840fa576e035d68cbc34c0023dc1c0e2.ppt

- Количество слайдов: 35

Strategies in Volatile Times – Mine. Africa David Shaver – Managing Director, UBS Securities Canada February 28, 2009

Strategies in Volatile Times – Mine. Africa David Shaver – Managing Director, UBS Securities Canada February 28, 2009

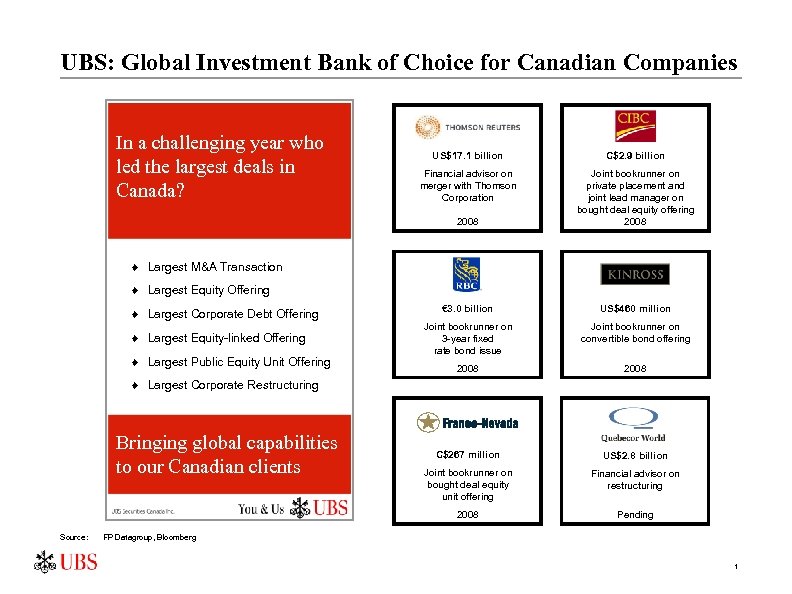

UBS: Global Investment Bank of Choice for Canadian Companies In a challenging year who led the largest deals in Canada? US$17. 1 billion C$2. 9 billion Financial advisor on merger with Thomson Corporation 2008 Joint bookrunner on private placement and joint lead manager on bought deal equity offering 2008 € 3. 0 billion US$460 million Joint bookrunner on 3 -year fixed rate bond issue Joint bookrunner on convertible bond offering 2008 C$267 million US$2. 8 billion ¨ Largest M&A Transaction ¨ Largest Equity Offering ¨ Largest Corporate Debt Offering ¨ Largest Equity-linked Offering ¨ Largest Public Equity Unit Offering ¨ Largest Corporate Restructuring Bringing global capabilities to our Canadian clients Joint bookrunner on bought deal equity unit offering 2008 Source: Financial advisor on restructuring Pending FP Datagroup, Bloomberg 1

UBS: Global Investment Bank of Choice for Canadian Companies In a challenging year who led the largest deals in Canada? US$17. 1 billion C$2. 9 billion Financial advisor on merger with Thomson Corporation 2008 Joint bookrunner on private placement and joint lead manager on bought deal equity offering 2008 € 3. 0 billion US$460 million Joint bookrunner on 3 -year fixed rate bond issue Joint bookrunner on convertible bond offering 2008 C$267 million US$2. 8 billion ¨ Largest M&A Transaction ¨ Largest Equity Offering ¨ Largest Corporate Debt Offering ¨ Largest Equity-linked Offering ¨ Largest Public Equity Unit Offering ¨ Largest Corporate Restructuring Bringing global capabilities to our Canadian clients Joint bookrunner on bought deal equity unit offering 2008 Source: Financial advisor on restructuring Pending FP Datagroup, Bloomberg 1

UBS: World’s Largest Equity Trader UBS is the #1 equity trader in the world and trades 1 in 9 shares globally 2

UBS: World’s Largest Equity Trader UBS is the #1 equity trader in the world and trades 1 in 9 shares globally 2

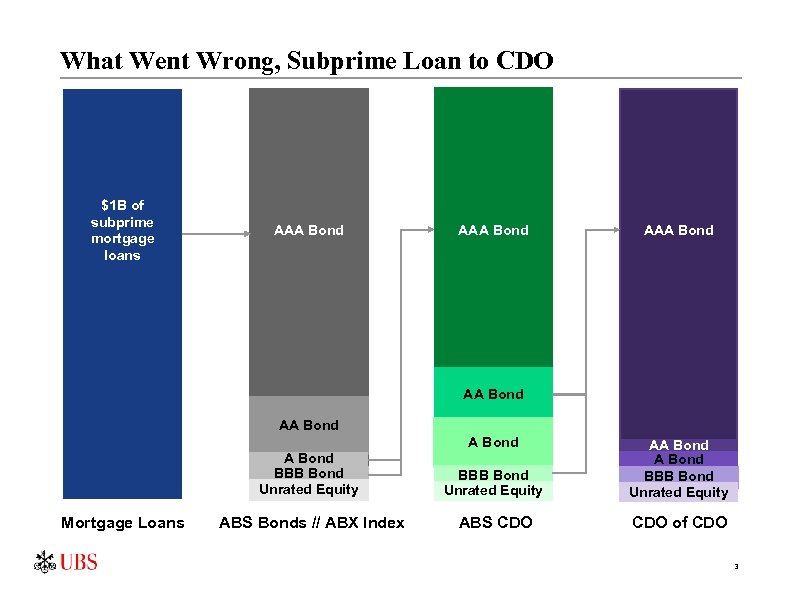

What Went Wrong, Subprime Loan to CDO $1 B of subprime mortgage loans AAA Bond AA Bond BBB Bond Unrated Equity Mortgage Loans BBB Bond Unrated Equity AA Bond BBB Bond Unrated Equity ABS Bonds // ABX Index ABS CDO of CDO 3

What Went Wrong, Subprime Loan to CDO $1 B of subprime mortgage loans AAA Bond AA Bond BBB Bond Unrated Equity Mortgage Loans BBB Bond Unrated Equity AA Bond BBB Bond Unrated Equity ABS Bonds // ABX Index ABS CDO of CDO 3

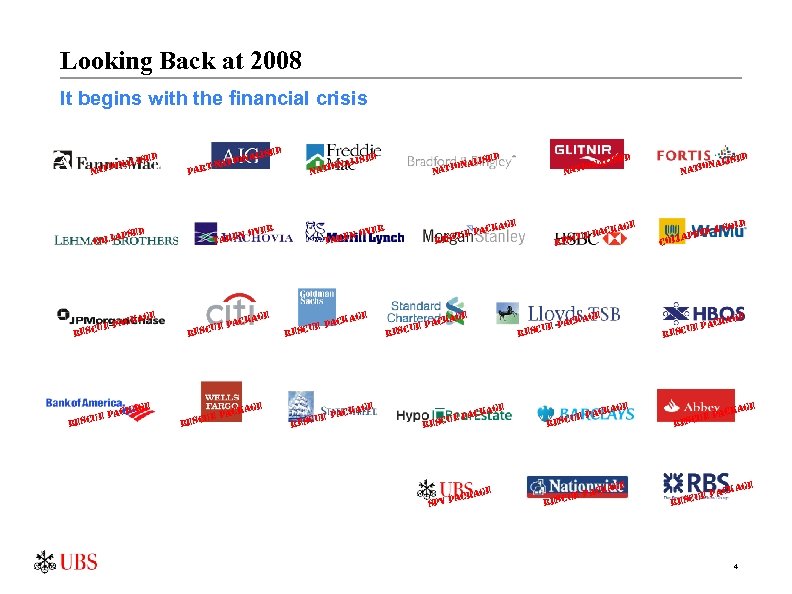

Looking Back at 2008 It begins with the financial crisis ed nal. Is at. Io rt-n d e nal. Is at. Io n c age k e pac escu r ge acka cue p res r k e pac escu r age ge a pack scue re age k e pac escu r ack ue p resc ed nal. Is o nat. I age k e pac escu Ised onal nat. I er n ov take psed olla Ised onal nat. I pa e ckag e pa escu r age ack spv p ge ack ue p resc d& apse coll ue resc acka ue p resc age Ised onal nat. I sold ge a pack age ack ue p resc ge a pack scue re 4

