54c6439dff3356847a60130484e7d76e.ppt

- Количество слайдов: 100

Strategy Practitioner Tools Core Tools October 1999 DRAFT: FOR DISCUSSION ONLY /Version: 660_w 3/ppt/sf 0 © 1998, Pricewaterhouse. Coopers L. L. P.

Table of Contents 1 ANALYSIS PLAN 16 KEY PERFORMANCE INDICATORS 2 BREAKTHROUGH MODEL 17 MARKET PROFITABILITY 3 4 5 6 7 8 9 10 11 12 COMPETITIVE BENCHMARKING COMPETITIVE POSITIONING CORE COMPETENCTY ANALYSIS CUSTOMER SEGMENTATION EXPERIENCE CURVE FINANCIAL MODELING FIT VS. ATTRACTIVENESS MODEL FIVE FORCES ANALYSIS GANTT CHART GAP ANALYSIS 18 19 20 21 22 23 24 25 26 27 PORTFOLIO ANALYSIS REAL OPTIONS/STRATEGIC OPTION SCALE CURVE SCENARIO ENVISIONING SENSITIVITY ANALYSIS SEVEN S FRAMEWORK STAKEHOLDER ANALYSIS SWOT VALUE BASED MANAGEMENT VALUE CHAIN ANALYSIS 13 14 15 GROWTH SHARE MATRIX INDUSTRY VALUE CHAIN ANALYSIS ISSUE TREE/ISSUE MAP 28 29 VALUE TREE VOICE OF THE CUSTOMER SC 111898 KR-Sydney 1 © 1998, Pricewaterhouse. Coopers L. L. P.

Analysis Plan Summary The analysis plan details a problem-solving process and specific analysis which must be developed to assess a hypothesis. The analysis plan must be flexible and that the analyses to be conducted and the deliverables to be produced may change during the course of the project. CLIENT EXAMPLE: HYPOTHESIS/ANALYTICAL PLAN Hypothesis Analysis Info. Required Info. Source End Products Overall Hypothesis Organizational philosophy needs to be modified Supporting Hypothesis Existing organization does not adequately support the business strategy Business System Diagrams • Define business system, operating environment • Define CSFs, organizational requirements along business system • Define how existing organization supports business system, CSFs • Key activities, processes by LOB • CSFs along business system by LOB • Existing organizational elements • Management interviews • Secondary research • HR documents impacting business system Activity ~~~~ ~~~~ CSF ~~~~ ~~~~ Financial Metrics Even after adjusting for asset write-up, • Financial performance vs. financial performance has not met competitors, budget/plans corporate expectations or competitive • Overview of cost structure (e. g. , standards due to an inappropriate fixed vs. variable costs) organization (and cost) structure • ROA, NI adjusted for asset write-ups The increasing complexity of business • Define actual vs. perceived vs. “real” organization chart, decision-making and the evolving importance of, and process/responsibilities; identify gaps coordination required between specialized expertise requires changes • Define expertise, info required to make decision, organizational requirements in the decision-making process and • Define evolving nature of organization and information flows SC 111898 KR-Sydney • Historic and projected financial • Key decisions • Key individuals involved in data • Asset write-up information • Summary cost, volume info for • Annual reports, 10 Ks, 10 Qs, etc. • Company financial reports • Financial department interviews production units decision-making process • Information flows 2 • Management interviews • Organization charts • Memos/documents on Data/Info Flows Org Charts management processes • System flow charts © 1998, Pricewaterhouse. Coopers L. L. P.

Analysis Plan When To Apply When it is necessary to lay out problem-solving process in depth/detail and identify the analyses which need to be undertaken to validate the selected hypotheses Approach • Define an issue on which a specific action depends and phrase it as a “yes” or no” question • Establish a hypothesis: a statement of likely resolution of the issue including the reasons for answering “yes” or “no” • Develop an analysis statement that outlines the “models” that will be explored in order to prove or disprove the hypothesis • Identify the likely location or means of obtaining data to accomplish the analysis • Develop end products (presentations) to graphically represent the output of the analysis SC 111898 KR-Sydney 3 © 1998, Pricewaterhouse. Coopers L. L. P.

Analysis Plan Citations - Client and Industry Experience Source List • Compaq/Technology/Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Post Office Counters Ltd. /Transportation Services/KIT database • Pw. C MCS/Consulting/Vasu Krishnamurthy • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney 4 © 1998, Pricewaterhouse. Coopers L. L. P.

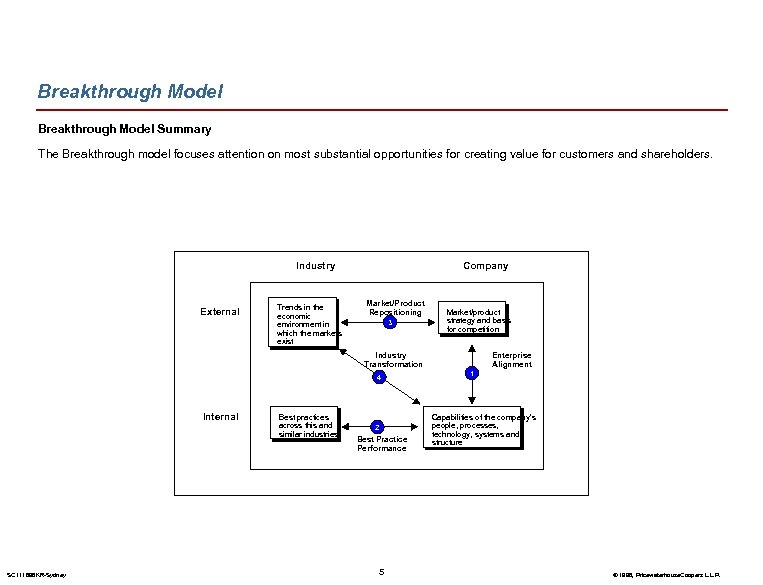

Breakthrough Model Summary The Breakthrough model focuses attention on most substantial opportunities for creating value for customers and shareholders. Industry External Trends in the economic environment in which the markets exist Company Market/Product Repositioning 3 Market/product strategy and basis for competition Industry Transformation 4 Internal SC 111898 KR-Sydney Best practices across this and similar industries 2 Best Practice Performance 5 Enterprise Alignment 1 Capabilities of the company’s people, processes, technology, systems and structure © 1998, Pricewaterhouse. Coopers L. L. P.

Breakthrough Model When To Apply Utilize the Breakthrough model to identify and categorize all opportunities to create substantial incremental shareholder value. Approach When creating a Breakthrough model, the following criteria should be considered: • Summarize all opportunities to improve business performance from other analyses • Categorize them into four groups: • Enterprise alignment • Best practice performance • Market/product repositioning • Industry transformation • Determine approximate economic value of each type of strategy SC 111898 KR-Sydney 6 © 1998, Pricewaterhouse. Coopers L. L. P.

Breakthrough Model Citations - Client and Industry Experience Source List Non-Pw. C: • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Toyota: the lean production system • Frito-Lay: end-to-end supply chain management and the use of advanced technology • Intel: high velocity product development • Amazon. com: Internet based channels of distribution on behalf of shareholders. SC 111898 KR-Sydney 7 © 1998, Pricewaterhouse. Coopers L. L. P.

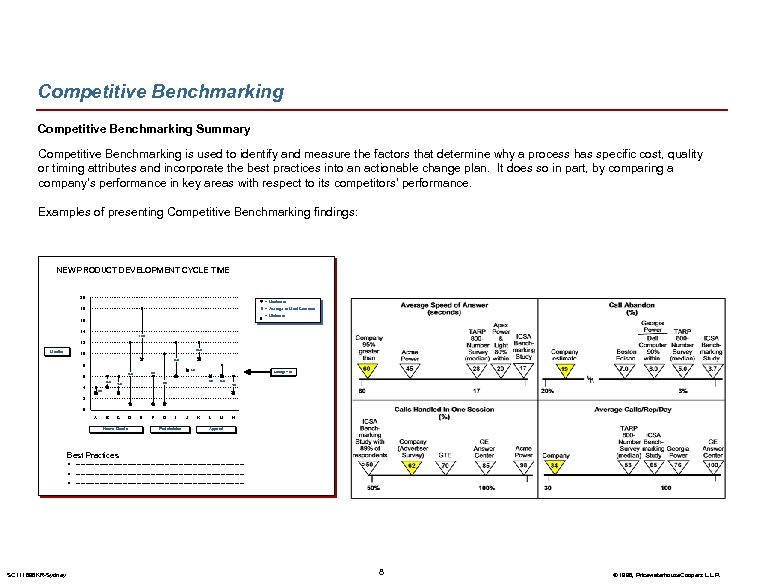

Competitive Benchmarking Summary Competitive Benchmarking is used to identify and measure the factors that determine why a process has specific cost, quality or timing attributes and incorporate the best practices into an actionable change plan. It does so in part, by comparing a company’s performance in key areas with respect to its competitors’ performance. Examples of presenting Competitive Benchmarking findings: NEW PRODUCT DEVELOPMENT CYCLE TIME 20 = Maximum # = Average or Most Common 18 = Minimum 16 14 13. 5 12 Months 10. 5 10 9. 0 8 5. 0 4 7. 0 6. 5 6 Average = 6. 7 6. 0 5. 0 4. 5 6. 0 4. 5 3. 5 2 0 A B C Home Goods D E F G I Perishables J K L M N Apparel Best Practices • ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ • ~~~~~~~~~~~~~~~~~~ SC 111898 KR-Sydney 8 © 1998, Pricewaterhouse. Coopers L. L. P.

Competitive Benchmarking When To Apply While not a comprehensive comparison, Competitive Benchmarking illustrates the efficiency of specific processes in comparison to a company’s competitors. Select companies to benchmark against carefully - remember that companies outside the client’s industry may be the best candidates. Ensure that data collected are comparable and the right processes are benchmarked; those which have the biggest impact on customer service/satisfaction/value. Approach • Examine the issues most important to the company’s situation to determine whether roles, processes, or strategic issues should by benchmarked • Identify key performance variables and determine which companies to use for comparison (both within company’s industry and outside the industry) • For process benchmarking, determine the metrics to be measured; these can be key performance indicators (KPI’s), or other measurements • Establish data collection methodology (industry sources, on-line databases, on-site visits, phone interviews, survey questionnaires, competitors, etc. ) • Measure client company performance • Measure performance of competitors and best practice leaders • Illustrate the spectrum of performances on an appropriate graph • Determine gaps and reasoning • Develop action plans/recommendation to address gaps • Implement actions and monitor progress SC 111898 KR-Sydney 9 © 1998, Pricewaterhouse. Coopers L. L. P.

Competitive Benchmarking Citations - Client and Industry Experience • Ball Corporation/Packaging /Vasu Krishnamurthy & Mike Weiss • Motorola/Technology/Vasu Krishnamurthy • Pw. C MCS/Consulting/Vasu Krishnamurthy • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney Source List • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Liam Fahey, Robert M. Randall, “The Portable MBA in Strategy” • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Michael Gould, Andrew Campbell, Marcus Alexander, “Corporate-Level Strategy: Creating Value in the Multibusiness Company” 10 © 1998, Pricewaterhouse. Coopers L. L. P.

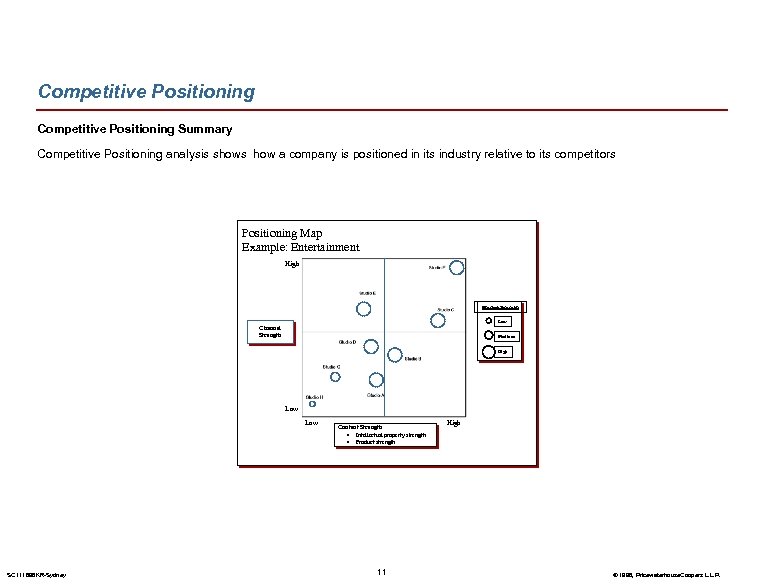

Competitive Positioning Summary Competitive Positioning analysis shows how a company is positioned in its industry relative to its competitors Positioning Map Example: Entertainment High Market Strength Low Channel Strength Medium High Low SC 111898 KR-Sydney Content Strength • Intellectual property strength • Product strength 11 High © 1998, Pricewaterhouse. Coopers L. L. P.

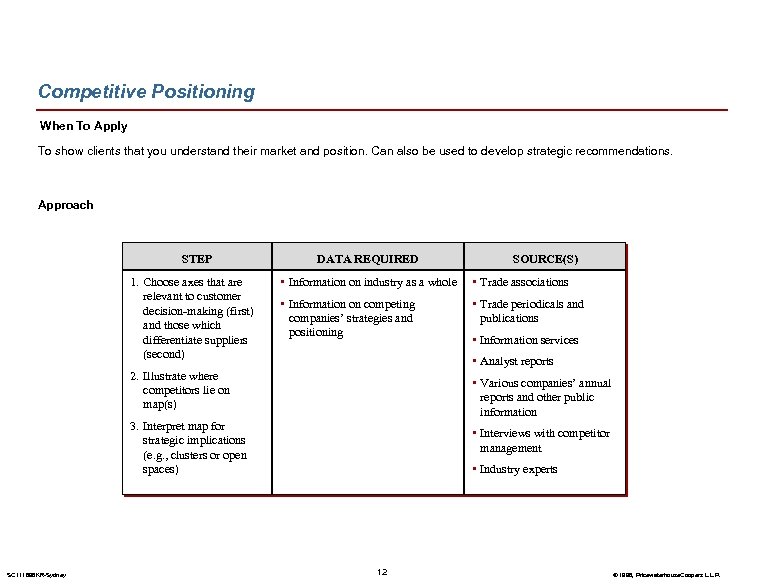

Competitive Positioning When To Apply To show clients that you understand their market and position. Can also be used to develop strategic recommendations. Approach STEP 1. Choose axes that are relevant to customer decision-making (first) and those which differentiate suppliers (second) DATA REQUIRED • Information on industry as a whole • Trade associations • Information on competing companies’ strategies and positioning • Trade periodicals and publications • Information services • Analyst reports 2. Illustrate where competitors lie on map(s) • Various companies’ annual reports and other public information 3. Interpret map for strategic implications (e. g. , clusters or open spaces) SC 111898 KR-Sydney SOURCE(S) • Interviews with competitor management • Industry experts 12 © 1998, Pricewaterhouse. Coopers L. L. P.

Competitive Positioning Citations - Client and Industry Experience Source List • Barclays Global Investors (BGI)/Banking/KIT database • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Blue Cross/Insurance/Mike Weiss • Boots/Retail/KIT database • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Giddings & Lewis/Machine Tool/Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis” • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” • Henry Mintzberg, James Brian Quinn, “The Strategy Process: Concepts, Contexts, Cases” • Osh Kosh B’ Gosh? SP/Retail/Mike Weiss • Pw. C MCS/Consulting/Vasu Krishnamurthy • Save & Prosper/Banking/KIT database SC 111898 KR-Sydney 13 © 1998, Pricewaterhouse. Coopers L. L. P.

