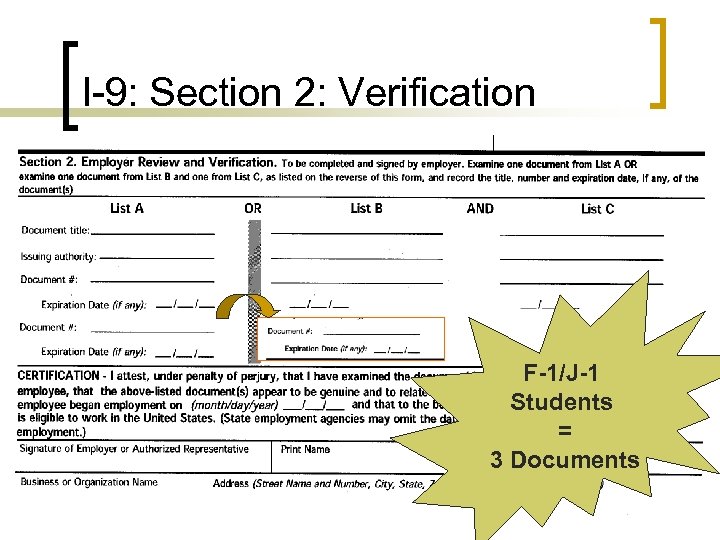

I-9: Section 2: Verification F-1/J-1 Students = 3 Documents

I-9: Section 2: Verification F-1/J-1 Students = 3 Documents

I-9 Documentation n n List of acceptable documents F-1 Documentation ¡ List A: Employment n SEVIS Form I-20, Eligibility & ID n I-94, Timely verification Arrival/Departure ¡ Must be verified within 3 n Passport days of start date n Reasonableness ¡ If appears genuine, accept document ¡ ¡ Personal Info Include visa stamp

I-9 Documentation n n List of acceptable documents F-1 Documentation ¡ List A: Employment n SEVIS Form I-20, Eligibility & ID n I-94, Timely verification Arrival/Departure ¡ Must be verified within 3 n Passport days of start date n Reasonableness ¡ If appears genuine, accept document ¡ ¡ Personal Info Include visa stamp

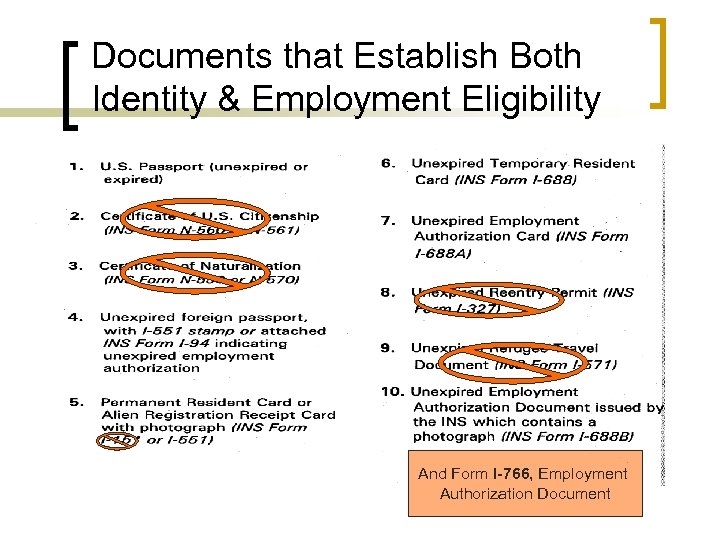

Documents that Establish Both Identity & Employment Eligibility And Form I-766, Employment Authorization Document

Documents that Establish Both Identity & Employment Eligibility And Form I-766, Employment Authorization Document

