01115c8bb0d5eb1940b70cda5f3a8cb3.ppt

- Количество слайдов: 35

STRUCTURED FINANCE – EXPORT FINANCE Presentation for xxxxx Date

STRUCTURED FINANCE – EXPORT FINANCE Presentation for xxxxx Date

Agenda Page 1. Facts & Figures about Bayern. LB 3 2. Export Finance at Bayern. LB 6 3. Export Finance Transactions 14 4. Typical Types of Financing 21 5. References and Awards 29 STRUCTURED FINANCE - EXPORT FINANCE Page 2

Agenda Page 1. Facts & Figures about Bayern. LB 3 2. Export Finance at Bayern. LB 6 3. Export Finance Transactions 14 4. Typical Types of Financing 21 5. References and Awards 29 STRUCTURED FINANCE - EXPORT FINANCE Page 2

Facts & Figures about Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 3

Facts & Figures about Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 3

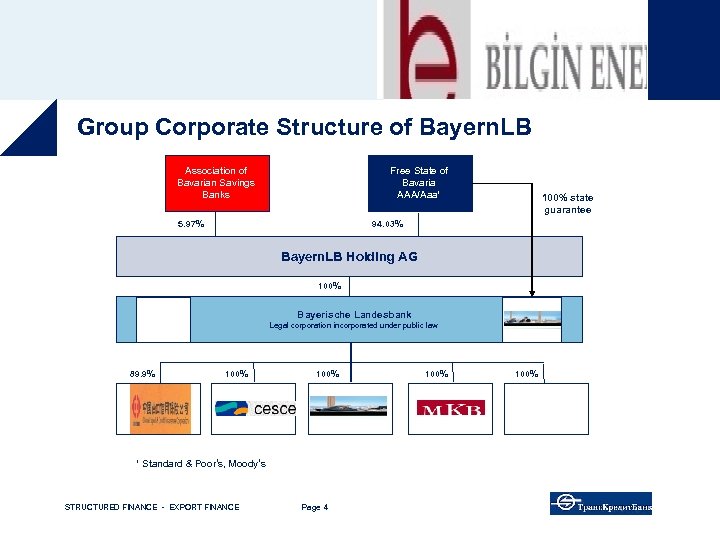

Group Corporate Structure of Bayern. LB Association of Bavarian Savings Banks Free State of Bavaria AAA/Aaa¹ 5. 97% 100% state guarantee 94. 03% Bayern. LB Holding AG 100% Bayerische Landesbank Legal corporation incorporated under public law 89. 9% 100% ¹ Standard & Poor‘s, Moody‘s ¹ STRUCTURED FINANCE - EXPORT FINANCE Page 4 100%

Group Corporate Structure of Bayern. LB Association of Bavarian Savings Banks Free State of Bavaria AAA/Aaa¹ 5. 97% 100% state guarantee 94. 03% Bayern. LB Holding AG 100% Bayerische Landesbank Legal corporation incorporated under public law 89. 9% 100% ¹ Standard & Poor‘s, Moody‘s ¹ STRUCTURED FINANCE - EXPORT FINANCE Page 4 100%

Highlights 2010 – key messages 1 Solid earnings before taxes of EUR 885 m in 2010 2 All earnings before taxes came from core activities 3 Investors benefit from good operating earnings 4 Deleveraging: Substantial reduction of risks, costs and total assets 5 Well capitalized – even under the new Basel III regime 6 Well balanced funding potential and moderate needs 7 Bayern. LB is one of the leading corporate financiers with good loan quality Bayern. LB is on track with its customer oriented business model STRUCTURED FINANCE - EXPORT FINANCE Page 5

Highlights 2010 – key messages 1 Solid earnings before taxes of EUR 885 m in 2010 2 All earnings before taxes came from core activities 3 Investors benefit from good operating earnings 4 Deleveraging: Substantial reduction of risks, costs and total assets 5 Well capitalized – even under the new Basel III regime 6 Well balanced funding potential and moderate needs 7 Bayern. LB is one of the leading corporate financiers with good loan quality Bayern. LB is on track with its customer oriented business model STRUCTURED FINANCE - EXPORT FINANCE Page 5

Export Finance at Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 6

Export Finance at Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 6

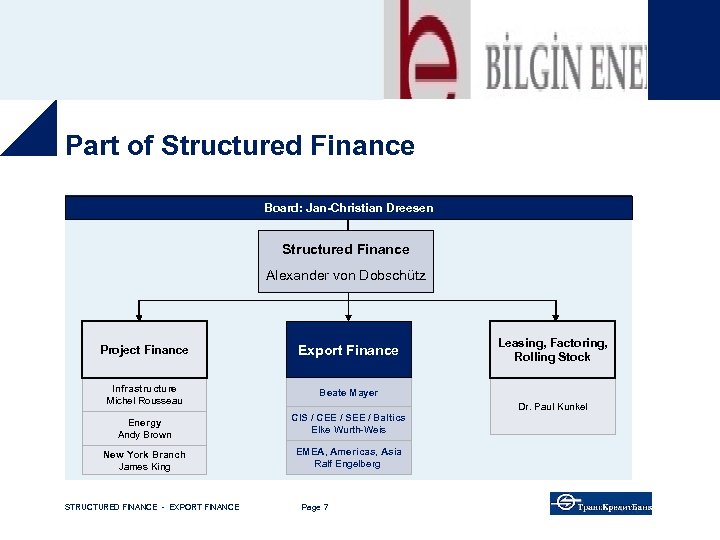

Part of Structured Finance Board: Jan-Christian Dreesen Structured Finance Alexander von Dobschütz Project Finance Export Finance Infrastructure Michel Rousseau Leasing, Factoring, Rolling Stock Beate Mayer Energy Andy Brown New York Branch James King CIS / CEE / SEE / Baltics Elke Wurth-Weis EMEA, Americas, Asia Ralf Engelberg STRUCTURED FINANCE - EXPORT FINANCE Page 7 Dr. Paul Kunkel