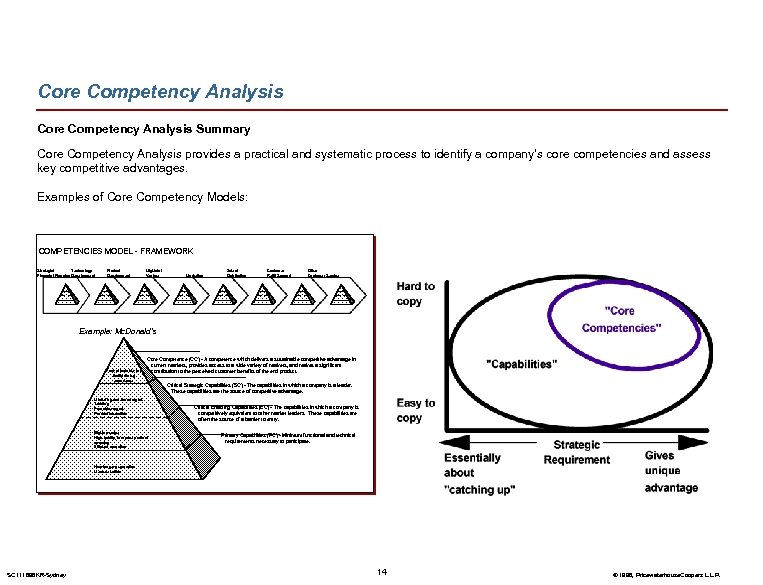

Core Competency Analysis Summary Core Competency Analysis provides a practical and systematic process to identify a company’s core competencies and assess key competitive advantages. Examples of Core Competency Models: COMPETENCIES MODEL - FRAMEWORK Strategic/ Technology Financial Planning Development Product Development Mfg/Joint Venture Marketing Sales/ Distribution Customer Refill Support Other Customer Service Example: Mc. Donald’s • Fast, affordable, fun, family dining experience Core Competence (CC) - A competence which delivers a sustainable competitive advantage in current markets, provides access to a wide variety of markets, and makes a significant contribution to the perceived customer benefits of the end product. Critical Strategic Capabilities (SC) - The capabilities in which a company is a leader. These capabilities are the source of competitive advantage. • • Marketing and brand mgmt. Training Franchise mgmt. Product innovation • Big. Mac recipe • High quality, low price product sourcing Critical Enabling Capabilities (EC) - The capabilities in which a company is competitively equivalent to other market leaders. These capabilities are often the source of a barrier to entry. Primary Capabilities (PC) - Minimum functional and technical requirements necessary to participate. • Efficient operation • Hamburger preparation • Menu selection SC 111898 KR-Sydney 14 © 1998, Pricewaterhouse. Coopers L. L. P.

Core Competency Analysis When To Apply Employ Core Competency analysis to evaluate a company’s capabilities in each function of the value chain with a hierarchical model which identifies capabilities and the degree to which they provide competitive advantage and can be leveraged. Please note that there is a risk of defining too narrowly the market in which the client competes, thus focusing on the wrong competency requirements or a subset of the competencies required to effectively compete. It is key that those projects and programs that aim at developing core competencies should not be open to re-prioritization at a later stage. Approach Adhere to the following guidelines when analyzing core competencies and developing a Competencies Model - Framework: • Interview company senior management and business line management as well as competitor management • Define company’s business system and activities performed within each function - Based on the total range of capabilities identified, ask the questions: • Which ones do we have to be “good at”? • Which ones do we have to be “market/world leading at”? • Determine whether each activity is a primary capability, a critical enabling capability, a critical strategic capability, or a core competence, based on the degree to which the activity provides competitive advantage and can be leveraged • Note that while all the identified capabilities will be critical to achieve the vision and strategy, the questions will help distinguish core from non-core by invoking management attention and reflection in a systematic and structured manner SC 111898 KR-Sydney 15 © 1998, Pricewaterhouse. Coopers L. L. P.

Core Competency Analysis Citations - Client and Industry Experience Source List • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • David A. Aaker, “Developing Business Strategies”, 5 th Edition • Giddings & Lewis/Machine Tool/Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Met. Life/Insurance/KIT database • Pw. C MCS/Consulting/Vasu Krishnamurthy • Save & Prosper/Banking/KIT database • Michael Gould, Andrew Campbell, Marcus Alexander, “Corporate-Level Strategy: Creating Value in the Multibusiness Company” • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategy Safari: A Guided Tour Through the Wilds of Strategic Management” • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” • Henry Mintzberg, James Brian Quinn, “The Strategy Process: Concepts, Contexts, Cases SC 111898 KR-Sydney 16 © 1998, Pricewaterhouse. Coopers L. L. P.

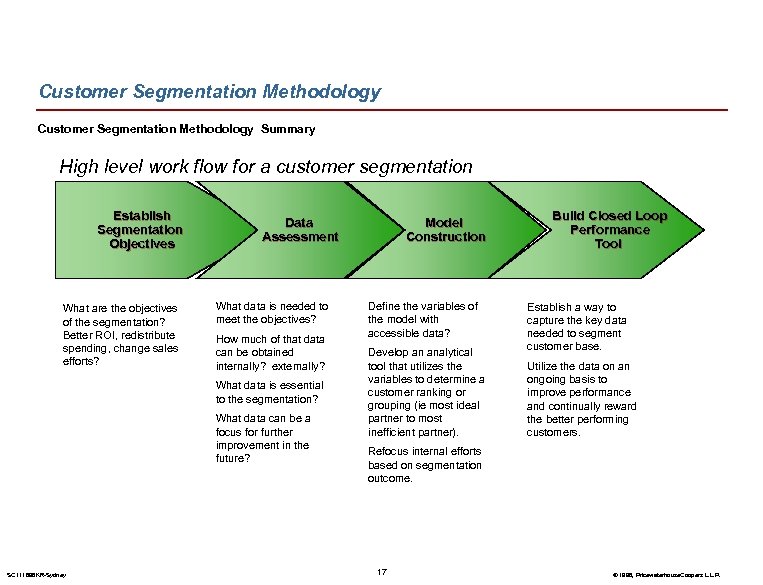

Customer Segmentation Methodology Summary High level work flow for a customer segmentation Establish Segmentation Objectives What are the objectives of the segmentation? Better ROI, redistribute spending, change sales efforts? Data Assessment What data is needed to meet the objectives? How much of that data can be obtained internally? externally? What data is essential to the segmentation? What data can be a focus for further improvement in the future? SC 111898 KR-Sydney Model Construction Define the variables of the model with accessible data? Develop an analytical tool that utilizes the variables to determine a customer ranking or grouping (ie most ideal partner to most inefficient partner). Build Closed Loop Performance Tool Establish a way to capture the key data needed to segment customer base. Utilize the data on an ongoing basis to improve performance and continually reward the better performing customers. Refocus internal efforts based on segmentation outcome. 17 © 1998, Pricewaterhouse. Coopers L. L. P.

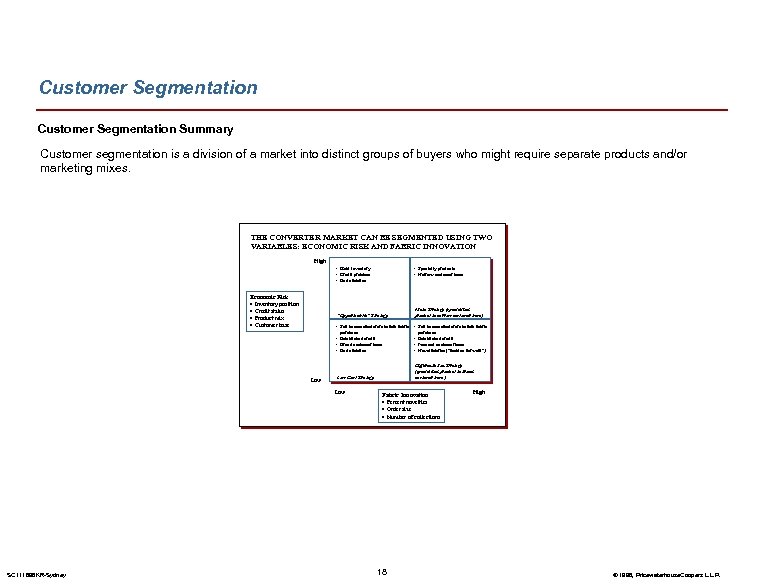

Customer Segmentation Summary Customer segmentation is a division of a market into distinct groups of buyers who might require separate products and/or marketing mixes. THE CONVERTER MARKET CAN BE SEGMENTED USING TWO VARIABLES: ECONOMIC RISK AND FABRIC INNOVATION High • Hold inventory • Credit problem • Basic fabrics Economic Risk • Inventory position • Credit status • Product mix • Customer base • Specialty products • Narrow customer base “Opportunistic” Strategy Niche Strategy (specialized product to narrow customer base) • Sell to manufacturers before fabric purchase • Established credit • Broad customer base • Basic fabrics Low • Established credit • Focused customer base • Novel fabrics (“fashion forward”) Low-Cost Strategy Differentiation Strategy (specialized product to broad customer base) Low SC 111898 KR-Sydney Fabric Innovation • Percent novelties • Order size • Number of collections 18 High © 1998, Pricewaterhouse. Coopers L. L. P.

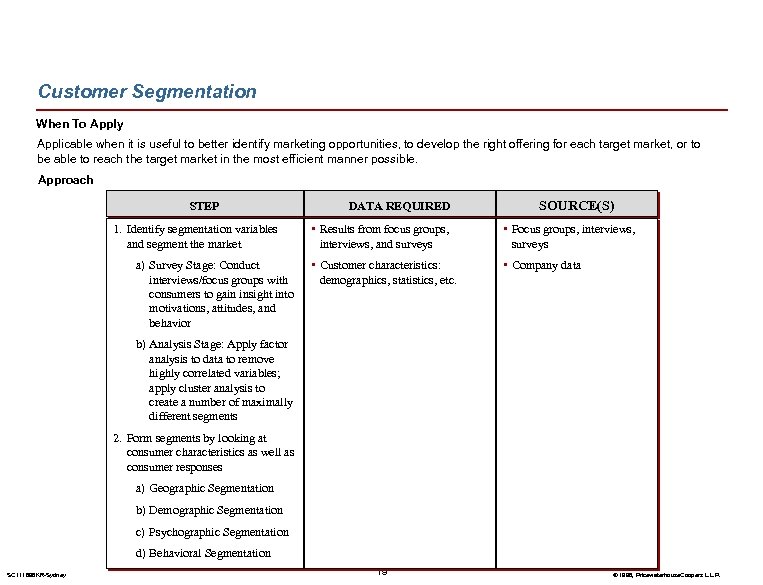

Customer Segmentation When To Apply Applicable when it is useful to better identify marketing opportunities, to develop the right offering for each target market, or to be able to reach the target market in the most efficient manner possible. Approach STEP 1. Identify segmentation variables and segment the market a) Survey Stage: Conduct interviews/focus groups with consumers to gain insight into motivations, attitudes, and behavior DATA REQUIRED SOURCE(S) • Results from focus groups, interviews, and surveys • Focus groups, interviews, surveys • Customer characteristics: demographics, statistics, etc. • Company data b) Analysis Stage: Apply factor analysis to data to remove highly correlated variables; apply cluster analysis to create a number of maximally different segments 2. Form segments by looking at consumer characteristics as well as consumer responses a) Geographic Segmentation b) Demographic Segmentation c) Psychographic Segmentation d) Behavioral Segmentation SC 111898 KR-Sydney 19 © 1998, Pricewaterhouse. Coopers L. L. P.

Customer Segmentation Citations - Client and Industry Experience Source List • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • General Mills/CIP/Johan Sauer • Robert M. Grant, “Contemporary Strategy Analysis” • Giddings & Lewis/Machine Tool/Vasu Krishnamurthy • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” • The Littlewoods Organization/Retail/KIT database • Pw. C MCS/Consulting/Vasu Krishnamurthy SC 111898 KR-Sydney 20 © 1998, Pricewaterhouse. Coopers L. L. P.

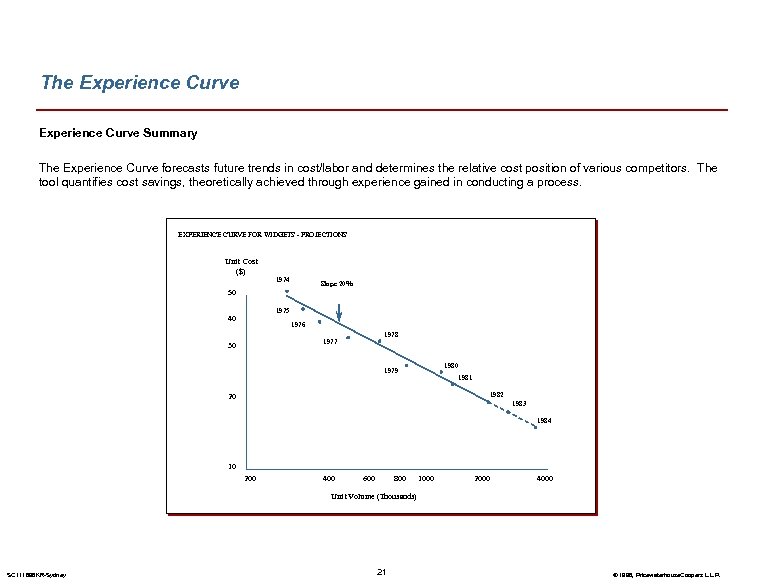

The Experience Curve Summary The Experience Curve forecasts future trends in cost/labor and determines the relative cost position of various competitors. The tool quantifies cost savings, theoretically achieved through experience gained in conducting a process. EXPERIENCE CURVE FOR WIDGETS - PROJECTIONS Unit Cost ($) 1974 Slope 20% 50 1975 40 1976 1978 1977 30 1980 1979 1981 1982 20 1983 1984 10 200 400 600 800 1000 2000 4000 Unit Volume (Thousands) SC 111898 KR-Sydney 21 © 1998, Pricewaterhouse. Coopers L. L. P.

Experience Curve When to Apply The Growth Share Matrix may be overly simplistic, market share does not always correlate with profitability and not all businesses have the same asset intensity. Conclusions are sensitive to business and market definitions; where lines are drawn. Practitioners must be creative, careful and consistent with market data. Approach Creating the Experience Curve requires yearly accumulated production volume for the entire indicative and individual competitors, and the unit cost for the entire industry and competitors (use price data if cost data is not available. ) Data can be secured from government agencies, trade associations, and from internal company data. Step 1 Plot accumulated volume for different years against unit cost on a log/log scale (unit cost should be deflated by using a general index such as the GNP deflator, or specific indices for the various pars of cost such as materials and labor. ) Step 2 Add a standard regression line to the graph. CAVEATS: • Cost figures must be defined in the same manner by all sources of data. If company cost-accounting data is used, it may need to be adjusted for overhead allocations and other costs not considered to be part of the activity, process, or product under study. If price data is used pricing behavior of participants needs to be considered • Innovation within any functional area (e. g. , product, process, distribution) can render the current experience curve useless as a strategy tool. Therefore, it is important to understand the environmental and customer trends in order not to rely too heavily on this analysis • The experience curve is only an analytical concept, and there is no guarantee that costs will actually decrease according to it. The company must actively manage costs down SC 111898 KR-Sydney 22 © 1998, Pricewaterhouse. Coopers L. L. P.

Experience Curve Citations - Client and Industry Experience Source List • David A. Aaker, “Developing Business Strategies”, 5 th Edition • The Boston Consulting Group, “Perspectives on Strategy” • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategy Safari: A Guided Tour Through the Wilds of Strategic Management SC 111898 KR-Sydney 23 © 1998, Pricewaterhouse. Coopers L. L. P.