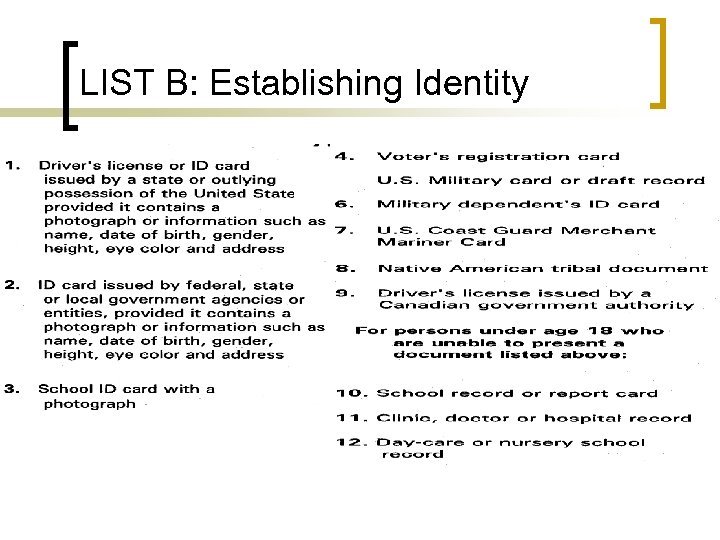

LIST B: Establishing Identity

LIST B: Establishing Identity

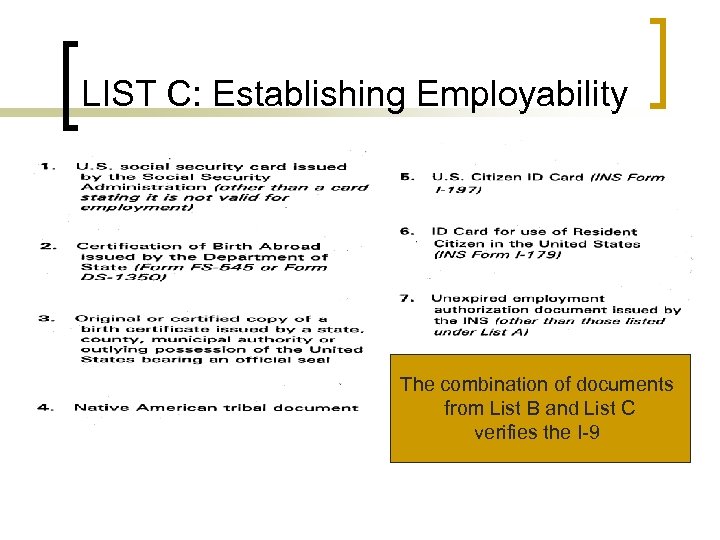

LIST C: Establishing Employability The combination of documents from List B and List C verifies the I-9

LIST C: Establishing Employability The combination of documents from List B and List C verifies the I-9

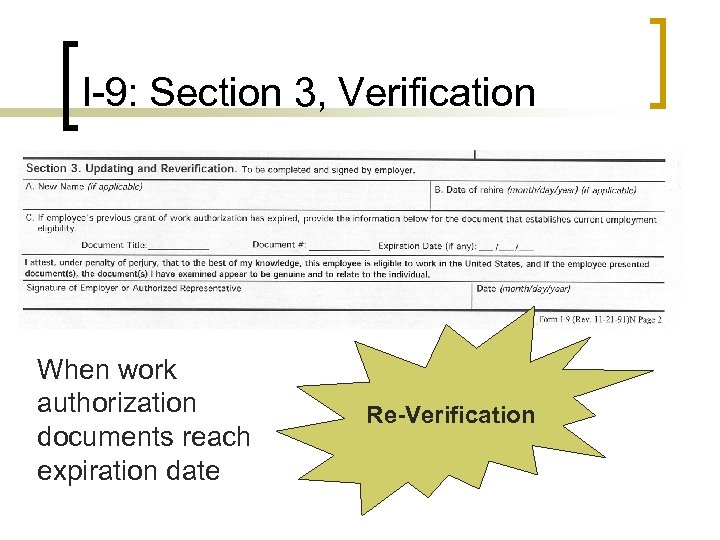

I-9: Section 3, Verification When work authorization documents reach expiration date Re-Verification

I-9: Section 3, Verification When work authorization documents reach expiration date Re-Verification

I-9 Record Retention I-9’s must be on hand for: n All current employees n Three years after employee’s hire date or 1 year after employee’s termination date whichever is later

I-9 Record Retention I-9’s must be on hand for: n All current employees n Three years after employee’s hire date or 1 year after employee’s termination date whichever is later

I-9 Record Recommendations n n n In case of audit, I-9’s must be retrievable in 3 days Recommend keeping I-9’s in a separate file DISCUSSION ¡ File Maintenance: Campuses

I-9 Record Recommendations n n n In case of audit, I-9’s must be retrievable in 3 days Recommend keeping I-9’s in a separate file DISCUSSION ¡ File Maintenance: Campuses