Part of Structured Finance Board: Jan-Christian Dreesen Structured Finance Alexander von Dobschütz Project Finance Export Finance Infrastructure Michel Rousseau Leasing, Factoring, Rolling Stock Beate Mayer Energy Andy Brown New York Branch James King CIS / CEE / SEE / Baltics Elke Wurth-Weis EMEA, Americas, Asia Ralf Engelberg STRUCTURED FINANCE - EXPORT FINANCE Page 7 Dr. Paul Kunkel

Export Finance Department Beate Mayer Tel. : (Head of Department) +49 (89) 2171 -23772 E-Mail: Beate. Mayer@bayernlb. de Volker Kuntz (Senior Specialist) Tel. : +49 (89) 2171 -23965 E-Mail: Volker. Kuntz@bayernlb. de STRUCTURED FINANCE - EXPORT FINANCE Page 8

Export Finance Department Beate Mayer Tel. : (Head of Department) +49 (89) 2171 -23772 E-Mail: Beate. Mayer@bayernlb. de Volker Kuntz (Senior Specialist) Tel. : +49 (89) 2171 -23965 E-Mail: Volker. Kuntz@bayernlb. de STRUCTURED FINANCE - EXPORT FINANCE Page 8

Export Finance The Team Section „CIS / CEE / SEE / Baltics“ Elke Wurth-Weis Hans Grutza Tel. : +49 (89) 2171 -23774 +49 (89) 2171 -23514 E-Mail: Elke. Wurth-Weis@bayernlb. de E-Mail: Hans. Grutza@bayernlb. de Herta Albert Evan Sirowinski Tel. : +49 (89) 2171 -23802 +49 (89) 2171 -23998 E-Mail: Herta. Albert@bayernlb. de E-Mail: Evan. Sirowinski@bayernlb. de Andreas Lettow Doris Wimmer Tel. : +49 (89) 2171 -23647 +49 (89) 2171 -23977 E-Mail: Andreas. Lettow@bayernlb. de E-Mail: Doris. Wimmer@bayernlb. de Harm Clasen Richard Lawrynowicz Tel. : +49 89 2171 -26388 E-Mail: Harm. Clasen@bayernlb. de STRUCTURED FINANCE - EXPORT FINANCE Page 9 +49 89 2171 -23513 E-Mail: Richard. Lawrynowicz@bayernlb. de

Export Finance The Team Section „CIS / CEE / SEE / Baltics“ Elke Wurth-Weis Hans Grutza Tel. : +49 (89) 2171 -23774 +49 (89) 2171 -23514 E-Mail: Elke. Wurth-Weis@bayernlb. de E-Mail: Hans. Grutza@bayernlb. de Herta Albert Evan Sirowinski Tel. : +49 (89) 2171 -23802 +49 (89) 2171 -23998 E-Mail: Herta. Albert@bayernlb. de E-Mail: Evan. Sirowinski@bayernlb. de Andreas Lettow Doris Wimmer Tel. : +49 (89) 2171 -23647 +49 (89) 2171 -23977 E-Mail: Andreas. Lettow@bayernlb. de E-Mail: Doris. Wimmer@bayernlb. de Harm Clasen Richard Lawrynowicz Tel. : +49 89 2171 -26388 E-Mail: Harm. Clasen@bayernlb. de STRUCTURED FINANCE - EXPORT FINANCE Page 9 +49 89 2171 -23513 E-Mail: Richard. Lawrynowicz@bayernlb. de

What are our Strengths? Long-term relationship • Export & Trade Finance experience for more than 30 years • Supporting growth of our customers in their markets in the long run • Structuring capabilities Competence • Large underwriting capabilities • Placing / syndication power • Tailor-made solutions and services • Know how in specific regions (Europe, CIS, Asia, N&M East, Americas) People • Expertise in specific sectors (Utilities, Metals, Oil/Gas, Telecom, M&E, Aviation) • Dedicated staff in key markets STRUCTURED FINANCE - EXPORT FINANCE Page 10

What are our Strengths? Long-term relationship • Export & Trade Finance experience for more than 30 years • Supporting growth of our customers in their markets in the long run • Structuring capabilities Competence • Large underwriting capabilities • Placing / syndication power • Tailor-made solutions and services • Know how in specific regions (Europe, CIS, Asia, N&M East, Americas) People • Expertise in specific sectors (Utilities, Metals, Oil/Gas, Telecom, M&E, Aviation) • Dedicated staff in key markets STRUCTURED FINANCE - EXPORT FINANCE Page 10

What are our Products? Structured Export Finance • Multi-source financing of up to 100% of project value • long tenors (often > 10 years) • Lending on basis of corporate risk • Credit enhancement by ECA and/or PRI and/or off-take structures Trade Finance • Documentary business • Short term trade finance (e. g. advances, post-shipment finance) • Forfaiting Cross-selling products • Hedging instruments for FX, interest and commodities • Emission Certificates (Joint Implementation Certificates, Clean Development Mechanism) • Emission trading • Consulting and advisory services STRUCTURED FINANCE - EXPORT FINANCE Page 11