Looking Back at 2008 It begins with the financial crisis ed nal. Is at. Io rt-n d e nal. Is at. Io n c age k e pac escu r ge acka cue p res r k e pac escu r age ge a pack scue re age k e pac escu r ack ue p resc ed nal. Is o nat. I age k e pac escu Ised onal nat. I er n ov take psed olla Ised onal nat. I pa e ckag e pa escu r age ack spv p ge ack ue p resc d& apse coll ue resc acka ue p resc age Ised onal nat. I sold ge a pack age ack ue p resc ge a pack scue re 4

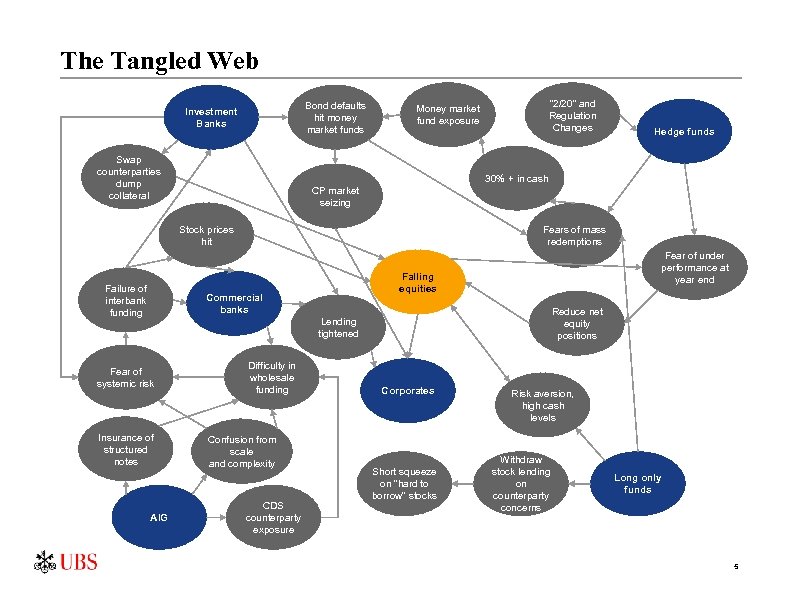

The Tangled Web Bond defaults hit money market funds Investment Banks Swap counterparties dump collateral 30% + in cash Fears of mass redemptions Reduce net equity positions Lending tightened Insurance of structured notes AIG Difficulty in wholesale funding Confusion from scale and complexity CDS counterparty exposure Fear of under performance at year end Falling equities Commercial banks Fear of systemic risk Hedge funds CP market seizing Stock prices hit Failure of interbank funding “ 2/20” and Regulation Changes Money market fund exposure Corporates Short squeeze on “hard to borrow” stocks Risk aversion, high cash levels Withdraw stock lending on counterparty concerns Long only funds 5

The Tangled Web Bond defaults hit money market funds Investment Banks Swap counterparties dump collateral 30% + in cash Fears of mass redemptions Reduce net equity positions Lending tightened Insurance of structured notes AIG Difficulty in wholesale funding Confusion from scale and complexity CDS counterparty exposure Fear of under performance at year end Falling equities Commercial banks Fear of systemic risk Hedge funds CP market seizing Stock prices hit Failure of interbank funding “ 2/20” and Regulation Changes Money market fund exposure Corporates Short squeeze on “hard to borrow” stocks Risk aversion, high cash levels Withdraw stock lending on counterparty concerns Long only funds 5

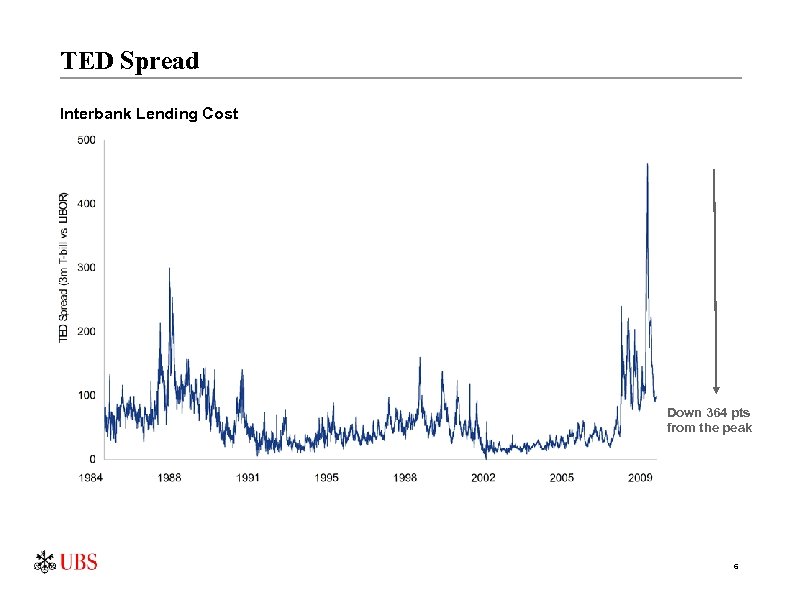

TED Spread Interbank Lending Cost Current = 99 Down 364 pts from the peak 6

TED Spread Interbank Lending Cost Current = 99 Down 364 pts from the peak 6

Credit Default Swaps 7

Credit Default Swaps 7

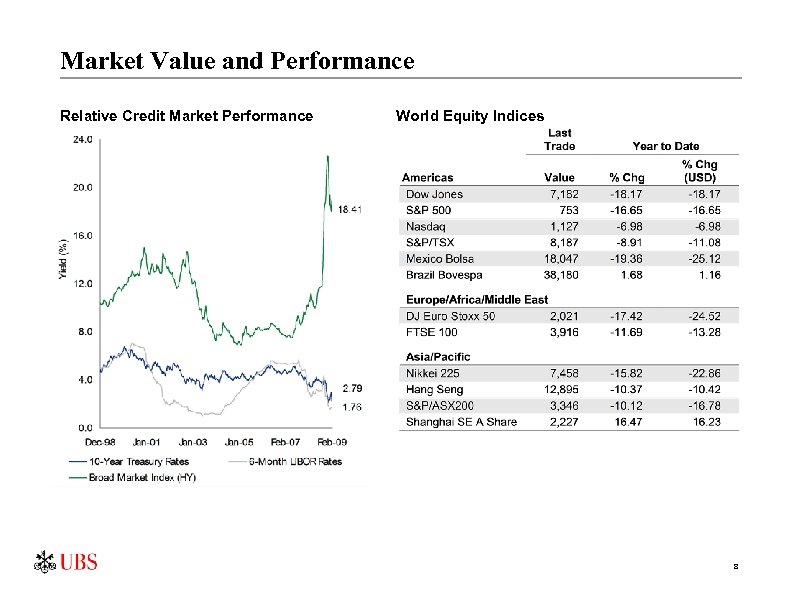

Market Value and Performance Relative Credit Market Performance World Equity Indices 8

Market Value and Performance Relative Credit Market Performance World Equity Indices 8