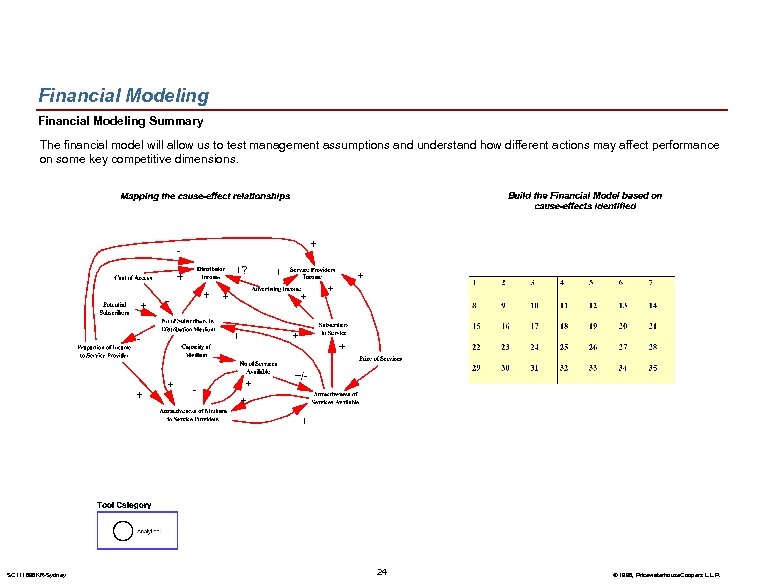

Financial Modeling Summary The financial model will allow us to test management assumptions and understand how different actions may affect performance on some key competitive dimensions. SC 111898 KR-Sydney 24 © 1998, Pricewaterhouse. Coopers L. L. P.

Financial Modeling When To Apply Financial Modeling is effective in analyzing how a company’s performance, in core areas of business, will be affected by pursuing different courses of action. This tool facilitates an understanding of various cause-effect and provides a model by which to test various "what if" statements. Approach Follow these steps to successfully create a Financial Model Step 1 Gather information on key drivers ie. • From the cash flow analysis performed as part of the SVA • Data and insight from Voice of the Customer is another source of insight Step 2 Map the relationships and identify factors which reinforce one another vs. those that have a negative relationship (e. g. increase in price may have a negative effect on demand) Step 3 Build the financial model based on the cause-effect relationships identified Step 4 Gather data from industry analysis or internal corporate data Step 5 Test the quality of the model by doing manual calculations on some "what if” Step 6 Perform "what if" to assess the completeness of the model SC 111898 KR-Sydney 25 © 1998, Pricewaterhouse. Coopers L. L. P.

Financial Modeling Citations - Client and Industry Experience Source List • Flemings Fund Management Ltd (FFML)/Banking/KIT database • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Osh Kosh B’ Gosh? SP/Retail/Mike Weiss • Pw. C MCS/Consulting/Vasu Krishnamurthy • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney 26 © 1998, Pricewaterhouse. Coopers L. L. P.

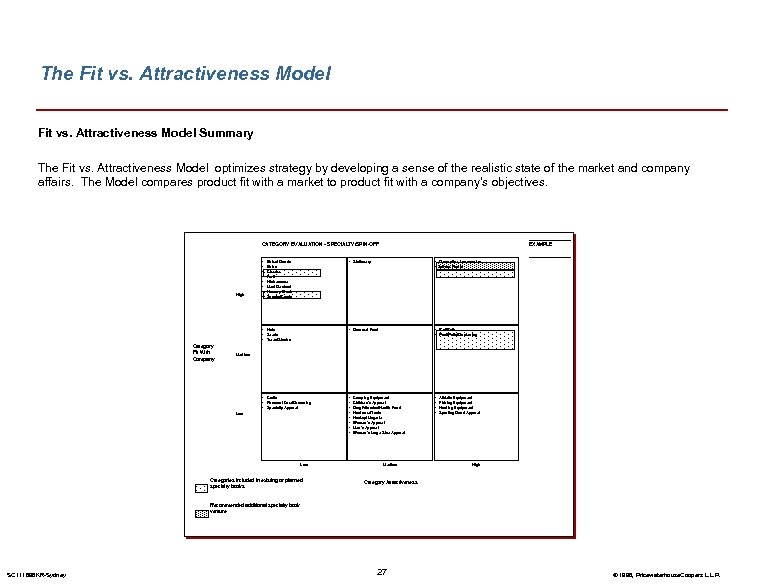

The Fit vs. Attractiveness Model Summary The Fit vs. Attractiveness Model optimizes strategy by developing a sense of the realistic state of the market and company affairs. The Model compares product fit with a market to product fit with a company’s objectives. CATEGORY EVALUATION - SPECIALTY/SPIN-OFF • Decorative Accessories • Indoor Plants • Gourmet Food • Bed/Bath • Pool/Patio/Gardening • Crafts • Personal Care/Grooming • Specialty Apparel Category Fit With Company • Stationery • Nuts • Seeds • Trees/Shrubs High • • EXAMPLE • • • Baked Goods Bulbs Cheese Fruit Kitchenware Meat/Seafood Nursery Stock Snacks/Candy Medium Low Categories included in existing or planned specialty books Camping Equipment Children’s Apparel Drug/Vitamins/Health Food Hardware/Tools Hosiery/Lingerie Women’s Apparel Men’s Apparel Women’s Large Size Apparel Medium Athletic Equipment Fishing Equipment Hunting Equipment Sporting Good Apparel High Category Attractiveness Recommended additional specialty book venture SC 111898 KR-Sydney 27 © 1998, Pricewaterhouse. Coopers L. L. P.

Fit vs. Attractiveness Model When to Apply The Fit Vs. Attractiveness Model is used to analyze a new product or service offering’s fit within a company, in comparison to the overall attractiveness of the product or offering. This particular model requires judgements which are subjective in nature; one should be aware that this model may oversimplify the market situation. Approach Step 1 Identify product, category or market overall attractiveness as being low, medium, or high. Plot along x-axis. Step 2 Identify product category, or market fit with company objectives as being low, medium, or high. Plot along y-axis. Step 3 Evaluate newly created matrix; aim to reveal products, categories, or markets that fall under high overall attractiveness and high fit with company objectives. SC 111898 KR-Sydney 28 © 1998, Pricewaterhouse. Coopers L. L. P.

Fit vs. Attractiveness Model Citations - Client and Industry Experience Source List • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Pw. C MCS/Consulting/Vasu Krishnamurthy SC 111898 KR-Sydney • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” 29 © 1998, Pricewaterhouse. Coopers L. L. P.

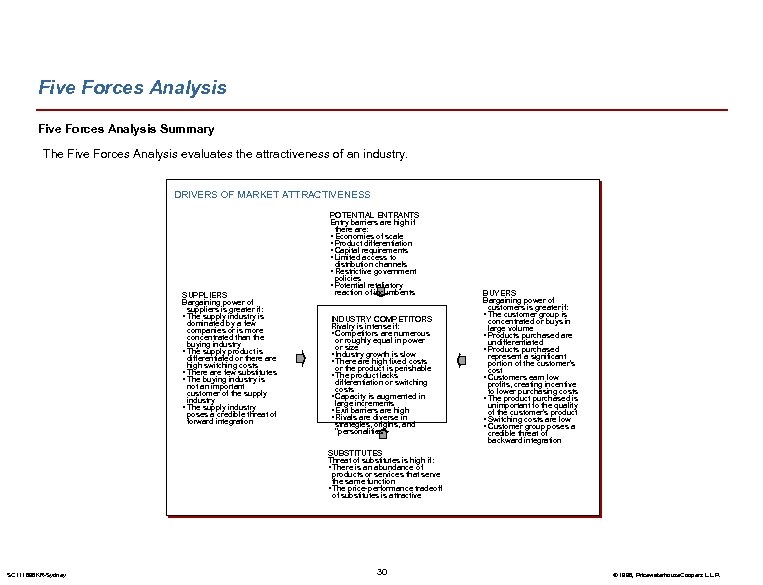

Five Forces Analysis Summary The Five Forces Analysis evaluates the attractiveness of an industry. DRIVERS OF MARKET ATTRACTIVENESS SUPPLIERS Bargaining power of suppliers is greater if: • The supply industry is dominated by a few companies or is more concentrated than the buying industry • The supply product is differentiated or there are high switching costs • There are few substitutes • The buying industry is not an important customer of the supply industry • The supply industry poses a credible threat of forward integration POTENTIAL ENTRANTS Entry barriers are high if there are: • Economies of scale • Product differentiation • Capital requirements • Limited access to distribution channels • Restrictive government policies • Potential retaliatory reaction of incumbents INDUSTRY COMPETITORS Rivalry is intense if: • Competitors are numerous or roughly equal in power or size • Industry growth is slow • There are high fixed costs or the product is perishable • The product lacks differentiation or switching costs • Capacity is augmented in large increments • Exit barriers are high • Rivals are diverse in strategies, origins, and "personalities" BUYERS Bargaining power of customers is greater if: • The customer group is concentrated or buys in large volume • Products purchased are undifferentiated • Products purchased represent a significant portion of the customer's cost • Customers earn low profits, creating incentive to lower purchasing costs • The product purchased is unimportant to the quality of the customer's product • Switching costs are low • Customer group poses a credible threat of backward integration SUBSTITUTES Threat of substitutes is high if: • There is an abundance of products or services that serve the same function • The price-performance tradeoff of substitutes is attractive SC 111898 KR-Sydney 30 © 1998, Pricewaterhouse. Coopers L. L. P.

Five Forces Analysis When To Apply Use the Five Force analysis to evaluate a market’s structure and the trends affecting a market’s profitability. Please note that the structural conditions alone do not provide a quantification of total future market profitability or the viability of a company. Therefore, it is important to integrate company specific insights and confirm that the model accurately reflects what is happening in the market. Approach Five Forces analysis utilizes a four step approach and is applied as a starting point for understanding a market’s attractiveness: Step 1: Collect data Step 2: Evaluate strength of key forces, including: (What about technology? ) • Buyers • Suppliers • Substitutes • Competitors • Potential entrants Step 3: Qualitatively assign a high, medium or low score to each key force Step 4: Assess the overall effect of the forces on industry attractiveness and strategic implications SC 111898 KR-Sydney 31 © 1998, Pricewaterhouse. Coopers L. L. P.

Five Forces Analysis Citations - Client and Industry Experience Source List • Aerospace & Electronics Alliance/Multi-Industry/KIT database • David P Baron, “The Nonmarket Strategy System”, Sloan Management Review, Fall 1995 • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Liam Fahey, Robert M. Randall, “The Portable MBA in • Iberdrola and Johnson & Johnson/TC-Utilities/KIT database Strategy” • la Caixa/FM-Banking/KIT database • Levi Straus, Merk and Motorola/Multi-Industry/KIT database • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Pw. C MCS/Consulting/Vasu Krishnamurthy SC 111898 KR-Sydney 32 © 1998, Pricewaterhouse. Coopers L. L. P.

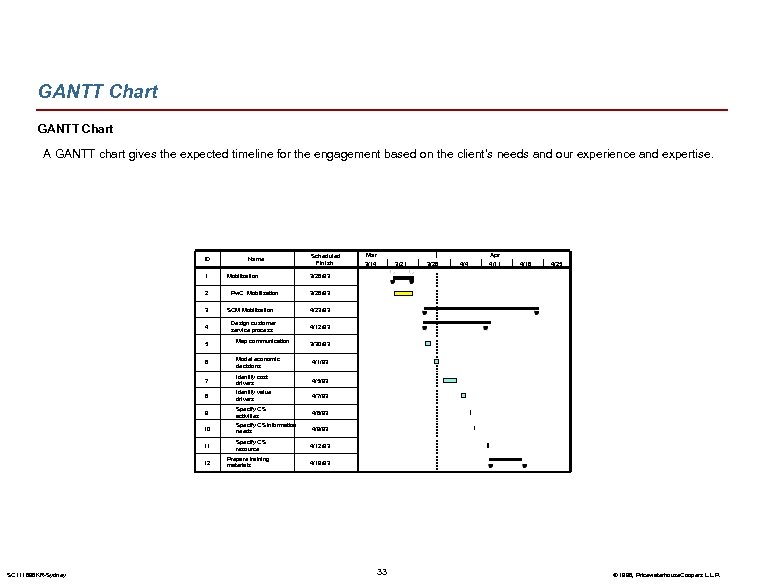

GANTT Chart A GANTT chart gives the expected timeline for the engagement based on the client’s needs and our experience and expertise. ID 1 2 3 4 5 Name Mobilization Pw. C Mobilization SCM Mobilization Design customer service process Map communication Scheduled Finish 3/21 3/28 4/4 Apr 4/11 4/18 4/25 3/26/93 4/23/93 4/12/93 3/30/93 6 Model economic decisions 4/1/93 7 Identify cost drivers 4/5/93 8 Identify value drivers 4/7/93 9 10 11 12 SC 111898 KR-Sydney Mar 3/14 Specify CS activities Specify CS information needs Specify CS resource Prepare training materials 4/8/93 4/9/93 4/12/93 4/19/93 33 © 1998, Pricewaterhouse. Coopers L. L. P.

GANTT Chart When To Apply When it is necessary to Illustrate for the client a rough timeline for the proposed engagement. Approach • Determine the approximate duration for each task. • Understand the prospective client's time constraints. • Using a project management software tool such as Microsoft Project, determine the specific timeline for the project • Work either forward from an anticipated start date to determine the approximate time of completion, or backward from a client's "must-complete-by" date to determine the necessary duration of tasks, or both SC 111898 KR-Sydney 34 © 1998, Pricewaterhouse. Coopers L. L. P.

GANTT Chart Citations - Client and Industry Experience Source List • Chrysler/Automotive/Vasu Krishnamurthy • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” • E. B. Eddy - Forestry & Wood Products Division/Agriculture, Forestry & Fisheries/KIT database • Giddings & Lewis/Machine Tool/Vasu Krishnamurthy • RBMG/Mortgage Banking/Vasu Krishnamurthy • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney 35 © 1998, Pricewaterhouse. Coopers L. L. P.

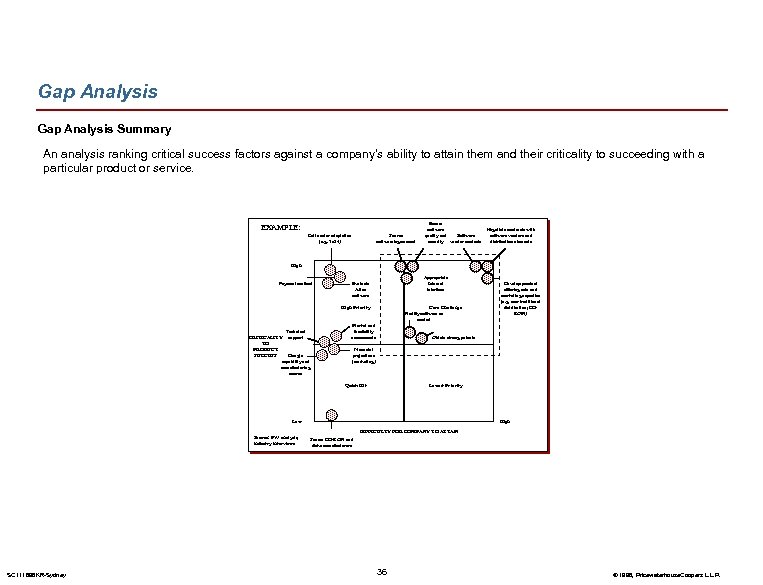

Gap Analysis Summary An analysis ranking critical success factors against a company’s ability to attain them and their criticality to succeeding with a particular product or service. EXAMPLE: Source software/agreement Call center adaptation (e. g. 7 x 24) Ensure software Software quality and security vendor contacts Negotiate contracts with software vendors and distribution channels High Payment method Appropriate Internet interface Evaluate Atlas software High Priority Technical CRITICALITY support TO PRODUCT SUCCESS Dongle capability and manufacturing source Core Challenge Modify software as needed Market and feasibility assessments Develop product offering mix and marketing expertise (e. g. non-traditional distribution; CDROM) Obtain strong patents Financial projections (marketing) Quick Hit Lowest Priority Low High DIFFICULTY FOR COMPANY TO ATTAIN Source: PW analysis, industry interviews SC 111898 KR-Sydney Source CD-ROM and disks manufacturers 36 © 1998, Pricewaterhouse. Coopers L. L. P.