What are our Products? Structured Export Finance • Multi-source financing of up to 100% of project value • long tenors (often > 10 years) • Lending on basis of corporate risk • Credit enhancement by ECA and/or PRI and/or off-take structures Trade Finance • Documentary business • Short term trade finance (e. g. advances, post-shipment finance) • Forfaiting Cross-selling products • Hedging instruments for FX, interest and commodities • Emission Certificates (Joint Implementation Certificates, Clean Development Mechanism) • Emission trading • Consulting and advisory services STRUCTURED FINANCE - EXPORT FINANCE Page 11

Who are our Partners? • Exporters Structured Export Finance • Importers • Export Credit Agencies (ECAs) • Private Risk Insurance Companies • Commercial Banks • Multinational Finance Institutions (MFIs) • Exporters Trade Finance • Trading Companies • Commercial Banks • Off-takers • Private Insurance Companies STRUCTURED FINANCE - EXPORT FINANCE Page 12

Who are our Partners? • Exporters Structured Export Finance • Importers • Export Credit Agencies (ECAs) • Private Risk Insurance Companies • Commercial Banks • Multinational Finance Institutions (MFIs) • Exporters Trade Finance • Trading Companies • Commercial Banks • Off-takers • Private Insurance Companies STRUCTURED FINANCE - EXPORT FINANCE Page 12

Our Main Partner Banks in Russia Existing Basic Agreements for ECA covered Buyer‘s Credits Advantages: • Efficient Work Flow • Close Cooperation • International Documentation Standards • Track Record STRUCTURED FINANCE - EXPORT FINANCE Page 13

Our Main Partner Banks in Russia Existing Basic Agreements for ECA covered Buyer‘s Credits Advantages: • Efficient Work Flow • Close Cooperation • International Documentation Standards • Track Record STRUCTURED FINANCE - EXPORT FINANCE Page 13

Export Finance Transactions STRUCTURED FINANCE - EXPORT FINANCE Page 14

Export Finance Transactions STRUCTURED FINANCE - EXPORT FINANCE Page 14

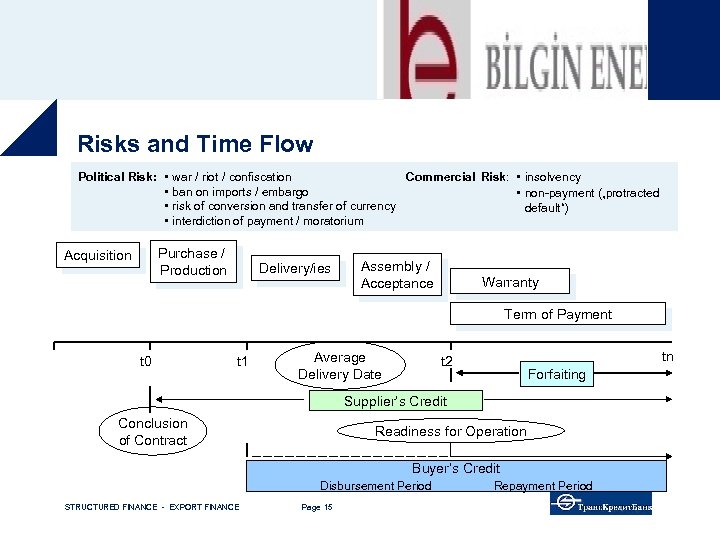

Risks and Time Flow Commercial Risk: insolvency Political Risk: war / riot / confiscation ban on imports / embargo non-payment („protracted risk of conversion and transfer of currency default“) interdiction of payment / moratorium Purchase / Production Acquisition Delivery/ies Assembly / Acceptance Warranty Term of Payment t 0 t 1 Average Delivery Date t 2 tn Forfaiting Supplier‘s Credit Conclusion of Contract Readiness for Operation Buyer‘s Credit Disbursement Period Repayment Period STRUCTURED FINANCE - EXPORT FINANCE Page 15

Risks and Time Flow Commercial Risk: insolvency Political Risk: war / riot / confiscation ban on imports / embargo non-payment („protracted risk of conversion and transfer of currency default“) interdiction of payment / moratorium Purchase / Production Acquisition Delivery/ies Assembly / Acceptance Warranty Term of Payment t 0 t 1 Average Delivery Date t 2 tn Forfaiting Supplier‘s Credit Conclusion of Contract Readiness for Operation Buyer‘s Credit Disbursement Period Repayment Period STRUCTURED FINANCE - EXPORT FINANCE Page 15

