28f60f0668336cd3a4bbe7d2666d771f.ppt

- Количество слайдов: 39

STUDENT FINANCE

STUDENT FINANCE

MAIN TOPICS § What are the costs? § How will students pay for it? § What are the repayments?

MAIN TOPICS § What are the costs? § How will students pay for it? § What are the repayments?

OFFA § Office for Fair Access (OFFA) proposal written April 2013 § OFFA Agreements confirmed July 2013 Check university website for details

OFFA § Office for Fair Access (OFFA) proposal written April 2013 § OFFA Agreements confirmed July 2013 Check university website for details

WHAT ARE THE COSTS? Two main costs: § Tuition Fees § Living Costs

WHAT ARE THE COSTS? Two main costs: § Tuition Fees § Living Costs

TUITION FEES £ 6, 000 - £ 9, 000 per year (2013 entry) (Check individual universities and courses for details) Oxford Brookes University £ 9, 000 per year (Undergraduate degrees taught at Oxford Brookes)

TUITION FEES £ 6, 000 - £ 9, 000 per year (2013 entry) (Check individual universities and courses for details) Oxford Brookes University £ 9, 000 per year (Undergraduate degrees taught at Oxford Brookes)

FOUNDATION DEGREES Foundation degree costs may differ to onsite degrees Oxford Brookes University £ 6, 000 per year / £ 7, 000 per year for top up year (Foundation/Bachelor degrees taught in Further Education Colleges)

FOUNDATION DEGREES Foundation degree costs may differ to onsite degrees Oxford Brookes University £ 6, 000 per year / £ 7, 000 per year for top up year (Foundation/Bachelor degrees taught in Further Education Colleges)

LIVING COSTS

LIVING COSTS

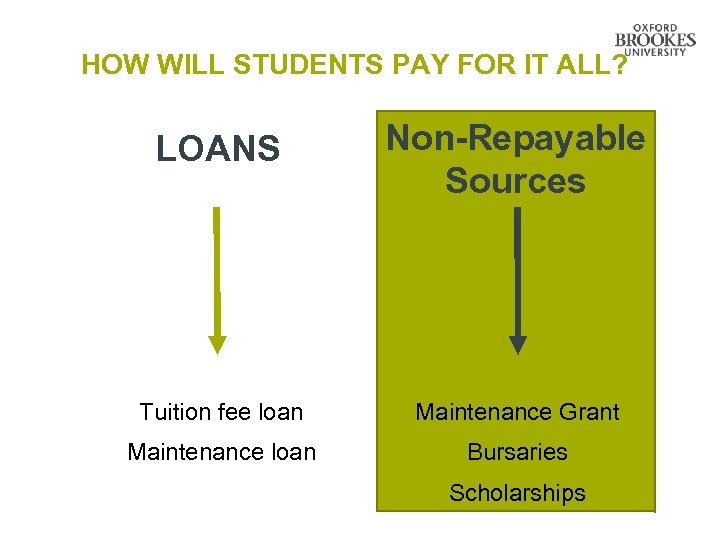

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

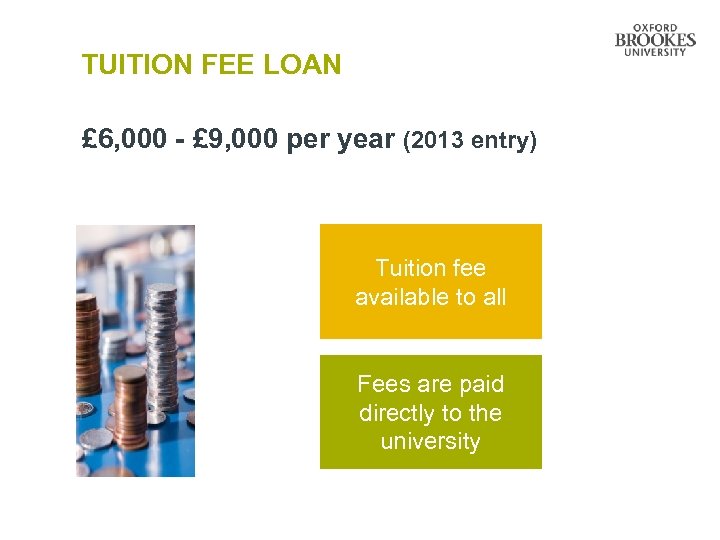

TUITION FEE LOAN £ 6, 000 - £ 9, 000 per year (2013 entry) Tuition fee available to all Fees are paid directly to the university

TUITION FEE LOAN £ 6, 000 - £ 9, 000 per year (2013 entry) Tuition fee available to all Fees are paid directly to the university

MAINTENANCE LOAN To help pay for living costs All full-time UK students eligible (for 65%) Means-tested (35%)

MAINTENANCE LOAN To help pay for living costs All full-time UK students eligible (for 65%) Means-tested (35%)

