03c85e76c3c128f50839387e080c5ee5.ppt

- Количество слайдов: 13

STRI - A reality check from an engineer Roger Flanagan Reading University

STRI - A reality check from an engineer Roger Flanagan Reading University

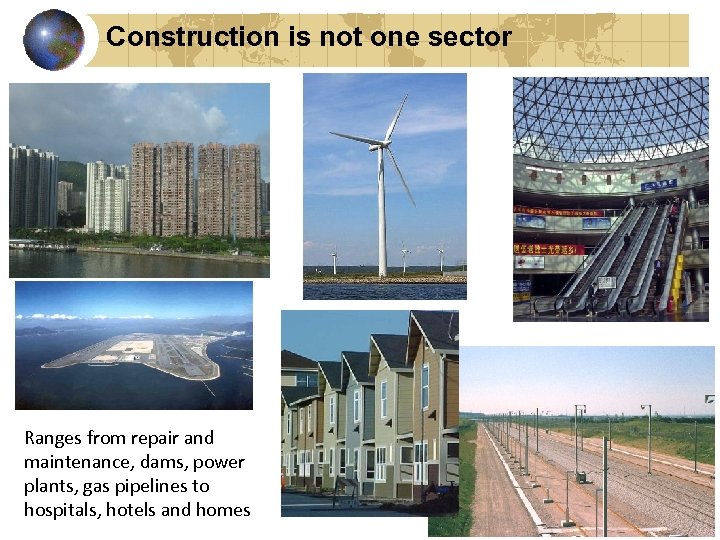

Construction is not one sector Ranges from repair and maintenance, dams, power plants, gas pipelines to hospitals, hotels and homes

Construction is not one sector Ranges from repair and maintenance, dams, power plants, gas pipelines to hospitals, hotels and homes

Local markets are very different. . local construction tools and methods are different

Local markets are very different. . local construction tools and methods are different

Construction is very different. . and the methods of procurement and delivery are different

Construction is very different. . and the methods of procurement and delivery are different

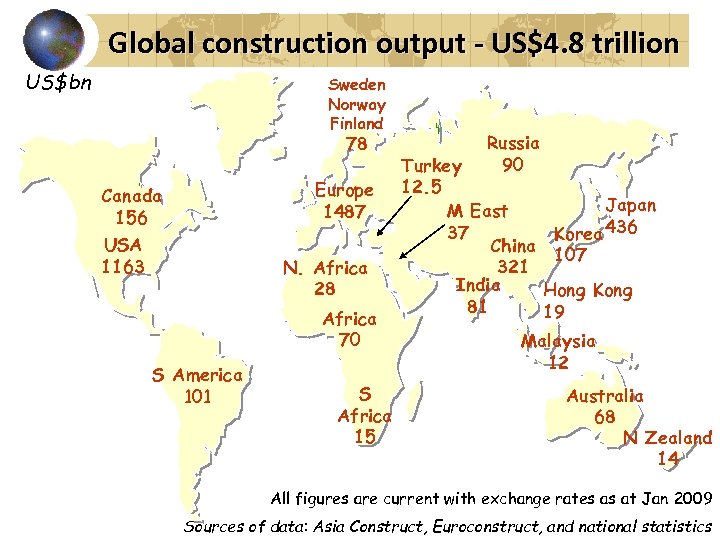

Global construction output - US$4. 8 trillion US$bn Sweden Norway Finland 78 Europe 1487 Canada 156 USA 1163 N. Africa 28 Africa 70 S America 101 S Africa 15 Russia 90 Turkey 12. 5 Japan M East 37 Korea 436 China 107 321 India Hong Kong 81 19 Malaysia 12 Australia 68 N Zealand 14 All figures are current with exchange rates as at Jan 2009 Sources of data: Asia Construct, Euroconstruct, and national statistics

Global construction output - US$4. 8 trillion US$bn Sweden Norway Finland 78 Europe 1487 Canada 156 USA 1163 N. Africa 28 Africa 70 S America 101 S Africa 15 Russia 90 Turkey 12. 5 Japan M East 37 Korea 436 China 107 321 India Hong Kong 81 19 Malaysia 12 Australia 68 N Zealand 14 All figures are current with exchange rates as at Jan 2009 Sources of data: Asia Construct, Euroconstruct, and national statistics

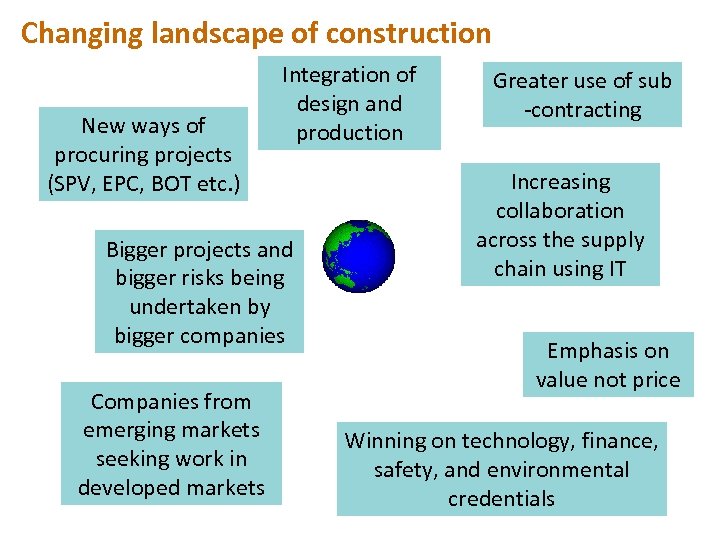

Changing landscape of construction New ways of procuring projects (SPV, EPC, BOT etc. ) Integration of design and production Bigger projects and bigger risks being undertaken by bigger companies Companies from emerging markets seeking work in developed markets Greater use of sub -contracting Increasing collaboration across the supply chain using IT Emphasis on value not price Winning on technology, finance, safety, and environmental credentials