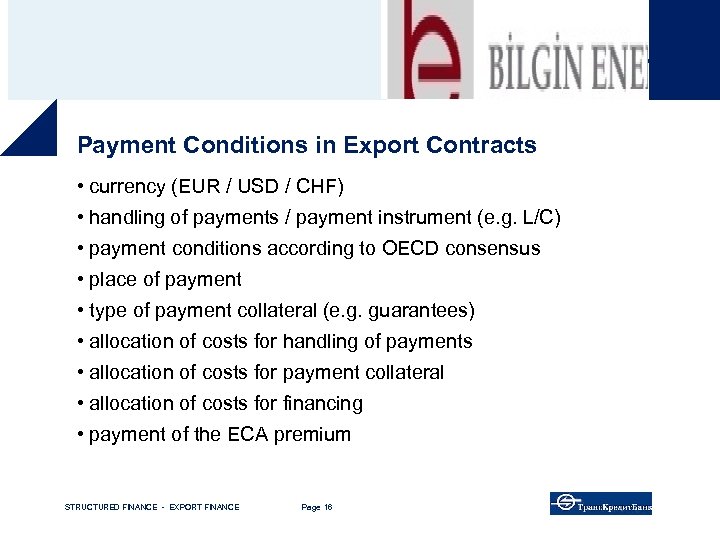

Good operating business – Bayern. LB „back on track“ Payment Conditions in Export Contracts • currency (EUR / USD / CHF) • handling of payments / payment instrument (e. g. L/C) • payment conditions according to OECD consensus • place of payment • type of payment collateral (e. g. guarantees) • allocation of costs for handling of payments • allocation of costs for payment collateral • allocation of costs for financing • payment of the ECA premium STRUCTURED FINANCE - EXPORT FINANCE Page 16

Good operating business – Bayern. LB „back on track“ Payment Conditions in Export Contracts • currency (EUR / USD / CHF) • handling of payments / payment instrument (e. g. L/C) • payment conditions according to OECD consensus • place of payment • type of payment collateral (e. g. guarantees) • allocation of costs for handling of payments • allocation of costs for payment collateral • allocation of costs for financing • payment of the ECA premium STRUCTURED FINANCE - EXPORT FINANCE Page 16

Governmental Support for Exports: OECD Consensus Ø „Gentlemen‘s Agreement“ of the OECD countries about rules of governmental support of exports Ø Target: avoid distortion of competition Ø Valid for all state-aided export finance transactions with a credit period of more than 2 years • (National) Export Credit Insurance (ECA) Instruments • Direct credits or refinancing schemes • Subsidies for interest payments • Insurance against unlawful claim of guarantee STRUCTURED FINANCE - EXPORT FINANCE Page 17

Governmental Support for Exports: OECD Consensus Ø „Gentlemen‘s Agreement“ of the OECD countries about rules of governmental support of exports Ø Target: avoid distortion of competition Ø Valid for all state-aided export finance transactions with a credit period of more than 2 years • (National) Export Credit Insurance (ECA) Instruments • Direct credits or refinancing schemes • Subsidies for interest payments • Insurance against unlawful claim of guarantee STRUCTURED FINANCE - EXPORT FINANCE Page 17

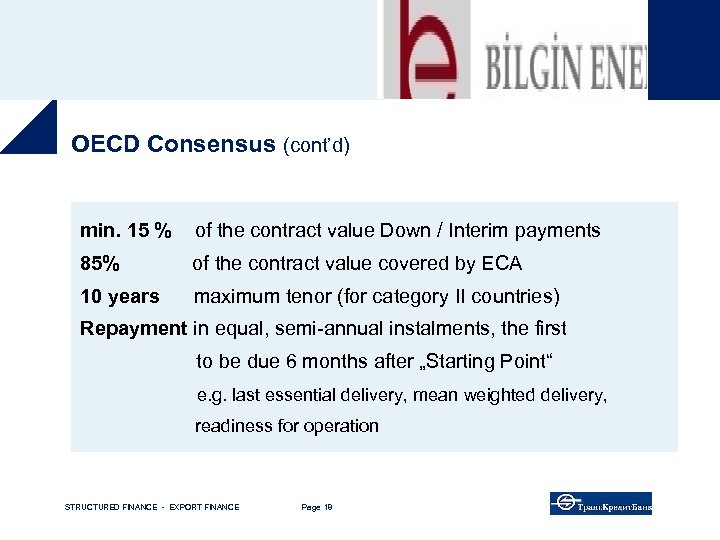

OECD Consensus (cont’d) min. 15 % of the contract value Down / Interim payments 85% of the contract value covered by ECA 10 years maximum tenor (for category II countries) Repayment in equal, semi-annual instalments, the first to be due 6 months after „Starting Point“ e. g. last essential delivery, mean weighted delivery, readiness for operation STRUCTURED FINANCE - EXPORT FINANCE Page 18

OECD Consensus (cont’d) min. 15 % of the contract value Down / Interim payments 85% of the contract value covered by ECA 10 years maximum tenor (for category II countries) Repayment in equal, semi-annual instalments, the first to be due 6 months after „Starting Point“ e. g. last essential delivery, mean weighted delivery, readiness for operation STRUCTURED FINANCE - EXPORT FINANCE Page 18

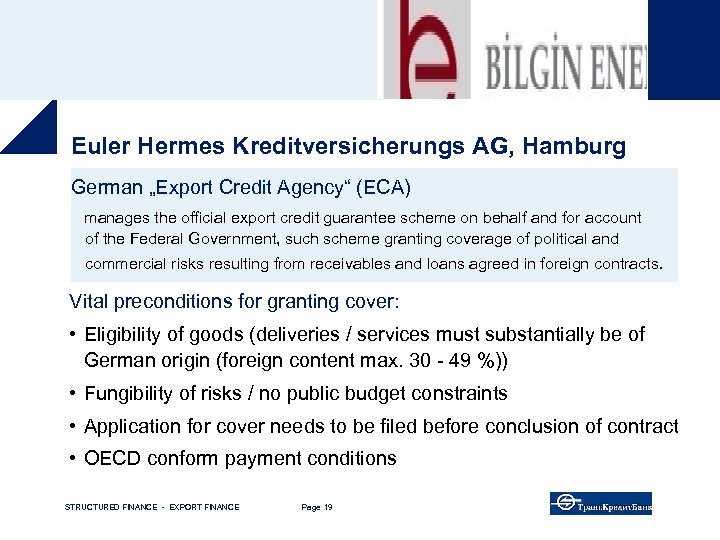

Euler Hermes Kreditversicherungs AG, Hamburg German „Export Credit Agency“ (ECA) manages the official export credit guarantee scheme on behalf and for account of the Federal Government, such scheme granting coverage of political and commercial risks resulting from receivables and loans agreed in foreign contracts. Vital preconditions for granting cover: • Eligibility of goods (deliveries / services must substantially be of German origin (foreign content max. 30 - 49 %)) • Fungibility of risks / no public budget constraints • Application for cover needs to be filed before conclusion of contract • OECD conform payment conditions STRUCTURED FINANCE - EXPORT FINANCE Page 19