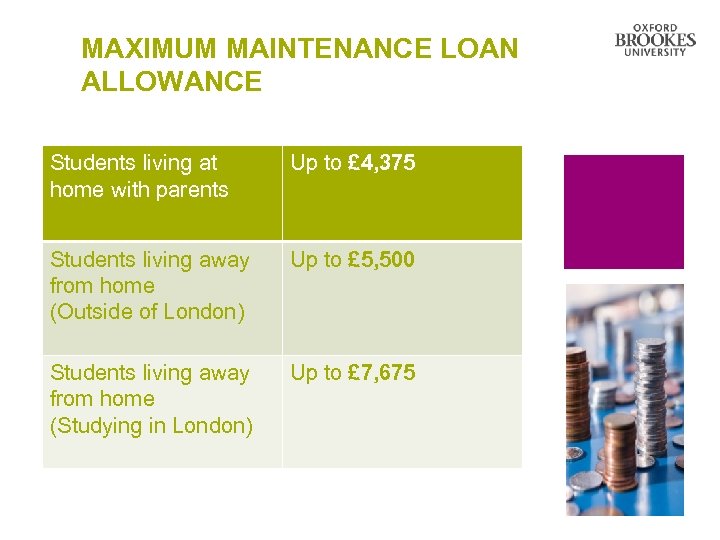

MAXIMUM MAINTENANCE LOAN ALLOWANCE Students living at home with parents Up to £ 4, 375 Students living away from home (Outside of London) Up to £ 5, 500 Students living away from home (Studying in London) Up to £ 7, 675

MAXIMUM MAINTENANCE LOAN ALLOWANCE Students living at home with parents Up to £ 4, 375 Students living away from home (Outside of London) Up to £ 5, 500 Students living away from home (Studying in London) Up to £ 7, 675

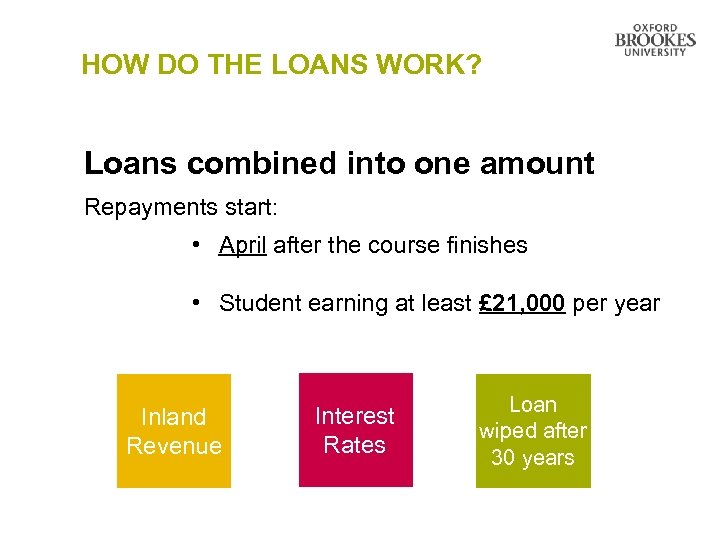

HOW DO THE LOANS WORK? Loans combined into one amount Repayments start: • April after the course finishes • Student earning at least £ 21, 000 per year Inland Revenue Interest Rates Loan wiped after 30 years

HOW DO THE LOANS WORK? Loans combined into one amount Repayments start: • April after the course finishes • Student earning at least £ 21, 000 per year Inland Revenue Interest Rates Loan wiped after 30 years

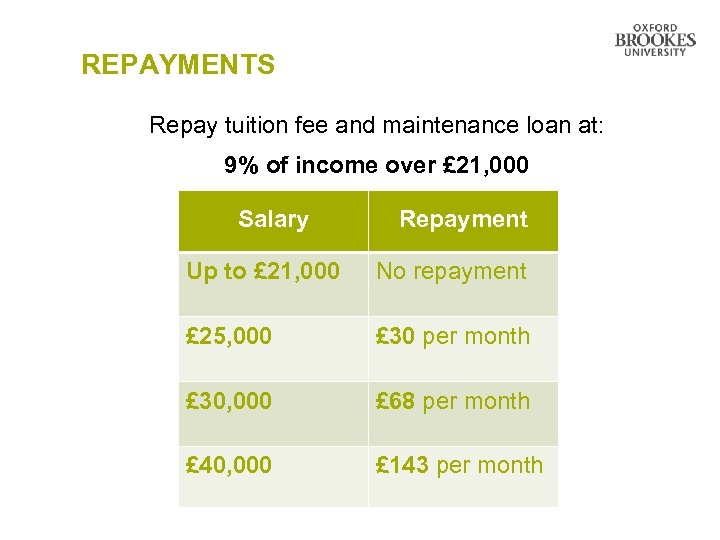

REPAYMENTS Repay tuition fee and maintenance loan at: 9% of income over £ 21, 000 Salary Repayment Up to £ 21, 000 No repayment £ 25, 000 £ 30 per month £ 30, 000 £ 68 per month £ 40, 000 £ 143 per month

REPAYMENTS Repay tuition fee and maintenance loan at: 9% of income over £ 21, 000 Salary Repayment Up to £ 21, 000 No repayment £ 25, 000 £ 30 per month £ 30, 000 £ 68 per month £ 40, 000 £ 143 per month