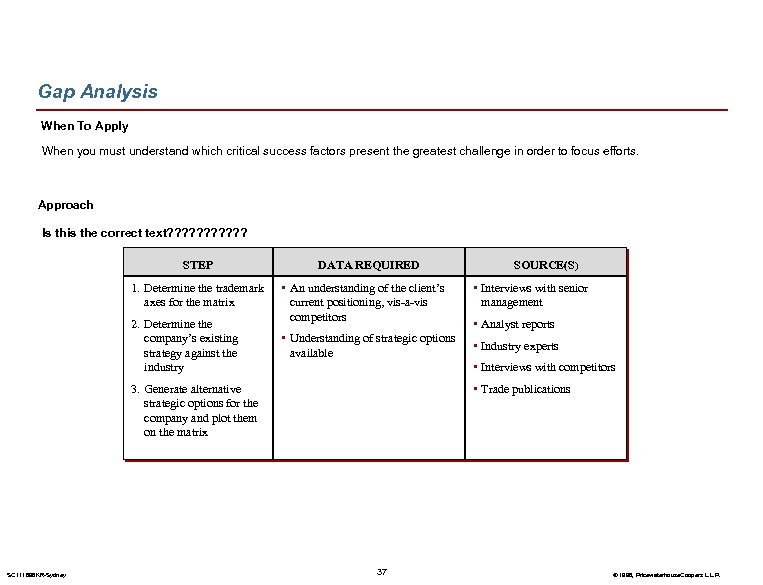

Gap Analysis When To Apply When you must understand which critical success factors present the greatest challenge in order to focus efforts. Approach Is this the correct text? ? ? STEP 1. Determine the trademark axes for the matrix 2. Determine the company’s existing strategy against the industry DATA REQUIRED • An understanding of the client’s current positioning, vis-a-vis competitors • Understanding of strategic options available • Interviews with senior management • Analyst reports • Industry experts • Interviews with competitors • Trade publications 3. Generate alternative strategic options for the company and plot them on the matrix SC 111898 KR-Sydney SOURCE(S) 37 © 1998, Pricewaterhouse. Coopers L. L. P.

Gap Analysis Citations - Client and Industry Experience Source List • Flemings Fund Management Ltd (FFML)/Banking/KIT database • David A. Aaker, “Developing Business Strategies”, 5 th Edition • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis” 3 rd Edition • General Motors/Automotive/KIT database • Philips/Multi-Industry/KIT database • Michael Gould, Andrew Campbell, Marcus Alexander, “Corporate-Level Strategy: Creating Value in the Multibusiness Company” • Pw. C MCS/Consulting/Vasu Krishnamurthy SC 111898 KR-Sydney 38 © 1998, Pricewaterhouse. Coopers L. L. P.

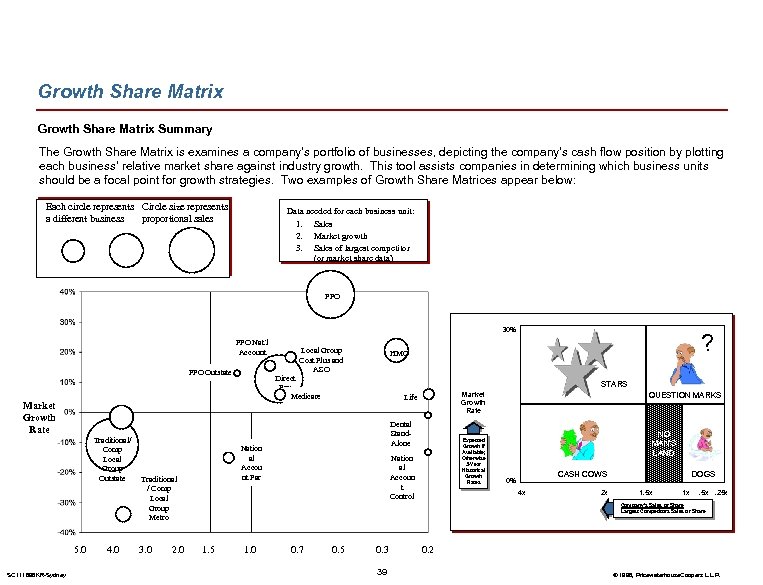

Growth Share Matrix Summary The Growth Share Matrix is examines a company’s portfolio of businesses, depicting the company’s cash flow position by plotting each business’ relative market share against industry growth. This tool assists companies in determining which business units should be a focal point for growth strategies. Two examples of Growth Share Matrices appear below: Each circle represents Circle size represents a different business proportional sales Data needed for each business unit: 1. Sales 2. Market growth 3. Sales of largest competitor (or market share data) PPO 30% PPO Nat’l Account PPO Outstate 5. 0 SC 111898 KR-Sydney 4. 0 3. 0 2. 0 STARS Market Growth Rate Life Dental Stand. Alone Nation al Accou nt Par Traditional / Comp Local Group Metro ? HMO Direct Pay M Comp edicare Market Growth Rate Traditional/ Comp Local Group Outstate Local Group Cost Plus and ASO Expected Growth if Available; Otherwise 3 -Year Historical Growth Rates Nation al Accoun t Control QUESTION MARKS NO MAN’S LAND CASH COWS 0% 4 x 2 x DOGS 1. 5 x 1 x . 5 x. 25 x Company’s Sales or Share Largest Competitors Sales or Share 1. 5 1. 0 0. 7 0. 5 0. 3 39 0. 2 © 1998, Pricewaterhouse. Coopers L. L. P.

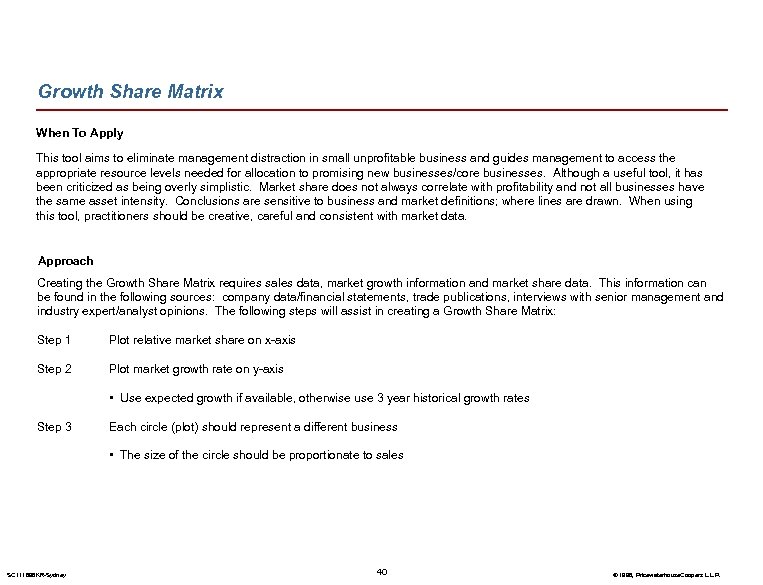

Growth Share Matrix When To Apply This tool aims to eliminate management distraction in small unprofitable business and guides management to access the appropriate resource levels needed for allocation to promising new businesses/core businesses. Although a useful tool, it has been criticized as being overly simplistic. Market share does not always correlate with profitability and not all businesses have the same asset intensity. Conclusions are sensitive to business and market definitions; where lines are drawn. When using this tool, practitioners should be creative, careful and consistent with market data. Approach Creating the Growth Share Matrix requires sales data, market growth information and market share data. This information can be found in the following sources: company data/financial statements, trade publications, interviews with senior management and industry expert/analyst opinions. The following steps will assist in creating a Growth Share Matrix: Step 1 Plot relative market share on x-axis Step 2 Plot market growth rate on y-axis • Use expected growth if available, otherwise use 3 year historical growth rates Step 3 Each circle (plot) should represent a different business • The size of the circle should be proportionate to sales SC 111898 KR-Sydney 40 © 1998, Pricewaterhouse. Coopers L. L. P.

Growth Share Matrix Citations - Client and Industry Experience Source List • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • David A. Aaker, “Developing Business Strategies”, 5 th Edition • Pw. C MCS/Consulting/Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • John Micklethwait & Adrian Wooldridge, “The Witch Doctors: Making Sense of the Management Gurus” SC 111898 KR-Sydney 41 © 1998, Pricewaterhouse. Coopers L. L. P.

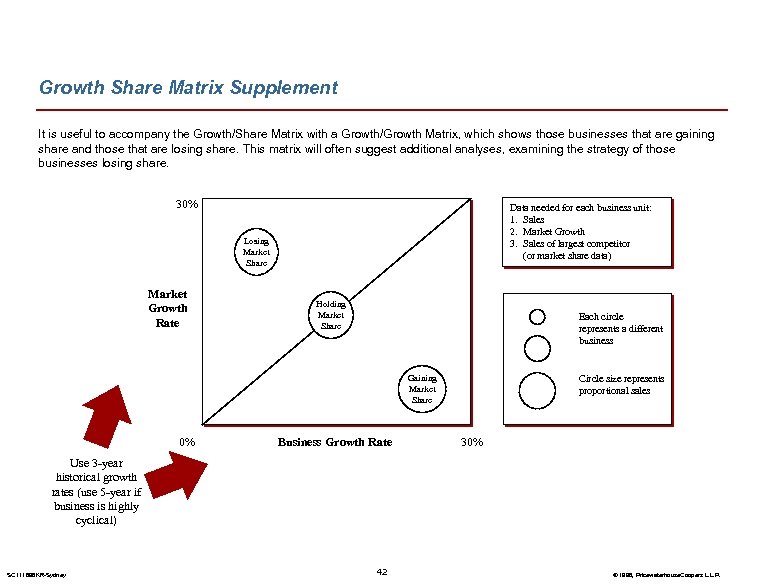

Growth Share Matrix Supplement It is useful to accompany the Growth/Share Matrix with a Growth/Growth Matrix, which shows those businesses that are gaining share and those that are losing share. This matrix will often suggest additional analyses, examining the strategy of those businesses losing share. 30% Data needed for each business unit: 1. Sales 2. Market Growth 3. Sales of largest competitor (or market share data) Losing Market Share Market Growth Rate Holding Market Share Each circle represents a different business Circle size represents proportional sales Gaining Market Share 0% Business Growth Rate 30% Use 3 -year historical growth rates (use 5 -year if business is highly cyclical) SC 111898 KR-Sydney 42 © 1998, Pricewaterhouse. Coopers L. L. P.

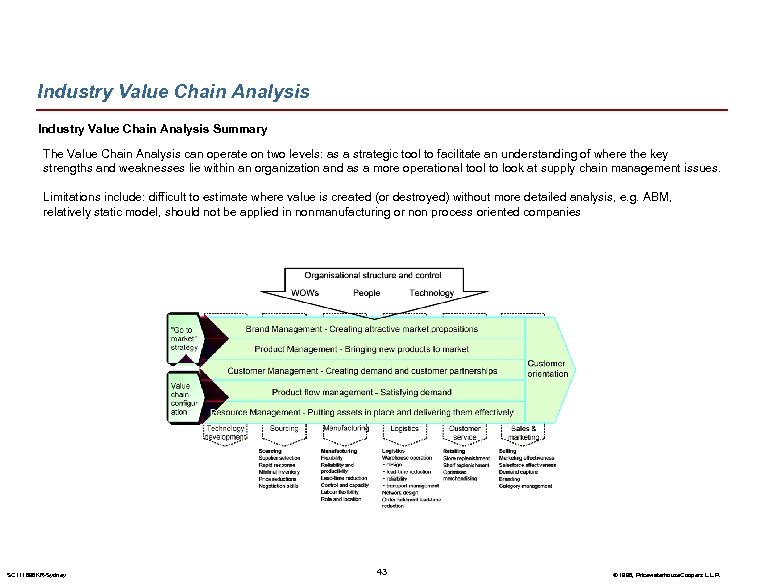

Industry Value Chain Analysis Summary The Value Chain Analysis can operate on two levels: as a strategic tool to facilitate an understanding of where the key strengths and weaknesses lie within an organization and as a more operational tool to look at supply chain management issues. Limitations include: difficult to estimate where value is created (or destroyed) without more detailed analysis, e. g. ABM, relatively static model, should not be applied in nonmanufacturing or non process oriented companies SC 111898 KR-Sydney 43 © 1998, Pricewaterhouse. Coopers L. L. P.

Industry Value Chain Analysis When To Apply Understand opportunities for adding value by improving the various elements of the value chain Approach The value chain analysis is at its' simplest a high level diagnostic to see where the organization needs to improve or maintain value creation. Step 1 Identify the key primary and support activities Step 2 Identify value added at each stage Step 3 Assess the contribution of each stage to the organization's competitive advantage Step 4 Identify the key cost drivers Step 5 Assess potential for increasing value and decreasing costs SC 111898 KR-Sydney 44 © 1998, Pricewaterhouse. Coopers L. L. P.

Industry Value Chain Analysis Citations - Client and Industry Experience Source List • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Liam Fahey, Robert M. Randall, “The Portable MBA in Strategy” • Robert Grant, “Contemporary Strategy Analysis” • Henry Mintzberg, James Brian Quinn, Sumantra Ghoshal, “The Strategy Process” • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategic Safari: A Guided Tour Through the Wilds of Strategic Management” SC 111898 KR-Sydney 45 © 1998, Pricewaterhouse. Coopers L. L. P.

Issue Tree/Issue Map Summary An Issue Tree/Issue Map typically begins with a broad question and defines the sequence of key issues (phrased as yes or no choices) that will support a specific answer. A practitioner would use issue maps to frame options, usually later in the project. A more detailed example is included as a supplement. However, a basic representation can be found below. Issue Map (Yes/No Tree) Yes ? No SC 111898 KR-Sydney 46 © 1998, Pricewaterhouse. Coopers L. L. P.

Issue Tree/Issue Map When To Apply This tool is most effective when considering discrete or well-defined alternatives and is extremely practical for communication related issues. A practitioner should be recognize that an Issue Tree/Issue Map requires strong knowledge of problem or issue, client and industry. It can be frustrating to push decision branches to yes/no questions and difficult (time consuming) to create MECE options. Approach An Issue Tree/Issue Map ensures logical integrity of the problem solving framework and reduces potential for oversights or missed opportunities. Follow these 5 steps to successfully create an Issue Tree/Issue Map: Step 1 Identify the key issues Step 2 Define the starting points (i. e. what factors drive these issues? ) Step 3 Identify all possible outcomes Step 4 Develop the logic flow connections among these options Step 5 Start over SC 111898 KR-Sydney 47 © 1998, Pricewaterhouse. Coopers L. L. P.

Issue Tree/Issue Map Citations - Client and Industry Experience Source List • BCBSF/ /Chuck Stern • Strategic Change MBA Training • Galileo/Travel/ Spencer Lin & Vasu Krishnamurthy • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney 48 © 1998, Pricewaterhouse. Coopers L. L. P.

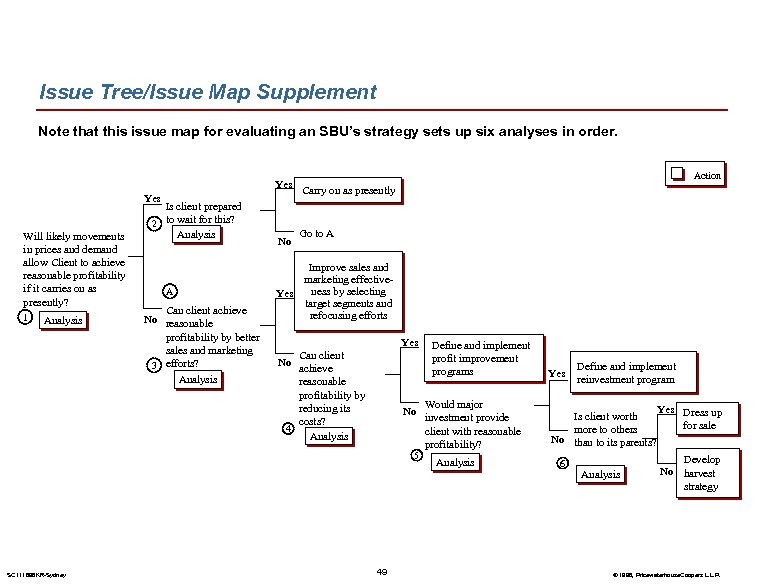

Issue Tree/Issue Map Supplement Note that this issue map for evaluating an SBU’s strategy sets up six analyses in order. Yes Will likely movements in prices and demand allow Client to achieve reasonable profitability if it carries on as presently? 1 Analysis Is client prepared 2 to wait for this? Analysis A Can client achieve No reasonable profitability by better sales and marketing 3 efforts? Analysis No Action Carry on as presently Go to A Improve sales and marketing effectiveness by selecting Yes target segments and refocusing efforts Yes Can client No achieve reasonable profitability by reducing its costs? 4 Analysis No 5 SC 111898 KR-Sydney 49 Define and implement profit improvement programs Would major investment provide client with reasonable profitability? Analysis Yes Define and implement reinvestment program Is client worth more to others No than to its parents? 6 Analysis Yes Dress up for sale Develop No harvest strategy © 1998, Pricewaterhouse. Coopers L. L. P.