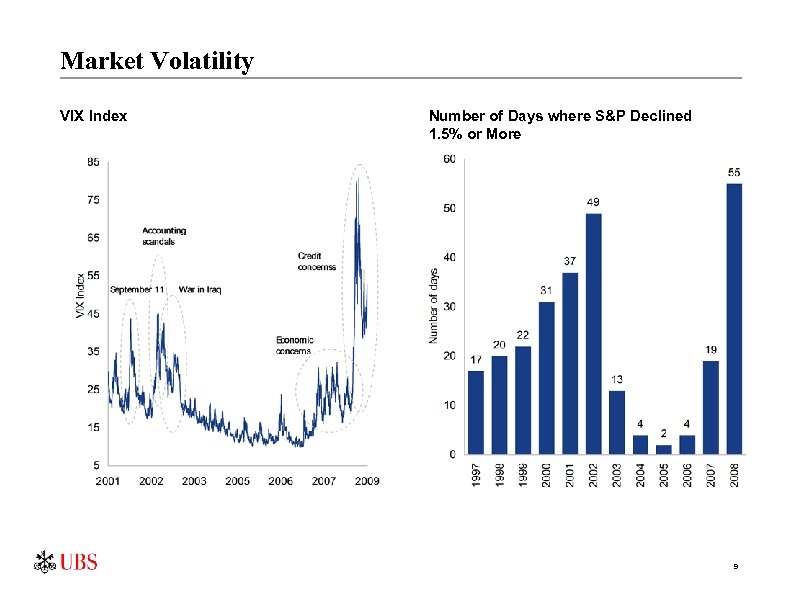

Market Volatility VIX Index Number of Days where S&P Declined 1. 5% or More 9

Market Volatility VIX Index Number of Days where S&P Declined 1. 5% or More 9

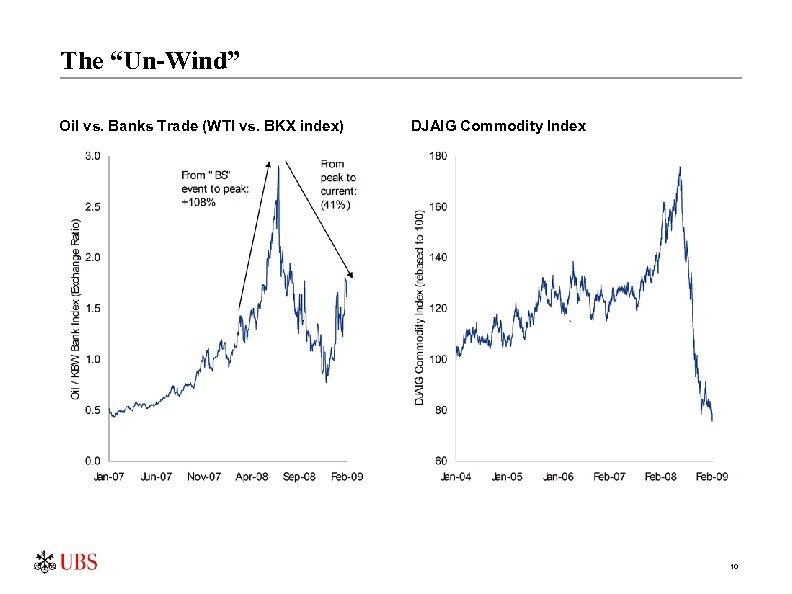

The “Un-Wind” Oil vs. Banks Trade (WTI vs. BKX index) DJAIG Commodity Index 10

The “Un-Wind” Oil vs. Banks Trade (WTI vs. BKX index) DJAIG Commodity Index 10

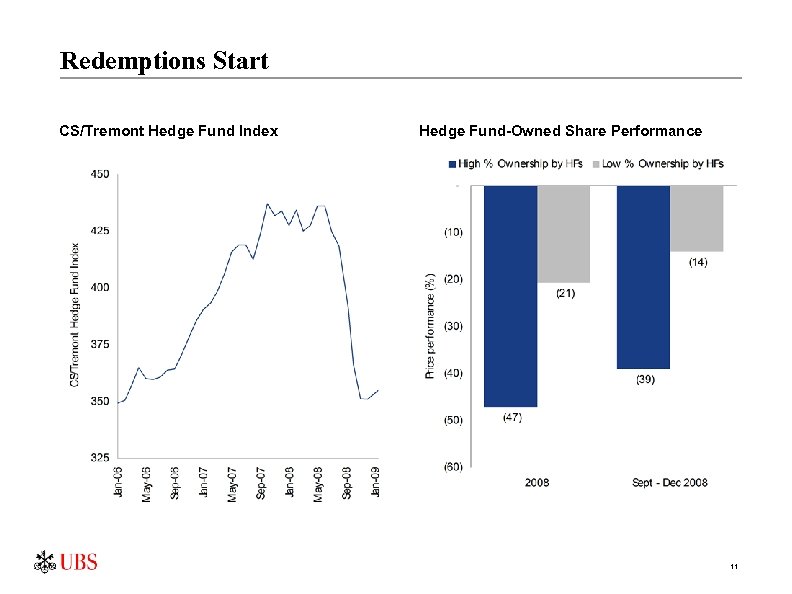

Redemptions Start CS/Tremont Hedge Fund Index Hedge Fund-Owned Share Performance 11

Redemptions Start CS/Tremont Hedge Fund Index Hedge Fund-Owned Share Performance 11

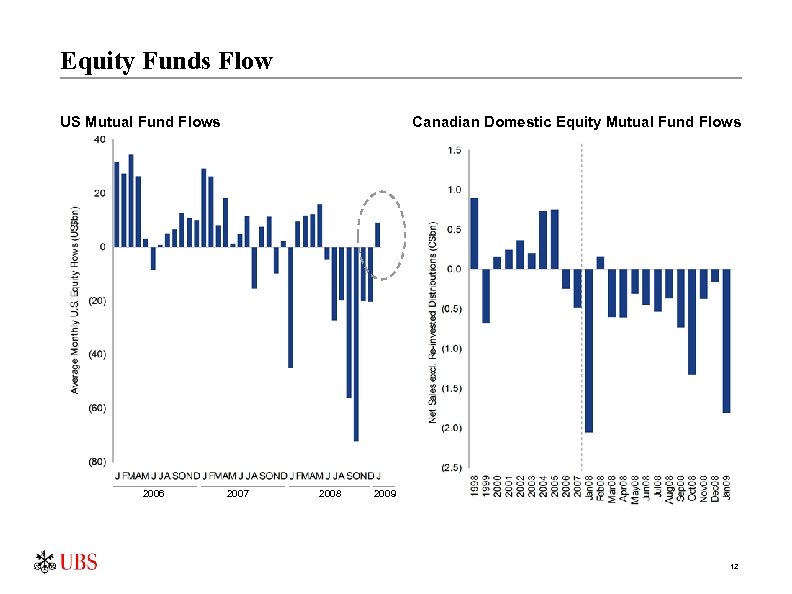

Equity Funds Flow US Mutual Fund Flows 2006 Canadian Domestic Equity Mutual Fund Flows 2007 2008 2009 12

Equity Funds Flow US Mutual Fund Flows 2006 Canadian Domestic Equity Mutual Fund Flows 2007 2008 2009 12

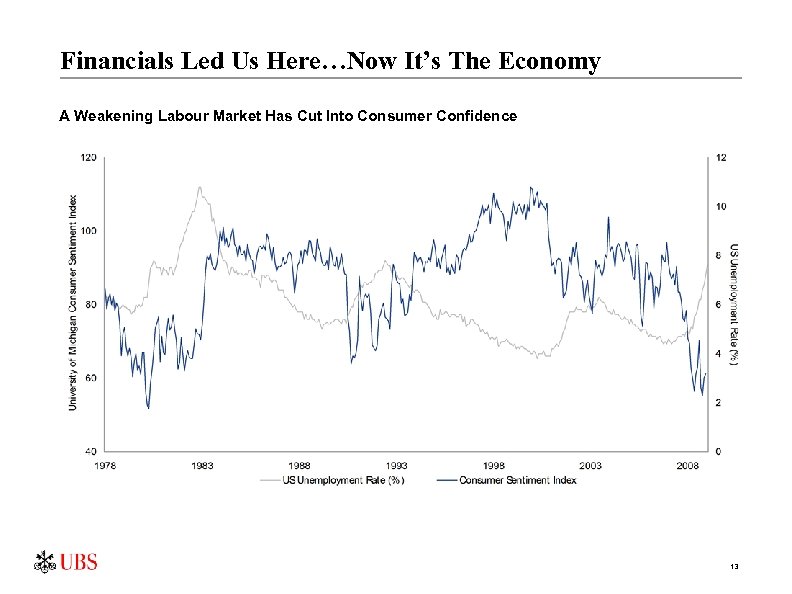

Financials Led Us Here…Now It’s The Economy A Weakening Labour Market Has Cut Into Consumer Confidence 13

Financials Led Us Here…Now It’s The Economy A Weakening Labour Market Has Cut Into Consumer Confidence 13