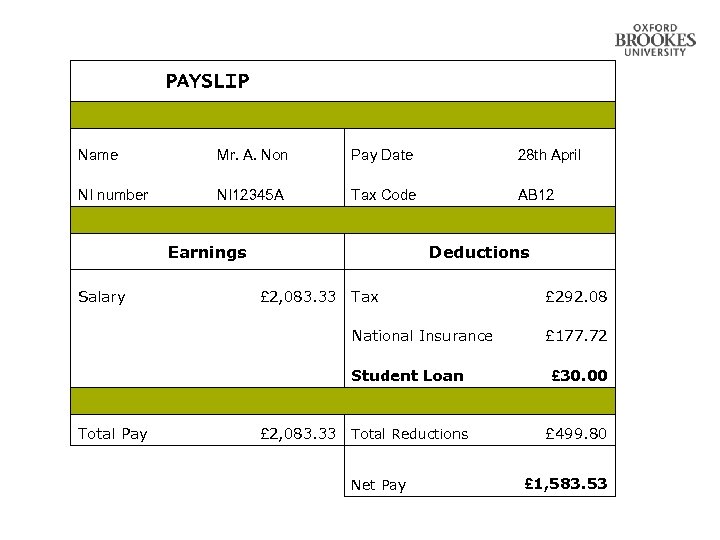

PAYSLIP Name Mr. A. Non Pay Date 28 th April NI number NI 12345 A Tax Code AB 12 Earnings Salary Deductions £ 2, 083. 33 Tax National Insurance Student Loan £ 292. 08 Total Pay £ 2, 083. 33 Total Reductions Net Pay £ 177. 72 £ 30. 00 £ 499. 80 £ 1, 583. 53

PAYSLIP Name Mr. A. Non Pay Date 28 th April NI number NI 12345 A Tax Code AB 12 Earnings Salary Deductions £ 2, 083. 33 Tax National Insurance Student Loan £ 292. 08 Total Pay £ 2, 083. 33 Total Reductions Net Pay £ 177. 72 £ 30. 00 £ 499. 80 £ 1, 583. 53

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

HOW WILL STUDENTS PAY FOR IT ALL? LOANS Non-Repayable Sources Tuition fee loan Maintenance Grant Maintenance loan Bursaries Scholarships

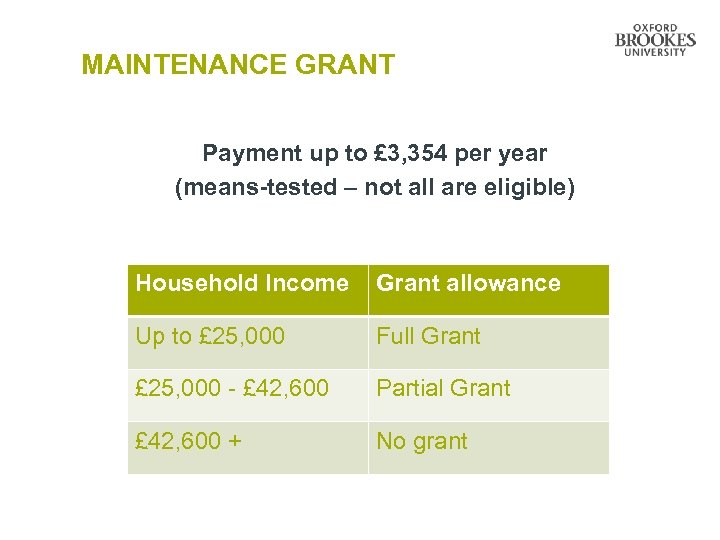

MAINTENANCE GRANT Payment up to £ 3, 354 per year (means-tested – not all are eligible) Household Income Grant allowance Up to £ 25, 000 Full Grant £ 25, 000 - £ 42, 600 Partial Grant £ 42, 600 + No grant

MAINTENANCE GRANT Payment up to £ 3, 354 per year (means-tested – not all are eligible) Household Income Grant allowance Up to £ 25, 000 Full Grant £ 25, 000 - £ 42, 600 Partial Grant £ 42, 600 + No grant

