795a31a64ce59e224380f684555deefd.ppt

- Количество слайдов: 17

Strategy. Quant Algorithmic Trading – Why and How?

Strategy. Quant Algorithmic Trading – Why and How?

Disclaimer The following presentation is for educational purposes only. All symbols and trading ideas discussed are for demonstration purposes only and are not recommendations. Active trading is not suitable for everyone. Risk Warning - Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. www. strategyquant. com

Disclaimer The following presentation is for educational purposes only. All symbols and trading ideas discussed are for demonstration purposes only and are not recommendations. Active trading is not suitable for everyone. Risk Warning - Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. www. strategyquant. com

Trading Strategy (EA, Forex robot) www. strategyquant. com

Trading Strategy (EA, Forex robot) www. strategyquant. com

Computers & Trading People rely on computers for wide range of tasks, including complicated ones like landing of airplanes or controlling a vehicle on Mars, so of course they are used for trading too. . Two main types of trading approach: 1. Discretionary – based on traders experience, opinion, actual feeling, etc. Trader follows a plan, but it doesn’t need to be 100% exact. 2. Automatic 1. High Frequency Trading - usually deals with best execution 2. Strategies/Systems Trading – developing and trading strategies that have exact rules that can be programmed into a robot or traded mechanically, but without any room for subjective judgment www. strategyquant. com

Computers & Trading People rely on computers for wide range of tasks, including complicated ones like landing of airplanes or controlling a vehicle on Mars, so of course they are used for trading too. . Two main types of trading approach: 1. Discretionary – based on traders experience, opinion, actual feeling, etc. Trader follows a plan, but it doesn’t need to be 100% exact. 2. Automatic 1. High Frequency Trading - usually deals with best execution 2. Strategies/Systems Trading – developing and trading strategies that have exact rules that can be programmed into a robot or traded mechanically, but without any room for subjective judgment www. strategyquant. com

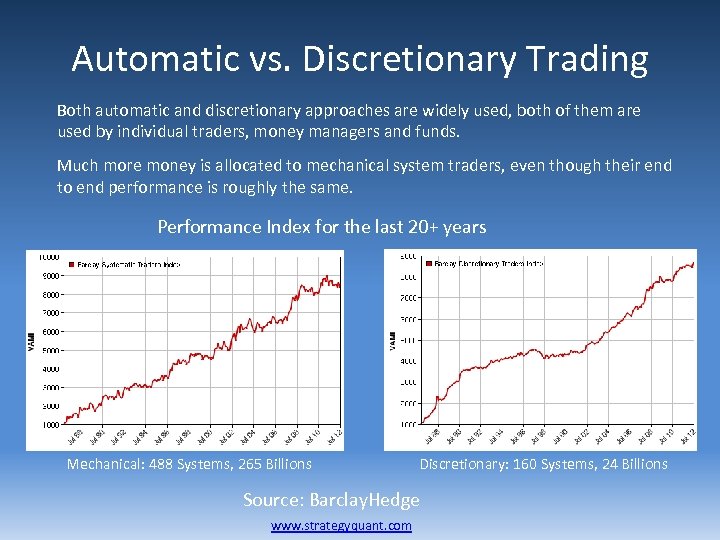

Automatic vs. Discretionary Trading Both automatic and discretionary approaches are widely used, both of them are used by individual traders, money managers and funds. Much more money is allocated to mechanical system traders, even though their end to end performance is roughly the same. Performance Index for the last 20+ years Mechanical: 488 Systems, 265 Billions Discretionary: 160 Systems, 24 Billions Source: Barclay. Hedge www. strategyquant. com

Automatic vs. Discretionary Trading Both automatic and discretionary approaches are widely used, both of them are used by individual traders, money managers and funds. Much more money is allocated to mechanical system traders, even though their end to end performance is roughly the same. Performance Index for the last 20+ years Mechanical: 488 Systems, 265 Billions Discretionary: 160 Systems, 24 Billions Source: Barclay. Hedge www. strategyquant. com

Manual Design of Trading Strategy www. strategyquant. com

Manual Design of Trading Strategy www. strategyquant. com

Now imagine you have a tool that does all this manual work for you, and does it 1000 x faster. . . Introducing Strategy. Quant www. strategyquant. com

Now imagine you have a tool that does all this manual work for you, and does it 1000 x faster. . . Introducing Strategy. Quant www. strategyquant. com

What is Strategy. Quant SQ is a software that can automatically design new trading strategies using the power of genetic programming and evolution. It can generate new trading strategies from the scratch, according to given entry configuration. It is not an Optimizer, but a generator of trading systems based on predefined rules, parameters, indicators, price patterns, etc. www. strategyquant. com

What is Strategy. Quant SQ is a software that can automatically design new trading strategies using the power of genetic programming and evolution. It can generate new trading strategies from the scratch, according to given entry configuration. It is not an Optimizer, but a generator of trading systems based on predefined rules, parameters, indicators, price patterns, etc. www. strategyquant. com

How it works Let's say you want to create a new trading strategy for EURUSD. You'll choose the EURUSD data source, choose timeframe and time range. Define which blocks the strategy should consist of (indicators, price data, operators, etc. ). Define what should be the parameters of resulting strategy - for example, total Net Profit must be above $ 5000, % Drawdown must be lower than 20%, Return/DD ratio must be above 4, it must produce at least 300 trades. The just hit the Start button and Strategy. Quant will do the work. It will randomly generate new trading strategies using building blocks you selected, tests them right away and stores the ones that fit your requirements for your review. www. strategyquant. com