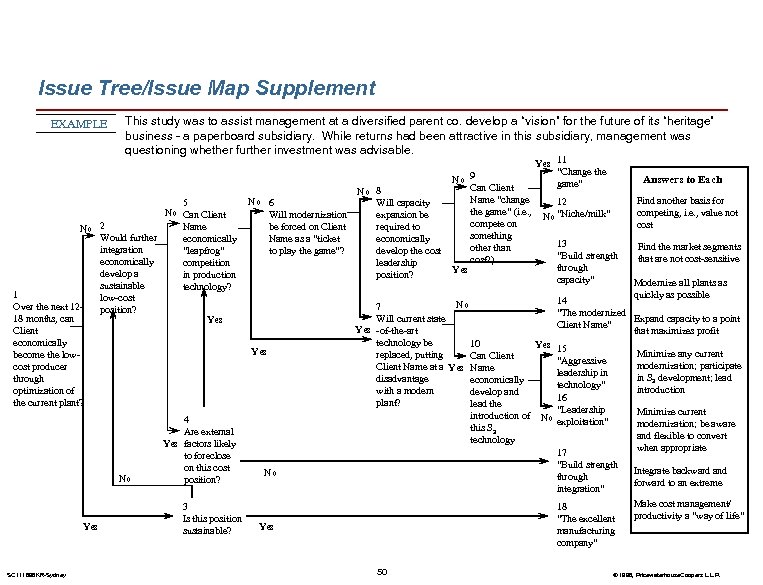

Issue Tree/Issue Map Supplement EXAMPLE This study was to assist management at a diversified parent co. develop a “vision” for the future of its “heritage” business - a paperboard subsidiary. While returns had been attractive in this subsidiary, management was questioning whether further investment was advisable. 5 No Can Client Name No 2 Would further economically integration “leapfrog” economically competition develop a in production sustainable technology? 1 low-cost Over the next 12 position? 18 months, can Yes Client economically become the lowcost producer through optimization of the current plant? No Yes SC 111898 KR-Sydney 4 Are external Yes factors likely to foreclose on this cost position? 3 Is this position sustainable? No 6 Will modernization be forced on Client Name as a “ticket to play the game”? Yes No No 8 Will capacity expansion be required to economically develop the cost leadership position? No 9 Can Client Name “change the game” (i. e. , compete on something other than cost? ) Yes 11 “Change the game” Answers to Each Find another basis for competing, i. e. , value not cost 12 No “Niche/milk” 13 “Build strength through capacity” 14 No 7 “The modernized Will current state Client Name” Yes -of-the-art technology be 10 Yes 15 replaced, putting Can Client “Aggressive Client Name at a Yes Name leadership in disadvantage economically technology” with a modern develop and 16 plant? lead the “Leadership introduction of No exploitation” this S 3 technology 17 “Build strength through integration” 18 “The excellent manufacturing company” Yes 50 Find the market segments that are not cost-sensitive Modernize all plants as quickly as possible Expand capacity to a point that maximizes profit Minimize any current modernization; participate in S 3 development; lead introduction Minimize current modernization; be aware and flexible to convert when appropriate Integrate backward and forward to an extreme Make cost management/ productivity a “way of life” © 1998, Pricewaterhouse. Coopers L. L. P.

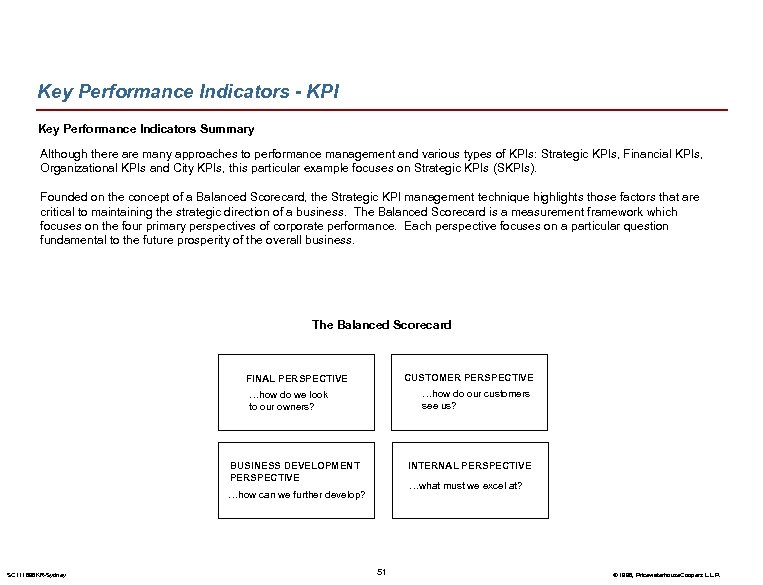

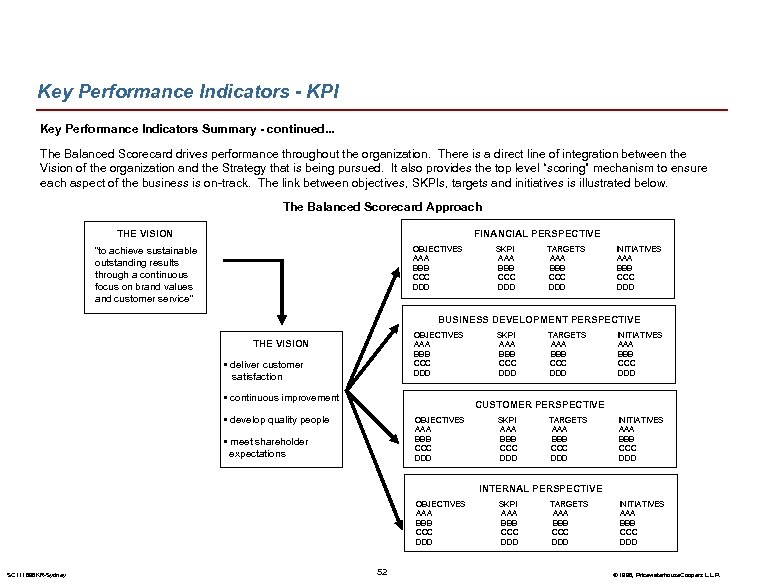

Key Performance Indicators - KPI Key Performance Indicators Summary Although there are many approaches to performance management and various types of KPIs: Strategic KPIs, Financial KPIs, Organizational KPIs and City KPIs, this particular example focuses on Strategic KPIs (SKPIs). Founded on the concept of a Balanced Scorecard, the Strategic KPI management technique highlights those factors that are critical to maintaining the strategic direction of a business. The Balanced Scorecard is a measurement framework which focuses on the four primary perspectives of corporate performance. Each perspective focuses on a particular question fundamental to the future prosperity of the overall business. The Balanced Scorecard CUSTOMER PERSPECTIVE FINAL PERSPECTIVE …how do our customers see us? …how do we look to our owners? BUSINESS DEVELOPMENT PERSPECTIVE INTERNAL PERSPECTIVE …what must we excel at? …how can we further develop? SC 111898 KR-Sydney 51 © 1998, Pricewaterhouse. Coopers L. L. P.

Key Performance Indicators - KPI Key Performance Indicators Summary - continued. . . The Balanced Scorecard drives performance throughout the organization. There is a direct line of integration between the Vision of the organization and the Strategy that is being pursued. It also provides the top level “scoring” mechanism to ensure each aspect of the business is on-track. The link between objectives, SKPIs, targets and initiatives is illustrated below. The Balanced Scorecard Approach FINANCIAL PERSPECTIVE THE VISION OBJECTIVES AAA BBB CCC DDD “to achieve sustainable outstanding results through a continuous focus on brand values and customer service” SKPI AAA BBB CCC DDD TARGETS AAA BBB CCC DDD INITIATIVES AAA BBB CCC DDD BUSINESS DEVELOPMENT PERSPECTIVE OBJECTIVES AAA BBB CCC DDD THE VISION • deliver customer satisfaction • continuous improvement SKPI AAA BBB CCC DDD TARGETS AAA BBB CCC DDD INITIATIVES AAA BBB CCC DDD CUSTOMER PERSPECTIVE • develop quality people OBJECTIVES AAA BBB CCC DDD • meet shareholder expectations SKPI AAA BBB CCC DDD TARGETS AAA BBB CCC DDD INITIATIVES AAA BBB CCC DDD INTERNAL PERSPECTIVE OBJECTIVES AAA BBB CCC DDD SC 111898 KR-Sydney 52 SKPI AAA BBB CCC DDD TARGETS AAA BBB CCC DDD INITIATIVES AAA BBB CCC DDD © 1998, Pricewaterhouse. Coopers L. L. P.

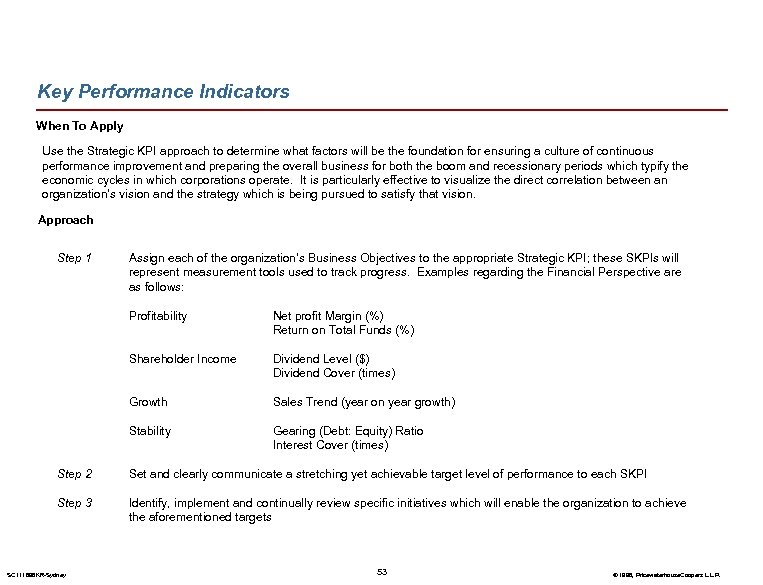

Key Performance Indicators When To Apply Use the Strategic KPI approach to determine what factors will be the foundation for ensuring a culture of continuous performance improvement and preparing the overall business for both the boom and recessionary periods which typify the economic cycles in which corporations operate. It is particularly effective to visualize the direct correlation between an organization’s vision and the strategy which is being pursued to satisfy that vision. Approach Step 1 Assign each of the organization’s Business Objectives to the appropriate Strategic KPI; these SKPIs will represent measurement tools used to track progress. Examples regarding the Financial Perspective are as follows: Profitability Net profit Margin (%) Return on Total Funds (%) Shareholder Income Dividend Level ($) Dividend Cover (times) Growth Sales Trend (year on year growth) Stability Gearing (Debt: Equity) Ratio Interest Cover (times) Step 2 Set and clearly communicate a stretching yet achievable target level of performance to each SKPI Step 3 Identify, implement and continually review specific initiatives which will enable the organization to achieve the aforementioned targets SC 111898 KR-Sydney 53 © 1998, Pricewaterhouse. Coopers L. L. P.

Key Performance Indicators Citations - Client and Industry Experience Source List • Du. Pont/Chemicals/Vasu Krishnamurthy • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Ericsson/Technology/KIT database • Flemings Fund Management Ltd (FFML)/Banking/KIT database • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • International Paper Company/Multi-Industry/KIT database • SAP/CIP/KIT database • Sega of America/Technology/KIT database • Valco/Chemicals/Vasu Krishnamurthy SC 111898 KR-Sydney 54 © 1998, Pricewaterhouse. Coopers L. L. P.

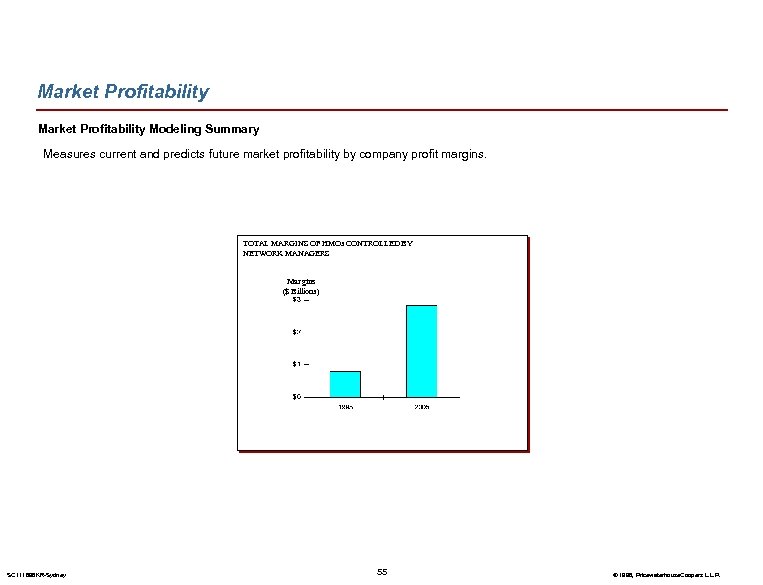

Market Profitability Modeling Summary Measures current and predicts future market profitability by company profit margins. TOTAL MARGINS OF HMOs CONTROLLED BY NETWORK MANAGERS Margins ($ Billions) SC 111898 KR-Sydney 55 © 1998, Pricewaterhouse. Coopers L. L. P.

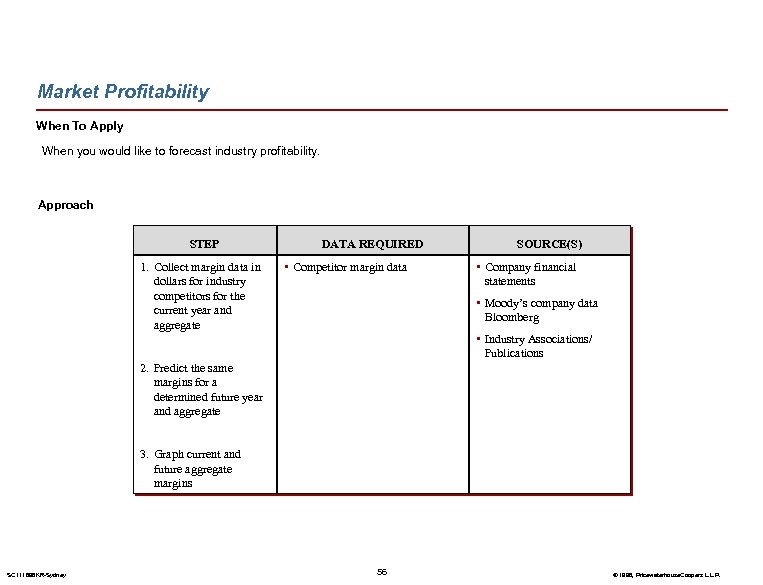

Market Profitability When To Apply When you would like to forecast industry profitability. Approach STEP 1. Collect margin data in dollars for industry competitors for the current year and aggregate DATA REQUIRED • Competitor margin data SOURCE(S) • Company financial statements • Moody’s company data Bloomberg • Industry Associations/ Publications 2. Predict the same margins for a determined future year and aggregate 3. Graph current and future aggregate margins SC 111898 KR-Sydney 56 © 1998, Pricewaterhouse. Coopers L. L. P.