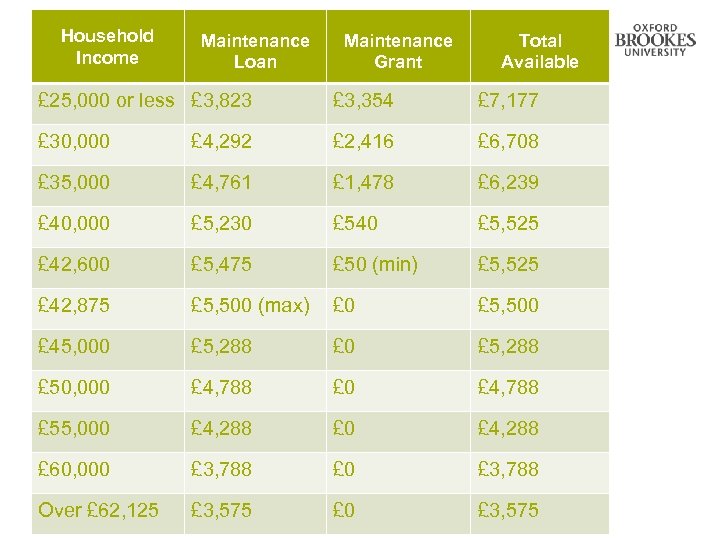

Household Income Maintenance Loan Maintenance Grant Total Available £ 25, 000 or less £ 3, 823 £ 3, 354 £ 7, 177 £ 30, 000 £ 4, 292 £ 2, 416 £ 6, 708 £ 35, 000 £ 4, 761 £ 1, 478 £ 6, 239 £ 40, 000 £ 5, 230 £ 540 £ 5, 525 £ 42, 600 £ 5, 475 £ 50 (min) £ 5, 525 £ 42, 875 £ 5, 500 (max) £ 0 £ 5, 500 £ 45, 000 £ 5, 288 £ 50, 000 £ 4, 788 £ 55, 000 £ 4, 288 £ 60, 000 £ 3, 788 £ 0 £ 3, 788 Over £ 62, 125 £ 3, 575 £ 0 £ 3, 575

Household Income Maintenance Loan Maintenance Grant Total Available £ 25, 000 or less £ 3, 823 £ 3, 354 £ 7, 177 £ 30, 000 £ 4, 292 £ 2, 416 £ 6, 708 £ 35, 000 £ 4, 761 £ 1, 478 £ 6, 239 £ 40, 000 £ 5, 230 £ 540 £ 5, 525 £ 42, 600 £ 5, 475 £ 50 (min) £ 5, 525 £ 42, 875 £ 5, 500 (max) £ 0 £ 5, 500 £ 45, 000 £ 5, 288 £ 50, 000 £ 4, 788 £ 55, 000 £ 4, 288 £ 60, 000 £ 3, 788 £ 0 £ 3, 788 Over £ 62, 125 £ 3, 575 £ 0 £ 3, 575

APPLICATION NOT DEPENDENT ON HOUSEHOLD INCOME § Applying for: o Tuition Fee loan and o Basic maintenance loan (non means-tested) § Student can fill in application without parental information

APPLICATION NOT DEPENDENT ON HOUSEHOLD INCOME § Applying for: o Tuition Fee loan and o Basic maintenance loan (non means-tested) § Student can fill in application without parental information

APPLICATIONS DEPENDENT ON HOUSEHOLD INCOME Before starting online application, the following information is needed: § Passport (do not send) OR Birth Certificate § University and Course details § Bank account details § National Insurance number; and § Parent’s or partner’s National Insurance number and income details (parents must also register) Applications cannot be processed until all information given

APPLICATIONS DEPENDENT ON HOUSEHOLD INCOME Before starting online application, the following information is needed: § Passport (do not send) OR Birth Certificate § University and Course details § Bank account details § National Insurance number; and § Parent’s or partner’s National Insurance number and income details (parents must also register) Applications cannot be processed until all information given

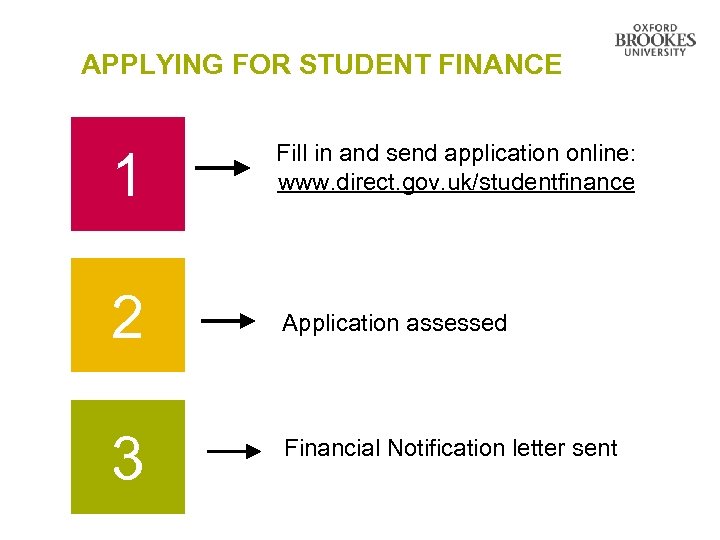

APPLYING FOR STUDENT FINANCE 1 Fill in and send application online: www. direct. gov. uk/studentfinance 2 Application assessed 3 Financial Notification letter sent

APPLYING FOR STUDENT FINANCE 1 Fill in and send application online: www. direct. gov. uk/studentfinance 2 Application assessed 3 Financial Notification letter sent