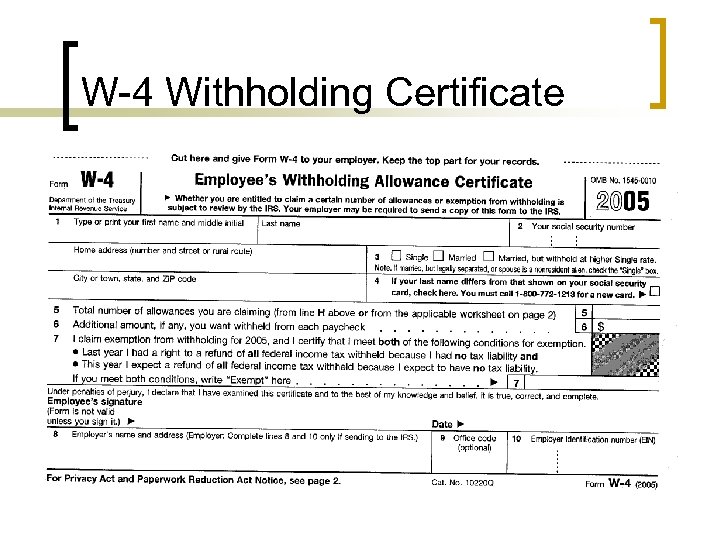

W-4 Withholding Certificate

W-4 Withholding Certificate

W-4 New from the IRS n Withholding agents are no longer required to send copies of W-4’s to IRS, unless specifically requested

W-4 New from the IRS n Withholding agents are no longer required to send copies of W-4’s to IRS, unless specifically requested

W-4 General Rules n What to do if no W-4? ¡ ¡ n Validity: Any unauthorized change or addition to Form W-4 makes it invalid. ¡ ¡ n S-0 If you have an earlier Form W-4 for this employee that is valid, withhold as you did before. This includes taking out any language by which the employee certifies that the form is correct. A Form W-4 is also invalid if, by the date an employee gives it to you, he or she indicates in any way that it is false. When you get an invalid Form W-4, do not use it to figure federal withholding. Tell the employee that it is invalid and ask for another one.

W-4 General Rules n What to do if no W-4? ¡ ¡ n Validity: Any unauthorized change or addition to Form W-4 makes it invalid. ¡ ¡ n S-0 If you have an earlier Form W-4 for this employee that is valid, withhold as you did before. This includes taking out any language by which the employee certifies that the form is correct. A Form W-4 is also invalid if, by the date an employee gives it to you, he or she indicates in any way that it is false. When you get an invalid Form W-4, do not use it to figure federal withholding. Tell the employee that it is invalid and ask for another one.

Claiming Exemption n IRS Code section 3402(n): An employee may claim exemption from income tax withholding if he or she: 1) Had no income tax liability last year and 2) Expects to have no tax liability this year. § Exemption is good for one year only § W-4 must be submitted by February 15 th § If the employee does not provide a new Form W-4, the employer must withhold tax as if the employee were single with zero withholding allowances.

Claiming Exemption n IRS Code section 3402(n): An employee may claim exemption from income tax withholding if he or she: 1) Had no income tax liability last year and 2) Expects to have no tax liability this year. § Exemption is good for one year only § W-4 must be submitted by February 15 th § If the employee does not provide a new Form W-4, the employer must withhold tax as if the employee were single with zero withholding allowances.

Figuring Withholding Allowances: Employee Advice IRS Withholding Calculator http: //www. irs. gov/individuals/article/0, , id=9 6196, 00. html n Most recent pay stubs, most recent tax return n The results of this program helps employee to complete a new Form W-4 n

Figuring Withholding Allowances: Employee Advice IRS Withholding Calculator http: //www. irs. gov/individuals/article/0, , id=9 6196, 00. html n Most recent pay stubs, most recent tax return n The results of this program helps employee to complete a new Form W-4 n

Figuring Withholding Allowances: Employee Advice IRS Publication 919: How Do I Adjust My Tax Withholding? http: //www. irs. gov/pub/irs-pdf/p 919. pdf n Detailed instructions and worksheets for computing tax withholding n

Figuring Withholding Allowances: Employee Advice IRS Publication 919: How Do I Adjust My Tax Withholding? http: //www. irs. gov/pub/irs-pdf/p 919. pdf n Detailed instructions and worksheets for computing tax withholding n

W-4 Statutory Withholding When completing Form W-4, nonresident aliens are required to: n Not claim exemption from income tax withholding, n Request withholding as if they are single, regardless of their actual marital status, n Claim only one allowance, and n Request an additional $15. 30 in income tax withholding per bi weekly pay period

W-4 Statutory Withholding When completing Form W-4, nonresident aliens are required to: n Not claim exemption from income tax withholding, n Request withholding as if they are single, regardless of their actual marital status, n Claim only one allowance, and n Request an additional $15. 30 in income tax withholding per bi weekly pay period

Students from India & Statutory Withholding n n Article 21(2) of the United States-India Income Tax Treaty Does not have to request the additional withholding amount on line 6 of Form W-4. An additional withholding allowance may be claimed for a spouse if the spouse has no U. S. source gross income and may not be claimed as a dependent by another taxpayer. An additional withholding allowance for each dependent (usually a child) who has become a resident alien.