How it works Let's say you want to create a new trading strategy for EURUSD. You'll choose the EURUSD data source, choose timeframe and time range. Define which blocks the strategy should consist of (indicators, price data, operators, etc. ). Define what should be the parameters of resulting strategy - for example, total Net Profit must be above $ 5000, % Drawdown must be lower than 20%, Return/DD ratio must be above 4, it must produce at least 300 trades. The just hit the Start button and Strategy. Quant will do the work. It will randomly generate new trading strategies using building blocks you selected, tests them right away and stores the ones that fit your requirements for your review. www. strategyquant. com

How it works - Genetic Evolution mode www. strategyquant. com

How it works - Genetic Evolution mode www. strategyquant. com

Advantages of Strategy. Quant? www. strategyquant. com

Advantages of Strategy. Quant? www. strategyquant. com

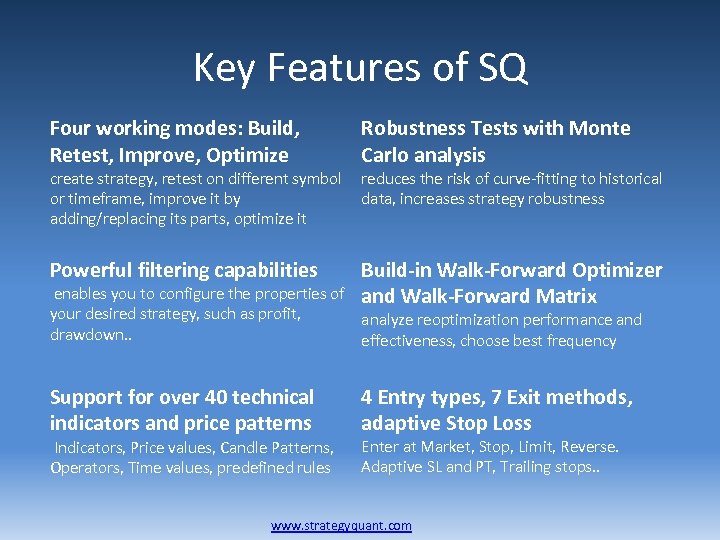

Key Features of SQ Four working modes: Build, Retest, Improve, Optimize Robustness Tests with Monte Carlo analysis Powerful filtering capabilities Build-in Walk-Forward Optimizer and Walk-Forward Matrix Support for over 40 technical indicators and price patterns 4 Entry types, 7 Exit methods, adaptive Stop Loss create strategy, retest on different symbol or timeframe, improve it by adding/replacing its parts, optimize it reduces the risk of curve-fitting to historical data, increases strategy robustness enables you to configure the properties of your desired strategy, such as profit, analyze reoptimization performance and drawdown. . effectiveness, choose best frequency Indicators, Price values, Candle Patterns, Operators, Time values, predefined rules Enter at Market, Stop, Limit, Reverse. Adaptive SL and PT, Trailing stops. . www. strategyquant. com

Key Features of SQ Four working modes: Build, Retest, Improve, Optimize Robustness Tests with Monte Carlo analysis Powerful filtering capabilities Build-in Walk-Forward Optimizer and Walk-Forward Matrix Support for over 40 technical indicators and price patterns 4 Entry types, 7 Exit methods, adaptive Stop Loss create strategy, retest on different symbol or timeframe, improve it by adding/replacing its parts, optimize it reduces the risk of curve-fitting to historical data, increases strategy robustness enables you to configure the properties of your desired strategy, such as profit, analyze reoptimization performance and drawdown. . effectiveness, choose best frequency Indicators, Price values, Candle Patterns, Operators, Time values, predefined rules Enter at Market, Stop, Limit, Reverse. Adaptive SL and PT, Trailing stops. . www. strategyquant. com

What To Expect? www. strategyquant. com

What To Expect? www. strategyquant. com

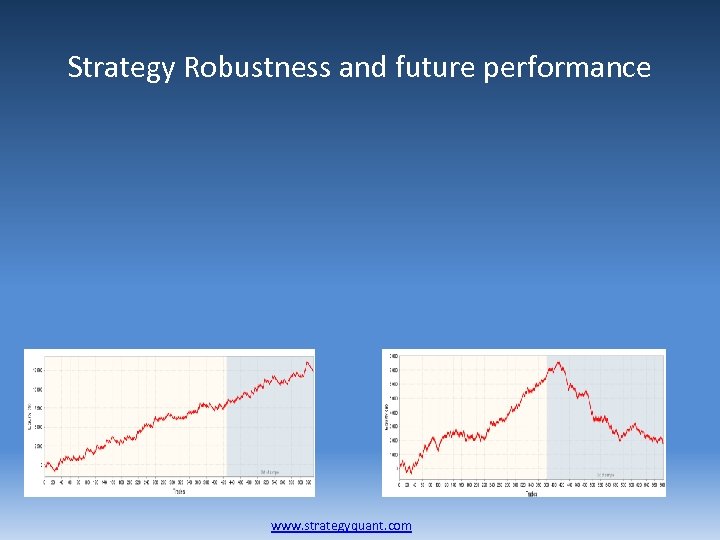

Strategy Robustness and future performance www. strategyquant. com

Strategy Robustness and future performance www. strategyquant. com

Strategy Robustness and future performance 2 www. strategyquant. com

Strategy Robustness and future performance 2 www. strategyquant. com

Aren’t you excited about increasing the possibility of earning more money by trading your own strategies? Why do traders buy Strategy. Quant? www. strategyquant. com

Aren’t you excited about increasing the possibility of earning more money by trading your own strategies? Why do traders buy Strategy. Quant? www. strategyquant. com

Machine designed trading systems are here! Contact: Mark Fric mfric@strategyquant. com www. strategyquant. com

Machine designed trading systems are here! Contact: Mark Fric mfric@strategyquant. com www. strategyquant. com