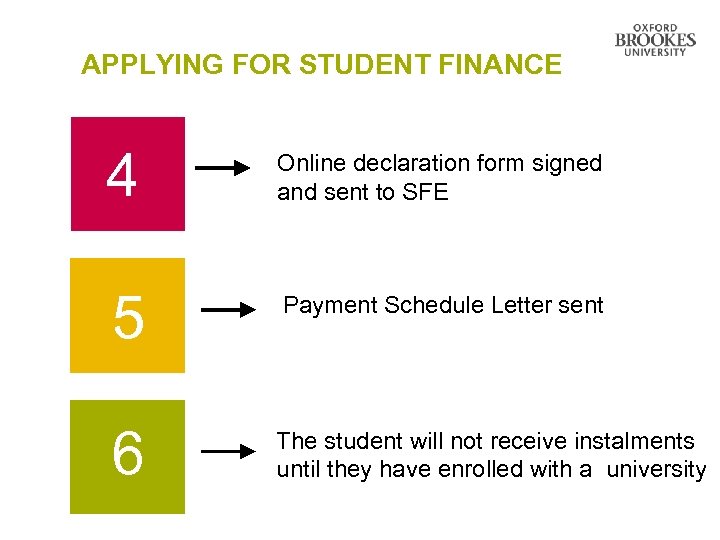

APPLYING FOR STUDENT FINANCE 4 Online declaration form signed and sent to SFE 5 Payment Schedule Letter sent 6 The student will not receive instalments until they have enrolled with a university

APPLYING FOR STUDENT FINANCE 4 Online declaration form signed and sent to SFE 5 Payment Schedule Letter sent 6 The student will not receive instalments until they have enrolled with a university

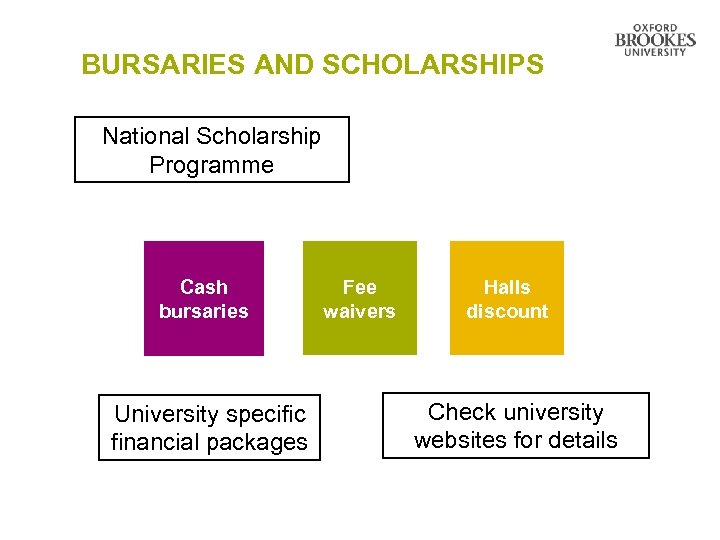

BURSARIES AND SCHOLARSHIPS National Scholarship Programme Cash bursaries University specific financial packages Fee waivers Halls discount Check university websites for details

BURSARIES AND SCHOLARSHIPS National Scholarship Programme Cash bursaries University specific financial packages Fee waivers Halls discount Check university websites for details

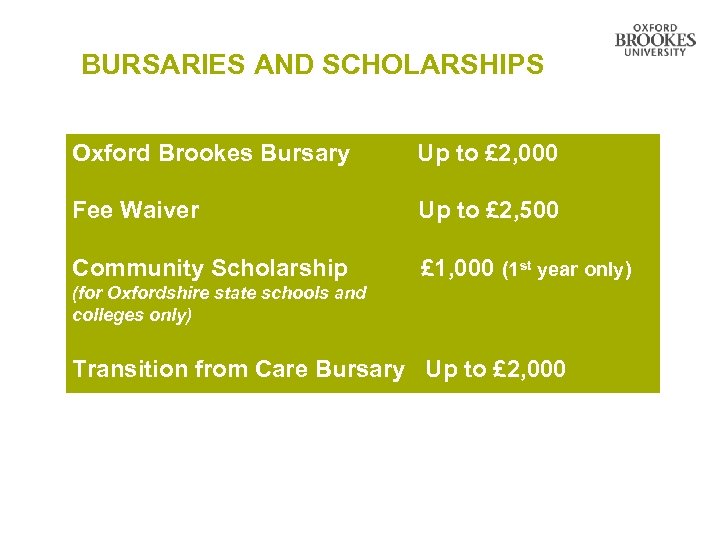

BURSARIES AND SCHOLARSHIPS Oxford Brookes Bursary Up to £ 2, 000 Fee Waiver Up to £ 2, 500 Community Scholarship £ 1, 000 (1 st year only) (for Oxfordshire state schools and colleges only) Transition from Care Bursary Up to £ 2, 000

BURSARIES AND SCHOLARSHIPS Oxford Brookes Bursary Up to £ 2, 000 Fee Waiver Up to £ 2, 500 Community Scholarship £ 1, 000 (1 st year only) (for Oxfordshire state schools and colleges only) Transition from Care Bursary Up to £ 2, 000