Students from India & Statutory Withholding n n Article 21(2) of the United States-India Income Tax Treaty Does not have to request the additional withholding amount on line 6 of Form W-4. An additional withholding allowance may be claimed for a spouse if the spouse has no U. S. source gross income and may not be claimed as a dependent by another taxpayer. An additional withholding allowance for each dependent (usually a child) who has become a resident alien.

Other Exceptions to Statutory Withholding n n Canada and Mexico, American Samoa and Northern Mariana Islands “Single” marital status; one withholding allowance plus additional withholding allowances for nonworking spouse and dependents; and additional tax of $15. 30. Japan and Korea “Single” marital status; one withholding allowance plus additional withholding allowances for nonworking spouse and dependents who are present in the US; and additional tax of $15. 30.

Other Exceptions to Statutory Withholding n n Canada and Mexico, American Samoa and Northern Mariana Islands “Single” marital status; one withholding allowance plus additional withholding allowances for nonworking spouse and dependents; and additional tax of $15. 30. Japan and Korea “Single” marital status; one withholding allowance plus additional withholding allowances for nonworking spouse and dependents who are present in the US; and additional tax of $15. 30.

W-4 Record Retention n n Form W-4 remains in effect until the employee gives you a new one. If an employee gives you a Form W-4 that replaces an existing Form W-4, begin withholding no later than the start of the first payroll period ending on or after the 30 th day from the date when you received the replacement Form W-4.

W-4 Record Retention n n Form W-4 remains in effect until the employee gives you a new one. If an employee gives you a Form W-4 that replaces an existing Form W-4, begin withholding no later than the start of the first payroll period ending on or after the 30 th day from the date when you received the replacement Form W-4.

W-4 Record Retention n A Form W-4 claiming exemption from withholding is valid for only one calendar year ¡ Request new W-4 each year from: n n n Employees claiming exemption NRA’s with 8233’s W-4’s must be kept on file for 7 years after the last applicable tax year

W-4 Record Retention n A Form W-4 claiming exemption from withholding is valid for only one calendar year ¡ Request new W-4 each year from: n n n Employees claiming exemption NRA’s with 8233’s W-4’s must be kept on file for 7 years after the last applicable tax year

W-4 Record Retention: Example n n Ann is hired in 2001 & fills out a 2001 W -4 In 2004, Ann fills out a new W-4 The 2001 W-4 was used to figure Ann’s withholding for 2001, 2002, 2003 and part of 2004. The 2001 W-4 must be kept until 2011

W-4 Record Retention: Example n n Ann is hired in 2001 & fills out a 2001 W -4 In 2004, Ann fills out a new W-4 The 2001 W-4 was used to figure Ann’s withholding for 2001, 2002, 2003 and part of 2004. The 2001 W-4 must be kept until 2011

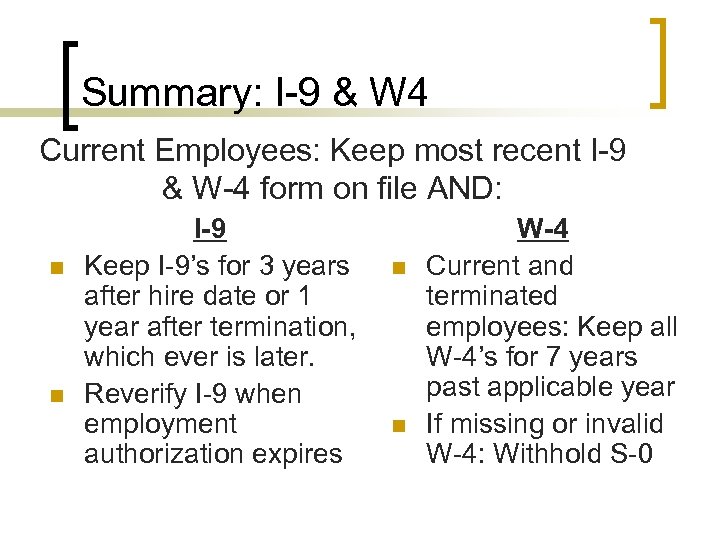

Summary: I-9 & W 4 Current Employees: Keep most recent I-9 & W-4 form on file AND: n n I-9 Keep I-9’s for 3 years after hire date or 1 year after termination, which ever is later. Reverify I-9 when employment authorization expires n n W-4 Current and terminated employees: Keep all W-4’s for 7 years past applicable year If missing or invalid W-4: Withhold S-0