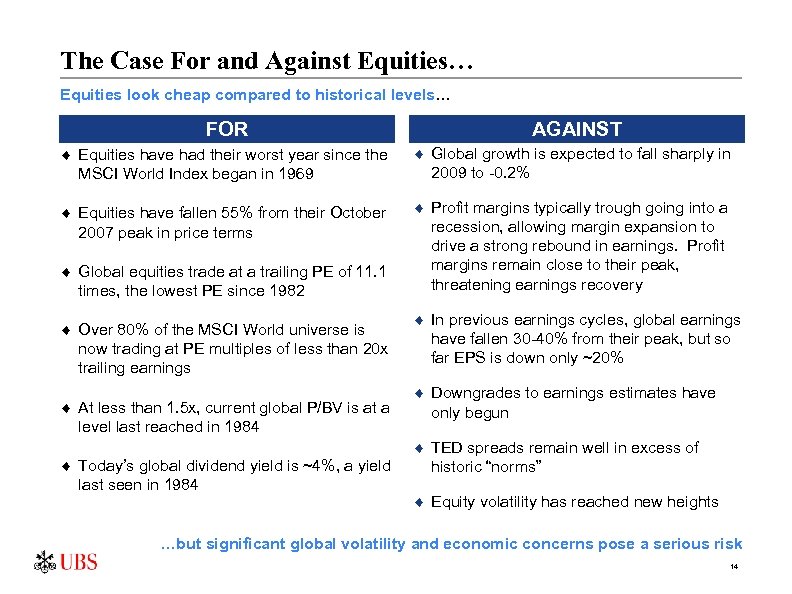

The Case For and Against Equities… Equities look cheap compared to historical levels… FOR AGAINST ¨ Equities have had their worst year since the MSCI World Index began in 1969 ¨ Global growth is expected to fall sharply in 2009 to -0. 2% ¨ Equities have fallen 55% from their October 2007 peak in price terms ¨ Profit margins typically trough going into a recession, allowing margin expansion to drive a strong rebound in earnings. Profit margins remain close to their peak, threatening earnings recovery ¨ Global equities trade at a trailing PE of 11. 1 times, the lowest PE since 1982 ¨ Over 80% of the MSCI World universe is now trading at PE multiples of less than 20 x trailing earnings ¨ At less than 1. 5 x, current global P/BV is at a level last reached in 1984 ¨ Today’s global dividend yield is ~4%, a yield last seen in 1984 ¨ In previous earnings cycles, global earnings have fallen 30 -40% from their peak, but so far EPS is down only ~20% ¨ Downgrades to earnings estimates have only begun ¨ TED spreads remain well in excess of historic “norms” ¨ Equity volatility has reached new heights …but significant global volatility and economic concerns pose a serious risk 14

The Case For and Against Equities… Equities look cheap compared to historical levels… FOR AGAINST ¨ Equities have had their worst year since the MSCI World Index began in 1969 ¨ Global growth is expected to fall sharply in 2009 to -0. 2% ¨ Equities have fallen 55% from their October 2007 peak in price terms ¨ Profit margins typically trough going into a recession, allowing margin expansion to drive a strong rebound in earnings. Profit margins remain close to their peak, threatening earnings recovery ¨ Global equities trade at a trailing PE of 11. 1 times, the lowest PE since 1982 ¨ Over 80% of the MSCI World universe is now trading at PE multiples of less than 20 x trailing earnings ¨ At less than 1. 5 x, current global P/BV is at a level last reached in 1984 ¨ Today’s global dividend yield is ~4%, a yield last seen in 1984 ¨ In previous earnings cycles, global earnings have fallen 30 -40% from their peak, but so far EPS is down only ~20% ¨ Downgrades to earnings estimates have only begun ¨ TED spreads remain well in excess of historic “norms” ¨ Equity volatility has reached new heights …but significant global volatility and economic concerns pose a serious risk 14

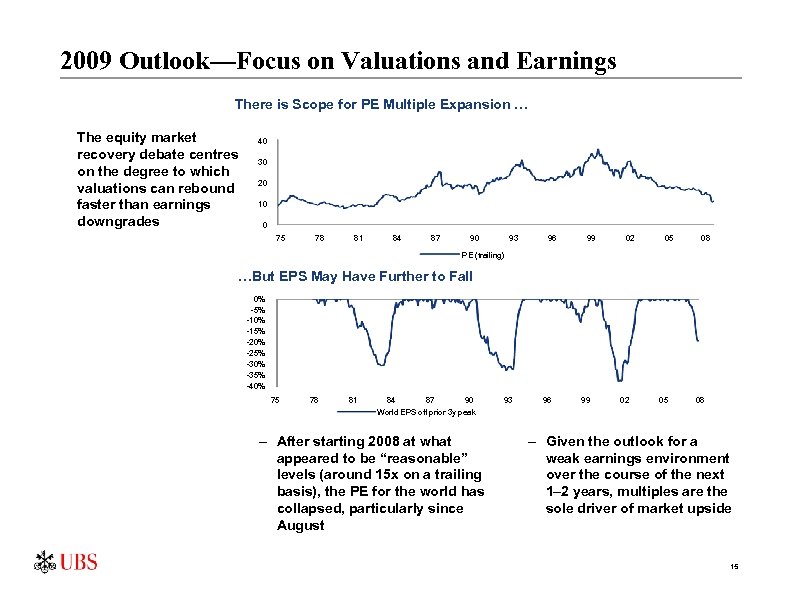

2009 Outlook—Focus on Valuations and Earnings There is Scope for PE Multiple Expansion … The equity market recovery debate centres on the degree to which valuations can rebound faster than earnings downgrades 40 30 20 10 0 75 78 81 84 87 90 93 96 99 02 05 08 PE (trailing) …But EPS May Have Further to Fall 0% -5% -10% -15% -20% -25% -30% -35% -40% 75 78 81 84 87 90 93 96 99 02 05 08 World EPS off prior 3 y peak – After starting 2008 at what appeared to be “reasonable” levels (around 15 x on a trailing basis), the PE for the world has collapsed, particularly since August – Given the outlook for a weak earnings environment over the course of the next 1– 2 years, multiples are the sole driver of market upside 15

2009 Outlook—Focus on Valuations and Earnings There is Scope for PE Multiple Expansion … The equity market recovery debate centres on the degree to which valuations can rebound faster than earnings downgrades 40 30 20 10 0 75 78 81 84 87 90 93 96 99 02 05 08 PE (trailing) …But EPS May Have Further to Fall 0% -5% -10% -15% -20% -25% -30% -35% -40% 75 78 81 84 87 90 93 96 99 02 05 08 World EPS off prior 3 y peak – After starting 2008 at what appeared to be “reasonable” levels (around 15 x on a trailing basis), the PE for the world has collapsed, particularly since August – Given the outlook for a weak earnings environment over the course of the next 1– 2 years, multiples are the sole driver of market upside 15

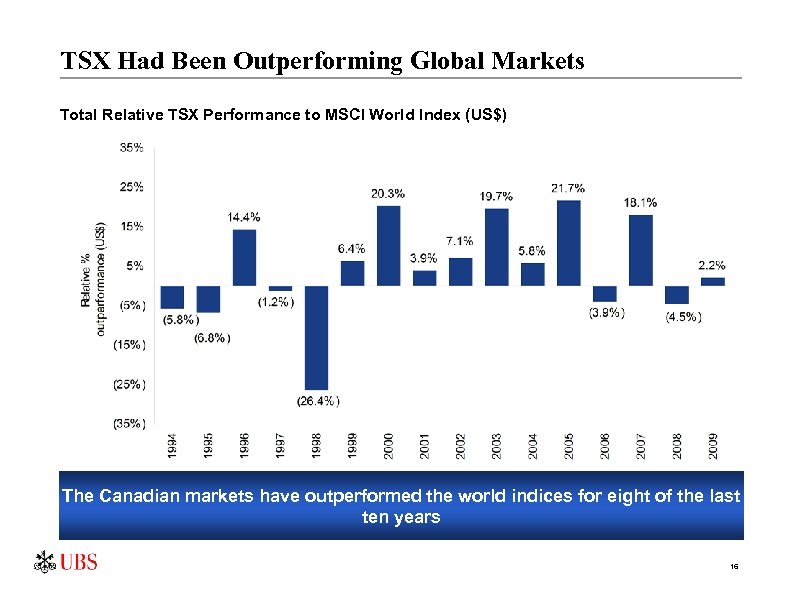

TSX Had Been Outperforming Global Markets Total Relative TSX Performance to MSCI World Index (US$) The Canadian markets have outperformed the world indices for eight of the last ten years 16