Market Profitability Citations - Client and Industry Experience Source List • Braun/CIP/KIT database • David A. Aaker, “Developing Business Strategies”, 5 th Edition • Pw. C MCS/Consulting/Vasu Krishnamurthy • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition SC 111898 KR-Sydney 57 © 1998, Pricewaterhouse. Coopers L. L. P.

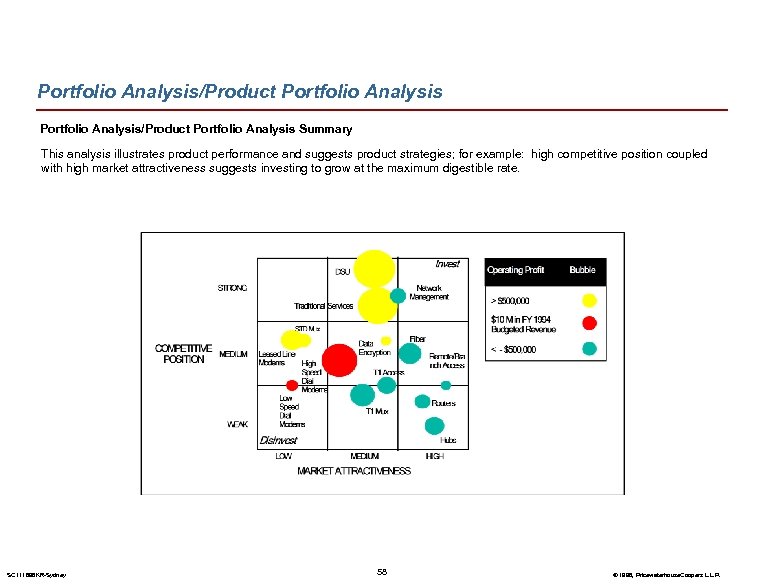

Portfolio Analysis/Product Portfolio Analysis Summary This analysis illustrates product performance and suggests product strategies; for example: high competitive position coupled with high market attractiveness suggests investing to grow at the maximum digestible rate. SC 111898 KR-Sydney 58 © 1998, Pricewaterhouse. Coopers L. L. P.

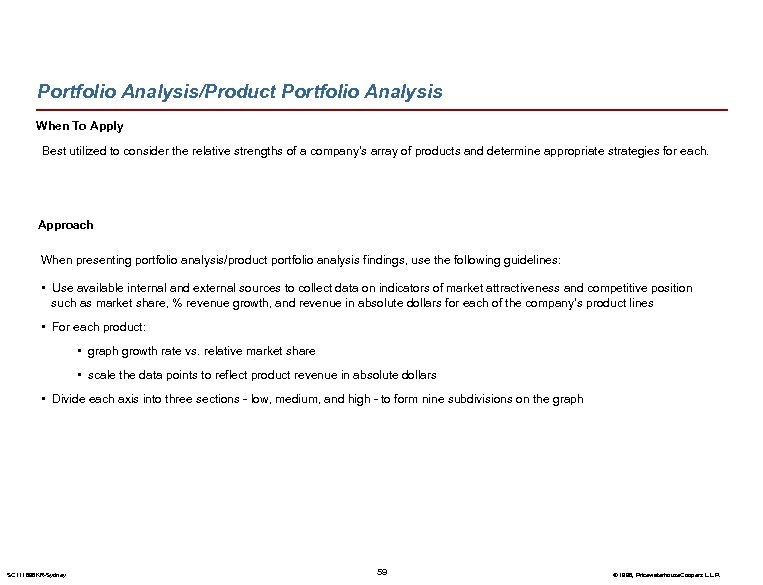

Portfolio Analysis/Product Portfolio Analysis When To Apply Best utilized to consider the relative strengths of a company’s array of products and determine appropriate strategies for each. Approach When presenting portfolio analysis/product portfolio analysis findings, use the following guidelines: • Use available internal and external sources to collect data on indicators of market attractiveness and competitive position such as market share, % revenue growth, and revenue in absolute dollars for each of the company’s product lines • For each product: • graph growth rate vs. relative market share • scale the data points to reflect product revenue in absolute dollars • Divide each axis into three sections - low, medium, and high - to form nine subdivisions on the graph SC 111898 KR-Sydney 59 © 1998, Pricewaterhouse. Coopers L. L. P.

Portfolio Analysis/Product Portfolio Analysis Citations - Client and Industry Experience Source List • Allstate Insurance Company/Banking/KIT database • David A. Aaker, “Developing Business Strategies”, 5 th Edition • Vanguard/Banking/KIT database • The Boston Consulting Group, “Perspectives on Strategy” SC 111898 KR-Sydney 60 © 1998, Pricewaterhouse. Coopers L. L. P.

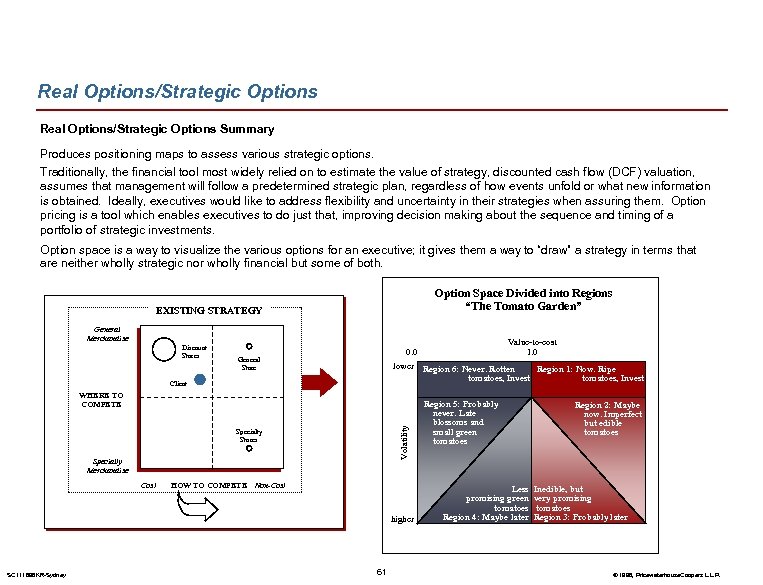

Real Options/Strategic Options Summary Produces positioning maps to assess various strategic options. Traditionally, the financial tool most widely relied on to estimate the value of strategy, discounted cash flow (DCF) valuation, assumes that management will follow a predetermined strategic plan, regardless of how events unfold or what new information is obtained. Ideally, executives would like to address flexibility and uncertainty in their strategies when assuring them. Option pricing is a tool which enables executives to do just that, improving decision making about the sequence and timing of a portfolio of strategic investments. Option space is a way to visualize the various options for an executive; it gives them a way to “draw” a strategy in terms that are neither wholly strategic nor wholly financial but some of both. Option Space Divided into Regions “The Tomato Garden” EXISTING STRATEGY General Merchandise Discount Stores General Store lower Client Volatility WHERE TO COMPETE Specialty Stores Specialty Merchandise Cost HOW TO COMPETE Non-Cost higher SC 111898 KR-Sydney Value-to-cost 1. 0 0. 0 61 Region 6: Never. Rotten Region 1: Now. Ripe tomatoes, Invest Region 5: Probably never. Late blossoms and small green tomatoes Less promising green tomatoes Region 4: Maybe later Region 2: Maybe now. Imperfect but edible tomatoes Inedible, but very promising tomatoes Region 3: Probably later © 1998, Pricewaterhouse. Coopers L. L. P.

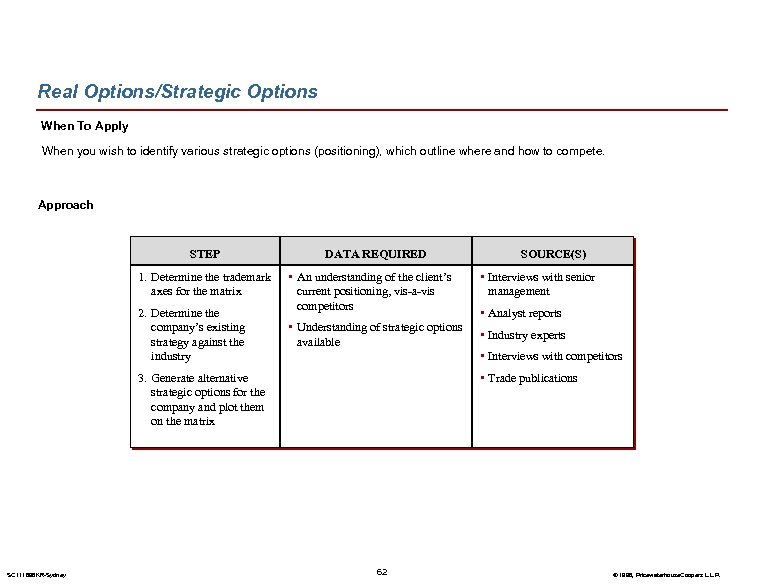

Real Options/Strategic Options When To Apply When you wish to identify various strategic options (positioning), which outline where and how to compete. Approach STEP 1. Determine the trademark axes for the matrix 2. Determine the company’s existing strategy against the industry DATA REQUIRED • An understanding of the client’s current positioning, vis-a-vis competitors • Understanding of strategic options available • Interviews with senior management • Analyst reports • Industry experts • Interviews with competitors • Trade publications 3. Generate alternative strategic options for the company and plot them on the matrix SC 111898 KR-Sydney SOURCE(S) 62 © 1998, Pricewaterhouse. Coopers L. L. P.

Real Options/Strategic Options Citations - Client and Industry Experience • GTE Cyber. Trust/Banking/KIT database • Kellogg Company/Food & Beverage/KIT database Source List • Robert M. Grant, “Contemporary Strategy Analysis” • Timothy Luehrman, “Investment Opportunities as Real Options: Getting Started on the Numbers”, HBR, July 1998 • Timothy Luehrman, “Strategy as a Portfolio of Real Options”, HBR, September 1998 • Robeco Bank SA/Banking/KIT database • Star System Inc. - E-Commerce Workshop/Banking/KIT database SC 111898 KR-Sydney 63 © 1998, Pricewaterhouse. Coopers L. L. P.

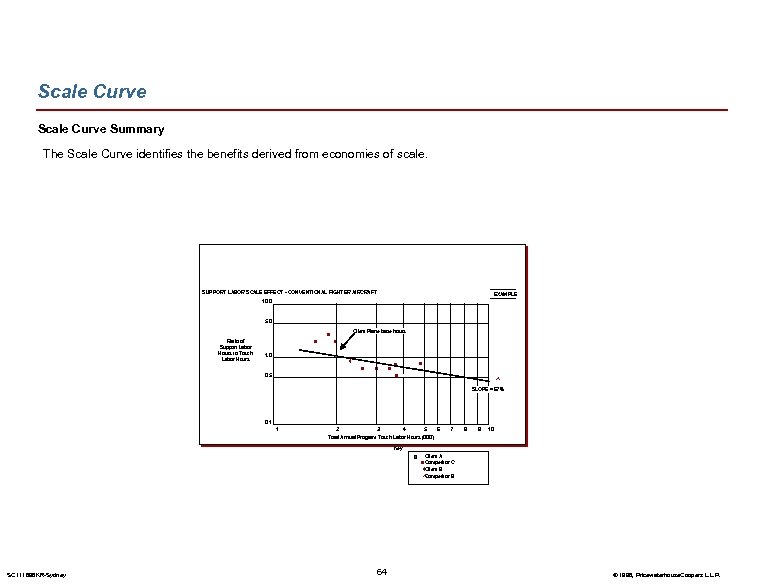

Scale Curve Summary The Scale Curve identifies the benefits derived from economies of scale. SUPPORT LABOR SCALE EFFECT - CONVENTIONAL FIGHTER AIRCRAFT EXAMPLE 10. 0 5. 0 Ratio of Support Labor Hours to Touch Labor Hours n 1 A Client Plane base hours 1. 0 t 1 A 0. 5 n 1 A n 1 A © 1 A SLOPE = 67% 0. 1 1 2 3 4 5 6 7 8 9 10 Total Annual Program Touch Labor Hours (000) Key Client A n 1 A Competitor C t. Client B 1 A © Competitor B 1 A SC 111898 KR-Sydney 64 © 1998, Pricewaterhouse. Coopers L. L. P.

Scale Curve When To Apply When it is necessary to determine if there is a benefit to derived from economies of scale. Approach • Gather cost information of producing a service or a product at various volumes • Display information in scale curve for relevant products or functions SC 111898 KR-Sydney 65 © 1998, Pricewaterhouse. Coopers L. L. P.

Scale Curve Citations - Client and Industry Experience Source List • BCBSF/ /Chuck Stern • Robert Grant, “Contemporary Strategy Analysis” SC 111898 KR-Sydney 66 © 1998, Pricewaterhouse. Coopers L. L. P.

Scenario Envisioning Summary The Scenario Envisioning concept is an inductive, “top-down” approach to developing future industry/market scenarios. The approach hypothesizes future scenarios independent of the past and present upfront and then links them to past and current trends. The scenarios are then used in simulating business outcomes such as consumer preferences, business systems and competitive actions, which in turn are used to identify value added opportunities and future strategies. Pricewaterhouse. Coopers’ Scenario Envisioning has been developed to assist companies in mapping the possible future of an industry in transition. Decision makers are using Scenario Envisioning to rethink how the driving forces of their industry might combine in surprising ways. In these new models of the future, they test current strategy, develop and explore other options. Executives practice operating and understanding their business in states that current rivals don’t expect, making decisions today that will enhance their organization’s chances of succeeding tomorrow. Most managers expect Scenario Envisioning to begin with prefabricated world visions of economic and geopolitical trends. In contrast, Scenario Envisioning develops customized pictures of a company’s future markets that are distinctly different from the present and yet quite possible. Hence, managers experience what it would be like to operate in new markets and serve customers with new needs. SC 111898 KR-Sydney 67 © 1998, Pricewaterhouse. Coopers L. L. P.

Scenario Envisioning When to Apply Scenario Envisioning is a powerful approach for companies in industries that are experiencing rapid discontinuous change – where the future cannot be extrapolated from the past and present. Scenario Envisioning fulfills the key needs formulating strategy in a rapid discontinuous change environment. The central conflict in economics …. is the battle between past and future, the war between the existing configuration of industries and the industries that will soon replace them, ” observed the Wall Street Journal recently. A few years ago, planners labeled such industry transformation “discontinuity, ” or a break in established trends. A more descriptive word is “convergence, ” one type of discontinuity that creates a new set of customer values and products when two or more industries or technologies collide. This phenomenon has already redefined many markets and is even transforming whole industries. Executives today tasked with formulating strategic plans face the uncertain future of these converging industries. Scenario Envisioning can be employed, but not limited to the following situations: • Organization leaders who seek to understand the emerging future and its implications for making immediate decisions. • Management beginning corporate repositioning, strategic visioning, or re-invention initiatives • Managers of such functions as mergers and acquisitions, research and development, marketing and sales who need to test the consequences of current and potential decisions in different competitive futures • Staff units needing to depict, assess and communicate the implications of the alternative futures facing their organizations as part of the planning cycle • Corporate development managers who want to monitor emerging technologies and potential competitive conditions • Product and service marketers who track the rapid evolution of customer needs • Senior executives who integrate and coordinate mergers and acquisitions, joint ventures and strategic alliances and who need a clear vision of the outcomes and benefits of these ventures. SC 111898 KR-Sydney 68 © 1998, Pricewaterhouse. Coopers L. L. P.