Euler Hermes Kreditversicherungs AG, Hamburg German „Export Credit Agency“ (ECA) manages the official export credit guarantee scheme on behalf and for account of the Federal Government, such scheme granting coverage of political and commercial risks resulting from receivables and loans agreed in foreign contracts. Vital preconditions for granting cover: • Eligibility of goods (deliveries / services must substantially be of German origin (foreign content max. 30 - 49 %)) • Fungibility of risks / no public budget constraints • Application for cover needs to be filed before conclusion of contract • OECD conform payment conditions STRUCTURED FINANCE - EXPORT FINANCE Page 19

Bayern LB is Partner for Public Export Credit Agencies (ECAs) Multi Source / ECA Desk STRUCTURED FINANCE - EXPORT FINANCE Page 20

Bayern LB is Partner for Public Export Credit Agencies (ECAs) Multi Source / ECA Desk STRUCTURED FINANCE - EXPORT FINANCE Page 20

Typical Types of Financing STRUCTURED FINANCE - EXPORT FINANCE Page 21

Typical Types of Financing STRUCTURED FINANCE - EXPORT FINANCE Page 21

ECA-covered Buyer’s Credit • Definition: the principal bank of a foreign contractual partner of the exporter („buyer“) or the buyer is granted a loan whereas the borrowed funds are disbursed directly to the exporter for payment of the purchase price • Loan Amount: 85% of the contract value plus 100% of the ECA premium plus part of local costs if eligible for ECA cover • Additional uncovered financing possibilies: possible financing of the down/interim payments qualified financing of remaining local costs STRUCTURED FINANCE - EXPORT FINANCE Page 22

ECA-covered Buyer’s Credit • Definition: the principal bank of a foreign contractual partner of the exporter („buyer“) or the buyer is granted a loan whereas the borrowed funds are disbursed directly to the exporter for payment of the purchase price • Loan Amount: 85% of the contract value plus 100% of the ECA premium plus part of local costs if eligible for ECA cover • Additional uncovered financing possibilies: possible financing of the down/interim payments qualified financing of remaining local costs STRUCTURED FINANCE - EXPORT FINANCE Page 22

ECA-covered Buyer’s Credit (cont’d) Additional Collateral required by the ECA: • Exporter‘s undertaking • Financial statements according to IRFS in case the buyer is acting as borrower • Guarantees (as the case may be) • Pledge of assets (as the case may be) STRUCTURED FINANCE - EXPORT FINANCE Page 23

ECA-covered Buyer’s Credit (cont’d) Additional Collateral required by the ECA: • Exporter‘s undertaking • Financial statements according to IRFS in case the buyer is acting as borrower • Guarantees (as the case may be) • Pledge of assets (as the case may be) STRUCTURED FINANCE - EXPORT FINANCE Page 23

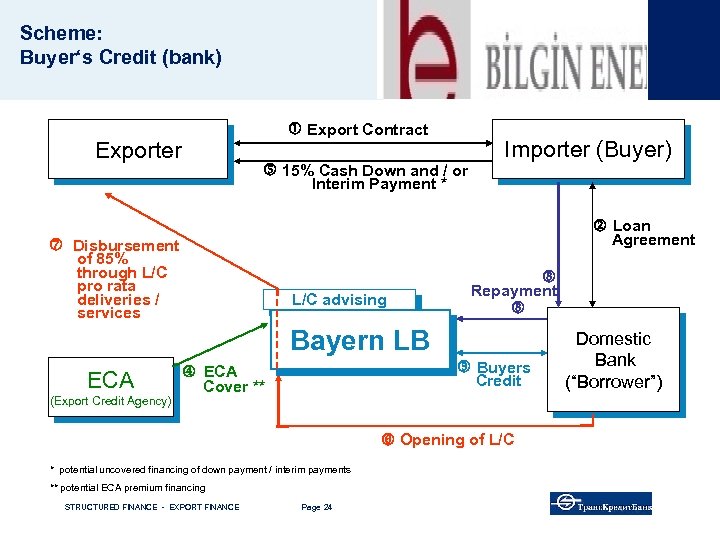

Scheme: Buyer‘s Credit (bank) Export Contract Exporter 15% Cash Down and / or Interim Payment * Loan Agreement Disbursement of 85% through L/C pro rata deliveries / services ECA (Export Credit Agency) Importer (Buyer) L/C advising Repayment Bayern LB ECA Cover ** Buyers Credit Opening of L/C * potential uncovered financing of down payment / interim payments ** potential ECA premium financing STRUCTURED FINANCE - EXPORT FINANCE Page 24 Domestic Bank (“Borrower”)