Summary: I-9 & W 4 Current Employees: Keep most recent I-9 & W-4 form on file AND: n n I-9 Keep I-9’s for 3 years after hire date or 1 year after termination, which ever is later. Reverify I-9 when employment authorization expires n n W-4 Current and terminated employees: Keep all W-4’s for 7 years past applicable year If missing or invalid W-4: Withhold S-0

Retention: Payroll Forms n 7 Years past applicable tax year ¡ Timesheets ¡ W-4 Forms ¡ TRIF ¡ 8233 Forms ¡ Contracts

Retention: Payroll Forms n 7 Years past applicable tax year ¡ Timesheets ¡ W-4 Forms ¡ TRIF ¡ 8233 Forms ¡ Contracts

QUESTIONS & DISCUSSION

QUESTIONS & DISCUSSION

Intermission LUNCH

Intermission LUNCH

Student Payroll: TRIF Update & Other Issues

Student Payroll: TRIF Update & Other Issues

Student Payroll Tax Residency Information Form “New” Version n Documentation Requirements n ISRS Tax Residency Year field n Questions n

Student Payroll Tax Residency Information Form “New” Version n Documentation Requirements n ISRS Tax Residency Year field n Questions n

Tax Residency Information Form n n Employee’s who indicate on their I -9 that they are “other alien authorized to work until xx/xx/xxxx” must fill out Tax Residency Information Form. Section E applies SPT

Tax Residency Information Form n n Employee’s who indicate on their I -9 that they are “other alien authorized to work until xx/xx/xxxx” must fill out Tax Residency Information Form. Section E applies SPT