Scenario Envisioning Approach Through Pricewaterhouse. Coopers’ work with companies in evolving industries, a ten-step approach has been developed that previews innovative and nontraditional industry and market capabilities. Innovative hypothesis about the future, based on extensive expert industry knowledge and research are formulated for study and review. The scenario team converts these theories of logical futures - ones that diverge from the past and present trends - into a set of distinctly different scenarios. Develop Future Industry Scenarios Step 1 Define the broad future industry and market context within which the scenarios will be developed. For example, the banking industry, the broader context may be financial services or even personal information services. Step 2 Identify the paramount forces that will shape this industry and market context. For example, what consumer, regulatory, social, legal and technological changes can or could exert the most powerful influence on your industry? How do these interact on a global basis? Which of these is the most uncertain? Step 3 Identify the boundary parameters - the full range of uncertainty - of the paramount forces. For example, if regulation is one of the paramount forces, could the industry be intensively regulated or completely deregulated? Step 4 Develop logical but innovative hypotheses that explain how the most powerful and uncertain forces could interact. For example, will a major segment of the banking industry evolve into an on-line personal with building industry, fostered by deregulation and increasing consumer technological capability? Step 5 Create a set of scenarios that show a few key unpredictable forces with the highest impact could interact. Using a matrix model, the interaction of two or more unpredictable conditions results in a number of distinct possibilities. The goal is to cover a comprehensive spectrum of market conditions. SC 111898 KR-Sydney 69 © 1998, Pricewaterhouse. Coopers L. L. P.

Scenario Envisioning Approach cont. Step 6 Test the credibility of the scenarios by assessing the viability of enabling events required to make them happen. For example, as today’s youngsters quickly adapt to interactive games, will the market for this type of entertainment continue to grow as they mature? Step 7 Plot the evolutionary paths of the scenarios. For example, the delivery of broadband TV to the home by fiber optics cable may not occur for many years. In the meantime, a variety of “compromise” technologies such as direct broadcast satellite TV, ISDN phone lines, and ultra-fast modems, may flourish. Key business outcomes of the scenarios such as value chains and competitive dynamics are simulated. By viewing the potential evolutionary paths of markets , decision makers can anticipate what moves will put a company into the most advantageous position. Assess Economic Potential and Define Strategy Options Step 8 Simulate business outcomes and such as new value chains and new competitor dynamics created by the evolutionary paths of the scenarios. This will identify which segments of your industry may have increased profit potential and which types of market participants are likely to reap the benefits. Step 9 Assess your company’s capabilities and compare them to capabilities needed to compete in the various scenarios. Identify the company’s capability gaps and develop potential solutions to overcome them. Step 10 Develop, prioritize, and select a portfolio of optimal strategic options to compete successfully in each of the scenarios, and compare them with the present direction. This will allow the company to rehearse its potential future. SC 111898 KR-Sydney 70 © 1998, Pricewaterhouse. Coopers L. L. P.

Scenario Envisioning Citations - Client and Industry Experience Source List • Hollywood Studio/Entertainment At a major Hollywood Studio, Pw. C was employed to lead studio executives through the Scenario Envisioning ten step approach. Please refer to Sample Deliverables. • Saul J. Berman and Steve Redwood, “Developing Strategy in Changing Markets: A Case Study in Scenario Envisioning” • Strategic Change: Scenario Envisioning Approach to Strategy Development • Galileo/Travel/Spencer Lin & Vasu Krishnamurthy At Galileo, Pw. C used the Scenario Envisioning tool to develop potential diversification strategies. Deliverables are available for review. • Tetra-pack/? /E-Business/Susan? SC 111898 KR-Sydney 71 © 1998, Pricewaterhouse. Coopers L. L. P.

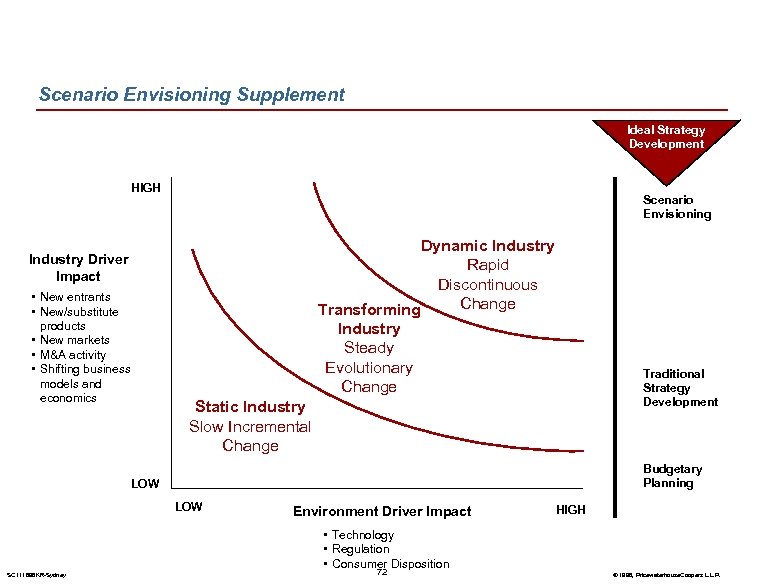

Scenario Envisioning Supplement Ideal Strategy Development HIGH Scenario Envisioning Dynamic Industry Rapid Discontinuous Change Transforming Industry Driver Impact • New entrants • New/substitute products • New markets • M&A activity • Shifting business models and economics Industry Steady Evolutionary Change Traditional Strategy Development Static Industry Slow Incremental Change Budgetary Planning LOW Environment Driver Impact HIGH • Technology • Regulation • Consumer Disposition SC 111898 KR-Sydney 72 © 1998, Pricewaterhouse. Coopers L. L. P.

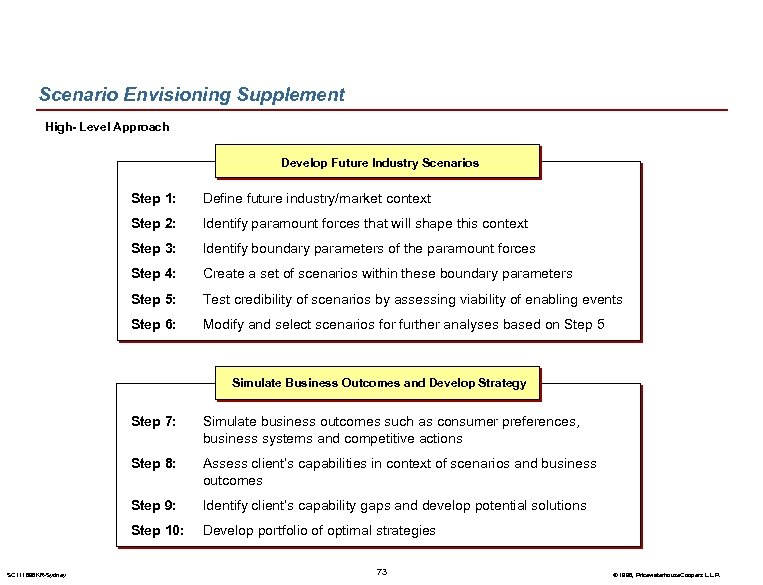

Scenario Envisioning Supplement High- Level Approach Develop Future Industry Scenarios Step 1: Define future industry/market context Step 2: Identify paramount forces that will shape this context Step 3: Identify boundary parameters of the paramount forces Step 4: Create a set of scenarios within these boundary parameters Step 5: Test credibility of scenarios by assessing viability of enabling events Step 6: Modify and select scenarios for further analyses based on Step 5 Simulate Business Outcomes and Develop Strategy Step 7: Step 8: Assess client’s capabilities in context of scenarios and business outcomes Step 9: Identify client’s capability gaps and develop potential solutions Step 10: SC 111898 KR-Sydney Simulate business outcomes such as consumer preferences, business systems and competitive actions Develop portfolio of optimal strategies 73 © 1998, Pricewaterhouse. Coopers L. L. P.

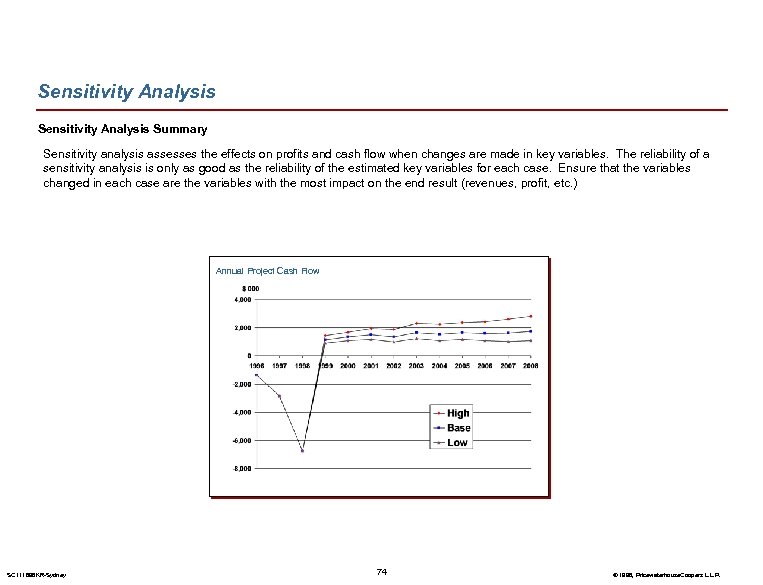

Sensitivity Analysis Summary Sensitivity analysis assesses the effects on profits and cash flow when changes are made in key variables. The reliability of a sensitivity analysis is only as good as the reliability of the estimated key variables for each case. Ensure that the variables changed in each case are the variables with the most impact on the end result (revenues, profit, etc. ) Annual Project Cash Flow SC 111898 KR-Sydney 74 © 1998, Pricewaterhouse. Coopers L. L. P.

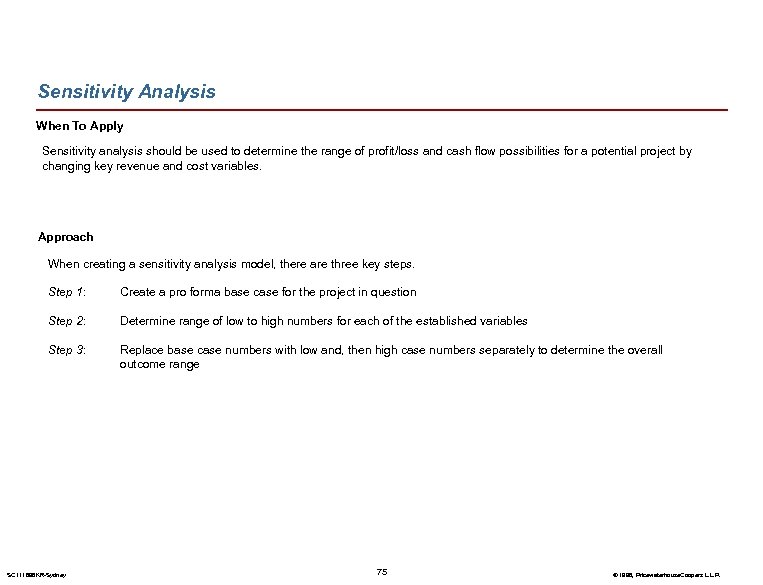

Sensitivity Analysis When To Apply Sensitivity analysis should be used to determine the range of profit/loss and cash flow possibilities for a potential project by changing key revenue and cost variables. Approach When creating a sensitivity analysis model, there are three key steps. Step 1: Create a pro forma base case for the project in question Step 2: Determine range of low to high numbers for each of the established variables Step 3: Replace base case numbers with low and, then high case numbers separately to determine the overall outcome range SC 111898 KR-Sydney 75 © 1998, Pricewaterhouse. Coopers L. L. P.

Sensitivity Analysis Citations - Client and Industry Experience Source List • Braun/Multi-Industry/KIT database • David Matheson and Jim Matheson, “The Smart Organization: Creating Value through Strategic R&D” • Compaq/Technology/Vasu Krishnamurthy • Motorola/Technology/Vasu Krishnamurthy • National Brands Limited/Food & Beverage/KIT database • Top European Brewery/Food & Beverage/KIT database SC 111898 KR-Sydney 76 © 1998, Pricewaterhouse. Coopers L. L. P.

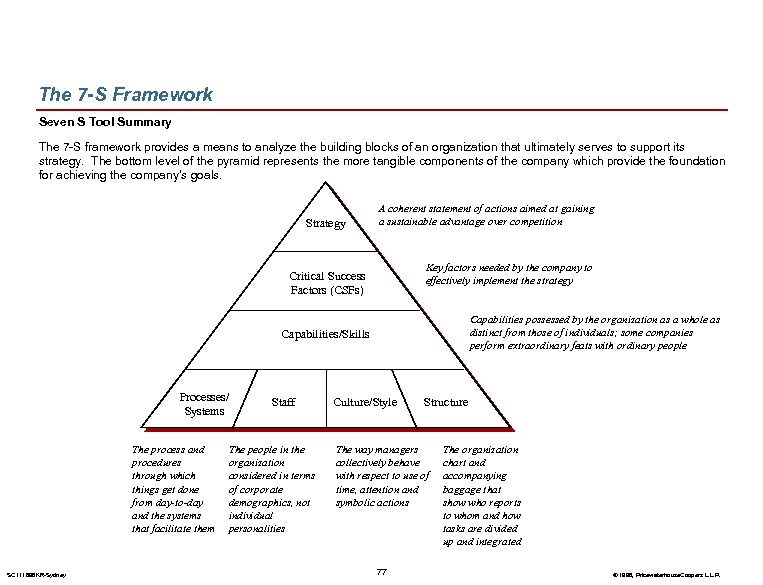

The 7 -S Framework Seven S Tool Summary The 7 -S framework provides a means to analyze the building blocks of an organization that ultimately serves to support its strategy. The bottom level of the pyramid represents the more tangible components of the company which provide the foundation for achieving the company’s goals. Strategy A coherent statement of actions aimed at gaining a sustainable advantage over competition Key factors needed by the company to effectively implement the strategy Critical Success Factors (CSFs) Capabilities possessed by the organization as a whole as distinct from those of individuals; some companies perform extraordinary feats with ordinary people Capabilities/Skills Processes/ Systems The process and procedures through which things get done from day-to-day and the systems that facilitate them SC 111898 KR-Sydney Staff The people in the organization considered in terms of corporate demographics, not individual personalities Culture/Style Structure The way managers collectively behave with respect to use of time, attention and symbolic actions 77 The organization chart and accompanying baggage that show who reports to whom and how tasks are divided up and integrated © 1998, Pricewaterhouse. Coopers L. L. P.

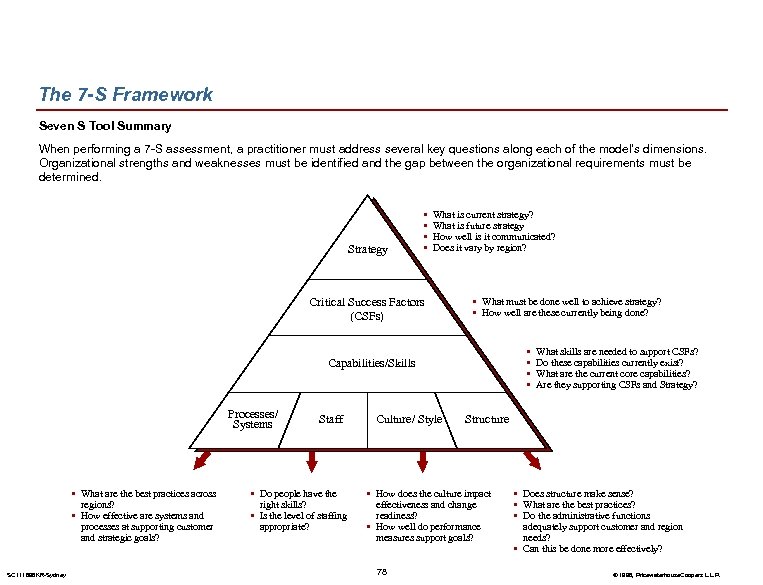

The 7 -S Framework Seven S Tool Summary When performing a 7 -S assessment, a practitioner must address several key questions along each of the model’s dimensions. Organizational strengths and weaknesses must be identified and the gap between the organizational requirements must be determined. Strategy • • What is current strategy? What is future strategy How well is it communicated? Does it vary by region? Critical Success Factors (CSFs) • What must be done well to achieve strategy? • How well are these currently being done? • • Capabilities/Skills Processes/ Systems • What are the best practices across regions? • How effective are systems and processes at supporting customer and strategic goals? SC 111898 KR-Sydney Staff • Do people have the right skills? • Is the level of staffing appropriate? Culture/ Style Structure • How does the culture impact effectiveness and change readiness? • How well do performance measures support goals? 78 What skills are needed to support CSFs? Do these capabilities currently exist? What are the current core capabilities? Are they supporting CSFs and Strategy? • Does structure make sense? • What are the best practices? • Do the administrative functions adequately support customer and region needs? • Can this be done more effectively? © 1998, Pricewaterhouse. Coopers L. L. P.