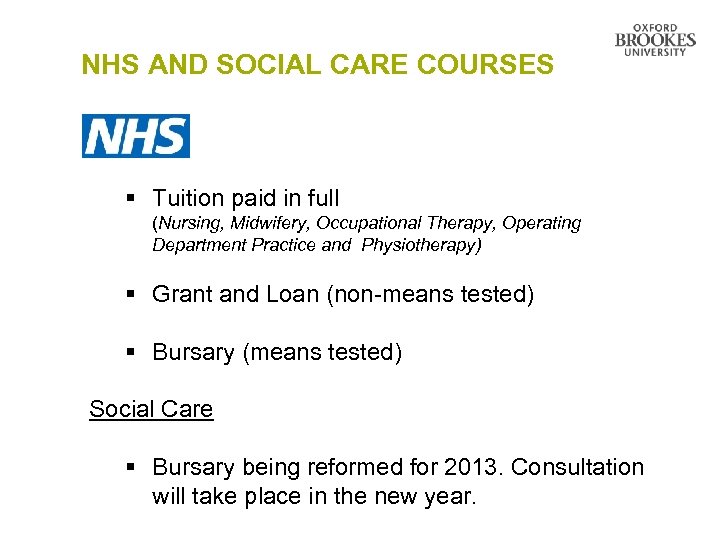

NHS AND SOCIAL CARE COURSES § Tuition paid in full (Nursing, Midwifery, Occupational Therapy, Operating Department Practice and Physiotherapy) § Grant and Loan (non-means tested) § Bursary (means tested) Social Care § Bursary being reformed for 2013. Consultation will take place in the new year.

NHS AND SOCIAL CARE COURSES § Tuition paid in full (Nursing, Midwifery, Occupational Therapy, Operating Department Practice and Physiotherapy) § Grant and Loan (non-means tested) § Bursary (means tested) Social Care § Bursary being reformed for 2013. Consultation will take place in the new year.

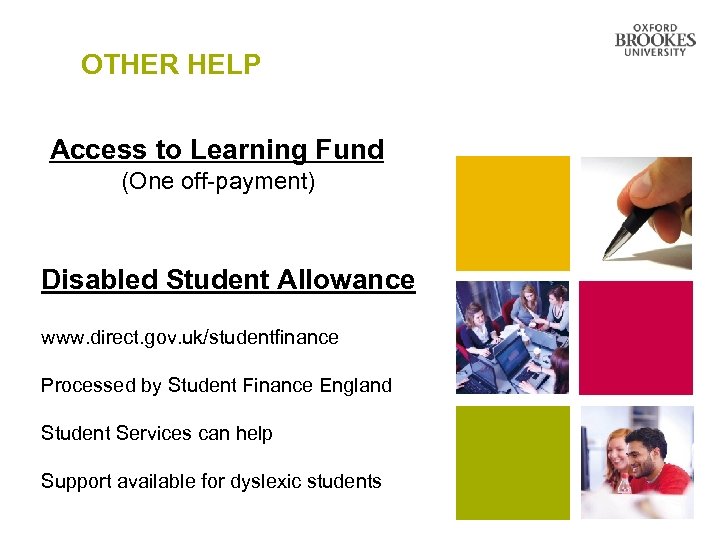

OTHER HELP Access to Learning Fund (One off-payment) Disabled Student Allowance www. direct. gov. uk/studentfinance Processed by Student Finance England Student Services can help Support available for dyslexic students

OTHER HELP Access to Learning Fund (One off-payment) Disabled Student Allowance www. direct. gov. uk/studentfinance Processed by Student Finance England Student Services can help Support available for dyslexic students

Other sources of income

Other sources of income

EXTRA INCOME

EXTRA INCOME

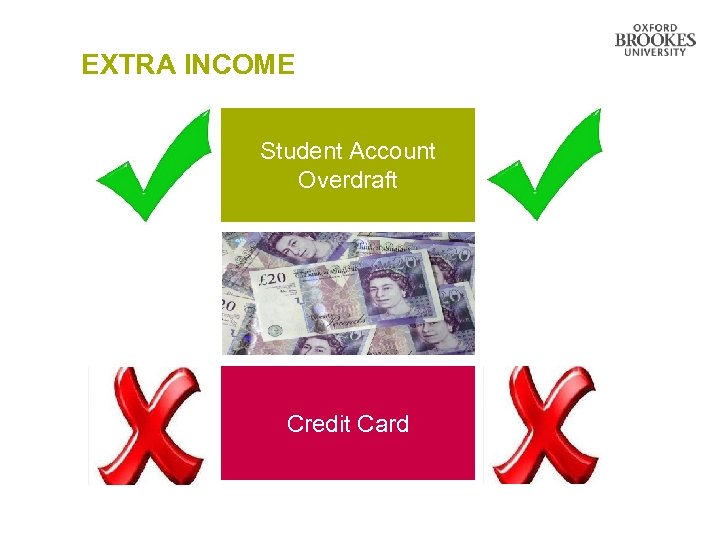

EXTRA INCOME Student Account Overdraft Credit Card

EXTRA INCOME Student Account Overdraft Credit Card

HOW TO SAVE MONEY! § NUS Card § Bulk Buy § Value Food § Mobile Phone tariff § 16 – 25 Railway Card

HOW TO SAVE MONEY! § NUS Card § Bulk Buy § Value Food § Mobile Phone tariff § 16 – 25 Railway Card