TSX Had Been Outperforming Global Markets Total Relative TSX Performance to MSCI World Index (US$) The Canadian markets have outperformed the world indices for eight of the last ten years 16

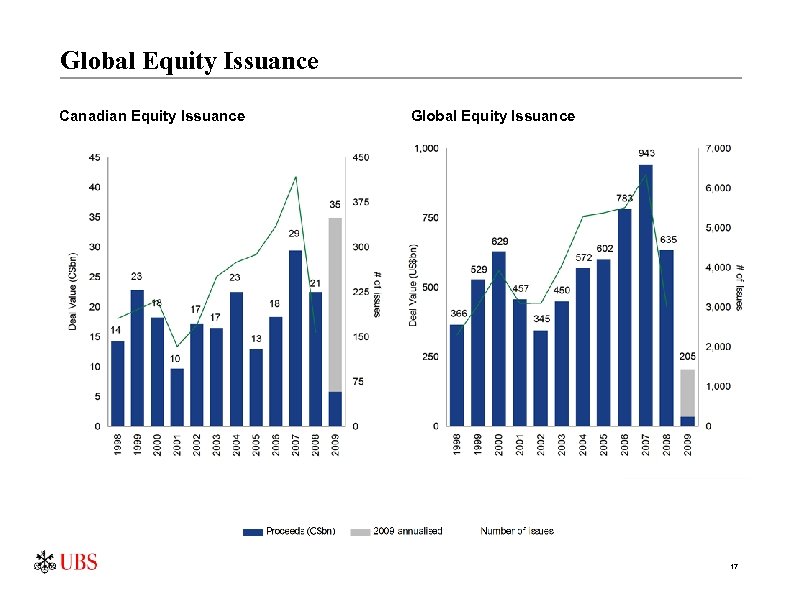

Global Equity Issuance Canadian Equity Issuance Global Equity Issuance 17

Global Equity Issuance Canadian Equity Issuance Global Equity Issuance 17

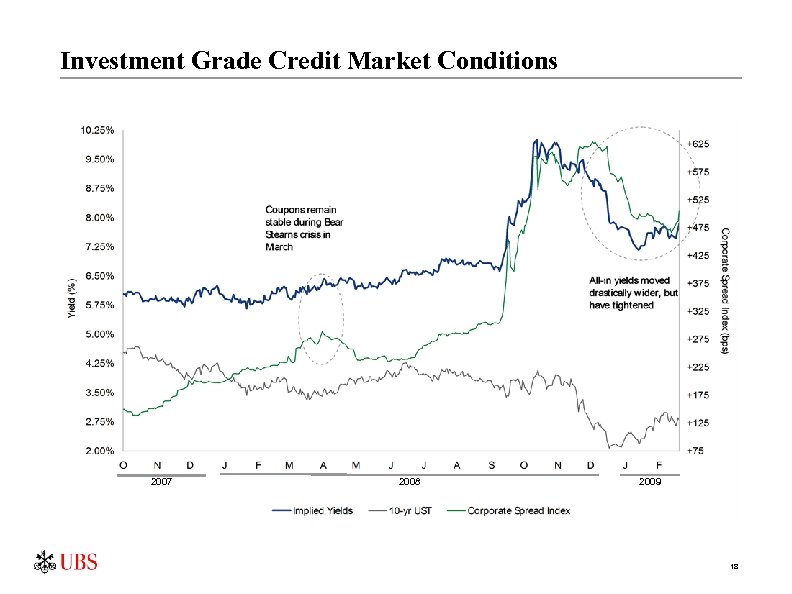

Investment Grade Credit Market Conditions 2007 2008 2009 18

Investment Grade Credit Market Conditions 2007 2008 2009 18

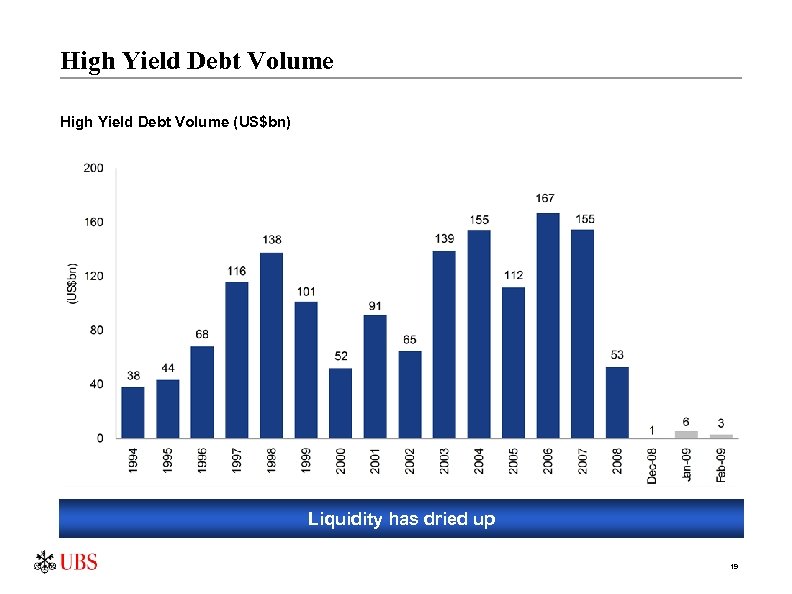

High Yield Debt Volume (US$bn) Liquidity has dried up 19

High Yield Debt Volume (US$bn) Liquidity has dried up 19

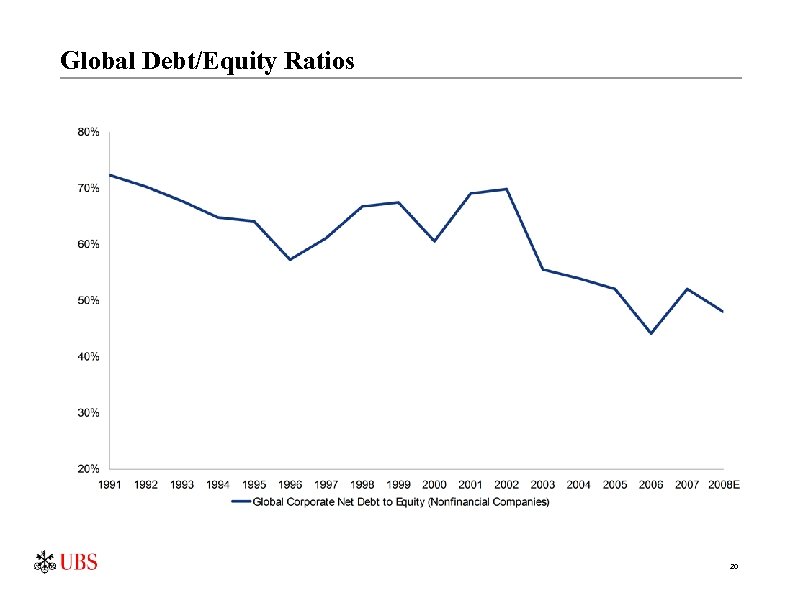

Global Debt/Equity Ratios 20

Global Debt/Equity Ratios 20

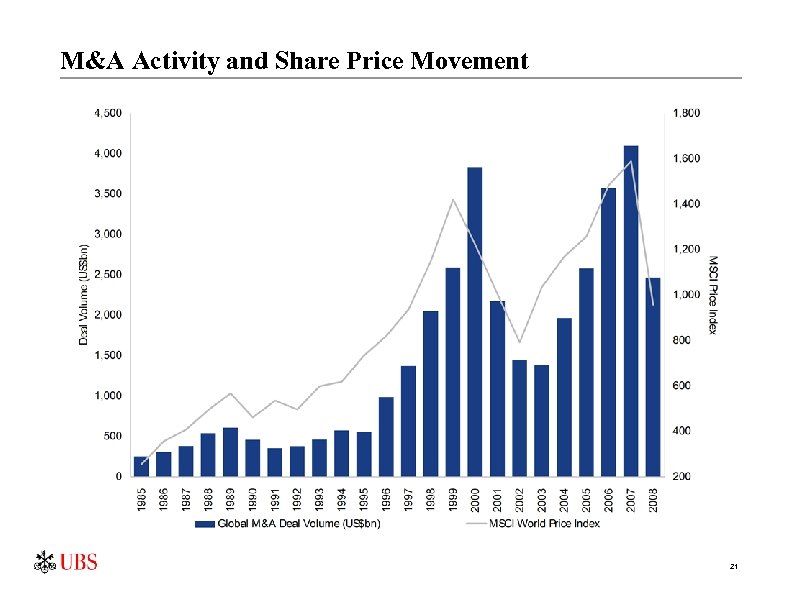

M&A Activity and Share Price Movement 21

M&A Activity and Share Price Movement 21

Factors Impacting the Global M&A Market From the Seller’s Perspective ¨ Financial need is the key reason to sell ¨ High premiums expected due to depressed share prices From the Buyer’s Perspective ¨ Buyers balancing desire to preserve cash with unwillingness to issue shares at depressed prices ¨ Companies reluctant to buy while length and severity of the market downturn is still unknown ¨ Large and well-financed buyers want clarity on forecast price decks before buying companies in the commodity space ¨ Acquisitions likely to be relatively “small” Other Factors and Considerations ¨ Activity expected to pick up once the “worst is over” and the markets stabilize ¨ Hostile approaches are increasingly common due to gap between buyers’ and sellers’ price expectations ¨ Emerging market nations are still meaningful players in the M&A market 22

Factors Impacting the Global M&A Market From the Seller’s Perspective ¨ Financial need is the key reason to sell ¨ High premiums expected due to depressed share prices From the Buyer’s Perspective ¨ Buyers balancing desire to preserve cash with unwillingness to issue shares at depressed prices ¨ Companies reluctant to buy while length and severity of the market downturn is still unknown ¨ Large and well-financed buyers want clarity on forecast price decks before buying