Changing landscape of construction New ways of procuring projects (SPV, EPC, BOT etc. ) Integration of design and production Bigger projects and bigger risks being undertaken by bigger companies Companies from emerging markets seeking work in developed markets Greater use of sub -contracting Increasing collaboration across the supply chain using IT Emphasis on value not price Winning on technology, finance, safety, and environmental credentials

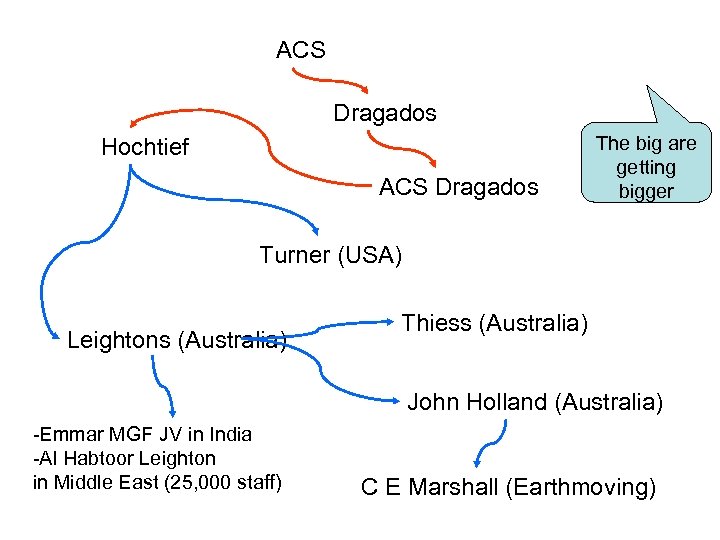

ACS Dragados Hochtief ACS Dragados The big are getting bigger Turner (USA) Leightons (Australia) Thiess (Australia) John Holland (Australia) -Emmar MGF JV in India -Al Habtoor Leighton in Middle East (25, 000 staff) C E Marshall (Earthmoving)

ACS Dragados Hochtief ACS Dragados The big are getting bigger Turner (USA) Leightons (Australia) Thiess (Australia) John Holland (Australia) -Emmar MGF JV in India -Al Habtoor Leighton in Middle East (25, 000 staff) C E Marshall (Earthmoving)

The industry Table 1 listing W/120 describes construction services. It fails to describe the way that delivering projects has changed. Design has become an integrated part of the delivery process with Build-Operate-Transfer (BOT), Public. Private Partnerships (PPP), Design and Build and Engineer-Procure-Construct (EPC) being used more extensively around the world. The global construction market is huge – US$4. 8 trillion, this doesn’t take account of the informal sector

The industry Table 1 listing W/120 describes construction services. It fails to describe the way that delivering projects has changed. Design has become an integrated part of the delivery process with Build-Operate-Transfer (BOT), Public. Private Partnerships (PPP), Design and Build and Engineer-Procure-Construct (EPC) being used more extensively around the world. The global construction market is huge – US$4. 8 trillion, this doesn’t take account of the informal sector

The STRI - some observations • A very good comprehensive and rigorous report; the methodology appears robust • The reliability of the data and its realism is an issue • Construction has not received as much attention as other sectors, probably because of its complexity • Figure 3 has some surprising results - Japan is not known for being an easy market to enter for construction.

The STRI - some observations • A very good comprehensive and rigorous report; the methodology appears robust • The reliability of the data and its realism is an issue • Construction has not received as much attention as other sectors, probably because of its complexity • Figure 3 has some surprising results - Japan is not known for being an easy market to enter for construction.

Messages Thought needs to be given about how the index will be used, updated and ultimately interpreted by the industry. The restrictions on the movement of people are always capable of being overcome – and IT has made a huge difference in knowledge management. There is a significant overlap with architectural and engineering and construction services. Hence, if the two indexes give a contradictory message about country entry, there will be a credibility issue.

Messages Thought needs to be given about how the index will be used, updated and ultimately interpreted by the industry. The restrictions on the movement of people are always capable of being overcome – and IT has made a huge difference in knowledge management. There is a significant overlap with architectural and engineering and construction services. Hence, if the two indexes give a contradictory message about country entry, there will be a credibility issue.

Messages The weightings should be re-visited with a view to fine tuning to better reflect the characteristics of the sector The weighting on restrictions of foreign ownership and other market entry conditions (40%) would appear somewhat high, bearing in mind the way that a Special Purpose Vehicle/Joint Venture is used for project delivery. STRI is about restrictiveness, whereas the business focus is attractiveness and project delivery - contractors are very good hunter-gatherers, weighing up ease of entry against opportunity.

Messages The weightings should be re-visited with a view to fine tuning to better reflect the characteristics of the sector The weighting on restrictions of foreign ownership and other market entry conditions (40%) would appear somewhat high, bearing in mind the way that a Special Purpose Vehicle/Joint Venture is used for project delivery. STRI is about restrictiveness, whereas the business focus is attractiveness and project delivery - contractors are very good hunter-gatherers, weighing up ease of entry against opportunity.

The contractor – in the face of adversity!

The contractor – in the face of adversity!