Scheme: Buyer‘s Credit (bank) Export Contract Exporter 15% Cash Down and / or Interim Payment * Loan Agreement Disbursement of 85% through L/C pro rata deliveries / services ECA (Export Credit Agency) Importer (Buyer) L/C advising Repayment Bayern LB ECA Cover ** Buyers Credit Opening of L/C * potential uncovered financing of down payment / interim payments ** potential ECA premium financing STRUCTURED FINANCE - EXPORT FINANCE Page 24 Domestic Bank (“Borrower”)

Scheme: Buyer‘s Credit (corporate) Export Contract Exporter (Export Credit Agency) “Borrower” 15% Cash Down and / or Interim Payment * Repayment Disbursement of 85% through L/C pro rata deliveries / services ECA Importer (Buyer) L/C advising Bayern LB ECA Cover ** Loan Agreement / Buyer's Credit (“tied export credit”) Guarantee support (optional) Opening of L/C * potential uncovered financing of down payment / interim payments ** potential ECA premium financing STRUCTURED FINANCE - EXPORT FINANCE Page 25 Domestic Bank

Scheme: Buyer‘s Credit (corporate) Export Contract Exporter (Export Credit Agency) “Borrower” 15% Cash Down and / or Interim Payment * Repayment Disbursement of 85% through L/C pro rata deliveries / services ECA Importer (Buyer) L/C advising Bayern LB ECA Cover ** Loan Agreement / Buyer's Credit (“tied export credit”) Guarantee support (optional) Opening of L/C * potential uncovered financing of down payment / interim payments ** potential ECA premium financing STRUCTURED FINANCE - EXPORT FINANCE Page 25 Domestic Bank

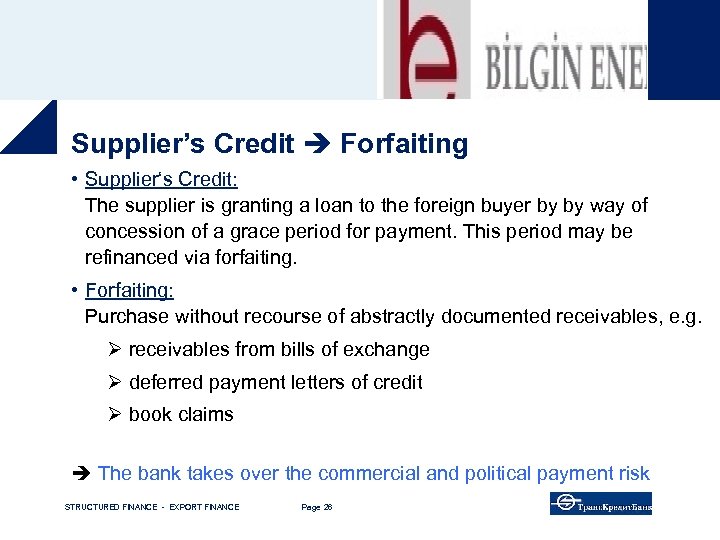

Supplier’s Credit Forfaiting • Supplier‘s Credit: The supplier is granting a loan to the foreign buyer by by way of concession of a grace period for payment. This period may be refinanced via forfaiting. • Forfaiting: Purchase without recourse of abstractly documented receivables, e. g. Ø receivables from bills of exchange Ø deferred payment letters of credit Ø book claims The bank takes over the commercial and political payment risk STRUCTURED FINANCE - EXPORT FINANCE Page 26

Supplier’s Credit Forfaiting • Supplier‘s Credit: The supplier is granting a loan to the foreign buyer by by way of concession of a grace period for payment. This period may be refinanced via forfaiting. • Forfaiting: Purchase without recourse of abstractly documented receivables, e. g. Ø receivables from bills of exchange Ø deferred payment letters of credit Ø book claims The bank takes over the commercial and political payment risk STRUCTURED FINANCE - EXPORT FINANCE Page 26

Forfaiting (cont’d) Requirements for Forfaitability: • Additional collateral as might be required by the ECA or the bank • Export contract has to allow assignment of claims • Export contract has to foresee yearly presentation of financial statements according to IFRS • Purchased claims have to be free of objections and/or counterclaims under the export contract STRUCTURED FINANCE - EXPORT FINANCE Page 27

Forfaiting (cont’d) Requirements for Forfaitability: • Additional collateral as might be required by the ECA or the bank • Export contract has to allow assignment of claims • Export contract has to foresee yearly presentation of financial statements according to IFRS • Purchased claims have to be free of objections and/or counterclaims under the export contract STRUCTURED FINANCE - EXPORT FINANCE Page 27

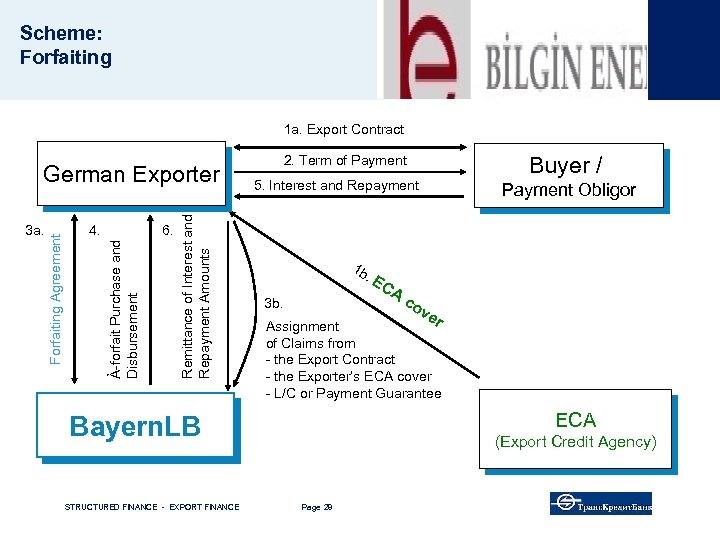

Scheme: Forfaiting 1 a. Export Contract 6. Remittance of Interest and Repayment Amounts 4. À-forfait Purchase and Disbursement 3 a. Forfaiting Agreement German Exporter 2. Term of Payment Buyer / 5. Interest and Repayment 1 b Payment Obligor . E 3 b. CA co v e r Assignment of Claims from - the Export Contract - the Exporter‘s ECA cover - L/C or Payment Guarantee Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 28 ECA (Export Credit Agency)