companies in the commodity space ¨ Acquisitions likely to be relatively “small” Other Factors and Considerations ¨ Activity expected to pick up once the “worst is over” and the markets stabilize ¨ Hostile approaches are increasingly common due to gap between buyers’ and sellers’ price expectations ¨ Emerging market nations are still meaningful players in the M&A market 22

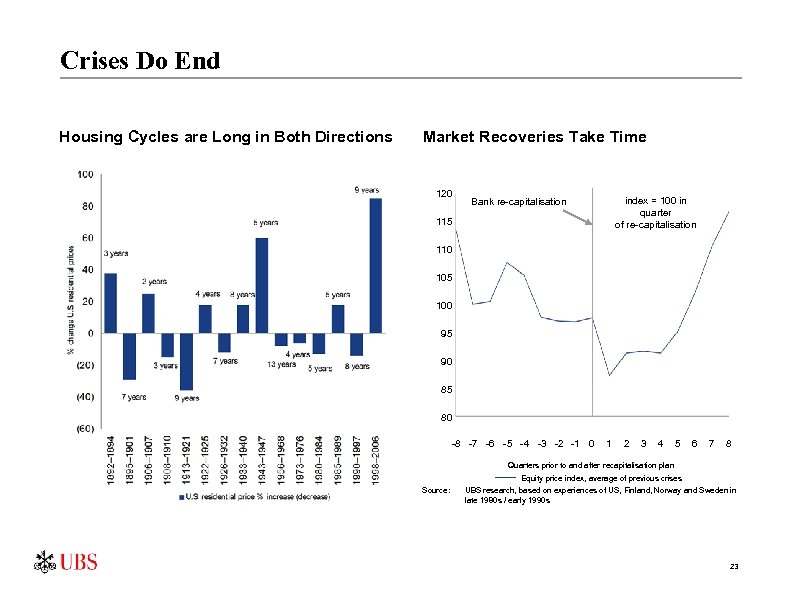

Crises Do End Housing Cycles are Long in Both Directions Market Recoveries Take Time 120 index = 100 in quarter of re-capitalisation Bank re-capitalisation 115 110 105 100 95 90 85 80 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 Quarters prior to and after recapitalisation plan Equity price index, average of previous crises Source: UBS research, based on experiences of US, Finland, Norway and Sweden in late 1980 s / early 1990 s 23

Crises Do End Housing Cycles are Long in Both Directions Market Recoveries Take Time 120 index = 100 in quarter of re-capitalisation Bank re-capitalisation 115 110 105 100 95 90 85 80 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 Quarters prior to and after recapitalisation plan Equity price index, average of previous crises Source: UBS research, based on experiences of US, Finland, Norway and Sweden in late 1980 s / early 1990 s 23

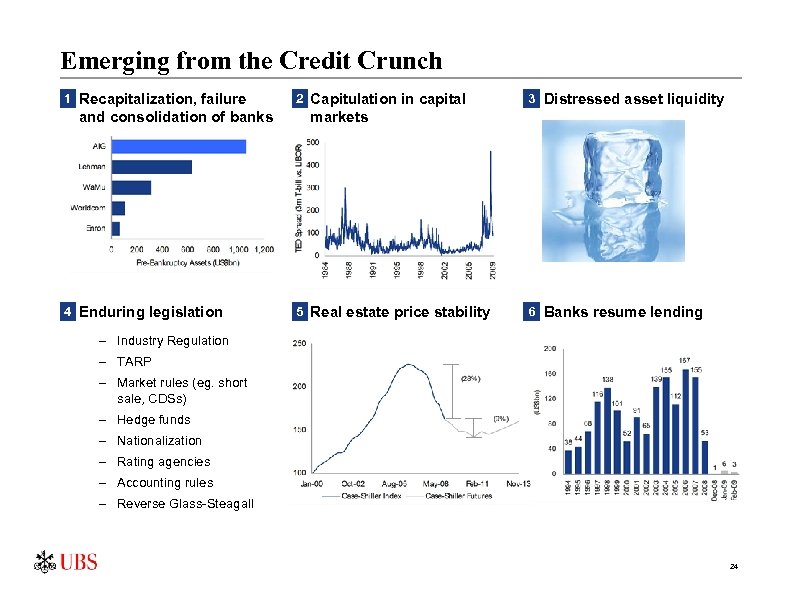

Emerging from the Credit Crunch 1 Recapitalization, failure and consolidation of banks 4 Enduring legislation 2 Capitulation in capital 3 Distressed asset liquidity markets 5 Real estate price stability 6 Banks resume lending – Industry Regulation – TARP – Market rules (eg. short sale, CDSs) – Hedge funds – Nationalization – Rating agencies – Accounting rules – Reverse Glass-Steagall 24

Emerging from the Credit Crunch 1 Recapitalization, failure and consolidation of banks 4 Enduring legislation 2 Capitulation in capital 3 Distressed asset liquidity markets 5 Real estate price stability 6 Banks resume lending – Industry Regulation – TARP – Market rules (eg. short sale, CDSs) – Hedge funds – Nationalization – Rating agencies – Accounting rules – Reverse Glass-Steagall 24

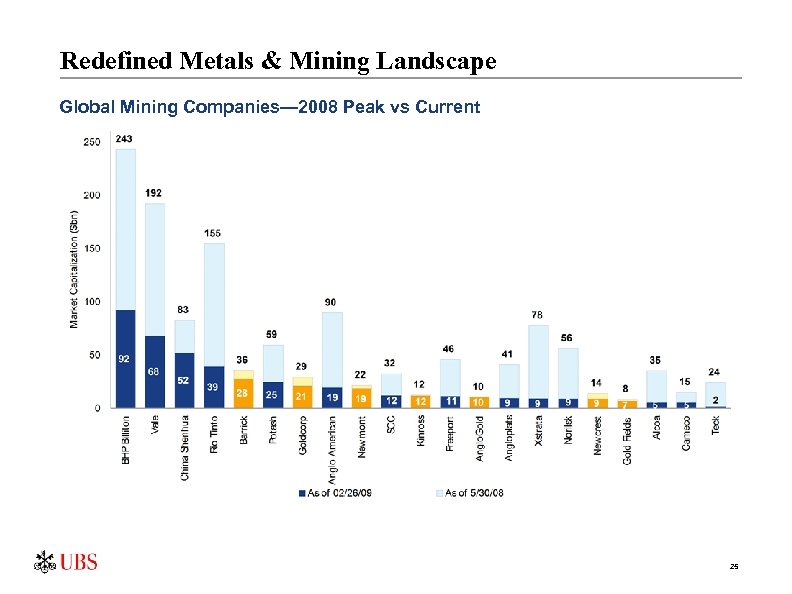

Redefined Metals & Mining Landscape Global Mining Companies— 2008 Peak vs Current 25