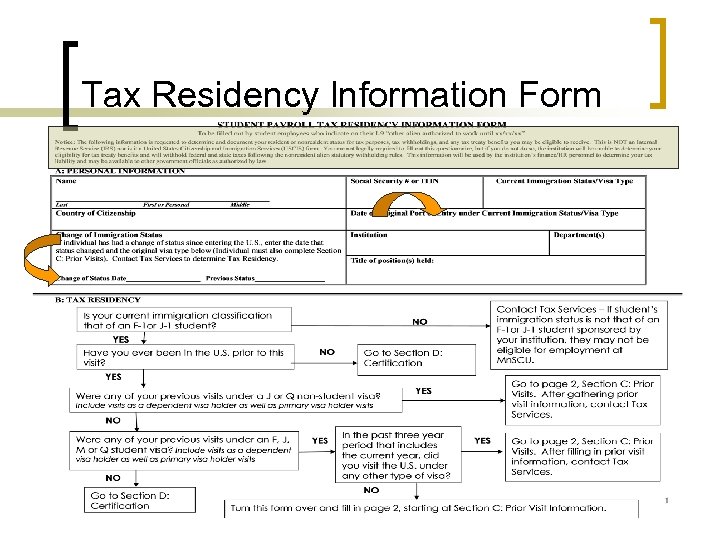

Tax Residency Information Form

Tax Residency Information Form

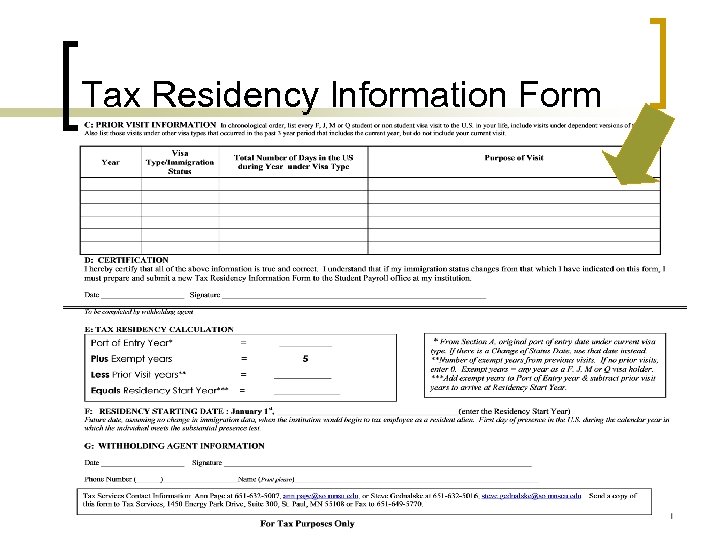

Tax Residency Information Form

Tax Residency Information Form

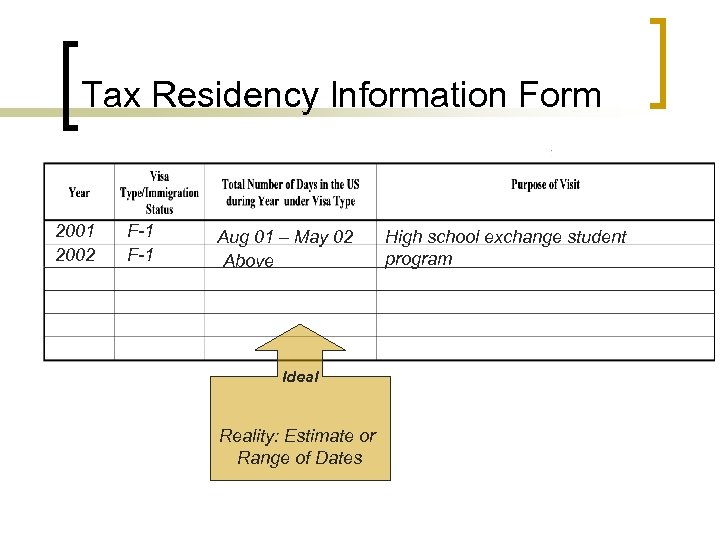

Tax Residency Information Form 2001 2002 F-1 Aug 01 – May 02 Above Ideal Reality: Estimate or Range of Dates High school exchange student program

Tax Residency Information Form 2001 2002 F-1 Aug 01 – May 02 Above Ideal Reality: Estimate or Range of Dates High school exchange student program

Discussion Nonresident TRIF n Questions n Comments n Concerns

Discussion Nonresident TRIF n Questions n Comments n Concerns

TRIF Documentation F-1 Students n n n I-20 & Attachments I-94 Passport J-1 Students n n n DS-2016 & Employment Letters I-94 Passport

TRIF Documentation F-1 Students n n n I-20 & Attachments I-94 Passport J-1 Students n n n DS-2016 & Employment Letters I-94 Passport