Scheme: Forfaiting 1 a. Export Contract 6. Remittance of Interest and Repayment Amounts 4. À-forfait Purchase and Disbursement 3 a. Forfaiting Agreement German Exporter 2. Term of Payment Buyer / 5. Interest and Repayment 1 b Payment Obligor . E 3 b. CA co v e r Assignment of Claims from - the Export Contract - the Exporter‘s ECA cover - L/C or Payment Guarantee Bayern. LB STRUCTURED FINANCE - EXPORT FINANCE Page 28 ECA (Export Credit Agency)

References and Awards STRUCTURED FINANCE - EXPORT FINANCE Page 29

References and Awards STRUCTURED FINANCE - EXPORT FINANCE Page 29

Deal Highlights 2010 Undersecretariat of Treasury EUR 1, 878, 700, 000 EUR 149, 351, 984 EUR 1, 500, 000 € 3, 900, 000 6 submarines Type 214 Hermes covered Export Finance Facility Euler Hermes covered Export Finance Facility Syndicated Pre Export Finance Mandated Lead Arranger (Turkey) Mandated Lead Arranger (Russia) Gas Pipeline Baltic Sea Region Mandated Lead Arranger 2010 OAO Kabbalkgips EUR 26, 205, 806 Wind Energy Converters Turkey Export Credit Facility Euler-Hermes Cover Lead Arranger EUR 115, 500, 000 Export Finance Facility Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 30 EUR 325, 000 for SIF Revolving Collateralised Loan Facility Mandated Lead Arranger (Russia) USD 475, 000 Issuance of Import LOCs Participating Lender (Hungary)

Deal Highlights 2010 Undersecretariat of Treasury EUR 1, 878, 700, 000 EUR 149, 351, 984 EUR 1, 500, 000 € 3, 900, 000 6 submarines Type 214 Hermes covered Export Finance Facility Euler Hermes covered Export Finance Facility Syndicated Pre Export Finance Mandated Lead Arranger (Turkey) Mandated Lead Arranger (Russia) Gas Pipeline Baltic Sea Region Mandated Lead Arranger 2010 OAO Kabbalkgips EUR 26, 205, 806 Wind Energy Converters Turkey Export Credit Facility Euler-Hermes Cover Lead Arranger EUR 115, 500, 000 Export Finance Facility Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 30 EUR 325, 000 for SIF Revolving Collateralised Loan Facility Mandated Lead Arranger (Russia) USD 475, 000 Issuance of Import LOCs Participating Lender (Hungary)

Deal Highlights (cont’d) 2009 Vyksa Steel Works Tomis Team / M. W. Team Invest EUR 262, 350, 000 Fantanele Windfarm EUR 69, 892, 500 EUR 524, 000 Wind turbine generators EUR 346, 920, 200 Multi-Source Master Export Finance Facility Euler Hermes covered Export Finance Facility Euler. Hermes covered Export Finance Facility Mandated Lead Arranger (Russia) Lead Arranger (Turkey) 2008 2009 Mandated Lead Arranger (Russia) Jamshedpur Expansion Project Azeryolservis OJSC EUR 264, 000 USD 80, 500, 000 Export Credit Facility Euler-Hermes Cover Mandated Lead Arranger (India) EUR 255, 000 Road Infrastructure Export Finance Facility Co-Arranger (Azerbaijan) STRUCTURED FINANCE - EXPORT FINANCE Page 31 EBRD A/B-Loan Facility 347. 5 MW Euler Hermes covered Export Finance Facility Agent & MLA 2008 Indramayu Power Project USD 592, 224, 258 First project under new Sustainable Energy Action Plan Export Credit Facility Sinosure Cover Mandated Lead Arranger (Kazakhstan) Senior Lead Arranger (Indonesia)

Deal Highlights (cont’d) 2009 Vyksa Steel Works Tomis Team / M. W. Team Invest EUR 262, 350, 000 Fantanele Windfarm EUR 69, 892, 500 EUR 524, 000 Wind turbine generators EUR 346, 920, 200 Multi-Source Master Export Finance Facility Euler Hermes covered Export Finance Facility Euler. Hermes covered Export Finance Facility Mandated Lead Arranger (Russia) Lead Arranger (Turkey) 2008 2009 Mandated Lead Arranger (Russia) Jamshedpur Expansion Project Azeryolservis OJSC EUR 264, 000 USD 80, 500, 000 Export Credit Facility Euler-Hermes Cover Mandated Lead Arranger (India) EUR 255, 000 Road Infrastructure Export Finance Facility Co-Arranger (Azerbaijan) STRUCTURED FINANCE - EXPORT FINANCE Page 31 EBRD A/B-Loan Facility 347. 5 MW Euler Hermes covered Export Finance Facility Agent & MLA 2008 Indramayu Power Project USD 592, 224, 258 First project under new Sustainable Energy Action Plan Export Credit Facility Sinosure Cover Mandated Lead Arranger (Kazakhstan) Senior Lead Arranger (Indonesia)