Redefined Metals & Mining Landscape Global Mining Companies— 2008 Peak vs Current 25

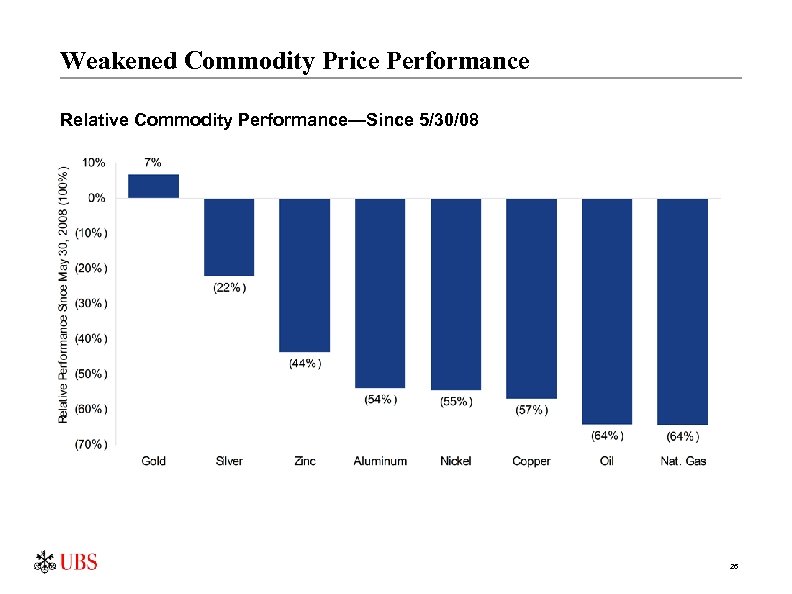

Weakened Commodity Price Performance Relative Commodity Performance—Since 5/30/08 26

Weakened Commodity Price Performance Relative Commodity Performance—Since 5/30/08 26

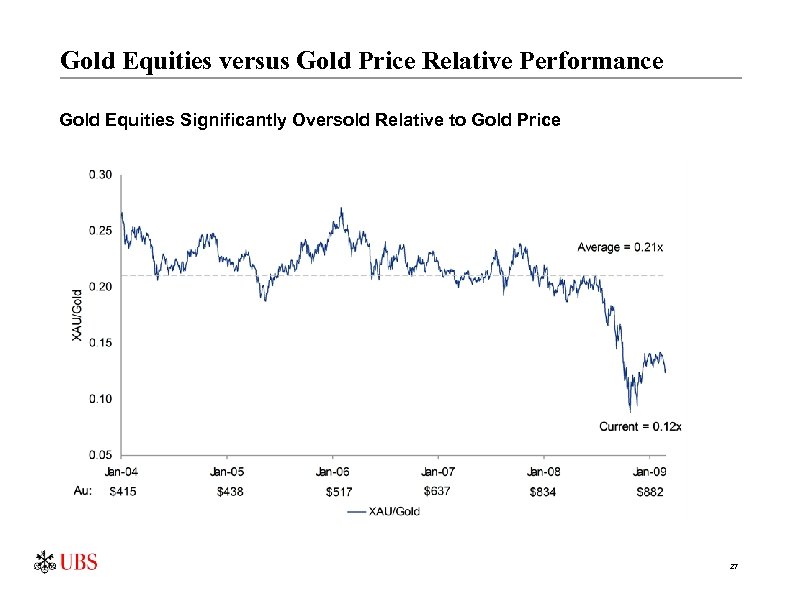

Gold Equities versus Gold Price Relative Performance Gold Equities Significantly Oversold Relative to Gold Price 27

Gold Equities versus Gold Price Relative Performance Gold Equities Significantly Oversold Relative to Gold Price 27

What Happened to the Materials Bull Market Why are commodity prices struggling… 1 – Demand weakness 2009 global GDP expected to be -0. 2%, likely pushing surpluses up and negating positive effects of poor supply growth 2 – De-leveraging Hedge fund selling has resulted in high volatility and pressure in the asset class 3 – Fund redemptions Further selling pressure generated from less sophisticated money 4 – US dollar strength Recent strength has added to selling pressure in commodities. Could be a catalyst if reversed 5 6 – Chinese growth concerns Domestic construction activity and steel consumption has slowed – Regulatory pressures Concerns regarding disruptive impact of speculators in commodities markets – further regulation expected 28

What Happened to the Materials Bull Market Why are commodity prices struggling… 1 – Demand weakness 2009 global GDP expected to be -0. 2%, likely pushing surpluses up and negating positive effects of poor supply growth 2 – De-leveraging Hedge fund selling has resulted in high volatility and pressure in the asset class 3 – Fund redemptions Further selling pressure generated from less sophisticated money 4 – US dollar strength Recent strength has added to selling pressure in commodities. Could be a catalyst if reversed 5 6 – Chinese growth concerns Domestic construction activity and steel consumption has slowed – Regulatory pressures Concerns regarding disruptive impact of speculators in commodities markets – further regulation expected 28

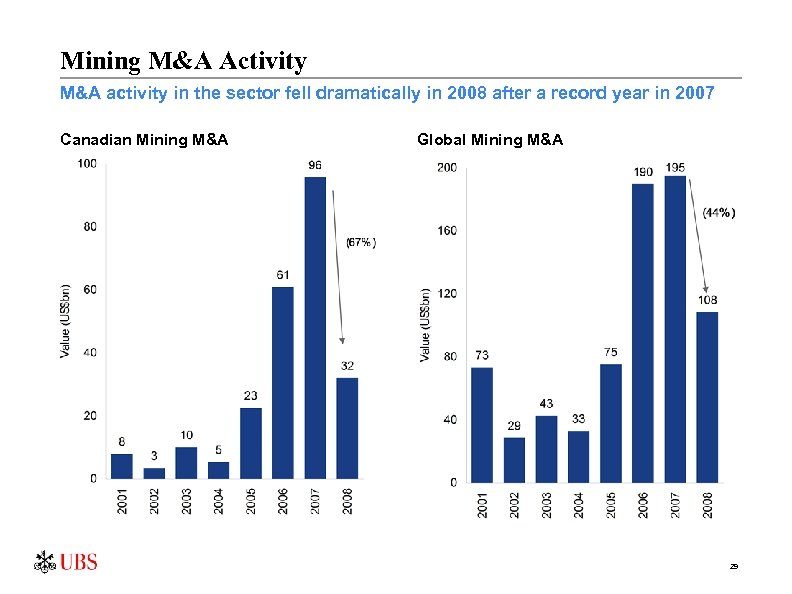

Mining M&A Activity M&A activity in the sector fell dramatically in 2008 after a record year in 2007 Canadian Mining M&A Global Mining M&A 29

Mining M&A Activity M&A activity in the sector fell dramatically in 2008 after a record year in 2007 Canadian Mining M&A Global Mining M&A 29