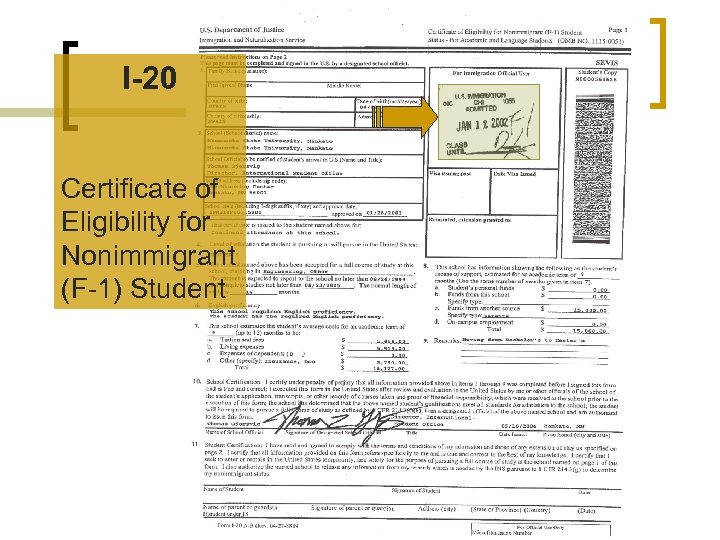

I-20 Certificate of Eligibility for Nonimmigrant (F-1) Student

I-20 Certificate of Eligibility for Nonimmigrant (F-1) Student

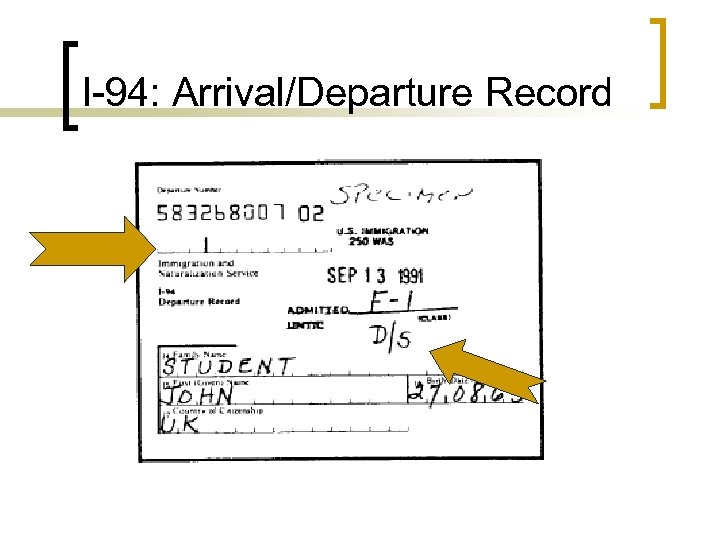

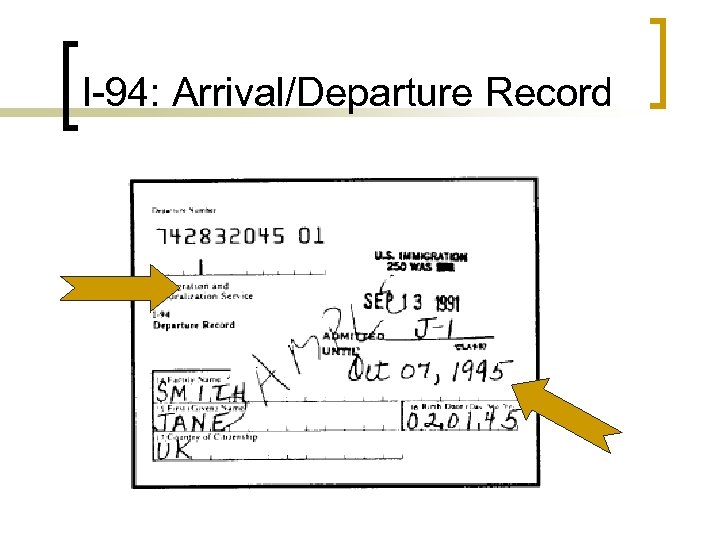

I-94: Arrival/Departure Record

I-94: Arrival/Departure Record

I-94: Arrival/Departure Record

I-94: Arrival/Departure Record

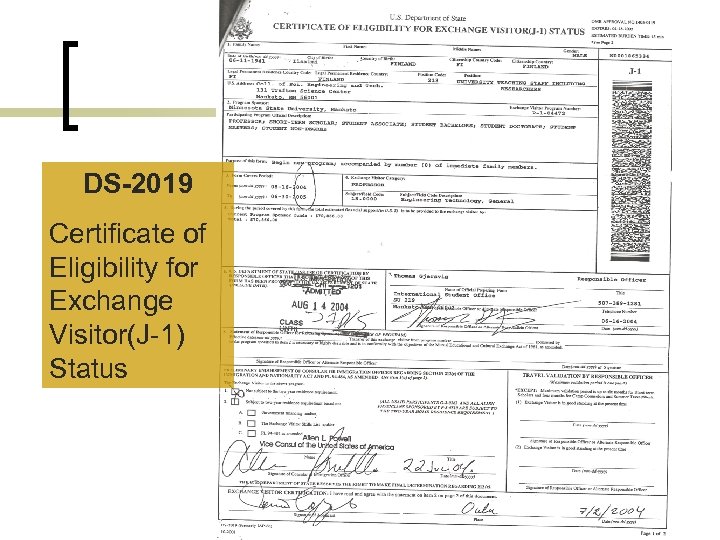

DS-2019 Certificate of Eligibility for Exchange Visitor(J-1) Status

DS-2019 Certificate of Eligibility for Exchange Visitor(J-1) Status

Passport Information n Identification Page Current visa information Prior visits to US

Passport Information n Identification Page Current visa information Prior visits to US