Deal Highlights (cont’d) 2008 EUR 600, 000 EUR 60, 000 EBRD A/B-Loan Facility Euler Hermes Covered Export Finance Facilities Energy Efficiency Loan Sole Lender (Russia) Arranger (Russia) 2008 2007 2008 CHF 45, 000 Refinancing of the Leasing Portfolio Participating Lender (Russia) EUR 278, 800, 000 Euler Hermes covered Export Finance Facility Mandated Lead Arranger (Russia) 2007 LLP Ka. R-Tel EUR 218, 000 USD 47, 500, 000 Euler Hermes Covered Export Finance Facility Sole Lender (Kazakhstan) Export Credit Facility Finnvera-covered Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 32 USD 300, 000 USD 50, 000 EBRD A/B-Loan Facility Refinancing of the Leasing Portfolio Environmental Loan Mandated Lead Arranger (Russia) Participating Lender (Russia)

Deal Highlights (cont’d) 2008 EUR 600, 000 EUR 60, 000 EBRD A/B-Loan Facility Euler Hermes Covered Export Finance Facilities Energy Efficiency Loan Sole Lender (Russia) Arranger (Russia) 2008 2007 2008 CHF 45, 000 Refinancing of the Leasing Portfolio Participating Lender (Russia) EUR 278, 800, 000 Euler Hermes covered Export Finance Facility Mandated Lead Arranger (Russia) 2007 LLP Ka. R-Tel EUR 218, 000 USD 47, 500, 000 Euler Hermes Covered Export Finance Facility Sole Lender (Kazakhstan) Export Credit Facility Finnvera-covered Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 32 USD 300, 000 USD 50, 000 EBRD A/B-Loan Facility Refinancing of the Leasing Portfolio Environmental Loan Mandated Lead Arranger (Russia) Participating Lender (Russia)

Deal Highlights (cont’d) 2007 2005 2002 „Azer. Enerji“ JSC USD 307, 237, 810 Commercial Loan + USD 174, 606, 198 Export Finance Euler-Hermes Cover Participant (Turkey) EUR 185, 000 HERMEScovered EUR 74, 500, 000 SACE-covered USD 238, 000 Finnvera-covered Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 33 EUR 300, 000 Power Project Export Finance Facility Mandated Lead Arranger (Azerbaijan) Undersecretariat of Treasury EUR 613, 000 Ermenek Dam and HEPP Oe. KB covered Export Finance Facility plus Commercial Loans Lead Arranger

Deal Highlights (cont’d) 2007 2005 2002 „Azer. Enerji“ JSC USD 307, 237, 810 Commercial Loan + USD 174, 606, 198 Export Finance Euler-Hermes Cover Participant (Turkey) EUR 185, 000 HERMEScovered EUR 74, 500, 000 SACE-covered USD 238, 000 Finnvera-covered Mandated Lead Arranger (Russia) STRUCTURED FINANCE - EXPORT FINANCE Page 33 EUR 300, 000 Power Project Export Finance Facility Mandated Lead Arranger (Azerbaijan) Undersecretariat of Treasury EUR 613, 000 Ermenek Dam and HEPP Oe. KB covered Export Finance Facility plus Commercial Loans Lead Arranger

International Awards (since 2009) Trade & Forfaiting Review - Deal of the Year Awards 2009 Russia - NLMK – ECA-backed financing Trade Finance Deal of the Year Awards 2009 Russia - NLMK - ECA-backed financing Russia - Vyksa - ECA-backed financing STRUCTURED FINANCE - EXPORT FINANCE Page 34

International Awards (since 2009) Trade & Forfaiting Review - Deal of the Year Awards 2009 Russia - NLMK – ECA-backed financing Trade Finance Deal of the Year Awards 2009 Russia - NLMK - ECA-backed financing Russia - Vyksa - ECA-backed financing STRUCTURED FINANCE - EXPORT FINANCE Page 34

Awards Project Finance since 2009 Category: Deal of the Year GTR Best Deals of 2009 GSM-Rail – Europe Telecoms Deal of the Year R 1 – Europe Infrastructure Deal of the Year Castor – Europe Oil & Gas Deal of the Year M 25 – Europe PPP Deal of the Year Barka III & Sohar II – Middle East Power Deal of the Year Dolphin – Middle East Oil & Gas Deal of the Year Shuweihat – Gulf Power Deal of the Year Nord Stream – Gas Deal of the Year Centrica/TCW Windfarm Portfolio – Portfolio Deal of the Year STRUCTURED FINANCE - EXPORT FINANCE Page 35

Awards Project Finance since 2009 Category: Deal of the Year GTR Best Deals of 2009 GSM-Rail – Europe Telecoms Deal of the Year R 1 – Europe Infrastructure Deal of the Year Castor – Europe Oil & Gas Deal of the Year M 25 – Europe PPP Deal of the Year Barka III & Sohar II – Middle East Power Deal of the Year Dolphin – Middle East Oil & Gas Deal of the Year Shuweihat – Gulf Power Deal of the Year Nord Stream – Gas Deal of the Year Centrica/TCW Windfarm Portfolio – Portfolio Deal of the Year STRUCTURED FINANCE - EXPORT FINANCE Page 35