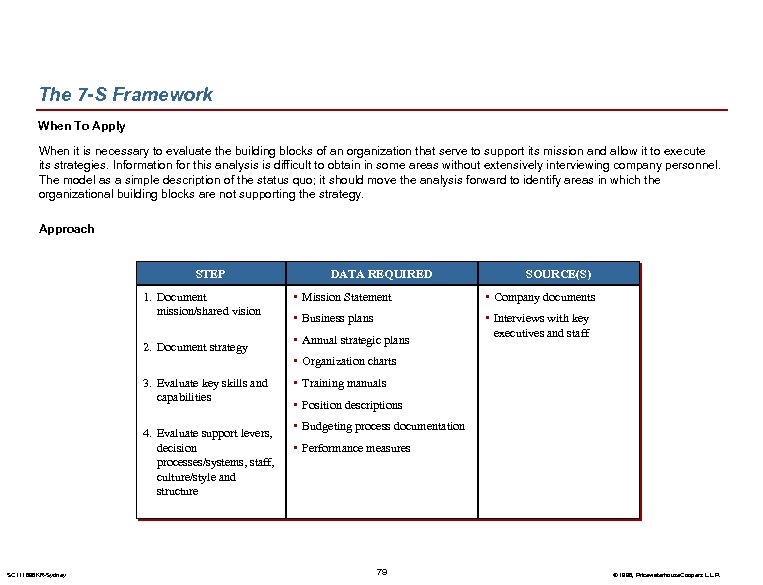

The 7 -S Framework When To Apply When it is necessary to evaluate the building blocks of an organization that serve to support its mission and allow it to execute its strategies. Information for this analysis is difficult to obtain in some areas without extensively interviewing company personnel. The model as a simple description of the status quo; it should move the analysis forward to identify areas in which the organizational building blocks are not supporting the strategy. Approach STEP 1. Document mission/shared vision 2. Document strategy DATA REQUIRED SOURCE(S) • Mission Statement • Company documents • Business plans • Interviews with key executives and staff • Annual strategic plans • Organization charts 3. Evaluate key skills and capabilities 4. Evaluate support levers, decision processes/systems, staff, culture/style and structure SC 111898 KR-Sydney • Training manuals • Position descriptions • Budgeting process documentation • Performance measures 79 © 1998, Pricewaterhouse. Coopers L. L. P.

7 - S Framework Citations - Client and Industry Experience Source List • Du. Pont/Chemicals/Vasu Krishnamurthy • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • MCS Market Strategy/FIP/Steve Malloy • Rover/Automotive & Transportation/KIT database • United Airlines/Travel/Vasu Krishnamurthy SC 111898 KR-Sydney • Liam Fahey, Robert M. Randall, “The Portable MBA in Strategy” • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategy Safari: A Guided Tour Through the Wilds of Strategic Management” 80 © 1998, Pricewaterhouse. Coopers L. L. P.

Stakeholder Analysis Summary This tool reveals stakeholder expectations, identifies potential conflicting objectives, and allows management to make conscious choices on which stakeholders to prioritize, and how to deal effectively with those that are not prioritized. SC 111898 KR-Sydney 81 © 1998, Pricewaterhouse. Coopers L. L. P.

Stakeholder Analysis When To Apply Stakeholder analysis is used to understand the objectives and interests of various stakeholders in order to identify potential conflicts of interest. While some conflicts are not readily resolvable, discussing them will raise awareness of their existence. Approach Adhere to the following criteria when performing an analysis of stakeholder interests: • Identify potential stakeholders at the client organization • Identify potential objectives through discussions with management, key owners, union representatives, etc. • Support the objectives by available secondary information (e. g. , union purpose statements) • Identify potential areas of conflict and discuss with management potential actions to resolve the conflicts SC 111898 KR-Sydney 82 © 1998, Pricewaterhouse. Coopers L. L. P.

Stakeholder Analysis Citations - Client and Industry Experience Source List • All State/Insurance/Julia Stamberger • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Crown Life Insurance Company/Insurance/KIT database • Dana/Automotive/Mike Weiss • Frito Lay/CIP/Mike Weiss • la Caixa/Banking/KIT database • Pillsbury/CIP/Julia Stamberger • Shell Italia/Energy (Petroleum)/KIT database SC 111898 KR-Sydney • Liam Fahey, Robert M. Randall, “The Portable MBA in Strategy” • Michael Gould, Andrew Campbell, Marcus Alexander, “Corporate-Level Strategy: Creating Value in the Multibusiness Company” • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategy Safari: A Guided Tour Through the Wilds of Strategic Management 83 © 1998, Pricewaterhouse. Coopers L. L. P.

SWOT Analysis Summary SWOT Ana; ysis is a framework used to identify the Strengths, Weaknesses, Opportunities, and Threats an organization is facing. SWOT provides a high-level understanding of the internal challenges and direction of a company, and the external environment’s developing forces. SWOT can be simultaneously simple and powerful, providing an overall assessment of a business. Strengths Weaknesses • Entertainment industry expertise and thought leadership –EMC 2000 –Technology Forecast –ETC –Publications • Not enough consultants with industry expertise and functional experience to meet demand • Minimum media client experience • Internal competition for industry vs. functional resources • Functional experience –Financial systems –Strategy development • Limited visibility in the “business issues” market on the CEO and COO level • Large, existing client base in entertainment • Inconsistent client management and consulting skills • Concentrated focus through EMC practice, marketing and PR • Limited ability to respond quickly efforts • No software package to leverage • Broad range of consulting services • International network of partners and consultants • Strong vendor relationships (e. g. , Oracle, SAP) to leverage • High visibility with CFOs gained through financial systems projects Opportunities to Increase Revenue Threats • Leverage existing client relationships • Competition aggressively targeting EMC industry clients • New areas of business –Content management –Digital asset management –Internet applications • Building of resources slower than market growth • Limited ability to quickly recruit and effectively deploy qualified consultants with deep industry experience • Increased demand for current services –Cost reduction –Change management –revenue enhancement –new business opportunities –infrastructure development • Potential conflicts of interest as client list grows • Shrinking client base due to industry consolidation • Growth through acquisition or alliance • Increased consultancy needs due to regulatory changes SC 111898 KR-Sydney 84 © 1998, Pricewaterhouse. Coopers L. L. P.

SWOT Analysis When to Apply SWOT is tool, used to identify market opportunities facing a company, competitor issues, and key success factors to leverage. It can be effective in combining various issues identified through other forms of analysis. Approach SWOT Analysis involves a 4 step approach, requiring input from both internal and external sources, including, interviews with senior and business line management, as well as, expert opinions from industry analysts and trade publications. Step 1 Interview company management Step 2 Perform competitive analysis Step 3 List strengths and weaknesses of company Step 4 Determine opportunities and threats the company faces SC 111898 KR-Sydney 85 © 1998, Pricewaterhouse. Coopers L. L. P.

SWOT Analysis Citations - Client and Industry Experience Source List • Galileo/Travel/Spencer Lin & Vasu Krishnamurthy • Paul Elkin, “Mastering Business Planning and Strategy: The Power and Application of Strategic Thinking” • Philips/Multi-Industry/KIT database • Pw. C MCS/Consulting/Vasu Krishnamurthy • Liam Fahey, Robert M. Randall, “The Portable MBA in Strategy” • Pw. C Specialty Chemicals Point of View/Energy Practice & Strategic Change/KIT database • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Ralston Purina Company/CIP/KIT database • Henry Mintzberg, Bruce Ahlstrand, Joseph Lampel, “Strategy Safari: A Guided Tour Through the Wilds of Strategic Management • US Postal Service/Multi-Industry/KIT database SC 111898 KR-Sydney 86 © 1998, Pricewaterhouse. Coopers L. L. P.

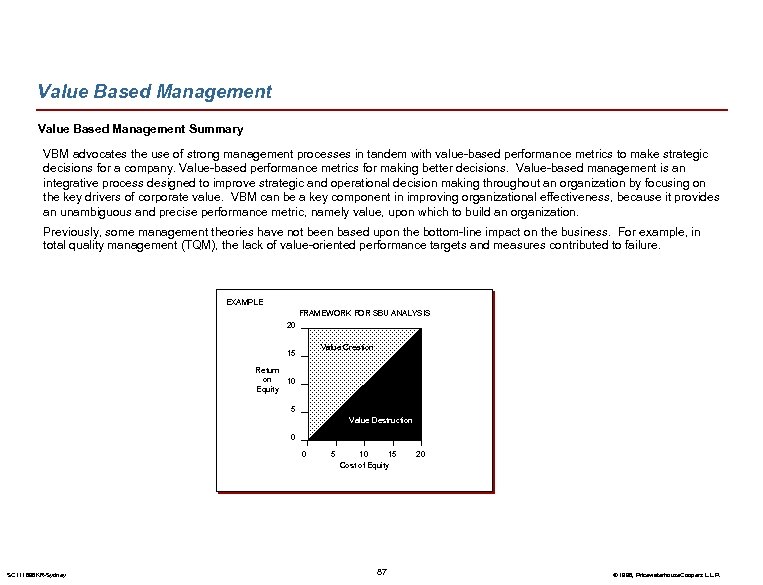

Value Based Management Summary VBM advocates the use of strong management processes in tandem with value-based performance metrics to make strategic decisions for a company. Value-based performance metrics for making better decisions. Value-based management is an integrative process designed to improve strategic and operational decision making throughout an organization by focusing on the key drivers of corporate value. VBM can be a key component in improving organizational effectiveness, because it provides an unambiguous and precise performance metric, namely value, upon which to build an organization. Previously, some management theories have not been based upon the bottom-line impact on the business. For example, in total quality management (TQM), the lack of value-oriented performance targets and measures contributed to failure. EXAMPLE FRAMEWORK FOR SBU ANALYSIS 20 Value Creation 15 Return on 10 Equity 5 Value Destruction 0 0 SC 111898 KR-Sydney 5 10 15 Cost of Equity 87 20 © 1998, Pricewaterhouse. Coopers L. L. P.

Value Based Management When To Apply To evaluate whether a company’s financial results have created or destroyed shareholder value. Can be applied in business unit analysis or to the organization as a whole. Approach • Properly allocate overhead to business area, and calculate profitability* • Determine measure of business risk and required returns through extensive external analysis of similar public companies • Allocating equity or assets among the business units • Determine cost of equity and return on equity *For Business Unit Analysis SC 111898 KR-Sydney 88 © 1998, Pricewaterhouse. Coopers L. L. P.

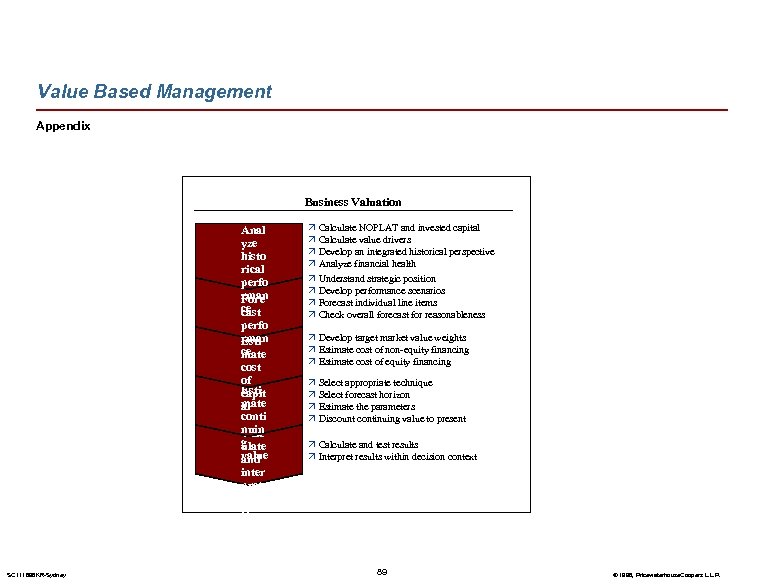

Value Based Management Appendix 1. Anal yze histo 2. rical perfo rman Fore ce 3. cast perfo rman Esti ce mate 4. cost of Esti capit al 5. mate conti nuin Calc g ulate value and inter pret resul ts SC 111898 KR-Sydney Business Valuation ä Calculate NOPLAT and invested capital ä Calculate value drivers ä Develop an integrated historical perspective ä Analyze financial health ä Understand strategic position ä Develop performance scenarios ä Forecast individual line items ä Check overall forecast for reasonableness ä Develop target market value weights ä Estimate cost of non-equity financing ä Estimate cost of equity financing ä Select appropriate technique ä Select forecast horizon ä Estimate the parameters ä Discount continuing value to present ä Calculate and test results ä Interpret results within decision context 89 © 1998, Pricewaterhouse. Coopers L. L. P.

Value Based Management Citations - Client and Industry Experience Source List • Amoco/Energy (Petroleum)/KIT database • Copeland, Kaller and Murrin, “Valuation: Measuring and Managing the Value of Companies • Compaq/Technology/Vasu Krishnamurthy • Delta/Transportation/Dave Morgan • Motorola/Technology/Vasu Krishnamurthy • Union Pacific/Transportation/Dave Morgan SC 111898 KR-Sydney • Robert M. Grant, “Contemporary Strategy Analysis”, 3 rd Edition • Michael Gould, Andrew Campbell, Marcus Alexander, “Corporate-Level Strategy: Creating Value in the Multibusiness Company” 90 © 1998, Pricewaterhouse. Coopers L. L. P.

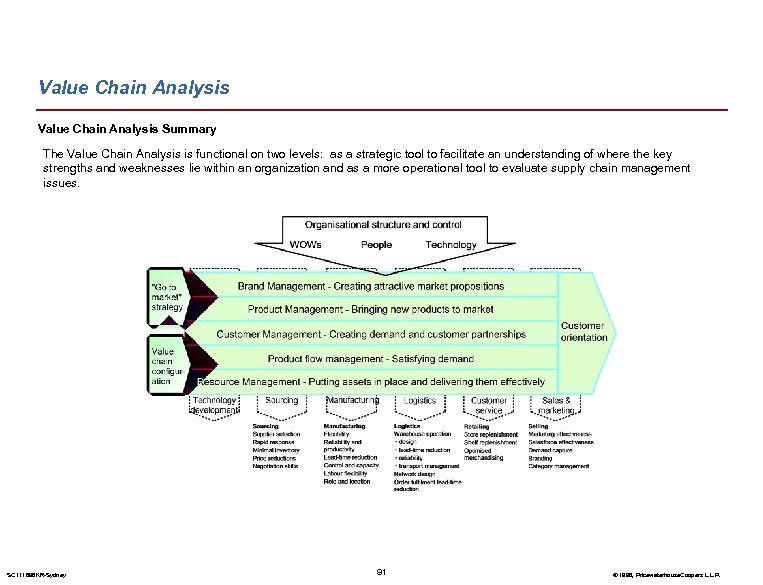

Value Chain Analysis Summary The Value Chain Analysis is functional on two levels: as a strategic tool to facilitate an understanding of where the key strengths and weaknesses lie within an organization and as a more operational tool to evaluate supply chain management issues. SC 111898 KR-Sydney 91 © 1998, Pricewaterhouse. Coopers L. L. P.