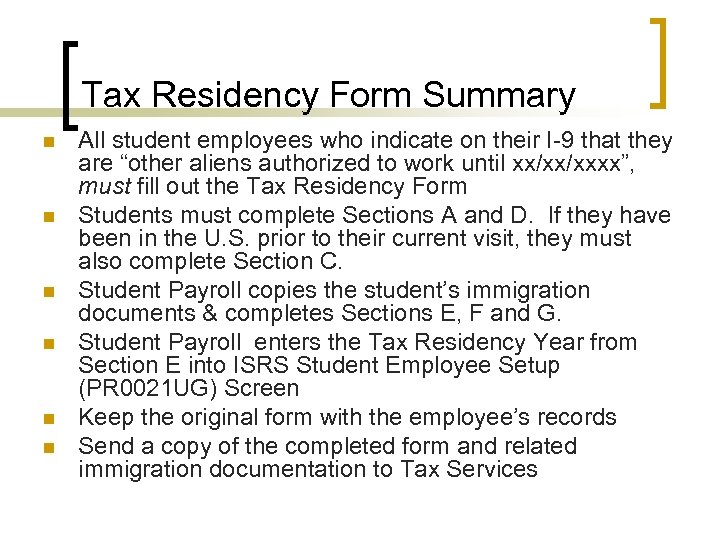

Tax Residency Form Summary n n n All student employees who indicate on their I-9 that they are “other aliens authorized to work until xx/xx/xxxx”, must fill out the Tax Residency Form Students must complete Sections A and D. If they have been in the U. S. prior to their current visit, they must also complete Section C. Student Payroll copies the student’s immigration documents & completes Sections E, F and G. Student Payroll enters the Tax Residency Year from Section E into ISRS Student Employee Setup (PR 0021 UG) Screen Keep the original form with the employee’s records Send a copy of the completed form and related immigration documentation to Tax Services

Tax Residency Form Summary n n n All student employees who indicate on their I-9 that they are “other aliens authorized to work until xx/xx/xxxx”, must fill out the Tax Residency Form Students must complete Sections A and D. If they have been in the U. S. prior to their current visit, they must also complete Section C. Student Payroll copies the student’s immigration documents & completes Sections E, F and G. Student Payroll enters the Tax Residency Year from Section E into ISRS Student Employee Setup (PR 0021 UG) Screen Keep the original form with the employee’s records Send a copy of the completed form and related immigration documentation to Tax Services

Joke Break A student on his deathbed called his friend and said, "Bob, I want you to promise me that when I die you will have my remains cremated. " Bob agreed to take care of his friend's request and asked "What do you want me to do with your ashes? " The student said, "Just put them in an envelope and mail them to the Internal Revenue Service and write on the envelope: "Now you have everything. "

Joke Break A student on his deathbed called his friend and said, "Bob, I want you to promise me that when I die you will have my remains cremated. " Bob agreed to take care of his friend's request and asked "What do you want me to do with your ashes? " The student said, "Just put them in an envelope and mail them to the Internal Revenue Service and write on the envelope: "Now you have everything. "

Student FICA Rule Changes – eff. 4/1/2005 n Full time employees not exempt ¡ ¡ n Employees who regularly work 40 hours a week = full time, career employees >30 Hour a week = full time Tracking ¡ ¡ Supervisor Hire Form ISRS & Tax Service Reports

Student FICA Rule Changes – eff. 4/1/2005 n Full time employees not exempt ¡ ¡ n Employees who regularly work 40 hours a week = full time, career employees >30 Hour a week = full time Tracking ¡ ¡ Supervisor Hire Form ISRS & Tax Service Reports

ISRS Data Entry & Tax Filing n Name Entry ¡ ¡ n Legal name, Should be the same as on Social Security Card; New names (ex: married) may not be used until employee has changed their Social Security records with the Social Security Administration (SSA). Social Security Numbers (SSN) ¡ Look at Social Security Card or call SSA

ISRS Data Entry & Tax Filing n Name Entry ¡ ¡ n Legal name, Should be the same as on Social Security Card; New names (ex: married) may not be used until employee has changed their Social Security records with the Social Security Administration (SSA). Social Security Numbers (SSN) ¡ Look at Social Security Card or call SSA

ISRS Data: Addresses n n n Alpha entry No odd characters: colons (: ), slashes (/), asterix (*) Addresses Enter address information in appropriate data fields State must be entered for a US address Province should be entered in State field for Canadian Address International Address must have a Country entered

ISRS Data: Addresses n n n Alpha entry No odd characters: colons (: ), slashes (/), asterix (*) Addresses Enter address information in appropriate data fields State must be entered for a US address Province should be entered in State field for Canadian Address International Address must have a Country entered

QUESTIONS & DISCUSSION

QUESTIONS & DISCUSSION

Contact Information Tax Services Website: http: //www. financialreporting. mnscu. e du/Tax_Services/index. html n Ann Page, 651 -632 -5007 Ann. Page@so. mnscu. edu n Steve Gednalske, 651 -632 -5016, Steve. Gednalske@so. mnscu. edu n

Contact Information Tax Services Website: http: //www. financialreporting. mnscu. e du/Tax_Services/index. html n Ann Page, 651 -632 -5007 Ann. Page@so. mnscu. edu n Steve Gednalske, 651 -632 -5016, Steve. Gednalske@so. mnscu. edu n