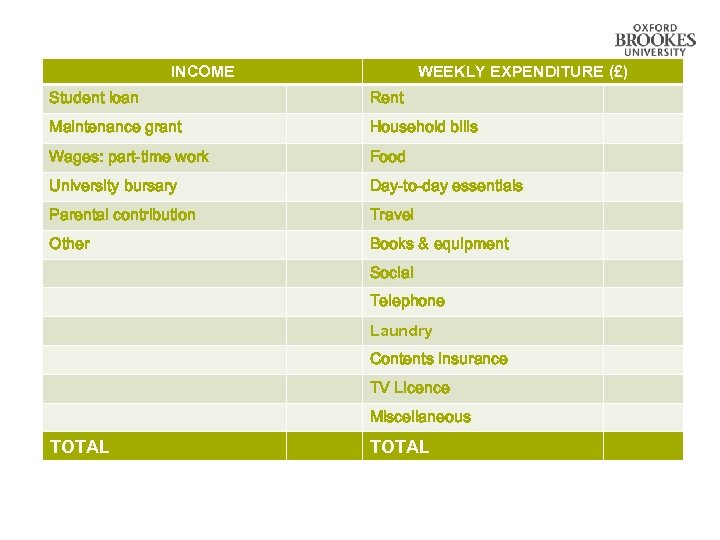

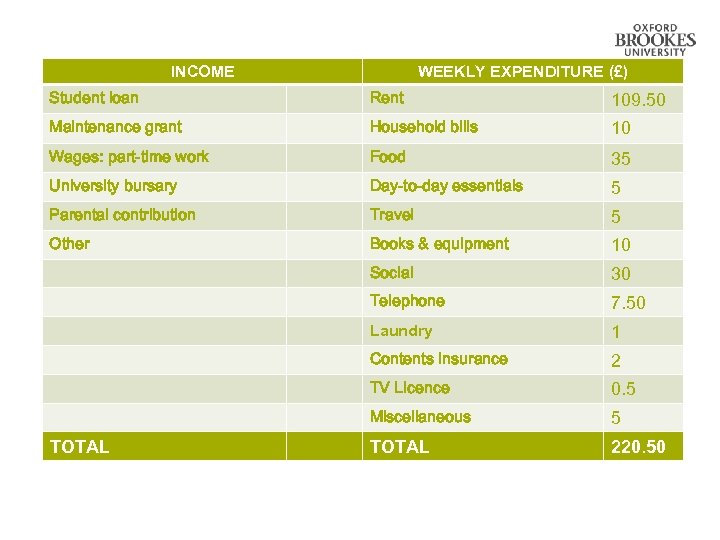

INCOME WEEKLY EXPENDITURE (£) Student loan Rent Maintenance grant Household bills Wages: part-time work Food University bursary Day-to-day essentials Parental contribution Travel Other Books & equipment Social Telephone Laundry Contents Insurance TV Licence Miscellaneous TOTAL

INCOME WEEKLY EXPENDITURE (£) Student loan Rent Maintenance grant Household bills Wages: part-time work Food University bursary Day-to-day essentials Parental contribution Travel Other Books & equipment Social Telephone Laundry Contents Insurance TV Licence Miscellaneous TOTAL

INCOME WEEKLY EXPENDITURE (£) Student loan Rent 109. 50 Maintenance grant Household bills 10 Wages: part-time work Food 35 University bursary Day-to-day essentials 5 Parental contribution Travel 5 Other Books & equipment 10 Social 30 Telephone 7. 50 Laundry 1 Contents Insurance 2 TV Licence 0. 5 Miscellaneous 5 TOTAL 220. 50 TOTAL

INCOME WEEKLY EXPENDITURE (£) Student loan Rent 109. 50 Maintenance grant Household bills 10 Wages: part-time work Food 35 University bursary Day-to-day essentials 5 Parental contribution Travel 5 Other Books & equipment 10 Social 30 Telephone 7. 50 Laundry 1 Contents Insurance 2 TV Licence 0. 5 Miscellaneous 5 TOTAL 220. 50 TOTAL

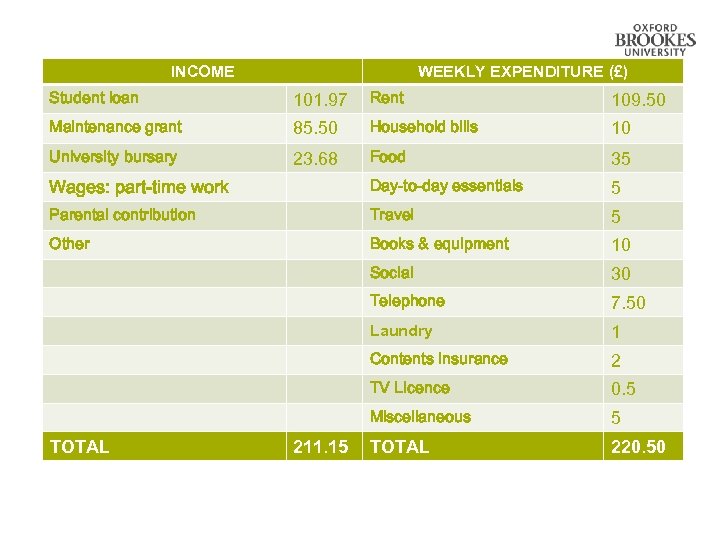

INCOME WEEKLY EXPENDITURE (£) Student loan 101. 97 Rent 109. 50 Maintenance grant 85. 50 Household bills 10 University bursary 23. 68 Food 35 Wages: part-time work Day-to-day essentials 5 Parental contribution Travel 5 Other Books & equipment 10 Social 30 Telephone 7. 50 Laundry 1 Contents Insurance 2 TV Licence 0. 5 Miscellaneous 5 TOTAL 220. 50 TOTAL 211. 15