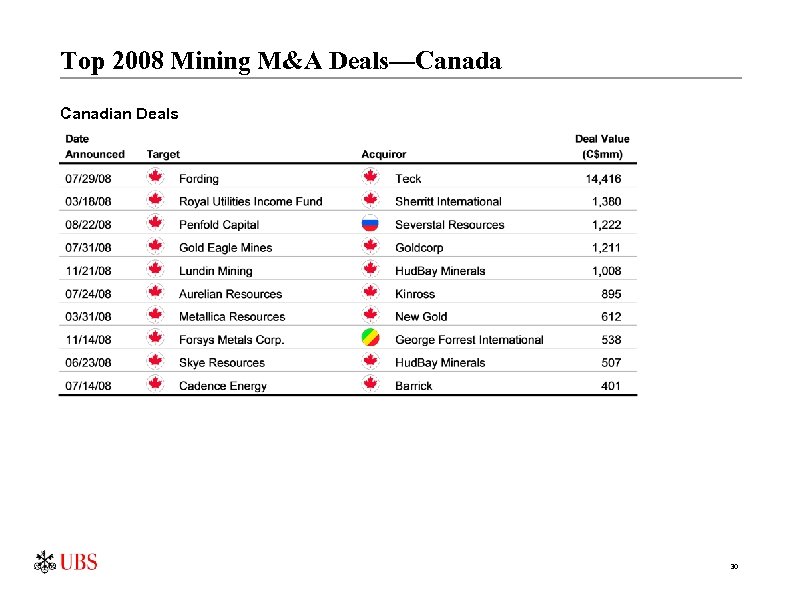

Top 2008 Mining M&A Deals—Canada Canadian Deals 30

Top 2008 Mining M&A Deals—Canada Canadian Deals 30

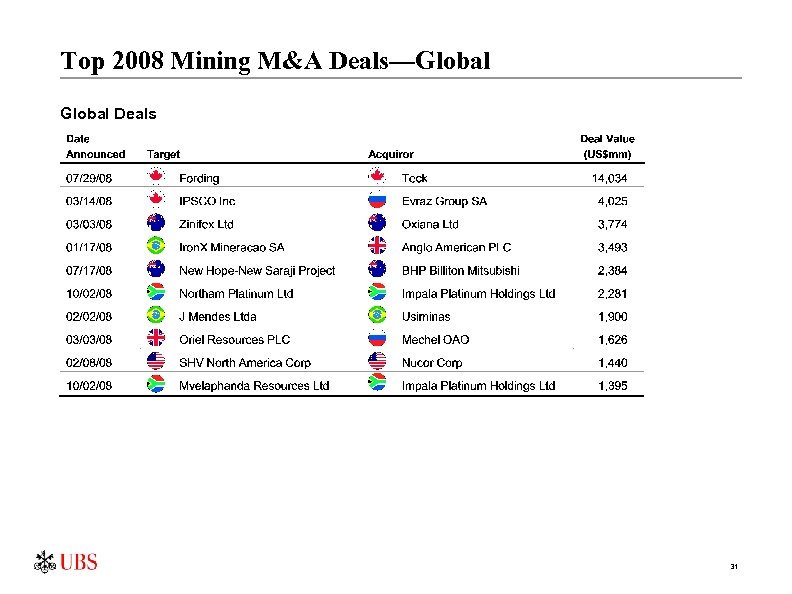

Top 2008 Mining M&A Deals—Global Deals 31

Top 2008 Mining M&A Deals—Global Deals 31

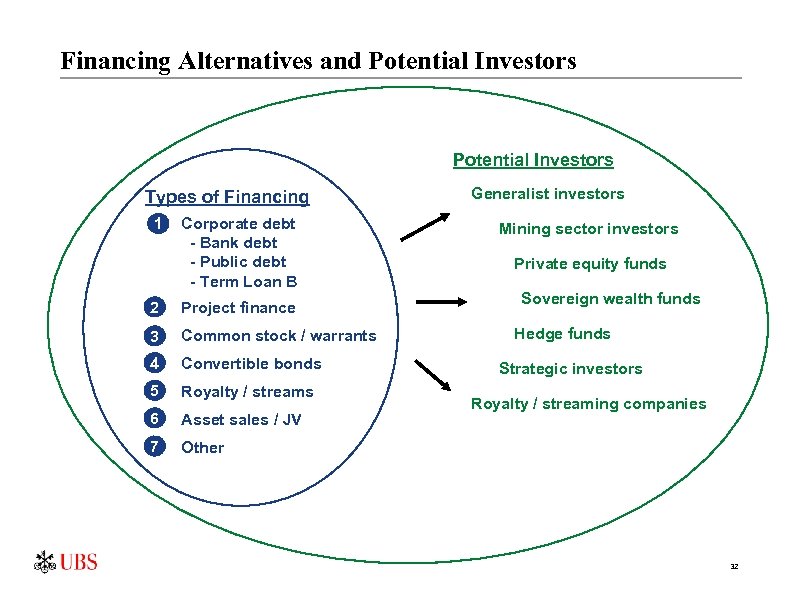

Financing Alternatives and Potential Investors Types of Financing 1 Corporate debt - Bank debt - Public debt - Term Loan B 2 Project finance 3 Common stock / warrants 4 Convertible bonds 5 Royalty / streams 6 Asset sales / JV 7 Generalist investors Mining sector investors Private equity funds Sovereign wealth funds Other Hedge funds Strategic investors Royalty / streaming companies 32

Financing Alternatives and Potential Investors Types of Financing 1 Corporate debt - Bank debt - Public debt - Term Loan B 2 Project finance 3 Common stock / warrants 4 Convertible bonds 5 Royalty / streams 6 Asset sales / JV 7 Generalist investors Mining sector investors Private equity funds Sovereign wealth funds Other Hedge funds Strategic investors Royalty / streaming companies 32

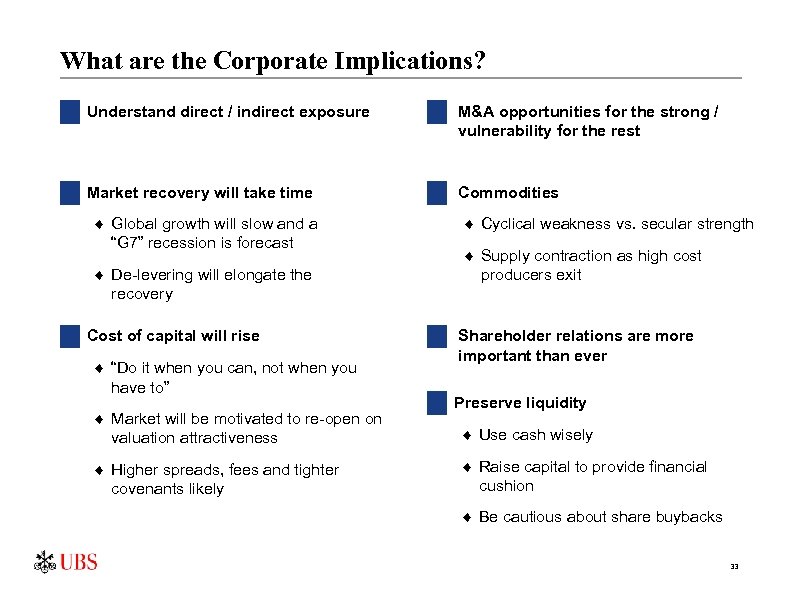

What are the Corporate Implications? Understand direct / indirect exposure M&A opportunities for the strong / vulnerability for the rest Market recovery will take time Commodities ¨ Global growth will slow and a “G 7” recession is forecast ¨ De-levering will elongate the recovery Cost of capital will rise ¨ “Do it when you can, not when you have to” ¨ Market will be motivated to re-open on valuation attractiveness ¨ Higher spreads, fees and tighter covenants likely ¨ Cyclical weakness vs. secular strength ¨ Supply contraction as high cost producers exit Shareholder relations are more important than ever Preserve liquidity ¨ Use cash wisely ¨ Raise capital to provide financial cushion ¨ Be cautious about share buybacks 33

What are the Corporate Implications? Understand direct / indirect exposure M&A opportunities for the strong / vulnerability for the rest Market recovery will take time Commodities ¨ Global growth will slow and a “G 7” recession is forecast ¨ De-levering will elongate the recovery Cost of capital will rise ¨ “Do it when you can, not when you have to” ¨ Market will be motivated to re-open on valuation attractiveness ¨ Higher spreads, fees and tighter covenants likely ¨ Cyclical weakness vs. secular strength ¨ Supply contraction as high cost producers exit Shareholder relations are more important than ever Preserve liquidity ¨ Use cash wisely ¨ Raise capital to provide financial cushion ¨ Be cautious about share buybacks 33

Is Humour a Sign of Capitulation? “A banker, eh? Can you make a living at that? ” “Honey, we’re homeless” WALL ST ONE WAY First National Bank & Grill Source: The New Yorker, October 6, 2008 34

Is Humour a Sign of Capitulation? “A banker, eh? Can you make a living at that? ” “Honey, we’re homeless” WALL ST ONE WAY First National Bank & Grill Source: The New Yorker, October 6, 2008 34