INCOME WEEKLY EXPENDITURE (£) Student loan 101. 97 Rent 109. 50 Maintenance grant 85. 50 Household bills 10 University bursary 23. 68 Food 35 Wages: part-time work Day-to-day essentials 5 Parental contribution Travel 5 Other Books & equipment 10 Social 30 Telephone 7. 50 Laundry 1 Contents Insurance 2 TV Licence 0. 5 Miscellaneous 5 TOTAL 220. 50 TOTAL 211. 15

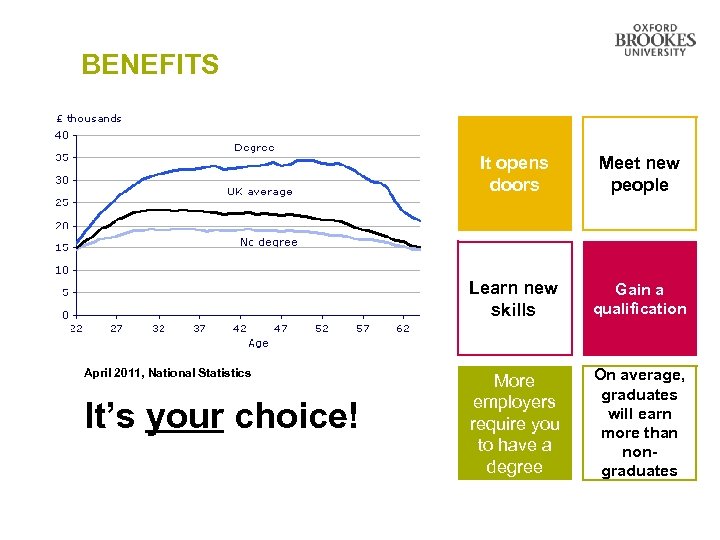

BENEFITS It opens doors Learn new skills April 2011, National Statistics It’s your choice! Meet new people Gain a qualification More employers require you to have a degree On average, graduates will earn more than nongraduates

BENEFITS It opens doors Learn new skills April 2011, National Statistics It’s your choice! Meet new people Gain a qualification More employers require you to have a degree On average, graduates will earn more than nongraduates

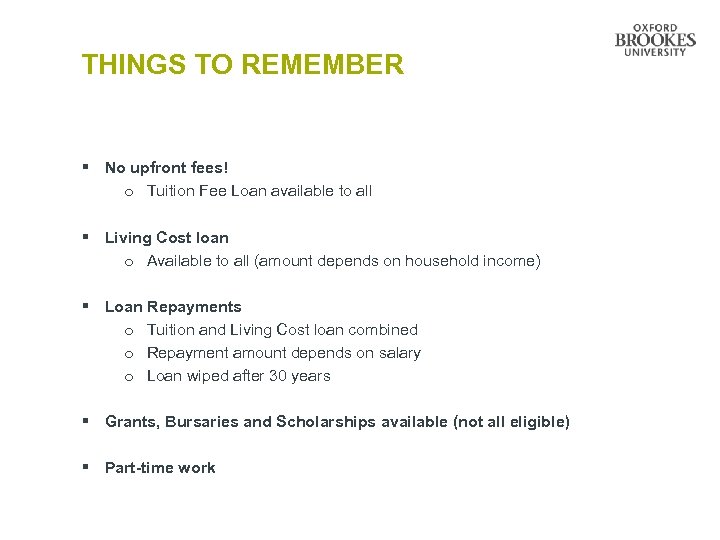

THINGS TO REMEMBER § No upfront fees! o Tuition Fee Loan available to all § Living Cost loan o Available to all (amount depends on household income) § Loan Repayments o Tuition and Living Cost loan combined o Repayment amount depends on salary o Loan wiped after 30 years § Grants, Bursaries and Scholarships available (not all eligible) § Part-time work

THINGS TO REMEMBER § No upfront fees! o Tuition Fee Loan available to all § Living Cost loan o Available to all (amount depends on household income) § Loan Repayments o Tuition and Living Cost loan combined o Repayment amount depends on salary o Loan wiped after 30 years § Grants, Bursaries and Scholarships available (not all eligible) § Part-time work

ALL YOU NEED TO KNOW ABOUT UNIVERSITY www. unipodadvice. com

ALL YOU NEED TO KNOW ABOUT UNIVERSITY www. unipodadvice. com

USEFUL WEBSITES FINANCE: www. gov. uk/studentfinance www. brookes. ac. uk/studying/finance www. nhsbsa. nhs. uk/students (NHS and Social Care courses) BROOKES: www. brookes. ac. uk

USEFUL WEBSITES FINANCE: www. gov. uk/studentfinance www. brookes. ac. uk/studying/finance www. nhsbsa. nhs. uk/students (NHS and Social Care courses) BROOKES: www. brookes. ac. uk

Any Questions?

Any Questions?